EUROPE-LEGAL-282811198/3 168111-0003 Indivior PLC Malus & Clawback Policy Approved by the Remuneration Committee on February 20, 2024 and adopted with effect from May 9, 2024 1. Introduction 1.1 The Remuneration Committee of the Board of Directors (the Committee) of Indivior PLC (the Company) has adopted this Malus & Clawback Policy (the Policy). This Policy sets out the principles to be applied across the Company, its subsidiaries, and any other company which is associated with the Company and designated by the Committee (the Group) regarding the adjustment and/or clawback of compensation. 1.2 This Policy applies to any awards over or related to shares in the Company (Shares) (including but not limited to options, conditional awards and free shares), phantom awards, cash bonus awards, and any other form of variable compensation (Awards) as the Committee may determine as being the subject to the Policy in the relevant award certificate or such other communication to the relevant individual. 1.3 The Policy is effective from the date set out above, and applies to all Awards granted on or after such date, unless otherwise specified. 1.4 The Policy shall be administered by the Committee and may be amended by the Committee from time to time as it deems necessary. The Committee is authorised to interpret and construe this Policy and to make all determinations necessary, appropriate, or advisable for the administration of this Policy. Any determination made by the Committee shall be final, conclusive and binding on all interested parties. 2. Long Term Incentive Plan Paragraph 2 applies to any Award granted under the Company’s 2024 Long Term Incentive Plan. Triggers 2.1 Paragraph 2 applies in circumstances where the Committee has determined, in its absolute discretion, that there is a Trigger Event. A Trigger Event is: • (having taken advice from the Company’s auditors) a material misstatement of the Company’s or Group’s results; or • at any time during the individual’s employment, serious misconduct by that individual; or • serious reputational damage to any member of the Group. Malus 2.2 Paragraph 2.3 applies in respect of any Award that: • is unvested, vested but remains subject to a holding period, or vested but remains unexercised; and Exhibit 97.1

EUROPE-LEGAL-282811198/3 168111-0003 • relates to the same vesting or performance period (either wholly or partly) as the period in relation to which a Trigger Event has occurred. 2.3 In case of a Trigger Event, the Committee may, to the extent that it considers appropriate (taking account of the extent of the relevant misstatement, misconduct, or reputational damage) determine in its absolute discretion that any of the following actions may be undertaken: (i) the number of Shares or cash amount subject to such Award may be adjusted in such manner as the Committee considers appropriate; or (ii) the Award shall lapse with immediate effect; or (iii) the relevant performance period may be extended and performance targets adjusted; or (iv) the exercise period (if applicable) may be deferred. Clawback 2.4 Paragraphs 2.5 and 2.6 apply in respect of any Award that has vested, been exercised (if applicable) and is no longer subject to a holding period (if applicable). 2.5 If a Trigger Event occurs before the later of (i) the second anniversary of the date on which the Award vests (or is no longer subject to the holding period, if applicable), and (ii) the fifth anniversary of the grant date, then the Committee may, to the extent that it considers appropriate (taking account of the extent of the relevant misconduct, misstatement, or reputational damage), determine in its absolute discretion that the relevant individual must by way of clawback repay to the Company or Member of the Group such amount as the Committee may determine in cash or transfer to the Company such number of Shares as the Committee may determine, in each case taking account of the number of Shares which were comprised in the relevant Award and their value or the cash amount paid in respect of the Award (net of any tax and/or social security contributions paid by the individual which is not refundable). 2.6 Following such determination under paragraph 2.5 above, the Committee may, in each case, to the extent permitted under applicable law: (i) make a reduction of an equivalent amount to: (A) any unvested Awards which the individual may have under any employee share scheme or any other incentive arrangements operated by the Company; and/or (B) any future bonus payment which would otherwise have been payable to the individual; and/or (C) any salary payments or other remuneration which are due or would otherwise have been payable to the individual, and/or (ii) require the relevant individual to repay to the Company an equivalent amount or to transfer a specified number of Shares to the Company within such period as it determines, and/or

EUROPE-LEGAL-282811198/3 168111-0003 (iii) in respect of any Awards that remain subject to a holding period, or have not otherwise been vested, exercised or paid, to reduce the number of Shares or cash amount subject to the Award or cancel the Award in its entirety. 3. Deferred Bonus Plan Paragraph 3 applies to any Award granted under the Company’s 2018 Deferred Bonus Plan. 3.1 Paragraph 3 applies in circumstances where the Committee has determined, in its absolute discretion, that there is a Trigger Event. A Trigger Event is: • (having taken advice from the Company’s auditors) a material misstatement of the Company’s or Group’s results in respect of the relevant bonus year; or • at any time during the individual’s employment, serious misconduct by that individual; or • serious reputational damage to any member of the Group whether during or after the relevant bonus year. Malus 3.2 Paragraph 3.3 applies in respect of any Award that is unvested, or vested but remains unexercised. 3.3 In case of a Trigger Event, the Committee may, to the extent that it considers appropriate (taking account of the extent of the relevant misstatement, misconduct, or reputational damage) determine in its absolute discretion that any of the following actions may be undertaken: (i) the number of Shares or notional Shares subject to such Award may be adjusted in such manner as the Committee considers appropriate; or (ii) the Award shall lapse with immediate effect; or (iii) the deferral period may be extended. Clawback 3.4 Paragraph 3.5 applies in respect of any Award that has vested and been exercised (if applicable). 3.5 If a Trigger Event occurs before the second anniversary of the date on which the Award vests, then the Committee may, to the extent that it considers appropriate (taking account of the extent of the relevant misconduct, misstatement, or reputational damage), determine in its absolute discretion that the relevant individual must by way of clawback repay to the Company or Member of the Group such amount as the Committee may determine in cash or transfer to the Company such number of Shares as the Committee may determine, in each case taking account of the number of Shares or notional shares which were comprised in the relevant Award and their value or the cash amount paid in respect of the Award (net of any tax and/or social security contributions paid by the individual which is not refundable). 3.6 Following such determination under paragraph 3.5 above, the Committee may, in each case, to the extent permitted under applicable law:

EUROPE-LEGAL-282811198/3 168111-0003 (i) make a reduction of an equivalent amount to: (A) any unvested Awards which the individual may have under any employee share scheme operated by the Company; and/or (B) any future bonus payment which would otherwise have been payable to the individual; and/or (C) any salary payments or other remuneration which are due or would otherwise have been payable to the individual, and/or (ii) require the relevant individual to repay to the Company an equivalent amount or to transfer a specified number of Shares to the Company within such period as it determines. 4. Annual Incentive Plan Paragraph 4 applies to any Award granted under the Company’s Annual Incentive Plan. Triggers 4.1 Paragraph 4applies in circumstances where the Committee has determined, in its absolute discretion, that there is a Trigger Event. A Trigger Event is: • a material misstatement of the Group or business unit results; or • at any time during the individual’s employment, a breach of the Company’s Code of Conduct, policies or procedures by that individual. Clawback 4.2 Paragraph 4.3 applies in respect of any Award that has already been paid. 4.3 If a Trigger Event occurs, then the Committee may, to the extent that it considers appropriate (taking account of the extent of the relevant misconduct, misstatement, or reputational damage), determine in its absolute discretion that the relevant individual must by way of clawback repay to the Company or Member of the Group such amount as the Committee may determine in cash or transfer to the Company such number of Shares as the Committee may determine, in each case taking account of the cash amount paid to the individual (net of any tax and/or social security contributions paid by the individual which is not refundable). 4.4 Following such determination under paragraph 4.3 above, the Committee may, in each case, to the extent permitted under applicable law: (i) make a reduction of an equivalent amount to: (A) any future bonus payment which would otherwise have been payable to the individual; and/or (B) any salary payments or other remuneration which are due or would otherwise have been payable to the individual; and/or (ii) require the relevant individual to repay to the Company an equivalent amount on such terms as directed by the Company.

EUROPE-LEGAL-282811198/3 168111-0003 General 5. Other malus & clawback provisions 5.1 The Policy is without prejudice to any other malus and clawback policies or provisions the Company may adopt or agree with individuals from time to time, including, without limitation: • Appendix 1 (Incentive Compensation Policies – US and EUCAN/UK/Ireland), • Appendix 2 (Executive Financial Recoupment Program), and • Appendix 3 (Indivior Executive Compensation Clawback Policy). Awards may be subject to such terms, whether or not such terms were in place at the time of grant of the Award. 6. Governing Law and Jurisdiction 6.1 This Policy and any non-contractual obligations arising out of or in connection with this Policy shall be governed by, and interpreted in accordance with, English law, excluding any choice of law rules or principles that may direct the application of the laws of another jurisdiction. All actions arising out of or relating to this Policy shall be heard and determined exclusively in the courts of England and Wales.

Incentive Compensation Policy Document Type Policy Document Reference POL.HR.10375 Version Number 6.0 Owning Facility/Site United States Effective Date : 16 Apr 2024 Page 1 of 8 1 PURPOSE The Incentive Compensation Policy (“Policy”) describes the governing principles for Incentive Compensation through the Annual Incentive Plan (“AIP”), Commercial Incentive Plan (“CIP”), awards programs, and any individual written employment agreement between an Employee and their employing Company (collectively referred to as “Incentive Compensation”) for eligible Unaited States (“US”) Employees (as defined below) of Indivior Inc. and Indivior Treatment Services, Inc. (each a “Company” and collectively the “Companies”). Inappropriately incentivizing Employees may result in legal and regulatory risks to the Companies. 1.1 Inherent Risk Areas Improper External Communication and/or Interaction Presenting, promoting or soliciting information regarding Company products that is untruthful, inaccurate, and/or misleading or information that goes beyond approved product label. Also includes promoting products to ineligible persons. Inappropriate Transfer of Value Providing, promising, offering, soliciting or receiving anything of value to or from a health care professional, government/foreign official, health care entity, patient advocacy organization, patient, third-party payor or anyone in exchange for past or future prescribing, recommendation of company product(s) or to improperly influence their actions. 2 SCOPE This Policy applies to all full-time and part-time employees (each an “Employee”) who are eligible for Incentive Compensation in the US. 3 POLICY DETAILS 3.1 Key Principles 3.1.1 Incentive Compensation is designed to drive performance and behaviors consistent with Indivior’s purpose and its Code of Conduct and other written standards, values, and strategy. 3.1.2 Incentive Compensation provides a variable pay component as an incentive, in addition to an Employee’s regular salary. The combination of the base salary POL.HR.10375 Version: 6.0 Status: Effective Effective Date: 16 Apr 2024 Next Review Date: 16 Apr 2025 Last Review Date: This document is only current on day of printing. Printed copies are uncontrolled unless they are part of a Quality or Technical Manual. APPENDIX 1

Incentive Compensation Policy Document Type Policy Document Reference POL.HR.10375 Version Number 6.0 Owning Facility/Site United States Effective Date : 16 Apr 2024 Page 2 of 8 compensation and the Incentive Compensation is designed to yield a competitive total compensation opportunity. 3.1.3 Incentive Compensation is designed so that financial incentives do not inappropriately incentivize Employees to engage in or tolerate marketing, promoting, or selling of Indivior’s products (1) for unapproved uses, (2) to prescribers who practice within an excluded specialty, (3) to prescribers on a government debarred list or who have been delisted pursuant to the Prescriber Concern Reporting Policy, or (4) at dosages above maximum recommended doses listed in the package insert. 3.2 Eligibility Rules 3.2.1 Incentive Compensation is available only through the AIP, the CIP, or as provided in an employment agreement. Employees are never eligible for Incentive Compensation through both the AIP and CIP. Contingent Workers and Consultants are not eligible for AIP or CIP. An Employee must receive written confirmation from the Company to be eligible for Incentive Compensation. Incentive Compensation targets, multipliers, and levels shall be designated in an Employee’s offer letter, employment agreement, or other written correspondence from the Company as well as the Annual Incentive Plan SOP (SOP.HR.10413) or the Commercial Incentive Plan SOP (SOP.COM.10523). . Refer to the Commercial Incentive Plan SOP for further information on the development, implementation, and execution of the CIP. 3.2.2 The Company reserves the right to, in its sole discretion, cancel or modify any Employee’s eligibility for Incentive Compensation at any time. For example, Employees may not be eligible, or may have limited eligibility for Incentive Compensation, where: • the Employee has been found by the Company to have committed violations of Indivior’s written standards, as tracked by Integrity & Compliance; • the Employee has not completed required compliance training; or • the Employee has had unsatisfactory job performance (e.g., having a rating of ‘needs improvement’ or lower on their annual Performance and Development Review (“PDR”), or being placed on a performance improvement plan, as tracked by Human Resources (“HR”). 3.2.3 The Company reserves the right, in its sole discretion, to withhold payment of Incentive Compensation to an Employee who is relevant to an ongoing internal POL.HR.10375 Version: 6.0 Status: Effective Effective Date: 16 Apr 2024 Next Review Date: 16 Apr 2025 Last Review Date: This document is only current on day of printing. Printed copies are uncontrolled unless they are part of a Quality or Technical Manual.

Incentive Compensation Policy Document Type Policy Document Reference POL.HR.10375 Version Number 6.0 Owning Facility/Site United States Effective Date : 16 Apr 2024 Page 3 of 8 investigation. Based on the outcome of an internal investigation, the Company reserves the right, in its sole discretion, to pay the full amount of Incentive Compensation to the Employee, pay only a partial amount of Incentive Compensation to the Employee, or not pay any Incentive Compensation to the Employee. 3.2.4 The ability to participate in Incentive Compensation in any one year does not guarantee participation in future years. The Company reserves the right to amend or terminate the terms of the Incentive Compensation programs at any time, either on an individual Employee or global basis. 3.2.5 If an Employee’s employment commenced part-way through the fiscal year, any Incentive Compensation payment will be made on a pro-rata basis from the Employee’s start date unless otherwise provided in an employment agreement. 3.2.6 If an Employee changes jobs, or receives a base salary increase during the fiscal year, be it in the same country or via international transfer, resulting in changed targets, the Employee’s Incentive Compensation payout will be based, pro rata, on the achievements of each set of targets over the course of the fiscal year unless otherwise provided in an employment agreement. 3.2.7 Employees will not be paid Incentive Compensation during any periods of long- term sickness or disability, or unpaid leave unless required by local laws and regulations. 3.2.8 Pro rata Incentive Compensation payments may be granted, at the sole discretion of the Company, to Company Employees who retire or become disabled during the fiscal year, or to the estate of a former Employee who is deceased where the deceased Employee died while employed during the fiscal year. 3.2.9 Acquisitions, divestments, or major launches will be considered on a case-by-case basis and may result in an adjustment of Incentive Compensation results at the end of the year at the sole discretion of the Company. 3.2.10 The Company may, in compliance with the principles and requirements of this Policy, adjust the formulaic bonus outcomes, as needed, both upwards and downwards (including to zero) to ensure alignment of pay with performance. 3.2.11 Participation in Incentive Compensation will end if the Company determines that: • Payment of Incentive Compensation becomes unreasonable or inappropriate due to collective bargaining, statutory provisions, or other reasons; or POL.HR.10375 Version: 6.0 Status: Effective Effective Date: 16 Apr 2024 Next Review Date: 16 Apr 2025 Last Review Date: This document is only current on day of printing. Printed copies are uncontrolled unless they are part of a Quality or Technical Manual.

Incentive Compensation Policy Document Type Policy Document Reference POL.HR.10375 Version Number 6.0 Owning Facility/Site United States Effective Date : 16 Apr 2024 Page 4 of 8 • the Company is no longer in a position to make Incentive Compensation payments. 3.3 Supplemental Payments 3.3.1 There may be additional supplemental payments provided by the Company to eligible Employees at the sole discretion of the Company. All supplemental payments must be reviewed and approved, at a minimum, by Integrity & Compliance and HR prior to payment. Integrity & Compliance and HR may request counsel from Legal and other relevant business stakeholders, as needed, particularly when the supplemental payment is available to eligible Employees. 3.4 Termination of Employment 3.4.1 Participation in Incentive Compensation does not alter the “Employment at Will” status of Employees or the right of the Company or the right of the Employee to terminate his or her employment at any time, with or without Cause. 3.4.2 If an Employee’s employment terminates by reason of resignation or for Cause prior to Incentive Compensation payout (whether such termination occurs during or after the fiscal year), such Employee is not entitled to an Incentive Compensation payment unless otherwise provided in an employment agreement. 3.4.3 The Company may exercise its judgment to determine what, if any, Incentive Compensation payment should be paid to an Employee in the event the Employee’s employment terminates due to position elimination, change in job responsibilities, or a reduction-in-force during the fiscal year. However, if such Employee has a written employment agreement, the terms of the written employment agreement will be followed as to this issue. In the absence of a written employment agreement, factors that the Company may consider include, but are not limited to the following: • When during the fiscal year the separation occurred • Whether the Employee’s objectives were met • The overall performance of the Indivior Group 3.5 Clawback 3.5.1 The Company reserves the right to, in its sole discretion and subject to applicable law, seek redress from individuals in circumstances where there has been a material misstatement of the Indivior Group or business unit results, or a failure to comply with the Indivior Code of Conduct or other written standards, irrespective of the POL.HR.10375 Version: 6.0 Status: Effective Effective Date: 16 Apr 2024 Next Review Date: 16 Apr 2025 Last Review Date: This document is only current on day of printing. Printed copies are uncontrolled unless they are part of a Quality or Technical Manual.

Incentive Compensation Policy Document Type Policy Document Reference POL.HR.10375 Version Number 6.0 Owning Facility/Site United States Effective Date : 16 Apr 2024 Page 5 of 8 position the Employee might hold and whether they are employed or not employed by the Company at the time of the breach of the Indivior Code of Conduct or other written standards. 3.5.2 The Company shall in its sole discretion decide on the amount of the Incentive Compensation payment subject to Clawback in light of the circumstances triggering the Clawback. The amount subject to Clawback shall be limited to the portion of the Incentive Compensation that was paid or is otherwise payable that the Company determines exceeds the amount that would have been paid or would otherwise be payable but for the events described in Section 3.5.1. 3.5.3 The Company may use any lawful methods to satisfy the Clawback, including at least: • Reducing (including, if appropriate, to zero) the amount of any future Incentive Compensation; or, • Requiring an Employee to pay the Company or any associated entity (e.g., subsidiary) the amount required to satisfy the Clawback in full, on terms directed by the Company (including, without limitation, on terms that the relevant amount is to be withheld or deducted from the Employee’s salary or from any other payment to be made to the Employee by the Company or associated entity). 3.5.4 Employees, as a condition to participating in, and being eligible to receive Incentive Compensation, agree to: • Authorize the Company and/or associated entities to deduct the Clawback amount from the Employee’s remuneration or payments due to them if permitted by applicable law; • Repay to the Company or associated entity the Clawback amount on demand as a debt; and, • Pay and indemnify, and keep indemnified, the Company and all associated entities against any costs and expenses, which may include reasonable legal expenses, incurred by the Company or any associated entity in enforcing the Clawback provisions. 3.5.5 No delay or omission on the part of the Company or any associated entity in exercising its rights under this Policy shall operate as a waiver of any such rights to seek redress. POL.HR.10375 Version: 6.0 Status: Effective Effective Date: 16 Apr 2024 Next Review Date: 16 Apr 2025 Last Review Date: This document is only current on day of printing. Printed copies are uncontrolled unless they are part of a Quality or Technical Manual.

Incentive Compensation Policy Document Type Policy Document Reference POL.HR.10375 Version Number 6.0 Owning Facility/Site United States Effective Date : 16 Apr 2024 Page 6 of 8 3.5.6 The Company may terminate the employment of any Employee who fails to cooperate with the Company in satisfying any Clawback. 3.5.7 Clawback provisions under the Incentive Compensation policy are in addition to, and not a limitation of, (i) any clawback policies or related provisions in benefits plans, award agreements, or employment contracts, and (ii) the Indivior PLC Executive Compensation Clawback Policy (POL.LEG.11646). 4 CORPORATE INTEGRITY AGREEMENT 4.1 Incentive Compensation will comply with the terms of Indivior’s government agreements. 5 TRAINING 5.1 HR is responsible for ensuring that relevant Employees read and acknowledge their understanding of this Policy annually. 6 ENFORCEMENT 6.1 Non-compliance with this Policy can subject Employees to disciplinary actions up to and including termination. 6.2 This Policy and any dispute or claim arising out of or in connection with it shall be governed by and construed in accordance with Virginia law. The state or federal courts of Virginia shall have exclusive jurisdiction to settle any dispute or claim that arises out of or in connection with this Policy or its subject matter or formation (including non-contractual disputes or claims). 7 REFERENCES • Annual Incentive Plan SOP (SOP.HR.10413) • Anti-Bribery Policy (GUI.IC.10001) • Indivior Code of Conduct (POL.IC.10003) • Competition Law Compliance Manual (POL.LEG.10006) • Equal Employment Opportunity (EEO) Policy (USA) (POL.HR.10130) • Global Policy on Healthcare Business Ethics • Harassment Policy (USA) (POL.HR.10131) • Prescriber Concern Report Policy (POL.MED.10042) POL.HR.10375 Version: 6.0 Status: Effective Effective Date: 16 Apr 2024 Next Review Date: 16 Apr 2025 Last Review Date: This document is only current on day of printing. Printed copies are uncontrolled unless they are part of a Quality or Technical Manual.

Incentive Compensation Policy Document Type Policy Document Reference POL.HR.10375 Version Number 6.0 Owning Facility/Site United States Effective Date : 16 Apr 2024 Page 7 of 8 • Commercial Incentive Plan SOP (SOP.COM.10523) • Indivior PLC Executive Compensation Clawback Policy (POL.LEG.11646) 8 DEFINITIONS/ABBREVIATIONS 8.1 “Cause” shall have the meaning as defined in any employment agreement then in effect between the Employee and their employing Company, or if not defined therein, or if there is no such agreement, “Cause” refers to an Employee’s (a) failure to substantially perform the Employee’s duties and obligations to the Company as an Employee, including one or more acts of gross negligence or insubordination or a material breach of Indivior’s policies and procedures; (b) material breach of Indivior’s Code of Conduct, its Equal Opportunity and Anti- Harassment policies (including the Equal Employment Opportunity (EEO) Policy (USA) and Harassment Policy (USA)), or compliance policies (including the Anti- Bribery Policy, the Competition Law Compliance Manual, and the Global Policy on Healthcare Business Ethics); (c) indictment for, conviction of, or plea of guilty or nolo contendere to, a felony or any other crime involving fraud, dishonesty, theft, breach of trust or moral turpitude; (d) willful engagement in conduct which results in, or could reasonably be expected to result in, material injury to the Company’s financial condition, reputation, or ability to do business; (e) breach of any other agreement with the Company; (f) violation of state or federal securities laws or regulations; (g) discharge for poor performance; or (h) willful failure to cooperate with a bona fide internal investigation or an investigation by regulatory or law enforcement authorities, after being instructed by the Company to cooperate, willful destruction or failure to preserve documents or other materials relevant to such investigation, or willful inducement of others to fail to cooperate or to produce documents or other materials in connection with such investigation. The determination of the existence of Cause shall be made by the Company, and such determination shall be conclusive. 8.2 “Clawback” refers to any reduction or forfeiture of, or obligation to repay, an amount of compensation otherwise payable or paid pursuant to Section 3.5. 8.3 “Consultant” refers to any entity or individual the Company engages and contracts with to perform tasks, activities or services on behalf of the Company, including Healthcare Professionals. Consultants are not intended by the Company to be Employees. 8.4 “Contingent Worker” refers to a temporary worker hired to cover vacancies due to promotions, terminations, illness, leave of absence, etc. Their tasks are generally expected to be performed by regular Employees in the medium to long-term. Contingent Workers are not intended by the Company to be Employees. POL.HR.10375 Version: 6.0 Status: Effective Effective Date: 16 Apr 2024 Next Review Date: 16 Apr 2025 Last Review Date: This document is only current on day of printing. Printed copies are uncontrolled unless they are part of a Quality or Technical Manual.

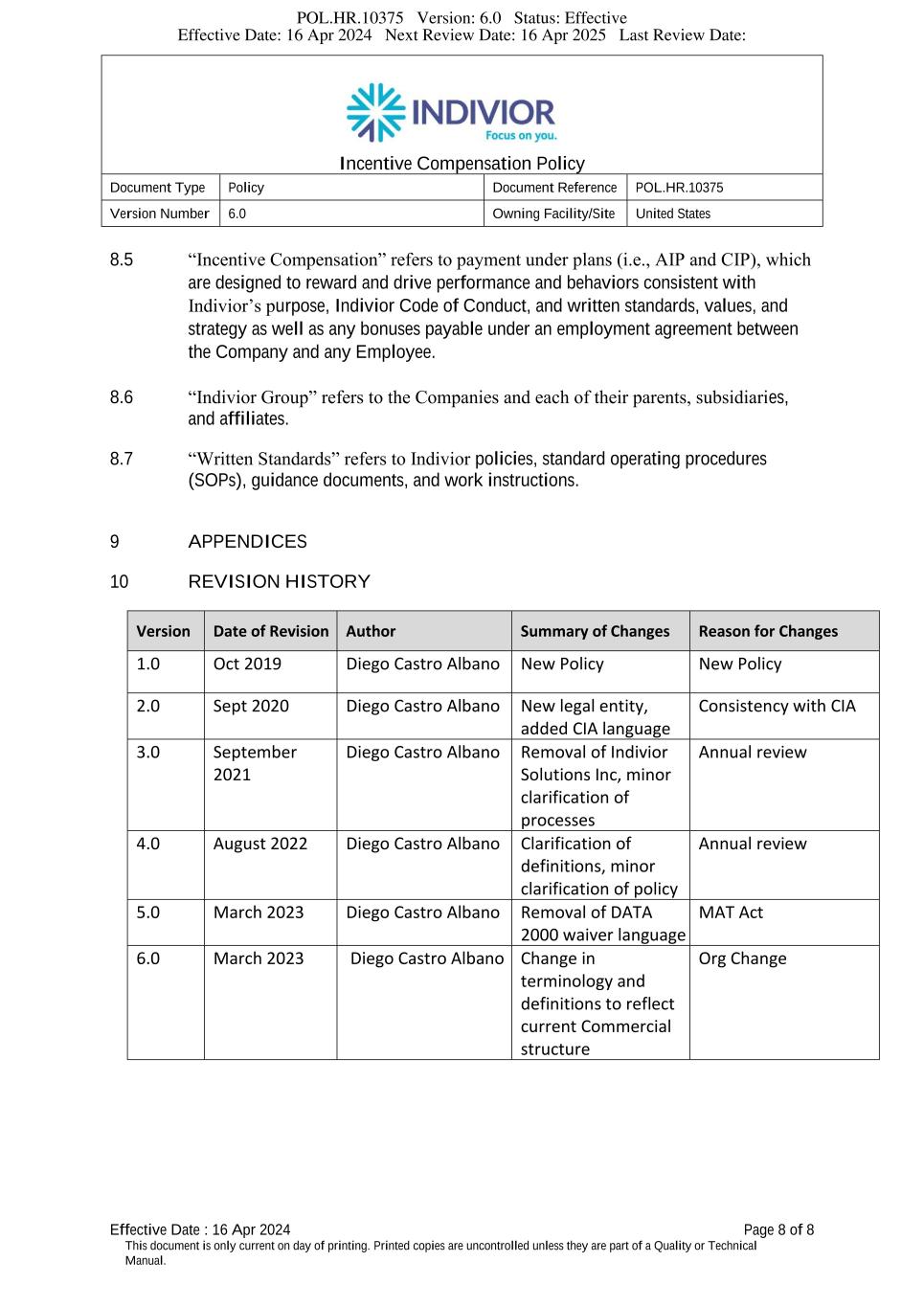

Incentive Compensation Policy Document Type Policy Document Reference POL.HR.10375 Version Number 6.0 Owning Facility/Site United States Effective Date : 16 Apr 2024 Page 8 of 8 8.5 “Incentive Compensation” refers to payment under plans (i.e., AIP and CIP), which are designed to reward and drive performance and behaviors consistent with Indivior’s purpose, Indivior Code of Conduct, and written standards, values, and strategy as well as any bonuses payable under an employment agreement between the Company and any Employee. 8.6 “Indivior Group” refers to the Companies and each of their parents, subsidiaries, and affiliates. 8.7 “Written Standards” refers to Indivior policies, standard operating procedures (SOPs), guidance documents, and work instructions. 9 APPENDICES 10 REVISION HISTORY Version Date of Revision Author Summary of Changes Reason for Changes 1.0 Oct 2019 Diego Castro Albano New Policy New Policy 2.0 Sept 2020 Diego Castro Albano New legal entity, added CIA language Consistency with CIA 3.0 September 2021 Diego Castro Albano Removal of Indivior Solutions Inc, minor clarification of processes Annual review 4.0 August 2022 Diego Castro Albano Clarification of definitions, minor clarification of policy Annual review 5.0 March 2023 Diego Castro Albano Removal of DATA 2000 waiver language MAT Act 6.0 March 2023 Diego Castro Albano Change in terminology and definitions to reflect current Commercial structure Org Change POL.HR.10375 Version: 6.0 Status: Effective Effective Date: 16 Apr 2024 Next Review Date: 16 Apr 2025 Last Review Date: This document is only current on day of printing. Printed copies are uncontrolled unless they are part of a Quality or Technical Manual.

Document Approvals Approved Date: 08 Apr 2024 Approval Task Verdict: Approve Kevin Espinoza, (kevin.espinoza@indivior.com) I&C Approver 08-Apr-2024 12:28:19 GMT+0000 CAC Approver Task Verdict: CAC Approved Kevin Espinoza, (kevin.espinoza@indivior.com) CAC Approver 08-Apr-2024 12:30:23 GMT+0000 POL.HR.10375 Version: 6.0 Status: Effective Effective Date: 16 Apr 2024 Next Review Date: 16 Apr 2025 Last Review Date:

Incentive Compensation Policy Version 4 Jurisdiction; EUCAN/UK Wide/Ireland Owner: Arti Chander Author: Ruby Asghar Effective Date: July 2021 PURPOSE The Incentive Compensation Policy (“Policy”) describes the governing principles for Incentive Compensation through the Annual Incentive Plan (“AIP”), Sales Incentive Plan (“SIP”) and any individual written employment agreement between an Employee and their employing company (collectively referred to as “Incentive Compensation”) for eligible Employees (as defined below) of the various Indivior local companies within the EUCAN region (each a “Company” and collectively the “Companies). SCOPE This Policy applies to all full-time and part-time employees, fixed term contractors, officers, and directors (collectively, “Employee”) who are eligible for Incentive Compensation in EUCAN and UK & Ireland Employees. 1 POLICY DETAILS 1.1 Key Principles 1.1.1 Incentive Compensation is designed to drive performance and behaviours consistent with Indivior’s purpose, and Indivior’s Code of Conduct, policies, values, and strategy. 1.1.2 Incentive Compensation provides a variable pay component as an incentive, in addition to an Employee’s regular salary. The combination of the base salary compensation and the Incentive Compensation is designed to yield a competitive total compensation opportunity. 1.1.3 Incentive Compensation is designed so that financial incentives do not inappropriately incentivize Employees to engage in or tolerate marketing, promoting, or selling of Indivior’s products (1) for unapproved uses, (2) to prescribers of buprenorphine products who practice within an excluded specialty or, depending the country have not been certified or trained in addiction care. This Policy sets the overall expectation and intention of Indivior’s compensation principles. Implementation of this Policy and the associated principles by a Company will always be subject to, and in accordance with, local laws and regulations, associated employment policies. 1.2 Eligibility Rules 1.2.1 Where Employees are eligible for Incentive Compensation, this is through only one of the following three ways : the AIP, the SIP, or an employment/Trade Union/Works Council agreement. Employees are never eligible for more than one Incentive Compensation; Employees may also be eligible for approved local incentive kickers/competitions. Contingent Workers and Consultants are not eligible for AIP or SIP. Incentive Compensation targets, multipliers, and levels shall POL.COM.10791 Version: 1.0 Status: Effective Effective Date: 08 Oct 2021 Next Review Date: 08 Oct 2023 Last Review Date:

be designated in an Employee’s offer letter, employment agreement or other written correspondence from the Company. 1.2.2 Indivior reserves the right to, in its absolute discretion, cancel or modify any Employee’s eligibility for Incentive Compensation at any time. Employees may not be eligible, or may have limited eligibility for Incentive Compensation in the following cases: • Employees who have been found to have committed violations of Indivior’s policies and procedures may be ineligible to participate in any bonus, incentive, or awards program or recognition. • Employees who have not completed their compliance training. • Employees with unsatisfactory job performance (which includes, but is not limited to, Employees with a rating of ‘Improvement required’ on their annual Performance and Development Review (“PDR”), or who are on a performance improvement plan, as tracked by Human Resources (“HR”)) are generally ineligible to participate in any bonus, incentive, or awards program. 1.2.3 Subject to local laws and regulations, Indivior reserves the right to, in its absolute discretion, withhold payment of Incentive Compensation to an Employee who is relevant to an ongoing internal investigation and, based on the outcome of an internal investigation, pay an appropriate amount of any Incentive Compensation to the Employee (if any) as per the findings of the internal investigation, circumstances identified and reflecting the impact of any inappropriate behaviour. 1.2.4 The ability to participate in Incentive Compensation in any one year does not guarantee participation in future years. Indivior reserves the right to amend or terminate the terms of the Incentive Compensation programs at any time, either for an individual Employee (where permissible), program, country, or wider basis. 1.2.5 If an Employee’s employment commenced part-way through the fiscal year, any Incentive Compensation payment will be made on a pro rata basis from the Employee’s start date. 1.2.6 If an Employee changes jobs, or receives a base salary increase during the fiscal year, be it in the same country or via international transfer, resulting in changed targets, the Employee’s Incentive Compensation pay-out will be based, pro rata, on the achievements of each set of targets over the course of the fiscal year. 1.2.7 Subject to local laws and regulations, Employees will not be paid Incentive Compensation during any periods of unauthorized absence or long- term sickness (other than a disability). 1.2.8 Pro rata Incentive Compensation payments may be granted at the sole discretion of the Company to Company Employees who retire or become disabled during the fiscal year, or to the estate of former Employees who are deceased. 1.2.9 Acquisitions, divestments, parallel trade, or major launches will be considered on a case-by-case basis and may result in an adjustment of Incentive Compensation results at the end of the year in the sole discretion of the Company. 1.2.10 The Company may, in compliance with the principles and requirements of this Policy, adjust the formulaic bonus outcomes, as needed, both upwards and downwards (including to zero) to ensure alignment of pay with performance. 1.2.11 Participation in Incentive Compensation will end if the Company determines that: • Payment of Incentive Compensation becomes unreasonable or inappropriate due to collective bargaining, statutory provisions, or other reasons; or, • It is no longer in a position to make Incentive Compensation payments. POL.COM.10791 Version: 1.0 Status: Effective Effective Date: 08 Oct 2021 Next Review Date: 08 Oct 2023 Last Review Date:

1.3 Supplemental Payments 1.3.1 There may be additional supplemental payments provided by the Company to eligible Employees. All supplemental payments must be reviewed and approved, at a minimum, by HR and Compensation & Benefits prior to payment. HR and Compensation & Benefits may request review by Integrity & Compliance and counsel from Legal and other relevant business stakeholders, as needed. 1.4 Termination of Employment 1.4.1 Participation in Incentive Compensation does not alter the right of the Company or the right of the Employee to terminate his or her employment at any time, with or without Cause. 1.4.2 Subject to the terms of a written employment agreement and locals laws and regulations, if employment is terminated by reason of resignation or by Cause prior to Incentive Compensation pay-out (whether such termination occurs during or after the fiscal year), Employees are not entitled to an Incentive Compensation payment. 1.4.3 Subject to the terms of a written employment agreement and locals laws and regulations, the Company may exercise its judgment to determine what, if any, Incentive Compensation payment should be paid in the event of an elimination of a position, a change in job responsibilities, or a reduction-in-force during the fiscal year. Factors that may be considered include, but are not limited to the following: • When in the fiscal year the separation occurred; • If the Employee’s objectives were met; and • The overall performance of the Company and the Indivior Group 1.5 Clawback 1.5.1 Clawback provision as described in this section 3.5 shall apply to senior leadership positions in EUCAN, specifically members of the EUCAN Management Committee (“EMC”) and Regional Finance Directors. . 1.5.2 The Company reserves the right to, in its absolute discretion and subject to applicable laws and regulations, seek redress from individuals covered by this section 3.5 in circumstances where such individuals have acted in a way leading to, are responsible for a material misstatement of business unit results, or a failure to comply with the Indivior Code of Conduct, policies or procedures, irrespective of whether they are employed or not employed by the Company at the time of seeking such redress (“Clawback”). 1.5.3 The Company shall determine the amount of the Incentive Compensation payment subject to Clawback in light of the circumstances triggering the Clawback. The amount subject to Clawback shall be limited to the net (post- tax) portion of the Incentive Compensation that was paid or is otherwise payable that the Company acting reasonably determines exceeds the amount that would have been paid or would otherwise be payable but for the events described in section 3.5.2 and shall be recoverable for the period(s) during which such events occurred. 1.5.4 The Company may use any lawful methods to satisfy the Clawback, including the following: • Reduce (including, if appropriate, to zero) the amount of any future Incentive Compensation; or, • Require such persons to pay the Company or any associated entity the amount required to satisfy the Clawback in full, on terms directed by the Company (including, without limitation, to terms that the relevant amount is to be withheld or deducted from such person’s salary or from any other payment to POL.COM.10791 Version: 1.0 Status: Effective Effective Date: 08 Oct 2021 Next Review Date: 08 Oct 2023 Last Review Date:

be made to such persons by the Company or associated entity). 1.5.5 Subject to local laws and regulations, as a condition to participating in, and being eligible to receive Incentive Compensation, persons covered by this section 3.5 agree to: • Authorize the Company and/or associated entities to deduct the Clawback amount from their remuneration or payments due to them if permitted by applicable law; and • Repay to the Company or associated entity the Clawback amount on demand as a debt. 1.5.6 No delay or omission on the part of the Company or any associated entity in exercising its rights under this Policy shall operate as a waiver of any such rights to seek redress. 1.5.7 Subject to local laws and regulations, the Company may terminate the employment of any person who fails to cooperate with the Company in satisfying any Clawback to which the Company is legally entitled. 2 TIMING OF PAYMENT 2.1 Payment of Annual Incentive compensation will be made in the year following the year that it is earned but usually not later than during March of such following year. 3 TRAINING EXPECTATIONS & NOTICE 3.1 Human Resources is responsible for ensuring that relevant Employees are (as HR determines appropriate) trained on, or provided with required notice of, this Policy. 4 ENFORCEMENT 4.1 Enforcement of this Policy is subject to local employment laws, which may override this Policy. 4.2 Non-compliance with this Policy can subject Employees to disciplinary actions up to and including termination, in line with local laws, regulations and applicable local employment policies. 4.3 This Policy and any dispute or claim arising out of or in connection with it shall be governed by and construed in accordance with local laws of the country where the Employee is or was employed. 5 REFERENCES • Annual Incentive Plan SOP • Anti-Bribery Policy (GUI.IC.10001) • Indivior Code of Conduct (POL.IC.10003) • Commercial Interactions with Healthcare Professionals Policy (POL.IC.10004) • Competition Law Compliance Manual (POL.LEG.10006) • Equal Employment Opportunity (EEO) Policy (USA) (POL.HR.10130) • Global Policy on Healthcare Business Ethics • EFPIA Code on Interactions with Healthcare Professionals POL.COM.10791 Version: 1.0 Status: Effective Effective Date: 08 Oct 2021 Next Review Date: 08 Oct 2023 Last Review Date:

6 DEFINITIONS/ABBREVIATIONS 6.1 “Cause” shall have the meaning as defined in any employment agreement then in effect between the Employee and their employing Company, or if not defined therein, or if there is no such agreement, “Cause” refers to an Employee’s (a) failure to substantially perform the Employee’s duties and obligation to the Company as an Employee, including one or more acts of gross negligence or insubordination or a material breach of Indivior’s policies and procedures; (b) material breach of Indivior’s Code of Conduct, its Equal Opportunity and Anti- Harassment policies, or compliance policies (including the Anti- Bribery Policy, the Competition Law Compliance Manual, and the Global Policy on Healthcare Business Ethics); (c) conviction of, or plea of guilty to, a crime involving fraud, dishonesty, theft or breach of trust; (d) wilful engagement in conduct which results in, or could reasonably be expected to result in, material injury to the Company’s financial condition, reputation, or ability to do business; (e) breach of any other agreement with the Company; (f) violation of applicable securities laws or regulations; (g) discharge for poor performance; or (h) wilful failure to cooperate with a bona fide internal investigation or an investigation by regulatory or law enforcement authorities, after being instructed by the Company to cooperate (including, without limitation, wilful destruction or failure to preserve documents or other materials relevant to such investigation, wilful inducement of others to fail to cooperate or to produce documents or other materials in connection with such investigation).. 6.2 “Clawback” refers to any reduction or forfeiture of, or obligation to repay, an amount of compensation otherwise payable or paid pursuant to section 3.5. 6.3 “Consultant” refers to any entity or individual the Company engages and contracts with to perform tasks, activities, or services on behalf of the Company, including Healthcare Professionals. Consultants are not Employees. 6.4 “Contingent Worker” refers to a temporary non-employee worker hired to cover vacancies due to promotions, terminations, illness, leave of absence, etc. Their tasks are generally expected to be performed by regular Employees in the medium to long-term. Contingent Workers are not Employees. 6.5 “Incentive Compensation” refers to payment under plans (i.e., AIP and SIP), which are designed to reward and drive performance and behaviours consistent with Indivior’s purpose, Indivior Code of Conduct, and policies, values, and strategy as well as any bonuses payable under an employment agreement between the Company and any Employee. 7 APPENDICES • N/A 8 REVISION HISTORY Version Date of Revision Author Summary of Changes Reason for Changes 1.0 Jan 2021 Arti Chander New Policy for EUCAN Prior Global Policy replaced by US specific one meant EUCAN needs new policy 1.1 May 2021 Arti Chander Amendment to clawback provision Review of local laws and applicability. 1.2 July 2021 Steve Lucas Reviewed and amended Legal review and approval POL.COM.10791 Version: 1.0 Status: Effective Effective Date: 08 Oct 2021 Next Review Date: 08 Oct 2023 Last Review Date:

POL.COM.10791 Version: 1.0 Status: Effective Effective Date: 08 Oct 2021 Next Review Date: 08 Oct 2023 Last Review Date:

Document Approvals Approved Date: 08 Oct 2021 Approval Task Verdict: Approve Arti Chander, (Arti.chander@indivior.com) HR Approver 08-Oct-2021 11:49:06 GMT+0000 POL.COM.10791 Version: 1.0 Status: Effective Effective Date: 08 Oct 2021 Next Review Date: 08 Oct 2023 Last Review Date: This document copy was retrieved from the system by Rebecca Jones on 16 May 2024

APPENDIX 2

Indivior PLC Executive Compensation Clawback Policy Page 1 of 6 Confidential: Downloaded or Printed Copies are uncontrolled and are for reference only on the date of retrieval or printing. Type Policy Number TBC Level TBC Version 1.0 Geographic Impact TBC Effective Date December 1, 2023 1. Purpose. The purpose of this Policy is to set out the circumstances under which Executive Officers of the Company will be required to repay or return certain Excess Awarded Compensation to the Group to comply with the U.S. Clawback Rule and the U.S. Listing Rule. 2. Administration. This Policy shall be administered by the Committee. The Committee is authorised to interpret and construe this Policy and to make all determinations necessary, appropriate, or advisable for the administration of this Policy. Any determinations made by the Committee shall be final, conclusive and binding on all interested parties. 3. Recovery of Excess Awarded Compensation. a) Recovery of Excess Awarded Compensation. If there is an Accounting Restatement, the Committee shall reasonably promptly determine the amount of any Excess Awarded Compensation for each Covered Executive Officer in connection with such Accounting Restatement and then notify each Covered Executive Officer in writing of the amount of Excess Awarded Compensation and a demand for repayment or return, as applicable. b) Forms of Recovery. The Committee shall determine, in its sole discretion, the method(s) for recovering any Excess Awarded Compensation, which may include: (i) requiring cash reimbursement; (ii) seeking recovery or forfeiture of any gain realised on the vesting, exercise, settlement, sale, transfer or other disposition of any equity-based awards; (iii) offsetting the amount from any compensation otherwise owed by the Company to the applicable Covered Executive Officer; (iv) reducing or cancelling outstanding vested or unvested equity awards; or (v) taking any other remedial and recovery action permitted by law, as determined by the Committee. The Group may not accept less than the amount of Excess Awarded Compensation in satisfaction of a Covered Executive Officer’s obligations. c) Executive Officer’s Failure to Repay. If a Covered Executive Officer fails to repay any portion of Excess Awarded Compensation to the Group when due, the Company shall, or shall cause another member of the Group to, take all actions reasonable and appropriate to recover such Excess Awarded Compensation from the applicable Covered Executive Officer (including suing for repayment and/or enforcing such Covered Executive Officer’s obligation to make payment APPENDIX 3

Indivior PLC Executive Compensation Clawback Policy Effective Date: December 1, 2023 POL.LEG.[TBC] Version: 1.0 Page 2 of 6 Confidential: Downloaded or Printed Copies are uncontrolled and are for reference only on the date of retrieval or printing. through the reduction or cancellation of outstanding and future compensation). The applicable Covered Executive Officer shall be required to reimburse the Group for any and all expenses reasonably incurred (including legal fees) by the Group in recovering such Excess Awarded Compensation. d) No Indemnification. No member of the Group shall be permitted to indemnify any Covered Executive Officer against: (i) the loss of any Excess Awarded Compensation that is repaid, returned or recovered pursuant to the terms of this Policy; or (ii) any claims relating to the Company’s enforcement of its rights under this Policy (including, for the avoidance of doubt, any advancement of costs related to such enforcement). Further, no member of the Group shall enter into any agreement that exempts any Performance-Based Compensation from the application of this Policy or that waives the Company’s right to recovery of any Excess Awarded Compensation and this Policy shall supersede any such agreement (whether entered into before, on or after the Effective Date). e) Exceptions to Recovery. Notwithstanding anything in this Policy to the contrary, the Company shall not be required to take the actions contemplated by Section b) above if the following conditions are met and the Committee determines that recovery would be impracticable: i. The direct expenses paid to a third party to assist in enforcing the Policy against a Covered Executive Officer would exceed the amount to be recovered, after the Company has made a reasonable attempt to recover the applicable Excess Awarded Compensation, and the Committee has documented such attempt(s) and provided such documentation to the U.S. Exchange; ii. Recovery would violate the home country law of the Company, where that law was adopted prior to 28 November 2022, provided that, before determining that it would be impracticable to recover any amount of Excess Awarded Compensation based on violation of home country law, the Company has obtained an opinion of home country counsel, acceptable to the U.S. Exchange, that recovery would result in such a violation and a copy of the opinion is provided to the U.S. Exchange; or iii. Recovery would likely cause an otherwise tax-qualified retirement plan, under which benefits are broadly available to employees of any member of the Group, to fail to meet the U.S. requirements of 26 U.S.C 401(a)(13), and the regulations thereunder, or 26 U.S.C. 411(a), and the regulations thereunder. 4. Amendment and Termination. The Board shall amend this Policy as it deems necessary, including as and when it determines that it is legally required by any U.S. federal securities laws (including the U.S. Clawback Rule), the SEC Rule or the U.S. Listing Rule. The Board may terminate this Policy at any time. Notwithstanding anything in this Section 4 to the contrary, no amendment or termination of this Policy shall be effective if such amendment or termination would (after taking into account any actions taken by the Company

Indivior PLC Executive Compensation Clawback Policy Effective Date: December 1, 2023 POL.LEG.[TBC] Version: 1.0 Page 3 of 6 Confidential: Downloaded or Printed Copies are uncontrolled and are for reference only on the date of retrieval or printing. contemporaneously with such amendment or termination) cause the Company to violate any U.S. federal securities laws (including the U.S. Clawback Rule), the SEC Rule or the U.S. Listing Rule. 5. Condition of future awards. The Committee may require that any employment agreement, equity award agreement, or any other agreement entered into on or after the Effective Date shall, as a condition to the grant of any benefits, require an Executive Officer to agree to abide by the terms of this Policy. 6. Filing Requirements. The Company shall file all relevant disclosures with respect to this Policy in accordance with the requirements of the U.S. federal securities laws, including relevant disclosures required by SEC filings. 7. Non-Exclusivity. Any right of recoupment under this Policy is in addition to, and not in lieu of, any other remedies or rights of recoupment that may be available to any member of the Group under applicable law, regulation or rule or pursuant to the terms of any similar policy in any employment contract, service agreement, equity award agreement, or similar agreement and any other legal remedies available to the Group. 8. Successors. This Policy shall be binding and enforceable against all Covered Executive Officers and their beneficiaries, heirs, executors, administrators or other legal representatives. 9. Governing Law and Jurisdiction. This Policy and any non-contractual obligations arising out of or in connection with this Policy shall be governed by, and interpreted in accordance with, the laws of the Commonwealth of Virginia, excluding any choice of law rules or principles that may direct the application of the laws of another jurisdiction. All actions arising out of or relating to this Policy shall be heard and determined exclusively in the courts of the Commonwealth of Virginia, if such courts decline to exercise jurisdiction or if subject matter jurisdiction over the matter that is the subject of any such legal action or proceeding is vested exclusively in the U.S. federal courts, the Eastern District Court of Virginia.

Indivior PLC Executive Compensation Clawback Policy Effective Date: December 1, 2023 POL.LEG.[TBC] Version: 1.0 Page 4 of 6 Confidential: Downloaded or Printed Copies are uncontrolled and are for reference only on the date of retrieval or printing. Definitions Accounting Restatement means an accounting restatement: (i) due to the material non-compliance of the Company with any financial reporting requirement under applicable securities laws, including any required accounting restatement to correct an error in previously issued financial statements of the Company that is material to the previously issued financial statements of the Company; or (ii) that corrects an error that is not material to previously issued financial statements of the Company, but would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period; Board means the board of directors of the Company or a duly authorised committee of it which may include the Committee; Committee means the Remuneration Committee of the Board or such other appropriately constituted committee; Company means Indivior PLC, registered in England and Wales under number 09237894; Covered Executive Officer means, with respect to any Performance-Based Compensation, each current and former Executive Officer who serves, or served, as an Executive Officer at any time during the performance period in respect of which such Performance-Based Compensation is Received by such Executive Officer; Covered Period means, with respect to any Accounting Restatement, the three completed Financial Years of the Company immediately preceding the Restatement Date and any Transition Period of less than nine months within or immediately following those three completed Financial Years; Effective Date means December 1, 2023; Excess Awarded Compensation means, with respect to a Covered Executive Officer, the gross amount of Performance-Based Compensation Received by that Covered Executive Officer during a Covered Period that exceeds the amount of Performance-Based Compensation that the Covered Executive Officer would have Received had it been determined based on the Accounting Restatement; provided that, for Performance-Based Compensation that is based on or related to the Company’s share price or total shareholder return where the amount of Excess Awarded Compensation is not subject to mathematical recalculation directly from information in the applicable Accounting Restatement, the amount that would have been Received shall be determined by the Committee based on a reasonable estimate of the effect of the Accounting Restatement on the share price or total shareholder return, as applicable, upon which the Performance-Based Compensation was Received (in which case, the Company shall maintain documentation of such determination of that reasonable estimate and provide such documentation to the U.S. Exchange). Notwithstanding this, compensation amounts shall only be considered “Excess Awarded Compensation” for the purposes of the Policy if such compensation is Received: (i) while the Company has a class of securities listed on a U.S. securities exchange or a U.S. securities association; and (ii) on or after October 2, 2023;

Indivior PLC Executive Compensation Clawback Policy Effective Date: December 1, 2023 POL.LEG.[TBC] Version: 1.0 Page 5 of 6 Confidential: Downloaded or Printed Copies are uncontrolled and are for reference only on the date of retrieval or printing. Executive Officer means the Company’s president, principal financial officer, principal accounting officer (or if there is no such accounting officer, the controller), any vice president of the Company in charge of a principal business unit, division, or function (such as sales, administration, or finance), any other officer who performs a policy-making function, or any other person who performs similar policy-making functions for the Company. Executive officers of the Company’s parent(s) or subsidiaries shall be deemed executive officers of the Company if they perform such policy-making functions for the Company; Financial Reporting Measure means any measure that is determined and presented in accordance with the accounting principles used in preparing the Company’s financial statements, and any other measure that is derived wholly or in part from such measure (in each case, regardless of whether such measure is presented within the Company’s financial statements or included in a filing with the SEC); Financial Year means the Company’s financial year; provided that a Transition Period between the last day of the Company’s previous financial year end and the first day of its new financial year that comprises a period of nine to twelve months will be deemed a completed financial year; Group means the Company, together with each of its direct and indirect parents and subsidiaries and member of the Group shall be construed accordingly; Performance-Based Compensation means any compensation (whether cash or equity-based) that is granted, earned, or vested based wholly or in part upon the attainment of a Financial Reporting Measure, and may include, but shall not be limited to, performance bonuses, commissions, or long-term incentive awards such as share options, share appreciation rights, restricted shares, restricted share units, performance shares, performance share units or other equity-based awards, whether or not granted under the Company’s equity incentive plans. For the avoidance of doubt, Performance-Based Compensation does not include any compensation to the extent that it is: (i) granted, earned, or vested exclusively upon completion of a specified employment period, without any performance condition; (ii) discretionary; or (iii) based on subjective goals or goals that do not constitute Financial Reporting Measures; Policy means this Indivior PLC Executive Compensation Clawback Policy, as may be amended from time to time; Received means, with respect to Performance-Based Compensation, the date of deemed receipt, and for these purposes, Performance-Based Compensation shall be deemed Received in the Financial Year during which the applicable Financial Reporting Measure is attained, even if payment or grant of the Performance-Based Compensation occurs after the end of that period; Restatement Date means the earlier of: (i) the date that the Board or an officer or officers of the Company authorised to take such action if Board action is not required, concludes, or reasonably should have concluded, that the Company is required to prepare an Accounting Restatement; or (ii) the date a court, regulator, or other legally authorised body directs the Company to prepare an Accounting Restatement; SEC means the U.S. Securities and Exchange Commission;

Indivior PLC Executive Compensation Clawback Policy Effective Date: December 1, 2023 POL.LEG.[TBC] Version: 1.0 Page 6 of 6 Confidential: Downloaded or Printed Copies are uncontrolled and are for reference only on the date of retrieval or printing. SEC Rule means the rules, regulations, orders, statements and interpretations published or issued by the SEC, as amended, that implement Section 954 of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010; Transition Period means any transition period that results from a change in the Company’s Financial Year within or immediately following the three completed Financial Years immediately preceding the Restatement Date; U.S. Clawback Rule means Section 10D of the U.S. Exchange Act and the rules and regulations pursuant to it, each as may be amended from time to time; U.S. Exchange means mean The Nasdaq Stock Market; U.S. Exchange Act means the U.S. Securities Exchange Act of 1934, as amended; and U.S. Listing Rule means Listing Rule 5608, as promulgated by The Nasdaq Stock Market LLC, as such rule may be amended from time to time.