Please wait

MOXIE FREEDOM LLC

Financial Statements

December 31, 2024

(With Independent Auditors’ Report Thereon)

[KPMG LOGO]

KPMG LLP

Suite 4000

1735 Market Street

Philadelphia, PA 19103-7501

Independent Auditors’ Report

The Member

Moxie Freedom, LLC:

Opinion

We have audited the financial statements of Moxie Freedom, LLC (the Company), which comprise the balance sheet as of December 31, 2024, and the related statements of operations, member’s capital, and cash flows for the year then ended, and the related notes to the financial statements.

In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2024, and the results of its operations and its cash flows for the year then ended in accordance with U.S. generally accepted accounting principles.

Basis for Opinion

We conducted our audit in accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities under those standards are further described in the Auditors’ Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with U.S. generally accepted accounting principles, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for one year after the date that the financial statements are available to be issued.

Auditors’ Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material

if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements.

In performing an audit in accordance with GAAS, we:

•Exercise professional judgment and maintain professional skepticism throughout the audit.

•Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements.

•Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, no such opinion is expressed.

•Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements.

•Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time.

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control related matters that we identified during the audit.

/s/ KPMG LLP

Philadelphia, Pennsylvania

September 12, 2025

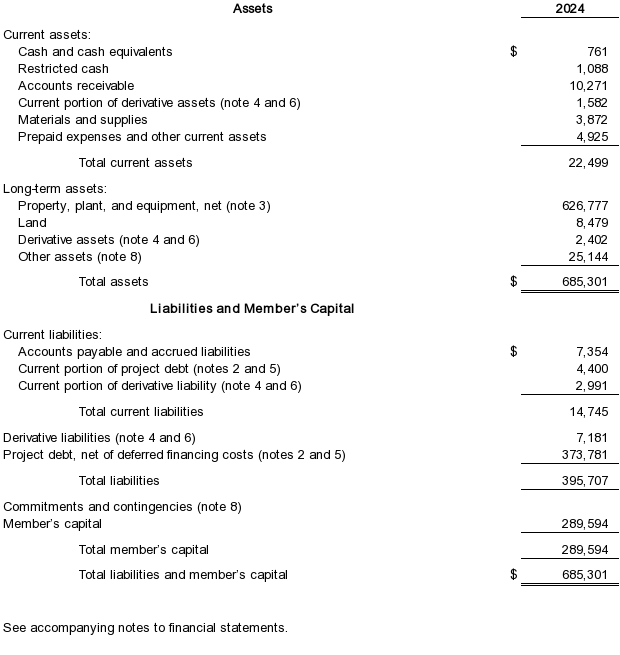

MOXIE FREEDOM LLC

Balance Sheet

December 31, 2024

(Dollars in thousands)

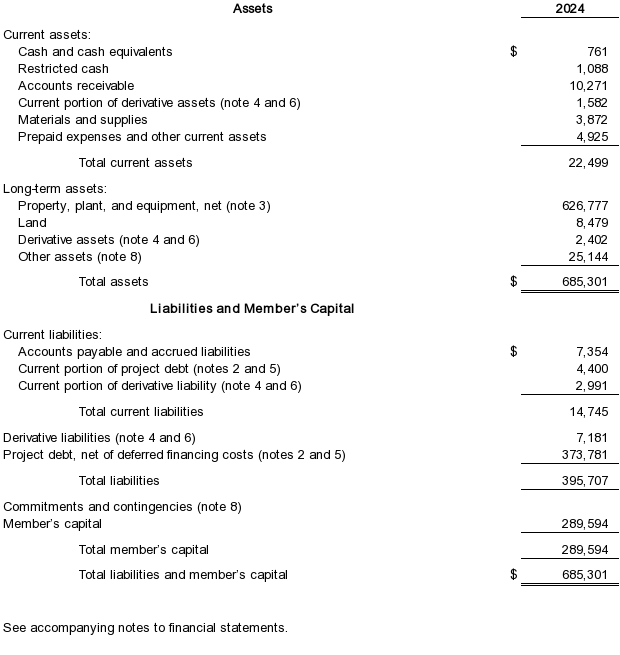

MOXIE FREEDOM LLC

Statement of Operations

Years ended December 31, 2024

(Dollars in thousands)

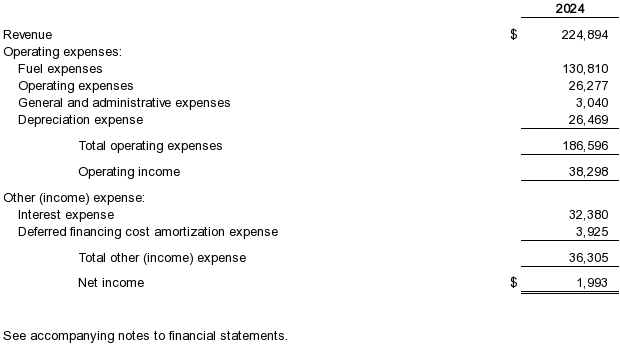

MOXIE FREEDOM LLC

Statement of Member’s Capital

Years ended December 31, 2024

(Dollars in thousands)

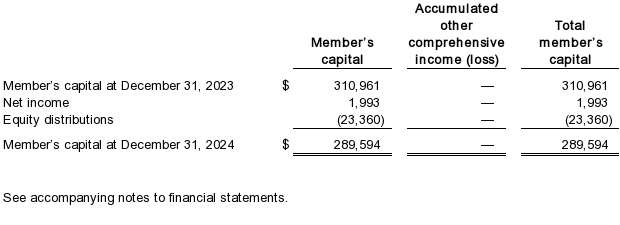

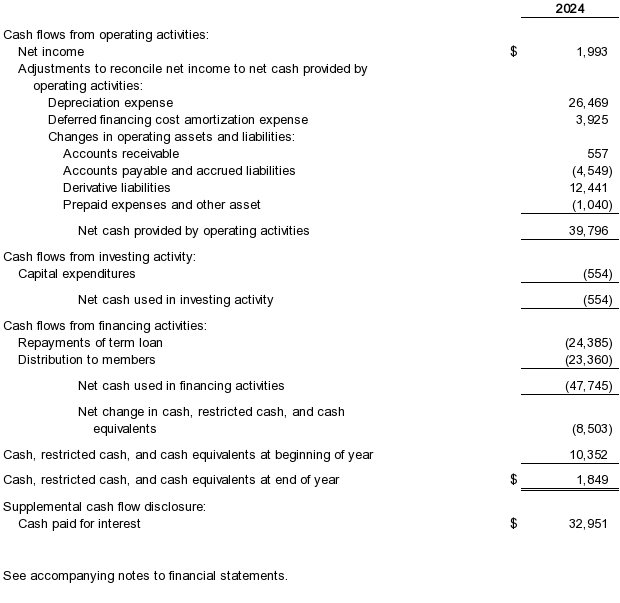

MOXIE FREEDOM LLC

Statement of Cash Flows

Years ended December 31, 2024

(Dollars in thousands)

MOXIE FREEDOM LLC

Notes to Financial Statements

December 31, 2024

(1)Organization and Operation of the Company

(a)Description of Business

Moxie Freedom LLC (the Company) was formed on March 4, 2014, as a Delaware limited liability company to develop, finance, construct, own, and operate a gas-fired combined cycle power generation facility with a capacity of approximately 1,105 MW that is located in Salem Township, Luzerne County, Pennsylvania (the Project or the Facility). The Company’s members were Moxie Energy, LLC and various related individuals until November 9, 2015 when 100% of all outstanding interest was transferred to Moxie Freedom Holdings LLC, an affiliate. The Company is governed by a limited liability company agreement.

The Company started construction of the Project during 2015 and was placed in commercial operation on September 1, 2018, its commercial operation date (COD).

(2)Summary of Significant Accounting Policies

(a)Basis of Accounting and Presentation

The accompanying financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (U.S. GAAP) and reflects all adjustments, which the Company believes are necessary to fairly present the financial position, results of operations, and cash flows of the Company for the year ended December 31, 2024.

(b)Reclassifications and Immaterial Error Corrections

The Company identified immaterial errors in the presentation of unrealized gains and losses in previously issued financial statements that have been corrected.

(c)Accounts Receivable and Revenue Recognition

Accounts receivable consist of receivables from PJM Interconnection, LLC (PJM) for capacity, energy, and ancillary services payments. The Company earns merchant revenue for incremental capacity, energy, and ancillary services provided to PJM. Merchant capacity, energy, and ancillary services revenue is recorded as electricity sales at the end of each operating period based upon energy delivered and services provided during the period.

In the normal course of business, the Company has future performance obligations for capacity sales awarded through market-based capacity auctions and (or) for capacity sales under bilateral contractual arrangements.

The PJM Base Residual Auction (BRA) for the 2025/2026 PJM Capacity Year was held in July 2024. The Company cleared a total of 767.70 MW at a clearing price of 269.92 per MW-day for the PJM MAAC locational delivery areas.

As of December 31, 2024, the expected future period capacity revenues subject to unsatisfied or partially unsatisfied performance obligations were:

The PJM BRA for delivery year 2026/2027 was held in July 2025. The Company cleared a total of 711.50 MW at a clearing price of 329.17 per MW-day.

MOXIE FREEDOM LLC

Notes to Financial Statements

December 31, 2024

The Company’s revenue includes sales from commodity contracts that are accounted for under ASC 815, Derivatives and Hedging (ASC 815). Revenue from commodity contracts primarily relates to forward sales of commodities merchant energy prices, which are accounted for as derivatives at fair value under ASC 815. These forward sales meet the definition of a derivative under ASC 815 as they have an underlying (e.g. the price of gas), a notional amount (e.g. tons), no initial net investment and can be net settled since the commodity is readily convertible to cash. Revenue from commodity contracts is recognized in electricity sales for the contracted amount when the contracts are settled at a point in time by transferring control of the commodity to the customer, similarly to revenue recognized from contracts with customers under ASC 606. From inception through settlement, these forward sales arrangements are recorded at fair value under ASC 815 with unrealized gains and losses recognized in the respective statement of operations caption (Revenue or Interest Expense) and carried on the balance sheet as assets or liabilities (see Note 6: Derivative Instruments and Hedging Activities), respectively. Further information about the fair value of these contracts is presented in the Note 4: Fair Value Measurements.

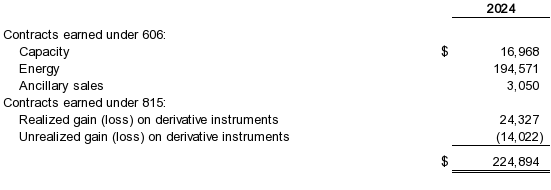

The following table represents merchant capacity, energy, ancillary services sales, realized and unrealized gain (loss) on commodity contracts at December 31, 2024.

(d)Cash and Cash Equivalents

The Company considers all highly liquid investments purchased with an original maturity of three months or less to be cash equivalents. The carrying amount of these instruments approximates fair value because of their short-term maturity.

(e)Restricted Cash

Restricted cash represents amounts that are required to be maintained in separate accounts in connection with the Project Debt (note 5) for future debt service, major maintenance requirements, and general corporate purposes.

All funds are held in highly rated money market accounts, and the carrying value approximates fair value as of December 31, 2024.

(f)Property, Plant, and Equipment, Net

The Company’s property, plant, and equipment are stated at cost net of accumulated depreciation. Depreciation is recorded on a straight-line basis over the estimated useful life of the related assets.

MOXIE FREEDOM LLC

Notes to Financial Statements

December 31, 2024

The following table provides the depreciable lives used for each asset class:

(g)Materials and Supplies

Materials and supplies in the amount of $3,872 as of December 31, 2024, are stated at the lower of the average cost or net realizable value.

(h)Income Taxes

The Company is a disregarded entity for tax purposes. Accordingly, any effect of income taxes is recognized at their indirect parent.

(i)Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, and member’s capital and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue, expenses, and allocation of profits and losses during the reporting period. Actual results could differ from those estimates. The Company is unaware of any change of conditions or situations that would cause any material change in estimates used to prepare the financial statements.

(j)Asset Retirement Obligations

The Company has no legal, constructive, or regulatory obligations related to the closure of the Facility, and accordingly, no asset retirement obligation is recorded in the financial statements.

(k)Impairment of Long-Lived Assets

Long-lived assets, such as property, plant, and equipment and purchased intangibles subject to amortization, are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to estimated undiscounted future cash flows expected to be generated by the asset. If the carrying amount of an asset exceeds its estimated future cash flows, an impairment charge is recognized by the amount by which the carrying amount of the asset exceeds fair value of the asset. Assets to be disposed of would be separately presented in the balance sheets and reported at the lower of the carrying amount or fair value less costs to sell and are no longer depreciated. The assets and liabilities of a disposed group classified as held-for-sale would be presented separately in the appropriate asset and liability sections of the balance sheets.

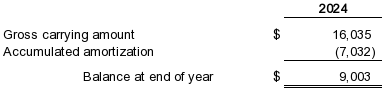

(l)Deferred Financing Costs

Deferred financing costs represent costs to obtain long-term financing and are amortized using the effective-interest method over the term of the related debt. Deferred financing costs have

MOXIE FREEDOM LLC

Notes to Financial Statements

December 31, 2024

been netted against long-term project debt (note 5) and at December 31, 2024 consist of the following:

The related amortization expense for the year ended December 31, 2024 was $3,925.

(m)Fair Value of Financial Instruments

The carrying amounts reported in the balance sheet for cash and cash equivalents, restricted cash, accounts payable, and other liabilities approximate their respective fair values due to their short-term maturities. The fair value of the Company’s long-term debt is estimated based on quoted market prices for the same or similar issues and the current rates offered to the Company for debt with the same remaining maturities. The carrying value of the Company’s debt approximates fair market value due to the variable nature of the interest rate.

(n)Derivative and Hedging Activities

The Company recognizes derivative instruments as either assets or liabilities in the balance sheet at their respective fair values, unless they qualify for the normal purchase-normal sale exception. These instruments are reported gross on the Company's balance sheet. The Company uses derivative instruments to manage its exposure to interest rate risk and merchant power price risk and does not hold or issue derivative instruments for speculative or trading purposes.

The Company did not elect hedge accounting for all of its derivatives. The Company carries the derivatives at their fair value on the balance sheet and recognizes any subsequent changes in their fair value in earnings.

(o)Leases

The Company accounts for leases in accordance with Topic 842. The Company reviews its arrangements at contract inception to determine if it is or contains a lease. As of December 31, 2024 the Company has not entered into any material leases.

(p)Interest Expense

Interest payments are reported as interest expense on the statements of operations. Total interest expense was $32,380 as of December 31, 2024. Interest expense includes interest on debt, commitment fees, interest rate swap settlements and corresponding changes in fair value. The interest rate swaps are derivative financial instruments and are recorded on the consolidated balance sheets at fair value.

(q)Concentration of Credit Risk

Financial instruments that potentially subject the Company to concentrations of credit risk consist of accounts receivable, which are concentrated within the energy industry and derivative financial instruments with large creditworthy financial institutions. These industry concentrations may

MOXIE FREEDOM LLC

Notes to Financial Statements

December 31, 2024

impact the Company’s overall exposure to credit risk, either positively or negatively, in that the customers may be similarly affected by changes in economic, industry or other conditions. Receivables and other contractual arrangements are subject to collateral requirements under the terms of enabling agreements. However, the Company believes that the credit risk posed by industry concentration is offset by the diversification and creditworthiness of its customer base. As of December 31, 2024, substantially all the Company’s revenue and accounts receivable is with one counterparty.

(3)Property, Plant, and Equipment, Net

Property, plant, and equipment, net at December 31, 2024 consists of the following:

Depreciation expense was $26,469 for the year ended December 31, 2024.

(4)Fair Value Measurements

ASC Topic 820, Fair Value Measurement, establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to measurements involving significant unobservable inputs (Level 3 measurements).

Assets and liabilities measured at fair value on a recurring basis as of December 31, 2024 are summarized below under the three-level hierarchy established by ASC Topic 820, which defines the levels within the hierarchy as follows:

•Level 1 – Consists of assets or liabilities whose value is based on unadjusted quoted prices in active markets at the measurement date. The Company holds no assets or liabilities that meet the definition of level 1.

•Level 2 – Consists of assets or liabilities valued using industry standard models and based on prices, other than quoted prices within Level 1, that are either directly or indirectly observable as of the measurement date.

•Level 3 – Consists of assets or liabilities whose fair value is estimated based on internally developed models or methodologies using inputs that are generally less readily observable and supported by little, if any, market activity at the measurement date.

MOXIE FREEDOM LLC

Notes to Financial Statements

December 31, 2024

The following tables set forth by level within the fair value hierarchy the financial assets and liabilities that were accounted for at fair value on a recurring basis as of December 31, 2024. These financial assets and liabilities are classified in their entirety based on the lowest level of input that is significant to the fair value measurement. The Company’s assessment of the significance of a particular input to the fair value measurement requires judgment and may affect the valuation of fair value assets and liabilities and their placement within the fair value hierarchy levels.

The valuation techniques used to measure the fair value of the Level 2 derivative financial instruments above in which the counterparties have high credit ratings were derived using the income approach from discounted cash flow from pricing models, with all significant inputs derived from or corroborated by observable market data. The Company’s discounted cash flow techniques use observable market inputs, such as SOFR based yield curves.

The Commodity swaps referenced above have been designated as Level 3 derivative financial instruments due to their illiquidity. The Commodity swaps have been entered into with counterparties with high credit ratings.

(a)Additional Information Regarding Level 3 Measurements

For valuations that include both observable and unobservable inputs, if the unobservable input is determined to be significant to the overall inputs, the entire valuation is categorized in Level 3. This includes derivatives valued using indicative price quotations for contracts with tenors that extend into periods with no observable pricing. For the year ended December 31, 2024, the significant unobservable inputs used in the fair value measurement of the Power Swaps are as follows:

MOXIE FREEDOM LLC

Notes to Financial Statements

December 31, 2024

(5)Project Debt

On November 10, 2015, the Company entered into a $532 million floating rate construction and term loan facility to finance the construction of the project and a $60 million working capital facility (together the Project Debt).

On April 4, 2023, the Company entered into a Credit Agreement (Refinance Agreement) with multiple lenders for a new Term loan facility in the amount of $432,599 and a working capital loan facility in the amount of $30,000. The proceeds from the Refinance Agreement were used to pay off the original term loan facility. This replaced the Project Debt with new loan terms and interest rates. One lender from the original term loan facility rolled over the principal amount of $20,977 to be deemed borrowed under the refinance agreement. The rollover did not result in an actual exchange of cash.

Due to the majority of new lenders and materially different terms on the new loan this transaction was treated as an extinguishment of the original project debt and placement of new debt for these financial statements. The unamortized deferred financing costs of $1,867 from the original project debt were written off as part of extinguishment, the Company recorded to deferred financing cost amortization expense in the statements of operations.

The Project Refinance Agreement contains certain restrictive covenants that, among other things, limit the Company’s ability to incur additional indebtedness, maintain reserve accounts, make distributions, and the requirement to hedge the majority of interest rate risk.

The working capital facility has two primary uses: (i) to issue letters of credit and (ii) make working capital loans. Any working capital loans drawn pay interest at SOFR +400 bps and must be fully repaid by the fifth anniversary of the closing date. Repayments of working capital loans may be re-borrowed after the working capital loan has been repaid.

During 2024, the Company has debt outstanding as follows:

The principal and interest payments on the Project Refinancing Agreement are made quarterly on March 31, June 30, September 30, and December 31 of each year. The amount of these payments includes a mandatory principal payment in addition to a cash sweep mechanism for additional principal payments calculated on a quarterly basis.

MOXIE FREEDOM LLC

Notes to Financial Statements

December 31, 2024

The annual maturities of the Refinance Agreement based on mandatory principal payments are as follows:

(6)Derivative Instruments and Hedging Activities

The Company uses interest rate derivative instruments to manage its exposure to changes in the interest rate on its variable rate debt instruments. In addition, from time to time the Company uses Commodity swaps to manage its merchant power price risk.

By using derivative financial instruments to hedge exposures to changes in interest rates and fluctuating power prices the Company exposes itself to credit risk and market risk. Credit risk is the failure of the counterparty to perform under the terms of the derivative contract. When the fair value of a derivative contract is positive, the counterparty owes the Company, which creates credit risk for the Company. When the fair value of a derivative contract is negative, the Company owes the counterparty, and therefore, the Company is not exposed to the counterparty’s credit risk in those circumstances. The Company minimizes counterparty credit risk in derivative instruments by entering transactions with high-quality counterparties.

Market risk is the adverse effect on the value of a derivative instrument that results from a change in interest rates or merchant power prices. The market risk associated with interest-rate contracts and Commodity swap contracts is managed by establishing and monitoring parameters that limit the types and degree of market risk that may be undertaken.

MOXIE FREEDOM LLC

Notes to Financial Statements

December 31, 2024

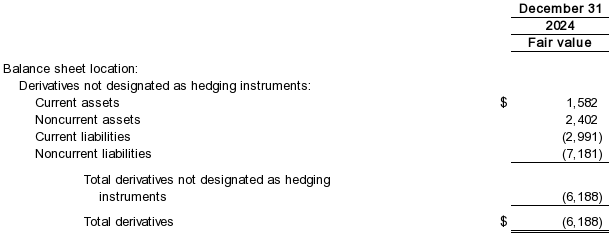

The tables listed below provide a reconciliation of the beginning and ending net balances for the derivative instruments measured at fair value. All interest rate swaps are classified as Level 2 in the fair value hierarchy and all Commodity swaps are classified as Level 3 in the fair value hierarchy:

The following table summarizes the fair value within the derivative instrument valuation on the balance sheets as of December 31, 2024:

(a)Interest Rate Swaps

On November 10, 2015, the Company entered into eleven interest rate swap agreements, each with the same terms, which were designated as cash flow hedges of the forecasted interest payments for 75% of the expected outstanding Project Debt under the credit facility. The interest rate swaps are in effect from June 29, 2018 to June 30, 2023 and effectively convert the floating rate for the hedged portion of the Project Debt to a fixed interest rate of 2.521%. The interest rate swaps are derivative financial instruments and are recorded on the balance sheet at fair value. Changes in the combined fair value of the interest rate swaps of $(9,810) were recorded in other comprehensive income (loss) for the year ended December 31, 2019. On December 31, 2019, the Company discontinued use of hedge accounting and $9,266 was frozen in accumulated other

MOXIE FREEDOM LLC

Notes to Financial Statements

December 31, 2024

comprehensive income. This amount will be amortized into income using the effective-interest method (over the remaining life of the derivatives) through June 30, 2023.

On March 28, 2023, the Company terminated and settled its existing interest rate swap agreements, as part of the Refinance Agreement (see note 5). As part of the settlement of the existing interest rate swap agreements, the Company received $1,950 for early redemption recorded as a reduction to interest expense. The Company entered into new interest rate swaps who’s combined notional value which represent at least 75% of the outstanding principal of the Project Debt at all times. The interest rate swaps are in effect from June 30 ,2023 to December 31, 2029 and effectively convert the floating rate for the hedged portion of the Project Refinanced Agreement to a fixed interest rate between 3.45% and 3.75%.

(b)Commodity Swaps

During 2024 the Company entered into various Commodity Swap Transactions. These swaps lock in various fixed pricing of the Projects output. The notional volume of the Company’s open derivative transactions is 2,405,900 MWH’s for the year ended December 31, 2024.

(7)Related Party Transactions

(a)Administrative Management Agreement (AMA)

The Company executed an AMA with Caithness Freedom Administrative Management, LLC on November 10, 2015 to act as an independent contractor who performs operational management and general administrative services. The services and fees under the AMA began on January 1, 2018 and continue throughout the operating period of the Project. The Company pays an annual fee of $2,000, which will be subject to annual increases based on the Consumer Price Index increase for the immediately preceding 12-month period. For the year ended December 31, 2024 the AMA fees of $2,490 were incurred and recorded in general and administrative expenses in the statements of operation.

(b)Amounts Due from and Due to Related Parties

Amounts due to related parties pertain to payments of normal course of business expenses paid on behalf of the Company and intercompany loans. The amounts due to related parties as of December 31, 2024 is $0.

(8)Commitment and Contingencies

The Company obtained Letters of Credit (LOC) under the working capital facility to satisfy the obligations for various site permit requirements. The table below summarizes the LOC drawn balance outstanding as of December 31, 2024:

MOXIE FREEDOM LLC

Notes to Financial Statements

December 31, 2024

The Company paid commitment fees in connection with the undrawn balance of the working capital facility. For the year ended December 31, 2024, the commitment fees, of $997, are included in interest expense.

The table below summarizes the Company’s commitment fees as of December 31, 2024:

(a)Operation and Maintenance Agreement (OMA)

On November 10, 2015, the Company entered into an OMA with EthosEnergy Power Plant Services, LLC (EEP), to provide for the operation and maintenance of the Facility. EEP provides appropriate staffing and perform the day-to-day operations, routine testing, maintenance, repair of the Facility, and other services required for electrical energy production. EEP procures all goods, services, accessories, consumables, parts, and equipment as needed to perform their duties as operator and receives payment for all payroll costs for on-site staffing as well as an annual fee to cover all costs to perform their duties as operator. The OMA is due to expire on the earlier of (i) five years after the Operational Phase, subject to extension upon mutual agreement of the Company and EEP and (ii) termination of the agreement by the Company or EEP. The terms of the OMA permit the Company to terminate the agreement at any time during the Operational Phase without cause upon giving 60 days’ written notice to EEP.

Contract pricing under the terms of the OMA are as follows:

•Mobilization Phase: $20 each month with an expected total of $240, plus reimbursement of payroll costs and other operating expenses

•Operational Phase: $300 annual fees, paid in $25 monthly installments, plus reimbursement of payroll costs and other operating expenses

The OMA also provides for an annual performance adjustment, which, if positive, shall consist of a payment by the Company to EEP or, if negative, shall consist of a payment from EEP to the Company. The terms of the performance adjustment are as follows:

•Annual base amount of $180, escalated by the change in the CPI compared to the CPI at the date of the OMA execution.

•Consideration of operator performance in safety, environmental, budget compliance and facility availability (all as defined in the OMA).

For the year ended December 31, 2024, the fees expensed were $4,034.

(b)Contract Service Agreement (CSA)

On September 17, 2015, the Company entered into a CSA with General Electric International, Inc., pursuant to which they will provide parts and services for the installed gas turbines. The CSA will cover maintenance, repair of collateral damage, initial spare parts, monitoring systems,

MOXIE FREEDOM LLC

Notes to Financial Statements

December 31, 2024

unscheduled outage obligations, nonhazardous cleanup, and permits having to do with the installed turbines.

The term of the CSA is for 20 years with no option to terminate by either party without penalty. Minimum payments required under the contract vary by year totaling $27,000 from 2024 through 2030 excluding direct costs and variable fees.

(c)Contract for Sale and Purchase of Natural Gas (GSA)

On August 7, 2015, the Company entered into the GSA with South Jersey Resources Group, LLC (SJRG) for the firm supply and transportation of up to 157,000 MMBtu of natural gas to the project for a period of 10 years from the in-service date. In 2015, the Company elected ASC 815 scope except for normal purchase-normal sale. SJRG will procure gas from Coterra Energy, Inc. (formerly known as Cabot Oil & Gas) and sell it to the Project using a three-tranche pricing formula.

Pursuant to the terms of the agreement, the Project must bid all available energy (consistent with 150,000 MMBtus of gas) into the PJM Interconnection, LLC (PJM) day-ahead market. If the unit is unavailable to generate energy, there is no gas purchase requirement.

For the year ended December 31, 2024, the Company incurred expenses of $130,666, which have been recorded as fuel expense.

(d)Interconnection Service Agreement (ISA)

On November 6, 2015, PJM and PPL Electric Utilities Corporation executed an ISA with the Company to allow the Facility to connect to PJM’s transmission system with 980 megawatts of capacity interconnections rights. The Facility is interconnected to the PJM grid through a new 500-kilovolt switchyard along the Susquehanna-Lackawanna 500-kilovolt line. The substation and transmission system upgrades cost $34.5 million, which were capitalized to property, plant, and equipment Effective February 24, 2022, PJM and PPL Electric Utilities Corporation executed a revised ISA with the Company to allow the Facility to connect to PJM’s transmission system for an additional 65 MW for a total of 1,045 MW of capacity interconnections rights.

(9)Subsequent Events

On July 17, 2025 the Moxie Freedom Holdings, LLC, the sole owner of the Company entered into an agreement to sell its entire interest in the Company to an unrelated third party. This transaction is not expected to have any effect on the Company's financial position.

In September 2025, the Company received notice from an unrelated third party alleging breach of contract. The Company has conducted a thorough review of the case and consulted with legal counsel. Based on the information currently available, the Company believes that the claims are without merit and intends to vigorously defend against them. At this time, no reserve has been recorded in the financial statements for potential liabilities related to this litigation, as management does not expect any material adverse impact on the Company's financial position or results of operations. Subsequent events have been evaluated and disclosed as required through the report issuance date of September 12, 2025.