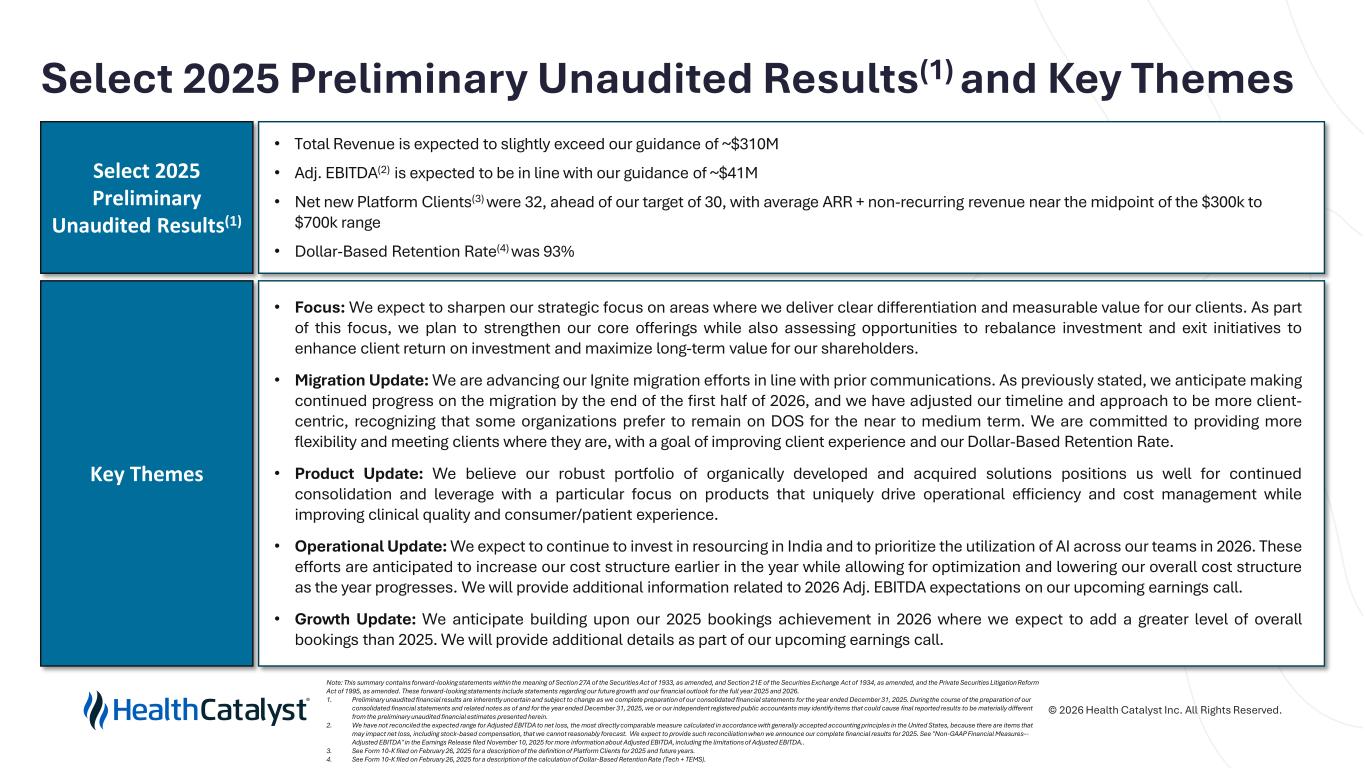

© 2026 Health Catalyst Inc. All Rights Reserved. Select 2025 Preliminary Unaudited Results(1) and Key Themes Note: This summary contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, as amended. These forward-looking statements include statements regarding our future growth and our financial outlook for the full year 2025 and 2026. 1. Preliminary unaudited financial results are inherently uncertain and subject to change as we complete preparation of our consolidated financial statements for the year ended December 31, 2025. During the course of the preparation of our consolidated financial statements and related notes as of and for the year ended December 31, 2025, we or our independent registered public accountants may identify items that could cause final reported results to be materially different from the preliminary unaudited financial estimates presented herein. 2. We have not reconciled the expected range for Adjusted EBITDA to net loss, the most directly comparable measure calculated in accordance with generally accepted accounting principles in the United States, because there are items that may impact net loss, including stock-based compensation, that we cannot reasonably forecast. We expect to provide such reconciliation when we announce our complete financial results for 2025. See "Non-GAAP Financial Measures-- Adjusted EBITDA" in the Earnings Release filed November 10, 2025 for more information about Adjusted EBITDA, including the limitations of Adjusted EBITDA.. 3. See Form 10-K filed on February 26, 2025 for a description of the definition of Platform Clients for 2025 and future years. 4. See Form 10-K filed on February 26, 2025 for a description of the calculation of Dollar-Based Retention Rate (Tech + TEMS). • Total Revenue is expected to slightly exceed our guidance of ~$310M • Adj. EBITDA(2) is expected to be in line with our guidance of ~$41M • Net new Platform Clients(3) were 32, ahead of our target of 30, with average ARR + non-recurring revenue near the midpoint of the $300k to $700k range • Dollar-Based Retention Rate(4) was 93% Select 2025 Preliminary Unaudited Results(1) Key Themes • Focus: We expect to sharpen our strategic focus on areas where we deliver clear differentiation and measurable value for our clients. As part of this focus, we plan to strengthen our core offerings while also assessing opportunities to rebalance investment and exit initiatives to enhance client return on investment and maximize long-term value for our shareholders. • Migration Update: We are advancing our Ignite migration efforts in line with prior communications. As previously stated, we anticipate making continued progress on the migration by the end of the first half of 2026, and we have adjusted our timeline and approach to be more client- centric, recognizing that some organizations prefer to remain on DOS for the near to medium term. We are committed to providing more flexibility and meeting clients where they are, with a goal of improving client experience and our Dollar-Based Retention Rate. • Product Update: We believe our robust portfolio of organically developed and acquired solutions positions us well for continued consolidation and leverage with a particular focus on products that uniquely drive operational efficiency and cost management while improving clinical quality and consumer/patient experience. • Operational Update: We expect to continue to invest in resourcing in India and to prioritize the utilization of AI across our teams in 2026. These efforts are anticipated to increase our cost structure earlier in the year while allowing for optimization and lowering our overall cost structure as the year progresses. We will provide additional information related to 2026 Adj. EBITDA expectations on our upcoming earnings call. • Growth Update: We anticipate building upon our 2025 bookings achievement in 2026 where we expect to add a greater level of overall bookings than 2025. We will provide additional details as part of our upcoming earnings call.