STACEY CARAVELLA VP, INVESTOR RELATIONS

Colleen Keating, CEO o Capitalizing on unique moment Brian Povinelli, CMO o Evolving our brand to drive growth Bill Bode, COO o Executing a high value member experience Chip Ohlsson, CDO o Accelerating new club growth Jay Stasz, CFO o Bringing it all together with long-term growth outlook Q&A AGENDA

COLLEEN KEATING CHIEF EXECUTIVE OFFICER

10 YEARS OF TREMENDOUS GROWTH 2,800 CLUBS from 1,000

10 YEARS OF TREMENDOUS GROWTH 21M MEMBERS from 7M+ Nearly

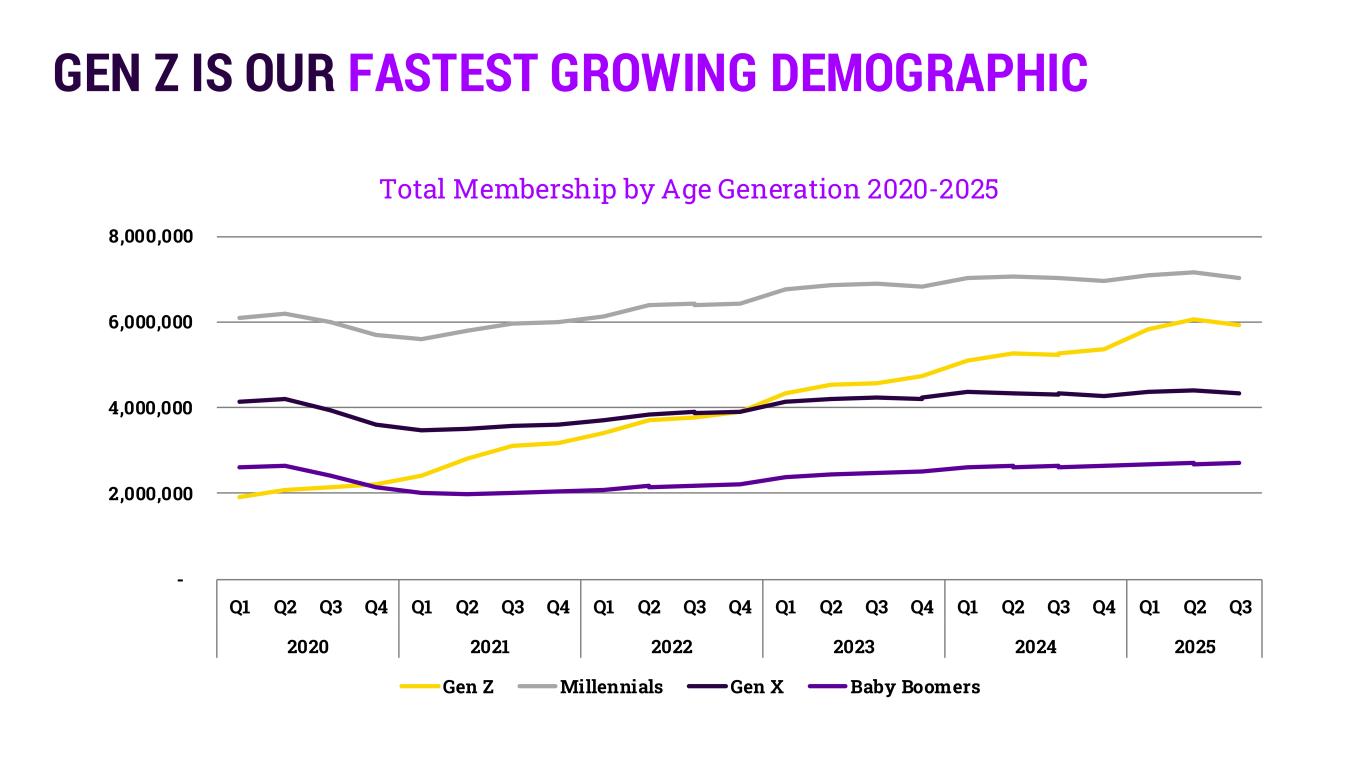

GEN Z IS OUR FASTEST GROWING DEMOGRAPHIC - 2,000,000 4,000,000 6,000,000 8,000,000 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 2020 2021 2022 2023 2024 2025 Total Membership by Age Generation 2020-2025 Gen Z Millennials Gen X Baby Boomers

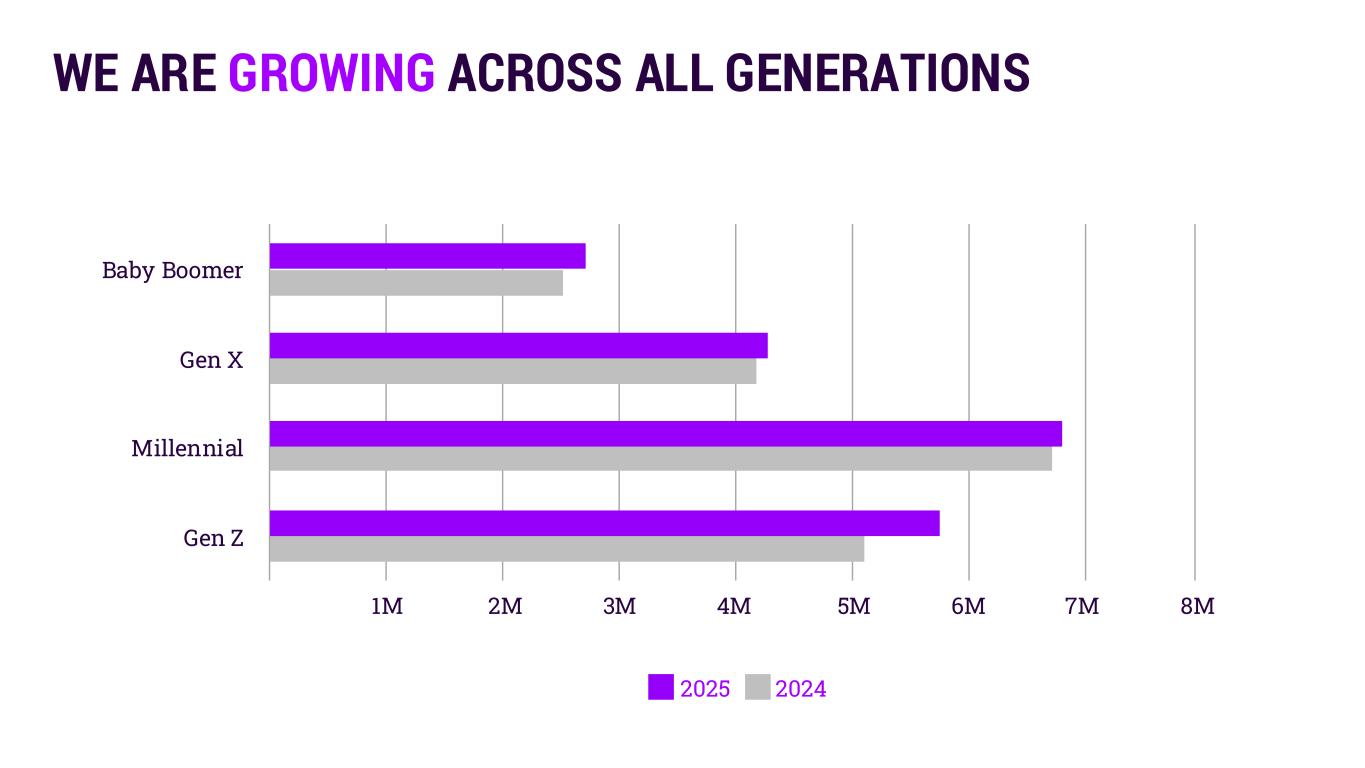

WE ARE GROWING ACROSS ALL GENERATIONS 2025 2024 Baby Boomer Gen X Millennial Gen Z 1M 2M 3M 4M 5M 6M 7M 8M

RISE IN RETAIL BANKRUPTCIES 5,6001 6,2001 9,9002 2023 2024 2025 1. Sources: 2023 and 2024: CNN: cnn.com https://www.cnn.com/2024/10/25/business/the-retail-apocalypse-is-back 2. Jones Lang LaSalle: https://www.jll.com/en-us/guides/retail-closures-should-free-up-140-million-square-feet-of-much-needed-retail-space

ENHANCING OUR MEMBER EXPERIENCE ACCELERATING NEW CLUB GROWTH REFINING OUR PRODUCT & OPTIMIZING OUR LAYOUT REDEFINING OUR BRAND PROMISE

STRATEGIC IMPERATIVE #1: REDEFINING OUR BRAND PROMISE

+1 MILLION NET NEW MEMBERS THROUGH Q3 2025

5% INCREASE* ACTIVE MEMBER VISITS *Through Q3 2025

STRATEGIC IMPERATIVE #2: ENHANCING OUR MEMBER EXPERIENCE

STRATEGIC IMPERATIVE #3: REFINING OUR PRODUCT & OPTIMIZING OUR FORMAT

STRATEGIC IMPERATIVE #4: ACCELERATING NEW CLUB GROWTH

ENHANCING OUR MEMBER EXPERIENCE ACCELERATING NEW CLUB GROWTH REFINING OUR PRODUCT & OPTIMIZING OUR LAYOUT REDEFINING OUR BRAND PROMISE

EXECUTIVE LEADERSHIP TEAM Sarah Powell GENERAL COUNSEL* Paul Barber CHIEF INFORMATION OFFICER Bill Bode CHIEF OPERATING OFFICER McCall Gosselin CHIEF CORPORATE AFFAIRS OFFICER Chip Ohlsson CHIEF DEVELOPMENT OFFICER Brian Povinelli CHIEF MARKETING OFFICER Jennifer Simmons CHIEF STRATEGY OFFICER Jay Stasz CHIEF FINANCIAL OFFICER *Starts on 11/17/2025 Stacey Caravella VP, INVESTOR RELATIONS Ed Welsh SVP, PEOPLE & CULTURE

BRIAN POVINELLI CHIEF MARKETING OFFICER

33 EVOLVING THE BRAND TO DRIVE GROWTH

WHY EVOLVE NOW?

CHANGING CONSUMER Open to better image CHANGING CONSUMER

INCREASINGLY CROWDED MARKETPLACE Boutiques Digital offerings HVlp 2.0/3.0 Social content

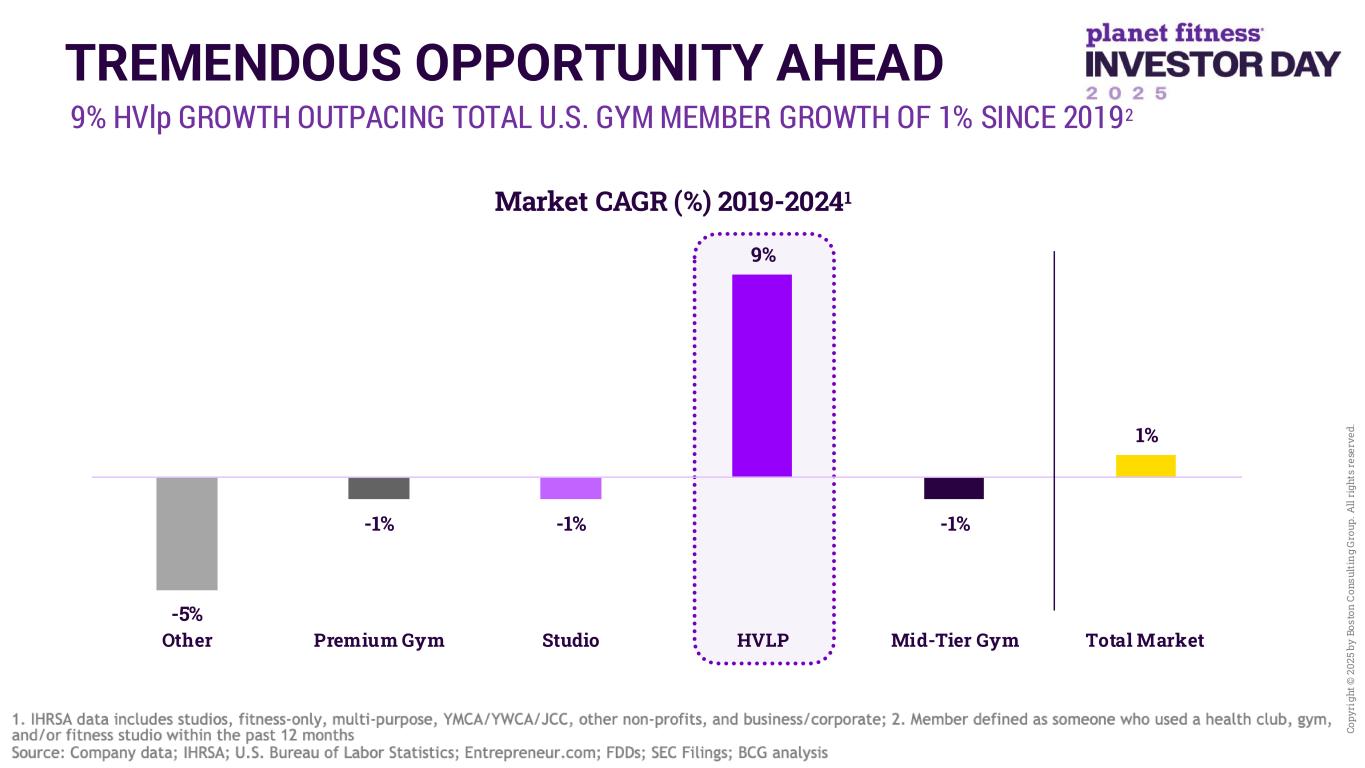

Co py ri gh t © 2 02 5 by B os to n C on su lt in g G ro up . A ll ri gh ts r es er ve d. 9% HVlp GROWTH OUTPACING TOTAL U.S. GYM MEMBER GROWTH OF 1% SINCE 20192 TREMENDOUS OPPORTUNITY AHEAD -5% -1% -1% 9% -1% 1% Other Premium Gym Studio HVLP Mid-Tier Gym Total Market Market CAGR (%) 2019-20241

38 OUR APPROACH TO EVOLUTION…

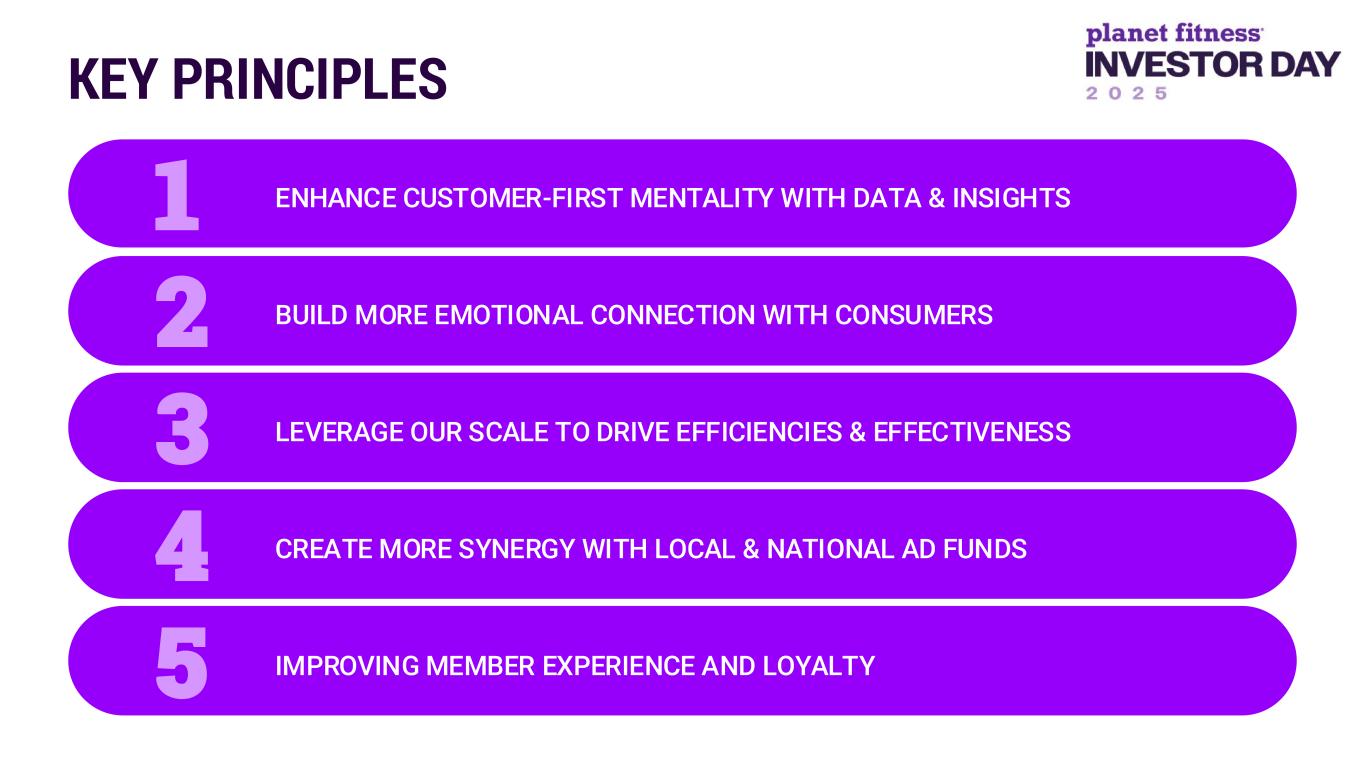

KEY PRINCIPLES ENHANCE CUSTOMER-FIRST MENTALITY WITH DATA & INSIGHTS1 1 BUILD MORE EMOTIONAL CONNECTION WITH CONSUMERS2 LEVERAGE OUR SCALE TO DRIVE EFFICIENCIES & EFFECTIVENESS3 CREATE MORE SYNERGY WITH LOCAL & NATIONAL AD FUNDS4 IMPROVING MEMBER EXPERIENCE AND LOYALTY5

40 INVEST IN DATA/INSIGHTS TO DRIVE A CUSTOMER- FIRST MINDSET

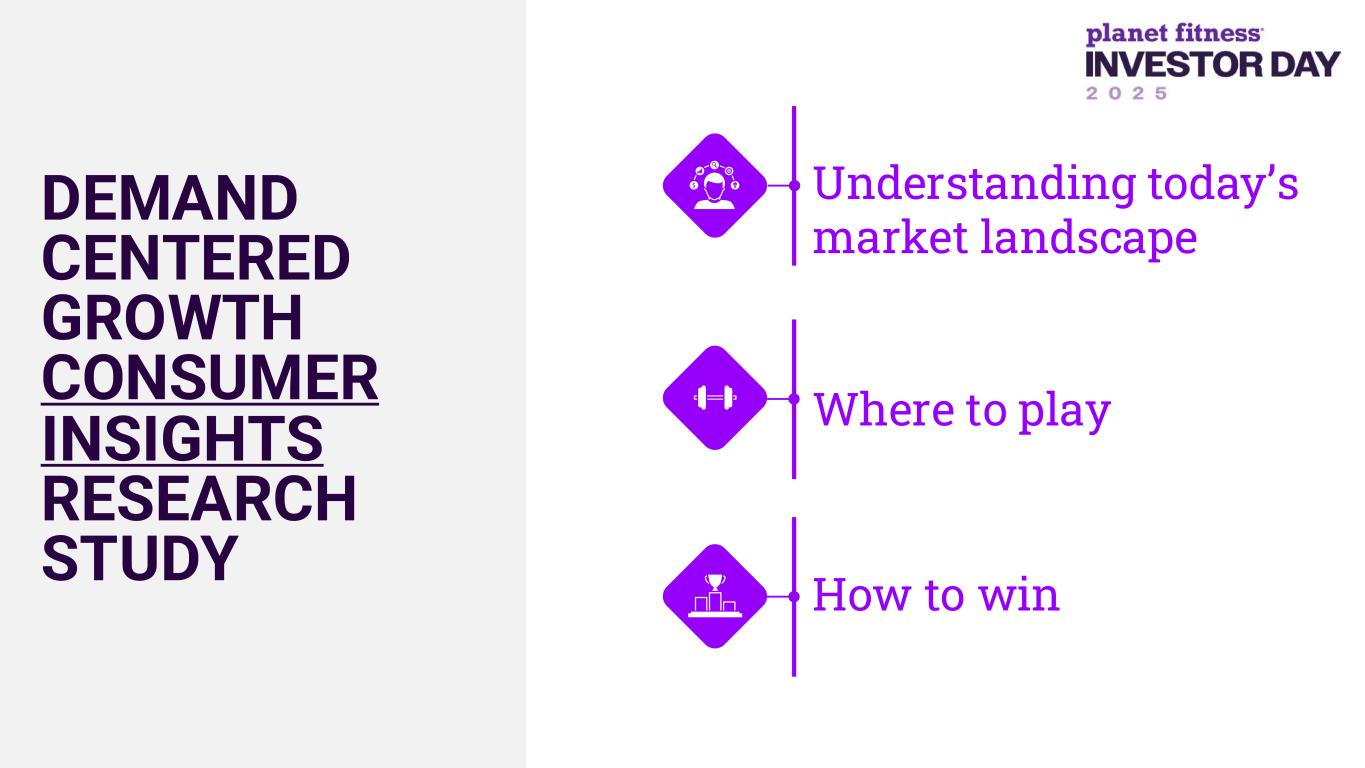

Understanding today’s market landscape Where to play How to win DEMAND CENTERED GROWTH CONSUMER INSIGHTS RESEARCH STUDY

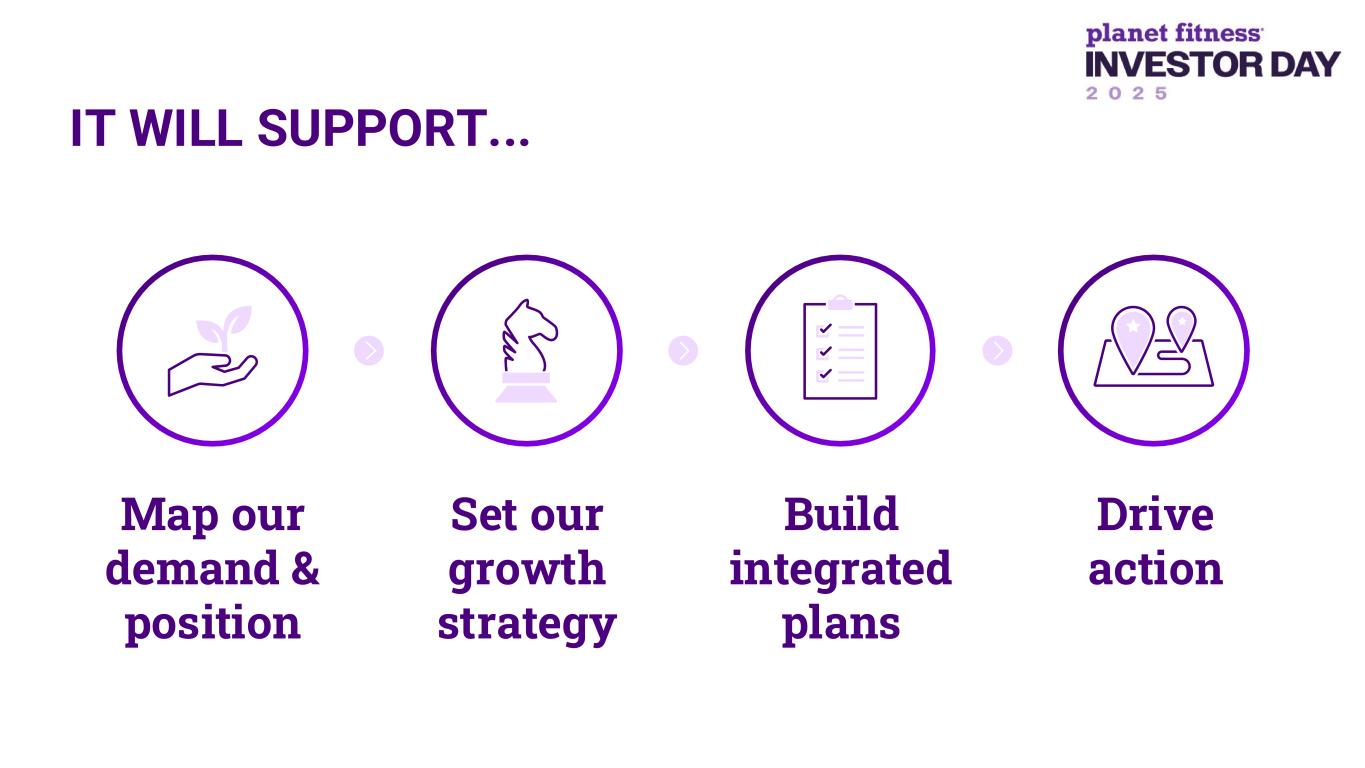

Drive action Build integrated plans Set our growth strategy Map our demand & position IT WILL SUPPORT...

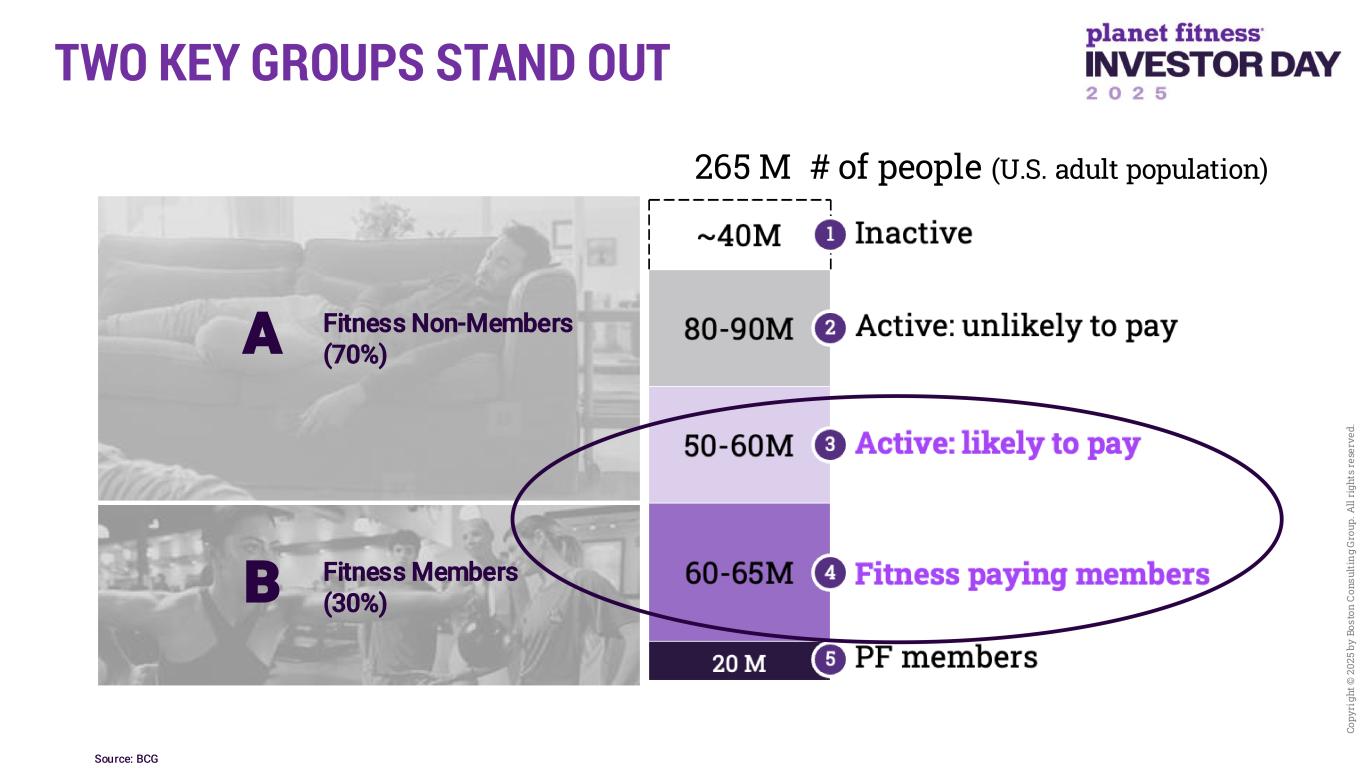

Co py ri gh t © 2 02 5 by B os to n C on su lt in g G ro up . A ll ri gh ts r es er ve d. TWO KEY GROUPS STAND OUT Fitness Non-Members (70%)A Fitness Members (30%)B 265 M # of people (U.S. adult population) 1. Source: BCG

LAPSED MEMBERS ARE A KEY OPPORTUNITY MORE LIKELY THAN NON-MEMBERS TO ENGAGE IN PAYING FITNESS MARKET* 2X 1. *PF data

Co py ri gh t © 2 02 5 by B os to n C on su lt in g G ro up . A ll ri gh ts r es er ve d. NEED SOME GRAPHIC THAT CONCEPTUALLY SPEAKS TO A CUSTOMER SEGMENTATION MAP DEFEND ENHANCE DE-PRIORITIZE CUSTOMER SEGMENTATION

48 BUILD MORE EMOTIONAL EQUITIES

49 EMOTIONAL + FUNCTIONAL

FUNCTIONAL NEEDS Machine Variety & Availability Easy to get in-&-out Convenient Location Value for Money pf Low Price HVlp

EMOTIONAL NEEDS

EVOLVED BRAND ID COMING IN 2H 2026

56 LEVERAGE OUR SCALE

~$400M US AD FUND ~2,800 CLUBS As of September 30, 2025

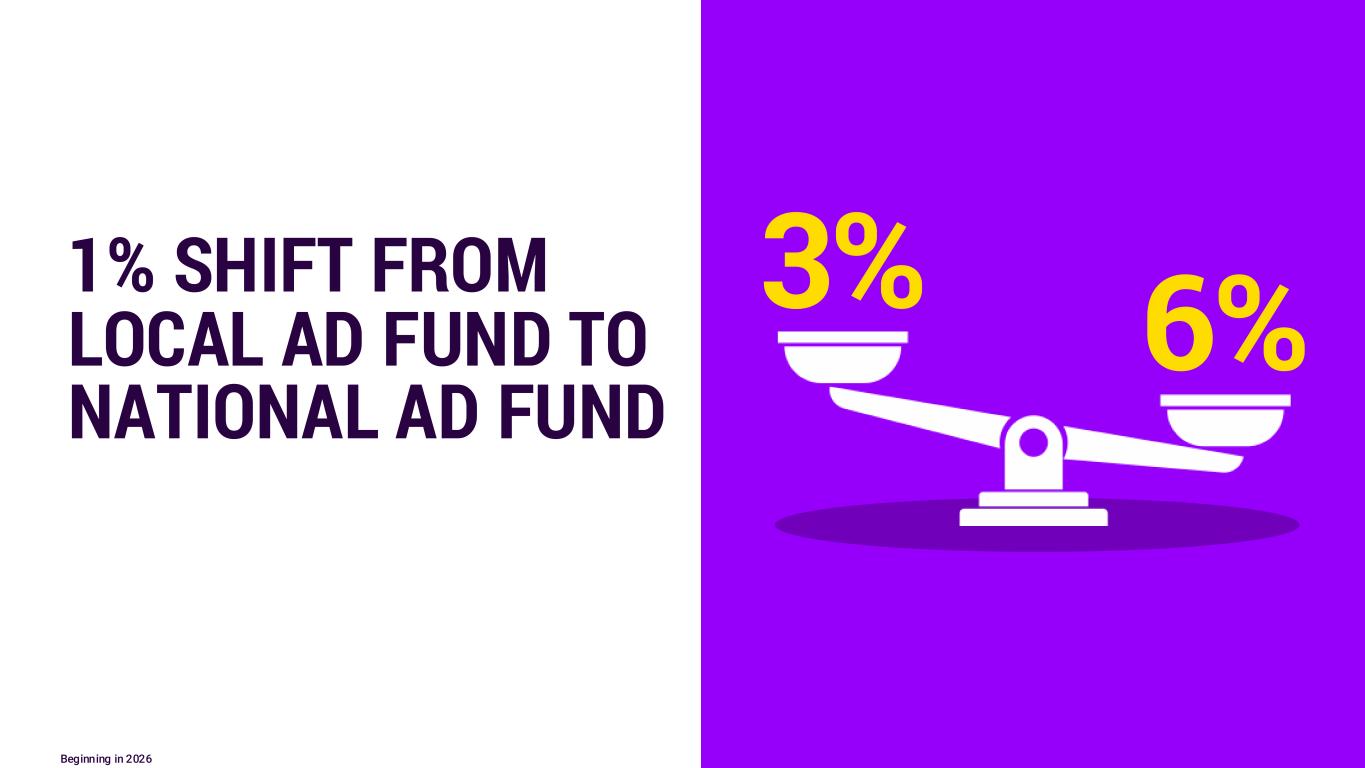

1% SHIFT FROM LOCAL AD FUND TO NATIONAL AD FUND 3% 6% Beginning in 2026

WORKING MEDIA ~10% savings in local agency fees As of October 2025

60 MODERNIZE OUR MARKETING TECHNOLOGY INVESTING IN DCO DYNAMIC CREATIVE OPTIMIZATION

62 MODERNIZE OUR MARKETING TECHNOLOGY INVESTING IN CRM CUSTOMER RELATIONSHIP MANAGEMENT

63 UNLOCKING NEW MEDIA OPPORTUNITIES Logos are registered trademarks of those brands.

64 UNLOCKING NEW MEDIA OPPORTUNITIES Logos are registered trademarks of those brands.

65 ALL NATIONAL PROMOS NOW SUPPORTED BY NAF MEDIA DOLLARS

66 MEMBER EXPERIENCE

67 MEMBER-CENTERED JOURNEY MAPPING DAY 100 DAY 1

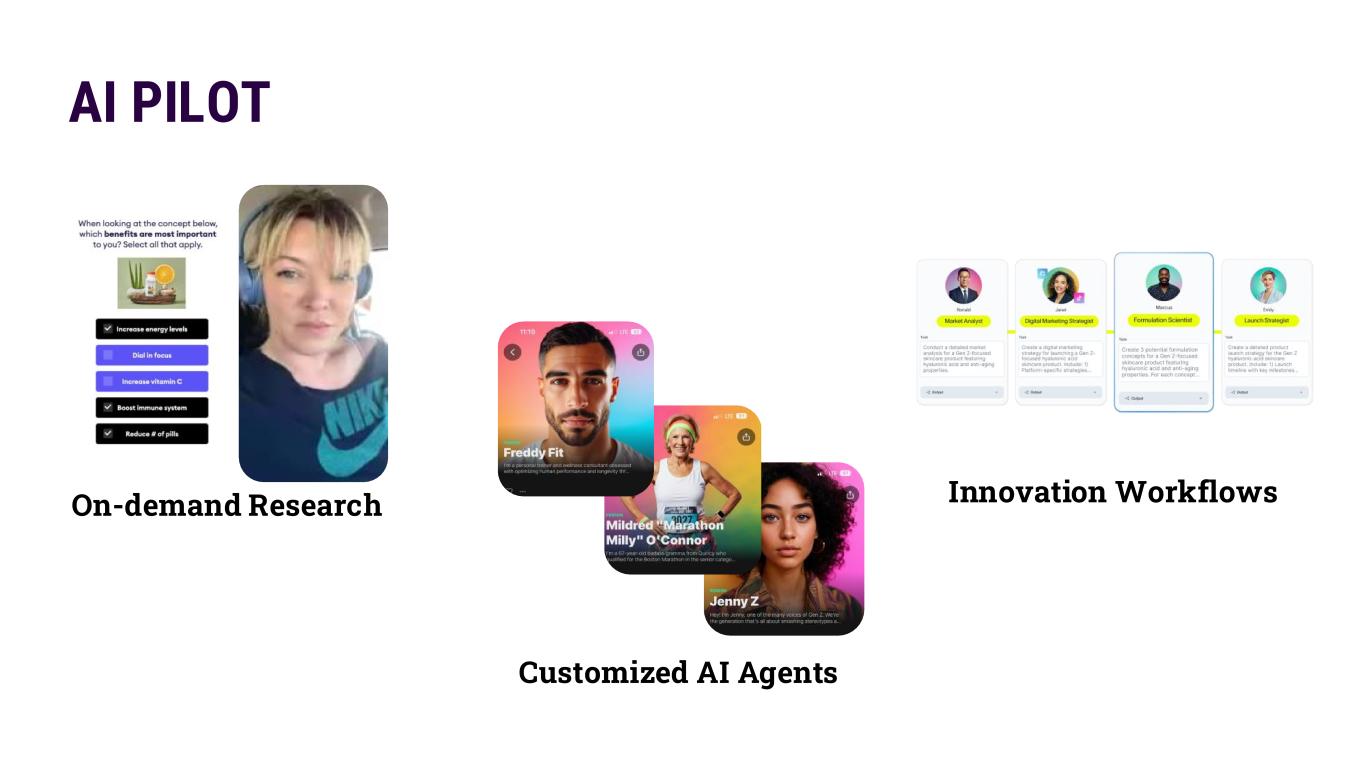

LEVERAGING AI 68

On-demand Research Customized AI Agents Innovation Workflows AI PILOT

UPLIFTER CUSTOMER PANEL

71 NEW CHANNELS

72 NEW OPPORTUNITIES

KEY PRINCIPLES ENHANCE CUSTOMER-FIRST MENTALITY WITH DATA & INSIGHTS1 1 BUILD MORE EMOTIONAL CONNECTION WITH CONSUMERS2 LEVERAGE OUR SCALE TO DRIVE EFFICIENCIES & EFFECTIVENESS3 CREATE MORE SYNERGY WITH LOCAL & NATIONAL AD FUNDS4 IMPROVING MEMBER EXPERIENCE AND LOYALTY5

BILL BODE CHIEF OPERATING OFFICER

77 EXECUTING A HIGH VALUE MEMBER EXPERIENCE

Build the largest, most inspiring fitness community where all members are proud to belong. PLANET FITNESS VISION

FIRST 100 DAYS FORMAT-OPTIMIZED CLUB BLACK CARD SPA EVOLUTION 1 2 3

FIRST 100 DAYS

Strengthen the WELCOME experience.

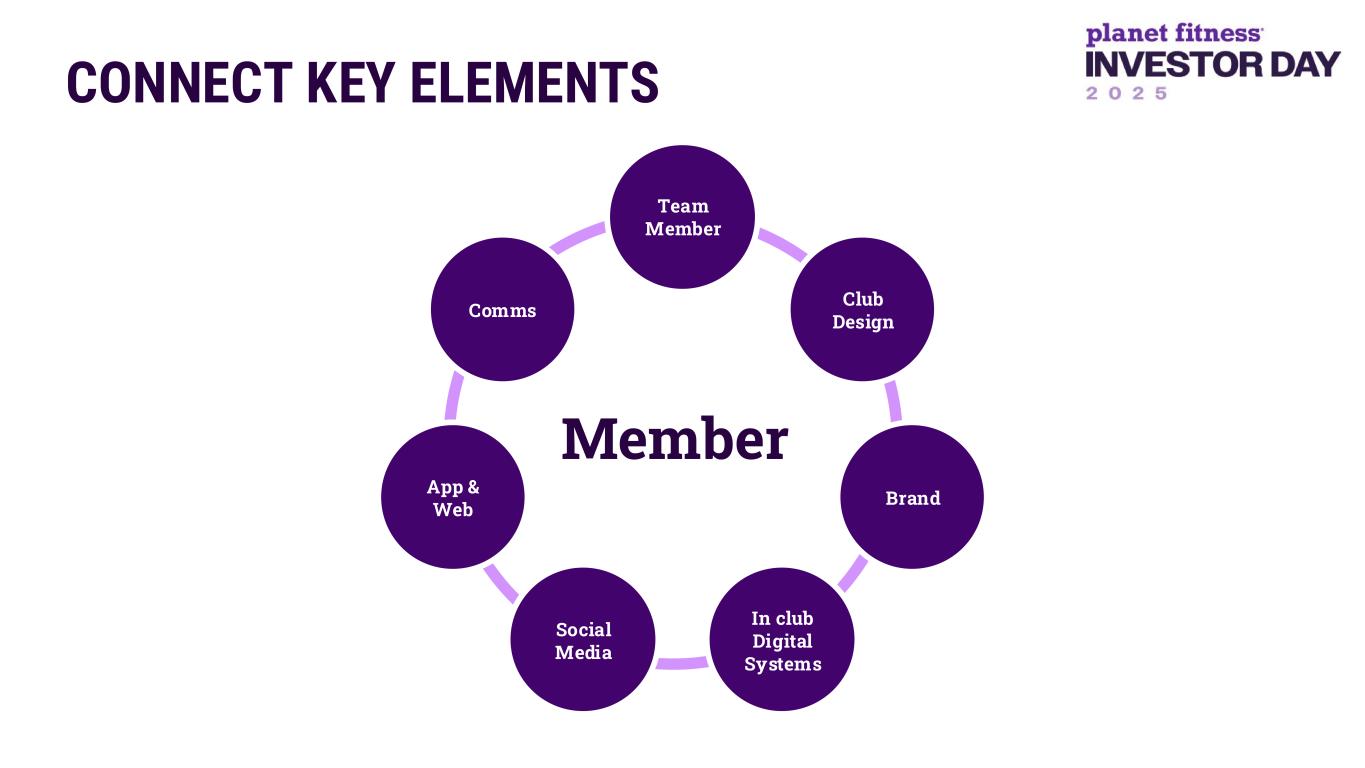

CONNECT KEY ELEMENTS Social Media In club Digital Systems App & Web Brand Comms Club Design Team Member Member

Recognition: ‘I feel seen’ Connected: ‘I fit in’ Continuous Value: ‘I keep getting more’ Lightly Gated: ‘I feel special’ Seamless: ‘It's intuitive’ Clear Purpose: ‘I’m part of something that matters’ BEST-IN-CLASS MEMBER EXPERIENCE

Format- Optimized Club

85 STATE OF STRENGTH

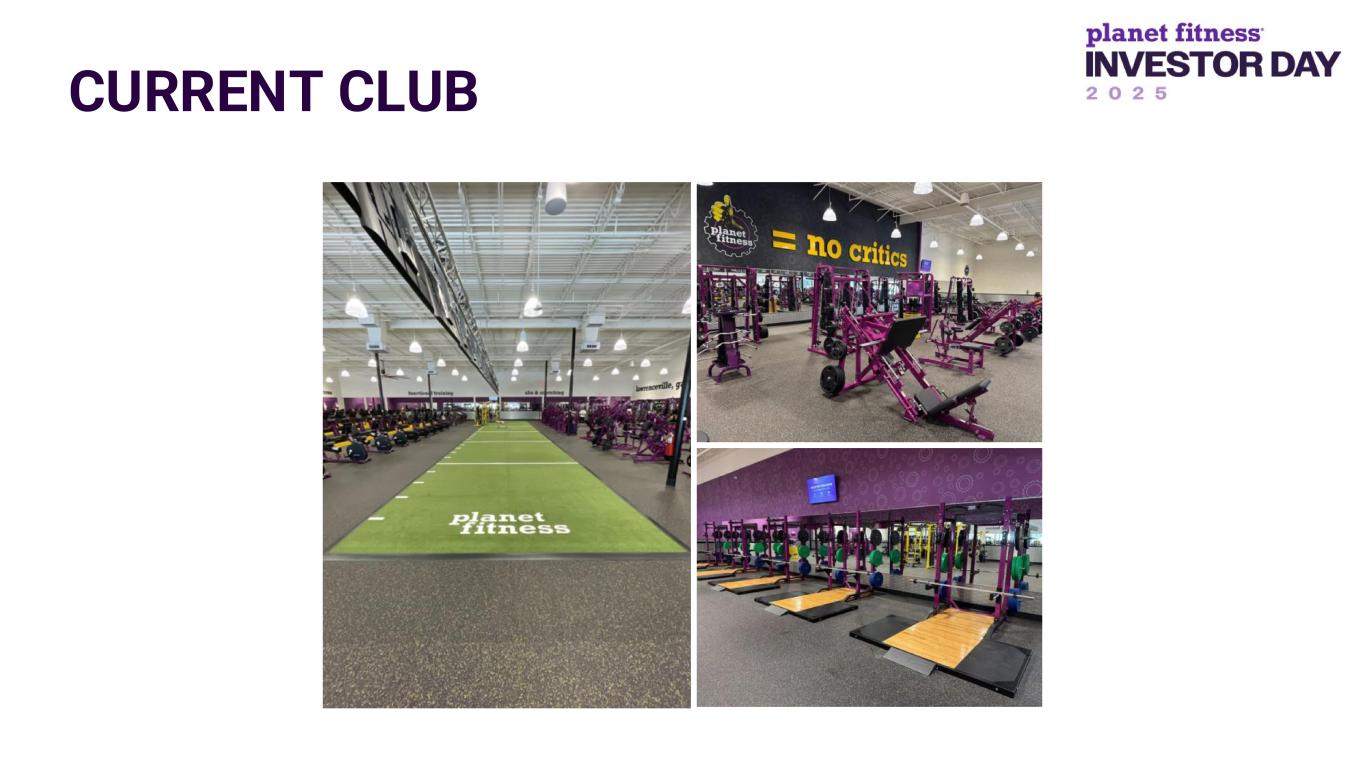

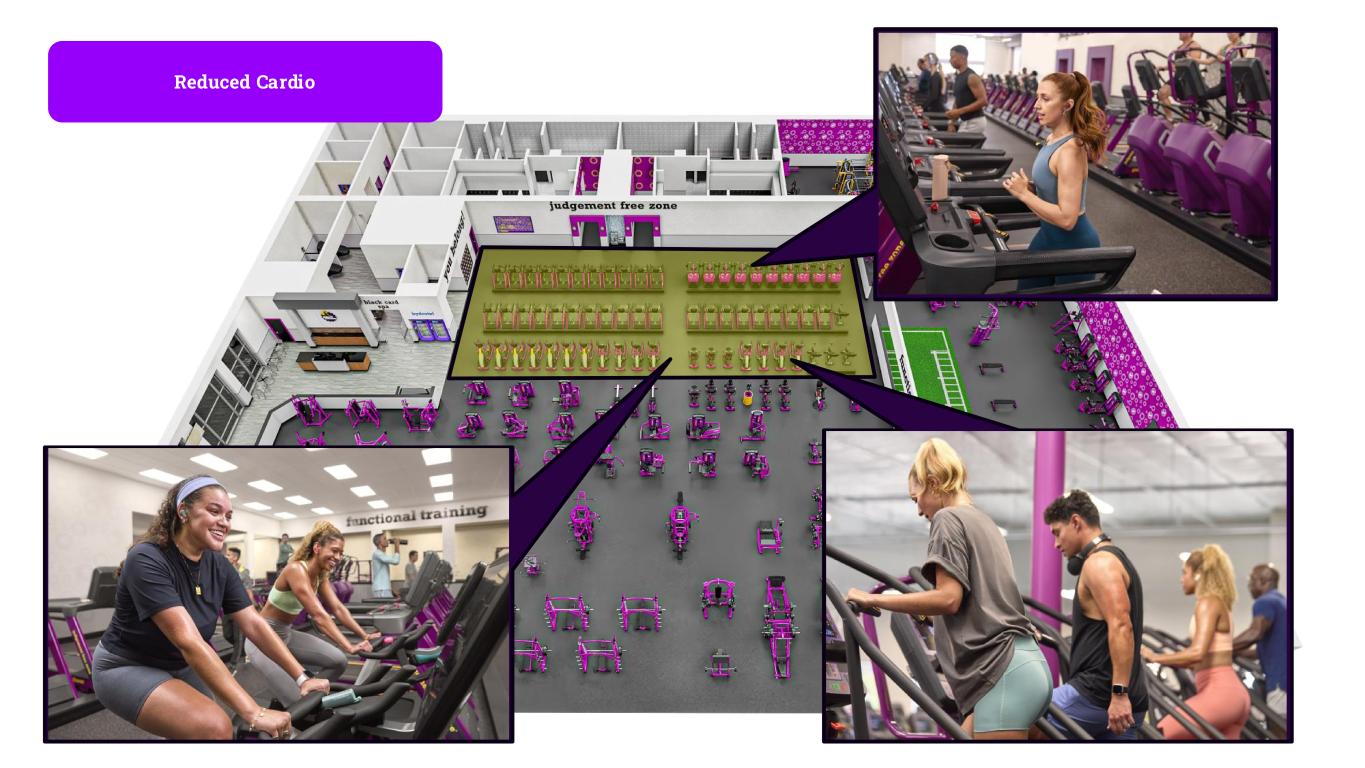

CURRENT CLUB

Reduced Cardio

Reduced Cardio

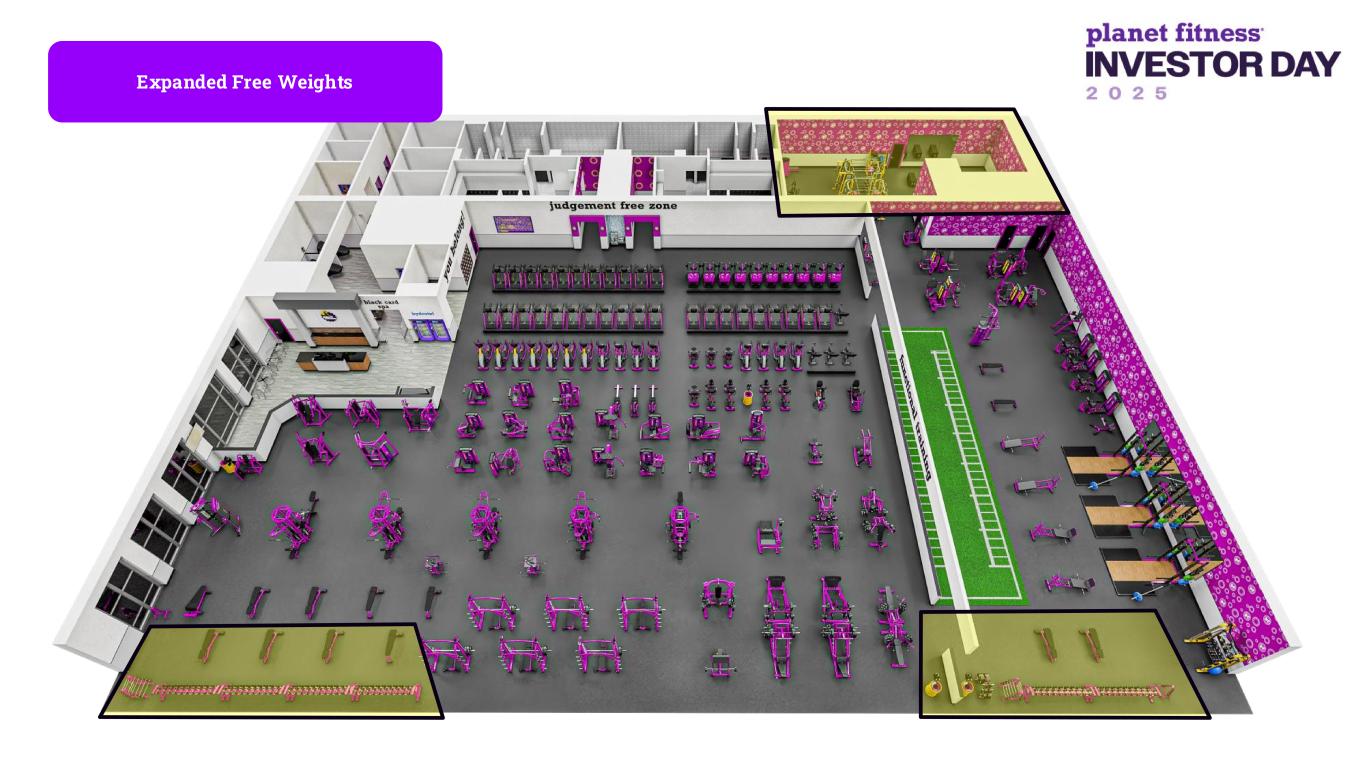

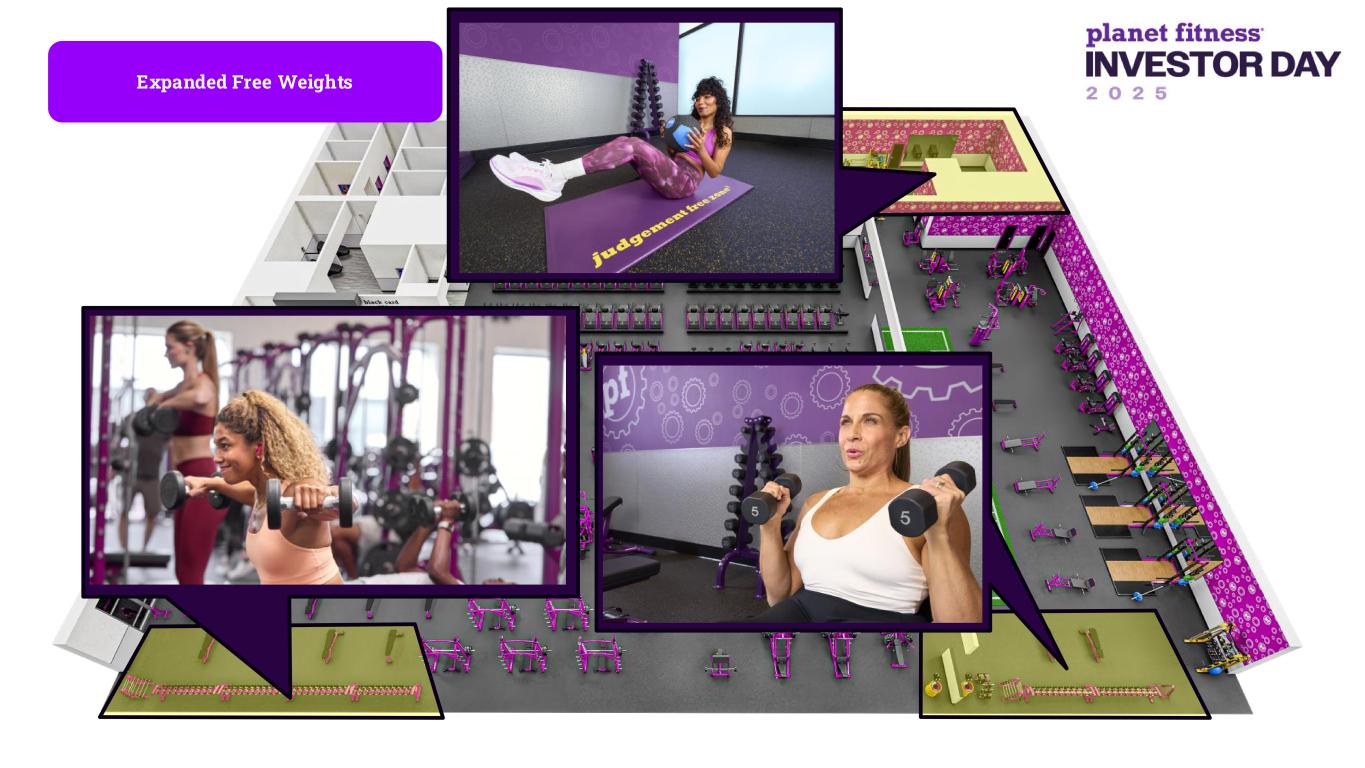

Expanded Free Weights

Expanded Free Weights

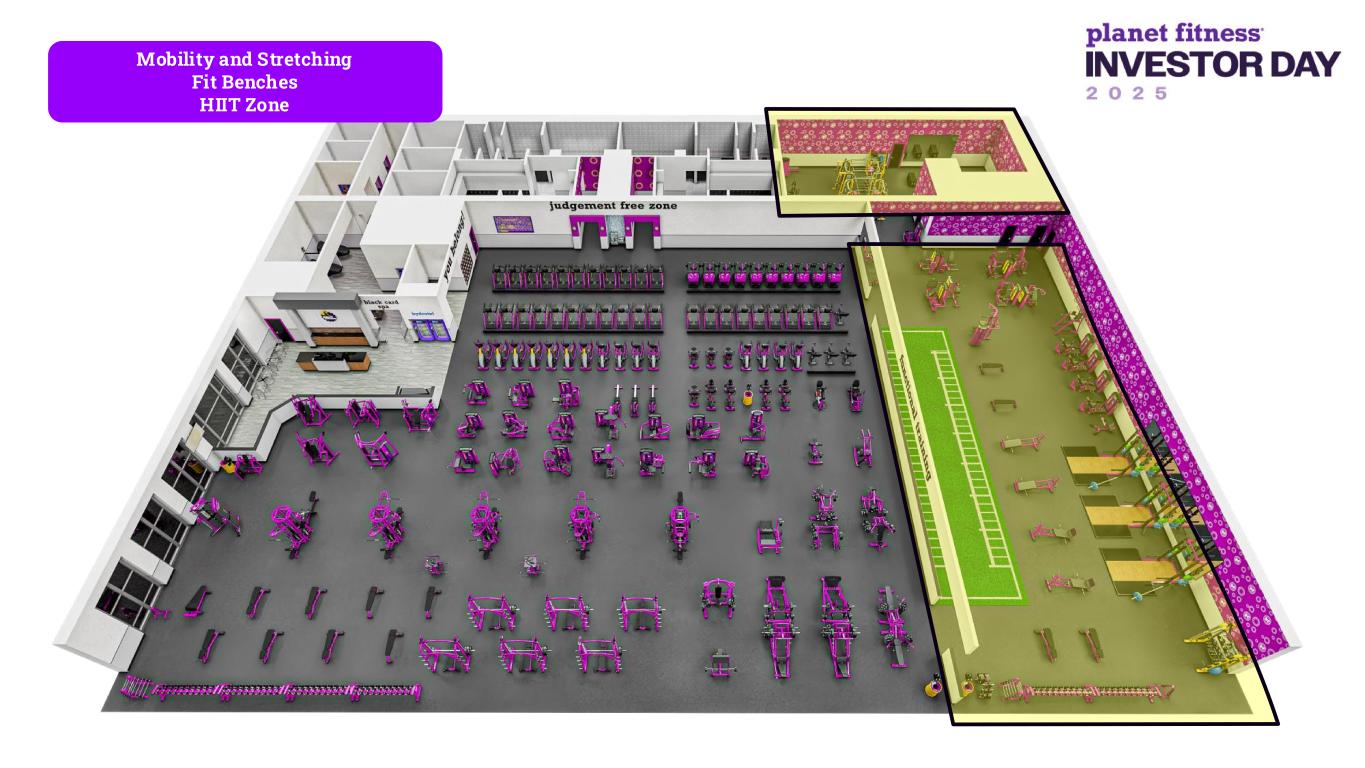

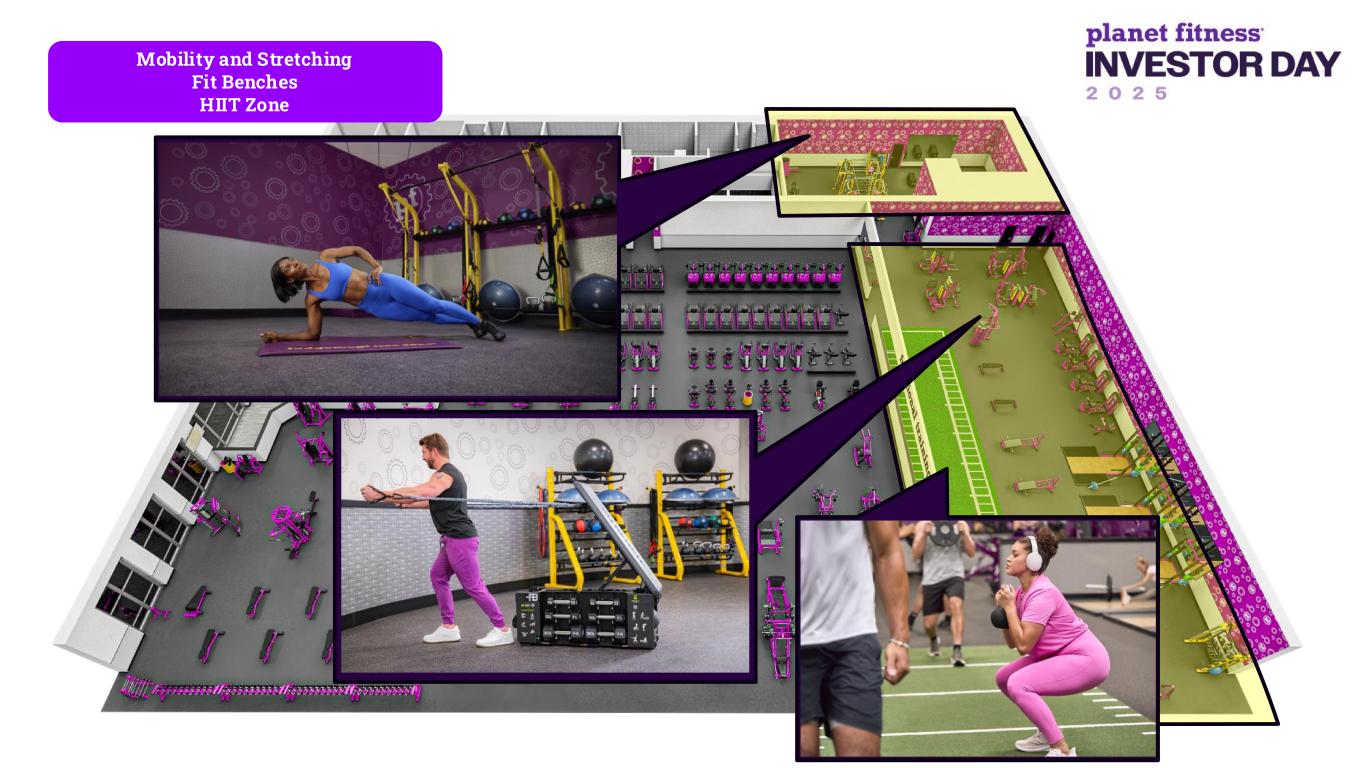

Mobility and Stretching Fit Benches HIIT Zone

Mobility and Stretching Fit Benches HIIT Zone

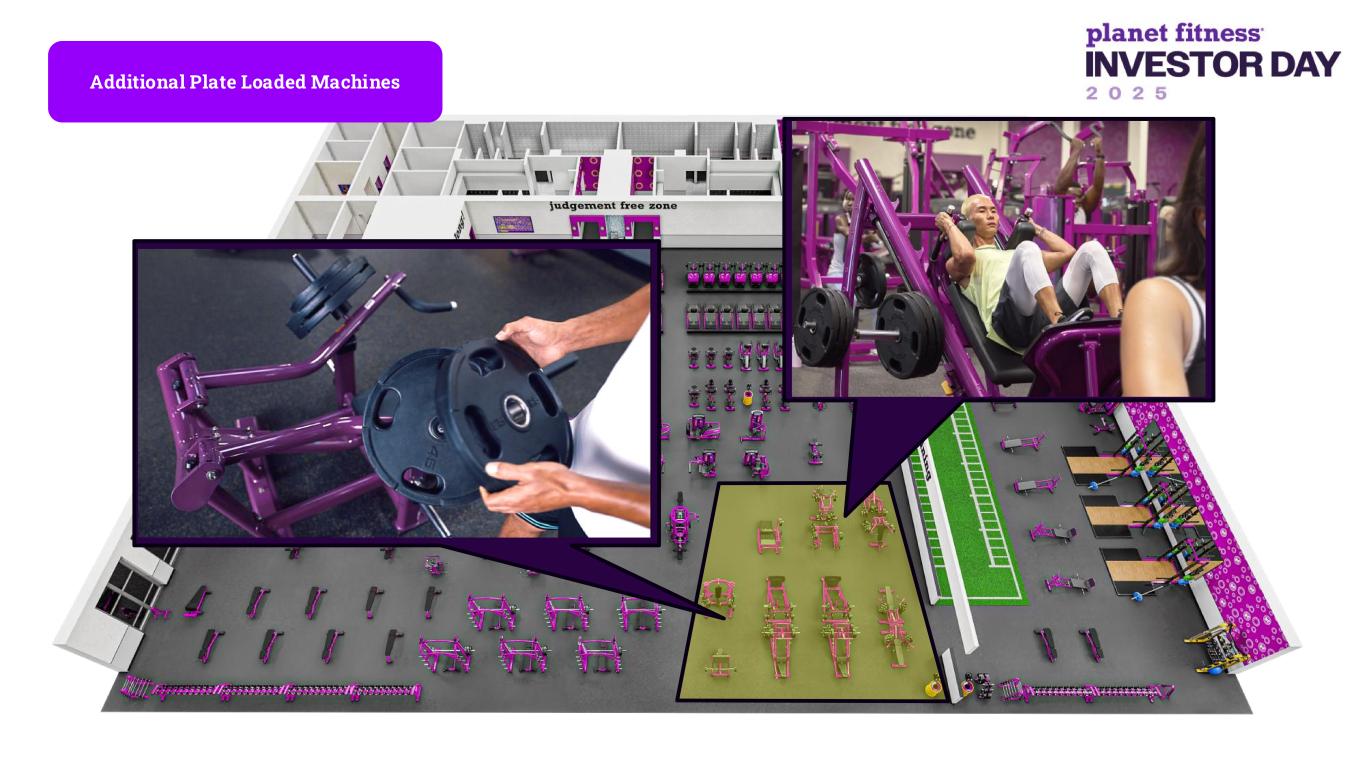

Additional Plate Loaded Machines

Additional Plate Loaded Machines

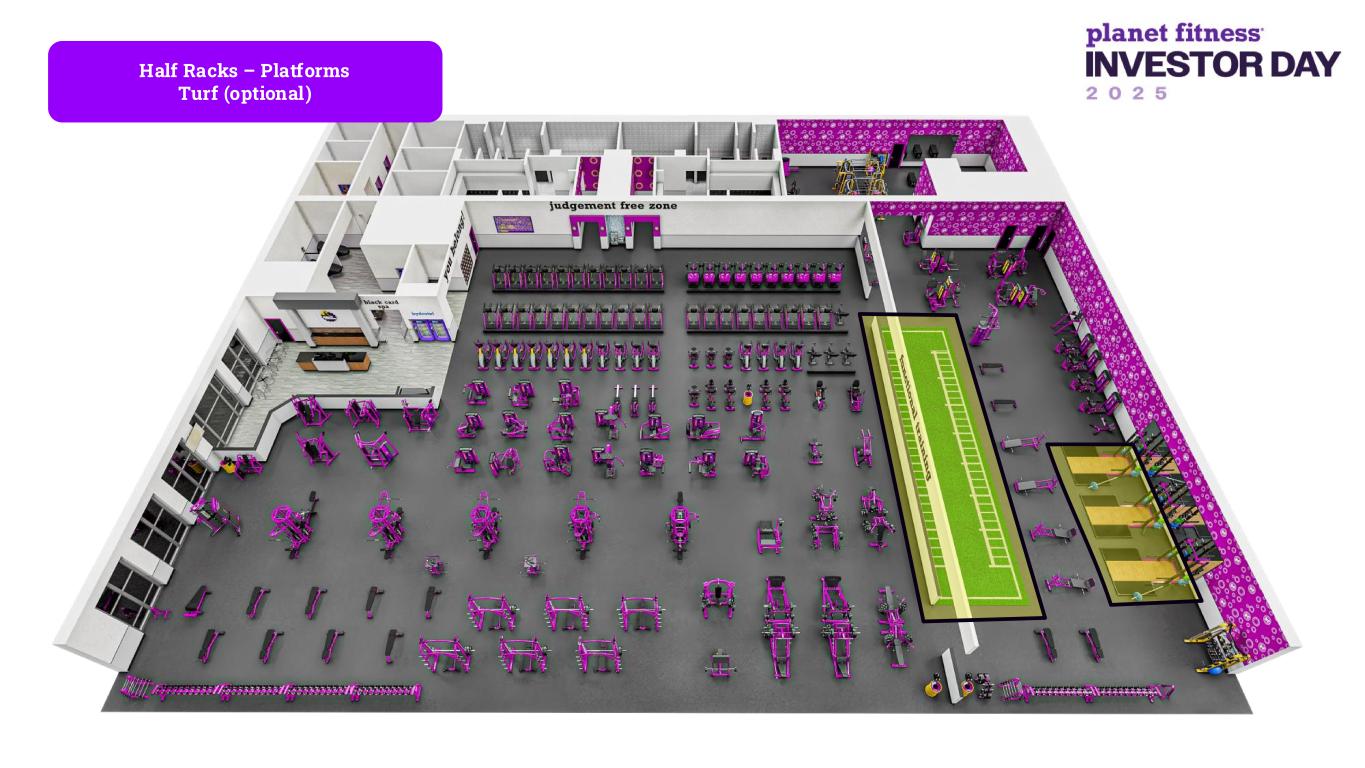

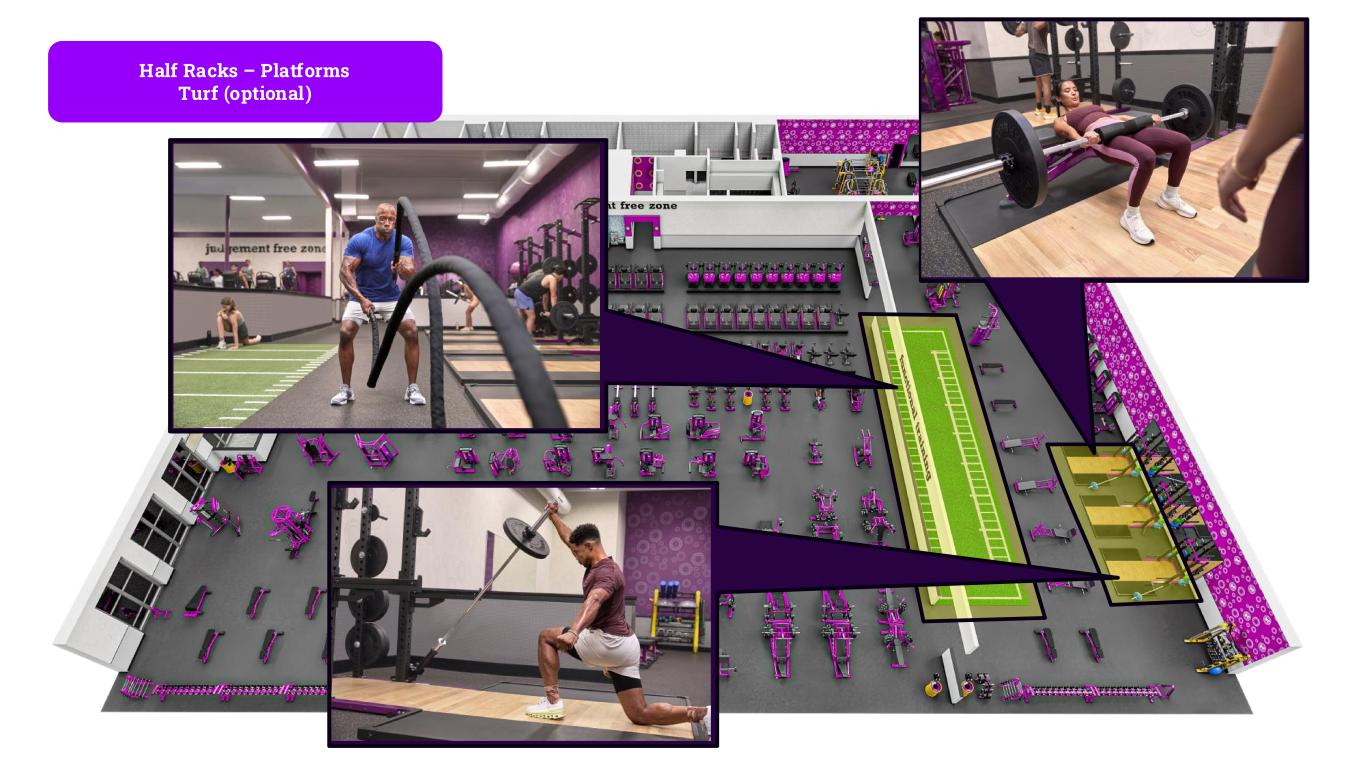

Half Racks – Platforms Turf (optional)

Half Racks – Platforms Turf (optional)

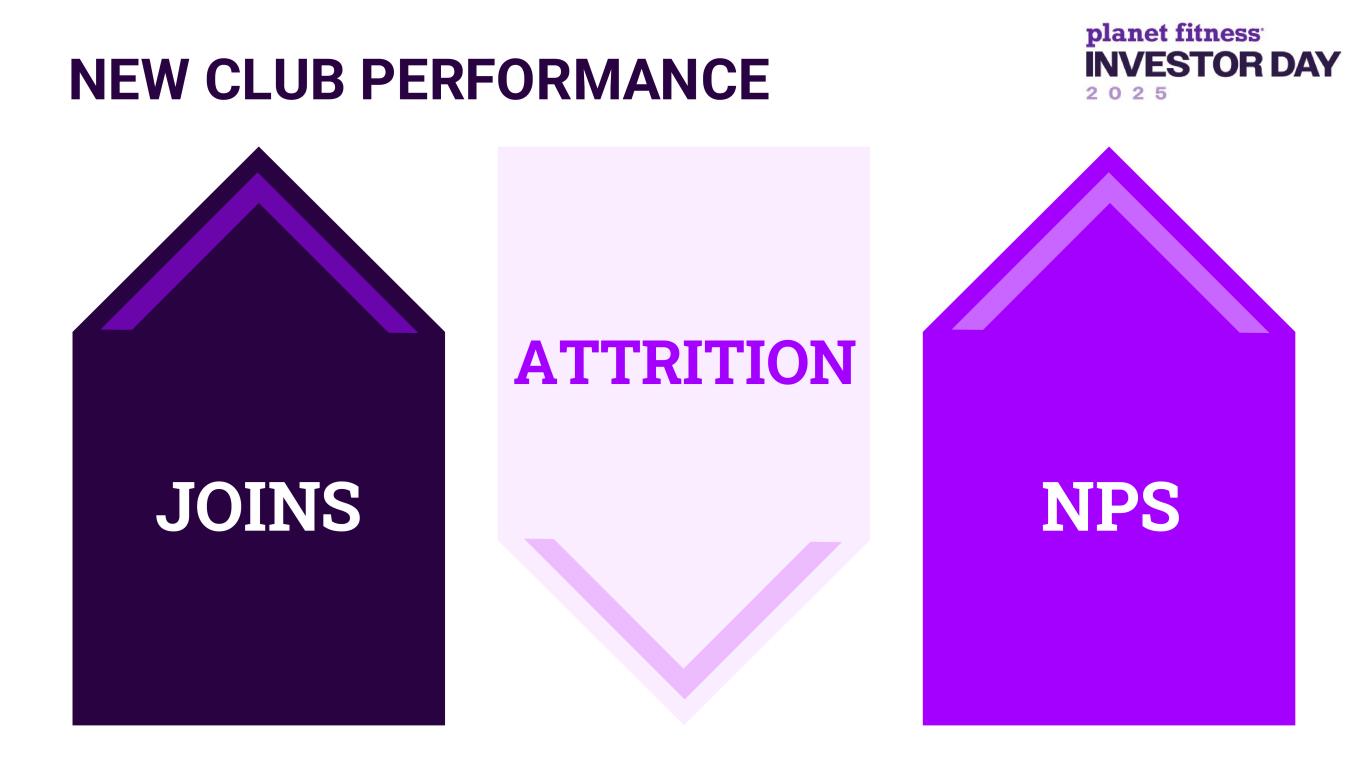

NEW CLUB PERFORMANCE JOINS NPS ATTRITION

Black Card Spa Evolution

CURRENT STATE FUTURE STATE

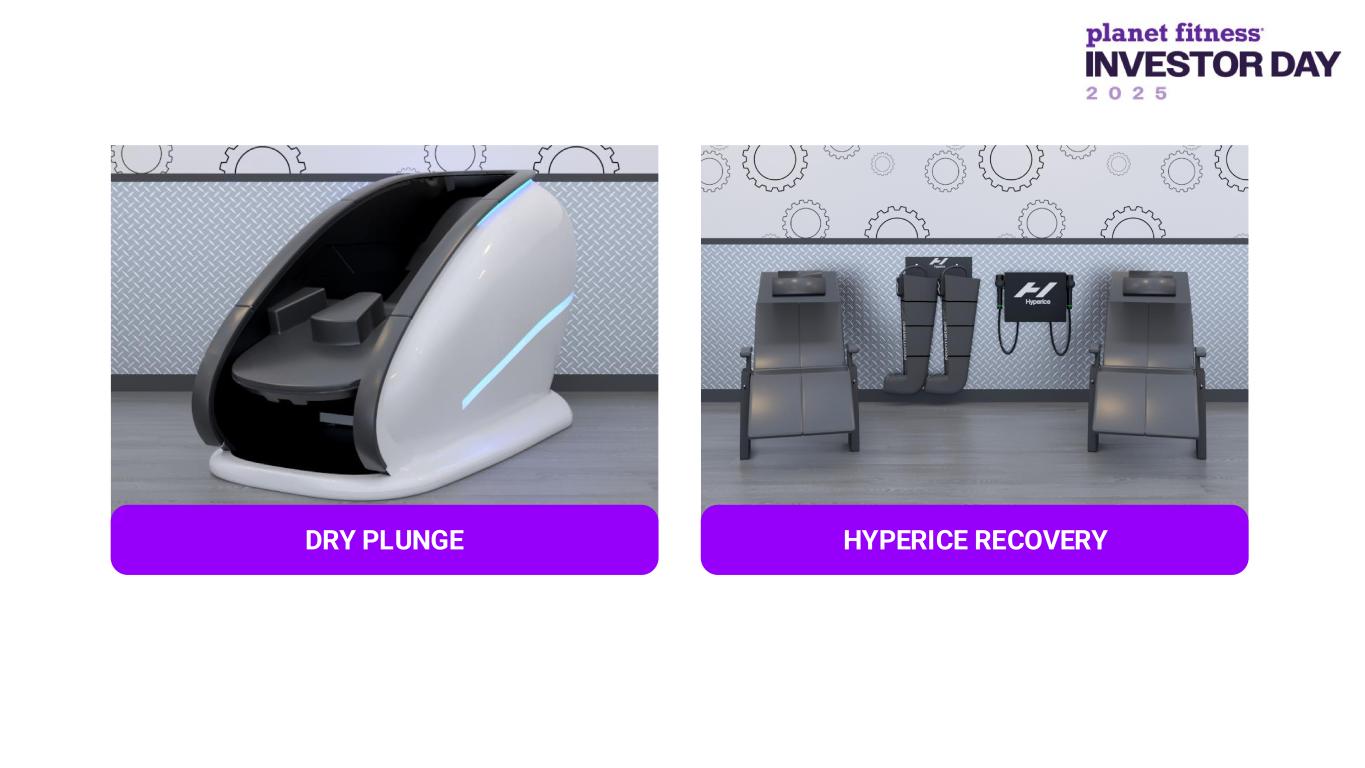

DRY PLUNGE HYPERICE RECOVERY Considerers Switchers

RED LIGHT INFRARED SAUNA WELLFIT SKIN HYDRATION RED LIGHT RECOVERY PRO

TEST & LEARN IN 2026

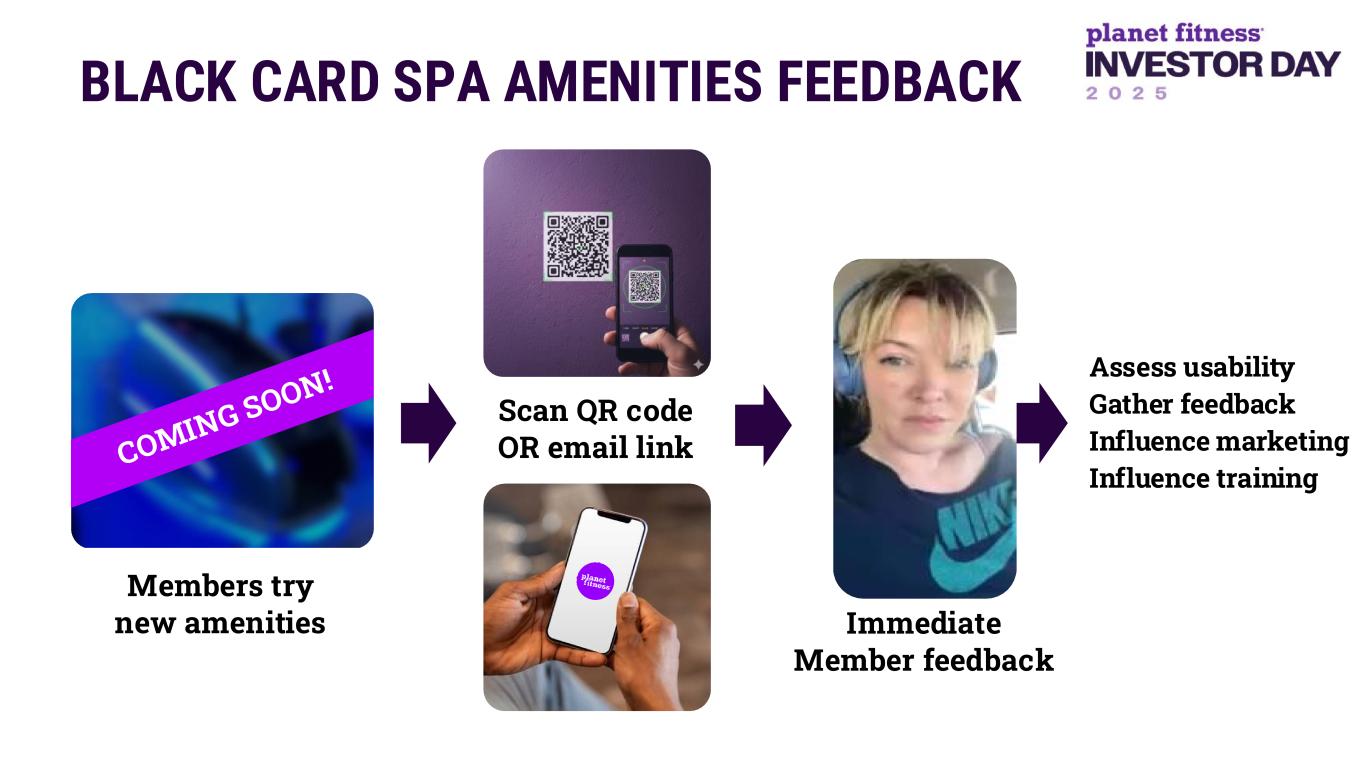

Members try new amenities Scan QR code OR email link Immediate Member feedback BLACK CARD SPA AMENITIES FEEDBACK Assess usability Gather feedback Influence marketing Influence training

CHIP OHLSSON CHIEF DEVELOPMENT OFFICER

ACCELERATING CLUB GROWTH

INTERNATIONAL GROWTH

Across our international markets 1 MILLION+ MEMBERS

SPAIN 10 CLUBS GROWING OUR BRAND INTERNATIONALLY *September 30, 2025 CANADA 84 CLUBS MEXICO 36 CLUBS PANAMA 8 CLUBS AUSTRALIA 25 CLUBS

…AND ALSO GROWING IN SPAIN GROWING IN SPAIN

113

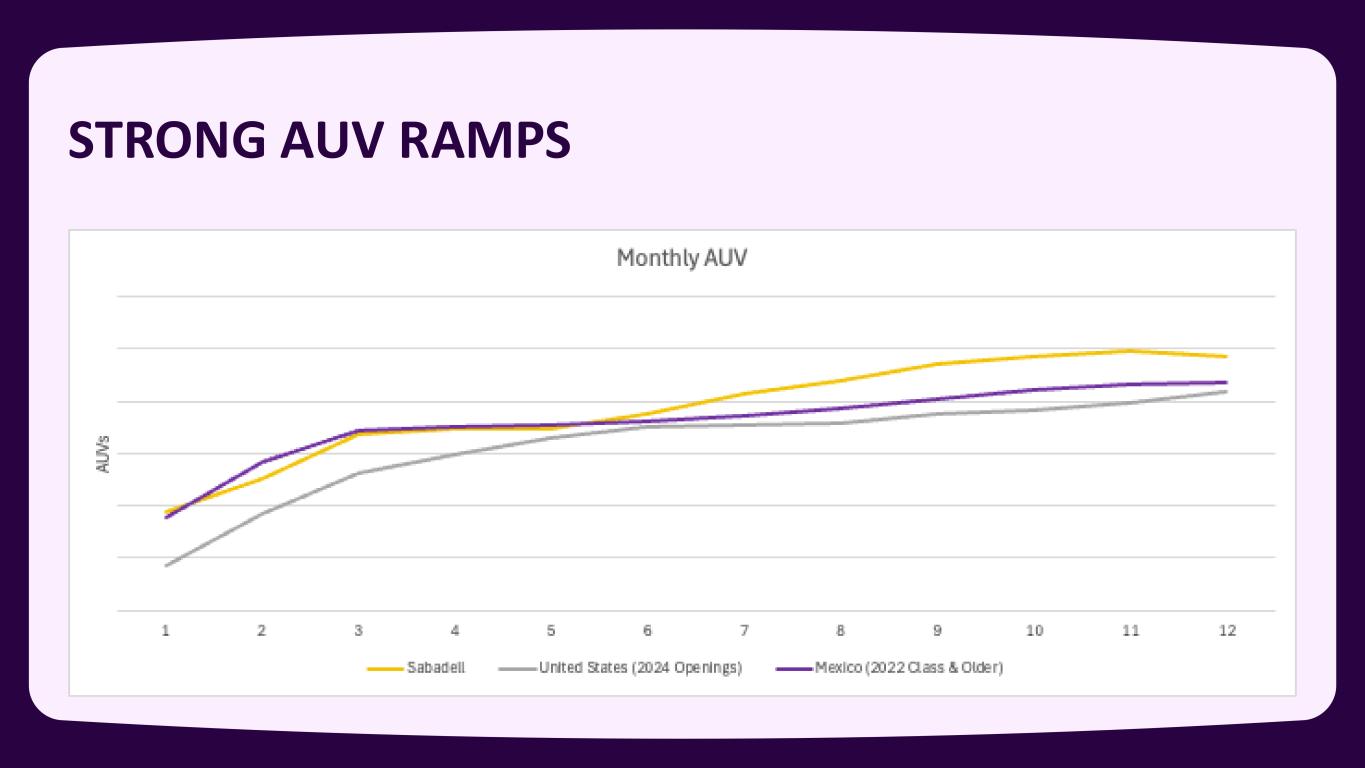

STRONG AUV RAMPS

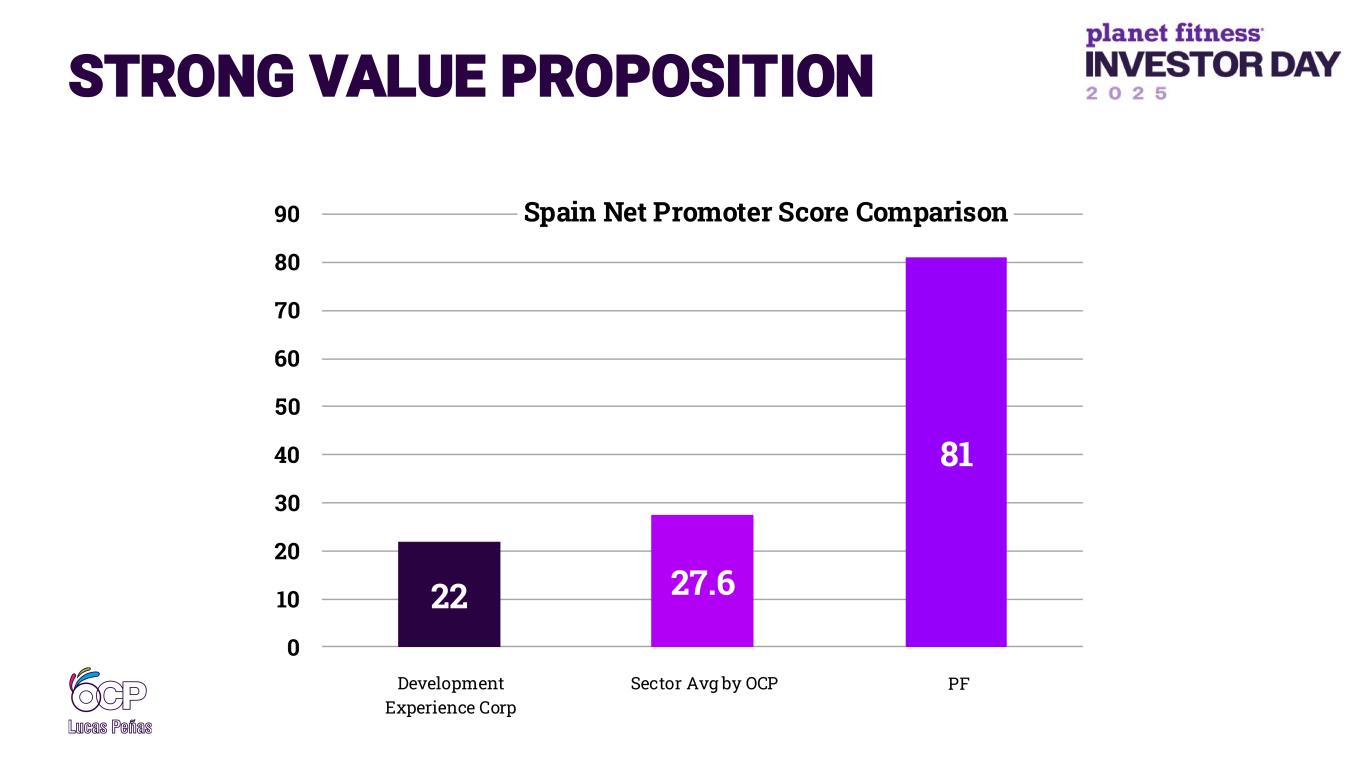

STRONG VALUE PROPOSITION 22 27.6 81 0 10 20 30 40 50 60 70 80 90 Spain Net Promoter Score Comparison Development Experience Corp Sector Avg by OCP PF

116

A DISCIPLINED APPROACH TO GLOBAL GROWTH PRIORITIZING NEW MARKET OPPORTUNITIES RECRUITING WELL-ESTABLISHED LOCAL OPERATORS SUCCESSFULLY OPEN NEW MARKETS Target: 1-2 new markets per year

DOMESTIC GROWTH

• Record low of new supply at 6.98M SF — lowest since 2000 • Negative absorption amid retail bankruptcies – likely extend into 2026 • Availability tight at 5.3% Source: MarketsGroup https://www.marketsgroup.org/news/us-retail-leasing-volume-declines-in-q2-2025-amid-uncertainty-lack-of-prime-supply Q2 2025 U.S. RETAIL REAL ESTATE

STRATEGIES TO UNLOCK REAL ESTATE OPPORTUNITIES PARTNERING WITH FRANCHISEES RELATIONSHIPS WITH LANDLORDS CONVERSION OPPORTUNITIES

•Consents and Approvals •Negotiations •Leases •Brand Favorability Data •Portfolio Reviews •Landlord and Retailer Decks •Co-Tenancy •Multiple Deals PARTNERING WITH FRANCHISEES

WHY WE'RE THE RIGHT CHOICE FOR LANDLORDS

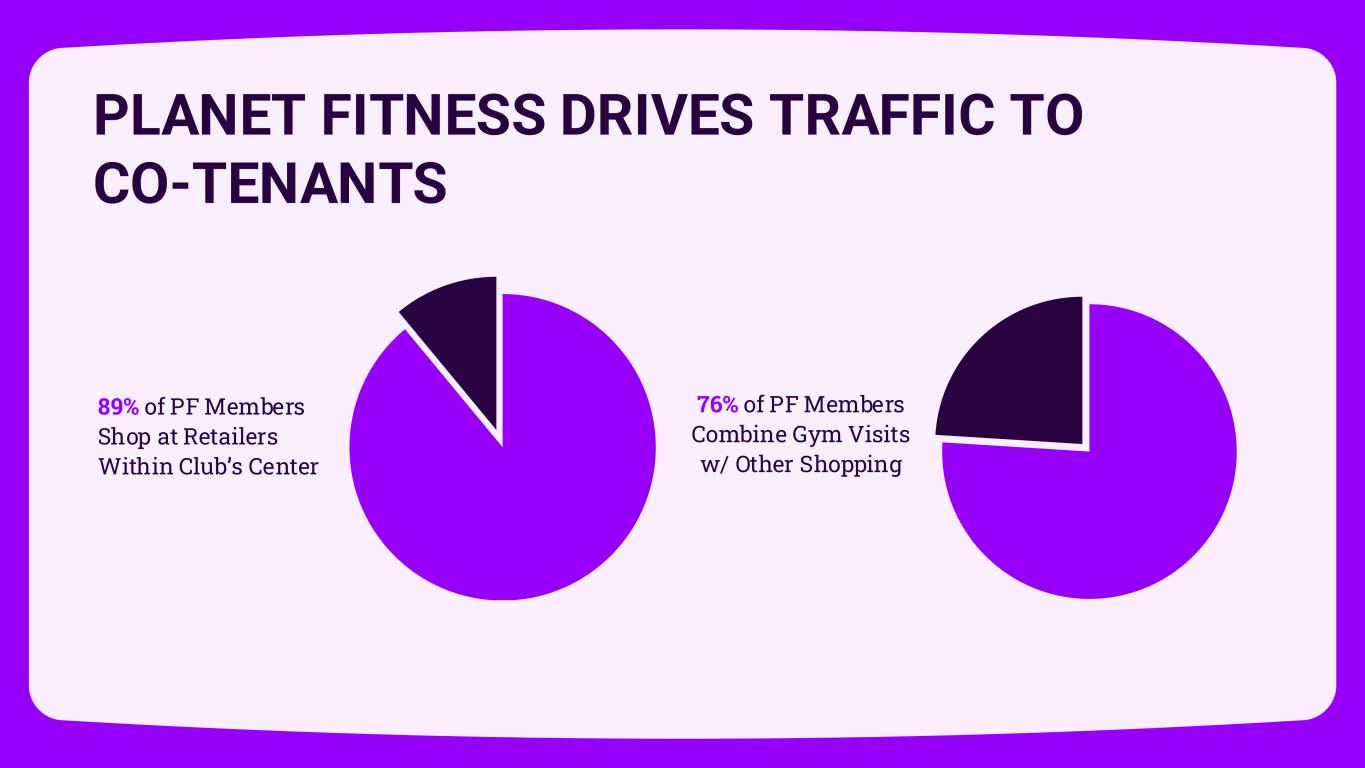

PLANET FITNESS DRIVES TRAFFIC TO CO-TENANTS 76% of PF Members Combine Gym Visits w/ Other Shopping 89% of PF Members Shop at Retailers Within Club’s Center

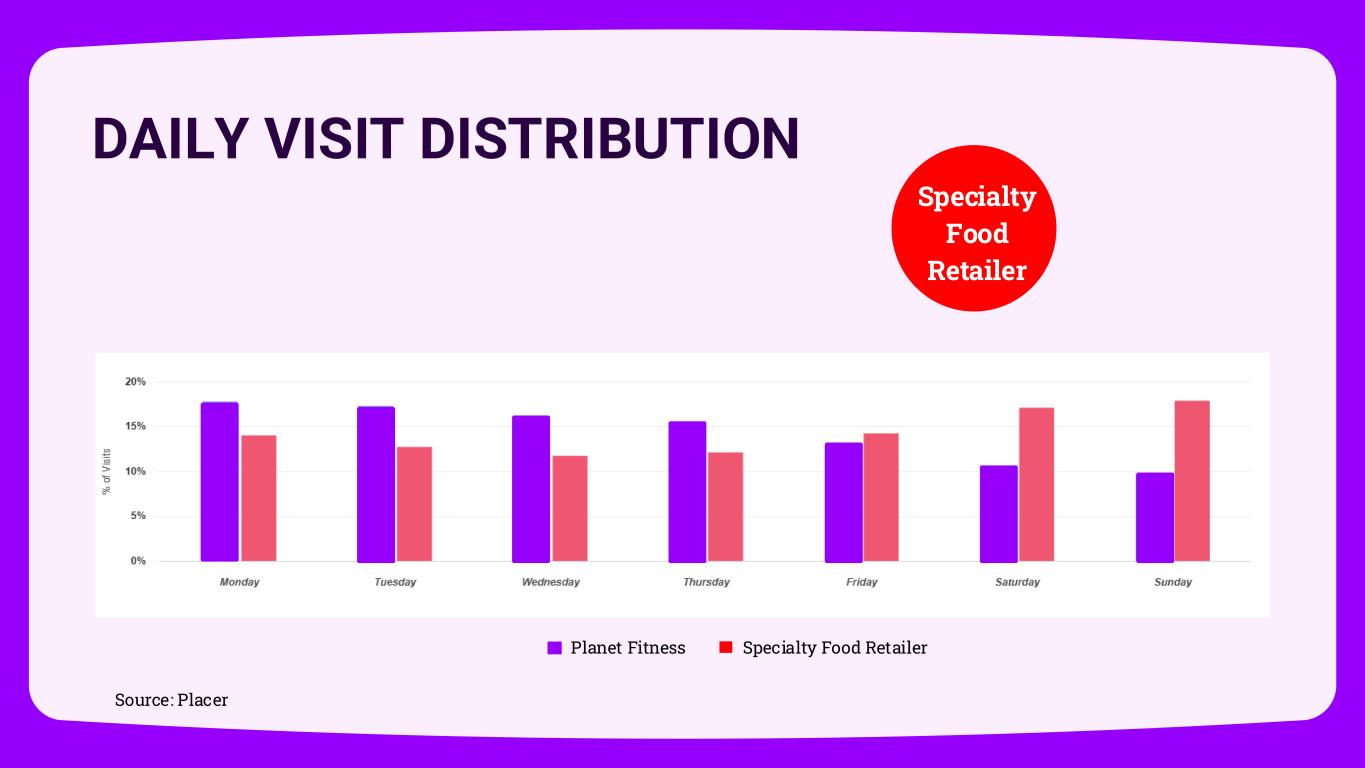

DAILY VISIT DISTRIBUTION Specialty Food Retailer Planet Fitness Specialty Food Retailer Source: Placer

CONVERSION OPPORTUNITIES

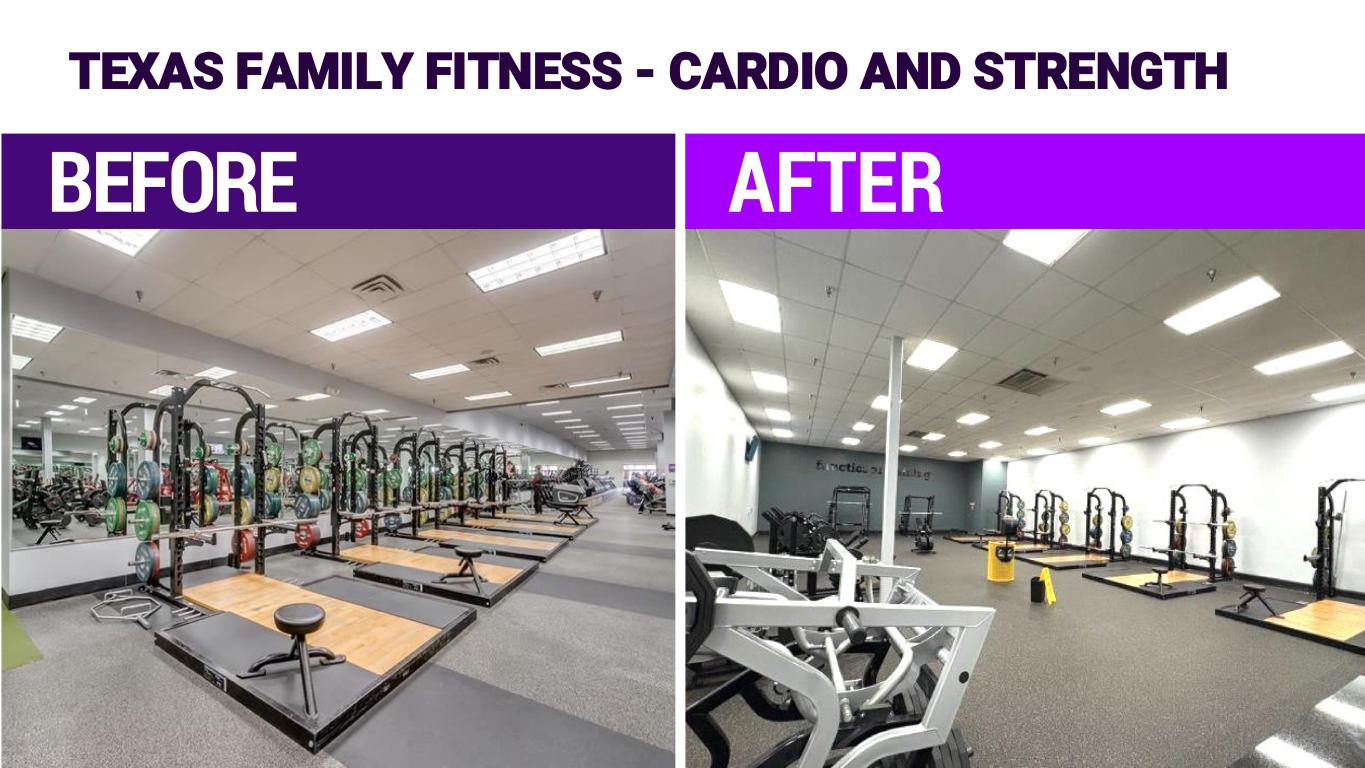

BEFORE AFTER

TEXAS FAMILY FITNESS BLACK CARD SPA BEFORE

TEXAS FAMILY FITNESS BLACK CARD SPA AFTER

TEXAS FAMILY FITNESS - CARDIO AND STRENGTH BEFORE AFTER

TEXAS FAMILY FITNESS - CARDIO AND STRENGTH BEFORE AFTER

CONSTRUCTION EFFICIENCIES

~$3.0M AVERAGE CLUB COST* *Actual 2025 construction cost depends on market, size of club, and other external factors.

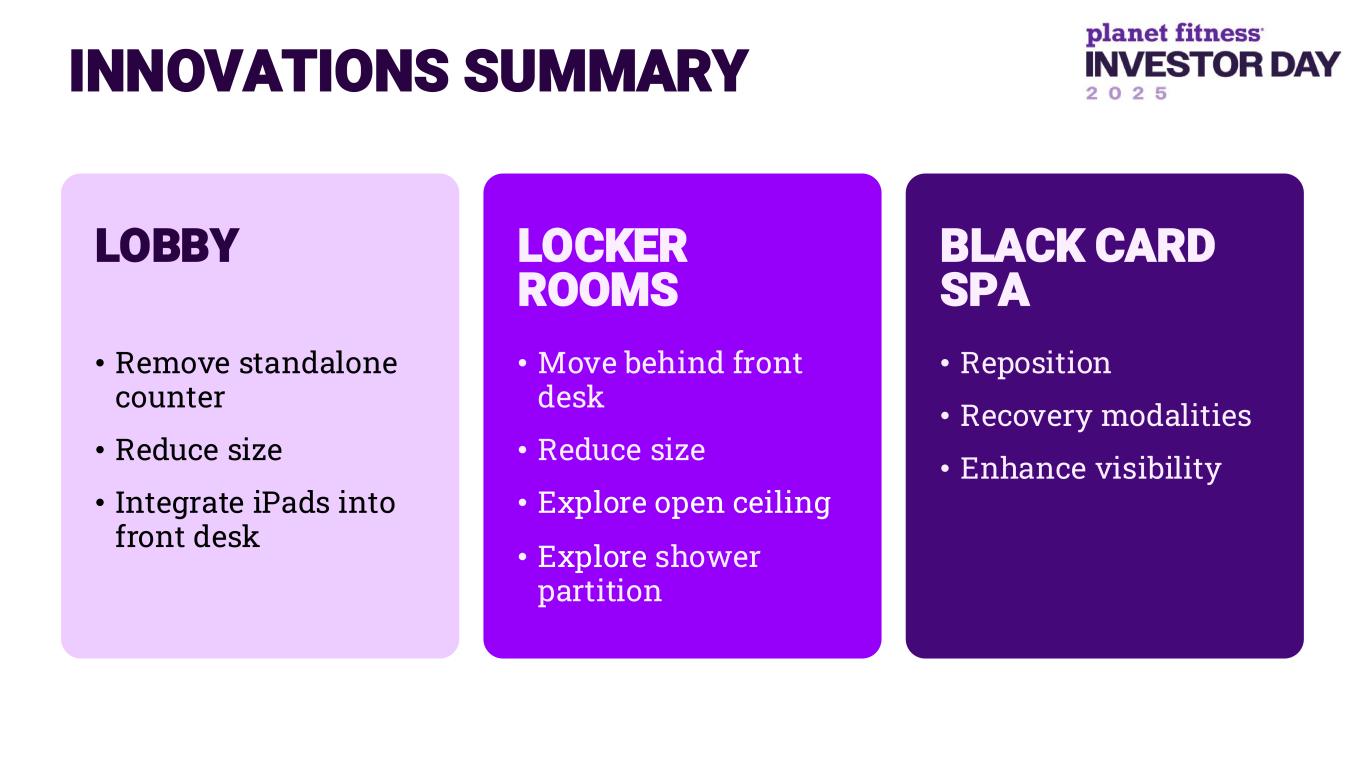

INNOVATIONS SUMMARY • Remove standalone counter • Reduce size • Integrate iPads into front desk LOBBY • Move behind front desk • Reduce size • Explore open ceiling • Explore shower partition LOCKER ROOMS • Reposition • Recovery modalities • Enhance visibility BLACK CARD SPA Correct

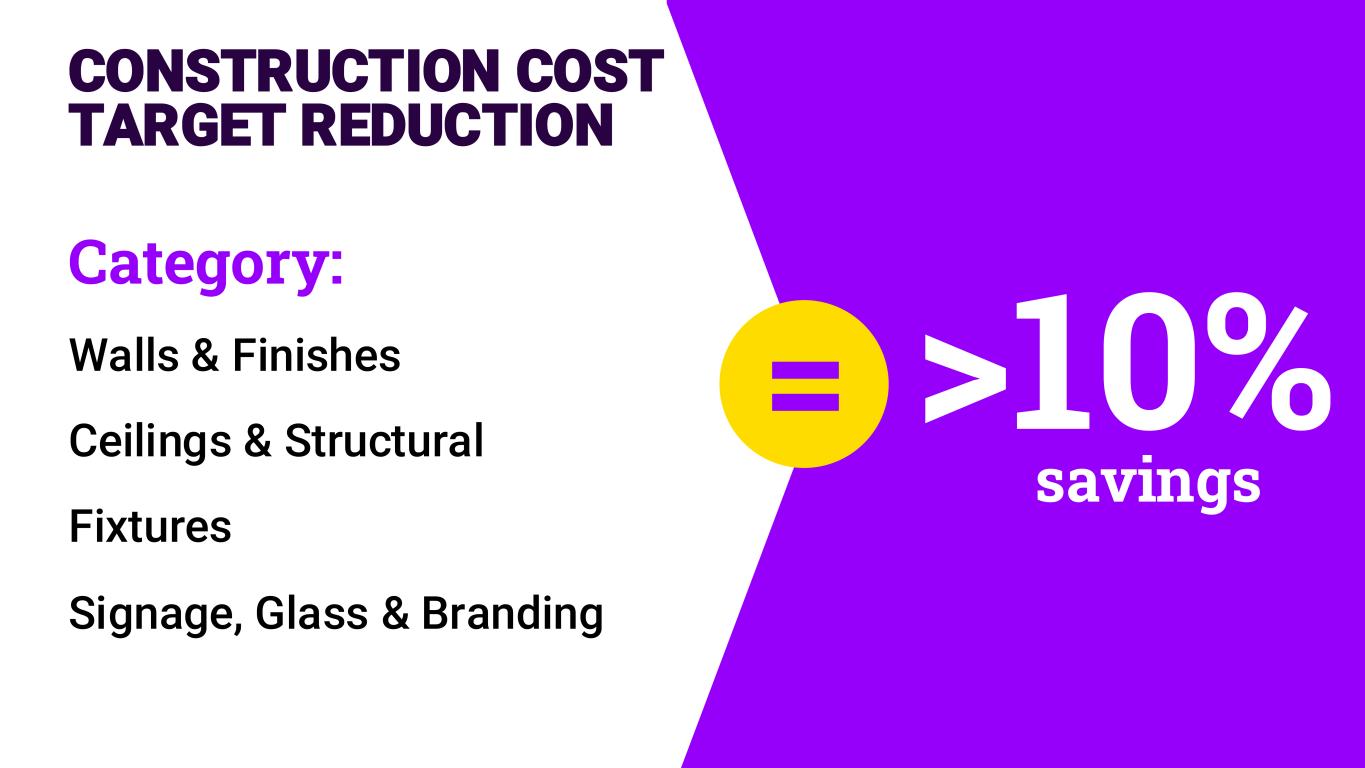

CONSTRUCTION COST TARGET REDUCTION >10% savings Category: Walls & Finishes Ceilings & Structural Fixtures Signage, Glass & Branding =

CONCEPT CLUB

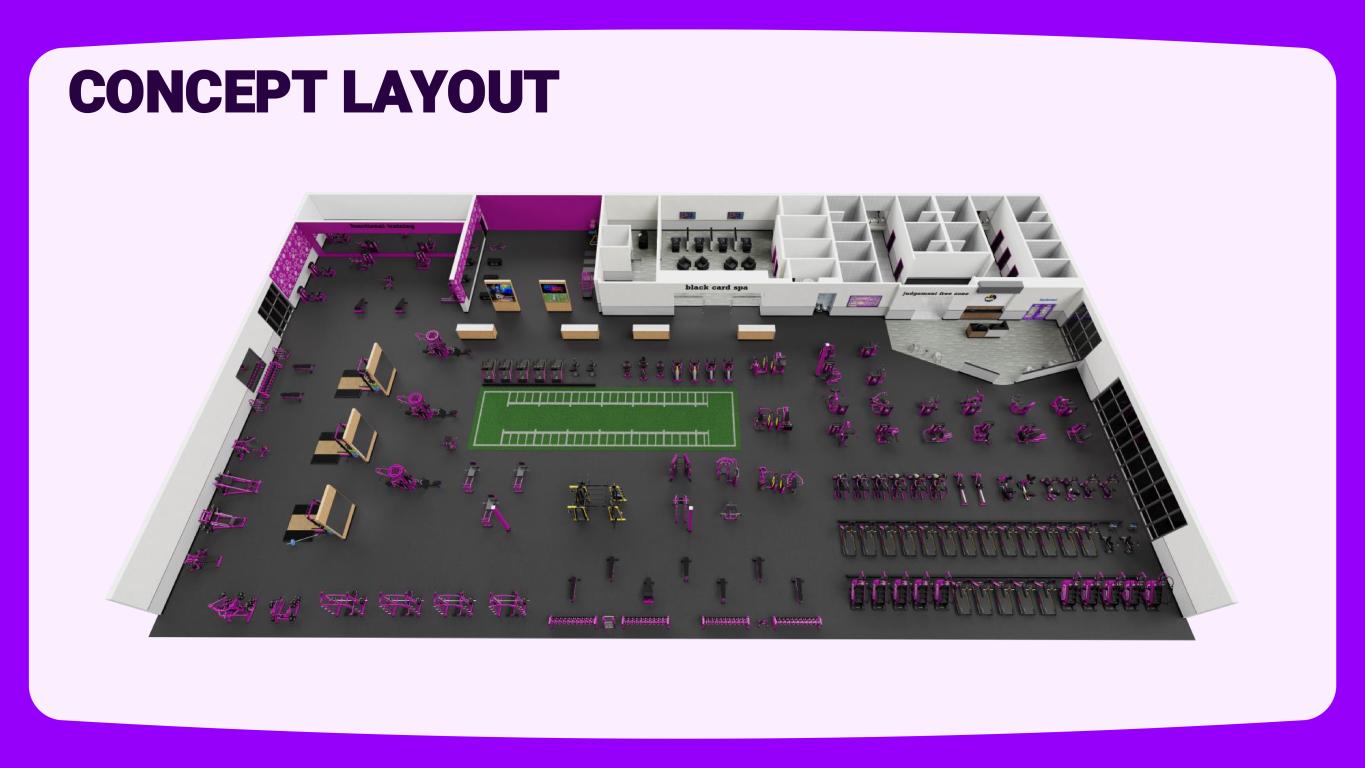

CONCEPT LAYOUT

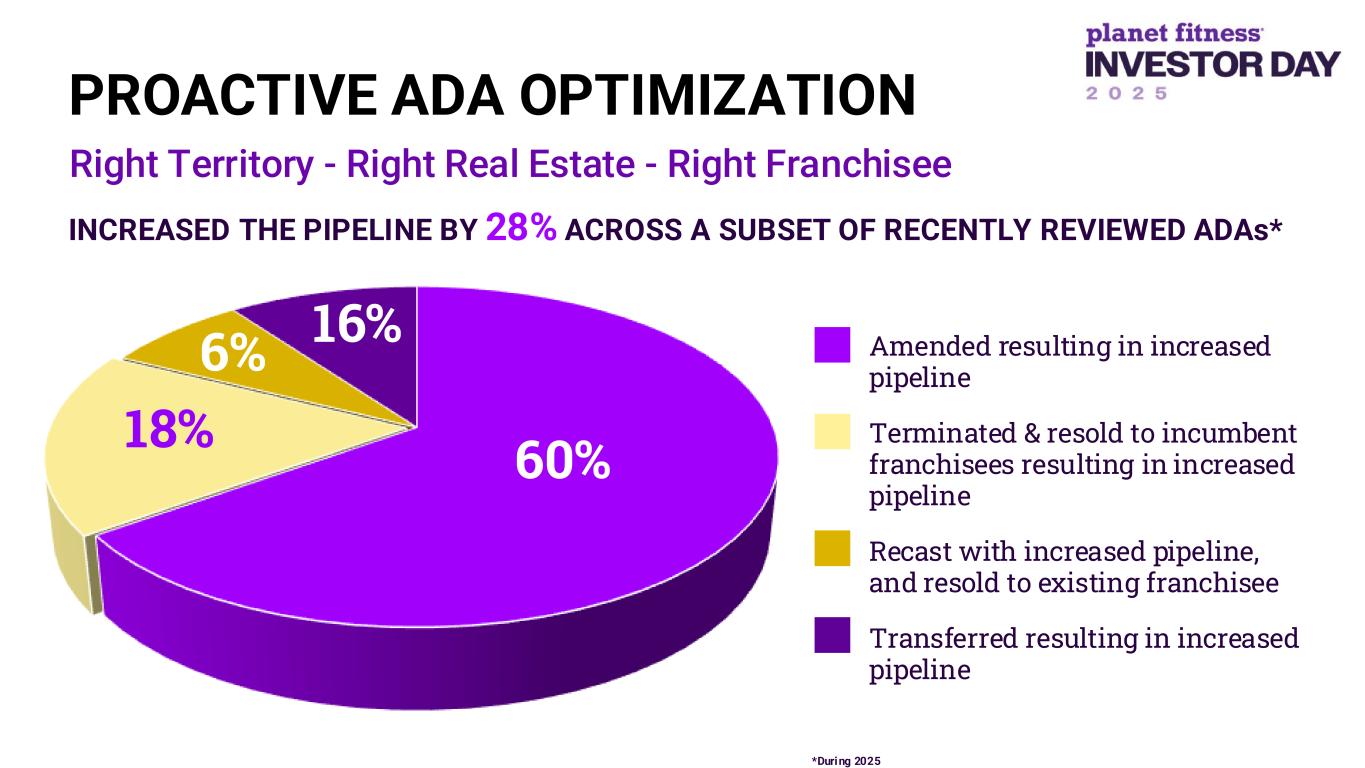

UNLOCKING TERRITORY FOR GROWTH

Right Territory - Right Real Estate - Right Franchisee 60%18% 6% 16% PROACTIVE ADA OPTIMIZATION Amended resulting in increased pipeline Terminated & resold to incumbent franchisees resulting in increased pipeline Recast with increased pipeline, and resold to existing franchisee Transferred resulting in increased pipeline INCREASED THE PIPELINE BY 28% ACROSS A SUBSET OF RECENTLY REVIEWED ADAs* *During 2025

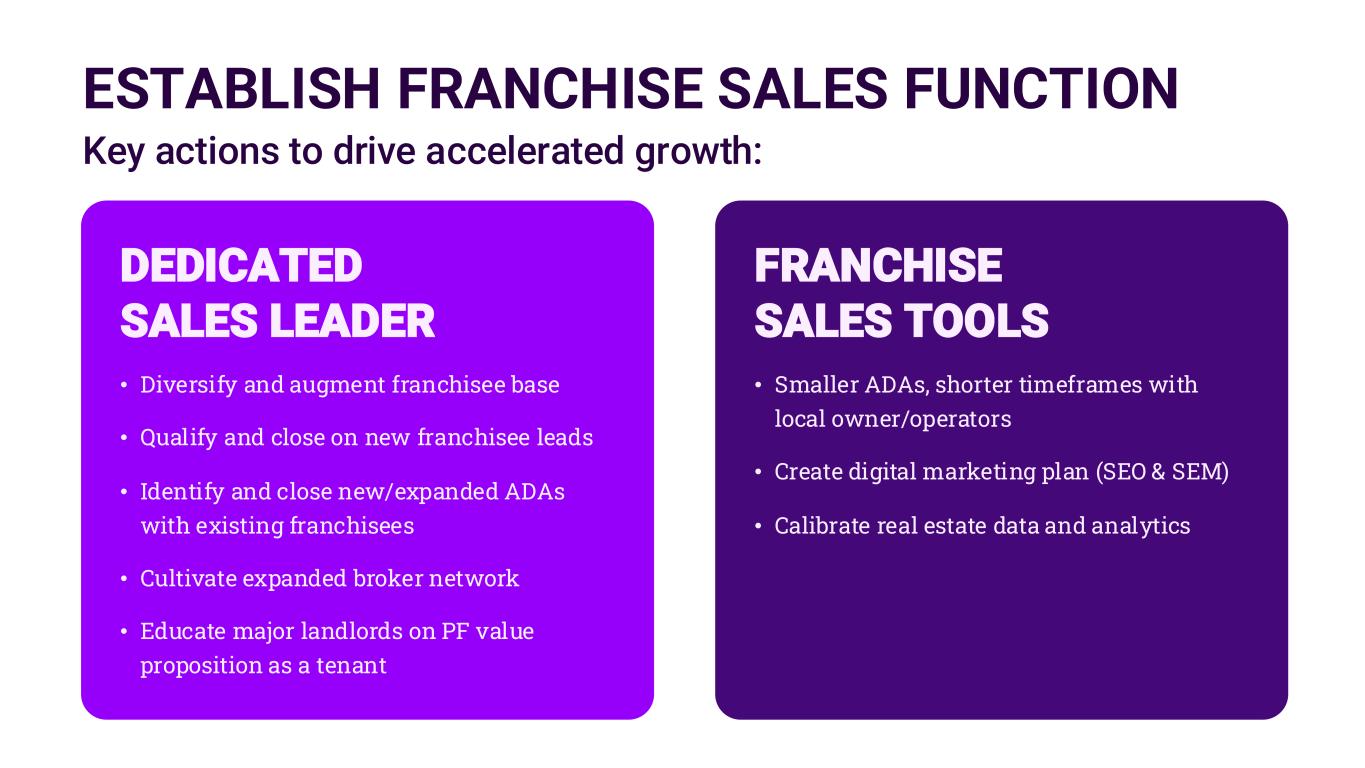

ESTABLISH FRANCHISE SALES FUNCTION Key actions to drive accelerated growth: • Smaller ADAs, shorter timeframes with local owner/operators • Create digital marketing plan (SEO & SEM) • Calibrate real estate data and analytics FRANCHISE SALES TOOLS • Diversify and augment franchisee base • Qualify and close on new franchisee leads • Identify and close new/expanded ADAs with existing franchisees • Cultivate expanded broker network • Educate major landlords on PF value proposition as a tenant DEDICATED SALES LEADER

142

JAY STASZ CHIEF FINANCIAL OFFICER

WE'RE LEVERAGING OUR SCALE TO: DRIVE PROFITABLE GROWTH EXPAND OUR COMPETITIVE EDGE STRENGTHEN OUR INDUSTRY LEADERSHIP

PLANET FITNESS IS... AN INDUSTRY-LEADING FRANCHISED GROWTH COMPANY WITH A CAPITAL-LIGHT MODEL THAT DELIVERS STRONG CASH FLOW

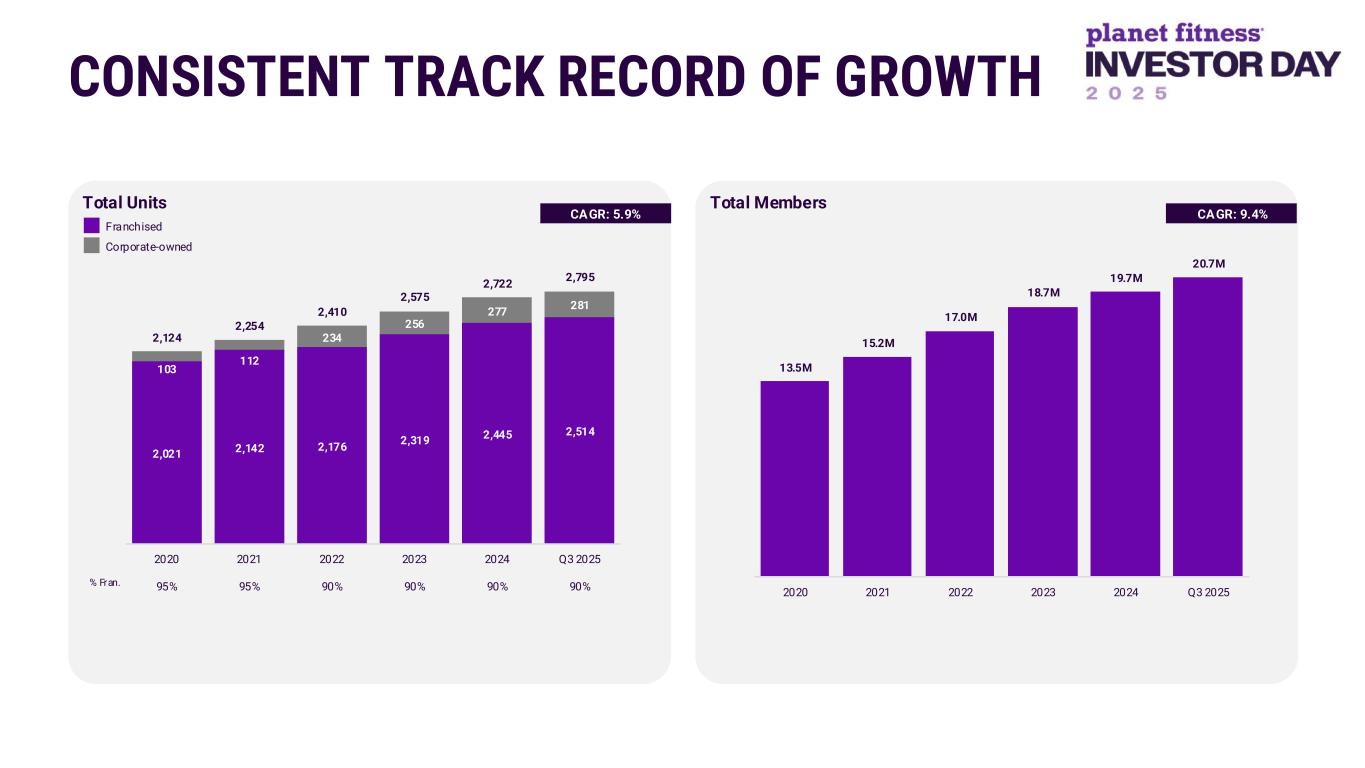

Total Units Total Members CAGR: 5.9% CAGR: 9.4% Franchised Corporate-owned % Fran. CONSISTENT TRACK RECORD OF GROWTH 2,021 2,142 2,176 2,319 2,445 2,514 103 112 234 256 277 281 2,124 2,254 2,410 2,575 2,722 2,795 2020 95% 2021 95% 2022 90% 2023 90% 2024 90% Q3 2025 90% 13.5M 15.2M 17.0M 18.7M 19.7M 20.7M 2020 2021 2022 2023 2024 Q3 2025

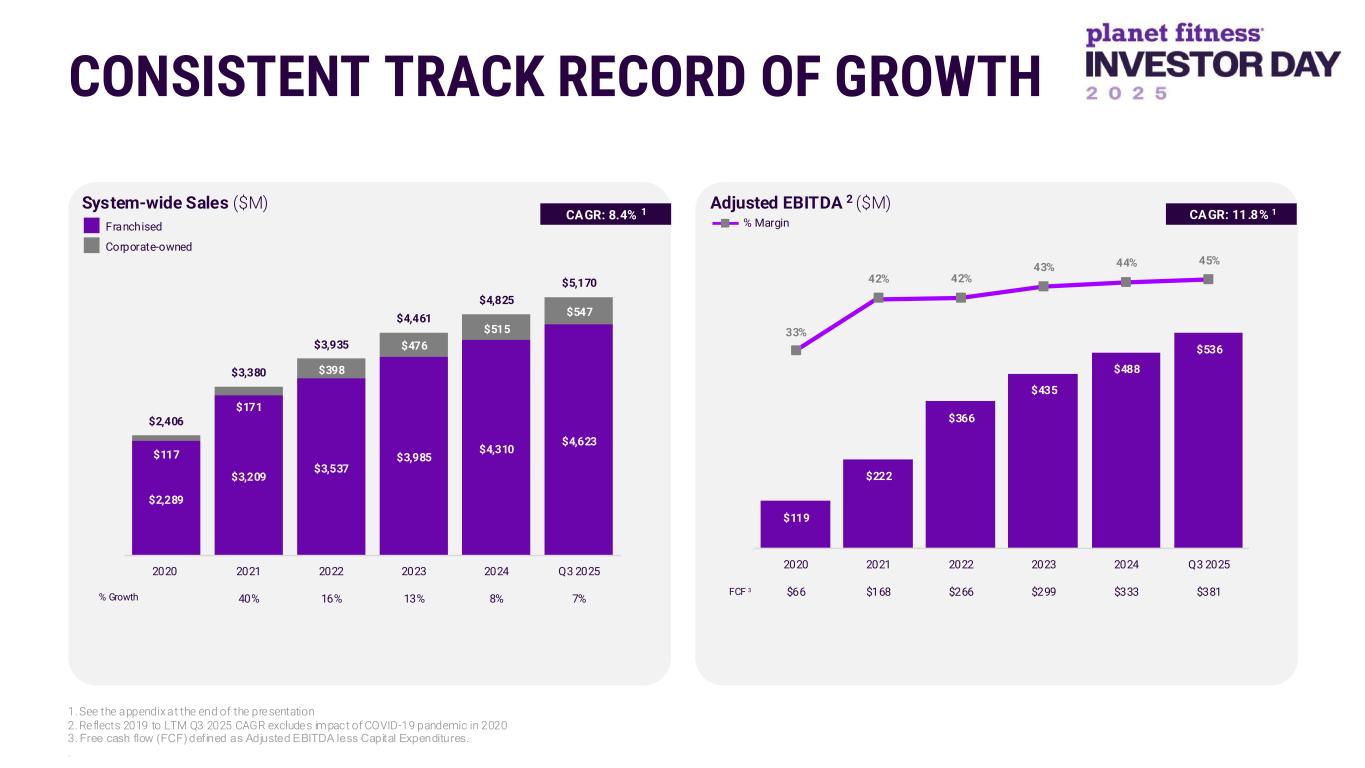

1. See the appendix at the end of the presentation System-wide Sales ($M) Adjusted EBITDA 2 ($M) CAGR: 8.4% 1 CAGR: 11.8% 1 % Growth FCF 3 % Margin CONSISTENT TRACK RECORD OF GROWTH 2. Reflects 2019 to LTM Q3 2025 CAGR excludes impact of COVID-19 pandemic in 2020 3. Free cash flow (FCF) def ined as Adjusted EBITDA less Capital Expenditures. . $2,289 $3,209 $3,537 $3,985 $4,310 $4,623 $117 $171 $398 $476 $515 $547 $2,406 $3,380 $3,935 $4,461 $4,825 $5,170 2020 2021 40% 2022 16% 2023 13% 2024 8% Q3 2025 7% $119 $222 $366 $435 $488 $536 33% 42% 42% 43% 44% 45% 2020 $66 2021 $168 2022 $266 2023 $299 2024 $333 Q3 2025 $381 Franchised Corporate-owned

CONSISTENT TRACK RECORD OF SCS GROWTH Pre-COVID: Current: 53 straight quarters 17 straight quarters1 1. Through Q3 2025

CLUB LEVEL RETURNS CAPITAL ALLOCATION STRATEGY 3 YEAR GROWTH ALGORITHM pf1 2 3

1 CLUB LEVEL RETURNS

STRENGTHENING CLUB RETURNS •New growth model •CC and BC price increase •Blue Ribbon team •Strategic imperatives •Value engineering •Procurement

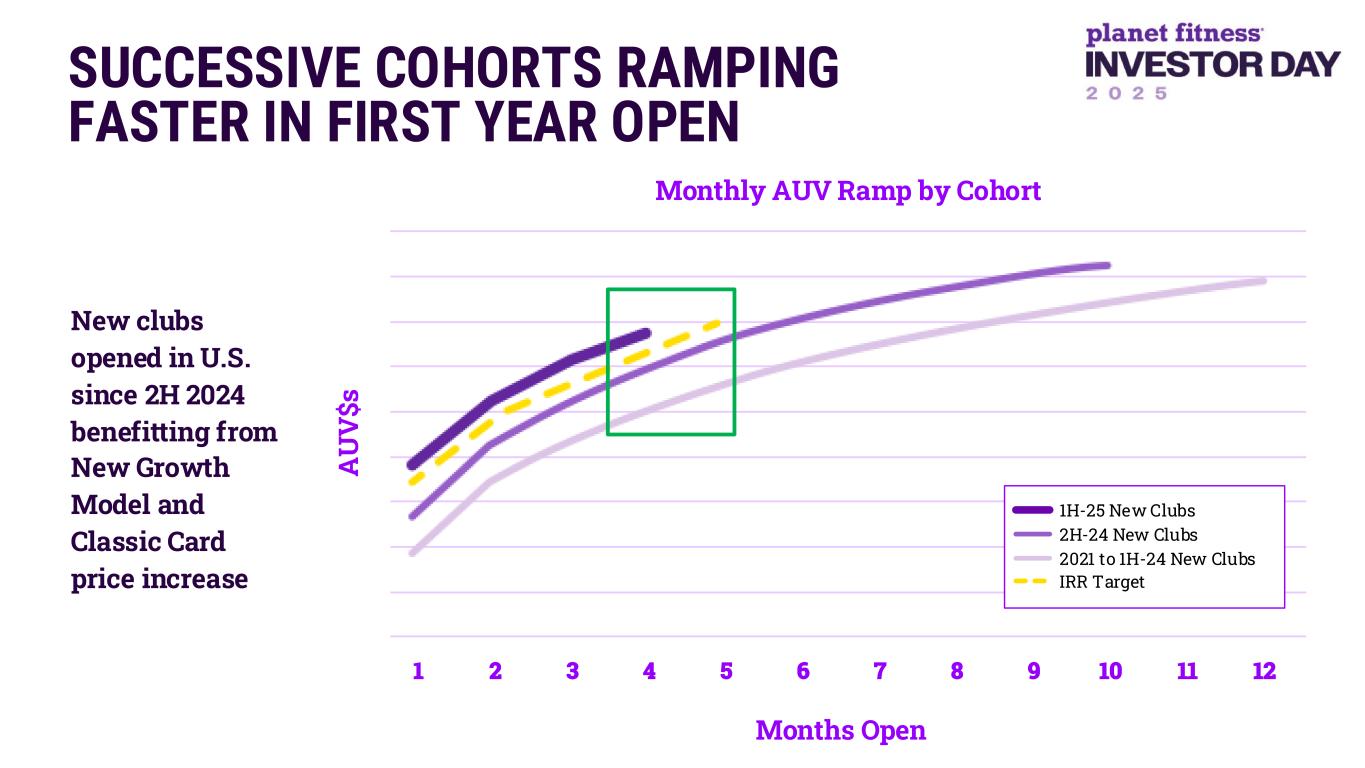

SUCCESSIVE COHORTS RAMPING FASTER IN FIRST YEAR OPEN New clubs opened in U.S. since 2H 2024 benefitting from New Growth Model and Classic Card price increase Months Open 1 2 3 4 5 6 7 8 9 10 11 12 A U V $s Monthly AUV Ramp by Cohort 1H-25 New Clubs 2H-24 New Clubs 2021 to 1H-24 New Clubs IRR Target

CAPITAL ALLOCATION2

CAPITAL ALLOCATION PRIORITIES 1 2 3 Invest in the Business Shareholder Return Optimized Capital Structure Investing in growth Committed to share buyback program Operating within target leverage levels

DISCIPLINED INVESTMENT IN BUSINESS FOR GROWTH Focused on highest return opportunities: o Scalable technology o Innovation o Corporate clubs o Opportunistic

RETURNED TO SHAREHOLDERS VIA SHARE REPURCHASES SINCE 2018 $1.5B

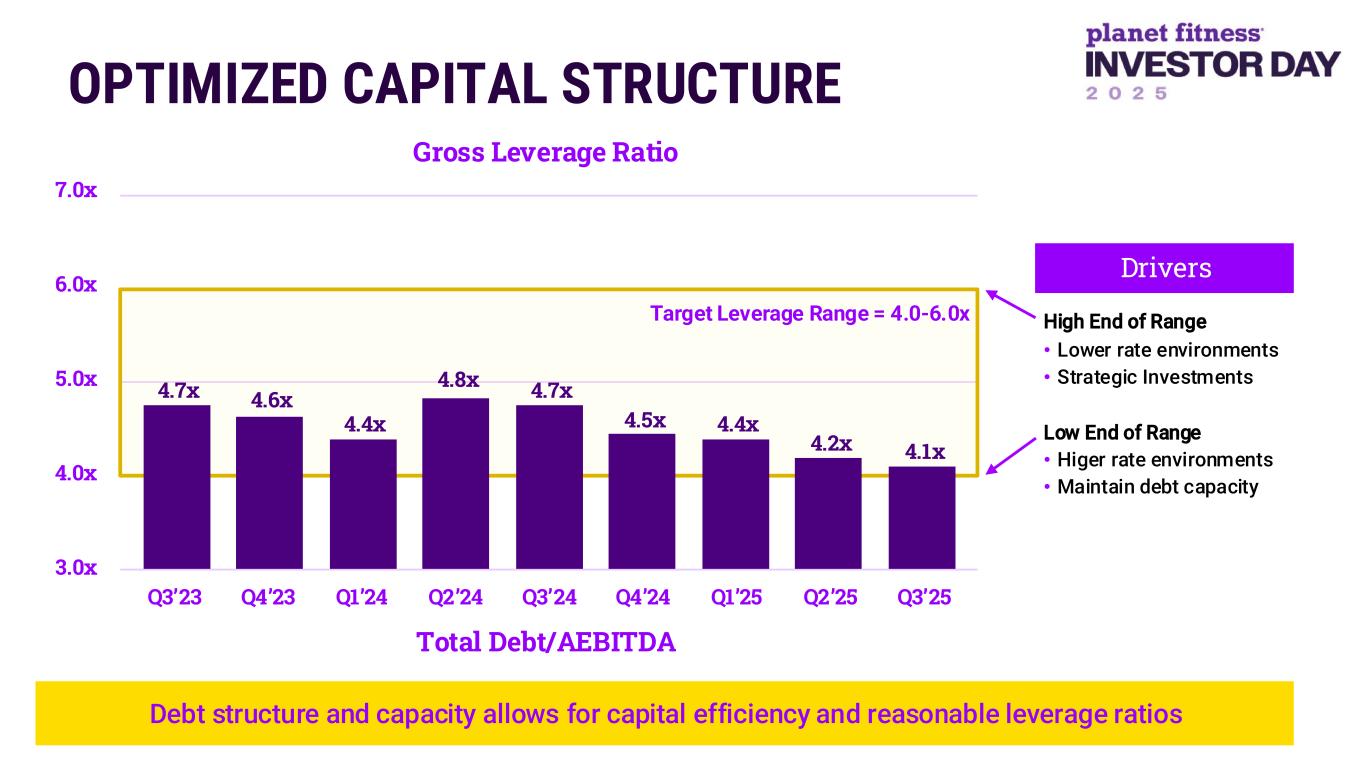

OPTIMIZED CAPITAL STRUCTURE Gross Leverage Ratio Total Debt/AEBITDA Q3’23 Q4’23 Q1’24 Q2’24 Q3’24 Q4’24 Q1’25 Q2’25 Q3’25 7.0x 6.0x 5.0x 4.0x 3.0x 4.7x 4.6x 4.4x 4.8x 4.7x 4.5x 4.4x 4.2x 4.1x Target Leverage Range = 4.0-6.0x Debt structure and capacity allows for capital efficiency and reasonable leverage ratios Drivers High End of Range • Lower rate environments • Strategic Investments Low End of Range • Higer rate environments • Maintain debt capacity

3 YEAR GROWTH ALGORITHM

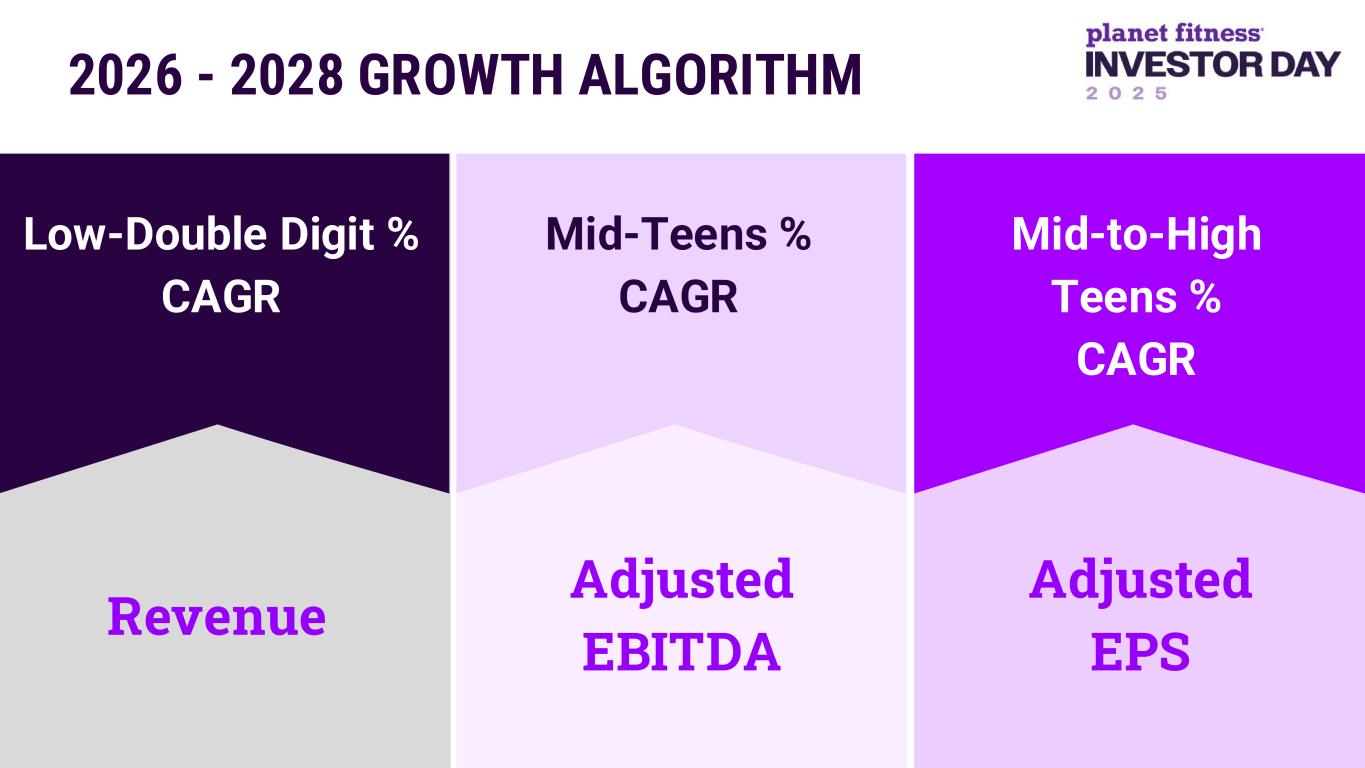

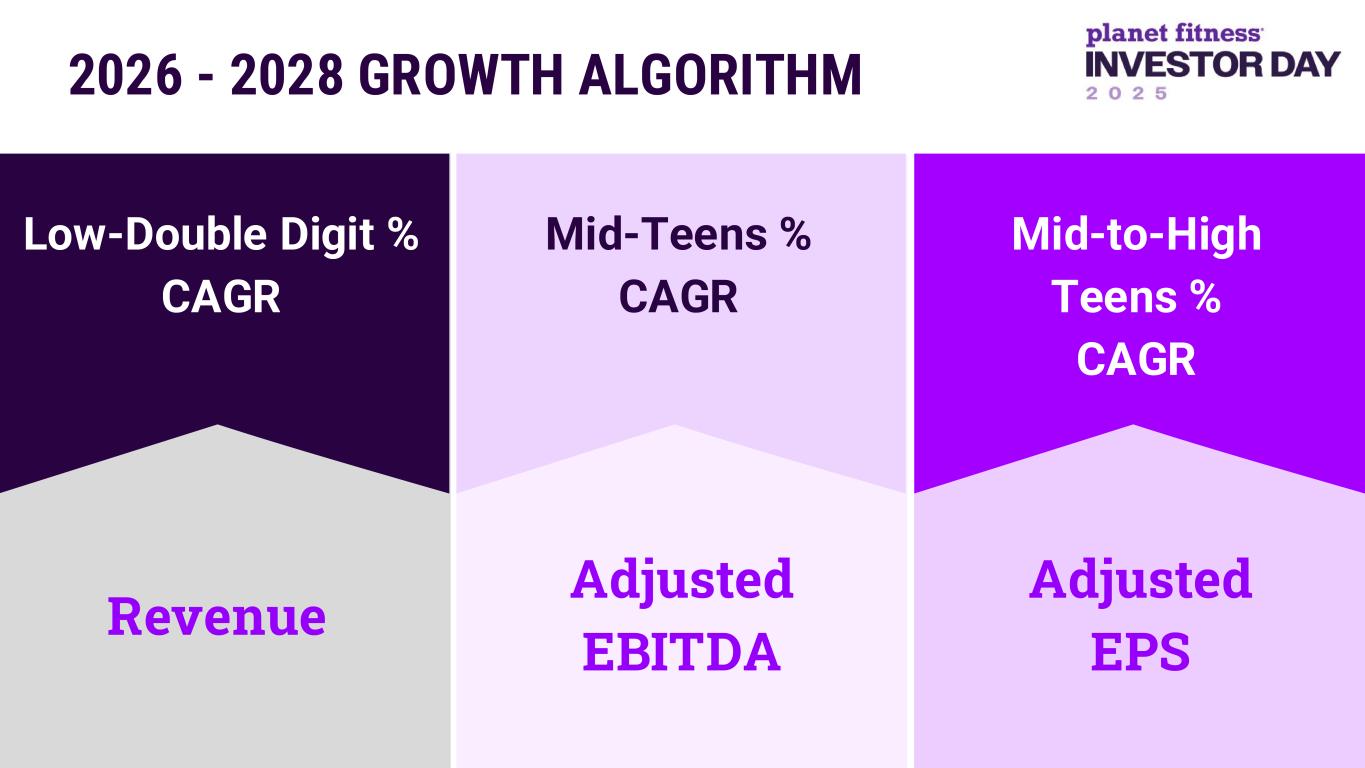

2026 - 2028 GROWTH ALGORITHM Adjusted EBITDA Revenue Adjusted EPS Low-Double Digit % CAGR Mid-Teens % CAGR Mid-to-High Teens % CAGR

REVENUE Rate ~75 % Volume ~25 % Franchise Corporate 3-Year Growth Targets Low-Double Digit % CAGR Same Club Sales Mid-Single % New Club Unit Growth 6-7 % Domestic International

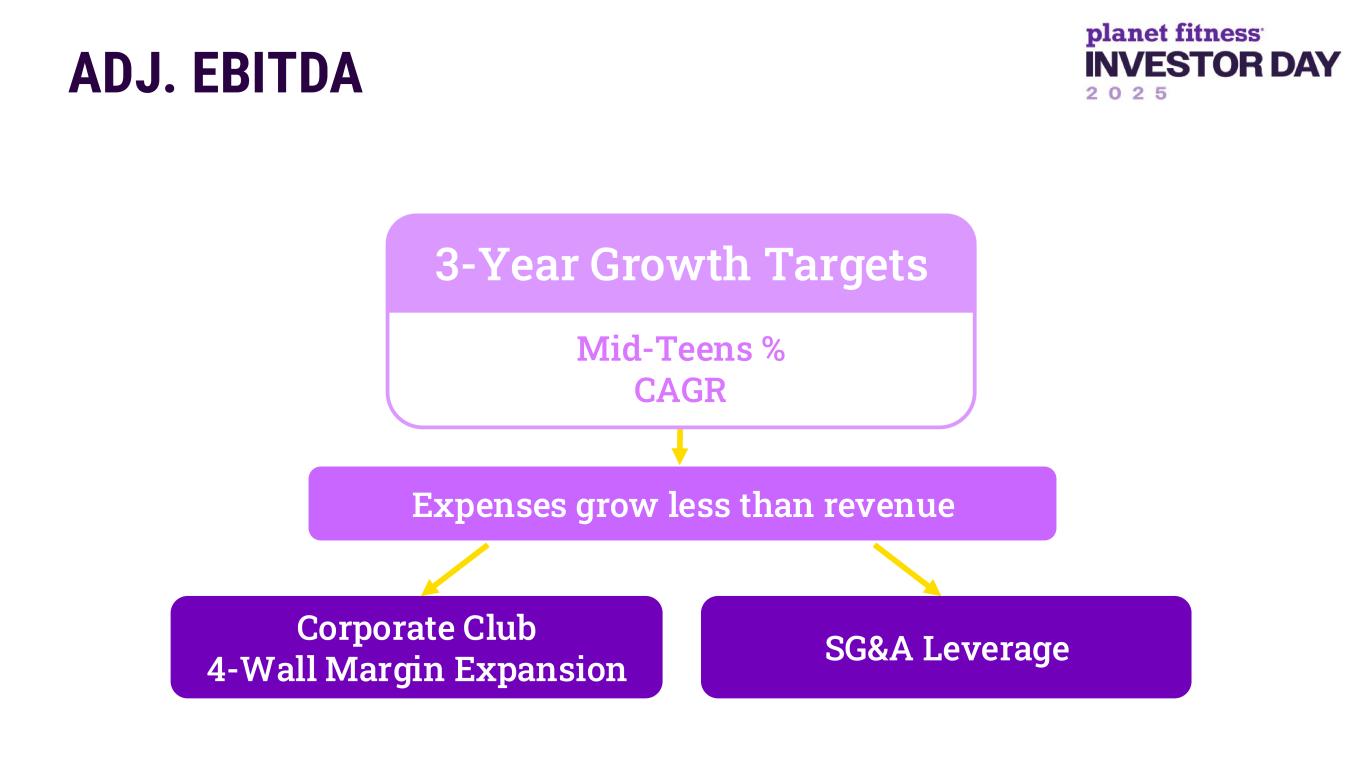

ADJ. EBITDA SG&A Leverage Corporate Club 4-Wall Margin Expansion Expenses grow less than revenue 3-Year Growth Targets Mid-Teens % CAGR SG&A LeverageCorporate Club 4-Wall Margin Expansion

ADJ. EPS 3-Year Growth Targets Mid-to-High Teens % CAGR Interest Rates Share Repurchase

2026 - 2028 GROWTH ALGORITHM Adjusted EBITDA Revenue Adjusted EPS Low-Double Digit % CAGR Mid-Teens % CAGR Mid-to-High Teens % CAGR

PLANET FITNESS IS... AN INDUSTRY-LEADING FRANCHISED GROWTH COMPANY WITH A CAPITAL-LIGHT MODEL THAT DELIVERS STRONG CASH FLOW