Management's

Discussions and Analysis

For the year

ended

December 31, 2025

| OR Royalties Inc. 2025 – Annual Report |

Management’s Discussion and Analysis |

The following management discussion and analysis ("MD&A") of the consolidated operations and financial position of OR Royalties Inc. ("OR Royalties" or the "Company") and its subsidiaries for the year ended December 31, 2025 should be read in conjunction with the Company's audited consolidated financial statements and related notes for the year ended December 31, 2025. The audited consolidated financial statements have been prepared in accordance with IFRS Accounting Standards as issued by the International Accounting Standards Board ("IASB"). Management is responsible for the preparation of the consolidated financial statements and other financial information relating to the Company included in this report. The Board of Directors is responsible for ensuring that management fulfills its responsibilities for financial reporting. In furtherance of the foregoing, the Board of Directors has appointed an Audit and Risk Committee composed of independent directors. The Audit Committee meets with management and the auditors in order to discuss results of operations and the financial condition of the Company prior to making recommendations and submitting the consolidated financial statements to the Board of Directors for its consideration and approval for issuance to shareholders. The information included in this MD&A is as of February 18, 2026, the date when the Board of Directors has approved the Company's audited consolidated financial statements for the year ended December 31, 2025 following the recommendation of the Audit and Risk Committee. All monetary amounts included in this report are expressed in U.S. dollars, the Company's reporting currency, unless otherwise noted. This MD&A contains forward-looking statements and should be read in conjunction with the risk factors described in the "Forward-Looking Statements" section.

Table of Contents

| OR Royalties Inc. 2025 – Annual Report |

Management’s Discussion and Analysis |

Description of the Business

At the annual and special meeting of shareholders held on May 8, 2025, the shareholders of the Company approved the resolution to amend the articles of the Company to change its name from "Osisko Gold Royalties Ltd" to "OR Royalties Inc.". The name change became effective on that date.

OR Royalties is engaged in the business of acquiring and managing royalties, streams and similar interests on precious metals and other commodities that fit the Company's risk/reward objectives. The Company owns a portfolio of royalties, streams, options on royalty/stream financings and exclusive rights to participate in future royalty/stream financings on various projects. The Company's cornerstone asset is a 3-5% net smelter return ("NSR") royalty on the Canadian Malartic Complex, located in Québec, Canada.

OR Royalties is a public company domiciled in the Province of Québec, Canada, whose shares trade on the Toronto Stock Exchange ("TSX") and the New York Stock Exchange ("NYSE") and is constituted under the Business Corporations Act (Québec). The address of its registered office is 1100, avenue des Canadiens-de-Montréal, Suite 300, Montréal, Québec.

Business Model and Strategy

OR Royalties is focused on acquiring high-quality, long-life precious metals royalties and streams on assets located in favourable jurisdictions that are operated by established mining companies. The Company deploys capital through the acquisition of royalty and stream investments on metal mining projects at various stages of operation and development. OR Royalties endeavours to provide investors with lower-risk precious metals exposure via a geographically and operationally diversified asset base. OR Royalties' objective is to deploy capital into new and accretive investment opportunities to further enhance its growth profile.

Highlights

Year 2025

1 GEOs are calculated on a quarterly basis and include royalties and streams. Silver ounces and copper tonnes earned from royalty and stream agreements are converted to gold equivalent ounces by multiplying the silver ounces or copper tonnes earned by the average silver price per ounce or copper price per tonne for the period and dividing by the average gold price per ounce for the period. Cash royalties, other metals and commodities are converted into gold equivalent ounces by dividing the associated revenue by the average gold price per ounce for the period. For average metal prices used, refer to the Portfolio of Royalty, Stream and Other Interests section of this MD&A.

2 "Adjusted earnings" and "Adjusted earnings per basic share" are non-IFRS financial performance measures which have no standard definition under IFRS Accounting Standards and might not be comparable to similar financial measures disclosed by other issuers. Refer to the non-IFRS measures provided under the Non-IFRS Financial Performance Measures section of this MD&A for further information and for a quantitative reconciliation of each non-IFRS financial measure to the most directly comparable IFRS financial measure.

| OR Royalties Inc. 2025 – Annual Report |

Management’s Discussion and Analysis |

Subsequent to December 31, 2025

Corporate Update

On January 29, 2026, the Company announced the appointment of Mr. Kevin Thomson as an Independent Director to its Board of Directors. Concurrently, the Company announced that Mr. William Murray John has resigned as a director of the Company, effective immediately.

Mr. Kevin Thomson brings over 40 years of senior strategic mergers and acquisitions experience in the mining industry. Most recently, Mr. Thomson served as Senior Executive Vice President, Strategic Matters for Barrick Gold Corporation ("Barrick") where he was involved in all matters of strategic significance, including the management of complex negotiations, development of Barrick's corporate strategy, involvement in complex legal issues, and governance-related matters.

Guidance for 2026 and 5-Year Outlook

2026 Guidance

OR Royalties expects GEOs earned to range between 80,000 to 90,000 in 2026 at an average cash margin3 of approximately 97%. For the 2026 guidance, deliveries of silver, copper, and cash royalties were converted to GEOs using commodity prices based on February 2026 consensus commodity prices and a gold/silver price ratio of 73:1.

The 2026 guidance assumed ramp-ups at both the Dalgaranga and San Gabriel mines, as well as first payments received under those gross revenue and NSR royalties from Ramelius Resources Ltd. and Buenaventura, respectively. The guidance also assumes increased payments associated GEOs earned from the Company's 2.0% NSR royalty covering Cardinal Namdini Mining Ltd.'s Namdini mine. In addition, the guidance assumes relatively consistent year-over-year GEO deliveries from Capstone Copper Corp.'s Mantos Blancos mine. Finally, the guidance assumes conservative estimates of GEOs expected to be earned from Harmony's CSA mine, as Harmony's ownership transition continues and the Harmony team continues to condition the asset for optimized performance over the long-term.

OR Royalties' 2026 guidance on royalty and stream interests is largely based on publicly available forecasts from its operating partners. When publicly available forecasts on properties are not available, OR Royalties obtains internal forecasts from the producers or uses management's best estimate.

5-Year Outlook

OR Royalties expects its portfolio to generate between 120,000 and 135,000 GEOs in 2030. The outlook assumes the commencement of production at Gold Fields' Windfall, South32 Limited's Hermosa/Taylor, Osisko Development Corp.'s Cariboo, Solidus Resources LLC's Spring Valley, United Gold's Amulsar and Orla Mining Ltd.'s South Railroad projects, respectively. It also assumes increased production from certain other operators that are advancing expansions including Alamos Gold Inc.'s Island Gold District Expansion, amongst others. The 5-year outlook assumes there will be no GEO contribution from the Eagle Gold mine, which remains in receivership.

3 Cash margin is a non-IFRS financial performance measure which has no standard definition under IFRS Accounting Standards and might not be comparable to similar financial measures disclosed by other issuers. It is calculated by deducting the cost of sales (excluding depletion) from the revenues. Please refer to the Non-IFRS Financial Performance Measures section of this MD&A for further information and for a quantitative reconciliation of each non-IFRS financial measure to the most directly comparable IFRS financial measure.

| OR Royalties Inc. 2025 – Annual Report |

Management’s Discussion and Analysis |

Beyond this growth profile, OR Royalties owns several other growth assets, which have not been factored into the 5-year outlook, as their respective development timelines are either longer, or difficult to reasonably forecast at this time. As these operators provide additional clarity on these respective assets, OR Royalties will seek to include them in future long-term outlooks.

The 5-year outlook is based on internal judgements of publicly available forecasts and other disclosure by the third-party owners and operators of the Company's assets and could differ materially from actual results. When publicly available forecasts on properties are not available, OR Royalties obtains internal forecasts from the operators or uses management's best estimate. The commodity price assumptions that were used in the 5-year outlook are based on current long-term consensus and a gold/silver price ratio of 82:1.

This 5-year outlook replaces the 5-year outlook previously released in February 2025, the latter of which should be considered as withdrawn. Investors should not use the current 5-year outlook to extrapolate forecast results to any year within the 5-year period (2026-2030).

Portfolio of Royalty, Stream and Other Interests

The following table details the GEOs earned by the Company's producing royalty, stream and other interests:

| Three months ended December 31, |

Year ended December 31, |

|||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||

| Gold | ||||||||||||

| Canadian Malartic Complex royalty | 7,830 | 7,460 | 31,914 | 32,588 | ||||||||

| Éléonore royalty | 1,211 | 1,358 | 5,123 | 5,273 | ||||||||

| Island Gold District royalty | 823 | 765 | 3,274 | 3,011 | ||||||||

| Seabee royalty | 261 | 298 | 2,135 | 2,456 | ||||||||

| Ermitaño royalty | 477 | 652 | 1,967 | 2,419 | ||||||||

| Lamaque Complex royalty | 384 | 409 | 1,788 | 1,737 | ||||||||

| Namdini royalty (i) | 677 | - | 1,435 | - | ||||||||

| Pan royalty | 361 | 344 | 1,283 | 1,340 | ||||||||

| Tocantinzinho royalty (ii) | 305 | 120 | 1,102 | 120 | ||||||||

| Bald Mountain royalty | 357 | - | 825 | 869 | ||||||||

| Fruta del Norte royalty | 104 | 115 | 451 | 416 | ||||||||

| Eagle Gold royalty (iii) | - | - | - | 2,857 | ||||||||

| Others | 356 | 190 | 1,184 | 719 | ||||||||

| 13,146 | 11,711 | 52,481 | 53,805 | |||||||||

| Silver | ||||||||||||

| Mantos Blancos stream | 4,683 | 2,385 | 12,830 | 9,430 | ||||||||

| CSA stream | 1,483 | 1,545 | 4,782 | 5,407 | ||||||||

| Sasa stream | 1,130 | 1,094 | 4,406 | 4,286 | ||||||||

| Gibraltar stream | 747 | 472 | 2,217 | 2,132 | ||||||||

| Canadian Malartic Complex royalty | 61 | 46 | 191 | 175 | ||||||||

| Others | 54 | 63 | 210 | 180 | ||||||||

| 8,158 | 5,605 | 24,636 | 21,610 | |||||||||

| Copper and others | ||||||||||||

| CSA copper stream (iv) | 408 | 1,350 | 2,930 | 2,679 | ||||||||

| Renard diamond stream (v) | - | 285 | 646 | 1,529 | ||||||||

| Others | 23 | 1,054 | 82 | 1,117 | ||||||||

| 431 | 2,689 | 3,658 | 5,325 | |||||||||

| Total GEOs | 21,735 | 20,005 | 80,775 | 80,740 | ||||||||

(i) The Company received its first payment during the second quarter of 2025. The Namdini mine is currently ramping up production towards full design capacity.

(ii) G Mining Ventures Corp. announced its first gold production on July 9, 2024. Commercial production was declared on September 3, 2024, and the first royalty payment was received in the fourth quarter of 2024.

(iii) On June 24, 2024, Victoria Gold Corp. ("Victoria") announced a slope failure of its heap leach facility at the Eagle Gold mine and operations have since been suspended. Please refer to the Portfolio of Royalty, Stream and Other Interests section of this MD&A for more details.

(iv) The CSA copper stream was acquired on June 15, 2023, with an effective date of June 15, 2024. The first delivery of copper was received and sold by OR Royalties International (formerly Osisko Bermuda Limited) during the third quarter of 2024. Copper is delivered on the last day of each quarter, and may, in certain situations, be sold in the subsequent quarter.

(v) On October 27, 2023, Stornoway Diamonds (Canada) Inc. ("Stornoway"), the operator of the Renard diamond mine, announced it was suspending operations and placing itself under the protection of the Companies' Creditors Arrangement Act ("CCAA"). In 2024 and 2025, the Renard mine processed and sold a small number of diamonds as part of the care and maintenance plan.

| OR Royalties Inc. 2025 – Annual Report |

Management’s Discussion and Analysis |

2025 Actual Results vs Guidance

The following table compares the actual results with the guidance released in February 2025:

| Actual Results | Guidance | ||||||||||||||

| |

GEOs |

Cash Margin |

Low | High | Cash Margin |

||||||||||

| (%) | (GEOs) | (GEOs) | (%) | ||||||||||||

| Royalties and streams | 80,775 | 96.7% | 80,000 | 88,000 | 97.0 | ||||||||||

GEOs earned in 2025 were within the original guidance published in February 2025, despite being negatively affected by the higher gold to silver and gold to copper ratios (when compared to budgeted ratios used for the 2025 guidance).

GEOs earned, year-over-year, were stable in 2025. The stoppage of operations at the Eagle Gold mine in June 2024 (2,857 GEOs were earned from the Eagle Gold mine royalty in 2024) were more than offset by an increase in silver deliveries from the Mantos Blancos mine and an increase from the Tocantinzinho royalty payments, as the mine was ramping up its operations during the year. The Company also received its first payment from its Namdini royalty, where the operator was also ramping up its operations in 2025.

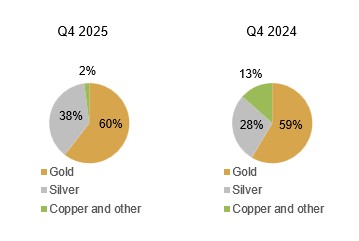

GEOs by Product

|

|

Average Metal Prices and Exchange Rate

| Three months ended December 31, | Year ended December 31, | |||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||||

| Realized | Average | Realized | Average | Realized | Average | Realized | Average | |||||||||||||||||

| Gold (i) | $4,122 | $4,135 | $2,656 | $2,663 | $3,425 | $3,432 | $2,361 | $2,386 | ||||||||||||||||

| Silver (ii) | $55 | $55 | $31 | $31 | $41 | $40 | $28 | $28 | ||||||||||||||||

| Copper (iii) | $11,750 | $11,092 | $8,880 | $9,193 | $10,153 | $9,945 | $8,920 | $9,147 | ||||||||||||||||

| Exchange rate (C$/US$) (iv) | n/a | 0.7170 | n/a | 0.7154 | n/a | 0.7157 | n/a | 0.730 | ||||||||||||||||

(i) The average price represents the London Bullion Market Association's PM price in U.S. dollars per ounce.

(ii) The average price represents the London Bullion Market Association's price in U.S. dollars per ounce.

(iii) The average price represents the London Metal Exchange's price in U.S. dollars per tonne.

(iv) Bank of Canada daily rate.

| OR Royalties Inc. 2025 – Annual Report |

Management’s Discussion and Analysis |

Royalty, Stream and Other Interests Portfolio Overview

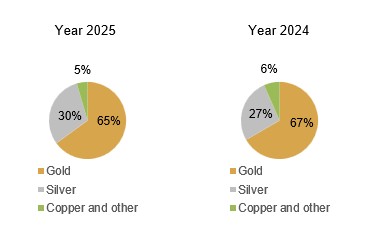

As at February 18, 2026, OR Royalties owned a portfolio of 179 royalties, 15 streams and 3 offtakes, as well as 7 royalty options. Currently, the Company has 22 producing assets.

Portfolio by asset stage

| Asset stage | Royalties | Streams | Offtakes | Total number of assets |

||||||||

| Producing | 17 | 5 | - | 22 | ||||||||

| Development | 16 | 9 | 1 | 26 | ||||||||

| Exploration and evaluation | 146 | 1 | 2 | 149 | ||||||||

| 179 | 15 | 3 | 197 |

Producing assets (i)

| Asset | Operator | Interest (ii) | Commodity | Jurisdiction |

| North America | ||||

| Akasaba West (iii) | Agnico Eagle Mines Limited | 2.5% NSR royalty | Au, Cu | Canada |

| Bald Mtn. Alligator Ridge / Duke & Trapper |

Kinross Gold Corporation | 1% / 4% GSR (iv) royalty | Au | USA |

| Bralorne (v) | Talisker Resources Ltd. | 1.7% NSR royalty | Au | Canada |

| Canadian Malartic Complex | Agnico Eagle Mines Limited | 3 - 5% NSR royalty | Au, Ag | Canada |

| Éléonore | Dhilmar Ltd. | 2.2 - 3.5% NSR royalty | Au | Canada |

| Ermitaño | First Majestic Silver Corp. | 2% NSR royalty | Au, Ag | Mexico |

| Gibraltar | Taseko Mines Limited | 100% stream | Ag | Canada |

| Island Gold District | Alamos Gold Inc. | 1.38 - 3% NSR royalty | Au | Canada |

| Lamaque Complex | Eldorado Gold Corporation | 1% NSR royalty | Au | Canada |

| Macassa TH | Agnico Eagle Mines Limited | 1% NSR royalty | Au | Canada |

| Pan | Minera Alamos Inc. | 4% NSR royalty | Au | USA |

| Parral | GoGold Resources Inc. | 2.4% stream | Au, Ag | Mexico |

| Santana | Minera Alamos Inc. | 3% NSR royalty | Au | Mexico |

| Seabee | SSR Mining Inc. | 3% NSR royalty | Au | Canada |

| Outside of North America | ||||

| Brauna | Lipari Mineração Ltda | 1% GRR (vi) | Diamonds | Brazil |

| CSA | Harmony Gold Mining Company Limited | 100% stream 2.25 - 4.875% stream |

Ag Cu |

Australia |

| Dolphin Tungsten | Group 6 Metals Limited | 1.5% GRR | Tungsten (W) | Australia |

| Fruta del Norte | Lundin Gold Inc. | 0.1% NSR royalty | Au | Ecuador |

| Mantos Blancos | Capstone Copper Corp. | 100% stream | Ag | Chile |

| Namdini (vii) | Cardinal Namdini Mining Ltd. | 2% NSR royalty | Au | Ghana |

| Sasa | Central Asia Metals plc | 100% stream | Ag | North Macedonia |

| Tocantinzinho | G Mining Ventures Corp. | 0.75% NSR royalty | Au | Brazil |

| OR Royalties Inc. 2025 – Annual Report |

Management’s Discussion and Analysis |

Key exploration/evaluation and development assets

| Asset | Operator | Interest | Commodities | Jurisdiction |

| Altar | Aldebaran Resources Inc. and Sibanye-Stillwater Ltd. | 1% NSR royalty | Cu, Au | Argentina |

| Amulsar | United Gold (private) | 3.34% Au / 49.22% Ag streams | Au, Ag | Armenia |

| Arctic | South32 Limited / Trilogy Metals Inc. | 1% NSR royalty | Cu | USA |

| AntaKori | Regulus Resources Inc. | 0.75% - 1.5% NSR royalty | Cu, Au | Peru |

| Back Forty | Gold Resource Corporation | 18.5% Au / 85% Ag streams | Au, Ag | USA |

| Cariboo | Osisko Development Corp. | 5% NSR royalty | Au | Canada |

| Cascabel | SolGold plc (viii) | 6% stream 0.6% NSR royalty |

Au Cu, Au |

Ecuador |

| Casino | Western Copper & Gold Corporation | 2.75% NSR royalty | Au, Ag, Cu | Canada |

| Copperwood | Highland Copper Company Inc. | 1.5% NSR royalty 0.115% NSR royalty |

Cu Ag |

USA |

| Dalgaranga | Ramelius Resources Limited | 1.44% GRR | Au | Australia |

| Eagle Gold (ix) | Victoria Gold Corp. | 5% NSR royalty | Au | Canada |

| Hammond Reef | Agnico Eagle Mines Limited | 2% NSR royalty | Au | Canada |

| Hermosa (Taylor) | South32 Limited | 1% NSR royalty on sulphide ores | Zn, Pb, Ag | USA |

| Horne 5 | Falco Resources Ltd. | 90% - 100% stream | Ag | Canada |

| Marban | Agnico Eagle Mines Limited | 0.435-2% NSR royalty | Au | Canada |

| Marimaca MOD | Marimaca Copper Corp. | 1% NSR royalty | Cu | Chile |

| Pine Point | Pine Point Mining Limited | 3% NSR royalty | Zn, Pb | Canada |

| Shaakichiuwaanaan | PMET Resources Inc. | 2% NSR royalty | Lithium (Li) | Canada |

| South Railroad | Orla Mining Ltd. | 100% Ag stream | Ag | USA |

| Spring Valley (x) | Solidus Resources LLC | 0.5 - 3.5% NSR royalty | Au | USA |

| Upper Beaver | Agnico Eagle Mines Limited | 2% NSR royalty | Au, Cu | Canada |

| West Kenya | Saturn Resources Ltd. | 2% NSR royalty | Au | Kenya |

| Wharekirauponga (WKP) | OceanaGold Corporation | 2% NSR royalty | Au, Ag | New Zealand |

| White Pine | White Pine Copper LLC | 1.5% NSR royalty 11.5% NSR royalty |

Cu Ag |

USA |

| Windfall | Gold Fields Limited | 2.0 - 3.0% NSR royalty | Au | Canada |

(i) The Renard diamond stream is excluded from producing assets as deliveries received since 2023 are only related to residual production from the care and maintenance plan.

(ii) Excluding tail royalties and streams reduction, when applicable.

(iii) The royalty covers less than half of the planned open-pit mine surface area.

(iv) Gross smelter return ("GSR").

(v) In April 2025, Talisker Resources Ltd. announced that it has begun lateral development on the Alhambra Vein at the Bralorne gold project. The Company received its first royalty payment in April 2025.

(vi) Gross revenue royalty ("GRR").

(vii) During the second quarter of 2025, the Company received its first royalty payment from the Namdini gold mine. In January 2026, the Company acquired an additional 1% NSR royalty on the Namdini mine for a total royalty of 2%.

(viii) On December 24, 2025, SolGold plc announced it had agreed to be acquired by its largest shareholder, Jiangxi Copper Company Limited.

(ix) On June 24, 2024, Victoria announced a slope failure of its heap leach facility at the Eagle Gold mine and operations have since been suspended. On August 14, 2024, PricewaterhouseCoopers Inc., LIT was appointed as receiver and manager of Victoria Gold Corp. by the Ontario Superior Court of Justice. Please refer to the Portfolio of Royalty, Stream and Other Interests section of this MD&A for more details.

(x) A 2.5% to 3.0% NSR royalty is applicable to the core resource area; a separate 0.5% NSR royalty is applicable on the periphery of the property.

| OR Royalties Inc. 2025 – Annual Report |

Management’s Discussion and Analysis |

Main Producing Assets

Geographical Distribution of Assets

| OR Royalties Inc. 2025 – Annual Report |

Management’s Discussion and Analysis |

Royalty, Stream and Other Interests - Main Transactions (2025)

In May 2025, OR Royalties International acquired a silver stream on Orla Mining Ltd.'s South Railroad project in Nevada, United States, from a third-party for $13.0 million. OR Royalties International will be entitled to receive 100% of the silver production from the Dark Star, Pinion and Jasperoid Wash deposits for the life of mine, in exchange for ongoing cash payments for refined silver equal to 15% of the silver spot price at the time of delivery.

In July 2025, OR Royalties International completed the second payment of $10.0 million on the Cascabel gold stream. The remaining deposit of $205.0 million will be paid as follows:

Royalty, Stream and Other Interests - Buy-back and Buy-down Rights

Some royalty, stream and other interests are subject to buy-back and/or buy-down rights held by the operators. The significant buy-back and buy-down rights are described below.

CSA copper stream

OR Royalties International owns separate silver and copper streams on the CSA mine. Specific to the copper stream agreement, OR Royalties International is entitled to receive refined copper equal to 3.0% of payable copper produced from the CSA mine until the 5th anniversary of the agreement, then 4.875% of payable copper produced from the CSA mine until 33,000 metric tonnes have been delivered in aggregate, and thereafter 2.25% of payable copper produced from the CSA mine for the remaining life of the mine.

On the 5th anniversary of the closing date (June 15, 2028), the owner of the mine will have the option to exercise certain buy-down rights by paying a one-time cash payment to OR Royalties International of $20.0 million to $40.0 million. If the option is exercised, OR Royalties International will still be entitled to receive refined copper equal to 3.25% - 4.0625% of payable copper produced from the CSA mine until 23,900 to 28,450 metric tonnes have been delivered in aggregate, and thereafter 1.5% - 1.875% of payable copper produced from the CSA mine for the remaining life of the mine.

Cascabel NSR royalty and gold stream

OR Royalties owns a 0.6% NSR royalty on the Cascabel project, which is subject to a buy-down option. On November 30, 2026, the owner of the Cascabel project may buy-down 1/3 of the NSR royalty in exchange for a one-time cash payment of approximately $35.0 million.

OR Royalties International owns a 6.0% gold stream on contained ounces of gold produced from the Cascabel project until 225,000 ounces of gold have been delivered, and 3.6% thereafter for the remaining life of the mine. On December 24, 2025, SolGold plc, the current owner of the Cascabel project, announced it had agreed to be acquired by its largest shareholder, Jiangxi Copper Company Limited. As a result of the change of control, the gold stream will be subject to a buy-down option once the transaction is completed. Prior to July 15, 2027, the new owner will have a one-time right to repurchase 50% of the gold stream for a one-time payment of gold equal to 50% of the then advanced amount of OR Royalties International's total pre-construction and construction deposits, plus certain adjustments.

| OR Royalties Inc. 2025 – Annual Report |

Management’s Discussion and Analysis |

Main Producing Assets - Updates

Canadian Malartic Complex Royalty (Agnico Eagle Mines Limited)

The Company holds a 3-5% NSR royalty on the Canadian Malartic mine, which is located in Malartic, Québec and is operated by Agnico Eagle Mines Limited ("Agnico Eagle"). OR Royalties also holds a 5.0% NSR royalty on the East Gouldie and Odyssey South underground deposits, a 3.0% NSR royalty on the Odyssey North underground deposit and a 3.0-5.0% NSR royalty on the East Malartic underground deposit, which are located adjacent to the Canadian Malartic mine. The Canadian Malartic mine and the Odyssey mine now form the Canadian Malartic Complex. In addition, a C$0.40 per tonne milling fee is payable to OR Royalties on ore processed from any property that was not part of the Canadian Malartic property at the time of the sale of the mine in 2014.

Guidance - 2026 and three-year forecast

On February 12, 2026, Agnico Eagle reported production guidance of 575,000 to 605,000 ounces of gold at Canadian Malartic for the year 2026, compared to 642,612 ounces of gold produced in 2025. The company's gold production is forecast to range between 640,000 to 670,000 ounces in 2027 and 720,000 - 750,000 ounces in 2028.

Agnico Eagle continues to advance the transition to underground mining with the construction of the Odyssey mine. Once the Barnat pit at Canadian Malartic is depleted in 2029, annual gold production is expected to be in the range of 550,000 to 600,000 ounces, supported by an underground mining rate of approximately 19,000 tpd from four deposits. At that time, the processing plant is expected to have approximately 40,000 tpd of excess capacity. The Company is advancing three projects to potentially utilize a portion of this excess capacity and position Canadian Malartic to ramp-up toward one million ounces of annual gold production starting in 2033. These projects include (i) a second shaft at Odyssey, (ii) the development of a satellite open pit at Marban and (iii) the development of the Wasamac underground project. Marban and Wasamac are located approximately 12 kilometres and 100 kilometres from the Canadian Malartic mill, respectively. In 2026, Canadian Malartic has planned four-day quarterly shutdowns for regular maintenance at the mill. OR Royalties owns several royalties over Marban that have a blended ~0.9% NSR royalty, and both Marban and Wasamac would be eligible to the C$0.40 toll milling fee for the Canadiam Malartic mill.

Update on operations

On February 12, 2026, Agnico Eagle reported gold production at the Canadian Malartic Complex of 153,433 ounces in the fourth quarter of 2025, compared to 146,485 ounces in the fourth quarter of 2024. For the full year 2025, production reached 642,612 ounces of gold compared to 655,654 ounces of gold in 2024.

Update on Odyssey

Exploration drilling in 2025 continued to expand the mineral reserves and mineral resources at the Odyssey mine, further demonstrating the quality and scale of the East Gouldie and Odyssey deposits. As of December 31, 2025, Mineral Reserves are estimated at 6.0 million ounces of gold (59.7 million tonnes grading 3.14 g/t Au). Measured and Indicated Resources are estimated at 3.4 million ounces of gold (57.8 million tonnes grading 1.85 g/t Au), and Inferred Resources are estimated at 12.7 million ounces of gold (177.7 million tonnes grading 2.21 g/t Au) and is undertaking a technical evaluation expected to be completed at the end of 2026.

The June 2023 technical update incorporated approximately 9.0 million ounces in the mine plan and envisioned a mine life extending to 2042. The significant growth of the mineral reserve and mineral resource base since December 31, 2022 supports the potential for a meaningful extension of the Odyssey mine life and provides a strong foundation for a larger, long-term production profile, with the addition of a new mining front supported by a second shaft. Agnico Eagle believes this positions Odyssey as a multi-decade, world-class asset.

Odyssey Shaft #1

Mine development continued to progress ahead of schedule in the fourth quarter of 2025, delivering record quarterly advancement at Odyssey. The focus remains on preparing East Gouldie for the start of ramp-based production, expected in the first quarter of 2026 (three months earlier than planned). Development of the production levels for the first mining area has been completed, with workings now accessing East Gouldie mineralization, and the main ramp has reached the bottom of the second mining sequence at level 111 (a depth of 1,112 metres). Installation of the paste distribution infrastructure and essential services is nearing completion. Ventilation development also advanced, with raise excavations to level 58 ongoing and construction of the main exhaust fan station underway.

Development of the material-handling infrastructure for the first shaft loading station between levels 102 and 114 continued to advance on schedule, supporting the expected start of shaft-hoisted production from East Gouldie in the second quarter of 2027. Shaft sinking progressed ahead of plan, reaching a depth of 1,466 metres as at December 31, 2025, reaching the top of the planned second loading station. Excavation of the material-handling infrastructure for the second loading station between levels 146 and 150 is now underway and is expected to continue through the third quarter of 2026. Shaft sinking remains on track to complete the first phase in the first quarter of 2027 at a planned depth of 1,600 metres, with the second loading station targeted for commissioning in 2029. A second phase of sinking is expected to resume in 2029 and be completed in 2031, extending the shaft to its final expected depth of 1,870 metres. The third loading station, located between levels 181 and 187, is expected to be completed and commissioned in 2031.

| OR Royalties Inc. 2025 – Annual Report |

Management’s Discussion and Analysis |

Construction of key surface infrastructure progressed on schedule and on budget. Fabrication of the production hoist is underway in Germany, with delivery expected in the second quarter of 2026. Construction progressed on phase two of the paste plant (designed for a 20,000 tpd capacity) and is expected to be completed in 2027.

Odyssey Shaft #2

Agnico Eagle is advancing a technical evaluation of a potential second shaft at the Odyssey mine, with the preferred shaft location now confirmed near Shaft #1 and close to the centre of gravity of the deposit. Drilling of the geotechnical pilot hole is progressing well, reaching a depth of 831 metres as at December 31, 2025, toward a planned depth of approximately 2,200 metres. The evaluation, which incorporates the year-end 2025 mineral resource update, will assess the potential for developing an 8,000 to 10,000 tpd operation, supported by a second shaft equipped with a friction hoist and dedicated service hoist, a configuration expected to lower operating costs and capital expenditures, accelerate start-up by requiring only one loading station and reduce the surface footprint.

The technical evaluation is expected to be completed at the end of 2026, with permitting studies scheduled to begin in the third quarter of 2026 and potential formal permit submission in early 2027. Approval of an amendment to the existing decree is expected to take approximately one year from submission of the application. Subject to permitting and board approval, construction, shaft sinking and development of the associated underground material-handling and production infrastructure would be expected to take place over a four-year period, positioning the project for potential initial production in 2033.

Marban - Satellite Open Pit

The Company holds a 0.435% - 2% NSR royalty on the Marban Deposit.

As part of Agnico Eagle's "fill-the-mill" strategy at the Canadian Malartic complex, the Marban property, located immediately northeast of the Canadian Malartic property, was acquired in March 2025 as an advanced exploration project that could potentially support an open pit mining operation similar to the Barnat open pit operation at Canadian Malartic.

In the fourth quarter of 2025, Agnico Eagle completed an internal evaluation on Marban, removing previous property-boundary constraints on the pit design, which resulted in the company's initial declaration of estimated probable mineral reserves of 1.58 million ounces of gold (51.6 million tonnes grading 0.95 g/t Au) at December 31, 2025. Additionally, drilling completed in the quarter confirmed and extended the Marban gold deposit onto the company's adjacent Callahan property to the east. The results of the drilling were not included in the 2025 mineral reserves and mineral resource estimates.

The technical evaluation envisions a 14,000 to 16,000 tpd open pit operation producing between 120,000 to 150,000 ounces of gold annually over a 12-year life of mine. In 2026, Agnico Eagle will integrate new drilling into an optimized pit design and assess opportunities to redeploy mobile equipment from the Barnat pit at Canadian Malartic to minimize capital expenditures for the project. The results of this evaluation, expected at the end of 2026, will support the permitting process which is expected to be completed in 2030. Project construction could begin in 2031, with the potential for initial production as early as 2033.

Update on exploration

On February 12, 2026, Agnico Eagle noted that at Odyssey in 2025, exploration drilling totalled 233,754 metres supplemented by an additional 34,672 metres of drilling dedicated to regional exploration around Canadian Malartic. Exploration drilling targeted multiple areas of the Odyssey mine, returning positive results in the eastern extension of the Odyssey South zone, the central, upper eastern, western and deeper areas of the East Gouldie deposit and in the Sheehan zone located west of the shaft.

Underground drilling in the upper eastern extension of the East Gouldie deposit was highlighted by hole UGED-071-029 intersecting 3.5 g/t Au over 19.8 metres at 1,010 metres depth, hole UGED-075-057 intersecting 4.9 g/t Au over 11.9 metres at 929 metres depth and hole UGED-095-004 intersecting 6.8 g/t Au over 9.3 metres at 990 metres depth. The results from this area of the deposit contributed to a large portion of the Mineral Reserves and Inferred Mineral Resources added to East Gouldie at year-end 2025.

Agnico Eagle expects to spend approximately $32.6 million for 190,700 metres of drilling at Canadian Malartic in 2026 with up to 20 drill rigs active at surface and underground to further assess the full potential of the Odyssey mine area and throughout the Canadian Malartic property package. The primary exploration targets remain the lateral extensions of the East Gouldie deposit and the Eclipse zone while at the Odyssey South and North zones infill drilling and the investigation of potential lateral extensions will continue. Studies are ongoing at the East Malartic deposit with the objective of converting mineral resources into mineral reserves as part of the Odyssey underground mine.

| OR Royalties Inc. 2025 – Annual Report |

Management’s Discussion and Analysis |

An additional $11 million for 45,000 metres of drilling will be spent in the Marban area for exploration and condemnation drilling around the Marban deposit under potential mining infrastructure, as well as for the purposes of mineral resource conversion and expansion of the Marban deposit.

Update on Mineral Reserve and Resource Estimates

Mineral Reserves and Mineral Resources at the Odyssey mine continued to grow significantly in 2025, further demonstrating the high-quality nature of the East Gouldie and Odyssey deposits. In total, the Odyssey mine hosted 6.0 million ounces of gold in Proven and Probable Mineral Reserves (59.7 million tonnes grading 3.14 g/t Au), 3.4 million ounces of gold in Measured and Indicated Mineral Resources (57.8 million tonnes grading 1.85 g/t Au) and 12.7 million ounces of gold in Inferred Mineral Resources (177.7 million tonnes grading 2.21 g/t Au) at December 31, 2025. These substantial Mineral Reserves and Mineral Resources continue to support the Company's vision for Canadian Malartic to potentially expand production in the future in combination with the development of satellite orebodies in the surrounding area.

At the Odyssey deposit's Odyssey South zone and Odyssey internal zone, positive reconciliation observed in the underground production and improvements to the Mineral Reserve model contributed to mineral reserves replacement at the Odyssey mine reaching 90%. As a result, the Mineral Reserves of the Odyssey deposit totalled 0.3 million ounces of gold (4.8 million tonnes grading 2.12 g/t Au) at December 31, 2025, similar to the previous year.

At the Canadian Malartic mine, the continued positive reconciliation observed in the open pit and improvements to the Mineral Reserve model contributed to the addition of 115,000 ounces of gold to Mineral Reserves in the open pit during 2025. As a result, the Mineral Reserve decreased by approximately 495,000 ounces of gold while the gold production accounted for 610,000 in-situ ounces of gold.

Exploration drilling during 2025 continued to extend the limits of the East Gouldie Inferred Mineral Resource laterally to the west and to the east. As a result, Inferred Mineral Resources at the East Gouldie deposit (including the sub-parallel Eclipse zone) increased by 62% (2.8 million ounces of gold) year over year to 7.4 million ounces of gold (94.3 million tonnes grading 2.43 g/t Au) at December 31, 2025.

Drilling targeting the Eclipse zone in 2025 resulted in the declaration at year-end of initial Inferred Mineral Resources of 0.6 million ounces of gold (6.7 million tonnes grading 2.74 g/t Au) within close proximity to the planned underground infrastructure.

For additional information, please refer to Agnico Eagle's press release dated February 12, 2026 titled "Agnico Eagle Reports Fourth Quarter And Full Year 2025 Results - Record Quarterly And Annual Free Cash Flow; 2025 Production Guidance Achieved; Total 2025 Shareholder Returns Of $1.4 Billion; Dividend Increased By 12.5%; Updated Three-Year Guidance" and Agnico Eagle's press release dated February 12, 2026 titled "Agnico Eagle Provides An Update On 2025 Exploration Results And 2026 Exploration Plans - Year Over Year Mineral Reserves Increase 2% To 55.4 Moz; Indicated Mineral Resources Increase 10% To 47.1 Moz And Inferred Mineral Resources Increase 15% To 41.8 Moz", both filed on www.sedarplus.ca.

Mantos Blancos Stream (Capstone Copper Corp.)

OR Royalties, through OR Royalties International, owns a 100% silver stream on the Mantos Blancos mine, an open-pit mine located in the Antofagasta region of Chile. The Mantos Blancos mine is owned and operated by Capstone Copper Corp. ("Capstone").

Under the stream, OR Royalties International will receive refined silver equal to 100% of the payable silver from the Mantos Blancos mine until 19.3 million ounces have been delivered (7.5 million ounces have been delivered as at December 31, 2025), after which the stream percentage will be reduced to 40%. The purchase price for the silver under the Mantos Blancos stream is 8% of the monthly average silver market price for each ounce of refined silver sold and delivered and/or credited by Capstone to OR Royalties International. OR Royalties International receives deliveries from Mantos Blancos production with a two-month lag.

Guidance - 2026

On February 17, 2026, Capstone reported production guidance of 48,000 to 56,000 tonnes of copper for the year 2026. Copper production at Mantos Blancos is forecast to decrease in 2026 when compared to a strong 2025 due to a one-year period of lower copper grades. Due to mine sequencing, sulphide copper grades are expected to approximate 0.70% in 2026, with higher copper grades expected to approximate 0.85% in 2027. Planned maintenance shutdowns are scheduled during the second quarter (4 days) and the third quarter of 2026 (3 days).

| OR Royalties Inc. 2025 – Annual Report |

Management’s Discussion and Analysis |

Update on operations

On January 15, 2026, Capstone reported that Mantos Blancos achieved record quarterly copper production of 16,861 tonnes in the fourth quarter, with an average sulphide plant throughput of approximately 21,391 tpd, exceeding design throughput levels for the second quarter in 2025. Total plant throughput averaged approximately 19,981 tpd in 2025, representing a 25% increase over 2024 driven by the successful ramp-up after the debottlenecking initiative. Annual copper production at Mantos Blancos was 61,919 tonnes, surpassing its 2025 production guidance range of 43,000 to 51,000 tonnes from its sulphides business and 6,000 to 8,000 tonnes from its cathode business, following a year of strong operations, and representing a 39% increase over 2024.

Capstone is currently evaluating the next phases of growth for Mantos Blancos, including the potential to increase the concentrator plant throughput to at least 27,000 tpd and increase cathode production from the underutilized SX-EW plant. A Mantos Blancos Phase II study focusing on the sulphide concentrator plant expansion is expected in the first half of 2026. The sulphide concentrator plant expansion is expected to utilize existing unused or underutilized process equipment, plus additional equipment for concentrate filtration, thickening and filtering of tailings.

Update on exploration

On October 30, 2025, Capstone reported that exploration drilling commenced at the Veronica and Nora-Quinta areas within and adjacent to the resource pit area. The program totals approximately 7,900 metres and was expected to be completed before year-end 2025. In parallel, infill drilling was undertaken during the third quarter of 2025, with activities focused on Phases 15 and 16. Sonic drilling over historic stockpiles was also completed early during the third quarter.

In addition, a passive seismic (ambient noise tomography) geophysical survey is underway at Mantos Blancos. Data acquisition has been completed along the pit area and in its immediate surrounding, with data processing and modelling scheduled for the fourth quarter of 2025. The survey aims to improve understanding of the local stratigraphy and may help identify new drill targets at depth or near the current deposit area.

For additional information, please refer to Capstone's press release dated October 30, 2025 titled "Capstone Copper Reports Third Quarter 2025 Results" and Capstone's press release dated January 15, 2026 titled "Capstone Copper Announces Record 2025 Production Results and Provides Update on Mantoverde Labour Negotiations", both filed on www.sedarplus.ca.

CSA Streams (Harmony Gold Mining Company Limited)

In May 2025, MAC Copper Limited ("MAC Copper") announced that it had entered into a binding scheme implementation deed with Harmony, under which it was proposed that Harmony Gold (Australia) Pty Ltd ("Harmony Australia") would acquire 100% of the issued share capital in MAC Copper in exchange for $12.25 cash per MAC Copper share. The Transaction closed in October 2025 and OR Royalties International received proceeds of $49.0 million in exchange for its equity investment, generating a gross profit of $9.0 million or 22% over a period of approximately 2 years.

OR Royalties, through OR Royalties International, holds a silver stream and a copper stream on the CSA copper mine, now operated by Harmony. OR Royalties International will purchase an amount of refined silver equal to 100% of the payable silver produced from CSA for the life of the mine and will make ongoing payments for refined silver delivered equal to 4% of the spot silver price at the time of delivery. OR Royalties International will also be entitled to purchase refined copper equal to 3.0% of payable copper produced from CSA until the 5th anniversary of the closing date (June 15, 2028), then 4.875% of payable copper produced from CSA until 33,000 metric tonnes have been delivered in aggregate, and thereafter 2.25% of payable copper produced from CSA for the remaining life of the mine. OR Royalties International will make ongoing payments for refined copper delivered equal to 4% of the spot copper price at the time of delivery. On the 5th anniversary of the closing date, Harmony will have the option to exercise certain buy-down rights on the copper stream by paying a one-time cash payment to OR Royalties International of $20.0 million to $40.0 million.

In July 2023, OR Royalties International received its first delivery of silver. The first delivery of copper under the CSA copper stream occurred in the first week of July 2024. As of December 31, 2025, a total of 1,748 tonnes of copper have been delivered to OR Royalties International under the stream agreement.

Guidance and operations

On February 24, 2025, MAC Copper maintained its production guidance for the next two years, which was originally released on July 22, 2024. Copper production was expected to range between 43,000 to 48,000 tonnes in 2025 and 48,000 to 53,000 tonnes in 2026. This two-year production guidance was based primarily on Mineral Reserves, but also on Measured and Indicated Mineral Resources (as at December 31, 2024).

| OR Royalties Inc. 2025 – Annual Report |

Management’s Discussion and Analysis |

The CSA copper mine is high grade in general, but a small number of very high-grade stopes (plus 8% copper) comprise an outsized proportion of annual production. The sequencing of these can have a significant impact on month-to-month production and along with typical summer storms and power interruptions, the March quarters are typically the weakest quarter in a year.

On October 24, 2025, Harmony noted that the integration of the CSA mine into the Harmony portfolio would commence. Over the next three months, Harmony embedded the mine into the broader Harmony Group, aligning its operations with its planning and performance frameworks. This process was designed to unlock synergies, enhance operational efficiency, and position CSA to contribute meaningfully to Harmony's long-term value creation. A detailed update on operational performance and key development milestones - including the ventilation project, upper Merrin mine development and exploration activities through December 2025 - is expected to be provided at Harmony's half-year results presentation scheduled for March 11, 2026. On February 3, 2026, Harmony noted that the integration activities at the CSA copper mine were progressing well, with initial activities focusing on integrating the mine into Harmony's systems, processes and culture.

Harmony's planning parameters for financial year 2027 will be embedded into CSA mine to develop its financial year life-of-mine plan, in alignment with the planning approach used across its other operations. The CSA mine life-of-mine plan will be released alongside the financial year 2026 results expected in August 2026.

Update on Mineral Reserve and Resource Estimates

On February 24, 2025, MAC Copper announced an updated 2024 Mineral Resources and Mineral Reserves statement, including an updated life-of-mine of 12 years based on Mineral Reserves only. As at December 31, 2024, Mineral Reserves were estimated at 545,000 tonnes of copper and 6.8 million ounces of silver (15.9 million tonnes grading 3.4% Cu and 13.3 g/t Ag), Measured and Indicated Mineral Resources were estimated at 286,000 tonnes of copper and 3 million ounces of silver (5.6 million tonnes grading 5.1% Cu and 16.7 g/t Ag), and Inferred Mineral Resources were estimated at 178,000 tonnes of copper and 3.9 million ounces of silver (5.4 million tonnes grading 3.3% Cu and 22 g/t Ag). The 2024 Mineral Reserves only extends 70 metres vertically below the current decline position requiring only minimal annual development.

For more information, refer to MAC Copper's press release dated February 24, 2025 titled "MAC Copper Limited Announces 2024 Resource and Reserve Statement and Production Guidance", MAC Copper's press release dated May 27, 2025 titled "MAC Copper Limited Enters Into Binding Scheme Implementation Deed With Harmony", and MAC Copper's press release dated July 29, 2025 titled "MAC Copper Limited Announces June 2025 Quarterly Report", all filed on www.sec.gov/edgar, Harmony's press release dated October 24, 2025 titled "Harmony completes MAC Copper acquisition, securing full ownership of CSA mine and unlocking immediate copper production" and Harmony's press release dated February 3, 2026 titled "Harmony's full year guidance on track; higher gold price boosts cash flows", available on Harmony's website (www.harmony.co.za)

Éléonore Royalty (Dhilmar Ltd.)

OR Royalties owns a sliding scale 1.8% to 3.5% NSR royalty on the Éléonore gold mine ("Éléonore") located in the Province of Québec and operated by Dhilmar Ltd. ("Dhilmar"). Dhilmar acquired Éléonore from Newmont Corporation ("Newmont") in the first quarter of 2025 for a cash consideration of $795 million. OR Royalties currently receives a NSR royalty of 2.2% on production at the Éléonore mine, until 3.0 million ounces of gold have been produced by the mine, at which point the royalty rate will increase to 2.45%. As of December 31, 2025, the mine has produced a cumulative total of 2.9 million ounces of gold.

Update on Reserve and Resource Estimates

On February 20, 2025, Newmont reported Proven and Probable Mineral Reserves at Éléonore comprising 10.1 million tonnes grading 5.05 g/t Au for 1.6 million ounces of gold as at December 31, 2024.

For additional information, please refer to Newmont's press release dated February 20, 2025 titled "Newmont Reports 2024 Mineral Reserves of 134.1 Million Gold Ounces and 13.5 Million Tonnes of Copper", filed on www.sedarplus.ca.

| OR Royalties Inc. 2025 – Annual Report |

Management’s Discussion and Analysis |

Sasa Stream (Central Asia Metals plc)

OR Royalties, through OR Royalties International, owns a 100% silver stream on the Sasa mine, operated by Central Asia Metals plc ("Central Asia") and located in North Macedonia. The Sasa mine is one of the largest zinc, lead and silver mines in Europe. OR Royalties International's entitlement under the Sasa stream applies to 100% of the payable silver production in exchange for $5 per ounce (plus refining costs) of refined silver delivered, increased for inflation annually from 2017 ($6.665 per ounce in 2026).

Guidance - 2026

Sasa's guidance for 2026 is forecast at 800,000 to 820,000 tonnes of ore mined and processed, and metal-in-concentrate production is estimated to 18,000 to 20,000 tonnes of zinc and 26,000 to 28,000 tonnes of lead.

Update on operations

On January 8, 2026, Central Asia reported sales of 94,655 ounces of silver to OR Royalties International in the fourth quarter of 2025, bringing the total for 2025 to 380,433 ounces. Sasa recorded increases in tonnes mined and milled during the fourth quarter of 2025, with both parameters exceeding the 820,000 tonnes per annum level on an annualized basis.

The Dry Stack Tailings Plant (the "DST Plant") continued to operate consistently in the fourth quarter of 2025, and by the end of December had produced over 260,000 tonnes of dry tailings. Since the DST Plant became operational at the end of the first quarter of 2025, tailings stored as dry tailings or underground as paste backfill represent approximately 75% of the total generated. This exceeds Central Asia's 2026 target of 70% of Sasa's tailings to be stored using these two more environmentally responsible methods.

Efforts are being made to improve near-term mine planning, as in addition to becoming typically narrower as mining has progressed, the orebody is also proving more variable. These include increasing the intensity of sampling of the working faces and additional external training of key personnel involved in orebody modelling. In addition, work is under way to improve management's knowledge of the orebody at depth, with a view to long-term mine planning.

For more information on the Sasa mine, refer to Central Asia's press release dated January 8, 2026, titled "2025 Operations Update", available on their website at www.centralasiametals.com.

Island Gold District Royalty (Alamos Gold Inc.)

OR Royalties owns NSR royalties ranging from 1.38% to 3.00% on the Island Gold mine property (nearly all current Island Gold Mineral Reserves and Resources are covered by the royalties), which is now included in the Island Gold District (regrouping the Island Gold and Magino properties), operated by Alamos Gold Inc. ("Alamos") and located in Ontario, Canada. OR Royalties also owns a 3% NSR over a small fraction at the eastern limit of the Magino open pit mine.

On February 3, 2026, Alamos reported that at Island Gold, the total effective NSR royalty averages approximately 2.6% over the life of mine, based on ounces produced, with approximately 90% of this royalty paid in-kind (the latest representing the royalty held by the Company). This implies that the royalties owned by OR Royalties over the Island Gold underground mine have a weighted average of 2.34% NSR royalty coverage over the new life of mine.

Guidance - 2026-2028

On February 4, 2026, Alamos released its three-year guidance. Gold production at the Island Gold District is expected to range between 290,000 and 330,000 ounces in 2026, down 9% from the previous guidance of 330,000 to 355,000 ounces, reflecting decreased milling rates from the Magino mill and a slightly slower ramp-up of underground mining rates at Island Gold to 2,400 tpd. With the shaft expected to be operational towards the end of 2026, mining rates are now expected to ramp-up to planned rates of 2,400 tpd early in 2027, compared to the fourth quarter of 2026 previously.

Gold production for the Island Gold District in 2027 increased to 380,000 - 420,000 ounces, from 375,000 - 400,000 ounces under the previous guidance. A first gold production guidance was also released for 2028 of 470,000 - 510,000 ounces. The guidance data has not been provided separately for the Island Gold and the Magino mines.

Update on operations

On January 14, 2026, Alamos reported production at the Island Gold District of 60,000 ounces of gold in the fourth quarter of 2025, an 8% increase from the prior year comparative period. The results of the fourth quarter were down from the third quarter and below plan due to lower underground grades and mining rates, as well as reduced mill throughput. For the full year, the Island Gold District produced 250,400 ounces, slightly below the low-end of the revised annual guidance.

| OR Royalties Inc. 2025 – Annual Report |

Management’s Discussion and Analysis |

At the Island Gold mine, underground mining rates averaged 1,157 tpd in the fourth quarter, below full year guidance and down from the third quarter reflecting additional rehabilitation work related to the seismic event in October, as well as downtime in late December due to severe winter weather. Severe snowstorms and subsequent road closures prevented delivery of supplies, and access to site by personnel and emergency services. This required a standdown of underground mining operations for a total of three days.

The majority of the underground rehabilitation work was completed during the quarter but was more extensive than originally anticipated, which impacted mining rates in the quarter. With substantial progress made through the end of November, underground mining rates improved to average 1,220 tpd for the month of December. Excluding the impact of the three days of weather-related downtime near the end of the quarter, mining rates would have averaged approximately 1,350 tpd in December. Completion of the rehabilitation positions the operation to meet the ramp up of mining rates through 2026 as part of the completion of the P3+ Expansion in the latter part of the year.

Underground grades mined averaged 10.61 g/t Au for the quarter and 11.44 g/t Au for the year, both in line with guidance. Milling rates were consistent with mining rates and recoveries of 98% were consistent with guidance.

Update on Island Gold District Expansion

In 2022, Alamos announced the Phase 3+ Expansion at Island Gold to 2,400 tpd from the current rate of 1,200 tpd, which included various infrastructure investments. These included the installation of a shaft, paste plant, as well as accelerated development to support the higher mining rates. Following the completion of the expansion in 2026, the operation was expected to transition from trucking ore and waste up the ramp to skipping ore and waste to surface through the new shaft infrastructure, driving production higher and costs significantly lower.

On June 23, 2025, Alamos announced the Base Case Life of Mine Plan ("Base Case LOM Plan") with the total growth capital estimate for the Phase 3+ Expansion revised to $835 million. This represented a 10% increase from the original growth capital estimate prepared in 2022. As at September 30, 2025, 84% of the total growth capital has been spent and committed on the Phase 3+ Expansion.

On February 3, 2026, Alamos reported the results of the Expansion Study ("IGD Expansion") completed on the Island Gold District operation. Compared to the Base Case LOM Plan, the IGD Expansion incorporates a 30% increase in Mineral Reserves, and an expansion of the Magino mill to 20,000 tpd supporting increased processing rates of 3,000 tpd of high-grade underground ore from Island Gold, and 17,000 tpd from the open pit at Magino. This is expected to drive production higher and create one of the largest, longest life, and most profitable gold operations in Canada. The IGD Expansion study highlighted increased gold production for an average annual production of 534,000 ounces over 10 years post expansion (2028+), a 27% increase from the Base Case LOM, and 113% increase from 2025. The average annual production is expected to reach 490,000 ounces of gold over 15 years during which both the open pit and underground are operating (based on Mineral Reserves only). The IGD Expansion is expected to be completed in 2028. The Phase 3+ Expansion remains on track for completion late in 2026, with the shaft and paste plant infrastructure designed to support higher underground mining rates of 3,000 tpd. Construction of the larger mill is well underway and sized for 20,000 tpd such that key components of the IGD Expansion are largely de-risked, as per Alamos management.

The Island Gold mill will continue operating in 2026 and 2027 and will be dedicated to processing approximately 1,265 tpd of higher-grade underground ore until the expected completion of the mill expansion in the first quarter of 2028. The remaining underground ore mined will be blended at increasing rates with open pit ore, and processed within the Magino mill. Following the completion of the IGD Expansion in 2028, the Island Gold mill will be shut down and all underground ore from Island Gold and open pit ore from Magino will be processed through the larger, centralized and more cost-effective Magino mill. Underground mining rates at Island Gold are expected to ramp up through 2026 from 1,400 tpd to 2,000 tpd by the end of the year. Following the expected completion of the Phase 3+ Expansion in the fourth quarter of 2026, underground mining will transition from trucking ore and waste to skipping ore and waste to surface through the new shaft infrastructure. This is expected to drive an increase in underground mining rates to 2,400 tpd in 2027. As part of the IGD Expansion, a further increase in underground mining rates to 3,000 tpd is expected by 2029, with the shaft and related infrastructure designed to support the higher mining rates. This will be processed through the expanded 20,000 tpd Magino mill with the remaining 17,000 tpd coming from the open pit at Magino. The new projected annual gold production contributions from the Island Gold mine is shown as the orange bars in the histogram below (provided in the February 3, 2026 press release).

| OR Royalties Inc. 2025 – Annual Report |

Management’s Discussion and Analysis |

Update on Reserve and Resource Estimates

On February 3, 2026, Alamos reported Proven and Probable Mineral Reserve of 15.1 million ounces of gold at Island Gold underground (15.1 million tonnes grading 10.61 g/t Au), representing a 25% increase from the 4.1 million ounces contained in the June 2025 update (11.8 million tonnes grading 10.85 g/t Au). The increase was driven by a successful delineation drilling program with the focus on converting a large portion of Mineral Resource base into Mineral Reserves. Measured and Indicated Mineral Resources decreased by 44% compared to the June 2025 update at Island Gold, to 0.6 million ounces of gold (2.1 million tonnes grading 8.77 g/t Au), as a result of the conversion to Mineral Reserves. Inferred Mineral Resources also decreased by 45% to 1.4 million ounces (16.9 million tonnes grading 2.57 g/t Au), also as a result of the conversion program.

Update on exploration

On February 2, 2026, Alamos reported new results from underground and surface drilling at Island Gold. Exploration drilling continues to extend high-grade gold mineralization across the Island Gold deposit, as well as within several hanging wall and footwall structures, and delineation drilling continues to support the conversion of high-grade Mineral Resources to high-grade Mineral Reserves. Based on the exploration ongoing success, and with the deposit open laterally and at depth, management expects the main Island Gold deposit to continue to grow well into the future.

A total of $24 million was spent on exploration at the Island Gold District in 2025, up from $20 million spent in 2024. Following up on a successful 2024 program, a total of 46,889 metres of underground drilling was completed in 180 holes in 2025 with a focus on defining new Mineral Reserves and Resources in proximity to existing production horizons and infrastructure. Additionally, 14,609 metres of surface exploration drilling was completed in 15 holes targeting the area between the Island Gold and Magino deposits, as well as the down-plunge extension of the Island Gold deposit, below a depth of 1,500 metres. A primary focus of the 2025 drill program was the conversion of a portion of the large Mineral Resource base to Mineral Reserves to be included in the Island Gold District Expansion Study. As part of that focus, a total of 33,964 metres of underground delineation drilling was completed in 117 holes, and 12,269 metres of surface delineation drilling was completed in 12 holes.

For more information, refer to Alamos' press release dated June 23, 2025 titled "Alamos Gold Announces Island Gold District Base Case Life of Mine Plan Outlining One of the Largest and Lowest-Cost Gold Mines in Canada with Significant Upside", Alamos' press release dated January 14, 2026 titled "Alamos Gold Reports Fourth Quarter and Annual 2025 Production", Alamos' press release dated February 2, 2026 titled "Alamos Gold Extends High-Grade Mineralization Across the Island Gold Deposit and Nearby Regional Targets Including Best Hole Ever at Cline-Pick, Intersecting 178 g/t Gold over 3.5 Metres", Alamos' press release dated February 3, 2026 titled "Alamos Gold Announces Island Gold District Expansion to 20,000 TPD, Creating One of Canada's Largest and Lowest Cost Gold Mines with Attractive Economics, including 69% After-Tax IRR and $12.2 Billion NPV at $4,500/oz Gold", and Alamos' press release dated February 4, 2026 titled "Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs", all filed on www.sedarplus.ca.

| OR Royalties Inc. 2025 – Annual Report |

Management’s Discussion and Analysis |

Seabee Royalty (SSR Mining Inc.)

OR Royalties holds a 3% NSR royalty on the Seabee gold operations operated by SSR Mining Inc. ("SSR Mining") and located in Saskatchewan, Canada.

Guidance - 2026

On February 17, 2026, SSR Mining reported 2026 annual guidance for the Seabee mine of 60,000 to 70,000 ounces of gold. In 2026, production from Seabee is expected to be strongest in the fourth quarter due to higher grades. Over the course of the year, processed grades at Seabee are expected to average approximately 5.0 g/t Au, while process plant throughputs are expected to average approximately 1,200 tpd, inclusive of planned maintenance downtime in the second quarter.

Update on operations

On February 17, 2026, SSR Mining reported gold production at the Seabee mine of 8,869 ounces in the fourth quarter of 2025, compared to 27,811 ounces in the fourth quarter of 2024. Production for the year 2025 amounted to 54,986 ounces of gold, compared to 78,545 ounces of gold in 2024. Production from Seabee in 2025 reflected the temporary suspension of operations in the second quarter due to the impacts of regional forest fires, as well as the previously guided effort to prioritize underground mine development in the second half of the year.

Update on exploration

On February 17, 2026, SSR Mining announced that growth expenditures at Seabee are expected to total $15.0 million in 2026 as it advances near-mine drilling exploration and resource development activity at Santoy and progresses engineering at Porky ahead of potential development in 2027.

Update on Mineral Reserve and Resource Estimates

On February 17, 2026, SSR Mining reported updated Mineral Reserves estimates at Seabee as of December 31, 2025. Proven and Probable contained gold ounces increased by 192,000 ounces, or 64%. Factors contributing to the change include: (i) re-interpretation of the mineralized envelopes using the most updated drill hole information, (ii) change to optimization parameters in terms of cost changes and cut-off grade, (iii) inclusion of Porky West in Mineral Reserves, and (iv) depletion. An initial Mineral Reserve of 203,000 ounces of gold was declared at Porky in 2025 with the potential to represent a new underground mining front to further complement and extend the existing Seabee mine life. These ounces are within the Probable Reserves of 3.052 million tonnes of 4.55 g/t Au for 447,000 ounces of gold and Proven Reserves of 0.332 million tonnes of 5.33 g/t Au for 57,000 ounces of gold. Measured and Indicated Resources include 1.402 million tonnes of 3.58 g/t Au for 162,000 ounces of gold and Inferred Resources include 1.605 million tonnes of 3.94 g/t Au for 203,000 ounces of gold.

For more information, refer SSR Mining's press release dated February 17, 2026 titled "SSR Mining Reports Full-Year 2025 Results and 2026 Operating Guidance", filed on www.sedarplus.ca, as well as SSR Mining's Forms 10-K filed on EDGAR at www.sec.gov.

Ermitaño Royalty (First Majestic Silver Corp.)

OR Royalties holds a 2% NSR royalty on the Ermitaño underground gold and silver mine ("Ermitaño") operated by First Majestic Silver Corp. ("First Majestic") and located in Sonora State, Mexico.

Guidance - 2026

On January 15, 2026, First Majestic reported its annual guidance for Santa Elena of 1.3 million to 1.5 million ounces of silver and 64,000 to 71,000 ounces of gold. This production should be mostly from ore covered by the royalty held by OR Royalties on Ermitaño.

One of First Majestic's key initiatives for 2026 is the expansion of the Santa Elena processing plant, increasing capacity from 3,200 tpd to 3,500 tpd.

| OR Royalties Inc. 2025 – Annual Report |

Management’s Discussion and Analysis |

Update on operations

On January 15, 2026, First Majestic announced production of 358,185 ounces of silver and 25,083 ounces of gold in the fourth quarter of 2025 at Santa Elena. Silver production was down 6% while gold production was down 15% year-over-year primarily due to lower grade silver and gold ore from the lower levels of the Ermitaño mine, as expected under the 2025 mining plan.

The mill processed a quarterly record of 283,721 tonnes of ore, 4% higher than the same period last year, with average silver and gold head grades of 62 g/t and 2.91 g/t, respectively. Average silver ore grades decreased 7%, while gold ore grades declined 11% for the quarter, in line with the mine plan.

Silver and gold recoveries during the quarter averaged 64% and 95%, respectively, compared to 69% and 96% in the same period last year. Lower recoveries were anticipated and are a direct correlation to lower feed grades.

Update on exploration

On July 30, 2024, First Majestic announced the discovery of a significant new, vein-hosted gold and silver mineralized system at its Santa Elena property. This new high-grade discovery, the Navidad vein system ("Navidad"), was made at depth adjacent to the company's producing Ermitaño mine and is within OR Royalties' royalty boundaries. This is the most promising discovery at the Santa Elena property since Ermitaño was discovered in 2016.

During the fourth quarter of 2025, six drill rigs, consisting of three surface rigs and three underground rigs, completed 10,846 metres of drilling on the Santa Elena property. Drilling focused on testing extensions of the newly discovered Santo Niño and Navidad resources, and the conversion of Inferred Mineral Resources to Indicated Mineral Resources at Ermitaño-Luna.

At Santa Elena, approximately 78,000 metres of drilling is planned in 2026. Drilling at Santa Elena will focus on converting Inferred to Indicated Resources at the Santo Niño Discovery (not covered by the royalty held by OR Royalties), continuing to drill test extensions of Navidad (covered by the royalty held by OR Royalties) and testing several greenfield targets within a 10-kilometre radius around the processing plant where a new geologic understanding of district geology has highlighted the presence of large areas with exploration upside.

Update on Mineral Reserve and Resource Estimates

On March 31, 2025, First Majestic released updated 2024 Mineral Reserve and Mineral Resource estimates for the Ermitaño underground mine. Ermitaño's Proven Mineral Reserve is estimated at 2.2 million ounces of silver and 93,000 ounces of gold (797,000 tonnes grading 85 g/t Ag and 3.65 g/t Au) and Probable Mineral Reserve is estimated at 2.5 million ounces of silver and 105,000 ounces of gold (2.0 million tonnes grading 38 g/t Ag and 1.61 g/t Au).

The Navidad discovery at Santa Elena added 2.3 million tonnes of Inferred Mineral Resources containing 5.9 million ounces of silver and 249,000 ounces of gold with metal grades of 81 g/t Ag and 3.42 g/t Au, respectively. To date, only a portion of the newly delineated vein system has been classified within the resource estimate, with significant upside potential to be realized through additional drilling.

For more information, refer to First Majestic's press release dated July 30, 2024 titled "First Majestic Announces New High-Grade Gold and Silver Discovery at Santa Elena", First Majestic's press release dated March 31, 2025 titled "First Majestic Announces 2024 Mineral Reserve and Mineral Resource Estimates" and First Majestic's press release dated January 15, 2026 titled "First Majestic Reports 2025 Production and 2026 Outlook; Increases Dividend", all filed on www.sedarplus.ca.

Gibraltar Stream (Taseko Mines Limited)

OR Royalties owns a silver stream referenced to 100% of Gibraltar copper mine's production, operated by Taseko Mines Limited ("Taseko") and located in British Columbia, Canada, until a total of 6.8 million ounces of silver has been delivered, after which the refined silver to be delivered will be reduced to 35% of the payable silver produced. There is no cash transfer price payable by OR Royalties at the time of delivery for the silver ounces delivered. As of December 31, 2025, a total of 1.6 million ounces of silver have been delivered under the stream agreement.

Guidance - 2026

As of the date of this MD&A, Taseko has not yet released its 2026 production guidance.

| OR Royalties Inc. 2025 – Annual Report |

Management’s Discussion and Analysis |

Update on operations

On January 13, 2026, Taseko reported copper and molybdenum production for the 2025 year of 98 million pounds and 1.9 million pounds, respectively. Fourth quarter copper production was 31 million pounds of copper, a significant increase over the previous quarters of 2025. Production in the fourth quarter was impacted by unanticipated mill downtime, due to unscheduled maintenance activities and a serious accident which resulted in a temporary site wide shut down in November. Gibraltar production in the second half of the year was a notable improvement over the first half of the year with higher grades and better-quality ore. Looking ahead to 2026, Taseko management expects more consistent quarterly production, now that the company is better situated in the Connector pit, and higher overall copper production.

For more information, refer to Taseko's press release dated January 13, 2026 titled "Taseko Provides Update on Florence Copper Ramp-up and Gibraltar 2025 Production Results", filed on www.sedarplus.ca.

Lamaque Complex Royalty (Eldorado Gold Corporation)

OR Royalties owns a 1% NSR royalty on the producing Triangle deposit as well as the prospective Ormaque, Plug #4, and Parallel deposits of the Lamaque Complex. The Lamaque Complex, which includes the Triangle mine (upper and lower zones), the Ormaque mine, the Parallel deposit, the Plug #4 deposit, and the Sigma Mill, is operated by Eldorado Gold Corporation ("Eldorado") and is located in Québec, Canada. OR Royalties also holds a 2.5% NSR royalty on the Bourlamaque property.

Guidance - 2026

As of the date of this MD&A, Eldorado has not yet released its 2026 production guidance.

Update on operations

On January 20, 2026, Eldorado announced production at the Lamaque Complex of 49,307 ounces of gold, for a total of 187,208 ounces of gold in 2025. During the fourth quarter, production increased slightly over the third quarter, driven by higher ore grade and mill throughput. Production during the year benefited from the higher grade Ormaque bulk sample, record mill throughput and continued operational excellence.

Update on Mineral Reserve and Resource Estimates

On November 26, 2025, Eldorado released its updated Mineral Reserves and Mineral Resources as of September 30, 2025. Proven and Probable Mineral Reserves included 1.285 million tonnes of 5.78 g/t Au and 5.588 million tonnes of 7.53 g/t Au, respectively, for a total of 1.591 million ounces of gold. Measured and Indicated Resources included 2.185 million tonnes of 6.73 g/t Au and 8.605 million tonnes of 7.97 g/t Au, respectively, for a total of 2.677 million ounces of gold. Inferred Resources included 8.087 million tonnes of 7.69 g/t Au for 2.0 million ounces. The updated technical report outlines a Reserve Case with an 8-year mine life.

Mineral Reserves increased 25% at Lamaque, driven by conversion at Ormaque and Triangle, in addition to declaring initial Mineral Reserves at Plug #4. The increase in total Measured and Indicated Mineral Resources was primarily driven by conversion from Inferred Mineral Resources.

Update on exploration

On January 26, 2026, Eldorado announced the discovery of four new high-grade zones at the Lamaque Complex and the commencement of studies aimed at unlocking a potential expansion. Recent results confirmed high-grade mineralization across multiple deposits on the property, with Ormaque adding flexibility near existing infrastructure. These results, along with emerging targets on the wider Bourlamaque property highlight a compelling opportunity for low-risk, capital efficient organic growth and mine life extension. As a result of recent exploration success and the potential for additional resources in close proximity to the Sigma mill, Eldorado has commenced studies to expand throughput from its current capacity of approximately 2,500 tpd towards its fully permitted capacity of 5,000 tpd.

For more information, refer to Eldorado's press release dated November 26, 2025 titled "Eldorado Gold Releases Updated Mineral Reserve and Mineral Resource Statement; Offsetting Depletion and Increasing Mineral Reserves at Key Operations", Eldorado's press release dated January 20, 2026 titled "Eldorado Gold Achieves Higher-End of 2025 Production Guidance; Appoints Dr. Sally Eyre to the Board of Directors; Details 2026 Reporting Schedule and Provides Q4 2025 Conference Call Details", and Eldorado's press release dated January 26, 2026 titled "Eldorado Announces Strong Exploration Results of Multiple New High-Grade Zones in Canada and Greece and Increases 2026 Exploration Investment, Reinforcing Confidence in Discovery Strategy", all filed on www.sedarplus.ca.