Lawrenceburg Waterford Darby Acquisition of Lawrenceburg, Waterford, & Darby January 15, 2026

2 The information contained herein, as well as any information that has been supplied orally in connection herewith, speaks only as of the date of this presentation. Talen Energy Corporation (“Talen,” “TEC,” the “Company,” “we,” “our,” or “us”) and our affiliates and representatives expressly disclaim any obligation to update any information contained herein, whether as a result of new information or circumstances, future events or otherwise. The information contained herein is summary. For additional information, see the Company’s historical financial statements and other information included in its periodic reports and other filings with the Securities and Exchange Commission (the “SEC”) (available at www.sec.gov/edgar). Nothing contained herein should be construed as legal, business, tax, accounting or other professional advice, and you should consult your own advisors regarding such matters. These materials should not be relied upon for the maintenance of your books and records for any tax, accounting, legal or other procedures. Non-GAAP Financial Measures We include in this presentation Adjusted EBITDA and Adjusted Free Cash Flow, which we use as measures of our performance, and which are not financial measures prepared under U.S. Generally Accepted Accounting Principles (“GAAP”). Non-GAAP financial measures, such as Adjusted EBITDA and Adjusted Free Cash Flow, do not have definitions under GAAP and may be defined differently by, and not be comparable to, similarly titled measures used by other companies or used in our credit facilities, the indentures governing our notes or any of our other debt agreements. Generally, a non-GAAP financial measure is a numerical measure of financial performance, financial position or cash flows that excludes (or includes) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP. Management cautions investors not to place undue reliance on such non-GAAP measures, but to consider them along with their most directly comparable GAAP measures. Adjusted EBITDA and Adjusted Free Cash Flow have limitations as analytical tools and should not be considered in isolation or as a substitute for analyzing our results as reported under GAAP. Due to the difficulty in predicting certain components of Adjusted EBITDA and Adjusted Free Cash Flow for the Lawrenceburg, Waterford, and Darby assets with a reasonable degree of certainty, we are unable to reconcile these non-GAAP financial measures to the comparable GAAP measures without unreasonable efforts. Market and Industry Data This presentation includes market data and other information from independent industry publications, as well as surveys and our own research and knowledge of the industry. Some data is also based on management’s estimates, which are derived from our review of internal sources, as well as the independent sources described above. Although we believe these sources are reliable, the third-party information contained in this presentation has not been independently investigated, verified or audited and, therefore, we cannot guarantee the accuracy or completeness of such information. As a result, you should be aware that market share, ranking and other similar data set forth in this presentation, and estimates and beliefs based on such data, may not be reliable. Forward Looking Statements Statements contained in this presentation concerning expectations, beliefs, plans, objectives, goals, strategies, future events or performance, shareholder returns and underlying assumptions, and other statements that are not statements of historical fact are “forward-looking statements,” and should be considered estimates, assumptions or projections. These statements often include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “target,” “project,” “forecast,” “seek,” “will,” “may,” “should,” “could,” “would” “goal,” “predict,” “continue,” “potential” or similar expressions. Any such forward-looking statements reflect various estimates and assumptions. Although we believe that the expectations and assumptions reflected in these statements are reasonable, there can be no assurance that they will prove to be correct. No representations or warranties are made by Talen or any of its affiliates, shareholders, directors, officers, employees, agents, partners or professional advisors as to the accuracy or achievability of any such forward-looking statements. Except as otherwise required by law, Talen undertakes no obligation to update any forward-looking statement to reflect new information or circumstances, future events or otherwise after the date on which such statement is made. Forward-looking statements are subject to many risks and uncertainties, and actual results may differ materially due to many factors. New factors emerge from time to time, and it is not possible for us to predict all of these factors. In addition to the specific factors discussed in the sections entitled “Cautionary Note Regarding Forward-Looking Information” and “Risk Factors” in our periodic reports and other filings with the SEC, the following are among the important factors that could cause actual results to differ materially from forward-looking statements: Talen’s or its subsidiaries’ levels of indebtedness; the terms and conditions of debt instruments that may restrict Talen’s ability to operate its business; operational, price and credit risks in the wholesale and retail electricity markets (including as a result of increases in the supply of electricity generally due to new power or intermittent renewable power generation); the effectiveness of Talen’s risk management techniques, including hedging, with respect to electricity and fuel prices, interest rates and counterparty and joint venture partner credit and non-performance risks; methods of accounting and developments in or interpretations of accounting requirements that may impact reported results, including with respect to, but not limited to, hedging activity; Talen’s ability to forecast and provide the actual load needed to perform sales contracts; the effects of transmission congestion due to line maintenance outages and the performance of transmission facilities and any changes in the structure and operation of, or the pricing limitations imposed by, the Regional Transmission Organizations and Independent System Operators that operate those facilities; blackouts due to disruptions in neighboring interconnected systems; the impacts of federal, state, local and market legislation, regulation, proceedings and other actions, including but not limited to those related to energy, the environment and tax, the outcomes thereof and the costs of compliance therewith; the impacts of new or revised United States and/or international trade tariffs, treaties, policies, and regulations; the costs of complying with environmental, social and related worker health and safety laws and regulations; the impacts of climate change, including changes in regulation or their enforcement; the availability and cost of emission allowances; the performance of Talen’s subsidiaries and affiliates, on which our ability to meet our debt obligations largely depend; the risks inherent with variable rate indebtedness; disruption in or adverse developments of financial markets; acquisition or divestiture activities, including Talen’s ability to realize expected synergies and other benefits from such business transactions; Talen’s ability to achieve anticipated cost savings; the execution and development of proposed future enterprises, including the ability to permit, develop, construct and operate proposed renewable energy, energy storage and/or data center facilities, realization of assumptions underlying the statements regarding future enterprises, and realization of estimates of valuations of future enterprises; Talen’s ability to optimize its competitive power generation operations and the costs associated with any capital expenditures; the proposed Lawrenceburg, Waterford, and Darby acquisition, including the financing, expected timing and completion (including required regulatory approvals), and anticipated impacts thereof; the integration of and anticipated benefits from the recent Freedom and Guernsey acquisitions; significant increases in operation and maintenance expenses, such as health care, and pension costs, including as a result of changes in interest rates; the loss of key personnel, the ability to hire and retain qualified employees, and the possibility of union strikes or work stoppages; war (including supply chain disruptions as a result of war, and including the effects of the Ukraine/Russia and Middle East conflicts, attendant sanctions and related disruptions in oil and natural gas production and the supply of nuclear fuel), armed conflicts or terrorist attacks, including cyber-based attacks; and pandemics, including COVID-19. Recipients are cautioned to not place undue reliance on such forward-looking statements. Disclaimer

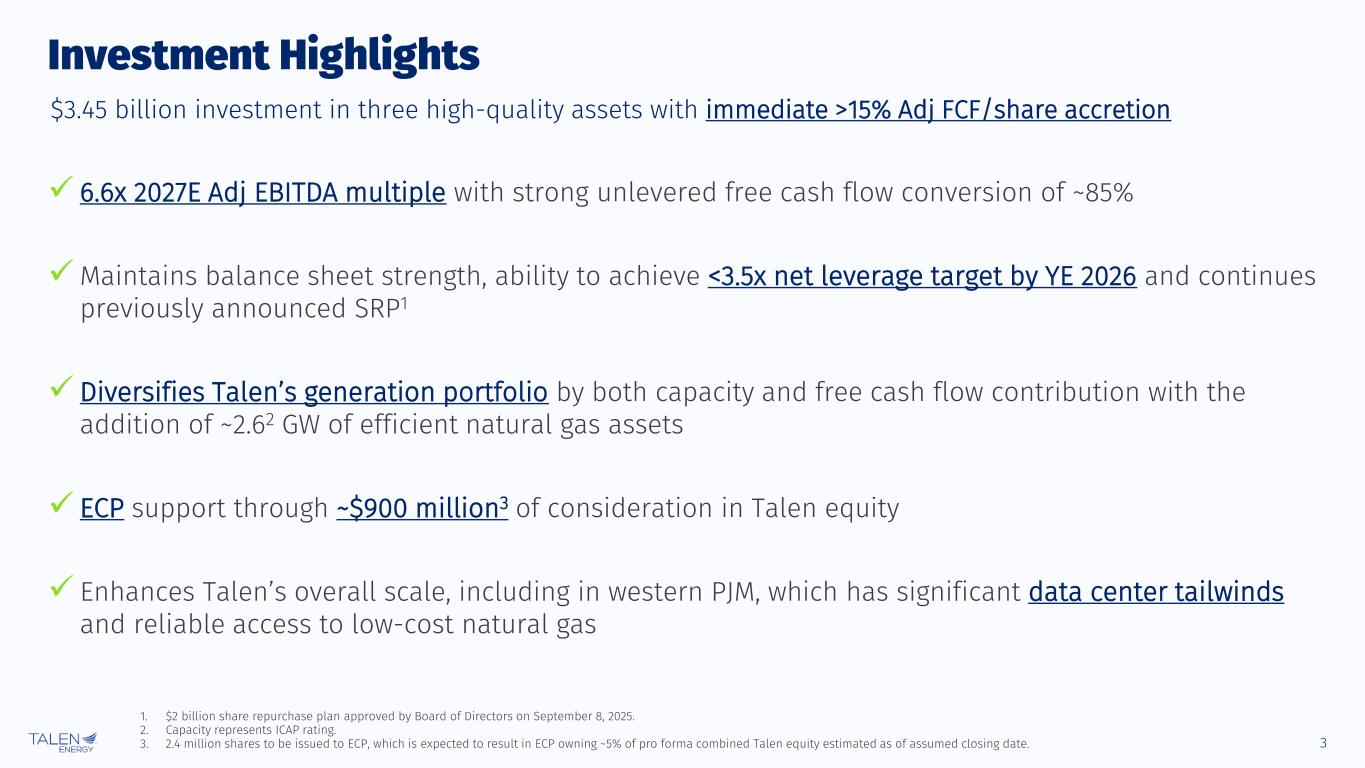

3 Investment Highlights ✓ 6.6x 2027E Adj EBITDA multiple with strong unlevered free cash flow conversion of ~85% ✓Maintains balance sheet strength, ability to achieve <3.5x net leverage target by YE 2026 and continues previously announced SRP1 ✓ Diversifies Talen’s generation portfolio by both capacity and free cash flow contribution with the addition of ~2.62 GW of efficient natural gas assets ✓ ECP support through ~$900 million3 of consideration in Talen equity ✓ Enhances Talen’s overall scale, including in western PJM, which has significant data center tailwinds and reliable access to low-cost natural gas 1. $2 billion share repurchase plan approved by Board of Directors on September 8, 2025. 2. Capacity represents ICAP rating. 3. 2.4 million shares to be issued to ECP, which is expected to result in ECP owning ~5% of pro forma combined Talen equity estimated as of assumed closing date. $3.45 billion investment in three high-quality assets with immediate >15% Adj FCF/share accretion

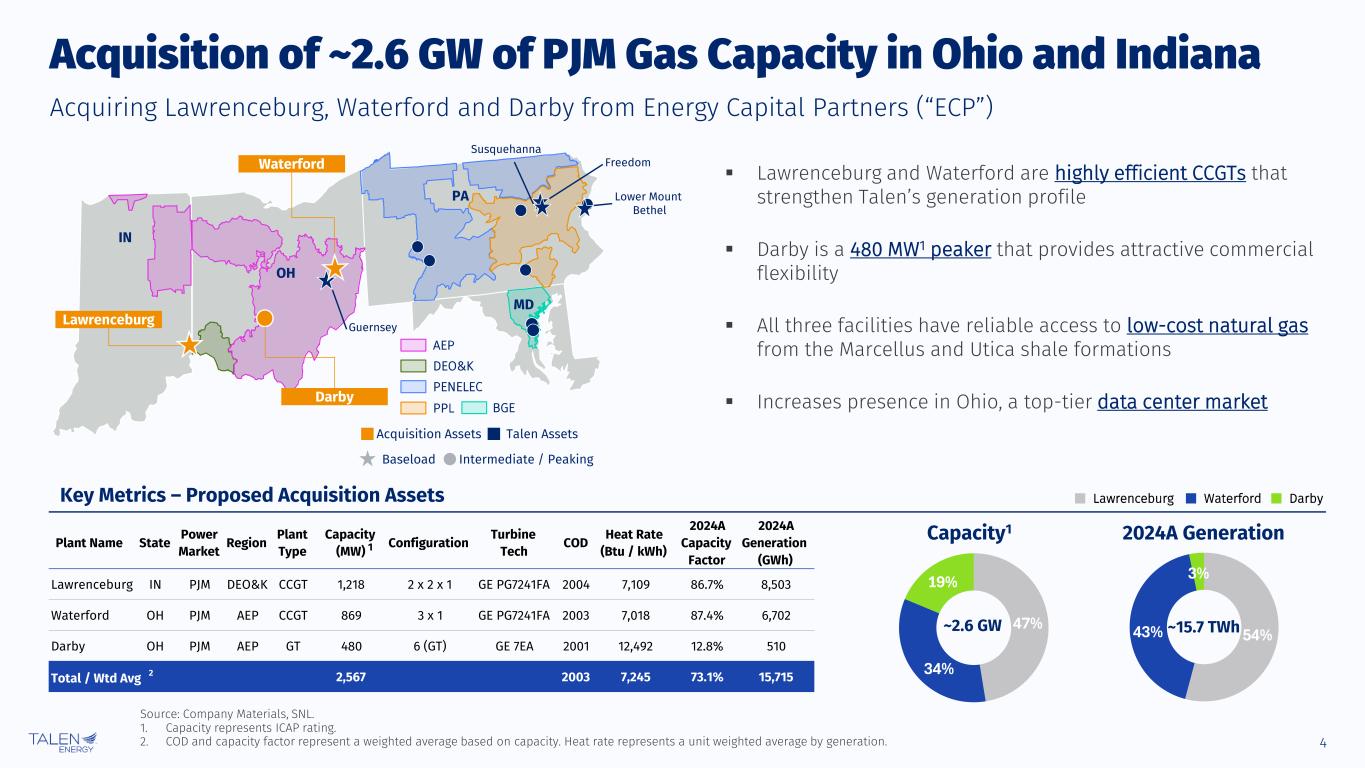

4 ▪ Lawrenceburg and Waterford are highly efficient CCGTs that strengthen Talen’s generation profile ▪ Darby is a 480 MW1 peaker that provides attractive commercial flexibility ▪ All three facilities have reliable access to low-cost natural gas from the Marcellus and Utica shale formations ▪ Increases presence in Ohio, a top-tier data center market Acquiring Lawrenceburg, Waterford and Darby from Energy Capital Partners (“ECP”) Key Metrics – Proposed Acquisition Assets Acquisition of ~2.6 GW of PJM Gas Capacity in Ohio and Indiana Source: Company Materials, SNL. 1. Capacity represents ICAP rating. 2. COD and capacity factor represent a weighted average based on capacity. Heat rate represents a unit weighted average by generation. Capacity1 2024A Generation Lawrenceburg Waterford Darby ~15.7 TWh~2.6 GW Acquisition Assets Talen Assets Baseload Lower Mount Bethel Waterford Darby Guernsey Freedom Susquehanna Lawrenceburg DEO&K AEP PENELEC PPL BGE IN OH PA MD Intermediate / Peaking 1Plant Name State Power Market Region Plant Type Capacity (MW) Configuration Turbine Tech COD Heat Rate (Btu / kWh) 2024A Capacity Factor 2024A Generation (GWh) Lawrenceburg IN PJM DEO&K CCGT 1,218 2 x 2 x 1 GE PG7241FA 2004 7,109 86.7% 8,503 Waterford OH PJM AEP CCGT 869 3 x 1 GE PG7241FA 2003 7,018 87.4% 6,702 Darby OH PJM AEP GT 480 6 (GT) GE 7EA 2001 12,492 12.8% 510 Total / Wtd Avg 2 2,567 2003 7,245 73.1% 15,715

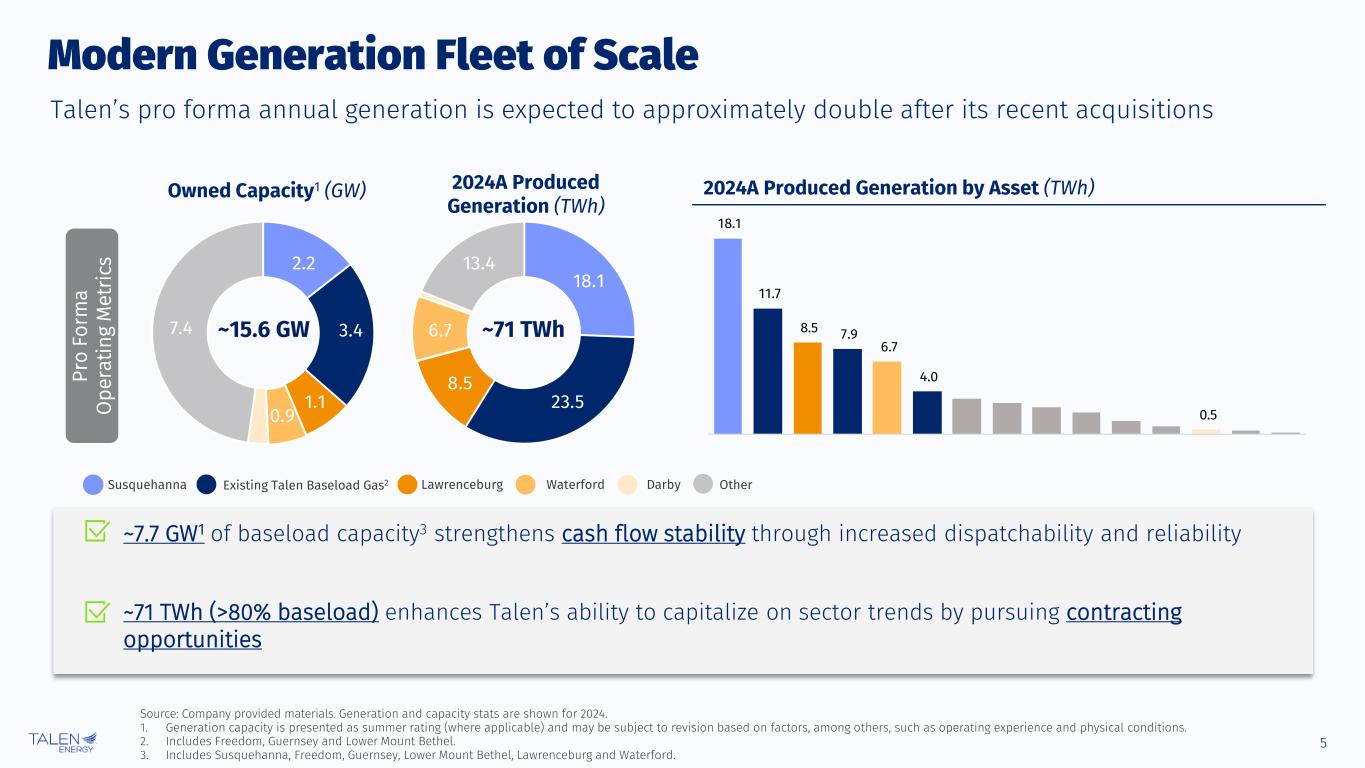

5 Modern Generation Fleet of Scale ~71 TWh 2024A Produced Generation (TWh) ~15.6 GW Owned Capacity1 (GW) Talen’s pro forma annual generation is expected to approximately double after its recent acquisitions ~7.7 GW1 of baseload capacity3 strengthens cash flow stability through increased dispatchability and reliability ~71 TWh (>80% baseload) enhances Talen’s ability to capitalize on sector trends by pursuing contracting opportunities Source: Company provided materials. Generation and capacity stats are shown for 2024. 1. Generation capacity is presented as summer rating (where applicable) and may be subject to revision based on factors, among others, such as operating experience and physical conditions. 2. Includes Freedom, Guernsey and Lower Mount Bethel. 3. Includes Susquehanna, Freedom, Guernsey, Lower Mount Bethel, Lawrenceburg and Waterford. OtherExisting Talen Baseload Gas2 DarbySusquehanna Lawrenceburg Waterford 2024A Produced Generation by Asset (TWh) Pr o Fo rm a O pe ra ti ng M et ri cs

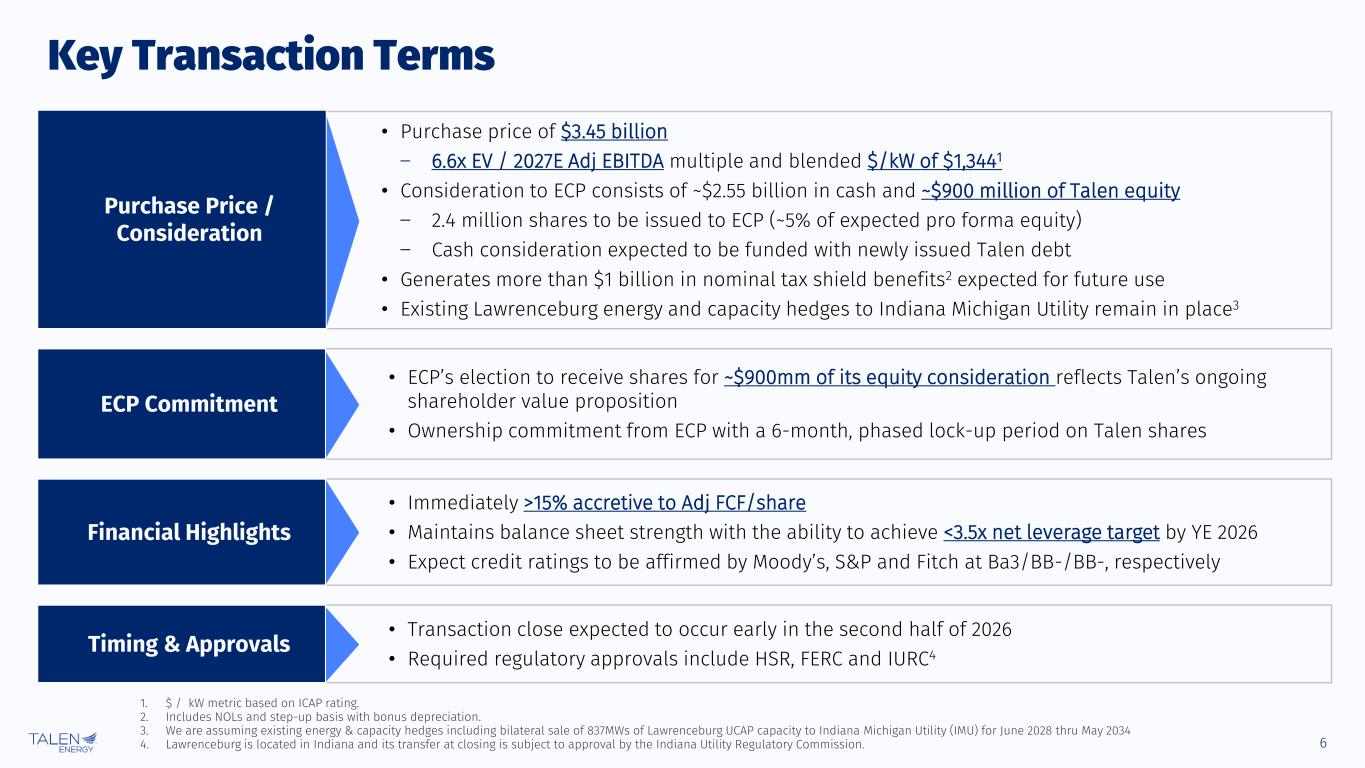

6 Key Transaction Terms • Purchase price of $3.45 billion ‒ 6.6x EV / 2027E Adj EBITDA multiple and blended $/kW of $1,3441 • Consideration to ECP consists of ~$2.55 billion in cash and ~$900 million of Talen equity ‒ 2.4 million shares to be issued to ECP (~5% of expected pro forma equity) ‒ Cash consideration expected to be funded with newly issued Talen debt • Generates more than $1 billion in nominal tax shield benefits2 expected for future use • Existing Lawrenceburg energy and capacity hedges to Indiana Michigan Utility remain in place3 Purchase Price / Consideration • ECP’s election to receive shares for ~$900mm of its equity consideration reflects Talen’s ongoing shareholder value proposition • Ownership commitment from ECP with a 6-month, phased lock-up period on Talen shares ECP Commitment • Immediately >15% accretive to Adj FCF/share • Maintains balance sheet strength with the ability to achieve <3.5x net leverage target by YE 2026 • Expect credit ratings to be affirmed by Moody’s, S&P and Fitch at Ba3/BB-/BB-, respectively Financial Highlights • Transaction close expected to occur early in the second half of 2026 • Required regulatory approvals include HSR, FERC and IURC4Timing & Approvals 1. $ / kW metric based on ICAP rating. 2. Includes NOLs and step-up basis with bonus depreciation. 3. We are assuming existing energy & capacity hedges including bilateral sale of 837MWs of Lawrenceburg UCAP capacity to Indiana Michigan Utility (IMU) for June 2028 thru May 2034 4. Lawrenceburg is located in Indiana and its transfer at closing is subject to approval by the Indiana Utility Regulatory Commission.

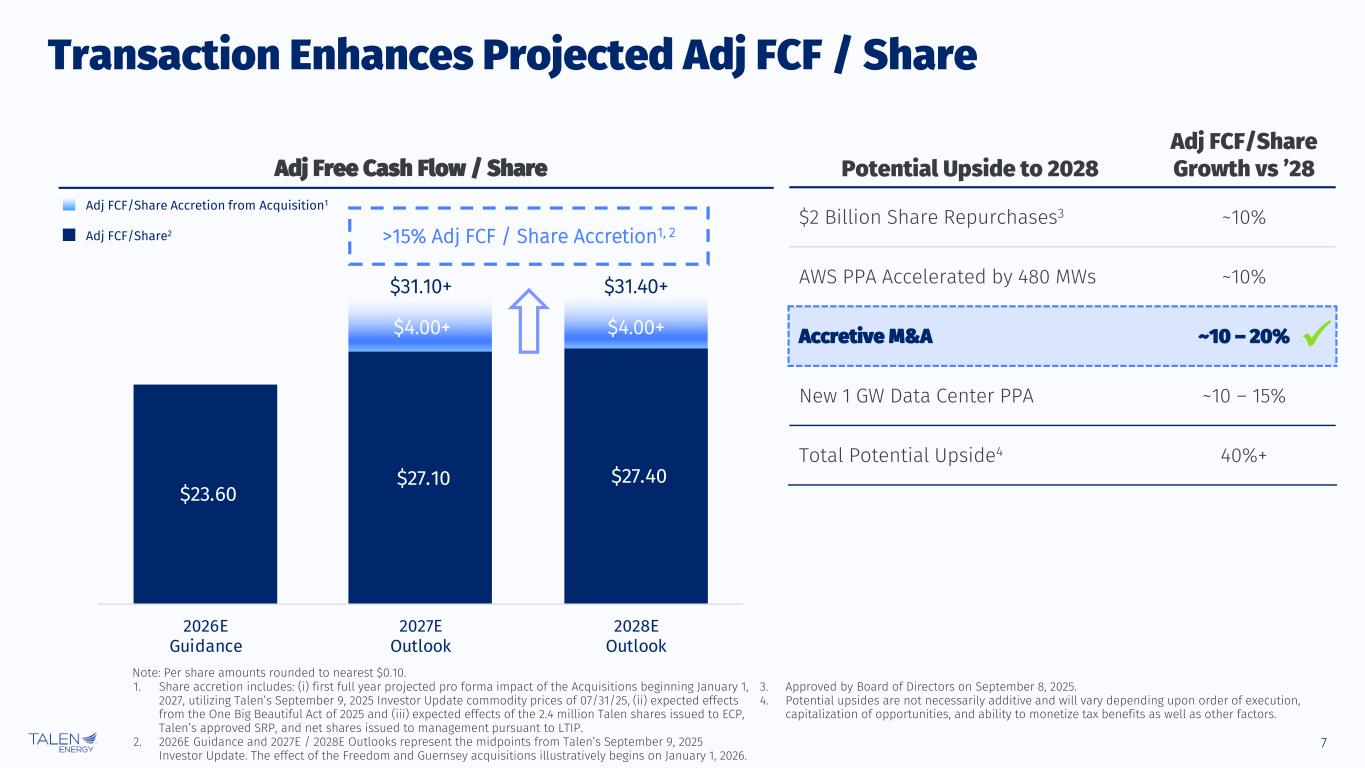

7 Adj Free Cash Flow / Share 1. Share accretion includes: (i) first full year projected pro forma impact of the Acquisitions beginning January 1, 2027, utilizing Talen’s September 9, 2025 Investor Update commodity prices of 07/31/25, (ii) expected effects from the One Big Beautiful Act of 2025 and (iii) expected effects of the 2.4 million Talen shares issued to ECP, Talen’s approved SRP, and net shares issued to management pursuant to LTIP. 2. 2026E Guidance and 2027E / 2028E Outlooks represent the midpoints from Talen’s September 9, 2025 Investor Update. The effect of the Freedom and Guernsey acquisitions illustratively begins on January 1, 2026. 3. Approved by Board of Directors on September 8, 2025. 4. Potential upsides are not necessarily additive and will vary depending upon order of execution, capitalization of opportunities, and ability to monetize tax benefits as well as other factors. Note: Per share amounts rounded to nearest $0.10. Potential Upside to 2028 Adj FCF/Share Growth vs ’28 $2 Billion Share Repurchases3 ~10% AWS PPA Accelerated by 480 MWs ~10% Accretive M&A ~10 – 20% New 1 GW Data Center PPA ~10 – 15% Total Potential Upside4 40%+ ✓ >15% Adj FCF / Share Accretion1, 2 $4.00+ $4.00+ Adj FCF/Share2 Adj FCF/Share Accretion from Acquisition1 Transaction Enhances Projected Adj FCF / Share $31.10+ $31.40+

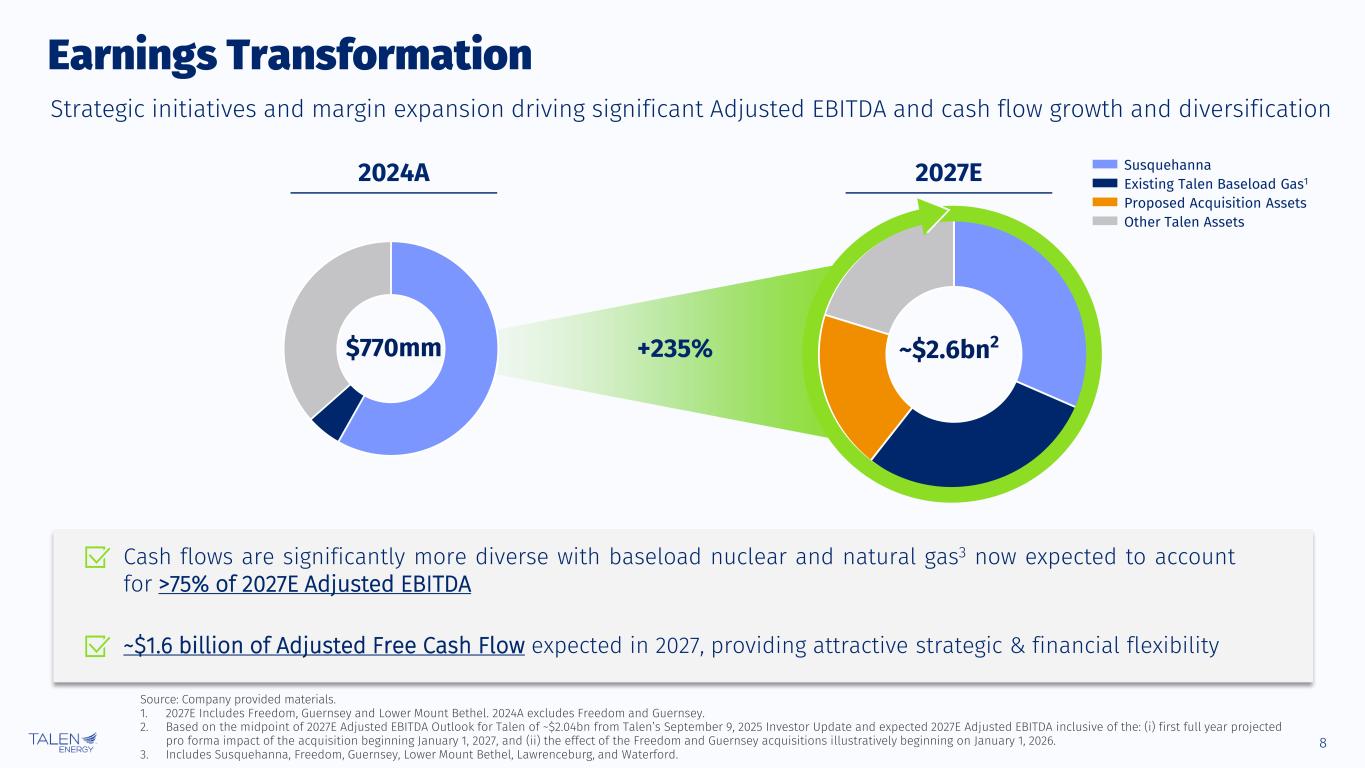

8 Earnings Transformation Cash flows are significantly more diverse with baseload nuclear and natural gas3 now expected to account for >75% of 2027E Adjusted EBITDA ~$1.6 billion of Adjusted Free Cash Flow expected in 2027, providing attractive strategic & financial flexibility Strategic initiatives and margin expansion driving significant Adjusted EBITDA and cash flow growth and diversification +235% ~$2.6bn2$770mm Source: Company provided materials. 1. 2027E Includes Freedom, Guernsey and Lower Mount Bethel. 2024A excludes Freedom and Guernsey. 2. Based on the midpoint of 2027E Adjusted EBITDA Outlook for Talen of ~$2.04bn from Talen’s September 9, 2025 Investor Update and expected 2027E Adjusted EBITDA inclusive of the: (i) first full year projected pro forma impact of the acquisition beginning January 1, 2027, and (ii) the effect of the Freedom and Guernsey acquisitions illustratively beginning on January 1, 2026. 3. Includes Susquehanna, Freedom, Guernsey, Lower Mount Bethel, Lawrenceburg, and Waterford. 2027E2024A Other Talen Assets Susquehanna Existing Talen Baseload Gas1 Proposed Acquisition Assets

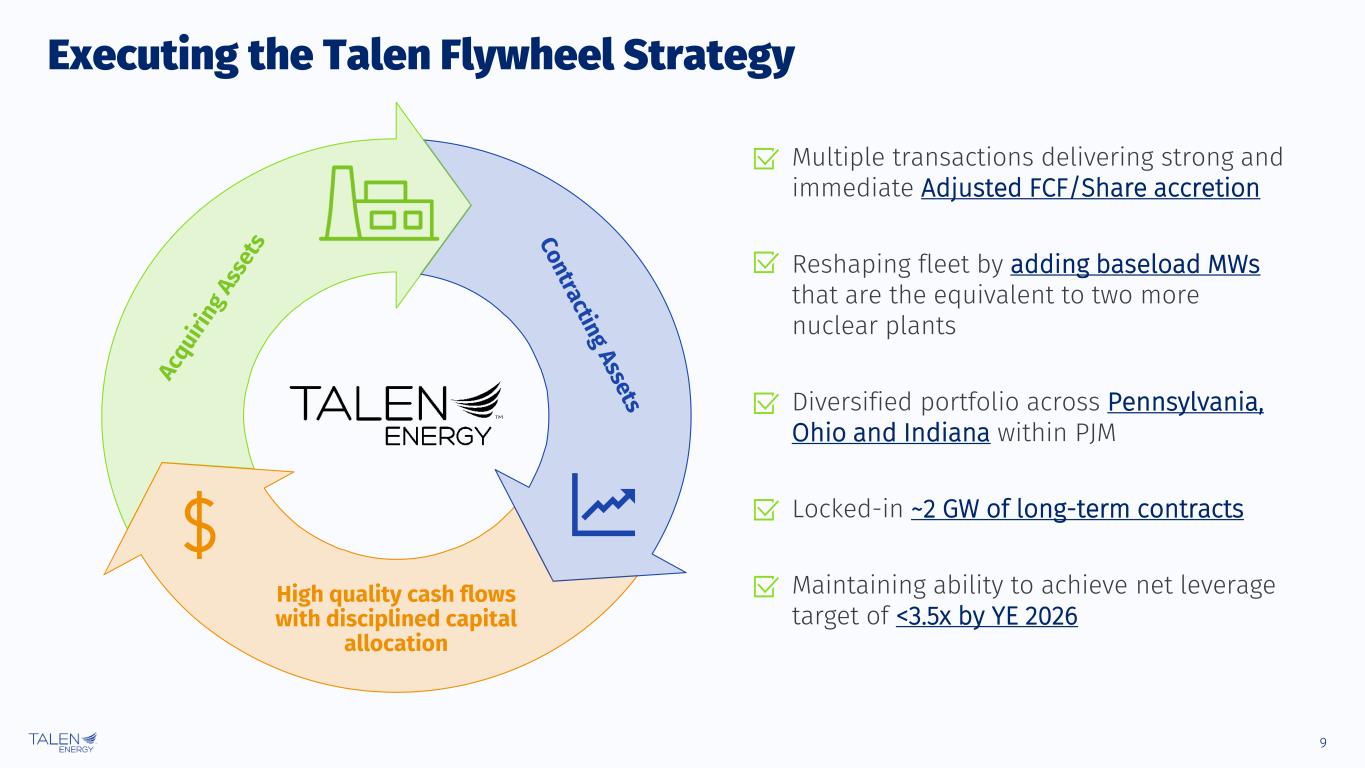

9 High quality cash flows with disciplined capital allocation Executing the Talen Flywheel Strategy Multiple transactions delivering strong and immediate Adjusted FCF/Share accretion Reshaping fleet by adding baseload MWs that are the equivalent to two more nuclear plants Diversified portfolio across Pennsylvania, Ohio and Indiana within PJM Locked-in ~2 GW of long-term contracts Maintaining ability to achieve net leverage target of <3.5x by YE 2026

10 Appendix

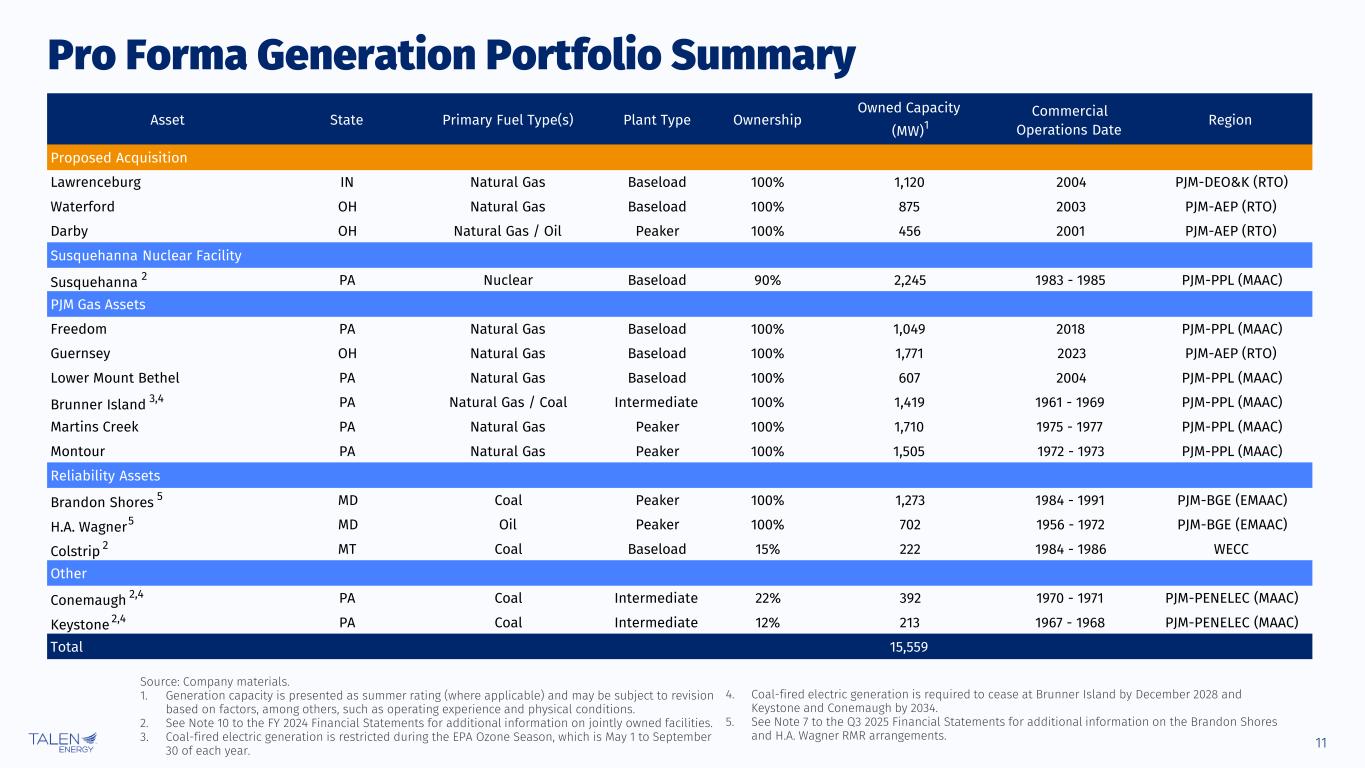

11 4. Coal-fired electric generation is required to cease at Brunner Island by December 2028 and Keystone and Conemaugh by 2034. 5. See Note 7 to the Q3 2025 Financial Statements for additional information on the Brandon Shores and H.A. Wagner RMR arrangements. Source: Company materials. 1. Generation capacity is presented as summer rating (where applicable) and may be subject to revision based on factors, among others, such as operating experience and physical conditions. 2. See Note 10 to the FY 2024 Financial Statements for additional information on jointly owned facilities. 3. Coal-fired electric generation is restricted during the EPA Ozone Season, which is May 1 to September 30 of each year. Pro Forma Generation Portfolio Summary Asset State Primary Fuel Type(s) Plant Type Ownership Owned Capacity (MW)1 Commercial Operations Date Region Proposed Acquisition Lawrenceburg IN Natural Gas Baseload 100% 1,120 2004 PJM-DEO&K (RTO) Waterford OH Natural Gas Baseload 100% 875 2003 PJM-AEP (RTO) Darby OH Natural Gas / Oil Peaker 100% 456 2001 PJM-AEP (RTO) Susquehanna Nuclear Facility Susquehanna 2 PA Nuclear Baseload 90% 2,245 1983 - 1985 PJM-PPL (MAAC) PJM Gas Assets Freedom PA Natural Gas Baseload 100% 1,049 2018 PJM-PPL (MAAC) Guernsey OH Natural Gas Baseload 100% 1,771 2023 PJM-AEP (RTO) Lower Mount Bethel PA Natural Gas Baseload 100% 607 2004 PJM-PPL (MAAC) Brunner Island 3,4 PA Natural Gas / Coal Intermediate 100% 1,419 1961 - 1969 PJM-PPL (MAAC) Martins Creek PA Natural Gas Peaker 100% 1,710 1975 - 1977 PJM-PPL (MAAC) Montour PA Natural Gas Peaker 100% 1,505 1972 - 1973 PJM-PPL (MAAC) Reliability Assets Brandon Shores 5 MD Coal Peaker 100% 1,273 1984 - 1991 PJM-BGE (EMAAC) H.A. Wagner5 MD Oil Peaker 100% 702 1956 - 1972 PJM-BGE (EMAAC) Colstrip 2 MT Coal Baseload 15% 222 1984 - 1986 WECC Other Conemaugh 2,4 PA Coal Intermediate 22% 392 1970 - 1971 PJM-PENELEC (MAAC) Keystone 2,4 PA Coal Intermediate 12% 213 1967 - 1968 PJM-PENELEC (MAAC) Total 15,559

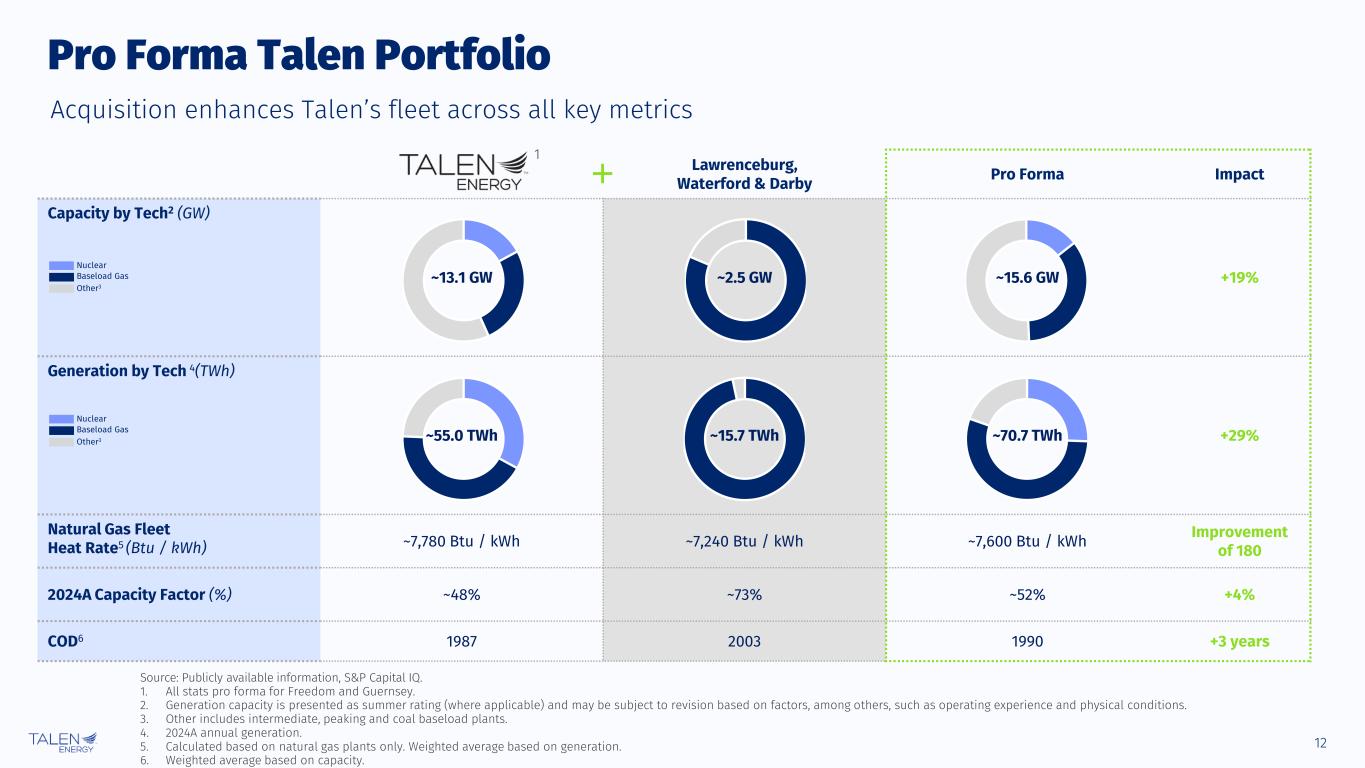

12 Pro Forma Talen Portfolio Source: Publicly available information, S&P Capital IQ. 1. All stats pro forma for Freedom and Guernsey. 2. Generation capacity is presented as summer rating (where applicable) and may be subject to revision based on factors, among others, such as operating experience and physical conditions. 3. Other includes intermediate, peaking and coal baseload plants. 4. 2024A annual generation. 5. Calculated based on natural gas plants only. Weighted average based on generation. 6. Weighted average based on capacity. Lawrenceburg, Waterford & Darby Pro Forma Impact Capacity by Tech2 (GW) ~13.1 GW ~2.5 GW ~15.6 GW +19% Generation by Tech 4(TWh) ~55.0 TWh ~15.7 TWh ~70.7 TWh +29% Natural Gas Fleet Heat Rate5 (Btu / kWh) ~7,780 Btu / kWh ~7,240 Btu / kWh ~7,600 Btu / kWh Improvement of 180 2024A Capacity Factor (%) ~48% ~73% ~52% +4% COD6 1987 2003 1990 +3 years + Other3 Baseload Gas Nuclear 1 Other3 Baseload Gas Nuclear Acquisition enhances Talen’s fleet across all key metrics