All-Employee Townhall August 31, 2020 .2

A Momentous Day in Aimmune’s History Founded in 2012, we developed and launched PALFORZIA®, the world’s first approved treatment for food allergy less than 10 years later EMA and Swissmedic approvals anticipated this year and next, respectively US PALFORZIA launch underway and queued up in Germany and UK for 2021 Pipeline development is progressing, including AIMab7195 Today marks the greatest acknowledgement of the value we have created together and the beginning of the acquisition process Aimmune and an entity part of Nestle Health Science (NHSc) signed an agreement for Aimmune to be acquired at a price of $34.50 per share in an all-cash transaction The transaction is expected to close in the fourth quarter

We Will Continue Normal Business Operations During this process, we continue to operate as an independent, separate company Aimmune will continue its normal business activities: There is no change to our business plan or the way that we do our work Current manager and job responsibilities remain unchanged prior to the closing No immediate impact to current roles as a result of this transaction Remain focused on day-to-day responsibilities and overall performance objectives Continue doing the great work you always do!

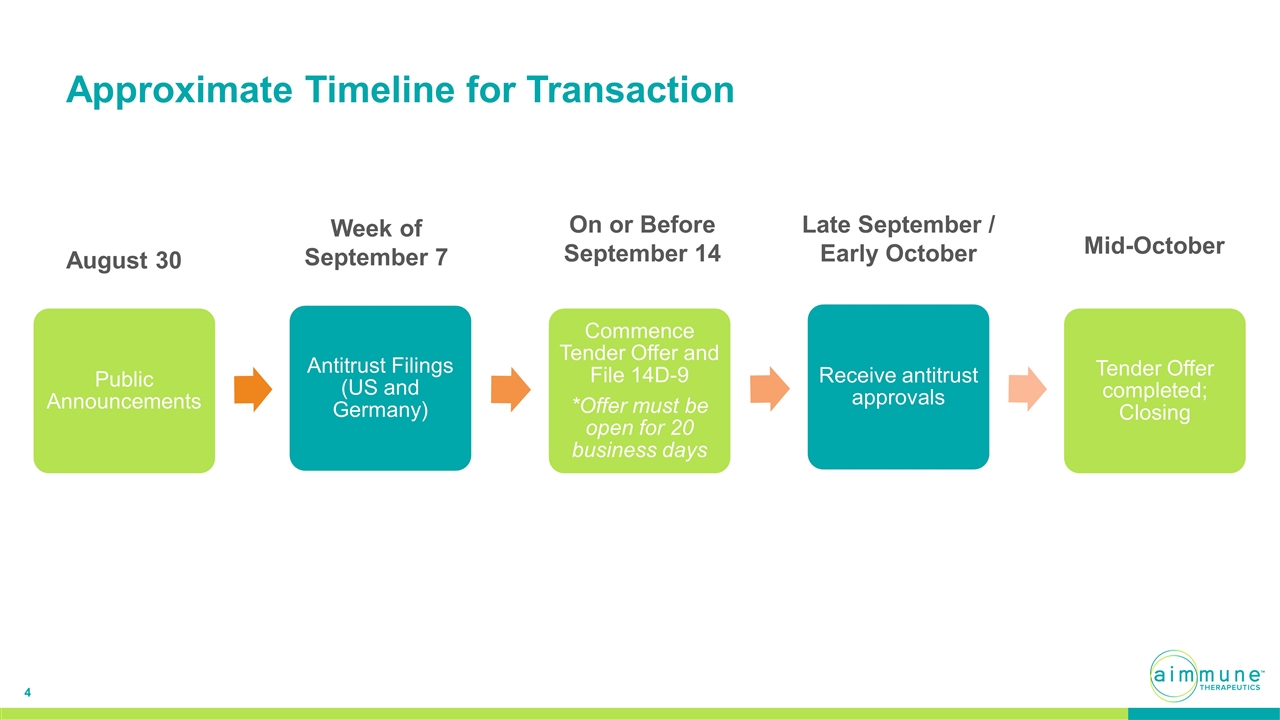

Approximate Timeline for Transaction August 30 Week of September 7 On or Before September 14 Late September / Early October Mid-October Public Announcements Antitrust Filings (US and Germany) Commence Tender Offer and File 14D -9 *Offer must be open for 20 business days Receive antitrust approvals Tender Offer completed; Closing

Compensation Matters Stock Options & RSUs ESPP 2020 Bonus Payroll

What to Expect From Us We will communicate and provide answers once we know more We are available to answer questions (EC, managers, HR) September 10th Town Hall will proceed as scheduled with a focus on our business

Additional Information and Where to Find It The tender offer described above has not yet commenced. This communication is neither an offer to purchase nor a solicitation of an offer to sell any securities of Aimmune Therapeutics, Inc. (“Aimmune”). The solicitation and the offer to purchase shares of Aimmune’s common stock will only be made pursuant to a tender offer statement on Schedule TO, including an offer to purchase, a letter of transmittal and other related materials that Sociétés des Produits Nestlé S.A., a société anonyme organized under the laws of Switzerland (“Nestlé”) and SPN MergerSub, Inc., a Delaware corporation (“Merger Sub”) intend to file with the Securities and Exchange Commission (“SEC”). In addition, Aimmune will file with the SEC a Solicitation/Recommendation Statement on Schedule 14D-9 and a Schedule 13E-3 transaction statement, in each case with respect to the tender offer. Once filed, investors will be able to obtain a free copy of these materials and other documents filed by Nestlé, Merger Sub and Aimmune with the SEC at the website maintained by the SEC at www.sec.gov. Investors may also obtain, at no charge, any such documents filed with or furnished to the SEC by Aimmune under the “Investors & Media” section of Aimmune’s website at www.aimmune.com. INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ THESE DOCUMENTS WHEN THEY BECOME AVAILABLE, INCLUDING THE OFFER TO PURCHASE AND THE SOLICITATION/RECOMMENDATION STATEMENT AND THE SCHEDULE 13E-3 TRANSACTION STATEMENT OF AIMMUNE, AND ANY AMENDMENTS THERETO, AS WELL AS ANY OTHER DOCUMENTS RELATING TO THE TENDER OFFER AND THE MERGER THAT ARE FILED WITH THE SEC, CAREFULLY AND IN THEIR ENTIRETY PRIOR TO MAKING ANY DECISIONS WITH RESPECT TO WHETHER TO TENDER THEIR SHARES INTO THE TENDER OFFER BECAUSE THEY CONTAIN IMPORTANT INFORMATION, INCLUDING THE TERMS AND CONDITIONS OF THE TENDER OFFER.

Forward-Looking Statements The statements included above that are not a description of historical facts are forward-looking statements. Words or phrases such as “believe,” “may,” “could,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “seek,” “plan,” “expect,” “should,” “would” or similar expressions are intended to identify forward-looking statements. These forward-looking statements include without limitation statements regarding the planned completion of the transactions contemplated by the Agreement and Plan of Merger dated as of August 29, 2020 by and among Aimmune, Merger Sub and Nestlé. Additional statements include, but are not limited to, statements regarding: Aimmune’s expectations regarding the potential benefits of PALFORZIA; Aimmune’s expectations regarding the potential commercial launch of PALFORZIA; and Aimmune’s expectations regarding potential applications of the CODIT approach to treating life-threatening food allergies. Risks and uncertainties that could cause results to differ from expectations include: uncertainties as to the timing and completion of the tender offer and the merger; uncertainties as to the percentage of Aimmune stockholders tendering their shares in the tender offer; the possibility that competing offers may be made; the possibility that various closing conditions for the tender offer or the merger may not be satisfied or waived, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the merger; the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement; the effects of disruption caused by the transaction making it more difficult to maintain relationships with employees, collaborators, vendors and other business partners; the risk that stockholder litigation in connection with the tender offer or the merger may result in significant costs of defense, indemnification and liability; and risks and uncertainties pertaining to Aimmune’s business, including the risks and uncertainties detailed in Aimmune’s public periodic filings with the SEC, as well as the tender offer materials to be filed by Merger Sub and Nestlé, the Solicitation/Recommendation Statement and the Schedule 13E-3 transaction statement to be filed by Aimmune in connection with the tender offer. Risks and uncertainties that contribute to the uncertain nature of the forward-looking statements regarding Aimmune’s business may include: the expectation that Aimmune will need additional funds to finance its operations; Aimmune’s dependence on the success of PALFORZIA; Aimmune’s ability to build a commercial field organization and distribution network; the degree of acceptance of PALFORZIA among physicians, patients, healthcare payors, patient advocacy groups and the general medical community; Aimmune’s ability to obtain favorable coverage and reimbursement from third-party payors for PALFORZIA; Aimmune’s reliance on third parties for the manufacture of PALFORZIA; Aimmune’s ability to implement and comply with the REMS for PALFORZIA; possible regulatory developments in the United States and foreign countries; and Aimmune’s ability to attract and retain senior management personnel. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement and Aimmune undertakes no obligation to revise or update these statements to reflect events or circumstances after the date hereof, except as required by law.

Thank you for helping to deliver on our mission, transforming the landscape of food allergy treatment, and building our company and business for the future

Q&A