Please wait

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

Amendment No. 1

(Mark One)

|

| |

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______ to _______

Commission file number 1-37671

|

| | | |

FOREST CITY REALTY TRUST, INC. |

(Exact name of registrant as specified in its charter) |

Maryland | | 47-4113168 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

Key Tower Suite 3100 | 127 Public Square Cleveland, Ohio | | 44114 |

(Address of principal executive offices) | | (Zip Code) |

| | |

Registrant’s telephone number, including area code | | 216-621-6060 |

Securities registered pursuant to Section 12(b) of the Act: | | |

Title of each class | | Name of each exchange on which registered |

Class A Common Stock ($.01 par value) | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

YES ý NO ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

YES ¨ NO ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES ý NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YES ý NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act: (Check one):

|

| | | |

Large accelerated filer | ý | Accelerated filer | ¨ |

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

| | Emerging growth company | ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES ¨ NO ý

The aggregate market value of the outstanding common equity held by non-affiliates as of the last business day of the registrant’s most recently completed second fiscal quarter was $5,864,717,541.

The number of shares of registrant’s Class A common stock outstanding on April 25, 2018 was 267,192,318.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Explanatory Paragraph

This Amendment No. 1 to Form 10-K (this "Form 10-K/A") amends the Annual Report on Form 10-K for the fiscal year ended December 31, 2017 originally filed on February 22, 2018 (the "Original Filing") by Forest City Realty Trust, Inc., a Maryland corporation ("Forest City", the "Company", "we" or "us"). We are filing this Form 10-K/A to present the information required by Part III of the Form 10-K as we will not file our definitive proxy statement within 120 days of the end of our fiscal year ended December 31, 2017.

Except as described above, no other changes have been made to the Original Filing. The Original Filing continues to speak as of the date of the Original Filing, and we have not updated the disclosures contained therein to reflect any events which occurred at a date subsequent to the filing of the Original Filing.

PART III

Item 10. Directors, Executive Officers and Corporate Governance

Directors of the Registrant

Set forth below are each director's name, age, year first elected as a director, principal occupation, professional history and public company directorships held currently and during the past five years, and detailed information about the qualifications, experience, attributes and skills that led to the conclusion that such person should serve as our director.

|

| | |

| | Kenneth J. Bacon Principal Occupation and Business Experience Mr. Bacon co-founded RailField Partners, a financial advisory and asset management firm based in Washington, D.C., in 2012. Mr. Bacon retired from the Federal National Mortgage Association (Fannie Mae) in 2012 after nearly 20 years with the company. Mr. Bacon joined Fannie Mae as senior vice president, Northeast Region. In 1998, he was selected to lead Fannie Mae’s American Communities Fund. In 2000, he became senior vice president of the organization’s Multifamily Division and in 2005 he was promoted to executive vice president of the division. Prior to Fannie Mae, Mr. Bacon served as director of policy for the Oversight Board at Resolution Trust Corporation, and was later named director of securitization. Prior to this, he worked at Morgan Stanley, where his focus was mortgage finance and related products. Mr. Bacon began his career with Kidder Peabody. Mr. Bacon is a board member of three other publicly-traded companies: Comcast Corporation, a global media and technology company, where he has been a director since 2002; Ally Financial Inc., a financial service company, where he has been a director since 2015; and Welltower Inc., a healthcare property REIT, where he has been a director since January 2016. He is also a board member of the National Multifamily Housing Council and serves on the Advisory Board of the Stanford Center on Longevity. Mr. Bacon has a B.A. from Stanford University, a M.Sc. from the London School of Economics, and an MBA from the Harvard Graduate School of Business. Key Experience, Attributes and Skills Mr. Bacon brings significant financial, asset management and real estate experience to our Board of Directors. His varied professional officer roles as well as his board service with other publicly-traded companies and real estate industry organizations, make him a tremendous asset to Forest City and our Board. In addition, he provides recommendations on best practices in areas such as governmental affairs, the financial industry and the non-profit, educational and philanthropic communities.

|

Age: 63 Director Since: 2012 Independent Board Committee: - Audit Other Current Registered Company Directorships: - Comcast Corporation - Ally Financial Inc. - Welltower, Inc.

| |

|

| | |

| | Z. Jamie Behar Principal Occupation and Business Experience Ms. Behar served as Managing Director, Real Estate & Alternative Investments for GM Investment Management Corp. (GMIMCo), the asset management arm of General Motors Company, from 2005 to 2015. While at GMIMCo, she managed GMIMCo’s clients’ real estate investment portfolios, including both private market and publicly traded security investments, as well as their alternative investment portfolios, totaling approximately $12 billion at peak portfolio value. She was also a member of GMIMCo’s Board of Directors, the Investment Management Committee, the Private Equity Investment Approval Committee and the Risk Management Committee. Ms. Behar is currently a board member of two additional publicly-traded companies: Gramercy Property Trust, a REIT that specializes in acquiring and managing single-tenant, net-leased industrial and office properties, where she has been a director since 2015 and serves as a member of the Investment Committee and Audit Committee; and Sunstone Hotel Investors, Inc., a U.S. hotel company, where she has been a director since 2004 and serves as Chair of the Nominating & Corporate Governance Committee and as a member of the Audit Committee. She also serves as a board member of Broadstone Real Estate Access Fund, a registered, closed-end management investment company, where she has been a director since January 2018 and serves as Chair of the Nominating and Corporate Governance Committee. Ms. Behar previously served on the Board of Directors of Desarrolladora Homex, S.A. de C.V., a publicly-traded home development company located in Mexico, from 2004 to 2013, where she served on the Audit Committee. Ms. Behar was a member of the Board of Directors of the Pension Real Estate Association (PREA) from March 2008 through March 2014, having held the position of Board Chair from March 2010 to March 2011, and was a member of the Real Estate Investment Advisory Council of the National Association of Real Estate Investment Trusts (NAREIT) from its inception through 2015. Ms. Behar holds a B.S.E. from The Wharton School, University of Pennsylvania, an MBA from Columbia University Graduate School of Business, and the CFA Charter. Key Experience, Attributes and Skills Ms. Behar has significant real estate company board experience and is a seasoned business executive and CFA with extensive investment experience in a diverse range of public and private real estate equity and debt, and other private equity, portfolios. She brings a wealth of executive and board-level experience in investment strategy, financial management, corporate governance and other areas, making her an outstanding member of our Board.

|

Age: 60 Director Since: 2017 Independent Board Committees: - Audit - Corporate Governance and Nominating Other Current Registered Company Directorships: - Gramercy Property Trust - Sunstone Hotel Investors, Inc. - Broadstone Real Estate Access Fund

| |

|

|

| | |

| | Michelle Felman Principal Occupation and Business Experience Ms. Felman founded JAM Holdings, an investment and advisory firm, in 2016. Prior to founding JAM Holdings, Ms. Felman served as an executive vice president - Co-Head of Acquisitions and Capital Markets at Vornado Realty Trust, a publicly traded REIT, from 1997 to 2010 and remained a consultant for VNO through December 2012. She began her career at Morgan Stanley in the Investment Banking Division and later joined GE Capital as a Managing Director of Business Development. Ms. Felman is a board member of Partners Group Holdings AG, a registered, global private equity firm, where she serves as the Chair of the Investment Oversight Committee. She is also a Trustee of Choice Properties, a publicly traded retail REIT in Canada, which was spun off by Loblaws Companies Limited, where she serves on the Governance and Compensation committees. Ms. Felman has resigned from Choice Properties, effective May 2, 2018. Ms. Felman also serves on the boards of Reonomy, a private real estate technology company, and Cumming Corp, a global project management and cost consulting company, and on the Advisory Board at Turner Impact Capital, a social impact platform that focuses on healthcare, charter schools and workforce housing. Until 2017, Ms. Felman was a member of the Executive Committee of the Zell Lurie Center at Wharton Business School, where she also served as a visiting professor. Ms. Felman has a bachelor’s degree in economics from the University of California and an MBA from Wharton Business School at the University of Pennsylvania. Key Experience, Attributes and Skills Ms. Felman brings over 30 years of investment and strategic advisory experience in the real estate industry to our Board of Directors. Her background in investment banking and as the Chair of the Investment Oversight Committee at a global private equity firm has provided her tremendous experience with strategy and risk management, and she brings a track record of creating value to stockholders.

|

Age: 55 Director Since: April 2018 Independent Board Committee: - Compensation Other Current Registered Company Directorship: - Partners Group Holdings AG | |

| |

|

| | |

| | Jerome J. Lande Principal Occupation and Business Experience Jerome J. Lande has served as the Head of Special Situations at Scopia Capital Management LP, an institutional alternative asset management firm and one of Forest City’s largest stockholders, since April 2016 and as a Partner since January 2017. Previously, Mr. Lande co-founded Coppersmith Capital Management LLC, an asset management firm focused on equity investing and active engagement for long-term value creation, in April 2012 and served as Managing Partner until April 2016. Prior to co-founding Coppersmith, from December 1998 to December 2011, Mr. Lande was a partner of MCM Management LLC, the general partner of MMI Investments, LP, a small-cap investment fund that employed private equity investing methodologies in public equities, where he oversaw research, trading and activism. He also served as Corporate Development Officer of Key Components, Inc., a global diversified industrial manufacturer, from 1999 until its acquisition in 2004. Mr. Lande is currently a director of two additional publicly traded companies: CONMED Corporation, a global medical technology company, since April 2014, where he serves as a member of the Compensation and Strategy Committees; and Itron, Inc., a technology company offering products and services in energy and water resource management, since December 2015, where he serves as a member of the Audit/Finance and Value Enhancement committees. Mr. Lande has a bachelor’s degree from Cornell University. Key Experience, Attributes and Skills Mr. Lande brings significant investment acumen as a result of his 20 years of professional experience, in both public and private markets, to our Board of Directors. Mr. Lande’s expertise on corporate governance and transactional matters, as well as his extensive experience in optimizing corporate strategy, operational performance, business configurations and stockholder value creation, provides unique and valuable insight to our Board.

Arrangement Regarding Selection as a Director

Pursuant to the agreement, dated March 22, 2018, between Forest City Realty Trust, Inc. and Scopia Capital Management LP and certain of its affiliates, Scopia recommended Mr. Lande as its appointee as director and he was appointed by the Board effective April 16, 2018.

|

Age: 42 Director Since: April 2018 Independent

Board Committee: - Corporate Governance and Nominating Other Current Registered Company Directorships: - CONMED Corporation - Itron, Inc.

| |

| |

|

| | |

| | David J. LaRue

Principal Occupation and Business Experience

Mr. LaRue has been the president and chief executive officer of Forest City since June 2011. He is also an officer of various subsidiaries of Forest City. Prior to becoming president and chief executive officer, Mr. LaRue served as executive vice president and chief operating officer from March 2010 to June 2011. Mr. LaRue served as president and chief operating officer of Forest City Commercial Group, Inc. (now known as Forest City Commercial Group, LLC) from 2003 to March 2010 and as executive vice president of Forest City Rental Properties, Inc. (now known as Forest City Properties, LLC) from 1997 to 2003. Prior to joining Forest City in 1986, Mr. LaRue was an internal auditor and financial analyst with the Sherwin-Williams Company. Mr. LaRue served on the Board of CubeSmart, a publicly-traded real estate investment trust focused on self-storage facilities, from 2004 to May 2013. Mr. LaRue is a member of the Board of Trustees and chair of the Capital Committee of the Friends of the Cleveland School of the Arts; a trustee and member of the Finance Committee of the Lawrence School; a member of the Board of Directors of St. Edward High School; and a member of the Board of Directors of the Greater Cleveland Partnership. Mr. LaRue’s prior industry service includes being a member of the Board of Trustees of the International Council of Shopping Centers (ICSC), including service as its chairman in 2013; a member of the Board of Advisors of the National Association of the Real Estate Investment Trust (NAREIT); and a member of the Board of Directors of The Real Estate Round Table.

Key Experience, Attributes and Skills

Under Mr. LaRue’s leadership as president and chief executive officer, Forest City successfully executed a merger transaction in connection with its conversion to REIT status, and continues to make significant progress achieving its strategic objectives of focusing on core products in core markets, building a sustainable capital structure and achieving operational excellence. As an employee of Forest City since 1986, Mr. LaRue brings vast experience in virtually every aspect of our business, along with broad strategic, operational and financial acumen to the Board of Directors.

|

Age: 56 Director Since: 2011 Forest City Executive

| |

| |

|

| | |

| | Adam S. Metz Principal Occupation and Business Experience Mr. Metz served as Managing Director and Head of International Real Estate at The Carlyle Group, a private equity, alternative asset management and financial services corporation, from September 2013 to April 2018. From March 2011 to August 2013, Mr. Metz served as Senior Advisor to TPG Capital's Real Estate Group, where he worked on all facets of the business including the sourcing of deals, asset management, financing, fundraising and developing strategy. Prior to joining TPG, he was the Chief Executive Officer of General Growth Properties, Inc., from 2008 to 2010, where he led the company through one of the largest and most successful bankruptcy and restructurings in REIT history. In 2002, he co-founded Polaris Capital LLC, where he served as a partner until 2008. Previously, Mr. Metz held executive positions at Rodamco, North America NV, Urban Shopping Centers, Inc., and JMB Realty. Mr. Metz began his career serving in the Commercial Real Estate Lending Group at the First National Bank of Chicago. Mr. Metz served as a director of Parkway Properties, a former NYSE-listed REIT that invested in Sun Belt office buildings, from June 2012 to November 2016, where he was a member of the Audit and Compensation committees. He currently serves on the advisory board of the Cornell Baker Program in Real Estate (Cornell University) and the Kellogg Real Estate Advisory Board (Northwestern University). He also serves on the board of trustees of the Smithsonian Hirshhorn Museum and Sculpture Garden. Mr. Metz is currently a member of Real Estate Roundtable, International Council of Shopping Centers, the Urban Land Institute and the University of Southern California Lusk Center for Real Estate. Mr. Metz has a Master of Management degree from the Kellogg School of Management at Northwestern University, and a bachelor’s degree from Cornell University. Key Experience, Attributes and Skills Mr. Metz brings more than 30 years of real estate experience, both in the U.S. and abroad, to our Board of Directors. Possessing experience in numerous property sectors as an executive leader and director, Mr. Metz brings a track record of creating value for stockholders.

|

Age: 56 Director Since: April 2018 Independent Board Committees: - Audit - Compensation

| |

| |

|

| | |

| | Gavin T. Molinelli Principal Occupation and Business Experience Gavin T. Molinelli has served as a Partner and Director of Starboard Value LP, an investment adviser and one of Forest City’s largest stockholders, since 2011. Prior to Starboard Value LP’s formation, Mr. Molinelli was Investment Analyst and Vice President at Ramius LLC, a privately owned hedge fund sponsor, from February 2009 to 2011, where he also served as an associate from October 2006 to February 2009. Prior to joining Ramius LLC, Mr. Molinelli was a member of the Technology Investment Banking group at Banc of America Securities LLC from June 2005 to September 2006. During the past five years, Mr. Molinelli has served on two additional publicly traded company boards, including: Depomed, Inc., a pharmaceutical company, from March 2017 to August 2017, where he served as a member of the Compensation and Nominating and Corporate Governance committees; and Wausau Paper Corp., a provider of away-from-home towel and tissue products, from July 2014 until it was acquired by SCA Tissue North America LLC in January 2016, where he served as a member of the Compensation and Corporate Governance committees. Mr. Molinelli has a bachelor’s degree from Washington and Lee University. Key Experience, Attributes and Skills Mr. Molinelli’s financial acumen, investor perspective, strategic planning expertise and past publicly traded company directorships provide our Board with important insight. Through his service in multiple managerial and leadership roles, Mr. Molinelli brings a track record of creating stockholder value

Arrangement Regarding Selection as a Director

Pursuant to the agreement, dated March 22, 2018, between Forest City Realty Trust, Inc. and Starboard Value LP and certain of its affiliates, Starboard recommended Mr. Molinelli as its appointee as director and he was appointed by the Board effective April 16, 2018.

|

Age: 34 Director Since: April 2018 Independent Board Committees: - Compensation - Corporate Governance and Nominating (Chair)

| |

| |

|

| | |

| | Marran H. Ogilvie Principal Occupation and Business Experience Marran H. Ogilvie has served as an advisor to the Creditors’ Committee for the Lehman Brothers International (Europe) Administration since 2008 and currently serves as an independent board member of several companies. Ms. Ogilvie was a member of Ramius, LLC (merged with Cowen Group, Inc. in 2009), an alternative investment management firm, where she served in various capacities from 1994 to 2010, including as Chief of Staff from 2009 to 2010, Chief Operating Officer, Partner and Member of the Management Committee from 2007 to 2009 and General Counsel and Chief Compliance Officer from 1997 to 2007. Ms. Ogilvie also serves as a board member of four additional publicly traded companies: Evolution Petroleum, a developer and producer of oil and gas reserves, since December 2017, where she serves as a member of the Audit Committee; Ferro Corporation, a supplier of functional coatings and color solutions, since October 2017, where she serves as a member of the Audit and Nominating and Governance Committees; Four Corners Property Trust, Inc., a REIT, since November 2015, where she chairs the Audit and Nominating and Governance Committees and serves on the Compensation Committee; and Bemis Company, Inc., a flexible packaging company, since March 2018. She previously served as a director for Southwest Bancorp, a regional commercial bank, from September 2011 to April 2015; Zais Financial Corp., a REIT, from February 2013 to October 2016; Seventy Seven Energy Inc., an oil field services company, from July 2014 to July 2016; the Korea Fund, a closed-end investment company, from November 2012 to December 2017; and LSB Industries, Inc., a manufacturing company, from April 2015 to April 2018. In addition to her public company board experience, Ms. Ogilvie serves as a member of the Executive Board of A Chance to Change, a civic organization serving families in Oklahoma, and as a member of the Board of Directors of Oklahoma Contemporary Arts Center. Ms. Ogilvie has a Juris Doctor degree from the St. John’s University School of Law and a bachelor’s degree from the University of Oklahoma. Key Experience, Attributes and Skills A financial expert, Ms. Ogilvie brings extensive knowledge of capital markets, investment management and banking to our Board of Directors. Her legal background provides critical thinking and analysis to the Board. In building and managing successful international financial services businesses, Ms. Ogilvie’s experience in regulatory and legal issues, complex structures, strategic planning and business operations is a tremendous asset to our Board.

|

Age: 49 Director Since: April 2018 Independent Board Committees: - Audit - Corporate Governance and Nominating Other Current Registered Company Directorships: - Evolution Petroleum - Ferro Corporation - Four Corners Property Trust, Inc. - Bemis Company, Inc.

| |

| |

|

| | |

| | Mark S. Ordan Principal Occupation and Business Experience Mark S. Ordan has served as Chief Executive Officer of Quality Care Properties, a publicly traded real estate company and one of the largest actively managed companies focused on post-acute, skilled nursing and memory care/assisted living properties, since its spin-off from HCP, Inc. in October 2016. He served as a consultant to HCP from March 2016 to October 2016. Mr. Ordan previously served as Executive Chairman of Washington Prime Group, a publicly traded retail REIT, from January 2015 through June 2016, after serving as Chief Executive Officer from May 2014 to January 2015. From 2008 to 2013, he was Chief Executive Officer of Sunrise Senior Living, LLC, the successor to the management business of Sunrise Senior Living, Inc., a publicly traded real estate company, where he led a restructuring of the business and oversaw the sale of the company to Health Care REIT, Inc. in January 2013. From October 2006 to May 2007, Mr. Ordan was Chief Executive Officer and President of The Mills Corporation, a publicly traded developer, owner and operator of regional shopping malls and retail entertainment centers, after serving as chief operating officer from February 2006 to October 2006. While at The Mills Corporation, he also served as a director from December 2006 to May 2007. Previously, Mr. Ordan held executive positions at Sutton Place Group, LLC; High Noon Always, Inc.; Chatwell Health Management; and Fresh Fields Markets, Inc. Mr. Ordan began his career as a an Analyst in the Equities Division of Goldman Sachs & Co. Mr. Ordan is currently a director of two additional publicly traded companies: Quality Care Properties, Inc., a REIT, since October 2016, where he serves as Chairman; and VEREIT, Inc., a REIT, since 2015, where he serves as a member of the Audit and Compensation committees. In addition, he has served as Senior Advisor to HCP, Inc., a publicly traded REIT that primarily invests in real estate serving the U.S. healthcare industry, since 2016. In addition to his prior publicly traded company board service as a Chairman of Washington Prime Group, in the past five years, Mr. Ordan has served as a director of Harris Teeter Supermarkets, Inc., a supermarket chain, from February 2014 to January 2015. In addition to his public company board experience, Mr. Ordan serves on the U.S. Chamber of Commerce Executive Committee and as a board member of the Chesapeake Bay Foundation. Mr. Ordan has an MBA from Harvard Business School and a bachelor’s degree from Vassar College. Key Experience, Attributes and Skills Mr. Ordan brings extensive corporate leadership and a diversified set of real estate industry experience to our Board of Directors. His background as a Chief Executive Officer and director of multiple public companies provides advanced knowledge of strategic planning, capital markets, government relations, corporate governance and risk management to our Board. Mr. Ordan brings a track record of creating value for stockholders.

|

Age: 59 Director Since: April 2018 Independent Board Committee: - Compensation (Chair) Other Current Registered Company Directorships: - Quality Care Properties, Inc. - VEREIT, Inc.

| |

|

| |

|

| | |

| | James A. Ratner Principal Occupation and Business Experience

Mr. Ratner has been the non-executive chairman of the Forest City Board of Directors since December 31, 2016. Previously, Mr. Ratner served as executive vice president of the Company from March 1988 to December 2016, including service as our executive vice president - development from January 2016 to December 2016. He has also served as an officer and/or director of various subsidiaries of Forest City. Mr. Ratner has served as a board member of Hamilton Beach (previously NACCO Industries, Inc.), a publicly-traded mining, small appliances and specialty retail holding company, since 2012. Mr. Ratner is active with numerous community, charitable and professional organizations, including membership on the Board of Trustees of Case Western Reserve University, The Cleveland Museum of Art and The Playhouse Square Foundation, where he serves as Chair. Mr. Ratner holds a bachelor’s degree from Columbia University and an MBA from Harvard University.

Key Experience, Attributes and Skills

As a member of one of Forest City’s founding families, our former executive vice president - development and a large shareholder with over 40 years of experience at the Company, Mr. Ratner brings a wealth of leadership experience and knowledge of the Company and the real estate industry to the Board of Directors.

Family Relationships

James A. Ratner, our Chairman of the Board, and Ronald A. Ratner, our Executive Vice President - Development, are brothers.

|

Chairman Age: 73 Director Since: December 2016 Former Director Service: 1985 - 2012 Other Current Registered Company Directorship: - Hamilton Beach (previously NACCO Industries, Inc.) | |

|

|

|

|

|

|

| | |

| | William R. Roberts Principal Occupation and Business Experience William R. Roberts has served as President and Chief Executive Officer of the W.R. Roberts Company since 2012. At W.R. Roberts Company, Mr. Roberts provides business counseling services in the areas of operations, executive coaching, business development and strategic planning. From 1980 to December 2011, Mr. Roberts served in various positions with Verizon Communications, Inc. and various predecessor companies to Verizon, including service as regional president for Verizon Washington, D.C., Maryland and Virginia from 2010 to 2011, regional president for Verizon Washington, D.C. and Maryland from 2007 to 2010, president and chief executive officer of Verizon Public Policy Initiatives from 2000 to 2007, as well as various positions of increasing responsibility in Operations, Human Resources, Marketing, Public Affairs, and Government Relations from 1980 to 2000. Mr. Roberts serves on the Board of Directors of MedStar Health, the largest not-for-profit healthcare system in Maryland and the Washington, D.C., region, where he has been a director since 2004, served as immediate past Chairman of the Board and serves as Vice Chairman of the Executive Compensation Committee. In addition, he serves as an independent member of the board of UMUC Ventures, which provides an innovative business model for higher education that brings services and products to help higher education institutions compete and keep the costs of education affordable. Mr. Roberts has also served as Board Chairman for the Maryland Chamber of Commerce, National Aquarium in Baltimore and the Baltimore branch of the Federal Reserve Bank of Richmond. Mr. Roberts holds numerous honors and distinctive recognitions, including two honorary doctorate degrees. In 2012, he was inducted into the Maryland Chamber of Commerce Business Hall of Fame. Mr. Roberts has a bachelor’s degree from Morgan State University. Key Experience, Attributes and Skills Mr. Roberts brings more than 35 years of corporate leadership experience in a wide variety of different roles with two Fortune 25 companies to our Board of Directors. His expertise in consumer marketing, strategic planning, labor relations, business operations, public policy, and regulatory and governmental affairs provides significant insight and experience to our Board. |

Age: 62 Director Since: April 2018 Independent Board Committee: - Compensation | |

| |

|

| | |

| | Robert A. Schriesheim Principal Occupation and Business Experience Robert A. Schriesheim is chairman of Truax Partners LLC, through which he advises and partners with institutional investors and serves as a board member in public and private companies typically undergoing broad transformations. From August 2011 to October 2016, he served as the Executive Vice President and Chief Financial Officer of Sears Holdings Corporation, a publicly traded retail company, and served as a Corporate Advisor until January 2017. From January 2010 to October 2010, Mr. Schriesheim was Senior Vice President and Chief Financial Officer of Hewitt Associates, a global human resources consulting and outsourcing company that was acquired by Aon in October 2010. From 2006 to 2009, he was Executive Vice President and Chief Financial Officer and, until its 2011 acquisition by Infor and Golden Gate Capital, a board member of Lawson Software, a publicly traded ERP software provider. Previously, Mr. Schriesheim was a Venture Partner with ARCH Development Partners, LLC, a seed stage venture capital fund, and earlier he held executive positions at Global TeleSystems, Inc., SBC Equity Partners, Inc., Ameritech, AC Nielsen Company, and Brooke Group, Ltd. Mr. Schriesheim is a director of three additional publicly traded companies, including: Houlihan Lokey, Inc., a global investment banking firm, since its initial public offering in August 2015, where he chairs the Audit Committee and serves as a member of the Compensation Committee; NII Holdings Inc. (formerly Nextel International), a provider of wireless communications services in Latin America, since August 2015, where he chairs the Audit Committee and serves as a member of the Corporate Governance and Nominating Committee; and Skyworks Solutions, Inc., a global provider of semiconductors to the mobile communications industry, since May 2006, where he chairs the Audit Committee. He also serves on the board of two privately held companies, including First Advantage, a portfolio company of the private equity firm Symphony Technology Group, LLC, which provides analytics and outsourced talent acquisition solutions on a global basis; and Outcome Health, a digital media company operating a patient point-of-care health intelligence platform. Mr. Schriesheim has an MBA from the University of Chicago Booth School of Business, and a bachelor’s degree from Princeton University.

Key Experience, Attributes and Skills Mr. Schriesheim brings extensive corporate leadership and financial acumen to our Board of Directors. He has a track record of creating stockholder value during his distinguished career, having been the CFO of four publicly traded companies, as a member of nine publicly traded company boards and several more private company boards. His expertise in capital markets, strategy, operations and governance oversight is a tremendous asset to our Board.

|

Age: 57 Director Since: April 2018 Independent Board Committees: - Audit (Chair) - Corporate Governance and Nominating Other Current Registered Company Directorships: - Houlihan Lokey, Inc. - NII Holdings Inc. - Skyworks Solutions, Inc.

| |

| |

Executive Officers of the Registrant

The following list was previously included in Part I of the Annual Report on Form 10-K. The names and ages of and positions held by the executive officers of the Company are presented in the following list. Each individual has been appointed to serve for the period which ends on the date of the 2018 Annual Meeting of Stockholders.

|

| | |

Name | Age | Current Position |

David J. LaRue | 56 | President, Chief Executive Officer and Director |

Robert G. O’Brien | 60 | Executive Vice President and Chief Financial Officer |

Duane F. Bishop | 55 | Executive Vice President and Chief Operating Officer |

Charles D. Obert | 52 | Executive Vice President, Chief Accounting Officer and Corporate Controller |

Emily J. Holiday | 41 | Executive Vice President - Human Resources |

Ketan Patel | 47 | Executive Vice President, General Counsel and Secretary |

Brian J. Ratner (1) | 60 | Executive Vice President and Director |

Ronald A. Ratner (2) | 70 | Executive Vice President - Development and Director |

Deborah Ratner Salzberg (1) | 64 | Executive Vice President and Director |

| |

• | David J. LaRue has been Chief Executive Officer and President since June 2011. |

| |

• | Robert G. O’Brien has been Executive Vice President and Chief Financial Officer since April 2008. |

| |

• | Duane F. Bishop has been Executive Vice President and Chief Operating Officer since January 1, 2016. He previously served as the Executive Vice President and Chief Operating Officer of the Company’s Commercial Group from 2011 to December 31, 2015. |

| |

• | Charles D. Obert has been Chief Accounting Officer and Corporate Controller since September 2011 and Executive Vice President since March 1, 2017. He previously served as a Senior Vice President from September 2011 through February 28, 2017. |

| |

• | Emily J. Holiday has been Executive Vice President - Human Resources since March 1, 2017. She previously served as Senior Vice President - Human Resources from January 1, 2016 through February 28, 2017, Director - Talent Management from October 2014 through December 2015 and Vice President - Procurement from April 2011 through October 2014. |

| |

• | Ketan Patel has been Executive Vice President, General Counsel and Secretary since May 17, 2017. He previously served as Vice President, Corporate Secretary and Chief Ethics Officer of FirstEnergy Corp., a major Midwestern electric utility company, from July 2016 to May 17, 2017, where he served as a primary liaison to its board and managed a team of 150 associates across the company’s real estate and facilities, corporate and records and information compliance departments. From November 2012 through June 2016, he served as Director, Real Estate and Facilities of FirstEnergy Corp. |

| |

• | Brian J. Ratner has been Executive Vice President since June 2001. He has been President of Forest City Texas, LLC, a subsidiary of the Company, since 2011. |

| |

• | Ronald A. Ratner has been Executive Vice President - Development since January 1, 2016 and Executive Vice President since March 1988. |

| |

• | Deborah Ratner Salzberg has been Executive Vice President since June 2013. She has been President of Forest City Washington, LLC, a subsidiary of the Company, since 2002. |

| |

(1) | Brian J. Ratner and Deborah Ratner Salzberg are siblings. |

| |

(2) | James A. Ratner, the Company’s non-executive Chairman of the Board, and Ronald A. Ratner are brothers. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors, executive officers, and beneficial owners of more than 10% of a registered class of our equity securities to file with the Securities and Exchange Commission (the "SEC") and the New York Stock Exchange (the "NYSE") initial reports of beneficial ownership and reports of changes in ownership of common shares and other equity securities of ours. Executive officers, directors and owners of more than 10% of the common shares are required by SEC regulations to furnish us with copies of all forms they file pursuant to Section 16(a).

To our knowledge, based solely on our review of the copies of such reports filed with the SEC and written representations that no other reports were required during the year ended December 31, 2017, all Section 16(a) filing requirements applicable to our executive officers, directors and greater than 10% beneficial owners were complied with, except as follows: due to technical difficulties experienced with the Section 16 filing software used for reporting, a Form 4 for Ronald Ratner was filed one day late; due to the untimely reporting of transaction details by the filer’s representatives, a Form 4 for Ronald Ratner was not timely; and due to transaction details regarding an in-kind exchange of convertible securities not being made available until after a Form 4 was due, a Form 4 for Bruce Ratner was not timely.

Audit Committee

The Company’s Board of Directors has a standing Audit Committee. As of December 31, 2017, the Audit Committee’s membership was as follows: Michael P. Esposito, Jr. (Chair), Arthur F. Anton, Kenneth J. Bacon, and Z. Jamie Behar. Effective April 2018, Messrs. Esposito and Anton resigned from the Company's Board and all committees on which they served. Also effective April 2018, following their appointments to the Board, Robert A. Schriesheim was appointed as Chair of the Audit Committee and Adam S. Metz and Marran H. Ogilvie were appointed as members. The Board has determined that each member of the Audit Committee qualifies as an audit committee “financial expert” in accordance with the requirements of Section 407 of the Sarbanes-Oxley Act of 2002 and the SEC rules implementing that section. As of the date of this Form 10-K/A, Marran H. Ogilvie and Robert A. Schriesheim each serve on the audit committees of three additional publicly-traded companies. As such, the Board has taken their simultaneous service in consideration and determined that such service will not impair the ability of Ms. Ogilvie and Mr. Schriesheim to effectively serve on the Company's Audit Committee.

Code of Legal and Ethical Conduct

We require that all directors, officers and employees adhere to our Code of Legal and Ethical Conduct in addressing the legal and ethical issues encountered in conducting their work. The Code of Legal and Ethical Conduct requires, among other things, that our employees avoid conflicts of interest, comply with all laws and other legal requirements and otherwise act with integrity.

We require all directors, officers, and employees to annually review and acknowledge compliance with our Code of Legal and Ethical Conduct. Furthermore, all newly hired employees are required to acknowledge receipt and compliance with the Code of Legal and Ethical Conduct. In addition, those with supervisory duties are also required to acknowledge their responsibility for both informing and monitoring compliance with the Code of Legal and Ethical Conduct on the part of employees under their supervision. In 2017, 100% of our directors, officers and employees acknowledged compliance with the Code of Legal and Ethical Conduct.

The Board adopted a Senior Financial Officers Code of Ethical Conduct as an addendum to the Code of Legal and Ethical Conduct. The Senior Financial Officers Code of Ethical Conduct formalizes the general standards of honesty, integrity and judgment that we expect of our senior financial officers. We require our senior financial officers to annually acknowledge receipt of and compliance with the Senior Financial Officers Code of Ethical Conduct. In 2017, 100% of our senior financial officers acknowledged compliance with the Senior Financial Officers Code of Ethical Conduct.

In addition, the Board adopted a Supplier Code of Conduct in 2012. The Supplier Code of Conduct formalizes our expectations of suppliers and sets forth legal, moral, ethical and environmental standards and guidelines by which we expect our suppliers to abide. In 2014, the Board adopted substantial enhancements to the Supplier Code of Conduct to add additional standards related to health and human safety, and labor and human rights; and enhanced provisions related to gifts and gratuities.We have implemented an anonymous hotline monitored by an external, third-party firm. Our Audit Committee has adopted a policy statement entitled “Employee Complaint Procedures for Accounting and Auditing Matters” establishing procedures to investigate complaints.

The Company intends to disclose on its website any amendment to, or waiver of, any provision of the Code of Legal and Ethical Conduct applicable to its directors and executive officers that would otherwise be required to be disclosed under the rules of the SEC or NYSE.

Copies of the Code of Legal and Ethical Conduct and the Supplier Code of Conduct are available on the Company’s website at www.forestcity.net. The Code of Legal and Ethical Conduct is also available in print, free of charge, to any stockholder upon written request addressed to Corporate Secretary, Forest City Realty Trust, Inc., 127 Public Square, Suite 3100, Cleveland, Ohio 44114.

Item 11. Executive Compensation

Director Compensation

Our director compensation policy is outlined in the following chart and includes the compensation paid to our independent non-employee directors. Compensation is paid to nonemployee directors only. Directors who are also our employees receive no additional compensation for service as directors. All of our nonemployee directors serving on the Board during 2017, except James A. Ratner, were independent.

|

| |

Nonemployee Director Compensation Policy | Amount (1) |

Annual Board Retainer

| $65,000 |

Annual Stock Award (2) | $125,000 |

Annual Retainer to “Lead Director”

| $25,000 |

Annual Retainer to Committee Chairman for: | |

Audit Committee | $30,000 |

Compensation Committee | $20,000 |

Corporate Governance and Nominating Committee | $15,000 |

Annual Retainer to Committee Members (other than Chairman) for: | |

Audit Committee | $15,000 |

Compensation Committee | $10,000 |

Corporate Governance and Nominating Committee | $7,500 |

Other Fees for: | (fees per day) |

Attending other formal meetings in their capacity as directors not held on the same day as a board meeting or board committee meeting, such as Executive Committee and strategic planning meetings. | $1,500 |

Attending special meetings or performing special services in their capacity as members of a board committee, in each case as determined and approved by the applicable committee. | $1,500 |

Director Stock Ownership Requirement: (3) | |

Nonemployee directors have up to five years to accumulate ownership of our Common Stock in an amount of at least five times the annual board retainer, using a fixed number of shares approach to be reviewed at least once every three years and based upon the 90-day average price leading up to a December 31 measurement date. The shares may be acquired through direct acquisition, exercise of stock options, vesting of restricted stock, accumulation of stock units stock in their deferred compensation account and 60% of unvested restricted stock. |

| |

(1) | We pay annual retainers in quarterly installments. At the request of Mr. Lande, his cash director fees are paid directly to Scopia Capital Management LP, his employer and the beneficial owner of greater than 5% of the Company’s Common Stock, pursuant to internal compensation policies of Scopia. |

| |

(2) | Nonemployee directors may choose between stock options and/or restricted stock in 25% multiples. The default selection is 100% restricted stock. Equity grants to independent directors have one-year cliff vesting. Pursuant to our 1994 Stock Plan, as amended, the aggregate grant-date fair value of awards granted to a nonemployee director during any calendar year is limited to $250,000. The number of stock options granted is determined by dividing the amount of the award allocated to stock options by the Black-Scholes fair value, and the number of shares of restricted stock is determined by dividing the amount of the award allocated to restricted stock by the closing price of the Common Stock on the date of grant. The computed number of options and restricted shares are rounded down to eliminate fractional shares. Directors who are appointed to the Board after the annual equity grant are provided a prorated grant based on the date they are appointed to the Board. Mr. Lande has elected to waive any equity compensation payable to him, pursuant to internal compensation policies of Scopia, his employer and the beneficial owner of greater than 5% of the Company’s Common Stock. |

| |

(3) | As of January 31, 2018, all of our then current non-employee directors who presently remain on our Board, except Z. Jamie Behar, met the stock ownership requirement of 16,430 shares. Ms. Behar has until 2022 to meet the requirement and our newly appointed non-employee directors will have until 2023 to meet their requirements. |

The Deferred Compensation Plan for Nonemployee Directors (the “Deferred Compensation Plan”) permits nonemployee members of the Board of Directors to defer 50% or 100% of their annual board retainer. Directors electing to participate select either a cash investment option or stock investment option for fees deferred during the year. Fees deferred to the stock investment option are deemed to be invested in stock units of our Common Stock. Dividends earned on stock units are deemed to be reinvested in more shares. After the participant ceases to be our director, the stock units accumulated in the participant’s account will be paid out in shares of Common Stock or cash, as elected by the participant. Prior to her resignation, Deborah Harmon was the only participant who held stock units under the Deferred Compensation Plan to select the stock investment option. As of April 16, 2018, there were 5,785 stock units accumulated in Ms. Harmon’s account. Participants may make an annual election as of each December 31 to reallocate their account balances between the two investment options. The Deferred Compensation Plan does not limit the amount of stock that can be issued under the stock investment option.

The Corporate Governance and Nominating Committee bi-annually reviews the policy of nonemployee director compensation and annually reviews stock ownership requirements.

Effective as of 11:59 p.m., Eastern Time, on December 31, 2016, James A. Ratner resigned his position of Executive Vice President - Development to serve as non-executive Chairman of the Board. The Board approved an annual retainer of $150,000 and an annual equity award having a grant-date fair market value of $250,000 for his service as non-executive Chairman of the Board beginning in 2017. In approving these amounts, the Corporate Governance and Nominating Committee considered the benchmark data provided by Pearl Meyer (“Pearl Meyer”) pertaining to non-executive chairs at comparable REITs as well as within the general industry, Mr. Ratner’s unique expertise and experience which he brought to the role, and that Mr. Ratner was expected to devote significantly more hours annually to his role than typical non-executive board chairs.

The information presented in the following table is for the year ended December 31, 2017. All other individuals who served as directors during 2017, but are not listed, were our employees and received no compensation in their capacity as director during 2017.

Director Compensation Table

|

| | | | | | | | | | | | | | | | | | |

Name | Fees Earned or Paid in Cash ($) (1) | Stock Awards ($) (2) | Option Awards ($) (3) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) (4) | All Other Compensation ($) (5) | Total ($) |

Arthur F. Anton | $ | 112,500 |

| $ | 124,999 |

| $ | — |

| $ | — |

| $ | — |

| $ | 237,499 |

|

Kenneth J. Bacon | $ | 89,000 |

| $ | 124,999 |

| $ | — |

| $ | 514 |

| $ | — |

| $ | 214,513 |

|

Z. Jamie Behar | $ | 89,625 |

| $ | 114,983 |

| $ | — |

| $ | — |

| $ | — |

| $ | 204,608 |

|

Scott S. Cowen | $ | 138,750 |

| $ | 124,999 |

| $ | — |

| $ | — |

| $ | — |

| $ | 263,749 |

|

Christine R. Detrick | $ | 82,500 |

| $ | 124,999 |

| $ | — |

| $ | — |

| $ | — |

| $ | 207,499 |

|

Michael P. Esposito, Jr. | $ | 105,000 |

| $ | 124,999 |

| $ | — |

| $ | 434 |

| $ | — |

| $ | 230,433 |

|

Deborah L. Harmon | $ | 76,250 |

| $ | — |

| $ | 124,998 |

| $ | 626 |

| $ | — |

| $ | 201,874 |

|

Craig Macnab | $ | 59,250 |

| $ | 98,999 |

| $ | — |

| $ | — |

| $ | — |

| $ | 158,249 |

|

James A. Ratner | $ | 150,000 |

| $ | 249,997 |

| $ | — |

| $ | — |

| $ | — |

| $ | 399,997 |

|

Stan Ross | $ | 45,000 |

| $ | 124,999 |

| $ | — |

| $ | — |

| $ | — |

| $ | 169,999 |

|

| |

(1) | Includes fees earned during 2017 by members of the Transaction Committee established by the Board of Directors in connection with the process to review potential operating, strategic, financial and structural alternatives for the Company for the purpose of enhancing stockholder value (the “Strategic Alternatives Review”). Members of the Transaction Committee attended meetings during 2017 as follows: Mr. Anton, 10; Ms. Behar, 10; Dr. Cowen, 9; and Mr. Macnab, 9. Ms. Behar earned $15,000 and Dr. Cowen and Mr. Macnab each earned $13,500 ($1,500 per meeting) during 2017. Mr. Anton, as Chair, earned $22,500 ($2,250 per meeting) during 2017. |

| |

(2) | Restricted stock grants are valued at their grant-date fair value based on the closing price of the Common Stock on the date of grant computed in accordance with accounting guidance for share-based payments. During the year ended December 31, 2017, we granted restricted stock having a grant-date fair value of $21.83 per share as follows: Mr. Anton, 5,726; Mr. Bacon, 5,726; Dr. Cowen, 5,726; Ms. Detrick, 5,726; Mr. Esposito, 5,726; Mr. Ratner, 11,452; and Mr. Ross, 5,726. In May 2017, we granted 5,217 shares of restricted stock to Ms. Behar having a grant-date fair value of $22.04. In June 2017, we granted 4,064 shares of restricted stock to Mr. Macnab having a grant-date fair value of $24.36. The aggregate number of shares of unvested restricted stock outstanding as of December 31, 2017 was as follows: Mr. Anton, 5,726; Mr. Bacon, 5,726; Ms. Behar, 5,217; Dr. Cowen, 5,726; Ms. Detrick, 5,726; Mr. Esposito, 5,726; Mr. Macnab, 4,064; and Mr. Ratner, 27,176. |

| |

(3) | Stock option grants are valued at their grant-date fair value that is computed using the Black-Scholes option-pricing model. The assumptions used in the fair value calculations in 2017 are described in Footnote Q, “Stock-Based Compensation,” to our consolidated financial statements for the year ended December 31, 2017, which are included in our Annual Report on Form 10-K filed with the SEC. During the year ended December 31, 2017, we granted 26,112 stock options having a grant-date fair value of $4.79 per share to Ms. Harmon. The options have an exercise price of $21.83, which was the closing price of the underlying Common Stock on the date of grant. The aggregate number of stock options outstanding as of December 31, 2017 was as follows: Mr. Anton, 30,273; Mr. Bacon, 13,988; Dr. Cowen, 10,966; Ms. Detrick, 7,060; Mr. Esposito, 49,362; Ms. Harmon, 51,462; and Mr. Ratner, 191,862. |

| |

(4) | Amounts deferred under the Deferred Compensation Plan under the cash investment option earn interest at a rate equal to the average of the Moody’s Long-Term Corporate Bond Yields for Aaa, Aa and A, plus 0.5% (“Moody’s Rates”). The rate is updated every calendar quarter using the first published Moody’s Rates of the new quarter. Interest rates ranged from 4.27% to 4.55% during the year ended December 31, 2017. Interest is compounded quarterly. The amounts shown in this column represent the amount of above-market earnings on each director’s nonqualified deferred compensation balances. The amount of above-market earnings was computed to be the amount by which the actual earnings exceeded what the earnings would have been had we used 120% times the Federal Long-Term Rates published by the Internal Revenue Service in accordance with Section 1274(d) of the Internal Revenue Code. |

| |

(5) | All other compensation does not include our incremental cost for the use of our chartered airplane service by directors for attending board of directors meetings and committee meetings because such use is deemed to be a business expense. The total incremental cost of airplane usage by all directors for business purposes amounted to $82,092 for the year ended December 31, 2017. |

Compensation Committee Interlocks and Insider Participation

The Compensation Committee of the Board of Directors consists entirely of nonemployee, independent directors. No member of the Compensation Committee is a current or former officer or employee of ours or any of our subsidiaries, and no director had interlocking relationships with any other entities of the type that would be required to be disclosed.

Compensation Discussion & Analysis

Introduction

This Compensation Discussion and Analysis ("CD&A") provides an overview of our executive compensation program and 2017 fiscal year pay determinations for our Named Executive Officers ("NEOs") as identified below:

|

| |

Name | Title |

David J. LaRue | President and Chief Executive Officer |

Robert G. O'Brien | Executive Vice President and Chief Financial Officer |

Ronald A. Ratner | Executive Vice President - Development |

Duane F. Bishop | Executive Vice President - Chief Operating Officer |

Brian J. Ratner | Executive Vice President - Division |

Executive Summary

Our Company is principally engaged in the ownership, development, management and acquisition of commercial and residential real estate throughout the United States. Founded in 1920 and having been publicly-traded since 1960, we are headquartered in Cleveland, Ohio, with offices throughout the United States. As of December 31, 2017, we had approximately $8.1 billion in consolidated assets, 1,473 full-time and 75 part-time employees, annual consolidated revenues of $912 million, and an equity market capitalization of $6.4 billion.

We attribute our long-term success in large part to our highly talented and experienced employees as well as the following core values which reinforce our Company's culture:

| |

• | diversity and inclusion; |

| |

• | sustainability and stewardship; and |

Our executive compensation program is intended to support these values, drive long-term growth and stockholder value creation and reinforce our culture, using the following set of principles.

| |

• | Pay for performance: The guiding principle of our compensation philosophy is that pay should be linked to performance and that the interests of executives and stockholders should be aligned. Our executive compensation program emphasizes variable incentive pay tied to challenging performance goals, with no awards earned for results below designated threshold levels. The following table summarizes incentive award determinations for performance cycles ending in 2017: |

|

| | | |

Compensation Component | Performance Cycle | Performance Goals | Performance and Payout Levels |

Short-term Incentive Plan ("STIP") | 2017 | Operating Funds from Operations per Share

Net Debt/Adjusted EBITDA Ratio | • Performance: We exceeded the target performance level for each goal

• Payout: Ranged from 127% to 136% of an executive's target award opportunity

|

Cash Long-Term Incentive Plan ("LTIP") | 2014 - 2017 | Cumulative Funds from Operations (“FFO") per Share

Total Return, which is an internal measure of value creation

| • Performance: We exceeded the target performance level for cumulative FFO per share but failed to achieve the threshold performance level for Total Return

• Payout: approximately 94% of each executive's target opportunity

|

Cash LTIP | 2015 -2017 | Cumulative FFO per Share

Net Asset Value Growth per Share

| • Performance: We exceeded the target performance level for cumulative FFO per share but failed to achieve the threshold performance level for Net Asset Value Growth per share

• Payout: approximately 75% of each executive's target opportunity

|

Performance Shares | 2014 - 2017 | Total stockholder return ("TSR") relative to the NAREIT Index | • Performance: Our TSR was below the threshold performance level (40th percentile) relative to the NAREIT Index

• Payout: Forfeited without payout

|

Performance Shares | 2015 - 2017 | TSR relative to the NAREIT Index | • Performance: Our TSR was slightly above the threshold performance level relative to the NAREIT Index

• Payout: 38% of each executive's target opportunity

|

Out-Performance Plan | 2015 - 2017 | Annualized TSR | • Performance: Annualized TSR was below the threshold performance level

• Payout: Forfeited without payout

|

| |

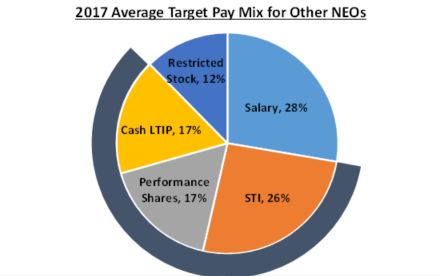

• | A majority of pay for top executives should be contingent on performance and tied to multiple time periods: Our core compensation program consists of base salary, STIP and LTIP (restricted shares, performance shares and Cash LTIP). As illustrated in the charts below, a majority of target total direct compensation, ranging from 60% to 68% for NEOs, is allocated to STIP, performance shares and Cash LTIP, which are "at risk", or not guaranteed pay, since they are tied to performance. Consistent with market practice, a greater percentage of David J. LaRue's target total direct compensation opportunity is "at risk" and tied to long-term incentives, as compared with other NEOs, reflecting his role as President and CEO. Based on a review conducted by Pearl Meyer, the Compensation Committee's independent consultant, the target pay mix for our NEOs was comparable with the median mix for executive officers at comparable organizations. |

At risk pay represents 68% of target 2017 Total Direct Compensation

At risk pay represents 60% of target 2017 Total Direct Compensation

| |

• | Long-term incentives are emphasized to align executive and stockholder interests: As illustrated above, our executive compensation program places greater emphasis on long-term incentives as compared with short-term incentives, to focus senior management on long-term strategic goals and stockholder value creation. Long-term incentives represent approximately 61% of target total direct compensation for David J. LaRue and 46% of target total direct compensation on average for other NEOs. We currently use a combination of equity-based and cash-based long-term award vehicles to minimize potential stockholder dilution that would result from the sole use of equity grants. |

| |

• | Total compensation should be fair, competitive and communicated: Our base salaries and short-term and long-term incentives are targeted competitively to attract and retain talented and experienced executives. With our emphasis on performance-based incentive compensation, actual total direct pay can be above or below targeted levels based on our actual versus planned performance results and level of stock price appreciation. |

| |

• | Our executive compensation program should not encourage the taking of excessive risks that could be detrimental to the interests of our stockholders: We believe our use of short-term and long-term incentives, with multiple types of award vehicles, performance criteria, measurement periods and stock ownership guidelines, clawback provisions, and stock hedging/pledging policies, do not encourage our NEOs and other senior executives to take unreasonable risks relating to our business. A comprehensive formal risk assessment is reviewed annually by our Compensation Committee. |

Say on Pay Voting Results and Impacts

We held our annual advisory vote on the compensation of our NEOs ("Say on Pay Proposal") at our annual meeting of stockholders on June 9, 2017. At that meeting, approximately 97.4% of the stockholders entitled to vote and present in person or by proxy

voted in favor of the Say on Pay Proposal. Overall, the Compensation Committee believes that this overwhelming level of stockholder support is evidence that our executive compensation program is appropriately structured and aligned with stockholder interests.

The Compensation Committee intends to provide a competitive compensation program that is appropriately aligned with our annual and strategic business plans and the interests of our stockholders. This is evidenced by a number of changes which have been made to our executive compensation program and corporate governance practices over time, such as the use of performance share grants tied to a relative TSR metric, greater transparency of metrics used under the Cash LTIP, primary emphasis on "at risk" variable pay, revisions to the Executive Stock Ownership Policy, adoption of a Clawback Policy and adoption of a Securities Hedging and Pledging Policy.

Our Commitment to Sound Corporate Governance |

| |

What We Do | What We Don't Do |

Use performance-based incentives tied to multiple metrics and challenging goals | Provide multi-year pay guarantees |

Place primary emphasis on performance contingent long-term incentives | Offer excessive perquisites with employment agreements |

Use tally sheets | Reprice stock options without stockholder approval |

Apply Executive Stock Ownership Policy | Provide tax gross ups on awards |

Have Clawback Policy | Pay dividends on unearned performance shares |

Have Hedging and Pledging Policy | Provide uncapped performance awards |

Components of the Executive Compensation Program

The primary components of our total rewards strategy within our executive compensation program are shown below. A more detailed description for each component follows.

|

| | | |

Compensation Component | Component Objective | Paid in | Performance Linkage |

Base Salary - Direct Compensation | Provide base pay commensurate with level of responsibility, experience and individual performance | Cash | Partially linked (merit increases tied to individual performance) |

Short-Term Incentives - Direct Compensation | Align pay with achievement of short-term performance goals in support of annual business plan and strategic goals | Cash | Strongly linked |

Long-Term Incentives - Direct Compensation | Align pay with achievement of longer-term strategic goals and stockholder value creation, enhance retention of senior management, and facilitate stock ownership | Cash and Performance Shares | Strongly linked |

Restricted Stock | Minimally linked |

Benefits & Perquisites - Indirect Compensation | Provide for health, welfare and retirement needs at a reasonable shared cost | Health Care Life and Disability Retirement Plans Perquisites | Minimally or not linked |

Base Salary: Base salary is reflective of each executive's level of responsibility, experience, individual performance and contributions to our overall success. It also impacts annual and long-term incentive award opportunities that are expressed as a percentage of base salary.

We did not make any changes to the base salaries of our NEOs in 2017, other than for Brian Ratner, who received a 3% merit increase.

Short-Term Incentives: Our NEOs and other eligible senior executives participate in the STIP. The STIP's primary objective is to motivate senior executives to achieve specified business objectives over the short-term that lead to long-term value creation. Actual awards earned, if any, can be considerably above or below target levels based on our actual performance.

For 2017, the STIP opportunity for each NEO was based on two equally-weighted company-wide metrics: Operating Funds From Operations ("Operating FFO") per share and Net Debt/Adjusted EBITDA, with one exception: Brian J. Ratner. To further enhance his line of sight, 25% of Brian J. Ratner’s STIP opportunity was based on individual performance which focused on various on-going and potential Development projects and the remaining 75% was based on the two equally-weighted corporate-wide components. For each performance component, the actual award could range from 0% to 200% of target.

The Compensation Committee selected Operating FFO per share and Net Debt/Adjusted EBITDA ratio as the STIP metrics since they reflect the ongoing operating performance of our portfolio and are key indicators of continuing operating results in planning and executing our business strategy. The calculation of Operating FFO is defined in the "Operating FFO per Share" section of this Form 10-K/A. The number is divided by fully diluted weighted average total common shares outstanding to arrive at Operating FFO per share. Net Debt/Adjusted EBITDA Ratio is defined in the "Net Debt/Adjusted EBITDA Ratio" section of this Form 10-K/A.

The calibration schedules used to determine the actual awards under the 2017 STIP are shown below.

Operating FFO per Share

We define Operating FFO as FFO adjusted to exclude: i) impairment of non-depreciable real estate; ii) write-offs of abandoned development projects and demolition costs; iii) income recognized on state and federal historic and other tax credits; iv) gains or losses from extinguishment of debt; v) change in fair market value of nondesignated hedges; vi) gains or losses on change in control of interests; vii) the adjustment to recognize rental revenues and rental expense using the straight-line method; viii) participation payments to ground lessors on refinancing of our properties; ix) other transactional items; x) the Nets pre-tax FFO; and xi) income taxes on FFO.

The 2017 target level of Operating FFO per share ($1.40 per share) was set above the 2016 target level of $1.33 per share but below the 2016 actual result of $1.46 per share. The 2017 target assumed that we would engage in a number of strategic asset dispositions, including the sale of our federally assisted housing apartment communities, the sale of various regional mall retail assets to Queensland Investment Corporation and the specialty retail transaction with Madison International. The budgeted impact of these liquidity transactions was partially offset by budgeted earnings generated through strategic initiatives, particularly those focused on overhead reduction and margin enhancement, along with the impact of new openings and a reduction in debt.

|

| | | |

Performance Level | Corresponding Operating FFO per Share | Percent of Target Achieved | Percent of Target Award Earned |

Below Threshold | Below $1.26 | Below 90% | 0% |

Threshold | $1.26 | 90% | 25% |

Target Range Low | $1.33 | 95% | 80% |

$1.40 | 100% | 100% |

Target Range High | $1.54 | 110% | 140% |

Maximum | $1.68 and above | 120% | 200% |

Net Debt/Adjusted EBITDA Ratio

Net Debt to Adjusted EBITDA, a non-GAAP measure, is defined as total debt, net at our share (total debt includes outstanding borrowings on our revolving credit facility, term loan facility, convertible senior debt, net, nonrecourse mortgages and notes payable, net) less cash and equivalents, at our share, divided by Adjusted EBITDA.

EBITDA, a non-GAAP measure, is defined as net earnings excluding the following items at our share: i) non-cash charges for depreciation and amortization; ii) interest expense; iii) amortization of mortgage procurement costs; and iv) income taxes. We use EBITDA as the starting point in order to calculate Adjusted EBITDA as described below.

We define Adjusted EBITDA, a non-GAAP measure, as EBITDA attributable to the Company adjusted to exclude: i) impairment of non-depreciable real estate; ii) gains or losses from extinguishment of debt; and iii) other transactional items, including organizational transformation and termination benefits.

The 2017 target level of Net Debt/Adjusted EBITDA ratio (8.00) was set below the 2016 target level of 8.62 and the 2016 actual result of 8.92 (i.e., it was more rigorous than the 2016 target and 2016 actual results).

|

| | | |

Performance Level | Corresponding Net Debt/Adjusted EBITDA Ratio | Percent of Target Achieved | Percent of Target Award Earned |

Below Threshold | Above 8.89 | Below 90% | 0% |

Threshold | 8.89 | 90% | 25% |

Target Range Low | 8.42 | 95% | 80% |

Target | 8.00 | 100% | 100% |

Target Range High | 7.27 | 110% | 140% |

Maximum | 6.67 | 120% | 200% |

Approved actual performance for each of the two company-wide STIP metrics is shown in the following table:

|

| | | |

2017 STIP Metric | Target | Actual Performance | Percent of Target Award Earned Per Component |

Operating FFO per share | $1.40 | $1.54 | 140.00% |

Net Debt/Adjusted EBITDA Ratio | 8.00 | 7.40 | 132.43% |

The following table reflects the actual 2017 STIP award earned by each of our NEOs (as a percentage of target and a dollar amount). The table also sets out the target STIP award levels that were established for each NEO, which remained unchanged from 2016.

|

| | | | |

Named Executive Officer | 2017 STIP Target Award as a Percentage of Base Salary | 2017 STIP Target Award | 2017 STIP Actual Award as a Percentage of Target | 2017 STIP Actual Award Earned |

David J. LaRue | 130% | $975,000 | 136.22% | $1,328,096 |

Robert G. O'Brien | 100% | $583,000 | 136.22% | $794,133 |

Ronald A. Ratner | 100% | $500,000 | 136.22% | $681,075 |

Duane F. Bishop | 100% | $500,000 | 136.22% | $681,075 |

Brian J. Ratner | 80% | $378,216 | 127.16%* | $480,944 |

*Brian Ratner attained the target performance level (100%) for his individual goals, which comprised 25% of his STIP opportunity.

Long-Term Incentives: Our long-term incentives align pay with long-term strategic goals and stockholder value creation. They also enhance our retention of senior executives and managers, and facilitate stock ownership. Our long-term incentives consist primarily of two components which promote a balanced focus on objectives under the strategic plan in support of long-term value creation:

| |

• | Equity provided through the use of performance shares and restricted stock. |

In determining award levels for NEOs, the Compensation Committee gives consideration to competitive market practice, employee responsibility level, and internal equity.

As reflected in the table below, the targeted value mix of LTIP awards in 2017 for all of our NEOs, except Brian J. Ratner, was weighted 37.5% in the form of a Cash LTIP opportunity, 37.5% for a performance share grant opportunity and 25% for restricted stock. We believe this increased emphasis on performance-based LTI (with Cash LTIP and performance shares collectively comprising 75% of the total annual opportunity), provides an appropriate balance and further demonstrates our commitment to aligning NEO pay with long-term value creation. Brian J. Ratner's 2017 target value mix was equally weighted among all three award vehicles.

The table also sets out the target LTIP award levels that were established for each NEO, which remained unchanged from 2016. |

| | | | |

Named Executive Officer | 2017 Fiscal Year Target Award Equivalents (as a Percentage of Base Salary) |

Total Annualized LTIP Award as a Percent of Base Salary | Absolute Percentage in the form of Performance Shares (vesting determined at the end of the 2017 - 2019 performance period) | Absolute Percentage in the form of Restricted Stock | Absolute Percentage in the form of Cash LTIP (payment determined at the end of the 2017 - 2019 performance period) |

David J. LaRue | 375% | 140.625% | 93.75% | 140.625% |

Robert G. O'Brien | 200% | 75.00% | 50.00% | 75.00% |

Ronald A. Ratner | 200% | 75.00% | 50.00% | 75.00% |

Duane F. Bishop | 200% | 75.00% | 50.00% | 75.00% |

Brian J. Ratner | 100% | 33.330% | 33.33% | 33.33% |

Cash LTIP

The Cash LTIP provides for annual grants with three-year rolling performance periods. The potential target award for each performance period is calculated using the target award multiplied by the base salary of the participant as of the beginning of the performance period.

The following illustrates key attributes of the Cash LTIP for the 2016-2018 and the 2017-2019 performance cycles:

|

| | |

| January 1, 2016 to December 31, 2018 Performance Cycle | January 1, 2017 to December 31, 2019 Performance Cycle |

Duration of performance period | 36 months | 36 months |

Award Funding Calculation | Cumulative FFO per share and Net Asset Value growth per Share relative to approved targets | Cumulative FFO per share and Net Asset Value Growth per Share relative to approved targets |

Actual Awards Earned Subject to | Final results relative to targets and calibrations approved by the Compensation Committee | Final results relative to targets and calibrations approved by the Compensation Committee |

Awards Earned (if any) will be paid in | Early 2019 | Early 2020 |

2014 - 2017 Cash LTIP Performance Cycle

The maximum payout for designated participants under the 2014 - 2017 Cash LTIP cycle equaled 1.5% of the excess, if any, of cumulative FFO, as adjusted over $1 billion, with the award to any eligible NEO not to exceed $1.75 million. Actual cumulative FFO performance for the 2014 - 2017 performance cycle was $1.538 billion resulting in a maximum potential Cash LTIP award of $1.75 million per eligible NEO, subject to exercise of negative discretion by the Compensation Committee.

When determining actual payout levels for the 2014 - 2017 Cash LTIP cycle, the Compensation Committee considered the Company's performance relative to two equally-weighted metrics: cumulative FFO per share and an internal measure of value creation, Total Return. The calculation of FFO is defined in the "Cumulative FFO per Share" section of this Form 10-K/A. FFO is divided by fully diluted weighted average total common shares outstanding to arrive at FFO per share. Total Return is defined as change in net asset value plus or minus cash generated or used. The calibration schedules for these two metrics were as follows: