FISCAL SECOND QUARTER 2026 RESULTS MASTERCRAFT + MARINE PRODUCTS TO COMBINE F E B R U A R Y 5 , 2 0 2 6

DISCLAIMER Forward Looking Statement s This pr es ent ati on i ncl udes for war d- l ooki ng st at ements ( as s uc h t er m is defined in the Pri vat e Sec urities Liti gati on Ref or m Act of 1995 ) . For war d- l ooki ng st at ements c an oft en be identifi ed by s uch words and phr as es as “ beli eves,” “ antici pat es,” “ expects,” “ int ends,” “ estimates,” “ may, ” “ will,” “ s houl d,” “ conti nue,” and s imil ar expr essions and c ompar abl e terminology, or the negative thereof. For war d- l ooking st at ements ar e s ubject to r i sks, uncert ai nti es, and other i mport ant f act ors t hat c ould c ause act ual r es ults to diff er mat eri all y f r om t hos e express ed or i mpli ed in t he for war d- l ooki ng st at ements, incl udi ng, but not l i mit ed to: ( i ) t he antici pated f inanci al perf or manc e of t he combi ned c ompany; ( i i ) t he expect ed s yner gi es and effici encies to be ac hieved as a r esul t of the pr opos ed t rans acti ons ; ( i i i ) expect ati ons regardi ng t he diversific ati on and c ompl ement ar y nat ure of br and port foli os ; ( i v) expect ati ons r egar di ng t he compl ement ar y nat ur e of deal er networks ; ( v) expect ati ons r egar di ng enhancements to t he manuf act uri ng pl atf or m and tec hnologic al i nnovation; ( vi) the f inanci al pr ofil e and pr ofit abilit y of t he combi ned company; ( vi i ) expect ati ons regar di ng c ost savi ngs ; ( vi i i ) expect ati ons r egar di ng t he c ombined c ompany’ s empl oyees, vendors, deal ers, and manufact uring oper ati ons ; ( i x) expec tations r egar ding t he r ealizati on of benefits of t he pr opos ed t r ansactions and t he t i mi ng associat ed wit h r eali zati on ther eof; and ( x) t he r eceipt of all nec essary appr ovals to c l os e t he pr oposed t r ans actions, and t he t i ming ass ociat ed t her ewit h. Thes e and ot her i mport ant f actors discuss ed under t he c apti on “ Risk Fact ors” in Master Cr af t Boat Hol dings, Inc.’s (“ MCBH”) Annual Report on For m 10 - K f or the f i scal year ended June 30 , 2025 , f i l ed wit h t he Securiti es and Exc hange Commissi on ( t he “ SEC”) on August 27 , 2025 , s ubsequent Quart erl y Reports on Form 10 - Q, Curr ent Reports on For m 8 - K, and ot her f i l i ngs made wit h the SEC, and Mari ne Pr oducts Cor por ation’ s ( “ Mari ne Products”) Annual Report on For m 10 - K f or t he f i scal year ended Dec ember 31 , 2024 , f i l ed wit h t he SEC on Febr uar y 28 , 2025 , subs equent Quart erl y Repor ts on For m 10 - Q, Curr ent Repor ts on For m 8 - K, and ot her f i l ings made wi th the SEC, in each c as e c oul d c ause act ual r esults to differ mat eri ally f r om thos e i ndicat ed by t he f orwar d- l ooking stat em ents . Th e discussion of these r i sks is specifically incorporat ed by reference into this presentati on . Any suc h f or war d- l ooking stat ements r epr es ent est im at es as of t he dat e of t his pr esent ati on. Thes e f or war d- l ooking st at ement s shoul d not be reli ed upon as repres enti ng our views as of any dat e subs equent to the dat e of t his pr es ent ati on. MCBH undert ak es no obli gati on ( and expr essly disclai ms any obligati on) to update or s uppl ement any f orwar d- l ooki ng stat ements t hat may bec ome unt rue or c ause our vi ews to change, whet her becaus e of new inf ormat ion, f ut ur e events, c hanges in assumpti ons or ot her wise. Comparis ons of r es ults for curr ent and pri or peri ods ar e not i nt ended to expr ess any f ut ur e t r ends or i ndications of f ut ur e perf or mance, unl ess express ed as s uc h, and shoul d onl y be viewed as hi storic al data. Use of Non- GAAP Financi al Measures To suppl ement MCBH’ s f inancial meas ur es pr epared in accor danc e wit h Unit ed St at es gener all y accept ed acc ounti ng pri nciples ( “ GAAP”), the Company us es c ert ai n non- GAAP f inancial m eas ur es in t hi s pr es ent ati on. Reconcili ati ons of t he non- GAAP measur es us ed in t his r elease to t he most c omparabl e GAAP meas ur es f or t he r es pective peri ods can be found in t he appendi x to this pr es ent ati on. The non- GAAP meas ur es have l imitati ons as analytical tools and shoul d not be consi der ed in i s ol ati on or as a substit ut e f or MCBH’ s f inancial r es ults pr epar ed in accor danc e wit h GAAP. We do not pr ovide f orwar d- l ooking gui danc e f or cert ai n f i nancial meas ur es on a GAAP basis bec aus e we are unable to pr edict certain i tems contained in the GAAP measures without unreasonabl e efforts .

DISCLAIMER (CONTINUED) Additi onal Information and Where to Find It In c onnecti on wit h t he pr oposed t r ans actions, MCBH i nt ends to f i l e wit h t he SEC a r egistr ati on st at ement on Form S- 4 ( t he “ Registr ati on St at ement”), which will i ncl ude a pr ospect us with r espect to t he s har es of MCBH c ommon st ock to be i ssued in t he pr oposed t r ansacti ons and a joi nt pr oxy st at ement/ pr os pectus for MCBH’ s and Mari ne Pr oducts’ r espective stockhol ders ( t he “ J oi nt Proxy St at ement/ Pr ospec tus”) . The defi niti ve joi nt pr oxy st at ement ( i f and when avail abl e) will be mai led to stock hol ders of MCBH and Mari ne Pr oducts . Eac h of MCBH and Mari ne Pr oducts may als o f i l e wit h or f ur nish to t he SEC ot her r el evant doc um ents r egar di ng t he pr oposed t r ansacti ons . This pr es ent ati on is not a substit ut e for th e Registr ati on Statement, t he J oint Pr oxy St at ement / Pr ospect us or any ot her document t hat MCBH and Mari ne Pr oducts may mail to t heir r especti ve st ockholders in c onnecti on wi th t he proposed t ransactions . INVESTORS AND SECURI TY HOLDERS ARE U RGED TO READ THE REGISTRATI ON STATEMENT AND THE JOI NT PROXY STATEMENT/ PROSPECTUS, AS W ELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOC UM EN TS AND ANY OTHER RELEVANT DOCUMENTS FI LED OR TO BE FILED W ITH THE SEC IN CONNECTI ON W ITH THE PROPOSED TRANSACTI ONS, W HEN THEY BECOME AVAI LABLE, BECAUSE THEY DO AND W ILL CONTAIN I MPORTANT INFORMATI ON ABOUT MCBH, MARINE PRODUCTS CORPORATION, AND THE PROPOSED TRANSACTIONS. Investors and sec urit y hol ders may obtai n c opi es of thes e doc uments f r ee of char ge t hr ough t he websit e mai nt ai ned by the SEC at www. s ec. gov or f r om MCBH at its websit e, www. mast ercr aft . c om, or f rom Mari ne Pr oducts at i ts websit e, www. mari nepr oductscor p. c om. Doc uments f i l ed wit h t he SEC by MCBH will be avail abl e f r ee of charge by accessi ng t he investor secti on of MCBH’ s websit e, www. i nvest ors . mast ercr aft . c om, or, alt ernati vely, by di r ecting a r equest by email to MCBH at i nvest orr el ati ons@ mastercr aft . c om, and doc uments f i led wit h t he SEC by Mar ine Pr oducts will be avail abl e f r ee of c har ge by ac cessing Mari ne Pr oducts’ websit e at www. mari nepr oductscor p . c om under t he heading I nvest or Rel ati ons or, alternatively, by directing a request by email to Marine Products at j large@ mari nepr oductscor p . c om. Participant s in the Solicitation MCBH, Mari ne Pr oducts, and c ert ai n of t heir r es pective di r ectors, exec uti ve officers, and ot her members of management and empl oyees may be deemed to be partici pants in t h e solicitati on of pr oxi es f r om t he st ockhol ders of MCBH and Mari ne Pr oducts in connecti on wit h t he pr opos ed t r ansacti ons under t he r ul es of t he SEC. I nf ormati on about MCBH’ s dir ect ors and exec utive officers is availabl e in MCBH’ s pr oxy st at ement dat ed Sept ember 15 , 2025 f or its 2025 Annual Meeting of St ockhol ders ( avail abl e her e) . To t he ext ent hol di ngs of MCBH com m on st ock by t he di r ectors and exe cutive offic ers of MCBH have c hanged f r om t he amounts of MCBH common st ock hel d by s uc h per sons as r efl ect ed t her ei n, such changes have been or will be r efl ect ed on St at ements of Change in Owners hi p on Form 4 f i l ed with t he SEC ( avail able her e) . Information about Mari ne Pr oducts’ dir ect ors and exec uti ve offic ers is avai labl e in Mari ne Pr oducts’ pr oxy st at ement dat ed Marc h 12 , 2025 , f or i ts 2025 Annual Meeting of Stock holders ( avail abl e her e) . To t he ext ent hol di ngs of Mari ne Pr oducts common stock by t he dir ect ors and exec uti ve offic ers of Mari ne Pr oducts have c hanged f r om t he amounts of M ari ne Pr oducts common stock hel d by s uch pers ons as refl ect ed t her ei n, s uc h c hanges have been or will be reflect ed on St at ements of Change in Ownershi p on For m 4 f i l ed wit h t he SEC ( avail abl e her e) . Ot her i nf or mati on r egar di ng t he partici pants in the pr oxy s olicit ati on and a descripti on of t heir dir ect and i ndir ect i nt er ests, by sec urit y hol di ngs or ot herwis e, will be cont ai ned in the J oint Proxy Stat ement/ Pros pect us and ot her r elevant mat eri al s to be f i l ed wi th t he SEC r egar di ng t he pr oposed t r ans acti ons when t hey bec om e avail abl e. I nvestors s houl d r ead t he J oi nt Pr oxy Stat ement/ Pros pect us car ef ull y when it becomes availabl e bef or e maki ng any voti ng or i nvestm ent decisions . You may obt ai n f ree c opi es of t hes e documents f r om t he SEC’ s websit e at www. sec. gov or f rom MCBH or Marine Products using the sources indicated above. No Offer or Solicitation This pr es ent ati on does not c onstit ut e an offer to sell or t he s olicitati on of an off er to s ubscribe for or buy any sec uriti es or a s olicitati on of any vot e or appr oval wit h r es pect to t h e pr opos ed t r ans acti ons or ot her wise, nor shall t her e be any sal e, i ssuanc e or t ransf er of sec uriti es in any juris dicti on in whic h such off er, s olicitation, or sale woul d be unl awf ul prior to registration or qualification under the securities laws of such jurisdiction.

4 TODAY’S PRESENTERS Brad Nelson Chief Executive Officer and Director Scott Kent Chief Financial Officer

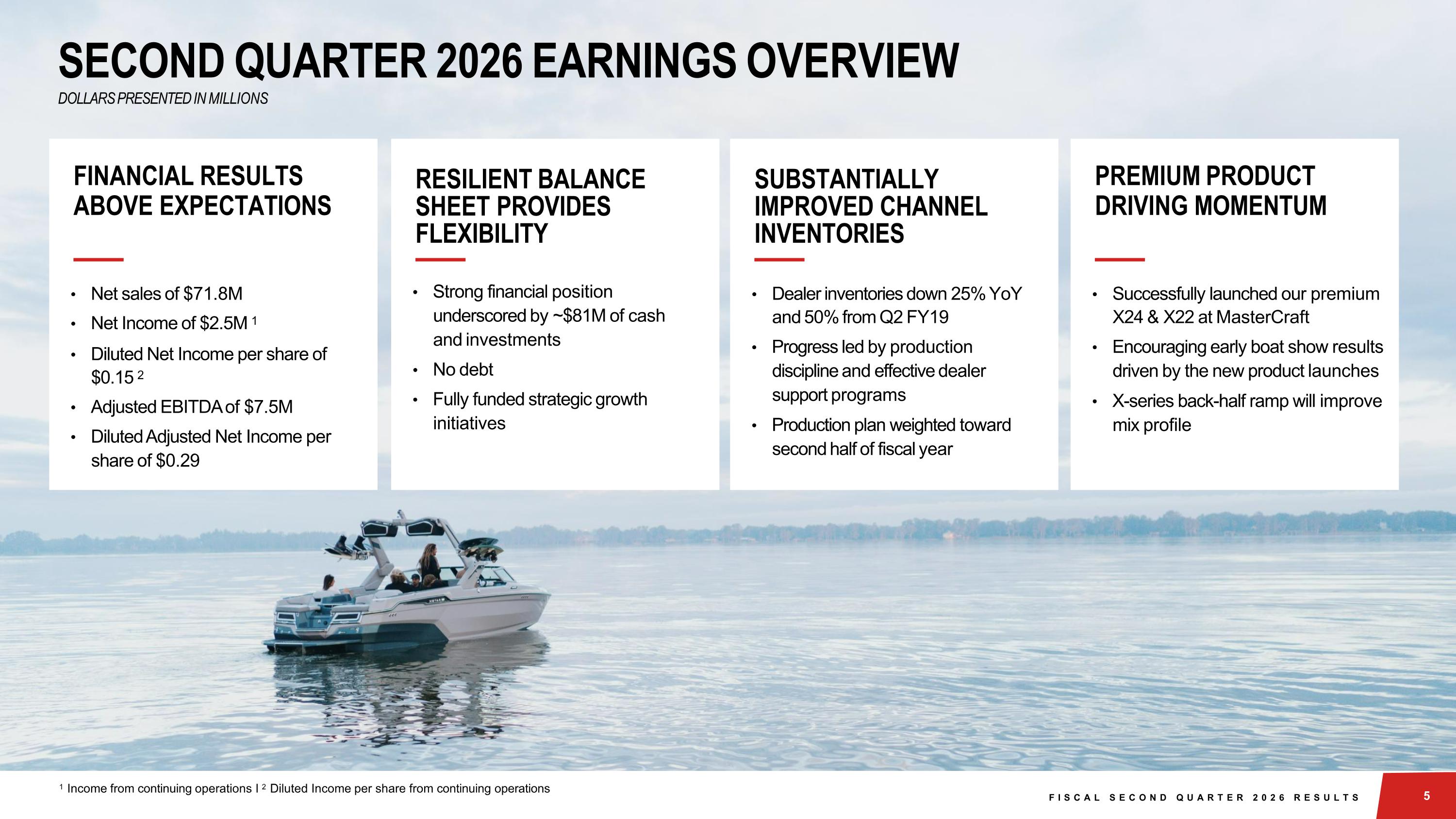

SECOND QUARTER 2026 EARNINGS OVERVIEW DOLLARS PRESENTED IN MILLIONS FINANCIAL RESULTS ABOVE EXPECTATIONS Net sales of $71.8M Net Income of $2.5M 1 Diluted Net Income per share of $0.15 2 Adjusted EBITDA of $7.5M Diluted Adjusted Net Income per share of $0.29 RESILIENT BALANCE SHEET PROVIDES FLEXIBILITY Strong financial position underscored by ~$81M of cash and investments No debt Fully funded strategic growth initiatives SUBSTANTIALLY IMPROVED CHANNEL INVENTORIES Dealer inventories down 25% YoY and 50% from Q2 FY19 Progress led by production discipline and effective dealer support programs Production plan weighted toward second half of fiscal year PREMIUM PRODUCT DRIVING MOMENTUM Successfully launched our premium X24 & X22 at MasterCraft Encouraging early boat show results driven by the new product launches X-series back-half ramp will improve mix profile 1 Income from continuing operations l 2 Diluted Income per share from continuing operations F I S C A L S E C O N D Q U A R T E R 2 0 2 6 R E S U L T S

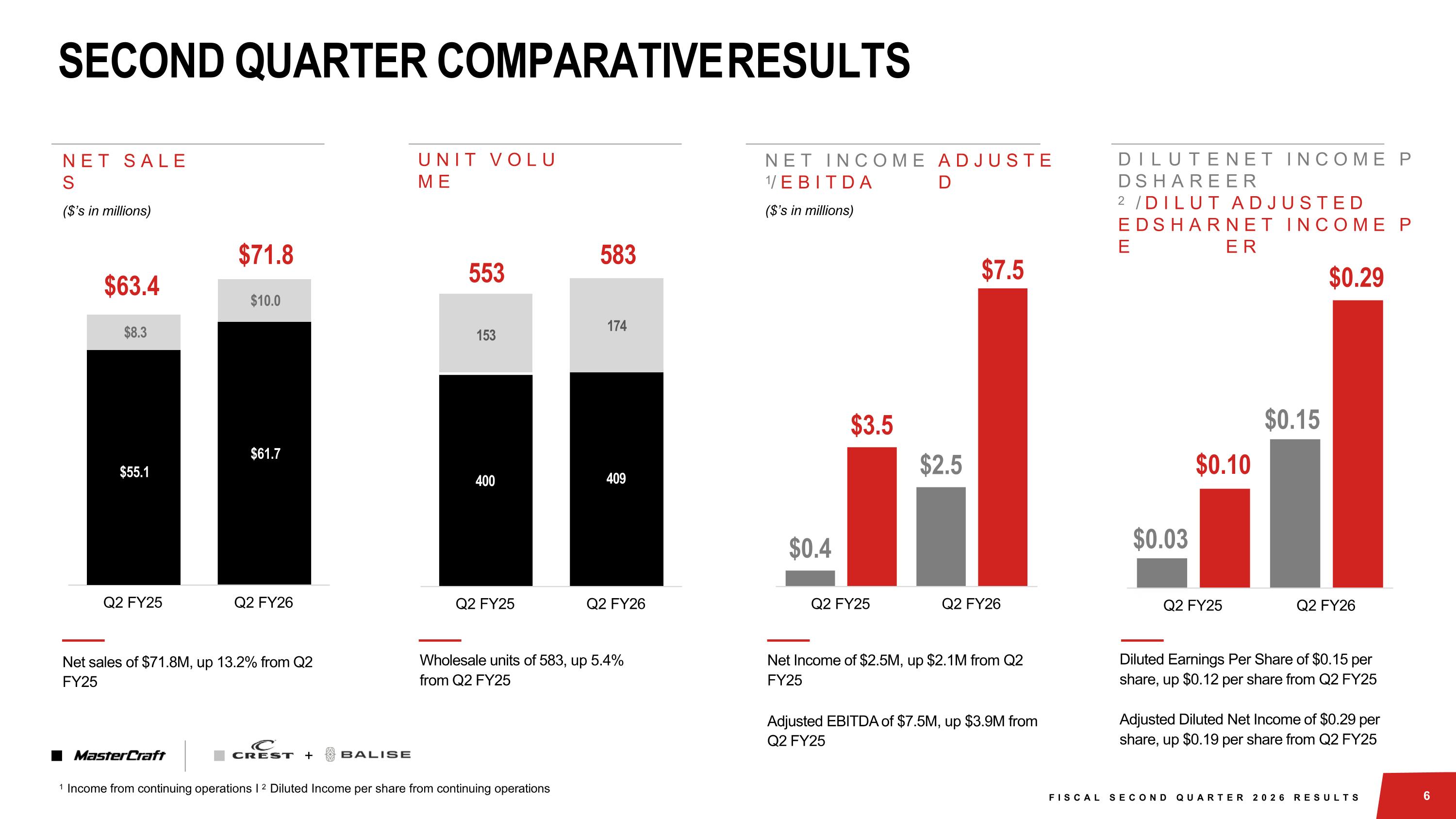

Net Income of $2.5M, up $2.1M from Q2 FY25 Adjusted EBITDA of $7.5M, up $3.9M from Q2 FY25 Wholesale units of 583, up 5.4% from Q2 FY25 Net sales of $71.8M, up 13.2% from Q2 FY25 Diluted Earnings Per Share of $0.15 per share, up $0.12 per share from Q2 FY25 Adjusted Diluted Net Income of $0.29 per share, up $0.19 per share from Q2 FY25 $0.4 $2.5 $3.5 $7.5 Q2 FY25 Q2 FY26 $0.03 $0.15 $0.10 $0.29 Q2 FY25 Q2 FY26 $55.1 $61.7 $8.3 $10.0 Q2 FY25 Q2 FY26 $63.4 N E T S A L E S ($’s in millions) N E T I N C O M E 1/ E B I T D A ($’s in millions) A D J U S T E D U N I T V O L U M E 400 409 153 174 Q2 FY25 Q2 FY26 553 583 SECOND QUARTER COMPARATIVE RESULTS $71.8 + D I L U T E D S H A R E 2 / D I L U T E D S H A R E 1 Income from continuing operations l 2 Diluted Income per share from continuing operations F I S C A L S E C O N D Q U A R T E R 2 0 2 6 R E S U L T S N E T I N C O M E P E R A D J U S T E D N E T I N C O M E P E R

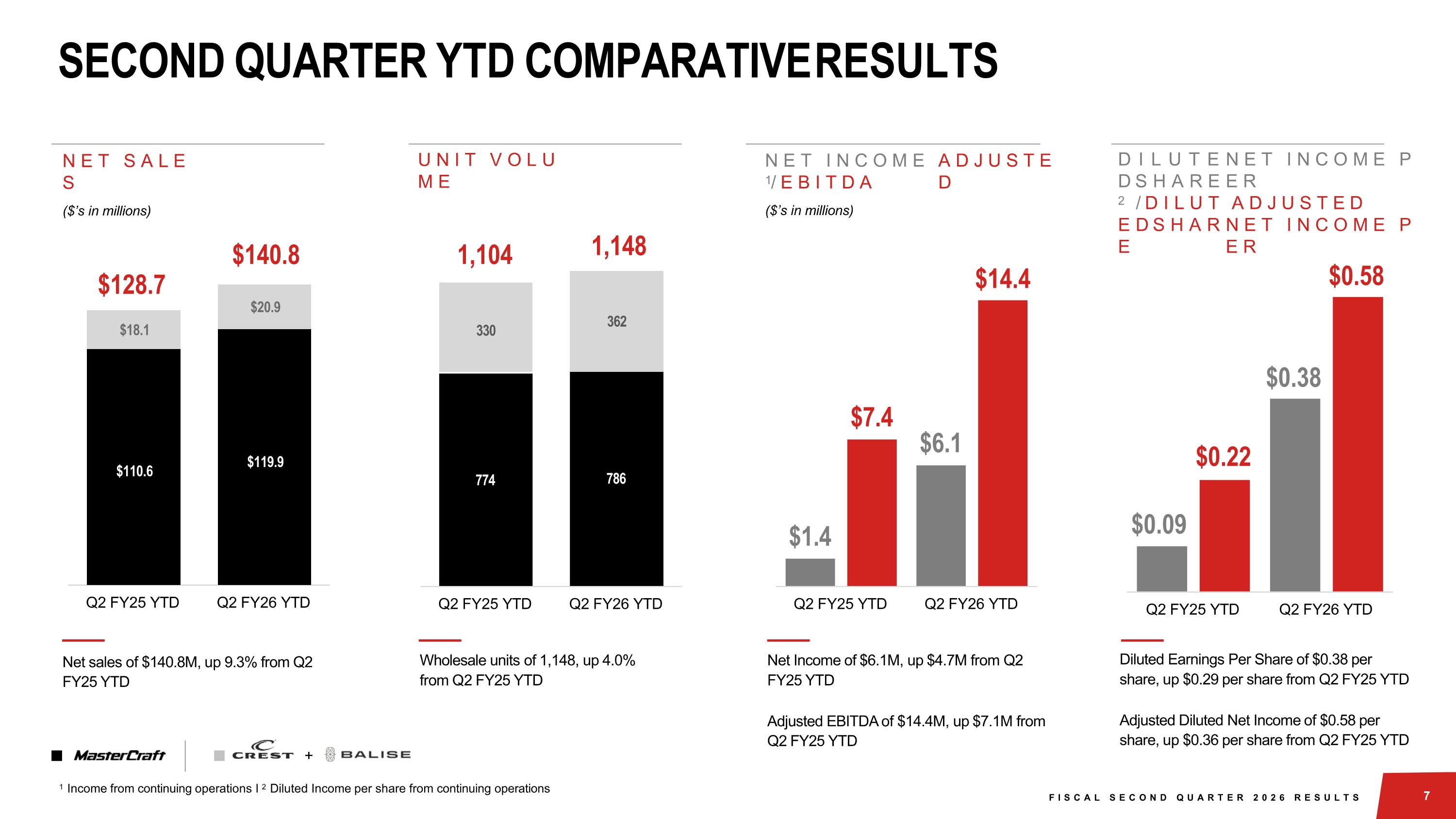

Net Income of $6.1M, up $4.7M from Q2 FY25 YTD Wholesale units of 1,148, up 4.0% from Q2 FY25 YTD Net sales of $140.8M, up 9.3% from Q2 FY25 YTD Diluted Earnings Per Share of $0.38 per share, up $0.29 per share from Q2 FY25 YTD $1.4 $6.1 $7.4 $14.4 Q2 FY25 YTD Q2 FY26 YTD $0.09 $0.38 $0.22 $0.58 Q2 FY25 YTD Q2 FY26 YTD $110.6 $119.9 $18.1 $20.9 Q2 FY25 YTD Q2 FY26 YTD $128.7 N E T S A L E S ($’s in millions) N E T I N C O M E 1/ E B I T D A ($’s in millions) A D J U S T E D U N I T V O L U M E 774 786 330 362 Q2 FY25 YTD Q2 FY26 YTD 1,104 1,148 SECOND QUARTER YTD COMPARATIVE RESULTS $140.8 D I L U T E D S H A R E 2 / D I L U T E D S H A R E Adjusted Diluted Net Income of $0.58 per share, up $0.36 per share from Q2 FY25 YTD Adjusted EBITDA of $14.4M, up $7.1M from Q2 FY25 YTD + 1 Income from continuing operations l 2 Diluted Income per share from continuing operations 7 F I S C A L S E C O N D Q U A R T E R 2 0 2 6 R E S U L T S N E T I N C O M E P E R A D J U S T E D N E T I N C O M E P E R

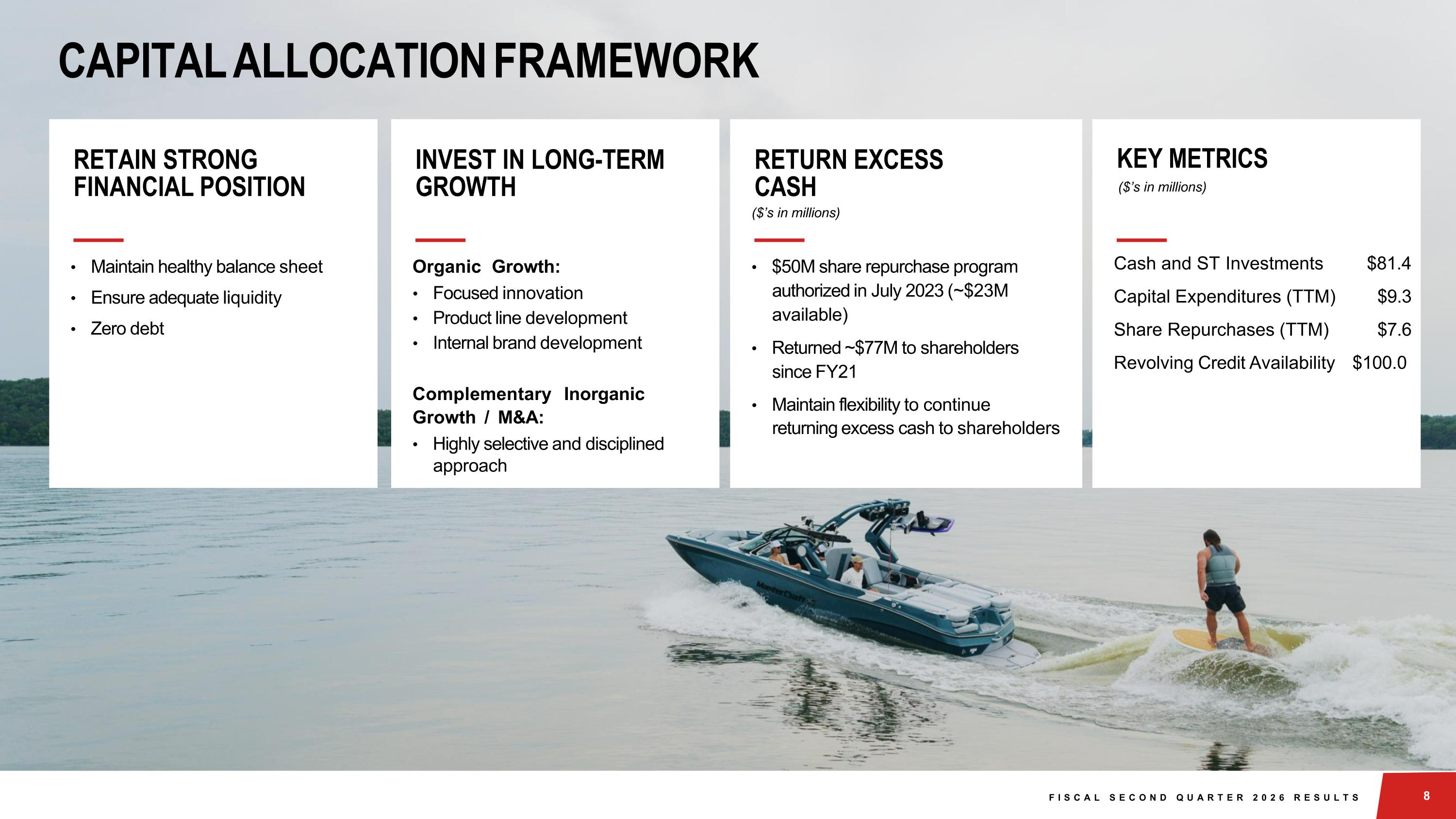

CAPITAL ALLOCATION FRAMEWORK RETAIN STRONG FINANCIAL POSITION Maintain healthy balance sheet Ensure adequate liquidity Zero debt INVEST IN LONG-TERM GROWTH Organic Growth: Focused innovation Product line development Internal brand development Complementary Inorganic Growth / M&A: Highly selective and disciplined approach KEY METRICS ($’s in millions) Cash and ST Investments $81.4 Capital Expenditures (TTM) $9.3 Share Repurchases (TTM) $7.6 Revolving Credit Availability $100.0 F I S C A L S E C O N D Q U A R T E R 2 0 2 6 R E S U L T S RETURN EXCESS CASH ($’s in millions) $50M share repurchase program authorized in July 2023 (~$23M available) Returned ~$77M to shareholders since FY21 Maintain flexibility to continue returning excess cash to shareholders

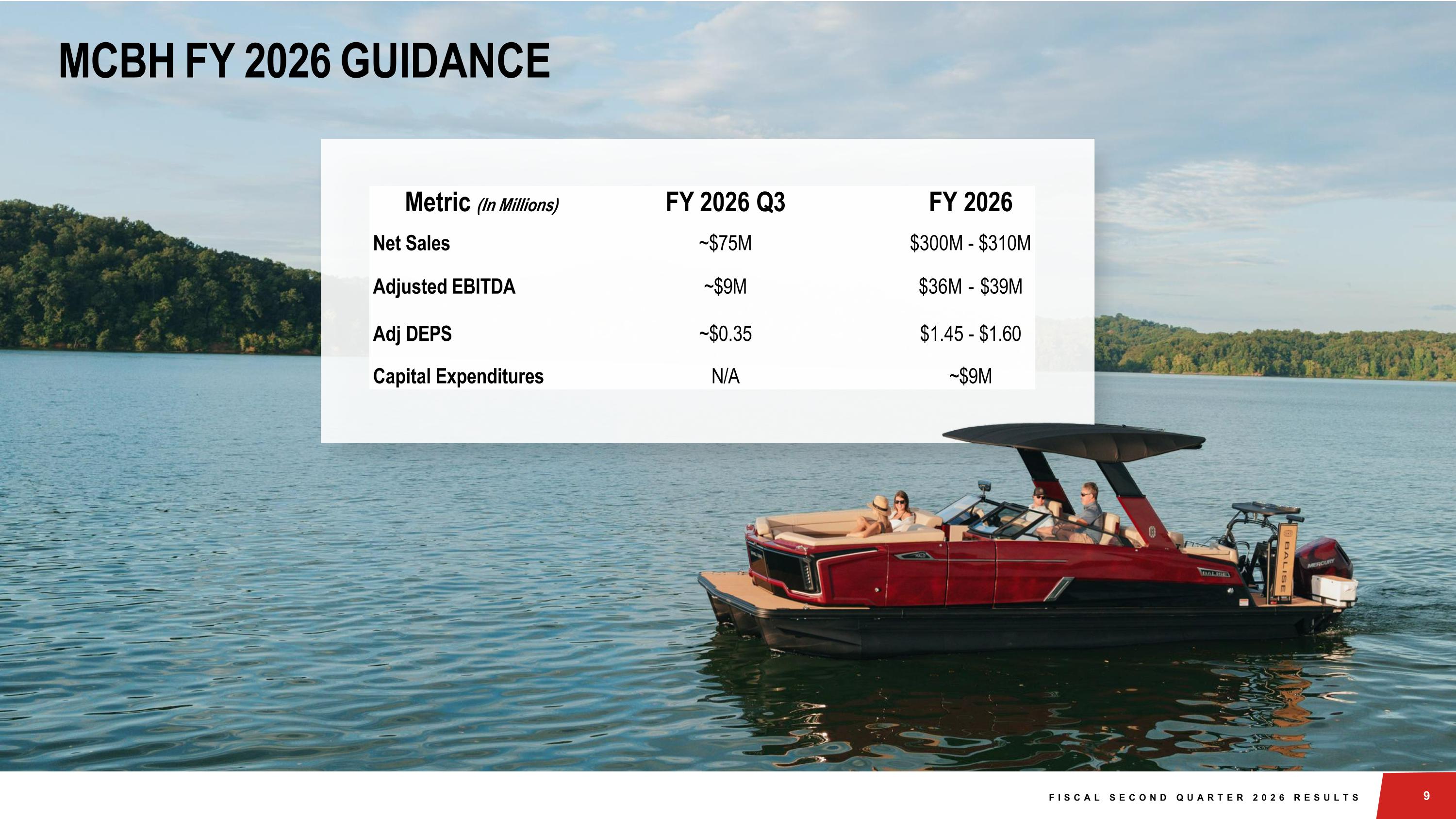

MCBH FY 2026 GUIDANCE Metric (In Millions) FY 2026 Q3 FY 2026 Net Sales ~$75M $300M - $310M Adjusted EBITDA ~$9M $36M - $39M Adj DEPS ~$0.35 $1.45 - $1.60 Capital Expenditures N/A ~$9M F I S C A L S E C O N D Q U A R T E R 2 0 2 6 R E S U L T S

1 0 MASTERCRAFT + MARINE PRODUCTS TO COMBINE

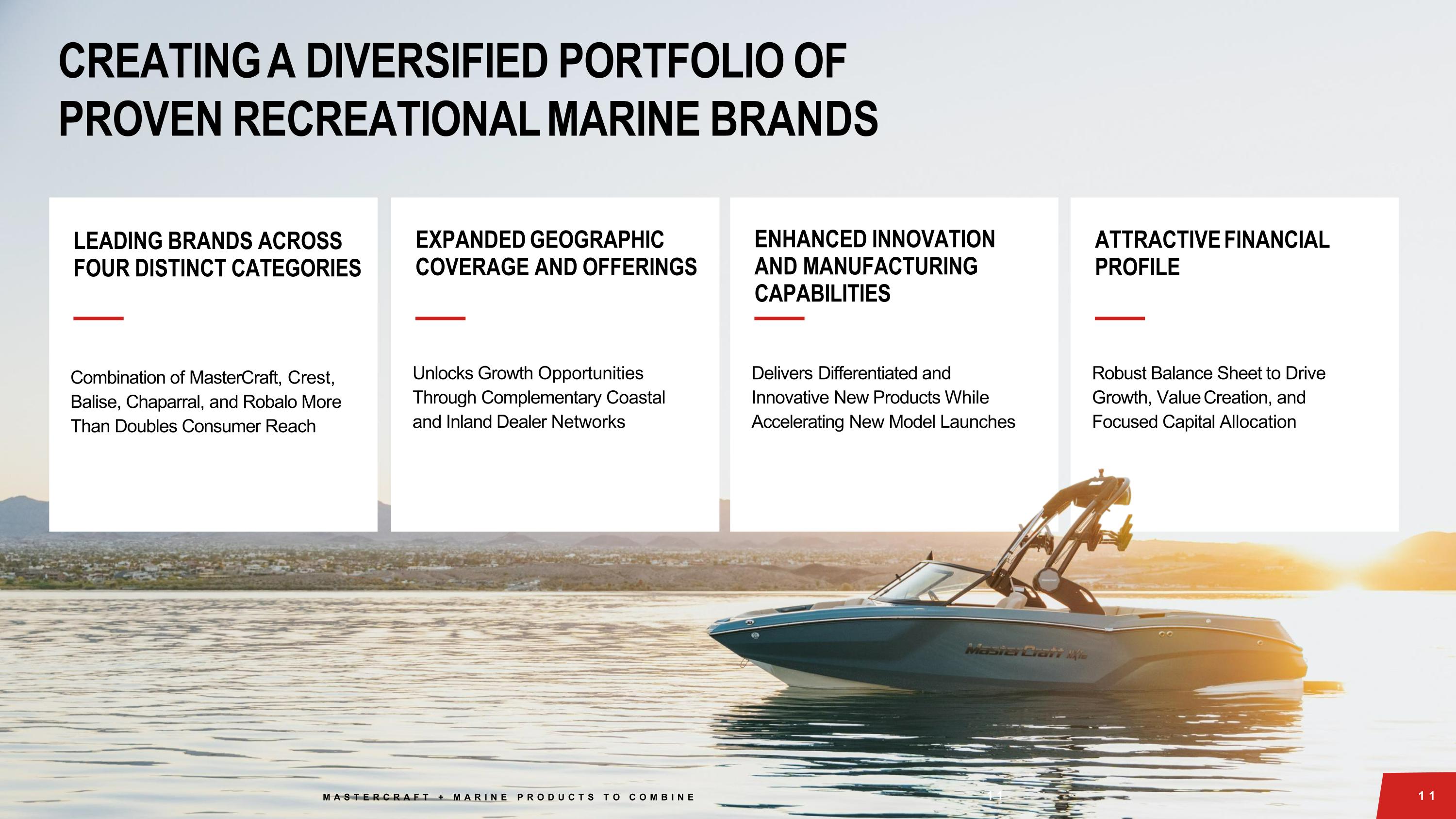

CREATING A DIVERSIFIED PORTFOLIO OF PROVEN RECREATIONAL MARINE BRANDS LEADING BRANDS ACROSS FOUR DISTINCT CATEGORIES Combination of MasterCraft, Crest, Balise, Chaparral, and Robalo More Than Doubles Consumer Reach EXPANDED GEOGRAPHIC COVERAGE AND OFFERINGS Unlocks Growth Opportunities Through Complementary Coastal and Inland Dealer Networks ENHANCED INNOVATION AND MANUFACTURING CAPABILITIES Delivers Differentiated and Innovative New Products While Accelerating New Model Launches ATTRACTIVE FINANCIAL PROFILE Robust Balance Sheet to Drive Growth, Value Creation, and Focused Capital Allocation 1 1M A S T E R C R A F T + M A R I N E P R O D U C T S T O C O M B I N E 1 1

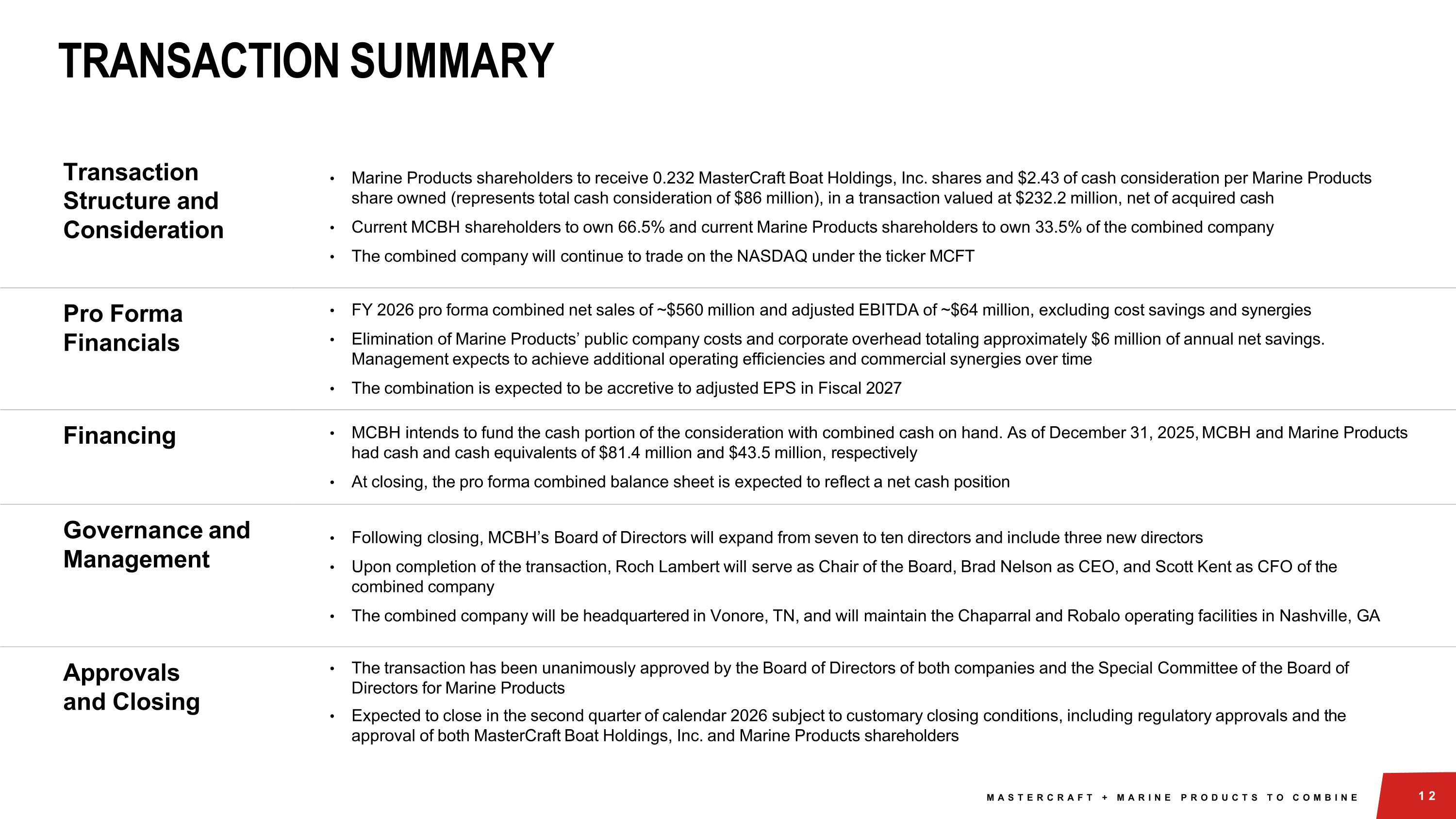

TRANSACTION SUMMARY M A S T E R C R A F T + M A R I N E P R O D U C T S T O C O M B I N E Transaction Structure and Consideration Marine Products shareholders to receive 0.232 MasterCraft Boat Holdings, Inc. shares and $2.43 of cash consideration per Marine Products share owned (represents total cash consideration of $86 million), in a transaction valued at $232.2 million, net of acquired cash Current MCBH shareholders to own 66.5% and current Marine Products shareholders to own 33.5% of the combined company The combined company will continue to trade on the NASDAQ under the ticker MCFT Pro Forma Financials FY 2026 pro forma combined net sales of ~$560 million and adjusted EBITDA of ~$64 million, excluding cost savings and synergies Elimination of Marine Products’ public company costs and corporate overhead totaling approximately $6 million of annual net savings. Management expects to achieve additional operating efficiencies and commercial synergies over time The combination is expected to be accretive to adjusted EPS in Fiscal 2027 Financing MCBH intends to fund the cash portion of the consideration with combined cash on hand. As of December 31, 2025, MCBH and Marine Products had cash and cash equivalents of $81.4 million and $43.5 million, respectively At closing, the pro forma combined balance sheet is expected to reflect a net cash position Governance and Management Following closing, MCBH’s Board of Directors will expand from seven to ten directors and include three new directors Upon completion of the transaction, Roch Lambert will serve as Chair of the Board, Brad Nelson as CEO, and Scott Kent as CFO of the combined company The combined company will be headquartered in Vonore, TN, and will maintain the Chaparral and Robalo operating facilities in Nashville, GA Approvals and Closing The transaction has been unanimously approved by the Board of Directors of both companies and the Special Committee of the Board of Directors for Marine Products Expected to close in the second quarter of calendar 2026 subject to customary closing conditions, including regulatory approvals and the approval of both MasterCraft Boat Holdings, Inc. and Marine Products shareholders

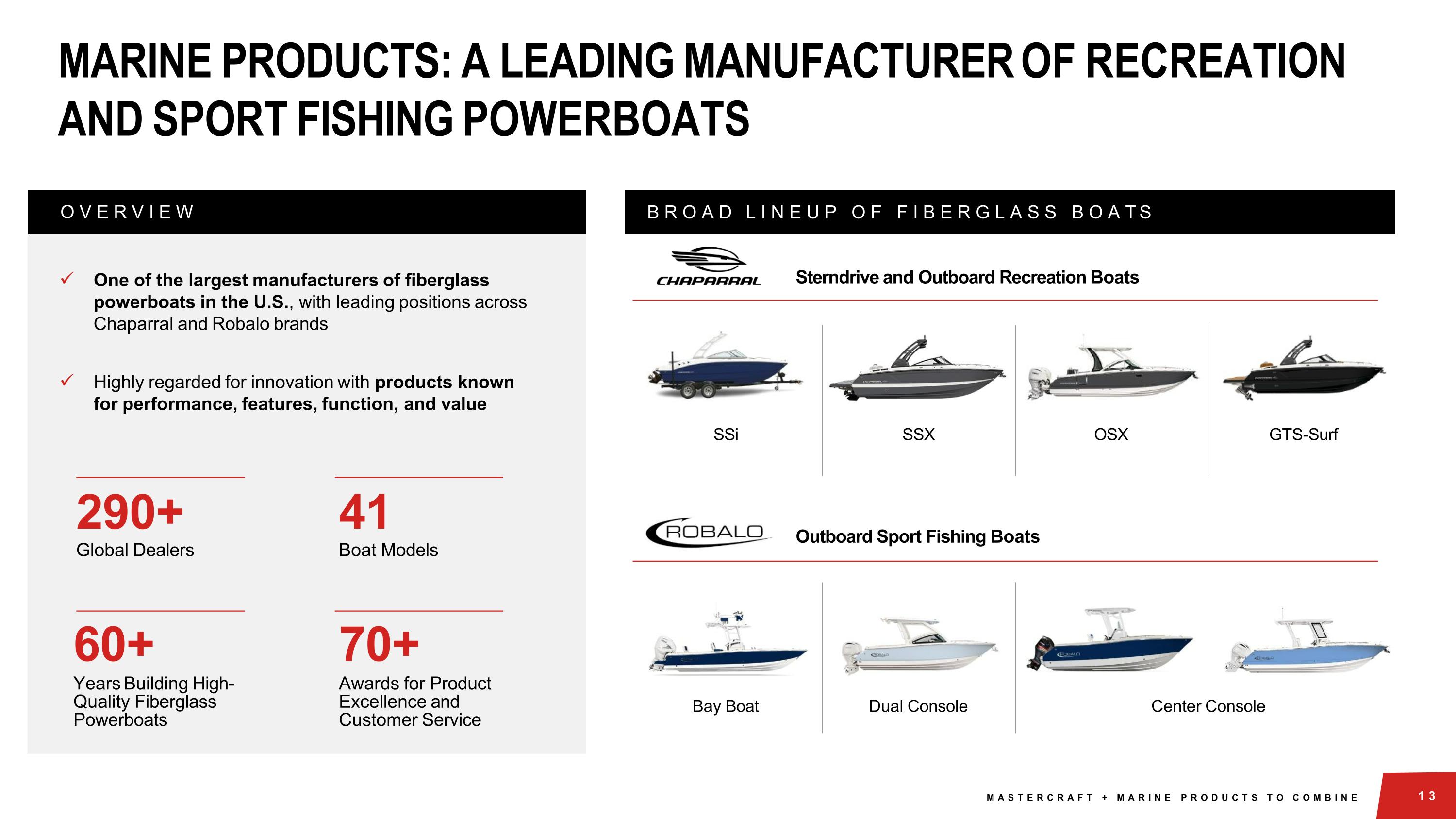

MARINE PRODUCTS: A LEADING MANUFACTURER OF RECREATION AND SPORT FISHING POWERBOATS Sterndrive and Outboard Recreation Boats SSi GTS-Surf OSX Bay Boat Outboard Sport Fishing Boats B R O A D L I N E U P O F F I B E R G L A S S B O A T S SSX Dual Console Center Console One of the largest manufacturers of fiberglass powerboats in the U.S., with leading positions across Chaparral and Robalo brands Highly regarded for innovation with products known for performance, features, function, and value 70+ Awards for Product Excellence and Customer Service 290+ Global Dealers 41 Boat Models 60+ Years Building High- Quality Fiberglass Powerboats O V E R V I E W M A S T E R C R A F T + M A R I N E P R O D U C T S T O C O M B I N E

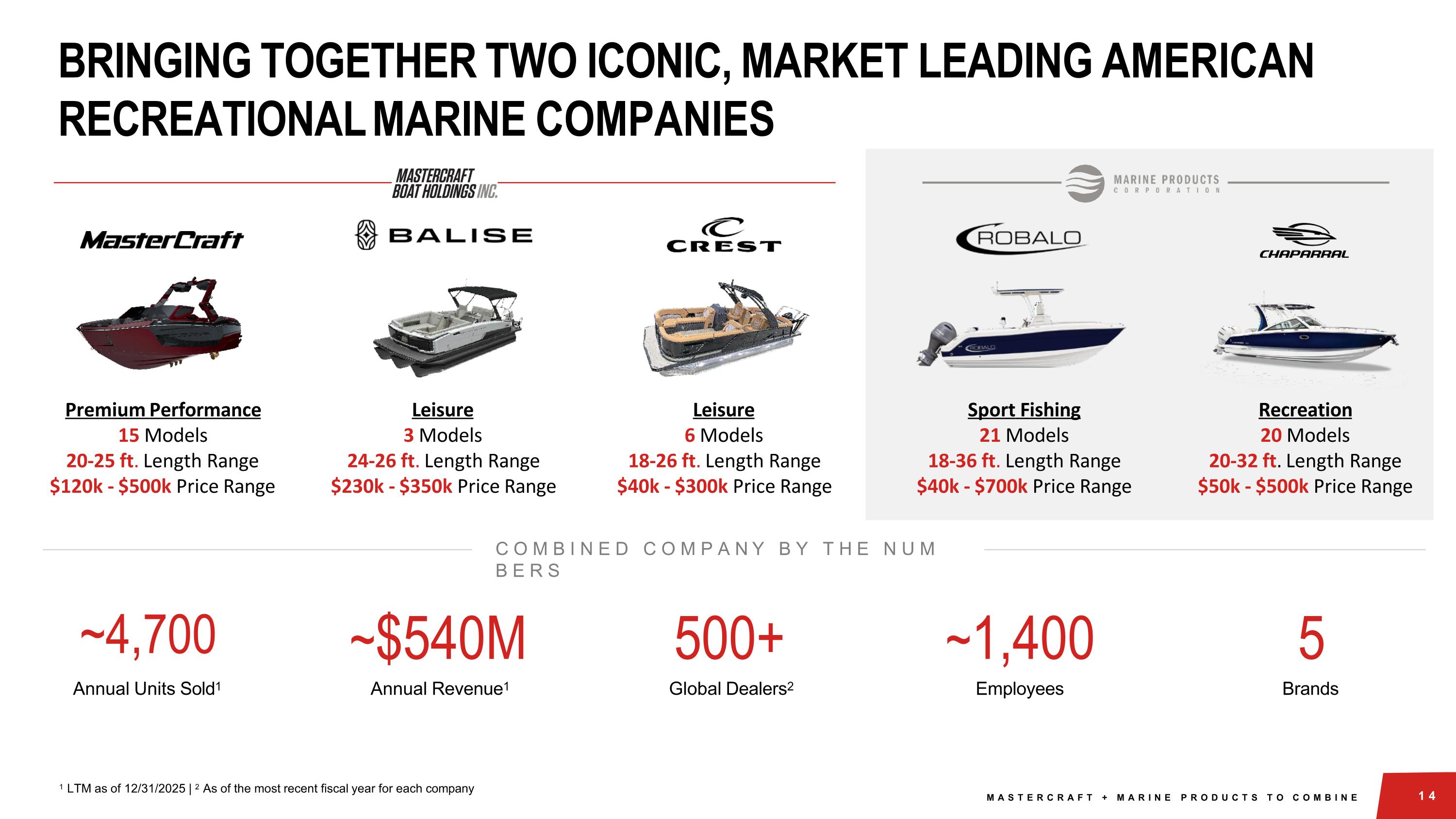

BRINGING TOGETHER TWO ICONIC, MARKET LEADING AMERICAN RECREATIONAL MARINE COMPANIES ~4,700 ~$540M 500+ ~1,400 5 Annual Units Sold1 Annual Revenue1 Global Dealers2 Employees Brands C O M B I N E D C O M P A N Y B Y T H E N U M B E R S Premium Performance 15 Models 20-25 ft. Length Range $120k - $500k Price Range Sport Fishing 21 Models 18-36 ft. Length Range $40k - $700k Price Range Recreation 20 Models 20-32 ft. Length Range $50k - $500k Price Range Leisure 3 Models 24-26 ft. Length Range $230k - $350k Price Range Leisure 6 Models 18-26 ft. Length Range $40k - $300k Price Range 1 LTM as of 12/31/2025 | 2 As of the most recent fiscal year for each company M A S T E R C R A F T + M A R I N E P R O D U C T S T O C O M B I N E

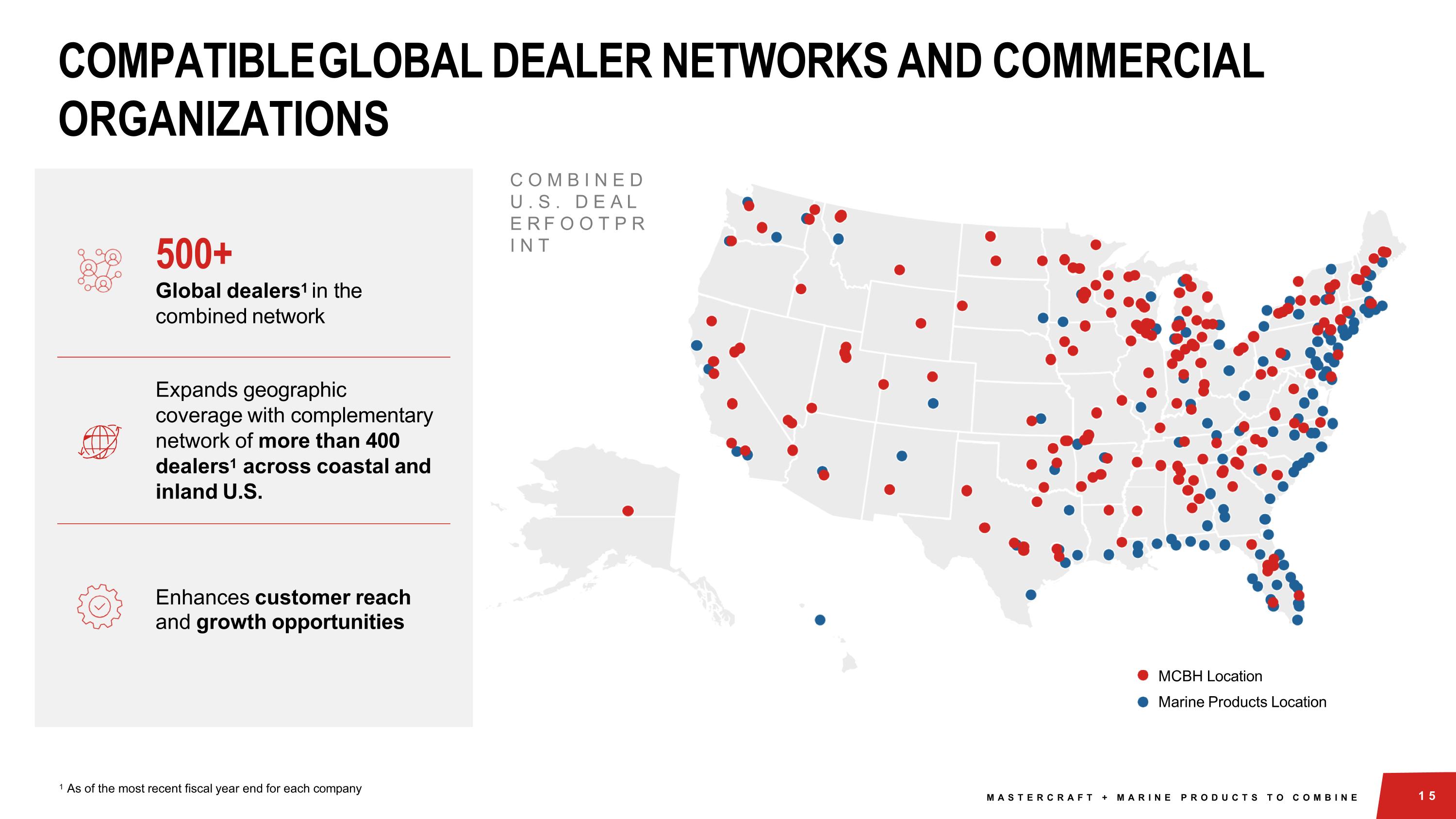

COMPATIBLE GLOBAL DEALER NETWORKS AND COMMERCIAL ORGANIZATIONS C O M B I N E D U . S . D E A L E R F O O T P R I N T 500+ Global dealers1 in the combined network Expands geographic coverage with complementary network of more than 400 dealers1 across coastal and inland U.S. Enhances customer reach and growth opportunities MCBH Location Marine Products Location 1 As of the most recent fiscal year end for each company M A S T E R C R A F T + M A R I N E P R O D U C T S T O C O M B I N E

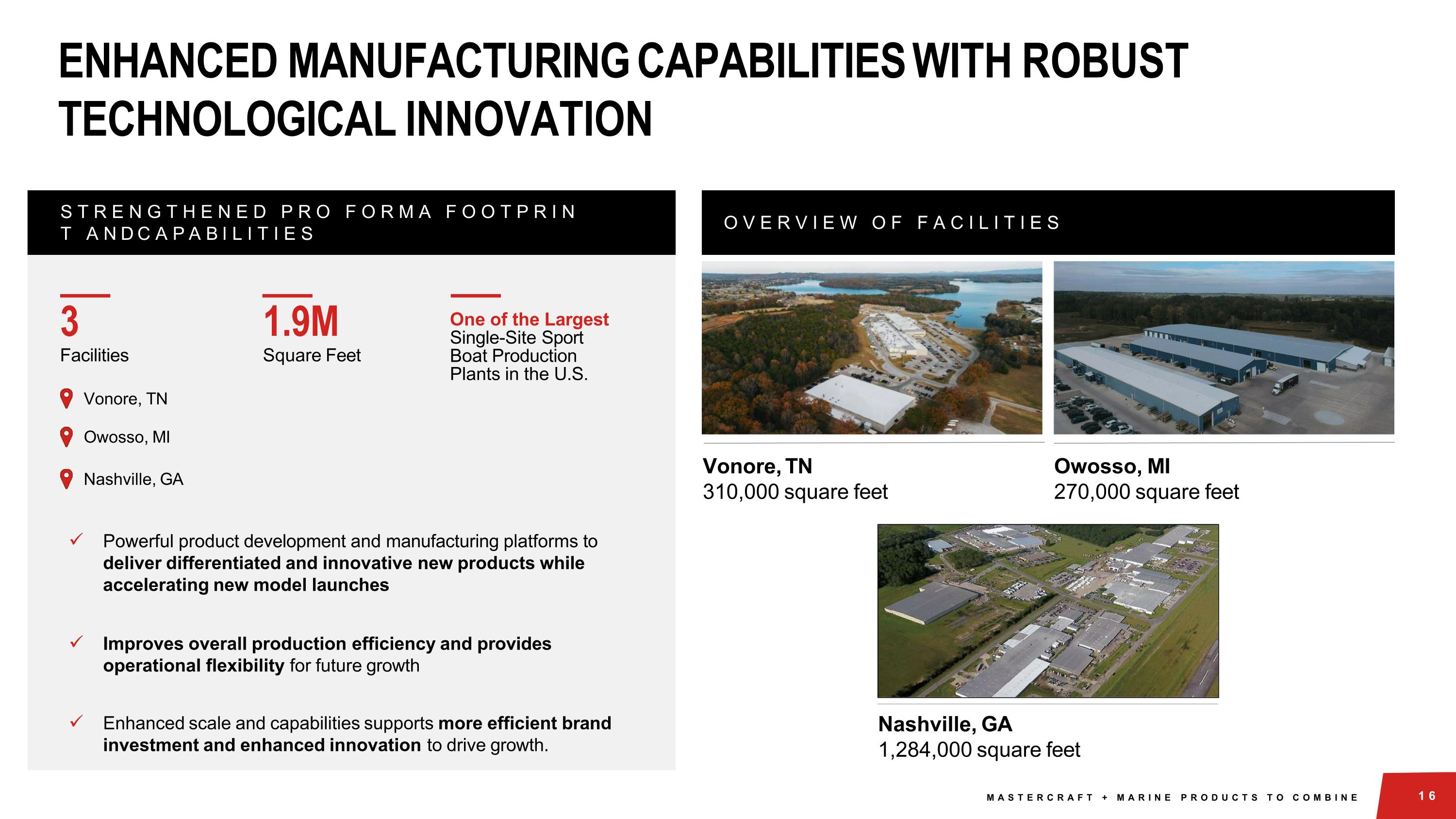

S T R E N G T H E N E D P R O F O R M A F O O T P R I N T A N D C A P A B I L I T I E S ENHANCED MANUFACTURING CAPABILITIES WITH ROBUST TECHNOLOGICAL INNOVATION Vonore, TN 310,000 square feet Owosso, MI 270,000 square feet Nashville, GA 1,284,000 square feet Vonore, TN Owosso, MI Nashville, GA Powerful product development and manufacturing platforms to deliver differentiated and innovative new products while accelerating new model launches Improves overall production efficiency and provides operational flexibility for future growth Enhanced scale and capabilities supports more efficient brand investment and enhanced innovation to drive growth. 1.9M Square Feet One of the Largest Single-Site Sport Boat Production Plants in the U.S. 3 Facilities O V E R V I E W O F F A C I L I T I E S M A S T E R C R A F T + M A R I N E P R O D U C T S T O C O M B I N E

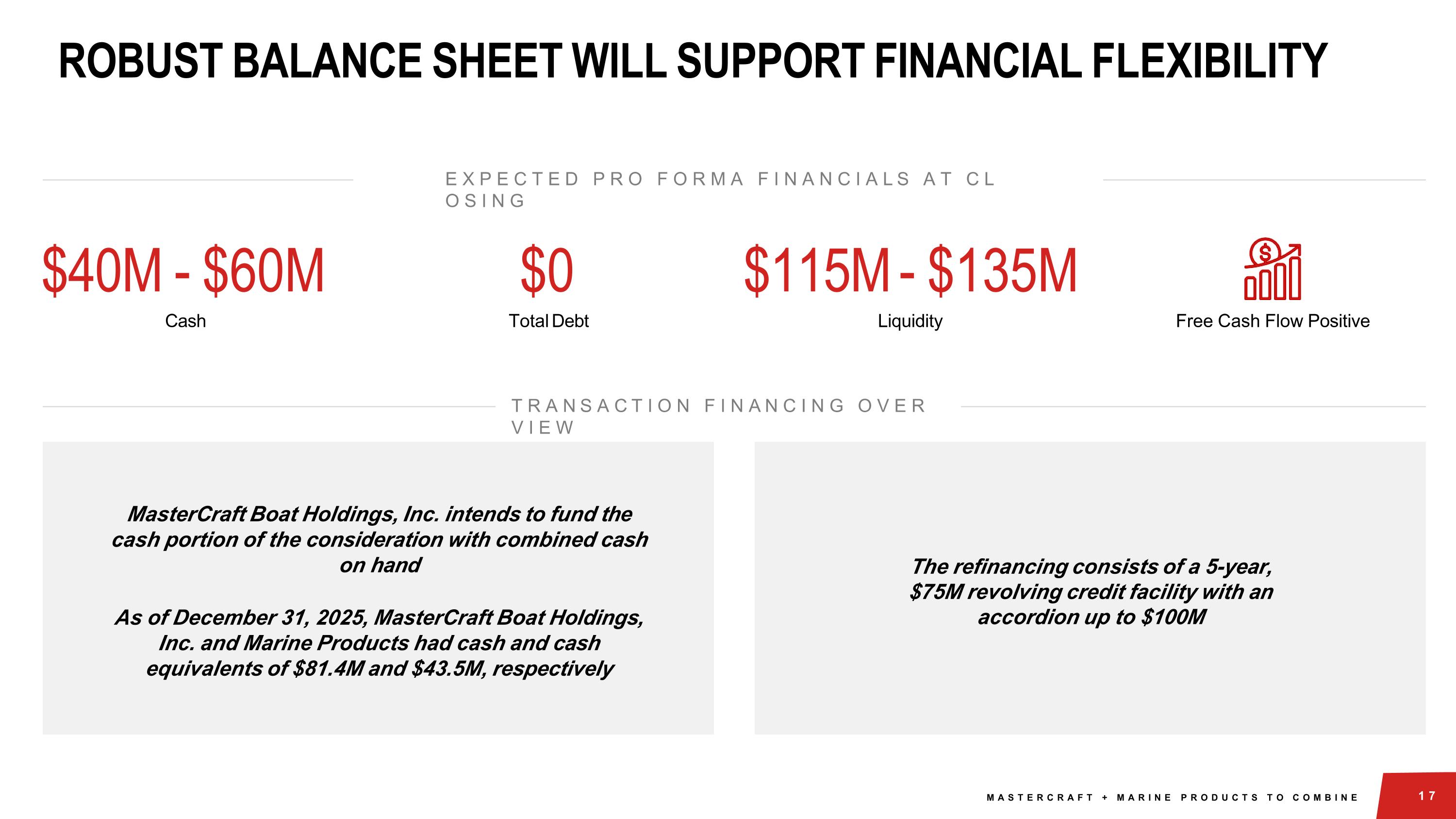

ROBUST BALANCE SHEET WILL SUPPORT FINANCIAL FLEXIBILITY $40M - $60M $0 $115M - $135M Cash Total Debt Liquidity Free Cash Flow Positive E X P E C T E D P R O F O R M A F I N A N C I A L S A T C L O S I N G T R A N S A C T I O N F I N A N C I N G O V E R V I E W M A S T E R C R A F T + M A R I N E P R O D U C T S T O C O M B I N E MasterCraft Boat Holdings, Inc. intends to fund the cash portion of the consideration with combined cash on hand As of December 31, 2025, MasterCraft Boat Holdings, Inc. and Marine Products had cash and cash equivalents of $81.4M and $43.5M, respectively The refinancing consists of a 5-year, $75M revolving credit facility with an accordion up to $100M

REALIZING NEAR-TERM COST SAVINGS, WITH OPPORTUNITY TO DRIVE SCALABLE REVENUE AND COST SYNERGIES CORPORATE COST SAVINGS T O T A L I N G ~ $ 6 M I L L I O N A N N U A L N E T S A V I N G S Public Company Costs Corporate Overhead Administrative Expenses M A S T E R C R A F T + M A R I N E P R O D U C T S T O C O M B I N E ADDITIONAL REVENUE AND COST SYNERGIES Combined Innovation Platform Complementary Dealer Network Manufacturing Best Practices Sourcing and Procurement Vertical Integration Opportunities Acceleration of New and Refreshed Products

TRANSFORMATIVE COMBINATION DELIVERING SCALE, INNOVATION, AND GROWTH TO DRIVE SHAREHOLDER VALUE CREATION LEADING BRANDS ACROSS FOUR DISTINCT CATEGORIES Combination of MasterCraft, Crest, Balise, Chaparral, and Robalo More Than Doubles Consumer Reach ENHANCED INNOVATION AND MANUFACTURING CAPABILITIES Delivers Differentiated and Innovative New Products While Accelerating New Model Launches ATTRACTIVE FINANCIAL PROFILE Robust Balance Sheet to Drive Growth, Value Creation, and Focused Capital Allocation EXPANDED GEOGRAPHIC COVERAGE AND OFFERINGS Unlocks Growth Opportunities Through Complementary Coastal and Inland Dealer Networks 1 9M A S T E R C R A F T + M A R I N E P R O D U C T S T O C O M B I N E M A S T E R C R A F T + M A R I N E P R O D U C T S T O C O M B I N E

2 0 APPENDIX

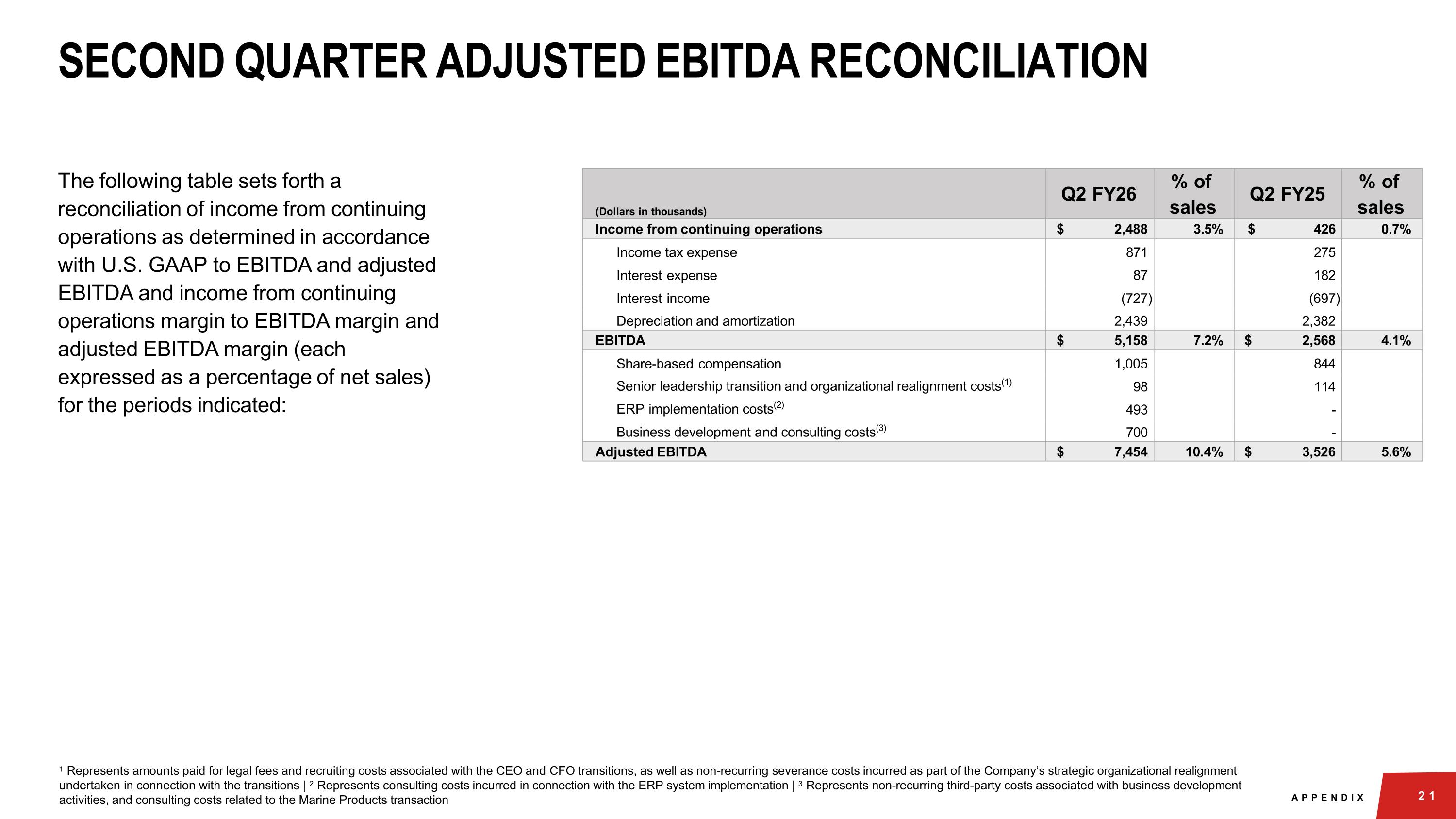

SECOND QUARTER ADJUSTED EBITDA RECONCILIATION 1 Represents amounts paid for legal fees and recruiting costs associated with the CEO and CFO transitions, as well as non-recurring severance costs incurred as part of the Company’s strategic organizational realignment undertaken in connection with the transitions | 2 Represents consulting costs incurred in connection with the ERP system implementation | 3 Represents non-recurring third-party costs associated with business development activities, and consulting costs related to the Marine Products transaction A P P E N D I X The following table sets forth a reconciliation of income from continuing operations as determined in accordance with U.S. GAAP to EBITDA and adjusted EBITDA and income from continuing operations margin to EBITDA margin and adjusted EBITDA margin (each expressed as a percentage of net sales) for the periods indicated: (Dollars in thousands) Q2 FY26 % of sales Q2 FY25 % of sales Income from continuing operations $ 2,488 3.5% $ 426 0.7% Income tax expense 871 275 Interest expense 87 182 Interest income (727) (697) Depreciation and amortization 2,439 2,382 EBITDA $ 5,158 7.2% $ 2,568 4.1% Share-based compensation 1,005 844 Senior leadership transition and organizational realignment costs(1) 98 114 ERP implementation costs(2) 493 - Business development and consulting costs(3) 700 - Adjusted EBITDA $ 7,454 10.4% $ 3,526 5.6%

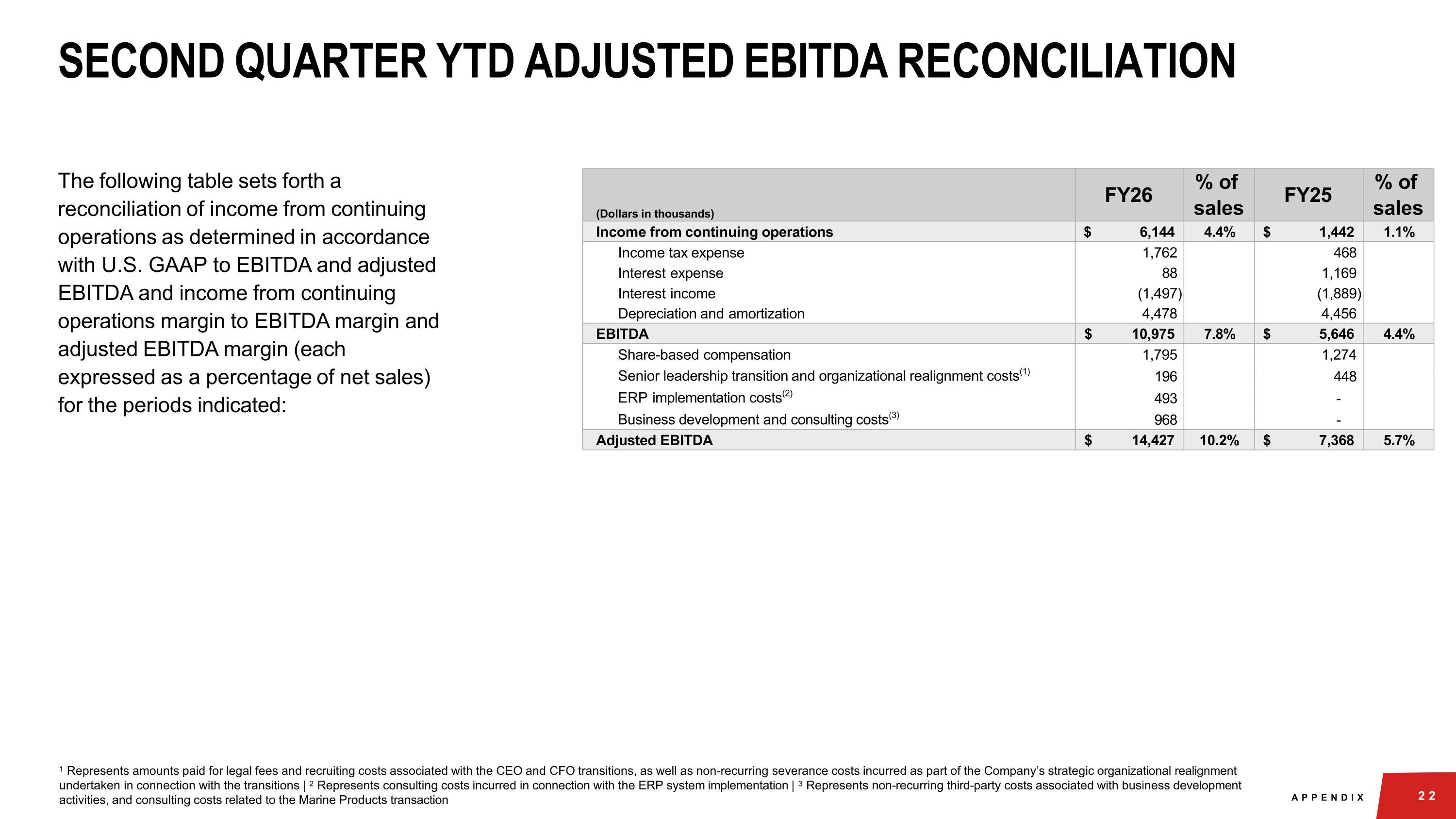

SECOND QUARTER YTD ADJUSTED EBITDA RECONCILIATION 1 Represents amounts paid for legal fees and recruiting costs associated with the CEO and CFO transitions, as well as non-recurring severance costs incurred as part of the Company’s strategic organizational realignment undertaken in connection with the transitions | 2 Represents consulting costs incurred in connection with the ERP system implementation | 3 Represents non-recurring third-party costs associated with business development activities, and consulting costs related to the Marine Products transaction A P P E N D I X The following table sets forth a reconciliation of income from continuing operations as determined in accordance with U.S. GAAP to EBITDA and adjusted EBITDA and income from continuing operations margin to EBITDA margin and adjusted EBITDA margin (each expressed as a percentage of net sales) for the periods indicated: (Dollars in thousands) FY26 % of sales FY25 % of sales Income from continuing operations $ 6,144 4.4% $ 1,442 1.1% Income tax expense 1,762 468 Interest expense 88 1,169 Interest income (1,497) (1,889) Depreciation and amortization 4,478 4,456 EBITDA $ 10,975 7.8% $ 5,646 4.4% Share-based compensation 1,795 1,274 Senior leadership transition and organizational realignment costs(1) 196 448 ERP implementation costs(2) 493 - Business development and consulting costs(3) 968 - Adjusted EBITDA $ 14,427 10.2% $ 7,368 5.7%

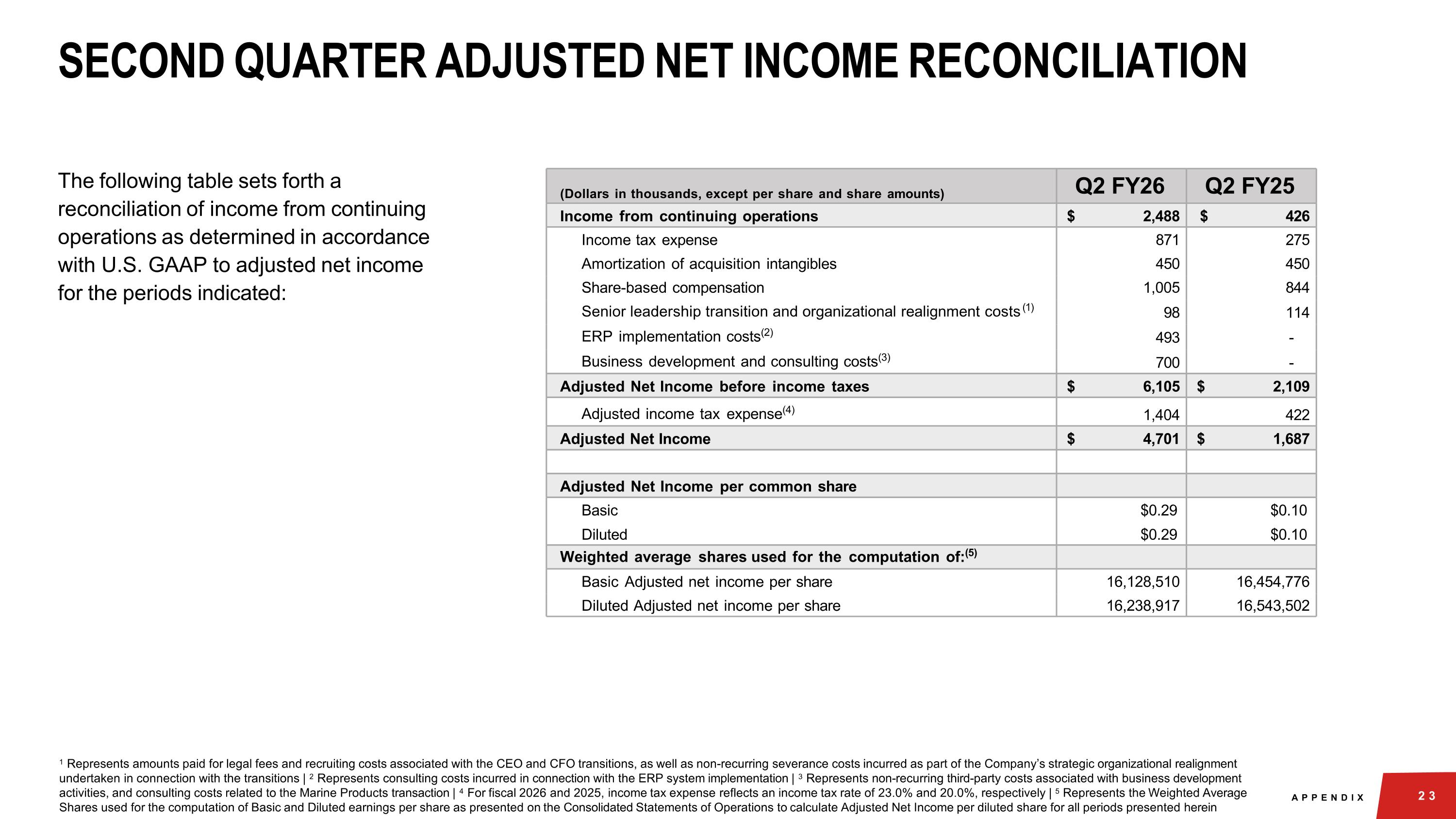

2 3 A P P E N D I X SECOND QUARTER ADJUSTED NET INCOME RECONCILIATION The following table sets forth a reconciliation of income from continuing operations as determined in accordance with U.S. GAAP to adjusted net income for the periods indicated: 1 Represents amounts paid for legal fees and recruiting costs associated with the CEO and CFO transitions, as well as non-recurring severance costs incurred as part of the Company’s strategic organizational realignment undertaken in connection with the transitions | 2 Represents consulting costs incurred in connection with the ERP system implementation | 3 Represents non-recurring third-party costs associated with business development activities, and consulting costs related to the Marine Products transaction | 4 For fiscal 2026 and 2025, income tax expense reflects an income tax rate of 23.0% and 20.0%, respectively | 5 Represents the Weighted Average Shares used for the computation of Basic and Diluted earnings per share as presented on the Consolidated Statements of Operations to calculate Adjusted Net Income per diluted share for all periods presented herein (Dollars in thousands, except per share and share amounts) Q2 FY26 Q2 FY25 Income from continuing operations $ 2,488 $ 426 Income tax expense 871 275 Amortization of acquisition intangibles 450 450 Share-based compensation 1,005 844 Senior leadership transition and organizational realignment costs (1) 98 114 ERP implementation costs(2) 493 - Business development and consulting costs(3) 700 - Adjusted Net Income before income taxes $ 6,105 $ 2,109 Adjusted income tax expense(4) 1,404 422 Adjusted Net Income $ 4,701 $ 1,687 Adjusted Net Income per common share Basic Diluted $0.29 $0.29 $0.10 $0.10 Weighted average shares used for the computation of:(5) Basic Adjusted net income per share 16,128,510 16,454,776 Diluted Adjusted net income per share 16,238,917 16,543,502

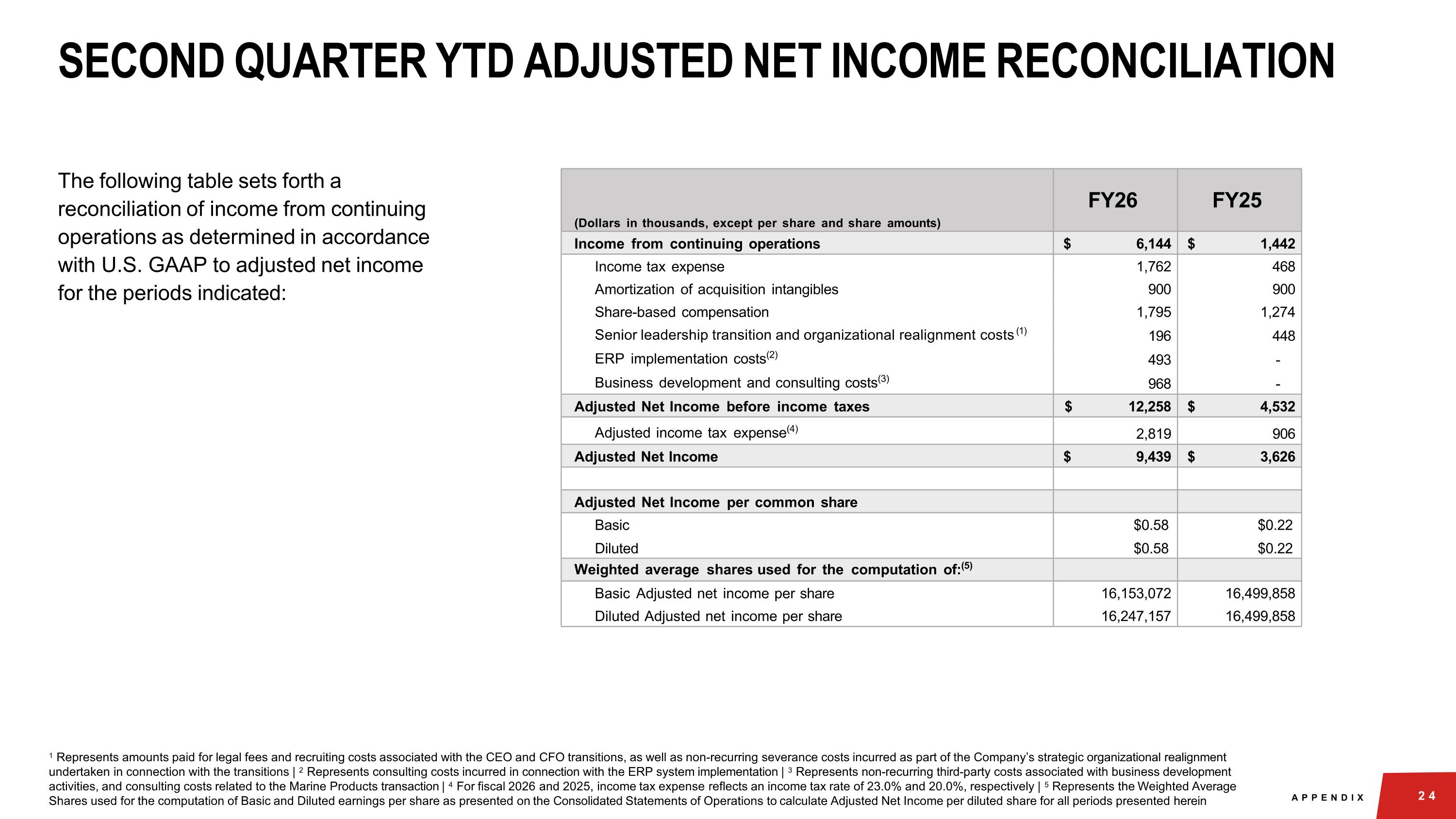

2 4 A P P E N D I X SECOND QUARTER YTD ADJUSTED NET INCOME RECONCILIATION The following table sets forth a reconciliation of income from continuing operations as determined in accordance with U.S. GAAP to adjusted net income for the periods indicated: 1 Represents amounts paid for legal fees and recruiting costs associated with the CEO and CFO transitions, as well as non-recurring severance costs incurred as part of the Company’s strategic organizational realignment undertaken in connection with the transitions | 2 Represents consulting costs incurred in connection with the ERP system implementation | 3 Represents non-recurring third-party costs associated with business development activities, and consulting costs related to the Marine Products transaction | 4 For fiscal 2026 and 2025, income tax expense reflects an income tax rate of 23.0% and 20.0%, respectively | 5 Represents the Weighted Average Shares used for the computation of Basic and Diluted earnings per share as presented on the Consolidated Statements of Operations to calculate Adjusted Net Income per diluted share for all periods presented herein (Dollars in thousands, except per share and share amounts) FY26 FY25 Income from continuing operations $ 6,144 $ 1,442 Income tax expense 1,762 468 Amortization of acquisition intangibles 900 900 Share-based compensation 1,795 1,274 Senior leadership transition and organizational realignment costs (1) 196 448 ERP implementation costs(2) 493 - Business development and consulting costs(3) 968 - Adjusted Net Income before income taxes $ 12,258 $ 4,532 Adjusted income tax expense(4) 2,819 906 Adjusted Net Income $ 9,439 $ 3,626 Adjusted Net Income per common share Basic Diluted $0.58 $0.58 $0.22 $0.22 Weighted average shares used for the computation of:(5) Basic Adjusted net income per share 16,153,072 16,499,858 Diluted Adjusted net income per share 16,247,157 16,499,858

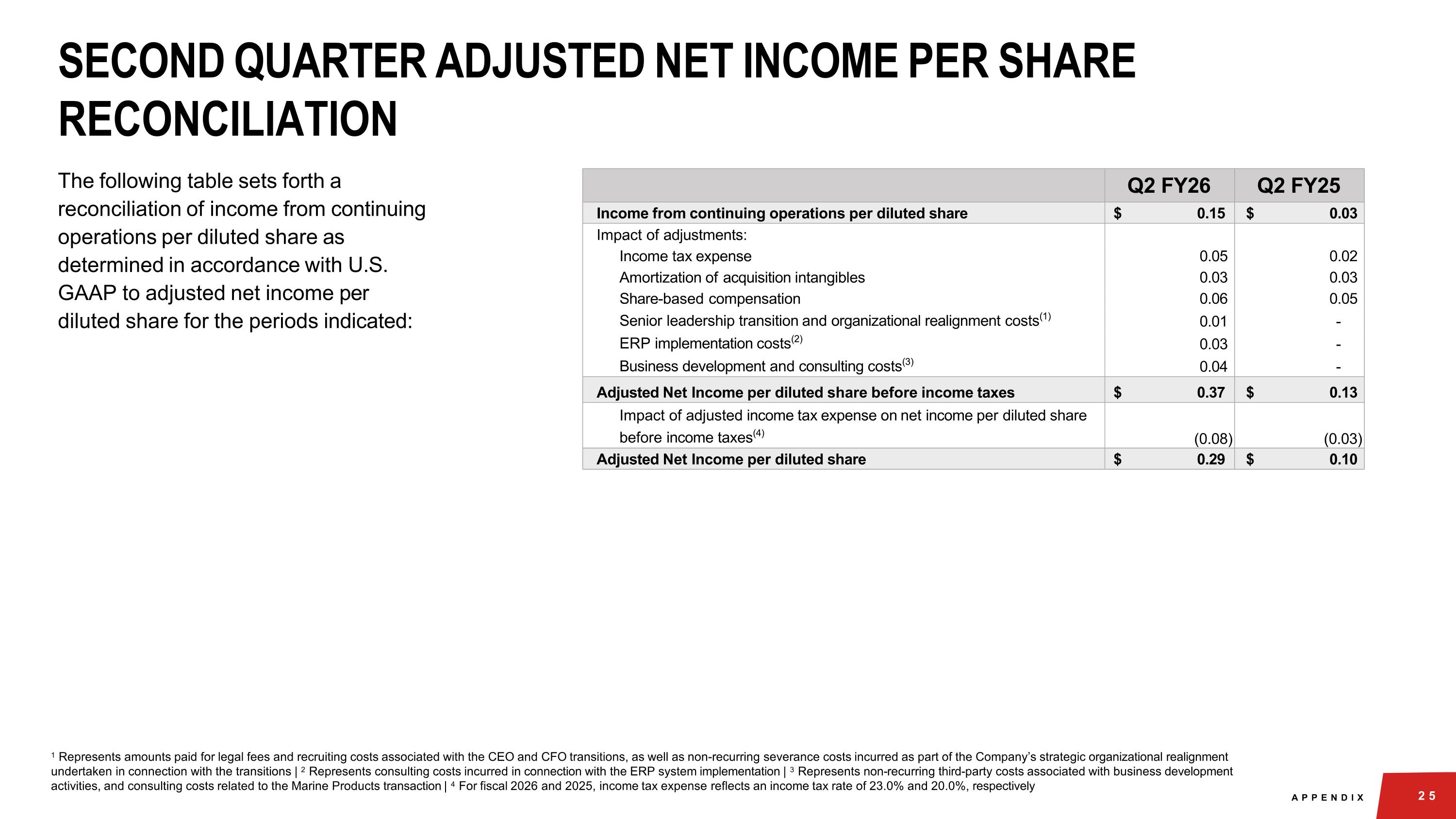

2 5 A P P E N D I X SECOND QUARTER ADJUSTED NET INCOME PER SHARE RECONCILIATION The following table sets forth a reconciliation of income from continuing operations per diluted share as determined in accordance with U.S. GAAP to adjusted net income per diluted share for the periods indicated: Q2 FY26 Q2 FY25 Income from continuing operations per diluted share $ 0.15 $ 0.03 Impact of adjustments: Income tax expense 0.05 0.02 Amortization of acquisition intangibles 0.03 0.03 Share-based compensation 0.06 0.05 Senior leadership transition and organizational realignment costs(1) 0.01 - ERP implementation costs(2) 0.03 - Business development and consulting costs(3) 0.04 - Adjusted Net Income per diluted share before income taxes $ 0.37 $ 0.13 Impact of adjusted income tax expense on net income per diluted share before income taxes(4) (0.08) (0.03) Adjusted Net Income per diluted share $ 0.29 $ 0.10 1 Represents amounts paid for legal fees and recruiting costs associated with the CEO and CFO transitions, as well as non-recurring severance costs incurred as part of the Company’s strategic organizational realignment undertaken in connection with the transitions | 2 Represents consulting costs incurred in connection with the ERP system implementation | 3 Represents non-recurring third-party costs associated with business development activities, and consulting costs related to the Marine Products transaction | 4 For fiscal 2026 and 2025, income tax expense reflects an income tax rate of 23.0% and 20.0%, respectively

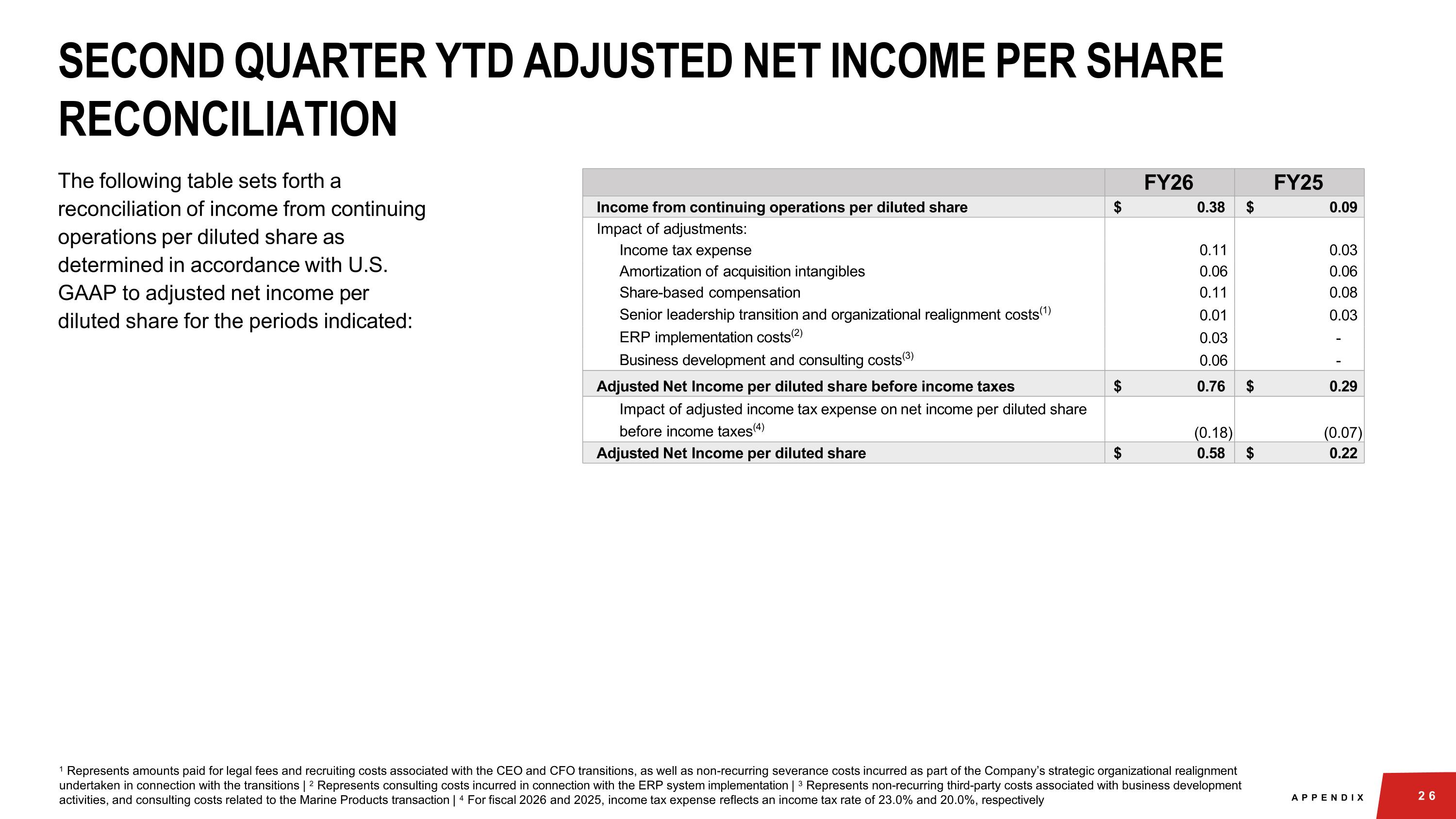

2 6 A P P E N D I X SECOND QUARTER YTD ADJUSTED NET INCOME PER SHARE RECONCILIATION The following table sets forth a reconciliation of income from continuing operations per diluted share as determined in accordance with U.S. GAAP to adjusted net income per diluted share for the periods indicated: FY26 FY25 Income from continuing operations per diluted share $ 0.38 $ 0.09 Impact of adjustments: Income tax expense 0.11 0.03 Amortization of acquisition intangibles 0.06 0.06 Share-based compensation 0.11 0.08 Senior leadership transition and organizational realignment costs(1) 0.01 0.03 ERP implementation costs(2) 0.03 - Business development and consulting costs(3) 0.06 - Adjusted Net Income per diluted share before income taxes $ 0.76 $ 0.29 Impact of adjusted income tax expense on net income per diluted share before income taxes(4) (0.18) (0.07) Adjusted Net Income per diluted share $ 0.58 $ 0.22 1 Represents amounts paid for legal fees and recruiting costs associated with the CEO and CFO transitions, as well as non-recurring severance costs incurred as part of the Company’s strategic organizational realignment undertaken in connection with the transitions | 2 Represents consulting costs incurred in connection with the ERP system implementation | 3 Represents non-recurring third-party costs associated with business development activities, and consulting costs related to the Marine Products transaction | 4 For fiscal 2026 and 2025, income tax expense reflects an income tax rate of 23.0% and 20.0%, respectively

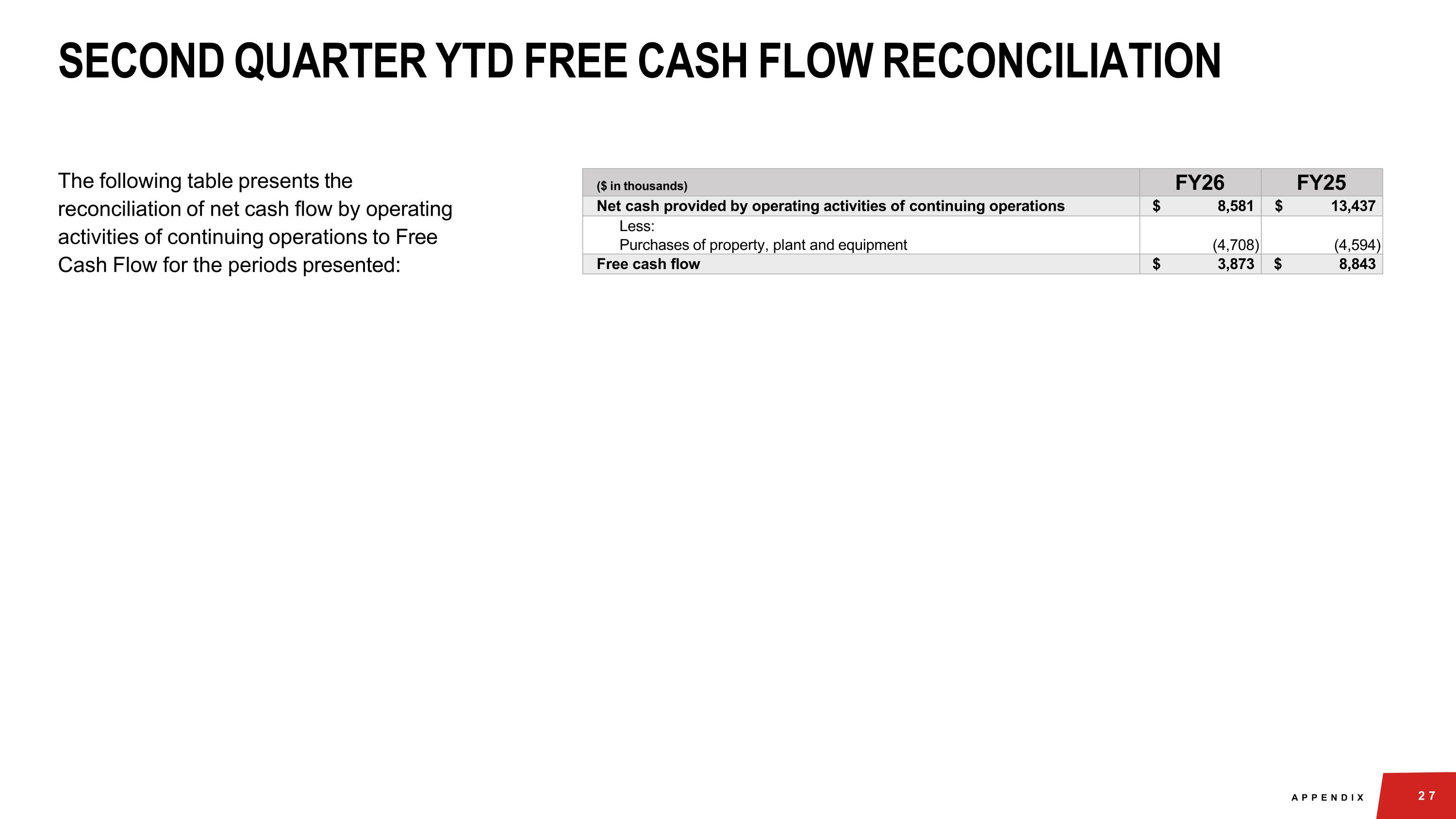

2 7 A P P E N D I X SECOND QUARTER YTD FREE CASH FLOW RECONCILIATION The following table presents the reconciliation of net cash flow by operating activities of continuing operations to Free Cash Flow for the periods presented: ($ in thousands) FY26 FY25 Net cash provided by operating activities of continuing operations $ 8,581 $ 13,437 Less: Purchases of property, plant and equipment (4,708) (4,594) Free cash flow $ 3,873 $ 8,843