Investor Presentation June 30, 2025

fidelisinsurance.com This presentation contains “forward-looking statements” which include all statements that do not relate solely to historical or current facts and which may concern our strategy, plans, targets, projections or intentions and are made pursuant to the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “continue,” “grow,” “opportunity,” “create,” “anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,” “project,” “estimate,” “target,” “tracking,” “expect,” “evolve,” “achieve,” “remain,” “proactive,” “pursue,” “optimize,” “emerge,” “build,” “looking ahead,” “commit,” “strategy,” “predict,” “potential,” “assumption,” “future,” “likely,” “may,” “should,” “could,” “will” and the negative of these and also similar terms and phrases. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are qualified by these cautionary statements, because they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, targets, projections, anticipated events and trends, the economy and other future conditions, but are subject to significant business, economic, legal and competitive uncertainties, many of which are beyond our control or are subject to change. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Examples of forward-looking statements may include, among others, statements we make in relation to: targeted operating results such as return on equity, net income and earnings per share, underwriting profitability and target combined, loss and expense ratios, growth in gross written premiums and book value per share; our expectations regarding current settlement discussions, court cases and current settlement and litigation strategies; our expectations regarding our business, including the industries we operate in, and capital management strategy and the performance of our business; information regarding our estimates for catastrophes, claims and other loss events; our liquidity and capital resources; and expectations of the effect on our results of operations and financial condition of our loss claims, litigation, climate change impacts, contingent liabilities and governmental and regulatory investigations and proceedings. Our actual results in the future could differ materially from those anticipated in any forward-looking statements as a result of changes in assumptions, risks, uncertainties and other factors impacting us, many of which are outside our control, including: our ability to manage risks associated with macroeconomic conditions including any escalation of the Ukraine Conflict or those in the Middle East, or related sanctions and other geopolitical events globally; trends related to premium rate hardening or premium rate softening leading to a cyclical downturn of pricing in the (re)insurance industry; the impact of inflation (including social inflation) or deflation in relevant economies in which we operate; our ability to evaluate and measure our business, prospects and performance metrics and respond accordingly; the failure of our risk management policies and procedures to be adequate to identify, monitor and manage risks, which may leave us exposed to unidentified or unanticipated risks; any litigation to which we are party being resolved unfavorably to our prior expectations, whether through court decisions or otherwise through effecting settlements (where such settlements are capable of being achieved), based on emerging information, the actions of other parties or any other failure to resolve such litigation favorably; the inherent unpredictability of litigation and any related settlement negotiations which may or may not lead to an agreed settlement of particular matters; the outcomes of probabilistic models which are based on historical assumptions and which can differ from actual results or other emerging information as compared to such assumptions; the less developed data and parameter inputs for industry catastrophe models for perils such as wildfires and flood; the effect of climate change on our business, including the trend towards increasingly frequent and severe catastrophic events; the possibility of greater frequency or severity of claims and loss activity than our underwriting, reserving or investment practices have anticipated; the development and pattern of earned and written premiums impacting embedded premium value; the reliability of pricing, accumulation and estimated loss models; the impact of complex causation and coverage issues associated with attribution of losses; the actual development of losses and expenses impacting estimates for claims which arose as a result of loss activity, particularly for events where estimates are preliminary until the development of such reserves based on emerging information over time; our ability to successfully implement our long-term strategy and compete successfully with more established competitors and increased competition relating to consolidation in the reinsurance and insurance industries; any downgrades, potential downgrades or other negative actions by rating agencies relating to us or our industry; changes to our strategic relationship with The Fidelis Partnership and our dependence on the Delegated Underwriting Authority Agreements for our underwriting and claims-handling operations; our dependence on key executives and ability to attract qualified personnel; our dependence on letter of credit facilities that may not be available on commercially acceptable terms; our potential inability to pay dividends or distributions in accordance with our current dividend policy, due to changing conditions; availability of outwards reinsurance on commercially acceptable terms; the recovery of losses and reinstatement premiums from our reinsurance providers; our potential need for additional capital in the future and the potential unavailability of such capital to us on favorable terms or at all; our dependence on clients’ evaluation of risks associated with such clients’ insurance underwriting; the suspension or revocation of our subsidiaries’ insurance licenses; our potentially being subject to certain adverse tax or regulatory consequences in the U.S., U.K. or Bermuda; risks associated with our investment strategy such as market risk, interest rate risk, currency risk and credit default risk; the impact of tax reform and changes in the regulatory environment and the potential for greater regulatory scrutiny of the Group as a result of the outsourcing arrangements; heightened risk of cybersecurity incidents and their potential impact on our business; risks associated with our use or anticipated use of emerging technologies, such as artificial intelligence technologies, including potential legal, regulatory and operational risks; operational failures, including the operational risk associated with outsourcing to The Fidelis Partnership, failure of information systems or failure to protect the confidentiality of customer information, including by service providers, or losses due to defaults, errors or omissions by third parties and affiliates; risks relating to our ability to identify and execute opportunities for growth or our ability to complete transactions as planned or realize the anticipated benefits of our acquisitions or other investments; our status as a foreign private issuer means that it will be subject to the reporting obligations under the U.S. Securities Exchange Act of 1934, as amended, that, to some extent, are more lenient and less frequent than those of a U.S. domestic public company; our ability to maintain the listing of our common shares on NYSE or another national securities exchange; and the other risks, uncertainties and other factors disclosed under the section titled “Risk Factors” in our Annual Report on Form 20-F filed with the SEC on March 11, 2025, as well as subsequent Current Report and other filings with the SEC available electronically at www.sec.gov. The foregoing factors should not be construed as exhaustive and should be read together with the other cautionary statements included in our filings with the SEC. All forward-looking statements included herein are expressly qualified in their entirety by the cautionary statements contained or referred to therein. The forward-looking statements contained in this press release are neither promises nor guarantees, and you should not place undue reliance on these forward-looking statements because they involve known and unknown risks, uncertainties, and other factors, many of which are beyond our control and which could cause actual results, performance or achievements to differ materially from those expressed or implied by these forward-looking statements. Any forward-looking statements, expectations, beliefs and projections made by us in this presentation speak only as of the date referenced on such date on which they are made and are expressed in good faith and our management believes that there is reasonable basis for them, based only on information currently available to us. There can be no assurance that management’s expectations, beliefs, and projections will be achieved and actual results may vary materially from what is expressed or indicated by the forward-looking statements. Furthermore, our past performance, and that of our management team and of The Fidelis Partnership, should not be construed as a guarantee of future performance. Except to the extent required by applicable laws and regulations, we undertake no obligation to update or revise any forward-looking statement contained in this press release, whether as a result of new information, future developments or otherwise. In light of these risks and uncertainties, you should keep in mind that any event described in a forward-looking statement might not occur. Basis of Presentation Cautionary Note Regarding Forward-Looking Statements 2

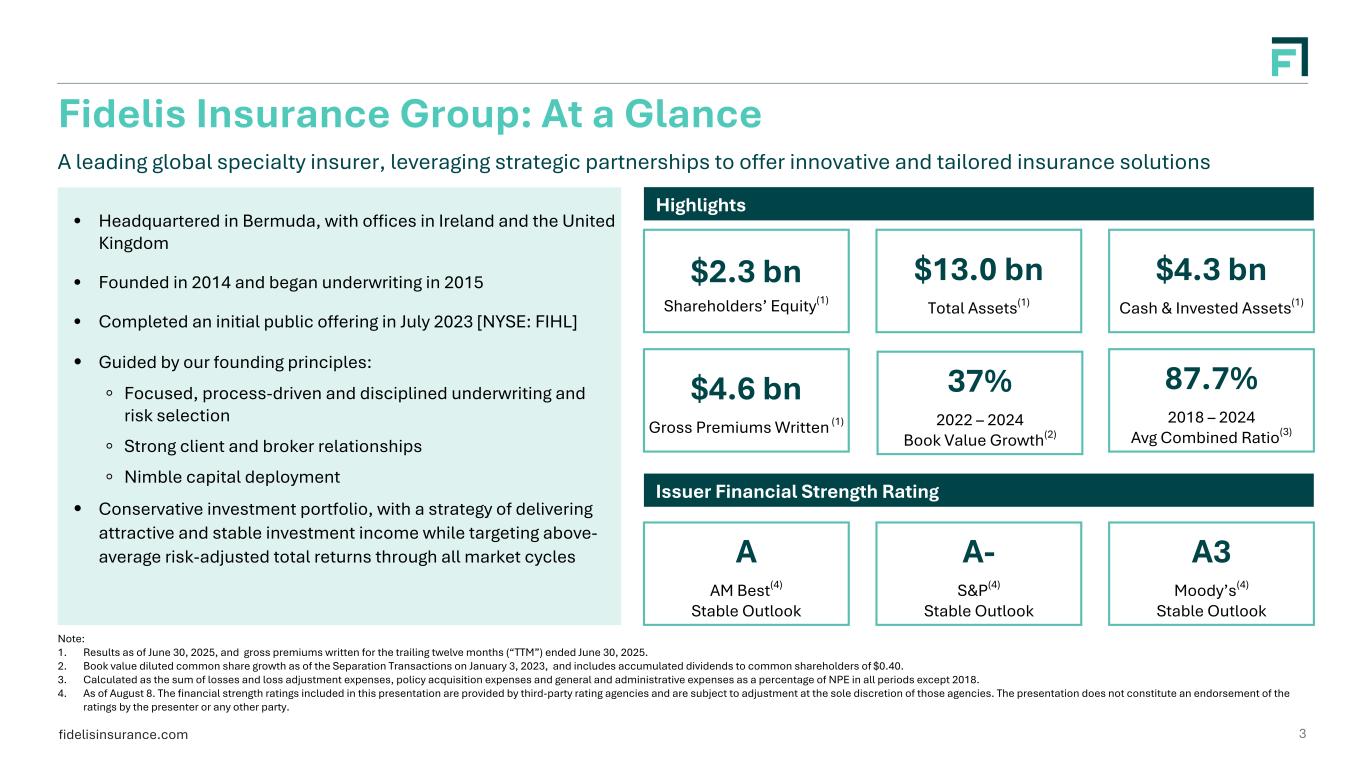

fidelisinsurance.com Fidelis Insurance Group: At a Glance Note: 1. Results as of June 30, 2025, and gross premiums written for the trailing twelve months (“TTM”) ended June 30, 2025. 2. Book value diluted common share growth as of the Separation Transactions on January 3, 2023, and includes accumulated dividends to common shareholders of $0.40. 3. Calculated as the sum of losses and loss adjustment expenses, policy acquisition expenses and general and administrative expenses as a percentage of NPE in all periods except 2018. 4. As of August 8. The financial strength ratings included in this presentation are provided by third-party rating agencies and are subject to adjustment at the sole discretion of those agencies. The presentation does not constitute an endorsement of the ratings by the presenter or any other party. Highlights A leading global specialty insurer, leveraging strategic partnerships to offer innovative and tailored insurance solutions 3 $13.0 bn Total Assets(1) $2.3 bn Shareholders’ Equity(1) $4.3 bn Cash & Invested Assets(1) $4.6 bn Gross Premiums Written (1) Issuer Financial Strength Rating 37% 2022 – 2024 Book Value Growth(2) 87.7% 2018 – 2024 Avg Combined Ratio(3) • Headquartered in Bermuda, with offices in Ireland and the United Kingdom • Founded in 2014 and began underwriting in 2015 • Completed an initial public offering in July 2023 [NYSE: FIHL] • Guided by our founding principles: ◦ Focused, process-driven and disciplined underwriting and risk selection ◦ Strong client and broker relationships ◦ Nimble capital deployment • Conservative investment portfolio, with a strategy of delivering attractive and stable investment income while targeting above- average risk-adjusted total returns through all market cycles A AM Best(4) Stable Outlook A- S&P(4) Stable Outlook A3 Moody’s(4) Stable Outlook

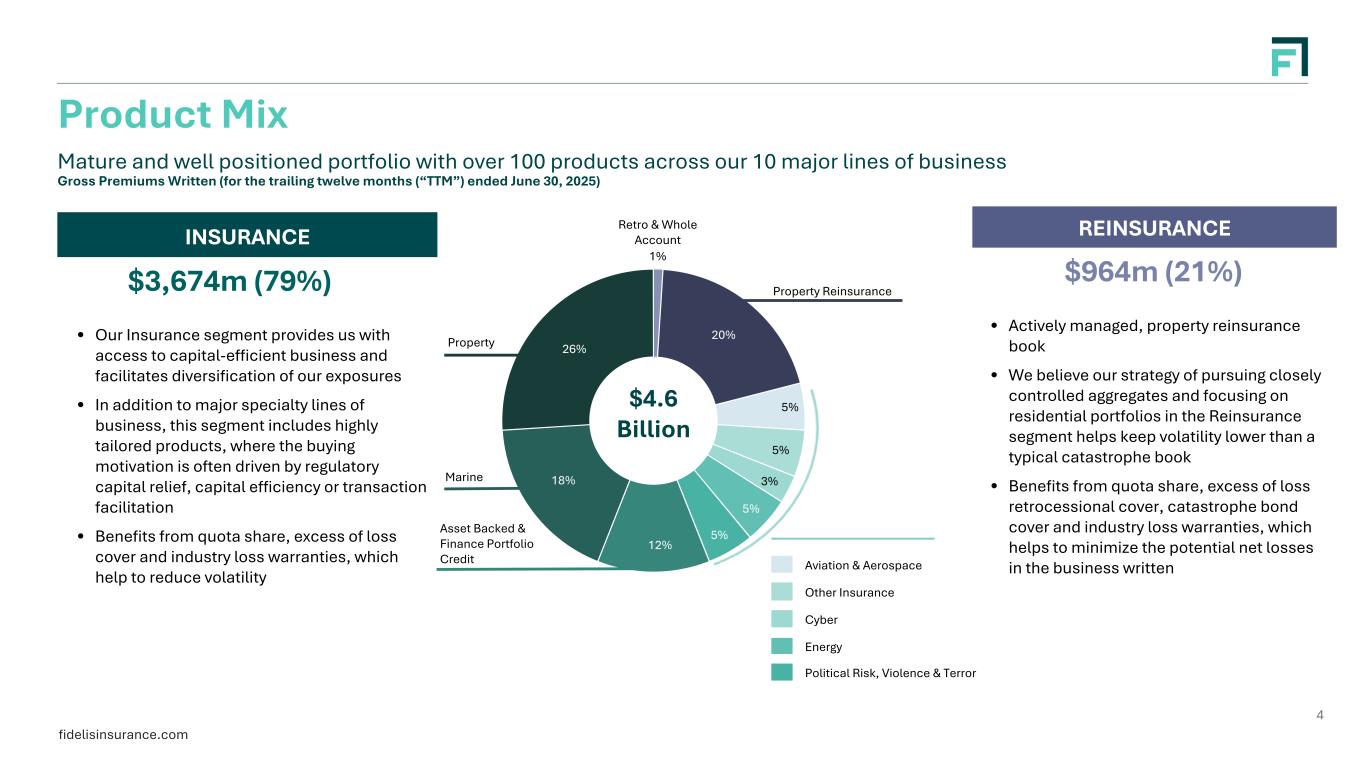

fidelisinsurance.com 1% 20% 5% 5% 3% 5% 5% 12% 18% 26% Over 100 products across our 10 major lines of business $964m (21%) • Actively managed, property reinsurance book • We believe our strategy of pursuing closely controlled aggregates and focusing on residential portfolios in the Reinsurance segment helps keep volatility lower than a typical catastrophe book • Benefits from quota share, excess of loss retrocessional cover, catastrophe bond cover and industry loss warranties, which helps to minimize the potential net losses in the business written INSURANCE $3,674m (79%) • Our Insurance segment provides us with access to capital-efficient business and facilitates diversification of our exposures • In addition to major specialty lines of business, this segment includes highly tailored products, where the buying motivation is often driven by regulatory capital relief, capital efficiency or transaction facilitation • Benefits from quota share, excess of loss cover and industry loss warranties, which help to reduce volatility Product Mix $4.6 Billion 4 REINSURANCE Gross Premiums Written (for the trailing twelve months (“TTM”) ended June 30, 2025) Mature and well positioned portfolio with over 100 products across our 10 major lines of business Retro & Whole Account Property Marine Property Reinsurance Aviation & Aerospace Other Insurance Cyber Energy Political Risk, Violence & Terror 1 Asset Backed & Finance Portfolio Credit

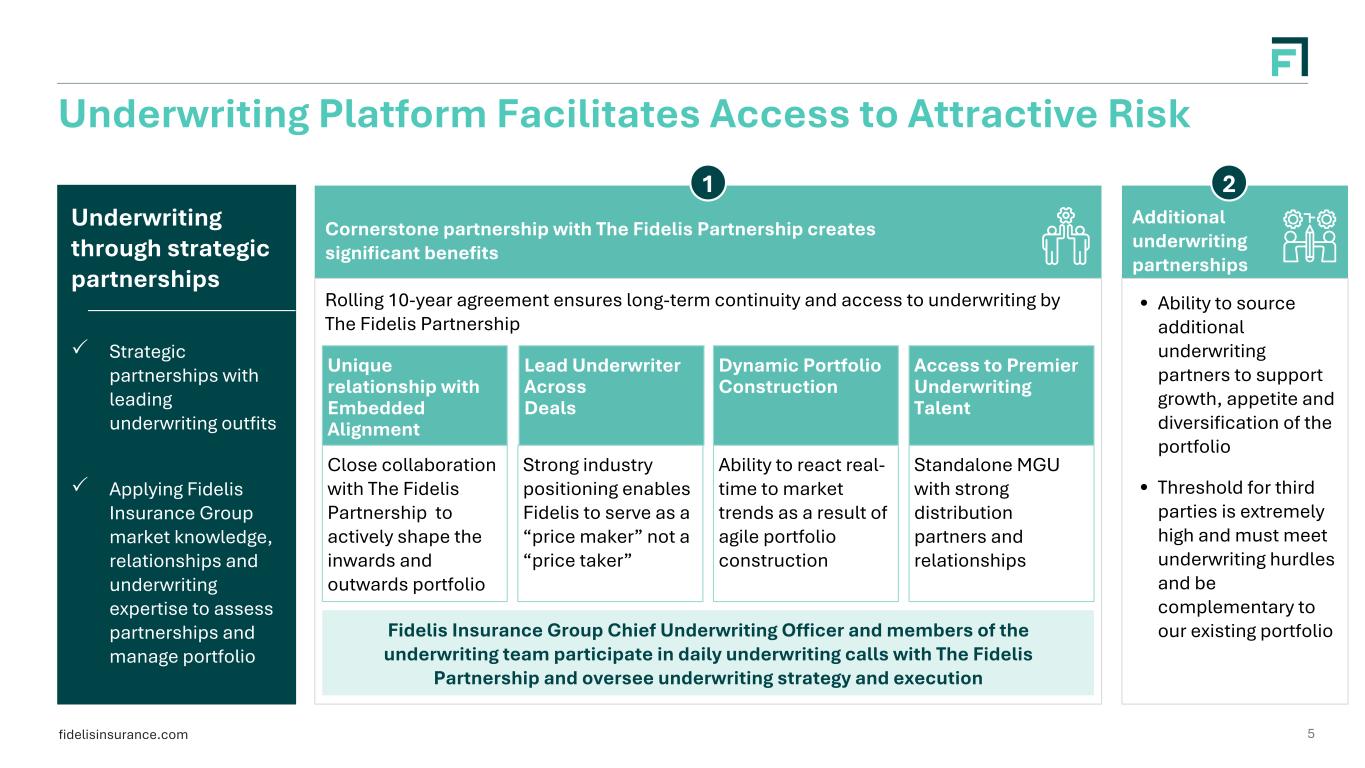

fidelisinsurance.com Underwriting Platform Facilitates Access to Attractive Risk Additional underwriting partnerships • Ability to source additional underwriting partners to support growth, appetite and diversification of the portfolio • Threshold for third parties is extremely high and must meet underwriting hurdles and be complementary to our existing portfolio Cornerstone partnership with The Fidelis Partnership creates significant benefits Rolling 10-year agreement ensures long-term continuity and access to underwriting by The Fidelis Partnership Fidelis Insurance Group Chief Underwriting Officer and members of the underwriting team participate in daily underwriting calls with The Fidelis Partnership and oversee underwriting strategy and execution Close collaboration with The Fidelis Partnership to actively shape the inwards and outwards portfolio Unique relationship with Embedded Alignment Strong industry positioning enables Fidelis to serve as a “price maker” not a “price taker” Lead Underwriter Across Deals Ability to react real- time to market trends as a result of agile portfolio construction Dynamic Portfolio Construction Access to Premier Underwriting Talent Standalone MGU with strong distribution partners and relationships 1 2 5 Underwriting through strategic partnerships P Strategic partnerships with leading underwriting outfits P Applying Fidelis Insurance Group market knowledge, relationships and underwriting expertise to assess partnerships and manage portfolio

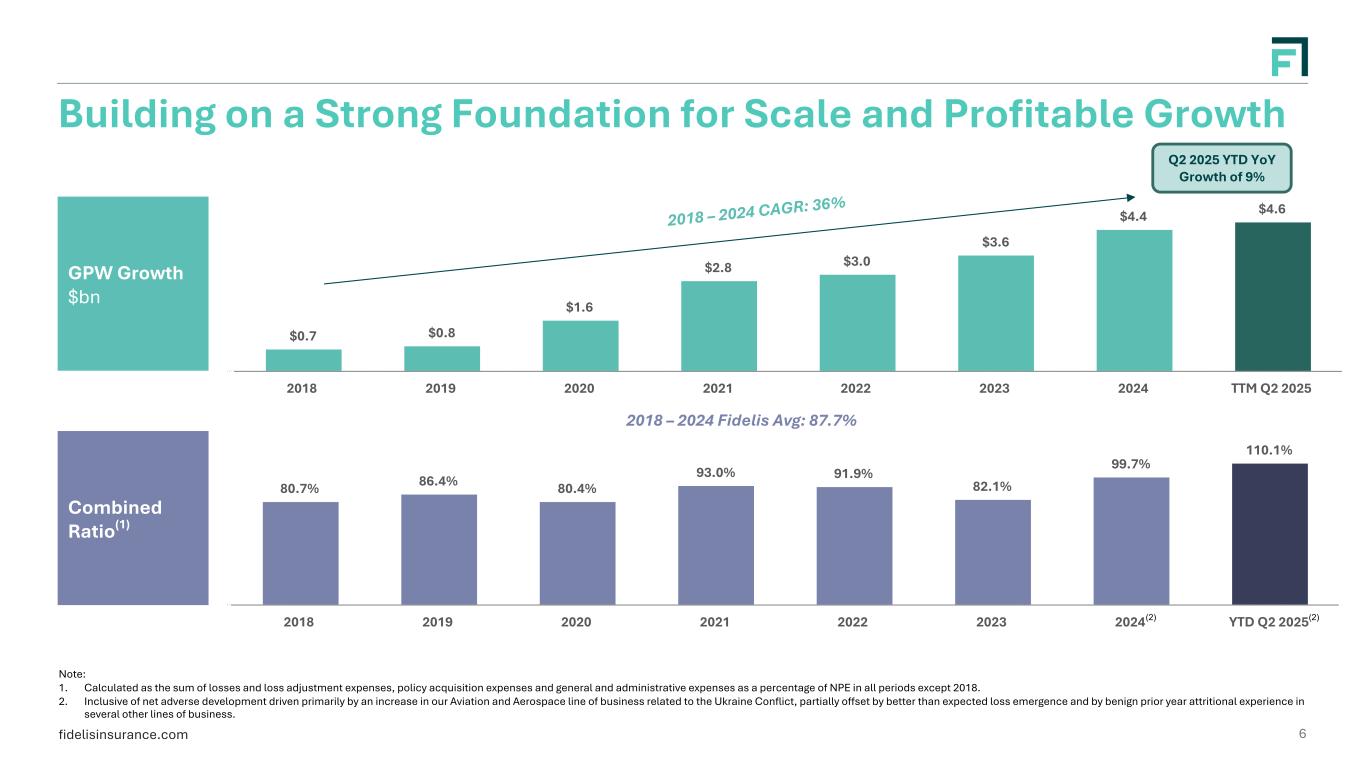

fidelisinsurance.com $0.7 $0.8 $1.6 $2.8 $3.0 $3.6 $4.4 $4.6 2018 2019 2020 2021 2022 2023 2024 TTM Q2 2025 80.7% 86.4% 80.4% 93.0% 91.9% 82.1% 99.7% 110.1% 2018 2019 2020 2021 2022 2023 2024 YTD Q2 2025 Building on a Strong Foundation for Scale and Profitable Growth Note: 1. Calculated as the sum of losses and loss adjustment expenses, policy acquisition expenses and general and administrative expenses as a percentage of NPE in all periods except 2018. 2. Inclusive of net adverse development driven primarily by an increase in our Aviation and Aerospace line of business related to the Ukraine Conflict, partially offset by better than expected loss emergence and by benign prior year attritional experience in several other lines of business. 6 2018 – 2024 CAGR: 36% GPW Growth $bn Combined Ratio(1) 2018 – 2024 Fidelis Avg: 87.7% (2) (2) Q2 2025 YTD YoY Growth of 9%

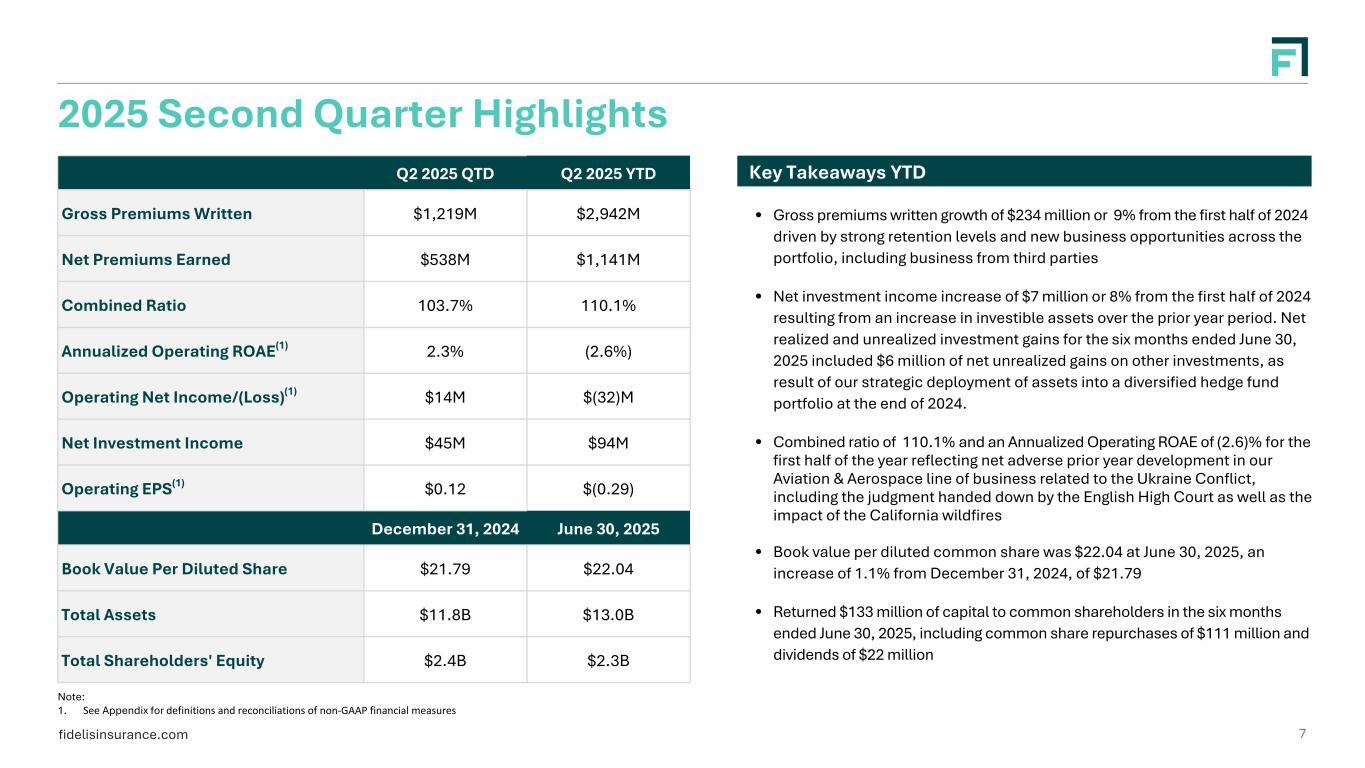

fidelisinsurance.com Key Takeaways YTD 2025 Second Quarter Highlights Note: 1. See Appendix for definitions and reconciliations of non-GAAP financial measures Q2 2025 QTD Q2 2025 YTD Gross Premiums Written $1,219M $2,942M Net Premiums Earned $538M $1,141M Combined Ratio 103.7% 110.1% Annualized Operating ROAE(1) 2.3% (2.6%) Operating Net Income/(Loss)(1) $14M $(32)M Net Investment Income $45M $94M Operating EPS(1) $0.12 $(0.29) December 31, 2024 June 30, 2025 Book Value Per Diluted Share $21.79 $22.04 Total Assets $11.8B $13.0B Total Shareholders' Equity $2.4B $2.3B • Gross premiums written growth of $234 million or 9% from the first half of 2024 driven by strong retention levels and new business opportunities across the portfolio, including business from third parties • Net investment income increase of $7 million or 8% from the first half of 2024 resulting from an increase in investible assets over the prior year period. Net realized and unrealized investment gains for the six months ended June 30, 2025 included $6 million of net unrealized gains on other investments, as result of our strategic deployment of assets into a diversified hedge fund portfolio at the end of 2024. • Combined ratio of 110.1% and an Annualized Operating ROAE of (2.6)% for the first half of the year reflecting net adverse prior year development in our Aviation & Aerospace line of business related to the Ukraine Conflict, including the judgment handed down by the English High Court as well as the impact of the California wildfires • Book value per diluted common share was $22.04 at June 30, 2025, an increase of 1.1% from December 31, 2024, of $21.79 • Returned $133 million of capital to common shareholders in the six months ended June 30, 2025, including common share repurchases of $111 million and dividends of $22 million 7

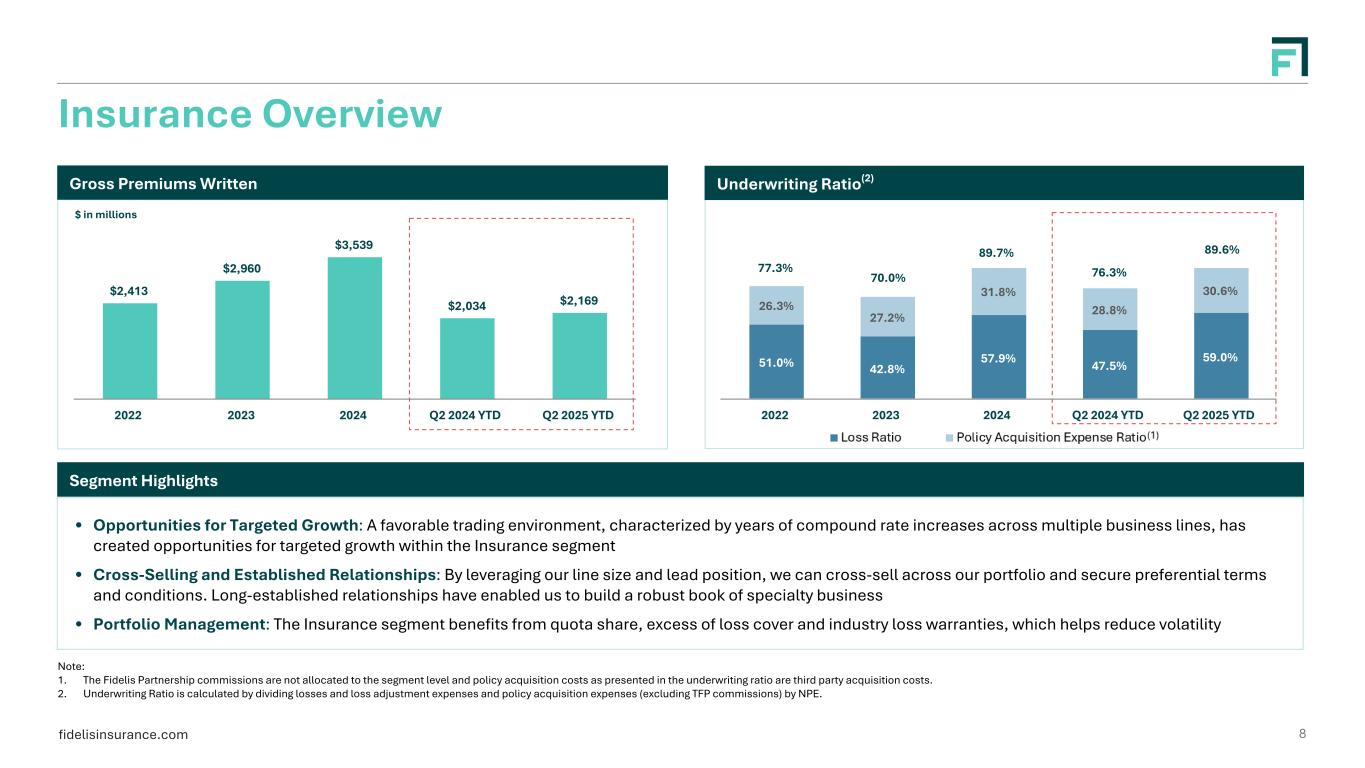

fidelisinsurance.com 51.0% 42.8% 57.9% 47.5% 59.0% 26.3% 27.2% 31.8% 28.8% 30.6% 2022 2023 2024 Q2 2024 YTD Q2 2025 YTD $2,413 $2,960 $3,539 $2,034 $2,169 2022 2023 2024 Q2 2024 YTD Q2 2025 YTD 8 Insurance Overview Note: 1. The Fidelis Partnership commissions are not allocated to the segment level and policy acquisition costs as presented in the underwriting ratio are third party acquisition costs. 2. Underwriting Ratio is calculated by dividing losses and loss adjustment expenses and policy acquisition expenses (excluding TFP commissions) by NPE. Gross Premiums Written Segment Highlights Underwriting Ratio(2) • Opportunities for Targeted Growth: A favorable trading environment, characterized by years of compound rate increases across multiple business lines, has created opportunities for targeted growth within the Insurance segment • Cross-Selling and Established Relationships: By leveraging our line size and lead position, we can cross-sell across our portfolio and secure preferential terms and conditions. Long-established relationships have enabled us to build a robust book of specialty business • Portfolio Management: The Insurance segment benefits from quota share, excess of loss cover and industry loss warranties, which helps reduce volatility 77.3% 89.7% 70.0% $ in millions 89.6% 76.3%

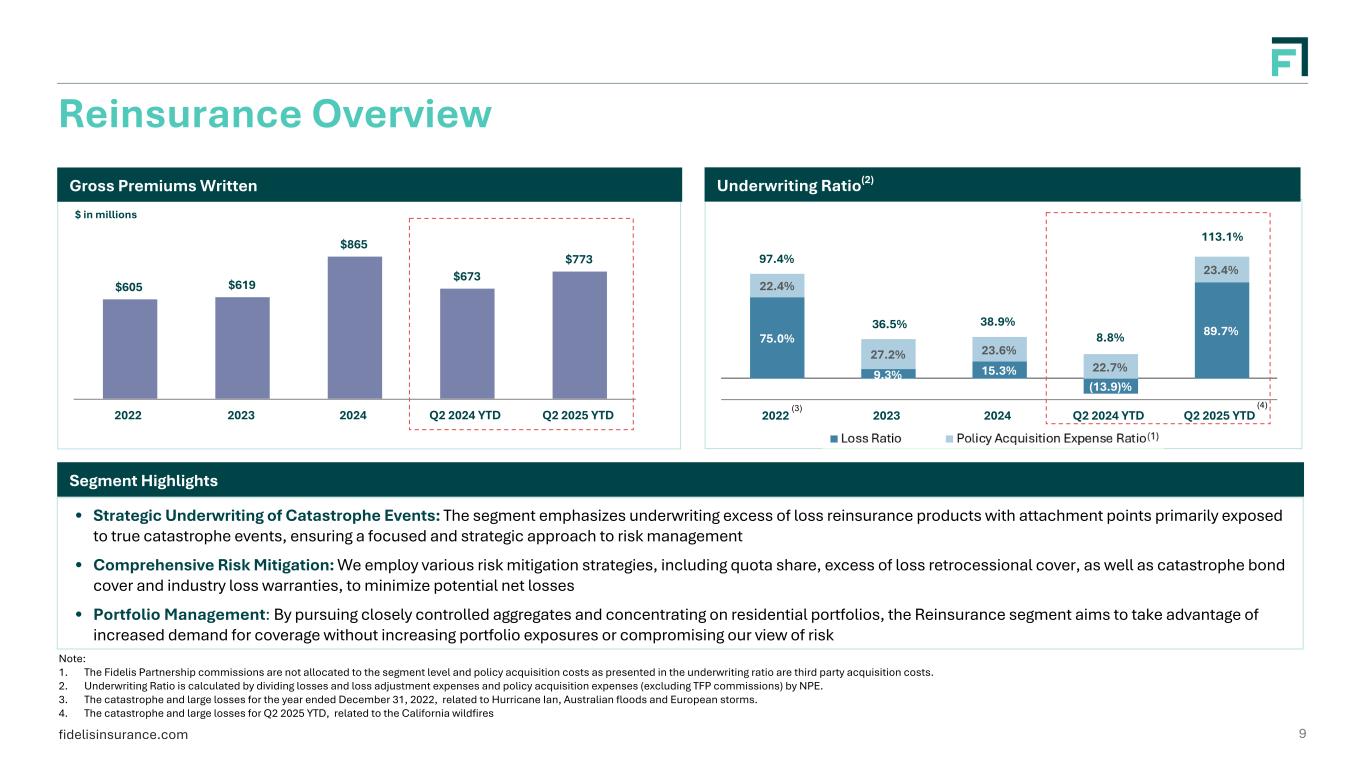

fidelisinsurance.com 75.0% 9.3% 15.3% (13.9)% 89.7% 22.4% 27.2% 23.6% 22.7% 23.4% 2022 2023 2024 Q2 2024 YTD Q2 2025 YTD $605 $619 $865 $673 $773 2022 2023 2024 Q2 2024 YTD Q2 2025 YTD 9 Reinsurance Overview Note: 1. The Fidelis Partnership commissions are not allocated to the segment level and policy acquisition costs as presented in the underwriting ratio are third party acquisition costs. 2. Underwriting Ratio is calculated by dividing losses and loss adjustment expenses and policy acquisition expenses (excluding TFP commissions) by NPE. 3. The catastrophe and large losses for the year ended December 31, 2022, related to Hurricane Ian, Australian floods and European storms. 4. The catastrophe and large losses for Q2 2025 YTD, related to the California wildfires • Strategic Underwriting of Catastrophe Events: The segment emphasizes underwriting excess of loss reinsurance products with attachment points primarily exposed to true catastrophe events, ensuring a focused and strategic approach to risk management • Comprehensive Risk Mitigation: We employ various risk mitigation strategies, including quota share, excess of loss retrocessional cover, as well as catastrophe bond cover and industry loss warranties, to minimize potential net losses • Portfolio Management: By pursuing closely controlled aggregates and concentrating on residential portfolios, the Reinsurance segment aims to take advantage of increased demand for coverage without increasing portfolio exposures or compromising our view of risk $ in millions Gross Premiums Written Segment Highlights Underwriting Ratio(2) 97.4% 38.9%36.5% (3) 113.1% 8.8% (4)

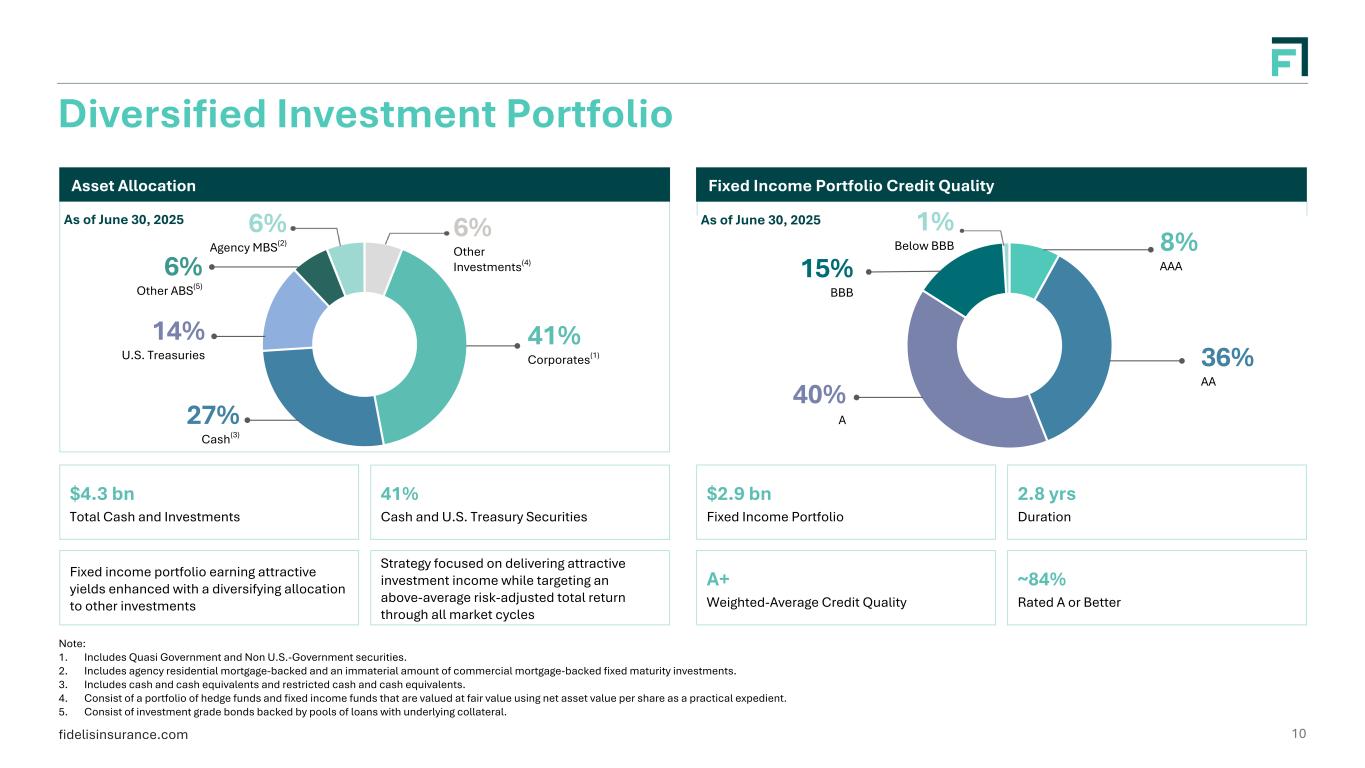

fidelisinsurance.com Diversified Investment Portfolio 10 Note: 1. Includes Quasi Government and Non U.S.-Government securities. 2. Includes agency residential mortgage-backed and an immaterial amount of commercial mortgage-backed fixed maturity investments. 3. Includes cash and cash equivalents and restricted cash and cash equivalents. 4. Consist of a portfolio of hedge funds and fixed income funds that are valued at fair value using net asset value per share as a practical expedient. 5. Consist of investment grade bonds backed by pools of loans with underlying collateral. Asset Allocation Fixed Income Portfolio Credit Quality $4.3 bn Total Cash and Investments 41% Cash and U.S. Treasury Securities Fixed income portfolio earning attractive yields enhanced with a diversifying allocation to other investments Strategy focused on delivering attractive investment income while targeting an above-average risk-adjusted total return through all market cycles As of June 30, 2025 As of June 30, 2025 $2.9 bn Fixed Income Portfolio 2.8 yrs Duration A+ Weighted-Average Credit Quality ~84% Rated A or Better 41% Corporates(1) 6% Other Investments(4) 6% Agency MBS(2) 6% Other ABS(5) 14% U.S. Treasuries 27% Cash(3) 15% BBB 40% A 1% Below BBB 8% AAA 36% AA

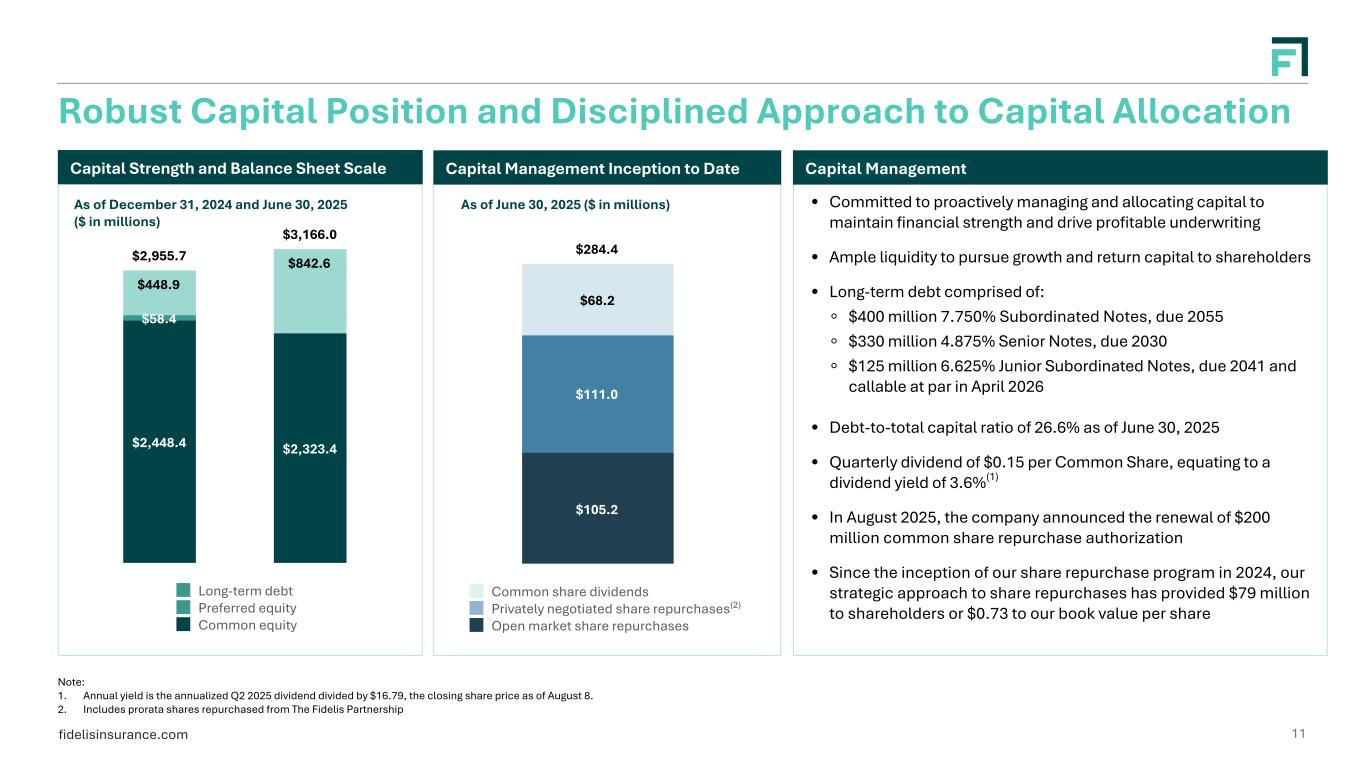

fidelisinsurance.com 11 • Committed to proactively managing and allocating capital to maintain financial strength and drive profitable underwriting • Ample liquidity to pursue growth and return capital to shareholders • Long-term debt comprised of: ◦ $400 million 7.750% Subordinated Notes, due 2055 ◦ $330 million 4.875% Senior Notes, due 2030 ◦ $125 million 6.625% Junior Subordinated Notes, due 2041 and callable at par in April 2026 • Debt-to-total capital ratio of 26.6% as of June 30, 2025 • Quarterly dividend of $0.15 per Common Share, equating to a dividend yield of 3.6%(1) • In August 2025, the company announced the renewal of $200 million common share repurchase authorization • Since the inception of our share repurchase program in 2024, our strategic approach to share repurchases has provided $79 million to shareholders or $0.73 to our book value per share Capital ManagementCapital Strength and Balance Sheet Scale Robust Capital Position and Disciplined Approach to Capital Allocation $284.4 $105.2 $111.0 $68.2 Common share dividends Privately negotiated share repurchases Open market share repurchases $2,955.7 $3,166.0 $2,448.4 $2,323.4 $58.4 $448.9 $842.6 Long-term debt Preferred equity Common equity Note: 1. Annual yield is the annualized Q2 2025 dividend divided by $16.79, the closing share price as of August 8. 2. Includes prorata shares repurchased from The Fidelis Partnership As of December 31, 2024 and June 30, 2025 ($ in millions) Capital Management Inception to Date As of June 30, 2025 ($ in millions) (2)

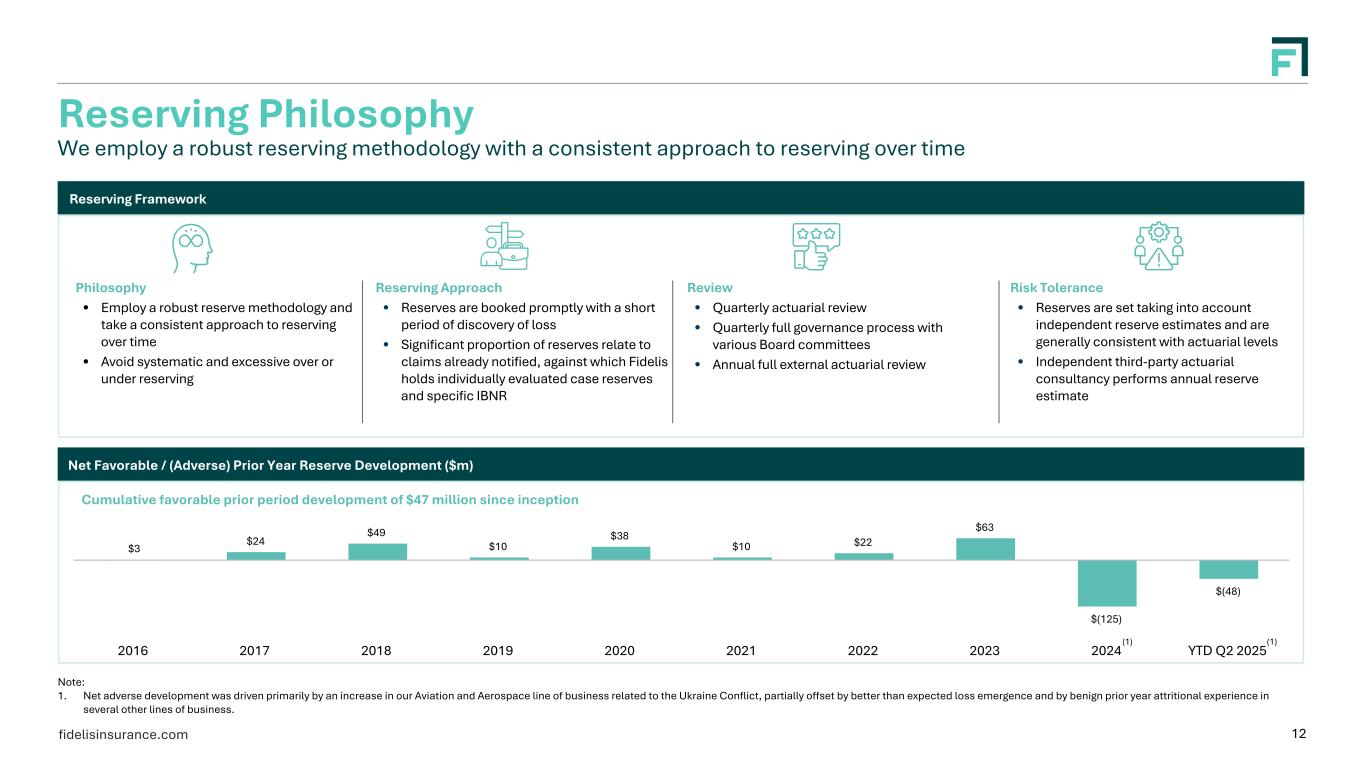

fidelisinsurance.com $3 $24 $49 $10 $38 $10 $22 $63 $(125) $(48) 2016 2017 2018 2019 2020 2021 2022 2023 2024 YTD Q2 2025 (1) Cumulative favorable prior period development of $47 million since inception Despite market wide issues such as deterioration on natural catastrophe events and inflationary environment, Fidelis has experienced favorable prior year development every financial year since inception Reserving Philosophy We employ a robust reserving methodology with a consistent approach to reserving over time Reserving Framework Philosophy • Employ a robust reserve methodology and take a consistent approach to reserving over time • Avoid systematic and excessive over or under reserving Risk Tolerance • Reserves are set taking into account independent reserve estimates and are generally consistent with actuarial levels • Independent third-party actuarial consultancy performs annual reserve estimate Reserving Approach • Reserves are booked promptly with a short period of discovery of loss • Significant proportion of reserves relate to claims already notified, against which Fidelis holds individually evaluated case reserves and specific IBNR Review • Quarterly actuarial review • Quarterly full governance process with various Board committees • Annual full external actuarial review Net Favorable / (Adverse) Prior Year Reserve Development ($m) 12 Note: 1. Net adverse development was driven primarily by an increase in our Aviation and Aerospace line of business related to the Ukraine Conflict, partially offset by better than expected loss emergence and by benign prior year attritional experience in several other lines of business. (1)

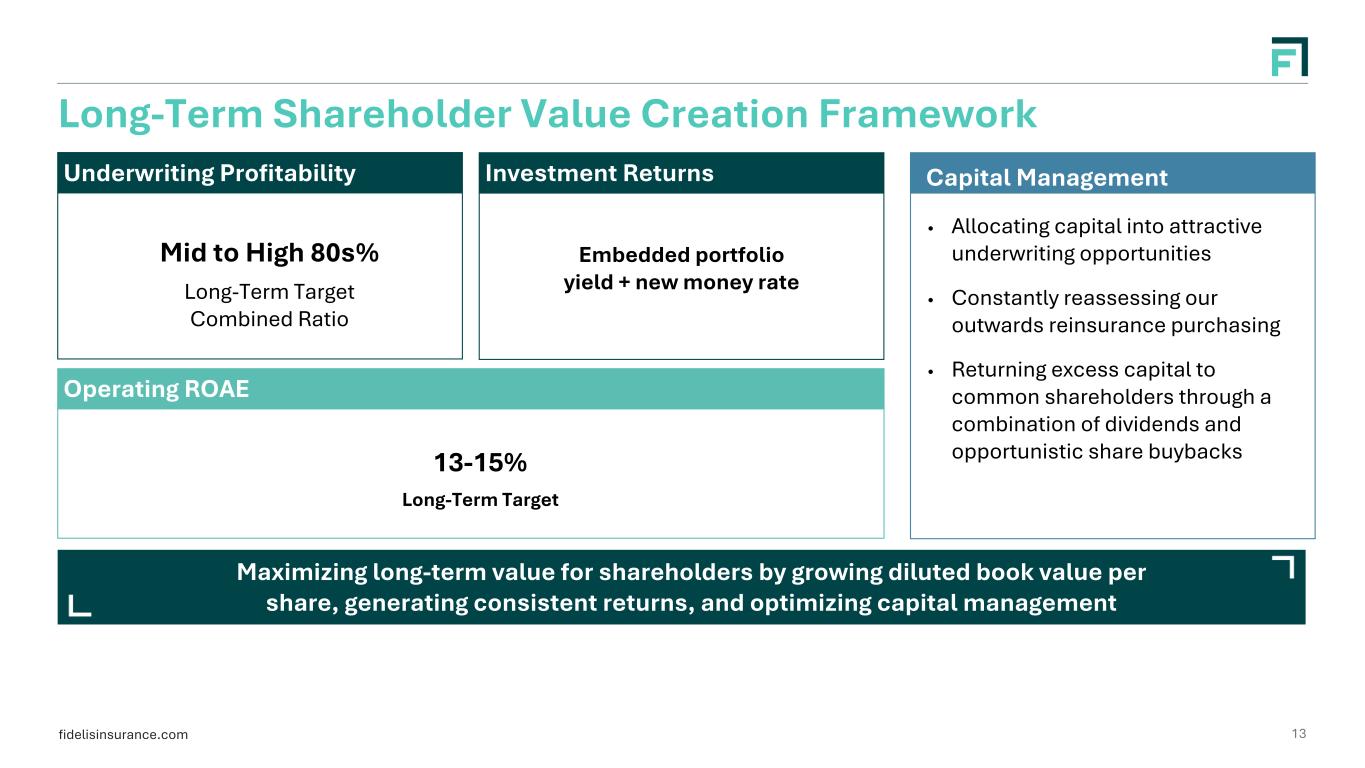

fidelisinsurance.com Long-Term Shareholder Value Creation Framework Underwriting Profitability Investment Returns Mid to High 80s% Long-Term Target Combined Ratio Embedded portfolio yield + new money rate 13-15% Long-Term Target Capital Management • Allocating capital into attractive underwriting opportunities • Constantly reassessing our outwards reinsurance purchasing • Returning excess capital to common shareholders through a combination of dividends and opportunistic share buybacks Operating ROAE Maximizing long-term value for shareholders by growing diluted book value per share, generating consistent returns, and optimizing capital management 13

fidelisinsurance.com Why Invest in Fidelis Insurance Group High quality, mature, and well positioned specialty insurance and reinsurance portfolio, enhanced by strategic partnerships with leading underwriters ensures reliable access to attractive risk Premium growth driven by differentiated lead positions and attractive conditions in a verticalized market Track record of delivering compelling combined ratios through the cycle Robust capital position with a disciplined and nimble approach to capital management, including returning capital to shareholders High quality book of specialty insurance business that creates long-term value by delivering returns to shareholders 14 Highly experienced leadership team with extensive underwriting, capital, and investment management expertise

fidelisinsurance.com 15 Appendix

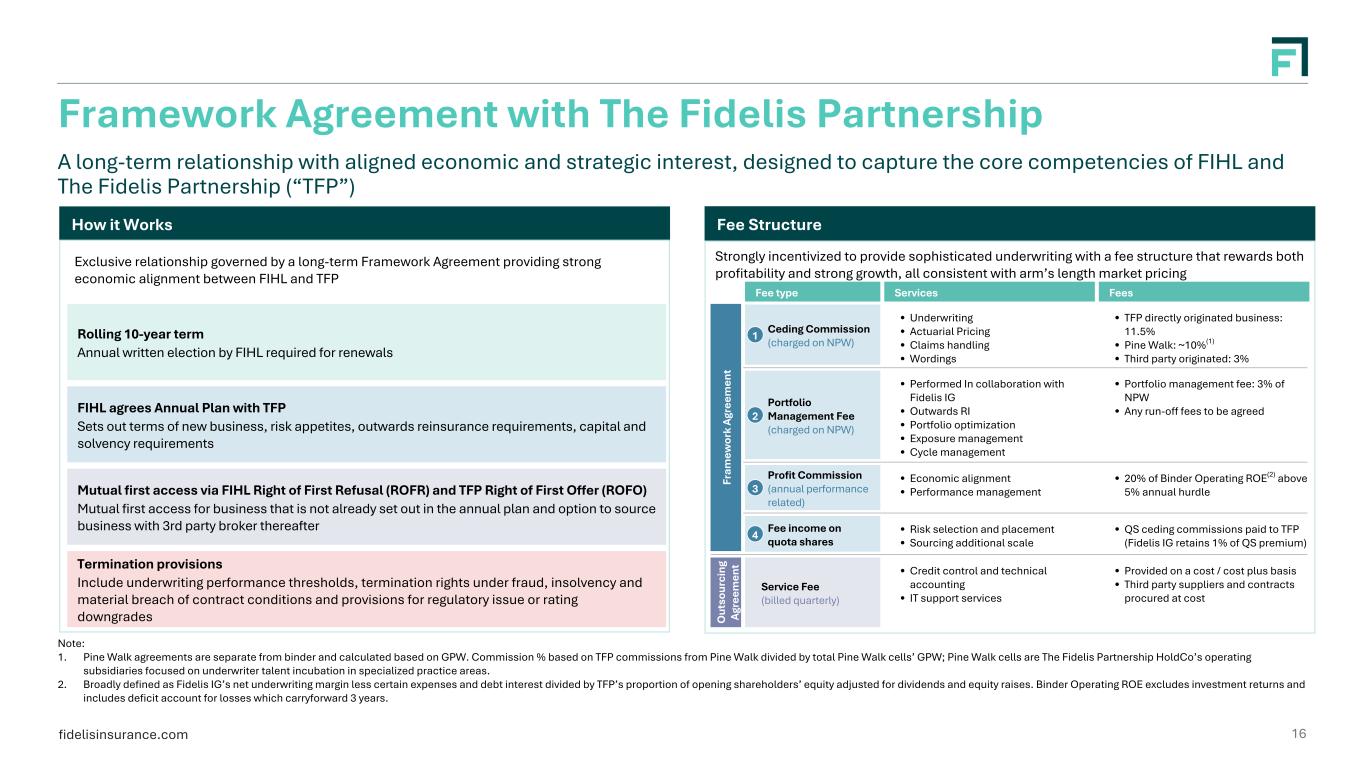

fidelisinsurance.com Framework Agreement with The Fidelis Partnership A long-term relationship with aligned economic and strategic interest, designed to capture the core competencies of FIHL and The Fidelis Partnership (“TFP”) How it Works Fee Structure Note: 1. Pine Walk agreements are separate from binder and calculated based on GPW. Commission % based on TFP commissions from Pine Walk divided by total Pine Walk cells’ GPW; Pine Walk cells are The Fidelis Partnership HoldCo’s operating subsidiaries focused on underwriter talent incubation in specialized practice areas. 2. Broadly defined as Fidelis IG’s net underwriting margin less certain expenses and debt interest divided by TFP’s proportion of opening shareholders’ equity adjusted for dividends and equity raises. Binder Operating ROE excludes investment returns and includes deficit account for losses which carryforward 3 years. Exclusive relationship governed by a long-term Framework Agreement providing strong economic alignment between FIHL and TFP Strongly incentivized to provide sophisticated underwriting with a fee structure that rewards both profitability and strong growth, all consistent with arm’s length market pricing FIHL agrees Annual Plan with TFP Sets out terms of new business, risk appetites, outwards reinsurance requirements, capital and solvency requirements Mutual first access via FIHL Right of First Refusal (ROFR) and TFP Right of First Offer (ROFO) Mutual first access for business that is not already set out in the annual plan and option to source business with 3rd party broker thereafter Termination provisions Include underwriting performance thresholds, termination rights under fraud, insolvency and material breach of contract conditions and provisions for regulatory issue or rating downgrades Rolling 10-year term Annual written election by FIHL required for renewals Fr am ew or k Ag re em en t O ut so ur ci ng Ag re em en t Services • Credit control and technical accounting • IT support services • Performed In collaboration with Fidelis IG • Outwards RI • Portfolio optimization • Exposure management • Cycle management • Economic alignment • Performance management • Risk selection and placement • Sourcing additional scale • Underwriting • Actuarial Pricing • Claims handling • Wordings Fees • Provided on a cost / cost plus basis • Third party suppliers and contracts procured at cost • Portfolio management fee: 3% of NPW • Any run-off fees to be agreed • 20% of Binder Operating ROE(2) above 5% annual hurdle • QS ceding commissions paid to TFP (Fidelis IG retains 1% of QS premium) • TFP directly originated business: 11.5% • Pine Walk: ~10%(1) • Third party originated: 3% Fee type Service Fee (billed quarterly) Portfolio Management Fee (charged on NPW) 2 Profit Commission (annual performance related) 3 Fee income on quota shares4 Ceding Commission (charged on NPW)1 16

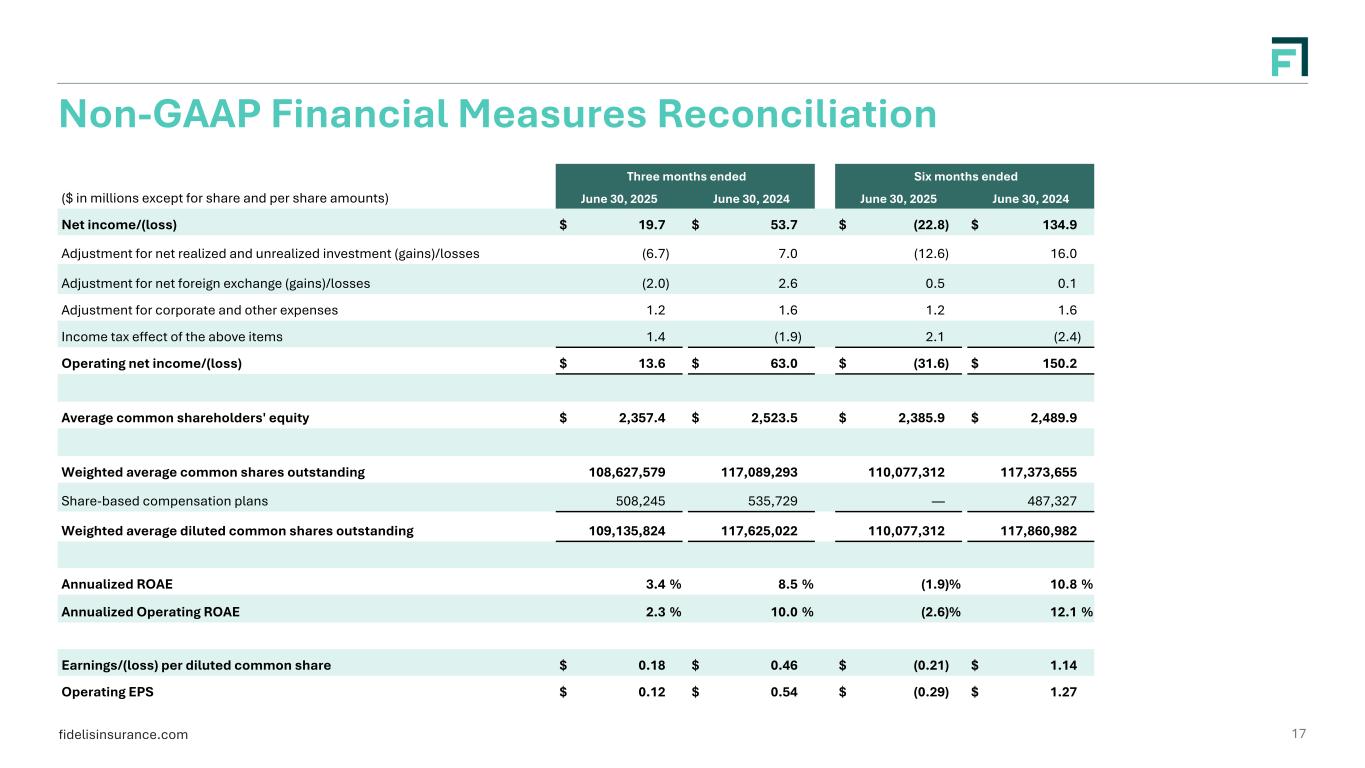

fidelisinsurance.com Non-GAAP Financial Measures Reconciliation Three months ended Six months ended ($ in millions except for share and per share amounts) June 30, 2025 June 30, 2024 June 30, 2025 June 30, 2024 Net income/(loss) $ 19.7 $ 53.7 $ (22.8) $ 134.9 Adjustment for net realized and unrealized investment (gains)/losses (6.7) 7.0 (12.6) 16.0 Adjustment for net foreign exchange (gains)/losses (2.0) 2.6 0.5 0.1 Adjustment for corporate and other expenses 1.2 1.6 1.2 1.6 Income tax effect of the above items 1.4 (1.9) 2.1 (2.4) Operating net income/(loss) $ 13.6 $ 63.0 $ (31.6) $ 150.2 Average common shareholders' equity $ 2,357.4 $ 2,523.5 $ 2,385.9 $ 2,489.9 Weighted average common shares outstanding 108,627,579 117,089,293 110,077,312 117,373,655 Share-based compensation plans 508,245 535,729 — 487,327 Weighted average diluted common shares outstanding 109,135,824 117,625,022 110,077,312 117,860,982 Annualized ROAE 3.4 % 8.5 % (1.9) % 10.8 % Annualized Operating ROAE 2.3 % 10.0 % (2.6) % 12.1 % Earnings/(loss) per diluted common share $ 0.18 $ 0.46 $ (0.21) $ 1.14 Operating EPS $ 0.12 $ 0.54 $ (0.29) $ 1.27 17

fidelisinsurance.com This Presentation includes certain financial measures that are not calculated in accordance with generally accepted accounting principles in the U.S. (“U.S. GAAP”) including operating net income, operating EPS, operating return on average common equity, and therefore are non-GAAP financial measures. Reconciliations of such measures to the most comparable GAAP figures are included in the attached financial information in accordance with Regulation G. Operating net income/(loss) is a non-GAAP financial measure of our performance which does not consider the impact of certain non-recurring and other items that may not properly reflect the ordinary activities of our business, its performance or its future outlook. This measure is calculated as net income/(loss) excluding net realized and unrealized investment gains/(losses), net foreign exchange gains/(losses), corporate and other expenses, and the income tax effect on these items. Annualized operating return on average common equity (“Annualized Operating ROAE”) is a non-GAAP financial measure that represents a meaningful comparison between periods of our financial performance expressed as a percentage and is calculated as operating net income divided by average common shareholders’ equity. Operating earnings per share (“Operating EPS”) is a non-GAAP financial measure that represents a valuable measure of profitability and enables investors, analysts, rating agencies and other users of Fidelis Insurance Group’s financial information to more easily analyze Fidelis Insurance Group’s results in a manner similar to how management analyzes Fidelis Insurance Group’s underlying business performance. It is calculated by dividing operating net income/(loss) by the weighted average diluted common shares outstanding. 18 Non-GAAP Financial Measures Reconciliation

fidelisinsurance.com Basis of Presentation Business Descriptions Insurance Segment: The Insurance segment comprises a portfolio of specialty risks. In addition to major specialty lines of business, this segment includes highly tailored products, where the buying motivation is often driven by regulatory capital relief, capital efficiency or transaction facilitation. The Insurance segment benefits from quota share, excess of loss cover and industry loss warranties, which help to reduce volatility. Our Insurance segment provides us with access to capital-efficient business and facilitates diversification of our exposures. The following are the lines of business in our Insurance segment: Property: provides cover for all risks of direct physical loss or damage, business interruption and natural catastrophe perils. The portfolio covers a wide range of occupancies from real estate portfolios, municipalities, infrastructure, schools, commercial and manufacturing accounts and construction risks. We write a mix of global, North American and individual international territory risks. Marine: provides cover for a range of exposures on a global basis including marine hull, marine cargo, construction and marine war. Asset Backed Finance & Portfolio Credit: includes asset-backed nonpayment, economically linked risk (e-cat), mortgage indemnity, structured credit, and surety. Drivers for specific risk transfer for these products are often different from traditional insurance procurement and include regulatory capital relief, capital efficiency and transaction facilitation. Aviation & Aerospace: provides a range of cover for owners and financiers of aircraft including airline hull and liability ‘all-risks’, contingent aviation, AV52 war liability and hull war as well as product liability for the world’s leading manufacturers. We also cover pre-launch, transit and launch risk for satellite manufacturers and operators in our Aerospace book. Energy: provides cover for a range of exposures across the energy spectrum. This includes construction and operational renewable energy projects globally, operational downstream energy/power & utilities, and construction and operational upstream energy. Political Risk Violence & Terror: provides insurance products for clients such as banks, commodity traders, corporations and multilateral and export credit agencies through political risk and contract frustration/non-payment coverages and both damage and non-damage cover from perils including terrorism, civil unrest, strikes, riots, civil commotion and sabotage through political violence and terror covers. Cyber: products reimburse damages and financial losses arising from accidental or malicious incidents affecting a business’s computer networks, software and data, both on a first and third party basis. We write a diverse mix of business from SME to large corporate, across a number of geographies predominantly on a reinsurance basis. Other Insurance: includes contingency providing coverage for event cancellation, non-appearance and other contingencies, title insurance, warranty insurance and other specialty risks. Reinsurance Segment: Our Reinsurance segment consists of an actively managed, property reinsurance book, providing reinsurance and a limited amount of retrocession coverage worldwide on a proportional or excess of loss basis. The portfolio is global, with a significant concentration in North America. Additionally, it includes smaller exposures in other regions around the world, particularly in Japan, Europe, and Australasia. The Reinsurance segment benefits from quota share, excess of loss retrocessional cover, catastrophe bond cover and industry loss warranties, which helps to minimize the potential net losses in the business written. We believe our strategy of pursuing closely controlled aggregates and focusing on residential portfolios in the Reinsurance segment helps keep volatility lower than a typical catastrophe book. Renewal Price Index Measure Renewal price index (RPI) is a measure that Fidelis Insurance Holdings Limited (“Fidelis Insurance Group”, “Fidelis”, “FIHL”, or the “Company”)has used to assess an approximate index of rate increases on a particular set of contracts, using the base of 100% for the rates for the relevant prior year. Although management considers RPI to be an appropriate statistical measure, it is not a financial measure that directly relates to the Fidelis consolidated financial results. Management’s calculation of RPI involves a degree of judgment in relation to comparability of contracts and the relative impacts of changes in price, exposure, retention levels, as well as any other changing terms and conditions on the RPI calculation. Consideration is given to potential renewals of a comparable nature so it does not reflect every contract in Fidelis’ portfolio. The future profitability and performance of a portfolio of contracts expressed within the RPI is dependent upon many factors besides the trends in premium rates, including policy terms, conditions and wording. 19