1 44th Annual J.P. Morgan Healthcare Conference John T. Treace, CEO, Founder, Chairman January 14, 2026

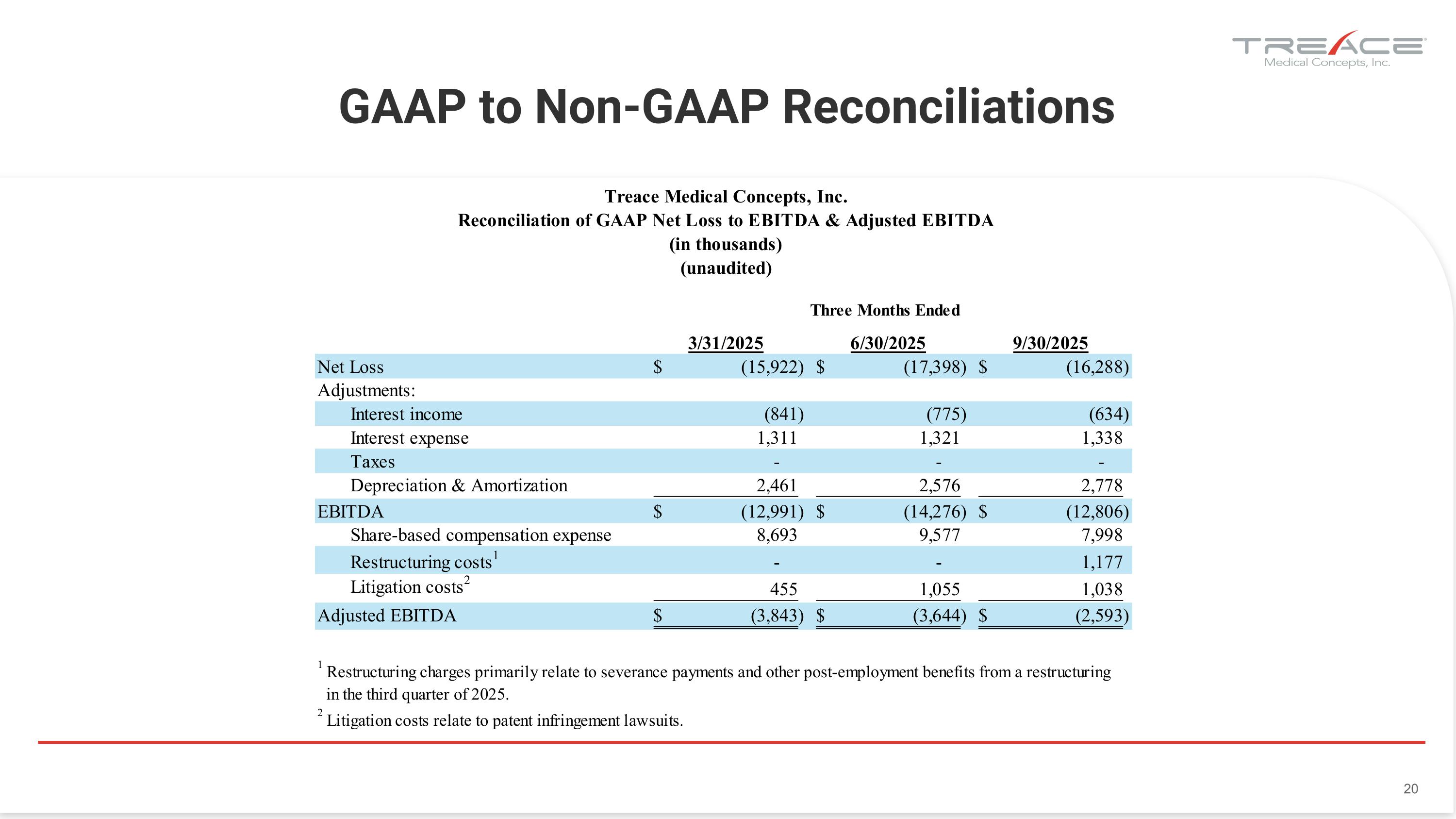

Forward-looking Statements: This presentation and our Q&A session may include forward-looking statements subject to substantial risks and uncertainties that may cause actual results to differ materially from those anticipated or implied by such forward-looking statements. We include forward-looking statements about, among other topics, our future results of operations and financial position, strategy and plans, industry environment, potential growth opportunities, and future product launches and operations. These forward-looking statements are based on our current assumptions, expectations and projections about future events and trends and are subject to risks and uncertainties, many of which are beyond our control. Information about these risks and uncertainties can be found in the section entitled Risk Factors in our filings with the SEC, including our 2024 Form 10-K as well as in our subsequent Form 10-Qs available at www.sec.gov and investors.treace.com. Also, since we operate in a very competitive and rapidly changing environment, new risks emerge from time to time. It is not possible for our management to predict all risks or their impact on our business. The forward-looking events and circumstances discussed in this presentation and Q&A session may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. The forward-looking statements in this presentation or during our Q&A session speak only as of their date, and we undertake no obligation to update or revise any of these statements. No representations or warranties (expressed or implied) are made about the accuracy of any such forward-looking statements. Market Data: This presentation contains estimates and statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves assumptions and limitations. You are cautioned not to give undue weight to such estimates. Also, projections, assumptions, and estimates of our future performance and the future performance of the markets in which we operate are subject to substantial uncertainty and risk. Investor’s Analysis: By attending or receiving this presentation, you acknowledge that you are solely responsible for your own assessment of the market and our market position, for conducting your own analysis, and for forming your own view of the potential future performance of our business. Non-GAAP Financial Measures: To supplement the financial results presented in accordance with GAAP, this presentation presents Adjusted EBITDA. Non-GAAP financial measures such as Adjusted EBITDA are presented in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. Reconciliations between GAAP and non‐GAAP results are included at the end of this presentation, and additional information about how management calculates and uses Adjusted EBITDA can be found in our press release issued on November 6, 2025. There are limitations related to the use of non-GAAP financial measures such as Adjusted EBITDA because they are not prepared in accordance with GAAP, may exclude significant income and expenses required by GAAP to be recognized in our financial statements, and may not be comparable to non-GAAP financial measures used by other companies. We encourage investors to carefully consider our results under GAAP, as well as our supplemental non‐GAAP information and the reconciliation between these presentations, to more fully understand our business. Forward-Looking Statements & Non-GAAP Financial Measures 2

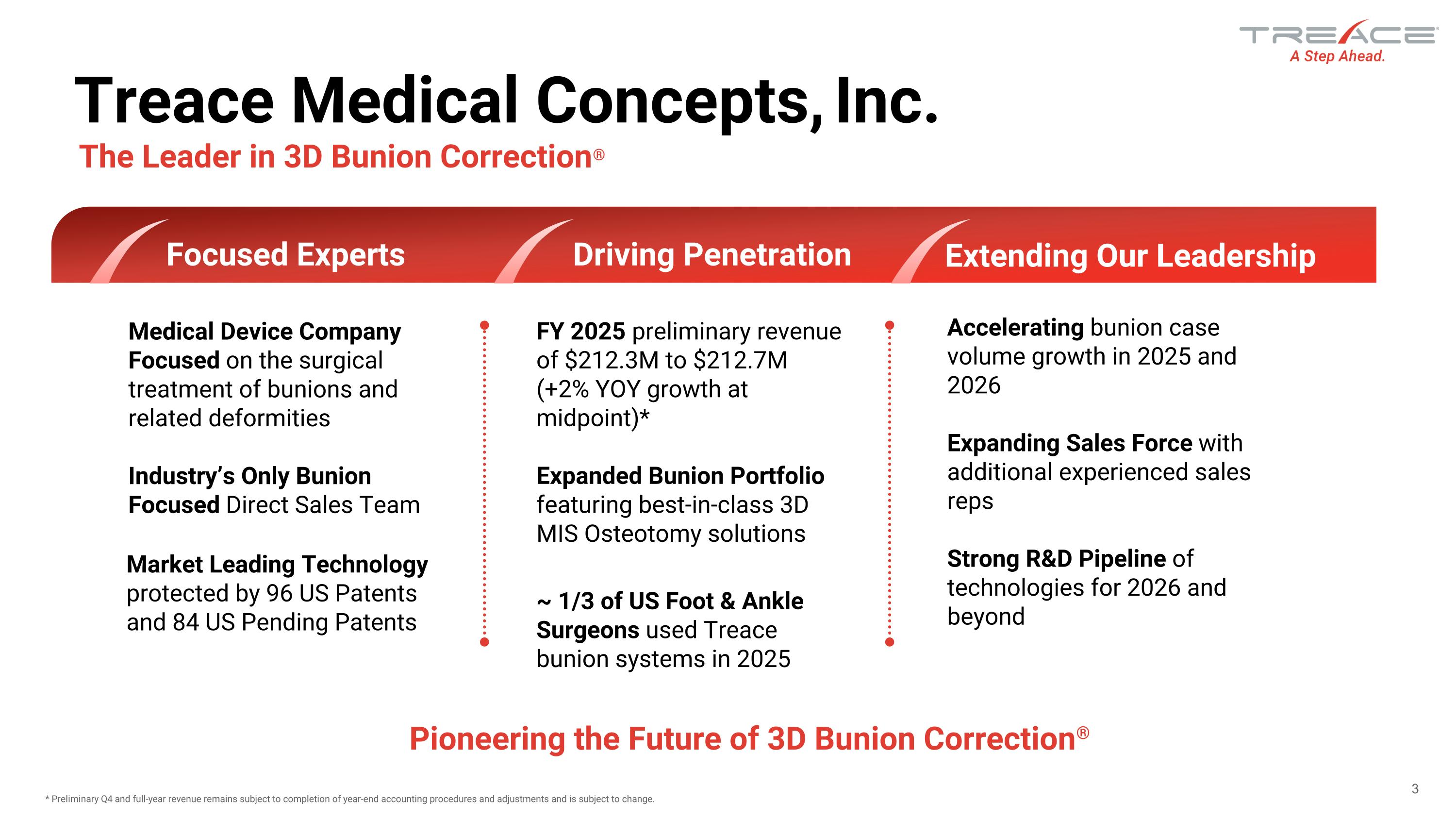

Treace Medical Concepts, Inc. Medical Device Company Focused on the surgical treatment of bunions and related deformities Industry’s Only Bunion Focused Direct Sales Team Market Leading Technology protected by 96 US Patents and 84 US Pending Patents Driving Penetration FY 2025 preliminary revenue of $212.3M to $212.7M (+2% YOY growth at midpoint)* Expanded Bunion Portfolio featuring best-in-class 3D MIS Osteotomy solutions ~ 1/3 of US Foot & Ankle Surgeons used Treace bunion systems in 2025 Extending Our Leadership Accelerating bunion case volume growth in 2025 and 2026 Expanding Sales Force with additional experienced sales reps Strong R&D Pipeline of technologies for 2026 and beyond The Leader in 3D Bunion Correction® Focused Experts * Preliminary Q4 and full-year revenue remains subject to completion of year-end accounting procedures and adjustments and is subject to change. Pioneering the Future of 3D Bunion Correction®

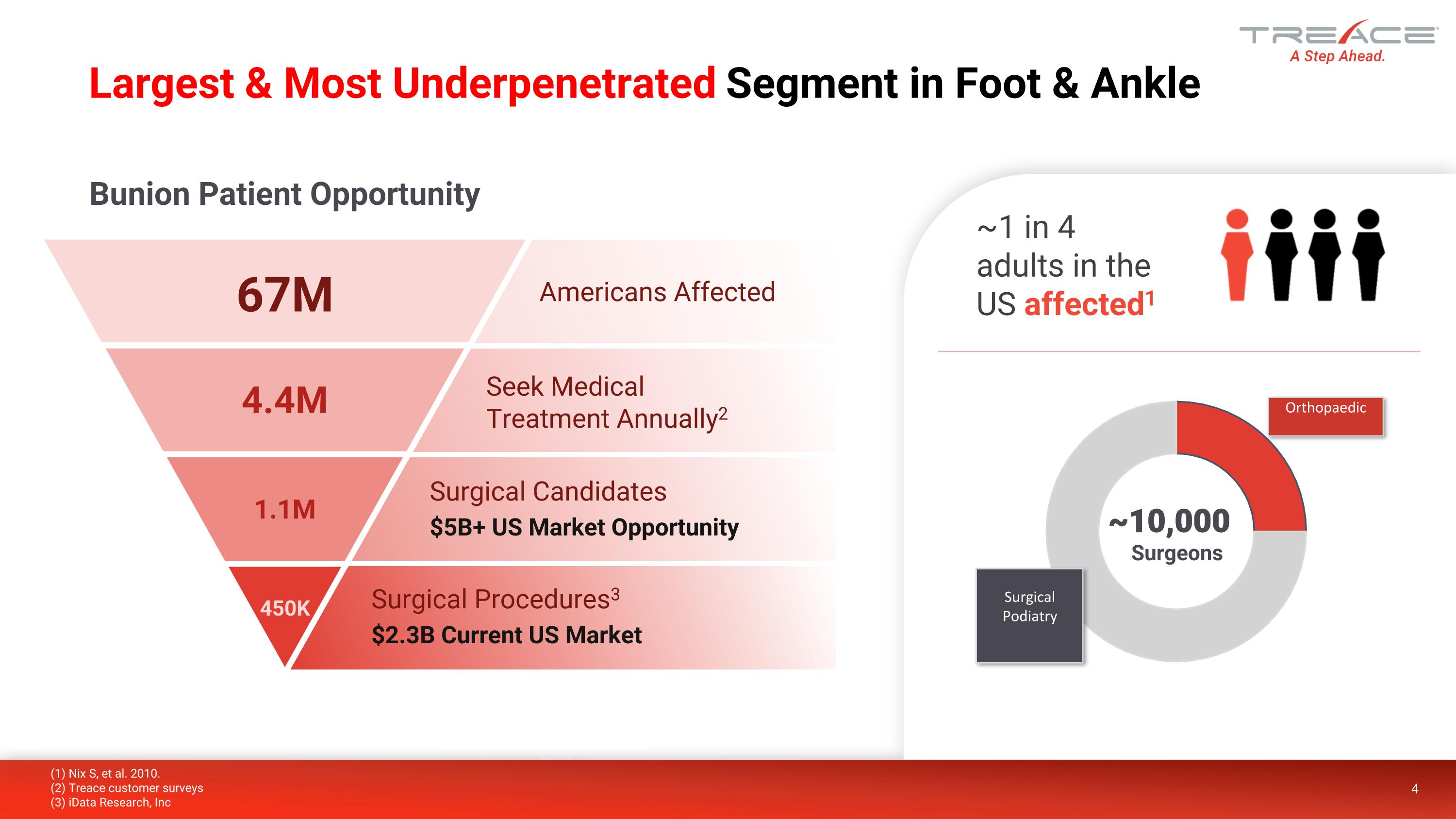

Largest & Most Underpenetrated Segment in Foot & Ankle 4.4M 1.1M 450K Bunion Patient Opportunity ~10,000 Surgeons ~1 in 4 adults in the US affected1 67M Surgical Procedures3 $2.3B Current US Market Surgical Candidates $5B+ US Market Opportunity Seek Medical Treatment Annually2 Americans Affected (1) Nix S, et al. 2010. (2) Treace customer surveys (3) iData Research, Inc 4

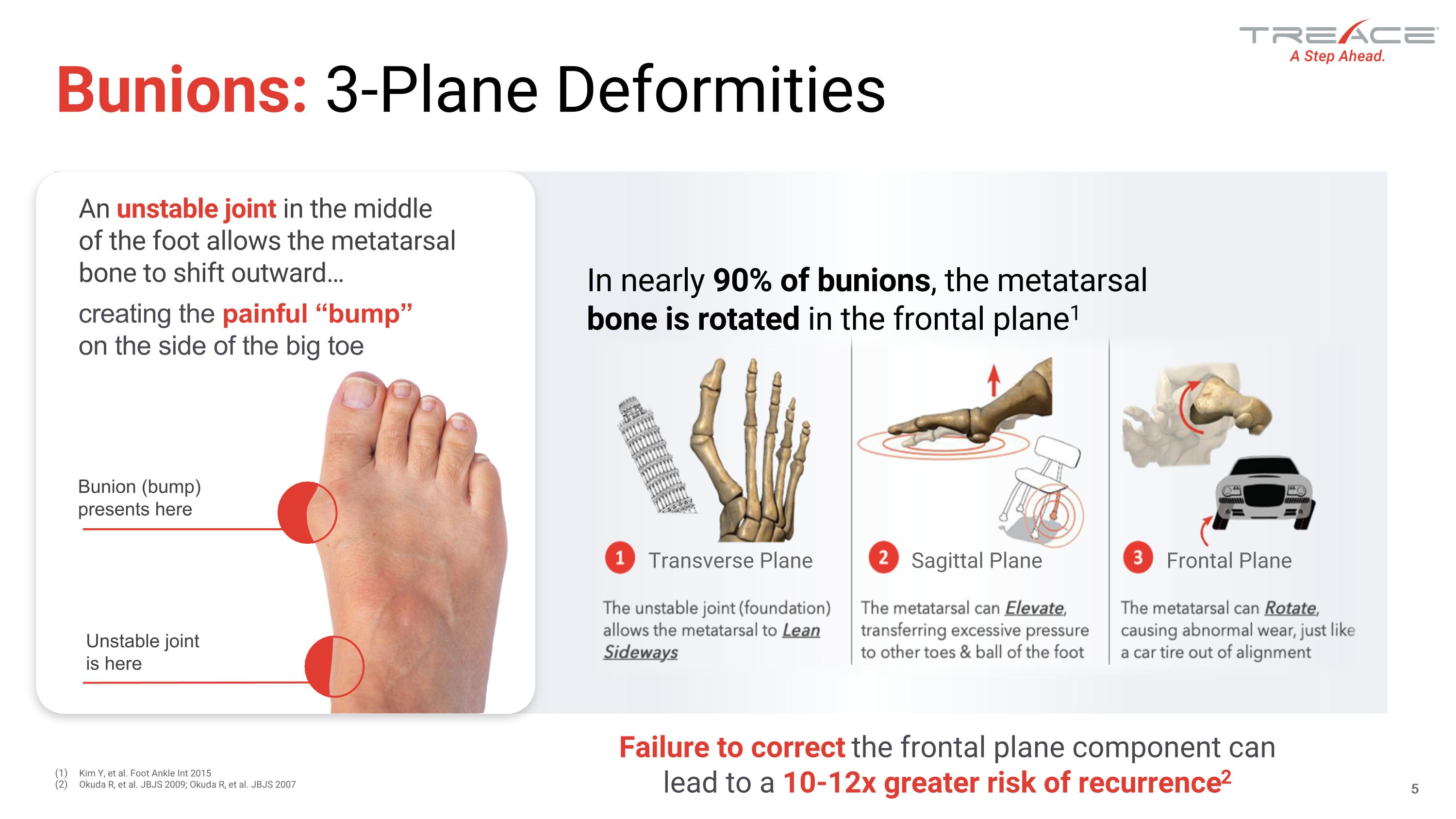

Transverse Plane Sagittal Plane Frontal Plane Bunions: 3-Plane Deformities 5 An unstable joint in the middle of the foot allows the metatarsal bone to shift outward… creating the painful “bump” on the side of the big toe Bunion (bump) presents here Unstable joint is here In nearly 90% of bunions, the metatarsal bone is rotated in the frontal plane1 Kim Y, et al. Foot Ankle Int 2015 Okuda R, et al. JBJS 2009; Okuda R, et al. JBJS 2007 5 Failure to correct the frontal plane component can lead to a 10-12x greater risk of recurrence2

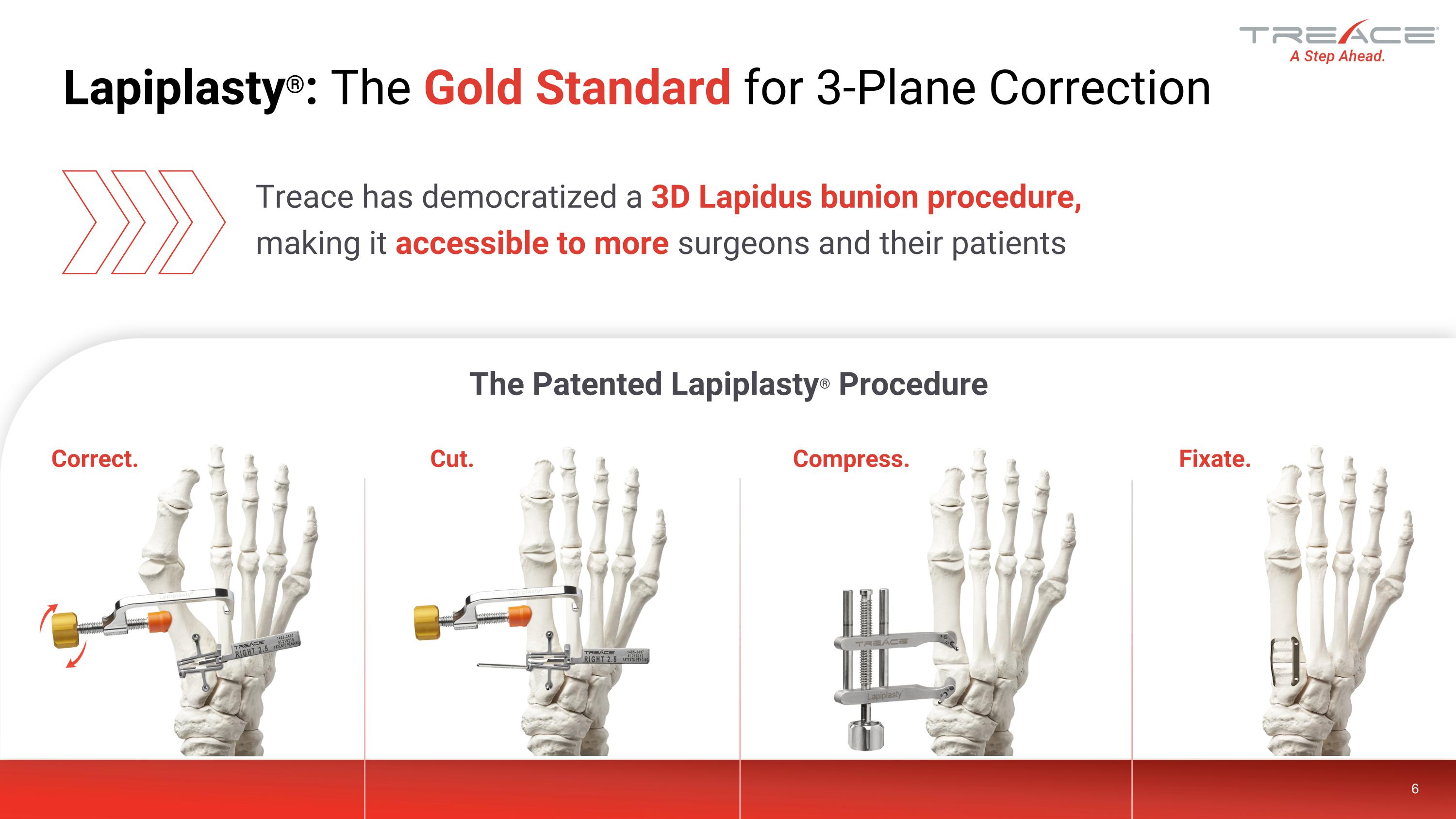

Lapiplasty®: The Gold Standard for 3-Plane Correction 6 Treace has democratized a 3D Lapidus bunion procedure, making it accessible to more surgeons and their patients Correct. Fixate. Cut. Compress. The Patented Lapiplasty® Procedure

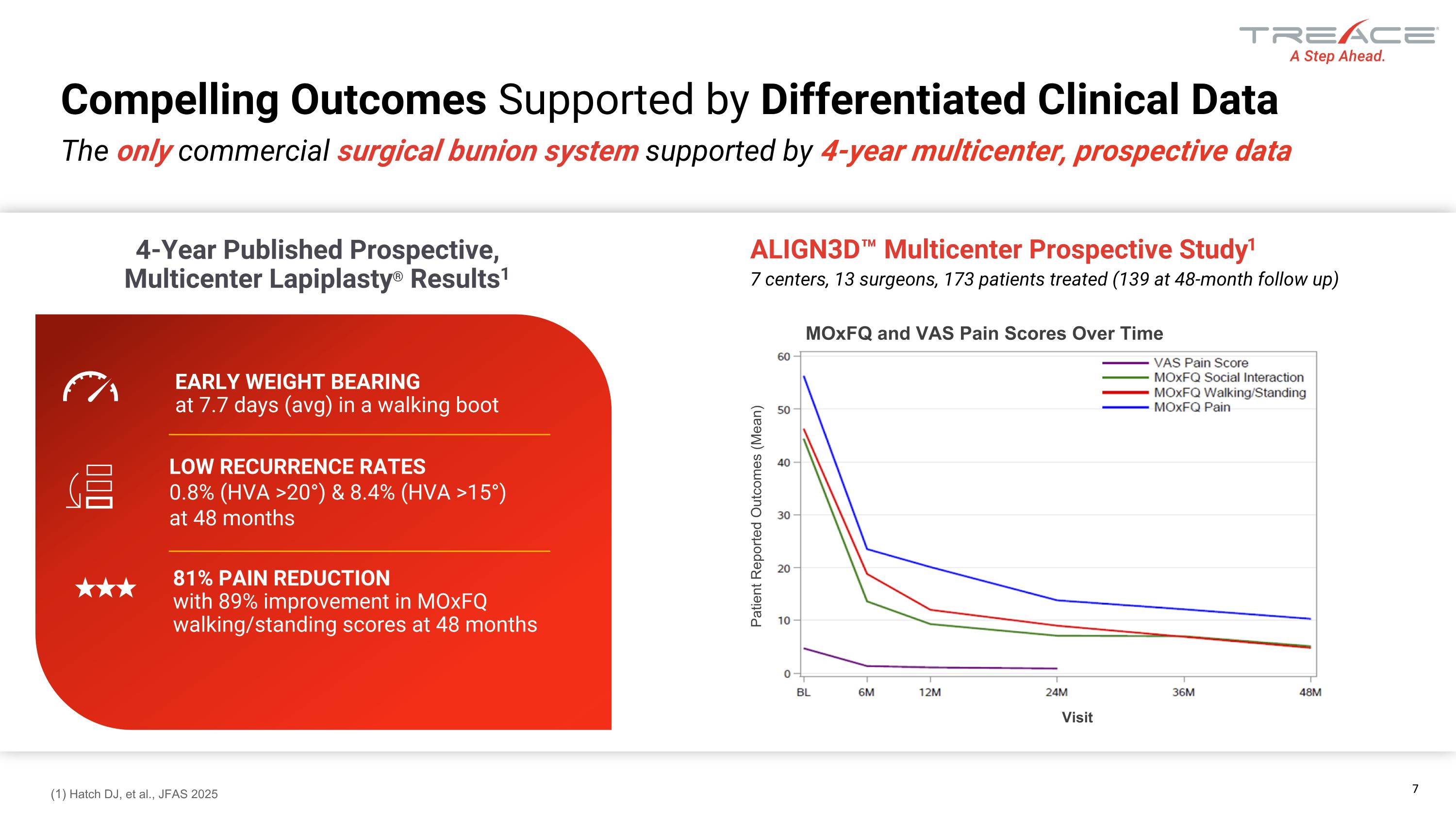

Patient Reported Outcomes (Mean) Visit MOxFQ and VAS Pain Scores Over Time ALIGN3D™ Multicenter Prospective Study1 7 centers, 13 surgeons, 173 patients treated (139 at 48-month follow up) Compelling Outcomes Supported by Differentiated Clinical Data The only commercial surgical bunion system supported by 4-year multicenter, prospective data EARLY WEIGHT BEARING at 7.7 days (avg) in a walking boot 81% pain reduction with 89% improvement in MOxFQ walking/standing scores at 48 months Low recurrence rates 0.8% (HVA >20°) & 8.4% (HVA >15°) at 48 months 4-Year Published Prospective, Multicenter Lapiplasty® Results1 Hatch DJ, et al., JFAS 2025

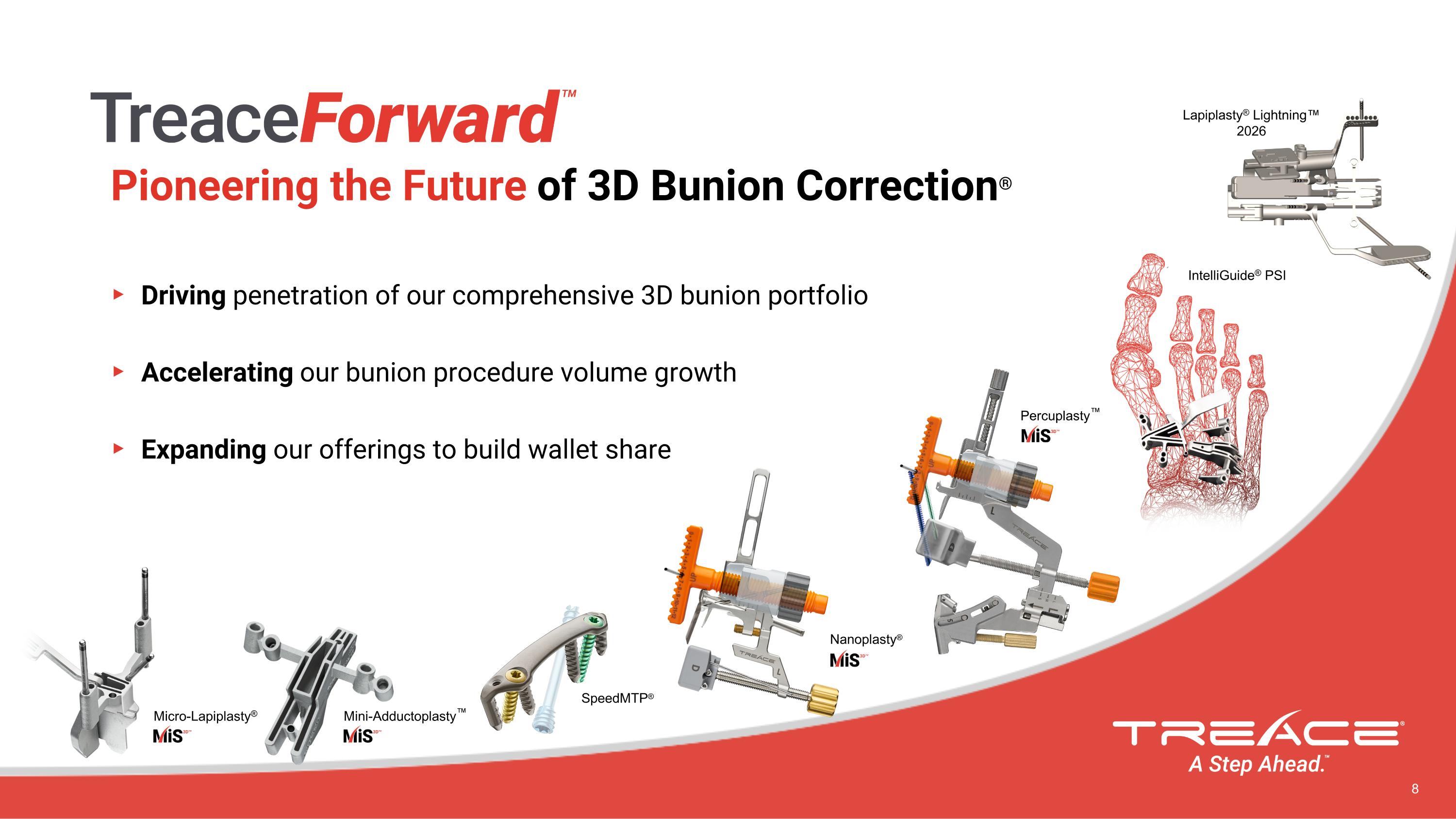

Driving penetration of our comprehensive 3D bunion portfolio Accelerating our bunion procedure volume growth Expanding our offerings to build wallet share Micro-Lapiplasty® Mini-Adductoplasty™ SpeedMTP® Percuplasty™ IntelliGuide® PSI Nanoplasty® Lapiplasty® Lightning™ 2026 Pioneering the Future of 3D Bunion Correction® 8

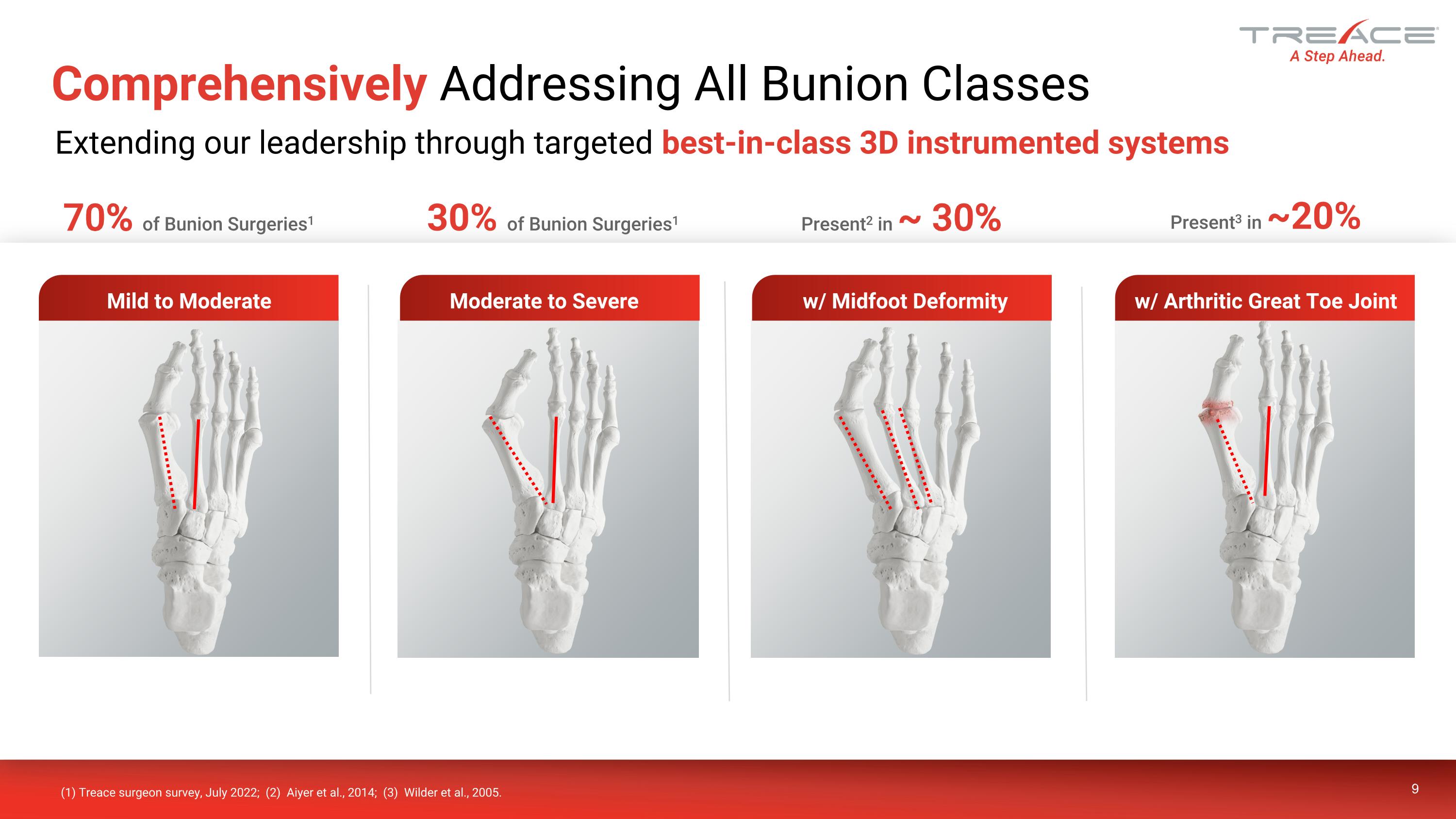

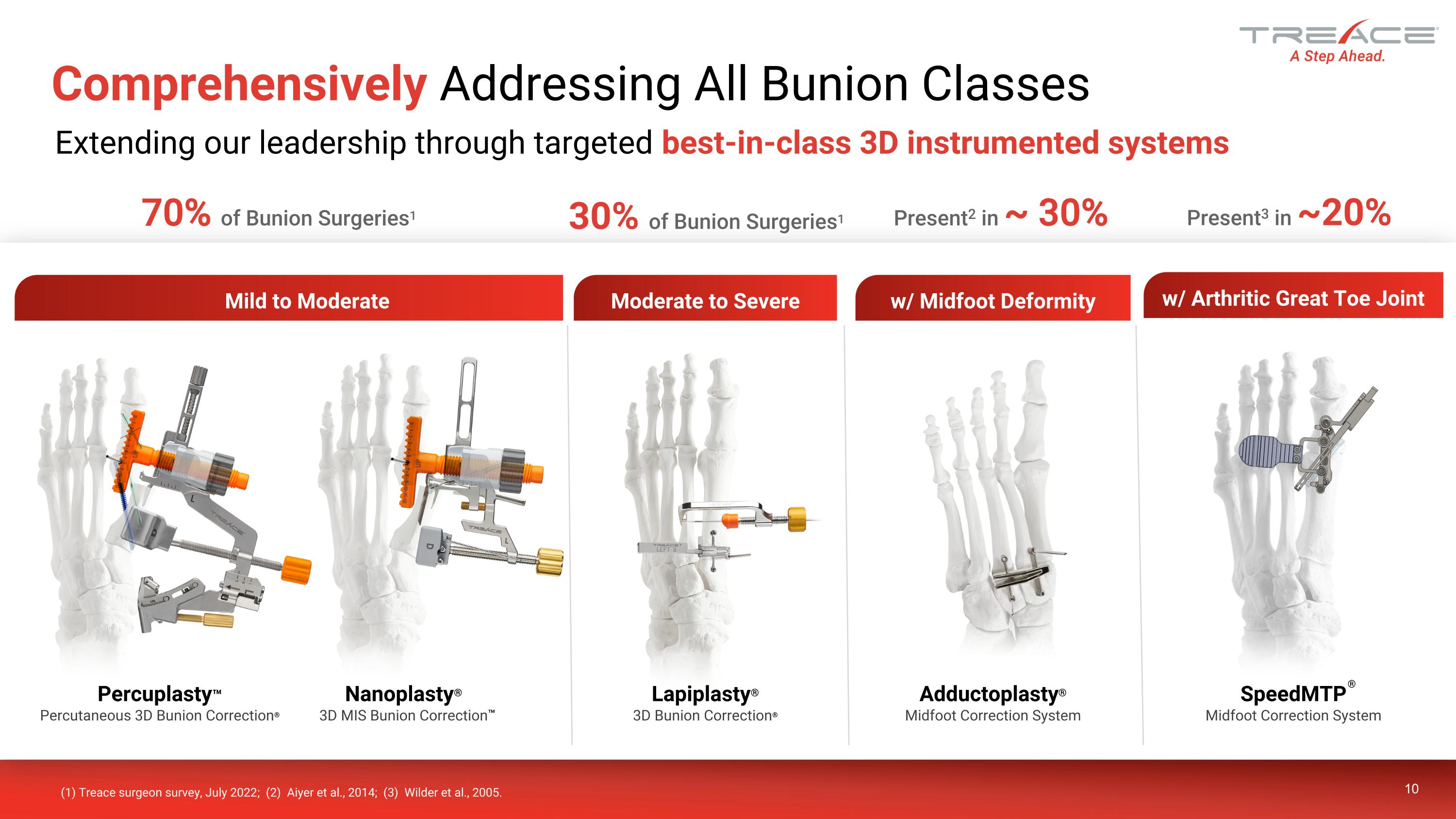

Mild to Moderate Moderate to Severe w/ Midfoot Deformity w/ Arthritic Great Toe Joint Comprehensively Addressing All Bunion Classes 9 Extending our leadership through targeted best-in-class 3D instrumented systems 70% of Bunion Surgeries1 30% of Bunion Surgeries1 Present2 in ~ 30% Present3 in ~20% (1) Treace surgeon survey, July 2022; (2) Aiyer et al., 2014; (3) Wilder et al., 2005.

Mild to Moderate Moderate to Severe w/ Midfoot Deformity w/ Arthritic Great Toe Joint Comprehensively Addressing All Bunion Classes 10 Extending our leadership through targeted best-in-class 3D instrumented systems 70% of Bunion Surgeries1 30% of Bunion Surgeries1 Present2 in ~ 30% Present3 in ~20% Adductoplasty® Midfoot Correction System SpeedMTP Midfoot Correction System ® Lapiplasty® 3D Bunion Correction® Nanoplasty® 3D MIS Bunion Correction TM Percuplasty™ Percutaneous 3D Bunion Correction® (1) Treace surgeon survey, July 2022; (2) Aiyer et al., 2014; (3) Wilder et al., 2005.

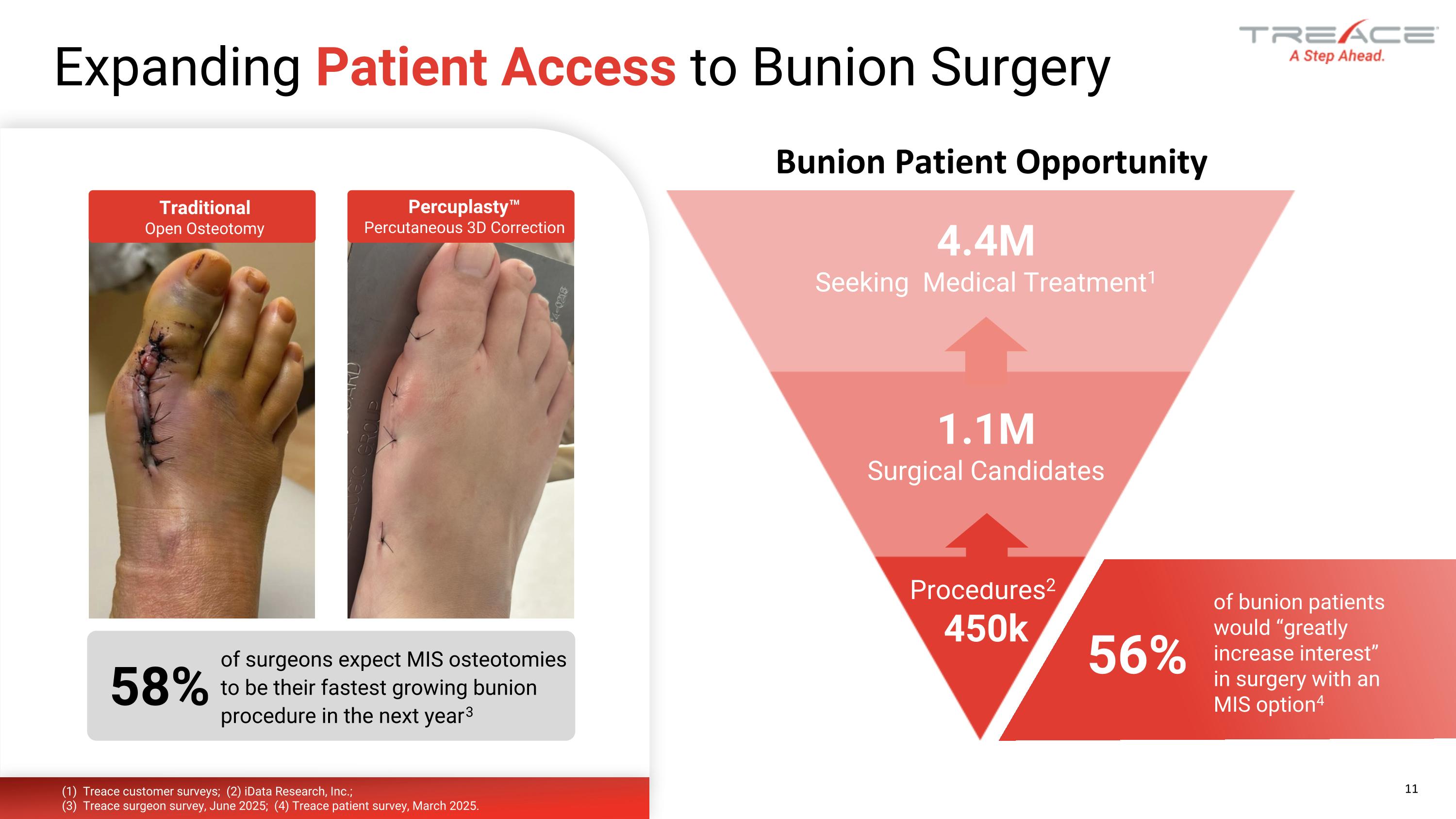

Expanding Patient Access to Bunion Surgery Intelliguide™ PSI Micro-Lapiplasty® Lapiplasty® Of surgeons expect MIS osteotomies to be their fastest growing bunion procedure in the next year* 58% Traditional Open Osteotomy Percuplasty™ Percutaneous 3D Correction 4.4M Seeking Medical Treatment1 1.1M Surgical Candidates Procedures2 450k of bunion patients would “greatly increase interest” in surgery with an MIS option4 (1) Treace customer surveys; (2) iData Research, Inc.; (3) Treace surgeon survey, June 2025; (4) Treace patient survey, March 2025. Bunion Patient Opportunity of surgeons expect MIS osteotomies to be their fastest growing bunion procedure in the next year3 56% 11

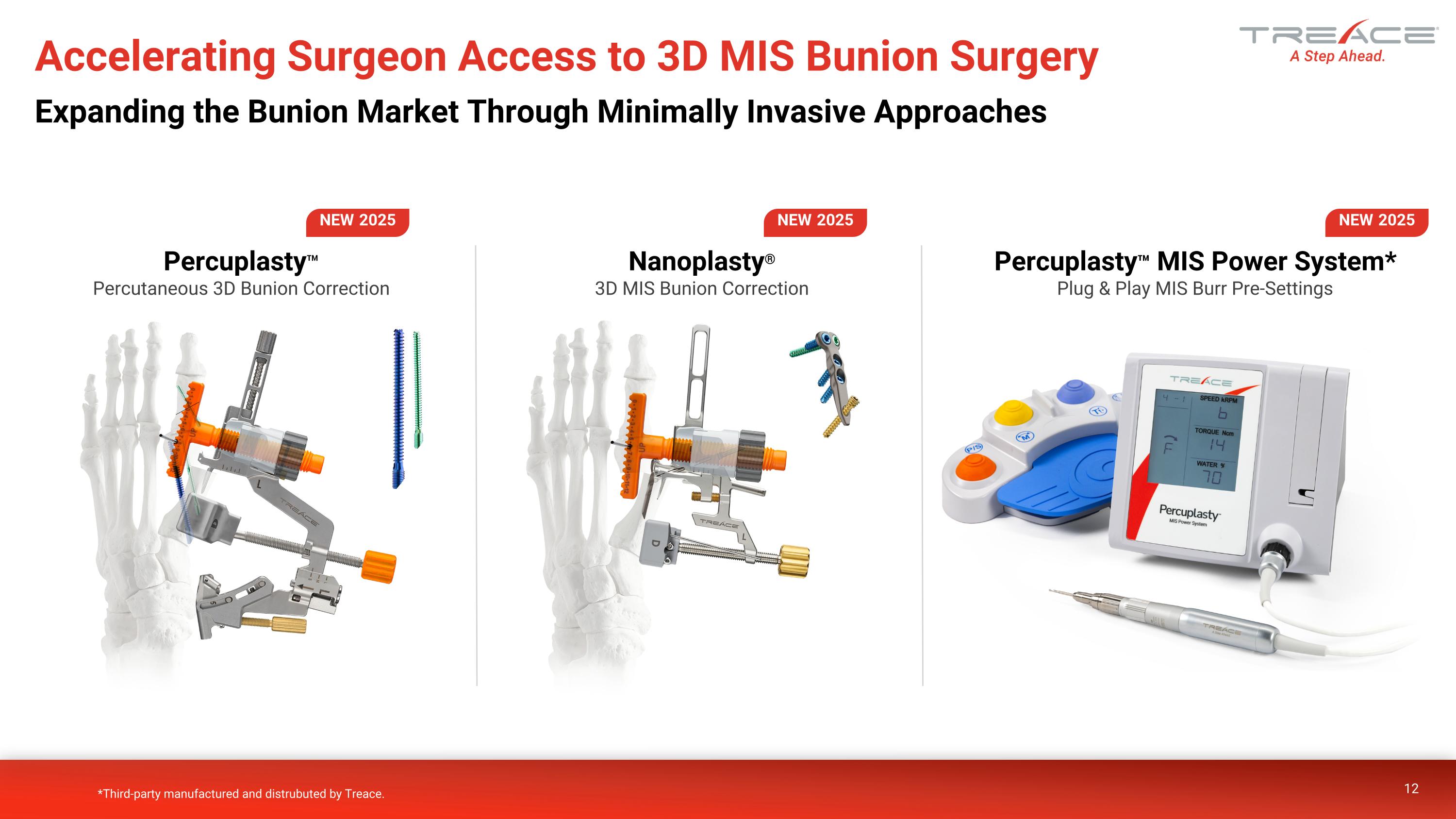

12 Percuplasty™ Percutaneous 3D Bunion Correction Percuplasty™ MIS Power System* Plug & Play MIS Burr Pre-Settings Nanoplasty® 3D MIS Bunion Correction Accelerating Surgeon Access to 3D MIS Bunion Surgery Expanding the Bunion Market Through Minimally Invasive Approaches *Third-party manufactured and distrubuted by Treace. NEW 2025 NEW 2025 NEW 2025

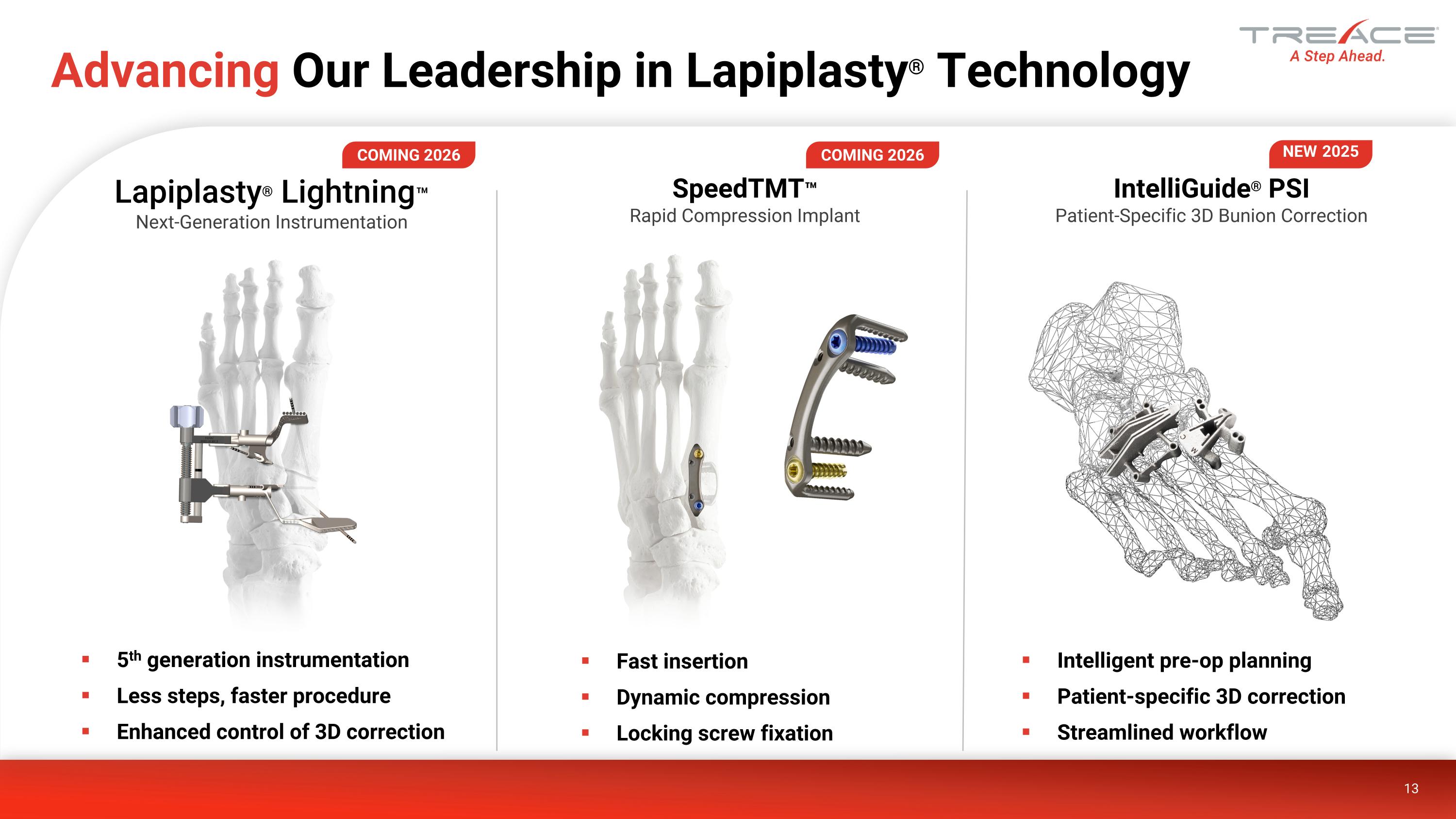

13 Advancing Our Leadership in Lapiplasty® Technology Lapiplasty® Lightning™ Next-Generation Instrumentation IntelliGuide® PSI Patient-Specific 3D Bunion Correction SpeedTMT™ Rapid Compression Implant 5th generation instrumentation Less steps, faster procedure Enhanced control of 3D correction Fast insertion Dynamic compression Locking screw fixation Intelligent pre-op planning Patient-specific 3D correction Streamlined workflow COMING 2026 NEW 2025 COMING 2026

Expanding Offerings for Our Growing Customer Base 14 Cortifuse™ Demineralized Cortical Fibers SpeedMTP® SpeedAkin™ MicroQuad™ Allograft Wedges SpeedPlate® Implants Complementary Biologics1 Sterile Instruments Percuplasty™ SuperBite™ 1Third party manufactured and distributed by Treace. COMING 2026 NEW 2025 NEW 2025 NEW 2025 NEW 2025 NEW 2025 NEW 2025

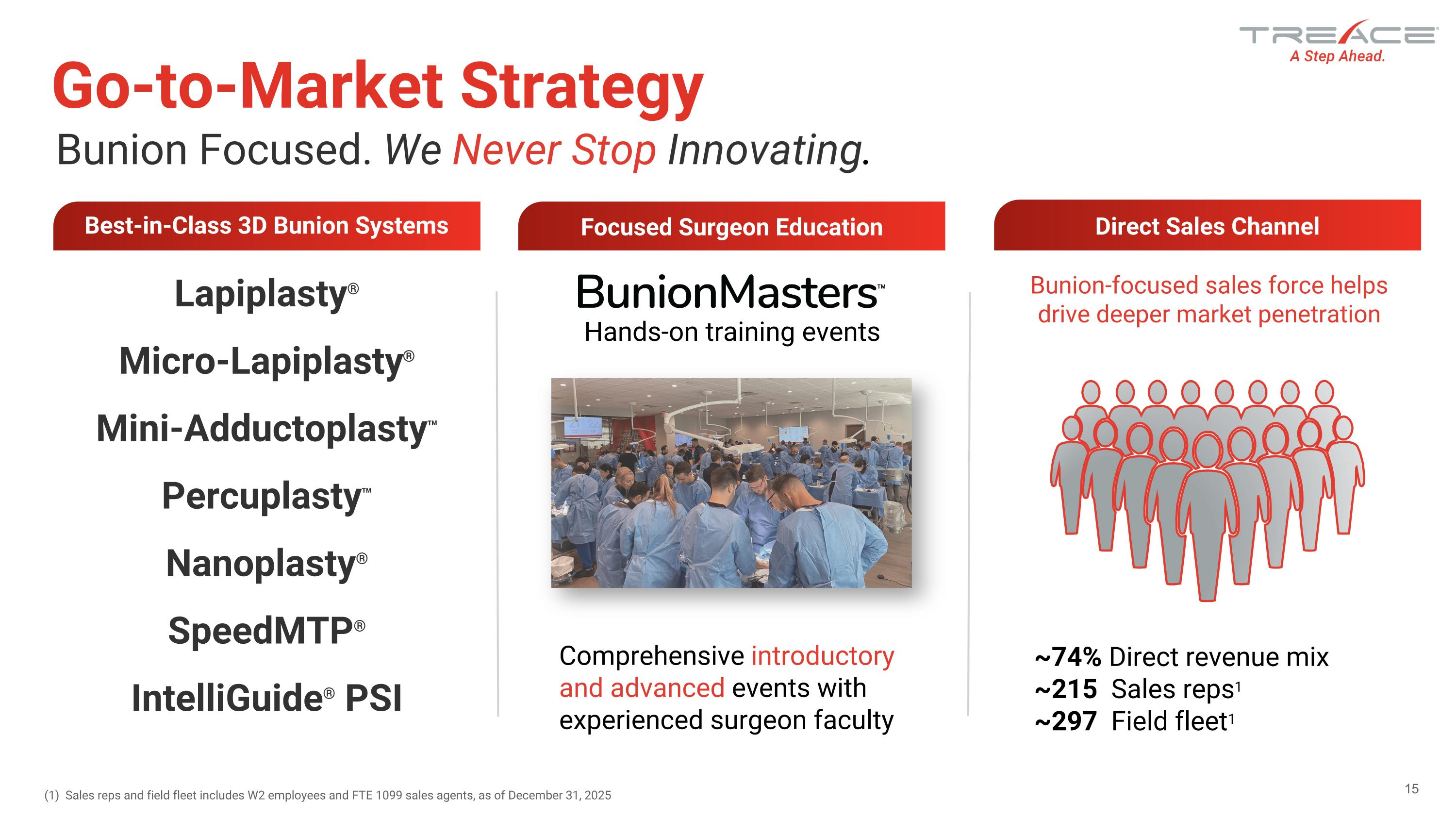

Go-to-Market Strategy (1) Sales reps and field fleet includes W2 employees and FTE 1099 sales agents, as of December 31, 2025 Comprehensive introductory and advanced events with experienced surgeon faculty Hands-on training events Focused Surgeon Education Bunion-focused sales force helps drive deeper market penetration Direct Sales Channel ~74% Direct revenue mix ~215 Sales reps1 ~297 Field fleet1 Best-in-Class 3D Bunion Systems Bunion Focused. We Never Stop Innovating. Lapiplasty® Micro-Lapiplasty® Mini-Adductoplasty™ Percuplasty™ Nanoplasty® SpeedMTP® IntelliGuide® PSI 15

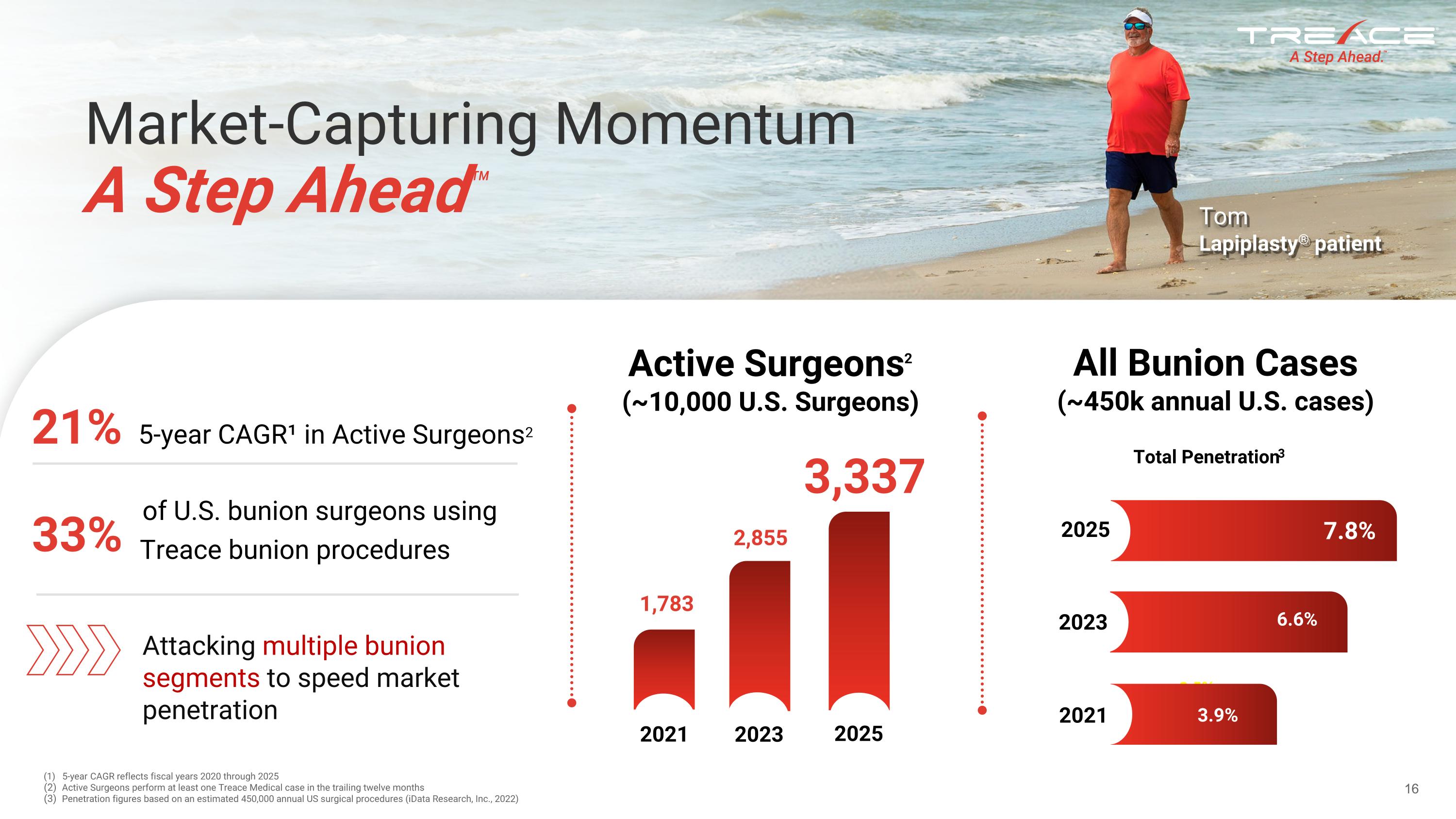

Market-Capturing Momentum A Step Ahead™ 16 Tom Lapiplasty® patient All Bunion Cases (~450k annual U.S. cases) Total Penetration3 2.5% 5.5% 7.8% 6.6% 3.9% 2025 2023 2021 21% 5-year CAGR¹ in Active Surgeons2 33% Treace bunion procedures of U.S. bunion surgeons using Active Surgeons2 (~10,000 U.S. Surgeons) 1,783 2,855 3,337 Attacking multiple bunion segments to speed market penetration (1) 5-year CAGR reflects fiscal years 2020 through 2025 Active Surgeons perform at least one Treace Medical case in the trailing twelve months Penetration figures based on an estimated 450,000 annual US surgical procedures (iData Research, Inc., 2022) 2025 2021 2023

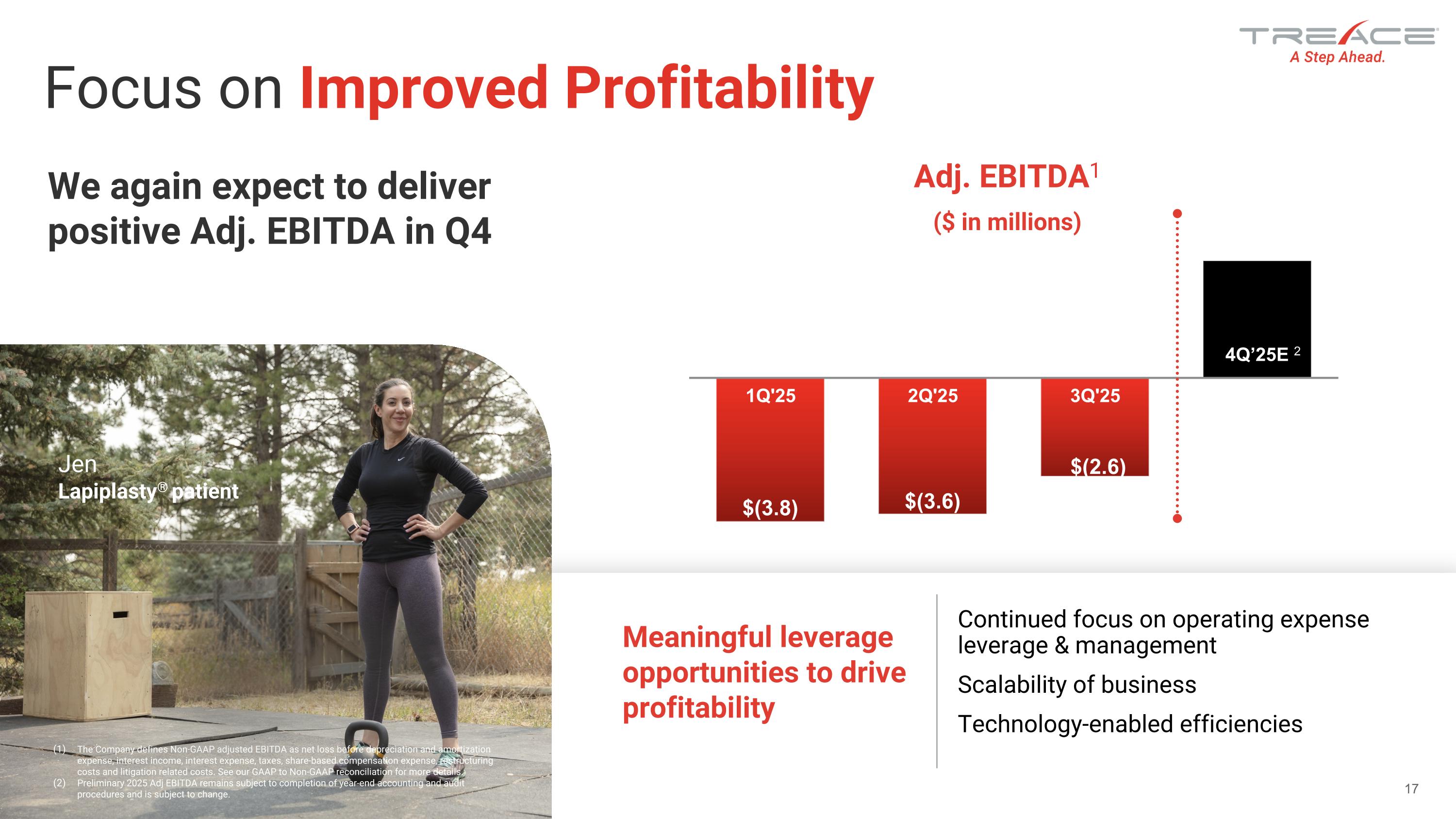

Meaningful leverage opportunities to drive profitability Continued focus on operating expense leverage & management Scalability of business Technology-enabled efficiencies 17 Focus on Improved Profitability 4Q’25E 2 We again expect to deliver positive Adj. EBITDA in Q4 The Company defines Non-GAAP adjusted EBITDA as net loss before depreciation and amortization expense, interest income, interest expense, taxes, share-based compensation expense, restructuring costs and litigation related costs. See our GAAP to Non-GAAP reconciliation for more details. Preliminary 2025 Adj EBITDA remains subject to completion of year-end accounting and audit procedures and is subject to change. Jen Lapiplasty® patient

Now a comprehensive bunion solutions company with multiple new technologies Positioned to deliver continued procedure volume growth in 2026 and beyond Strong R&D pipeline of technologies for 2026 and beyond The Leader in the largest and most underpenetrated segment of the foot and ankle market¹ Multiple growth drivers: + Expanded product portfolio + More new products in 2026 + New surgeons + Sales force growth + Reimbursement TMCI estimate based on other publicly-traded peers participating in the foot and ankle market Pioneering the Future of 3D Bunion Correction®

19 The Leader in 3D Bunion Correction®

GAAP to Non-GAAP Reconciliations 20