2025 Morgan Stanley Global Consumer Conference December 3, 2025 +

This document contains both historical and forward-looking statements. Forward-looking statements are not based on historical facts but instead reflect our expectations, estimates or projections concerning future results or events, including, without limitation, the future sales, gross margins, costs, earnings, cash flows, tax rates and performance of the Company. These statements generally can be identified by the use of forward-looking words or phrases such as "believe," "expect," "expectation," "anticipate," "may," "could," "will," "intend," "belief," "estimate," "plan," "target," "predict," "likely," "should," "forecast," "outlook," or other similar words or phrases. These statements are not guarantees of performance and are inherently subject to known and unknown risks, uncertainties and assumptions that are difficult to predict and could cause our actual results to differ materially from those indicated by those statements. We cannot assure you that any of our expectations, estimates or projections will be achieved. The forward-looking statements included in this document are only made as of the date of this document and we disclaim any obligation to publicly update any forward-looking statement to reflect subsequent events or circumstances. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty. Numerous factors could cause our actual results and events to differ materially from those expressed or implied by forward-looking statements, including, without limitation: Global economic and financial market conditions beyond our control might materially and negatively impact us. Competition in our product categories might hinder our ability to execute our business strategy, achieve profitability, or maintain relationships with existing customers. Changes in the retail environment and consumer preferences could adversely affect our business, financial condition and results of operations. Loss or impairment of the reputation of our Company or our leading brands or failure of our marketing plans could have an adverse effect on our business. Loss of any of our principal customers could significantly decrease our sales and profitability. Our ability to meet our growth targets depends on successful product, marketing and operations innovation and successful responses to competitive innovation and changing consumer habits. We are subject to risks related to our international operations, including tariffs and currency fluctuations, which could adversely affect our results of operations. We must successfully manage the demand, supply, and operational challenges brought on by disease outbreak, including epidemics, pandemics, or similar widespread public health concerns. If we fail to protect our intellectual property rights, competitors may manufacture and market similar products, which could adversely affect our market share and results of operations. Changes in production costs, including raw material prices and transportation costs, from inflation or otherwise, have adversely affected, and in the future could erode, our profit margins and negatively impact operating results. Our reliance on certain significant suppliers subjects us to numerous risks, including possible interruptions in supply, which could adversely affect our business. Our business is vulnerable to the availability of raw materials, as well as our ability to forecast customer demand and manage production capacity. The manufacturing facilities, supply channels or other business operations of the Company and our suppliers may be subject to disruption from events beyond our control. Our future results may be affected by our operational execution, including our ability to achieve cost savings as a result of any current or future restructuring efforts. If our goodwill and indefinite-lived intangible assets become impaired, we will be required to record impairment charges, which may be significant. Sales of certain of our products are seasonal and adverse weather conditions during our peak selling seasons for certain auto care products could have a material adverse effect. A failure of a key information technology system could adversely impact our ability to conduct business. We rely significantly on information technology and any inadequacy, interruption, theft or loss of data, malicious attack, integration failure, failure to maintain the security, confidentiality or privacy of sensitive data residing on our systems or other security failure of that technology could harm our ability to effectively operate our business and damage the reputation of our brands. We may not be able to attract, retain and develop key employees, as well as effectively manage human capital resources. We have significant debt obligations that could adversely affect our business. Our credit ratings are important to our cost of capital. We may experience losses or be subject to increased funding and expenses related to our pension plans. The estimates and assumptions on which our financial projections are based may prove to be inaccurate, which may cause our actual results to materially differ from our projections, which may adversely affect our future profitability, cash flows and stock price. If we pursue strategic acquisitions, divestitures or joint ventures, we might experience operating difficulties, dilution, and other consequences that may harm our business, financial condition, and operating results, and we may not be able to successfully consummate favorable transactions or successfully integrate acquired businesses. Our business involves the potential for product liability claims, labeling claims, commercial claims and other legal claims against us, which could affect our results of operations and financial condition and result in product recalls or withdrawals. Our business is subject to increasing government regulations in both the U.S. and abroad that could impose material costs. Increased focus by governmental and non-governmental organizations, customers, consumers and shareholders on environmental, social and governance (ESG) issues, including those related to sustainability and climate change, may have an adverse effect on our business, financial condition and results of operations and damage our reputation. We are subject to environmental laws and regulations that may expose us to significant liabilities and have a material adverse effect on our results of operations and financial condition. Section 45X of the Internal Revenue Code contains production tax credits for certain battery components. Our ability to benefit from Section 45X production tax credits is not guaranteed and is dependent upon the federal government's ongoing implementation, guidance, regulations, or rulemakings. In addition, other risks and uncertainties not presently known to us or that we consider immaterial could affect the accuracy of any such forward-looking statements. The list of factors above is illustrative, but by no means exhaustive. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty. Additional risks and uncertainties include those detailed from time to time in our publicly filed documents, including those described under the heading “Risk Factors” in our Form 10-K filed with the Securities and Exchange Commission on November 18, 2025. Forward-Looking Statements

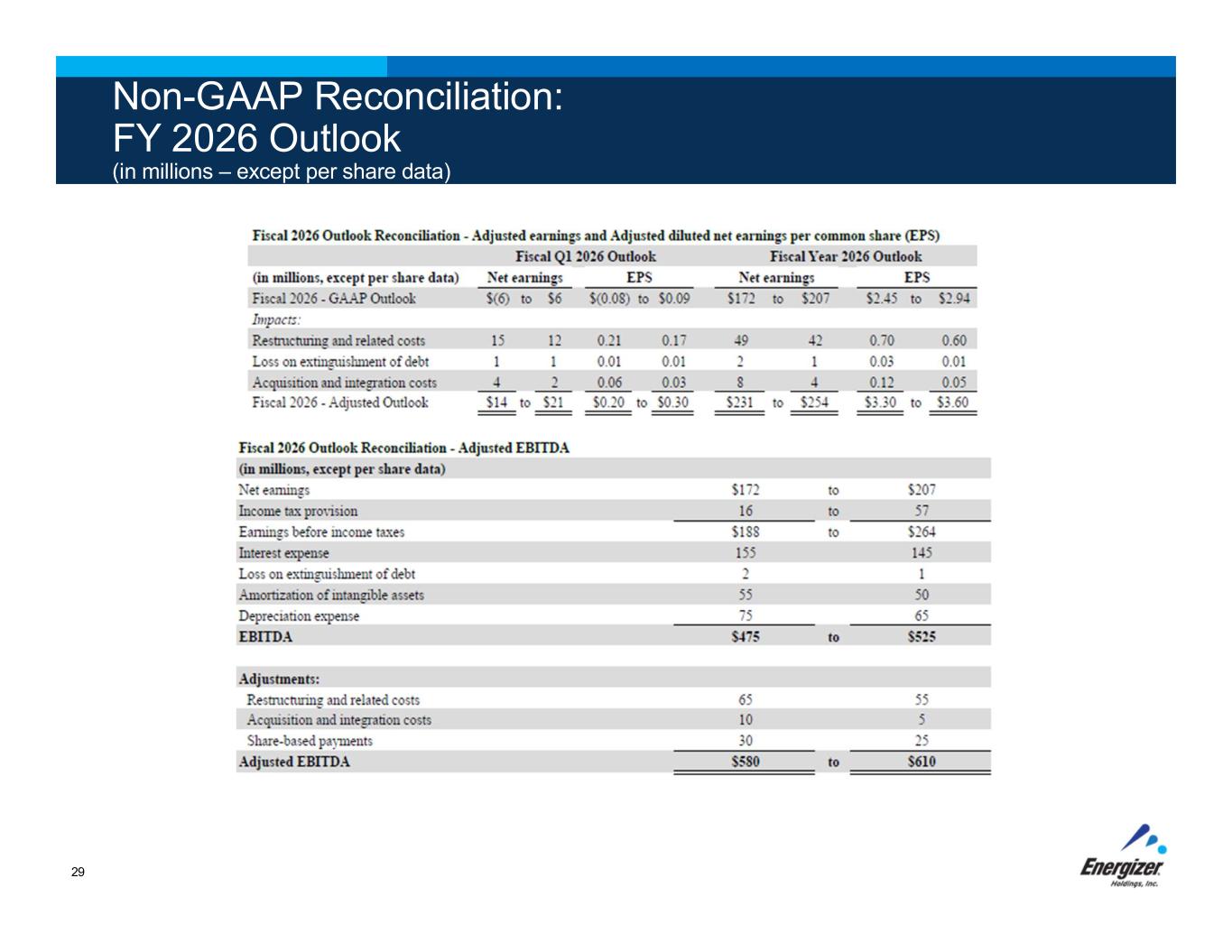

Non-GAAP Financial Measures The Company reports its financial results in accordance with accounting principles generally accepted in the U.S. ("GAAP"). However, management believes that certain non-GAAP financial measures provide users with additional meaningful comparisons to the corresponding historical or future period, and are used for management incentive compensation. These non-GAAP financial measures exclude items that are not reflective of the Company's on-going operating performance, such as impairment on intangible assets, restructuring and related costs, network transition costs, acquisition and integration costs, FY23 & FY24 production credits, a litigation matter, the Loss/(gain) on extinguishment/modification of debt, the December 2023 Argentina Economic Reform and the Settlement loss on US pension annuity buy out. In addition, these measures help investors to analyze year over year comparability when excluding currency fluctuations as well as other Company initiatives that are not on-going. We believe these non-GAAP financial measures are an enhancement to assist investors in understanding our business and in performing analysis consistent with financial models developed by research analysts. Investors should consider non-GAAP measures in addition to, not as a substitute for, or superior to, the comparable GAAP measures. In addition, these non-GAAP measures may not be the same as similar measures used by other companies due to possible differences in methods and in the items being adjusted. We provide the following non-GAAP measures and calculations, as well as the corresponding reconciliation to the closest GAAP measure in the following supplemental schedules: Organic. This is the non-GAAP financial measurement of the change in Net sales or segment profit that excludes or otherwise adjusts for the Acquisition impact, Change in highly inflationary markets and Impact of currency from the changes in foreign currency exchange rates as defined below: • Acquisition impact. The Company completed the Advanced Power Solutions NV (APS NV) acquisition on May 2, 2025. These adjustments include the impact of the operations associated with the acquired branded battery business. The Company will be working to transition from these branded business to legacy brands by December 31, 2025. This does not include the impact of acquisition and integration costs associated with this acquisition. • Change in highly inflationary markets. The Company is presenting separately all changes in sales and segment profit from our Egypt and Argentina affiliates due to the designation of the economies as highly inflationary as of October 1, 2024 and July 1, 2018, respectively. • Impact of currency. The Company evaluates the operating performance of our Company on a currency neutral basis. The Impact of Currency is the change in foreign currency exchange rates year-over-year on reported results, which is calculated by comparing the value of current year foreign operations at the current period USD exchange rate versus the value of current year foreign operations at the prior period USD exchange rate. The impact of currency also includes (gains)/losses of currency hedging programs, and it excludes highly inflationary markets. • Adjusted Comparisons. Detail for adjusted gross profit and adjusted gross margin are also supplemental non-GAAP measure disclosures. These measures exclude the impact of restructuring and related costs, network transition costs, acquisition and integration costs and FY23 & FY24 production credits. • Free Cash Flow. Free Cash Flow is defined as net cash provided by operating activities reduced by capital expenditures, net of the proceeds from asset sales. • Adjusted Net Earnings and Adjusted Diluted Net Earnings Per Common Share (EPS). These measures exclude the impact of restructuring and related costs, the costs related to acquisition and integration, network transition costs, FY23 & FY24 production credits, litigation matters, impairment of intangible assets, the loss/(gain) on extinguishment/modification of debt and the December 2023 Argentina Economic Reform. Adjusted EPS Excluding Production Credits further excludes the benefit of the FY25 production credits, net of related compensation costs and tax impacts. • EBITDA and Adjusted EBITDA. EBITDA is defined as net earnings before income tax provision, interest, the loss/(gain) on extinguishment/modification of debt, and depreciation and amortization. Adjusted EBITDA further excludes the impact of costs related to restructuring, network transition costs, acquisition and integration costs, FY23 & FY24 production credits, litigation matter, the December 2023 Argentina Economic Reform, the impairment of intangible assets, the Settlement loss on US pension annuity buy out and share based payments. • Net Debt. Net Debt is defined as total Company debt, less cash and cash equivalents. Net leverage is defined as Net debt divided by Adjusted EBITDA for the last twelve month period (LTM).

2025 Financial Results & 2026 Outlook

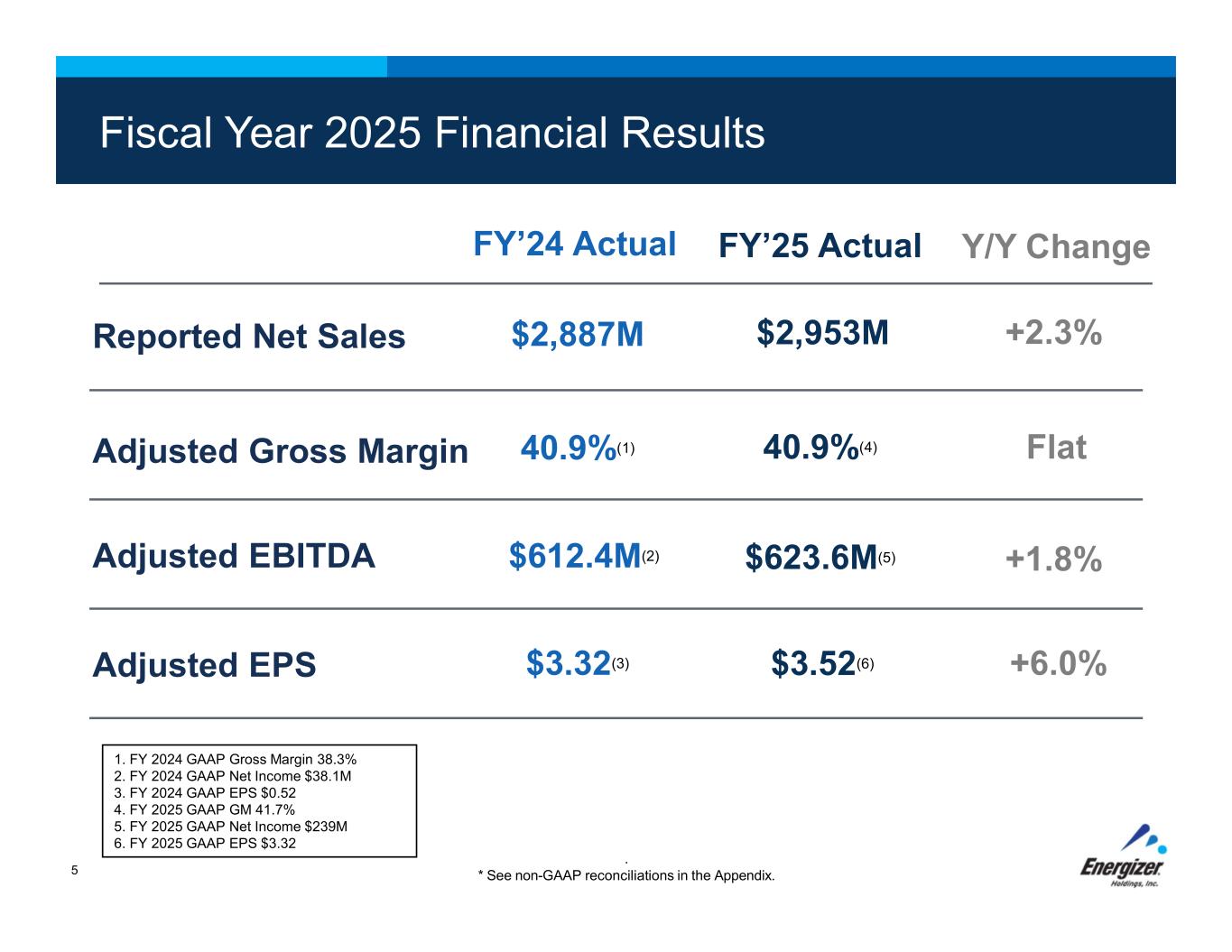

FOR INTERNAL USE ONLY – DO NOT DISTRIBUTE Fiscal Year 2025 Financial Results Reported Net Sales $2,887M +2.3% FY’24 Actual Y/Y Change 5 . * See non-GAAP reconciliations in the Appendix. 1. FY 2024 GAAP Gross Margin 38.3% 2. FY 2024 GAAP Net Income $38.1M 3. FY 2024 GAAP EPS $0.52 4. FY 2025 GAAP GM 41.7% 5. FY 2025 GAAP Net Income $239M 6. FY 2025 GAAP EPS $3.32 $2,953M FY’25 Actual Adjusted Gross Margin Adjusted EBITDA Adjusted EPS 40.9%(1) $612.4M(2) $3.32(3) 40.9%(4) $623.6M(5) $3.52(6) Flat +1.8% +6.0%

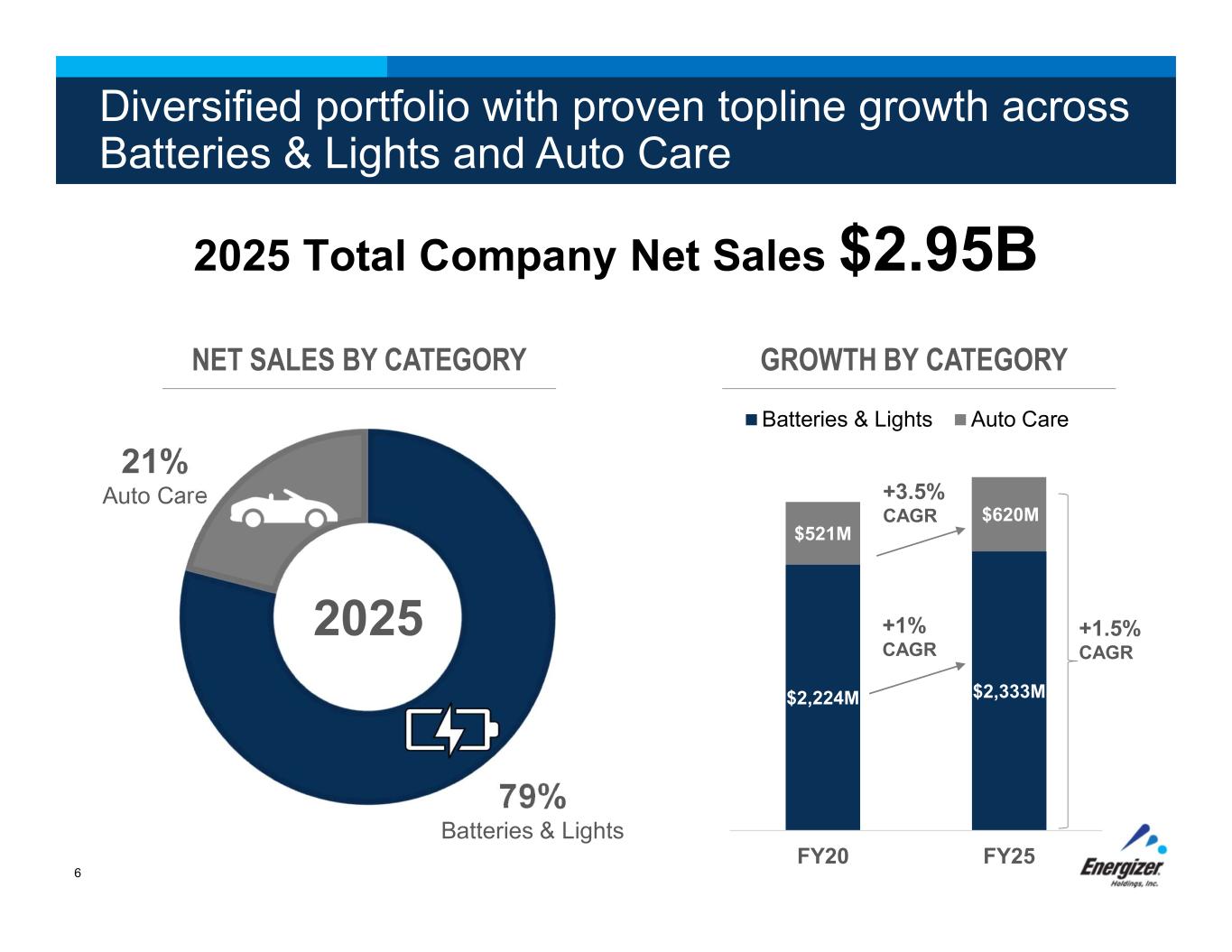

FOR INTERNAL USE ONLY – DO NOT DISTRIBUTE6 GROWTH BY CATEGORY $2.4B $0.6B$2,224M $2,333M $521M $620M FY20 FY25 Batteries & Lights Auto Care +3.5% CAGR +1% CAGR 2025 Total Company Net Sales $2.95B Diversified portfolio with proven topline growth across Batteries & Lights and Auto Care +1.5% CAGR NET SALES BY CATEGORY 79% Batteries & Lights 21% Auto Care 2025

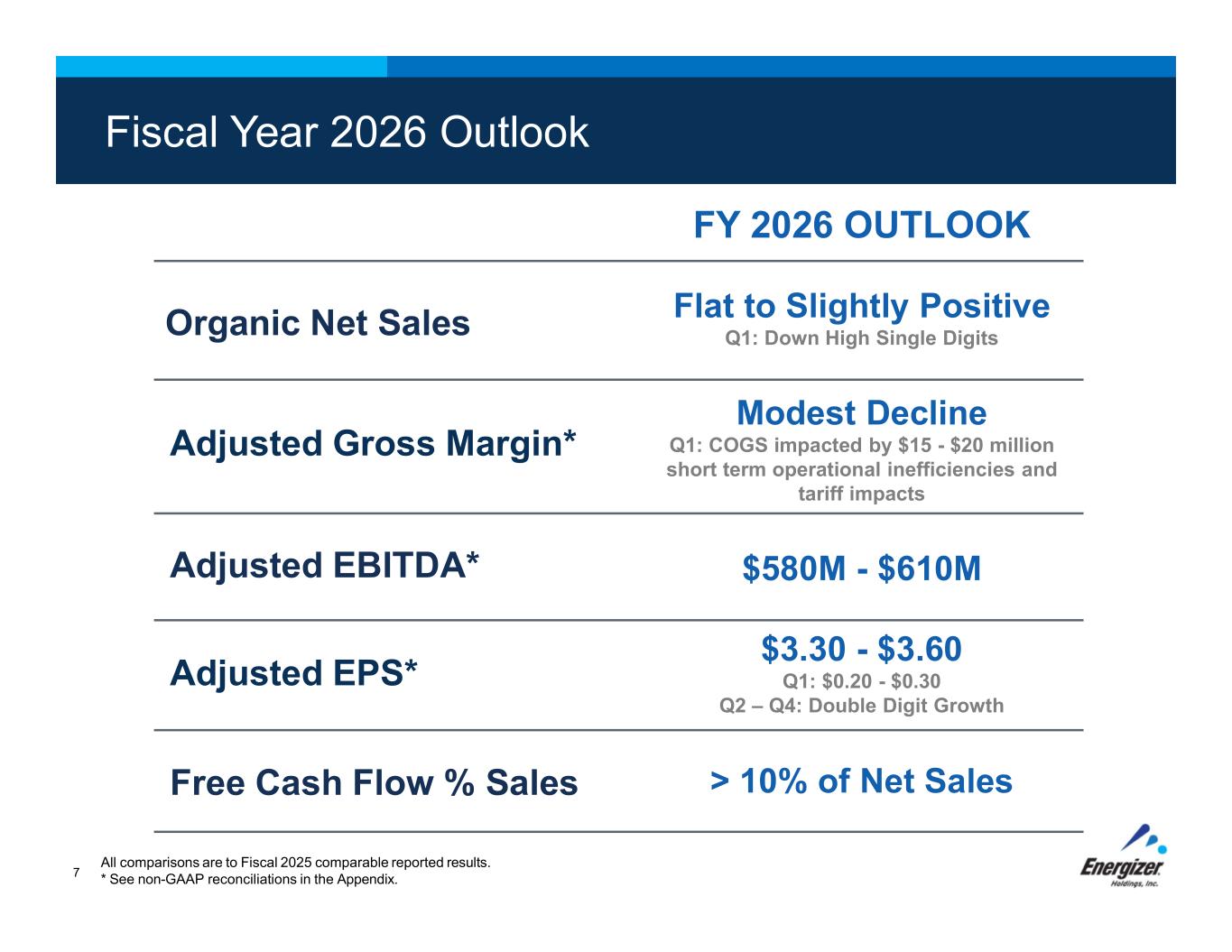

FOR INTERNAL USE ONLY – DO NOT DISTRIBUTE Fiscal Year 2026 Outlook Organic Net Sales Flat to Slightly Positive Q1: Down High Single Digits Adjusted Gross Margin* Modest Decline Q1: COGS impacted by $15 - $20 million short term operational inefficiencies and tariff impacts Adjusted EBITDA* $580M - $610M Adjusted EPS* $3.30 - $3.60 Q1: $0.20 - $0.30 Q2 – Q4: Double Digit Growth Free Cash Flow % Sales > 10% of Net Sales 7 All comparisons are to Fiscal 2025 comparable reported results. * See non-GAAP reconciliations in the Appendix. FY 2026 OUTLOOK

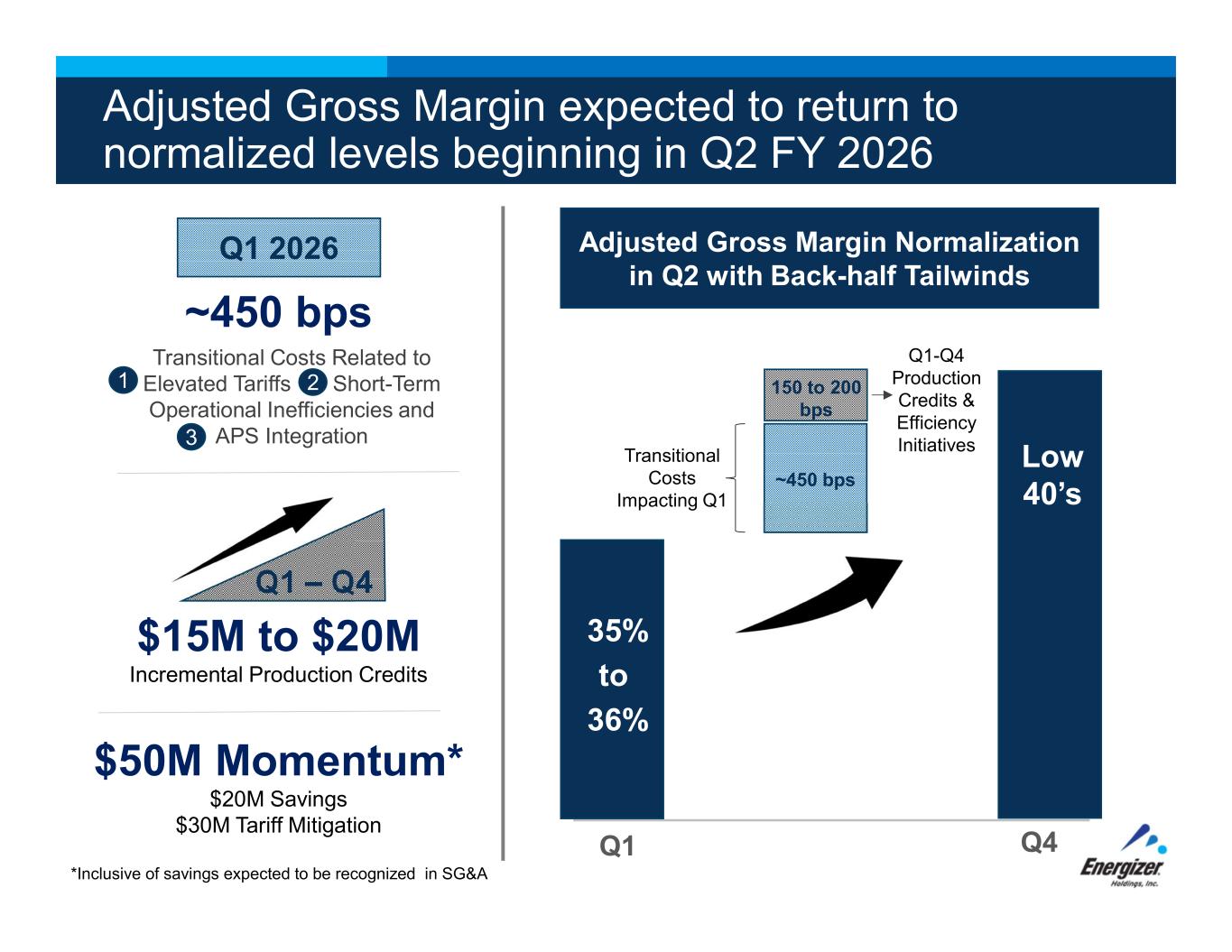

FOR INTERNAL USE ONLY – DO NOT DISTRIBUTE Q1 Q4 Adjusted Gross Margin expected to return to normalized levels beginning in Q2 FY 2026 ~450 bps 35% to 36% Low 40’s Q1-Q4 Production Credits & Efficiency Initiatives ~450 bps Transitional Costs Related to Elevated Tariffs Short-Term Operational Inefficiencies and APS Integration $15M to $20M Incremental Production Credits $50M Momentum* $20M Savings $30M Tariff Mitigation Adjusted Gross Margin Normalization in Q2 with Back-half Tailwinds Q1 2026 1 2 3 Q1 – Q4 *Inclusive of savings expected to be recognized in SG&A 150 to 200 bps Transitional Costs Impacting Q1

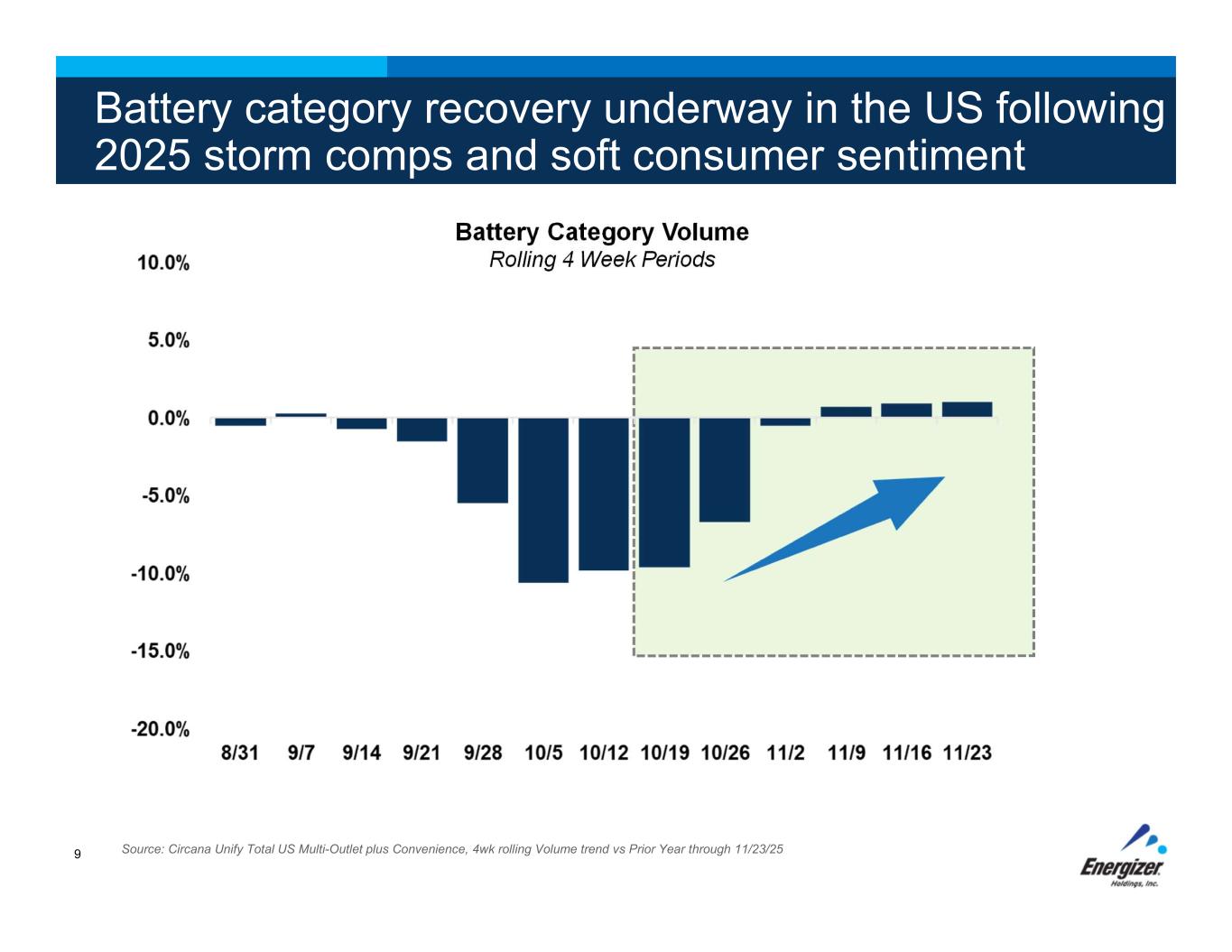

Battery category recovery underway in the US following 2025 storm comps and soft consumer sentiment 9 Source: Circana Unify Total US Multi-Outlet plus Convenience, 4wk rolling Volume trend vs Prior Year through 11/23/25 Battery Category Volume Rolling 4 Week Periods

FOR INTERNAL USE ONLY – DO NOT DISTRIBUTE Basement/ Storage Flashlights Lanterns Stud Finder Laser Level Smoke Detector Bathroom Bathroom Scale Thermometer Blood Pressure Monitor Powered Toothbrush Hearing Aid Mustache/Hair Trimmer Outside Car Key Fob Electronic Door Lock Garage Door Keypad Doorbell Camera Outdoor Timers Doorbell / Chime Office Wireless Mouse Calculator Wireless Keyboard Digital Camera Lighting/Fan Remote Desk Clock Label Maker Kitchen Kitchen Scale Kitchen Timer Wet Mop Meat Thermometer Smoke Detector Can Opener Wine Opener Home Security Sensor Bedrooms Smoke Detector Ceiling Fan Remote Touch/Tap Light Power Window Blinds Travel Alarm Baby Monitor Motorized Toys Electronic Games RC Car Living Room TV Remote Clock Programmable Thermostat Home Security Sensor Air Freshener Flameless Candle Video Game Controller Smart Lightbulb Remote Smoke Detector Smart Vents Every room in the house contains multiple battery- powered devices Source: Energizer FY23 Device Inventory Study, U.S. 10

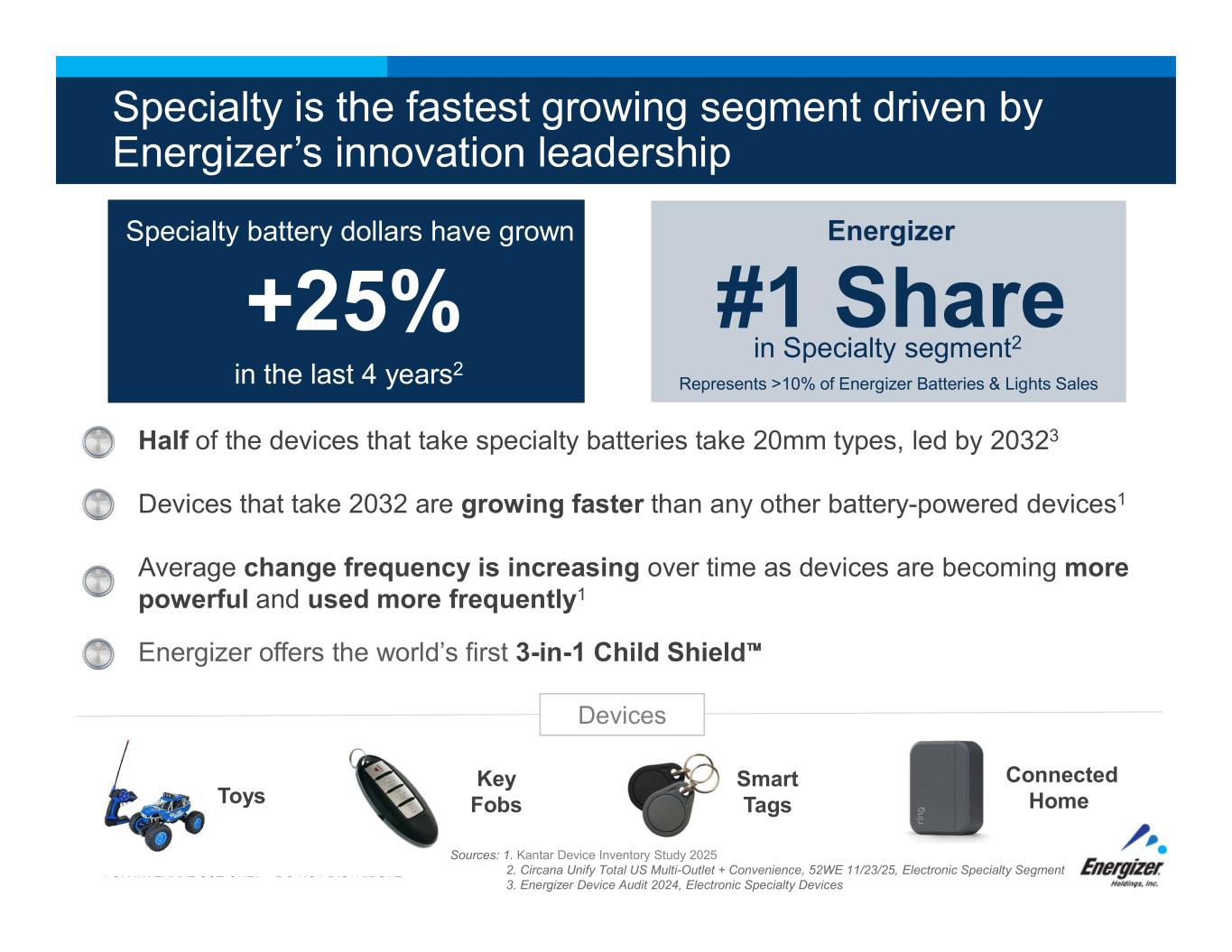

FOR INTERNAL USE ONLY – DO NOT DISTRIBUTE Half of the devices that take specialty batteries take 20mm types, led by 20323 Devices that take 2032 are growing faster than any other battery-powered devices1 Average change frequency is increasing over time as devices are becoming more powerful and used more frequently1 Energizer offers the world’s first 3-in-1 Child Shield Smart Tags Connected Home Key FobsToys +25% Specialty battery dollars have grown in the last 4 years2 Specialty is the fastest growing segment driven by Energizer’s innovation leadership #1 Share Energizer in Specialty segment2 Sources: 1. Kantar Device Inventory Study 2025 2. Circana Unify Total US Multi-Outlet + Convenience, 52WE 11/23/25, Electronic Specialty Segment 3. Energizer Device Audit 2024, Electronic Specialty Devices Represents >10% of Energizer Batteries & Lights Sales Devices

Project Momentum Driving Efficiency and Growth

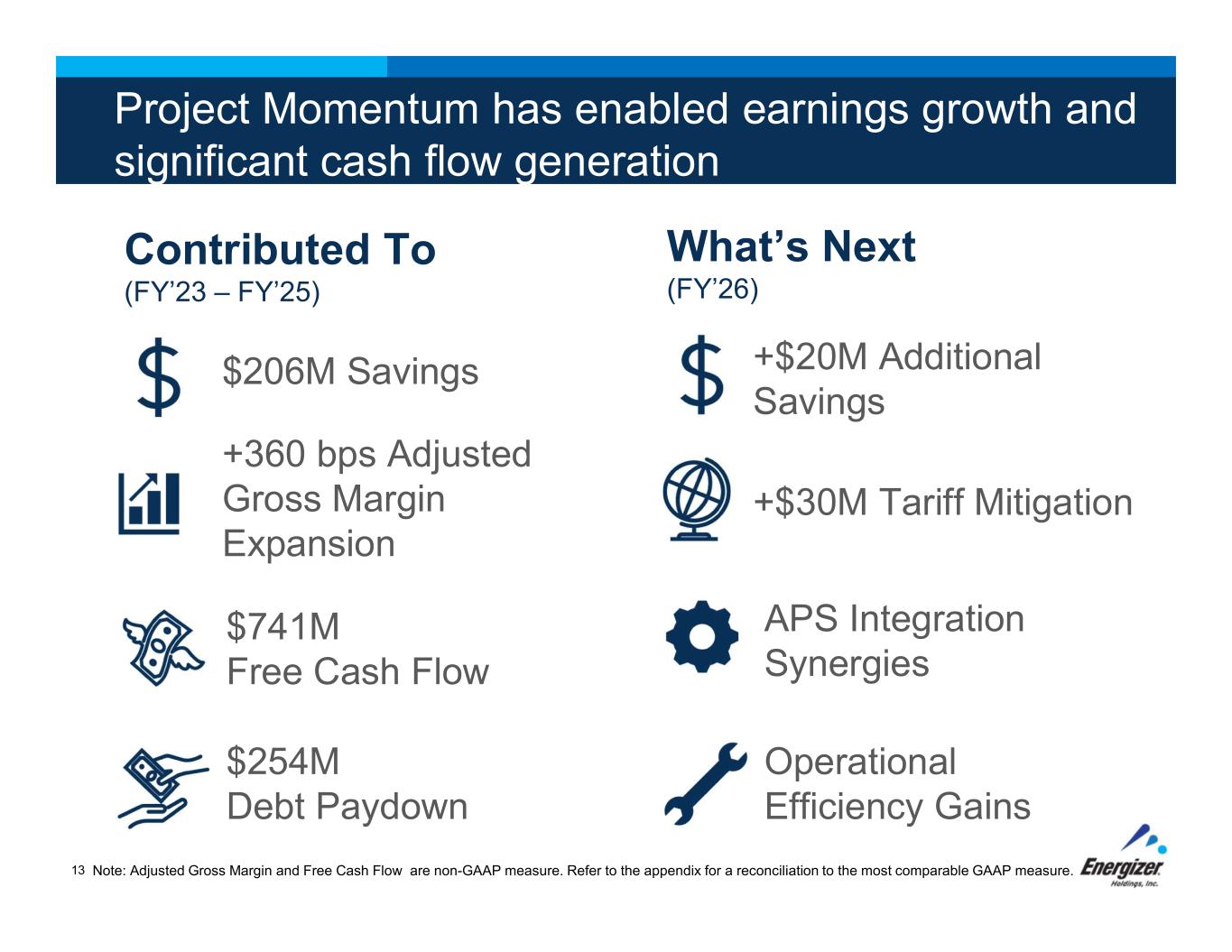

FOR INTERNAL USE ONLY – DO NOT DISTRIBUTE Project Momentum has enabled earnings growth and significant cash flow generation 13 Contributed To (FY’23 – FY’25) What’s Next (FY’26) $206M Savings +$20M Additional Savings +$30M Tariff Mitigation +360 bps Adjusted Gross Margin Expansion $741M Free Cash Flow $254M Debt Paydown APS Integration Synergies Operational Efficiency Gains Note: Adjusted Gross Margin and Free Cash Flow are non-GAAP measure. Refer to the appendix for a reconciliation to the most comparable GAAP measure.

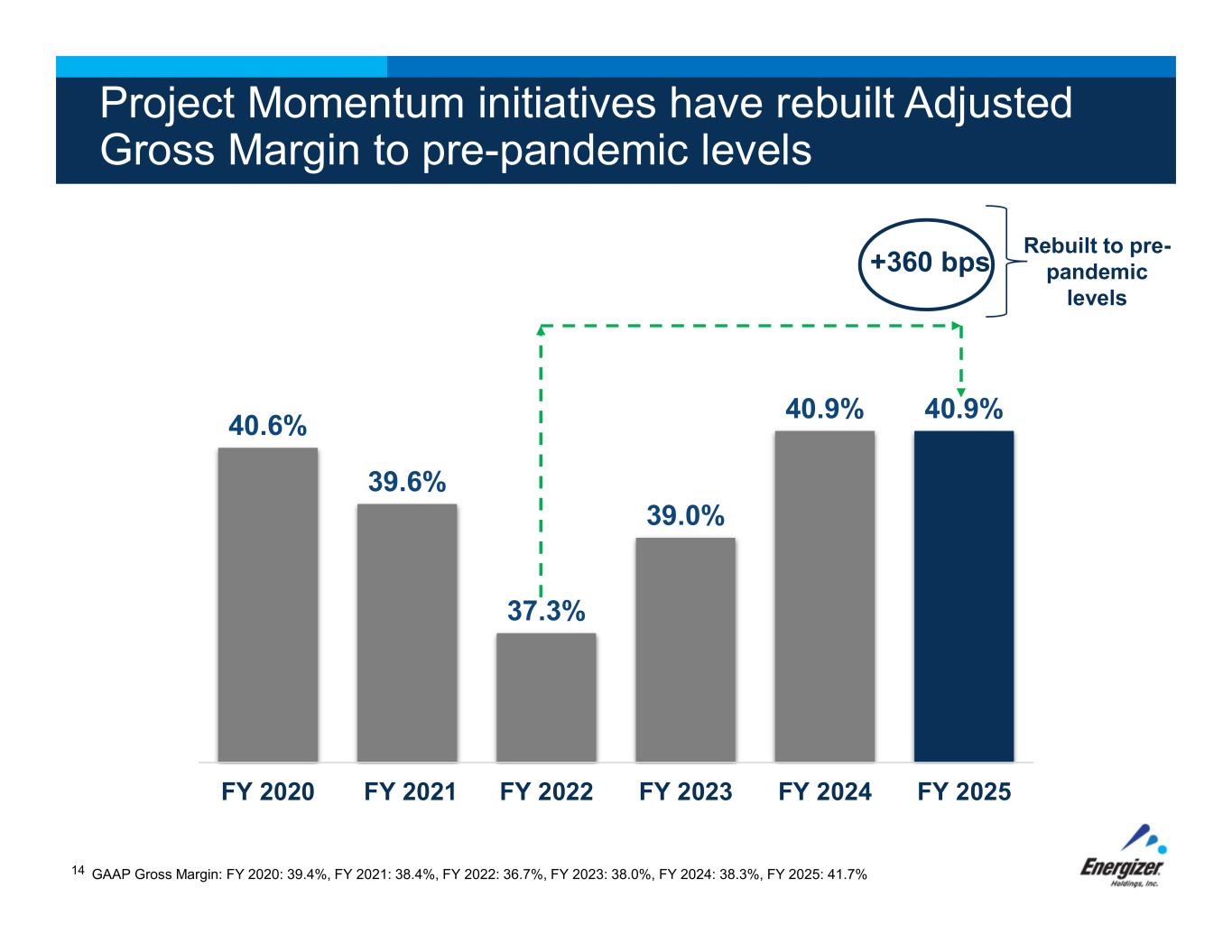

FOR INTERNAL USE ONLY – DO NOT DISTRIBUTE Rebuilt to pre- pandemic levels 14 GAAP Gross Margin: FY 2020: 39.4%, FY 2021: 38.4%, FY 2022: 36.7%, FY 2023: 38.0%, FY 2024: 38.3%, FY 2025: 41.7% +360 bps Project Momentum initiatives have rebuilt Adjusted Gross Margin to pre-pandemic levels 40.6% 39.6% 37.3% 39.0% 40.9% 40.9% FY 2020 FY 2021 FY 2022 FY 2023 FY 2024 FY 2025

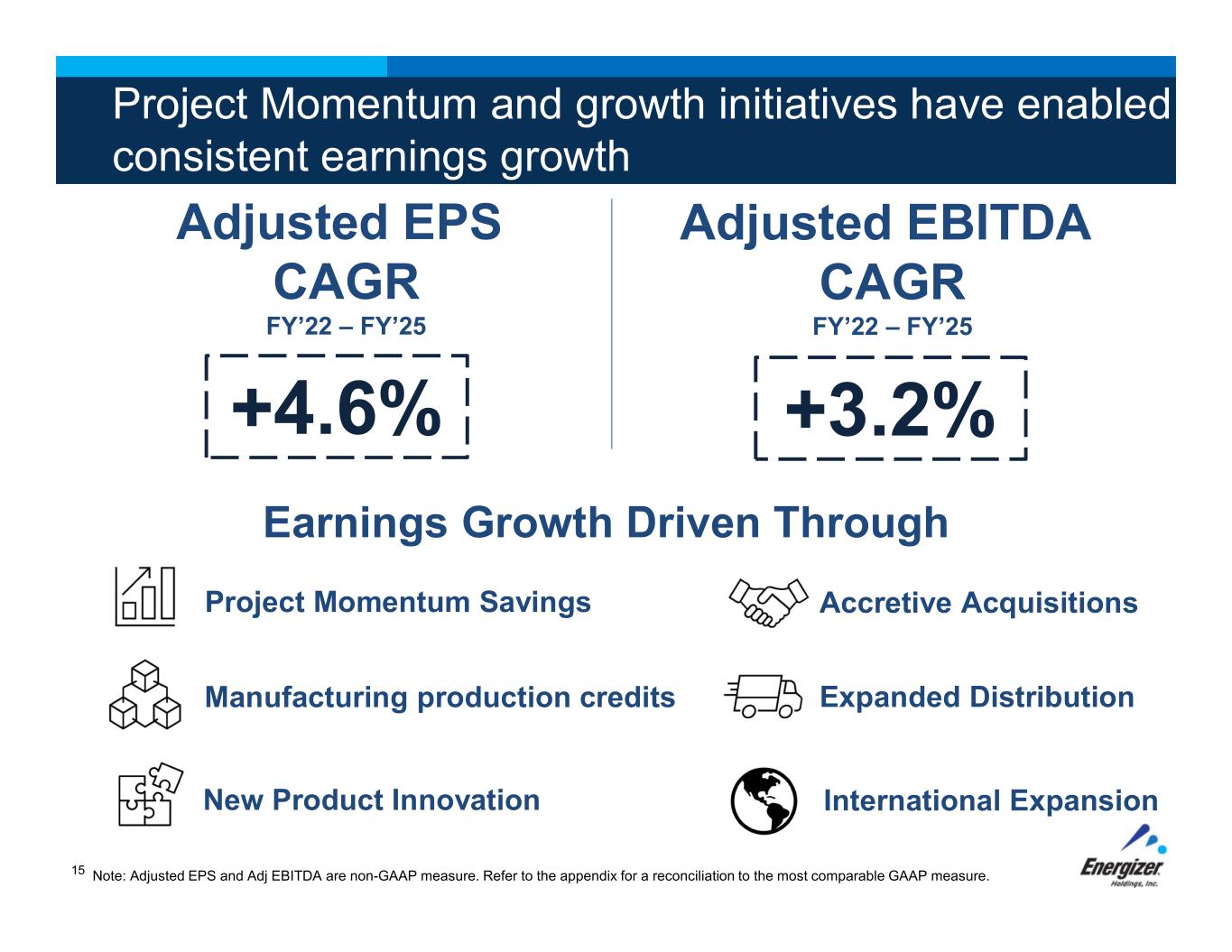

Project Momentum and growth initiatives have enabled consistent earnings growth Note: Adjusted EPS and Adj EBITDA are non-GAAP measure. Refer to the appendix for a reconciliation to the most comparable GAAP measure.15 Adjusted EPS CAGR FY’22 – FY’25 Adjusted EBITDA CAGR FY’22 – FY’25 +4.6% +3.2% Earnings Growth Driven Through Manufacturing production credits Project Momentum Savings New Product Innovation Accretive Acquisitions Expanded Distribution International Expansion

Debt Capital Structure & Capital Allocation Priorities

FOR INTERNAL USE ONLY – DO NOT DISTRIBUTE Continue to optimize debt capital structure 17 ~$1.2B Existing Maturities Extended in FY’25 92% Fixed Rate Structure 4.6% Weighted Average Interest Rate No Meaningful Maturities Until 2028

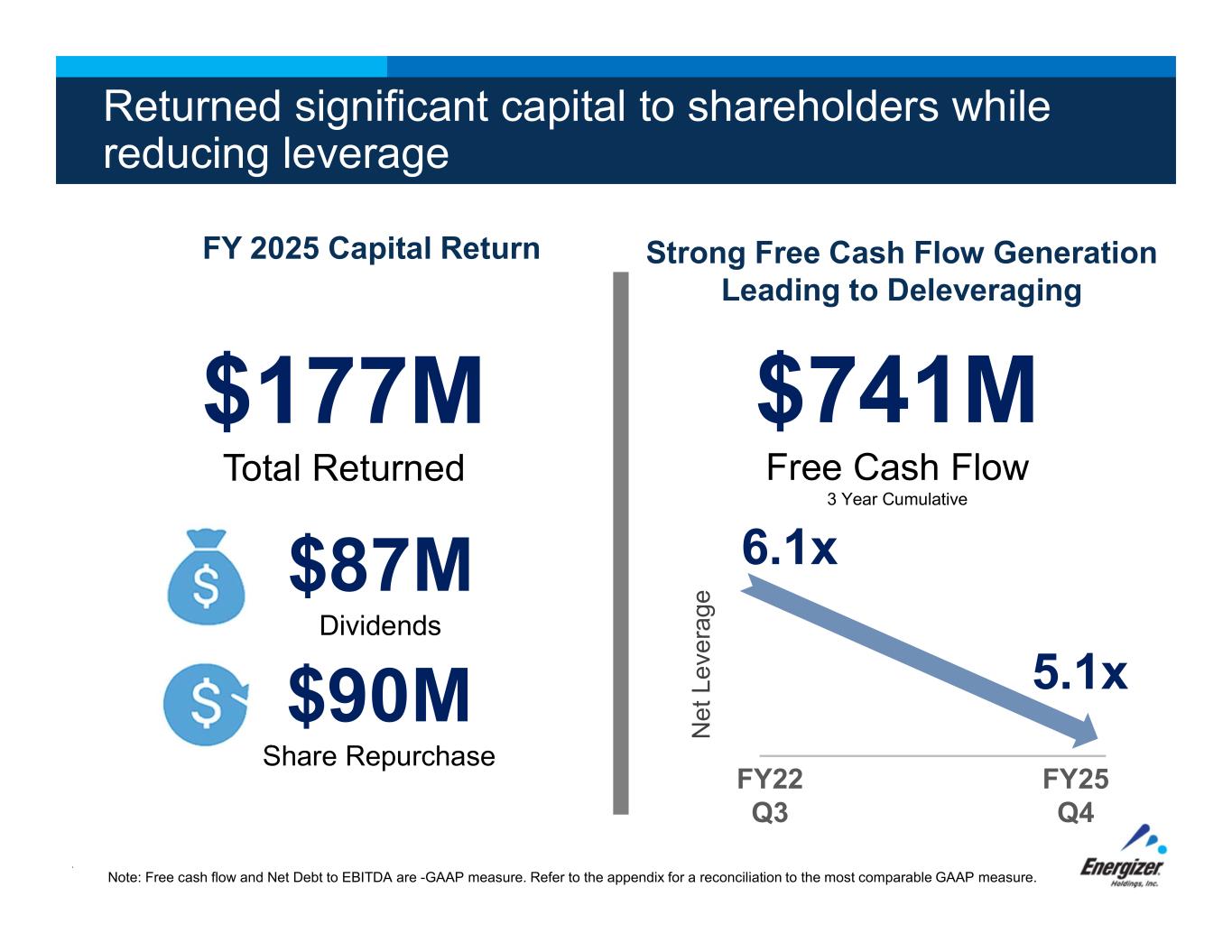

FOR INTERNAL USE ONLY – DO NOT DISTRIBUTE FY 2025 Capital Return $177M Total Returned $87M Dividends $90M Share Repurchase 5.1x FY22 Q3 FY25 Q4 6.1x Returned significant capital to shareholders while reducing leverage 18 $741M Free Cash Flow 3 Year Cumulative Strong Free Cash Flow Generation Leading to Deleveraging N e t L e ve ra g e Note: Free cash flow and Net Debt to EBITDA are -GAAP measure. Refer to the appendix for a reconciliation to the most comparable GAAP measure.

FOR INTERNAL USE ONLY – DO NOT DISTRIBUTE19 Creating Long-Term Shareholder Value Steadily growing Adjusted EBITDA through profitable Net Sales growth and disciplined cost management Reducing debt, transferring value from debt to equity holders Paying a competitive dividend Opportunistic share-repurchase and accretive M&A while maintaining a healthy Debt Capital Structure

Appendix Materials: Non-GAAP Reconciliations 20

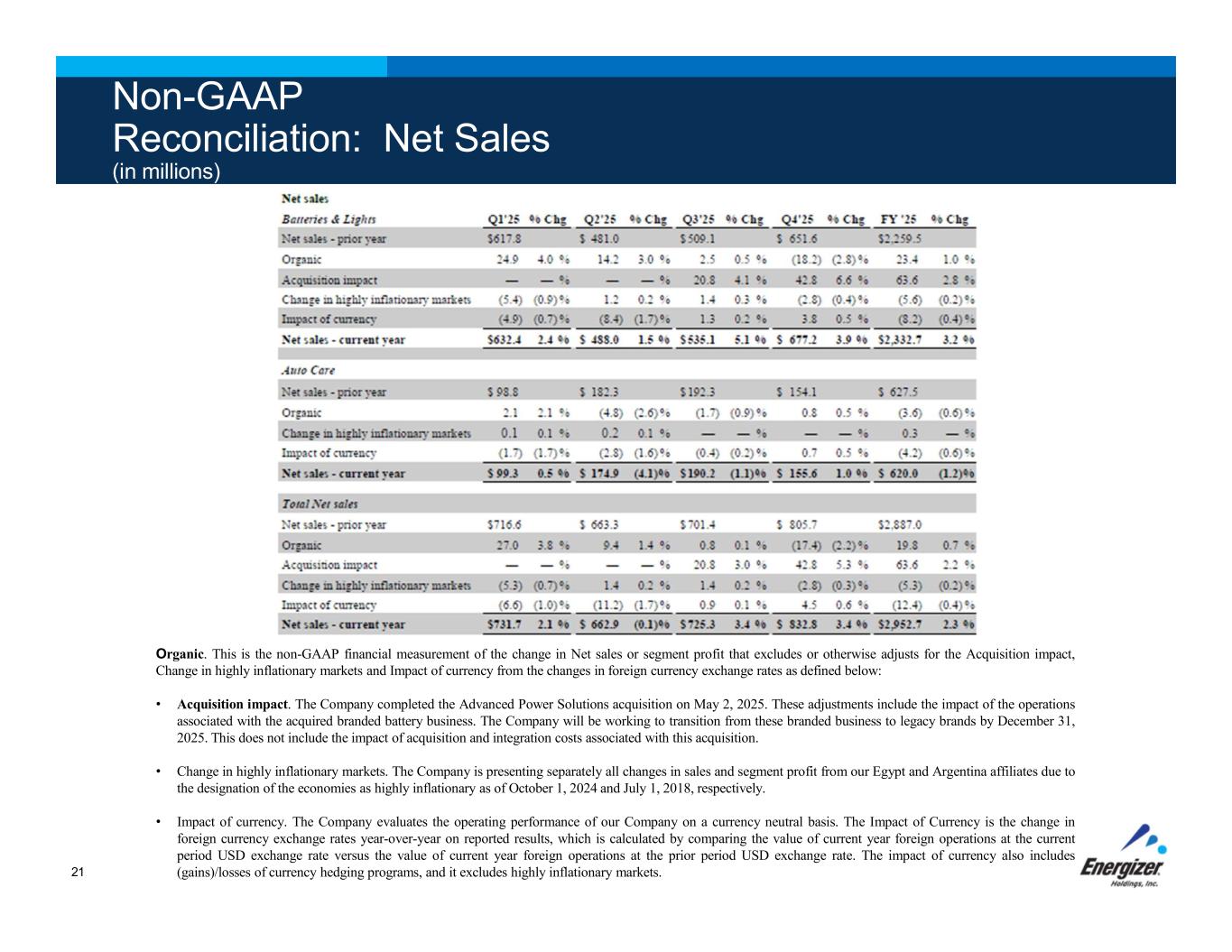

Non-GAAP Reconciliation: Net Sales (in millions) Organic. This is the non-GAAP financial measurement of the change in Net sales or segment profit that excludes or otherwise adjusts for the Acquisition impact, Change in highly inflationary markets and Impact of currency from the changes in foreign currency exchange rates as defined below: • Acquisition impact. The Company completed the Advanced Power Solutions acquisition on May 2, 2025. These adjustments include the impact of the operations associated with the acquired branded battery business. The Company will be working to transition from these branded business to legacy brands by December 31, 2025. This does not include the impact of acquisition and integration costs associated with this acquisition. • Change in highly inflationary markets. The Company is presenting separately all changes in sales and segment profit from our Egypt and Argentina affiliates due to the designation of the economies as highly inflationary as of October 1, 2024 and July 1, 2018, respectively. • Impact of currency. The Company evaluates the operating performance of our Company on a currency neutral basis. The Impact of Currency is the change in foreign currency exchange rates year-over-year on reported results, which is calculated by comparing the value of current year foreign operations at the current period USD exchange rate versus the value of current year foreign operations at the prior period USD exchange rate. The impact of currency also includes (gains)/losses of currency hedging programs, and it excludes highly inflationary markets.21

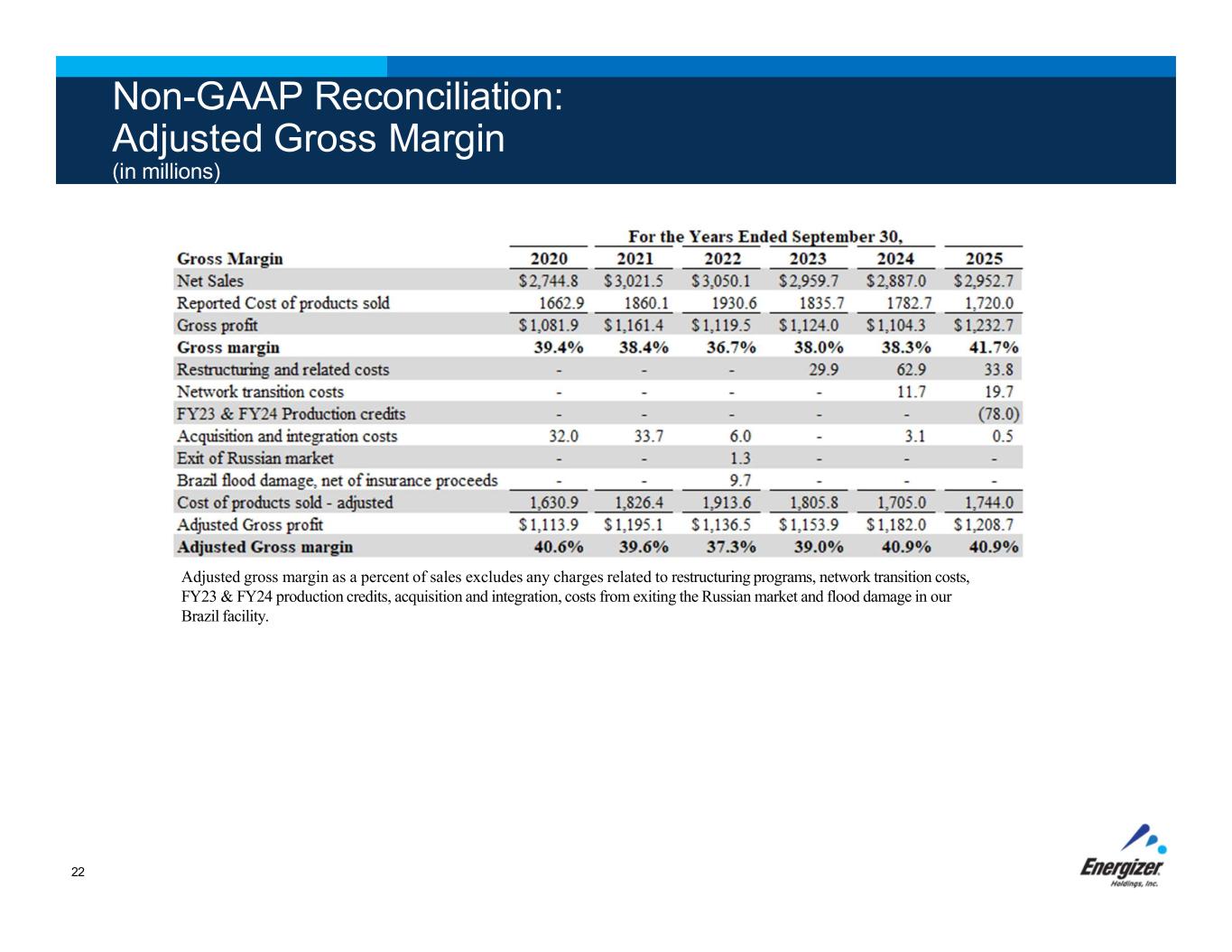

Non-GAAP Reconciliation: Adjusted Gross Margin (in millions) Adjusted gross margin as a percent of sales excludes any charges related to restructuring programs, network transition costs, FY23 & FY24 production credits, acquisition and integration, costs from exiting the Russian market and flood damage in our Brazil facility. 22

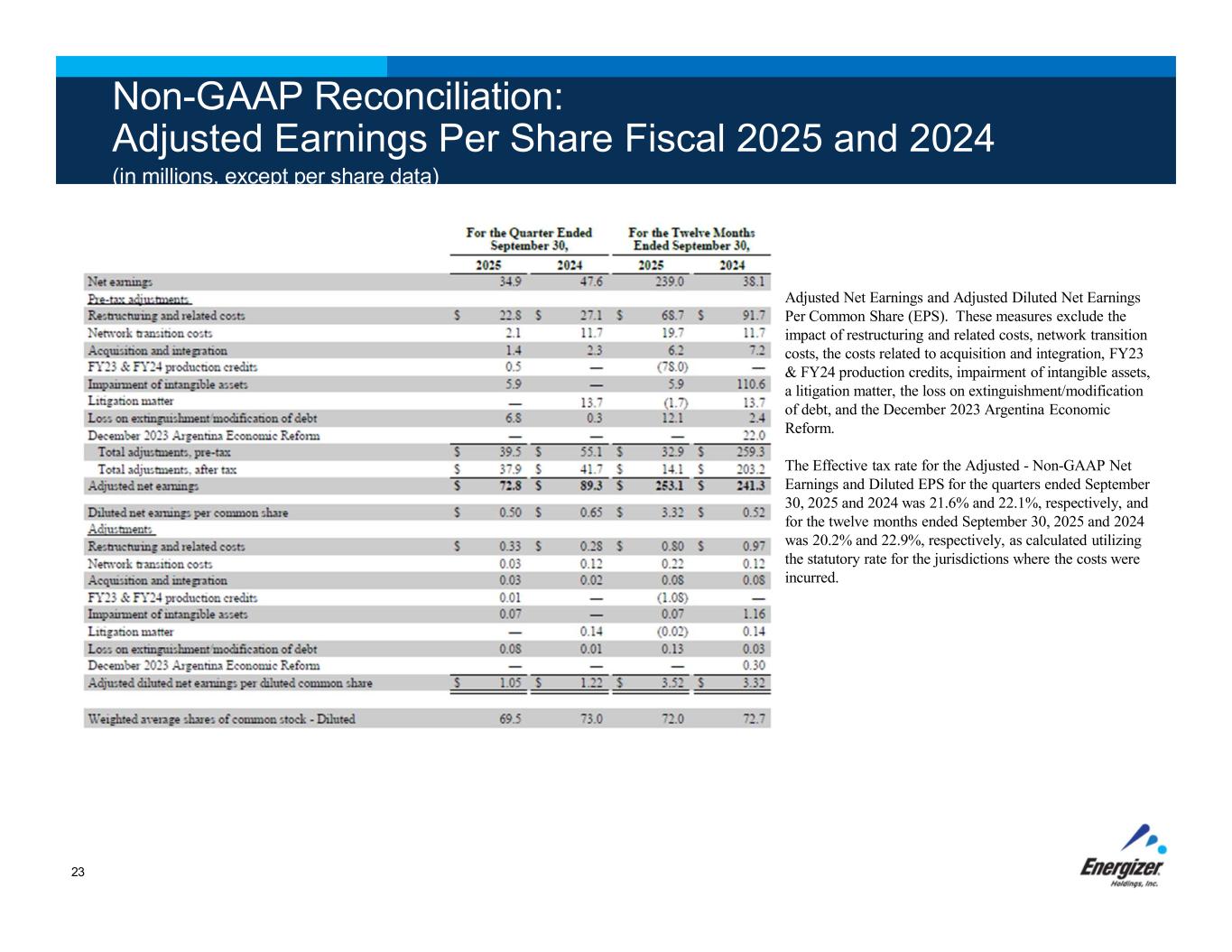

Non-GAAP Reconciliation: Adjusted Earnings Per Share Fiscal 2025 and 2024 (in millions, except per share data) Adjusted Net Earnings and Adjusted Diluted Net Earnings Per Common Share (EPS). These measures exclude the impact of restructuring and related costs, network transition costs, the costs related to acquisition and integration, FY23 & FY24 production credits, impairment of intangible assets, a litigation matter, the loss on extinguishment/modification of debt, and the December 2023 Argentina Economic Reform. The Effective tax rate for the Adjusted - Non-GAAP Net Earnings and Diluted EPS for the quarters ended September 30, 2025 and 2024 was 21.6% and 22.1%, respectively, and for the twelve months ended September 30, 2025 and 2024 was 20.2% and 22.9%, respectively, as calculated utilizing the statutory rate for the jurisdictions where the costs were incurred. 23

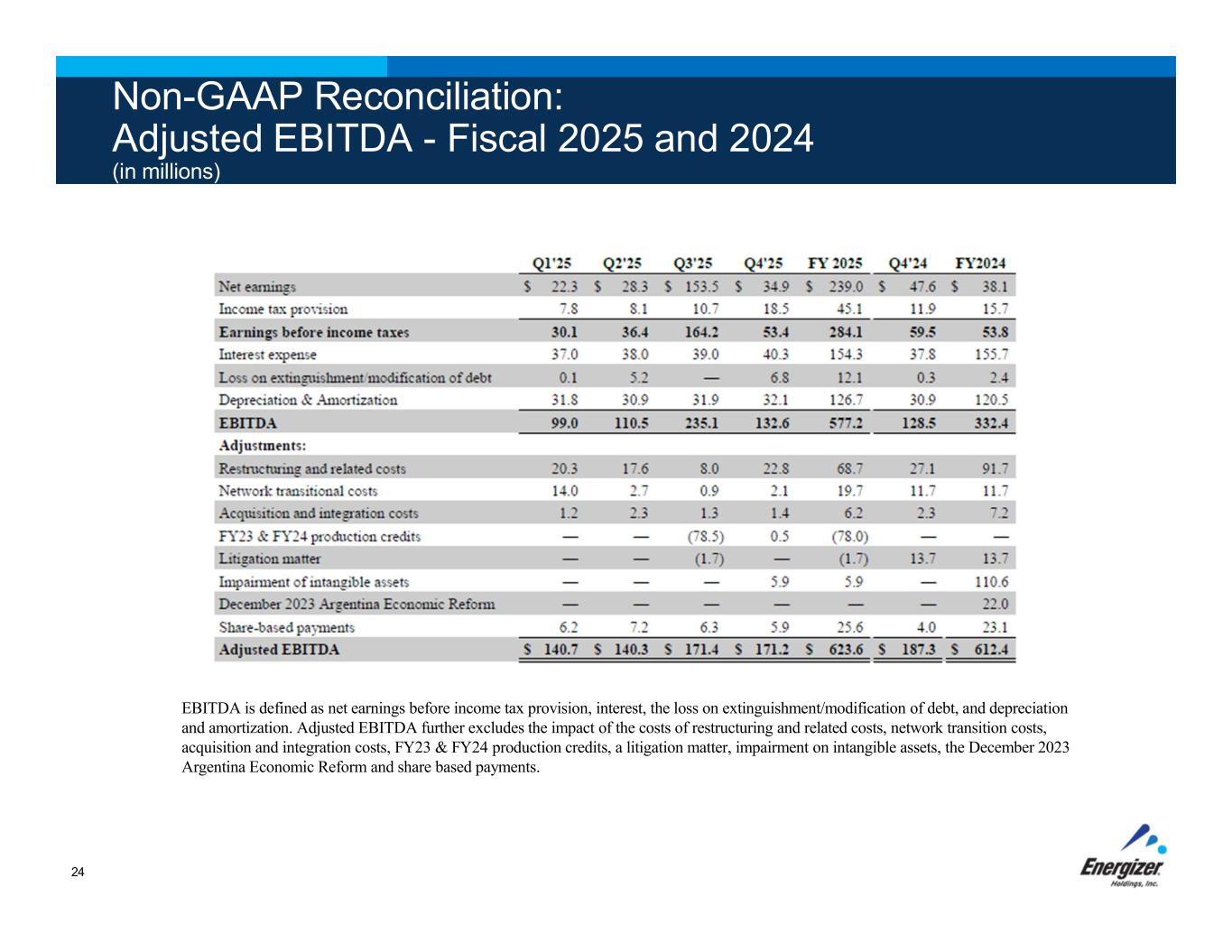

Non-GAAP Reconciliation: Adjusted EBITDA - Fiscal 2025 and 2024 (in millions) EBITDA is defined as net earnings before income tax provision, interest, the loss on extinguishment/modification of debt, and depreciation and amortization. Adjusted EBITDA further excludes the impact of the costs of restructuring and related costs, network transition costs, acquisition and integration costs, FY23 & FY24 production credits, a litigation matter, impairment on intangible assets, the December 2023 Argentina Economic Reform and share based payments. 24

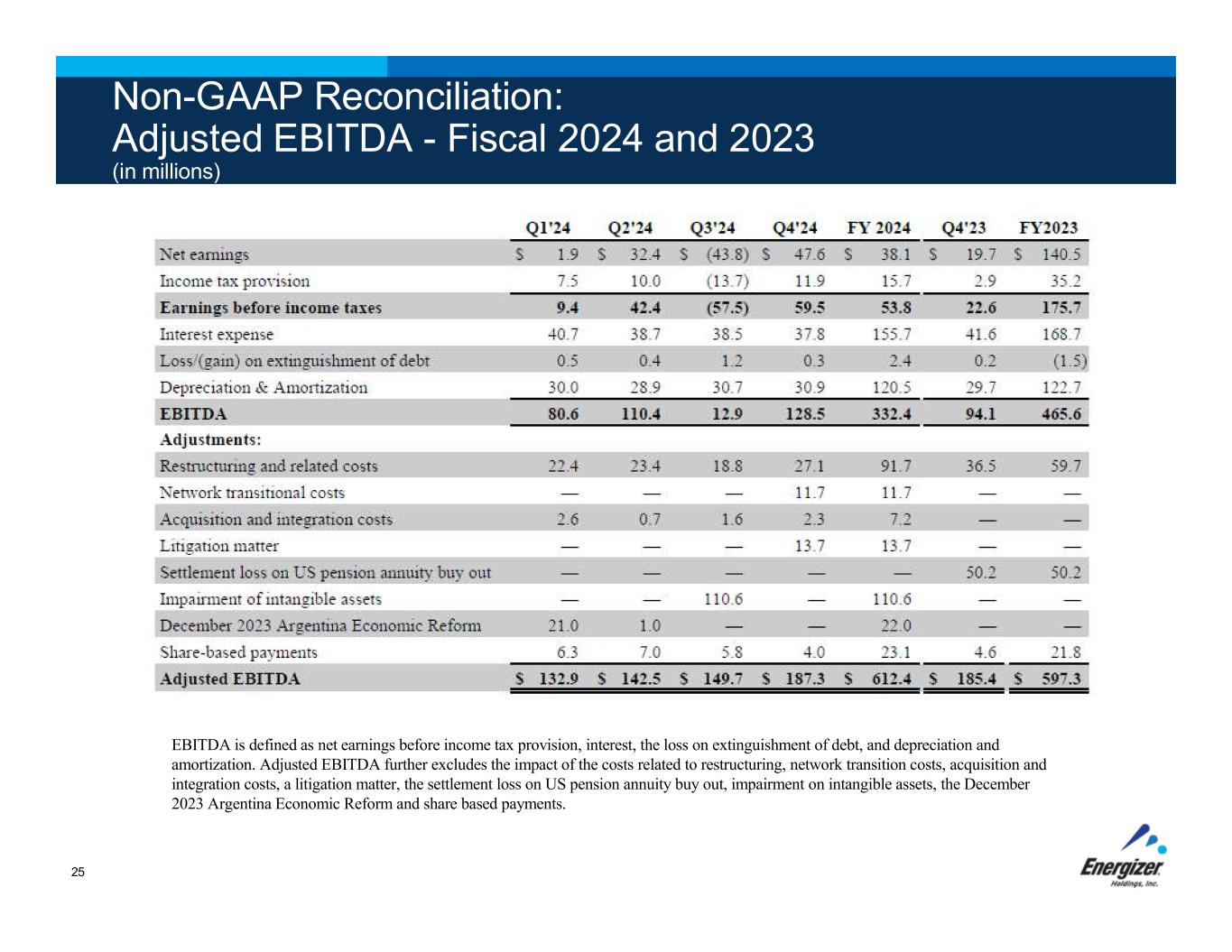

Non-GAAP Reconciliation: Adjusted EBITDA - Fiscal 2024 and 2023 (in millions) EBITDA is defined as net earnings before income tax provision, interest, the loss on extinguishment of debt, and depreciation and amortization. Adjusted EBITDA further excludes the impact of the costs related to restructuring, network transition costs, acquisition and integration costs, a litigation matter, the settlement loss on US pension annuity buy out, impairment on intangible assets, the December 2023 Argentina Economic Reform and share based payments. 25

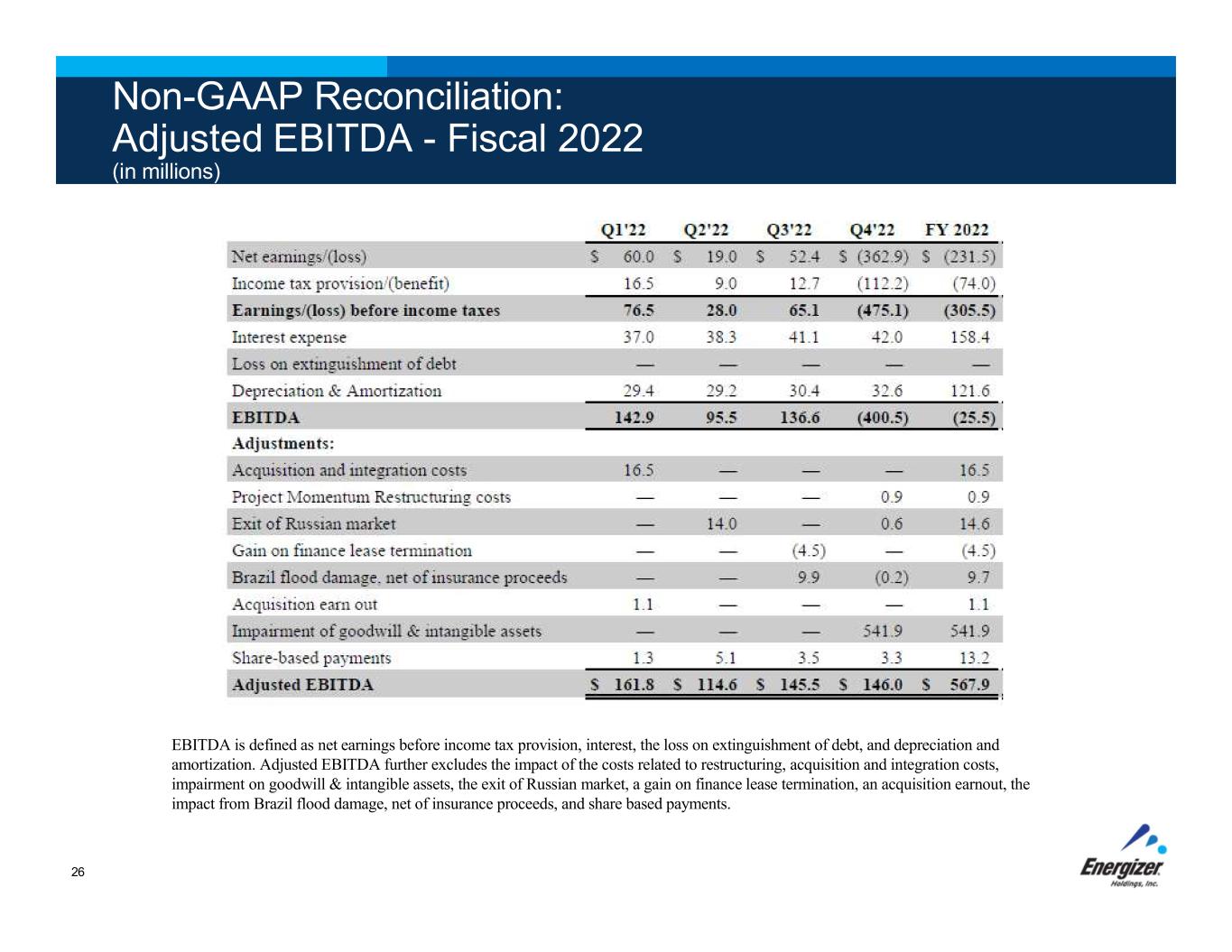

Non-GAAP Reconciliation: Adjusted EBITDA - Fiscal 2022 (in millions) EBITDA is defined as net earnings before income tax provision, interest, the loss on extinguishment of debt, and depreciation and amortization. Adjusted EBITDA further excludes the impact of the costs related to restructuring, acquisition and integration costs, impairment on goodwill & intangible assets, the exit of Russian market, a gain on finance lease termination, an acquisition earnout, the impact from Brazil flood damage, net of insurance proceeds, and share based payments. 26

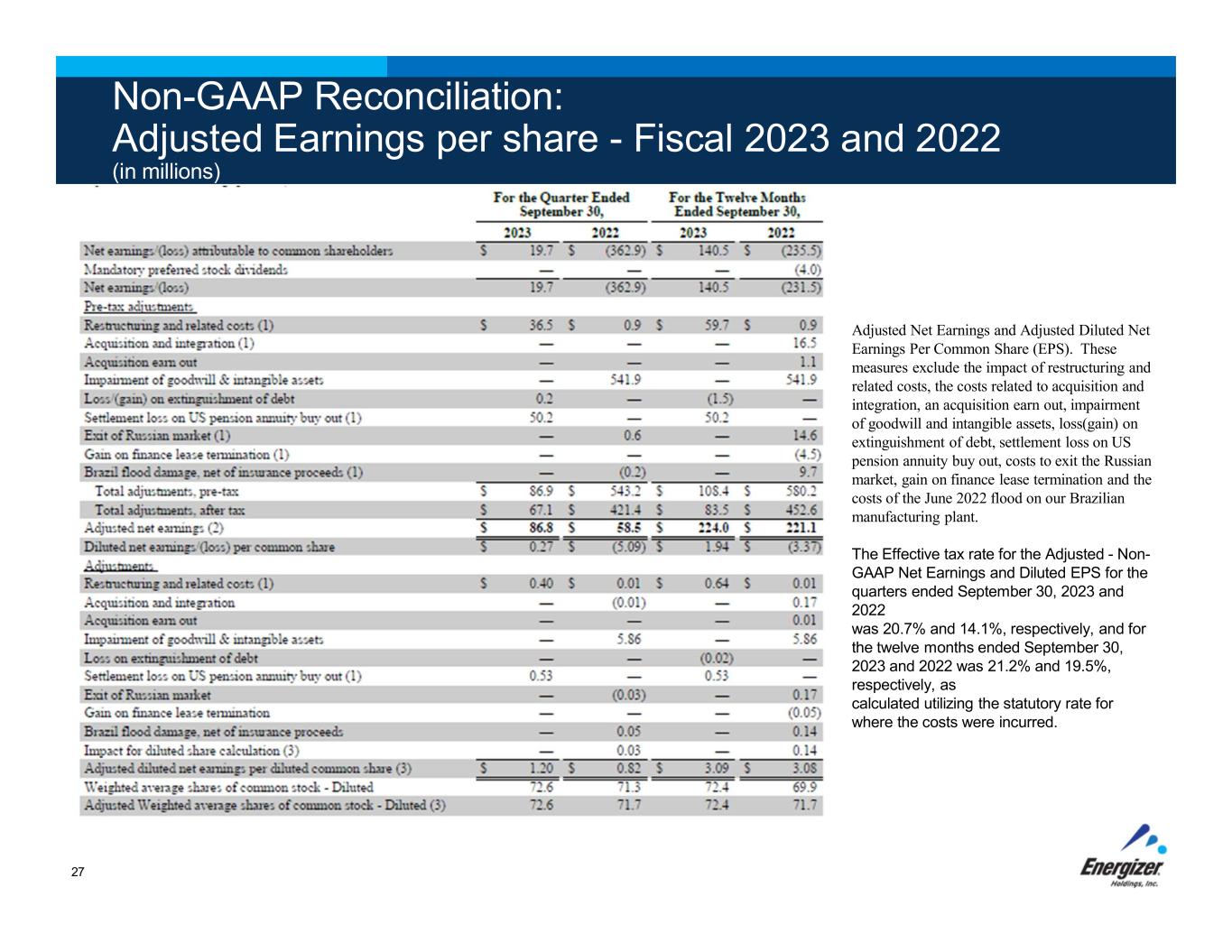

Non-GAAP Reconciliation: Adjusted Earnings per share - Fiscal 2023 and 2022 (in millions) 27 Adjusted Net Earnings and Adjusted Diluted Net Earnings Per Common Share (EPS). These measures exclude the impact of restructuring and related costs, the costs related to acquisition and integration, an acquisition earn out, impairment of goodwill and intangible assets, loss(gain) on extinguishment of debt, settlement loss on US pension annuity buy out, costs to exit the Russian market, gain on finance lease termination and the costs of the June 2022 flood on our Brazilian manufacturing plant. The Effective tax rate for the Adjusted - Non- GAAP Net Earnings and Diluted EPS for the quarters ended September 30, 2023 and 2022 was 20.7% and 14.1%, respectively, and for the twelve months ended September 30, 2023 and 2022 was 21.2% and 19.5%, respectively, as calculated utilizing the statutory rate for where the costs were incurred.

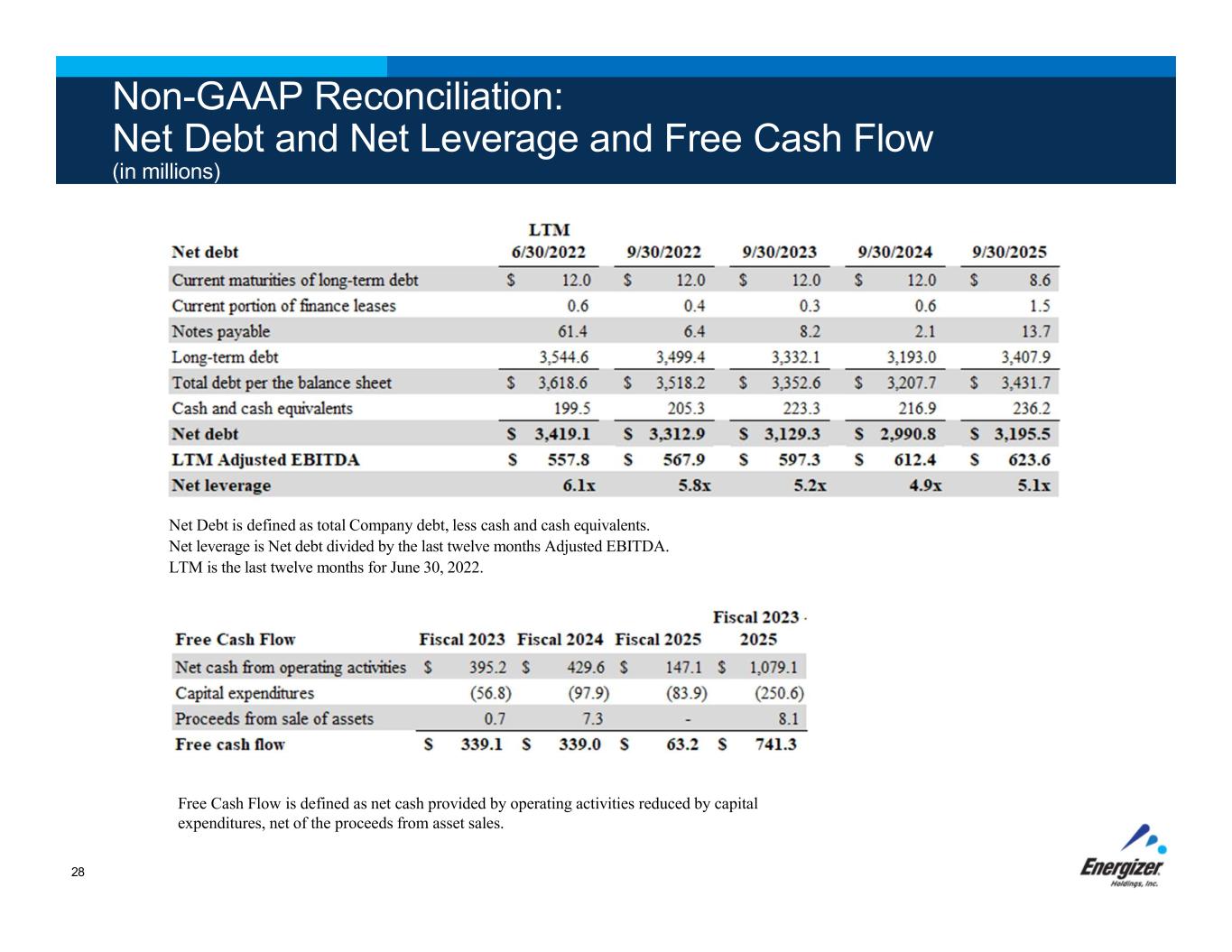

Non-GAAP Reconciliation: Net Debt and Net Leverage and Free Cash Flow (in millions) Net Debt is defined as total Company debt, less cash and cash equivalents. Net leverage is Net debt divided by the last twelve months Adjusted EBITDA. LTM is the last twelve months for June 30, 2022. 28 Free Cash Flow is defined as net cash provided by operating activities reduced by capital expenditures, net of the proceeds from asset sales.

Non-GAAP Reconciliation: FY 2026 Outlook (in millions – except per share data) 29