UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ |

No fee required. |

☐ |

Fee paid previously with preliminary materials. |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

April 7, 2025 |

|

Dear Fellow Stockholder: You are cordially invited to attend the 2025 Annual Meeting of Stockholders of Treace Medical Concepts, Inc. ("Treace Medical") to be held on Tuesday, May 20, 2025, at 11:00 a.m., Eastern Time. The Annual Meeting will be held via live webcast. You will be able to attend the 2025 Annual Meeting, vote and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/TMCI2025. You may vote your shares before the Annual Meeting by regular mail, telephone or online, or you may vote online during the Annual Meeting. Additional information about the matters to be addressed at the Annual Meeting and how to vote your shares can be found in the accompanying proxy statement. |

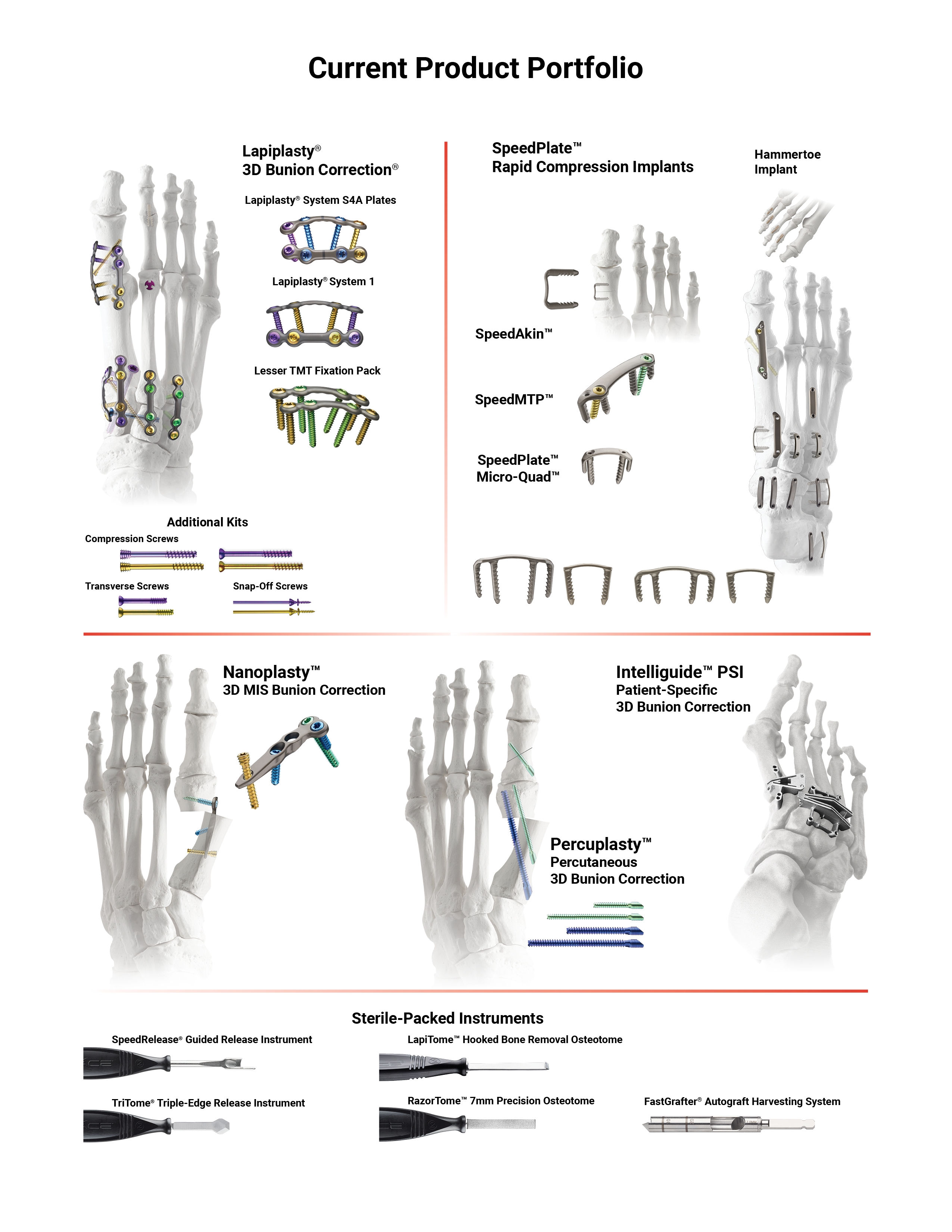

2024 Key Accomplishments - Introducing Solutions for All 4 Bunion Classes

At Treace Medical, our goal is to advance the standard of care for the surgical management of bunion and related midfoot deformities. Millions of people suffer from bunions, which can have a significant impact on mobility and quality of life.

In 2024, we executed on our agenda to comprehensively address the evolving needs of surgeons and patients with an expanding portfolio of innovative bunion solutions. Since our inception, we have worked closely with surgeons to understand and serve the large, unmet needs in the bunion market. In 2018, our Surgeon Advisory Board published a peer-reviewed paper describing four different classes of bunion deformities; these include (1) milder bunion deformities, (2) deformities that are more severe in nature, (3) bunions with a co-existing deformity of the midfoot, and (4) bunions with a co-existing arthritic great toe joint.

To address bunions across a broad spectrum of bunion classes, our patented Lapiplasty® System leads the way in both market position and innovation with over 120,000 patients treated since late 2015. To address bunions with a co-existing deformity of the midfoot, we introduced our Adductoplasty® System in 2021. To address mild or moderate bunions, which surgeons may prefer to address with a metatarsal osteotomy, we introduced two systems for osteotomy surgeries in late 2024: (1) the Nanoplasty™ 3D Minimally Invasive Bunion Correction System, and (2) the Percuplasty™ Percutaneous 3D Bunion Correction System. To address bunions with a co-existing arthritic great toe joint, in late 2024, we introduced our SpeedMTP™ System which combines our SpeedPlate™ compressive fixation technology with additive locking screws to provide surgeons with a new option for great toe fusions. We look forward to sharing more product and business developments with our stockholders during 2025.

Culture of Integrity and Focus on Sound Governance

At Treace Medical, we believe a strong culture of integrity and compliance is critically important to building a world-class business. Our board of directors recognize that a key element of this culture is sound corporate governance. More information about our corporate governance practices is included in our proxy statement.

As the Annual Meeting approaches, I wanted to take a moment to thank James T. Treace who will be retiring from our board of directors at the Annual Meeting. Jim has served as chairman of the board of directors since Treace Medical's inception in 2014. His unwavering service and insightful advice has been a meaningful part of the company's operational success.

On behalf of the board of directors, the officers and employees of Treace Medical, I would like to thank our stockholders for their continued support. We look forward to seeing you at the Annual Meeting.

Sincerely, |

John T. Treace, Chief Executive Officer, Director and Founder |

NOTICE OF 2025 ANNUAL MEETING OF STOCKHOLDERS

NOTICE IS HEREBY given that the 2025 Annual Meeting of Stockholders (the "Annual Meeting") of Treace Medical Concepts, Inc., a Delaware corporation (the "Company"), will be held by means of a virtual webcast at 11:00 a.m., Eastern Time, on Tuesday, May 20, 2025 for the following purposes:

Voting Items |

• To elect two Class I directors to serve for a three-year term of office expiring at the 2028 annual meeting of stockholders and until their respective successors have been duly elected and qualified; |

• To approve, on an advisory, non-binding basis, the compensation of our named executive officers; |

• To ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2025; and |

• To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

These proposals are more fully described in the proxy statement following this Notice.

The board of directors of the Company recommends that you vote "FOR" the election of both nominees to serve as Class I directors of the Company, "FOR" the advisory approval of the compensation of our named executive officers, and "FOR" the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the year ending December 31, 2025.

The board of directors has fixed the close of business on March 24, 2025, as the record date for the determination of the stockholders entitled to notice of, and to vote at, the Annual Meeting. Only stockholders of record at the close of business on that date will be entitled to vote at the Annual Meeting.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE VIRTUAL ANNUAL MEETING, WE ENCOURAGE YOU TO READ THE ACCOMPANYING PROXY STATEMENT AND OUR ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED December 31, 2024, AND SUBMIT YOUR PROXY AS SOON AS POSSIBLE USING ONE OF THE THREE CONVENIENT VOTING METHODS DESCRIBED IN THE "QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING" SECTION IN THE PROXY STATEMENT. IF YOU RECEIVE MORE THAN ONE SET OF PROXY MATERIALS OR NOTICE OF INTERNET AVAILABILITY BECAUSE YOUR SHARES ARE REGISTERED IN DIFFERENT NAMES OR ADDRESSES, EACH PROXY SHOULD BE SIGNED AND SUBMITTED TO ENSURE THAT ALL OF YOUR SHARES WILL BE VOTED.

By Order of the Board of Directors,

Scot M. Elder

Chief Legal and Compliance Officer, Corporate Secretary

April 7, 2025

YOUR VOTE IS IMPORTANT.

Please vote via the mail, internet or telephone.

Internet: www.proxyvote.com

Phone: 1-800-690-6903

Important Notice Regarding the Internet Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on May 20, 2025 at 11:00 am ET via live webcast at www.virtualshareholdermeeting.com/TMCI2025.

This proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2024 are available at http://materials.proxyvote.com/89455T.

|

TABLE OF CONTENTS

1 |

|

30 |

||

|

|

|

31 |

|

2 |

Questions and Answers about these Proxy Materials and Voting |

|

|

|

|

31 |

|||

8 |

|

43 |

||

|

44 |

|||

|

|

|

46 |

|

8 |

|

47 |

||

12 |

|

48 |

||

12 |

|

49 |

||

13 |

|

|||

|

50 |

|||

14 |

|

51 |

||

16 |

|

|

|

|

21 |

|

53 |

||

23 |

|

54 |

||

26 |

|

|||

|

55 |

|||

26 |

|

57 |

Stockholder Proposals for 2026 Annual Meeting of Stockholders |

|

27 |

|

|||

|

58 |

|||

28 |

Proposal 3: Ratification of Selection of Independent Registered Public Accounting Firm |

|

||

|

58 |

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

May 20, 2025

ABOUT THE MEETING

We have sent you this proxy statement and the enclosed proxy card because our board of directors (the "Board") is soliciting your proxy for the 2025 Annual Meeting of Stockholders (the "Annual Meeting") of Treace Medical Concepts, Inc., a Delaware corporation (the "Company", "TMCI", "we", "us" or "our") and at any adjournment or postponement of the meeting for the purposes described in this proxy statement and the accompanying Notice of 2025 Annual Meeting of Stockholders.

The Annual Meeting will occur on May 20, 2025 at 11:00 a.m., Eastern Time, in a virtual meeting via live webcast on the internet. If you held shares of our common stock as of the close of business on the record date, March 24, 2025 (the "Record Date"), you are invited to attend the meeting at www.virtualshareholdermeeting.com/TMCI2025 and vote on the proposals described in this proxy statement. There will be no physical meeting location.

In addition to solicitations by mail, our directors, officers and regular employees, without additional remuneration, may solicit proxies by telephone, e-mail and personal interviews. We may retain outside consultants to solicit proxies on our behalf as well. All costs of solicitation of proxies will be borne by us. Brokers, custodians and fiduciaries will be requested to forward proxy soliciting material to the beneficial owners of common stock held in their names, and we may reimburse them for their reasonable out-of-pocket expenses incurred in connection with the distribution of proxy materials.

On or about April 7, 2025, we will begin mailing a Notice of Internet Availability of Proxy Materials (the "Internet Notice") to our stockholders. The Internet Notice provides instructions on how to access the proxy materials over the internet, including our proxy statement, Notice of 2025 Annual Meeting of Stockholders, proxy card and our Annual Report on Form 10-K for the year ended December 31, 2024 ("2024 Annual Report"). The Internet Notice will also describe how to vote by mail, telephone or online and, if desired, how to receive a printed set of proxy materials. If you requested your materials via email, the email contains voting instructions and links to the materials on the internet. In addition, we have provided brokers, dealers, banks, voting trustees, and their nominees, at our expense, with additional copies of our proxy materials and the 2024 Annual Report so that they can supply these materials to the beneficial owners of shares of our common stock as of the Record Date. You may obtain, free of charge, a copy of the 2024 Annual Report (excluding exhibits and documents incorporated by reference) by writing to Treace Medical Concepts, Inc., 100 Palmetto Park Place, Ponte Vedra, FL 32081 Attention: Corporate Secretary or by emailing us at legal@treace.net. Copies of exhibits will be provided upon request. The 2024 Annual Report is also available in the "Financials & Filings" section of our website at https://investors.treace.com.

|

2025 PROXY STATEMENT |

1 |

About the Meeting

Questions and Answers about these Proxy Materials and Voting

Why did I receive a Notice of Internet Availability of Proxy Materials in the mail instead of a full set of proxy materials?

Under rules adopted by the Securities and Exchange Commission (the "SEC"), we have elected to provide access to our proxy materials over the internet. Accordingly, we have sent you the Internet Notice. The Internet Notice will instruct you as to how you may access and review the proxy materials on the internet and, if desired, how to request a printed set of proxy materials. In addition, by following the instructions in the Internet Notice, you may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. We believe that these rules allow us to conserve natural resources and reduce our costs of printing and delivering proxy materials, while providing a convenient method for stockholders to access the materials and vote.

To request that a full set of the proxy materials be sent to your specified postal address, you may use any of these three methods: (1) visit www.ProxyVote.com, (2) call 1-800-579-1639 or (3) send an email to sendmaterial@proxyvote.com. Please have your proxy card in hand when you access the website or call and follow the instructions provided. Please submit such request by May 6, 2025.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the Notice to ensure that all your shares are voted.

What is the date, time and place of the Annual Meeting?

The Annual Meeting will be held on Tuesday, May 20, 2025, beginning at 11:00 a.m., Eastern Time. We are pleased to announce that this year’s Annual Meeting will be a virtual meeting via live webcast on the internet. You will be able to attend the Annual Meeting, vote and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/TMCI2025 and entering the 16-digit control number included in the Internet Notice, on your proxy card or in the instructions that accompanied your proxy materials. There will be no physical meeting location.

What am I voting on?

There are three matters scheduled for a vote at the Annual Meeting:

For Proposal No. 1, you may vote "For All" the director nominees to the Board, "Withhold All" your votes for the director nominees to the Board, or vote “For All Except” the director nominees written on the line indicated on the proxy card.

For Proposal No. 2, you may vote "For" the proposal, "Against" the proposal or “Abstain” from voting on the proposal.

For Proposal No. 3, you may vote "For" the ratification, "Against" the ratification, or “Abstain” from voting on the ratification.

What if another matter is properly brought before the Annual Meeting?

If any other matters are properly brought before the Annual Meeting and you have properly submitted a proxy, the persons named in the accompanying proxy as proxy holders, Mark L. Hair and Scot M. Elder, will have the discretion to vote all proxies on such matters for you. As of the date of this proxy statement, the Board does not know of any other properly submitted business to be presented for consideration at the Annual Meeting. If any of our nominees for director are

2 |

|

|

About the Meeting

unavailable, or are unable to serve or for good cause will not serve, the persons named as proxy holders will vote your proxy for such other candidate or candidates, if any, as may be nominated by the Board.

What are the Board's recommendations?

Our Board recommends that you vote

"FOR" the election of Lawrence W. Hamilton and Deepti Jain as Class I directors (Proposal No. 1);

"FOR" the approval, on an advisory, non-binding basis, of the compensation of our named executive officers (Proposal No. 2); and

"FOR" the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2025 (Proposal No. 3).

Who is entitled to vote at the meeting?

Only our stockholders of record at the close of business on March 24, 2025, the Record Date for the Annual Meeting, are entitled to receive notice of, and to participate in and vote at, the Annual Meeting. As of the Record Date, there were 62,890,191 shares of common stock outstanding, all of which are entitled to be voted at the Annual Meeting.

Registered Stockholders. If shares of our common stock are registered directly in your name with our transfer agent, you are considered the stockholder of record with respect to those shares and the Internet Notice was provided to you directly by us. As the stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or vote in person at the Annual Meeting. Throughout this proxy statement, we refer to these registered stockholders as "stockholders of record."

Street Name Stockholders. If shares of our common stock are held on your behalf in a brokerage account or by a bank or other nominee, you are considered to be the beneficial owner of shares that are held in "street name," and the Internet Notice was forwarded to you by your broker or nominee. As the beneficial owner, you have the right to direct your broker, bank or other nominee as to how to vote your shares. If you wish to vote your shares at the Annual Meeting rather than submitting a voting instruction form to your broker, follow the instructions from your broker. Beneficial owners are also invited to attend the Annual Meeting.

What are the voting rights of the holders of our common stock?

Holders of common stock are entitled to one vote per share on each matter that is submitted to stockholders for approval.

How can I vote my shares without attending the Annual Meeting?

The procedures for voting depend on whether you are the stockholder of record or a beneficial owner in which your common shares are held by a bank, broker or other nominee (referred to as being held in "street name").

If you are a stockholder of record, you may submit a proxy by telephone, via the internet or by mail, as follows:

By casting your vote in any of the three ways listed above, you are authorizing the individuals named in the proxy to vote your shares in accordance with your instructions. All shares that have been properly voted, and not revoked, will be voted at the

|

2025 PROXY STATEMENT |

3 |

About the Meeting

Annual Meeting. If you sign and return your proxy card but do not give voting instructions, the shares represented by that proxy will be voted as recommended by the Board on all matters presented in this proxy statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting.

If your shares are held in the name of a broker, bank or other nominee, please follow their instructions for voting your shares. If you are a beneficial owner and do not provide the organization that holds your shares with any voting instructions, then such organization that holds your shares may generally vote your shares in their discretion on “routine” matters, but cannot vote your shares on “non-routine” matters. For more information, see “If I am a beneficial owner of shares held in street name and I do not provide my broker, bank or other nominee with voting instructions, what happens?”

If you are a beneficial owner and wish to vote at the Annual Meeting, you must obtain your 16-digit control number to access the meeting as a stockholder. If you haven’t received a 16-digit control number, you should contact your broker, bank or other nominee to obtain your control number or otherwise vote through such broker, bank or other nominee.

Can I change my vote after submitting my proxy?

Yes. Proxies may be revoked at any time before they are exercised at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

For shares held beneficially in street name, you may change your vote by submitting new voting instructions to your bank, broker or other nominee following the instructions it has provided, or, if you have obtained a 16-digit control number included on your Internet Notice, on your proxy card or on the instructions that accompanied your proxy materials, by attending the Annual Meeting and voting online.

How are votes counted?

Votes will be counted by the inspector of election, Broadridge Financial Solutions, Inc. ("Broadridge"), appointed for the Annual Meeting, who will separately count as follows:

If you are a stockholder of record, your executed proxy card is returned directly to Broadridge for tabulation. If you hold your shares through a bank or broker, your bank or broker returns one proxy card to Broadridge on behalf of all its clients.

What constitutes a quorum?

The presence at the meeting, in person or by remote communication, or by proxy, of the holders of a majority in voting power of the common stock issued and outstanding and entitled to vote on the Record Date will constitute a quorum, permitting the meeting to conduct its business. As of the Record Date, there were 62,890,191 shares of common stock outstanding, all of which are entitled to be voted at the Annual Meeting.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote online at the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, then either the chairperson of the meeting or a majority in voting power of the stockholders entitled to vote at the meeting, present in person or by remote communication, or represented by proxy, may adjourn the Annual Meeting to another date.

4 |

|

|

About the Meeting

If I am a stockholder of record and I do not vote, or if I return a proxy card or otherwise vote without giving specific voting instructions, what happens?

If you are a stockholder of record and do not vote by completing your proxy card, by telephone, via the internet, by mail or online at the Annual Meeting, your shares will not be voted.

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted as recommended by the Board.

If I am a beneficial owner of shares held in street name and I do not provide my broker, bank or other nominee with voting instructions, what happens?

If you are a beneficial owner of shares held in street name and do not provide the broker, bank or other nominee that holds your shares with specific voting instructions, then such broker may generally vote your shares in their discretion on "routine" matters, but cannot vote on "non-routine" matters.

Proposal No. 3, the ratification of the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025, is considered a routine matter. A broker, bank or other nominee may generally vote in their discretion on routine matters, and therefore no broker non-votes are expected in connection with Proposal No. 3.

Proposal No. 1, the director election, and Proposal 2, the advisory vote on executive compensation, are considered non-routine matters. If the broker, bank or other nominee that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, that nominee will inform the inspector of election that it does not have the authority to vote on the matter with respect to your shares. This is generally referred to as a "broker non-vote." Therefore, broker non-votes may exist in connection with Proposals No. 1 and No. 2. Broker non-votes count for purposes of determining whether a quorum is present.

How many votes are needed to approve each proposal?

Proposal |

|

Votes Required |

|

Effect of Votes Withheld / |

|

|

|

|

|

Proposal No. 1: Election of Directors |

|

The plurality of the votes cast. This means that the two nominees receiving the highest number of "FOR" votes will be elected as Class I directors. |

|

Votes withheld and broker non-votes will have no effect. |

Proposal No. 2: Approval, on an advisory (non-binding) basis, of the compensation of our named executive officers |

|

The majority of the votes cast. |

|

Abstentions and broker non-votes will have no effect. |

Proposal No. 3: Ratification of Appointment of Independent Registered Public Accounting Firm. |

|

The majority of the votes cast. |

|

Abstentions will have no effect. We do not expect any broker non-votes on this proposal. |

How can I attend the Annual Meeting online?

To join the Annual Meeting online, visit www.virtualshareholdermeeting.com/TMCI2025 and log in as a "stockholder" with your 16-digit control number included on your Internet Notice, on your proxy card or on the instructions that accompanied your proxy materials. If you do not have a control number, please contact your bank, broker or other nominee as soon as possible so that you can be provided with one. See "What if I did not receive a 16-digit control number?" at page 6 below for more instructions.

|

2025 PROXY STATEMENT |

5 |

About the Meeting

When can I join the virtual Annual Meeting?

The meeting will begin promptly at 11:00 a.m., Eastern Time, on Tuesday, May 20, 2025. You may access the meeting platform beginning at 10:45 a.m., Eastern Time, and we encourage you to join in advance of the meeting start time to allow sufficient time to log in and confirm your connection and audio are working properly.

Can I ask questions during the virtual Annual Meeting?

Yes. If you are logged in as a "stockholder" at the virtual Annual Meeting, you will have an opportunity to submit questions live via the internet during a designated portion of the virtual Annual Meeting. Once you are logged in, type your question into the question box and click "submit."

Subject to time constraints, we intend to answer questions pertinent to the Company and meeting matters submitted by stockholders during the Annual Meeting that comply with our rules of conduct for the Annual Meeting, which will be posted on the meeting website during the meeting.

How do I vote during the virtual Annual Meeting?

You will have an opportunity to vote your shares electronically during a designated portion of the virtual Annual Meeting after logging in as a "stockholder" with your 16-digit control number at www.virtualshareholdermeeting.com/TMCI2025. Whether or not you plan to join the Annual Meeting, we encourage you to vote and submit your proxy in advance of the meeting by one of the methods described in these proxy materials.

Internet proxy voting is provided to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies.

What if I lost my 16-digit control number?

You will be able to log into the virtual Annual Meeting as a guest. To join the meeting webcast, visit www.virtualshareholdermeeting.com/TMCI2025 and register as a guest. If you log in as a guest, you will not be able to vote your shares or ask questions during the meeting.

What if I did not receive a 16-digit control number?

If you are a beneficial owner of shares held in street name and did not receive a 16-digit control number on the Internet Notice, on your proxy card or on the instructions that accompanied your proxy materials, please contact your broker, bank or other nominee well in advance of the Annual Meeting for instructions on how to obtain a 16-digit control number and access the virtual meeting as a "stockholder." Instructions should also be provided on the voting instruction form provided by your broker, bank or other nominee. Without first obtaining your 16-digit control number and logging in as a "stockholder," you will still be able to attend the meeting by logging in as a guest, however, you will not be able to vote your shares or ask questions during the meeting.

What if I have technical difficulties?

On the meeting day, if you have trouble accessing the virtual meeting platform or encounter other technical difficulties with the platform before or during the meeting, please call the technical support number posted on the Annual Meeting login page at www.virtualshareholdermeeting.com/TMCI2025. Technical support information will also be available on www.virtualshareholdermeeting.com/TMCI2025 prior to the meeting day.

Will a list of stockholders be available for inspection prior to and during the meeting?

Yes. A list of stockholders will be available at our headquarters at 100 Palmetto Park Place, Ponte Vedra, FL 32081 for a period of ten days before the Annual Meeting for inspection by any stockholder. In addition, the list will be available for inspection online during the virtual Annual Meeting if you logged in as a "stockholder" with your 16-digit control number.

Who pays for costs relating to the proxy materials and Annual Meeting?

The costs of preparing, assembling and mailing this proxy statement, the Notice of Annual Meeting of Stockholders and the enclosed Annual Report and proxy card, along with the cost of posting the proxy materials on a website, will be borne by us.

6 |

|

|

About the Meeting

In addition to the use of mail, our directors, officers and regular employees may solicit proxies personally and by telephone, facsimile and other electronic means. They will receive no compensation in addition to their regular salaries or stipends. We may request banks, brokers and other custodians, nominees and fiduciaries to forward copies of the proxy material to their principals and to request authority for the execution of proxies. We may reimburse these persons for their expenses in so doing.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file a current report on Form 8-K within four business days after the Annual Meeting, we intend to file a current report on Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an amended report on Form 8-K to disclose the final results.

When are stockholder proposals due for next year’s Annual Meeting?

Stockholders wishing to include proposals in the proxy materials in relation to our annual meeting of stockholders to be held in 2026 under Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the "Exchange Act") must submit the proposal in writing so that it is received by the Company on or before December 8, 2025. Proposals should be addressed to Treace Medical Concepts, Inc., 100 Palmetto Park Place, Ponte Vedra, FL 32081, Attention: Corporate Secretary. Such proposals must also meet the other requirements and procedures prescribed by Rule 14a-8 under the Exchange Act relating to stockholders’ proposals. Nothing in this paragraph shall be deemed to require the Company to include in its proxy statement and proxy relating to the 2026 annual meeting of stockholders any stockholder proposal which may be omitted from the proxy materials according to applicable regulations of the SEC in effect at the time the proposal is received.

Under our amended and restated bylaws (the "Bylaws"), in order for a stockholder to present a proposal for next year’s annual meeting, other than proposals to be included in the proxy materials as described above, or to nominate a director, you must do so no earlier than January 20, 2026, and no later than February 19, 2026; provided that if the date of that annual meeting is more than 30 days before or more than 60 days after May 20, 2026, a stockholder must give notice not later than the 90th day prior to the annual meeting date or, if later, the 10th day following the day on which public disclosure of the annual meeting date is first made. You are also advised to review our Bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations. In addition to satisfying the requirements under our Bylaws, to comply with the universal proxy rules under the Exchange Act, stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act, no later than March 21, 2026.

|

2025 PROXY STATEMENT |

7 |

Board of Directors and Corporate Governance

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

DIRECTORS AND NOMINEES

Nominees for Election to a Three-Year Term Expiring at the 2028 Annual Meeting of Stockholders

|

|

Lawrence W. Hamilton Mr. Hamilton has served as a member of our Board since November 2020. Mr. Hamilton has served as an Executive Coach and Senior Adjunct Faculty with the Leadership Development Institute at Eckerd College since September 2008. From July 1993 to July 2006, Mr. Hamilton served in various roles at Tech Data Corporation, most recently as Senior Vice President, Human Resources and Chief Human Resources Officer. From 1991 to 1993, Mr. Hamilton served as Vice President of Human Resources and Administration at Linvatec. From 1985 to 1991, Mr. Hamilton served in a variety of human resource management positions at Bristol-Myers Squibb Company (NYSE: BMY). Mr. Hamilton has also previously served as a member of the board of directors of Wright Medical Group, Inc., which was acquired by Stryker Corporation (NYSE: SYK) in November 2020, and HomeBanc Mortgage (NYSE: HBMC). Mr. Hamilton holds a BA in Political Sciences from Fisk University, an MPA (Labor) Policy from the University of Alabama and an Ed.S. in Human Resources Development from George Washington University. Mr. Hamilton is a certified Senior Professional in Human Resources and holds the Certified Compensation Professional designation from the American Compensation Association and the Board Certified Coach credential from the Center For Credentialing and Education. Qualifications We believe that Mr. Hamilton is qualified to serve on our Board due to his experience in managing employees, establishing compensation policies and guidelines and serving in board committee roles. |

|

Age |

Tenure |

||

67 |

4.5 Years |

||

Committees • Audit • Compensation (Chair) |

|||

|

|

Deepti Jain Ms. Jain has served as a member of our Board since October 2021. From January 2019 to December 2020, Ms. Jain served as the President of IngenioRx, Inc., a subsidiary of Anthem, Inc. (NYSE: ANTM). From 2014 to 2018, Ms. Jain served as Senior Vice President and Chief Operating Officer of Anthem Pharmacy Solutions, a division of Anthem, Inc. Ms. Jain served as Chief Financial Officer and Senior Vice President of Finance of the Health Plan Division of Medco Health Solutions Inc. from 2010 to 2012. Ms. Jain served as a member of the board of directors, audit committee and compliance and reimbursement committee of Tactile Systems Technology, Inc. (NASDAQ: TCMD), a publicly traded medical device company, from January 2021 to May 2023. Ms. Jain holds a BA in Philosophy and Classical Music from Dayanand Anglo Vedic College, an MA in English Literature from Guru Nanak Dev University and an MBA from Zicklin School of Business at Baruch College. Qualifications We believe that Ms. Jain is qualified to serve on our Board due to her experience in launching fast-growing businesses, including as a chief financial officer and chief operating officer, her expertise in the healthcare industry, and her service on the boards of other publicly traded medical device companies. |

|

Age |

Tenure |

||

57 |

3.5 Years |

||

Committees • Audit • Nominating and Corporate Governance (Chair) |

|||

8 |

|

|

Board of Directors and Corporate Governance

Class II Directors whose terms in office expire at the 2026 Annual Meeting of Stockholders

|

|

Lance A. Berry Mr. Berry has served as a member of our Board since October 2022. Since December 2023, he has served as Executive Vice President and Chief Financial Officer of Artivion (NYSE: AORT), a cardiac and vascular surgery company focused on aortic disease. From December 2002 until its acquisition by Stryker Corporation (NYSE: SYK) in November 2020, Mr. Berry worked for Wright Medical Group, Inc., joining in 2002 as Corporate Controller and being promoted to various roles culminating in the roles of Senior Vice President and Chief Financial Officer from December 2009 to January 2019 and Executive Vice President, Chief Financial and Operations Officer from January 2019 to November 2020. Before joining Wright Medical, he was an accountant in the auditing division of Arthur Andersen, LLP, from 1995 to 2002. He served on the board of directors of Vapotherm (OTCQX: VAPO), a publicly traded developer and manufacturer of advanced respiratory technology, from January 2020 to September 2024. Mr. Berry is a Certified Public Accountant (inactive) and holds both a bachelor’s degree and a master’s degree in accounting from the University of Mississippi. Qualifications We believe that Mr. Berry is qualified to serve on our Board due to his extensive financial and managerial experience as a senior financial executive of a publicly traded medical device company, as well as his experience serving on the board of directors of other medical technology companies. |

|

Age |

Tenure |

||

52 |

2.5 Years |

||

Committees • Audit |

|||

|

|

Elizabeth "Betsy" S. Hanna Ms. Hanna has served as a member of our Board since October 2021. In March 2024, Ms. Hanna was appointed President of Cyted Health, Inc., a provider of genomic diagnostic tests for diseases of the esophagus. From March 2022 to September 2023, Ms. Hanna served as Executive Vice President and Chief Commercial Officer of Agendia, Inc., a provider of molecular diagnostic test solutions. She served as President and Chief Executive Officer and a board member of Clinical Genomics, Inc., a provider of cancer diagnostic solutions, from January 2019 to March 2022. From October 2018 until her promotion, she was Chief Commercial Officer of Clinical Genomics. From December 2014 to September 2018, she served as President and Chief Operating Officer of Origin, Inc., a clinical-stage biotech company. From 2006 to April 2014, Ms. Hanna held positions of increasing responsibility at Johnson & Johnson (NYSE: JNJ), including most recently as Vice President, Global Strategic Marketing – Acuvue Brand from October 2012 to April 2014. She also served as a member of the Global Management Board for J&J Vision Care from October 2012 to April 2014. Ms. Hanna holds a BS in Chemical Engineering from the University of Illinois and an MBA from Harvard Business School. Qualifications We believe that Ms. Hanna is qualified to serve on our Board due to her experience at developing company strategies, operational plans, leadership teams, and performance management systems to commercialize innovative medical therapies, including as a chief executive officer. |

|

Age |

Tenure |

||

60 |

3.5 Years |

||

Committees • Compensation • Nominating and Corporate Governance |

|||

|

2025 PROXY STATEMENT |

9 |

Board of Directors and Corporate Governance

|

|

Jane E. Kiernan Ms. Kiernan has served as a member of our Board since October 2022. Ms. Kiernan has served as the Chief Executive Officer and a member of the board of directors of Surgimatix, Inc., a privately held medical device company, since February 2022, after having served as its Chief Business Officer from May 2020 until February 2022. In January 2018, Ms. Kiernan co-founded K2 Biotechnology Ventures, an organization engaged in developing and commercializing university and medical center innovations. From October 2010 to May 2017, Ms. Kiernan served as the Chief Executive Officer of Salter Labs Inc., a manufacturer of specialty respiratory and airway management medical devices. From 2000 to 2010, Ms. Kiernan held executive and general management positions with Baxter Healthcare Corporation (NYSE: BAX). Ms. Kiernan serves on the board of Pharmazz, a private biopharmaceutical company, and AVeta Medical, a private medical device company. She previously served on the board of directors of Axonics, Inc. (NASDAQ: AXNX), a publicly traded global leader in incontinence therapies acquired by Boston Scientific in 2024, Endologix, Inc. (OTC: ELGXQ), a publicly traded provider of minimally invasive treatments of aortic disorders; and American Medical Systems (NASDAQ: AMMD), a publicly traded life sciences company acquired by Endo Pharmaceuticals. Ms. Kiernan holds a BS in business from Southern Methodist University. Qualifications We believe that Ms. Kiernan is qualified to serve on our Board due to her experience as an executive, including as a chief executive officer, leading medical device companies, as well as her experience serving on the board of directors, and audit and compensation committees of other medical technology companies. |

|

Age |

Tenure |

||

64 |

2.5 Years |

||

Committees • Compensation |

|||

Class III Directors whose terms in office expire at the 2027 Annual Meeting of Stockholders

|

|

John K. Bakewell Mr. Bakewell has served as a member of our Board since November 2020. He is an experienced executive with more than 30 years of service across the medical device, diagnostics, specialty pharma and healthcare services sectors. He most recently held the position of Chief Financial Officer of Exact Sciences Corporation (NASDAQ: EXAS), a molecular diagnostics company. Mr. Bakewell also previously served as Chief Financial Officer at Lantheus Holdings, Inc. (NASDAQ: LNTH), a diagnostic medical imaging company, Interline Brands, Inc., RegionalCare Hospital Partners, Inc., Wright Medical Group, Inc., which was acquired by Stryker Corporation (NYSE: SYK) in November 2020, Cyberonics, Inc., now part of LivaNova PLC (NASDAQ:LIVN), Altra Energy Technologies, Inc. and ZEOS International, Ltd. Mr. Bakewell has served as a member of the board of directors of Xtant Medical Holdings, Inc. (NYSE MKT: XTNT), a medical device company, since February 2018. Mr. Bakewell also previously served as a member of the board of directors of Neuronetics, Inc. (NASDAQ: STIM), a medical technology company, from May 2020 until May 2024, Entellus Medical, Inc., now part of Stryker Corporation (NYSE: SYK), ev3 Inc., now part of Medtronic plc (NYSE: MDT) and Corindus Vascular Robotics, Inc., now a Siemens Healthineers company. Mr. Bakewell holds a BA in Accounting from the University of Northern Iowa and is a certified public accountant (current status inactive). Qualifications We believe that Mr. Bakewell is qualified to serve on our Board due to his extensive financial and managerial experience as a senior executive of several publicly traded medical technology companies, as well as his experience serving on the board of directors of other medical technology companies. |

|

Age |

Tenure |

||

63 |

4.5 Years |

||

Committees • Audit (Chair) • Nominating and Corporate Governance |

|||

10 |

|

|

Board of Directors and Corporate Governance

|

|

Richard W. Mott Mr. Mott has served as a member of our Board since March 2015. Mr. Mott has served as the Principal of Walkabout Consulting LLC, a management consulting and private equity firm, since January 2009. He served as the Chairman and Interim Chief Executive Officer of Endologix, LLC, a medical device company, from October 2020 through November 2021 and served as chairman of its board from 2021 to March 2025. From March 2010 until August 2021, Mr. Mott was a Director and Owner of VFD Technologies, a private equity firm that invests in high performance materials and medical device manufacturing businesses. From September 2002 to November 2007, Mr. Mott served as President and Chief Executive Officer of Kyphon Inc., a global medical device company, including through its acquisition by Medtronic plc (NYSE: MDT). From 1993 to 2002, Mr. Mott held various management positions at Wilson Greatbatch Technologies, Inc. and Bristol-Myers Squibb Company (NYSE: BMY). From May 2008 to December 2017, Mr. Mott served as chairman of the board of directors of Silk Road Medical, Inc. (NASDAQ: SILK), a medical device company. Mr. Mott currently serves on the board of various private companies, including the medical device companies CeQur Corporation and Arsenal Medical, Inc. He holds a BS in Ceramic Engineering from Alfred University and is a graduate of Harvard University’s Advanced Management Program. Qualifications We believe that Mr. Mott is qualified to serve on our Board due to his extensive experience leading medical device companies from the early stages of development to liquidity events. |

|

Age |

Tenure |

||

66 |

10 Years |

||

Committees • Lead Independent Director • Compensation |

|||

|

|||

|

|

John T. Treace Mr. Treace founded Treace Medical Concepts in 2014 and has served as our Chief Executive Officer and a member of our Board since our inception. Before that, Mr. Treace served as Senior Vice President of U.S. Sales and Global Marketing from January 2010 to January 2013, as Vice President, Biologics and Extremities, from January 2003 to December 2009, as Senior Director of Biologics Marketing from July 2001 to June 2003, and as Senior Director of Sales Administration from November 2000 to June 2001 for Wright Medical Group, Inc., a medical device company, which was acquired by Stryker Corporation (NYSE: SYK) in November 2020. Before that, Mr. Treace held positions at Xomed Surgical Products, Inc., including as Director of Marketing from June 1998 to September 2000 and as Senior Product Manager from April 1996 to June 1998. From July 2010 to July 2013, Mr. Treace served on the board of directors of ENTrigue Surgical, which was acquired by Arthrocare Corporation. Mr. Treace holds a BS in Finance from Seattle University. Qualifications We believe Mr. Treace is qualified to serve on our Board due to his extensive knowledge as our Company’s founder and Chief Executive Officer, his prior commercial and general management experience with a market-leading, publicly traded foot and ankle medical device company and his prior experience as a board member for ENTrigue Surgical. |

|

Age |

Tenure |

||

53 |

11 Years |

||

• Founder |

|||

|

2025 PROXY STATEMENT |

11 |

Board of Directors and Corporate Governance

Class I Director whose term in office expires at the 2025 Annual Meeting

|

|

James T. Treace* Mr. Treace has served as the Chairman of our Board since July 2014. Mr. Treace has served as the Founder and President of J&A Group, LLC, a privately funded medical device investment and consulting company, since October 2000. From November 1999 to October 2000, Mr. Treace served as President of Medtronic Xomed, a subsidiary of Medtronic plc (NYSE: MDT). From April 1996 to November 1999, Mr. Treace served as Chief Executive Officer, President and Chairman of the Board of Directors of Xomed Surgical Products, Inc. (NASDAQ: XOMD), until it was acquired by Medtronic plc. From July 1993 to April 1996, Mr. Treace co-founded and served as the Chief Executive Officer and Chairman of the Board at TreBay Medical Corp., an orthopaedic and microsurgical device company. From September 1981 to July 1990, he served as President and Chief Executive Officer of Concept, Inc. (NASDAQ: CCPT), now known as Conmed Linvatec (NYSE: CNMD), and from June 1966 to September 1981 as Executive Vice President of Richards Medical, now known as Smith & Nephew (NYSE: SNN). Mr. Treace previously served as Chairman of the Boards of Kyphon, Inc. (NASDAQ: KYPH), now part of Medtronic plc, Wright Medical Group, Inc. which was acquired by Stryker Corporation (NYSE: SYK) in November 2020, and American Medical Systems, Inc. (NASDAQ: AMMD), now part of Endo Pharmaceuticals (NASDAQ: ENDP). Qualifications We believe that James T. Treace is qualified to serve on our Board due to his experience as chief executive officer and chairman of the board of publicly traded and privately held medical device companies. *James T. Treace has notified the Company that he will retire from the Board at the expiration of his current term at the Annual Meeting and not stand for re-election as a director at the Annual Meeting. Upon Mr. James T. Treace’s retirement, John T. Treace will serve as Chairman of the Board. |

|

Age |

Tenure |

||

79 |

11 Years |

||

Committees • Chairman of the Board • Nominating and Corporate Governance |

|||

FAMILY RELATIONSHIPS

Two members of our Board as of the date hereof, including our Chief Executive Officer, have a family relationship. John T. Treace, our Chief Executive Officer, is the nephew of our current Chairman of the Board and director James T. Treace. There are no family relationships among any of our executive officers. Each of our executive officers serves at the discretion of our Board and holds office until his or her successor is duly appointed and qualified or until his or her earlier resignation or removal.

BOARD COMPOSITION

Director Independence

As of the date of this proxy statement, our Board consists of nine members. James T. Treace, a Class I director, notified the Company that he will retire from the Board at the expiration of his current term at the Annual Meeting and not stand for re-election as a director at the Annual Meeting. In connection with Mr. James T. Treace’s departure from the Board, the Board has determined to decrease the number of members of the Board to eight, effective upon the expiration of Mr. James T. Treace’s current term at the Annual Meeting.

Under the Nasdaq Global Market listing requirements (the "Listing Rules"), independent directors must comprise a majority of a listed company’s board of directors within a specified period of time after listing on the Nasdaq Stock Market. The Listing Rule's definition of an independent director includes a series of objective tests, such as that the director is not, and has not been for at least three years, one of our employees and that neither the director nor any of his or her family members has engaged in any of various types of business dealings with us.

12 |

|

|

Board of Directors and Corporate Governance

As required by the Listing Rules, our Board has made a subjective determination as to the independence of each director and determined that directors Bakewell, Berry, Hamilton, Hanna, Jain, Kiernan and Mott, representing seven of our nine directors, are independent directors under the Listing Rules. James T. Treace is the uncle of our Chief Executive Officer. Our Board reviews the independence of each director at least annually. During these reviews, the Board considers transactions and relationships between each director, and his or her immediate family and affiliates, and our Company and its management to determine whether any such transactions or relationships are inconsistent with a determination that the director is independent. This review is based primarily on responses of the directors to questions in a directors’ and officers’ questionnaire regarding employment, business, familial, compensation and other relationships with our Company, including our management.

We believe that a majority of our directors and the composition of our Board meets the requirements for independence under current Listing Rules and SEC requirements. As required by the Listing Rules, our independent directors meet in regularly scheduled executive sessions at which only independent directors are present. We intend to comply with any future governance requirements to the extent they become applicable to us.

Classified Board of Directors

In accordance with our amended and restated certificate of incorporation as currently in effect (our "Certificate of Incorporation"), our Board is divided into three classes with staggered three-year terms. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following election or until their earlier death, resignation or removal. Our directors are divided among the three classes as follows:

Our Certificate of Incorporation and Bylaws provide that the authorized number of directors may be changed only by resolution of the Board. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. The division of our Board into three classes with staggered three-year terms, together with the requirement that stockholders may remove our directors only for cause with a two-thirds vote and the inability of stockholders to call special meetings, may have the effect of delaying or preventing a change in control or management of the Company.

MEETINGS OF OUR BOARD OF DIRECTORS AND COMMITTEES

Our Board held eight meetings during 2024 and acted by unanimous written consent six times. In 2024, the Audit Committee met four times and acted by unanimous written consent twice; the Compensation Committee met five times and acted by unanimous written consent six times; and the Nominating, Compliance and ESG Committee (now known as the Nominating & Corporate Governance Committee) (the "NCG Committee") met five times and acted by unanimous written consent once.

During 2024, each director attended at least 75% of the aggregate total number of meetings of the Board and the committees on which he or she served. We encourage our directors to attend our annual meetings of stockholders. Eight of the nine individuals who were directors at the time of our annual meeting held on May 21, 2024 attended the meeting.

|

2025 PROXY STATEMENT |

13 |

Board of Directors and Corporate Governance

BOARD COMMITTEES

Our Board has established a standing Audit Committee, Compensation Committee, and NCG Committee. Our Board may establish other committees to facilitate the management of our business. The composition and functions of each committee are described below. Members serve on these committees until their resignation or until otherwise determined by our Board. Each committee has adopted a written charter that satisfies applicable requirements of the Listing Rules and SEC regulations. The charters are posted in the "investors" area of our website under the "Corporate Governance" topic with the heading "Documents and Charters" at https://investors.treace.com/corporate-governance/documents-charters.

This reference to our website address and all other references to our website in this proxy statement do not incorporate by reference into this proxy statement the information contained at or available through our website, and you should not consider it to be a part of this proxy statement. The inclusion of our website address in this proxy statement is an inactive textual reference only.

|

|

Audit Committee All committee members meet the heightened independence and experience requirements applicable to Audit Committee members under the Listing Rules and SEC regulations. Further, each of Mr. Bakewell and Mr. Berry is an "audit committee financial expert" as defined under applicable rules of the SEC. Our Board has assessed whether all members of the Audit Committee meet the composition requirements of the Listing Rules, including the requirements regarding financial literacy and financial sophistication. Our Board found that each of the members of the Audit Committee has met the financial literacy and financial sophistication requirements under SEC regulations and the Listing Rules. Primary Responsibilities Under its charter, the Audit Committee responsibilities include: • appointing, determining the engagement, approving the compensation of and assessing the qualifications and independence of our independent auditor; • reviewing and discussing with management and the independent auditor our annual and quarterly financial statements and related disclosures; • discussing with management and the independent auditor the Company's process for assessing the adequacy and effectiveness of the Company's internal controls; • establishing procedures for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls, or auditing matters and for the confidential and anonymous submission of complaints regarding questionable accounting or auditing matters; • overseeing policies and processes to manage major risk exposures that may affect our financial statements, operations, reputation or business continuity, including enterprise-level risk assessments, investment policies, insurance programs and the reliability and security (including cybersecurity) of our information systems and technology (but excluding exposures from regulatory and compliance risks delegated to the NCG Committee and from compensation risks delegated to the Compensation Committee) and discussing with management the steps taken to monitor and mitigate these risks; • reviewing and approving all related party transactions; • reviewing and discussing with management, the independent auditor, and the senior internal auditor the scope of and plans for internal audits; • reporting regularly to the Board regarding the Audit Committee's activities; • annually reviewing and reassessing the Audit Committee charter; and • periodically performing an evaluation of the Audit Committee’s performance. |

Chair John K. Bakewell |

||

Other Members Lance A. Berry Lawrence W. Hamilton Deepti Jain |

||

Independent: 100% Meetings in 2024: 4 Actions by Consent: 2 2024 Meeting Attendance: 100% |

14 |

|

|

Board of Directors and Corporate Governance

|

|

Compensation Committee Each of the members of our Compensation Committee is independent as defined in the Listing Rules, is a "non-employee director" as defined in Rule 16b-3 promulgated under the Exchange Act and is an "outside director" as that term is defined in Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code"). The Compensation Committee reviews and evaluates, at least annually, the performance of the Compensation Committee and its members. Primary Responsibilities Under its charter, the Compensation Committee’s responsibilities include: • establishing and administering the annual incentive programs for the chief executive officer and other members of senior management; • annually reviewing the compensation of our chief executive officer and our other executive officers and recommending to the independent members of our Board the compensation of our chief executive officer; • reviewing and making recommendations to our Board with respect to director compensation; • overseeing and administering our equity incentive plans; • reporting regularly to the Board regarding the Compensation Committee's activities; • annually reviewing and reassessing the Compensation Committee charter; and • periodically performing an evaluation of the Compensation Committee’s performance. |

Chair Lawrence W. Hamilton |

||

Other Members Elizabeth S. Hanna Jane E. Kiernan Richard W. Mott |

||

Independent: 100% Meetings in 2024: 5 Actions by Consent: 6 2024 Meeting Attendance: 100% |

|

|

Nominating and Corporate Governance Committee Messrs. Bakewell and James T. Treace and Mss. Hanna and Jain each meet the independence requirements of the Listing Rules relating to NCG Committee independence. Primary Responsibilities Under its charter, the NCG Committee’s responsibilities include: • identifying individuals qualified to become Board members and recommending to the Board the nominees for election to the Board at the next annual meeting of stockholders; provided that for so long as the NCG Committee is not composed of all independent members, the independent members of the Board approve the nomination of directors; • recommending to the Board for its approval directors to serve as members of each committee and the Chairperson of each committee; • monitoring compliance with our code of business conduct and ethics; • overseeing our policies and programs related to compliance with laws and regulations; • reviewing hotline reports and compliance investigations (other than reports related to accounting, internal accounting controls, fraud or auditing matters), "whistleblower" reporting and non-retaliation policies; • receiving information about current and emerging risks and regulatory and enforcement trends, governmental inquiries or third-party claims; • developing and recommending to our Board corporate governance guidelines; • overseeing and recommending to our Board our practices, policies, strategies and reporting on environmental, social and governance matters; and • overseeing the evaluation of our Board and its committees and management. |

Chair Deepti Jain |

||

Other Members John K. Bakewell Elizabeth S. Hanna James T. Treace* |

||

Independent: 100% Meetings in 2024: 5 Actions by Consent: 1 2024 Meeting Attendance: 100% * Mr. James T. Treace will serve until the Annual Meeting. |

|

2025 PROXY STATEMENT |

15 |

Board of Directors and Corporate Governance

CORPORATE GOVERNANCE MATTERS

Corporate Governance Guidelines

We believe that good corporate governance is important to ensure that, as a public company, we will be managed for the long-term benefit of our stockholders. We and our Board have reviewed the corporate governance policies and practices of other public companies, as well as those suggested by various authorities in corporate governance. We have also considered the provisions of the Sarbanes-Oxley Act and the rules of the SEC and the Nasdaq Stock Market.

Based on this review, our Board has taken steps to implement many of these provisions and rules. In particular, we have adopted written corporate governance guidelines that provide the framework for our corporate governance, along with our Certificate of Incorporation, Bylaws, committee charters and other key governance practices and policies. Our corporate governance guidelines cover a range of topics including, but not limited to, independence of the Board, executive sessions, director qualification standards, board access to senior management and independent advisors, meeting attendance, service on other boards, board and committee self-evaluation, compensation and succession planning. The NCG Committee is responsible for reviewing and reassessing, from time to time as it deems appropriate, the adequacy of our corporate governance guidelines and recommending any proposed changes to the Board for approval. A copy of our corporate governance guidelines is available in the "investors" area of our website under the "Corporate Governance" topic with the heading "Documents and Charters" at https://investors.treace.com/corporate-governance/documents-charters.

Code of Conduct

We have also adopted a written code of conduct that applies to all of our employees, officers and directors, including those officers responsible for financial reporting. Our code of conduct is available in the "investors" area of our website under the "Corporate Governance" topic with the heading "Documents and Charters" at https://investors.treace.com/corporate-governance/documents-charters. We will disclose any amendments to the code, or any waivers of its requirements, on our website to the extent required by the applicable rules and exchange requirements.

We believe that a culture of integrity and compliance is critically important to fulfilling our mission. All employees and directors are expected to conduct business with high standards of business ethics. Each employee and director receives our code of conduct which emphasizes our four core values of Integrity, Courage, Excellence and Collaboration.

We cultivate an inclusive, open-door culture and have provided employees with many avenues to raise questions or concerns, without fear of retaliation, harassment, discrimination, or other inappropriate behavior, including anonymously reporting through a hotline accessible by phone or over the internet.

Insider Trading Compliance Policy

We have also

16 |

|

|

Board of Directors and Corporate Governance

Board Leadership Structure

Our Board established the following leadership structure in 2024:

Current Board Leadership Structure |

|||||

|

James T. Treace Chairman of the Board |

|

John T. Treace Chief Executive Officer |

|

Richard W. Mott Lead Independent Director |

|

|

|

|||

Key Responsibilities |

Key Responsibilities |

Key Responsibilities |

|||

• Serving as the primary sounding board for the CEO • Building consensus among the independent directors |

• Leading the Company's operations • Setting the Company's business strategies |

• Consulting with the CEO and management • Advising on board agendas and governance |

|||

John T. Treace currently serves as our Chief Executive Officer; James T. Treace serves as Chairman of the Board; and Richard W. Mott serves as lead independent director. Our NCG Committee recommended and our Board approved Mr. Mott's appointment as lead independent director effective in August 2024. The lead director’s responsibilities include, but are not limited to (1) presiding over all meetings of the Board at which the Board Chair is not present, including any executive sessions of the independent directors, (2) providing input and consulting on Board meeting schedules and agendas, (3) being available for and engaging in consultation with the Chief Executive Officer and other members of management, (4) playing an increased role in crisis and risk management, as appropriate, and (5) acting as the liaison between the independent directors and the Chief Executive Officer and Board Chair.

The Chairman of the Board (1) serves as the primary sounding board for the Chief Executive Officer, thereby fostering constructive and efficient communications between the Board and the Chief Executive Officer, (2) acts as a focal point for director communications, thereby helping to identify significant issues for Board consideration and gathering input from the other directors, and (3) communicates with and builds consensus among the independent directors, thereby reducing some of the demands on the Chief Executive Officer’s time.

Our NCG Committee is charged with periodically reviewing the leadership structure of our Board. During 2024, our NCG Committee, Board and independent directors determined that having a separate Board Chair and a lead independent director provide additional support and perspective to our Chief Executive Officer and enhance the effectiveness of our Board as a whole.

Our Bylaws provide our Board with the flexibility to combine or separate the positions of Board Chair and Chief Executive Officer, and our corporate governance guidelines provide for the independent directors to determine whether to elect a lead independent director.

James T. Treace's term as a director will expire at the Annual Meeting upon his retirement from the Board, and as previously announced, John T. Treace will assume the role of Chairman of the Board, at that time. Mr. Mott will continue to serve as lead independent director. With James Treace's retirement, the Board and NCG Committee have determined that combining the roles of Chief Executive Officer and Board Chair is appropriate since John T. Treace founded the Company, has extensive strategic, operational, and executive leadership experience, and has deep knowledge of the medical device market. He will be supported in the role by Mr. Mott as lead independent director. Mr. Mott has extensive experience as a chief executive officer and as an advisor to medical device companies in various stages of development as well as a decade as a Treace Board member, making him a trusted and respected advisor.

|

2025 PROXY STATEMENT |

17 |

Board of Directors and Corporate Governance

Role of the Board in Risk Oversight

The diagram below explains the allocation of risk oversight among the Board, its Committees and management.

Full Board of Directors Our full Board is ultimately responsible for oversight of risks affecting the Company and of management’s development and execution of mitigation strategies to address those risks. In this capacity, the Board has delegated oversight of certain risks to its Committees as described below. Oversight of additional matters of potential risk not expressly delegated remain the province of the full Board. |

|

||

|

|

|

|

Audit |

Nominating & Corp Governance |

Compensation |

|

• oversee our enterprise risk management and risk assessment processes • receive reports from management regarding management's processes and policies to manage, monitor and mitigate our major risk exposures affecting our financial statements, operations, business continuity, including enterprise-level risk assessments, investment policies, insurance programs and the reliability and security (including cybersecurity) of our information systems and technology • oversee and discuss with management the Company’s policies and controls relating to information technology, management information systems, and cybersecurity • report regularly to the Board on its risk oversight activities |

• oversee compliance programs related to legal and regulatory risks • receive reports from management about current and emerging risks and regulatory and enforcement trends, governmental inquiries, and third-party claims • review compliance hotline reports and compliance investigations, relevant “whistleblower” reporting and non-retaliation policies, and relevant education and training • review and provide recommendations to the Board regarding the Company’s environmental, social and governance -related practices, policies, disclosures and strategies as well as the Company’s public reporting on these matters • report regularly to the Board on its risk oversight activities |

• oversee policies to mitigate risks arising from compensation policies and practices, including the policies to recover incentive or equity-based compensation and limiting hedging activities related to Company stock • review with management and the Board the succession plans for the CEO and Company officers to ensure adequate levels of talent and development and minimize business disruptions in the event of a change in current leadership • generally supervise human capital management practices, including talent recruitment, development and retention; workplace and culture, and employee engagement • report regularly to the Board on its risk oversight activities |

|

|

|

|

|

Role of Management While the Board and its Committees oversee risk management, the Company’s senior management is responsible for identifying, assessing and mitigating risk on a day-to-day basis. To support the Board in the effective execution of its oversight role, the Company’s Chief Executive Officer and other management team members regularly report to the Board and its Committees on various risks and opportunities facing our business and management’s related strategies. Our Board expects management to consider risk and risk management in each business decision, to proactively develop and monitor risk management strategies and processes for day-to-day activities and to effectively implement risk management strategies adopted by the Audit Committee, NCG Committee, Compensation Committee, and the Board. |

|||

We believe this division of responsibilities is the most effective approach for addressing the risks we face, and our Board’s leadership structure, which also emphasizes the independence of the Board in its oversight of our business and affairs, supports this approach.

18 |

|

|

Board of Directors and Corporate Governance

Limitation on Liability and Indemnification Matters

Our Certificate of Incorporation and our Bylaws contain provisions that limit the liability of our directors for monetary damages to the fullest extent permitted by the Delaware General Corporation Law (the "DGCL"). The DGCL provides that directors of a corporation will not be personally liable to us or our stockholders for monetary damages for any breach of fiduciary duties as directors, except liability for any:

These limitations of liability do not apply to liabilities arising under federal securities laws and do not affect the availability of equitable remedies such as injunctive relief or rescission.

Our Certificate of Incorporation and our Bylaws require us to indemnify our directors and officers, in each case to the fullest extent permitted by the DGCL. Our Bylaws also provide that we are obligated to advance expenses (including attorney’s fees and disbursements) incurred by any indemnified person in advance of the final disposition of any action or proceeding, and permits us to secure insurance on behalf of any officer, director, employee or other agent for any liability arising out of his or her actions in that capacity regardless of whether we would otherwise be permitted to indemnify him or her under Delaware law.

We have entered, and expect to continue to enter, into separate agreements to indemnify our directors, executive officers and other employees as determined by our Board. With specified exceptions, these agreements provide for indemnification for related expenses including, among other things, attorneys’ fees, judgments, fines and settlement amounts incurred by any of these individuals in any action or proceeding. Insofar as indemnification for liabilities arising under the Securities Act of 1933, as amended (the "Securities Act") may be permitted to our directors, officers and controlling persons under the foregoing provisions, or otherwise, we have been advised that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act, and is, therefore, unenforceable. We believe that these provisions of our Bylaws and indemnification agreements are necessary to attract and retain qualified persons as directors and officers. We also maintain directors’ and officers’ liability insurance that insures our directors and officers against liability for actions taken in their capacities as directors and officers.

We believe that these provisions in our Certificate of Incorporation and Bylaws and these indemnification agreements are necessary to attract and retain qualified persons as directors and officers. However, the limitation of liability and indemnification provisions in our Certificate of Incorporation and Bylaws may discourage stockholders from bringing a lawsuit against our directors and officers for breach of their fiduciary duty. They may also reduce the likelihood of derivative litigation against our directors and officers, even though an action, if successful, might benefit us and our stockholders. Further, a stockholder’s investment may be adversely affected to the extent that we pay the costs of settlement and damages.

There is no pending litigation or proceeding naming any of our directors or officers as to which indemnification is being sought, nor are we aware of any pending or threatened litigation that may result in claims for indemnification by any director or officer.

Compensation Committee Interlocks and Insider Participation

During 2024, each of Lawrence W. Hamilton, Elizabeth S. Hanna, Jane E. Kiernan and Richard W. Mott served on our Compensation Committee, with Mr. Hamilton serving as chair. No member of our Compensation Committee was, during 2024, an officer, former officer or employee of the Company or had any relationship requiring disclosure by us under Item 404 of Regulation S-K. During 2024, none of our executive officers served (i) as a member of the Compensation Committee, or other committee serving an equivalent function, of any other entity in which one of its executive officers of such entity served as a member of our Board or our Compensation Committee or (ii) as a director of any other entity in which one of its executive officers of such entity served as a member of our Compensation Committee.

|

2025 PROXY STATEMENT |

19 |

Board of Directors and Corporate Governance

Board Member Selection

Our NCG Committee is responsible for reviewing with our Board, on an annual basis, the appropriate characteristics, skills and experience required for our Board as a whole and its individual members. In evaluating the suitability of individual candidates (both new candidates and current members), the NCG Committee, in recommending candidates for election, and our Board, in approving (and, in the case of vacancies, appointing) such candidates, may take into account many factors, including but not limited to the following: