First Quarter 2025 Supplemental .2

2 Forward-Looking Statements Certain statements contained in this supplemental, filed in conjunction with the First Quarter 2025 Earnings Press Release, including statements relating to American Healthcare REIT, Inc.'s (the "Company") expectations regarding its performance, interest expense savings, balance sheet, net income or loss per diluted share, NAREIT FFO per diluted share, NFFO per diluted share, NOI growth, total portfolio Same-Store NOI growth, segment-level Same-Store NOI growth or decline, occupancy, revenue growth, margin expansion, purchases and sales of assets, development plans, and plans for Trilogy may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The Company intends for all such forward-looking statements to be covered by the applicable safe harbor provisions for forward-looking statements contained in those acts. Such forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “can,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” “possible,” “initiatives,” “focus,” “seek,” “objective,” “goal,” “strategy,” “plan,” “potential,” “potentially,” “preparing,” “projected,” “future,” “long-term,” “once,” “should,” “could,” “would,” “might,” “uncertainty,” or other similar words. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this supplemental. Any such forward-looking statements are based on current expectations, estimates and projections about the industry and markets in which the Company operates and beliefs of, and assumptions made by, the Company's management and involve known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied therein, including, without limitation, risks disclosed in the Company’s periodic reports as filed with the Securities and Exchange Commission. Except as required by law, the Company does not undertake any obligation to update or revise any forward-looking statements contained in this Supplemental. Disclaimers

3 Non-GAAP Financial Measures The Company’s reported results are presented in accordance with GAAP. The Company also discloses the following non-GAAP financial measures: EBITDA, Adjusted EBITDA, Net Debt-to-Annualized Adjusted EBITDA, NAREIT FFO, NFFO, NOI and Same-Store NOI. The Company believes these non-GAAP financial measures are useful supplemental measures of its operating performance and used by investors and analysts to compare the operating performance of the Company between periods and to other REITs or companies on a consistent basis without having to account for differences caused by unanticipated and/or incalculable items. Definitions of the non-GAAP financial measures used herein and reconciliations to the most directly comparable financial measure calculated in accordance with GAAP can be found at the end of this Supplemental. See below for further information regarding the Company's non-GAAP financial measures. EBITDA and Adjusted EBITDA Management uses earnings before interest, taxes, depreciation and amortization (“EBITDA”) and Adjusted EBITDA to facilitate internal and external comparisons to our historical operating results and in making operating decisions. EBITDA and Adjusted EBITDA are widely used by investors, lenders, credit and equity analysts in the valuation, comparison, and investment recommendations of companies. Additionally, EBITDA and Adjusted EBITDA are utilized by our Board of Directors to evaluate management. Neither EBITDA nor Adjusted EBITDA represents net income (loss) or cash flows provided by operating activities as determined in accordance with GAAP and should not be considered as alternative measures of profitability or liquidity. Finally, EBITDA and Adjusted EBITDA may not be comparable to similarly entitled items reported by other REITs or other companies. In addition, management uses Net Debt-to-Annualized Adjusted EBITDA as a measure of our ability to service our debt. NAREIT Funds from Operations (FFO) and Normalized Funds from Operations (NFFO) We believe that the use of FFO, which excludes the impact of real estate-related depreciation and amortization and impairments, provides a further understanding of our operating performance to investors, industry analysts and our management, and when compared year over year, reflects the impact on our operations from trends in occupancy rates, rental rates, operating costs, general and administrative expenses and interest costs, which may not be immediately apparent from net income (loss) as determined in accordance with GAAP. However, FFO and NFFO should not be construed to be (i) more relevant or accurate than the current GAAP methodology in calculating net income (loss) as an indicator of our operating performance, (ii) more relevant or accurate than GAAP cash flows from operations as an indicator of our liquidity or (iii) indicative of funds available to fund our cash needs, including our ability to make distributions to our stockholders. The method utilized to evaluate the value and performance of real estate under GAAP should be construed as a more relevant measure of operational performance and considered more prominently than the non-GAAP FFO and NFFO measures and the adjustments to GAAP in calculating FFO and NFFO. Presentation of this information is intended to provide useful information to investors, industry analysts and management as they compare the operating performance metrics used by the REIT industry, although it should be noted that some REITs may use different methods of calculating funds from operations and normalized funds from operations, so comparisons with such REITs may not be meaningful. Net Operating Income We believe that NOI, Cash NOI, Pro-Rata Cash NOI and Same-Store NOI are appropriate supplemental performance measures to reflect the performance of our operating assets because NOI, Cash NOI, Pro-Rata Cash NOI and Same-Store NOI exclude certain items that are not associated with the operations of the properties. We believe that NOI, Cash NOI, Pro-Rata Cash NOI and Same-Store NOI are widely accepted measures of comparative operating performance in the real estate community and is useful to investors in understanding the profitability and operating performance of our property portfolio. However, our use of the terms NOI, Cash NOI, Pro-Rata Cash NOI and Same-Store NOI may not be comparable to that of other real estate companies as they may have different methodologies for computing these amounts. NOI, Cash NOI, Pro-Rata Cash NOI and Same-Store NOI are not equivalent to our net income (loss) as determined under GAAP and may not be a useful measure in measuring operational income or cash flows. Furthermore, NOI, Cash NOI, Pro-Rata Cash NOI and Same-Store NOI should not be considered as alternatives to net income (loss) as an indication of our operating performance or as an alternative to cash flows from operations as an indication of our liquidity. NOI, Cash NOI, Pro-Rata Cash NOI and Same-Store NOI should not be construed to be more relevant or accurate than the GAAP methodology in calculating net income (loss). NOI, Cash NOI, Pro-Rata Cash NOI and Same-Store NOI should be reviewed in conjunction with other measurements as an indication of our performance. Disclaimers

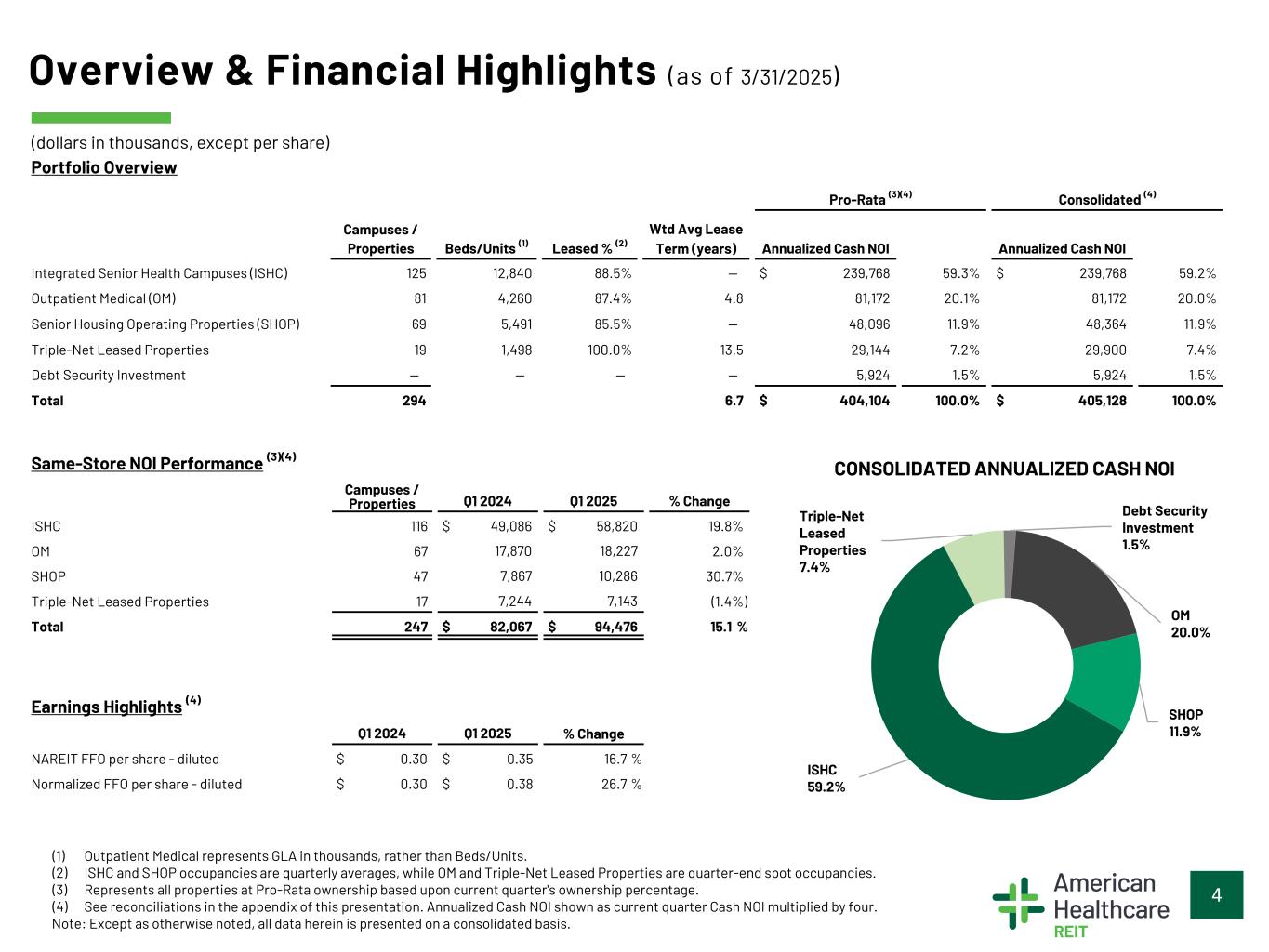

4 Overview & Financial Highlights (as of 3/31/2025) (dollars in thousands, except per share) Portfolio Overview Pro-Rata (3)(4) Consolidated (4) Campuses / Properties Beds/Units (1) Leased % (2) Wtd Avg Lease Term (years) Annualized Cash NOI Annualized Cash NOI Integrated Senior Health Campuses (ISHC) 125 12,840 88.5% — $ 239,768 59.3% $ 239,768 59.2% Outpatient Medical (OM) 81 4,260 87.4% 4.8 81,172 20.1% 81,172 20.0% Senior Housing Operating Properties (SHOP) 69 5,491 85.5% — 48,096 11.9% 48,364 11.9% Triple-Net Leased Properties 19 1,498 100.0% 13.5 29,144 7.2% 29,900 7.4% Debt Security Investment — — — — 5,924 1.5% 5,924 1.5% Total 294 6.7 $ 404,104 100.0% $ 405,128 100.0% CONSOLIDATED ANNUALIZED CASH NOI Debt Security Investment 1.5% OM 20.0% SHOP 11.9% ISHC 59.2% Triple-Net Leased Properties 7.4% (1) Outpatient Medical represents GLA in thousands, rather than Beds/Units. (2) ISHC and SHOP occupancies are quarterly averages, while OM and Triple-Net Leased Properties are quarter-end spot occupancies. (3) Represents all properties at Pro-Rata ownership based upon current quarter's ownership percentage. (4) See reconciliations in the appendix of this presentation. Annualized Cash NOI shown as current quarter Cash NOI multiplied by four. Note: Except as otherwise noted, all data herein is presented on a consolidated basis. Earnings Highlights (4) Q1 2024 Q1 2025 % Change NAREIT FFO per share - diluted $ 0.30 $ 0.35 16.7 % Normalized FFO per share - diluted $ 0.30 $ 0.38 26.7 % Same-Store NOI Performance (3)(4) Campuses / Properties Q1 2024 Q1 2025 % Change ISHC 116 $ 49,086 $ 58,820 19.8% OM 67 17,870 18,227 2.0% SHOP 47 7,867 10,286 30.7% Triple-Net Leased Properties 17 7,244 7,143 (1.4%) Total 247 $ 82,067 $ 94,476 15.1 %

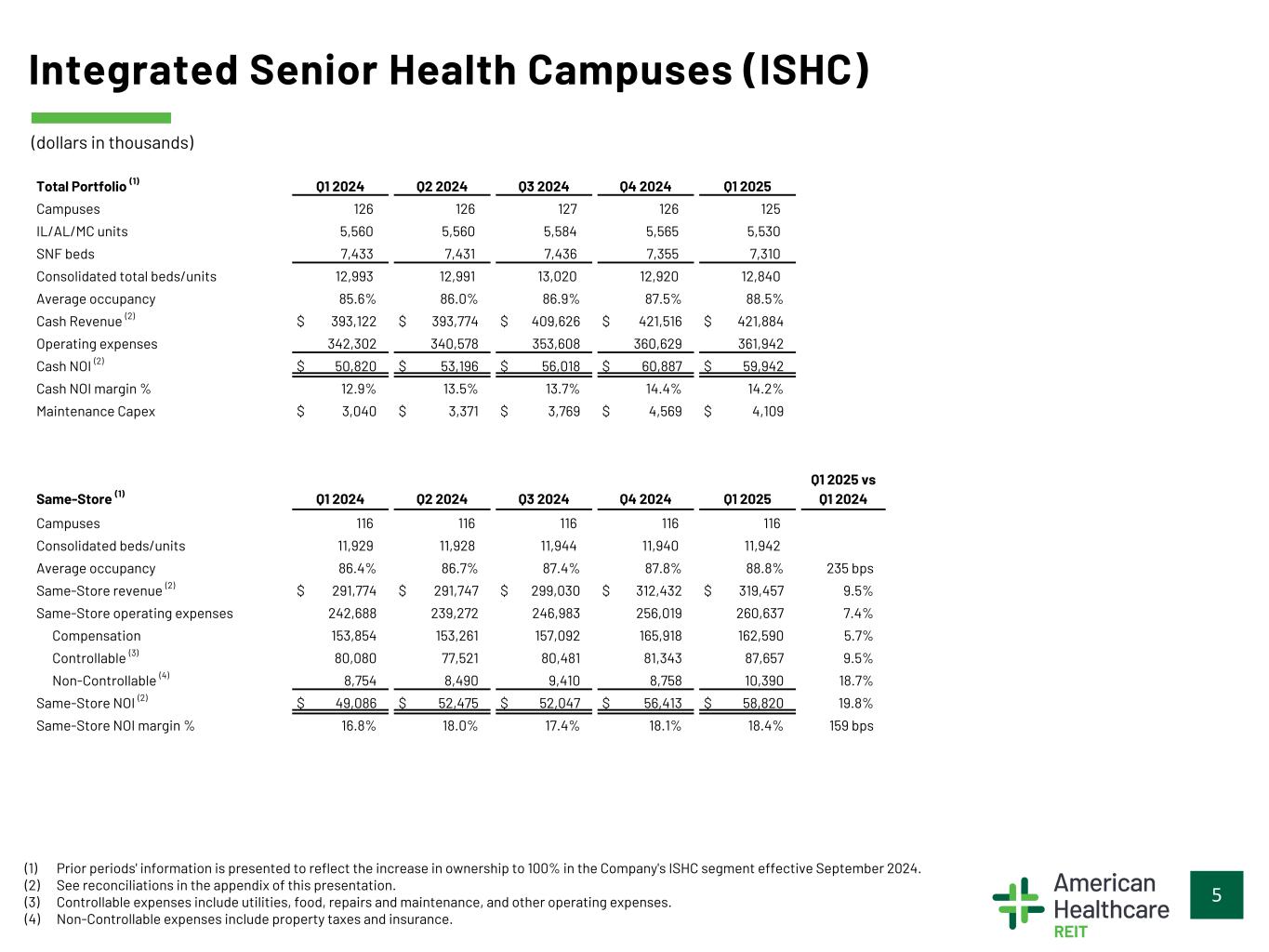

5 Integrated Senior Health Campuses (ISHC) (1) Prior periods' information is presented to reflect the increase in ownership to 100% in the Company's ISHC segment effective September 2024. (2) See reconciliations in the appendix of this presentation. (3) Controllable expenses include utilities, food, repairs and maintenance, and other operating expenses. (4) Non-Controllable expenses include property taxes and insurance. Total Portfolio (1) Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Campuses 126 126 127 126 125 IL/AL/MC units 5,560 5,560 5,584 5,565 5,530 SNF beds 7,433 7,431 7,436 7,355 7,310 Consolidated total beds/units 12,993 12,991 13,020 12,920 12,840 Average occupancy 85.6% 86.0% 86.9% 87.5% 88.5% Cash Revenue (2) $ 393,122 $ 393,774 $ 409,626 $ 421,516 $ 421,884 Operating expenses 342,302 340,578 353,608 360,629 361,942 Cash NOI (2) $ 50,820 $ 53,196 $ 56,018 $ 60,887 $ 59,942 Cash NOI margin % 12.9% 13.5% 13.7% 14.4% 14.2% Maintenance Capex $ 3,040 $ 3,371 $ 3,769 $ 4,569 $ 4,109 Same-Store (1) Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q1 2025 vs Q1 2024 Campuses 116 116 116 116 116 Consolidated beds/units 11,929 11,928 11,944 11,940 11,942 Average occupancy 86.4% 86.7% 87.4% 87.8% 88.8% 235 bps Same-Store revenue (2) $ 291,774 $ 291,747 $ 299,030 $ 312,432 $ 319,457 9.5% Same-Store operating expenses 242,688 239,272 246,983 256,019 260,637 7.4% Compensation 153,854 153,261 157,092 165,918 162,590 5.7% Controllable (3) 80,080 77,521 80,481 81,343 87,657 9.5% Non-Controllable (4) 8,754 8,490 9,410 8,758 10,390 18.7% Same-Store NOI (2) $ 49,086 $ 52,475 $ 52,047 $ 56,413 $ 58,820 19.8% Same-Store NOI margin % 16.8% 18.0% 17.4% 18.1% 18.4% 159 bps (dollars in thousands)

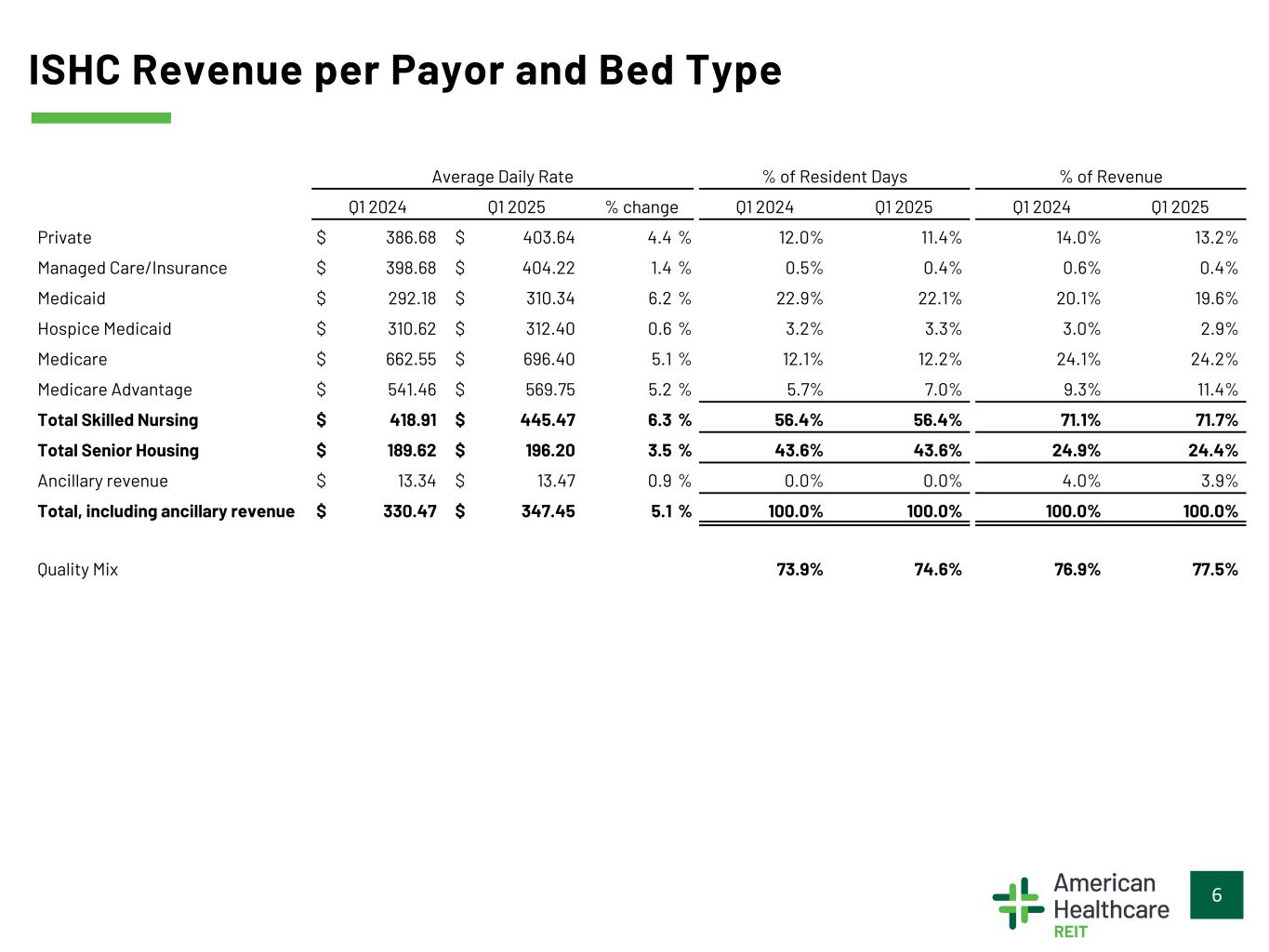

6 ISHC Revenue per Payor and Bed Type Average Daily Rate % of Resident Days % of Revenue Q1 2024 Q1 2025 % change Q1 2024 Q1 2025 Q1 2024 Q1 2025 Private $ 386.68 $ 403.64 4.4 % 12.0% 11.4% 14.0% 13.2% Managed Care/Insurance $ 398.68 $ 404.22 1.4 % 0.5% 0.4% 0.6% 0.4% Medicaid $ 292.18 $ 310.34 6.2 % 22.9% 22.1% 20.1% 19.6% Hospice Medicaid $ 310.62 $ 312.40 0.6 % 3.2% 3.3% 3.0% 2.9% Medicare $ 662.55 $ 696.40 5.1 % 12.1% 12.2% 24.1% 24.2% Medicare Advantage $ 541.46 $ 569.75 5.2 % 5.7% 7.0% 9.3% 11.4% Total Skilled Nursing $ 418.91 $ 445.47 6.3 % 56.4% 56.4% 71.1% 71.7% Total Senior Housing $ 189.62 $ 196.20 3.5 % 43.6% 43.6% 24.9% 24.4% Ancillary revenue $ 13.34 $ 13.47 0.9 % 0.0% 0.0% 4.0% 3.9% Total, including ancillary revenue $ 330.47 $ 347.45 5.1 % 100.0% 100.0% 100.0% 100.0% Quality Mix 73.9% 74.6% 76.9% 77.5%

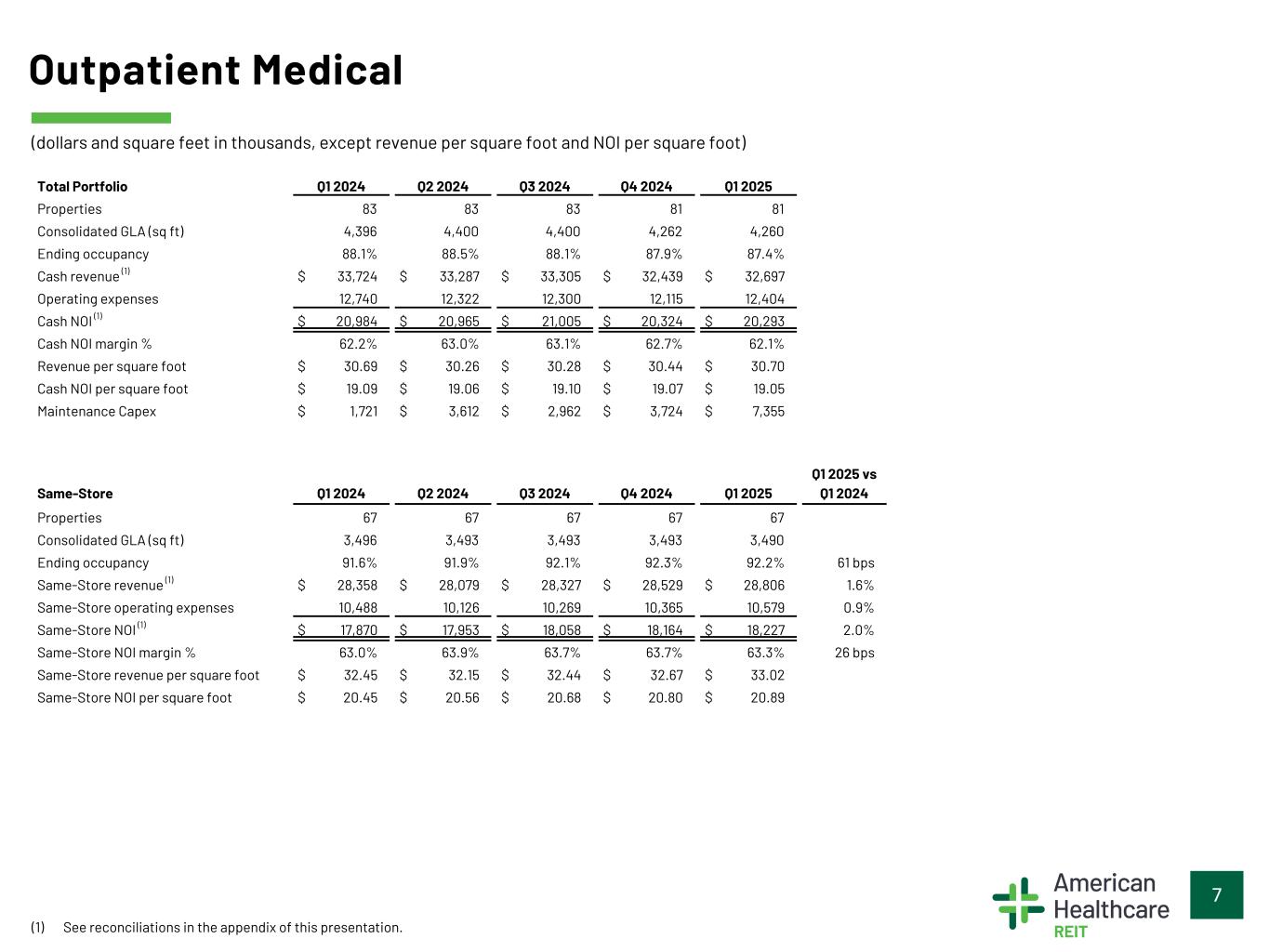

7 Outpatient Medical (1) See reconciliations in the appendix of this presentation. Total Portfolio Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Properties 83 83 83 81 81 Consolidated GLA (sq ft) 4,396 4,400 4,400 4,262 4,260 Ending occupancy 88.1% 88.5% 88.1% 87.9% 87.4% Cash revenue (1) $ 33,724 $ 33,287 $ 33,305 $ 32,439 $ 32,697 Operating expenses 12,740 12,322 12,300 12,115 12,404 Cash NOI (1) $ 20,984 $ 20,965 $ 21,005 $ 20,324 $ 20,293 Cash NOI margin % 62.2% 63.0% 63.1% 62.7% 62.1% Revenue per square foot $ 30.69 $ 30.26 $ 30.28 $ 30.44 $ 30.70 Cash NOI per square foot $ 19.09 $ 19.06 $ 19.10 $ 19.07 $ 19.05 Maintenance Capex $ 1,721 $ 3,612 $ 2,962 $ 3,724 $ 7,355 Same-Store Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q1 2025 vs Q1 2024 Properties 67 67 67 67 67 Consolidated GLA (sq ft) 3,496 3,493 3,493 3,493 3,490 Ending occupancy 91.6 % 91.9 % 92.1 % 92.3 % 92.2 % 61 bps Same-Store revenue (1) $ 28,358 $ 28,079 $ 28,327 $ 28,529 $ 28,806 1.6% Same-Store operating expenses 10,488 10,126 10,269 10,365 10,579 0.9% Same-Store NOI (1) $ 17,870 $ 17,953 $ 18,058 $ 18,164 $ 18,227 2.0% Same-Store NOI margin % 63.0 % 63.9 % 63.7 % 63.7 % 63.3 % 26 bps Same-Store revenue per square foot $ 32.45 $ 32.15 $ 32.44 $ 32.67 $ 33.02 Same-Store NOI per square foot $ 20.45 $ 20.56 $ 20.68 $ 20.80 $ 20.89 (dollars and square feet in thousands, except revenue per square foot and NOI per square foot)

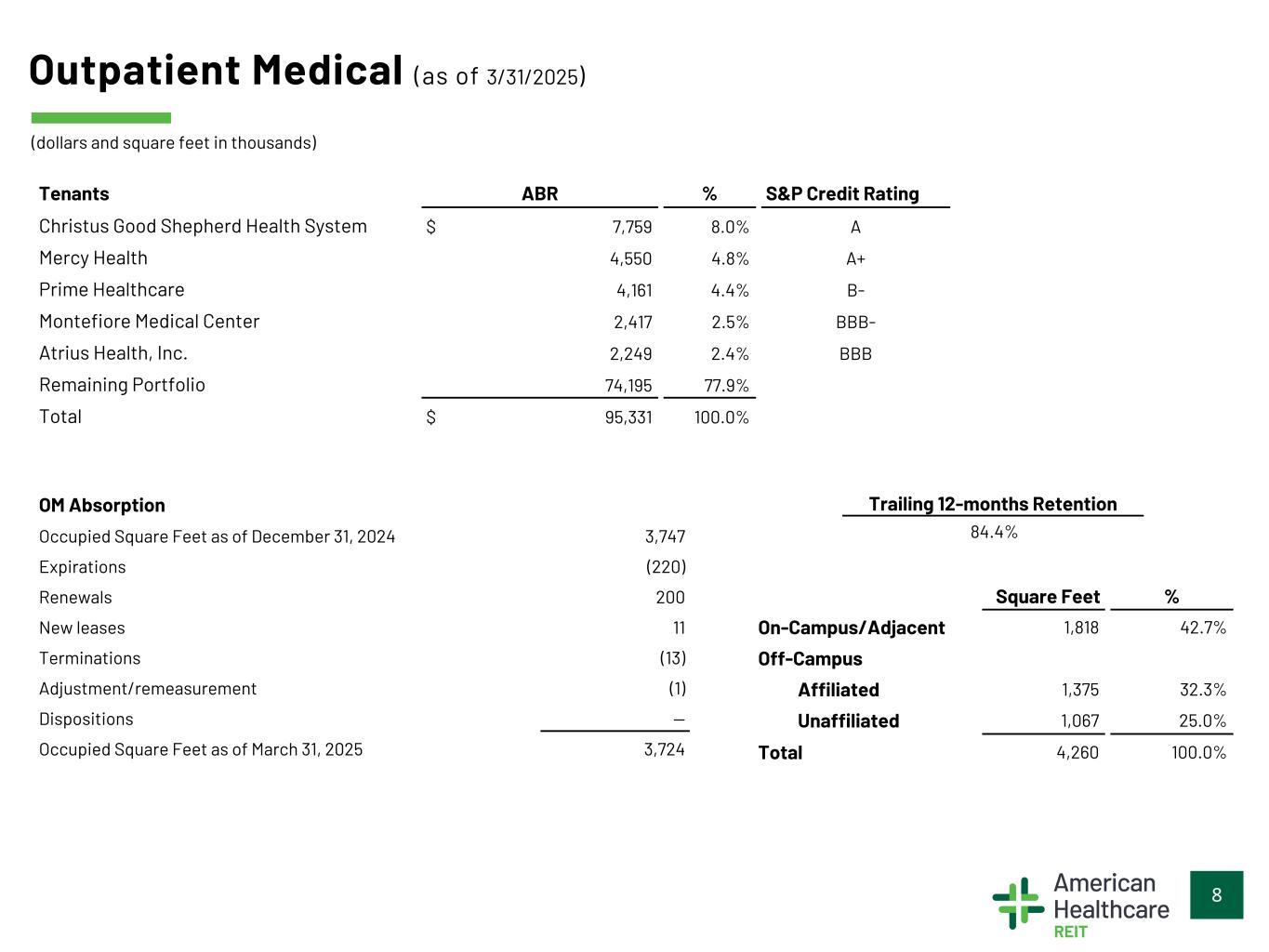

8 Outpatient Medical (as of 3/31/2025) Tenants ABR % S&P Credit Rating Christus Good Shepherd Health System $ 7,759 8.0% A Mercy Health 4,550 4.8% A+ Prime Healthcare 4,161 4.4% B- Montefiore Medical Center 2,417 2.5% BBB- Atrius Health, Inc. 2,249 2.4% BBB Remaining Portfolio 74,195 77.9% Total $ 95,331 100.0% Square Feet % On-Campus/Adjacent 1,818 42.7% Off-Campus Affiliated 1,375 32.3% Unaffiliated 1,067 25.0% Total 4,260 100.0% OM Absorption Occupied Square Feet as of December 31, 2024 3,747 Expirations (220) Renewals 200 New leases 11 Terminations (13) Adjustment/remeasurement (1) Dispositions — Occupied Square Feet as of March 31, 2025 3,724 Trailing 12-months Retention 84.4% (dollars and square feet in thousands)

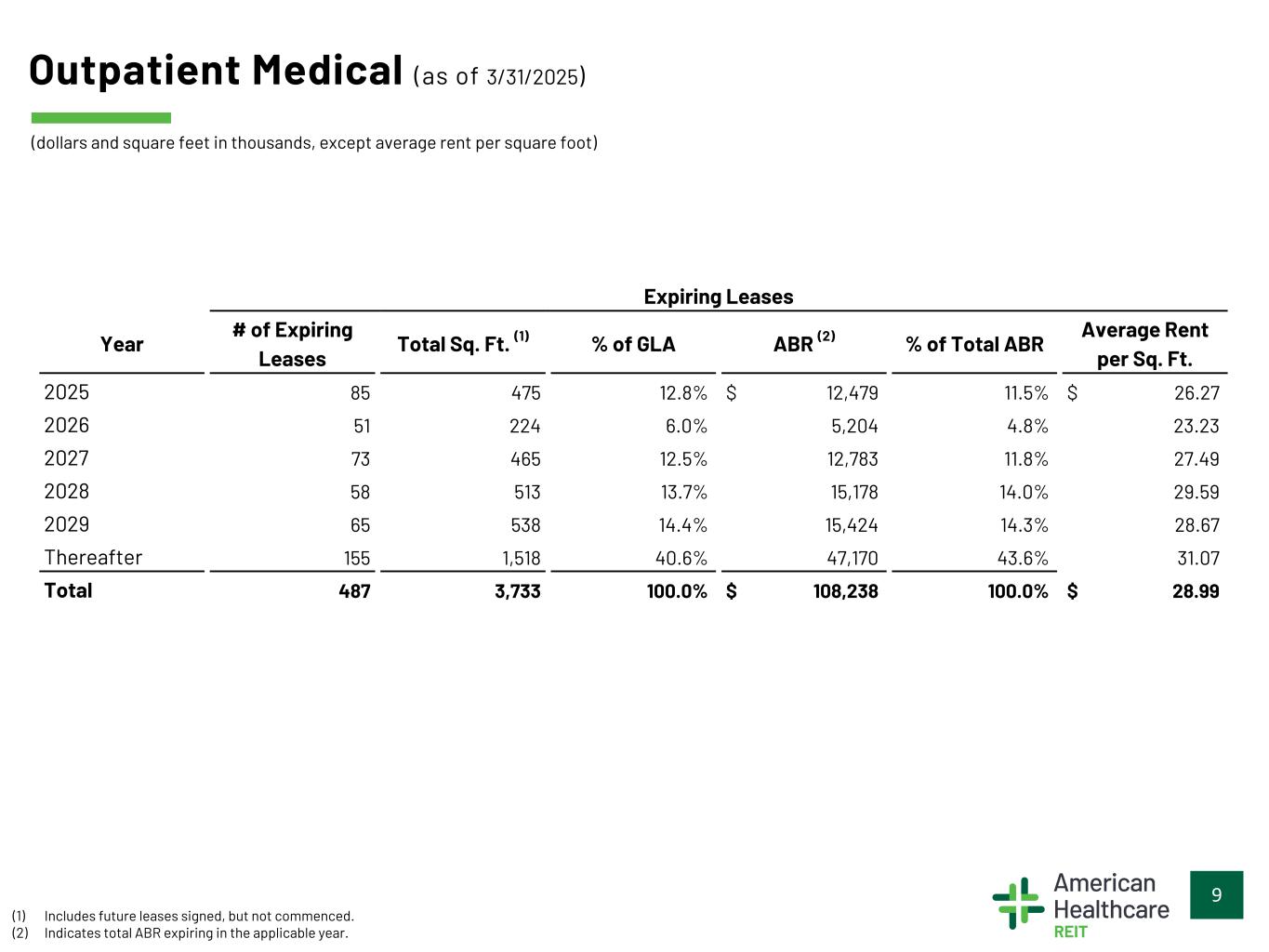

9 (1) Includes future leases signed, but not commenced. (2) Indicates total ABR expiring in the applicable year. Expiring Leases Year # of Expiring Leases Total Sq. Ft. (1) % of GLA ABR (2) % of Total ABR Average Rent per Sq. Ft. 2025 85 475 12.8% $ 12,479 11.5% $ 26.27 2026 51 224 6.0% 5,204 4.8% 23.23 2027 73 465 12.5% 12,783 11.8% 27.49 2028 58 513 13.7% 15,178 14.0% 29.59 2029 65 538 14.4% 15,424 14.3% 28.67 Thereafter 155 1,518 40.6% 47,170 43.6% 31.07 Total 487 3,733 100.0% $ 108,238 100.0% $ 28.99 (dollars and square feet in thousands, except average rent per square foot) Outpatient Medical (as of 3/31/2025)

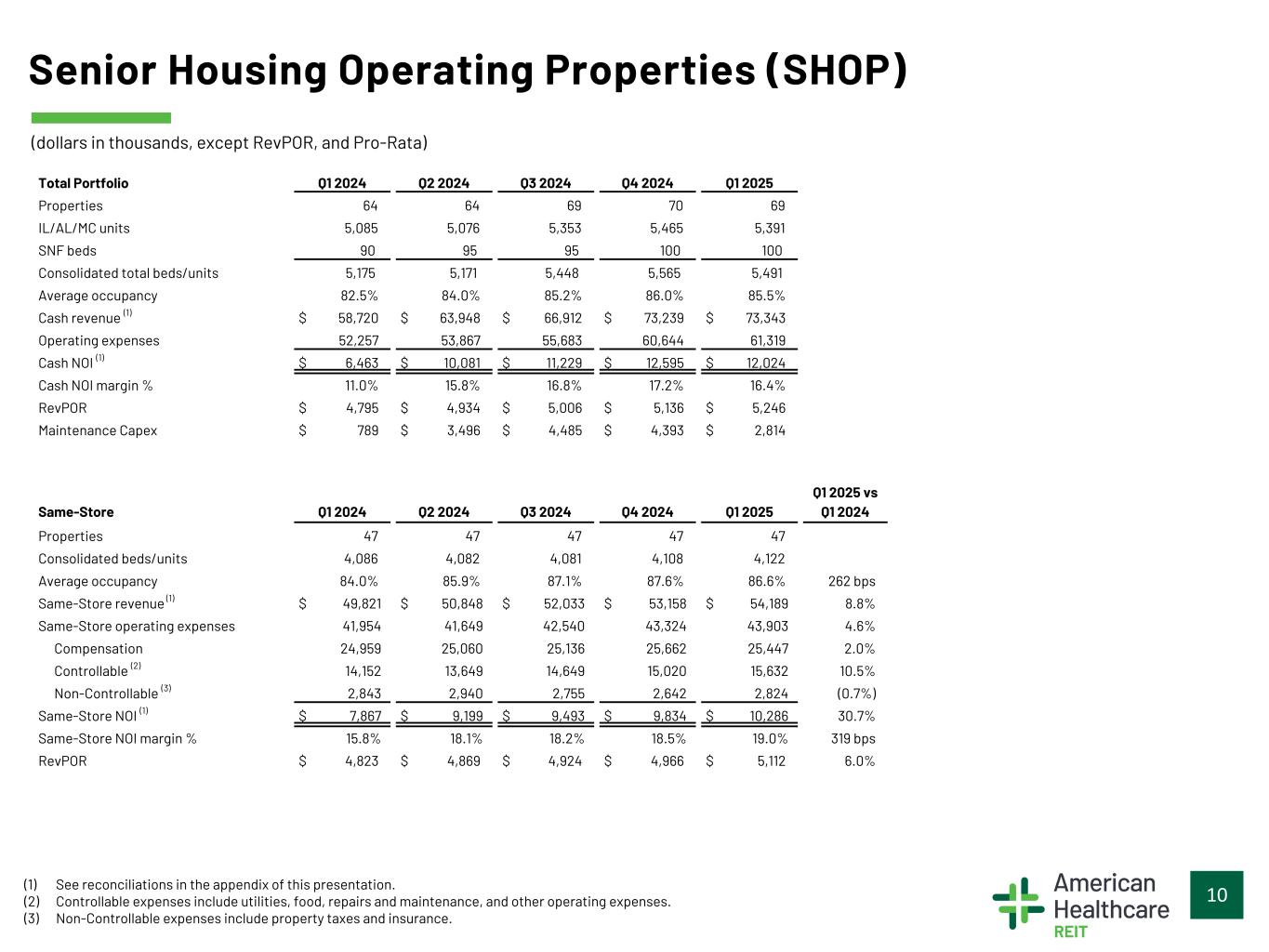

10 Senior Housing Operating Properties (SHOP) (1) See reconciliations in the appendix of this presentation. (2) Controllable expenses include utilities, food, repairs and maintenance, and other operating expenses. (3) Non-Controllable expenses include property taxes and insurance. Total Portfolio Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Properties 64 64 69 70 69 IL/AL/MC units 5,085 5,076 5,353 5,465 5,391 SNF beds 90 95 95 100 100 Consolidated total beds/units 5,175 5,171 5,448 5,565 5,491 Average occupancy 82.5 % 84.0 % 85.2 % 86.0 % 85.5 % Cash revenue (1) $ 58,720 $ 63,948 $ 66,912 $ 73,239 $ 73,343 Operating expenses 52,257 53,867 55,683 60,644 61,319 Cash NOI (1) $ 6,463 $ 10,081 $ 11,229 $ 12,595 $ 12,024 Cash NOI margin % 11.0 % 15.8 % 16.8 % 17.2 % 16.4 % RevPOR $ 4,795 $ 4,934 $ 5,006 $ 5,136 $ 5,246 Maintenance Capex $ 789 $ 3,496 $ 4,485 $ 4,393 $ 2,814 Same-Store Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q1 2025 vs Q1 2024 Properties 47 47 47 47 47 Consolidated beds/units 4,086 4,082 4,081 4,108 4,122 Average occupancy 84.0% 85.9% 87.1% 87.6% 86.6% 262 bps Same-Store revenue (1) $ 49,821 $ 50,848 $ 52,033 $ 53,158 $ 54,189 8.8% Same-Store operating expenses 41,954 41,649 42,540 43,324 43,903 4.6% Compensation 24,959 25,060 25,136 25,662 25,447 2.0% Controllable (2) 14,152 13,649 14,649 15,020 15,632 10.5% Non-Controllable (3) 2,843 2,940 2,755 2,642 2,824 (0.7%) Same-Store NOI (1) $ 7,867 $ 9,199 $ 9,493 $ 9,834 $ 10,286 30.7% Same-Store NOI margin % 15.8 % 18.1 % 18.2 % 18.5 % 19.0 % 319 bps RevPOR $ 4,823 $ 4,869 $ 4,924 $ 4,966 $ 5,112 6.0% (dollars in thousands, except RevPOR, and Pro-Rata)

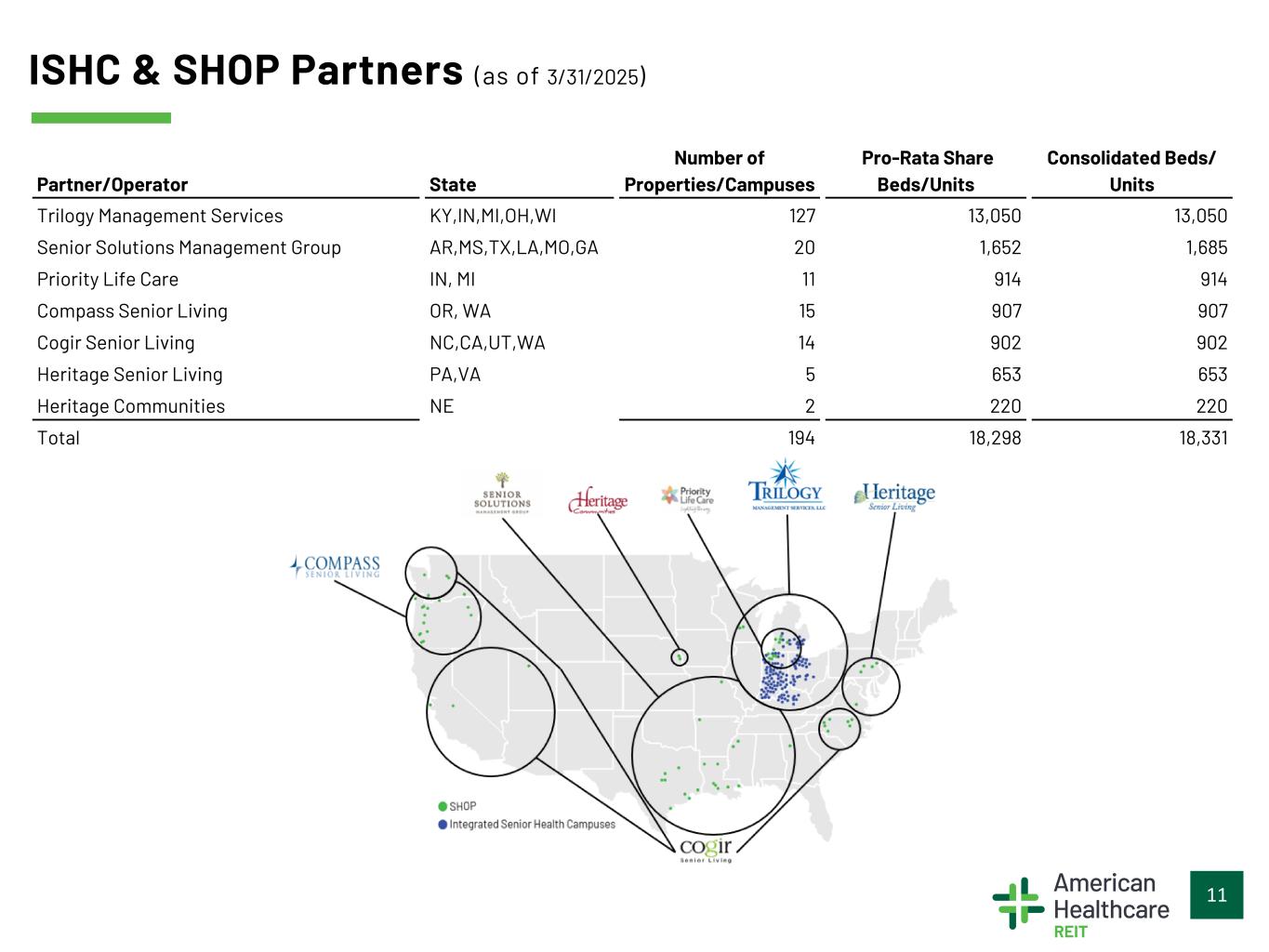

11 ISHC & SHOP Partners (as of 3/31/2025) Partner/Operator State Number of Properties/Campuses Pro-Rata Share Beds/Units Consolidated Beds/ Units Trilogy Management Services KY,IN,MI,OH,WI 127 13,050 13,050 Senior Solutions Management Group AR,MS,TX,LA,MO,GA 20 1,652 1,685 Priority Life Care IN, MI 11 914 914 Compass Senior Living OR, WA 15 907 907 Cogir Senior Living NC,CA,UT,WA 14 902 902 Heritage Senior Living PA,VA 5 653 653 Heritage Communities NE 2 220 220 Total 194 18,298 18,331

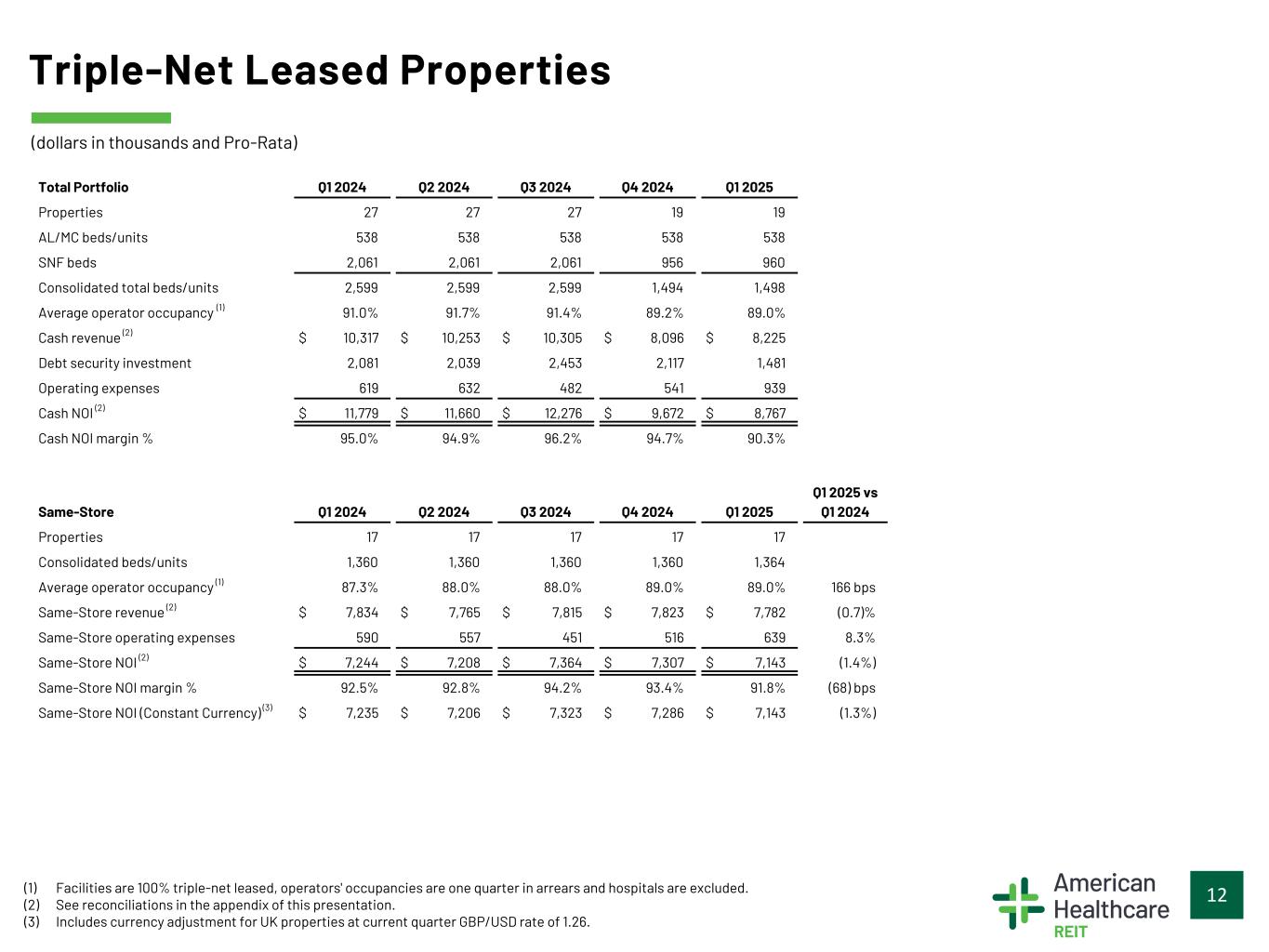

12 Triple-Net Leased Properties (1) Facilities are 100% triple-net leased, operators' occupancies are one quarter in arrears and hospitals are excluded. (2) See reconciliations in the appendix of this presentation. (3) Includes currency adjustment for UK properties at current quarter GBP/USD rate of 1.26. Total Portfolio Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Properties 27 27 27 19 19 AL/MC beds/units 538 538 538 538 538 SNF beds 2,061 2,061 2,061 956 960 Consolidated total beds/units 2,599 2,599 2,599 1,494 1,498 Average operator occupancy (1) 91.0% 91.7% 91.4% 89.2% 89.0% Cash revenue (2) $ 10,317 $ 10,253 $ 10,305 $ 8,096 $ 8,225 Debt security investment 2,081 2,039 2,453 2,117 1,481 Operating expenses 619 632 482 541 939 Cash NOI (2) $ 11,779 $ 11,660 $ 12,276 $ 9,672 $ 8,767 Cash NOI margin % 95.0% 94.9% 96.2% 94.7% 90.3% Same-Store Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q1 2025 vs Q1 2024 Properties 17 17 17 17 17 Consolidated beds/units 1,360 1,360 1,360 1,360 1,364 Average operator occupancy (1) 87.3 % 88.0 % 88.0 % 89.0 % 89.0 % 166 bps Same-Store revenue (2) $ 7,834 $ 7,765 $ 7,815 $ 7,823 $ 7,782 (0.7) % Same-Store operating expenses 590 557 451 516 639 8.3 % Same-Store NOI (2) $ 7,244 $ 7,208 $ 7,364 $ 7,307 $ 7,143 (1.4%) Same-Store NOI margin % 92.5 % 92.8 % 94.2 % 93.4 % 91.8 % (68) bps Same-Store NOI (Constant Currency) (3) $ 7,235 $ 7,206 $ 7,323 $ 7,286 $ 7,143 (1.3%) (dollars in thousands and Pro-Rata)

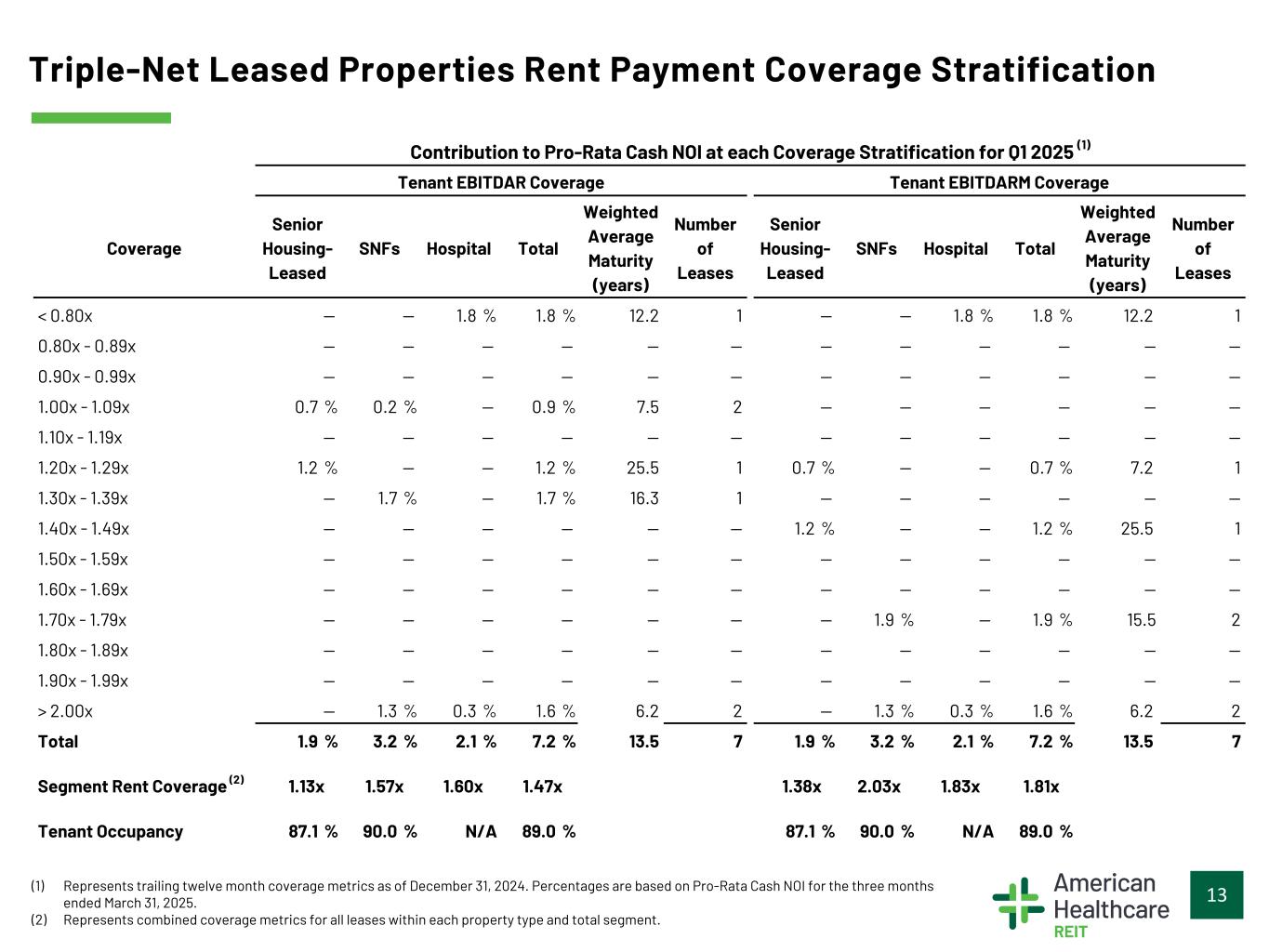

13 Triple-Net Leased Properties Rent Payment Coverage Stratification (1) Represents trailing twelve month coverage metrics as of December 31, 2024. Percentages are based on Pro-Rata Cash NOI for the three months ended March 31, 2025. (2) Represents combined coverage metrics for all leases within each property type and total segment. Contribution to Pro-Rata Cash NOI at each Coverage Stratification for Q1 2025 (1) Tenant EBITDAR Coverage Tenant EBITDARM Coverage Coverage Senior Housing- Leased SNFs Hospital Total Weighted Average Maturity (years) Number of Leases Senior Housing- Leased SNFs Hospital Total Weighted Average Maturity (years) Number of Leases < 0.80x — — 1.8 % 1.8 % 12.2 1 — — 1.8 % 1.8 % 12.2 1 0.80x - 0.89x — — — — — — — — — — — — 0.90x - 0.99x — — — — — — — — — — — — 1.00x - 1.09x 0.7 % 0.2 % — 0.9 % 7.5 2 — — — — — — 1.10x - 1.19x — — — — — — — — — — — — 1.20x - 1.29x 1.2 % — — 1.2 % 25.5 1 0.7 % — — 0.7 % 7.2 1 1.30x - 1.39x — 1.7 % — 1.7 % 16.3 1 — — — — — — 1.40x - 1.49x — — — — — — 1.2 % — — 1.2 % 25.5 1 1.50x - 1.59x — — — — — — — — — — — — 1.60x - 1.69x — — — — — — — — — — — — 1.70x - 1.79x — — — — — — — 1.9 % — 1.9 % 15.5 2 1.80x - 1.89x — — — — — — — — — — — — 1.90x - 1.99x — — — — — — — — — — — — > 2.00x — 1.3 % 0.3 % 1.6 % 6.2 2 — 1.3 % 0.3 % 1.6 % 6.2 2 Total 1.9 % 3.2 % 2.1 % 7.2 % 13.5 7 1.9 % 3.2 % 2.1 % 7.2 % 13.5 7 Segment Rent Coverage (2) 1.13x 1.57x 1.60x 1.47x 1.38x 2.03x 1.83x 1.81x Tenant Occupancy 87.1 % 90.0 % N/A 89.0 % 87.1 % 90.0 % N/A 89.0 %

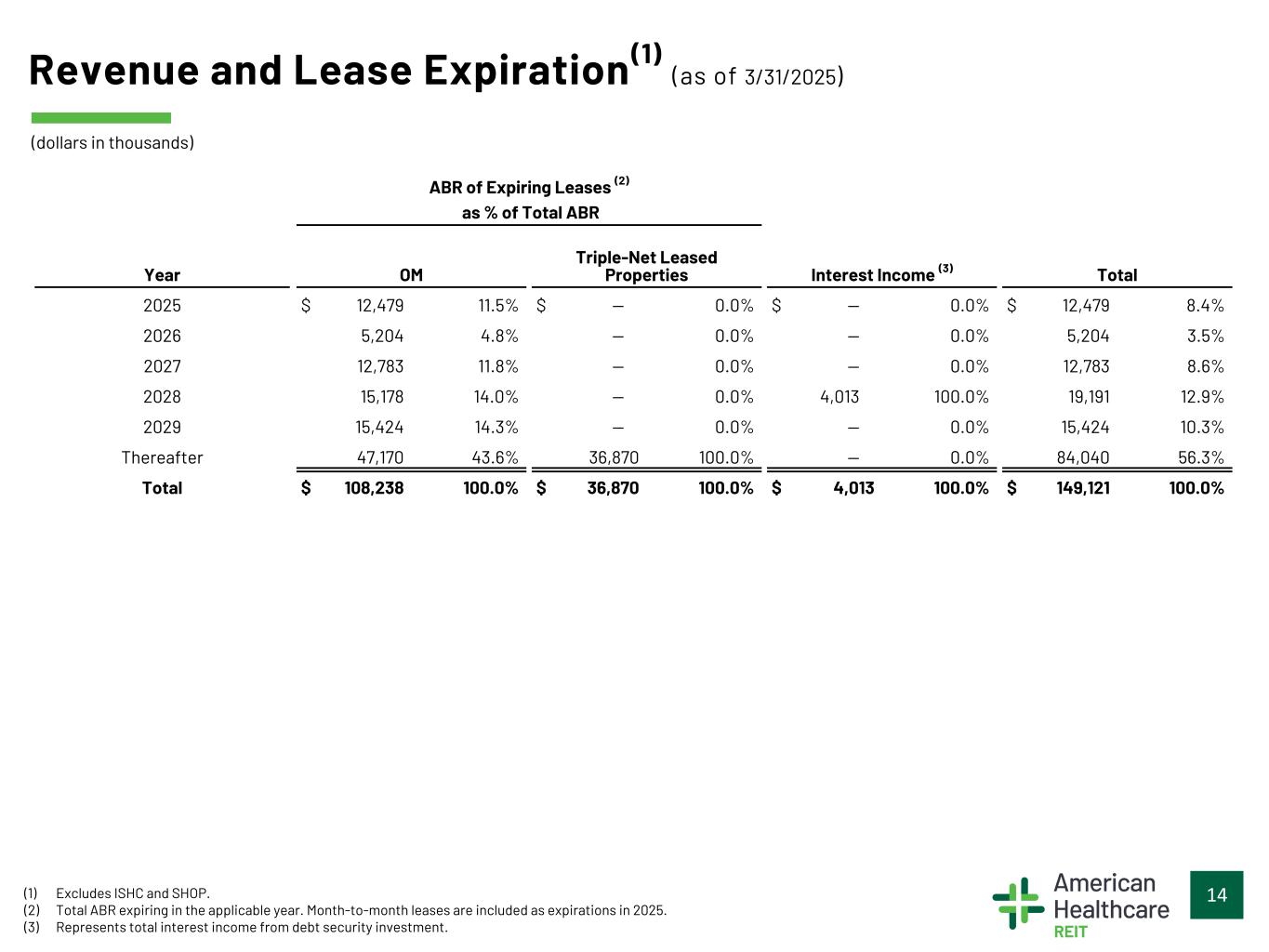

14 Revenue and Lease Expiration(1) (as of 3/31/2025) (1) Excludes ISHC and SHOP. (2) Total ABR expiring in the applicable year. Month-to-month leases are included as expirations in 2025. (3) Represents total interest income from debt security investment. ABR of Expiring Leases (2) as % of Total ABR Year OM Triple-Net Leased Properties Interest Income (3) Total 2025 $ 12,479 11.5% $ — 0.0% $ — 0.0% $ 12,479 8.4% 2026 5,204 4.8% — 0.0% — 0.0% 5,204 3.5% 2027 12,783 11.8% — 0.0% — 0.0% 12,783 8.6% 2028 15,178 14.0% — 0.0% 4,013 100.0% 19,191 12.9% 2029 15,424 14.3% — 0.0% — 0.0% 15,424 10.3% Thereafter 47,170 43.6% 36,870 100.0% — 0.0% 84,040 56.3% Total $ 108,238 100.0% $ 36,870 100.0% $ 4,013 100.0% $ 149,121 100.0% (dollars in thousands)

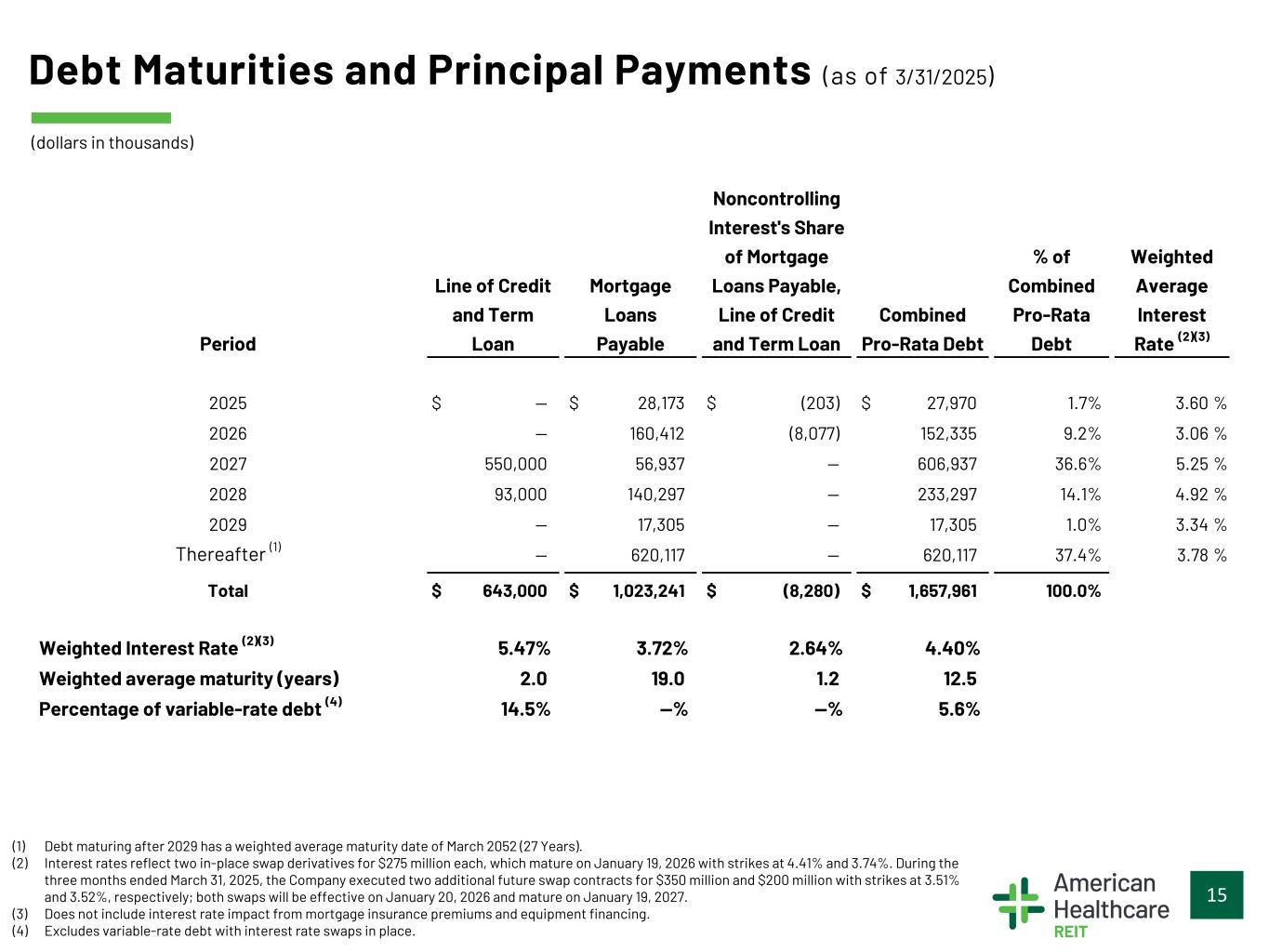

15 Debt Maturities and Principal Payments (as of 3/31/2025) (1) Debt maturing after 2029 has a weighted average maturity date of March 2052 (27 Years). (2) Interest rates reflect two in-place swap derivatives for $275 million each, which mature on January 19, 2026 with strikes at 4.41% and 3.74%. During the three months ended March 31, 2025, the Company executed two additional future swap contracts for $350 million and $200 million with strikes at 3.51% and 3.52%, respectively; both swaps will be effective on January 20, 2026 and mature on January 19, 2027. (3) Does not include interest rate impact from mortgage insurance premiums and equipment financing. (4) Excludes variable-rate debt with interest rate swaps in place. Period Line of Credit and Term Loan Mortgage Loans Payable Noncontrolling Interest's Share of Mortgage Loans Payable, Line of Credit and Term Loan Combined Pro-Rata Debt % of Combined Pro-Rata Debt Weighted Average Interest Rate (2)(3) 2025 $ — $ 28,173 $ (203) $ 27,970 1.7% 3.60 % 2026 — 160,412 (8,077) 152,335 9.2% 3.06 % 2027 550,000 56,937 — 606,937 36.6% 5.25 % 2028 93,000 140,297 — 233,297 14.1% 4.92 % 2029 — 17,305 — 17,305 1.0% 3.34 % Thereafter (1) — 620,117 — 620,117 37.4% 3.78 % Total $ 643,000 $ 1,023,241 $ (8,280) $ 1,657,961 100.0% Weighted Interest Rate (2)(3) 5.47% 3.72% 2.64% 4.40% Weighted average maturity (years) 2.0 19.0 1.2 12.5 Percentage of variable-rate debt (4) 14.5% —% —% 5.6% (dollars in thousands)

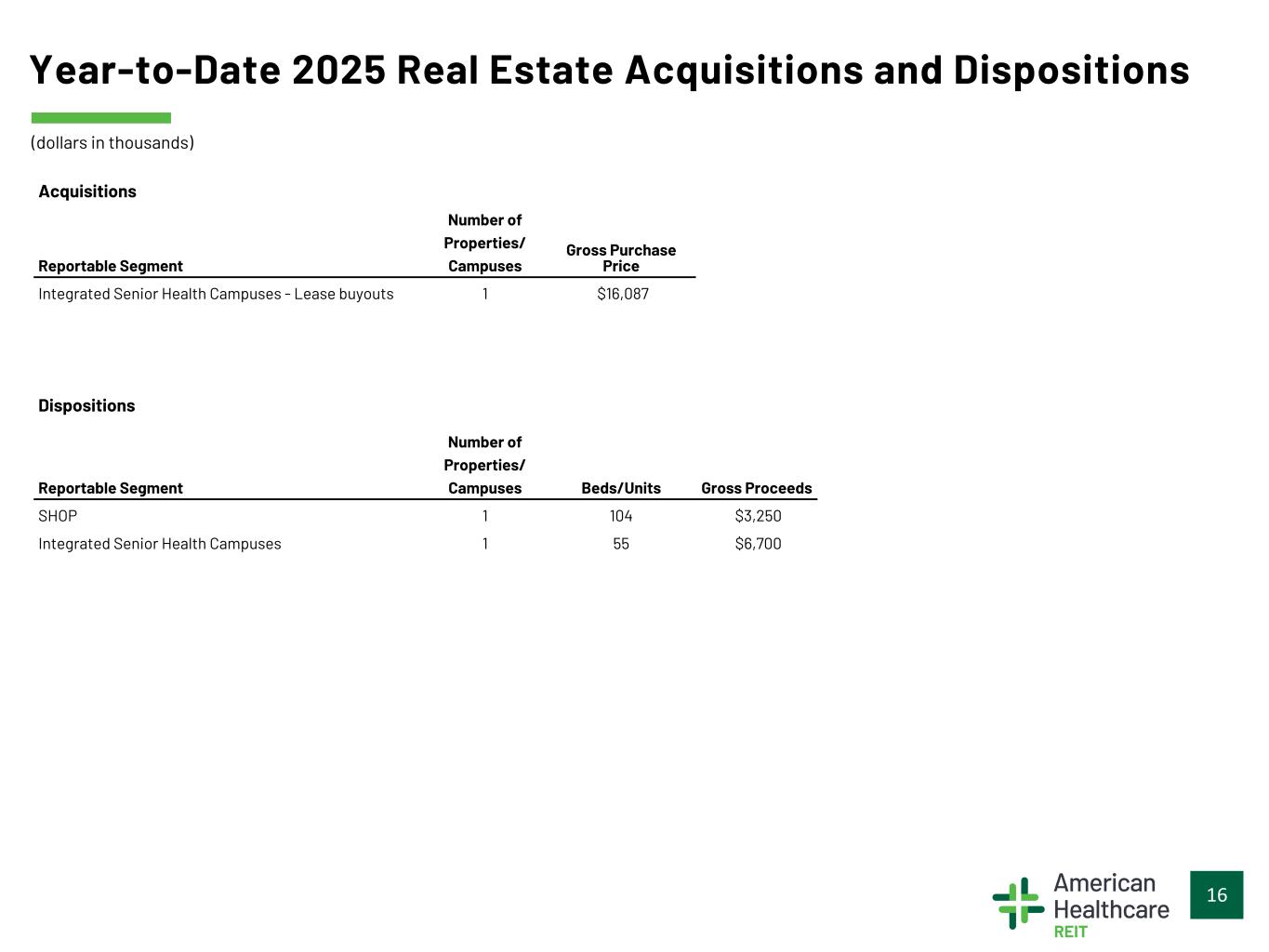

16 Year-to-Date 2025 Real Estate Acquisitions and Dispositions Acquisitions Reportable Segment Number of Properties/ Campuses Gross Purchase Price Integrated Senior Health Campuses - Lease buyouts 1 $16,087 Dispositions Reportable Segment Number of Properties/ Campuses Beds/Units Gross Proceeds SHOP 1 104 $3,250 Integrated Senior Health Campuses 1 55 $6,700 (dollars in thousands)

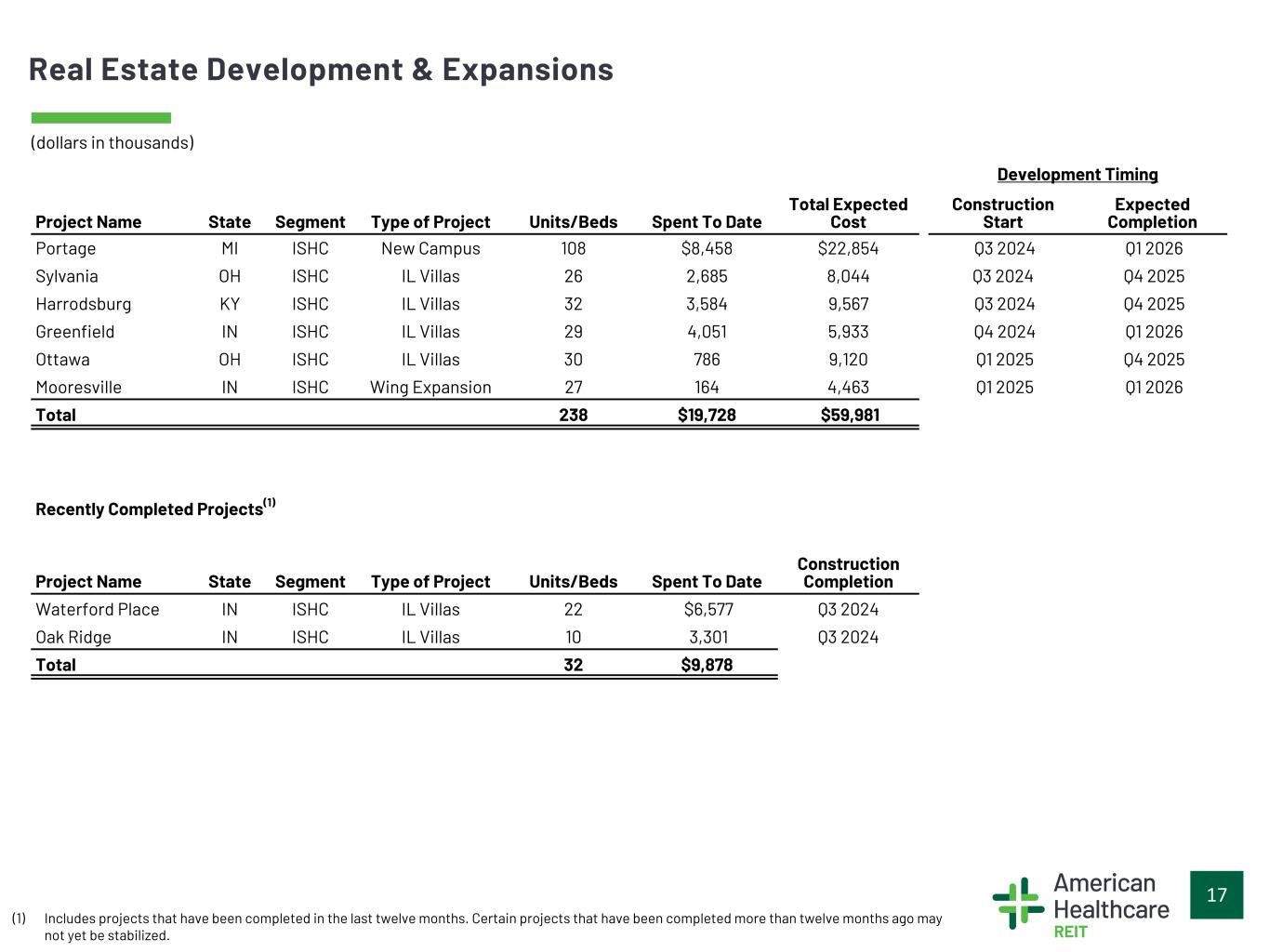

17 Real Estate Development & Expansions Development Timing Project Name State Segment Type of Project Units/Beds Spent To Date Total Expected Cost Construction Start Expected Completion Portage MI ISHC New Campus 108 $8,458 $22,854 Q3 2024 Q1 2026 Sylvania OH ISHC IL Villas 26 2,685 8,044 Q3 2024 Q4 2025 Harrodsburg KY ISHC IL Villas 32 3,584 9,567 Q3 2024 Q4 2025 Greenfield IN ISHC IL Villas 29 4,051 5,933 Q4 2024 Q1 2026 Ottawa OH ISHC IL Villas 30 786 9,120 Q1 2025 Q4 2025 Mooresville IN ISHC Wing Expansion 27 164 4,463 Q1 2025 Q1 2026 Total 238 $19,728 $59,981 Recently Completed Projects(1) Project Name State Segment Type of Project Units/Beds Spent To Date Construction Completion Waterford Place IN ISHC IL Villas 22 $6,577 Q3 2024 Oak Ridge IN ISHC IL Villas 10 3,301 Q3 2024 Total 32 $9,878 (dollars in thousands) (1) Includes projects that have been completed in the last twelve months. Certain projects that have been completed more than twelve months ago may not yet be stabilized.

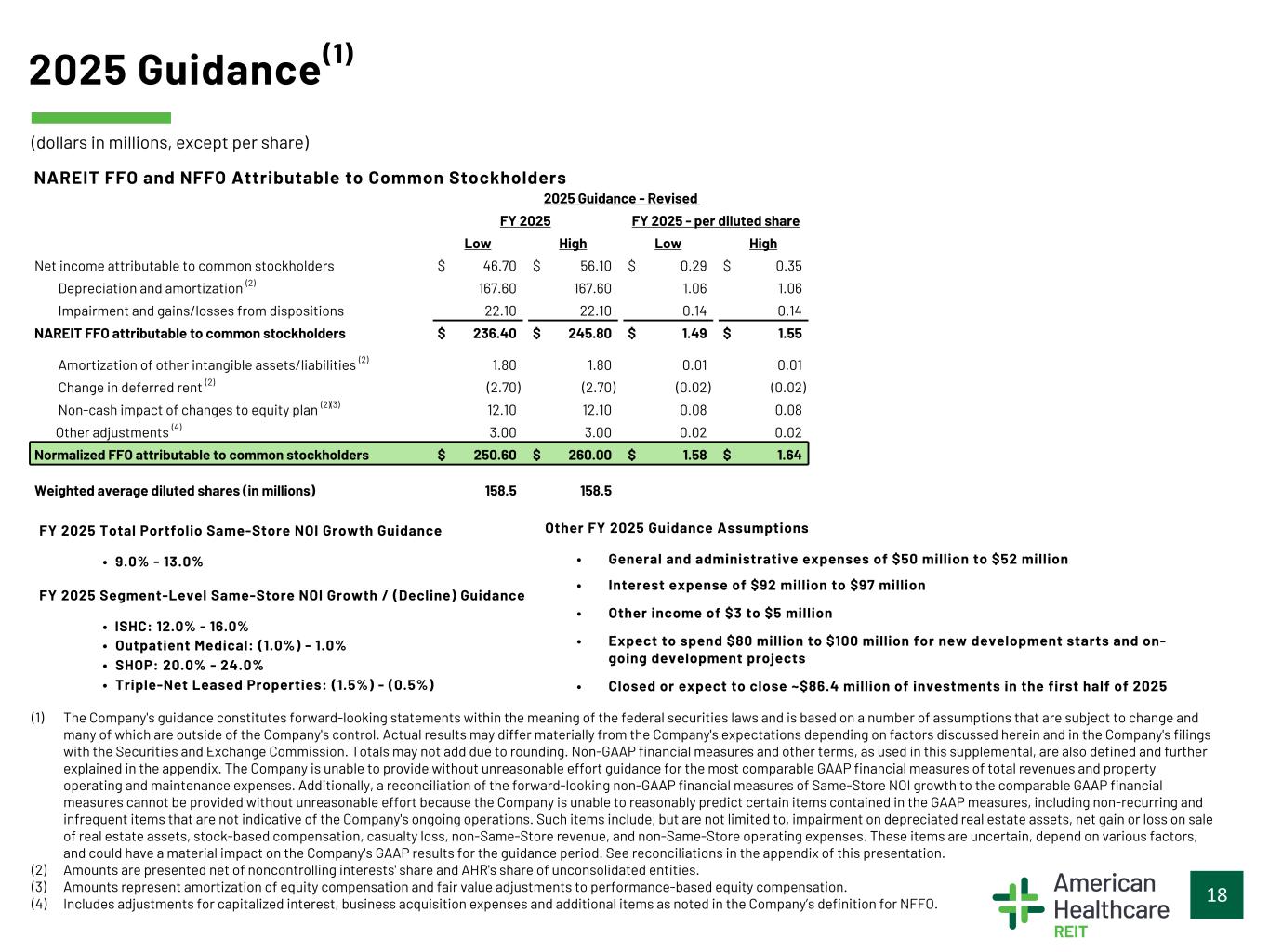

18 (1) The Company's guidance constitutes forward-looking statements within the meaning of the federal securities laws and is based on a number of assumptions that are subject to change and many of which are outside of the Company's control. Actual results may differ materially from the Company's expectations depending on factors discussed herein and in the Company's filings with the Securities and Exchange Commission. Totals may not add due to rounding. Non-GAAP financial measures and other terms, as used in this supplemental, are also defined and further explained in the appendix. The Company is unable to provide without unreasonable effort guidance for the most comparable GAAP financial measures of total revenues and property operating and maintenance expenses. Additionally, a reconciliation of the forward-looking non-GAAP financial measures of Same-Store NOI growth to the comparable GAAP financial measures cannot be provided without unreasonable effort because the Company is unable to reasonably predict certain items contained in the GAAP measures, including non-recurring and infrequent items that are not indicative of the Company's ongoing operations. Such items include, but are not limited to, impairment on depreciated real estate assets, net gain or loss on sale of real estate assets, stock-based compensation, casualty loss, non-Same-Store revenue, and non-Same-Store operating expenses. These items are uncertain, depend on various factors, and could have a material impact on the Company's GAAP results for the guidance period. See reconciliations in the appendix of this presentation. (2) Amounts are presented net of noncontrolling interests' share and AHR's share of unconsolidated entities. (3) Amounts represent amortization of equity compensation and fair value adjustments to performance-based equity compensation. (4) Includes adjustments for capitalized interest, business acquisition expenses and additional items as noted in the Company’s definition for NFFO. 2025 Guidance(1) NAREIT FFO and NFFO Attributable to Common Stockholders FY 2025 Total Portfolio Same-Store NOI Growth Guidance • 9.0% - 13.0% FY 2025 Segment-Level Same-Store NOI Growth / (Decline) Guidance • ISHC: 12.0% - 16.0% • Outpatient Medical: (1.0%) - 1.0% • SHOP: 20.0% - 24.0% • Triple-Net Leased Properties: (1.5%) - (0.5%) 2025 Guidance - Revised FY 2025 FY 2025 - per diluted share Low High Low High Net income attributable to common stockholders $ 46.70 $ 56.10 $ 0.29 $ 0.35 Depreciation and amortization (2) 167.60 167.60 1.06 1.06 Impairment and gains/losses from dispositions 22.10 22.10 0.14 0.14 NAREIT FFO attributable to common stockholders $ 236.40 $ 245.80 $ 1.49 $ 1.55 Amortization of other intangible assets/liabilities (2) 1.80 1.80 0.01 0.01 Change in deferred rent (2) (2.70) (2.70) (0.02) (0.02) Non-cash impact of changes to equity plan (2)(3) 12.10 12.10 0.08 0.08 Other adjustments (4) 3.00 3.00 0.02 0.02 Normalized FFO attributable to common stockholders $ 250.60 $ 260.00 $ 1.58 $ 1.64 Weighted average diluted shares (in millions) 158.5 158.5 (dollars in millions, except per share) Other FY 2025 Guidance Assumptions • General and administrative expenses of $50 million to $52 million • Interest expense of $92 million to $97 million • Other income of $3 to $5 million • Expect to spend $80 million to $100 million for new development starts and on- going development projects • Closed or expect to close ~$86.4 million of investments in the first half of 2025

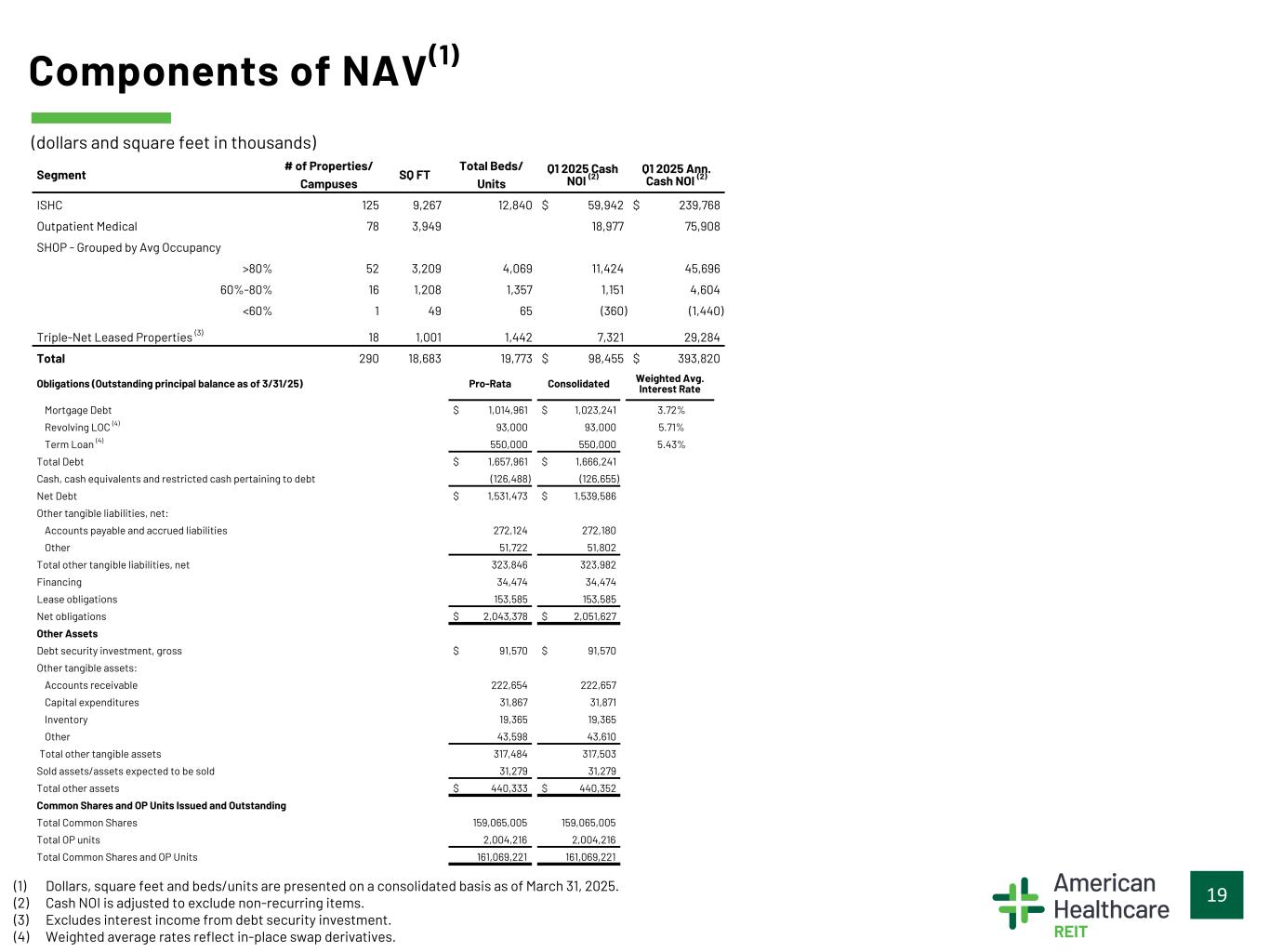

19 Components of NAV(1) (1) Dollars, square feet and beds/units are presented on a consolidated basis as of March 31, 2025. (2) Cash NOI is adjusted to exclude non-recurring items. (3) Excludes interest income from debt security investment. (4) Weighted average rates reflect in-place swap derivatives. Segment # of Properties/ Campuses SQ FT Total Beds/ Units Q1 2025 Cash NOI (2) Q1 2025 Ann. Cash NOI (2) ISHC 125 9,267 12,840 $ 59,942 $ 239,768 Outpatient Medical 78 3,949 18,977 75,908 SHOP - Grouped by Avg Occupancy >80% 52 3,209 4,069 11,424 45,696 60%-80% 16 1,208 1,357 1,151 4,604 <60% 1 49 65 (360) (1,440) Triple-Net Leased Properties (3) 18 1,001 1,442 7,321 29,284 Total 290 18,683 19,773 $ 98,455 $ 393,820 Obligations (Outstanding principal balance as of 3/31/25) Pro-Rata Consolidated Weighted Avg. Interest Rate Mortgage Debt $ 1,014,961 $ 1,023,241 3.72% Revolving LOC (4) 93,000 93,000 5.71% Term Loan (4) 550,000 550,000 5.43% Total Debt $ 1,657,961 $ 1,666,241 Cash, cash equivalents and restricted cash pertaining to debt (126,488) (126,655) Net Debt $ 1,531,473 $ 1,539,586 Other tangible liabilities, net: Accounts payable and accrued liabilities 272,124 272,180 Other 51,722 51,802 Total other tangible liabilities, net 323,846 323,982 Financing 34,474 34,474 Lease obligations 153,585 153,585 Net obligations $ 2,043,378 $ 2,051,627 Other Assets Debt security investment, gross $ 91,570 $ 91,570 Other tangible assets: Accounts receivable 222,654 222,657 Capital expenditures 31,867 31,871 Inventory 19,365 19,365 Other 43,598 43,610 Total other tangible assets 317,484 317,503 Sold assets/assets expected to be sold 31,279 31,279 Total other assets $ 440,333 $ 440,352 Common Shares and OP Units Issued and Outstanding Total Common Shares 159,065,005 159,065,005 Total OP units 2,004,216 2,004,216 Total Common Shares and OP Units 161,069,221 161,069,221 (dollars and square feet in thousands)

20 First Quarter 2025 Supplemental Appendix Non-GAAP Reconciliations and Defined Terms

21 FFO / NFFO Reconciliation(1) (in thousands, except share and per share amounts) QTD Q1 2025 Q1 2024 Net loss $ (6,840) $ (3,004) Depreciation and amortization related to real estate — consolidated properties 41,015 42,729 Depreciation and amortization related to real estate — unconsolidated entities 497 186 Impairment of real estate investment — consolidated properties 21,706 — Loss (gain) on dispositions of real estate investments, net — consolidated properties 359 (2,263) Net loss (income) attributable to noncontrolling interests 36 (888) Depreciation, amortization, impairment and net gain/loss on dispositions — noncontrolling interests (892) (5,462) NAREIT FFO attributable to controlling interest $ 55,881 $ 31,298 Business acquisition expenses 1,837 2,782 Amortization of above- and below-market leases 413 426 Amortization of closing costs — debt security investment 37 76 Change in deferred rent (672) (589) Non-cash impact of changes to equity instruments 2,551 1,935 Capitalized interest (97) (134) Loss on debt extinguishments 508 1,280 Loss (gain) in fair value of derivative financial instruments 750 (6,417) Foreign currency (gain) loss (1,416) 426 Adjustments for unconsolidated entities — (110) Adjustments for noncontrolling interests (50) 125 Normalized FFO attributable to controlling interest $ 59,742 $ 31,098 NAREIT FFO and Normalized FFO weighted average common shares outstanding — diluted 157,428,446 104,295,142 NAREIT FFO per common share attributable to controlling interest — diluted $ 0.35 $ 0.30 Normalized FFO per common share attributable to controlling interest — diluted $ 0.38 $ 0.30 Distributions paid in cash $ 39,548 $ 16,596 (1) Totals may not add due to rounding.

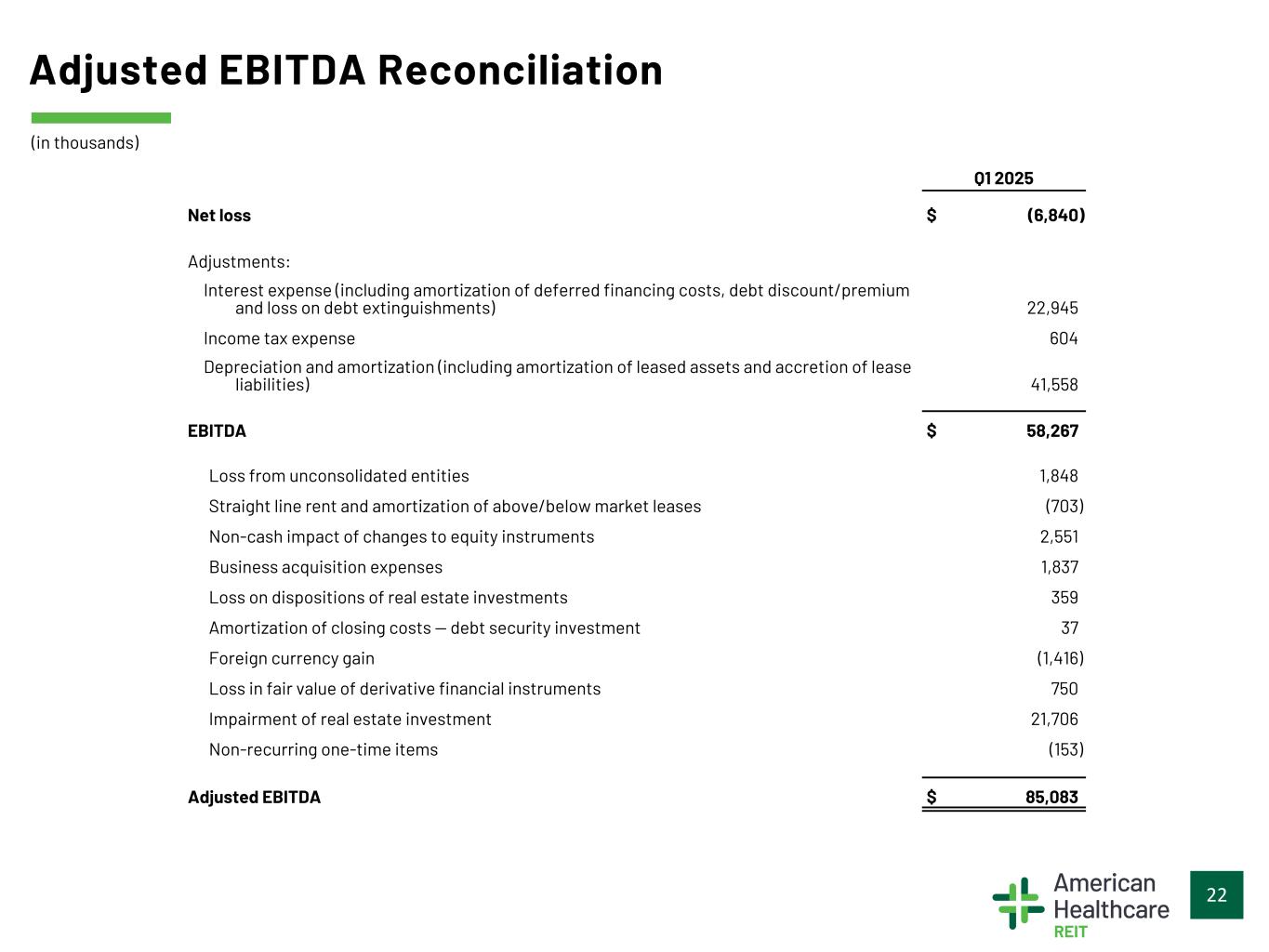

22 Adjusted EBITDA Reconciliation Q1 2025 Net loss $ (6,840) Adjustments: Interest expense (including amortization of deferred financing costs, debt discount/premium and loss on debt extinguishments) 22,945 Income tax expense 604 Depreciation and amortization (including amortization of leased assets and accretion of lease liabilities) 41,558 EBITDA $ 58,267 Loss from unconsolidated entities 1,848 Straight line rent and amortization of above/below market leases (703) Non-cash impact of changes to equity instruments 2,551 Business acquisition expenses 1,837 Loss on dispositions of real estate investments 359 Amortization of closing costs — debt security investment 37 Foreign currency gain (1,416) Loss in fair value of derivative financial instruments 750 Impairment of real estate investment 21,706 Non-recurring one-time items (153) Adjusted EBITDA $ 85,083 (in thousands)

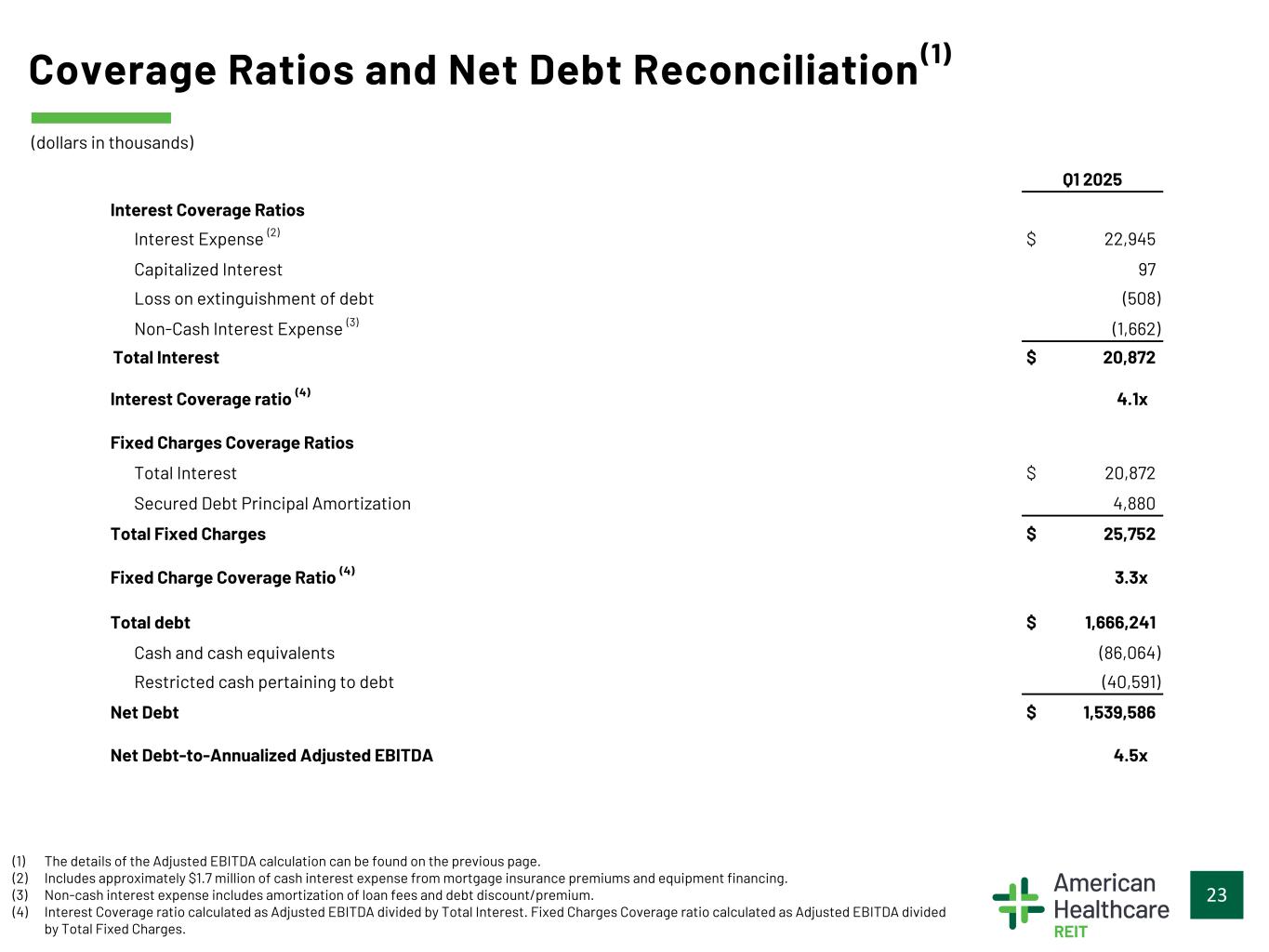

23 Coverage Ratios and Net Debt Reconciliation(1) (1) The details of the Adjusted EBITDA calculation can be found on the previous page. (2) Includes approximately $1.7 million of cash interest expense from mortgage insurance premiums and equipment financing. (3) Non-cash interest expense includes amortization of loan fees and debt discount/premium. (4) Interest Coverage ratio calculated as Adjusted EBITDA divided by Total Interest. Fixed Charges Coverage ratio calculated as Adjusted EBITDA divided by Total Fixed Charges. Q1 2025 Interest Coverage Ratios Interest Expense (2) $ 22,945 Capitalized Interest 97 Loss on extinguishment of debt (508) Non-Cash Interest Expense (3) (1,662) Total Interest $ 20,872 Interest Coverage ratio (4) 4.1x Fixed Charges Coverage Ratios Total Interest $ 20,872 Secured Debt Principal Amortization 4,880 Total Fixed Charges $ 25,752 Fixed Charge Coverage Ratio (4) 3.3x Total debt $ 1,666,241 Cash and cash equivalents (86,064) Restricted cash pertaining to debt (40,591) Net Debt $ 1,539,586 Net Debt-to-Annualized Adjusted EBITDA 4.5x (dollars in thousands)

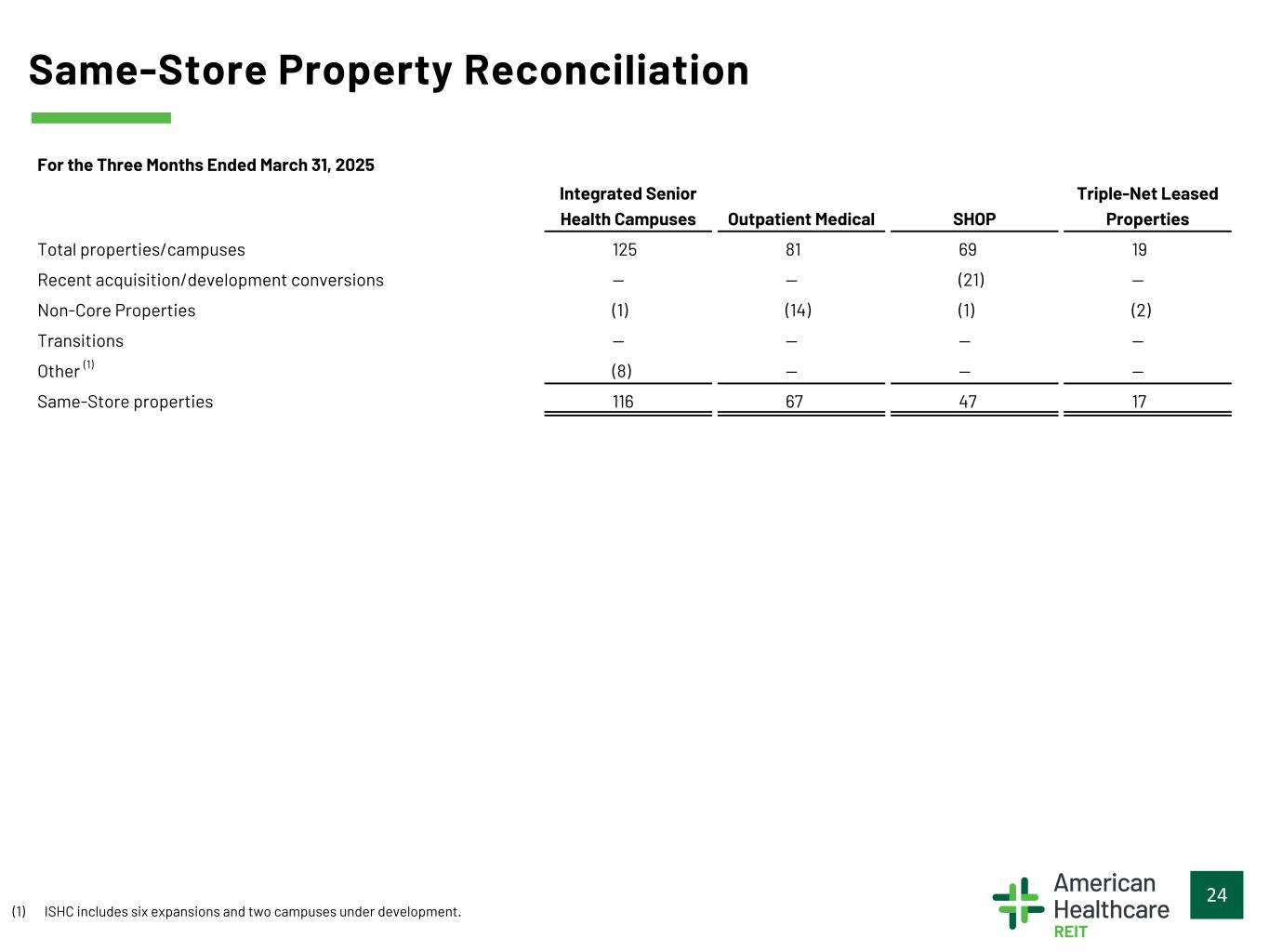

24 Same-Store Property Reconciliation For the Three Months Ended March 31, 2025 Integrated Senior Health Campuses Outpatient Medical SHOP Triple-Net Leased Properties Total properties/campuses 125 81 69 19 Recent acquisition/development conversions — — (21) — Non-Core Properties (1) (14) (1) (2) Transitions — — — — Other (1) (8) — — — Same-Store properties 116 67 47 17 (1) ISHC includes six expansions and two campuses under development.

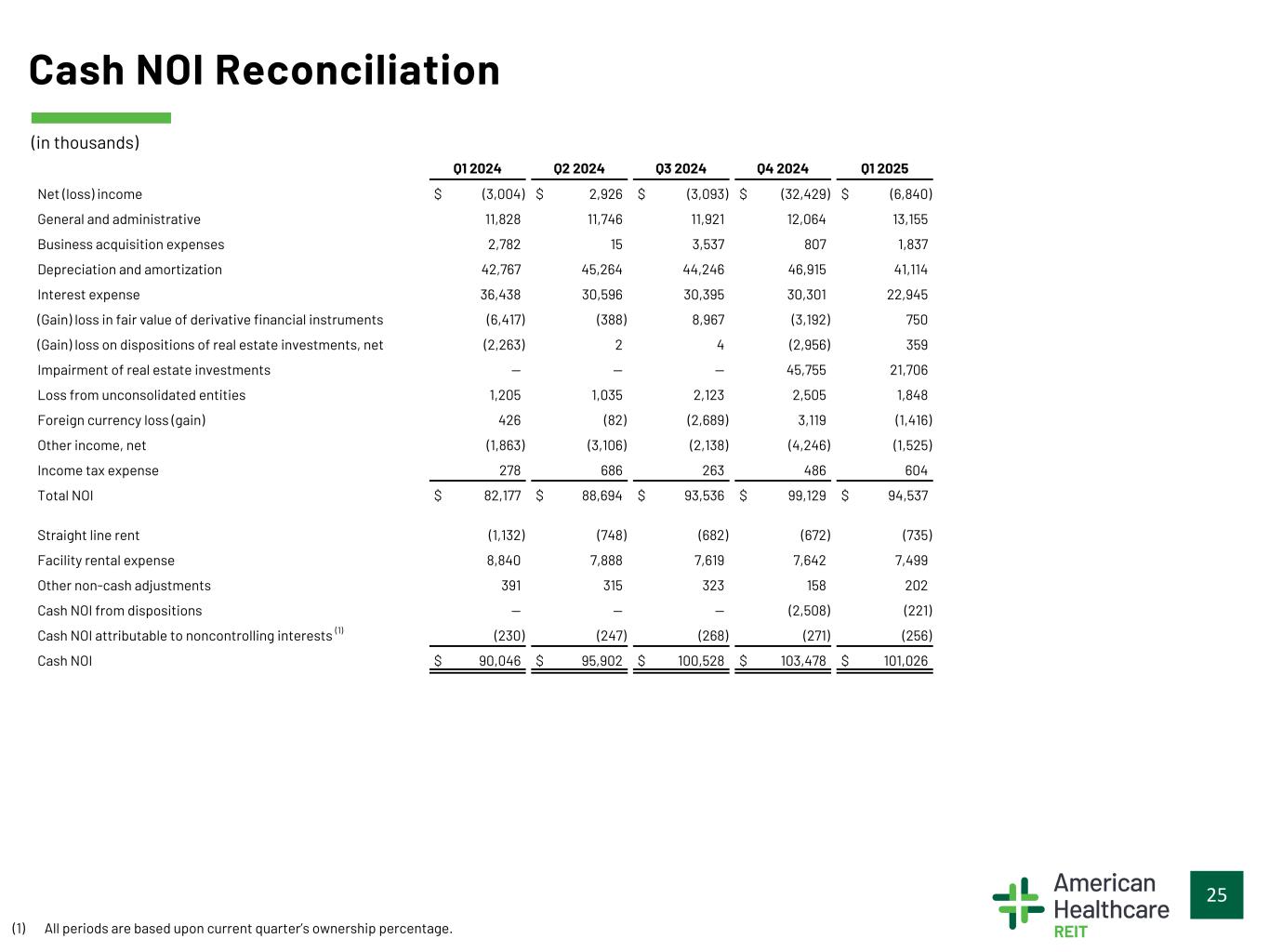

25 Cash NOI Reconciliation (1) All periods are based upon current quarter’s ownership percentage. Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Net (loss) income $ (3,004) $ 2,926 $ (3,093) $ (32,429) $ (6,840) General and administrative 11,828 11,746 11,921 12,064 13,155 Business acquisition expenses 2,782 15 3,537 807 1,837 Depreciation and amortization 42,767 45,264 44,246 46,915 41,114 Interest expense 36,438 30,596 30,395 30,301 22,945 (Gain) loss in fair value of derivative financial instruments (6,417) (388) 8,967 (3,192) 750 (Gain) loss on dispositions of real estate investments, net (2,263) 2 4 (2,956) 359 Impairment of real estate investments — — — 45,755 21,706 Loss from unconsolidated entities 1,205 1,035 2,123 2,505 1,848 Foreign currency loss (gain) 426 (82) (2,689) 3,119 (1,416) Other income, net (1,863) (3,106) (2,138) (4,246) (1,525) Income tax expense 278 686 263 486 604 Total NOI $ 82,177 $ 88,694 $ 93,536 $ 99,129 $ 94,537 Straight line rent (1,132) (748) (682) (672) (735) Facility rental expense 8,840 7,888 7,619 7,642 7,499 Other non-cash adjustments 391 315 323 158 202 Cash NOI from dispositions — — — (2,508) (221) Cash NOI attributable to noncontrolling interests (1) (230) (247) (268) (271) (256) Cash NOI $ 90,046 $ 95,902 $ 100,528 $ 103,478 $ 101,026 (in thousands)

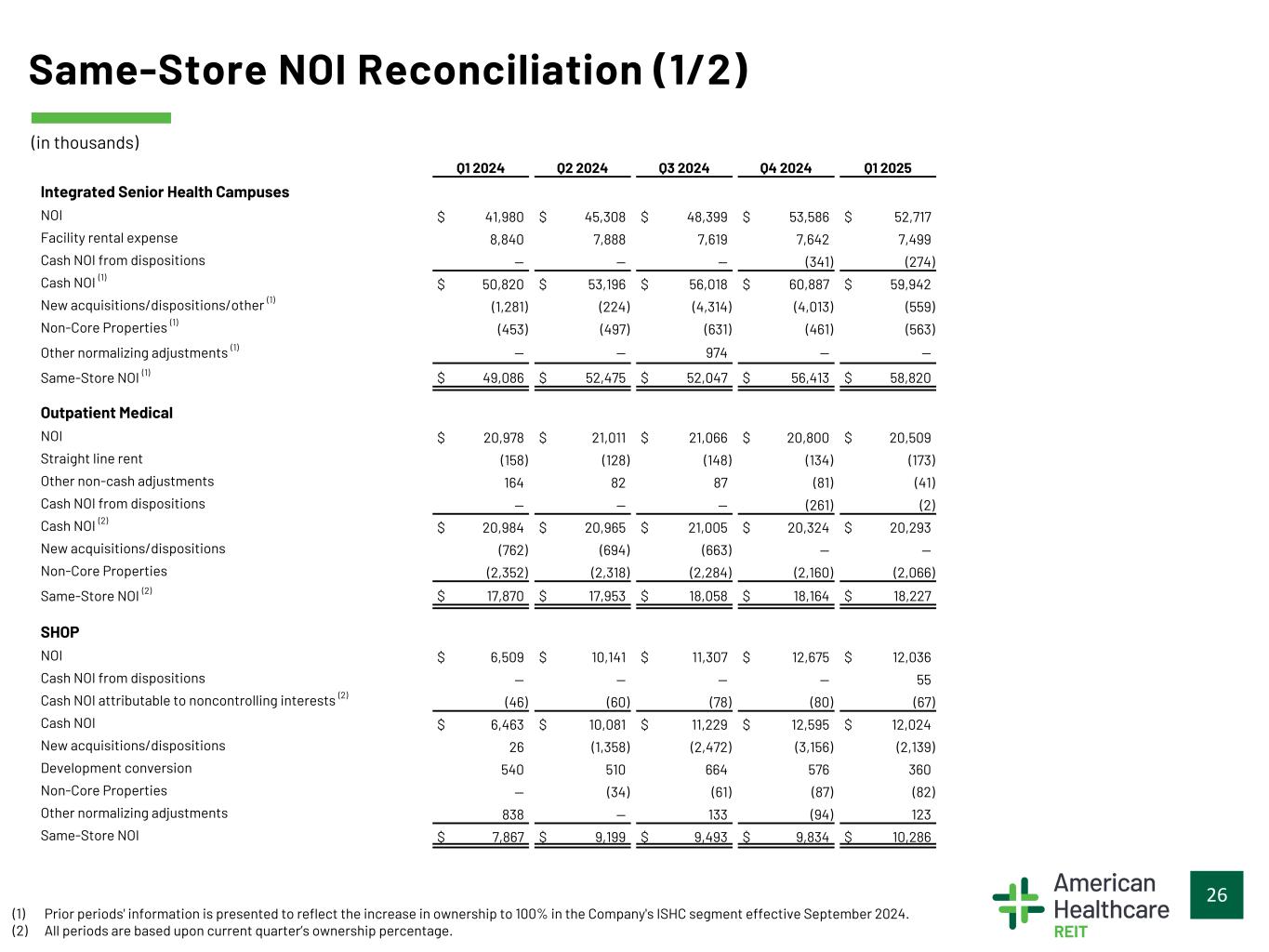

26 Same-Store NOI Reconciliation (1/2) Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Integrated Senior Health Campuses NOI $ 41,980 $ 45,308 $ 48,399 $ 53,586 $ 52,717 Facility rental expense 8,840 7,888 7,619 7,642 7,499 Cash NOI from dispositions — — — (341) (274) Cash NOI (1) $ 50,820 $ 53,196 $ 56,018 $ 60,887 $ 59,942 New acquisitions/dispositions/other (1) (1,281) (224) (4,314) (4,013) (559) Non-Core Properties (1) (453) (497) (631) (461) (563) Other normalizing adjustments (1) — — 974 — — Same-Store NOI (1) $ 49,086 $ 52,475 $ 52,047 $ 56,413 $ 58,820 Outpatient Medical NOI $ 20,978 $ 21,011 $ 21,066 $ 20,800 $ 20,509 Straight line rent (158) (128) (148) (134) (173) Other non-cash adjustments 164 82 87 (81) (41) Cash NOI from dispositions — — — (261) (2) Cash NOI (2) $ 20,984 $ 20,965 $ 21,005 $ 20,324 $ 20,293 New acquisitions/dispositions (762) (694) (663) — — Non-Core Properties (2,352) (2,318) (2,284) (2,160) (2,066) Same-Store NOI (2) $ 17,870 $ 17,953 $ 18,058 $ 18,164 $ 18,227 SHOP NOI $ 6,509 $ 10,141 $ 11,307 $ 12,675 $ 12,036 Cash NOI from dispositions — — — — 55 Cash NOI attributable to noncontrolling interests (2) (46) (60) (78) (80) (67) Cash NOI $ 6,463 $ 10,081 $ 11,229 $ 12,595 $ 12,024 New acquisitions/dispositions 26 (1,358) (2,472) (3,156) (2,139) Development conversion 540 510 664 576 360 Non-Core Properties — (34) (61) (87) (82) Other normalizing adjustments 838 — 133 (94) 123 Same-Store NOI $ 7,867 $ 9,199 $ 9,493 $ 9,834 $ 10,286 (in thousands) (1) Prior periods' information is presented to reflect the increase in ownership to 100% in the Company's ISHC segment effective September 2024. (2) All periods are based upon current quarter’s ownership percentage.

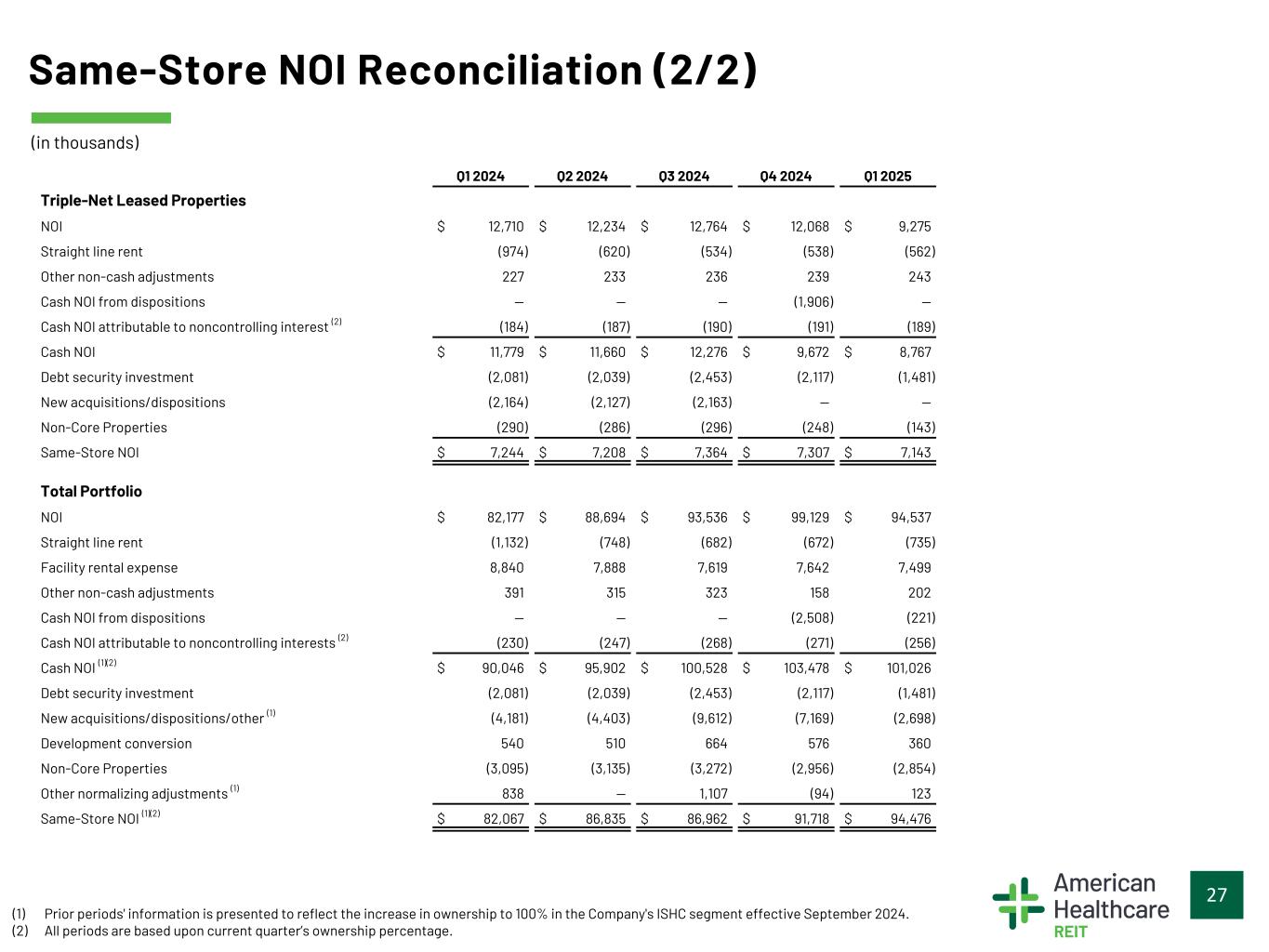

27 Same-Store NOI Reconciliation (2/2) Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Triple-Net Leased Properties NOI $ 12,710 $ 12,234 $ 12,764 $ 12,068 $ 9,275 Straight line rent (974) (620) (534) (538) (562) Other non-cash adjustments 227 233 236 239 243 Cash NOI from dispositions — — — (1,906) — Cash NOI attributable to noncontrolling interest (2) (184) (187) (190) (191) (189) Cash NOI $ 11,779 $ 11,660 $ 12,276 $ 9,672 $ 8,767 Debt security investment (2,081) (2,039) (2,453) (2,117) (1,481) New acquisitions/dispositions (2,164) (2,127) (2,163) — — Non-Core Properties (290) (286) (296) (248) (143) Same-Store NOI $ 7,244 $ 7,208 $ 7,364 $ 7,307 $ 7,143 Total Portfolio NOI $ 82,177 $ 88,694 $ 93,536 $ 99,129 $ 94,537 Straight line rent (1,132) (748) (682) (672) (735) Facility rental expense 8,840 7,888 7,619 7,642 7,499 Other non-cash adjustments 391 315 323 158 202 Cash NOI from dispositions — — — (2,508) (221) Cash NOI attributable to noncontrolling interests (2) (230) (247) (268) (271) (256) Cash NOI (1)(2) $ 90,046 $ 95,902 $ 100,528 $ 103,478 $ 101,026 Debt security investment (2,081) (2,039) (2,453) (2,117) (1,481) New acquisitions/dispositions/other (1) (4,181) (4,403) (9,612) (7,169) (2,698) Development conversion 540 510 664 576 360 Non-Core Properties (3,095) (3,135) (3,272) (2,956) (2,854) Other normalizing adjustments (1) 838 — 1,107 (94) 123 Same-Store NOI (1)(2) $ 82,067 $ 86,835 $ 86,962 $ 91,718 $ 94,476 (in thousands) (1) Prior periods' information is presented to reflect the increase in ownership to 100% in the Company's ISHC segment effective September 2024. (2) All periods are based upon current quarter’s ownership percentage.

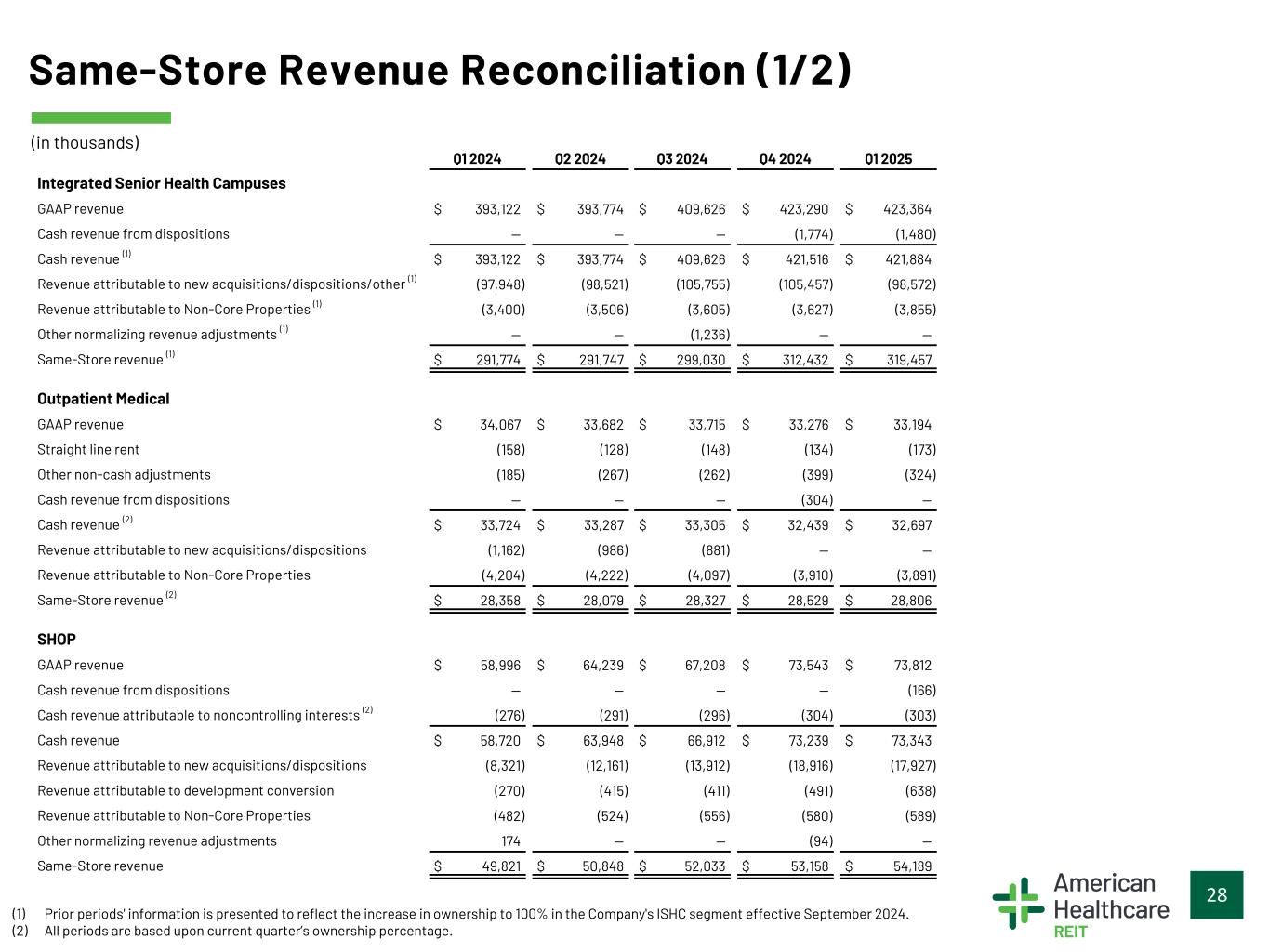

28 Same-Store Revenue Reconciliation (1/2) (1) Prior periods' information is presented to reflect the increase in ownership to 100% in the Company's ISHC segment effective September 2024. (2) All periods are based upon current quarter’s ownership percentage. Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Integrated Senior Health Campuses GAAP revenue $ 393,122 $ 393,774 $ 409,626 $ 423,290 $ 423,364 Cash revenue from dispositions — — — (1,774) (1,480) Cash revenue (1) $ 393,122 $ 393,774 $ 409,626 $ 421,516 $ 421,884 Revenue attributable to new acquisitions/dispositions/other (1) (97,948) (98,521) (105,755) (105,457) (98,572) Revenue attributable to Non-Core Properties (1) (3,400) (3,506) (3,605) (3,627) (3,855) Other normalizing revenue adjustments (1) — — (1,236) — — Same-Store revenue (1) $ 291,774 $ 291,747 $ 299,030 $ 312,432 $ 319,457 Outpatient Medical GAAP revenue $ 34,067 $ 33,682 $ 33,715 $ 33,276 $ 33,194 Straight line rent (158) (128) (148) (134) (173) Other non-cash adjustments (185) (267) (262) (399) (324) Cash revenue from dispositions — — — (304) — Cash revenue (2) $ 33,724 $ 33,287 $ 33,305 $ 32,439 $ 32,697 Revenue attributable to new acquisitions/dispositions (1,162) (986) (881) — — Revenue attributable to Non-Core Properties (4,204) (4,222) (4,097) (3,910) (3,891) Same-Store revenue (2) $ 28,358 $ 28,079 $ 28,327 $ 28,529 $ 28,806 SHOP GAAP revenue $ 58,996 $ 64,239 $ 67,208 $ 73,543 $ 73,812 Cash revenue from dispositions — — — — (166) Cash revenue attributable to noncontrolling interests (2) (276) (291) (296) (304) (303) Cash revenue $ 58,720 $ 63,948 $ 66,912 $ 73,239 $ 73,343 Revenue attributable to new acquisitions/dispositions (8,321) (12,161) (13,912) (18,916) (17,927) Revenue attributable to development conversion (270) (415) (411) (491) (638) Revenue attributable to Non-Core Properties (482) (524) (556) (580) (589) Other normalizing revenue adjustments 174 — — (94) — Same-Store revenue $ 49,821 $ 50,848 $ 52,033 $ 53,158 $ 54,189 (in thousands)

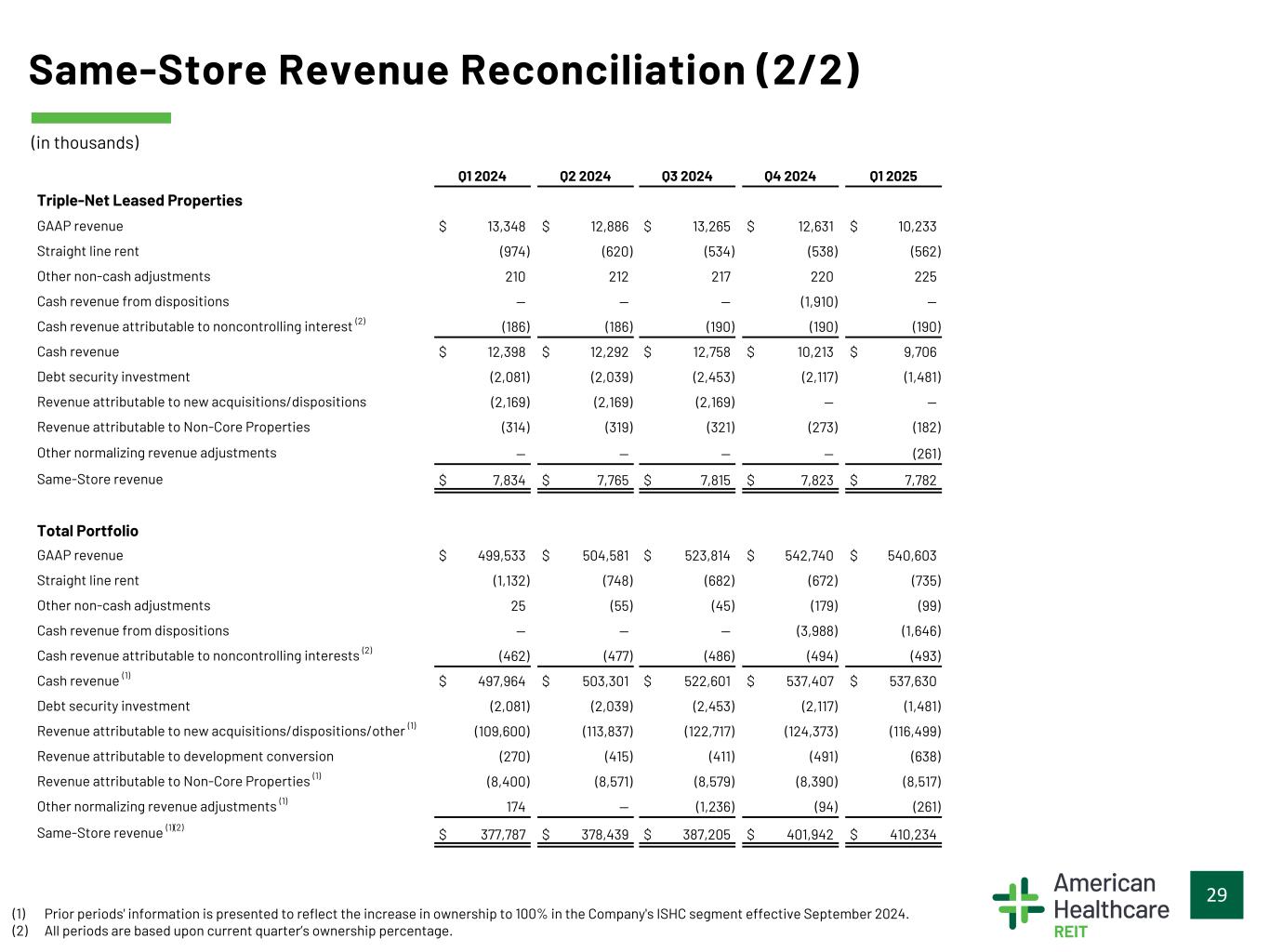

29 Same-Store Revenue Reconciliation (2/2) Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Triple-Net Leased Properties GAAP revenue $ 13,348 $ 12,886 $ 13,265 $ 12,631 $ 10,233 Straight line rent (974) (620) (534) (538) (562) Other non-cash adjustments 210 212 217 220 225 Cash revenue from dispositions — — — (1,910) — Cash revenue attributable to noncontrolling interest (2) (186) (186) (190) (190) (190) Cash revenue $ 12,398 $ 12,292 $ 12,758 $ 10,213 $ 9,706 Debt security investment (2,081) (2,039) (2,453) (2,117) (1,481) Revenue attributable to new acquisitions/dispositions (2,169) (2,169) (2,169) — — Revenue attributable to Non-Core Properties (314) (319) (321) (273) (182) Other normalizing revenue adjustments — — — — (261) Same-Store revenue $ 7,834 $ 7,765 $ 7,815 $ 7,823 $ 7,782 Total Portfolio GAAP revenue $ 499,533 $ 504,581 $ 523,814 $ 542,740 $ 540,603 Straight line rent (1,132) (748) (682) (672) (735) Other non-cash adjustments 25 (55) (45) (179) (99) Cash revenue from dispositions — — — (3,988) (1,646) Cash revenue attributable to noncontrolling interests (2) (462) (477) (486) (494) (493) Cash revenue (1) $ 497,964 $ 503,301 $ 522,601 $ 537,407 $ 537,630 Debt security investment (2,081) (2,039) (2,453) (2,117) (1,481) Revenue attributable to new acquisitions/dispositions/other (1) (109,600) (113,837) (122,717) (124,373) (116,499) Revenue attributable to development conversion (270) (415) (411) (491) (638) Revenue attributable to Non-Core Properties (1) (8,400) (8,571) (8,579) (8,390) (8,517) Other normalizing revenue adjustments (1) 174 — (1,236) (94) (261) Same-Store revenue (1)(2) $ 377,787 $ 378,439 $ 387,205 $ 401,942 $ 410,234 (in thousands) (1) Prior periods' information is presented to reflect the increase in ownership to 100% in the Company's ISHC segment effective September 2024. (2) All periods are based upon current quarter’s ownership percentage.

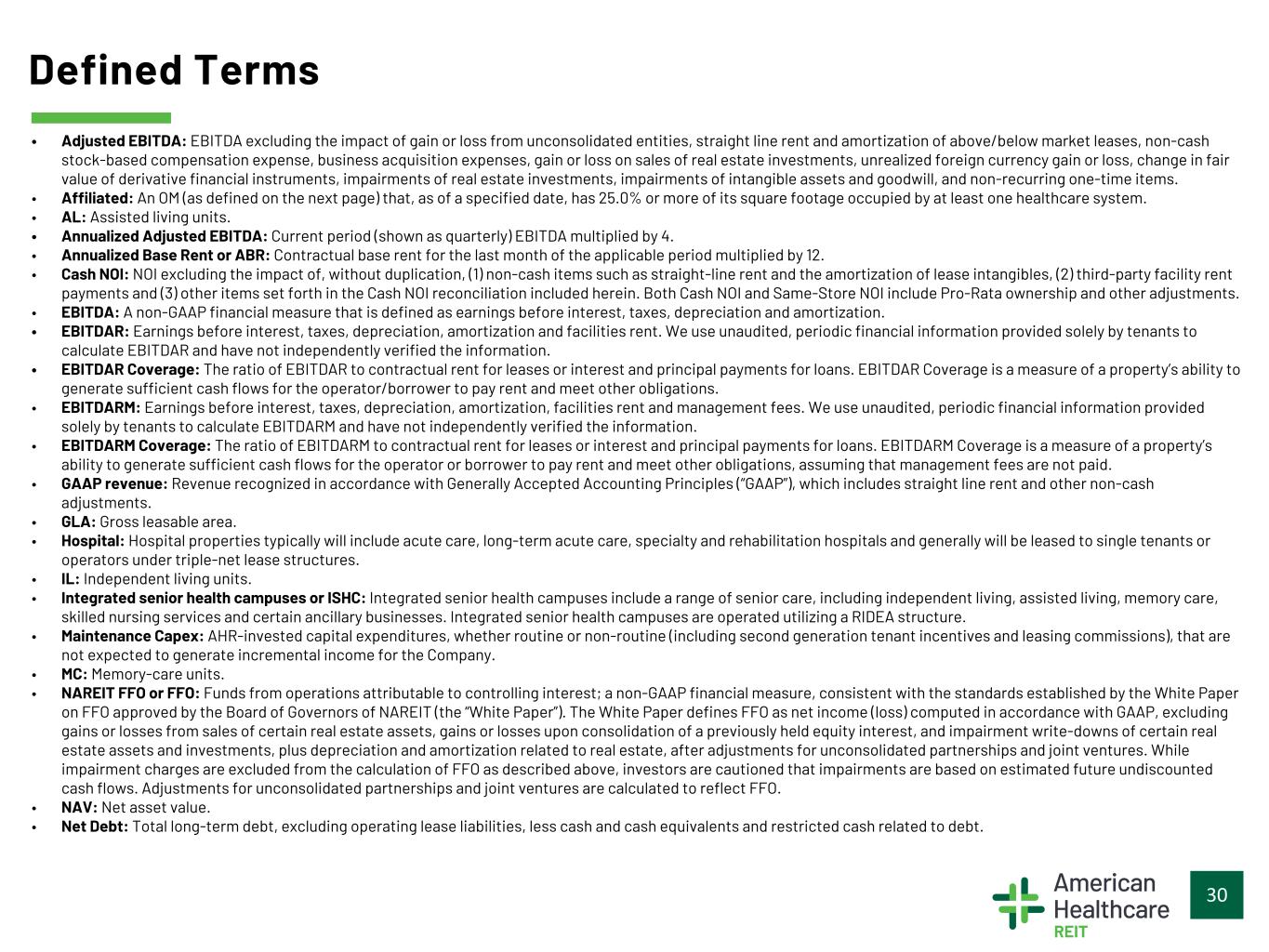

30 • Adjusted EBITDA: EBITDA excluding the impact of gain or loss from unconsolidated entities, straight line rent and amortization of above/below market leases, non-cash stock-based compensation expense, business acquisition expenses, gain or loss on sales of real estate investments, unrealized foreign currency gain or loss, change in fair value of derivative financial instruments, impairments of real estate investments, impairments of intangible assets and goodwill, and non-recurring one-time items. • Affiliated: An OM (as defined on the next page) that, as of a specified date, has 25.0% or more of its square footage occupied by at least one healthcare system. • AL: Assisted living units. • Annualized Adjusted EBITDA: Current period (shown as quarterly) EBITDA multiplied by 4. • Annualized Base Rent or ABR: Contractual base rent for the last month of the applicable period multiplied by 12. • Cash NOI: NOI excluding the impact of, without duplication, (1) non-cash items such as straight-line rent and the amortization of lease intangibles, (2) third-party facility rent payments and (3) other items set forth in the Cash NOI reconciliation included herein. Both Cash NOI and Same-Store NOI include Pro-Rata ownership and other adjustments. • EBITDA: A non-GAAP financial measure that is defined as earnings before interest, taxes, depreciation and amortization. • EBITDAR: Earnings before interest, taxes, depreciation, amortization and facilities rent. We use unaudited, periodic financial information provided solely by tenants to calculate EBITDAR and have not independently verified the information. • EBITDAR Coverage: The ratio of EBITDAR to contractual rent for leases or interest and principal payments for loans. EBITDAR Coverage is a measure of a property’s ability to generate sufficient cash flows for the operator/borrower to pay rent and meet other obligations. • EBITDARM: Earnings before interest, taxes, depreciation, amortization, facilities rent and management fees. We use unaudited, periodic financial information provided solely by tenants to calculate EBITDARM and have not independently verified the information. • EBITDARM Coverage: The ratio of EBITDARM to contractual rent for leases or interest and principal payments for loans. EBITDARM Coverage is a measure of a property’s ability to generate sufficient cash flows for the operator or borrower to pay rent and meet other obligations, assuming that management fees are not paid. • GAAP revenue: Revenue recognized in accordance with Generally Accepted Accounting Principles (“GAAP”), which includes straight line rent and other non-cash adjustments. • GLA: Gross leasable area. • Hospital: Hospital properties typically will include acute care, long-term acute care, specialty and rehabilitation hospitals and generally will be leased to single tenants or operators under triple-net lease structures. • IL: Independent living units. • Integrated senior health campuses or ISHC: Integrated senior health campuses include a range of senior care, including independent living, assisted living, memory care, skilled nursing services and certain ancillary businesses. Integrated senior health campuses are operated utilizing a RIDEA structure. • Maintenance Capex: AHR-invested capital expenditures, whether routine or non-routine (including second generation tenant incentives and leasing commissions), that are not expected to generate incremental income for the Company. • MC: Memory-care units. • NAREIT FFO or FFO: Funds from operations attributable to controlling interest; a non-GAAP financial measure, consistent with the standards established by the White Paper on FFO approved by the Board of Governors of NAREIT (the “White Paper”). The White Paper defines FFO as net income (loss) computed in accordance with GAAP, excluding gains or losses from sales of certain real estate assets, gains or losses upon consolidation of a previously held equity interest, and impairment write-downs of certain real estate assets and investments, plus depreciation and amortization related to real estate, after adjustments for unconsolidated partnerships and joint ventures. While impairment charges are excluded from the calculation of FFO as described above, investors are cautioned that impairments are based on estimated future undiscounted cash flows. Adjustments for unconsolidated partnerships and joint ventures are calculated to reflect FFO. • NAV: Net asset value. • Net Debt: Total long-term debt, excluding operating lease liabilities, less cash and cash equivalents and restricted cash related to debt. Defined Terms

31 • NOI: Net operating income; a non-GAAP financial measure that is defined as net income (loss), computed in accordance with GAAP, generated from properties before general and administrative expenses, business acquisition expenses, depreciation and amortization, interest expense, gain or loss in fair value of derivative financial instruments, gain or loss on dispositions, impairments of real estate investments, impairments of intangible assets and goodwill, income or loss from unconsolidated entities, gain on re-measurement of previously held equity interest, foreign currency gain or loss, other income or expense and income tax benefit or expense. • NOI margin: A profitability metric that measures how efficiently a property or portfolio is operated by comparing its NOI to its revenue. Calculated by dividing NOI by revenue. • Non-Core Properties: Assets that have been deemed not essential to generating future economic benefit or value to our day-to-day operations and/or are scheduled to be sold. • Normalized FFO attributable to controlling interest or NFFO: FFO further adjusted for the following items included in the determination of GAAP net income (loss): expensed acquisition fees and costs, which we refer to as business acquisition expenses; amounts relating to changes in deferred rent and amortization of above and below-market leases (which are adjusted in order to reflect such payments from a GAAP accrual basis); the non-cash impact of changes to our equity instruments; non-cash or non- recurring income or expense; the noncash effect of income tax benefits or expenses; capitalized interest; impairments of intangible assets and goodwill; amortization of closing costs on debt investments; mark-to-market adjustments included in net income (loss); gains or losses included in net income (loss) from the extinguishment or sale of debt, hedges, foreign exchange, derivatives or securities holdings where trading of such holdings is not a fundamental attribute of the business plan; and after adjustments for consolidated and unconsolidated partnerships and joint ventures, with such adjustments calculated to reflect Normalized FFO on the same basis. • Occupancy: With respect to OM, the percentage of total rentable square feet leased and occupied, including month-to-month leases, as of the date reported. With respect to all other property types, occupancy represents average quarterly operating occupancy based on the most recent quarter of available data. The Company uses unaudited, periodic financial information provided solely by tenants to calculate occupancy and has not independently verified the information. • OM: Outpatient Medical buildings. • OP unit: Units of limited partnership interest in the Operating Partnership, which are redeemable for cash or, at our election, shares of our common stock on a one-for-one basis, subject to certain adjustments. • Operating Partnership: American Healthcare REIT Holdings, LP, a Delaware limited partnership, through which we conduct substantially all of our business and of which Continental Merger Sub, LLC, a Delaware limited liability company and our wholly-owned subsidiary, is the sole general partner. • Pro-Rata: As of March 31, 2025 we owned and/or operated eight other buildings through entities of which we owned between 90.0% and 98.0% of the ownership interests. Because we have a controlling interest in these entities, these entities and the properties these entities own are consolidated in our financial statements in accordance with GAAP. However, while such properties are presented in our financial statements on a consolidated basis, we are only entitled to our Pro-Rata share of the net cash flows generated by such properties. As a result, we have presented certain property information herein based on our Pro-Rata ownership interest in these entities and the properties these entities own, as of the applicable date, and not on a consolidated basis. In such instances, information is noted as being presented on a “Pro-Rata share” basis. • Quality Mix: Total number of Medicare, Managed Care, Medicare Advantage and private days or revenue divided by the total number of actual patient days or total revenue for all payor types within Skilled Nursing and Senior Housing beds in the ISHC segment. • Retention: The ratio of total renewed square feet and month-to-month leases retained to the total square feet expiring, excluding the square feet for tenant leases terminated and leases in assets expected to be sold for the trailing 12-months. • RevPOR: Revenue per occupied room. RevPOR is calculated as total revenue generated by occupied rooms divided by the number of occupied rooms. • RIDEA: Used to describe properties within the portfolio that utilize the RIDEA structure as described in “RIDEA structure”. Defined Terms

32 • RIDEA structure: A structure permitted by the REIT Investment Diversification and Empowerment Act of 2007, pursuant to which we lease certain healthcare real estate properties to a wholly-owned taxable REIT subsidiary (TRS), which in turn contracts with an eligible independent contractor (EIK) to operate such properties for a fee. Under this structure, the EIK receives management fees, and the TRS receives revenue from the operation of the healthcare real estate properties and retains, as profit, any revenue remaining after payment of expenses (including intercompany rent paid to us and any taxes at the TRS level) necessary to operate the property. Through the RIDEA structure, in addition to receiving rental revenue from the TRS, we retain any after-tax profit from the operation of the healthcare real estate properties and benefit from any improved operational performance while bearing the risk of any decline in operating performance at the properties. • Same-Store or SS: Properties owned or consolidated the full year in both comparison years and that are not otherwise excluded. Properties are excluded from Same-Store if they are: (1) sold, classified as held for sale or properties whose operations were classified as discontinued operations in accordance with GAAP; (2) impacted by materially disruptive events, such as flood or fire for an extensive period of time; or (3) scheduled to undergo or currently undergoing major expansions/renovations or business model transitions or have transitioned business models after the start of the prior comparison period. • Same-Store NOI or SS NOI: Cash NOI for our Same-Store properties. Same-Store NOI is used to evaluate the operating performance of our properties using a consistent population which controls for changes in the composition of our portfolio. Both Cash NOI and Same-Store NOI include ownership and other adjustments. • Senior Housing-Leased: Senior housing facilities cater to different segments of the elderly population based upon their personal needs and include assisted living, memory care and independent living. Residents of assisted living facilities typically require limited medical care and need assistance with eating, bathing, dressing and/or medication management, and those services can be provided by staff at the facility. Resident programs offered at such facilities may include transportation, social activities and exercise and fitness programs. Our Senior Housing-Leased properties are Triple-net leased. • SHOP: Senior housing operating properties. • SNFs: Skilled nursing facilities. • Square Feet or Sq. Ft.: Net rentable square feet calculated utilizing Building Owners and Managers Association measurement standards. • Total Debt: The principal balances of the Company’s revolving credit facility, term loan and secured indebtedness as reported in the Company’s consolidated financial statements. • Trilogy: Trilogy Investors, LLC; in which we indirectly owned a 100% interest in Trilogy as of March 31, 2025. • Triple-net leased: A lease where the tenant is responsible for making rent payments, maintaining the leased property, and paying property taxes and other expenses. Defined Terms