UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-23016

(Investment Company Act file number)

Alternative Credit Income Fund

(Exact name of Registrant as specified in charter)

650 Madison Avenue, 3rd Floor

New York, NY 10022

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

Corporation Trust Center, 1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 891-2880

Date of fiscal year end: September 30

Date of reporting period: October 1, 2024– March 31, 2025

Item 1. Reports to Stockholders.

| (a) |

TABLE OF CONTENTS

| Shareholder Letter | 1 |

| Portfolio Update | 15 |

| Consolidated Schedule of Investments | 17 |

| Consolidated Statement of Assets and Liabilities | 24 |

| Consolidated Statement of Operations | 25 |

| Consolidated Statements of Changes in Net Assets | 26 |

| Consolidated Statement of Cash Flows | 28 |

| Financial Highlights | |

| Class A | 29 |

| Class C | 30 |

| Class W | 31 |

| Class I | 32 |

| Class L | 33 |

| Notes to Consolidated Financial Statements | 34 |

| Additional Information | 47 |

| Privacy Notice | 49 |

| Alternative Credit Income Fund | Shareholder Letter |

March 31, 2025 (Unaudited)

Dear Shareholders:

We are pleased to share this semi-annual letter for the Alternative Credit Income Fund (ticker: RCIIX) for six months ended March 31, 2025.

The Fund posted a total net return of -0.42% in the periodi, compared with Bank of America U.S. High Yield Index +1.1% and Morningstar LSTA Leveraged Loan Index of 2.76%.1

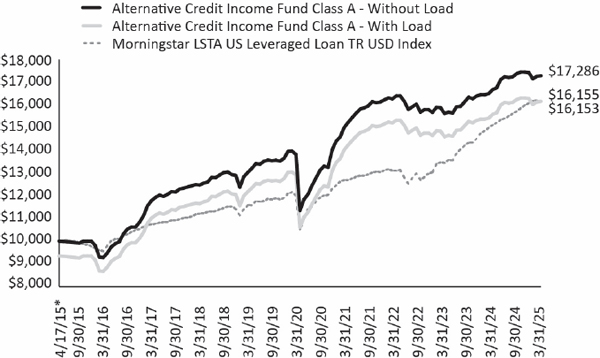

The fund's long-term performance --nearing ten years --handily outpaces fixed income benchmarks:

Cumulative returns RCIIX vs. Fixed Income Benchmarks

| Alternative Credit Income Fund (RCIIX) ii | 77.1% |

| Barclay's U.S. Aggregate Total Return Value Index iii | 15.5% |

| Morningstar / LSTA Loan Total Return Index iv | 63.8% |

| Bank of America High-Yield Index v | 65.3% |

Source: Bloomberg. Total return from 10/27/2015 through March 31, 2025

As discussed below, performance had been impacted by—with the trade war looming— the unexpected bankruptcy of Jo-Ann Stores (“JOAN”) as well as declines in loans backing cyber-security software company, Invanti.2

For JOAN, we are hopeful recovery will exceed our current mark. Separately, Invanti recently announced a capital market transaction that we believe will provide the capital and runway for recovery.

As a notable positive, we highlight that the Credit Income Fund paid a special distribution to our shareholders in the period. We emphasize that this income overage stemmed from outearning our dividend (not from realized or unrealized gains) and that the Fund remained largely unlevered throughout the six-month period (absent a modest currency hedge).

Before diving deeper into the Fund, however, we wanted to level-set our partners on how we view the broader macro environment. As always, we begin with our investment “Concerns”.

Macro Backdrop: The Concerning

Uncertainty Reigns

Investors have confronted near tragicomic uncertainty in early 2025 as policy shifts have threatened to unwind global trading patterns and security alliances. The resulting market selloff has witnessed a nuanced, but nevertheless potentially seismic, event—the decline of the U.S. dollar.

We believe, historically (and logically) the U.S. dollar should rise from tariffs as fewer purchases of overseas goods lowers demand for foreign currency. Additionally, the U.S. dollars has historically served as a haven during market turmoil as investors seek shelter. After the announcement of sweeping levies against Canada, China and Mexico in early March—prompting a selloff in risk-assets—the U.S. dollar, ominously, fell to the lowest level since early December.

One abnormal market response does not make a trend. However, one could surmise the unexpected dollar decline reflects dented confidence in the United States’ continued market leadership, broadly, and the U.S. dollar, in particular—both cornerstone of the world economy since Bretton Woods.

| 1 | Bloomberg, Bank of America U.S. High Yield (H0A0), 09/30/2024 – 03/31/2025, Total Return of 1.10% and Morningstar LSTA US Leveraged Loan TR (SPBDALB), 09/30/2024 – 03/31/2025, Total Return of 2.76%. |

All performance data is annualized and is reported net of the Fund's fees and expenses. You cannot invest directly in an index. Past performance benefited from an advantageous inception date for the Fund's strategy, as well as an outsized allocation to deeply discounted assets purchased from distressed sellers. The Fund's performance may differ substantially from the performance of an index. Because of these differences, the indices shown are not benchmarks, should not be relied upon as an accurate measure of comparison, and are shown only to present a comparison. There is no guarantee that such investment or market opportunities will repeat themselves in the future. Past performance does not guarantee future results and investment returns and principal value of the Fund will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted above. For performance information current to the most recent month-end, please call toll-free (833) 404-4103 or visit www.AltCIF.com.

| 2 | For a full list of Fund holdings please see schedule of investments included with this report. |

| Semi-Annual Report | March 31, 2025 | 1 |

| Alternative Credit Income Fund | Shareholder Letter |

March 31, 2025 (Unaudited)

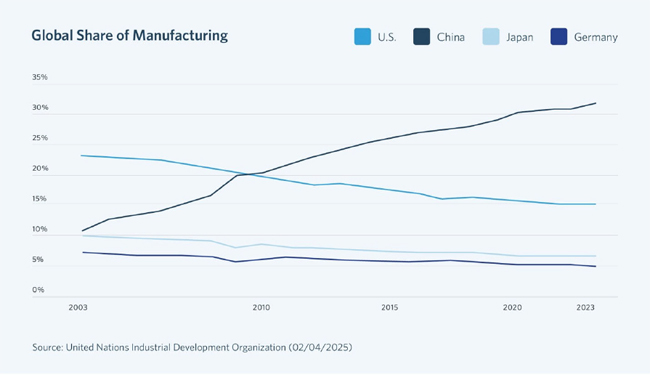

This is not to suggest the potential emerging changes are unilaterally bad. As suggested by the chart below, U.S. manufacturing has been crushed by global trade:

Source: United Nations Industrial Development Organization (02/04/2025)

The dollar’s haven-status has amplified the U.S. industrial demise by increasing the cost of exports.

| 2 | www.altcif.com |

| Alternative Credit Income Fund | Shareholder Letter |

March 31, 2025 (Unaudited)

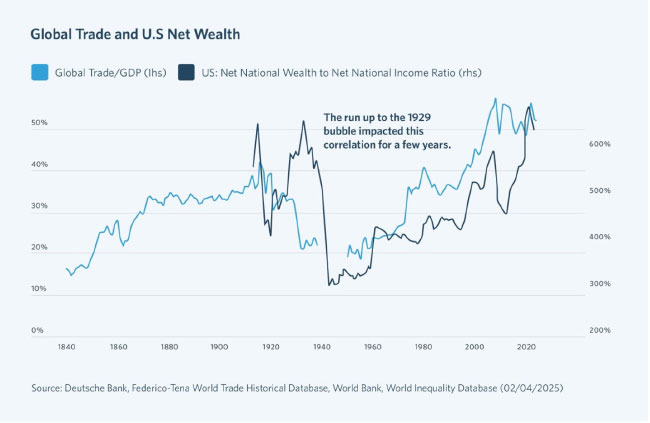

Nevertheless, the era of free trade, dollar dominance and global security has yielded tremendous economic growth—much to the benefit of U.S. markets and investors, as highlighted in the following chart:

These benefits have broadly lifted U.S. prosperity but have yielded clear “winners” (e.g. investors) and “losers” (e.g. U.S. blue-collar workers). Trying to readdress this imbalance by re-ordering global trade could benefit U.S. manufacturing (in time), but it will likely be costly.

Lower margins from trade friction will weigh on valuations for many U.S. businesses—threatening the wealth effects our economy has become reliant. Plus, ending the era of “cheap stuff” will reduce discretionary spending by effectively taxing household income.

Beyond the big picture, the recent global unease will likely hinder near-term GDP.

At its core, doubt foments inactivity. Businesses will remain reluctant to make any meaningful capital spending if its source of raw materials and/or export markets remain unsettled. If the U.S. implement clear and specific tariffs, we believe businesses would plan accordingly. Publicly declaring levies, only to shortly thereafter announce their delay, has only prolonged the unknown.

Similarly, household consumption is fundamentally premised on confidence; choosing to spend today is based on optimism about tomorrow. Uncertainty can chill consumption, as reflected by the collapse of consumer sentiment data in recent weeks.

Adding to growth concerns, the potential for tariffs likely pulled forward purchases in the closing days of 2024, robbing GDP from early 2025.

With that backdrop and amid the current haze of uncertainty, we believe the U.S. will be lucky to escape 1H 2025 without a dramatic decline in GDP growth.

| Semi-Annual Report | March 31, 2025 | 3 |

| Alternative Credit Income Fund | Shareholder Letter |

March 31, 2025 (Unaudited)

Growth engine reversing gears

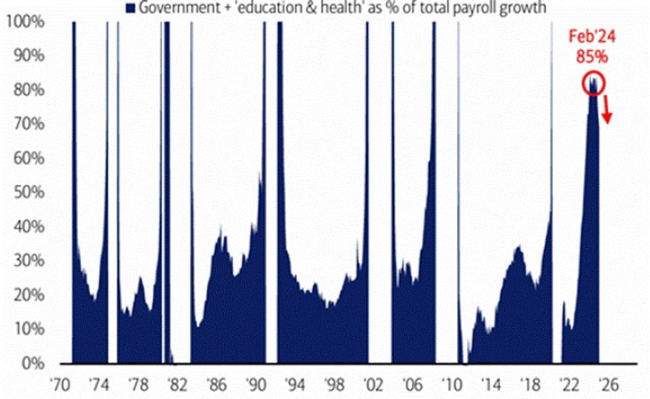

While headline numbers remain strong, the U.S. job market continues to reflect fractures.

As reflected below, 85% of recent payroll gains have stemmed from just three segments—government, education and healthcare:

Government and ‘education & health’ as % of payroll growth

Source: BofA Global Investment Strategy, Bloomberg (03/03/2025)

With government workers getting DOGE’d, the U.S. Department of Education threatened with closure and Medicaid in the crosshairs, the sectors that once drove job growth, will likely now drive job losses. Further, data from placement firm Challenger, Gray & Christmas showed that planned layoffs increased 245% in February 2025, levels not seen since the last two recessions.3

Relatedly, many U.S. businesses have begun clamping down on remote work, with Amazon, Dell and Washington Post (among others) having announced stricter office mandates;4 JP Morgan’s Jamie Dimon captured frontpage news for his strident anti-WFH commentary.

We believe back-to-office provide businesses a backdoor for shrinking their workforce (though “elective attrition”) and therefore further reflects labor market deterioration.

Shifting fiscal landscape

The U.S. economy/markets have catapulted past global peers in recent years, in part, due to the (astonishing) $5.6T of tax cuts and spending programs unleashed in the pandemic. However, with debt-to-GDP ratios now at precarious levels (despite a heretofore strong economy) and the administration promising belt tightening, the U.S. fiscal impulse appears to be fading.

The mantle may be tilting to Europe.

The forces that have driven the post-war German economy (cheap Russian natural gas, Chinese demand for goods and U.S. military security) have simultaneously vanished. The resulting economic malaise (with consecutive years of negative GDP) and increased security concerns (amid the United State wavering commitment to Ukraine), may prompt dramatic change.

In recent weeks, Germany has taken steps to lift its constitutional “debt brake” (implemented under Angela Merkel, but whose psychological roots trace to the Weimar Republic), which limits structural deficit to 0.35% of GDP.5 Friedrich Merz, Germany’s next chancellor, announced plans for as much as €500bn of deficit spending for rearmament and infrastructure.

| 3 | Challenger Job-Cut Announcement, Reuters and LSEG Datastream (03/06/2025) |

| 4 | “An Update on Return to Office Policies As We Enter 2025,” Forbes, (12/12/2024) |

| 5 | Euro Strategy: Germany’s Major Fiscal Pivot, CreditSights (03/04/2025) |

| 4 | www.altcif.com |

| Alternative Credit Income Fund | Shareholder Letter |

March 31, 2025 (Unaudited)

In a world of large numbers, perspective can sometimes be challenging. To frame the capital significance of Merz’ proposal, €500bn represents roughly 11% of normal German GDP.6 The prospect of greater growth and greater debt issuance saw German bonds suffer their greatest sell-off since the 1990s.

Germany’s high savings rate (roughly 20.5% vs. 4.6% in the U.S.) could amplify the fiscal impact if optimism loosens household purse strings.7 Several other Euro nations have pledged greater defense spending as well. Plus, at some point, Ukraine will need to be rebuilt, likely on the back of other European balance sheets.

These changes across the pond could profoundly impact U.S. markets.

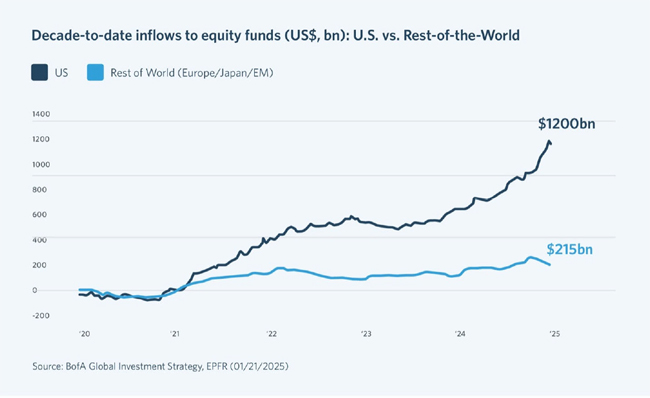

As starkly demonstrated below, amid otherwise languid global growth, the United States decade-to-date has enjoyed a wave of overseas capital into our equity markets:

| 6 | “Shifting Sands,” Alpine Macro (03/07/2025) |

| 7 | Euro Strategy: Germany’s Major Fiscal Pivot, CreditSights (03/04/2025) |

| Semi-Annual Report | March 31, 2025 | 5 |

| Alternative Credit Income Fund | Shareholder Letter |

March 31, 2025 (Unaudited)

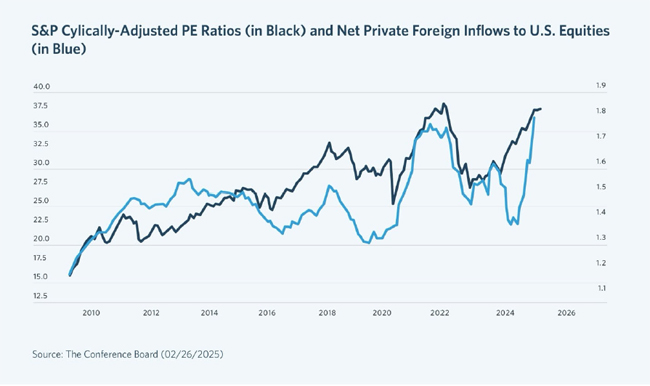

These foreign inflows had helped lift the S&P 500 to multi-year highs:8

This international capital has amplified U.S. GDP through the flywheel of wealth effects.

A fiscal tilt to Europe could jeopardize this dynamic if economic growth prompts capital to flee U.S. markets (beset by uncertainty and high valuations) into lower priced overseas markets. Nationalist instincts could amplify this dynamic. Further, last year, a record number of European firms eschewed domestic exchanges to list on U.S. markets.9 We would envision this dynamic may reverse if (what we have previously characterized as) T.I.N.A. U. of A. unwinds.

Macro Backdrop: The Uncertain

Inflation and Rates: The $64,000 Question

Last quarter we noted that tariffs do not necessarily cause broad-based inflation due to changes in consumption, import substitution and FX response. However, we were remiss not to note that tariffs can (as we have seen in recent weeks) change inflation expectations.

Buffeted by tariff headlines (despite modest implementation), higher prices have seeped into the consciousness of U.S. consumers. Increasing egg prices, though wholly unrelated to tariffs, has contributed to this dynamic as grocery items are particularly salient; shoppers confront those prices daily (unlike a new car, for example).

| 8 | We noted that investors cannot invest direct in the S&P 500 Index. Additionally, PE Ratios refers to the ratio of price to earnings for the constituency of the S&P Index |

| 9 | PitchBook (02/02/2025) |

| 6 | www.altcif.com |

| Alternative Credit Income Fund | Shareholder Letter |

March 31, 2025 (Unaudited)

As shown below, inflation expectations have rocketed:

On-again, off-again tariffs further risks anchoring inflation by keeping the topic front of the news cycle.

The risk is clear. Whether real or perceived, inflation can mute economic activity by eroding consumer confidence. Tangentially, it can also provoke distrust of government institutions writ large, as evidenced by the global electorate punishing incumbents in recent year (i.e. Biden/Harris, Sunak, Trudeau).

Elevated inflation concerns and potential for sluggish GDP has surfaced the risk of Stagflation (the phenomena of higher prices and slower economic growth) as well.

Inflation can undermine GDP, but it nevertheless represents a solvable problem (albeit painfully). As Paul Volker demonstrated, higher rates can arrest higher prices, in time, by sacrificing aggregate demand.

Stagflation, however, is more pernicious because it can immobilize policy makers. Lowering rates (or fiscal stimulus) to jumpstart a lagging economy would only inflame higher prices, while rising rates (or tightening fiscal policy) would further drag GDP.

This backdrop decidedly complicates the interest rate outlook.

Nascent signs that the U.S. economy is losing steam, would seem to suggest the potential for rate cuts.10 Interestingly, the CME is pricing just 0.8% chance the Fed Fund’s rate remains at 4.25%-4.50% in December 2025.11

However, in our view, the bar for lowering rates will be high due to inflation expectations. Additionally, the diminished growth outlook has arguably been self-induced—driven by policy versus fundamental degradation. The Fed therefore may be reticent to respond to potentially transitory factors.

| 10 | Bloomberg, U.S. Generic Government 10 Year Index |

| 11 | CME Group FedWatch Tool (03/10/2025) |

| Semi-Annual Report | March 31, 2025 | 7 |

| Alternative Credit Income Fund | Shareholder Letter |

March 31, 2025 (Unaudited)

Arguably, 1Q 2025 may represent peak uncertainty as the market adjusts to the new administration and therefore recession and inflation concerns may soon fade. For now, we expect the Fed will be stuck in place.

Macro Backdrop: The Good

CAPEX Bacchanal

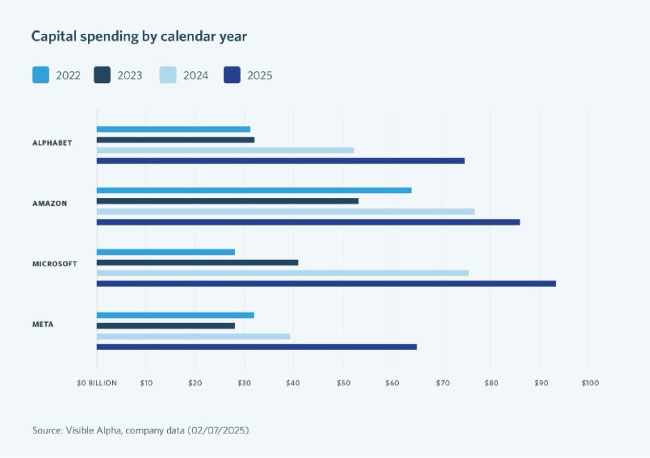

As well documented and evidenced below, U.S. mega-caps plan to ramp capex significantly in 2025, largely related to all things-AI:

History demonstrates that emerging technologies represent a thin reed for markets to attach its hopes. That said, however long the current mania lasts, we believe AI will boost our economy through outsized capital investments and by lifting market values.

Further, even after the bubble pops, these AI enterprises will have built infrastructure that will hopefully accrue to the long-term benefit of our economy.

For instance, the U.S. overallocated to housing in the run-up to 2008. Much of the equity and some of debt got wiped out in the downturn, but the housing stock remained. Imagine how much worse the U.S. housing situation would be without the pre-GFC overbuild.

Any potential AI overinvestment will hopefully follow a similar path. Most companies will likely go bust, but, in time, the data centers, power generation and computing power will find productive uses.

As a final (tangential) thought on AI, Big Tech has gained spectacular wealth and influence in recent decades–perhaps broadly stifling competition. We would highlight that the U.S. government dismantled AT&T in 1984 on anti-competition ground. At its peak, AT&T commanded a $60bn market cap, or roughly $150bn in today’s dollars.12 Meanwhile, Apple eclipsed a once unfathomable $4T market cap in 2024.

| 12 | Parmy Olson, Supremacy: AI, ChatGPT and the Race That Will Change the World, St. Martin Press, New York (2024) |

| 8 | www.altcif.com |

| Alternative Credit Income Fund | Shareholder Letter |

March 31, 2025 (Unaudited)

An unintended consequence of Big Tech dominance, however, may have yielded the U.S. an edge in the artificial intelligence race. U.S. Mega tech’s monopoly-esque rents now provide a seemingly bottomless war-chest for private-sector AI investment, which, given the industry’s potential winner-take-all dynamics and the (purported) gains of DeepSeek, motivates them to spend.

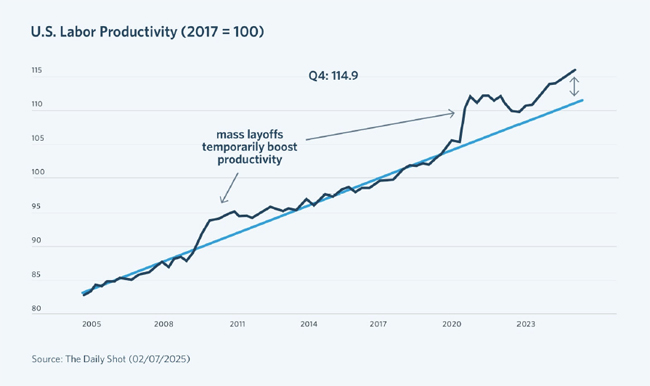

Productivity Boost

The uptick in U.S. productivity represents another clear economic positive.

U.S. Labor Productivity increased for the ninth consecutive quarter in 4Q 2024 and annual productivity increased at that highest pace in 14 years (ex. COVID) in 2024:

Source: The Daily Shot (02/07/2025)

It would be too early to attribute this leap to AI and more likely reflect two other COVID-related phenomena.

As noted earlier, the normalization of remote work has expanded the size the U.S. workforce. Additionally, difficulties in hiring during the pandemic prompted investment in labor-saving technologies (e.g. plant automation, kiosks at fast food), which have bolstered efficiency.

The recent productivity lift echoes the dot.com era where economic efficiency helped forestall inflation even as the economy roared, enabling Chairman Greenspan to keep interest rates flat.

If the current market regains its footing, this post-pandemic uplift would combat inflation and potentially contribute to the reemergence of the “higher for longer” rate outlook.

The Opportunity: Seek Shelter

Darkening equity outlook

We believe the shifting macro backdrop paints an ominous tableau for equity returns.

Again, reorienting supply chains will come at a cost: either businesses or households will be burdened with added expense. We believe that either path hurts markets.

| Semi-Annual Report | March 31, 2025 | 9 |

| Alternative Credit Income Fund | Shareholder Letter |

March 31, 2025 (Unaudited)

Further, pulling apart NATO would undermine the stability that has enabled post-war growth. Stability is indispensable for economic gains.

In the near-term, a muted U.S. fiscal outlook, waning consumer confidence and (potentially) resurgent Europe could reverse key factors that have propelled the United State’s post-COVID economy/markets.

Additionally, money plowed into equities immediately post-election ($140bn in January 2024 alone). Should the administration further signal that “growth” is not paramount, these dollars could cascade out of the market.

Finally, post-GFC, the Fed has seemed to step-in to quell market turmoil despite largely healthy economic conditions—with 2019 providing the most poignant example. After a sudden equity selloff in 4Q 2018, the Fed cut interest rates three times despite little sign of economic deterioration.

Low inflation has been the lodestone for this “Fed put.” However, the days of slashing rates with impunity may have died in COVID, limiting the Fed’s ability to intervene in the next downturn, which could accelerate a future selloff.

The Fed put is lower than the market believes, in our view.

Compelling Relative Value

After consecutive years of +20% returns, the earnings yield of the S&P 500 is hovering around 3.45%;13 this yield would further compress should earnings falter.

Stretched valuation amid an unsettled environment screams for investors to crystalize equity gains to increase their credit allocation. Credit will, in our view, provide greater absolute returns for investors while also muting future volatility.

High Yield spreads have backed up roughly ~150 basis points in 2025, but at roughly 454 basis points over Treasuries, remain only modestly wide to historical median and far from compelling value, in our view.14 We concede that all-in yield of 8.2% (helped by high risk-free rates) can be alluring, but believe investors risk downside-volatility if slowing growth ratchets defaults. Plus, High Yield can get mauled in risk-off markets and our investors recognized the structural flaws of many traditional credit vehicles.

We feel the opportunity remains titled towards private markets.

| 13 | S&P Returns, Bloomberg. Earnings yield for 4Q 2024, Bloomberg as of (04/09/2025) |

| 14 | Bank of America High Yield Index Spread (H0A0), as of (04/22/2025) and Median U.S. High Yield Spread 412bps “Spreads Stock and Vol Lower IG>HY,” Morgan Stanley (04/21/2025) |

| 10 | www.altcif.com |

| Alternative Credit Income Fund | Shareholder Letter |

March 31, 2025 (Unaudited)

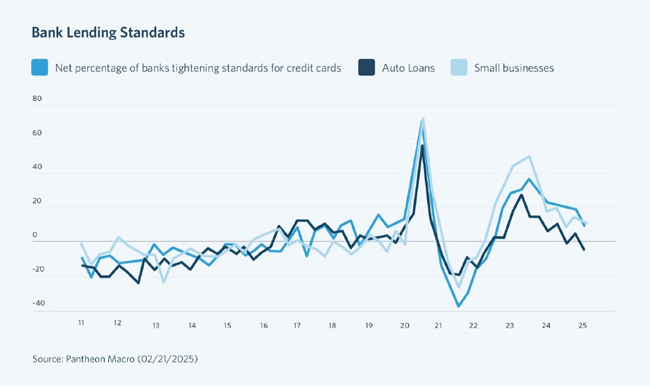

Candidly, heading into 2025, we had a modicum of concern that deregulation would awaken small- and-medium sized banks. However, as the chart below shows, banks have continued to tighten:

Growth risk will likely keep banks pinned to the sidelines.

We have said it before, and we will say it again: not all private credit solutions are the same. Much as there are growth and value equities that provide different attributes, there are different types of private credit.

As we’ve shared with our partners for years, the structure of the U.S. credit markets hinders potential returns. Unlike the equity markets, the credit space is dominated by monster firms and monster funds. There are limited returns to scale within fixed income. After a certain point, size can limit returns by hindering dexterity and shrinking the available universe.

This dynamic has recreated itself within private credit. The preponderance of capital in recent years has flowed to a handful of funds, whose size forces them to chase large opportunities. The backdrop will provide tough sledding for these strategies, in our view.

First, tight credits spreads enable fierce competition from the public market. Plus, private credit is no longer a new phenomenon and therefore the public markets have likely been picked over for “easy” private refinancing; adverse selection likely remains. Lastly, large and sponsor-based transactions require just that: transactions. Volatility and shifting macro dynamics will almost certainly chill deal activity, providing fewer opportunities for large cap private credit.

New Fund Investments

The Alternative Credit Income Fund continues to see a variety of opportunities in our wheelhouse of non-sponsor direct lending and specialty finance. Within specialty finance, the Fund recently provided financing to online content producer Pocket. Watch. The company repackages YouTube videos from its creators into 22 minute “shows” for broadcast on streaming platforms Prime and Hulu. Our facility contemplates a low-teen return for assuming Amazon and Hulu (majority owned by Disney) credit risk—arguably among the highest quality non-Sovereign counterparties in the world. Equipment-leasing and asset-backed lending remain a focus for the Alternative Credit Income Fund, as well. Within this private credit segment, active management and deal pipeline can unlock equity-like returns from 1st-dollar risk, we believe.

Further, these credits do not bear direct earnings risk. Even if a company “misses” on earnings, our investors collect our monthly lease payments. Should the company and/or market collapse (due to recession, trade war, etc.), equipment payments are typically the first-priority payment. Term Loan lenders may grant a forbearance, but a company needs to pay for critical equipment to keep its lights on. These payments are rarely interrupted in bankruptcy (to maintain estate value) and hard assets protect investors in the rare case of liquidation.

| Semi-Annual Report | March 31, 2025 | 11 |

| Alternative Credit Income Fund | Shareholder Letter |

March 31, 2025 (Unaudited)

We believe these are the risk/rewards investors should perhaps consider.

The Alternative Credit Income Fund recently purchased 60 Day vendor financing for Fulcrum U.S. Holdings, a Value Added Reseller (VAR) platform. This paper is both insured and enjoys “put rights” or the ability to sell back) to Fulcrum’s equity owners. Potential returns on this investment pencil to the context of 18-19% IRR—noteworthy in any market.

The last growth segment we would highlight is venture lending—also negatively correlated with the economy.

VC firms have been chasing all things AI, to the exclusion to nearly every segment, cooling valuations and capital availability for many growth businesses. Issuing equity in this backdrop has become punitively expensive, leading many firms to seek venture debt solutions.

These venture loans enjoy full collateralization and loan-to-values frequently 30% or lower from the last funding round. Yields typically begin in the mid-teens and with structured upside, total returns push into the high teens.

During the six-month period, the Fund invested in VertexOne, a software provider serving water, gas and electric utility companies; finding a more recession-resistant and trade-immune business would be challenging. Roughly 80% of revenue is recurring and VertexOne has greater than 100% net retention rates.

Finally, our deal benefits from tight covenants (requiring debt paydown sweeps), Board representation and significant equity cushion; we anticipate mid-teens returns with potential upside. We anticipate the potential for a deluge of opportunities if the economy slows.

Fund Specific Thoughts: Rocky out of the gate, but opportunity abounds

Again, the Fund suffered a disappointment in late 2024 and early 2025 with the restructuring of Jo-Ann Stores. With the trade war on the horizon, bank lenders throttled the company’s liquidity, impairing their ability to source peak seasonal inventory.

Long-time holders know that after the Credit Income Fund had previously purchased Jo-Ann Store loans in the 30s. In the pandemic, the company enjoyed a windfall from DIY mask-making, which enabled the company to repay its loans at par in late 2020.

We waded back to loans in the high 60s expecting the post-pandemic operating challenges would abate. Sadly, the drumbeat of trade conflict prompted the company’s demise. We hope our ultimate JOAN recovery will exceed our current mark.

Another detractor for the Fund in late 2024 / early 2025, had been loans of security software provider, Ivanti. The company’s loans slumped after suffering a cyberattack that temporarily disrupted its operations. Ivanti recently structured a capital solution (in which BC Partners participated) that will provide the company runway for recovery. We remain bullish on Ivanti and believe the recent “hack” will prove temporary.

Providing NAV “noise” during recent tariff-induce market volatility, public Business Development Companies (or “BDCs”) represent roughly 4.0% of our assets under management. Our shareholders know these assets can be notoriously volatile. We highlight the Fund has ratcheted down our BDC exposure to among the lowest in our history.

Investors, rightly, may ask why we own such (at times) fickle assets. Our answer is simple:

What is the biggest risk for funds? In our view, the answer is liquidity risk.

Funds go belly-up—and wealth is destroyed—if they are forced to sell assets in a downturn. A modest allocation to public BDCs helps reduce this (potentially ruinous) risk, in our view, and therefore justifies episodic NAV noise throughout a full cycle.

The Fund’s preferred holding in helmet manufacture Riddell gained 21.1% in the six-month period. We love this business’ monopolistic characteristics and (somewhat) jokingly refer to Riddell as a strategically important U.S. asset. Without Riddell, there is no football. Without football, life as we know it in the United States ceases to exist.

Kidding aside, we are in touch with management regarding the impact of tariffs. While levies remain a moving target, the company believes it has pricing power to offset potential higher raw material costs.

| 12 | www.altcif.com |

| Alternative Credit Income Fund | Shareholder Letter |

March 31, 2025 (Unaudited)

Other gainers include IT provider for the automarket, Autorola (+8.4%) as well as 1st Lien loans backing South Street Securities (+8.7%) on improved earnings—particularly in the company’s broker segment. Wrap-up: Amid the haze, the path is clear

Investors should never extrapolate long-term trends from a small amount of information. That said, the first several months of 2025 signal potential for dramatic shifts that could impact the U.S. economy. Markets are typically slow to react to big changes and then, often dramatically over-correct. Investors therefore have an incentive to move early.

Sluggish GDP and tempered equity gains seem increasingly like the base-case for 2025. Fortunately, this backdrop provides a straightforward path for investors: crystalize returns from the furious post-COVID equity rally and expand allocation to private solutions that will thrive amid a slowdown.

Should the market reaccelerate, “higher for longer” would return as market narrative, supporting continued high yield-based returns for our investors.

Lastly, we continue to highlight that, other than ~3.0% currency hedge, the Alternative Credit Income Fund remains unlevered. Because of that, the current market volatility, candidly, makes us extremely excited.

Our partners have seen how the Alternative Credit Income Fund has historically capitalized on unsettled markets. We aren’t there yet, but when the market-rolls over (roughly when credit spreads hit 800 basis points vs. ~450 basis points today), we will use that leverage to buy when the rest of the market is selling.

Many of our levered competitors may be unable to capitalize because they wasted their leverage in the “up” part of the cycle. We view this as a significant cost to their investors.

We are mindful that market turmoil often causes stress—and therefore we are mindful not to cheer the demise of others. Nevertheless, we have been anxiously awaiting a market reset that we believe may be long overdue. Our structure and strategy has been designed expressly with that backdrop in-mind.

Regards,

Michael Terwilliger, CFA

Portfolio Manager*

Alternative Credit Income Fund

| * | Effective October, 31, 2020, Sierra Crest Investment Management LLC (“Sierra Crest”) replaced Resource Alternative Advisor, LLC (“Resource”) as the Fund’s investment adviser. Michael Terwilliger has joined Sierra Crest as a portfolio manager to the Fund. |

| i | Fund performance refers to that of Class I. Reflects six-month returns through 03/31/2025. Past performance is not indicative of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Performance figures for periods less than one year are not annualized. For performance information current to the most recent month-end, please call toll-free 1-833-404-4103. The Adviser and the Fund have entered into an Expense Limitation Agreement under which the Adviser has agreed, until at least January 31, 2026 to waive its management fees (excluding any incentive fee) and to pay or absorb the ordinary annual operating expenses of the Fund (excluding incentive fees, all borrowing costs, dividends, amortization/accretion and interest on securities sold short, brokerage commissions, acquired fund fees and expenses and extraordinary expenses), to the extent that its management fees plus the Fund’s ordinary annual operating expenses exceed 2.34% per annum of the Fund’s average daily net assets attributable to Class I shares. Such Expense Limitation Agreement may not be terminated by the Adviser, but it may be terminated by the Board of Trustees, upon 60 days written notice to the Adviser. Any waiver or reimbursement by the Adviser is subject to repayment by the Fund within the three (3) years from the date the Adviser (or the previous investment adviser) waived any payment or reimbursed any expense, if the Fund is able to make the repayment without exceeding the lesser of the expense limitation in place at the time of the waiver or the current expense limitation and the repayment is approved by the Board of Trustees. See “Management of the Fund.” |

| ii | Fund performance refers to that of Class I. Reflects cumulative returns 10/29/2015 through 03/31/2025. Past performance is not indicative of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Performance figures for periods less than one year are not annualized. For performance information current to the most recent month-end, please call toll-free 1-833-404-4103. |

| iii | Barclays U.S. Aggregate Total Return Value Index – The Barclays U.S. Aggregate Total Return Value Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency). Investors cannot invest directly in an index. Reflects cumulative return 10/28/2015 through 03/31/2025. |

| Semi-Annual Report | March 31, 2025 | 13 |

| Alternative Credit Income Fund | Shareholder Letter |

March 31, 2025 (Unaudited)

| iv | Morningstar LSTA US Leveraged Loan TR USD Index – The Morningstar LSTA US Leveraged Loan TR USD Index is a market value-weighted index designed to measure the performance of the U.S. leveraged loan market based upon market weightings, spreads and interest payments. Investors cannot invest directly in an index. Reflects cumulative return 10/28/2015 through 03/31/2025. |

| v | ICE BofA U.S. High Yield Index – The ICE BofA U.S. High Yield Index tracks the performance of US dollar denominated below investment grade corporate debt publicly issued in the U.S. domestic market. Investors cannot invest directly in an index. Reflects cumulative return 10/28/2015 through 03/31/2025. |

Important Information:

An investor should consider the investment objectives, risks, charges, and expenses of the Fund carefully before investing. To obtain a prospectus containing this and other information, please call (800) 806-9756 or download the file from www.AltCIF.com. Read the prospectus carefully before you invest.

The Fund is distributed by ALPS Distributors, Inc. (ALPS Distributors, Inc. 1290 Broadway, Suite 1100, Denver, CO 80203). Sierra Crest Investment Management, LLC (the Fund’s investment adviser), its affiliates, and ALPS Distributors, Inc. are not affiliated.

Investing involves risk. Investment return and principal value of an investment will fluctuate, and an investor’s shares, when redeemed, may be worth more or less than their original cost. Alternative investment funds, ETFs, interval funds, and closed-end funds are subject to management and other expenses, which will be indirectly paid by the Fund. Debt instruments are subject to credit risk and interest rate risk and may be subordinated to more senior debt instruments. Business Development Companies (BDCs) often use leverage to enhance returns and are subject to interest rate risk, credit risk, and liquidity risk. CLOs are debt instruments but also carry additional risks related to the complexity and leverage inherent in the CLO structure. The use of leverage, such as borrowing money to purchase securities, will cause the Fund to incur additional expenses and magnify the Fund’s gains or losses.

There currently is no secondary market for the Fund’s shares and the Fund expects that no secondary market will develop. Shares of the Fund will not be listed on any securities exchange, which makes them inherently illiquid. An investment in the Fund’s shares is not suitable for investors who cannot tolerate risk of loss or who require liquidity, other than the liquidity provided through the Fund’s repurchase policy. The Fund’s distributions policy may, under certain circumstances, have certain adverse consequences to the Fund and its shareholders because it may result in a return of capital, resulting in less of a shareholder’s assets being invested in the Fund, and, over time, increase the Fund’s expense ratio. Any invested capital that is returned to the shareholder will be reduced by the Fund’s fees and expenses, as well as the applicable sales load. Limited liquidity is provided to shareholders only through the Fund’s quarterly repurchase offers, regardless of how the Fund performs. Investments in lesser-known, small and medium capitalization companies may be more vulnerable than larger, more established organizations. The sales of securities to fund repurchases could reduce the market price of those securities, which in turn would reduce the Fund’s Net Asset Value (NAV).

An investment in the Fund’s shares is not suitable for investors who cannot tolerate risk of loss or who require liquidity, other than liquidity provided through the Fund’s repurchase policy.

The Fund’s distributions policy may, under certain circumstances, have certain adverse consequences to the Fund and its shareholders because it may result in a return of capital, resulting in less of a shareholder’s assets being invested in the Fund, and, over time, increase the Fund’s expense ratio.

| 14 | www.altcif.com |

| Alternative Credit Income Fund | Portfolio Update |

March 31, 2025 (Unaudited)

The Fund’s performance figures for the periods ended March 31, 2025, compared to its benchmark:

| Alternative Credit Income Fund | 1 Month | Quarter | 6 Month | YTD | 1 Year | 3 Year | 5 Year | Since Inception* | Inception |

| Class A Shares - Without Load | 0.17% | -0.79% | -0.51% | -0.79% | 3.64% | 1.78% | 8.77% | 5.65% | 4/17/15 |

| Class A Shares - With Load | -5.62% | -6.47% | -6.22% | -6.47% | -2.34% | -0.22% | 7.48% | 4.94% | 4/17/15 |

| Class C Shares - Without Load | 0.00% | -0.95% | -1.01% | -0.95% | 2.72% | 0.98% | 7.93% | 5.04% | 4/17/15 |

| Class C Shares - With Load(a) | -0.98% | -1.92% | -1.96% | -1.92% | 1.77% | 0.98% | 7.93% | 5.04% | 4/17/15 |

| Class W Shares - Without Load | 0.16% | -0.80% | -0.62% | -0.80% | 3.52% | 1.78% | 8.74% | 5.60% | 4/17/15 |

| Class I Shares - Without Load | 0.23% | -0.73% | -0.42% | -0.73% | 3.76% | 2.00% | 9.01% | 5.89% | 4/17/15 |

| Class L Shares - Without Load | 0.21% | -0.75% | -0.70% | -0.75% | 3.42% | 1.54% | 8.50% | 4.41% | 7/28/17 |

| Class L Shares - With Load | -4.02% | -5.00% | -4.91% | -5.00% | -1.00% | 0.09% | 7.57% | 3.82% | 7/28/17 |

| Morningstar LSTA US Leveraged Loan TR USD Index | -0.31% | 0.48% | 2.76% | 0.48% | 6.86% | 7.21% | 8.96% | 4.93% | 4/17/15 |

| * | Annualized total return |

| (a) | Effective as of December 23, 2016, Class C shares no longer have a sales charge. |

The Morningstar LSTA US Leveraged Loan TR USD Index is a market value-weighted index designed to measure the performance of the U.S. leveraged loan market based upon market weightings, spreads and interest payments. Investors cannot invest directly in an index.

Past performance is not indicative of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Performance figures for periods less than one year are not annualized. As of the Fund’s most recent prospectus dated January 28, 2025, the Fund’s total annual operating expenses, including acquired fund fees and expenses, before fee waivers is 5.21% for Class A, 5.99% for Class C, 5.26% for Class W, 5.07% for Class I and 5.56% for Class L shares. After fee waivers, the Fund’s total annual operating expense is 4.84% for Class A, 5.60% for Class C, 4.84% for Class W, 4.59% for Class I and 5.09% for Class L shares. Class A shares are subject to maximum sales loads of 5.75% imposed on purchases. Class L shares are subject to a maximum sales load of 4.25% imposed on purchases. Share repurchases within 365 days may be subject to an early withdrawal charge of 0.50% for Class A and 1.00% for Class C shares. For performance information current to the most recent month-end, please call toll-free 1-833-404-4103.

| Semi-Annual Report | March 31, 2025 | 15 |

| Alternative Credit Income Fund | Portfolio Update |

March 31, 2025 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment

| * | Commencement of operations for Class A Shares. |

Consolidated Portfolio Composition as of March 31, 2025

| Asset Type | Percent of Net Assets |

| Bank Loans | 56.70% |

| Private Investment Funds | 18.38% |

| Common Equity | 9.55% |

| Asset Backed Securities | 3.93% |

| Short Term Investments | 3.70% |

| Preferred Stock | 3.57% |

| Corporate Bonds | 2.32% |

| Interval Fund | 2.02% |

| Equipment Financing | 0.57% |

| Warrants | 0.32% |

| Joint Venture | 0.19% |

| Total Investments | 101.25% |

| Liabilities in Excess of Other Assets | -1.25% |

| Net Assets | 100.00% |

Please see the Consolidated Schedule of Investments for a detailed listing of the Fund’s holdings.

| 16 | www.altcif.com |

| Alternative Credit Income Fund | Consolidated Schedule of Investments |

March 31, 2025 (Unaudited)

| Coupon | Reference Rate & Spread | Maturity | Principal | Value | ||||||||||||

| BANK LOANS (56.70%)(a)(b) | ||||||||||||||||

| Communication Services (2.68%) | ||||||||||||||||

| Next Flight Ventures, Delayed Draw Term Loan(c)(d)(e) | 14.57 | % | 3M SOFR + 10.00% | 12/26/2025 | $ | 992,203 | $ | 970,196 | ||||||||

| Next Flight Ventures, First Lien Term Loan(c)(d) | 14.56 | % | 14.56% PIK | 12/26/2025 | 4,650,895 | 4,559,737 | ||||||||||

| 5,529,933 | ||||||||||||||||

| Consumer Discretionary (4.41%) | ||||||||||||||||

| Arrow Purchaser, Inc., First Lien Initial Term Loan(c) | 11.19 | % | 3M SOFR + 6.75%, 1.00% Floor | 04/15/2026 | 2,041,667 | 1,857,917 | ||||||||||

| Lucky Bucks Holdings LLC, Subordinated Note(c)(f) | – | % | 3M SOFR + 4.75%, 0.75% Floor | 05/29/2028 | 10,013,460 | 1,938,606 | ||||||||||

| Needle Holdings LLC, First Lien Term Loan(c)(f) | – | % | 1M SOFR + 9.50% | 06/22/2027 | 2,354,542 | 623,953 | ||||||||||

| PMP OPCO, LLC, Delayed Draw Term Loan(c)(e)(g) | – | % | 1M SOFR + 8.50%, 2.00% Floor | 05/31/2029 | – | (39,066 | ) | |||||||||

| PMP OPCO, LLC, First Lien Term Loan(c)(g) | 12.82 | % | 1M SOFR + 8.50%, 2.00% Floor | 05/31/2029 | 1,256,133 | 1,185,413 | ||||||||||

| PMP OPCO, LLC, Revolver(c)(e)(g) | – | % | 1M SOFR + 8.50%, 2.00% Floor | 05/31/2029 | – | (7,917 | ) | |||||||||

| Riddell Inc., Delayed Draw Term Loan(c)(e)(g) | – | % | 1M SOFR + 6.00%, 1.00% Floor | 03/29/2029 | – | – | ||||||||||

| Riddell Inc., First Lien Term Loan(c)(g) | 10.32 | % | 1M SOFR + 6.00%, 1.00% Floor | 03/29/2029 | 3,545,455 | 3,545,455 | ||||||||||

| 9,104,361 | ||||||||||||||||

| Consumer Staples (6.51%) | ||||||||||||||||

| 8th Avenue Food & Provisions, Inc., Second Lien Term Loan(c) | 12.19 | % | 1M SOFR + 7.75% | 10/01/2026 | 2,500,000 | 2,315,238 | ||||||||||

| BrightPet, First Lien Term Loan(c)(d) | 11.44 | % | 3M SOFR + 4.00%, 3.00% PIK, 1.00% Floor | 10/06/2026 | 1,954,644 | 1,920,047 | ||||||||||

| BrightPet, Revolver(c)(d) | 11.45 | % | 3M SOFR + 4.00%, 3.00% PIK, 1.00% Floor | 10/06/2026 | 508,476 | 499,476 | ||||||||||

| Florida Food Products LLC, Second Lien Term Loan(c) | 12.56 | % | 3M SOFR + 8.00%, 0.75% Floor | 10/18/2029 | 5,652,174 | 4,253,261 | ||||||||||

| Phillips Feed Service, Inc., First Lien Term Loan(c) | 11.42 | % | 1M SOFR + 7.00% | 12/31/2026 | 5,250,000 | 4,464,075 | ||||||||||

| 13,452,097 | ||||||||||||||||

| Financials (10.34%) | ||||||||||||||||

| BetaNXT, Inc., First Lien Term Loan(c) | 10.05 | % | 3M SOFR + 5.75% | 07/01/2029 | 2,334,091 | 2,244,462 | ||||||||||

| Cor Leonis Limited, Revolver(c)(e) | 11.55 | % | 3M SOFR + 7.25%, 1.50% Floor | 05/15/2028 | 2,456,339 | 2,456,339 | ||||||||||

| DeltaDx Limited, LP - Barri/Dolex(c)(d) | 15.00 | % | 15.00% PIK | 06/14/2028 | 358,369 | 352,097 | ||||||||||

| H-CA II, LLC, First Lien Term Loan(c) | 16.00 | % | N/A | 09/01/2025 | 1,650,001 | 1,491,271 | ||||||||||

| Hunter Point Capital Structured Notes Issuer, LLC, Subordinated Delayed Draw Notes(c)(e) | N/A | N/A | 07/15/2052 | 2,319,510 | 2,950,575 | |||||||||||

| Irradiant Intermediate Holdings, LP, Delayed Draw Term Loan(c)(e) | 10.90 | % | 3M SOFR + 6.50%, 1.50% Floor | 06/08/2028 | 870,000 | 870,000 | ||||||||||

| Irradiant Intermediate Holdings, LP. First Lien Term Loan(c) | 10.90 | % | 3M SOFR + 6.50%, 1.50% Floor | 06/08/2028 | 1,450,000 | 1,450,000 | ||||||||||

| Money Transfer Acquisition Inc., First Lien Term Loan(c) | 12.67 | % | 1M SOFR + 8.25%, 1.00% Floor | 12/14/2027 | 5,963,863 | 5,839,814 | ||||||||||

| PocketWatch, Inc., First Lien Term Loan(c) | 16.00 | % | N/A | 07/15/2027 | 1,372,649 | 1,386,513 | ||||||||||

| SouthStreet Securities Holdings, Inc., First Lien Term Loan(c) | 9.00 | % | N/A | 09/20/2027 | 2,700,000 | 2,318,760 | ||||||||||

| 21,359,831 | ||||||||||||||||

| Health Care (8.09%) | ||||||||||||||||

| American Academy Holdings, LLC, Delayed Draw Term Loan(c)(d) | 14.19 | % | 1M SOFR + 4.50%, 5.25% PIK, 1.00% Floor | 06/30/2027 | 408,721 | 432,223 | ||||||||||

| American Academy Holdings, LLC, First Lien Term Loan(c)(d)14.19% | 1M SOFR + 4.50%, 5.25% PIK, 1.00% Floor | 06/30/2027 | 2,059,956 | 2,178,403 | ||||||||||||

| American Academy Holdings, LLC, Second Lien Term Loan(c)(d) | 14.50 | % | 14.50% PIK | 03/01/2028 | 4,390,712 | 4,308,606 | ||||||||||

| PhyNet Dermatology LLC, Delayed Draw Term Loan(c)(e) | – | % | 3M SOFR + 6.50%, 1.00% Floor | 10/20/2029 | – | 11,690 | ||||||||||

| PhyNet Dermatology LLC, First Lien Term Loan(c) | 10.79 | % | 3M SOFR + 6.50%, 1.00% Floor | 10/20/2029 | 1,936,096 | 1,928,932 | ||||||||||

| Upstream Rehabilitation, Inc., Second Lien Term Loan(c) | 12.89 | % | 3M SOFR + 8.50% | 11/22/2027 | 7,500,000 | 5,350,013 | ||||||||||

| VBC Spine Opco LLC (DxTx Pain and Spine LLC), Delayed Draw Term Loan(c)(e) | 12.44 | % | 3M SOFR + 8.00%, 2.00% Floor | 06/14/2028 | 619,742 | 621,803 | ||||||||||

| VBC Spine Opco LLC (DxTx Pain and Spine LLC), First Lien Term Loan(c) | 12.45 | % | 3M SOFR + 8.00%, 2.00% Floor | 06/14/2028 | 1,891,612 | 1,878,749 | ||||||||||

See Notes to Consolidated Financial Statements.

| Semi-Annual Report | March 31, 2025 | 17 |

| Alternative Credit Income Fund | Consolidated Schedule of Investments |

March 31, 2025 (Unaudited)

| Coupon | Reference Rate & Spread | Maturity | Principal | Value | ||||||||||||

| VBC Spine Opco LLC (DxTx Pain and Spine LLC), Revolver(c)(e) | – | % | 3M SOFR + 8.00%, 2.00% Floor | 06/14/2028 | $ | – | $ | (1,645 | ) | |||||||

| 16,708,774 | ||||||||||||||||

| Industrials (6.21%) | ||||||||||||||||

| Epic Staffing Group, First Lien Term Loan(c) | 10.31 | % | 3M SOFR + 6.00%, 0.50% Floor | 06/28/2029 | 1,949,185 | 1,759,140 | ||||||||||

| Marvel APS (Autorola Group Holding A/S), Delayed Draw Term Loan(c)(d)(h) | 10.00 | % | 10.00% PIK | 12/21/2027 | 3,449,768 | 4,072,681 | ||||||||||

| Material Handling Systems, Inc., First Lien Term Loan(c) | 9.76 | % | 3M SOFR + 5.50%, 0.50% Floor | 06/08/2029 | 1,887,263 | 1,606,061 | ||||||||||

| Newbury Franklin Industrials, LLC, Delayed Draw Term Loan(c)(e) | – | % | 3M SOFR + 7.00%, 2.00% Floor | 12/11/2029 | – | (12,336 | ) | |||||||||

| Newbury Franklin Industrials, LLC, First Lien Term Loan(c) | 11.18 | % | 3M SOFR + 7.00%, 2.00% Floor | 12/11/2029 | 4,003,125 | 3,903,047 | ||||||||||

| VORTEX OPCO, LLC, First Lien Term Loan (First Out)(c) | 10.55 | % | 3M SOFR + 6.25%, 0.50% Floor | 04/30/2030 | 720,000 | 740,099 | ||||||||||

| VORTEX OPCO, LLC, First Lien Term Loan (Second Out)(c)(f) | – | % | 3M SOFR + 4.25%, 0.50% Floor | 12/15/2028 | 1,579,879 | 768,216 | ||||||||||

| 12,836,908 | ||||||||||||||||

| Information Technology (18.46%) | ||||||||||||||||

| Accurate Background, LLC, First Lien Term Loan(c) | 10.56 | % | 3M SOFR + 6.00%, 1.00% Floor | 03/26/2029 | 4,355,901 | 4,320,183 | ||||||||||

| Ancile Solutions, Inc., First Lien Term Loan(c) | 14.56 | % | 3M SOFR + 10.00%, 1.00% Floor | 06/11/2026 | 3,410,780 | 3,410,780 | ||||||||||

| Colonnade Intermediate, LLC, Delayed Draw Term Loan(c)(f) | – | % | 1M SOFR + 7.00%, 1.00% Floor | 04/27/2024 | 1,473,901 | 1,055,313 | ||||||||||

| Colonnade Intermediate, LLC, First Lien Term Loan(c)(f) | – | % | 1M SOFR + 7.00%, 1.00% Floor | 04/27/2024 | 1,542,157 | 1,104,184 | ||||||||||

| DCert Buyer, Inc. First Amendment Term Loan Refinancing, Second Lien Term Loan(c) | 11.32 | % | 1M SOFR + 7.00% | 02/16/2029 | 3,600,000 | 2,943,000 | ||||||||||

| Diamanti, Inc., Subordinated Note(c)(d) | 15.00 | % | 15.00% PIK | 02/28/2025 | 4,262,544 | 4,312,416 | ||||||||||

| Fulcrum US Holdings, Inc., Revolver(c) | 13.50 | % | PRIME + 6.00%, 1.00% Floor | 05/20/2025 | 4,000,000 | 4,000,000 | ||||||||||

| Ivanti Software, Inc., Second Lien Initial Term Loan(c) | 11.82 | % | 3M SOFR + 7.25%, 0.50% Floor | 12/01/2028 | 4,000,000 | 1,896,560 | ||||||||||

| Kofax, Inc., Second Lien Term Loan(c) | 12.04 | % | 3M SOFR + 7.75%, 0.50% Floor | 07/20/2030 | 4,000,000 | 3,589,199 | ||||||||||

| Phoenix Finance, First Lien Term Loan(c) | 13.30 | % | 3M SOFR + 9.00%, 1.00% Floor | 08/14/2028 | 829,016 | 829,016 | ||||||||||

| Phoenix Finance, Second Lien Term Loan(c) | 11.95 | % | 3M SOFR + 7.50%, 1.00% Floor | 08/14/2028 | 1,233,913 | 1,233,913 | ||||||||||

| Precisely Software Incorporated, Second Lien Term Loan(c) | 11.80 | % | 3M SOFR + 7.25%, 0.75% Floor | 04/23/2029 | 3,000,000 | 2,898,120 | ||||||||||

| Spectrio, Delayed Draw Term Loan(c)(d) | 10.31 | % | 3M SOFR + 3.50%, 2.50% PIK, 1.00% Floor | 12/09/2026 | 1,171,700 | 1,057,459 | ||||||||||

| Spectrio, First Lien Term Loan(c)(d) | 10.31 | % | 3M SOFR + 3.50%, 2.50% PIK, 1.00% Floor | 12/09/2026 | 2,809,002 | 2,535,124 | ||||||||||

| VTX Intermediate Holdings, Inc., First Lien Term Loan(c)(d) | 11.56 | % | 1M SOFR + 6.00%, 1.00% PIK, 2.00% Floor | 12/12/2029 | 1,147,487 | 1,137,504 | ||||||||||

| VTX Intermediate Holdings, Inc., Second Lien Term Loan(c)(d) | 12.50 | % | 12.50% PIK | 12/12/2030 | 1,855,535 | 1,806,920 | ||||||||||

| 38,129,691 | ||||||||||||||||

| TOTAL BANK LOANS | ||||||||||||||||

| (Cost $134,455,172) | 117,121,595 | |||||||||||||||

| Shares | Value | |||||||||||||||

| COMMON EQUITY (9.55%)(b) | ||||||||||||||||

| Communication Services (–%) | ||||||||||||||||

| Next Flight Ventures(c)(i) | 88 | – | ||||||||||||||

| NFV Co-Pilot, Inc.(c)(i) | 441 | – | ||||||||||||||

| – | ||||||||||||||||

| Consumer Discretionary (0.53%) | ||||||||||||||||

| CEC Entertainment, Inc.(i) | 79,564 | 1,087,361 | ||||||||||||||

| JoAnn Inc.(c)(i) | 1,570,371 | – | ||||||||||||||

| 1,087,361 | ||||||||||||||||

| Diversified (5.48%) | ||||||||||||||||

| Ares Capital Corp. | 117,223 | 2,597,662 | ||||||||||||||

See Notes to Consolidated Financial Statements.

| 18 | www.altcif.com |

| Alternative Credit Income Fund | Consolidated Schedule of Investments |

March 31, 2025 (Unaudited)

| Shares | Value | |||||||||||||||

| COMMON EQUITY (9.55%)(b) (continued) | ||||||||||||||||

| Diversified (5.48%) (continued) | ||||||||||||||||

| CION Investment Corp. | 120,800 | $ | 1,250,280 | |||||||||||||

| Franklin BSP Capital Corp(c) | 66,100 | 933,786 | ||||||||||||||

| FS KKR Capital Corp. | 105,137 | 2,202,620 | ||||||||||||||

| Portman Ridge Finance Corp.(g) | 25,504 | 365,982 | ||||||||||||||

| SLR Investment Corp. | 115,211 | 1,942,457 | ||||||||||||||

| WhiteHorse Finance, Inc. | 207,328 | 2,000,715 | ||||||||||||||

| 11,293,502 | ||||||||||||||||

| Financials (0.80%) | ||||||||||||||||

| Aperture Dodge 18 LLC(c)(i) | 2,051,573 | 1,657,470 | ||||||||||||||

| Health Care (0.23%) | ||||||||||||||||

| American Academy Holdings. Inc., Common Units(c)(i)(j) | 0.05 | 278,039 | ||||||||||||||

| DxTx Pain and Spine LLC, Common Units(c)(i)(j) | 98,854 | 217,175 | ||||||||||||||

| 495,214 | ||||||||||||||||

| Industrials (0.50%) | ||||||||||||||||

| GreenPark Infrastructure, LLC Series M-1(c)(g)(i)(j) | 2,565 | 878,443 | ||||||||||||||

| Incora Top Holdco LLC(c)(i) | 5,350 | 162,260 | ||||||||||||||

| 1,040,703 | ||||||||||||||||

| Information Technology (0.01%) | ||||||||||||||||

| VTX Holdings, LLC(c)(i) | 932,474 | 27,173 | ||||||||||||||

| Real Estate (2.00%) | ||||||||||||||||

| Copper Property CTL Pass Through Trust(j) | 319,520 | 4,128,997 | ||||||||||||||

| TOTAL COMMON EQUITY | ||||||||||||||||

| (Cost $22,522,458) | 19,730,420 | |||||||||||||||

| ASSET BACKED SECURITIES (3.93%)(a)(b) | ||||||||||||||||

| Financials (3.93%) | ||||||||||||||||

| Canyon Capital CLO 2014-1, Ltd., Class ER(k) | 12.25 | % | 3M SOFR + 7.70% | 01/30/2031 | 1,000,000 | 659,564 | ||||||||||

| JMP Credit Advisors CLO IV, Ltd.(c) | – | % | N/A | 07/17/2029 | 4,836,540 | 161,540 | ||||||||||

| JMP Credit Advisors CLO V, Ltd.(c) | – | % | N/A | 07/17/2030 | 4,486,426 | 188,879 | ||||||||||

| Mount Logan Funding 2018-1 LP(c)(g)(k) | 22.14 | % | N/A | 01/22/2033 | 7,798,575 | 4,690,843 | ||||||||||

| Octagon Investment Partners 36, Ltd., Class F(k) | 12.31 | % | 3M SOFR + 7.75% | 04/15/2031 | 1,000,000 | 804,488 | ||||||||||

| Octagon Investment Partners XIV, Ltd., Class ER(k) | 12.91 | % | 3M SOFR + 8.35% | 07/15/2029 | 2,132,000 | 707,647 | ||||||||||

| Saranac CLO VII, Ltd., Class ER(k) | 11.30 | % | 3M SOFR + 6.72% | 11/20/2029 | 502,679 | 109,311 | ||||||||||

| Tralee CLO II, Ltd., Class ER(k) | 12.40 | % | 3M SOFR + 7.85% | 07/20/2029 | 1,000,000 | 796,999 | ||||||||||

| Tralee CLO II, Ltd., Class FR(f)(k) | – | % | 3M SOFR + 8.35% | 07/20/2029 | 1,000,000 | 139 | ||||||||||

| 8,119,410 | ||||||||||||||||

| TOTAL ASSET BACKED SECURITIES | ||||||||||||||||

| (Cost $14,286,097) | 8,119,410 | |||||||||||||||

| CORPORATE BONDS (2.32%)(a)(b) | ||||||||||||||||

| Communications (0.94%) | ||||||||||||||||

| Spanish Broadcasting System, Inc.(k) | 9.75 | % | N/A | 03/01/2026 | 3,000,000 | 1,936,975 | ||||||||||

| Consumer Discretionary (–%) | ||||||||||||||||

| Monitronics - Escrow(c) | – | % | N/A | 12/31/2049 | 2,650,000 | – | ||||||||||

See Notes to Consolidated Financial Statements.

| Semi-Annual Report | March 31, 2025 | 19 |

| Alternative Credit Income Fund | Consolidated Schedule of Investments |

March 31, 2025 (Unaudited)

| Shares | Value | ||||||||||||||||||

| CORPORATE BONDS (continued) | |||||||||||||||||||

| Financials (1.02%) | |||||||||||||||||||

| EJF CRT 2024-R1 LLC, Class R1(c) | 12.12 | % | N/A | 12/17/2055 | $ | 2,103,885 | $ | 2,103,885 | |||||||||||

| Industrials (0.36%) | |||||||||||||||||||

| Vortex Opco, LLC(f)(k) | – | % | 8.00% | 04/30/2030 | 3,135,000 | 752,400 | |||||||||||||

| TOTAL CORPORATE BONDS | |||||||||||||||||||

| (Cost $6,206,527) | 4,793,260 | ||||||||||||||||||

| EQUIPMENT FINANCING (0.57%) | |||||||||||||||||||

| Financials (0.57%) | |||||||||||||||||||

| White Oak Equipment Finance 1, LLC(b)(c)(j) | 10.75 | % | N/A | 01/01/2027 | 1,174,080 | 1,174,080 | |||||||||||||

| TOTAL EQUIPMENT FINANCING | |||||||||||||||||||

| (Cost $1,174,080) | 1,174,080 | ||||||||||||||||||

| Shares | Value | ||||||||||||||||||

| INTERVAL FUND (2.02%)(b) | |||||||||||||||||||

| Diversified (2.02%) | |||||||||||||||||||

| Opportunistic Credit Interval Fund(g) | 362,837 | 4,165,365 | |||||||||||||||||

| TOTAL INTERVAL FUND | |||||||||||||||||||

| (Cost $4,368,554) | 4,165,365 | ||||||||||||||||||

| Shares | Value | ||||||||||||||||||

| JOINT VENTURE (0.19%)(b) | |||||||||||||||||||

| Joint Venture (0.19%) | |||||||||||||||||||

| Great Lakes Funding II LLC, Series A(e)(g)(l)(m) | 408,051 | 391,098 | |||||||||||||||||

| TOTAL JOINT VENTURE | |||||||||||||||||||

| (Cost $408,051) | 391,098 | ||||||||||||||||||

| Shares | Value | ||||||||||||||||||

| PREFERRED STOCK (3.57%)(b) | |||||||||||||||||||

| Consumer Discretionary (3.39%) | |||||||||||||||||||

| EBSC Holdings LLC, Preferred(c)(d)(g) | 10.00% PIK | 1,103,518 | 1,269,046 | ||||||||||||||||

| Pennfoster(c)(d) | 15.19 | % | 5,670,969 | 5,545,074 | |||||||||||||||

| Princeton Medspa Partners, LLC(c)(d)(g)(j) | 12.50% PIK | 274,109 | 199,868 | ||||||||||||||||

| 7,013,988 | |||||||||||||||||||

| Health Care (0.08%) | |||||||||||||||||||

| American Academy Holdings. Inc., Preferred(c)(d)(j) | 18.00 | % | 90,970 | 156,469 | |||||||||||||||

| Industrials (0.10%) | |||||||||||||||||||

| GreenPark Infrastructure, LLC Series A, Preferred(c)(g)(i)(j) 400 | 200,000 | ||||||||||||||||||

| TOTAL PREFERRED STOCK | |||||||||||||||||||

| (Cost $7,139,683) | 7,370,457 | ||||||||||||||||||

| Shares | Value | ||||||||||||||||||

| PRIVATE INVESTMENT FUNDS (18.38%)(b) | |||||||||||||||||||

| BlackRock Global Credit Opportunities Fund, LP(e)(l)(n) | 8,629,530 | ||||||||||||||||||

| CVC European Mid-Market Solutions Fund(e)(l)(n) | 1,410,131 | ||||||||||||||||||

| EJF Financial Debt Strategies Fund LP(l) | 780,404 | ||||||||||||||||||

See Notes to Consolidated Financial Statements.

| 20 | www.altcif.com |

| Alternative Credit Income Fund | Consolidated Schedule of Investments |

March 31, 2025 (Unaudited)

| Shares | Value | |||||||

| PRIVATE INVESTMENT FUNDS (18.38%)(b) (continued) | ||||||||

| GSO Credit Alpha Fund II LP(e)(l)(n) | $ | 2,063,457 | ||||||

| Monroe Capital Private Credit Fund III LP(e)(l)(n) | 5,703,510 | |||||||

| Pelham S2K SBIC II, L.P.(e)(l)(n) | 356,545 | |||||||

| Tree Line Credit Strategies LP(l)(n) | 19,022,874 | |||||||

| 37,966,451 | ||||||||

| TOTAL PRIVATE INVESTMENT FUNDS | ||||||||

| (Cost $39,010,927) | 37,966,451 | |||||||

| WARRANTS (0.32%)(b) | ||||||||

| Consumer Discretionary (0.14%) | ||||||||

| CEC Entertainment, Inc. Warrants(i) | 237,941 | 273,632 | ||||||

| Princeton Medspa Partners, LLC, Warrants(c)(g)(i)(j) | 0.01 | 8,089 | ||||||

| 281,721 | ||||||||

| Financials (0.18%) | ||||||||

| SouthStreet Securities Holdings, Inc., Warrants(c) (i) | 3,400 | 376,924 | ||||||

| Information Technology (–%) | ||||||||

| Diamanti, Inc., Class A(c)(i) | 146,413 | – | ||||||

| TOTAL WARRANTS | ||||||||

| (Cost $390,456) | 658,645 | |||||||

| SHORT-TERM INVESTMENT (3.70%) | ||||||||

| Money Market Funds (3.70%) | ||||||||

| US BANK MMDA - USBGFS 9, 4.20%(b)(o) | 7,645,208 | 7,645,208 | ||||||

| TOTAL SHORT-TERM INVESTMENT | ||||||||

| (Cost $7,645,208) | 7,645,208 | |||||||

| Number

of Contracts | Value | |||||||

| DERIVATIVES (–%)(b) | ||||||||

| Consumer Discretionary (–%) | ||||||||

| Princeton Medspa Partners, LLC, Put Option(c)(g)(i)(j) | 250,000 | – | ||||||

| TOTAL DERIVATIVES | ||||||||

| (Cost $–) | – | |||||||

| INVESTMENTS, AT VALUE (101.25%) | ||||||||

| (Cost $237,607,213) | $ | 209,135,989 | ||||||

| Liabilities In Excess Of Other Assets (-1.25%) | (2,572,518 | ) | ||||||

| NET ASSETS (100.00%) | $ | 206,563,471 | ||||||

Investment Abbreviations:

SOFR - Secured Overnight Financing Rate

PIK - Payment in-Kind

Reference Rates:

1M SOFR - 1 Month US SOFR as of March 31, 2025 was 4.32%.

3M SOFR - 3 Month US SOFR as of March 31, 2025 was 4.28%.

6M SOFR - 6 Month US SOFR as of March 31, 2025 was 4.22%.

PRIME - US Prime Rate as of March 31, 2025 was 7.50%

See Notes to Consolidated Financial Statements.

| Semi-Annual Report | March 31, 2025 | 21 |

| Alternative Credit Income Fund | Consolidated Schedule of Investments |

March 31, 2025 (Unaudited)

| (a) | Variable rate investment. Interest rates reset periodically. Interest rate shown reflects the rate in effect at March 31, 2025. For securities based on a published reference rate and spread, the reference rate and spread are indicated in the description above. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description above. |

| (b) | These investments are pledged to secure the Fund’s debt obligations. |

| (c) | As a result of the use of significant unobservable inputs to determine fair value, these investments have been classified as Level 3 assets. |

| (d) | Payment in-kind security which may pay interest in additional par. |

| (e) | All or a portion of this commitment was unfunded as of March 31, 2025. |

| (f) | Non-accrual investment. |

| (g) | Affiliate company. |

| (h) | Principal balance denominated in euros. |

| (i) | Non-income producing security. |

| (j) | Investment is held through ACIF Master Blocker, LLC, wholly-owned subsidiary. |

| (k) | Securities exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. As of March 31, 2025, the aggregate market value of those securities was $10,458,366, representing 5.06% of net assets. |

| (l) | Restricted security. |

| (m) | During the period ended March 31, 2025, the Fund invested $29,638 in Great Lakes Funding II, LLC - Series A units, received a return of capital distribution of $10,936, and reported change in unrealized appreciation of $35,810 on Great Lakes Funding II, LLC - Series A units. Additionally, Great Lakes Funding II LLC - Series A declared distributions of $28,706. during the period ended March 31, 2025 |

| (n) | Investment is held through CIF Investments LLC, a wholly-owned subsidiary. |

| (o) | Money market fund; interest rate reflects seven-day effective yield on March 31, 2025. |

Securities determined to be restricted under the procedures approved by the Fund's Board of Trustees are as follows.

| Date(s) of Purchase | Security | Cost | Value | % of Net Assets | ||||||||||

| 03/31/2018 - 09/30/2024 | BlackRock Global Credit Opportunities Fund, LP | $ | 9,797,727 | $ | 8,629,530 | 4.18 | % | |||||||

| 09/30/2017 - 09/30/2021 | CVC European Mid-Market Solutions Fund | 2,911,406 | 1,410,131 | 0.68 | % | |||||||||

| 06/30/2024 - 09/30/2024 | EJF Financial Debt Strategies Fund LP | 750,000 | 780,404 | 0.38 | % | |||||||||

| 08/05/2022 - 12/31/2024 | Great Lakes Funding II LLC, Series A | 408,051 | 391,098 | 0.19 | % | |||||||||

| 06/30/2018 - 03/31/2021 | GSO Credit Alpha Fund II LP | 875,997 | 2,063,457 | 1.00 | % | |||||||||

| 09/30/2018 - 12/31/2020 | Monroe Capital Private Credit Fund III LP | 5,316,167 | 5,703,510 | 2.76 | % | |||||||||

| 11/14/2022 - 03/31/2025 | Pelham S2K SBIC II, L.P. | 359,630 | 356,545 | 0.17 | % | |||||||||

| 12/31/2017 - 06/30/2019 | Tree Line Credit Strategies LP | 19,000,000 | 19,022,874 | 9.21 | % | |||||||||

| Total | $ | 39,418,978 | $ | 38,357,549 | 18.57 | % | ||||||||

Additional information on investments in private investment funds and unfunded commitments:

| Security | Value | Redemption Frequency | Redemption Notice(Days) | Unfunded Commitments as of March 31, 2025 | ||||||||

| BlackRock Global Credit Opportunities Fund, LP(a) | $ | 8,629,530 | N/A | N/A | $ | 3,871,980 | ||||||

| CVC European Mid-Market Solutions Fund(b) | 1,410,131 | N/A | N/A | 206,342 | ||||||||

| EJF Financial Debt Strategies Fund LP | 780,404 | N/A | N/A | N/A | ||||||||

| Great Lakes Funding II LLC, Series A(a) | 391,098 | N/A | N/A | 86,687 | ||||||||

| GSO Credit Alpha Fund II LP(a) | 2,063,457 | N/A | N/A | 7,382,124 | ||||||||

| Monroe Capital Private Credit Fund III LP(b) | 5,703,510 | N/A | N/A | 1,498,740 | ||||||||

| Pelham S2K SBIC II, L.P. | 356,545 | N/A | N/A | 1,640,370 | ||||||||

| Tree Line Credit Strategies LP | 19,022,874 | Quarterly | 90 | N/A | ||||||||

| Total | $ | 38,357,549 | $ | 14,686,243 | ||||||||

Unfunded Commitments:

| Security | Value | Maturity | Unfunded Commitment | |||||||||

| Cor Leonis Limited, Revolver | $ | 2,456,339 | 05/15/2028 | $ | 640,788 | |||||||

| Hunter Point Capital Structured Notes Issuer, LLC, Subordinated | ||||||||||||

| Delayed Draw Notes | 2,950,575 | 07/15/2052 | 3,375,195 | |||||||||

| Irradiant Intermediate Holdings, LP, Delayed Draw Term Loan | 870,000 | 06/08/2028 | 580,000 | |||||||||

| Newbury Franklin Industrials, LLC, Delayed Draw Term Loan | (12,336 | ) | 12/11/2029 | 986,842 | ||||||||

See Notes to Consolidated Financial Statements.

| 22 | www.altcif.com |

| Alternative Credit Income Fund | Consolidated Schedule of Investments |

March 31, 2025 (Unaudited)

| Security | Value | Maturity | Unfunded Commitment | |||||||||

| Next Flight Ventures, Delayed Draw Term Loan | $ | 970,196 | 12/26/2025 | $ | 266,700 | |||||||

| PhyNet Dermatology LLC, Delayed Draw Term Loan | 11,690 | 10/20/2029 | 1,034,483 | |||||||||

| PMP OPCO, LLC, Delayed Draw Term Loan | (39,066 | ) | 05/31/2029 | 843,750 | ||||||||

| PMP OPCO, LLC, Revolver | (7,917 | ) | 05/31/2029 | 140,625 | ||||||||

| Riddell Inc., Delayed Draw Term Loan | – | 03/29/2029 | 363,636 | |||||||||

| VBC Spine Opco LLC (DxTx Pain and Spine LLC), Delayed Draw Term Loan | 621,803 | 06/14/2028 | 475,382 | |||||||||

| VBC Spine Opco LLC (DxTx Pain and Spine LLC), Revolver | (1,645 | ) | 06/14/2028 | 241,936 | ||||||||

| Total | $ | 7,819,639 | $ | 8,949,337 | ||||||||

| Total Unfunded Commitments | $ | 23,635,580 | ||||||||||

| (a) | A voluntary withdrawal may be permitted at the General Partner's discretion with the General Partner's consent. |

| (b) | A voluntary withdrawal may be permitted with the General Partner's prior written consent. |

See Notes to Consolidated Financial Statements.

| Semi-Annual Report | March 31, 2025 | 23 |

| Alternative Credit Income Fund | Consolidated Statement of Assets and Liabilities |

March 31, 2025 (Unaudited)

| ASSETS | ||||

| Investments, at value (Cost $218,196,209) | $ | 192,283,370 | ||

| Affiliated investments, at value (Cost $19,411,004) | 16,852,619 | |||

| Cash | – | |||

| Foreign cash, at value (Cost $11,735) | 11,747 | |||

| Interest and distributions receivable | 2,783,867 | |||

| Receivable for fund shares sold | 13,586 | |||

| Due from Adviser | 205,160 | |||

| Prepaid expenses and other assets | 35,188 | |||

| Total assets | $ | 212,185,537 | ||

| LIABILITIES | ||||

| USB Credit Facility (Cost $5,054,410) | 4,960,170 | |||

| Interest on line of credit payable | 78,398 | |||

| Administration fees payable | 112,447 | |||

| Custody fees payable | 6,082 | |||

| Transfer agency fees payable | 64,920 | |||

| Accrued expenses and other liabilities | 400,049 | |||

| Total liabilities | 5,622,066 | |||

| NET ASSETS | $ | 206,563,471 | ||

| NET ASSETS CONSISTS OF | ||||

| Paid-in capital | $ | 243,998,930 | ||

| Total accumulated deficit | (37,435,459 | ) | ||

| NET ASSETS | $ | 206,563,471 | ||

| Common Shares: | ||||

| Class A | ||||

| Net assets | $ | 24,987,027 | ||

| Shares of beneficial interest outstanding (no par value; unlimited number of shares) | 2,734,157 | |||

| Net asset value(a) | $ | 9.14 | ||

| Maximum offering price per share (maximum sales charge of 5.75%) | $ | 9.67 | ||

| Class C | ||||

| Net assets | $ | 27,064,015 | ||

| Shares of beneficial interest outstanding (no par value; unlimited shares) | 2,921,130 | |||

| Net asset value(a) | $ | 9.26 | ||

| Class W | ||||

| Net assets | $ | 41,147,621 | ||

| Shares of beneficial interest outstanding (no par value; unlimited shares) | 4,506,271 | |||

| Net asset value | $ | 9.13 | ||

| Class I | ||||

| Net assets | $ | 105,019,396 | ||

| Shares of beneficial interest outstanding (no par value; unlimited shares) | 11,489,477 | |||

| Net asset value | $ | 9.14 | ||

| Class L | ||||

| Net assets | $ | 8,345,412 | ||

| Shares of beneficial interest outstanding (no par value; unlimited shares) | 912,301 | |||

| Net asset value | $ | 9.15 | ||

| Maximum offering price per share (maximum sales charge of 4.25%) | $ | 9.54 | ||

| (a) | Redemption price varies based on length of time held (Note 6). |

See Notes to Consolidated Financial Statements.

| 24 | www.altcif.com |

| Alternative Credit Income Fund | Consolidated Statement of Operations |

For the Six Months Ended March 31, 2025 (Unaudited)

| INVESTMENT INCOME | ||||

| Interest | $ | 6,209,719 | ||

| Interest from affiliated investments | 999,012 | |||

| Dividends | 2,684,194 | |||

| Dividends from affiliated investments | 249,957 | |||

| Payment-in-kind interest - Non-Affiliates | 1,704,209 | |||

| Payment-in-kind interest - Affiliates | 69,265 | |||

| Other Income | 10,449 | |||

| Total investment income | 11,926,805 | |||

| EXPENSES | ||||

| Investment advisory fees (Note 4) | 1,917,672 | |||

| Sub-administrative fees (Note 4) | 245,116 | |||

| Distribution fees (Note 4): | ||||

| Class C | 92,705 | |||

| Class L | 10,697 | |||

| Shareholder servicing fees (Note 4): | ||||

| Class A | 23,489 | |||

| Class C | 30,904 | |||

| Class W | 53,039 | |||

| Class L | 10,697 | |||

| Interest expense (Note 7) | 246,229 | |||

| Incentive fees (Note 4) | – | |||

| Transfer agent fees (Note 4) | 133,097 | |||

| Professional fees | 616,904 | |||

| Printing expense | 66,159 | |||

| Registration fees | 30,310 | |||

| Custody fees | 12,863 | |||

| Insurance expense | 63,756 | |||

| Trustee fees and expenses (Note 4) | 20,197 | |||

| Compliance services fees | 7,307 | |||

| Networking Fees: | ||||

| Class A | 3,234 | |||

| Class C | 4,489 | |||

| Class W | 299 | |||

| Class I | 12,887 | |||

| Class L | 1,963 | |||

| Other expenses | 10,123 | |||

| Total expenses | 3,614,136 | |||

| Fees waived by Adviser net of recoupment (Note 4) | (679,992 | ) | ||

| Total net expenses | 2,934,144 | |||

| NET INVESTMENT INCOME | 8,992,661 | |||

| Net realized loss on investments | (11,961,362 | ) | ||

| Net realized loss on affiliated investments | (67,239 | ) | ||

| Net realized loss on foreign currency transactions | (2,076 | ) | ||

| Total net realized loss | (12,030,677 | ) | ||

| Net change in unrealized appreciation on investments | 3,020,440 | |||

| Net change in unrealized depreciation on affiliated investments | (1,379,024 | ) | ||

| Net change in unrealized appreciation on translation of assets and liabilities in foreign currencies | – | |||

| Net change in unrealized appreciation on debt | 101,868 | |||

| Total net change in unrealized appreciation | 1,743,284 | |||

| NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS | (10,287,393 | ) | ||

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | (1,294,732 | ) | |

See Notes to Consolidated Financial Statements.

| Semi-Annual Report | March 31, 2025 | 25 |

| Alternative Credit Income Fund | Consolidated

Statements of Changes in Net Assets |

| For the Six Months Ended March 31, 2025 (Unaudited) | For the Year Ended September 30, 2024 | |||||||

| OPERATIONS | ||||||||

| Net investment income | $ | 8,992,661 | $ | 23,494,018 | ||||

| Net realized loss on investments | (12,028,601 | ) | (5,376,469 | ) | ||||

| Net realized gain on securities sold short | – | 2,463,229 | ||||||

| Net realized gain/(loss) on foreign currency transactions | (2,076 | ) | 28,755 | |||||

| Net change in unrealized appreciation/(depreciation) on investments | 1,641,416 | (5,262,928 | ) | |||||

| Net change in unrealized depreciation on securities sold short | – | (703,228 | ) | |||||

| Net change in unrealized appreciation on debt | 101,868 | (7,676 | ) | |||||

| Net change in unrealized appreciation on translation of assets and liabilities in foreign currencies | – | 11 | ||||||

| Net increase/(decrease) in net assets resulting from operations | (1,294,732 | ) | 14,635,712 | |||||

| DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

| Total Distributable Earnings | ||||||||

| Class A | (1,384,048 | ) | (2,200,085 | ) | ||||

| Class C | (1,341,603 | ) | (2,237,560 | ) | ||||

| Class W | (2,319,344 | ) | (3,500,561 | ) | ||||

| Class I | (5,940,587 | ) | (8,500,670 | ) | ||||

| Class L | (439,477 | ) | (671,503 | ) | ||||

| Total distributions to shareholders | (11,425,059 | ) | (17,110,379 | ) | ||||

| COMMON SHARE TRANSACTIONS | ||||||||

| Class A | ||||||||

| Proceeds from sales of shares | 555,029 | 1,838,587 | ||||||

| Distributions reinvested | 489,312 | 1,035,451 | ||||||

| Cost of shares redeemed | (2,081,990 | ) | (9,370,560 | ) | ||||

| Net transferred in(out) | (202,481 | ) | (1,642,125 | ) | ||||

| Net decrease from share transactions | (1,240,130 | ) | (8,138,647 | ) | ||||

| Class C | ||||||||

| Proceeds from sales of shares | 190,984 | 799,942 | ||||||

| Distributions reinvested | 698,255 | 941,668 | ||||||

| Cost of shares redeemed | (1,922,541 | ) | (5,485,249 | ) | ||||

| Net transferred in(out) | (417,648 | ) | (6,806,712 | ) | ||||

| Net decrease from share transactions | (1,450,950 | ) | (10,550,351 | ) | ||||

| Class W | ||||||||

| Proceeds from sales of shares | 2,395,074 | 3,832,922 | ||||||

| Distributions reinvested | 560,831 | 853,187 | ||||||

| Cost of shares redeemed | (6,611,980 | ) | (10,411,110 | ) | ||||

| Net transferred in(out) | 7,130 | 519,360 | ||||||

| Net decrease from share transactions | (3,648,945 | ) | (5,205,641 | ) | ||||

| Class I | ||||||||

| Proceeds from sales of shares | 6,535,393 | 22,395,998 | ||||||

| Distributions reinvested | 1,947,454 | 3,035,631 | ||||||

| Cost of shares redeemed | (11,249,631 | ) | (29,206,944 | ) | ||||

| Net transferred in(out) | 612,999 | 7,929,477 | ||||||

| Net increase/(decrease) from share transactions | (2,153,785 | ) | 4,154,162 | |||||

| Class L | ||||||||

| Proceeds from sales of shares | 9,332 | 46,391 | ||||||

| Distributions reinvested | 257,260 | 405,045 | ||||||

| Cost of shares redeemed | (289,206 | ) | (2,597,798 | ) | ||||

| Net decrease from share transactions | (22,614 | ) | (2,146,362 | ) | ||||

| Total net decrease in net assets | (21,236,215 | ) | (24,361,506 | ) | ||||

See Notes to Consolidated Financial Statements.

| 26 | www.altcif.com |

| Alternative Credit Income Fund | Consolidated

Statements of Changes in Net Assets (continued) |

| For the Six Months Ended March 31, 2025 (Unaudited) | For the Year Ended September 30, 2024 | |||||||

| NET ASSETS | ||||||||

| Beginning of period | 227,799,686 | 252,161,192 | ||||||

| End of period | $ | 206,563,471 | $ | 227,799,686 | ||||

| OTHER INFORMATION | ||||||||

| Common Shares Transactions | ||||||||

| Class A | ||||||||

| Issued | 58,128 | 187,886 | ||||||

| Distributions reinvested | 52,158 | 106,890 | ||||||

| Redeemed | (219,302 | ) | (965,710 | ) | ||||

| Net Transferred in(out) | (20,987 | ) | (167,276 | ) | ||||

| Net decrease in shares | (130,003 | ) | (838,210 | ) | ||||

| Class C | ||||||||