POL.LEG.10031 Version: 5.0 Status: Effective Effective Date: 12 Jun 2023 Next Review Date: 11 Jun 2025 Last Review Date: Page 1 of 11 Confidential: Downloaded or Printed Copies are uncontrolled and are for reference only on the date of retrieval or printing. Exhibit 19.2 Indivior PLC Dealing Code Type Policy Number POL.LEG.10031 Level Global Version 5.0 Geographic Impact Global Effective Date 12 Jun 2023 1 Purpose The purpose of this Code is to ensure that the directors of Indivior PLC (the ‘Company’), and certain employees of the Company and its subsidiaries, do not abuse, and do not place themselves under suspicion of abusing, Inside Information and comply with their obligations under the Market Abuse Regulation, U.S. federal insider trading laws and regulations (including judicial interpretations) and other applicable law. 2 Scope Part A of this Code contains the Clearance to Deal (‘Clearance’) procedures which must be observed by the Company’s PDMRs and those employees who have been told that the Clearance procedures apply to them (collectively referred to as ‘Restricted Persons’). This means that there will be certain times when such persons cannot Deal in Company Securities. Part B sets out certain additional obligations which only apply to PDMRs. Failure by any person who is subject to this Code to observe and comply with its requirements may result in disciplinary action. Depending on the circumstances, such non-compliance may also constitute a civil and/or criminal offence. Schedule 1 sets out the meaning of capitalized words used in this Code. 3 Part A – Clearance Procedures 3.1 Clearance 3.1.1 You must not Deal for yourself or for anyone else, directly or indirectly, in Company Securities without obtaining Clearance from the Company in advance. 3.1.2 Applications for Clearance may be submitted to the Company Secretary using the electronic Clearance to Deal form in the Clearance to Deal section of the Indivior Insider Portal. Alternatively, you may submit your request for Clearance in writing using the form set out in Schedule 2.

POL.LEG.10031 Version: 5.0 Status: Effective Effective Date: 12 Jun 2023 Next Review Date: 11 Jun 2025 Last Review Date: Page 2 of 11 Confidential: Downloaded or Printed Copies are uncontrolled and are for reference only on the date of retrieval or printing. 3.1.3 You must not submit an application for Clearance if you are in possession of Inside Information. If you become aware that you are, or may be, in possession of Inside Information after you submit an application, you must inform the Company Secretary as soon as possible and you must refrain from Dealing (even if you have been given Clearance). 3.1.4 You will receive a response to your application for Clearance within five business days. The Company will not normally give you reasons if you are refused permission to Deal. You must keep any refusal confidential and not discuss it with any other person. 3.1.5 If you are given Clearance, you must Deal as soon as possible and in any event within two business days of receiving Clearance. 3.1.6 Clearance may be given subject to conditions. Where this is the case, you must observe those conditions when Dealing. 3.1.7 You must submit your transaction details as soon as possible and in any event by the end of the business day following the transaction date. You may do this via the Indivior Insider Portal or, alternatively, you may notify the Company Secretary using the template in Schedule 3. 3.1.8 You must not enter into, amend or cancel a Trading Plan or an Investment Program under which Company Securities may be purchased or sold unless Clearance has been given to do so. 3.1.9 Different Clearance procedures will apply where Dealing is being carried out by the Company in relation to an employee share plan (e.g. if shares are receivable by you upon a vesting under the Indivior Long-Term Incentive Plan). You will be notified separately of any arrangements for Clearance if this applies to you. 3.1.10 If you act as the trustee of a trust, you should speak to the Company Secretary about your obligations in respect of any Dealing in Company Securities carried out by the trustee(s) of that trust. 3.1.11 You should seek further guidance from the Company Secretary before transacting in: (A) units or shares in a collective investment undertaking (e.g. a UCITS or an Alternative Investment Fund) which holds, or might hold, Company Securities; or (B) financial instruments which provide exposure to a portfolio of assets which has, or may have, an exposure to Company Securities. This is the case even if you do not intend to transact in Company Securities by making the relevant investment.

POL.LEG.10031 Version: 5.0 Status: Effective Effective Date: 12 Jun 2023 Next Review Date: 11 Jun 2025 Last Review Date: Page 3 of 11 Confidential: Downloaded or Printed Copies are uncontrolled and are for reference only on the date of retrieval or printing. Indivior PLC Dealing Code Effective Date: June 12, 2023 POL.LEG.10031 Version: 5.0 3.2 Further Guidance If you are uncertain as to whether or not a particular transaction requires Clearance, you must obtain guidance from the Company Secretary before carrying out that transaction. 4 Part B – Additional Provisions for PDMRs 4.1 Circumstances for refusal You will not ordinarily be given Clearance to Deal in Company Securities during any period when there exists any matter which constitutes Inside Information or during a Closed Period. 4.2 Notification of transactions 4.2.1 You must notify the Company and the FCA in writing of every Notifiable Transaction in Company Securities conducted for your account. (A) Notifications to the Company may be made via the Indivior Insider Portal and should be reported as soon as practicable and in any event by the end of the business day following the transaction date. Alternatively, you may notify the Company Secretary using the template in Schedule 3. You should ensure that your investment managers (whether discretionary or not) notify you of any Notifiable Transactions conducted on your behalf promptly so as to allow you to notify the Company within this time frame. (B) Notifications to the FCA must be made within three business days of the transaction date. A copy of the notification form is available on the FCA’s website. If you would like, the Company Secretary can assist you with this notification, provided that you ask him or her to do so by the end of the business day following the transaction date. 4.2.2 If you are uncertain as to whether or not a particular transaction is a Notifiable Transaction, you must obtain guidance from the Company Secretary. 4.3 PCAs and Investment Managers 4.3.1 You must provide the Company with a list of your PCAs and notify the Company of any changes that need to be made to that list. 4.3.2 You should ask your PCAs not to Deal (whether directly or through an investment manager) in Company Securities during Closed Periods and not to Deal on considerations of a short-term nature. A sale of Company Securities which were

POL.LEG.10031 Version: 5.0 Status: Effective Effective Date: 12 Jun 2023 Next Review Date: 11 Jun 2025 Last Review Date: Page 4 of 11 Confidential: Downloaded or Printed Copies are uncontrolled and are for reference only on the date of retrieval or printing. Indivior PLC Dealing Code Effective Date: June 12, 2023 POL.LEG.10031 Version: 5.0 acquired less than a year previously will be considered to be a Dealing of a short- term nature. 4.3.3 Your PCAs are also required to notify the Company and the FCA, within the time frames given in paragraph 4.2.1, of every Notifiable Transaction conducted for their account. You should inform your PCAs in writing of this requirement and keep a copy; the Company Secretary will provide you with a letter that you can use to do this. If your PCAs would like, the Company Secretary can assist them with the notification to the FCA, provided that your PCA asks the Company Secretary to do so by the end of the business day following the transaction date. 4.3.4 You should ask your investment managers (whether or not discretionary) not to Deal in Company Securities on your behalf during Closed Periods. 4.4 Compliance with U.S. Federal Securities Laws 4.4.1 If you are a director or member of the Company’s Executive Committee, (i) any sale of your Company Securities within the U.S. must comply with Rule 144 under the Securities Act, including the volume limit, manner of sale and notice requirements under Rule 144(e), (f) and (h) and (ii) any sale of your Company Securities outside the U.S. must comply with Regulation S under the Securities Act or another exemption from the registration requirements of the Securities Act.

POL.LEG.10031 Version: 5.0 Status: Effective Effective Date: 12 Jun 2023 Next Review Date: 11 Jun 2025 Last Review Date: Page 5 of 11 Confidential: Downloaded or Printed Copies are uncontrolled and are for reference only on the date of retrieval or printing. Indivior PLC Dealing Code Effective Date: June 12, 2023 POL.LEG.10031 Version: 5.0 Schedule 1 – Defined Terms Closed Period means any of the following: (A) the period from 10 days prior to the end of the relevant financial year up to the start of the second full trading day on the London Stock Exchange and the Nasdaq Stock Market following the release of the preliminary announcement of the Company’s annual results; and (B) the period from 10 days prior to the end of the relevant financial period up to the start of the second full trading day on the London Stock Exchange and the Nasdaq Stock Market following the release of the Company’s first quarter financial results, half-yearly financial report or third quarter financial results, as applicable. Company Securities means any publicly traded or quoted shares or debt instruments of the Company (or of any of the Company’s subsidiaries or subsidiary undertakings) or derivatives or other financial instruments linked to any of them, including phantom options. Dealing (together with corresponding terms such as Deal and Deals) means any type of transaction in Company Securities, including purchases, sales, donating/gifting, the exercise of options, the receipt of shares under share plans, and entering into, amending or terminating any agreement in relation to Company Securities (e.g. a Trading Plan). Exchange Act means the U.S. Securities and Exchange Act of 1934, as amended. FCA means the UK Financial Conduct Authority. Inside Information means either (i) information which relates to the Company or any Company Securities, which is not publicly available, which is likely to have a non-trivial effect on the price of Company Securities and which an investor would be likely to use as part of the basis of his or her investment decision or (ii) non-public information that a reasonable investor would be substantially likely to consider important in deciding whether to buy, hold or sell Company Securities or view as significantly altering the total mix of information available in the marketplace about the Company as an issuer of the securities; any information (whether positive or negative) that could reasonably be expected to affect the market price of a Company Security is likely to be material. Investment Program means a share acquisition scheme relating only to the Company’s shares under which: (a) shares are purchased by a Restricted Person pursuant to a regular standing order or direct debit or by regular deduction from the person’s salary or director’s fees, provided such scheme complies with the requirements of Rule 10b5-1 under the Exchange Act; or (b) shares are acquired by a Restricted Person by way of a standing election to re-invest dividends or other distributions received; or (c) shares are acquired as part payment of a Restricted Person’s remuneration or director’s fees. Market Abuse Regulation means the UK Market Abuse Regulation. Non-public information means information that is not generally known or made available to the public; information is generally considered public if it has been disclosed through the issuance of a press release, media outlets or U.S. Securities and Exchange Commission filings and the public has been given a reasonable amount of time to absorb and evaluate the information provided.

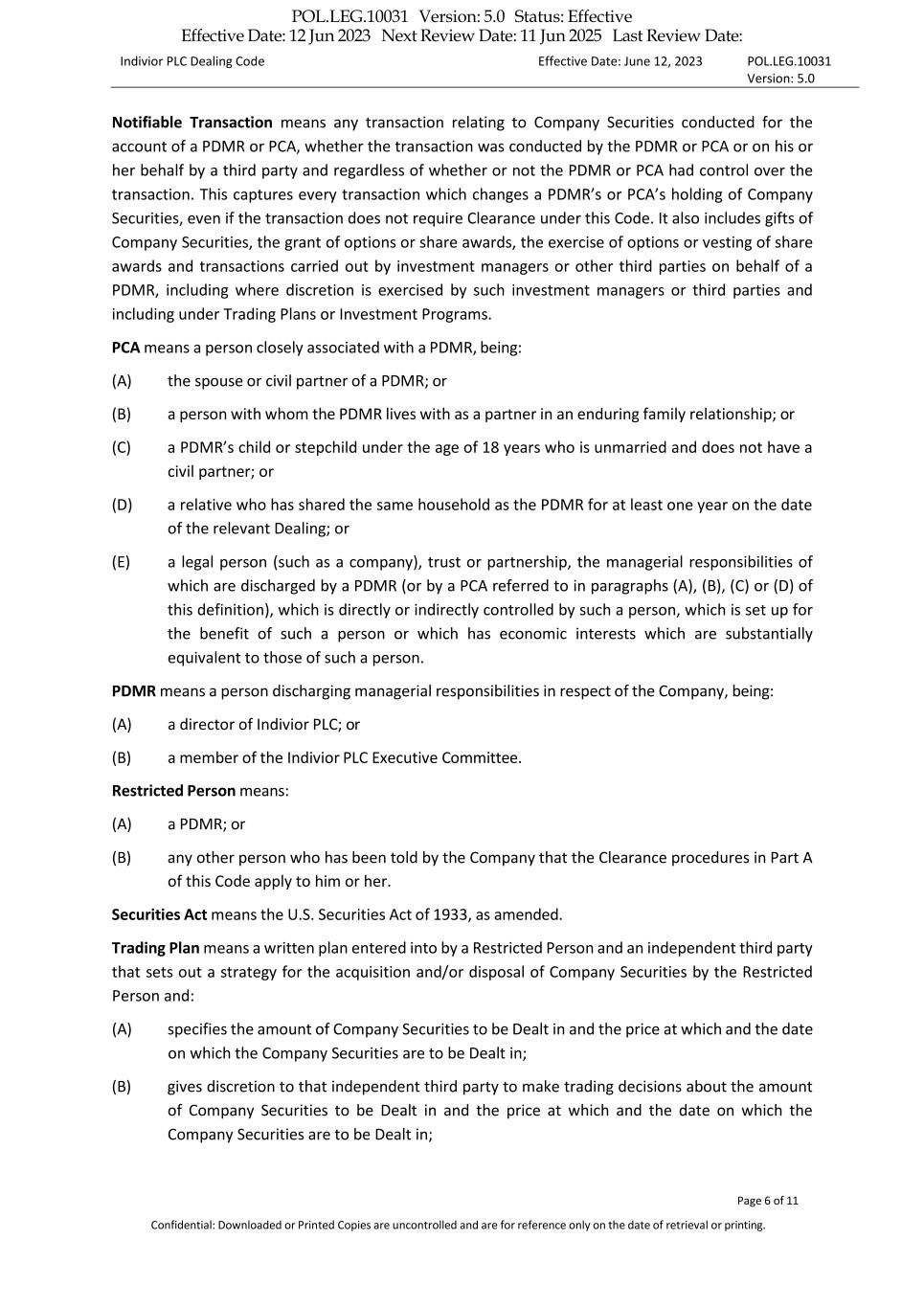

POL.LEG.10031 Version: 5.0 Status: Effective Effective Date: 12 Jun 2023 Next Review Date: 11 Jun 2025 Last Review Date: Page 6 of 11 Confidential: Downloaded or Printed Copies are uncontrolled and are for reference only on the date of retrieval or printing. Indivior PLC Dealing Code Effective Date: June 12, 2023 POL.LEG.10031 Version: 5.0 Notifiable Transaction means any transaction relating to Company Securities conducted for the account of a PDMR or PCA, whether the transaction was conducted by the PDMR or PCA or on his or her behalf by a third party and regardless of whether or not the PDMR or PCA had control over the transaction. This captures every transaction which changes a PDMR’s or PCA’s holding of Company Securities, even if the transaction does not require Clearance under this Code. It also includes gifts of Company Securities, the grant of options or share awards, the exercise of options or vesting of share awards and transactions carried out by investment managers or other third parties on behalf of a PDMR, including where discretion is exercised by such investment managers or third parties and including under Trading Plans or Investment Programs. PCA means a person closely associated with a PDMR, being: (A) the spouse or civil partner of a PDMR; or (B) a person with whom the PDMR lives with as a partner in an enduring family relationship; or (C) a PDMR’s child or stepchild under the age of 18 years who is unmarried and does not have a civil partner; or (D) a relative who has shared the same household as the PDMR for at least one year on the date of the relevant Dealing; or (E) a legal person (such as a company), trust or partnership, the managerial responsibilities of which are discharged by a PDMR (or by a PCA referred to in paragraphs (A), (B), (C) or (D) of this definition), which is directly or indirectly controlled by such a person, which is set up for the benefit of such a person or which has economic interests which are substantially equivalent to those of such a person. PDMR means a person discharging managerial responsibilities in respect of the Company, being: (A) a director of Indivior PLC; or (B) a member of the Indivior PLC Executive Committee. Restricted Person means: (A) a PDMR; or (B) any other person who has been told by the Company that the Clearance procedures in Part A of this Code apply to him or her. Securities Act means the U.S. Securities Act of 1933, as amended. Trading Plan means a written plan entered into by a Restricted Person and an independent third party that sets out a strategy for the acquisition and/or disposal of Company Securities by the Restricted Person and: (A) specifies the amount of Company Securities to be Dealt in and the price at which and the date on which the Company Securities are to be Dealt in; (B) gives discretion to that independent third party to make trading decisions about the amount of Company Securities to be Dealt in and the price at which and the date on which the Company Securities are to be Dealt in;

POL.LEG.10031 Version: 5.0 Status: Effective Effective Date: 12 Jun 2023 Next Review Date: 11 Jun 2025 Last Review Date: Page 7 of 11 Confidential: Downloaded or Printed Copies are uncontrolled and are for reference only on the date of retrieval or printing. Indivior PLC Dealing Code Effective Date: June 12, 2023 POL.LEG.10031 Version: 5.0 (C) includes a method for determining the amount of Company Securities to be Dealt in and the price at which and the date on which the Company Securities are to be Dealt in; and (D) complies with the requirements of Rule 10b5-1 under the Exchange Act.

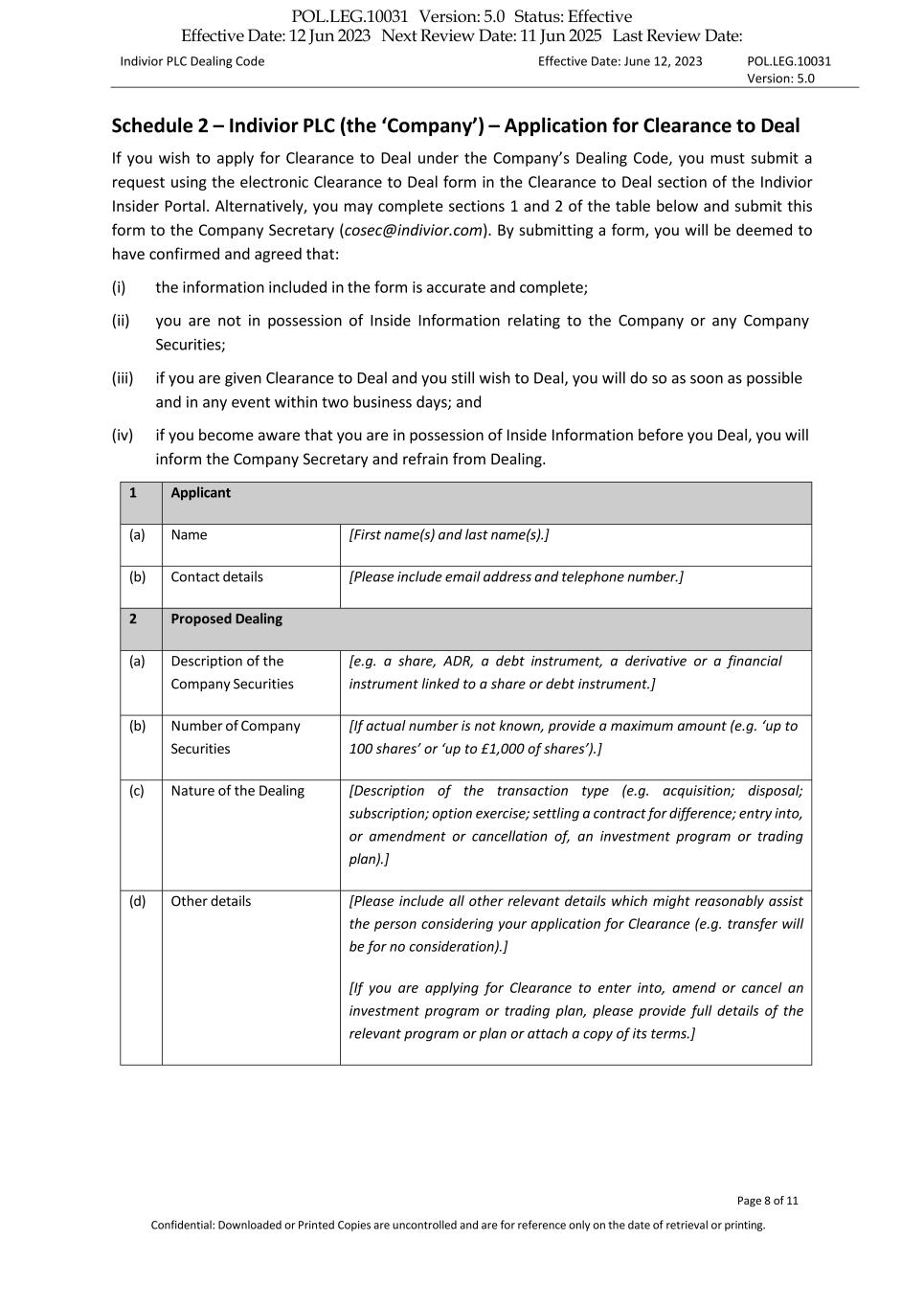

POL.LEG.10031 Version: 5.0 Status: Effective Effective Date: 12 Jun 2023 Next Review Date: 11 Jun 2025 Last Review Date: Page 8 of 11 Confidential: Downloaded or Printed Copies are uncontrolled and are for reference only on the date of retrieval or printing. Indivior PLC Dealing Code Effective Date: June 12, 2023 POL.LEG.10031 Version: 5.0 Schedule 2 – Indivior PLC (the ‘Company’) – Application for Clearance to Deal If you wish to apply for Clearance to Deal under the Company’s Dealing Code, you must submit a request using the electronic Clearance to Deal form in the Clearance to Deal section of the Indivior Insider Portal. Alternatively, you may complete sections 1 and 2 of the table below and submit this form to the Company Secretary (cosec@indivior.com). By submitting a form, you will be deemed to have confirmed and agreed that: (i) the information included in the form is accurate and complete; (ii) you are not in possession of Inside Information relating to the Company or any Company Securities; (iii) if you are given Clearance to Deal and you still wish to Deal, you will do so as soon as possible and in any event within two business days; and (iv) if you become aware that you are in possession of Inside Information before you Deal, you will inform the Company Secretary and refrain from Dealing. 1 Applicant (a) Name [First name(s) and last name(s).] (b) Contact details [Please include email address and telephone number.] 2 Proposed Dealing (a) Description of the Company Securities [e.g. a share, ADR, a debt instrument, a derivative or a financial instrument linked to a share or debt instrument.] (b) Number of Company Securities [If actual number is not known, provide a maximum amount (e.g. ‘up to 100 shares’ or ‘up to £1,000 of shares’).] (c) Nature of the Dealing [Description of the transaction type (e.g. acquisition; disposal; subscription; option exercise; settling a contract for difference; entry into, or amendment or cancellation of, an investment program or trading plan).] (d) Other details [Please include all other relevant details which might reasonably assist the person considering your application for Clearance (e.g. transfer will be for no consideration).] [If you are applying for Clearance to enter into, amend or cancel an investment program or trading plan, please provide full details of the relevant program or plan or attach a copy of its terms.]

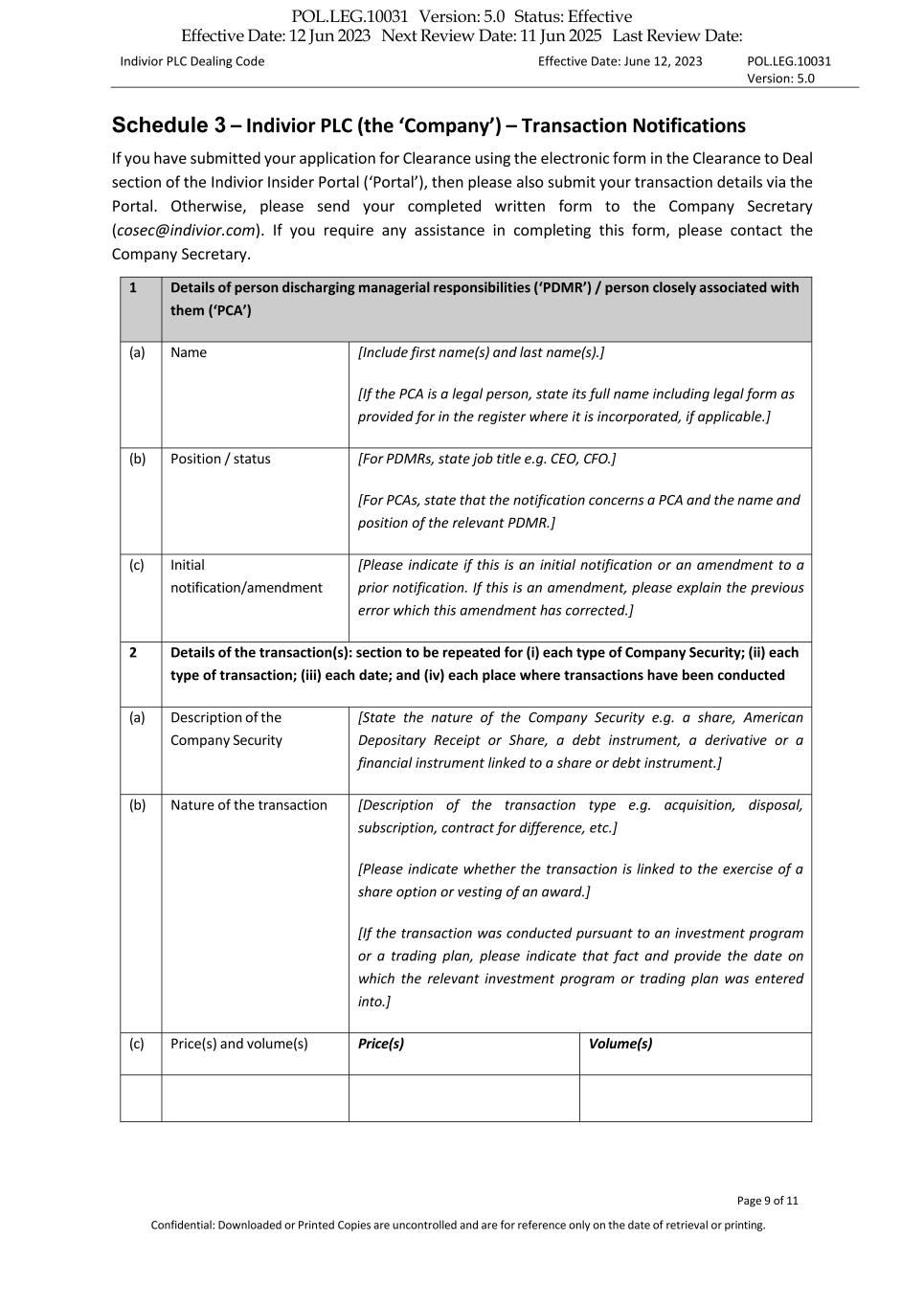

POL.LEG.10031 Version: 5.0 Status: Effective Effective Date: 12 Jun 2023 Next Review Date: 11 Jun 2025 Last Review Date: Page 9 of 11 Confidential: Downloaded or Printed Copies are uncontrolled and are for reference only on the date of retrieval or printing. Indivior PLC Dealing Code Effective Date: June 12, 2023 POL.LEG.10031 Version: 5.0 Schedule 3 – Indivior PLC (the ‘Company’) – Transaction Notifications If you have submitted your application for Clearance using the electronic form in the Clearance to Deal section of the Indivior Insider Portal (‘Portal’), then please also submit your transaction details via the Portal. Otherwise, please send your completed written form to the Company Secretary (cosec@indivior.com). If you require any assistance in completing this form, please contact the Company Secretary. 1 Details of person discharging managerial responsibilities (‘PDMR’) / person closely associated with them (‘PCA’) (a) Name [Include first name(s) and last name(s).] [If the PCA is a legal person, state its full name including legal form as provided for in the register where it is incorporated, if applicable.] (b) Position / status [For PDMRs, state job title e.g. CEO, CFO.] [For PCAs, state that the notification concerns a PCA and the name and position of the relevant PDMR.] (c) Initial notification/amendment [Please indicate if this is an initial notification or an amendment to a prior notification. If this is an amendment, please explain the previous error which this amendment has corrected.] 2 Details of the transaction(s): section to be repeated for (i) each type of Company Security; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted (a) Description of the Company Security [State the nature of the Company Security e.g. a share, American Depositary Receipt or Share, a debt instrument, a derivative or a financial instrument linked to a share or debt instrument.] (b) Nature of the transaction [Description of the transaction type e.g. acquisition, disposal, subscription, contract for difference, etc.] [Please indicate whether the transaction is linked to the exercise of a share option or vesting of an award.] [If the transaction was conducted pursuant to an investment program or a trading plan, please indicate that fact and provide the date on which the relevant investment program or trading plan was entered into.] (c) Price(s) and volume(s) Price(s) Volume(s)

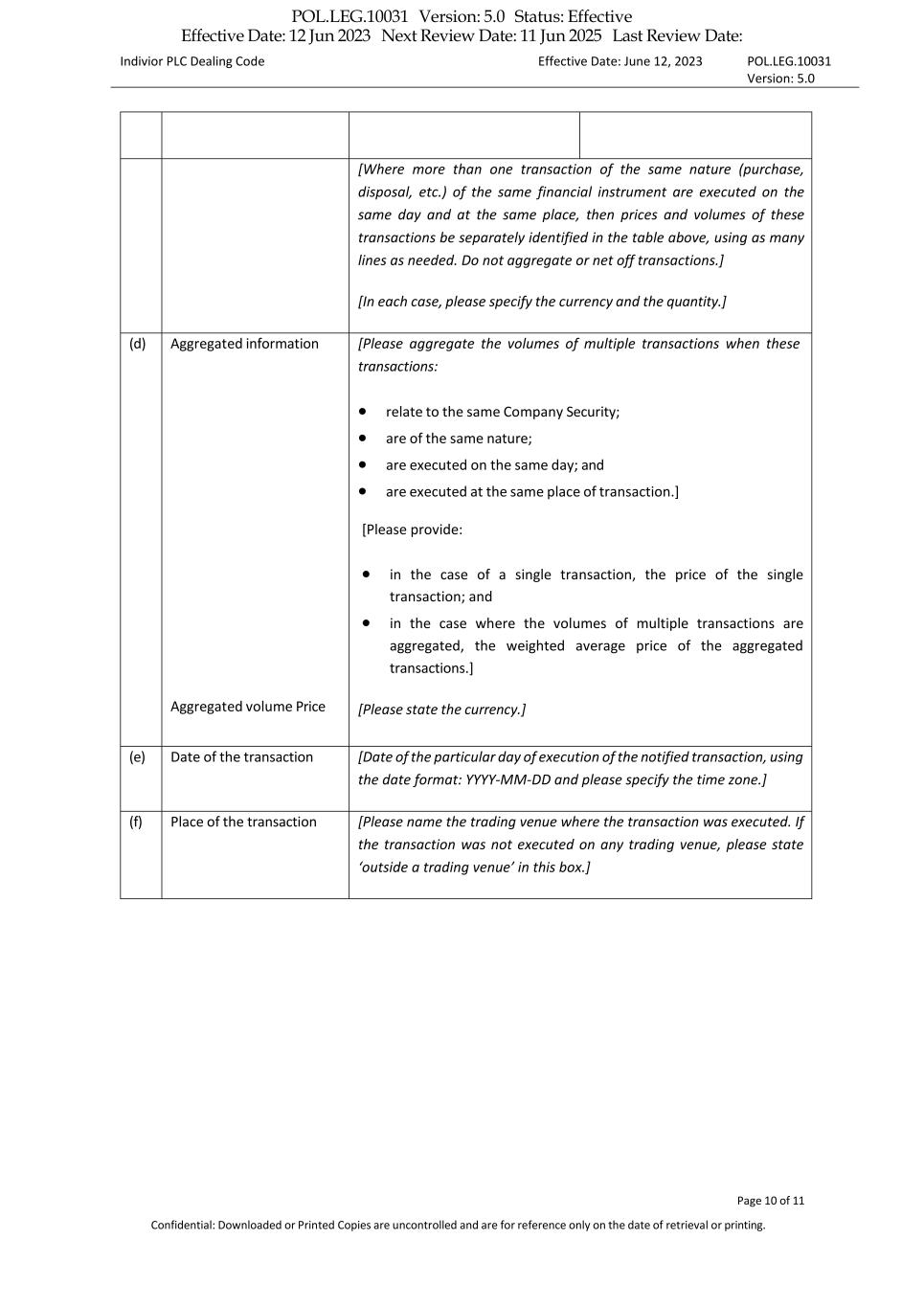

POL.LEG.10031 Version: 5.0 Status: Effective Effective Date: 12 Jun 2023 Next Review Date: 11 Jun 2025 Last Review Date: Page 10 of 11 Confidential: Downloaded or Printed Copies are uncontrolled and are for reference only on the date of retrieval or printing. Indivior PLC Dealing Code Effective Date: June 12, 2023 POL.LEG.10031 Version: 5.0 [Where more than one transaction of the same nature (purchase, disposal, etc.) of the same financial instrument are executed on the same day and at the same place, then prices and volumes of these transactions be separately identified in the table above, using as many lines as needed. Do not aggregate or net off transactions.] [In each case, please specify the currency and the quantity.] (d) Aggregated information Aggregated volume Price [Please aggregate the volumes of multiple transactions when these transactions: • relate to the same Company Security; • are of the same nature; • are executed on the same day; and • are executed at the same place of transaction.] [Please provide: • in the case of a single transaction, the price of the single transaction; and • in the case where the volumes of multiple transactions are aggregated, the weighted average price of the aggregated transactions.] [Please state the currency.] (e) Date of the transaction [Date of the particular day of execution of the notified transaction, using the date format: YYYY-MM-DD and please specify the time zone.] (f) Place of the transaction [Please name the trading venue where the transaction was executed. If the transaction was not executed on any trading venue, please state ‘outside a trading venue’ in this box.]

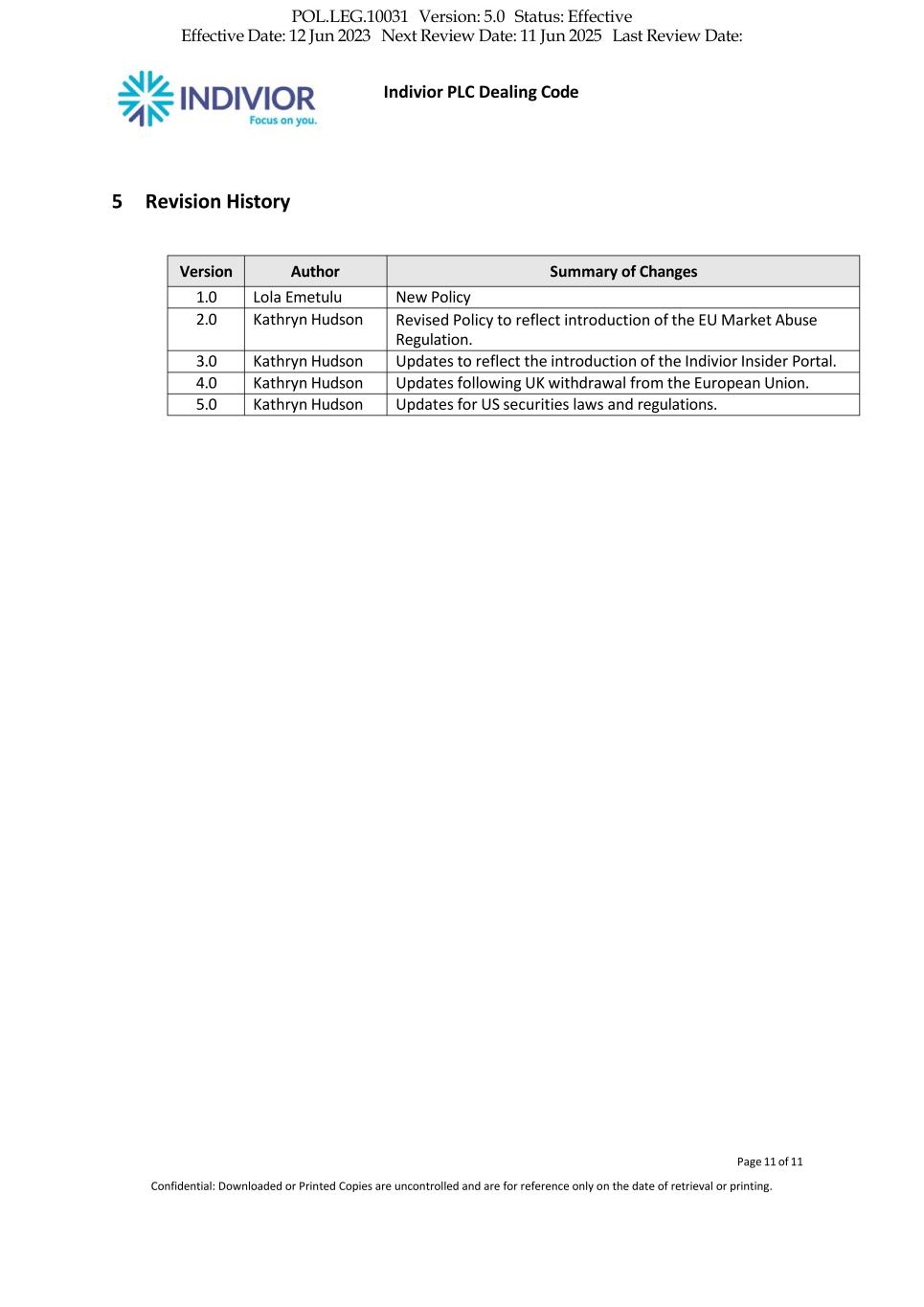

POL.LEG.10031 Version: 5.0 Status: Effective Effective Date: 12 Jun 2023 Next Review Date: 11 Jun 2025 Last Review Date: 5 Revision History Indivior PLC Dealing Code Version Author Summary of Changes 1.0 Lola Emetulu New Policy 2.0 Kathryn Hudson Revised Policy to reflect introduction of the EU Market Abuse Regulation. 3.0 Kathryn Hudson Updates to reflect the introduction of the Indivior Insider Portal. 4.0 Kathryn Hudson Updates following UK withdrawal from the European Union. 5.0 Kathryn Hudson Updates for US securities laws and regulations. Page 11 of 11 Confidential: Downloaded or Printed Copies are uncontrolled and are for reference only on the date of retrieval or printing.

POL.LEG.10031 Version: 5.0 Status: Effective Effective Date: 12 Jun 2023 Next Review Date: 11 Jun 2025 Last Review Date: Document Approvals Approved Date: 07 Jun 2023 Approval Task Adiah Reid, Verdict: Approve (adiah.reid@indivior.com) Legal Approver 07-Jun-2023 15:05:42 GMT+0000