BayFirst Financial Corp. (NASDAQ:BAFN) 2025 – Third Quarter Results (Unaudited)

In addition to the historical information contained herein, this presentation includes "forward-looking statements" within the meaning of such term in the Private Securities Litigation Reform Act of 1995. These statements are subject to many risks and uncertainties, including, but not limited to, the effects of health crises, global military hostilities, weather events, or climate change, including their effects on the economic environment, our customers and our operations, as well as any changes to federal, state or local government laws, regulations or orders in connection with them; the ability of the Company to implement its strategy and expand its banking operations; changes in interest rates and other general economic, business and political conditions, including changes in the financial markets; changes in business plans as circumstances warrant; risks related to mergers and acquisitions; changes in benchmark interest rates used to price loans and deposits, changes in tax laws, regulations and guidance; enforcement actions initiated by our regulators and their impact on our operations; and other risks detailed from time to time in filings made by the Company with the SEC, including, but not limited to those “Risk Factors” described in our most recent Form 10-K and Form 10-Q. Readers should note that the forward-looking statements included herein are not a guarantee of future events, and that actual events may differ materially from those made in or suggested by the forward-looking statements. Cautionary Statement Concerning Forward-Looking Information Forward-looking statements generally can be identified by the use of forward-looking terminology such as "will," "propose," "may," "plan," "seek," "expect," "intend," "estimate," "anticipate," "believe," "continue," or similar terminology. Any forward-looking statements presented herein are made only as of the date of this document, and we do not undertake any obligation to update or revise any forward-looking statements to reflect changes in assumptions, the occurrence of unanticipated events, or otherwise.

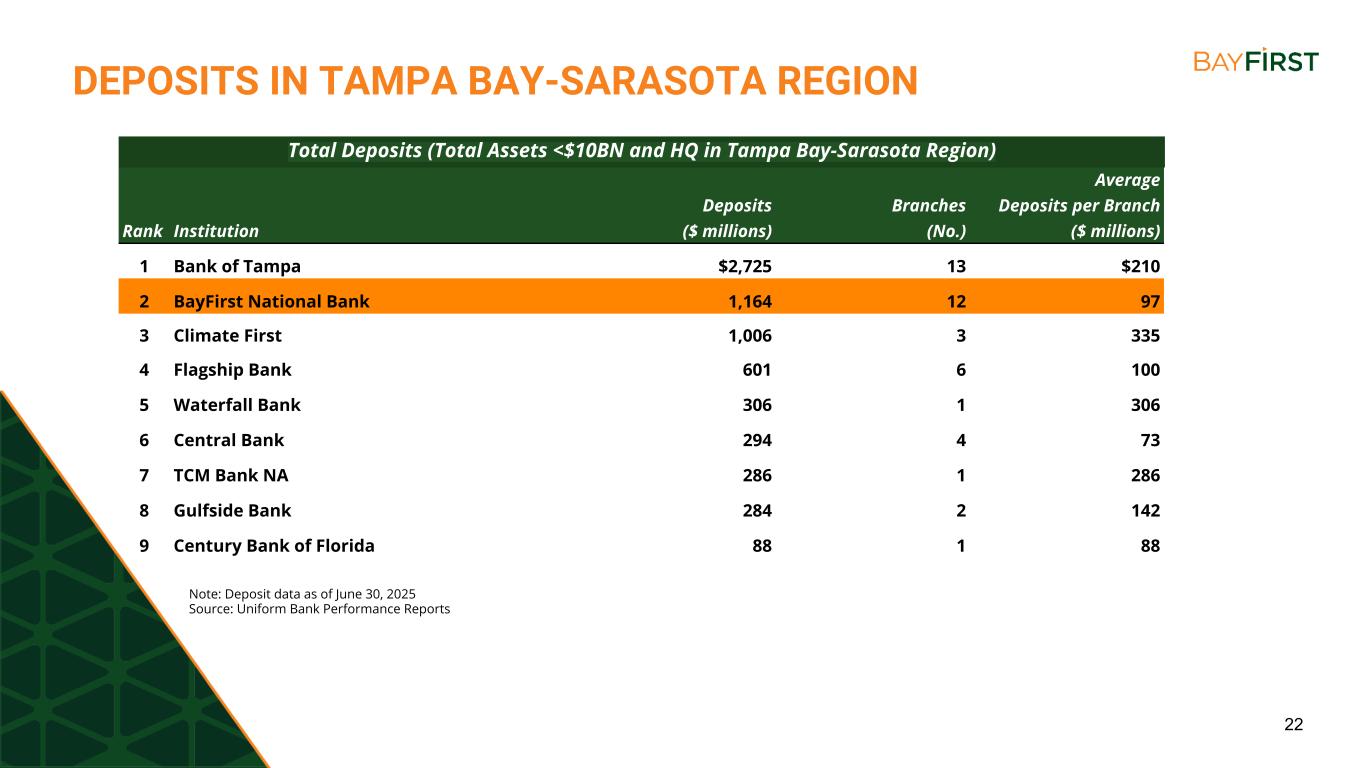

3 ABOUT BAYFIRST FINANCIAL CORP. TAMPA BAY’S PREMIER COMMUNITY BANKING FRANCHISE IN THE TAMPA BAY- SARASOTA REGION(1) HOW WE RANK 2 ASSET SIZE BILLION TOTAL ASSETS (2)$1.35 ASSET GROWTH ASSET GROWTH SINCE DEC 31, 2020(2)47% (1) Deposit ranking of banks with assets less than $10B headquartered in the Tampa Bay-Sarasota region as of June 30, 2025 from Uniform Bank Performance Reports (2) Financial data as of September 30, 2025 NET INTEREST MARGIN BASIS POINT IMPROVEMENT FROM THE PREVIOUS YEAR(2)27 DEPOSITS $59.3 MILLION IN TOTAL DEPOSIT GROWTH OVER THE PAST YEAR(2) COMMUNITY BANKING Expanded treasury management services through new platform and additional treasury management associates

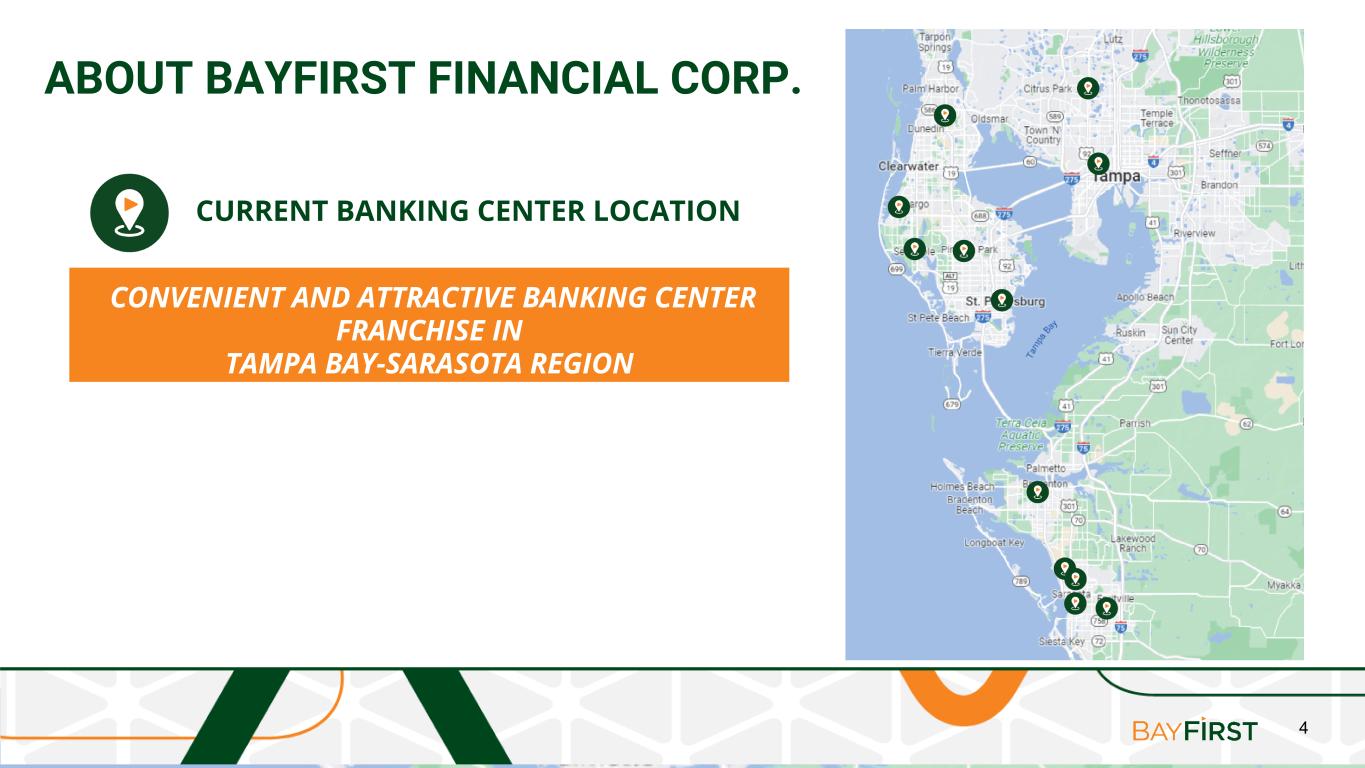

4 ABOUT BAYFIRST FINANCIAL CORP. CURRENT BANKING CENTER LOCATION CONVENIENT AND ATTRACTIVE BANKING CENTER FRANCHISE IN TAMPA BAY-SARASOTA REGION

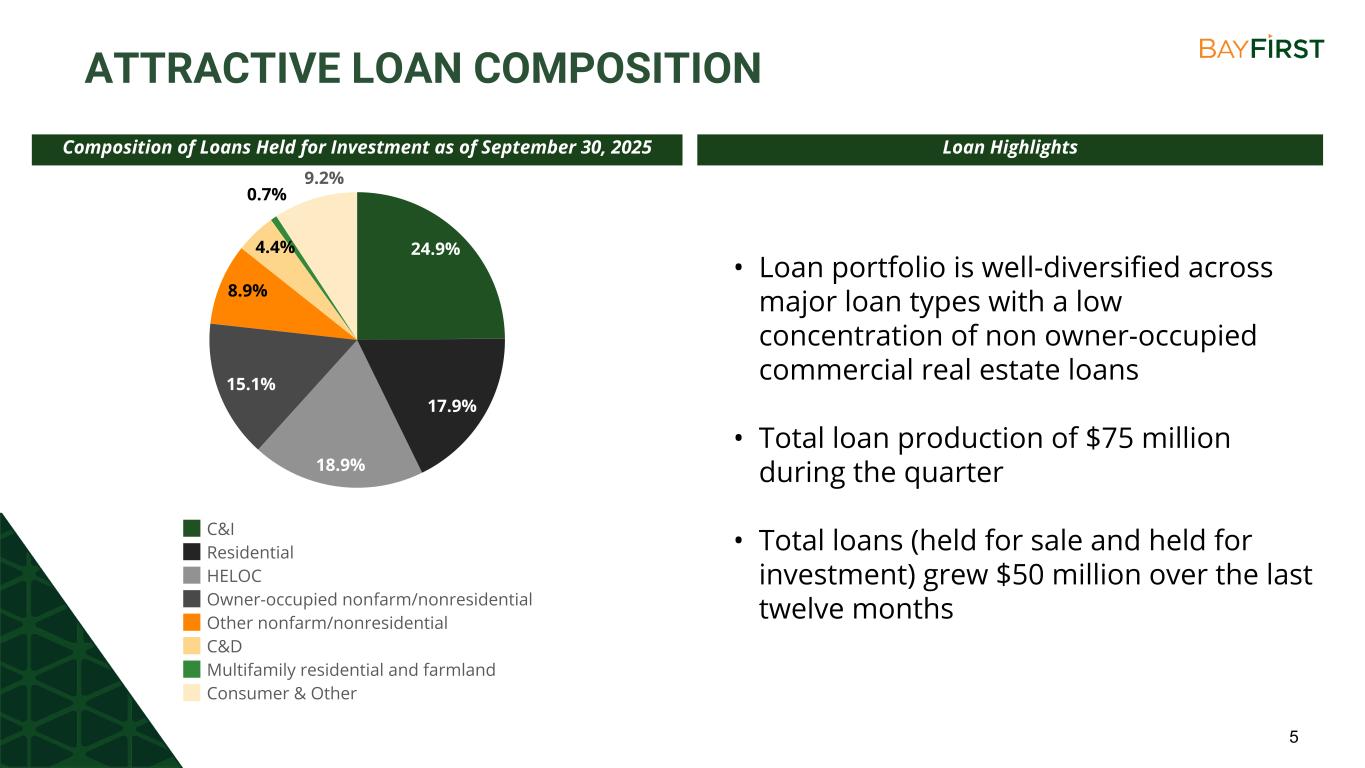

5 ATTRACTIVE LOAN COMPOSITION Composition of Loans Held for Investment as of September 30, 2025 24.9% 17.9% 18.9% 15.1% 8.9% 4.4% 0.7% 9.2% C&I Residential HELOC Owner-occupied nonfarm/nonresidential Other nonfarm/nonresidential C&D Multifamily residential and farmland Consumer & Other Loan Highlights • Loan portfolio is well-diversified across major loan types with a low concentration of non owner-occupied commercial real estate loans • Total loan production of $75 million during the quarter • Total loans (held for sale and held for investment) grew $50 million over the last twelve months

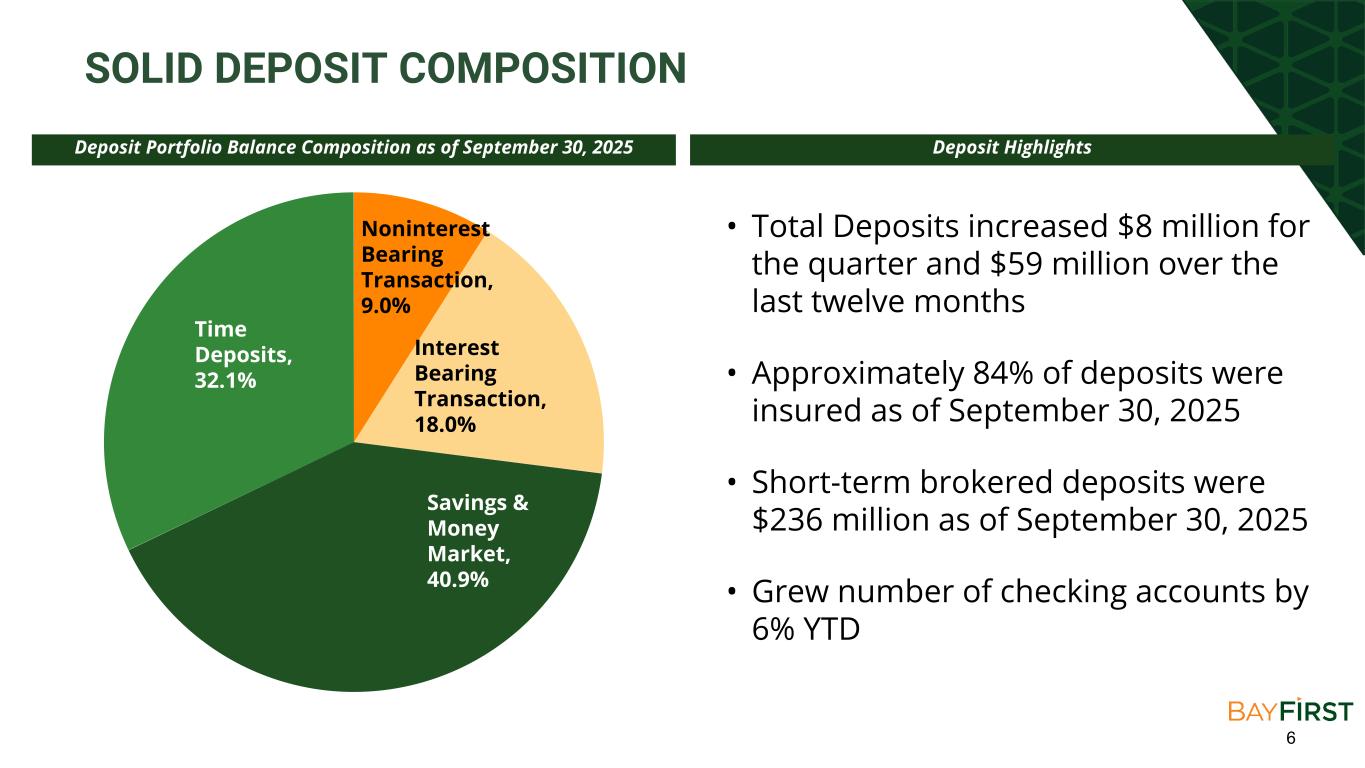

6 SOLID DEPOSIT COMPOSITION Deposit Portfolio Balance Composition as of September 30, 2025 • Total Deposits increased $8 million for the quarter and $59 million over the last twelve months • Approximately 84% of deposits were insured as of September 30, 2025 • Short-term brokered deposits were $236 million as of September 30, 2025 • Grew number of checking accounts by 6% YTD Noninterest Bearing Transaction, 9.0% Interest Bearing Transaction, 18.0% Savings & Money Market, 40.9% Time Deposits, 32.1% Deposit Highlights

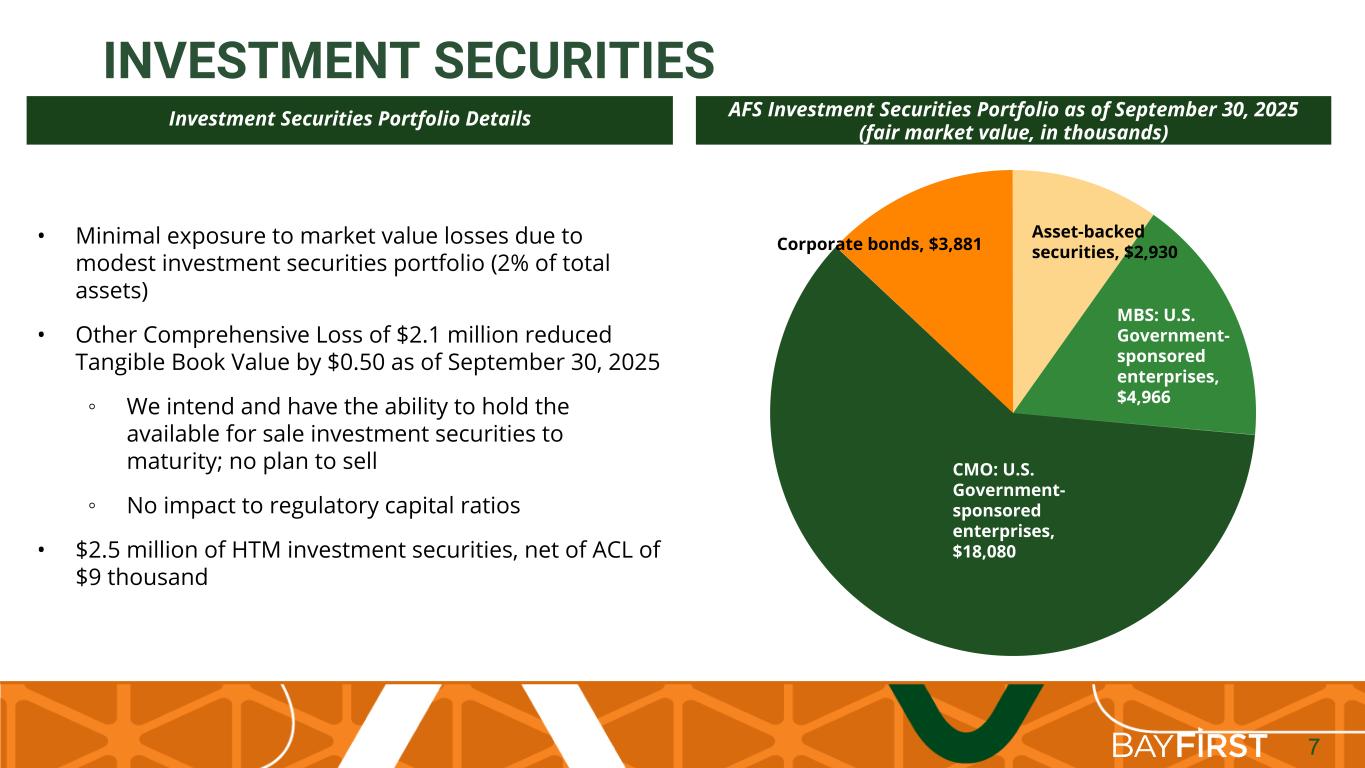

7 INVESTMENT SECURITIES AFS Investment Securities Portfolio as of September 30, 2025 (fair market value, in thousands) Investment Securities Portfolio Details • Minimal exposure to market value losses due to modest investment securities portfolio (2% of total assets) • Other Comprehensive Loss of $2.1 million reduced Tangible Book Value by $0.50 as of September 30, 2025 ◦ We intend and have the ability to hold the available for sale investment securities to maturity; no plan to sell ◦ No impact to regulatory capital ratios • $2.5 million of HTM investment securities, net of ACL of $9 thousand Asset-backed securities, $2,930 MBS: U.S. Government- sponsored enterprises, $4,966 CMO: U.S. Government- sponsored enterprises, $18,080 Corporate bonds, $3,881

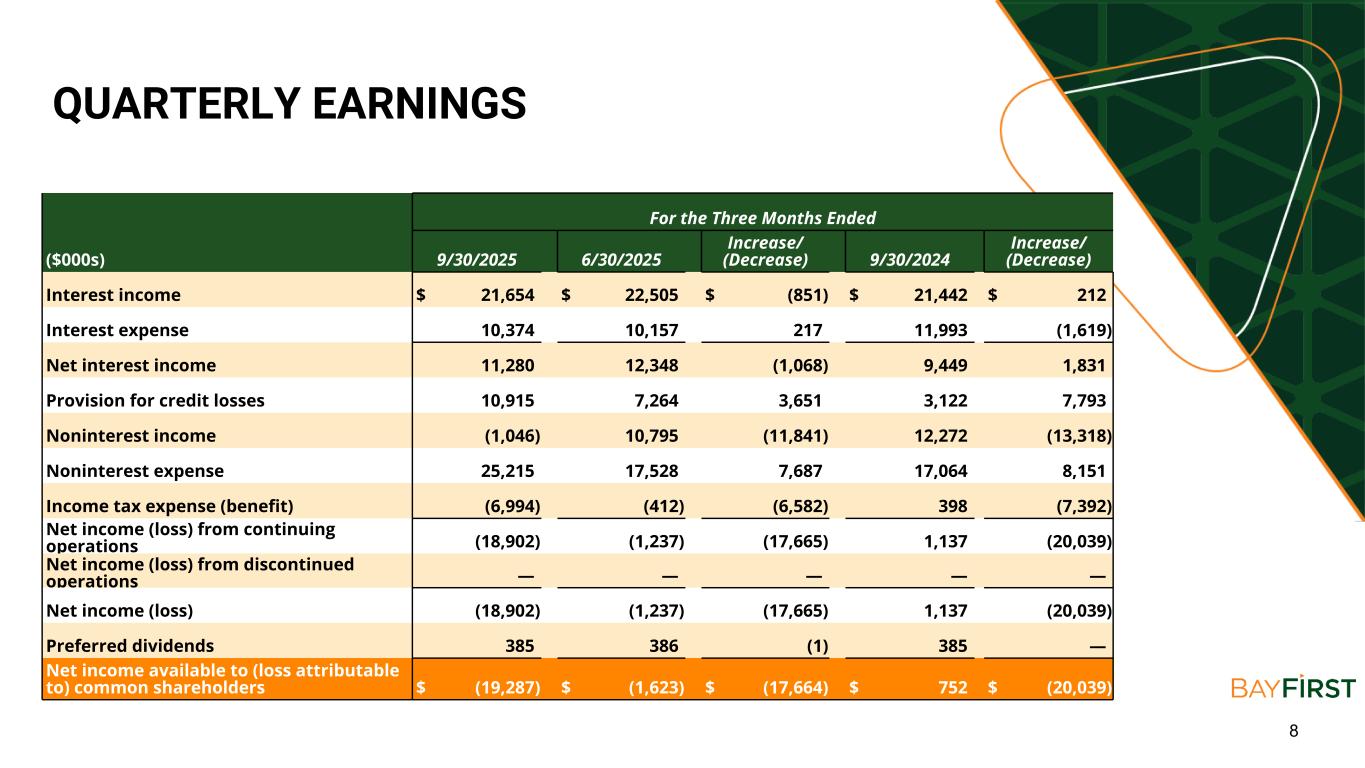

8 QUARTERLY EARNINGS For the Three Months Ended ($000s) 9/30/2025 6/30/2025 Increase/ (Decrease) 9/30/2024 Increase/ (Decrease) Interest income $ 21,654 $ 22,505 $ (851) $ 21,442 $ 212 Interest expense 10,374 10,157 217 11,993 (1,619) Net interest income 11,280 12,348 (1,068) 9,449 1,831 Provision for credit losses 10,915 7,264 3,651 3,122 7,793 Noninterest income (1,046) 10,795 (11,841) 12,272 (13,318) Noninterest expense 25,215 17,528 7,687 17,064 8,151 Income tax expense (benefit) (6,994) (412) (6,582) 398 (7,392) Net income (loss) from continuing operations (18,902) (1,237) (17,665) 1,137 (20,039) Net income (loss) from discontinued operations — — — — — Net income (loss) (18,902) (1,237) (17,665) 1,137 (20,039) Preferred dividends 385 386 (1) 385 — Net income available to (loss attributable to) common shareholders $ (19,287) $ (1,623) $ (17,664) $ 752 $ (20,039)

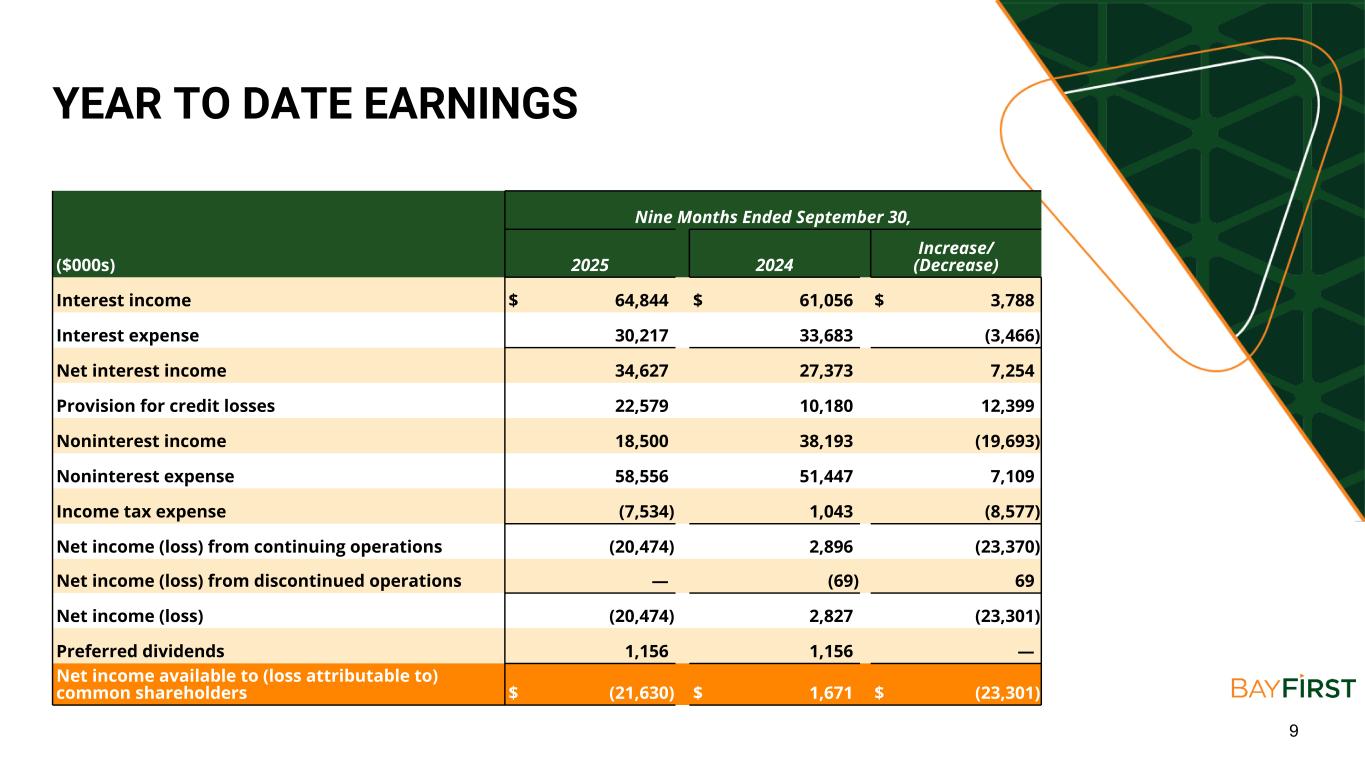

9 Nine Months Ended September 30, ($000s) 2025 2024 Increase/ (Decrease) Interest income $ 64,844 $ 61,056 $ 3,788 Interest expense 30,217 33,683 (3,466) Net interest income 34,627 27,373 7,254 Provision for credit losses 22,579 10,180 12,399 Noninterest income 18,500 38,193 (19,693) Noninterest expense 58,556 51,447 7,109 Income tax expense (7,534) 1,043 (8,577) Net income (loss) from continuing operations (20,474) 2,896 (23,370) Net income (loss) from discontinued operations — (69) 69 Net income (loss) (20,474) 2,827 (23,301) Preferred dividends 1,156 1,156 — Net income available to (loss attributable to) common shareholders $ (21,630) $ 1,671 $ (23,301) YEAR TO DATE EARNINGS

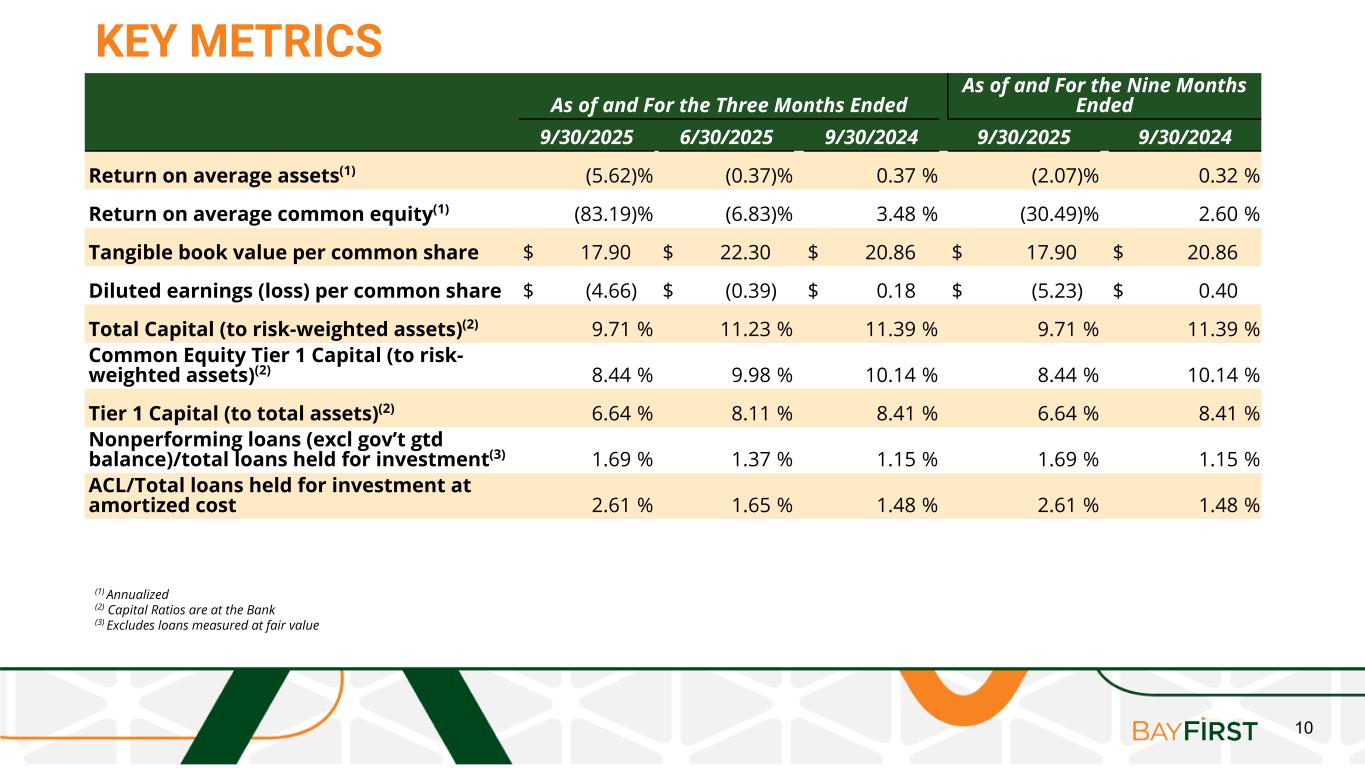

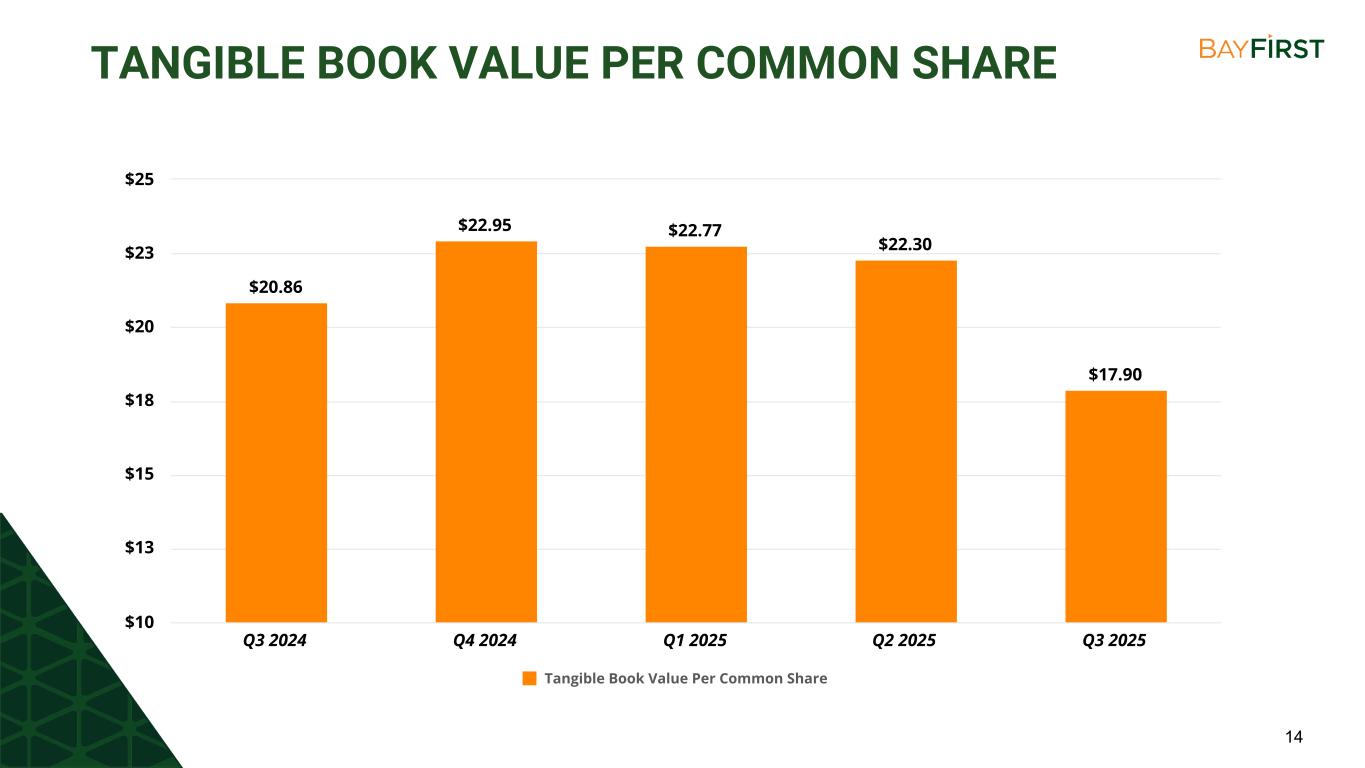

10 KEY METRICS As of and For the Three Months Ended As of and For the Nine Months Ended 9/30/2025 6/30/2025 9/30/2024 9/30/2025 9/30/2024 Return on average assets(1) (5.62) % (0.37) % 0.37 % (2.07) % 0.32 % Return on average common equity(1) (83.19) % (6.83) % 3.48 % (30.49) % 2.60 % Tangible book value per common share $ 17.90 $ 22.30 $ 20.86 $ 17.90 $ 20.86 Diluted earnings (loss) per common share $ (4.66) $ (0.39) $ 0.18 $ (5.23) $ 0.40 Total Capital (to risk-weighted assets)(2) 9.71 % 11.23 % 11.39 % 9.71 % 11.39 % Common Equity Tier 1 Capital (to risk- weighted assets)(2) 8.44 % 9.98 % 10.14 % 8.44 % 10.14 % Tier 1 Capital (to total assets)(2) 6.64 % 8.11 % 8.41 % 6.64 % 8.41 % Nonperforming loans (excl gov’t gtd balance)/total loans held for investment(3) 1.69 % 1.37 % 1.15 % 1.69 % 1.15 % ACL/Total loans held for investment at amortized cost 2.61 % 1.65 % 1.48 % 2.61 % 1.48 % (1) Annualized (2) Capital Ratios are at the Bank (3) Excludes loans measured at fair value

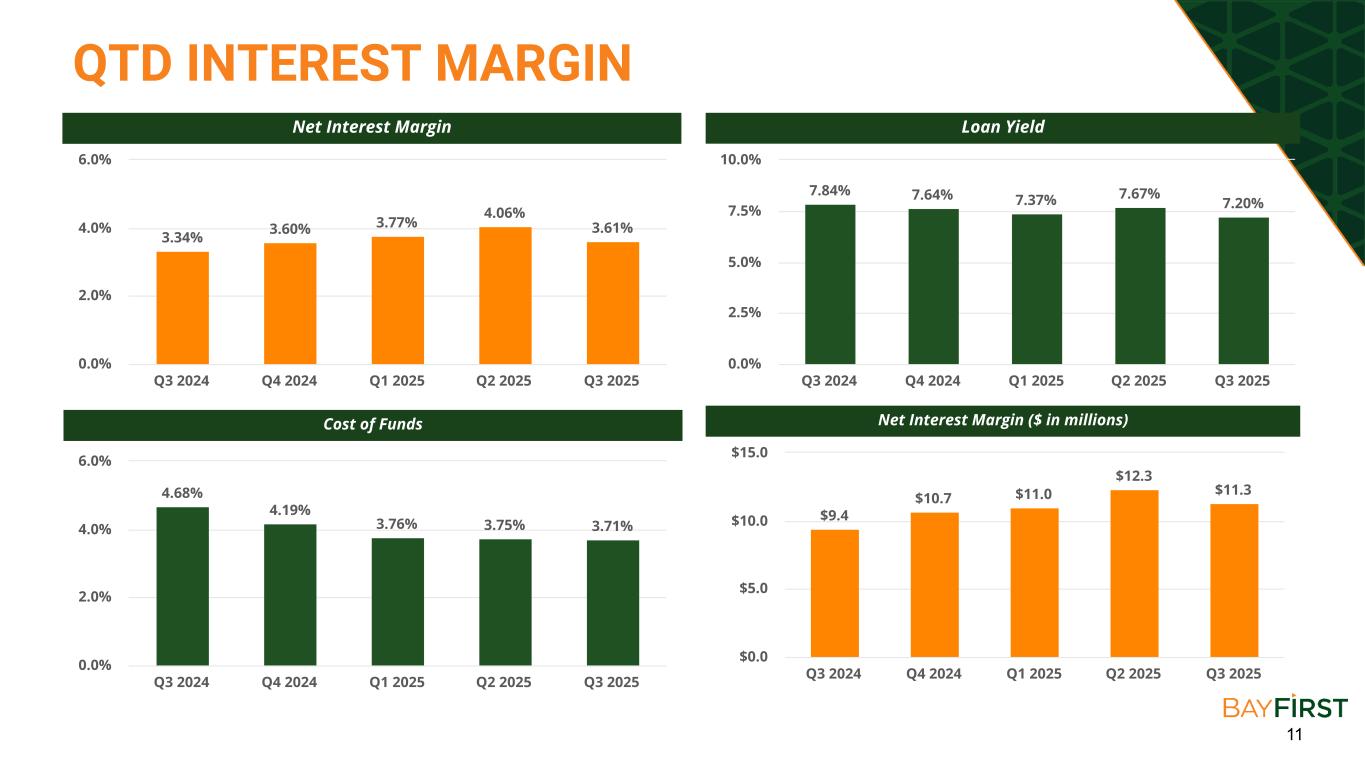

11 QTD INTEREST MARGIN 3.34% 3.60% 3.77% 4.06% 3.61% Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 0.0% 2.0% 4.0% 6.0% Net Interest Margin Loan Yield 7.84% 7.64% 7.37% 7.67% 7.20% Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 0.0% 2.5% 5.0% 7.5% 10.0% Cost of Funds Net Interest Margin ($ in millions) 4.68% 4.19% 3.76% 3.75% 3.71% Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 0.0% 2.0% 4.0% 6.0% $9.4 $10.7 $11.0 $12.3 $11.3 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 $0.0 $5.0 $10.0 $15.0

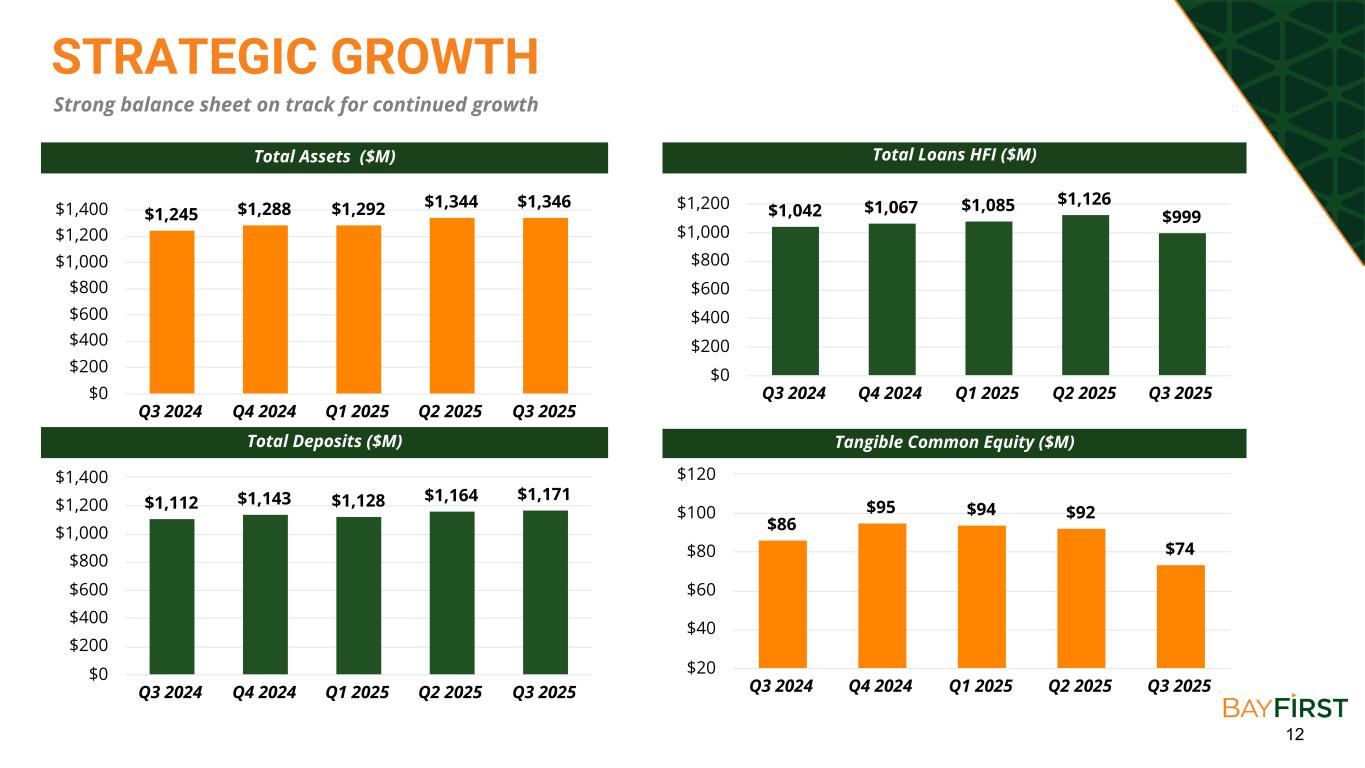

12 $86 $95 $94 $92 $74 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 $20 $40 $60 $80 $100 $120 Strong balance sheet on track for continued growth STRATEGIC GROWTH Total Assets ($M) Total Loans HFI ($M) Total Deposits ($M) Tangible Common Equity ($M) $1,245 $1,288 $1,292 $1,344 $1,346 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,042 $1,067 $1,085 $1,126 $999 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 $0 $200 $400 $600 $800 $1,000 $1,200 $1,112 $1,143 $1,128 $1,164 $1,171 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400

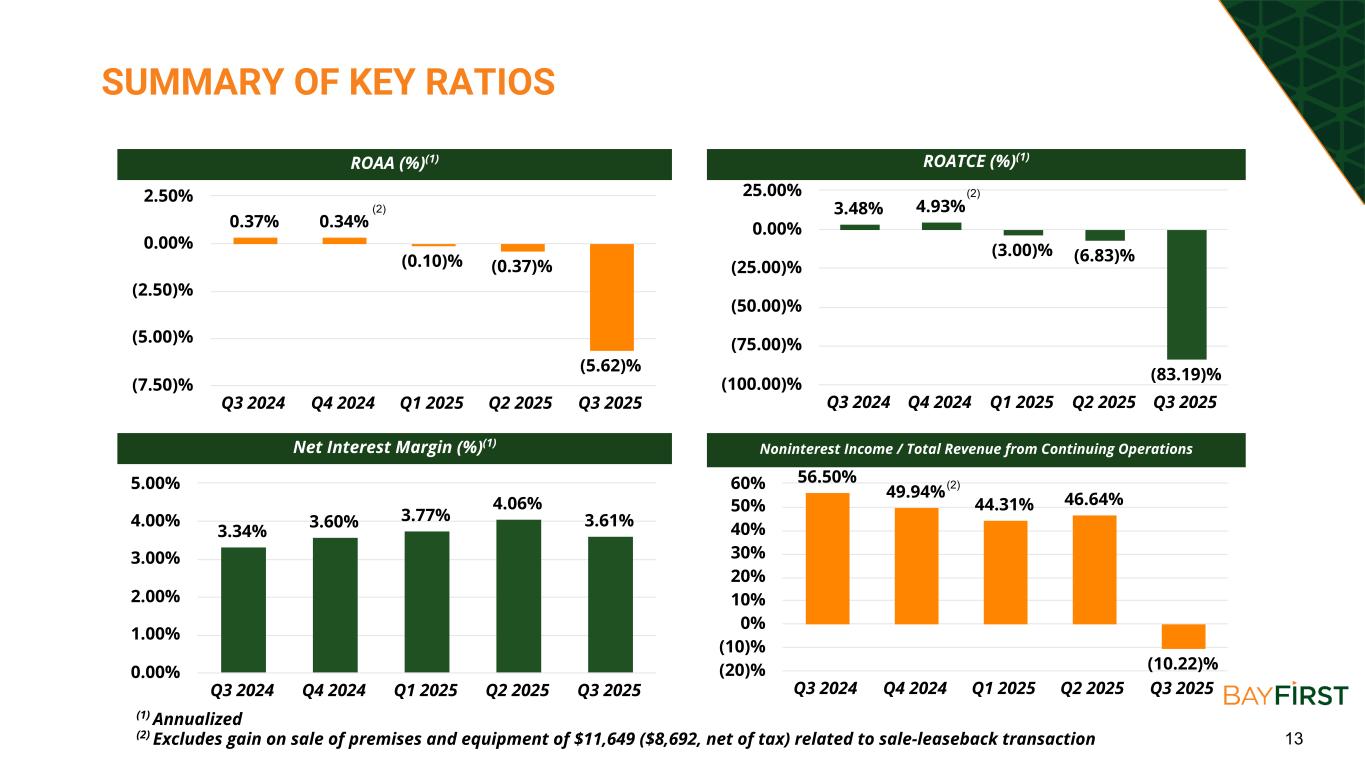

13 SUMMARY OF KEY RATIOS ROAA (%)(1) ROATCE (%)(1) Net Interest Margin (%)(1) Noninterest Income / Total Revenue from Continuing Operations 0.37% 0.34% (0.10)% (0.37)% (5.62)% Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 (7.50)% (5.00)% (2.50)% 0.00% 2.50% 3.48% 4.93% (3.00)% (6.83)% (83.19)% Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 (100.00)% (75.00)% (50.00)% (25.00)% 0.00% 25.00% 3.34% 3.60% 3.77% 4.06% 3.61% Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 56.50% 49.94% 44.31% 46.64% (10.22)% Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 (20)% (10)% 0% 10% 20% 30% 40% 50% 60% (1) Annualized (2) Excludes gain on sale of premises and equipment of $11,649 ($8,692, net of tax) related to sale-leaseback transaction (2) (2) (2)

14 TANGIBLE BOOK VALUE PER COMMON SHARE $20.86 $22.95 $22.77 $22.30 $17.90 Tangible Book Value Per Common Share Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 $10 $13 $15 $18 $20 $23 $25

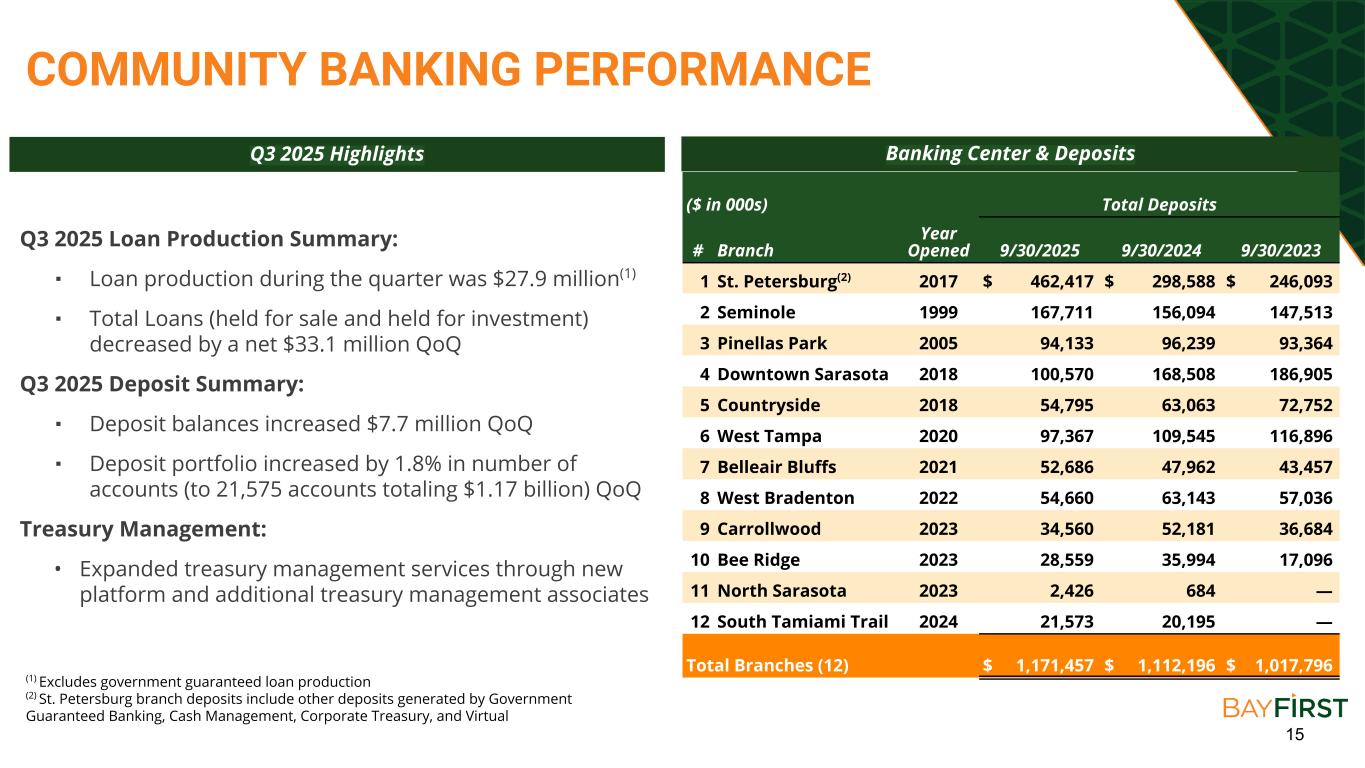

15 COMMUNITY BANKING PERFORMANCE Q3 2025 Loan Production Summary: ▪ Loan production during the quarter was $27.9 million(1) ▪ Total Loans (held for sale and held for investment) decreased by a net $33.1 million QoQ Q3 2025 Deposit Summary: ▪ Deposit balances increased $7.7 million QoQ ▪ Deposit portfolio increased by 1.8% in number of accounts (to 21,575 accounts totaling $1.17 billion) QoQ Treasury Management: • Expanded treasury management services through new platform and additional treasury management associates Q3 2025 Highlights Banking Center & Deposits ($ in 000s) Total Deposits # Branch Year Opened 9/30/2025 9/30/2024 9/30/2023 1 St. Petersburg(2) 2017 $ 462,417 $ 298,588 $ 246,093 2 Seminole 1999 167,711 156,094 147,513 3 Pinellas Park 2005 94,133 96,239 93,364 4 Downtown Sarasota 2018 100,570 168,508 186,905 5 Countryside 2018 54,795 63,063 72,752 6 West Tampa 2020 97,367 109,545 116,896 7 Belleair Bluffs 2021 52,686 47,962 43,457 8 West Bradenton 2022 54,660 63,143 57,036 9 Carrollwood 2023 34,560 52,181 36,684 10 Bee Ridge 2023 28,559 35,994 17,096 11 North Sarasota 2023 2,426 684 — 12 South Tamiami Trail 2024 21,573 20,195 — Total Branches (12) $ 1,171,457 $ 1,112,196 $ 1,017,796 (1) Excludes government guaranteed loan production (2) St. Petersburg branch deposits include other deposits generated by Government Guaranteed Banking, Cash Management, Corporate Treasury, and Virtual

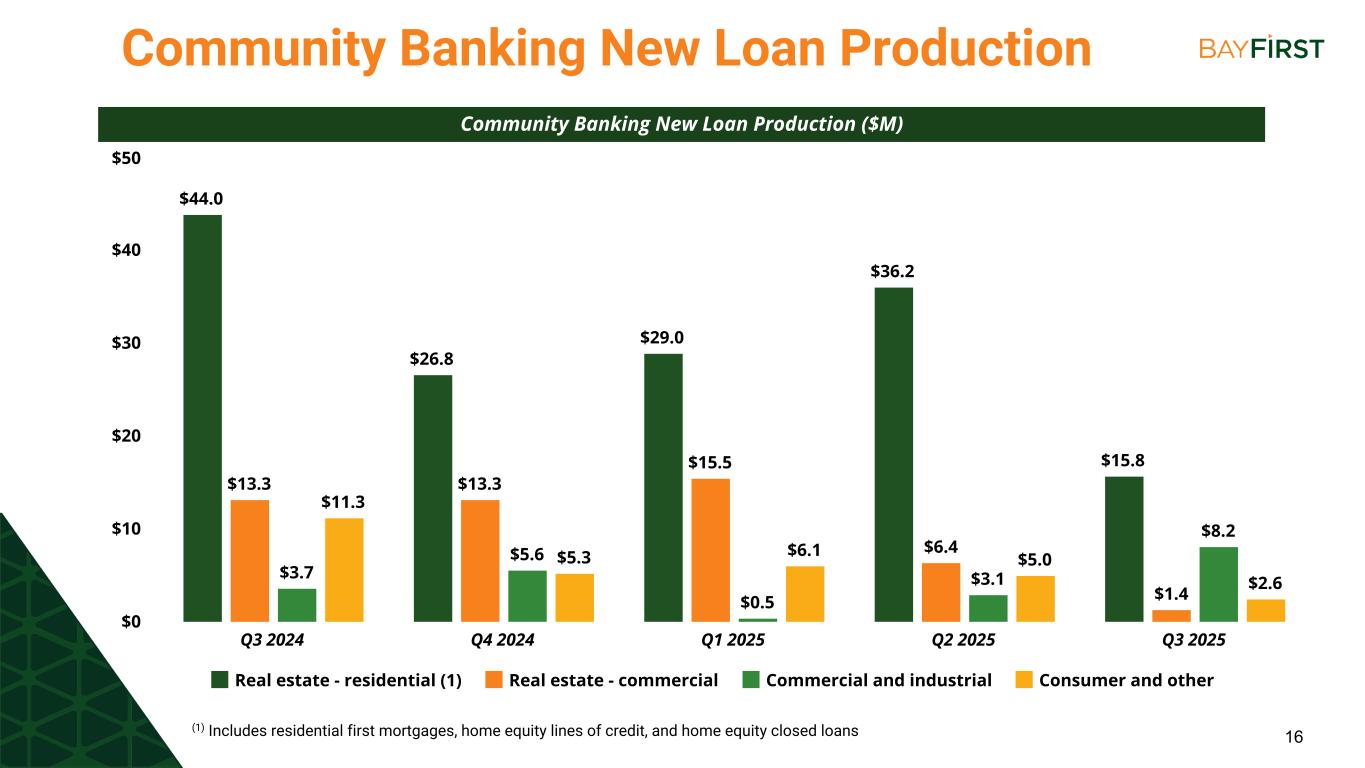

16 $44.0 $26.8 $29.0 $36.2 $15.8 $13.3 $13.3 $15.5 $6.4 $1.4 $3.7 $5.6 $0.5 $3.1 $8.2 $11.3 $5.3 $6.1 $5.0 $2.6 Real estate - residential (1) Real estate - commercial Commercial and industrial Consumer and other Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 $0 $10 $20 $30 $40 $50 Community Banking New Loan Production Community Banking New Loan Production ($M) (1) Includes residential first mortgages, home equity lines of credit, and home equity closed loans

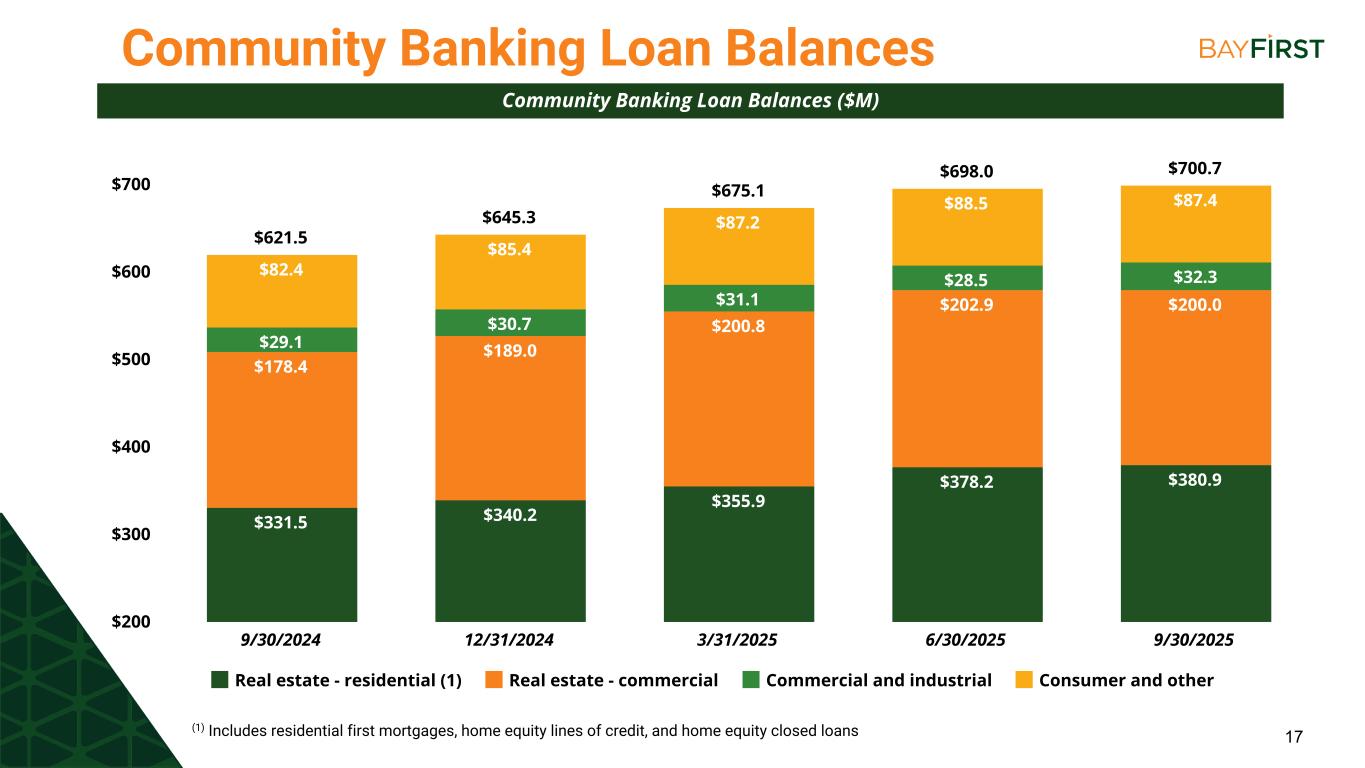

17 $621.5 $645.3 $675.1 $698.0 $700.7 $331.5 $340.2 $355.9 $378.2 $380.9 $178.4 $189.0 $200.8 $202.9 $200.0 $29.1 $30.7 $31.1 $28.5 $32.3$82.4 $85.4 $87.2 $88.5 $87.4 Real estate - residential (1) Real estate - commercial Commercial and industrial Consumer and other 9/30/2024 12/31/2024 3/31/2025 6/30/2025 9/30/2025 $200 $300 $400 $500 $600 $700 Community Banking Loan Balances Community Banking Loan Balances ($M) (1) Includes residential first mortgages, home equity lines of credit, and home equity closed loans

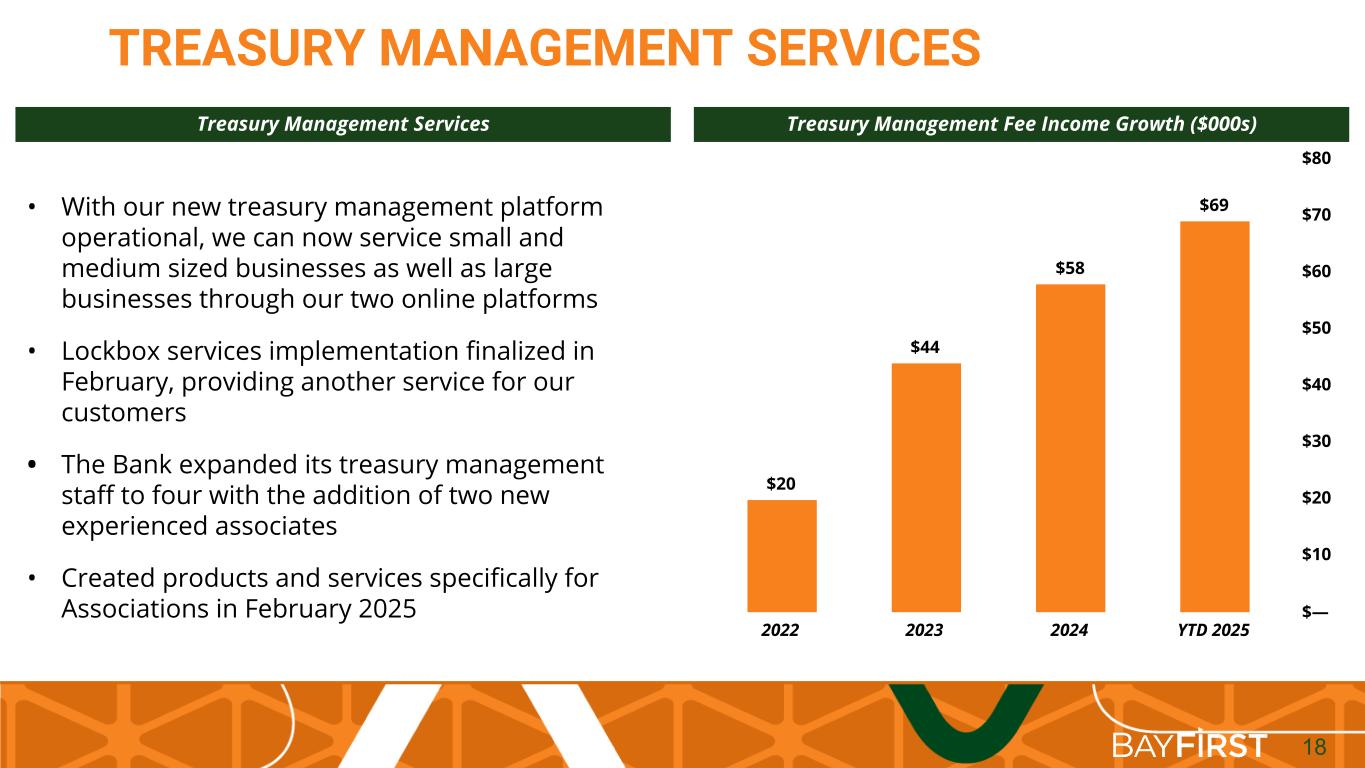

18 $20 $44 $58 $69 2022 2023 2024 YTD 2025 $— $10 $20 $30 $40 $50 $60 $70 $80 • With our new treasury management platform operational, we can now service small and medium sized businesses as well as large businesses through our two online platforms • Lockbox services implementation finalized in February, providing another service for our customers • The Bank expanded its treasury management staff to four with the addition of two new experienced associates • Created products and services specifically for Associations in February 2025 TREASURY MANAGEMENT SERVICES Treasury Management Services Treasury Management Fee Income Growth ($000s)

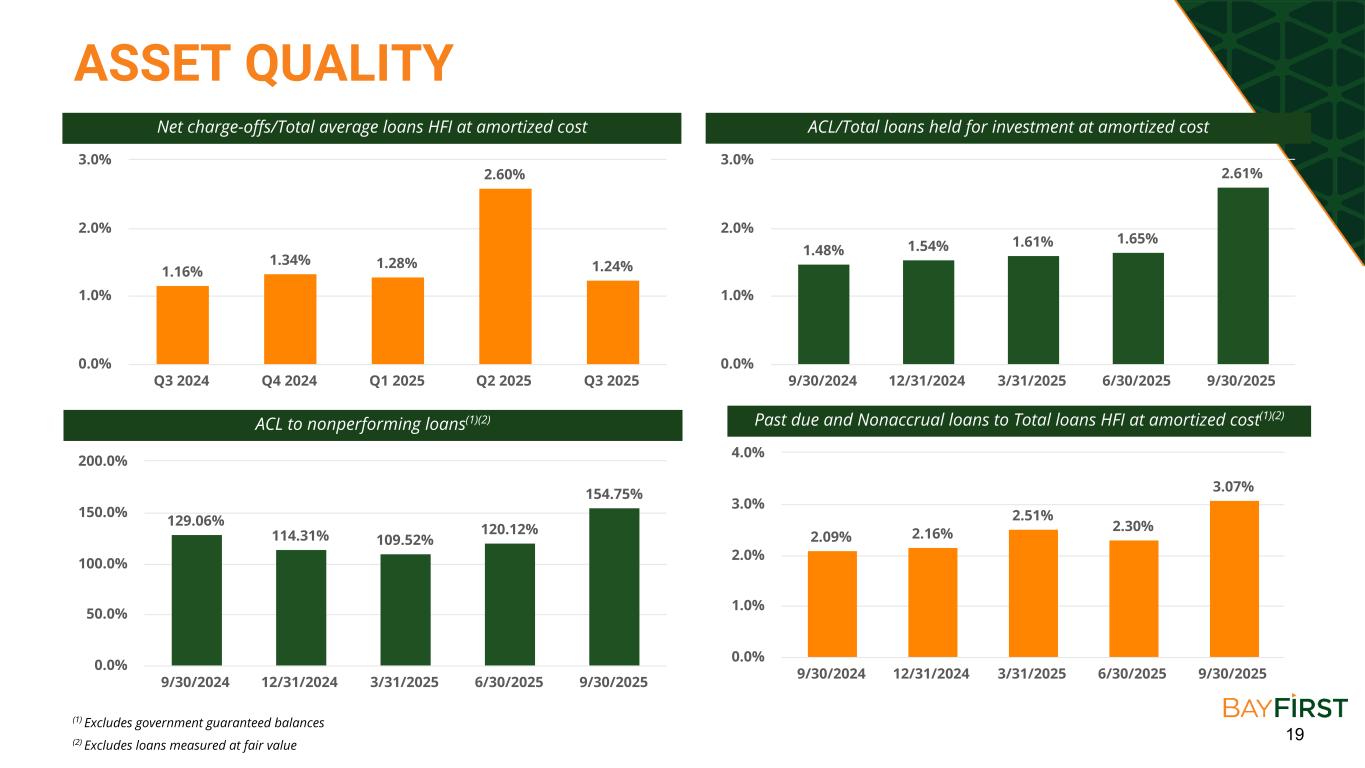

19 ASSET QUALITY 1.16% 1.34% 1.28% 2.60% 1.24% Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 0.0% 1.0% 2.0% 3.0% Net charge-offs/Total average loans HFI at amortized cost ACL/Total loans held for investment at amortized cost 1.48% 1.54% 1.61% 1.65% 2.61% 9/30/2024 12/31/2024 3/31/2025 6/30/2025 9/30/2025 0.0% 1.0% 2.0% 3.0% ACL to nonperforming loans(1)(2) Past due and Nonaccrual loans to Total loans HFI at amortized cost(1)(2) 129.06% 114.31% 109.52% 120.12% 154.75% 9/30/2024 12/31/2024 3/31/2025 6/30/2025 9/30/2025 0.0% 50.0% 100.0% 150.0% 200.0% 2.09% 2.16% 2.51% 2.30% 3.07% 9/30/2024 12/31/2024 3/31/2025 6/30/2025 9/30/2025 0.0% 1.0% 2.0% 3.0% 4.0% (1) Excludes government guaranteed balances (2) Excludes loans measured at fair value

20 APPENDIX

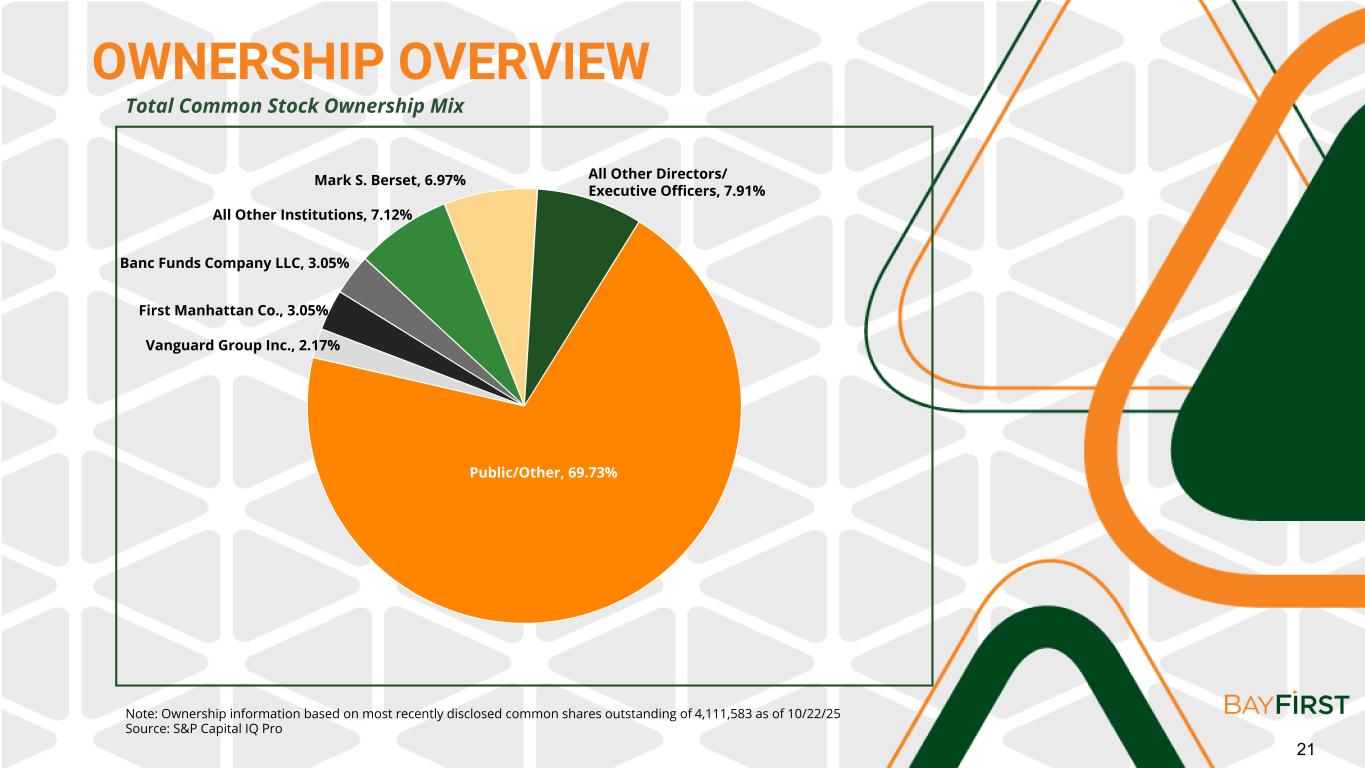

21 OWNERSHIP OVERVIEW Total Common Stock Ownership Mix Note: Ownership information based on most recently disclosed common shares outstanding of 4,111,583 as of 10/22/25 Source: S&P Capital IQ Pro Vanguard Group Inc., 2.17% First Manhattan Co., 3.05% Banc Funds Company LLC, 3.05% All Other Institutions, 7.12% Mark S. Berset, 6.97% All Other Directors/ Executive Officers, 7.91% Public/Other, 69.73%

22 DEPOSITS IN TAMPA BAY-SARASOTA REGION Total Deposits (Total Assets <$10BN and HQ in Tampa Bay-Sarasota Region) Note: Deposit data as of June 30, 2025 Source: Uniform Bank Performance Reports Average Deposits Branches Deposits per Branch Rank Institution ($ millions) (No.) ($ millions) 1 Bank of Tampa $2,725 13 $210 2 BayFirst National Bank 1,164 12 97 3 Climate First 1,006 3 335 4 Flagship Bank 601 6 100 5 Waterfall Bank 306 1 306 6 Central Bank 294 4 73 7 TCM Bank NA 286 1 286 8 Gulfside Bank 284 2 142 9 Century Bank of Florida 88 1 88

23 LIQUIDITY SOURCES • Available Liquidity ◦ $120 million in cash and due from other banks ◦ $30 million in AFS investment securities • Off Balance Sheet Sources of Liquidity ◦ $146 million of unused, available borrowing capacity at the FHLB based on pledged loans ◦ $56 million available at the Federal Reserve Bank based on pledged loans ◦ $50 million in available Fed Funds borrowing lines from other banks • Contingent Sources ◦ Up to $33 million in brokered deposits (1) ◦ Up to $403 million in listing service deposits (1) (1) Based on Bank’s policy limits Data as of September 30, 2025

24 EXPERIENCED LEADERSHIP TEAM • Joined BayFirst as CFO in Q2 2018; Prior to joining BayFirst, Controller of Central Bank & Trust Co., a $2.5 billion privately held financial institution in Lexington, Kentucky, from May 2014 to June 2018 • Approximately 16 years with Crowe LLP as an auditor in the financial institution practice; served over 80 financial institution clients with assets ranging from $50 million to $4.5 billion throughout career, including several SEC registrants and FDICIA reporting institutions • B.S. in Accounting from the University of Kentucky • Joined BayFirst in Q1 2016 • Previous experience includes Florida Market President of Stearns Bank, SBA Product Manager of HomeBanc, and Community Bank President and SBA President of Republic Bank (MI) • B.A. in Business Administration from University of Notre Dame Robin Oliver Thomas G. Zernick Chief Executive Officer & Director of BayFirst and the Bank President, Chief Operating Officer & Director of BayFirst and the Bank Scott J. McKim EVP, Chief Financial Officer of BayFirst and the Bank • Joined BayFirst in July 2023 • Previous experience includes Chief Strategy Officer of 121 Financial Credit Union, Chief Financial Officer and Chief Lending Officer of Publix Employees Federal Credit Union, and Director of Corporate Finance and Divisional CFO for Huntington Bancshares • B.S. in Accounting from Bowling Green State University and a M.B.A from Max M. Fisher College of Business, The Ohio State University

25 EXPERIENCED LEADERSHIP TEAM • Joined BayFirst in Q4 2017; Prior to joining BayFirst, over fifteen years of Mortgage Banking administration experience as well as Human Resources experience supporting mid-size financial institutions • B.B.S from The University of Florida and M.B.A from The University of Tampa Brandi Jaber Susan Khayat EVP, Chief Administrative Officer EVP, Chief Credit Officer Nick Smith EVP, Chief Human Resources Officer • Prior to joining the BayFirst HR team in January 2021, Nick served in leadership roles in the finance, aerospace, and pulp and paper industries. • BA from Murray State University and his MBA from University of Southern Indiana • Joined BayFirst in 2018 • Held leadership positions at multiple institutions amassing expertise in many areas of community banking and business development • B.S. in Economics with an emphasis in Mathematics from University of Wisconsin-Madison Thomas Quale EVP, Chief Lending Officer and Market President • Prior to joining BayFirst in 2025, Ms. Khayat served as Chief Credit Officer at Fieldpoint Private Bank and assisted Price Waterhouse Coopers with compliance risk reviews while contracted with MBO Partners in Atlanta and has served as Chief Risk Officer and Chief Credit Officer at other community banks and worked many years as a bank regulator with the US Department of the Treasury • Ms. Khayat received her BBA in Finance from Mercer University