| Second Quarter 2025 Investor Presentation August 8, 2025 |

| 2 Cautionary Statements Forward Looking Statements Certain statements and information in this presentation (as well as information included in other written or oral statements we make from time to time) may contain or constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The words “believe,” “estimate,” “project,” “expect,” “anticipate,” “affirm,” “plan,” “intend,” “foresee,” “should,” “would,” “could,” “continue,” “committed,” “attempt,” “aim,” “target,” “objective,” “guides,” “seek,” “focus,” “provides guidance,” “provides outlook” or other similar expressions are intended to identify forward-looking statements, which are not historical in nature. These forward-looking statements, including statements about our strategic initiatives and market opportunities, including our financial outlook for 2025, the impact of our investments in Arroweye and other solutions, and our qualitative color on our business in 2025 and beyond; are based on our current expectations and beliefs concerning future developments and their potential effect on us and other information currently available. Such forward-looking statements, because they relate to future events, are by their very nature subject to many important risks and uncertainties that could cause actual results or other events to differ materially from those contemplated. These risks and uncertainties include, but are not limited to: (i) risks relating to our business and industry, such as a deterioration in general economic conditions, including due to inflationary conditions, resulting in reduced consumer confidence and business spending, and a decline in consumer credit worthiness impacting demand for our products; the unpredictability of our operating results, including an inability to anticipate changes in customer inventory management practices and its impact on our business; our failure to retain our existing key customers or identify and attract new customers; the highly competitive, saturated and consolidated nature of our marketplace; our inability to develop, introduce and commercialize new products and services, including due to our inability to undertake research and development activities; new and developing technologies that make our existing technology solutions and products obsolete or less relevant or our failure to introduce new products and services in a timely manner or at all; system security risks, data protection breaches and cyber-attacks; the usage, or lack thereof, of artificial intelligence technologies; disruptions, delays or other failures in our supply chain, including as a result of inflationary pressures, single-source suppliers, failure or inability of suppliers to comply with our code of conduct or contractual requirements, trade restrictions, tariffs, foreign conflicts or political unrest in countries in which our suppliers operate, and our inability to pass related costs on to our customers or difficulty meeting customers’ delivery expectations due to extended lead times; changes in U.S. trade policy and the impact of tariffs on our business and results of operations; interruptions in our operations, including our information technology systems, or in the operations of the third parties that operate computing infrastructure on which we rely; defects in our software and computing systems; disruptions in production at one or more of our facilities due to weather conditions, climate change, political instability, or social unrest; problems in production quality, materials and process and costs relating to product defects and any related product liability and/or warranty claims and damage to our reputation; our inability to recruit, retain and develop qualified personnel, including key personnel, and implement effective succession processes; our substantial indebtedness, including the restrictive terms of our indebtedness and covenants of future agreements governing indebtedness and the resulting restraints on our ability to pursue our business strategies; our inability to make debt service payments or refinance such indebtedness; our inability to successfully execute on, integrate, or achieve the anticipated benefits of acquisitions, including the acquisition of Arroweye, or execute on divestitures or strategic relationships; our status as an accelerated filer and complying with the Sarbanes-Oxley Act of 2002 and the costs associated with such compliance and implementation of procedures thereunder; our failure to maintain effective internal control over financial reporting and risks relating to investor confidence in our financial reporting; environmental, social and governance (“ESG”) preferences and demands of various stakeholders and the related impact on our ability to access capital, produce our products in conformity with stakeholder preferences, comply with stakeholder demands and comply with any related legal or regulatory requirements or restrictions; negative perceptions of our products due to the impact of our products and production processes on the environment and other ESG-related risks; damage to our reputation or brand image; the effects of climate change on our business; our inability to adequately protect our trade secrets and intellectual property rights from misappropriation, infringement claims brought against us and risks related to open source software; our inability to renew licenses with key technology licensors; our limited ability to raise capital, which may lead to delays in innovation or the abandonment of our strategic initiatives; costs and impacts related to additional tax collection efforts by states, unclaimed property laws, or future increases in U.S. federal or state income taxes, resulting in additional expenses which we may be unable to pass along to our customers; our inability to realize the full value of our long-lived assets; costs and potential liabilities associated with compliance or failure to comply with laws and regulations, customer contractual requirements and evolving industry standards regarding consumer privacy and data use and security; our failure to operate our business in accordance with the Payment Card Industry Security Standards Council security standards or other industry standards; the effects of trade restrictions, delays or interruptions in our ability to source raw materials and components used in our products from foreign countries; the effects of ongoing foreign conflicts on the global economy; adverse conditions in the banking system and financial markets, including the failure of banks and financial institutions; our failure to comply with environmental, health and safety laws and regulations that apply to our products and the raw materials we use in our production processes; (ii) risks relating to ownership of our common stock, such as those associated with concentrated ownership of our stock by our significant stockholders and potential conflicts of interests with other stockholders; the impact of concentrated ownership of our common stock and the sale or perceived sale of a substantial amount of common stock on the trading volume and market price of our common stock; potential conflicts of interest that may arise due to our board of directors being comprised in part of directors who are principals of or were nominated by our significant stockholders; the influence of securities analysts over the trading market for and price of our common stock, particularly due to the lack of substantial research coverage of our common stock; the impact of stockholder activism or securities litigation on the trading price and volatility of our common stock; certain provisions of our organizational documents and other contractual provisions that may delay or prevent a change in control and make it difficult for stockholders other than our significant stockholders to change the composition of our board of directors; and (iii) general risks, such as relating to our ability to comply with a wide variety of complex evolving laws and regulations and the exposure to liability for any failure to comply; the effect of legal and regulatory proceedings and the adequacy of our insurance policies; and other risks that are described in Part I, Item 1A, Risk Factors in our Annual Report on Form 10-K for the year ended December 31, 2024 filed with the SEC on March 4, 2025, in Part II, Item 1A, Risk Factors of our Quarterly Report on Form 10-Q for the quarter ended March 31, 2025 filed with the SEC on May 7, 2025, and our other reports filed from time to time with the Securities and Exchange Commission (the “SEC”). We caution and advise readers not to place undue reliance on forward-looking statements, which speak only as of the date hereof. These statements are based on assumptions that may not be realized and involve risks and uncertainties that could cause actual results or other events to differ materially from the expectations and beliefs contained herein. We undertake no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise. Non-GAAP Financial Measures In addition to financial results reported in accordance with U.S. generally accepted accounting principles (“GAAP”), we have provided the following non-GAAP financial measures in this release, all reported on a continuing operations basis: Net Sales excluding the Impact of an Accounting Change, EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, Free Cash Flow, LTM Adjusted EBITDA and Net Leverage Ratio. These non-GAAP financial measures are utilized by management in comparing our operating performance on a consistent basis between fiscal periods and serve as a basis for certain Company compensation programs. We believe that these financial measures are appropriate to enhance an overall understanding of our underlying operating performance trends compared to historical and prospective periods and our peers. Management also believes that these measures are useful to investors in their analysis of our results of operations and provide improved comparability between fiscal periods. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information calculated in accordance with GAAP. Our non-GAAP measures may be different from similarly titled measures of other companies. Investors are encouraged to review the reconciliation of these historical non-GAAP measures to their most directly comparable GAAP financial measures included in the appendix to this presentation. |

| 3 Agenda Overview and Strategy Q2 Financial Review 2025 Outlook Summary 1 2 3 4 |

| Overview 4 Core business performing well Secure card Card@Once® instant issuance Prepaid solutions Arroweye off to strong start Margin pressures from sales mix and increased production costs, including tariffs 2025 full-year sales and Adjusted EBITDA¹ outlook updated Net sales outlook range increased to reflect Arroweye acquisition Adjusted EBITDA¹ outlook unchanged Outlook does not reflect potential impact of proposed tariffs on chips announced August 6 Continue to invest for long-term growth 1) Adjusted EBITDA is not a measurement of financial performance prepared in accordance with GAAP. We have provided non-GAAP Adjusted EBITDA expectations for 2025 because certain reconciling items are dependent on future events that either cannot be controlled or cannot be reliably predicted because they are not part of the Company’s routine activities, any of which could be significant. |

| Strategy Review 5 The Contactless Indicator mark, consisting of four graduating arcs, is a trademark owned by and used with permission of EMVCo, LLC. Strategic Pillars Customer focus Quality and efficiency Innovation and diversification People and culture Expand Addressable Markets Leverage technology connections and relationships within the U.S. payments eco-system to offer additional payment solutions, including digital solutions, for existing base of thousands of SME financial institution customers Provide existing solutions to new customer verticals Vision: To be the most trusted partner for innovative payment technology solutions |

| 6 Strategy: Arroweye Opportunities for CPI + Arroweye Complementary businesses Arroweye digitally-driven, all-in-one delivery process targets diverse use cases vs. CPI primary focus on debit and credit payment cards for financial institutions Arroweye serves prepaid program managers, payroll-related providers, fintechs, banks, credit unions, others Arroweye participates in a variety of segments, including incentives, rebates, gift cards, prepaid, payroll, healthcare, government, insurance, fleet, debit and credit, and others Minimal customer overlap CPI financial backing supports Arroweye share opportunity |

| Strategy: Key Investments to Enhance Long-term Growth 7 Beginning to realize benefits from investment spending Card@Once® instant issuance Entry into closed-loop prepaid packages market in U.S. Expanded healthcare payment card solutions Growing interest in other digital solutions Sales of metal cards CPI Confidential and Proprietary | Not for distribution |

| 2025 Q2 Financial Review 8 |

| Q2 Highlights 9 Solid sales growth from debit and credit card solutions portfolio; Arroweye acquisition completed; gross margins pressured Q2 net sales increased 9% to $129.8 million Sales increased 15% excluding the impact of accounting change affecting revenue recognition for work-in-process orders Debit and Credit organic growth led by Card@Once® instant issuance and contactless metal cards Gross margin decreased due to sales mix and increased production costs, including tariff expenses Net income impacted by acquisition-related costs, restructuring charges, higher interest expense, and gross margin decline, as well as accounting change; net income decreased 91% to $0.5 million and net income margin decreased from 5.1% to 0.4% Adjusted EBITDA¹ increased 3% to $22.5 million; Adjusted EBITDA margin¹ decreased from 18.4% to 17.3% 1) Adjusted EBITDA, Adjusted EBITDA margin and Free Cash Flow are not measurements of financial performance prepared in accordance with GAAP. See “Reconciliations of Non-GAAP Financial Measures” at the end of this document for more information and reconciliations to the most directly comparable GAAP financial measures. The Contactless Indicator mark, consisting of four graduating arcs, is a trademark owned by and used with permission of EMVCo, LLC. |

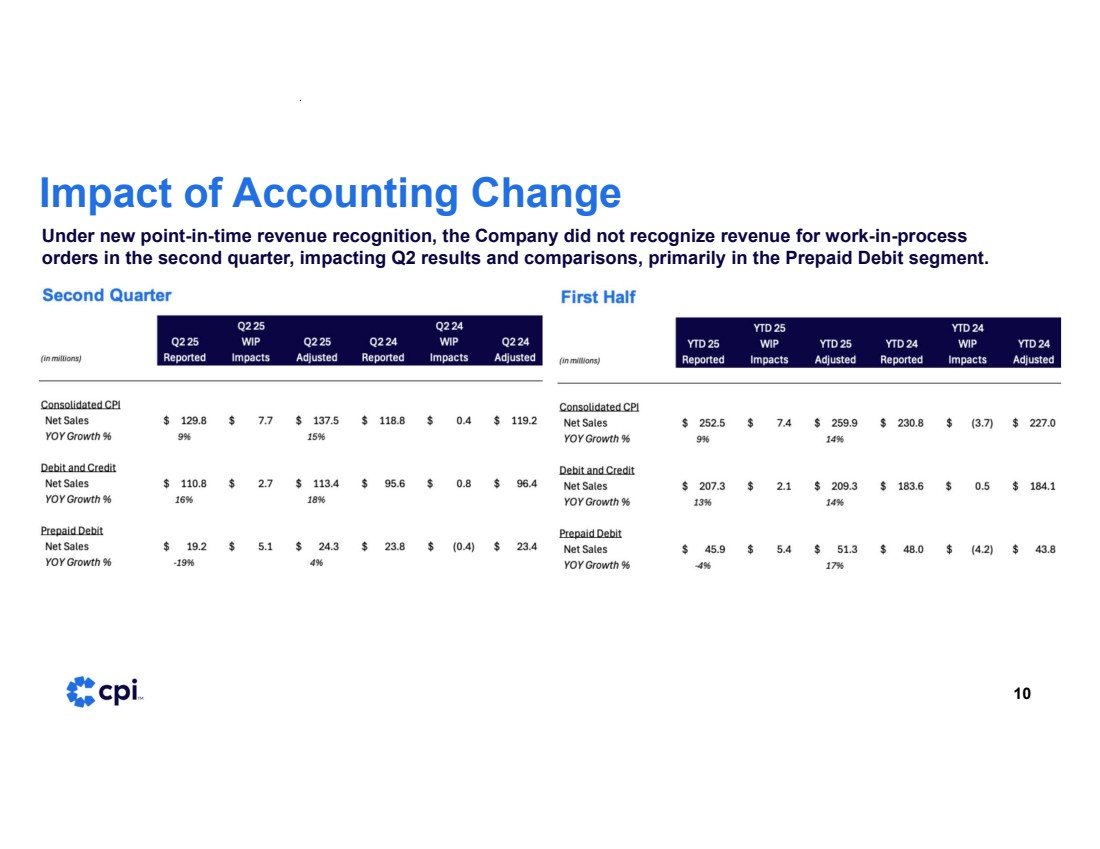

| Impact of Accounting Change 10 Under new point-in-time revenue recognition, the Company did not recognize revenue for work-in-process orders in the second quarter, impacting Q2 results and comparisons, primarily in the Prepaid Debit segment. |

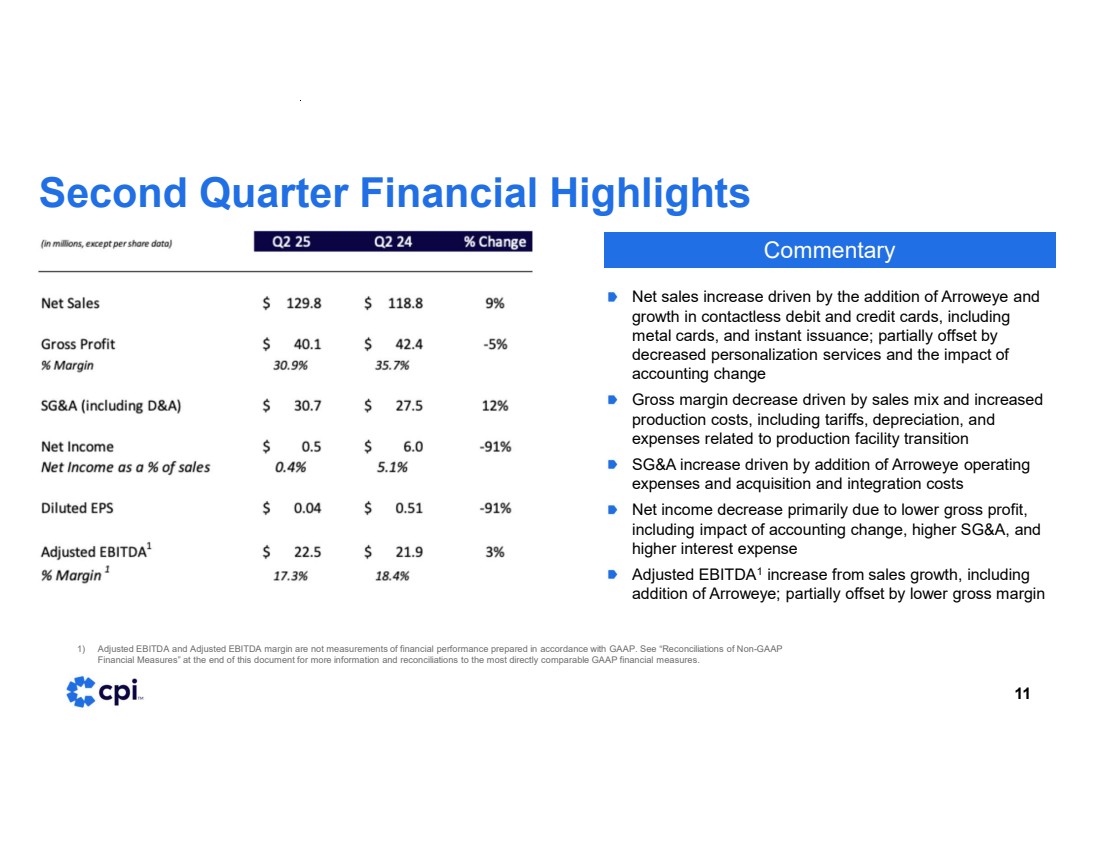

| Second Quarter Financial Highlights 11 1) Adjusted EBITDA and Adjusted EBITDA margin are not measurements of financial performance prepared in accordance with GAAP. See “Reconciliations of Non-GAAP Financial Measures” at the end of this document for more information and reconciliations to the most directly comparable GAAP financial measures. Net sales increase driven by the addition of Arroweye and growth in contactless debit and credit cards, including metal cards, and instant issuance; partially offset by decreased personalization services and the impact of accounting change Gross margin decrease driven by sales mix and increased production costs, including tariffs, depreciation, and expenses related to production facility transition SG&A increase driven by addition of Arroweye operating expenses and acquisition and integration costs Net income decrease primarily due to lower gross profit, including impact of accounting change, higher SG&A, and higher interest expense Adjusted EBITDA1 increase from sales growth, including addition of Arroweye; partially offset by lower gross margin Commentary |

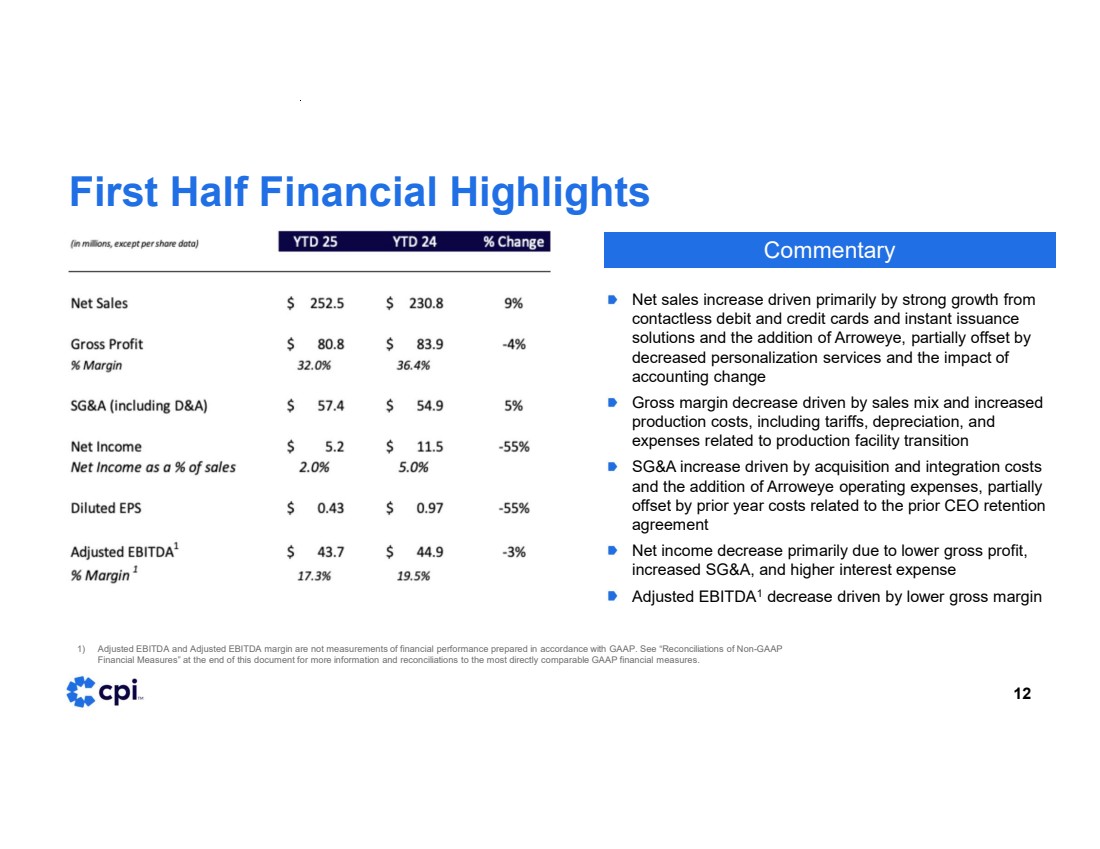

| First Half Financial Highlights 12 1) Adjusted EBITDA and Adjusted EBITDA margin are not measurements of financial performance prepared in accordance with GAAP. See “Reconciliations of Non-GAAP Financial Measures” at the end of this document for more information and reconciliations to the most directly comparable GAAP financial measures. Net sales increase driven primarily by strong growth from contactless debit and credit cards and instant issuance solutions and the addition of Arroweye, partially offset by decreased personalization services and the impact of accounting change Gross margin decrease driven by sales mix and increased production costs, including tariffs, depreciation, and expenses related to production facility transition SG&A increase driven by acquisition and integration costs and the addition of Arroweye operating expenses, partially offset by prior year costs related to the prior CEO retention agreement Net income decrease primarily due to lower gross profit, increased SG&A, and higher interest expense Adjusted EBITDA1 decrease driven by lower gross margin Commentary |

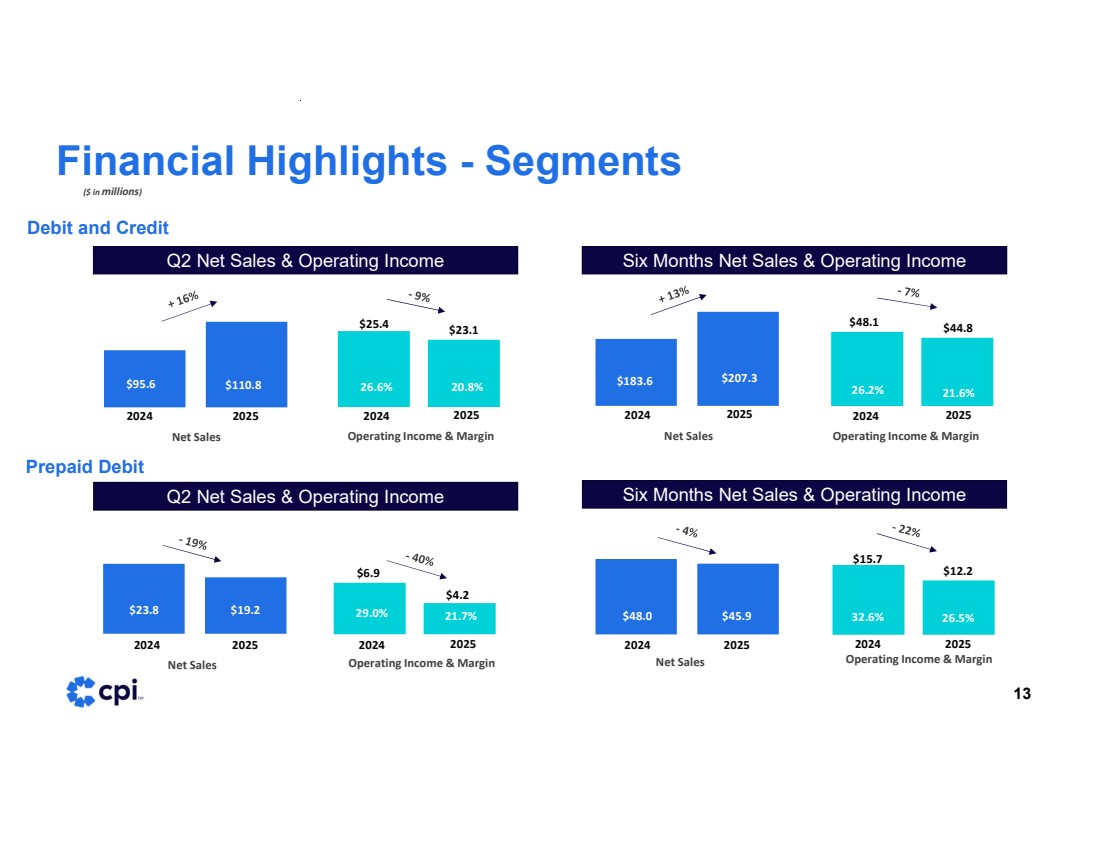

| Financial Highlights - Segments Debit and Credit Q2 Net Sales & Operating Income Q2 Net Sales & Operating Income Prepaid Debit ($ in millions) 24.0% 29.8% Operating Income & Margin Net Sales 37.0% 27.7% Operating Income & Margin $20.4 $19.2 $15.9 $22.1 24.3% 23.4% Net Sales $94.2 $93.2 $93.2 $94.2 26.9% 26.9% 2024 2025 $95.6 $110.8 2024 2025 26.6% 20.8% $25.4 $23.1 2024 2025 $23.8 $19.2 2024 2025 29.0% 21.7% $4.2 $6.9 13 Six Months Net Sales & Operating Income Six Months Net Sales & Operating Income 2024 $207.3 2025 Net Sales Operating Income & Margin Net Sales Operating Income & Margin $183.6 $207.3 2024 2025 $48.0 $45.9 32.6% 26.5% $12.2 $15.7 2024 2025 2024 2025 26.2% 21.6% $48.1 $44.8 |

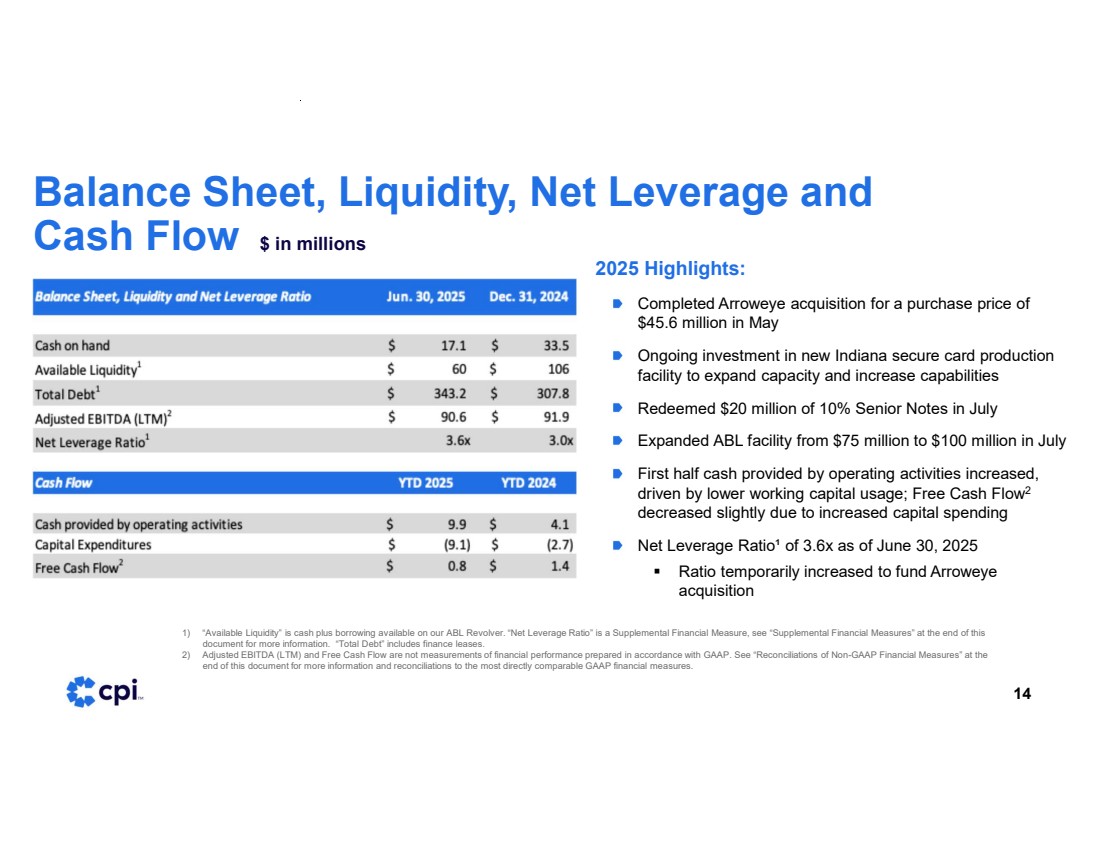

| Balance Sheet, Liquidity, Net Leverage and Cash Flow 14 $ in millions 2025 Highlights: Completed Arroweye acquisition for a purchase price of $45.6 million in May Ongoing investment in new Indiana secure card production facility to expand capacity and increase capabilities Redeemed $20 million of 10% Senior Notes in July Expanded ABL facility from $75 million to $100 million in July First half cash provided by operating activities increased, driven by lower working capital usage; Free Cash Flow2 decreased slightly due to increased capital spending Net Leverage Ratio¹ of 3.6x as of June 30, 2025 Ratio temporarily increased to fund Arroweye acquisition 1) “Available Liquidity” is cash plus borrowing available on our ABL Revolver. “Net Leverage Ratio” is a Supplemental Financial Measure, see “Supplemental Financial Measures” at the end of this document for more information. “Total Debt” includes finance leases. 2) Adjusted EBITDA (LTM) and Free Cash Flow are not measurements of financial performance prepared in accordance with GAAP. See “Reconciliations of Non-GAAP Financial Measures” at the end of this document for more information and reconciliations to the most directly comparable GAAP financial measures. |

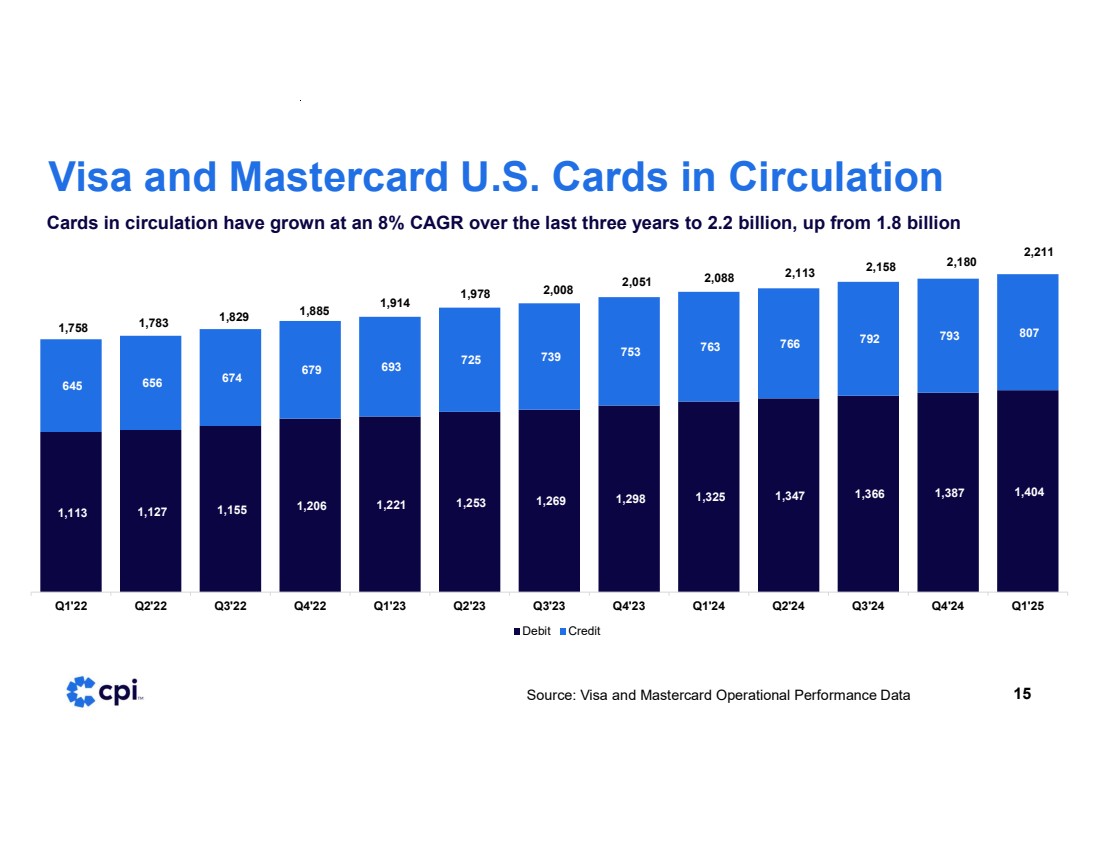

| 1,113 1,127 1,155 1,206 1,221 1,253 1,269 1,298 1,325 1,347 1,366 1,387 1,404 645 656 674 679 693 725 739 753 763 766 792 793 807 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 Q1'25 Debit Credit 15 2,051 2,088 2,113 2,158 2,180 1,758 2,211 1,783 1,829 1,885 1,914 1,978 2,008 Source: Visa and Mastercard Operational Performance Data Visa and Mastercard U.S. Cards in Circulation Cards in circulation have grown at an 8% CAGR over the last three years to 2.2 billion, up from 1.8 billion |

| 2025 Outlook 16 Net Sales and Adjusted EBITDA outlooks updated; changes from previous outlook primarily reflect addition of Arroweye, increased tariffs, and unfavorable sales mix Full-year outlook 2025 Net Sales: low double-digit to mid-teens increase (previously mid-to-high single-digit increase) Adjusted EBITDA¹: mid-to-high single-digit increase (unchanged) Outlook does not reflect potential impact of proposed tariffs on chips announced August 6 Long-term growth trends remain intact Growth in U.S. cards in circulation Recurring nature of business Trends toward adoption of higher value contactless cards and secure packaging solutions 1) Adjusted EBITDA and Free Cash Flow are not measurements of financial performance prepared in accordance with GAAP. We have provided non-GAAP Adjusted EBITDA expectations for 2025 because certain reconciling items are dependent on future events that either cannot be controlled or cannot be reliably predicted because they are not part of the Company’s routine activities, any of which could be significant. |

| Summary 17 Core businesses performing; Arroweye off to strong start Net sales and Adjusted EBITDA outlook for 2025 updated Organic sales growth on track with prior outlook Long-term secular trends remain intact CPI well-positioned with innovative and high-quality solutions and strong customer focus Strategic focus to build from current foundation and expand into adjacencies Continuing to invest to drive future growth Arroweye acquisition supports diversification strategy |

| Contact (877) 369-9016 investorrelations@cpicardgroup.com www.cpicardgroup.com 18 |

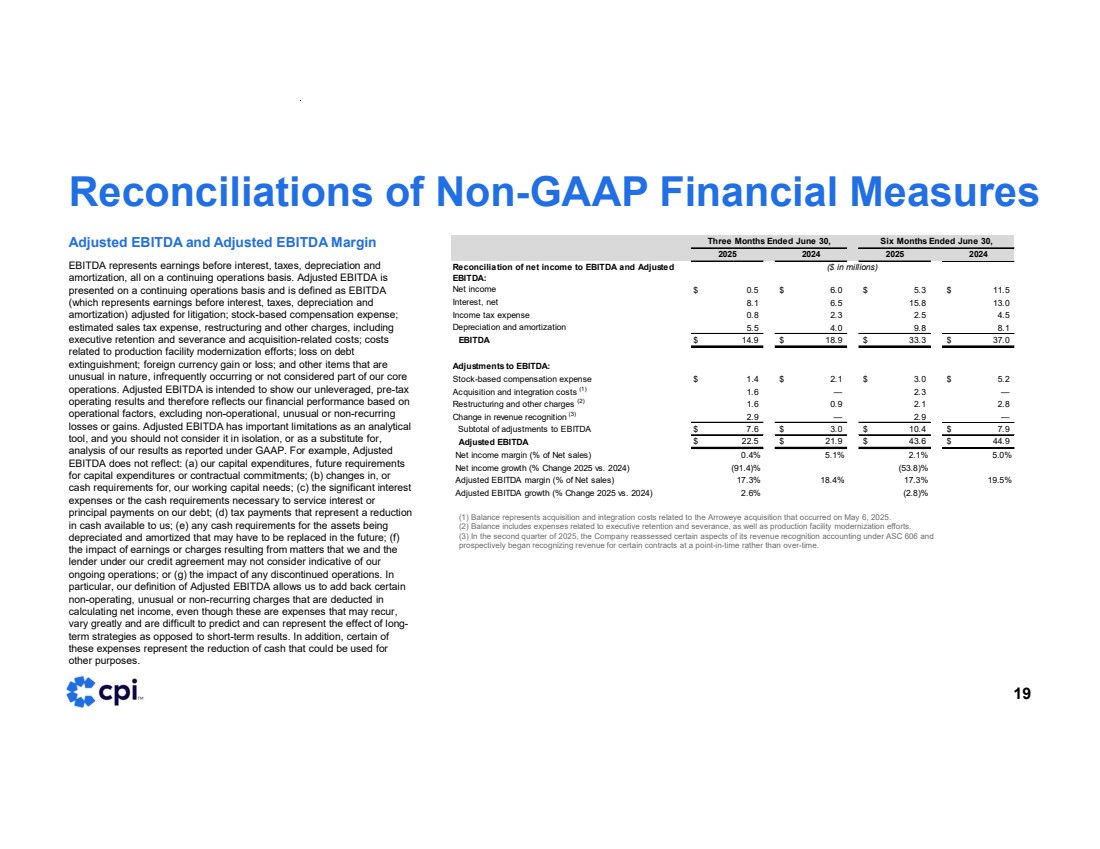

| Reconciliations of Non-GAAP Financial Measures 19 Adjusted EBITDA and Adjusted EBITDA Margin EBITDA represents earnings before interest, taxes, depreciation and amortization, all on a continuing operations basis. Adjusted EBITDA is presented on a continuing operations basis and is defined as EBITDA (which represents earnings before interest, taxes, depreciation and amortization) adjusted for litigation; stock-based compensation expense; estimated sales tax expense, restructuring and other charges, including executive retention and severance and acquisition-related costs; costs related to production facility modernization efforts; loss on debt extinguishment; foreign currency gain or loss; and other items that are unusual in nature, infrequently occurring or not considered part of our core operations. Adjusted EBITDA is intended to show our unleveraged, pre-tax operating results and therefore reflects our financial performance based on operational factors, excluding non-operational, unusual or non-recurring losses or gains. Adjusted EBITDA has important limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for, analysis of our results as reported under GAAP. For example, Adjusted EBITDA does not reflect: (a) our capital expenditures, future requirements for capital expenditures or contractual commitments; (b) changes in, or cash requirements for, our working capital needs; (c) the significant interest expenses or the cash requirements necessary to service interest or principal payments on our debt; (d) tax payments that represent a reduction in cash available to us; (e) any cash requirements for the assets being depreciated and amortized that may have to be replaced in the future; (f) the impact of earnings or charges resulting from matters that we and the lender under our credit agreement may not consider indicative of our ongoing operations; or (g) the impact of any discontinued operations. In particular, our definition of Adjusted EBITDA allows us to add back certain non-operating, unusual or non-recurring charges that are deducted in calculating net income, even though these are expenses that may recur, vary greatly and are difficult to predict and can represent the effect of long-term strategies as opposed to short-term results. In addition, certain of these expenses represent the reduction of cash that could be used for other purposes. (1) Balance represents acquisition and integration costs related to the Arroweye acquisition that occurred on May 6, 2025. (2) Balance includes expenses related to executive retention and severance, as well as production facility modernization efforts. (3) In the second quarter of 2025, the Company reassessed certain aspects of its revenue recognition accounting under ASC 606 and prospectively began recognizing revenue for certain contracts at a point-in-time rather than over-time. Reconciliation of net income to EBITDA and Adjusted EBITDA: Net income $ 0.5 $ 6.0 $ 5.3 $ 11.5 Interest, net 6.5 8.1 15.8 13.0 Income tax expense 2.3 0.8 2.5 4.5 Depreciation and amortization 4.0 5.5 9.8 8.1 EBITDA $ 14.9 $ 18.9 $ 33.3 $ 37.0 Adjustments to EBITDA: Stock-based compensation expense $ 1.4 $ 2.1 $ 3.0 $ 5.2 Acquisition and integration costs (1) — 1.6 2.3 — Restructuring and other charges (2) 0.9 1.6 2.1 2.8 Change in revenue recognition (3) — 2.9 2.9 — Subtotal of adjustments to EBITDA $ 7.6 $ 3.0 $ 10.4 $ 7.9 Adjusted EBITDA $ 22.5 $ 21.9 $ 43.6 $ 44.9 Net income margin (% of Net sales) 0.4% 5.1% 2.1% 5.0% Net income growth (% Change 2025 vs. 2024) (91.4)% (53.8)% Adjusted EBITDA margin (% of Net sales) 17.3% 18.4% 17.3% 19.5% Adjusted EBITDA growth (% Change 2025 vs. 2024) 2.6% (2.8)% ($ in millions) Three Months Ended June 30, Six Months Ended June 30, 2025 2024 2025 2024 |

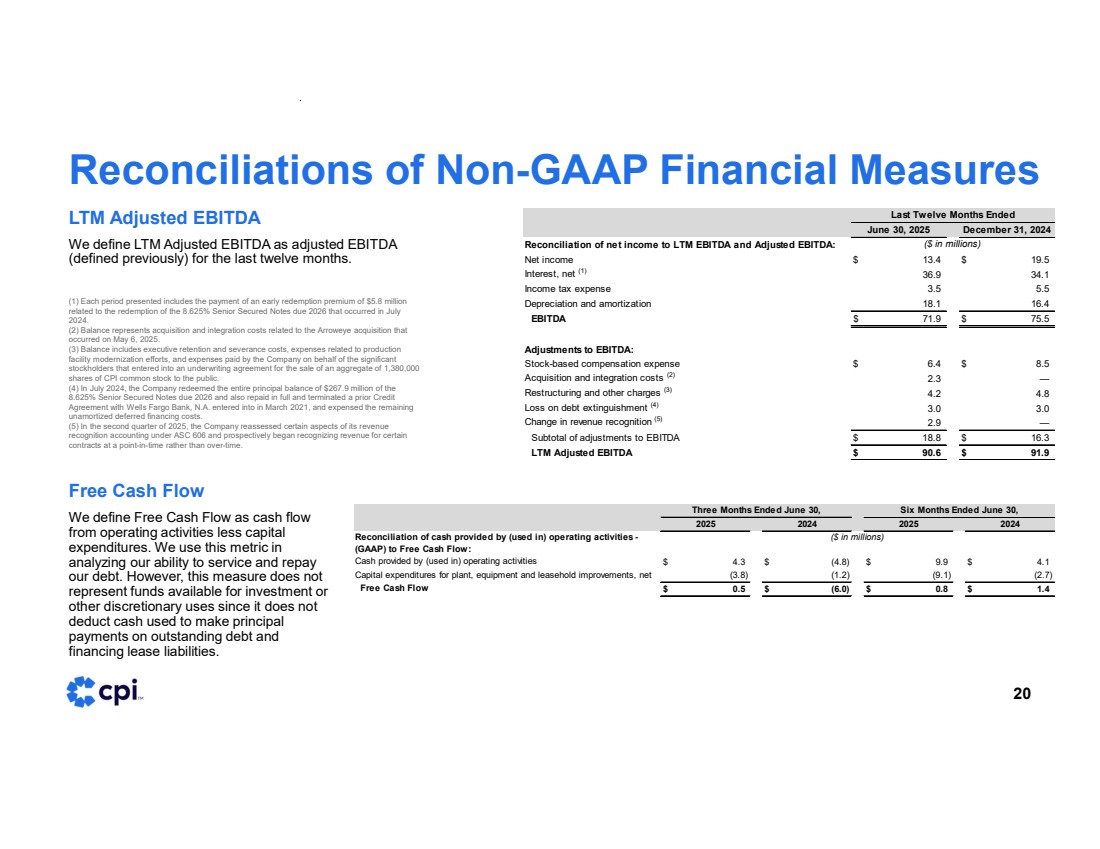

| Reconciliations of Non-GAAP Financial Measures 20 LTM Adjusted EBITDA We define LTM Adjusted EBITDA as adjusted EBITDA (defined previously) for the last twelve months. Free Cash Flow We define Free Cash Flow as cash flow from operating activities less capital expenditures. We use this metric in analyzing our ability to service and repay our debt. However, this measure does not represent funds available for investment or other discretionary uses since it does not deduct cash used to make principal payments on outstanding debt and financing lease liabilities. (1) Each period presented includes the payment of an early redemption premium of $5.8 million related to the redemption of the 8.625% Senior Secured Notes due 2026 that occurred in July 2024. (2) Balance represents acquisition and integration costs related to the Arroweye acquisition that occurred on May 6, 2025. (3) Balance includes executive retention and severance costs, expenses related to production facility modernization efforts, and expenses paid by the Company on behalf of the significant stockholders that entered into an underwriting agreement for the sale of an aggregate of 1,380,000 shares of CPI common stock to the public. (4) In July 2024, the Company redeemed the entire principal balance of $267.9 million of the 8.625% Senior Secured Notes due 2026 and also repaid in full and terminated a prior Credit Agreement with Wells Fargo Bank, N.A. entered into in March 2021, and expensed the remaining unamortized deferred financing costs. (5) In the second quarter of 2025, the Company reassessed certain aspects of its revenue recognition accounting under ASC 606 and prospectively began recognizing revenue for certain contracts at a point-in-time rather than over-time. Reconciliation of cash provided by (used in) operating activities - (GAAP) to Free Cash Flow: Cash provided by (used in) operating activities $ 4.3 $ (4.8) $ 9.9 $ 4.1 Capital expenditures for plant, equipment and leasehold improvements, net (3.8) (1.2) (9.1) (2.7) Free Cash Flow $ 0.5 $ (6.0) $ 0.8 $ 1.4 ($ in millions) Three Months Ended June 30, Six Months Ended June 30, 2025 2024 2025 2024 Reconciliation of net income to LTM EBITDA and Adjusted EBITDA: Net income $ 13.4 $ 19.5 Interest, net (1) 34.1 36.9 Income tax expense 3.5 5.5 Depreciation and amortization 18.1 16.4 EBITDA $ 71.9 $ 75.5 Adjustments to EBITDA: Stock-based compensation expense $ 6.4 $ 8.5 Acquisition and integration costs (2) — 2.3 Restructuring and other charges (3) 4.8 4.2 Loss on debt extinguishment (4) 3.0 3.0 Change in revenue recognition (5) — 2.9 Subtotal of adjustments to EBITDA $ 18.8 $ 16.3 LTM Adjusted EBITDA $ 90.6 $ 91.9 June 30, 2025 December 31, 2024 ($ in millions) Last Twelve Months Ended |

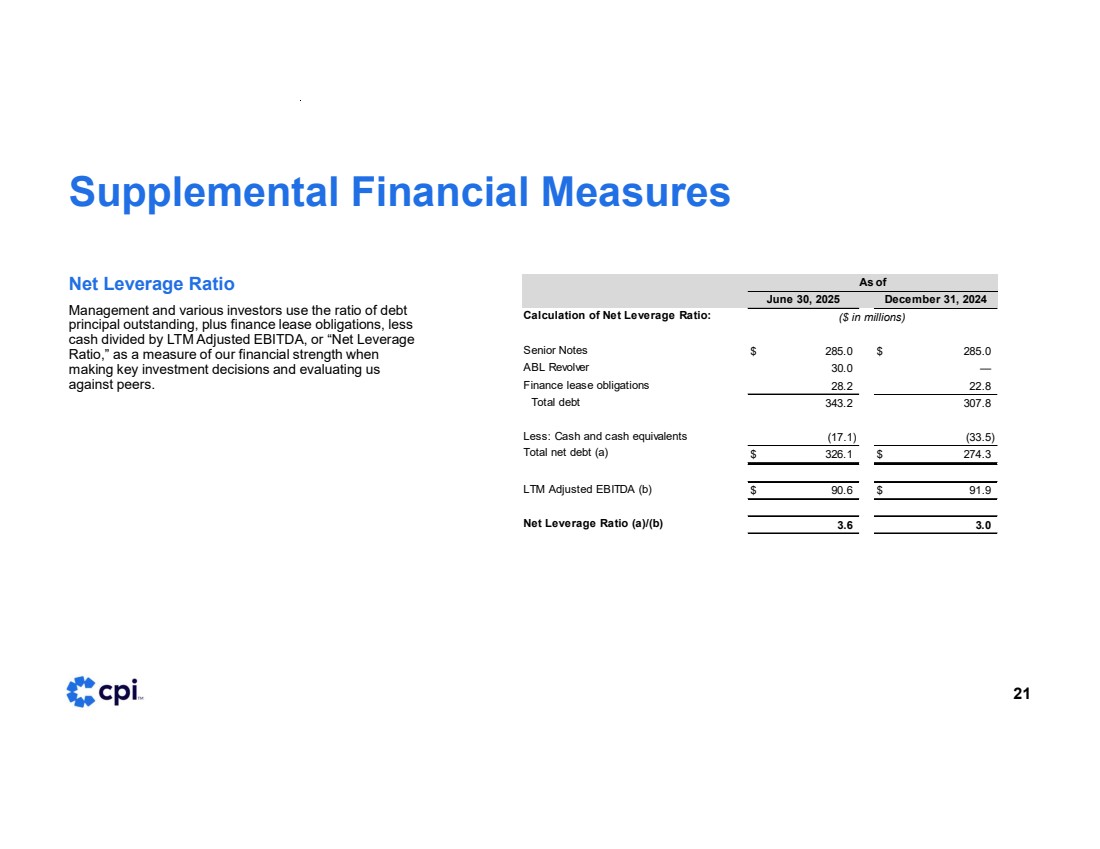

| Supplemental Financial Measures 21 Net Leverage Ratio Management and various investors use the ratio of debt principal outstanding, plus finance lease obligations, less cash divided by LTM Adjusted EBITDA, or “Net Leverage Ratio,” as a measure of our financial strength when making key investment decisions and evaluating us against peers. Calculation of Net Leverage Ratio: Senior Notes $ 285.0 $ 285.0 ABL Revolver — 30.0 Finance lease obligations 22.8 28.2 Total debt 307.8 343.2 Less: Cash and cash equivalents (33.5) (17.1) Total net debt (a) $ 326.1 $ 274.3 LTM Adjusted EBITDA (b) $ 90.6 $ 91.9 Net Leverage Ratio (a)/(b) 3.0 3.6 As of June 30, 2025 December 31, 2024 ($ in millions) |