POL.LEG.10032 Version: 4.0 Status: Effective Effective Date: 12 Jun 2023 Next Review Date: 11 Jun 2025 Last Review Date: Page 1 of 3 Confidential: Downloaded or Printed Copies are uncontrolled and are for reference only on the date of retrieval or printing. Exhibit 19.1 Indivior PLC Group-Wide Dealing Policy Type Policy Number POL.LEG.10032 Level Global Version 4.0 Geographic Impact Global Effective Date 12 Jun 2023 1 Purpose and Scope This Policy applies to all directors, employees, consultants and contractors of Indivior PLC (the ‘Company’) and its subsidiaries, their respective Immediate Family Members and any entity controlled by a person covered by this Policy. It has been designed to ensure that you do not misuse, or place yourself under suspicion of misusing, information about the Group which you have and which is not public. 2 Principles 2.1 You must not Deal in any Securities of the Group if you are in possession of Inside Information about the Group, other than Dealings made pursuant to a trading plan that complies with Rule 10b5-1 of the Exchange Act. You must also not recommend or encourage someone else to Deal in the Group’s Securities at that time – even if you will not profit from such Dealing. Rule 10b5-1(c) under the Exchange Act of 1934, as amended provides an affirmative defence to a claim of insider trading by providing that a person will not be viewed as having traded on the basis of material non-public information if that person can demonstrate that the transaction was effected pursuant to a written plan (or contract or instruction) that was established before the person became aware of that information. If you are interested in establishing a Rule 10b5-1 plan, please contact the Company Secretary. 2.2 You must not disclose any confidential information about the Group (including any Inside Information) except where you are required to do so as part of your employment or duties and have obtained prior approval. This means that you should not share the Group’s confidential information with family, friends or business acquaintances. 2.3 You may, from time to time, be given access to Inside Information about another group of companies (for example, one of the Group’s customers or suppliers). You must not Deal in the Securities of that group of companies at those times. You must also not recommend or encourage someone else to Deal in the Securities of that group of companies at those times – even if you will not profit from such Dealing.

POL.LEG.10032 Version: 4.0 Status: Effective Effective Date: 12 Jun 2023 Next Review Date: 11 Jun 2025 Last Review Date: Page 2 of 3 Confidential: Downloaded or Printed Copies are uncontrolled and are for reference only on the date of retrieval or printing. Indivior PLC Group-Wide Dealing Policy Effective Date: June 12, 2023 POL.LEG.10032 Version: 4.0 2.4 You may not, directly or indirectly, (a) trade in publicly-traded options, such as puts and calls, and other derivative securities with respect to the Securities of the Group (other than stock options, restricted stock units and other compensatory awards issued to you by the Company) or (b) purchase financial instruments (including prepaid variable forward contracts, equity swaps, collars and exchange funds), or otherwise engage in transactions, that hedge or offset, or are designed to hedge or offset, any decrease in the market value of equity securities either (i) granted to you by the Group as part of your compensation or (ii) held, directly or indirectly, by you. 2.5 You may not hold the Securities of the Group in a margin account or pledge the Securities of the Group as collateral for any loan or as part of any other pledging transaction. 2.6 The Group also operates a Dealing Code which applies to the Company’s directors and to employees who are able to access restricted information about the Group (for example, employees who are involved in the preparation of the Group’s financial reports and those working on other sensitive matters). You will be told if you are required to comply with the Dealing Code. Directors and employees who are required to comply with the Dealing Code must also comply with this Policy. 2.7 Failure to comply with this Policy may result in internal disciplinary action. It may also mean that you have committed a civil and/or criminal offence. 2.8 If you have any questions about this Policy, or if you are not sure whether you can Deal in Securities of the Group at any particular time, please contact the Company Secretary. 3 Glossary For the purposes of this Policy: Deal and Dealing covers any type of transaction in a company’s Securities, including purchases, sales, donating/gifting and the exercise of options but excludes any sell to cover transactions approved by the Board of Directors (or duly appointed Committee of the Board) ] to the extent the withholding is non-discretionary and approved and implemented by the Company, where shares are withheld by the Company upon vesting of equity awards and sold in order to satisfy tax withholding requirements; however, this exception does not apply to any other market sale for the purposes of paying required withholding. Exchange Act means the U.S. Securities and Exchange Act of 1934, as amended. the Group means the Company and its subsidiaries. Immediate Family Member means family members who reside with you including any child/stepchild, child/stepchild away at college, parent, stepparent, spouse, domestic

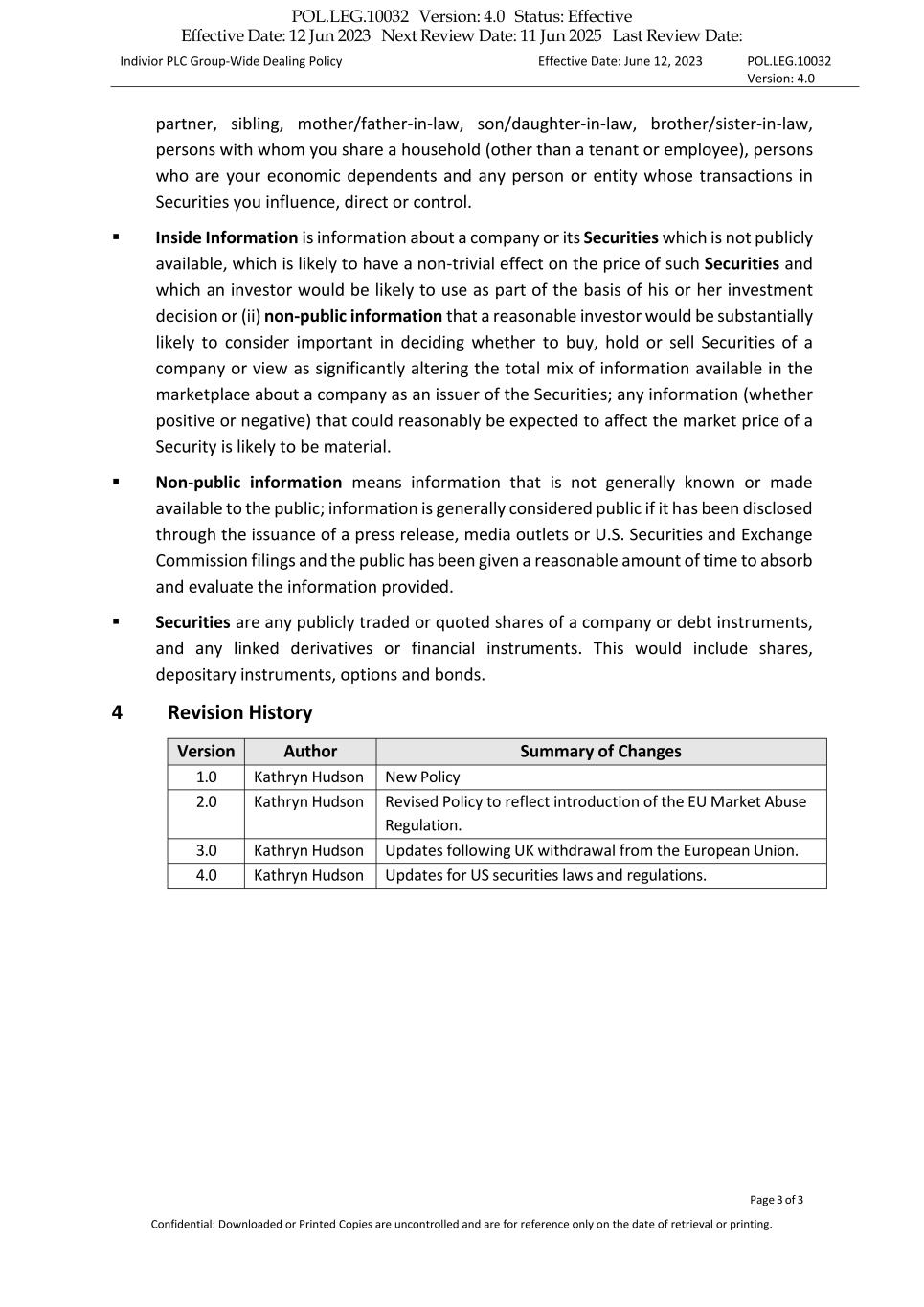

POL.LEG.10032 Version: 4.0 Status: Effective Effective Date: 12 Jun 2023 Next Review Date: 11 Jun 2025 Last Review Date: Indivior PLC Group-Wide Dealing Policy Effective Date: June 12, 2023 POL.LEG.10032 Version: 4.0 partner, sibling, mother/father-in-law, son/daughter-in-law, brother/sister-in-law, persons with whom you share a household (other than a tenant or employee), persons who are your economic dependents and any person or entity whose transactions in Securities you influence, direct or control. Inside Information is information about a company or its Securities which is not publicly available, which is likely to have a non-trivial effect on the price of such Securities and which an investor would be likely to use as part of the basis of his or her investment decision or (ii) non-public information that a reasonable investor would be substantially likely to consider important in deciding whether to buy, hold or sell Securities of a company or view as significantly altering the total mix of information available in the marketplace about a company as an issuer of the Securities; any information (whether positive or negative) that could reasonably be expected to affect the market price of a Security is likely to be material. Non-public information means information that is not generally known or made available to the public; information is generally considered public if it has been disclosed through the issuance of a press release, media outlets or U.S. Securities and Exchange Commission filings and the public has been given a reasonable amount of time to absorb and evaluate the information provided. Securities are any publicly traded or quoted shares of a company or debt instruments, and any linked derivatives or financial instruments. This would include shares, depositary instruments, options and bonds. 4 Revision History Version Author Summary of Changes 1.0 Kathryn Hudson New Policy 2.0 Kathryn Hudson Revised Policy to reflect introduction of the EU Market Abuse Regulation. 3.0 Kathryn Hudson Updates following UK withdrawal from the European Union. 4.0 Kathryn Hudson Updates for US securities laws and regulations. Page 3 of 3 Confidential: Downloaded or Printed Copies are uncontrolled and are for reference only on the date of retrieval or printing.

POL.LEG.10032 Version: 4.0 Status: Effective Effective Date: 12 Jun 2023 Next Review Date: 11 Jun 2025 Last Review Date: Document Approvals Approved Date: 07 Jun 2023 Approval Task Adiah Reid, Verdict: Approve (adiah.reid@indivior.com) Legal Approver 07-Jun-2023 15:04:12 GMT+0000