+ February 5, 2026 Q1 Fiscal 2026 Earnings .2

This document contains both historical and forward-looking statements. Forward-looking statements are not based on historical facts but instead reflect our expectations, estimates or projections concerning future results or events, including, without limitation, the future sales, gross margins, costs, earnings, cash flows, tax rates, packaging transition, and performance of the Company. These statements generally can be identified by the use of forward-looking words or phrases such as "believe," "expect," "expectation," "anticipate," "may," "could," "will," "intend," "belief," "estimate," "plan," "target," "predict," "likely," "should," "forecast," "outlook," or other similar words or phrases. These statements are not guarantees of performance and are inherently subject to known and unknown risks, uncertainties and assumptions that are difficult to predict and could cause our actual results to differ materially from those indicated by those statements. We cannot assure you that any of our expectations, estimates or projections will be achieved. The forward-looking statements included in this document are only made as of the date of this document and we disclaim any obligation to publicly update any forward-looking statement to reflect subsequent events or circumstances. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty. Numerous factors could cause our actual results and events to differ materially from those expressed or implied by forward-looking statements, including, without limitation: Global economic and financial market conditions beyond our control might materially and negatively impact us. Competition in our product categories might hinder our ability to execute our business strategy, achieve profitability, or maintain relationships with existing customers. Changes in the retail environment and consumer preferences could adversely affect our business, financial condition and results of operations. Loss or impairment of the reputation of our Company or our leading brands or failure of our marketing plans could have an adverse effect on our business. Loss of any of our principal customers could significantly decrease our sales and profitability. Our ability to meet our growth targets depends on successful product, marketing and operations innovation and successful responses to competitive innovation and changing consumer habits. We are subject to risks related to our international operations, including tariff and currency fluctuations, which could adversely affect our results of operations. We must successfully manage the demand, supply, and operational challenges brought on by any disease outbreak, including epidemics, pandemics, or similar widespread public health concerns. If we fail to protect our intellectual property rights, competitors may manufacture and market similar products, which could adversely affect our market share and results of operations. Changes in production costs, including raw material prices and transportation costs, from tariffs, inflation or otherwise, have adversely affected, and in the future could erode, our profit margins and negatively impact operating results. Our reliance on certain significant suppliers subjects us to numerous risks, including possible interruptions in supply, which could adversely affect our business. Our business is vulnerable to the availability of raw materials, as well as our ability to forecast customer demand and manage production capacity. The manufacturing facilities, supply channels or other business operations of the Company and our suppliers may be subject to disruption from events beyond our control. Our future results may be affected by our operational execution, including our ability to achieve cost savings as a result of any current or future restructuring efforts. If our goodwill and indefinite-lived intangible assets become impaired, we will be required to record impairment charges, which may be significant. Sales of certain of our products are seasonal and adverse weather conditions during our peak selling seasons for certain auto care products could have a material adverse effect. We may use artificial intelligence in our business, which could result in reputational harm, competitive harm, and legal liability, and adversely affect our operations. A failure of a key information technology system could adversely impact our ability to conduct business. We rely significantly on information technology and any inadequacy, interruption, theft or loss of data, malicious attack, integration failure, failure to maintain the security, confidentiality or privacy of sensitive data residing on our systems or other security failure of that technology could harm our ability to effectively operate our business and damage the reputation of our brands. We may not be able to attract, retain and develop key employees, as well as effectively manage human capital resources. We have significant debt obligations that could adversely affect our business. Our credit ratings are important to our cost of capital. We may experience losses or be subject to increased funding and expenses related to our pension plans. The estimates and assumptions on which our financial projections are based may prove to be inaccurate, which may cause our actual results to materially differ from our projections, which may adversely affect our future profitability, cash flows and stock price. If we pursue strategic acquisitions, divestitures or joint ventures, we might experience operating difficulties, dilution, and other consequences that may harm our business, financial condition, and operating results, and we may not be able to successfully consummate favorable transactions or successfully integrate acquired businesses. Our business involves the potential for product liability claims, labeling claims, commercial claims and other legal claims against us, which could affect our results of operations and financial condition and result in product recalls or withdrawals. Our business is subject to increasing government regulations in both the U.S. and abroad that could impose material costs. Section 45X of the Internal Revenue Code contains production tax credits for certain battery components. Our ability to benefit from Section 45X production tax credits is not guaranteed and is dependent upon the federal government's ongoing implementation, guidance, regulations, or rulemakings. Increased focus by governmental and non-governmental organizations, customers, consumers and shareholders on sustainability issues, including those related to climate change, may have an adverse effect on our business, financial condition and results of operations and damage our reputation. We are subject to environmental laws and regulations that may expose us to significant liabilities and have a material adverse effect on our results of operations and financial condit ion. In addition, other risks and uncertainties not presently known to us or that we consider immaterial could affect the accuracy of any such forward-looking statements. The list of factors above is illustrative, but by no means exhaustive. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty. Additional risks and uncertainties include those detailed from time to time in our publicly filed documents, including those described under the heading “Risk Factors” in our Form 10-K filed with the Securities and Exchange Commission on November 18, 2025. Forward-Looking Statements 2

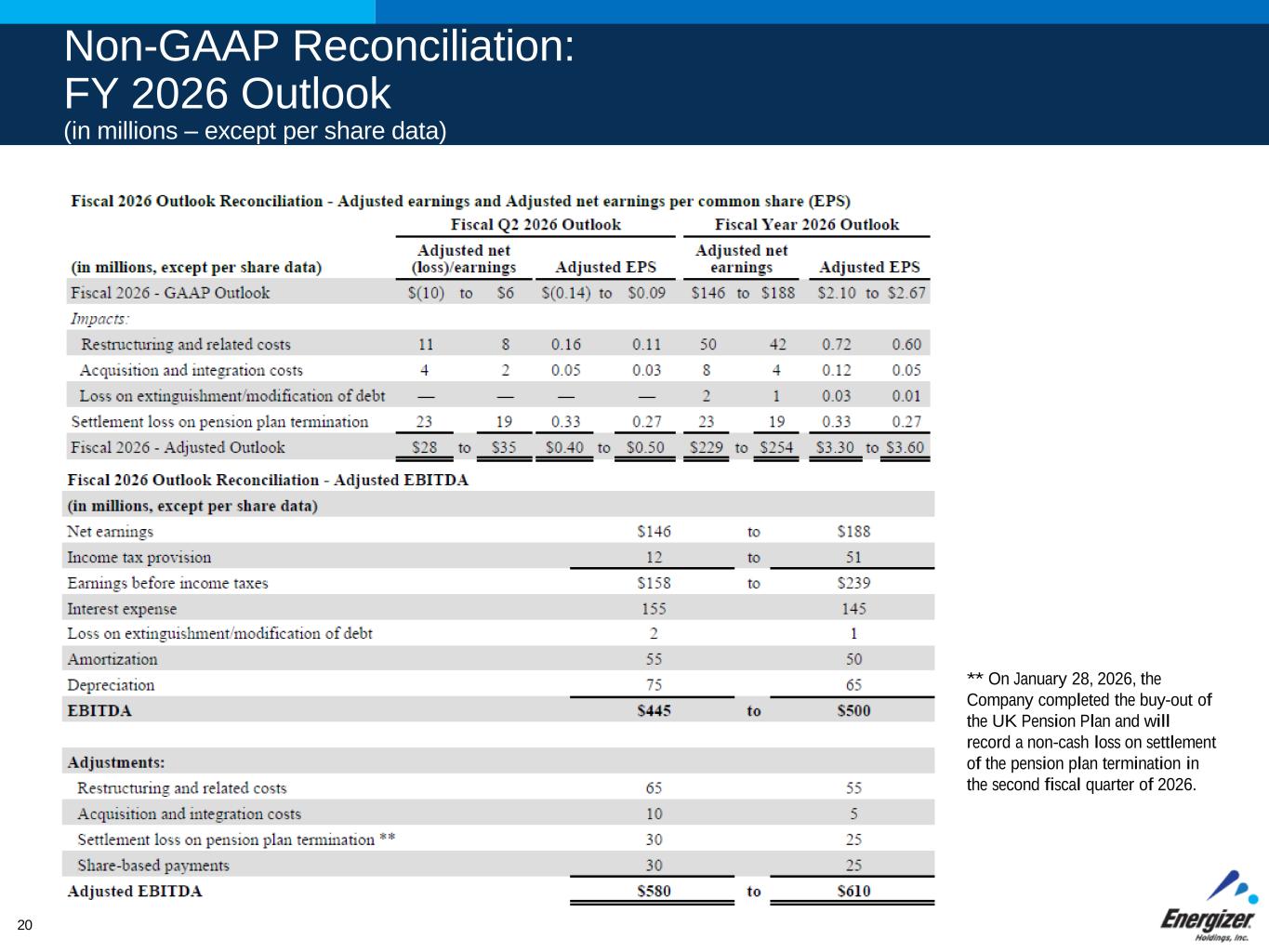

Non-GAAP Financial Measures The Company reports its financial results in accordance with accounting principles generally accepted in the U.S. ("GAAP"). However, management believes that certain non- GAAP financial measures provide users with additional meaningful comparisons to the corresponding historical or future period, and are used for management incentive compensation. These non-GAAP financial measures exclude items that are not reflective of the Company's on-going operating performance, such as restructuring and related costs, network transition costs, acquisition and integration costs and the loss on extinguishment/modification of debt. In addition, these measures help investors to analyze year over year comparability when excluding currency fluctuations as well as other Company initiatives that are not on-going. We believe these non-GAAP financial measures are an enhancement to assist investors in understanding our business and in performing analysis consistent with financial models developed by research analysts. Investors should consider non-GAAP measures in addition to, not as a substitute for, or superior to, the comparable GAAP measures. In addition, these non-GAAP measures may not be the same as similar measures used by other companies due to possible differences in methods and in the items being adjusted. We provide the following non-GAAP measures and calculations, as well as the corresponding reconciliation to the closest GAAP measure in the following supplemental schedules: Organic. This is the non-GAAP financial measurement of the change in Net sales or segment profit that excludes or otherwise adjusts for the Acquisition impact, Change in highly inflationary markets and Impact of currency from the changes in foreign currency exchange rates as defined below: • Acquisition impact. The Company completed the Advanced Power Solutions acquisition on May 2, 2025. These adjustments include the impact of the operations associated with the acquired branded battery business. The Company transitioned from these branded businesses to legacy brands by December 31, 2025. This does not include the impact of acquisition and integration costs associated with this acquisition. • Change in highly inflationary markets. The Company is presenting separately all changes in sales and segment profit from our Egypt and Argentina affiliates due to the designation of the economies as highly inflationary as of October 1, 2024 and July 1, 2018, respectively. • Impact of currency. The Company evaluates the operating performance of our Company on a currency neutral basis. The Impact of Currency is the change in foreign currency exchange rates year-over-year on reported results, which is calculated by comparing the value of current year foreign operations at the current period USD exchange rate versus the value of current year foreign operations at the prior period USD exchange rate. The impact of currency also includes (gains)/losses of currency hedging programs, and it excludes highly inflationary markets. •Adjusted Comparisons. Detail for adjusted gross profit and adjusted gross margin are also supplemental non-GAAP measure disclosures. These measures exclude the impact of restructuring and related costs and network transition costs. •Free Cash Flow. Free Cash Flow is defined as net cash provided by operating activities reduced by capital expenditures. •Adjusted Net Earnings and Adjusted Diluted Net Earnings Per Common Share (EPS). These measures exclude the impact of restructuring and related costs, the costs related to acquisition and integration, network transition costs and the loss/(gain) on extinguishment/modification of debt. •EBITDA and Adjusted EBITDA. EBITDA is defined as net (loss)/earnings before income tax (benefit)/provision, interest, the loss/(gain) on extinguishment/modification of debt, and depreciation and amortization. Adjusted EBITDA further excludes the impact of costs related to restructuring, network transition costs, acquisition and integration costs, and share based payments. 3

+ Q1 Fiscal 2026 Financial Results

FOR INTERNAL USE ONLY – DO NOT DISTRIBUTE5 Energizer’s Fiscal 2026 strategic priorities Restore Organic Net Sales growth through strengthened distribution and advancing innovation Rebuild Gross Margins impacted by tariffs Return to historical Free Cash Flow profile Disciplined deployment of Cash to maximize shareholder value 5

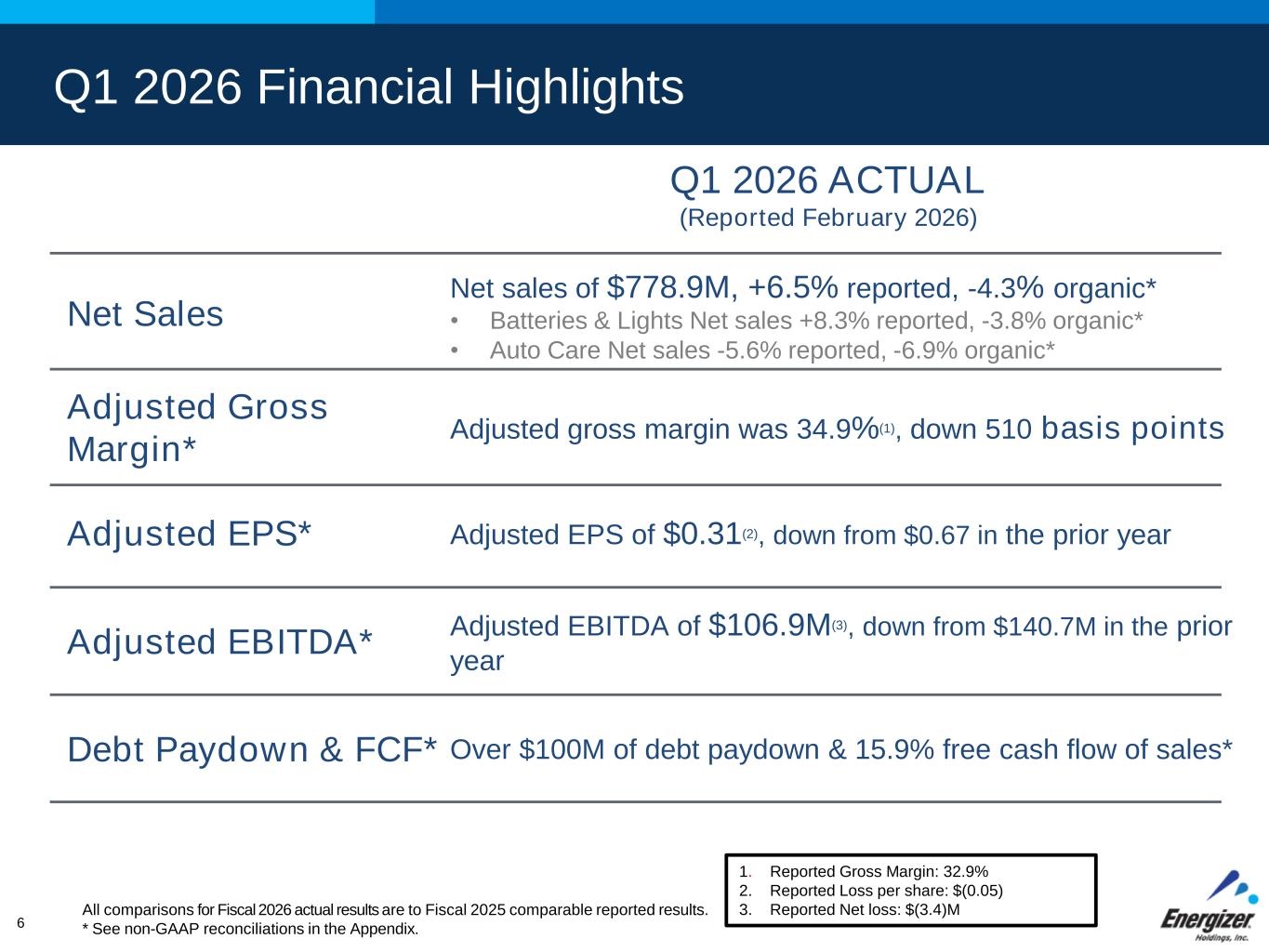

Q1 2026 Financial Highlights Q1 2026 ACTUAL (Reported February 2026) 6 1. Reported Gross Margin: 32.9% 2. Reported Loss per share: $(0.05) 3. Reported Net loss: $(3.4)M Net sales of $778.9M, +6.5% reported, -4.3% organic* • Batteries & Lights Net sales +8.3% reported, -3.8% organic* • Auto Care Net sales -5.6% reported, -6.9% organic* Adjusted gross margin was 34.9%(1), down 510 basis points Adjusted EPS of $0.31(2), down from $0.67 in the prior year Adjusted EBITDA of $106.9M(3), down from $140.7M in the prior year Net Sales Adjusted Gross Margin* Adjusted EPS* Adjusted EBITDA* Over $100M of debt paydown & 15.9% free cash flow of sales*Debt Paydown & FCF* All comparisons for Fiscal 2026 actual results are to Fiscal 2025 comparable reported results. * See non-GAAP reconciliations in the Appendix.

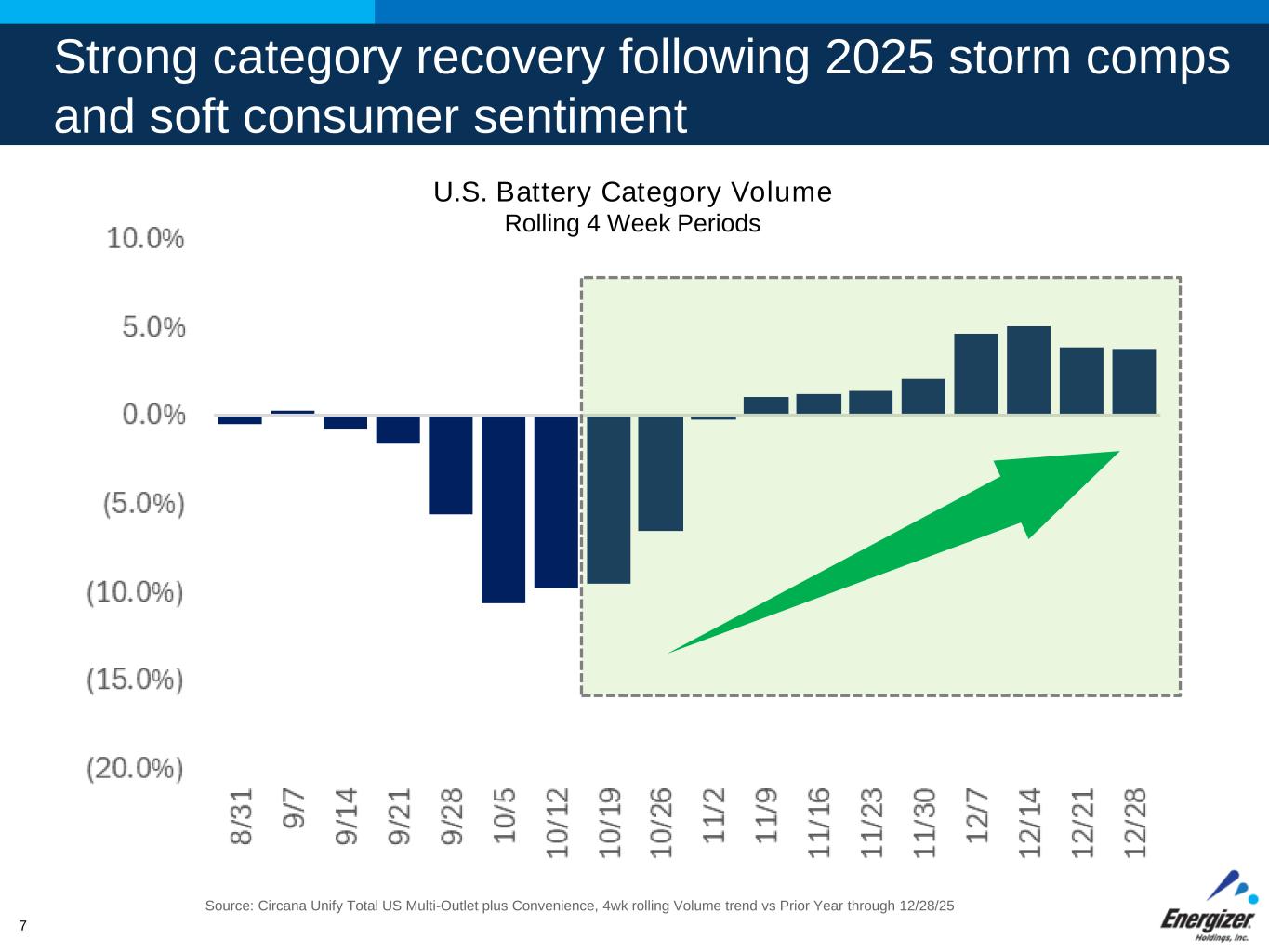

Strong category recovery following 2025 storm comps and soft consumer sentiment Source: Circana Unify Total US Multi-Outlet plus Convenience, 4wk rolling Volume trend vs Prior Year through 12/28/25 U.S. Battery Category Volume Rolling 4 Week Periods 7

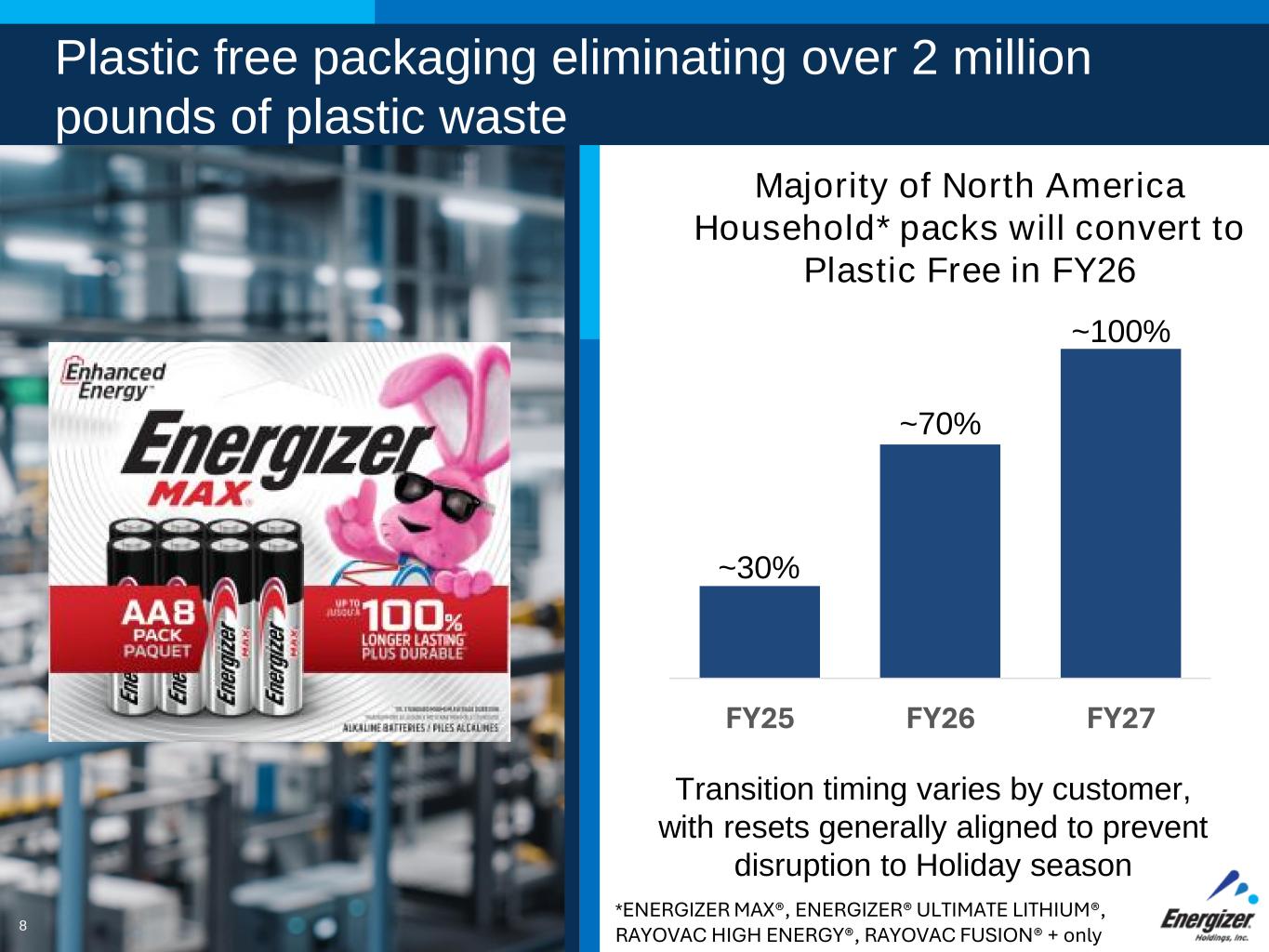

Plastic free packaging eliminating over 2 million pounds of plastic waste 8 FY25 FY26 FY27 ~30% ~70% ~100% Transition timing varies by customer, with resets generally aligned to prevent disruption to Holiday season 8 Majority of North America Household* packs will convert to Plastic Free in FY26 *ENERGIZER MAX®, ENERGIZER® ULTIMATE LITHIUM®, RAYOVAC HIGH ENERGY®, RAYOVAC FUSION® + only

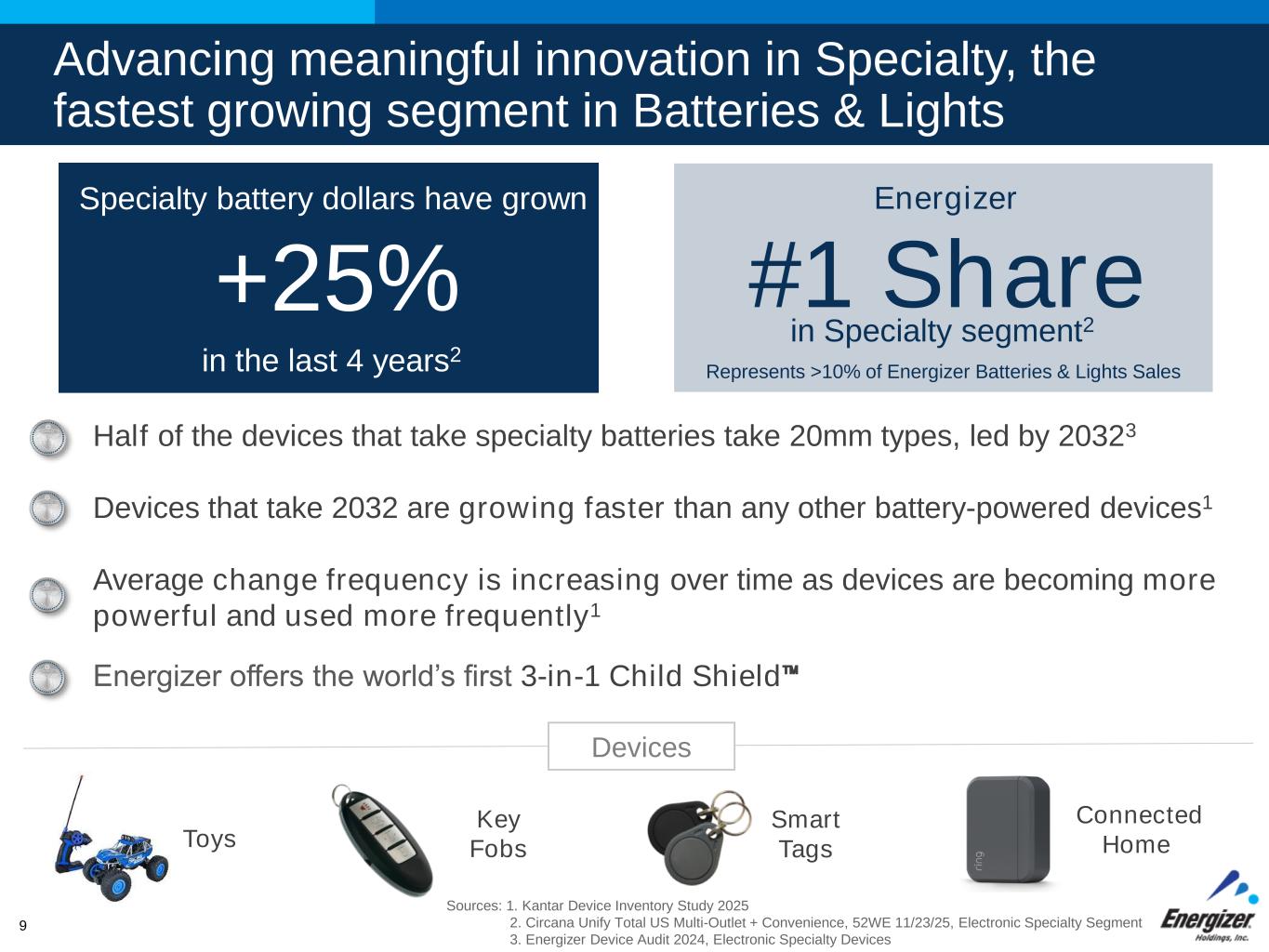

FOR INTERNAL USE ONLY – DO NOT DISTRIBUTE Half of the devices that take specialty batteries take 20mm types, led by 20323 Devices that take 2032 are growing faster than any other battery-powered devices1 Average change frequency is increasing over time as devices are becoming more powerful and used more frequently1 Energizer offers the world’s first 3-in-1 Child Shield™ Smart Tags Connected Home Key FobsToys +25% Specialty battery dollars have grown in the last 4 years2 Advancing meaningful innovation in Specialty, the fastest growing segment in Batteries & Lights #1 Share Energizer in Specialty segment2 Sources: 1. Kantar Device Inventory Study 2025 2. Circana Unify Total US Multi-Outlet + Convenience, 52WE 11/23/25, Electronic Specialty Segment 3. Energizer Device Audit 2024, Electronic Specialty Devices Represents >10% of Energizer Batteries & Lights Sales Devices 9

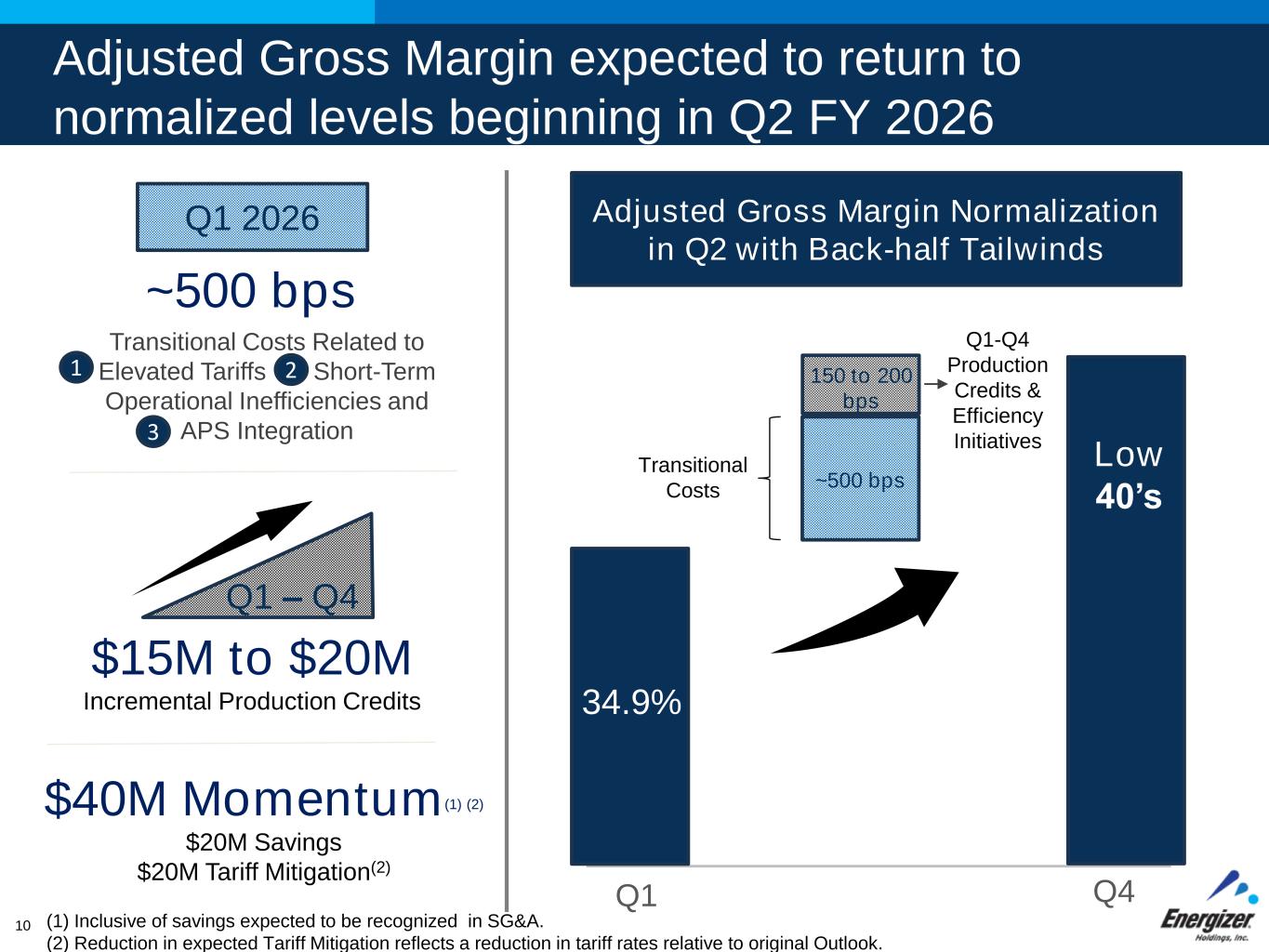

Q1 Q4 Adjusted Gross Margin expected to return to normalized levels beginning in Q2 FY 2026 ~500 bps 34.9% Low 40’s Q1-Q4 Production Credits & Efficiency Initiatives ~500 bps Transitional Costs Related to Elevated Tariffs Short-Term Operational Inefficiencies and APS Integration $15M to $20M Incremental Production Credits $40M Momentum(1) (2) $20M Savings $20M Tariff Mitigation(2) Adjusted Gross Margin Normalization in Q2 with Back-half Tailwinds Q1 2026 1 2 3 Q1 – Q4 (1) Inclusive of savings expected to be recognized in SG&A. (2) Reduction in expected Tariff Mitigation reflects a reduction in tariff rates relative to original Outlook. 150 to 200 bps Transitional Costs 10

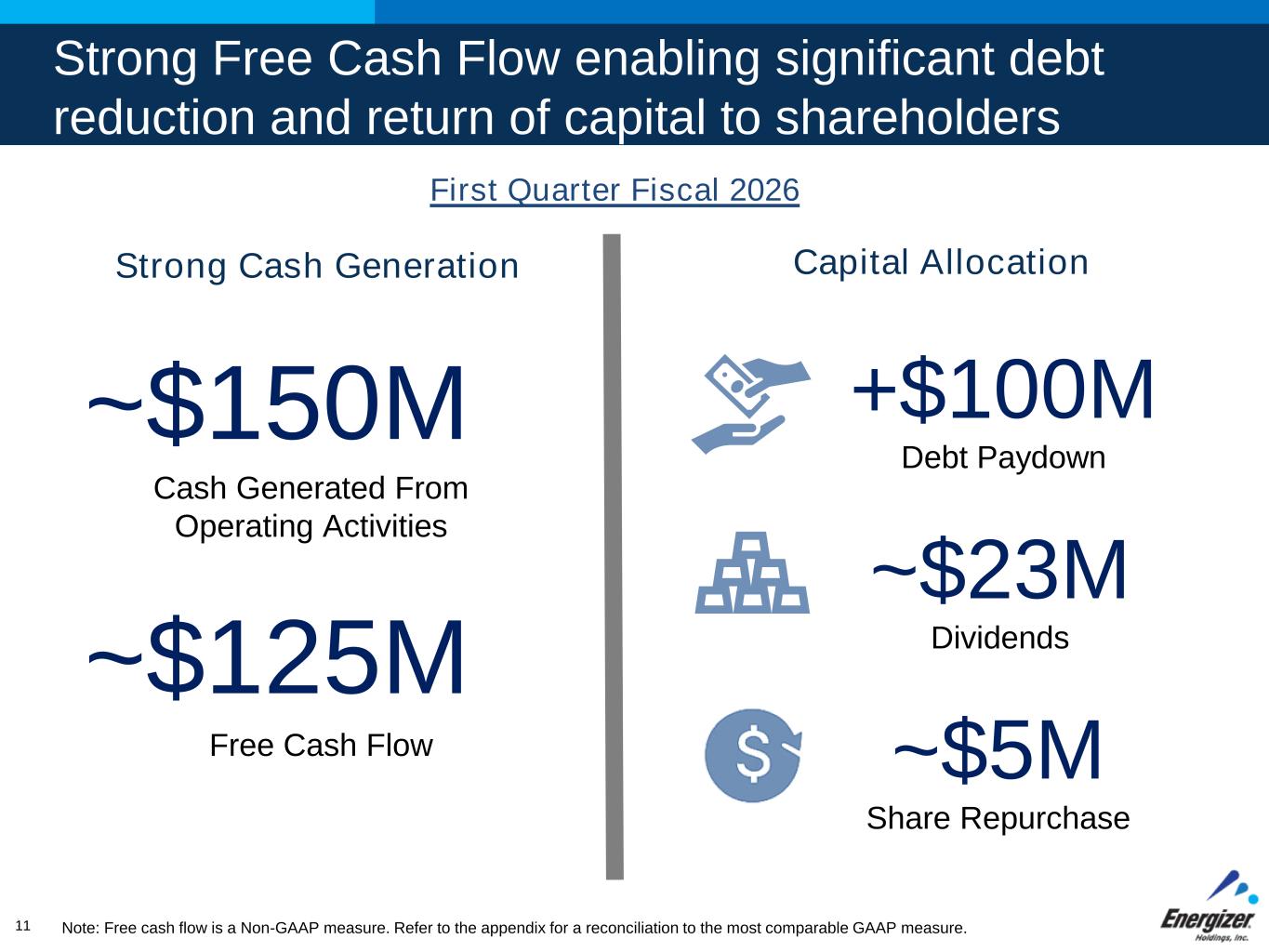

Capital Allocation ~$23M Dividends Strong Free Cash Flow enabling significant debt reduction and return of capital to shareholders 11 Strong Cash Generation Note: Free cash flow is a Non-GAAP measure. Refer to the appendix for a reconciliation to the most comparable GAAP measure. +$100M Debt Paydown ~$5M Share Repurchase ~$150M ~$125M Cash Generated From Operating Activities Free Cash Flow First Quarter Fiscal 2026 11

+ Fiscal 2026 & Q2 Outlook

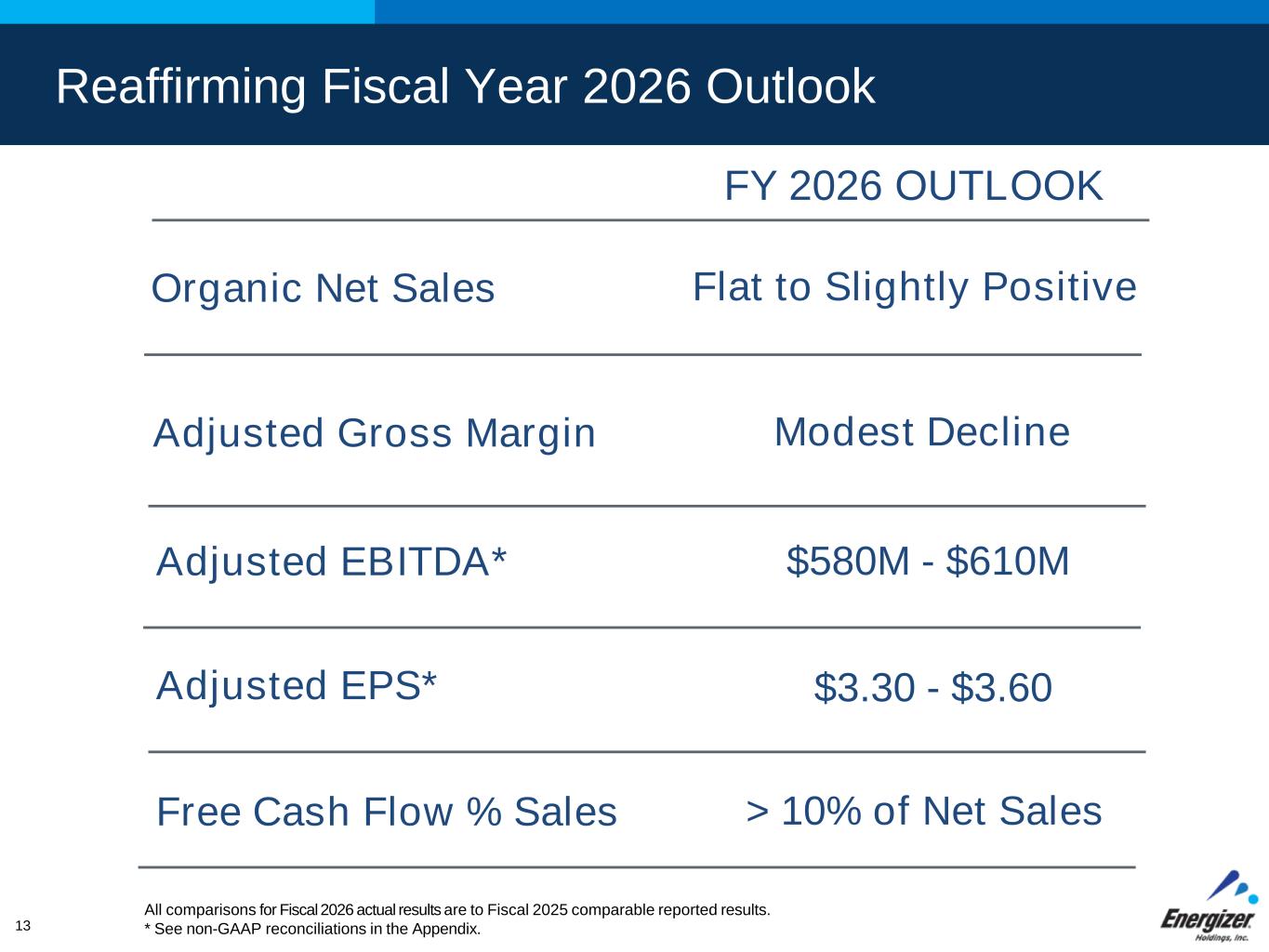

Reaffirming Fiscal Year 2026 Outlook Organic Net Sales Flat to Slightly Positive Adjusted Gross Margin Modest Decline Adjusted EBITDA* $580M - $610M Adjusted EPS* $3.30 - $3.60 Free Cash Flow % Sales > 10% of Net Sales 13 FY 2026 OUTLOOK All comparisons for Fiscal 2026 actual results are to Fiscal 2025 comparable reported results. * See non-GAAP reconciliations in the Appendix.

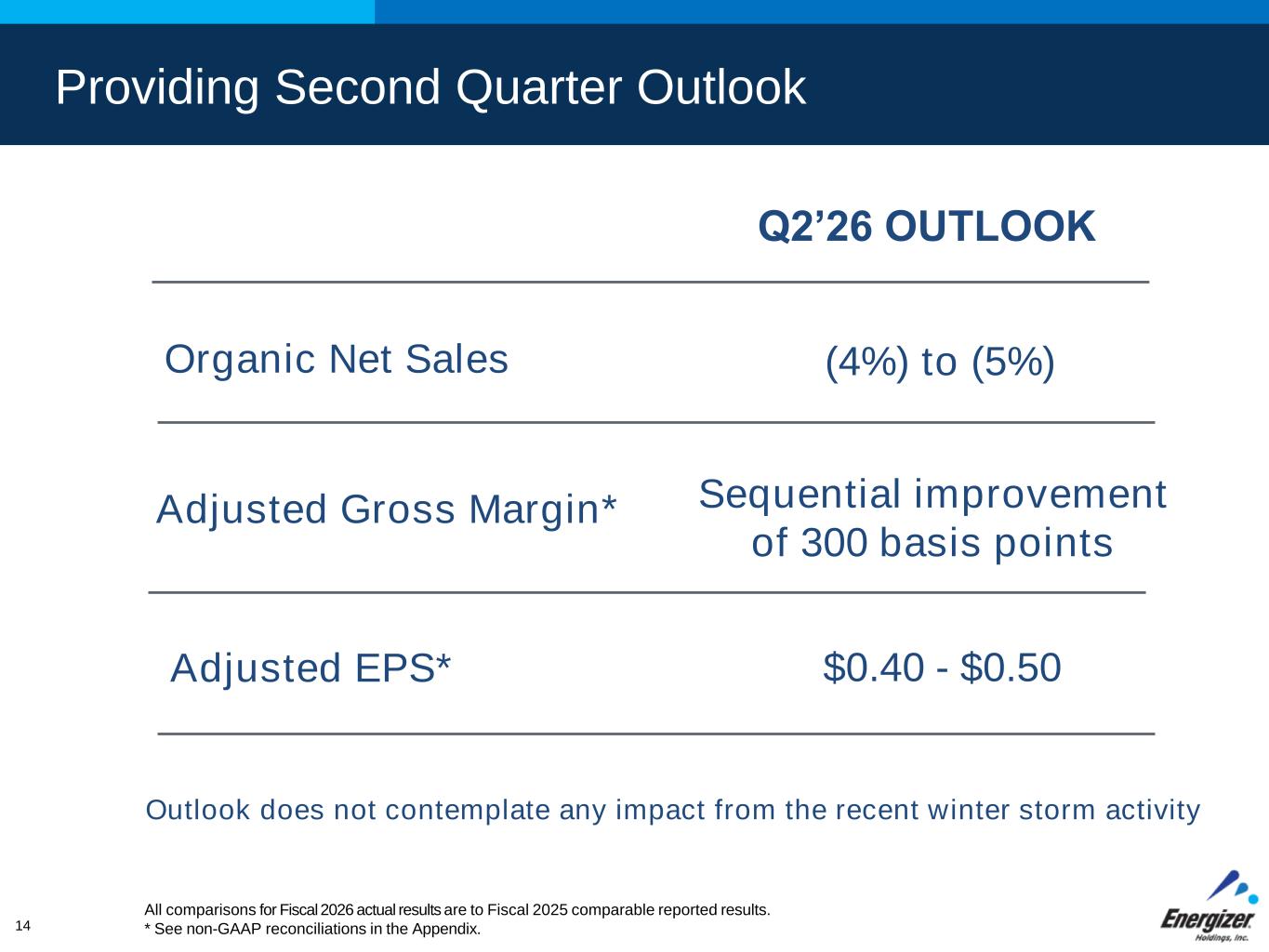

Providing Second Quarter Outlook Organic Net Sales (4%) to (5%) Adjusted Gross Margin* Sequential improvement of 300 basis points Adjusted EPS* $0.40 - $0.50 Q2’26 OUTLOOK All comparisons for Fiscal 2026 actual results are to Fiscal 2025 comparable reported results. * See non-GAAP reconciliations in the Appendix. Outlook does not contemplate any impact from the recent winter storm activity 14

Appendix Materials: Non-GAAP Reconciliations 15

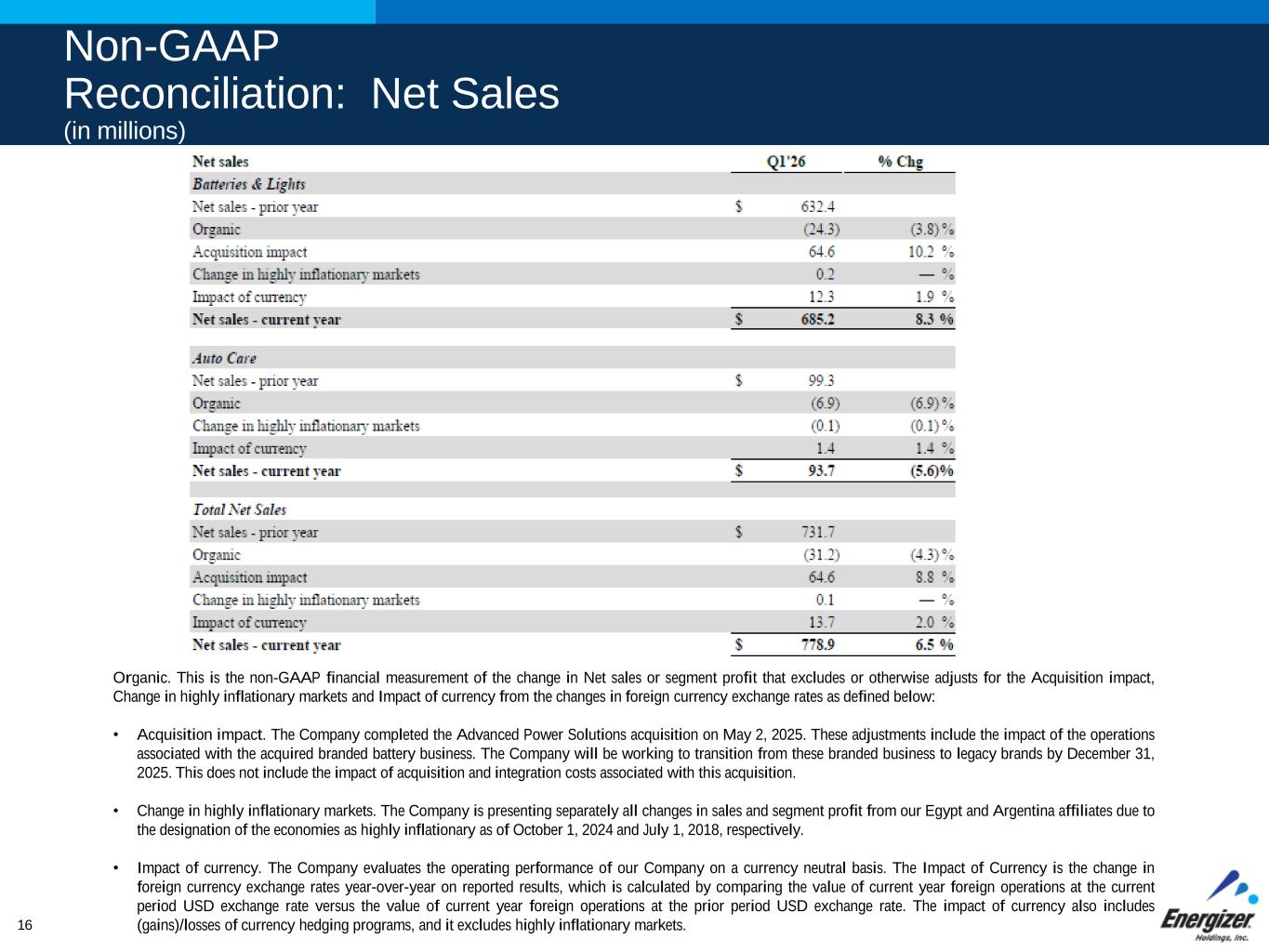

Non-GAAP Reconciliation: Net Sales (in millions) Organic. This is the non-GAAP financial measurement of the change in Net sales or segment profit that excludes or otherwise adjusts for the Acquisition impact, Change in highly inflationary markets and Impact of currency from the changes in foreign currency exchange rates as defined below: • Acquisition impact. The Company completed the Advanced Power Solutions acquisition on May 2, 2025. These adjustments include the impact of the operations associated with the acquired branded battery business. The Company will be working to transition from these branded business to legacy brands by December 31, 2025. This does not include the impact of acquisition and integration costs associated with this acquisition. • Change in highly inflationary markets. The Company is presenting separately all changes in sales and segment profit from our Egypt and Argentina affiliates due to the designation of the economies as highly inflationary as of October 1, 2024 and July 1, 2018, respectively. • Impact of currency. The Company evaluates the operating performance of our Company on a currency neutral basis. The Impact of Currency is the change in foreign currency exchange rates year-over-year on reported results, which is calculated by comparing the value of current year foreign operations at the current period USD exchange rate versus the value of current year foreign operations at the prior period USD exchange rate. The impact of currency also includes (gains)/losses of currency hedging programs, and it excludes highly inflationary markets.16

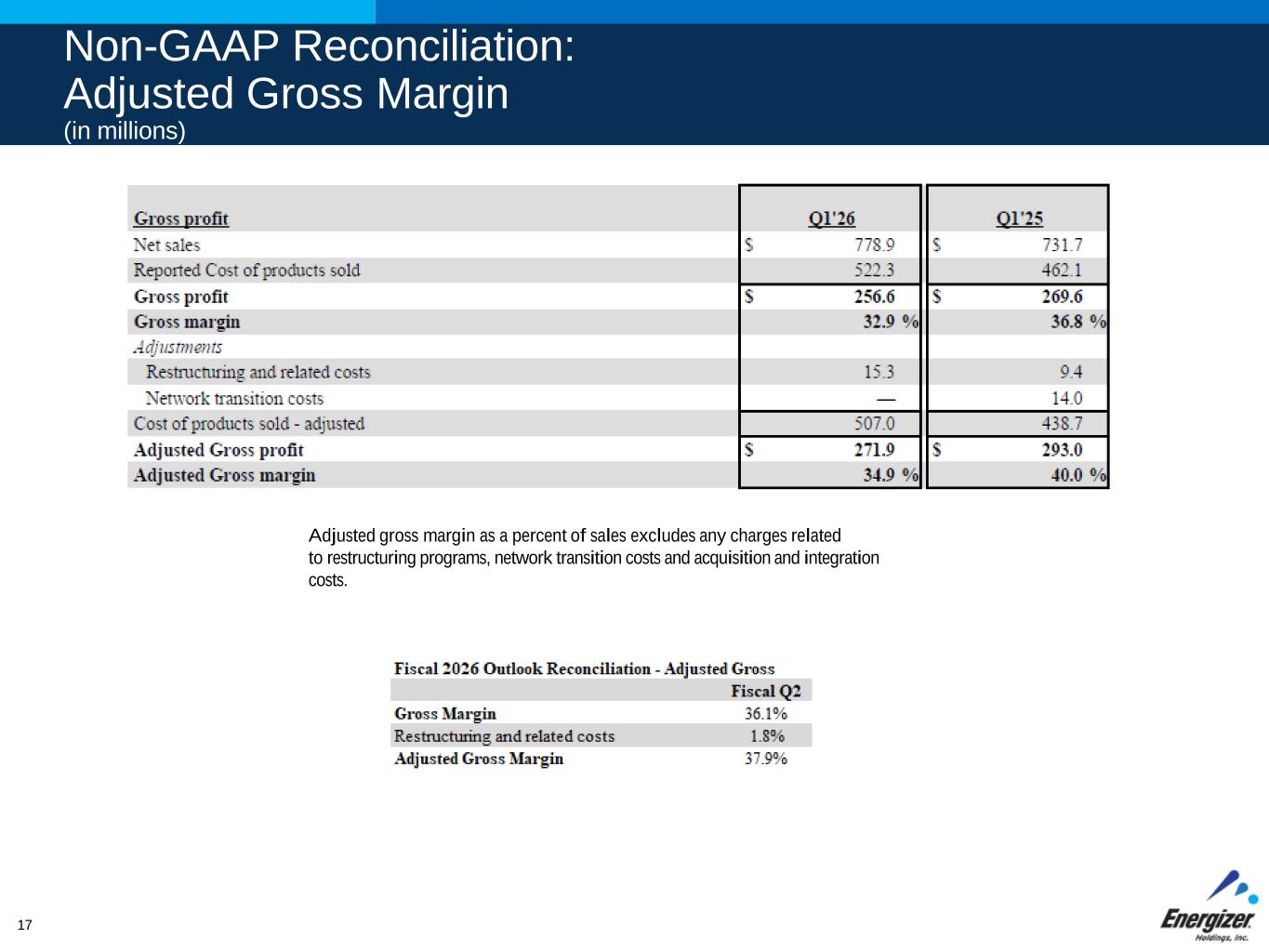

Non-GAAP Reconciliation: Adjusted Gross Margin (in millions) Adjusted gross margin as a percent of sales excludes any charges related to restructuring programs, network transition costs and acquisition and integration costs. 17

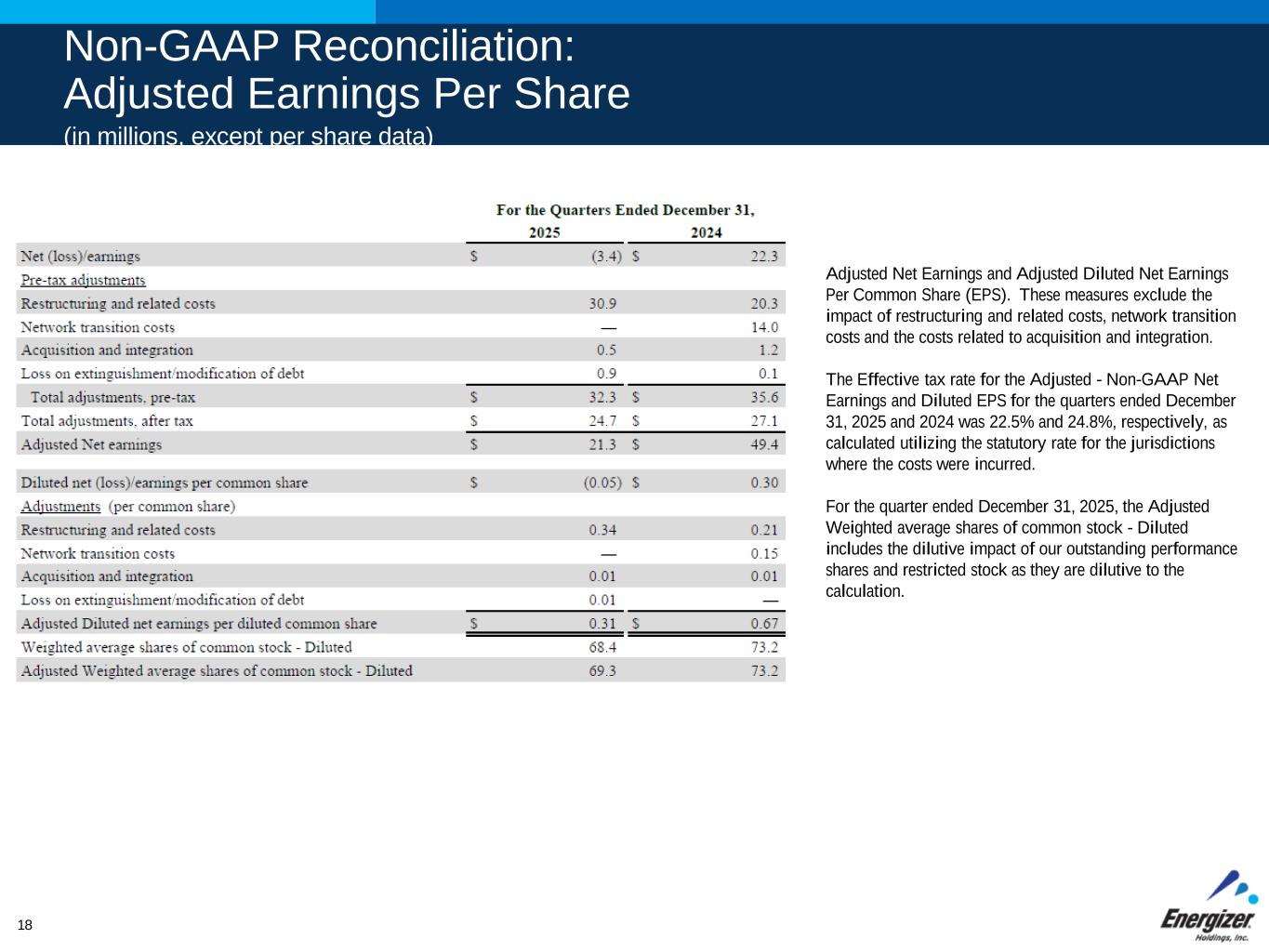

Non-GAAP Reconciliation: Adjusted Earnings Per Share (in millions, except per share data) Adjusted Net Earnings and Adjusted Diluted Net Earnings Per Common Share (EPS). These measures exclude the impact of restructuring and related costs, network transition costs and the costs related to acquisition and integration. The Effective tax rate for the Adjusted - Non-GAAP Net Earnings and Diluted EPS for the quarters ended December 31, 2025 and 2024 was 22.5% and 24.8%, respectively, as calculated utilizing the statutory rate for the jurisdictions where the costs were incurred. For the quarter ended December 31, 2025, the Adjusted Weighted average shares of common stock - Diluted includes the dilutive impact of our outstanding performance shares and restricted stock as they are dilutive to the calculation. 18

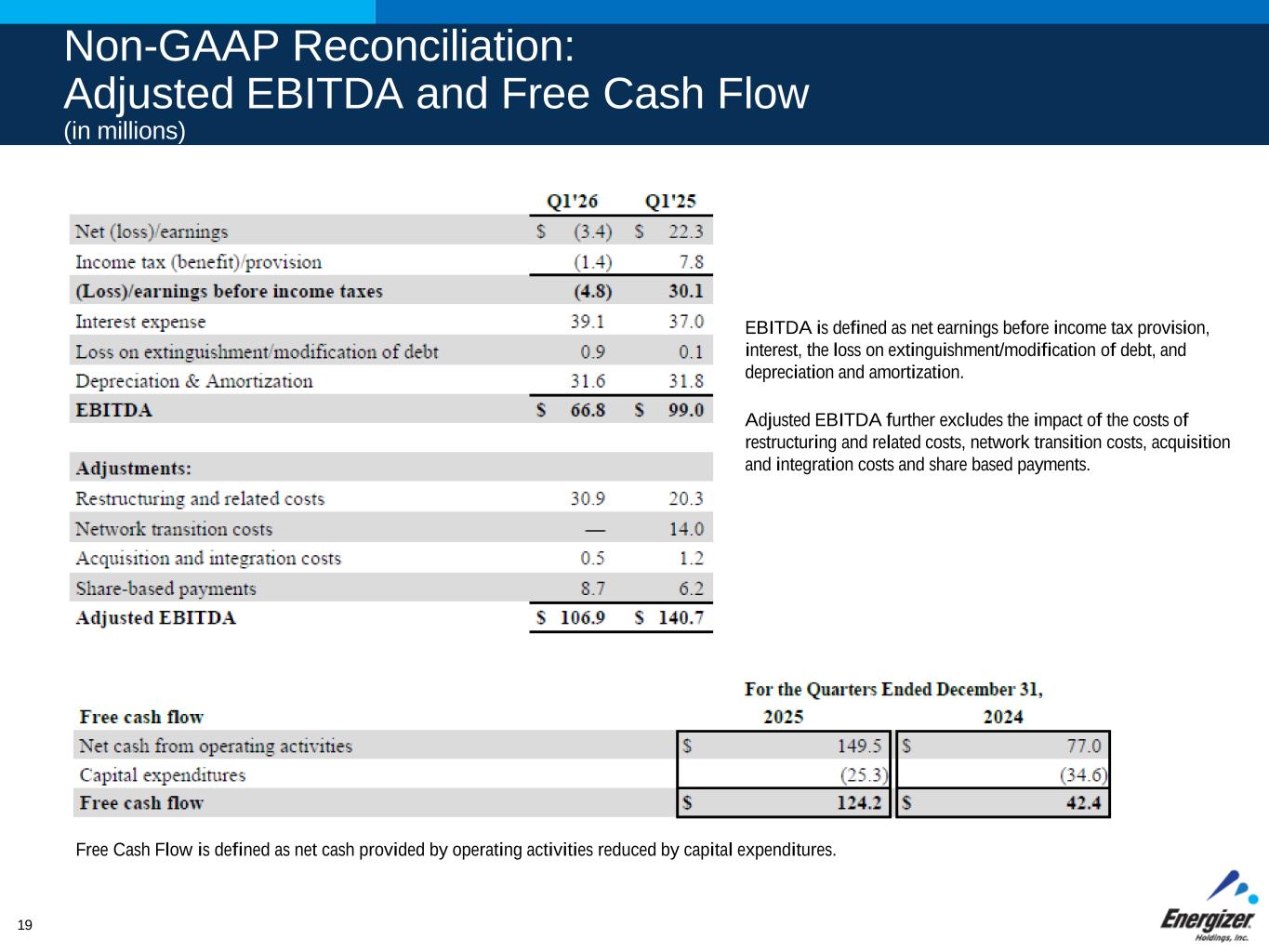

Non-GAAP Reconciliation: Adjusted EBITDA and Free Cash Flow (in millions) EBITDA is defined as net earnings before income tax provision, interest, the loss on extinguishment/modification of debt, and depreciation and amortization. Adjusted EBITDA further excludes the impact of the costs of restructuring and related costs, network transition costs, acquisition and integration costs and share based payments. 19 Free Cash Flow is defined as net cash provided by operating activities reduced by capital expenditures.

Non-GAAP Reconciliation: FY 2026 Outlook (in millions – except per share data) 20 ** On January 28, 2026, the Company completed the buy-out of the UK Pension Plan and will record a non-cash loss on settlement of the pension plan termination in the second fiscal quarter of 2026.