TERMS AND CONDITIONS GOVERNING EMPLOYEE RETENTION COMPENSATION PROGRAM 2021/2026 IN SPOTIFY TECHNOLOGY S.A. 1. RETENTION COMPENSATION PROVIDER AND RECIPIENT 1.1 Spotify Technology S.A., a Luxembourg société anonyme, with registered address at 42- 44, avenue de la Gare, L-1610 Luxembourg, registered with the Luxembourg Trade and Companies’ Register under number B 123.052 (the “Company”). 1.2 Employee of the Company or of any affiliate, subsidiary or other company controlled by the Company (collectively, the “Group”, each individually, a “Group Company”) who has received an individual notice of grant (the “Employee”). 2. BACKGROUND 2.1 The Company’s board of directors (the “Board”) considers the existence of efficient incentive programs for employees of the Group to be of material importance for the development of the Group. Retaining employees in the Group by creating compensation plans for employees that continue their employment within the Group hence promotes a long-term increase in value. 2.2 The foregoing notwithstanding, this Employee Retention Compensation Program 2021/2026 (the “Retention Compensation Program”) shall not form part of the Employees’ overall compensation and benefits under their contracts of employment with a Group Company, and, for the avoidance of doubt, shall not entitle any Employee to any pension benefits, or constitute the basis for any other benefits calculated on the Employee’s salary under their contracts of employment. In addition, the existence of a contract of employment between an Employee and a Group Company shall not give the Employee any right or expectation to be granted Retention Compensation at any time under the Retention Compensation Program or otherwise. Moreover, the granting of Retention Compensation shall not give the Employee any right or expectation to be granted additional Retention Compensation at any time under the Retention Compensation Program or otherwise. 3. RETENTION COMPENSATION Subject to the terms and conditions set out herein, the Employee is eligible to receive a certain maximum cash amount as communicated to the Employee, to be paid by the Company or another company within the Group (the “Retention Compensation”). Any Retention Compensation payable shall be deemed to be a gross amount, including any vacation pay. Consequently, the Company or another company within the Group shall not pay any additional vacation pay with regard to the Retention Compensation. 4. IMPLEMENTATION AND GRANT 4.1 The Retention Compensation Program shall be effective as per 1 April 2021 (the “Implementation Date”). 4.2 Participation in the Retention Compensation Program may be granted to Employees during the period as from and including 1 April 2021 up to and including 31 March 2026. The determination of the employees who will be granted Retention Compensation, and the date

2(10) or dates of grants of Retention Compensation Program participation during such period (each, a “Date of Grant”) shall be determined by the Board in its sole discretion. 5. VESTING AND DISTRIBUTION OF RETENTION COMPENSATION 5.1 Vesting 5.1.1 Subject to continued employment with the Group, vesting of the granted Retention Compensation shall occur on the same date in each relevant calendar month as the Date of Grant in accordance with the following: (a) initially, 3/48 shall vest on the third calendar month following the Date of Grant; and (b) thereafter, 1/48 shall vest each calendar month. Notwithstanding the foregoing, if there is no such date mentioned in (a) or (b) in the relevant calendar month, vesting shall occur on the last day of such month. The vesting schedule set out in this clause 5.1.1 may be amended pursuant to clause 5.2, 5.3 and 6. Payment of vested Retention Compensation shall be distributed by the Company or another company within the Group to the Employee in accordance with clause 5.4. 5.1.2 Notwithstanding the aforesaid, the Board shall be entitled, in its sole discretion, to resolve that part of or all unvested Retention Compensation shall vest in advance. 5.2 Leave of absence 5.2.1 If the Employee goes on leave of absence, such Employee’s Retention Compensation will not vest during the leave of absence, except as set forth below in this clause 5.2. The Retention Compensation that does not vest during the leave of absence as a consequence of the Employee’s leave of absence shall lapse immediately, if not otherwise determined by the Board. 5.2.2 If the Employee is on leave of absence due to parental leave, sick leave, vacation leave or other paid time off, such Employee’s Retention Compensation shall continue to vest on the original vesting schedule during the leave of absence. The same shall apply for any other leave of absence during which vesting on the original schedule must continue under applicable law. 5.2.3 If the Employee is on leave of absence due to any other reason (e.g. studying) than as set out in clause 5.2.2, or if the Employee otherwise reduces his/her contractual working hours for the employer after the Date of Grant of the Employee’s Retention Compensation, but the Employee still works part-time for the employer, such Employee’s Retention Compensation shall vest pro rata in relation to a full-time job. If the Employee’s contractual working hours prior to leave of absence or reduction of contractual working hours did not amount to a full-time job, such Employee’s Retention Compensation shall vest pro rata in relation to the contractual working hours prior to such leave of absence or reduction of contractual working hours. The same shall apply for any other leave of absence during which pro rata vesting must continue under applicable law. For the purpose of this clause 5.2.3, a full-time job shall correspond to the number of working hours per week set out in the Employee’s employment agreement as the standard for a full-time job. 5.3 Termination of employment 5.3.1 If (i) the Employee resigns, or (ii) the employer terminates the employment of the Employee with the Group (for whatever reason), or (iii) the Employee retires pursuant to

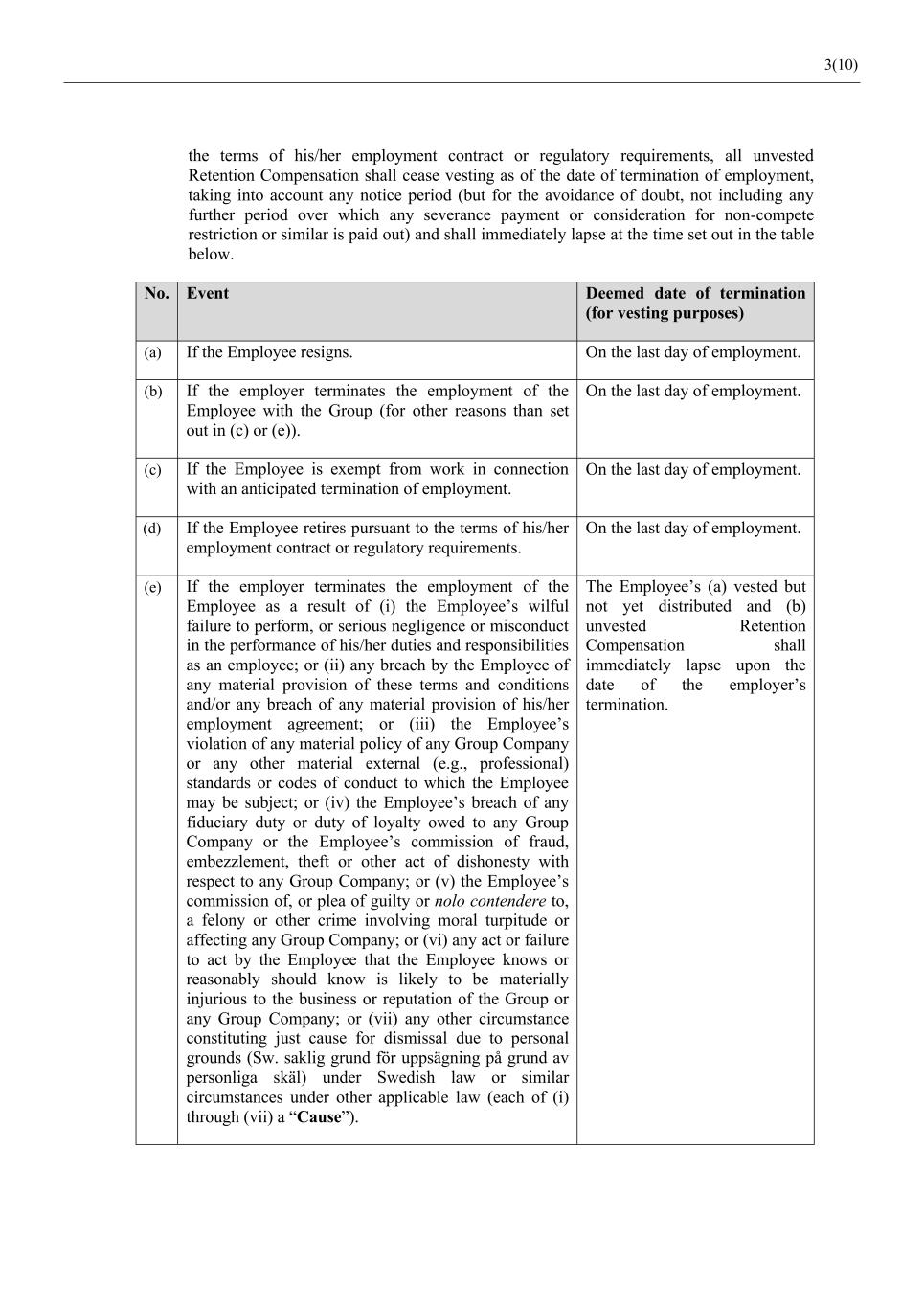

3(10) the terms of his/her employment contract or regulatory requirements, all unvested Retention Compensation shall cease vesting as of the date of termination of employment, taking into account any notice period (but for the avoidance of doubt, not including any further period over which any severance payment or consideration for non-compete restriction or similar is paid out) and shall immediately lapse at the time set out in the table below. No. Event Deemed date of termination (for vesting purposes) (a) If the Employee resigns. On the last day of employment. (b) If the employer terminates the employment of the Employee with the Group (for other reasons than set out in (c) or (e)). On the last day of employment. (c) If the Employee is exempt from work in connection with an anticipated termination of employment. On the last day of employment. (d) If the Employee retires pursuant to the terms of his/her employment contract or regulatory requirements. On the last day of employment. (e) If the employer terminates the employment of the Employee as a result of (i) the Employee’s wilful failure to perform, or serious negligence or misconduct in the performance of his/her duties and responsibilities as an employee; or (ii) any breach by the Employee of any material provision of these terms and conditions and/or any breach of any material provision of his/her employment agreement; or (iii) the Employee’s violation of any material policy of any Group Company or any other material external (e.g., professional) standards or codes of conduct to which the Employee may be subject; or (iv) the Employee’s breach of any fiduciary duty or duty of loyalty owed to any Group Company or the Employee’s commission of fraud, embezzlement, theft or other act of dishonesty with respect to any Group Company; or (v) the Employee’s commission of, or plea of guilty or nolo contendere to, a felony or other crime involving moral turpitude or affecting any Group Company; or (vi) any act or failure to act by the Employee that the Employee knows or reasonably should know is likely to be materially injurious to the business or reputation of the Group or any Group Company; or (vii) any other circumstance constituting just cause for dismissal due to personal grounds (Sw. saklig grund för uppsägning på grund av personliga skäl) under Swedish law or similar circumstances under other applicable law (each of (i) through (vii) a “Cause”). The Employee’s (a) vested but not yet distributed and (b) unvested Retention Compensation shall immediately lapse upon the date of the employer’s termination.

4(10) 5.3.2 Notwithstanding the foregoing, the Board shall be entitled, in its sole discretion, to resolve that termination of employment shall be deemed to occur at a later point in time. 5.3.3 If an Employee changes the entity for which he or she is employed, but remains employed by the Group, such change will not be deemed a termination of employment for purposes of his/her Retention Compensation, provided that there is no other interruption or termination of the Employee’s employment, unless the Board, in its sole discretion, determines that the entity to which the Employee transfers is not a qualified affiliate of the Group. If an Employee changes the capacity in which he/she provides service to the Group from an employee to an independent contractor or consultant, such change will be deemed a termination of employment for purposes of his/her Retention Compensation. 5.3.4 If the Employee, when he/she commences his/her employment with the Group, is subject to a probationary or trial employment and, at the end of such probationary or trial employment, the employment with the Group is terminated (for whatever reason), all unvested Retention Compensation shall lapse on the date of termination of employment. 5.4 Distribution of the Retention Compensation The Company, or another company within the Group, shall distribute the vested Retention Compensation in connection with the first subsequent ordinary salary payment to the Employee following each vesting of the Retention Compensation, which shall in all cases be no later than March 15 of the year following the year of vesting. The Retention Compensation shall be distributed by way of cash payments to the Employee into the bank account designated for the Employee’s ordinary salary payment. 6. AMENDMENT OF VESTING SCHEDULE ETC. 6.1 Change in Control 6.1.1 Notwithstanding clause 6.5, in the event of a Change in Control, the Board may, in its sole discretion, decide (i) to accelerate vesting of the Retention Compensation (an “Accelerated Vesting”) in accordance with the provisions of clause 6.3, and determine a new date for distribution of the Retention Compensation (to apply instead of the date applicable according to clause 5.4) (the “New Distribution Date”), (ii) to have these terms and conditions continue following the effective date of the Change in Control in accordance with the provisions of clause 6.4, or (iii) to allow an amendment of the terms and conditions, or to allow a grant of substantially equivalent rights to receive compensation from a new company, to the effect that, following the Change in Control, a new company assumes the Company’s rights and obligations hereunder or equivalent thereto in accordance with the provisions of clauses 6.1.2 and 6.1.3 respectively. With respect to any Employee who is a U.S. taxpayer, any New Distribution Date shall be set in a manner that is in compliance with, or exempt from, the requirements of Section 409A of the Internal Revenue Code of 1986, as amended and the final Treasury Regulations and official Internal Revenue Service guidance thereunder (“Section 409A”). 6.1.2 If the Board decides to allow a grant of substantially equivalent right to retention compensation in a new company as the Employee had in the Company immediately before the Change in Control, all vested and unvested Retention Compensation shall lapse as of the closing and, subject to the grant of such substantially equivalent compensation, the Employee shall have no further rights pursuant to the Retention Compensation Program after the closing.

5(10) 6.1.3 If the Board decides to allow an amendment of the terms and conditions to the effect that, following the Change in Control, a new company assumes the Company’s rights and obligations hereunder, the Employee’s right to Retention Compensation in accordance with clause 3 shall relate to compensation from such new company. 6.1.4 If the Group, or any successor thereto, in connection with or within a period of 6 months following the closing of a Change in Control, terminates the employment of the Employee, other than for Cause, and if any Retention Compensation are subject to continued vesting after the Change in Control in accordance with this clause 6, all of the Employee’s unvested Retention Compensation shall vest as of the date of his or her termination of employment. 6.2 Change in Control Definition 6.2.1 “Change in Control” shall mean and include each of the following: (i) a transaction or series of transactions (other than an offering of shares in the Company (“Shares”) to the general public through a registration statement filed with the Securities and Exchange Commission) whereby any “person” or related “group” of “persons” (as such terms are used in Sections 13(d) and 14(d)(2) of the Securities Exchange Act of 1934, as amended from time to time (the “Exchange Act”)) directly or indirectly acquires beneficial ownership (within the meaning of Rules 13d-3 and 13d-5 under the Exchange Act) of securities of the Company possessing more than 50 % of the total combined voting power of the Company’s securities outstanding immediately after such acquisition; provided, however, that the following acquisitions shall not constitute a Change in Control: (w) any acquisition by the Company; (x) any acquisition by an employee benefit plan maintained by the Company, (y) any acquisition which complies with clauses 6.2.1.(iii)(I)- (III); or (z) in respect of Retention Compensation or held by a particular Employee, any acquisition by the Employee or any group of persons including the Employee (or any entity controlled by the Employee or any group of persons including the Employee); (ii) the Incumbent Directors cease for any reason to constitute a majority of the Board; (iii) the consummation by the Company (whether directly involving the Company or indirectly involving the Company through one or more intermediaries) of (x) a merger, consolidation, reorganization, or business combination, (y) a sale or other disposition of all or substantially all of the Company’s assets in any single transaction or series of related transactions or (z) the acquisition of assets or stock of another entity, in each case other than a transaction: (I) which results in the Company’s voting securities outstanding immediately before the transaction continuing to represent (either by remaining outstanding or by being converted into voting securities of the Company or the person that, as a result of the transaction, controls, directly or indirectly, the Company or owns, directly or indirectly, all or substantially all of the Company’s assets or otherwise succeeds to the business of the Company (the Company or such person, the “Successor Entity”)) directly or indirectly, at least a majority of the combined voting power of the Successor Entity’s outstanding voting securities immediately after the transaction, and (II) after which no person or group beneficially owns voting securities representing 50% or more of the combined voting power of the Successor Entity; provided, however, that no person or group shall be treated for purposes of this clause (II) as beneficially owning 50% or more of the combined voting power of the Successor Entity solely as a result of the voting power held in the Company prior to the consummation of the transaction; and (III) after which at least a majority of the members of the board of directors (or the analogous governing body)

6(10) of the Successor Entity were Board members at the time of the Board's approval of the execution of the initial agreement providing for such transaction; or (iv) the date which is 10 days on which banks are open for business generally (and not for internet banking only) in Luxembourg and the U.S prior to the completion of a liquidation or dissolution of the Company. 6.2.2 “Incumbent Directors’ shall mean for any period of 12 consecutive months, individuals who, at the beginning of such period, constitute the Board together with any new director(s) (other than a director designated by a person who shall have entered into an agreement with the Company to effect a transaction described in clause 6.2.1, (i) or 6.2.1, (iii)) whose election or nomination for election to the Board was approved by a vote of at least a majority (either by a specific vote or by approval of the proxy statement of the Company in which such person is named as a nominee for director without objection to such nomination) of the directors then still in office who either were directors at the beginning of the 12-month period or whose election or nomination for election was previously so approved. No individual initially elected or nominated as a director of the Company as a result of an actual or threatened election contest with respect to directors or as a result of any other actual or threatened solicitation of proxies by or on behalf of any person other than the Board shall be an Incumbent Director. 6.3 Procedure upon Accelerated vesting If the Board decides that Accelerated Vesting shall take place due to a Change in Control, 50 per cent of the Employee’s unvested Retention Compensation shall vest as of the date of the Board’s decision. The Board shall be entitled, in its sole discretion, to decide whether to adopt an expiration date so that, at the conclusion of such Accelerated Vesting, any unvested Retention Compensation shall lapse (the “Expiration Date”), or whether unvested Retention Compensation will continue to vest. If the Board decides that any unvested Retention Compensation shall continue to vest, only 3/96 part of the Employee’s Retention Compensation shall vest at the first cliff vesting occasion set out in clause 5.1.1(a), if the Board’s notice is given prior to such date, and only 1/96 part of the Employee’s Retention Compensation shall vest on each subsequent regularly scheduled vesting occasion as set out in clause 5.1.1(b). If the Board decides to establish an Expiration Date so that any unvested Retention Compensation shall lapse, the Employee shall have no further rights pursuant to the Retention Compensation Program. 6.4 Continuing terms and conditions If the Board decides to have these terms and conditions continue following the effective date of the Change in Control, the vesting schedule, as set forth in clause 5, shall remain unaffected by the Change in Control. 6.5 Merger and de-merger In the event of a merger through which the Company is absorbed into another company (other than a Change in Control) or a de-merger through which the Company is divided into two or more new entities (other than a Change in Control) the Board shall ensure that any vested but not yet distributed Retention Compensation is distributed to the Employee before the liquidation, merger or de-merger becomes effective and any unvested Retention Compensation shall immediately lapse.

7(10) 7. CANCELLATION OF RETENTION COMPENSATION IN CASE OF A MATERIAL BREACH 7.1 If the Employee commits a material breach of any of its obligations under these terms and conditions and the breach has not been rectified within 15 calendar days from the date the Employee receives a written demand for rectification, the Company shall be entitled to cancel the Employee’s unpaid Retention Compensation (vested as well as unvested) which as a consequence thereof shall lapse. 7.2 A material breach for purposes of clause 7 and 8 shall mean a breach by the Employee of the provisions in clauses 9, 10 or 12.6 or any other breach by the Employee of these terms and conditions that is reasonably likely to have a material adverse effect on the Company. 8. LIQUIDATED DAMAGES IN CASE OF A MATERIAL BREACH 8.1 If the Employee commits a material breach in accordance with clause 7.2 and the breach has not been rectified within 15 calendar days from the date the Employee receives a written demand for rectification, the Employee shall upon written request by the Company pay liquidated damages in an amount corresponding to 50 percent of the Employee’s Retention Compensation (unvested as well as vested). The Company shall not be entitled to demand liquidated damages if the Company has cancelled the Employee’s Retention Compensation pursuant to clause 7.1. 8.2 If the Employee commits a material breach of any of its obligations under these terms and conditions, the Company is entitled, in addition to any liquidated damages in accordance with the provisions of clause 8.1, to claim damages in an amount corresponding to the difference between the actual damage suffered and the liquidated damages (if any), if such damage exceeds the amount of the liquidated damages (if any). 8.3 The payment by the Employee of any liquidated damages and regular damages shall not affect the Company’s right to pursue other remedies that the Company may have against the Employee as a result of a breach. 9. APPOINTMENT OF AGENT ETC. 9.1 The Employee hereby irrevocably authorises the Board, with full power of substitution, to endorse such documents on behalf of the Employee and to take any other action reasonably necessary to effect any of the Employee’s obligations under these terms and conditions. A withdrawal of the authorisation as provided for in this clause 9 constitutes a material breach of these terms and conditions for purposes of clause 7 and 8. 9.2 The Employee hereby undertakes to sign, execute and deliver such documents, and to take any other actions, as reasonably required by the Board in order to ensure compliance with or observation of the Employee’s obligations under these terms and conditions. 10. PAYMENT OF CERTAIN TAXES 10.1 The Group will perform withholding of taxes in relation to the Retention Compensation if and to the extent required by law or decisions by governmental authorities or if the Board in its reasonable opinion considers it appropriate for the Group to perform such withholding of taxes. For the avoidance of doubt, this clause 10.1 shall not affect the Employee’s liabilities and undertakings pursuant to clause 10.2 and 10.3.

8(10) 10.2 The Employee is liable for and undertakes to pay any taxes (including but not limited to income taxes, capital taxes, employment taxes, social security contributions as well as any tax penalties thereon) for which he/she may be liable in relation to the Retention Compensation (“Employee’s Tax Liability”). For the avoidance of doubt, withholding tax (whether preliminary or deducted at source) on employment income, dividends and capital gains will always be considered as Employee’s Tax Liability. 10.3 As a condition of a Retention Compensation, the Employee shall make such arrangements as the Board may require for the satisfaction of any Employee’s Tax Liability that may arise in relation to the Retention Compensation. For the avoidance of doubt, the Employee shall upon the Company’s request pay any Employees’ Tax Liability. Notwithstanding any contrary provision of this Retention Compensation Program, no Retention Compensation will be paid to Employee, unless and until all of the Employee’s Tax Liability which the Company determines must be withheld with respect to such Retention Compensation have been withheld. Employee will permanently forfeit the Retention Compensation if Employee fails to comply with his or her obligations in connection with the payment of required tax withholdings described in this clause 10. 10.4 The Group assumes no responsibility for any Employee’s Tax Liability. The Employee represents that the Employee is not relying on the Group for any tax advice and explicitly agrees not to demand any compensation from the Group to cover any Employee’s Tax Liability. 10.5 It is the intent of this Retention Compensation Program that all payments and benefits to U.S. taxpayers hereunder be exempt from the requirements of Section 409A so that none of the Retention Compensation provided under this Retention Compensation Program will be subject to the additional tax imposed under Section 409A, and any ambiguities herein will be interpreted to be so exempt. Each payment payable to a U.S. taxpayer under this Retention Compensation Program is intended to constitute a separate payment for purposes of Treasury Regulation Section 1.409A-2(b)(2). Each payment is intended to be subject to a “substantial risk of forfeiture” within the meaning of Section 409A prior to vesting, and paid within the “short-term deferral” period within the meaning of Section 409A. Further, any election to participate in this Retention Compensation Program was made within 30 days after the date that Employee first became eligible to participate in this Retention Compensation Program, Notwithstanding anything in the Retention Compensation Program or any other agreement (whether entered into before, on or after the Date of Grant) to the contrary, if the vesting of the balance, or some lesser portion of the balance, of the Retention Compensation is accelerated in connection with Employee’s termination of employment (provided that such termination is a “separation from service” within the meaning of Section 409A, as determined by the Company), other than due to death, and if (x) Employee is a U.S. taxpayer and a “specified employee” within the meaning of Section 409A at the time of such termination or employment and (y) the payment of such accelerated Retention Compensation will result in the imposition of additional tax under Section 409A if paid to Employee on or within the six (6) month period following Employee’s termination of employment, then the payment of such accelerated Retention Compensation will not be made until the date six (6) months and one (1) day following the date of Employee’s termination of employment, unless Employee dies following his or her termination of employment, in which case, the Retention Compensation will be paid to Employee’s estate as soon as practicable following his or her death.

9(10) Notwithstanding any other provision in the Retention Compensation Program or any other agreement (whether entered into before, on or after the Date of Grant) to the contrary, the Board may amend the Retention Compensation Program or any Retention Compensation without the consent of the Employee if the Board determines that such amendment is required or advisable for the Retention Compensation Program or any Retention Compensation to satisfy, comply with or meet the requirements of any law, regulation, rule or accounting standard, to preserve the economic benefits of or the intended tax treatment of the benefits provided under the Retention Compensation Program or to avoid any adverse tax consequences for any Employee or the Company resulting from participating in the Retention Compensation Program. The Group makes no representation or warranty with respect to the taxation of the Retention Compensation, and the Group shall have no liability to any Employee or any other person or entity if any Retention Compensation or payments under any provisions of the Retention Compensation Program are subject to (i) any early, retroactive or additional tax under Section 409A or any other provision of the Code or other law, or (ii) any modified tax treatment due to actions contemplated by this clause 10.5. 11. DATA PROTECTION For the purposes of implementing, managing and administering the Retention Compensation Program, and for the Employee to participate in the Retention Compensation Program, it is necessary for the Company, acting as a data controller, and other companies in the Group to process the Employee’s personal data. For more information regarding the processing of the Employee’s personal data, see the Company’s separate privacy notice which can be found in the ESOP Portal, that can be reached through the Internal Services webpage. 12. MISCELLANEOUS 12.1 The right to receive Retention Compensation shall not constitute securities. 12.2 The Company may assign its rights and obligations under these terms and conditions without the prior consent of the Employee. The right to receive Retention Compensation may not be transferred, otherwise disposed, pledged, borrowed against or used as any form of security. 12.3 The Company shall be entitled to amend these terms and conditions to the extent required by legislation, regulations, court decisions, decisions by public authorities or agreements, or if such amendments, in the reasonable judgment of the Company, are otherwise necessary for practical reasons, and provided in all of the aforementioned cases that the Employee’s rights are in no material respects adversely affected. If the Employee’s rights would be materially adversely affected, the Employee’s written consent shall be necessary for such amendment. 12.4 Nothing in these terms and conditions or in any right or Retention Compensation granted under these terms and conditions shall confer upon the Employee the right to continue in employment for any period of specific duration or interfere with or otherwise restrict in any way the rights of the Group or of the Employee, which rights are hereby expressly reserved by each, to terminate his or her employment at any time. 12.5 The Employee has no right to compensation or damages for any loss in respect of the Retention Compensation where such loss arises (or is claimed to arise), in whole or in part, from the termination of the Employee’s employment; or notice to terminate employment

10(10) given by or to the Employee. However, this exclusion of liability shall not apply however to termination of employment, or the giving of notice, where a competent tribunal or court, from which there can be no appeal (or which the relevant employing company has decided not to appeal), has found that the cessation of the Employee’s employment amounted to unfair or constructive dismissal of the Employee. 12.6 The Employee undertakes not to use or disclose the contents of these terms and conditions, or any financial information, trade secrets, customer lists or other information which it may from time to time receive or obtain (orally or in writing or in disc or electronic form) as a result of entering into or performing its obligations pursuant to these terms and conditions or otherwise, relating to the Group unless: (i) required to do so by law or pursuant to any order of court or other competent authority or tribunal; or (ii) such disclosure has been consented to by the Company, provided, however, that the Employee may disclose the terms and conditions of his or her Retention Compensation to the Employee’s spouse, personal attorney and/or tax preparer. If an Employee becomes required, in circumstances contemplated by (i) to disclose any information, the disclosing Employee shall use its best efforts to consult with the Company prior to any such disclosure. 13. TERM AND TERMINATION These terms and conditions shall enter into force on the Implementation Date and remain in force until close of business in Sweden on 31 March 2031. The parties shall, however, after such date continue to be bound by the provisions set out in clause 12.6 and 14. 14. GOVERNING LAW AND JURISDICTION 14.1 These terms and conditions shall be governed by and construed in accordance with the substantive law of Sweden (excluding its rules on conflict of laws). 14.2 The Company and the Employee undertake to use their best efforts to resolve any disagreements or disputes regarding these terms and conditions between them or any two or more of them through discussions and mutual agreement. 14.3 Any dispute, controversy or claim arising out of or in connection with these terms and conditions, or the breach, termination or invalidity thereof, shall be finally settled by arbitration in accordance with the Arbitration Rules of the Arbitration Institute of the Stockholm Chamber of Commerce. Unless otherwise agreed between the parties to such arbitration, the Arbitral Tribunal shall be composed of a sole arbitrator, the seat of arbitration shall be Stockholm and the language to be used in the arbitral proceedings shall be English. 14.4 The arbitral proceedings and all information and documentation related thereto shall be confidential, unless a disclosure is required under any applicable law, relevant stock exchange regulations or order of court, other tribunal or competition authority or as otherwise agreed between the Company and the Employee in writing.