Financial Results and Supplemental Information FISCAL FIRST QUARTER 2026 February 4, 2026 .2

2Fiscal Q1 2026 Table of Contents Trading Symbol: Common Shares: RMR Investor Relations Contact: Bryan Maher, Senior Vice President (617) 796-8230 bryan.maher@rmrgroup.com ir@rmrgroup.com Corporate Headquarters: Two Newton Place 255 Washington Street, Suite 300 Newton, Massachusetts 02458-1634 www.rmrgroup.com All amounts in this presentation are unaudited. Please refer to Non-GAAP Financial Measures and Certain Definitions starting on page 29 for terms used throughout this presentation. QUARTERLY RESULTS Fiscal First Quarter 2026 Highlights ...................................................................................................................................................................... 5 FINANCIALS Key Financial Data .................................................................................................................................................................................................... 7 Adjusted Net Income Attributable to The RMR Group Inc. Bridge ................................................................................................................ 8 Distributable Earnings Bridge ................................................................................................................................................................................ 9 AUM by Source ......................................................................................................................................................................................................... 10 Management and Advisory Services Revenues by Source ............................................................................................................................... 12 Well-Covered Dividend ........................................................................................................................................................................................... 13 GAAP Results: Condensed Consolidated Statements of Income ................................................................................................................... 14 GAAP Results: Earnings Per Common Share ...................................................................................................................................................... 16 GAAP Results: Condensed Consolidated Balance Sheets ............................................................................................................................... 17 NON-GAAP FINANCIAL MEASURES .......................................................................................................................................................................... 18 APPENDIX ........................................................................................................................................................................................................................ 24 WARNING CONCERNING FORWARD-LOOKING STATEMENTS ....................................................................................................................... 31

Quarterly Results

4Fiscal Q1 2026RETURN TO TABLE OF CONTENTS Newton, MA (February 4, 2026). The RMR Group Inc. (Nasdaq: RMR) today announced its financial results for the fiscal quarter ended December 31, 2025. Dividend RMR has declared a quarterly dividend on its Class A Common Stock and Class B-1 Common Stock of $0.45 per share to shareholders of record as of the close of business on January 26, 2026. This dividend will be paid on or about February 19, 2026. Conference Call A conference call to discuss RMR’s fiscal first quarter results will be held on Thursday February 5, 2026 at 10:00 a.m. Eastern Time. The conference call may be accessed by dialing (844) 481-2945 or (412) 317-1868 (if calling from outside the U.S. and Canada); a pass code is not required. A replay will be available for one week by dialing (855) 669-9658; the replay pass code is 4654163. A live audio webcast of the conference call will also be available in a listen- only mode on RMR’s website, at www.rmrgroup.com. The archived webcast will be available for replay on RMR’s website after the call. The transcription, recording and retransmission in any way are strictly prohibited without the prior written consent of RMR. About The RMR Group The RMR Group is a leading U.S. alternative asset management company, unique for its focus on both residential and commercial real estate (CRE) and related businesses. RMR’s vertical integration is supported by nearly 900 real estate professionals in more than 30 offices nationwide who manage over $37 billion in assets under management and leverage 40 years of institutional experience in buying, selling, financing and operating CRE. RMR benefits from a scalable platform, a deep and experienced management team and a diversity of direct real estate strategies across its clients. RMR is headquartered in Newton, MA and was founded in 1986. For more information, please visit www.rmrgroup.com. “We largely exceeded our expectations for RMR’s first quarter results as share price gains at DHC and ILPT, along with a full quarter contribution from two recently acquired residential communities, helped offset the adverse impact of the wind down of AlerisLife. Additionally, RMR earned $23.6 million of incentive fees for calendar year 2025 as DHC and ILPT materially outperformed their industry benchmarks. First quarter results reflect net income per share of $0.71, Adjusted Net Income per share of $0.20, Adjusted EBITDA of $19.5 million, Adjusted EBITDA Margin of 42.9% and Distributable Earnings per share of $0.47. During the quarter, we assisted our Managed Equity REITs with nearly $800 million in asset sales, using the proceeds primarily to delever their respective balance sheets. We also fully backstopped SEVN’s successful common share rights offering, increasing our ownership in SEVN to 20.3%. With $149.3 million in liquidity and a scalable operating platform, we believe we are well positioned to execute on our strategic goals as we enter 2026.” Adam Portnoy, President and Chief Executive Officer The RMR Group Inc. Announces Fiscal First Quarter 2026 Financial Results

5Fiscal Q1 2026RETURN TO TABLE OF CONTENTS Incentive Fees & Liquidity Financial Highlights Loan Sale & SEVN Rights Offering • Assets Under Management of $37.2 billion. • Net income of $26.8 million, net income margin of 40.2% and net income attributable to The RMR Group Inc. of $12.2 million, or $0.71 per diluted share. • Adjusted Net Income Attributable to The RMR Group Inc. of $3.4 million, or $0.20 per diluted share, and Distributable Earnings of $15.2 million, or $0.47 per diluted share. • Adjusted EBITDA of $19.5 million and Adjusted EBITDA Margin of 42.9%. Fiscal First Quarter 2026 Highlights • RMR sold its loan portfolio to Seven Hills Realty Trust (SEVN) for $61.7 million, repaid the $45.1 million outstanding on its secured financing facility and terminated the facility. This resulted in net proceeds of approximately $16.6 million. • RMR participated in and fully backstopped SEVN's common shares rights offering. As part of this offering, RMR invested approximately $24.8 million of cash on hand, including $17.4 million in connection with the backstop agreement, which increased its equity interest in SEVN to 20.3%. • RMR earned aggregate incentive fees of $23.6 million, including $17.9 million and $5.7 million from DHC and ILPT, respectively, for the 2025 calendar year. These fees were paid in January 2026. • As of December 31, 2025, RMR had $149.3 million of total liquidity, including $49.3 million of cash on hand and $100.0 million available on its revolving credit facility, for opportunistic investments and other strategic actions.

Financials

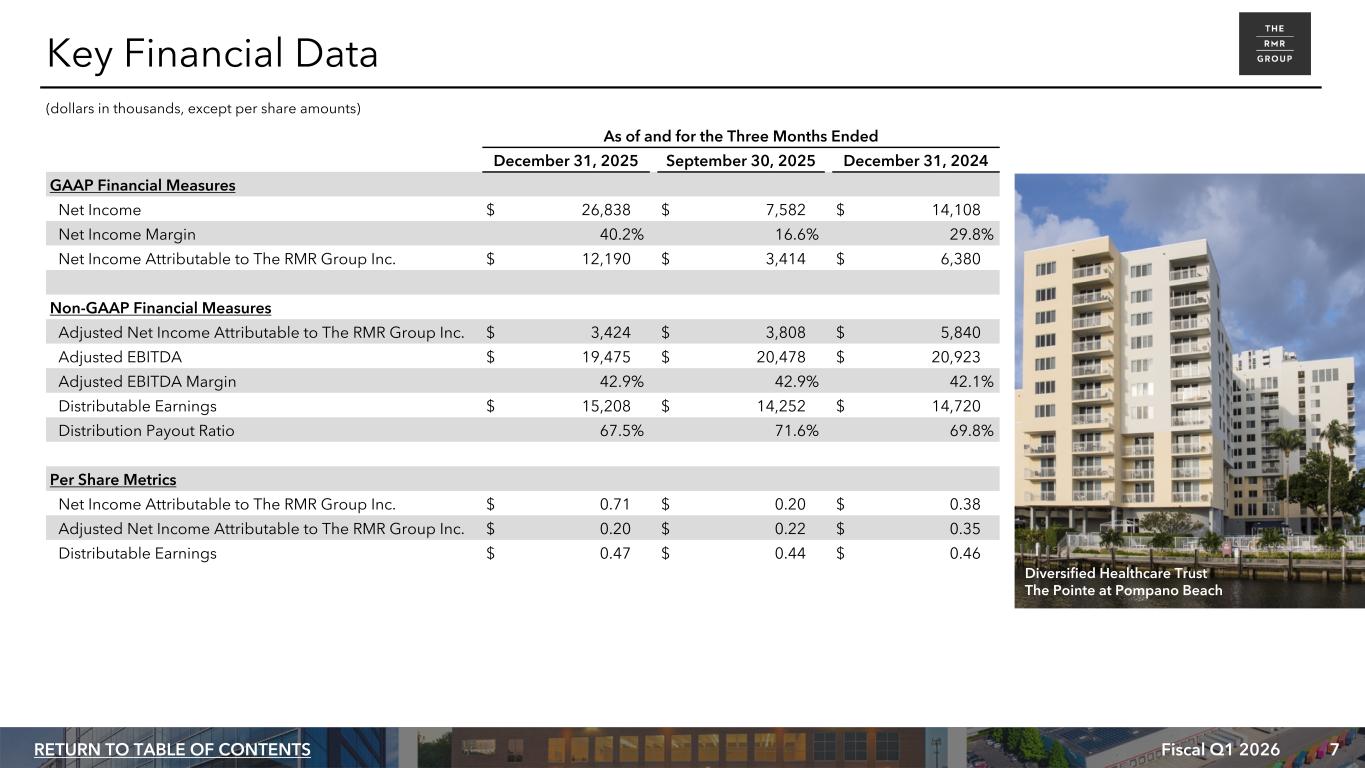

7Fiscal Q1 2026RETURN TO TABLE OF CONTENTS Key Financial Data As of and for the Three Months Ended December 31, 2025 September 30, 2025 December 31, 2024 GAAP Financial Measures Net Income $ 26,838 $ 7,582 $ 14,108 Net Income Margin 40.2% 16.6% 29.8% Net Income Attributable to The RMR Group Inc. $ 12,190 $ 3,414 $ 6,380 Non-GAAP Financial Measures Adjusted Net Income Attributable to The RMR Group Inc. $ 3,424 $ 3,808 $ 5,840 Adjusted EBITDA $ 19,475 $ 20,478 $ 20,923 Adjusted EBITDA Margin 42.9% 42.9% 42.1% Distributable Earnings $ 15,208 $ 14,252 $ 14,720 Distribution Payout Ratio 67.5% 71.6% 69.8% Per Share Metrics Net Income Attributable to The RMR Group Inc. $ 0.71 $ 0.20 $ 0.38 Adjusted Net Income Attributable to The RMR Group Inc. $ 0.20 $ 0.22 $ 0.35 Distributable Earnings $ 0.47 $ 0.44 $ 0.46 (dollars in thousands, except per share amounts) Diversified Healthcare Trust The Pointe at Pompano Beach

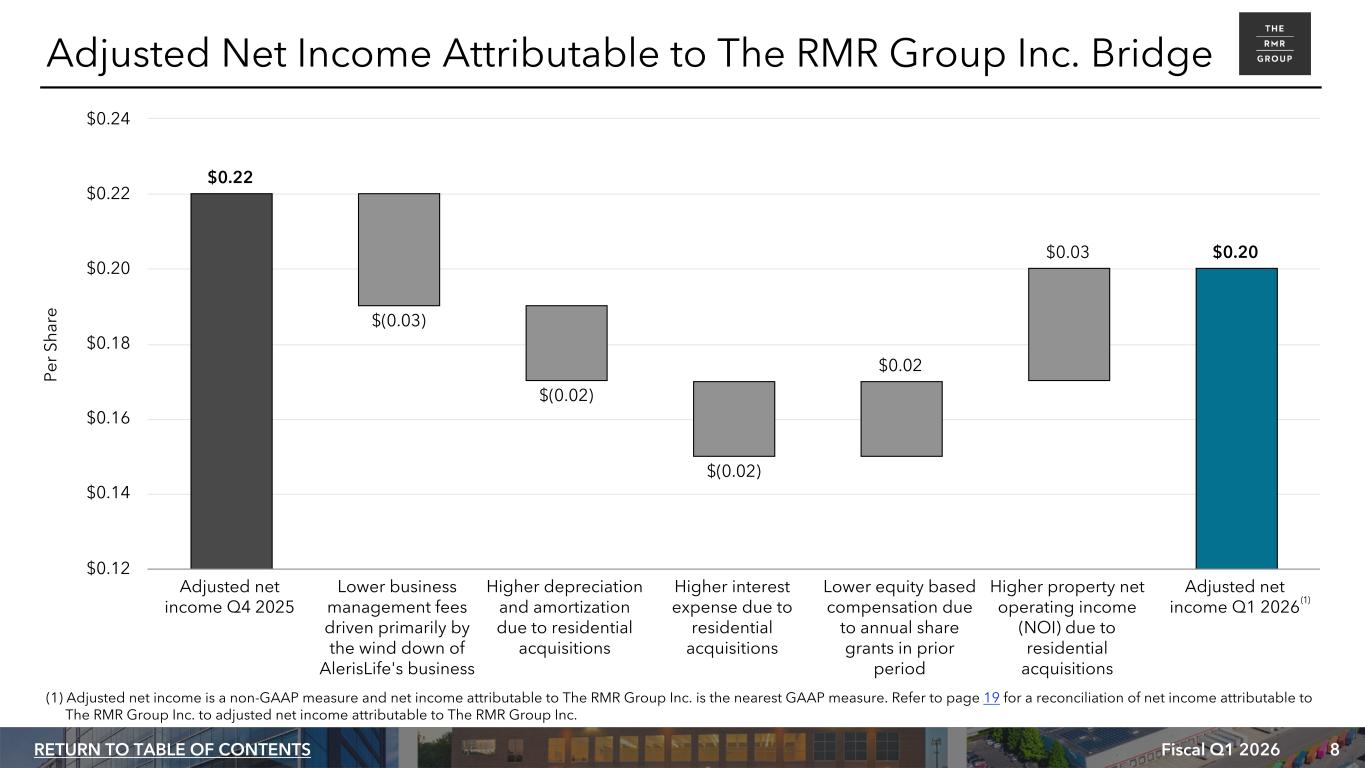

8Fiscal Q1 2026RETURN TO TABLE OF CONTENTS Adjusted Net Income Attributable to The RMR Group Inc. Bridge Pe r Sh ar e $0.22 $(0.03) $(0.02) $(0.02) $0.02 $0.03 $0.20 Adjusted net income Q4 2025 Lower business management fees driven primarily by the wind down of AlerisLife's business Higher depreciation and amortization due to residential acquisitions Higher interest expense due to residential acquisitions Lower equity based compensation due to annual share grants in prior period Higher property net operating income (NOI) due to residential acquisitions Adjusted net income Q1 2026 $0.12 $0.14 $0.16 $0.18 $0.20 $0.22 $0.24 (1) Adjusted net income is a non-GAAP measure and net income attributable to The RMR Group Inc. is the nearest GAAP measure. Refer to page 19 for a reconciliation of net income attributable to The RMR Group Inc. to adjusted net income attributable to The RMR Group Inc. (1)

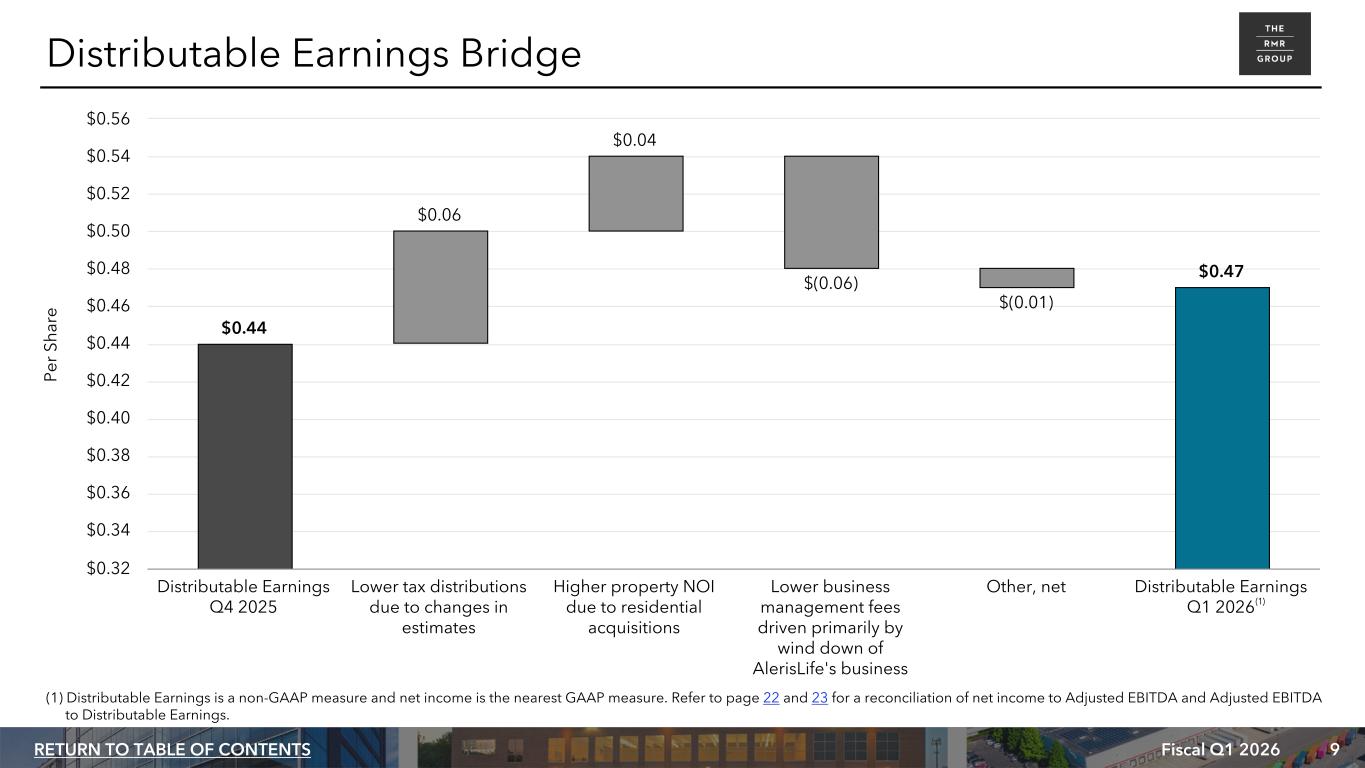

9Fiscal Q1 2026RETURN TO TABLE OF CONTENTS Distributable Earnings Bridge Pe r Sh ar e $0.44 $0.06 $0.04 $(0.06) $(0.01) $0.47 Distributable Earnings Q4 2025 Lower tax distributions due to changes in estimates Higher property NOI due to residential acquisitions Lower business management fees driven primarily by wind down of AlerisLife's business Other, net Distributable Earnings Q1 2026 $0.32 $0.34 $0.36 $0.38 $0.40 $0.42 $0.44 $0.46 $0.48 $0.50 $0.52 $0.54 $0.56 (1) Distributable Earnings is a non-GAAP measure and net income is the nearest GAAP measure. Refer to page 22 and 23 for a reconciliation of net income to Adjusted EBITDA and Adjusted EBITDA to Distributable Earnings. (1)

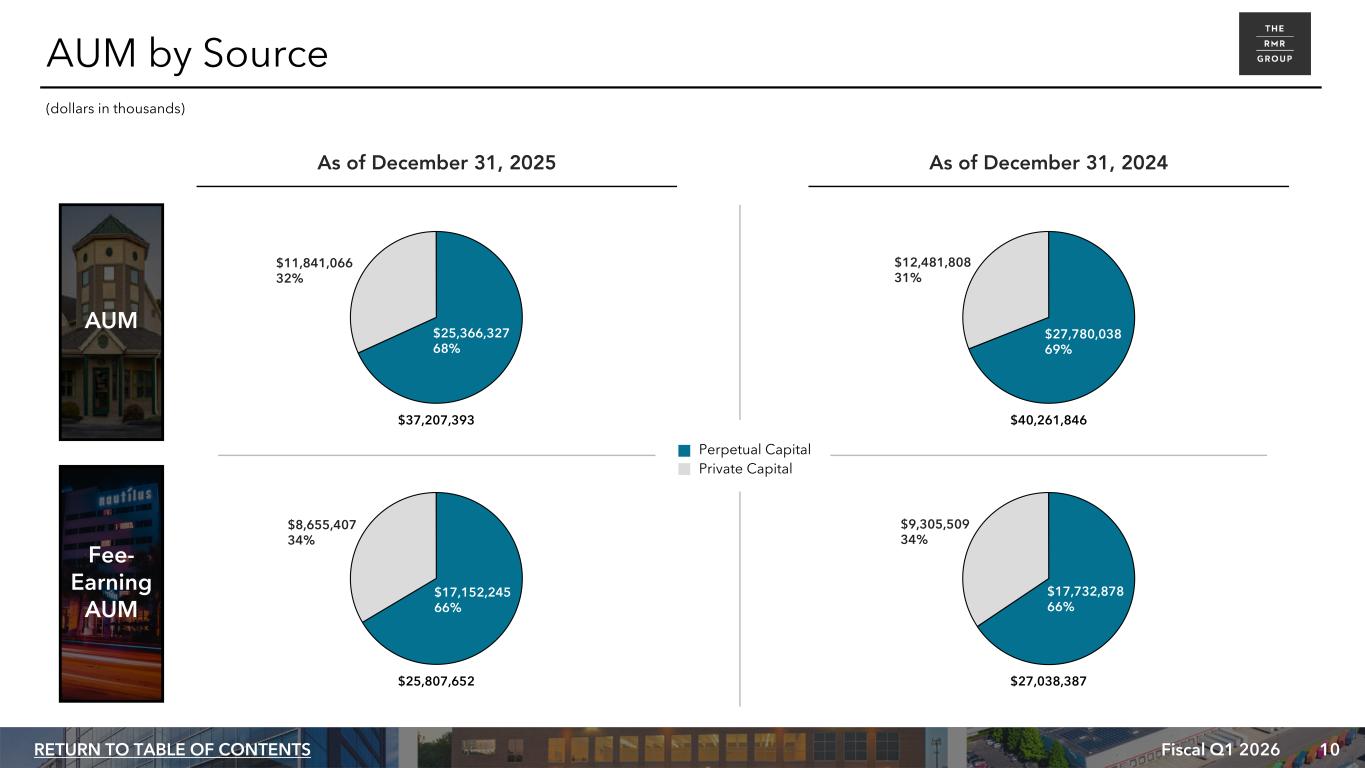

10Fiscal Q1 2026RETURN TO TABLE OF CONTENTS Fee- Earning AUM Managed Public Real Estate Capital Managed Private Real Estate Capital $25,366,327 68% $11,841,066 32% $37,207,393 $27,780,038 69% $12,481,808 31% $40,261,846 As of December 31, 2024 $17,152,245 66% $8,655,407 34% $25,807,652 $17,732,878 66% $9,305,509 34% $27,038,387 Perpetual Capit l Priv t Capi al AUM by Source (dollars in thousands) As of December 31, 2025 AUM

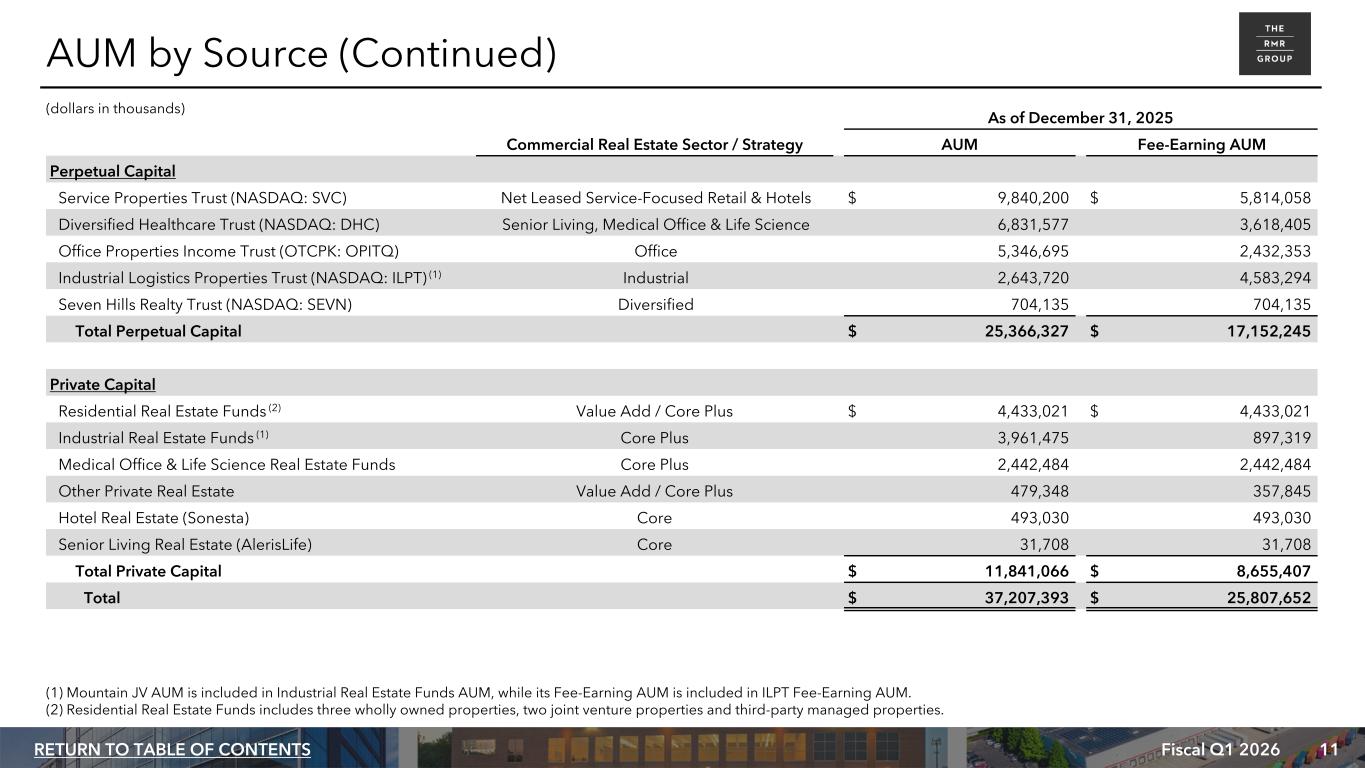

11Fiscal Q1 2026RETURN TO TABLE OF CONTENTS As of December 31, 2025 Commercial Real Estate Sector / Strategy AUM Fee-Earning AUM Perpetual Capital Service Properties Trust (NASDAQ: SVC) Net Leased Service-Focused Retail & Hotels $ 9,840,200 $ 5,814,058 Diversified Healthcare Trust (NASDAQ: DHC) Senior Living, Medical Office & Life Science 6,831,577 3,618,405 Office Properties Income Trust (OTCPK: OPITQ) Office 5,346,695 2,432,353 Industrial Logistics Properties Trust (NASDAQ: ILPT) (1) Industrial 2,643,720 4,583,294 Seven Hills Realty Trust (NASDAQ: SEVN) Diversified 704,135 704,135 Total Perpetual Capital $ 25,366,327 $ 17,152,245 Private Capital Residential Real Estate Funds (2) Value Add / Core Plus $ 4,433,021 $ 4,433,021 Industrial Real Estate Funds (1) Core Plus 3,961,475 897,319 Medical Office & Life Science Real Estate Funds Core Plus 2,442,484 2,442,484 Other Private Real Estate Value Add / Core Plus 479,348 357,845 Hotel Real Estate (Sonesta) Core 493,030 493,030 Senior Living Real Estate (AlerisLife) Core 31,708 31,708 Total Private Capital $ 11,841,066 $ 8,655,407 Total $ 37,207,393 $ 25,807,652 (1) Mountain JV AUM is included in Industrial Real Estate Funds AUM, while its Fee-Earning AUM is included in ILPT Fee-Earning AUM. (2) Residential Real Estate Funds includes three wholly owned properties, two joint venture properties and third-party managed properties. AUM by Source (Continued) (dollars in thousands)

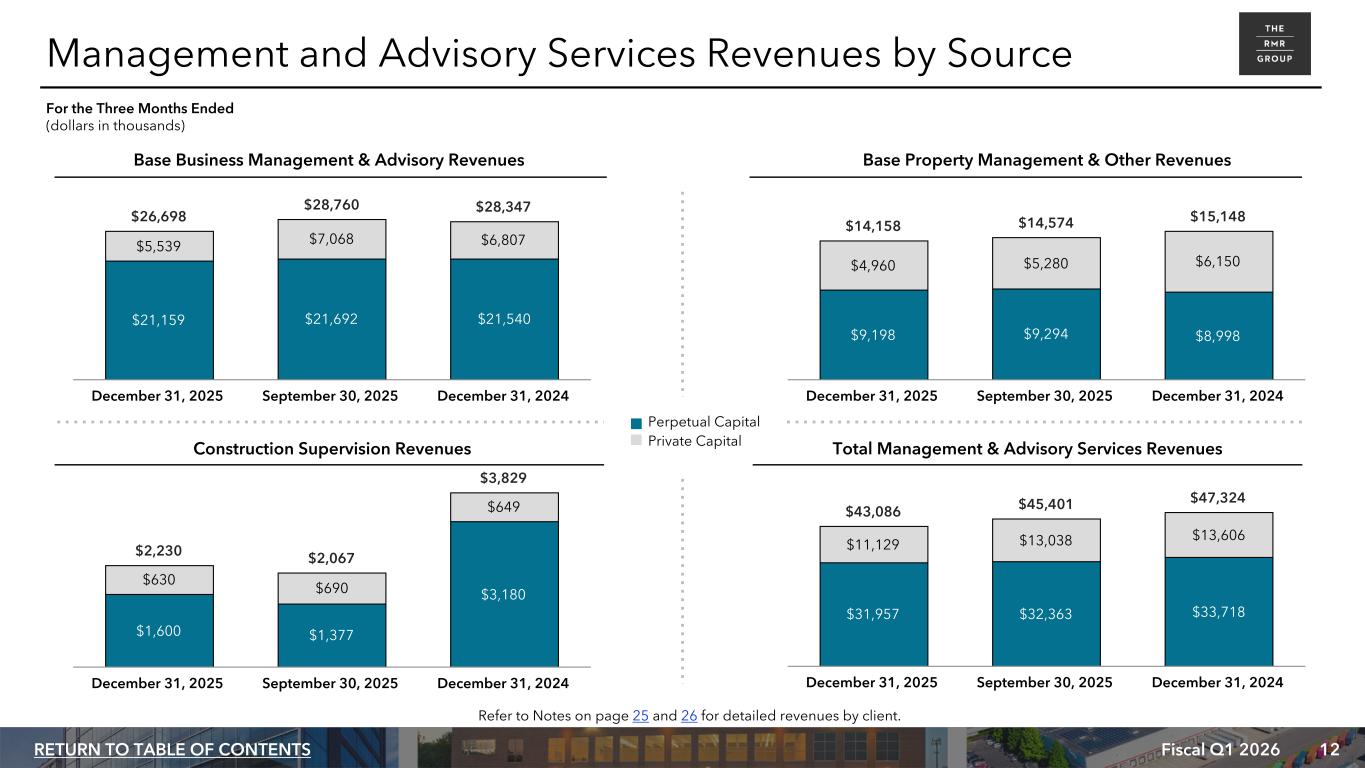

12Fiscal Q1 2026RETURN TO TABLE OF CONTENTS $43,086 $45,401 $47,324 $31,957 $32,363 $33,718 $11,129 $13,038 $13,606 December 31, 2025 September 30, 2025 December 31, 2024 $26,698 $28,760 $28,347 $21,159 $21,692 $21,540 $5,539 $7,068 $6,807 December 31, 2025 September 30, 2025 December 31, 2024 $14,158 $14,574 $15,148 $9,198 $9,294 $8,998 $4,960 $5,280 $6,150 December 31, 2025 September 30, 2025 December 31, 2024 $2,230 $2,067 $3,829 $1,600 $1,377 $3,180 $630 $690 $649 December 31, 2025 September 30, 2025 December 31, 2024 a b Base Business Management & Advisory Revenues Base Property Management & Other Revenues Construction Supervision Revenues Total Management & Advisory Services Revenues Perpetual Capital Private Capital Management and Advisory Services Revenues by Source For the Three Months Ended (dollars in thousands) Refer to Notes on page 25 and 26 for detailed revenues by client.

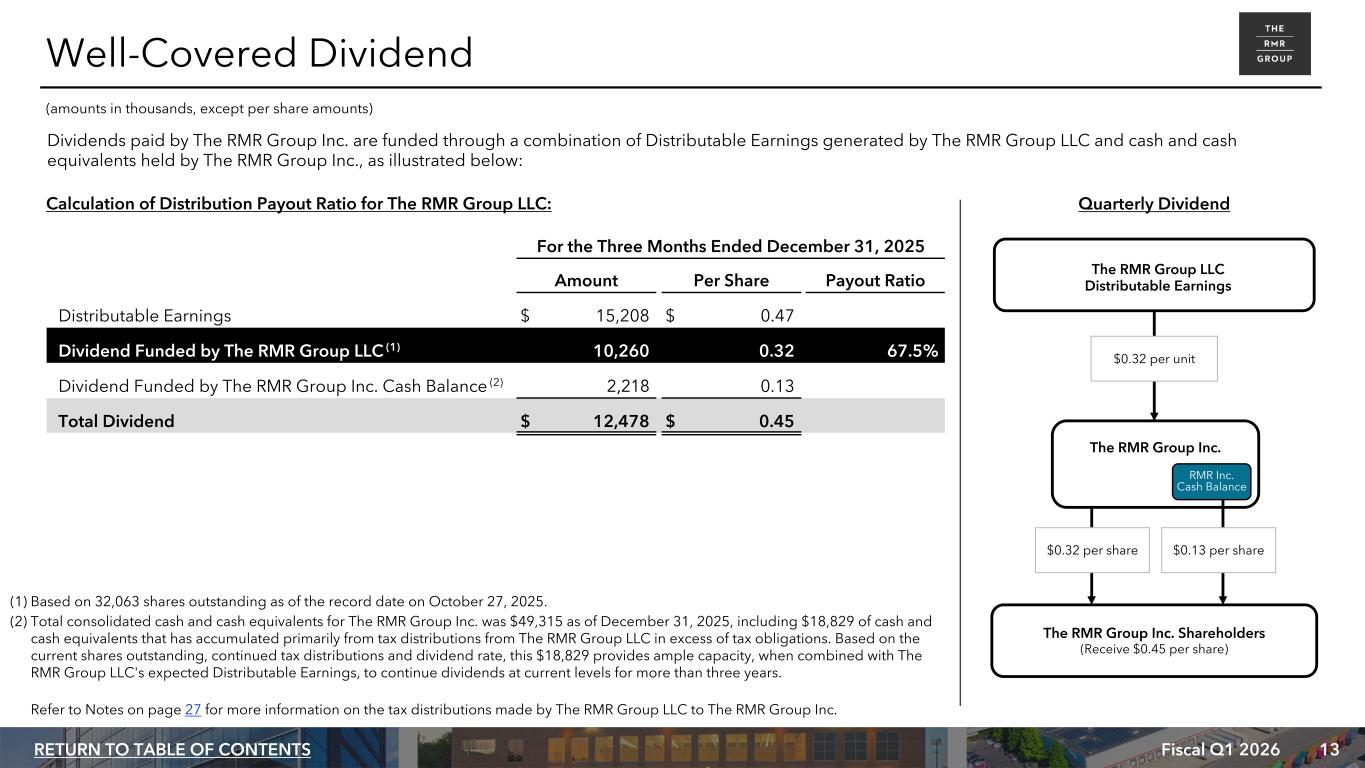

13Fiscal Q1 2026RETURN TO TABLE OF CONTENTS The RMR Group Inc. For the Three Months Ended December 31, 2025 Amount Per Share Payout Ratio Distributable Earnings $ 15,208 $ 0.47 Dividend Funded by The RMR Group LLC (1) 10,260 0.32 67.5% Dividend Funded by The RMR Group Inc. Cash Balance (2) 2,218 0.13 Total Dividend $ 12,478 $ 0.45 Well-Covered Dividend (amounts in thousands, except per share amounts) Dividends paid by The RMR Group Inc. are funded through a combination of Distributable Earnings generated by The RMR Group LLC and cash and cash equivalents held by The RMR Group Inc., as illustrated below: The RMR Group Inc. Shareholders (Receive $0.45 per share) Quarterly DividendCalculation of Distribution Payout Ratio for The RMR Group LLC: (1) Based on 32,063 shares outstanding as of the record date on October 27, 2025. (2) Total consolidated cash and cash equivalents for The RMR Group Inc. was $49,315 as of December 31, 2025, including $18,829 of cash and cash equivalents that has accumulated primarily from tax distributions from The RMR Group LLC in excess of tax obligations. Based on the current shares outstanding, continued tax distributions and dividend rate, this $18,829 provides ample capacity, when combined with The RMR Group LLC's expected Distributable Earnings, to continue dividends at current levels for more than three years. Refer to Notes on page 27 for more information on the tax distributions made by The RMR Group LLC to The RMR Group Inc. The RMR Group LLC Distributable Earnings $0.32 per unit $0.32 per share $0.13 per share RMR Inc. Cash Balance

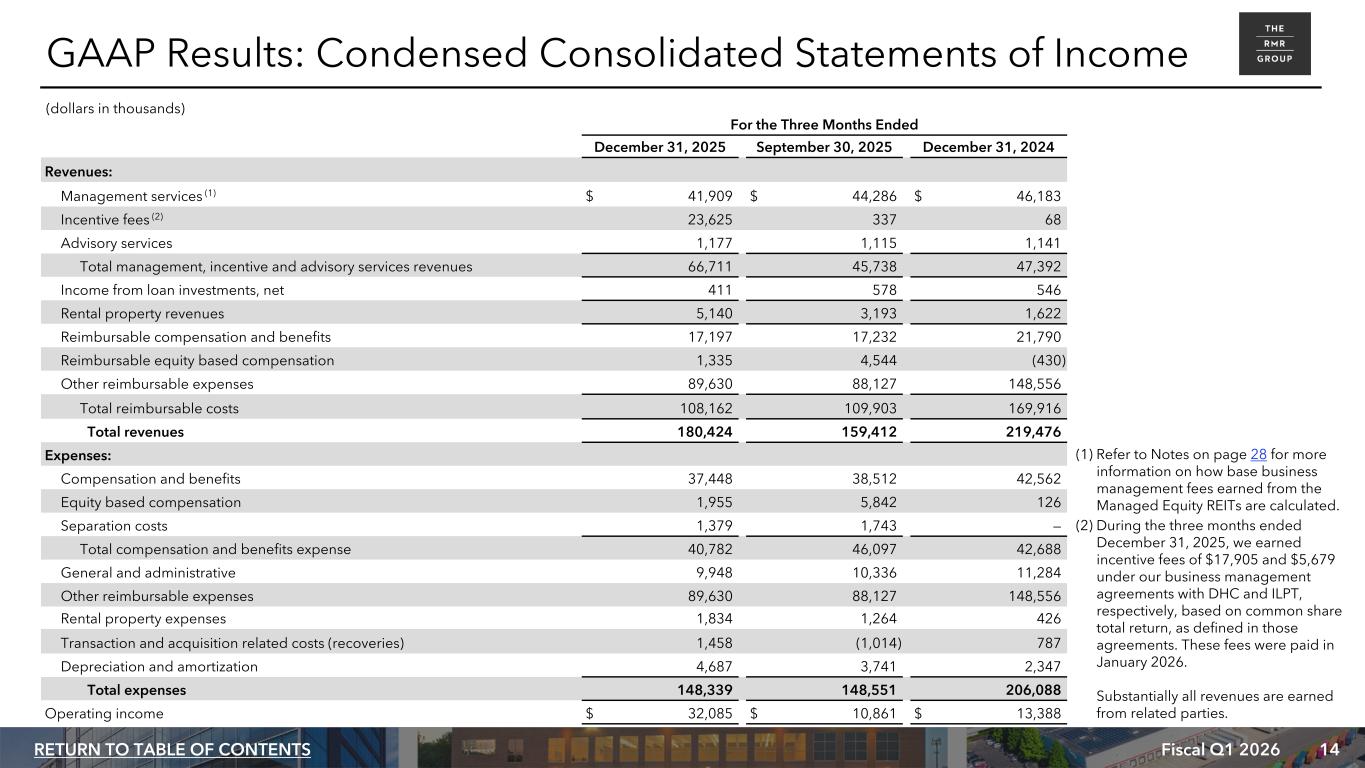

14Fiscal Q1 2026RETURN TO TABLE OF CONTENTS For the Three Months Ended December 31, 2025 September 30, 2025 December 31, 2024 Revenues: Management services (1) $ 41,909 $ 44,286 $ 46,183 Incentive fees (2) 23,625 337 68 Advisory services 1,177 1,115 1,141 Total management, incentive and advisory services revenues 66,711 45,738 47,392 Income from loan investments, net 411 578 546 Rental property revenues 5,140 3,193 1,622 Reimbursable compensation and benefits 17,197 17,232 21,790 Reimbursable equity based compensation 1,335 4,544 (430) Other reimbursable expenses 89,630 88,127 148,556 Total reimbursable costs 108,162 109,903 169,916 Total revenues 180,424 159,412 219,476 Expenses: Compensation and benefits 37,448 38,512 42,562 Equity based compensation 1,955 5,842 126 Separation costs 1,379 1,743 — Total compensation and benefits expense 40,782 46,097 42,688 General and administrative 9,948 10,336 11,284 Other reimbursable expenses 89,630 88,127 148,556 Rental property expenses 1,834 1,264 426 Transaction and acquisition related costs (recoveries) 1,458 (1,014) 787 Depreciation and amortization 4,687 3,741 2,347 Total expenses 148,339 148,551 206,088 Operating income $ 32,085 $ 10,861 $ 13,388 (1) Refer to Notes on page 28 for more information on how base business management fees earned from the Managed Equity REITs are calculated. (2) During the three months ended December 31, 2025, we earned incentive fees of $17,905 and $5,679 under our business management agreements with DHC and ILPT, respectively, based on common share total return, as defined in those agreements. These fees were paid in January 2026. Substantially all revenues are earned from related parties. (dollars in thousands) GAAP Results: Condensed Consolidated Statements of Income

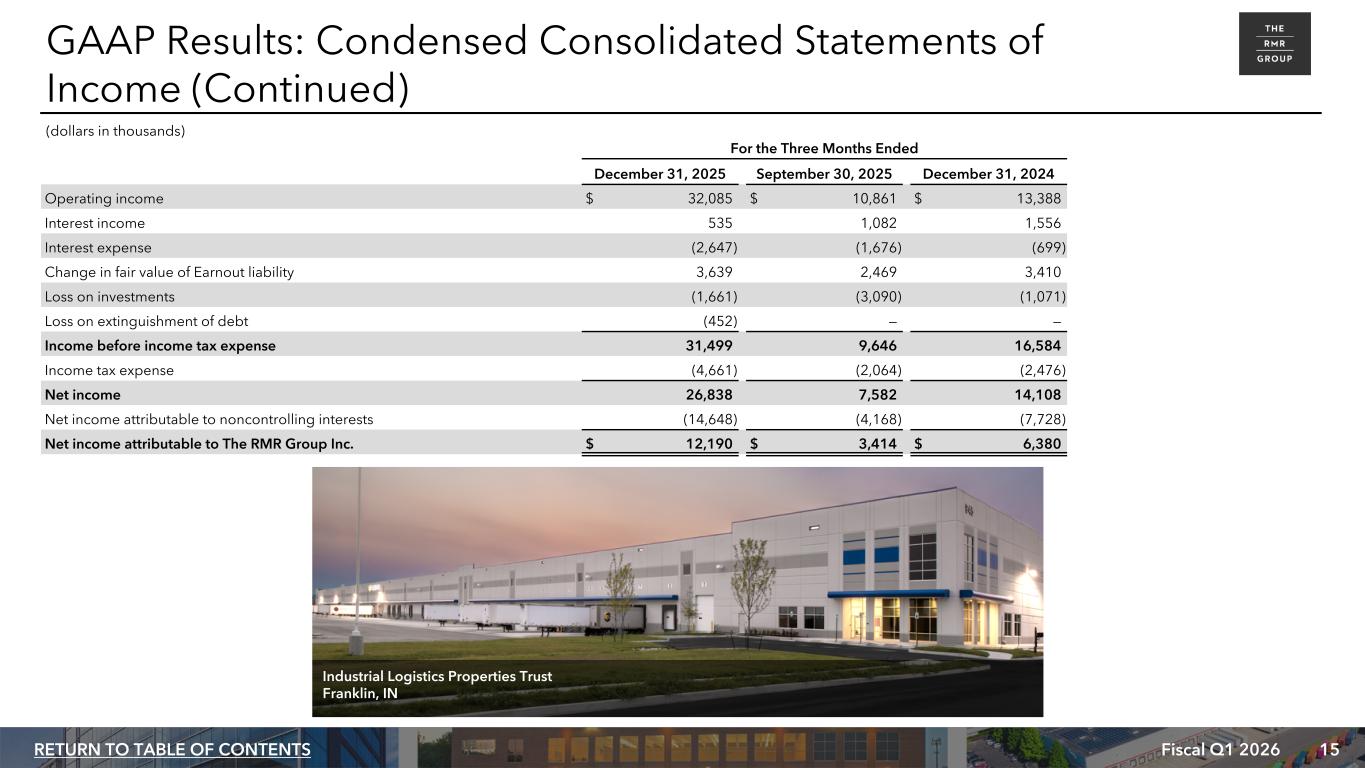

15Fiscal Q1 2026RETURN TO TABLE OF CONTENTS For the Three Months Ended December 31, 2025 September 30, 2025 December 31, 2024 Operating income $ 32,085 $ 10,861 $ 13,388 Interest income 535 1,082 1,556 Interest expense (2,647) (1,676) (699) Change in fair value of Earnout liability 3,639 2,469 3,410 Loss on investments (1,661) (3,090) (1,071) Loss on extinguishment of debt (452) — — Income before income tax expense 31,499 9,646 16,584 Income tax expense (4,661) (2,064) (2,476) Net income 26,838 7,582 14,108 Net income attributable to noncontrolling interests (14,648) (4,168) (7,728) Net income attributable to The RMR Group Inc. $ 12,190 $ 3,414 $ 6,380 GAAP Results: Condensed Consolidated Statements of Income (Continued) (dollars in thousands) Industrial Logistics Properties Trust Franklin, IN

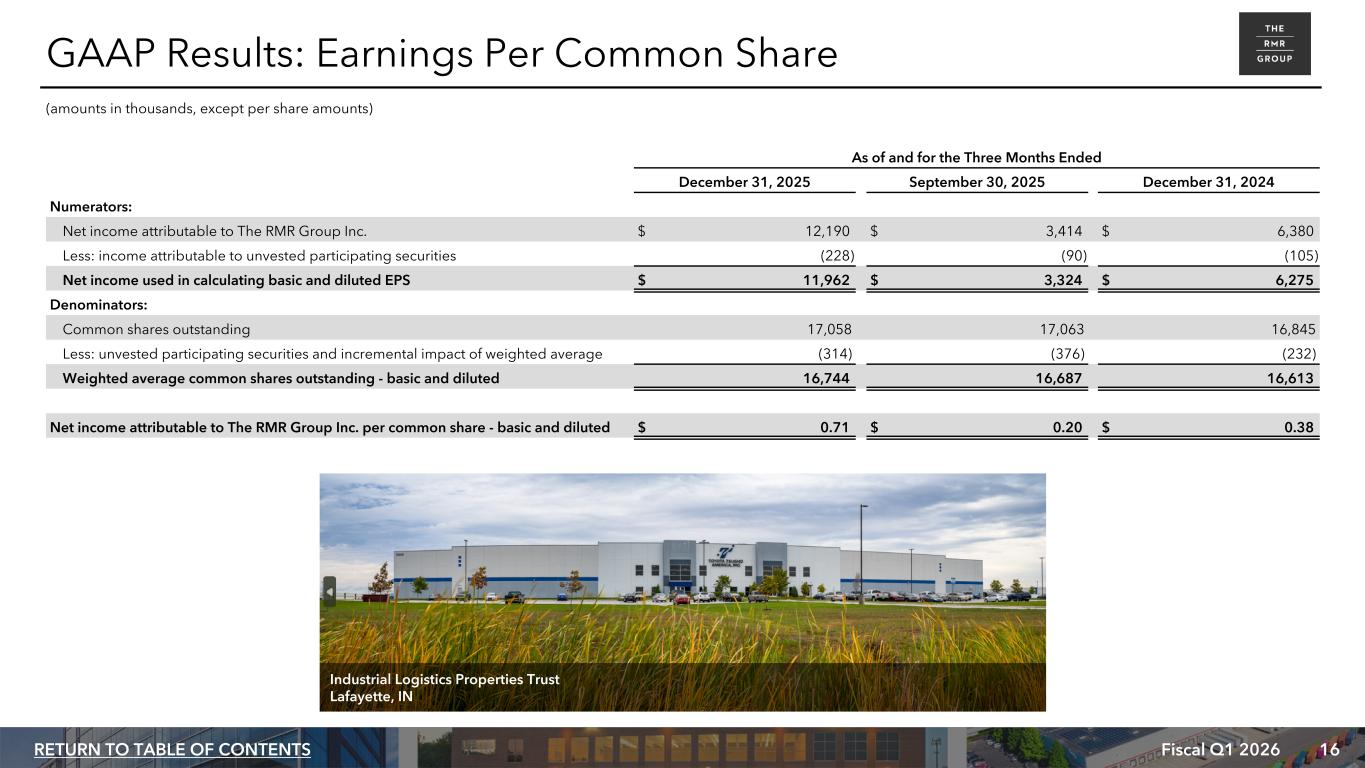

16Fiscal Q1 2026RETURN TO TABLE OF CONTENTS As of and for the Three Months Ended December 31, 2025 September 30, 2025 December 31, 2024 Numerators: Net income attributable to The RMR Group Inc. $ 12,190 $ 3,414 $ 6,380 Less: income attributable to unvested participating securities (228) (90) (105) Net income used in calculating basic and diluted EPS $ 11,962 $ 3,324 $ 6,275 Denominators: Common shares outstanding 17,058 17,063 16,845 Less: unvested participating securities and incremental impact of weighted average (314) (376) (232) Weighted average common shares outstanding - basic and diluted 16,744 16,687 16,613 Net income attributable to The RMR Group Inc. per common share - basic and diluted $ 0.71 $ 0.20 $ 0.38 GAAP Results: Earnings Per Common Share (amounts in thousands, except per share amounts) Industrial Logistics Properties Trust Lafayette, IN

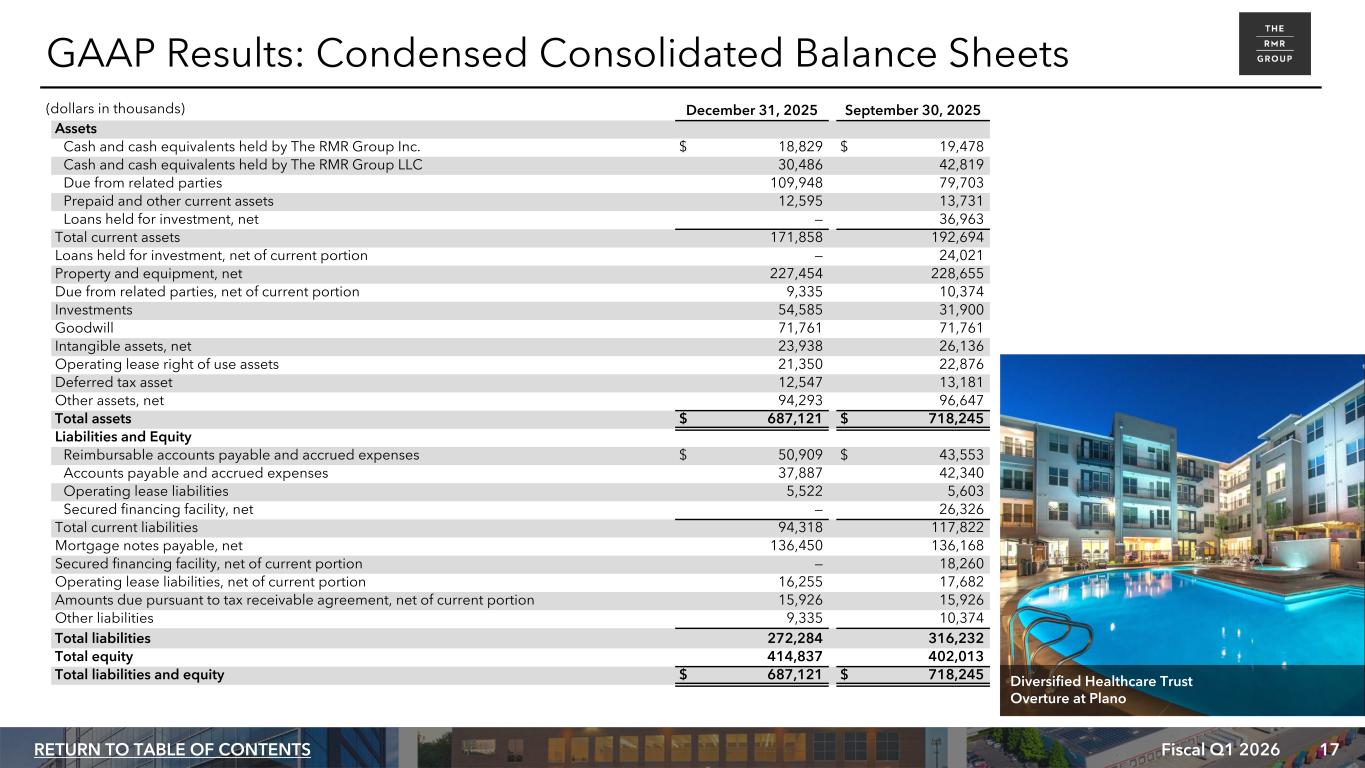

17Fiscal Q1 2026RETURN TO TABLE OF CONTENTS December 31, 2025 September 30, 2025 Assets Cash and cash equivalents held by The RMR Group Inc. $ 18,829 $ 19,478 Cash and cash equivalents held by The RMR Group LLC 30,486 42,819 Due from related parties 109,948 79,703 Prepaid and other current assets 12,595 13,731 Loans held for investment, net — 36,963 Total current assets 171,858 192,694 Loans held for investment, net of current portion — 24,021 Property and equipment, net 227,454 228,655 Due from related parties, net of current portion 9,335 10,374 Investments 54,585 31,900 Goodwill 71,761 71,761 Intangible assets, net 23,938 26,136 Operating lease right of use assets 21,350 22,876 Deferred tax asset 12,547 13,181 Other assets, net 94,293 96,647 Total assets $ 687,121 $ 718,245 Liabilities and Equity Reimbursable accounts payable and accrued expenses $ 50,909 $ 43,553 Accounts payable and accrued expenses 37,887 42,340 Operating lease liabilities 5,522 5,603 Secured financing facility, net — 26,326 Total current liabilities 94,318 117,822 Mortgage notes payable, net 136,450 136,168 Secured financing facility, net of current portion — 18,260 Operating lease liabilities, net of current portion 16,255 17,682 Amounts due pursuant to tax receivable agreement, net of current portion 15,926 15,926 Other liabilities 9,335 10,374 Total liabilities 272,284 316,232 Total equity 414,837 402,013 Total liabilities and equity $ 687,121 $ 718,245 GAAP Results: Condensed Consolidated Balance Sheets (dollars in thousands) Diversified Healthcare Trust Overture at Plano

Non-GAAP Financial Measures

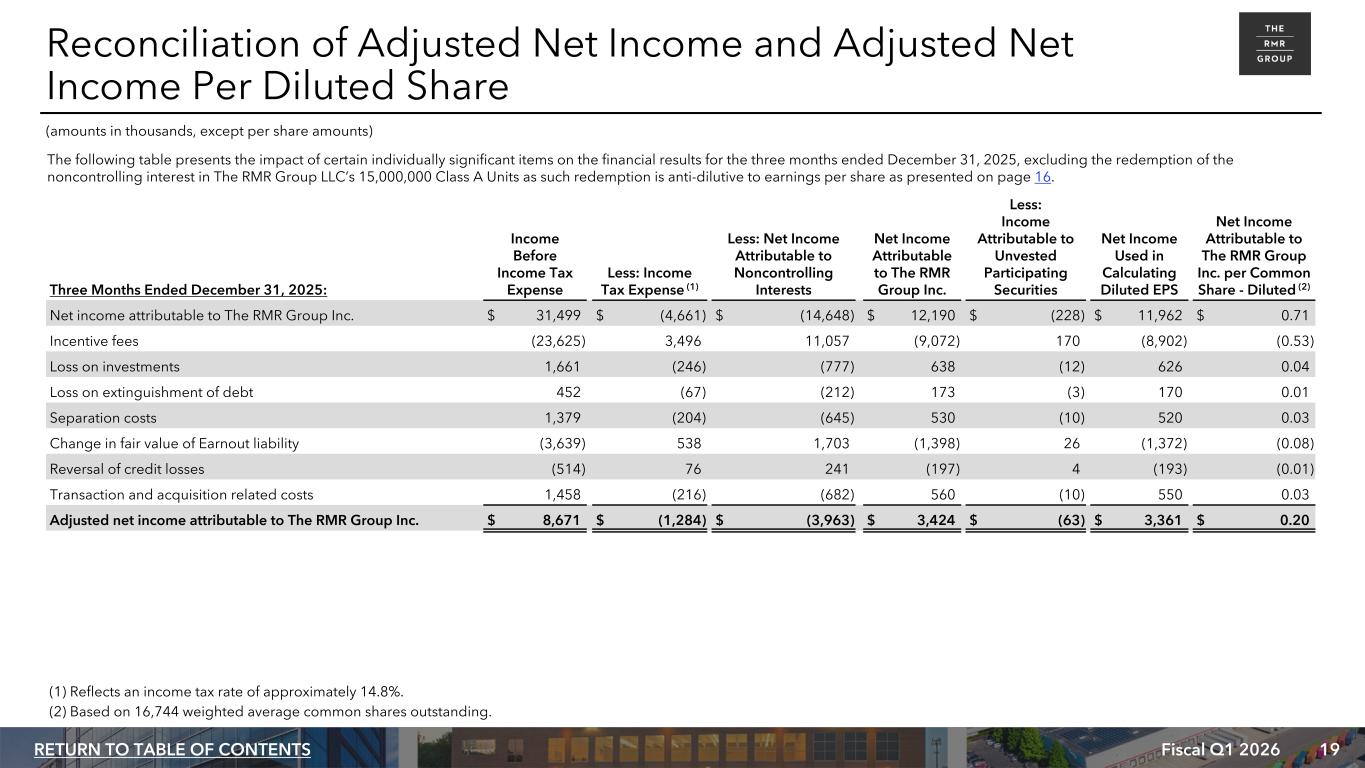

19Fiscal Q1 2026RETURN TO TABLE OF CONTENTS Three Months Ended December 31, 2025: Income Before Income Tax Expense Less: Income Tax Expense (1) Less: Net Income Attributable to Noncontrolling Interests Net Income Attributable to The RMR Group Inc. Less: Income Attributable to Unvested Participating Securities Net Income Used in Calculating Diluted EPS Net Income Attributable to The RMR Group Inc. per Common Share - Diluted (2) Net income attributable to The RMR Group Inc. $ 31,499 $ (4,661) $ (14,648) $ 12,190 $ (228) $ 11,962 $ 0.71 Incentive fees (23,625) 3,496 11,057 (9,072) 170 (8,902) (0.53) Loss on investments 1,661 (246) (777) 638 (12) 626 0.04 Loss on extinguishment of debt 452 (67) (212) 173 (3) 170 0.01 Separation costs 1,379 (204) (645) 530 (10) 520 0.03 Change in fair value of Earnout liability (3,639) 538 1,703 (1,398) 26 (1,372) (0.08) Reversal of credit losses (514) 76 241 (197) 4 (193) (0.01) Transaction and acquisition related costs 1,458 (216) (682) 560 (10) 550 0.03 Adjusted net income attributable to The RMR Group Inc. $ 8,671 $ (1,284) $ (3,963) $ 3,424 $ (63) $ 3,361 $ 0.20 The following table presents the impact of certain individually significant items on the financial results for the three months ended December 31, 2025, excluding the redemption of the noncontrolling interest in The RMR Group LLC’s 15,000,000 Class A Units as such redemption is anti-dilutive to earnings per share as presented on page 16. (1) Reflects an income tax rate of approximately 14.8%. (2) Based on 16,744 weighted average common shares outstanding. Reconciliation of Adjusted Net Income and Adjusted Net Income Per Diluted Share (amounts in thousands, except per share amounts)

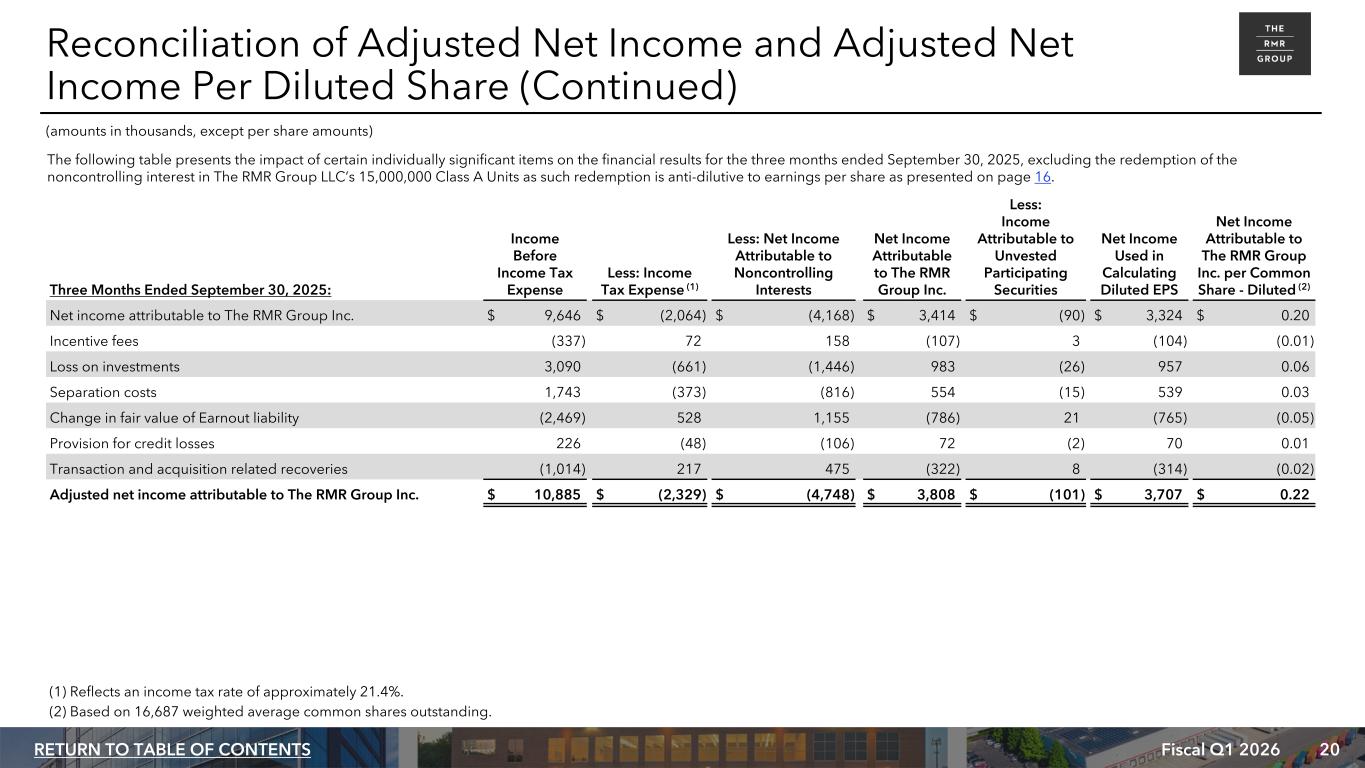

20Fiscal Q1 2026RETURN TO TABLE OF CONTENTS Reconciliation of Adjusted Net Income and Adjusted Net Income Per Diluted Share (Continued) (amounts in thousands, except per share amounts) The following table presents the impact of certain individually significant items on the financial results for the three months ended September 30, 2025, excluding the redemption of the noncontrolling interest in The RMR Group LLC’s 15,000,000 Class A Units as such redemption is anti-dilutive to earnings per share as presented on page 16. Three Months Ended September 30, 2025: Income Before Income Tax Expense Less: Income Tax Expense (1) Less: Net Income Attributable to Noncontrolling Interests Net Income Attributable to The RMR Group Inc. Less: Income Attributable to Unvested Participating Securities Net Income Used in Calculating Diluted EPS Net Income Attributable to The RMR Group Inc. per Common Share - Diluted (2) Net income attributable to The RMR Group Inc. $ 9,646 $ (2,064) $ (4,168) $ 3,414 $ (90) $ 3,324 $ 0.20 Incentive fees (337) 72 158 (107) 3 (104) (0.01) Loss on investments 3,090 (661) (1,446) 983 (26) 957 0.06 Separation costs 1,743 (373) (816) 554 (15) 539 0.03 Change in fair value of Earnout liability (2,469) 528 1,155 (786) 21 (765) (0.05) Provision for credit losses 226 (48) (106) 72 (2) 70 0.01 Transaction and acquisition related recoveries (1,014) 217 475 (322) 8 (314) (0.02) Adjusted net income attributable to The RMR Group Inc. $ 10,885 $ (2,329) $ (4,748) $ 3,808 $ (101) $ 3,707 $ 0.22 (1) Reflects an income tax rate of approximately 21.4%. (2) Based on 16,687 weighted average common shares outstanding.

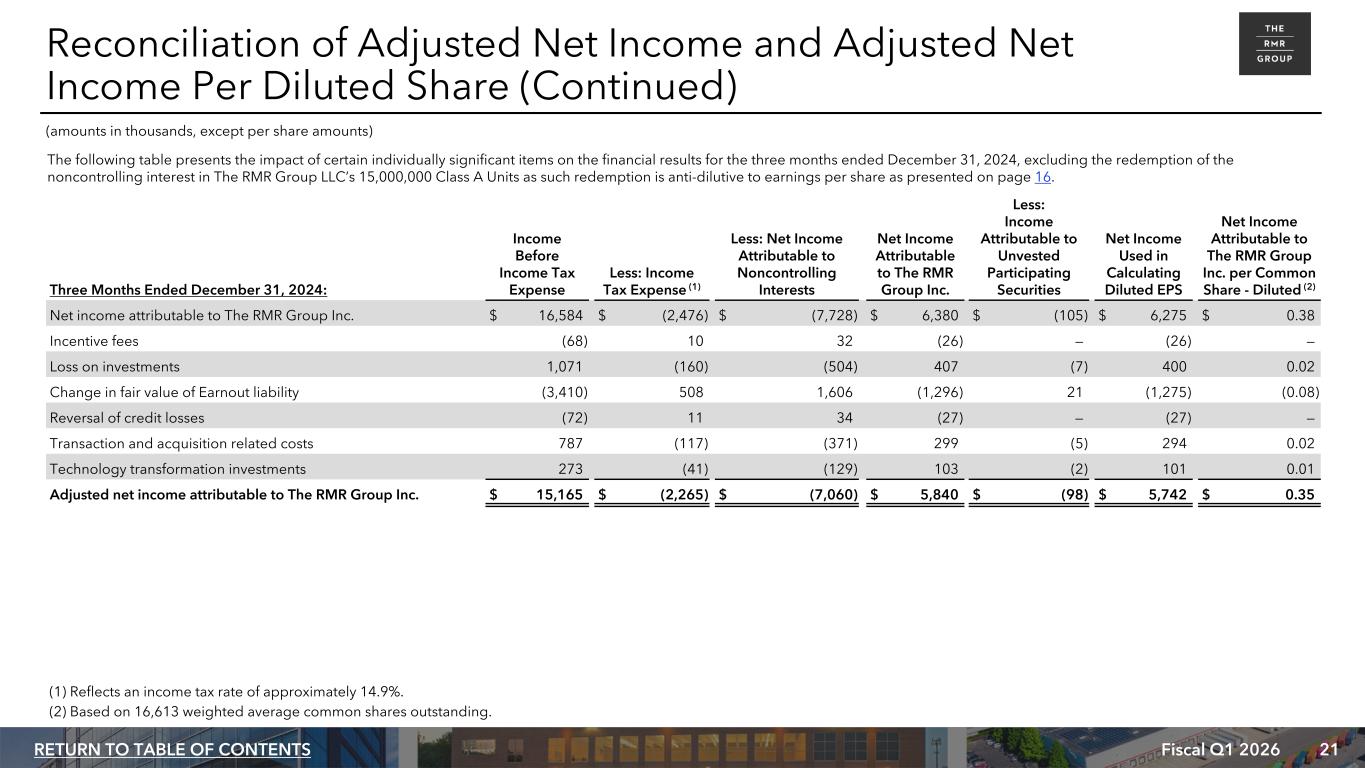

21Fiscal Q1 2026RETURN TO TABLE OF CONTENTS The following table presents the impact of certain individually significant items on the financial results for the three months ended December 31, 2024, excluding the redemption of the noncontrolling interest in The RMR Group LLC’s 15,000,000 Class A Units as such redemption is anti-dilutive to earnings per share as presented on page 16. (amounts in thousands, except per share amounts) Reconciliation of Adjusted Net Income and Adjusted Net Income Per Diluted Share (Continued) Three Months Ended December 31, 2024: Income Before Income Tax Expense Less: Income Tax Expense (1) Less: Net Income Attributable to Noncontrolling Interests Net Income Attributable to The RMR Group Inc. Less: Income Attributable to Unvested Participating Securities Net Income Used in Calculating Diluted EPS Net Income Attributable to The RMR Group Inc. per Common Share - Diluted (2) Net income attributable to The RMR Group Inc. $ 16,584 $ (2,476) $ (7,728) $ 6,380 $ (105) $ 6,275 $ 0.38 Incentive fees (68) 10 32 (26) — (26) — Loss on investments 1,071 (160) (504) 407 (7) 400 0.02 Change in fair value of Earnout liability (3,410) 508 1,606 (1,296) 21 (1,275) (0.08) Reversal of credit losses (72) 11 34 (27) — (27) — Transaction and acquisition related costs 787 (117) (371) 299 (5) 294 0.02 Technology transformation investments 273 (41) (129) 103 (2) 101 0.01 Adjusted net income attributable to The RMR Group Inc. $ 15,165 $ (2,265) $ (7,060) $ 5,840 $ (98) $ 5,742 $ 0.35 (1) Reflects an income tax rate of approximately 14.9%. (2) Based on 16,613 weighted average common shares outstanding.

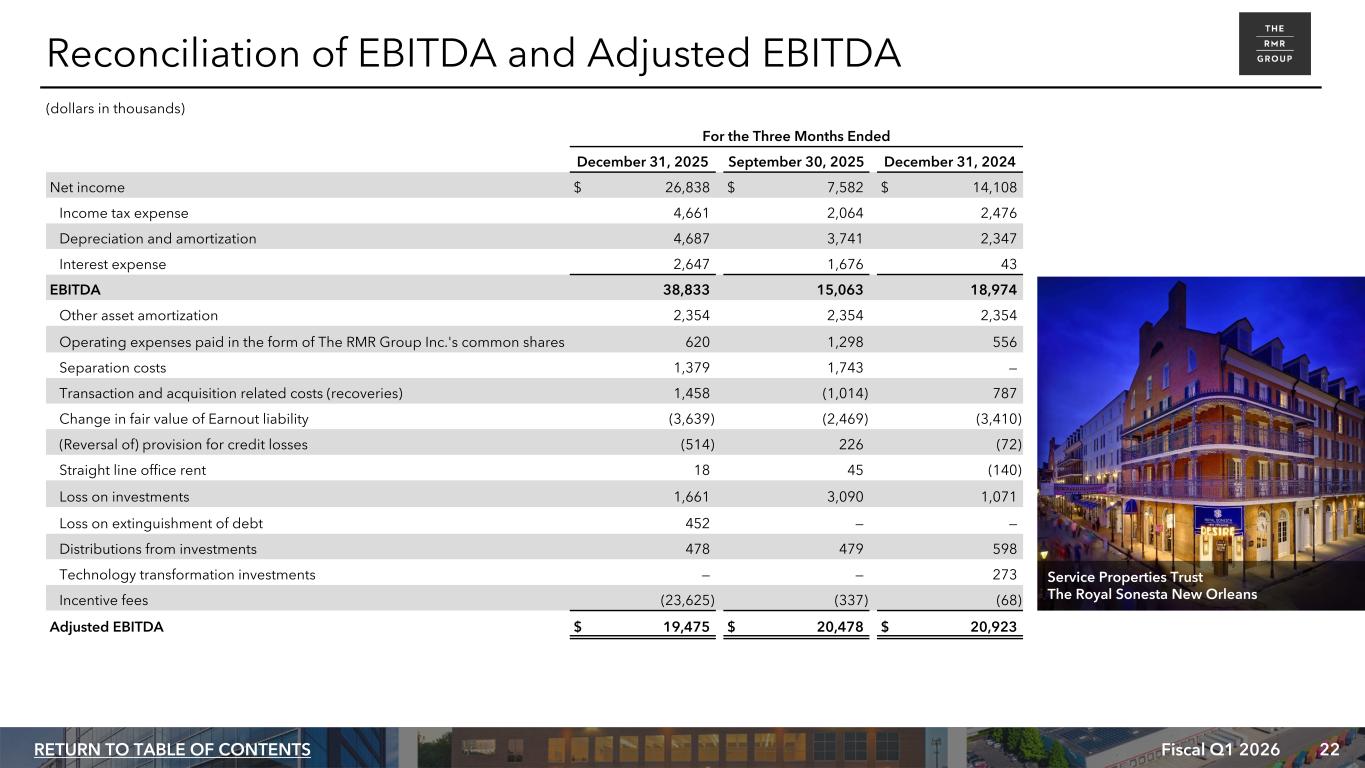

22Fiscal Q1 2026RETURN TO TABLE OF CONTENTS For the Three Months Ended December 31, 2025 September 30, 2025 December 31, 2024 Net income $ 26,838 $ 7,582 $ 14,108 Income tax expense 4,661 2,064 2,476 Depreciation and amortization 4,687 3,741 2,347 Interest expense 2,647 1,676 43 EBITDA 38,833 15,063 18,974 Other asset amortization 2,354 2,354 2,354 Operating expenses paid in the form of The RMR Group Inc.'s common shares 620 1,298 556 Separation costs 1,379 1,743 — Transaction and acquisition related costs (recoveries) 1,458 (1,014) 787 Change in fair value of Earnout liability (3,639) (2,469) (3,410) (Reversal of) provision for credit losses (514) 226 (72) Straight line office rent 18 45 (140) Loss on investments 1,661 3,090 1,071 Loss on extinguishment of debt 452 — — Distributions from investments 478 479 598 Technology transformation investments — — 273 Incentive fees (23,625) (337) (68) Adjusted EBITDA $ 19,475 $ 20,478 $ 20,923 Reconciliation of EBITDA and Adjusted EBITDA (dollars in thousands) Service Properties Trust The Royal Sonesta New Orleans

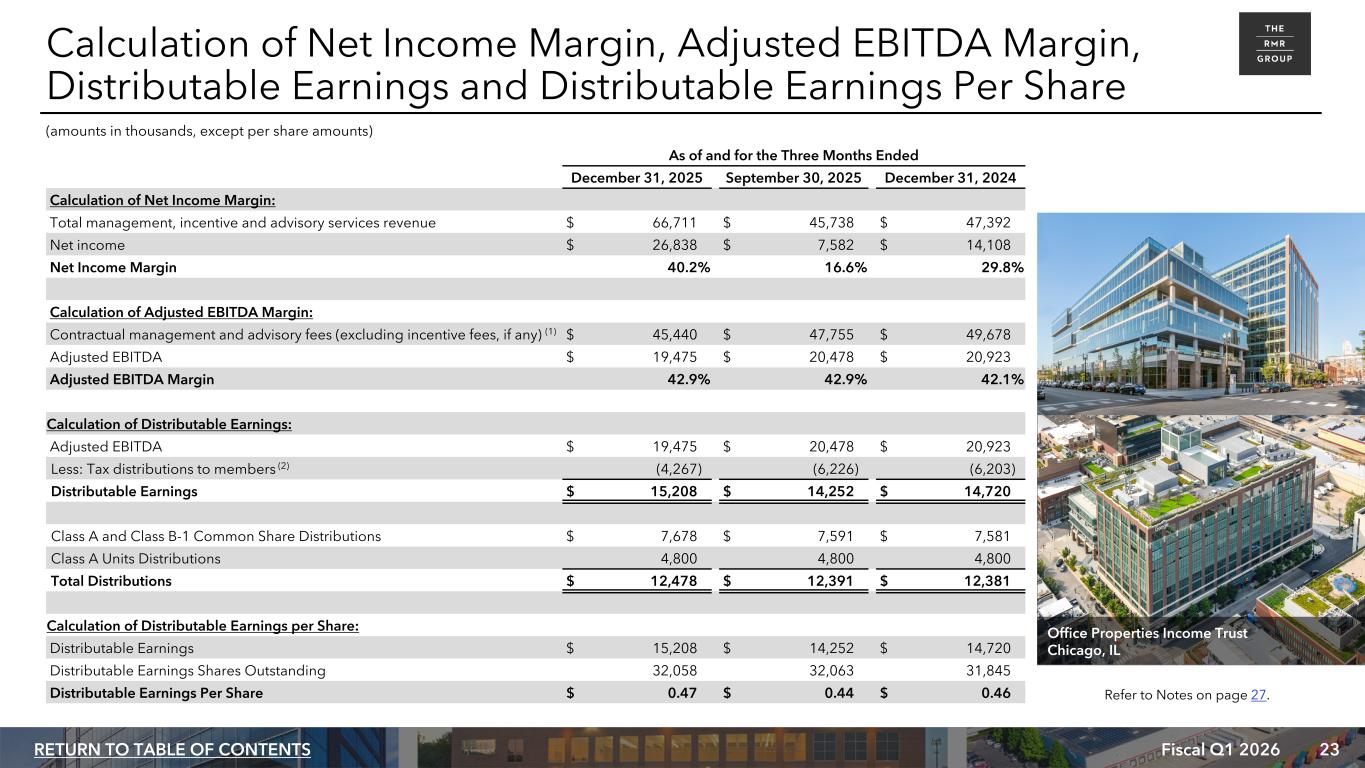

23Fiscal Q1 2026RETURN TO TABLE OF CONTENTS As of and for the Three Months Ended December 31, 2025 September 30, 2025 December 31, 2024 Calculation of Net Income Margin: Total management, incentive and advisory services revenue $ 66,711 $ 45,738 $ 47,392 Net income $ 26,838 $ 7,582 $ 14,108 Net Income Margin 40.2% 16.6% 29.8% Calculation of Adjusted EBITDA Margin: Contractual management and advisory fees (excluding incentive fees, if any) (1) $ 45,440 $ 47,755 $ 49,678 Adjusted EBITDA $ 19,475 $ 20,478 $ 20,923 Adjusted EBITDA Margin 42.9% 42.9% 42.1% Calculation of Distributable Earnings: Adjusted EBITDA $ 19,475 $ 20,478 $ 20,923 Less: Tax distributions to members (2) (4,267) (6,226) (6,203) Distributable Earnings $ 15,208 $ 14,252 $ 14,720 Class A and Class B-1 Common Share Distributions $ 7,678 $ 7,591 $ 7,581 Class A Units Distributions 4,800 4,800 4,800 Total Distributions $ 12,478 $ 12,391 $ 12,381 Calculation of Distributable Earnings per Share: Distributable Earnings $ 15,208 $ 14,252 $ 14,720 Distributable Earnings Shares Outstanding 32,058 32,063 31,845 Distributable Earnings Per Share $ 0.47 $ 0.44 $ 0.46 Calculation of Net Income Margin, Adjusted EBITDA Margin, Distributable Earnings and Distributable Earnings Per Share (amounts in thousands, except per share amounts) Refer to Notes on page 27. Office Properties Income Trust Chicago, IL

Appendix

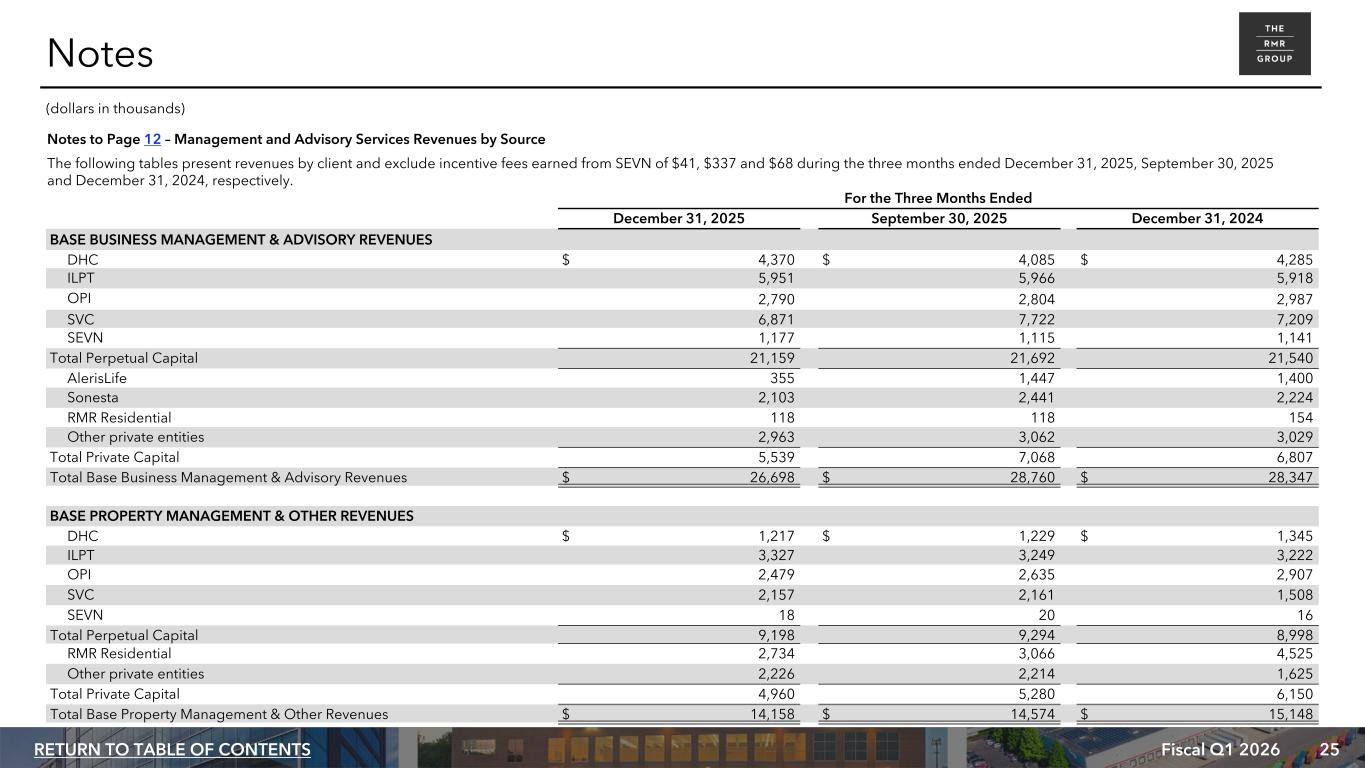

25Fiscal Q1 2026RETURN TO TABLE OF CONTENTS Notes to Page 12 – Management and Advisory Services Revenues by Source The following tables present revenues by client and exclude incentive fees earned from SEVN of $41, $337 and $68 during the three months ended December 31, 2025, September 30, 2025 and December 31, 2024, respectively. For the Three Months Ended December 31, 2025 September 30, 2025 December 31, 2024 BASE BUSINESS MANAGEMENT & ADVISORY REVENUES DHC $ 4,370 $ 4,085 $ 4,285 ILPT 5,951 5,966 5,918 OPI 2,790 2,804 2,987 SVC 6,871 7,722 7,209 SEVN 1,177 1,115 1,141 Total Perpetual Capital 21,159 21,692 21,540 AlerisLife 355 1,447 1,400 Sonesta 2,103 2,441 2,224 RMR Residential 118 118 154 Other private entities 2,963 3,062 3,029 Total Private Capital 5,539 7,068 6,807 Total Base Business Management & Advisory Revenues $ 26,698 $ 28,760 $ 28,347 BASE PROPERTY MANAGEMENT & OTHER REVENUES DHC $ 1,217 $ 1,229 $ 1,345 ILPT 3,327 3,249 3,222 OPI 2,479 2,635 2,907 SVC 2,157 2,161 1,508 SEVN 18 20 16 Total Perpetual Capital 9,198 9,294 8,998 RMR Residential 2,734 3,066 4,525 Other private entities 2,226 2,214 1,625 Total Private Capital 4,960 5,280 6,150 Total Base Property Management & Other Revenues $ 14,158 $ 14,574 $ 15,148 Notes (dollars in thousands)

26Fiscal Q1 2026RETURN TO TABLE OF CONTENTS Notes to Page 12 – Management and Advisory Services Revenues by Source (Continued) For the Three Months Ended December 31, 2025 September 30, 2025 December 31, 2024 CONSTRUCTION SUPERVISION REVENUES DHC $ 275 $ 342 $ 964 ILPT 126 217 170 OPI 307 417 652 SVC 884 401 1,389 SEVN 8 — 5 Total Perpetual Capital 1,600 1,377 3,180 RMR Residential 499 462 486 Other private entities 131 228 163 Total Private Capital 630 690 649 Total Construction Supervision Fees $ 2,230 $ 2,067 $ 3,829 TOTAL MANAGEMENT & ADVISORY SERVICES REVENUES DHC $ 5,862 $ 5,656 $ 6,594 ILPT 9,404 9,432 9,310 OPI 5,576 5,856 6,546 SVC 9,912 10,284 10,106 SEVN 1,203 1,135 1,162 Total Perpetual Capital 31,957 32,363 33,718 AlerisLife 355 1,447 1,400 Sonesta 2,103 2,441 2,224 RMR Residential 3,351 3,646 5,165 Other private entities 5,320 5,504 4,817 Total Private Capital 11,129 13,038 13,606 Total Management & Advisory Services Revenues $ 43,086 $ 45,401 $ 47,324 Notes (Continued) (dollars in thousands)

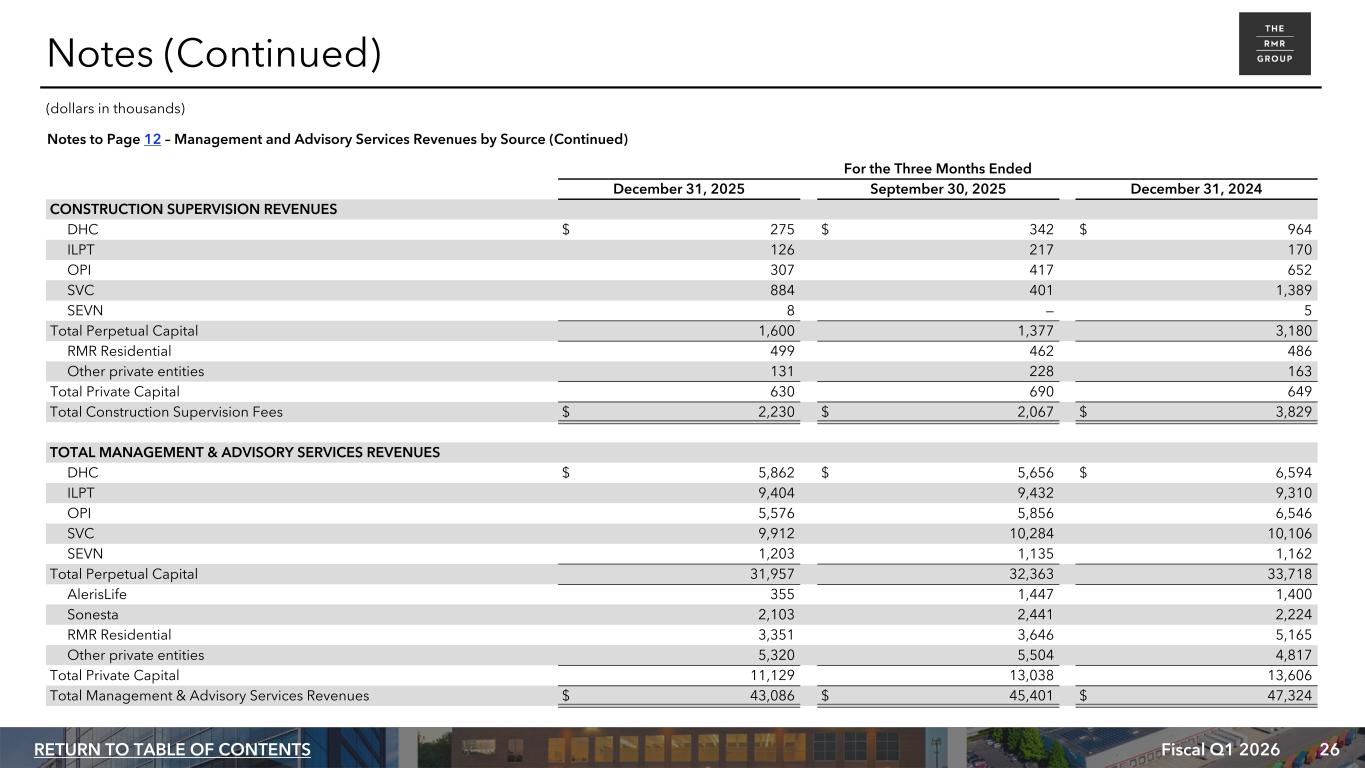

27Fiscal Q1 2026RETURN TO TABLE OF CONTENTS The RMR Group Inc. (C-Corp) The RMR Group LLC (Partnership) Quarterly Tax Distributions Notes to Page 13 – Well-Covered Dividend The following illustrative diagram presents certain tax information pertaining to The RMR Group LLC and The RMR Group Inc.: (1) Represents the current maximum combined federal and state tax rate applicable to The RMR Group LLC's members. (2) Represents The RMR Group Inc.'s effective combined federal and state cash income tax rate. Notes (Continued) Notes to Page 23 – Calculation of Net Income Margin, Adjusted EBITDA Margin, Distributable Earnings and Distributable Earnings Per Share (1) Contractual management and advisory fees are the base business management fees, property management fees and advisory fees RMR or its subsidiaries earn pursuant to their management agreements. These amounts are calculated pursuant to contractual formulas and do not deduct other asset amortization of $2,354 for each of the three month periods presented, required to be recognized as a reduction to management services revenues in accordance with GAAP. (2) Under The RMR Group LLC operating agreement, The RMR Group LLC is required to make quarterly pro rata cash distributions to The RMR Group Inc. and its noncontrolling interest based on each entity's estimated tax liabilities and respective ownership percentages. Estimated tax liabilities are determined quarterly on a cumulative basis. As such, there may be fluctuations from quarter to quarter to account for prior periods where pro rata cash distributions were more or less than amounts determined cumulatively through a particular quarter. For each of the three month periods presented, The RMR Group LLC made required quarterly tax distributions as follows: As of and for the Three Months Ended December 31, 2025 September 30, 2025 December 31, 2024 The RMR Group LLC tax distributions to The RMR Group Inc. $ 2,268 $ 3,274 $ 3,341 The RMR Group LLC tax distributions to noncontrolling interest 1,999 2,952 2,862 Total tax distributions to members from The RMR Group LLC $ 4,267 $ 6,226 $ 6,203 (dollars in thousands) Tax distributions for the three months ended December 31, 2024 exclude $26 to The RMR Group Inc. and $24 to the noncontrolling interest related to incentive fees earned from SEVN. Tax Rate: ~20.00% (2)Excess Distribution Taxing Authorities RMR Inc. Cash Balance Tax Rate: 37.25% (1)

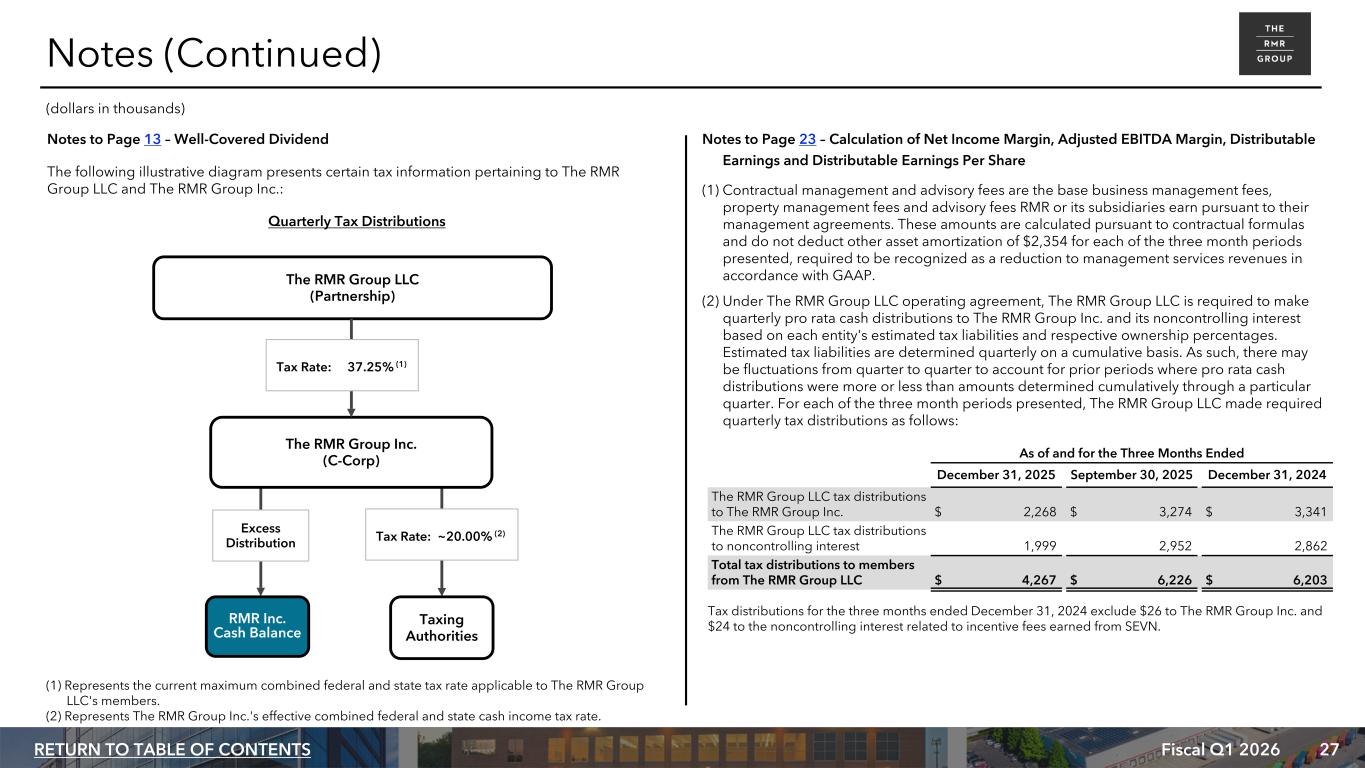

28Fiscal Q1 2026RETURN TO TABLE OF CONTENTS $30,210,587 $17,105,736 $17,105,736 $11,381,133 $6,254,869 $6,254,869 $5,454,782 $2,696,349 $2,696,349 $5,703,224 $4,549,255 $4,549,255 $7,671,448 $3,605,263 $3,605,263 Historical Cost Market Capitalization Lower of $27,726,348 $16,448,110 $16,448,110 $9,840,200 $5,814,058 $5,814,058 $5,346,695 $2,432,353 $2,432,353 $5,707,876 $4,583,294 $4,583,294 $6,831,577 $3,618,405 $3,618,405 Historical Cost Market Capitalization Lower of 0 DHC ILPT OPI SVC As of December 31, 2025 As of December 31, 2024 Notes to Page 14 – GAAP Results: Condensed Consolidated Statements of Income (1) Management services revenues include base business management fees earned from the Managed Equity REITs that are calculated monthly based upon the lower of (i) the average historical cost of each REIT’s properties, and (ii) each REIT’s average market capitalization. The information presented in the charts below is as of December 31, 2025 and 2024 and may differ from the basis on which base business management fees are calculated: Notes (Continued) (dollars in thousands)

29Fiscal Q1 2026RETURN TO TABLE OF CONTENTS RMR presents certain “non-GAAP financial measures” within the meaning of the applicable rules of the SEC, including Adjusted Net Income Attributable to The RMR Group Inc., Adjusted Net Income Attributable to The RMR Group Inc. per diluted share, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin and Distributable Earnings. The GAAP financial measure that is most directly comparable to Adjusted Net Income Attributable to The RMR Group Inc. is net income attributable to The RMR Group Inc. The GAAP financial measure that is most directly comparable to Adjusted Net Income Attributable to The RMR Group Inc. per diluted share is net income attributable to The RMR Group Inc. per diluted share. The GAAP financial measure that is most directly comparable to EBITDA, Adjusted EBITDA and Distributable Earnings is net income and the GAAP financial measure that is most directly comparable to Adjusted EBITDA Margin is net income margin, which represents net income divided by total revenues, excluding reimbursable costs. These non-GAAP financial measures do not represent net income, net income attributable to The RMR Group Inc., net income attributable to The RMR Group Inc. per diluted share or cash generated by operating activities determined in accordance with GAAP, and should not be considered alternatives to net income, net income attributable to The RMR Group Inc., net income attributable to The RMR Group Inc. per diluted share or net income margin determined in accordance with GAAP, as indicators of RMR’s financial performance or as measures of its liquidity. Other asset management businesses may calculate these non-GAAP measures differently than RMR does. • Adjusted Net Income Attributable to The RMR Group Inc. RMR calculates Adjusted Net Income Attributable to The RMR Group Inc. and Adjusted Net Income Attributable to The RMR Group Inc. per diluted share as net income attributable to The RMR Group Inc. and net income attributable to The RMR Group Inc. per diluted share, respectively, excluding the effects of certain individually significant items occurring or impacting its financial results during the quarter that are not expected to be regularly occurring, relate to a special project or initiatives or relate to gains or losses. RMR provides Adjusted Net Income Attributable to The RMR Group Inc. and Adjusted Net Income Attributable to The RMR Group Inc. per diluted share for supplemental informational purposes in order to enhance the understanding of RMR’s condensed consolidated statements of income and to facilitate a comparison of RMR’s current operating performance with its historical operating performance. • Distributable Earnings is calculated as Adjusted EBITDA less tax distributions to members and is considered to be an appropriate measure of RMR’s operating performance, along with net income attributable to The RMR Group Inc. RMR believes that Distributable Earnings provides useful information to investors because by excluding amounts payable for tax obligations, it increases comparability between periods and more accurately reflects earnings that may be available for distribution to shareholders. Distributable Earnings is among the factors RMR’s Board of Directors considers when determining shareholder dividends. • Distributable Earnings per Share calculations are based on end of period shares outstanding and includes 15,000,000 Redeemable Class A Units of The RMR Group LLC which are paired with RMR Inc's. Class B-2 common shares outstanding; actual dividends are paid to shareholders as of the applicable record date. • Distribution Payout Ratio is calculated as distributions to shareholders from The RMR Group LLC divided by Distributable Earnings. • EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin are supplemental measures used to assess operating performance, along with net income, net income attributable to The RMR Group Inc. and net income margin. RMR believes that EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin provide useful information to investors because by excluding the effects of certain amounts, such as non-cash or non-recurring items, EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin may facilitate a comparison of current operating performance with RMR’s historical operating performance and with the performance of other asset management businesses. RMR also believes that providing Adjusted EBITDA Margin may help investors assess RMR’s performance of its business by providing the margin that Adjusted EBITDA represents to its contractual management and advisory fees (excluding incentive fees, if any). Non-GAAP Financial Measures and Certain Definitions

30Fiscal Q1 2026RETURN TO TABLE OF CONTENTS • Assets Under Management (AUM) All references in this presentation to AUM on, or as of, a date are calculated at a point in time. ▪ AUM is calculated as: (i) the historical cost of real estate and related assets, excluding depreciation, amortization, impairment charges or other non-cash reserves, of the Managed Equity REITs and certain Private Capital clients, plus (ii) the gross book value of real estate assets, property and equipment of AlerisLife and Sonesta, excluding depreciation, amortization, impairment charges or other non-cash reserves, plus (iii) the carrying value of loans held for investment and real estate owned by SEVN, plus (iv) the fair value of RMR Residential, both owned and third-party managed assets. Upon deconsolidation from a Managed Equity REIT, the respective real estate and related assets are characterized as Private Capital and their historical cost represents the fair value of the real estate at the time of deconsolidation. ▪ Fee-Earning AUM is calculated (i) monthly for the Managed Equity REITs, based upon the lower of the average historical cost of each REIT's properties and its average market capitalization, plus (ii) for all other clients and wholly owned properties, Fee-Earning AUM equals AUM and includes amounts that may differ from the measures used for purposes of calculating fees under the terms of the respective management agreements. For additional information on the calculation of AUM for purposes of the fee provisions of the business management agreements, see RMR's Annual Report on Form 10-K for the fiscal year ended September 30, 2025, filed with the SEC. RMR's SEC filings are available at the SEC website: www.sec.gov. • GAAP refers to U.S. generally accepted accounting principles. • Managed Equity REITs refers to Diversified Healthcare Trust (DHC), Industrial Logistics Properties Trust (ILPT), Office Properties Income Trust (OPI) and Service Properties Trust (SVC). • Mountain JV refers to Mountain Industrial REIT LLC, a joint venture in which ILPT owns a majority interest (and accordingly is presented in ILPT’s consolidated results). • Perpetual Capital refers to capital with an indefinite duration, which may be terminated under certain conditions, and includes the Managed Equity REITs and Seven Hills Realty Trust (SEVN). • Private Capital consists of AlerisLife Inc. (AlerisLife), Sonesta International Hotels Corporation (Sonesta), residential real estate RMR manages through RMR Residential and other private capital vehicles including ABP Trust and other private entities that own commercial real estate. Some of the Managed Equity REITs own minority interests in certain of these entities. Non-GAAP Financial Measures and Certain Definitions (Continued)

31Fiscal Q1 2026RETURN TO TABLE OF CONTENTS This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws that are subject to risks and uncertainties. These statements may include words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, "opportunity", “will”, “may”, "positioned", "potential" and negatives or derivatives of these or similar expressions. These forward-looking statements include, among others, statements about: RMR's business strategy; economic and industry conditions, including as a result of changing tariffs or trade policies and the related uncertainty thereof; the impact and opportunities for RMR and RMR's clients' businesses from business cycles in the U.S. real estate industry as well as economic and industry conditions, including interest rates; RMR's belief that it is possible to grow real estate based businesses in selected property types or geographic areas despite national trends; RMR's liquidity, including its sufficiency to pursue a range of capital allocation strategies and fund RMR's operations and enhance its technology infrastructure and limit risk exposure; RMR's future profitability; and RMR's sustainability practices. Forward-looking statements reflect RMR’s current expectations, are based on judgments and assumptions, are inherently uncertain and are subject to risks, uncertainties and other factors, which could cause RMR's actual results, performance or achievements to differ materially from expected future results, performance or achievements expressed or implied in those forward-looking statements. Some of the risks, uncertainties and other factors that may cause actual results, performance or achievements to differ materially from those expressed or implied by forward-looking statements include, but are not limited to, the following: The dependence of RMR's revenues on a limited number of clients; the variability of its revenues; risks related to supply chain constraints, commodity pricing and inflation, including inflation impacting wages and employee benefits; changing market conditions, practices and trends, which may adversely impact its clients and the fees RMR receives from them; OPI's voluntary chapter 11 process to restructure its debt obligations and capital structure, which may reduce RMR's management fee revenue over time and may result in reputational harm to RMR; potential terminations of the management agreements with its clients; uncertainty surrounding interest rates and sustained high interest rates, which may impact RMR's clients and significantly reduce RMR's revenues or impede its growth; RMR's dependence on the growth and performance of its clients; RMR's ability to obtain or create new clients for its business which is often dependent on circumstances beyond RMR's control; the ability of RMR's clients to operate their businesses profitably, optimize their capital structures, comply with the terms of their debt agreements and financial covenants and to grow and increase their market capitalizations and total shareholder returns; RMR's ability to successfully provide management services to its clients; RMR's ability to maintain or increase the distributions RMR pays to its shareholders; RMR's ability to successfully pursue and execute capital allocation and new business strategies; RMR's ability to prudently invest in its business to enhance its operations, services and competitive positioning; RMR's ability to successfully grow the RMR Residential business and realize RMR's expected returns on its investment within the anticipated timeframe; RMR's ability to successfully integrate acquired businesses and realize the expected returns on its investments; the ability of Tremont to identify and close suitable investments for SEVN and to monitor, service and administer existing investments; RMR's ability to obtain additional capital from third party investors for its private capital initiatives in order to make additional investments and to increase potential returns; changes to RMR's operating leverage or client diversity; litigation risks; risks related to acquisitions, dispositions and other activities by RMR or among its clients; allegations, even if untrue, of any conflicts of interest arising from RMR's management activities; RMR's ability to retain the services of its managing directors and other key personnel; RMR's and its clients’ risks associated with RMR's and its clients' costs of compliance with laws and regulations, including securities regulations, exchange listing standards and other laws and regulations affecting public companies; and other matters. These risks, uncertainties and other factors are not exhaustive and should be read in conjunction with other cautionary statements that are included in RMR's periodic filings. The information contained in RMR’s filings with the Securities and Exchange Commission (SEC), including under the caption “Risk Factors” in its periodic reports, or incorporated therein, identifies important factors that could cause differences from the forward-looking statements in this presentation. RMR’s filings with the SEC are available on the SEC’s website at www.sec.gov. You should not place undue reliance on forward-looking statements. Except as required by law, RMR does not intend to update or change any forward-looking statements as a result of new information, future events or otherwise. Warning Concerning Forward-Looking Statements