Q2 FY26 1 Fellow shareholders, We had a fantastic Q2. We’re building a bloody great business. I’m convinced AI is great for Atlassian. Others think software is dead. In this environment, it seems that noise swamps signal, nuance gets lost. So this quarter I’m going to give you straight signal. The Q2 facts that make me bullish. And let our customers do the talking. 1. Revenue grew 23% YoY to $1.6 billion. Cloud revenue grew 26% YoY to $1.1 billion - our first ever $1 billion+ cloud quarter. 2. RPO up 44% YoY to $3.8 billion, continuing to accelerate - reflecting enterprise adoption and long-term customer commitments to us as a strategic platform. 3. Rovo sailed past 5 million MAU. Teamwork Graph now well past 100 billion+ objects & connections - our AI transformation continues to deliver for our customers’ workflows, with record agent & token use. 4. Record number of $1 million+ ACV deals, up nearly 2x YoY. 600+ customers with >$1 million of ARR, up almost 40% YoY - our enterprise transformation is delivering, with us becoming an ever-more strategic partner to customers. 5. Cloud net revenue retention rate (NRR) is 120%+, ticking up for the third consecutive quarter - customers are expanding use of our enterprise AI platform with more users, apps, and upgrades. 6. Over 350,000 customers, including 80% of the Fortune 500 and 60% of the Forbes AI 50 - with 50% of our users in finance, HR, marketing, ops, and other non-technical teams. 7. Teamwork Collection, our primary AI monetization, passed 1 million seats and 1,000 customers - exceeding our expectations, consolidating tools, and expanding seat counts by 10%+ over their standalone app footprint. 8. Service Collection launched Customer Service Management and passed 65,000 customers, including half of the Fortune 500 - while our enterprise business grew 60% YoY in Q2. 9. Software Collection launched, DX joined the team, and had a record Q2 - customers are choosing us for their AI- native software development lifecycle. 10. Accelerating our pace of buybacks, plans for H2 up ~2-3X vs H1 - we believe our shares are significantly undervalued. We’re using our strong free cash flow to opportunistically repurchase our stock. We just celebrated the 10-year anniversary of our IPO. What Scott and I wrote in our F-1 remains true today: We've run this company with a long-term mindset... We don't seek to maximize growth in any one year. We are focused on sustainable growth year after year. We're passionate about the long-term welfare of our customers, our employees, and our shareholders. Sustainable growth? Over the last decade, we’ve had a revenue CAGR of 30%+. In complex times, I focus on the simple things. Listen to customers. Anchor in facts. Adapt to reality. Execute with discipline. Give a sh*t. Work hard. Build with heart and balance. I believe you can’t fight uncertainty with certainty - you fight it with clarity and conviction. Back to work. LFG 👊 -Mike Mike Cannon-Brookes CEO and Co-founder Shareholder letter Q2 FY26 | February 5, 2026From the CEO

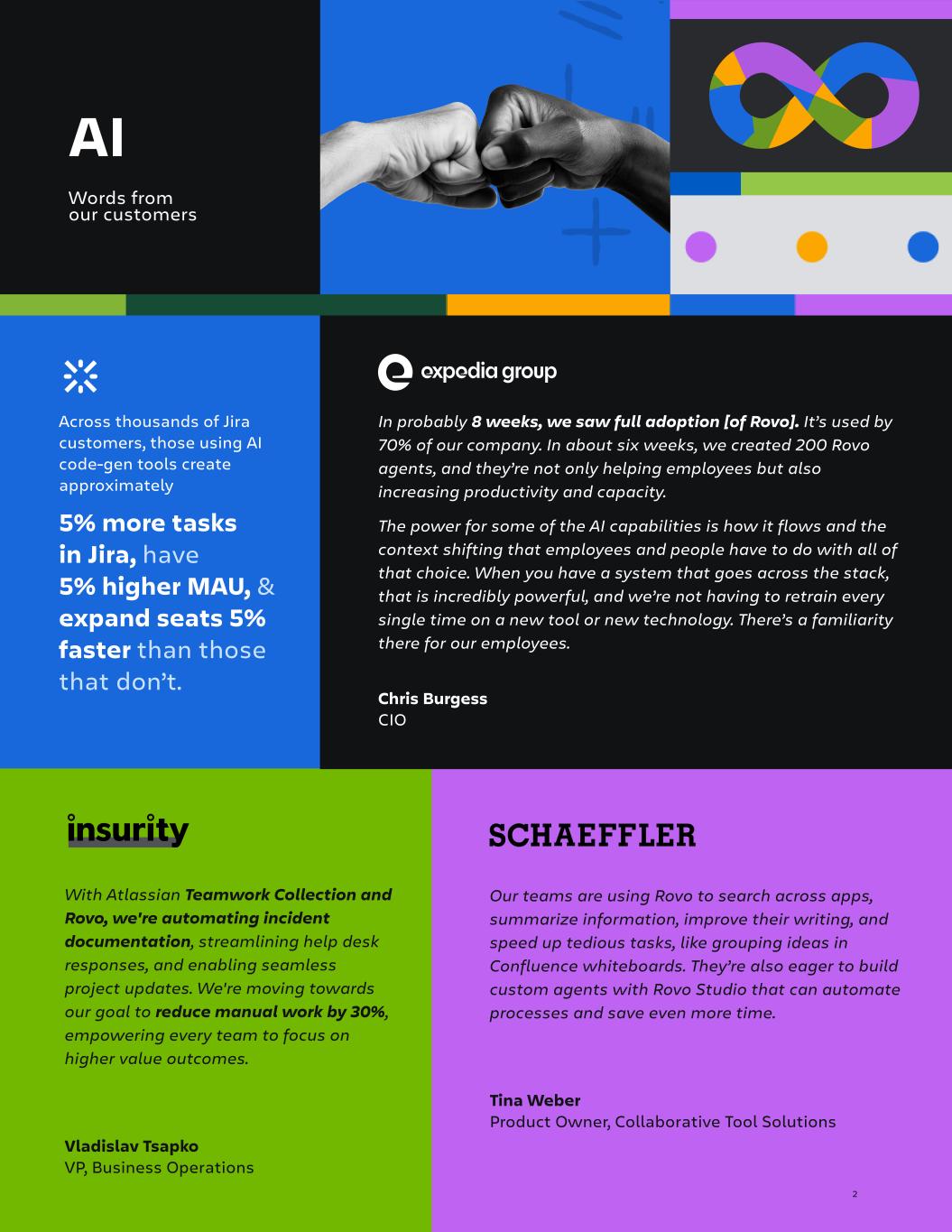

Q2 FY26 2 In probably 8 weeks, we saw full adoption [of Rovo]. It’s used by 70% of our company. In about six weeks, we created 200 Rovo agents, and they’re not only helping employees but also increasing productivity and capacity. The power for some of the AI capabilities is how it flows and the context shifting that employees and people have to do with all of that choice. When you have a system that goes across the stack, that is incredibly powerful, and we’re not having to retrain every single time on a new tool or new technology. There’s a familiarity there for our employees. Chris Burgess CIO With Atlassian Teamwork Collection and Rovo, we're automating incident documentation, streamlining help desk responses, and enabling seamless project updates. We're moving towards our goal to reduce manual work by 30%, empowering every team to focus on higher value outcomes. Vladislav Tsapko VP, Business Operations Our teams are using Rovo to search across apps, summarize information, improve their writing, and speed up tedious tasks, like grouping ideas in Confluence whiteboards. They’re also eager to build custom agents with Rovo Studio that can automate processes and save even more time. Tina Weber Product Owner, Collaborative Tool Solutions Across thousands of Jira customers, those using AI code-gen tools create approximately 5% more tasks in Jira, have 5% higher MAU, & expand seats 5% faster than those that don’t. AI Words from our customers

Q2 FY26 Enterprise After comparing collaboration and productivity tools, I knew Atlassian should be our #1 platform. Everything else felt too simple or too complex. Atlassian was intuitive enough for our basic users and advanced enough for our power users. Jousef Waggad Atlassian Administrator Delivery Hero, one of the world’s leading delivery platforms, recently migrated 40,000 users to Atlassian cloud in a matter of months, achieving a 40% faster migration than planned by using our tooling. By consolidating onto the Atlassian Platform, they’ve realized 69% cost and time savings, including more than 1,000 hours of maintenance work. Q2 DEAL HIGHLIGHTS FASTSHIFT POWERED MIGRATIONS Words from our customers 3

Q2 FY26 System of work With Teamwork Collection, Strategy Collection, and Guard, Synchrony is moving towards a centralized, secure System of Work where strategy and execution are seamlessly connected. Our vision is for every team to plan, deliver, and support work on a unified, governed platform—enabling proactive, data-driven decisions, preventing customer-impacting issues before they occur, and empowering over 15,000 knowledge workers to collaborate safely at scale while upholding the highest standards of financial data protection. Sudhanva Ramesh VP, Office of Agile Tools Lead Having a System of Work built on a great data platform with common ways of working allows us to make AI very effective and enable AI at scale. Jason Andrews VP of Strategy & Planning – Engineering Operations Words from our customers 4

Q2 FY26 With the Atlassian Teamwork Collection, we have improved our meeting culture and transformed the way we collaborate and communicate. Connecting our teams and data with the Teamwork Collection is saving us valuable time and money – a key enabler on our mission to help our customers do the same. With Loom, our teams have replaced unnecessary meetings and long Confluence pages with quick Loom videos – making communication faster, more engaging, and more digestible. Laura Bennett Atlassian Suite Administrator Customers such as Globant, Optimizely, Asurion, and Paysafe upgraded to ensure seamless collaboration across all teams in their organizations. All of this gives us even more confidence that our strategy is working. With Teamwork Collection, LPL Financial plans to unify our platform to modernize collaboration, reduce unnecessary meetings, and centralize communication—allowing us to work faster and smarter together. I look forward to breaking down silos, gaining deeper project insights, and empowering our teams to adopt new technologies like AI, all backed by strong executive alignment and a shared vision for the future. Camila Haselwood VP, Delivery Enablement Atlassian’s Teamwork Collection helps our global teams move faster and stay better connected. By bringing Jira, Confluence, and Loom together with the power of AI—and integrating them into our Sapient Slingshot platform—we’re able to link ideas to customer value more seamlessly. The tools give us scale and automation, but they also keep human creativity front and center —which is how we deliver real impact for our clients. Sheldon Monteiro EVP, Chief Product Officer Words from our customers 5

Q2 FY26 6 Moving to Atlassian Cloud and rolling Jira Service Management out to business teams like Finance has already transformed how we work — upgrades happen in the background, and automation took us from thousands of invoices in one queue down to a handful of tickets. We’re leaning into what’s next with Atlassian AI: engineers are looking forward to the Rovo Dev Agent beta, Loom is making it easy to add quick how‑to videos into Confluence, and we’re onboarding onto DX to take advantage of AI assistance and improve our developers’ everyday workflows. Curtis Valente IT Director Many organizations like Neta replace their existing enterprise service management solutions with Atlassian, joining customers like Mercedes-Benz, The Warehouse Group, and Sony Music Publishing in connecting Dev, IT, Operations, and business teams to deliver exceptional service at scale. Customers like Neta, a large European energy and utilities platform, that switched from a legacy provider to Service Collection, use JSM and Rovo to speed up incident response and run application support, cutting escalations by 35% and resolving tickets 10–30% faster. Words from our customers

Q2 FY26 Each automation removes friction, fosters creativity, and builds trust. That’s what makes Rovo Dev more than a tool — for us, it’s a catalyst for culture. Martin Bild Head of Product Excellence This is a small part of our overall business today but there’s a real appetite for AI-native software development. Rovo Dev, DX, and early Agentic Pipelines usage demonstrated that teams want smarter, more automated workflows. Flo, serving hundreds of millions of users worldwide, leveraged Atlassian's cloud platform to achieve a 900% increase in daily deployments, a 50% reduction in cycle time, and a 99% decrease in mean time to resolution, while enabling seamless collaboration across its global teams. And customers like Dropbox, Block, Pinterest, and BNY have experienced the benefits of measuring, understanding, and improving developer productivity and satisfaction with DX. Words from our customers DX 7

Q2 FY26 8 A Leader in the 2025 Gartner® Magic Quadrant™ for Collaborative Work Management2 A Leader in The Forrester Wave™ Enterprise Service Management Platforms, Q4 2025 A Leader in the 2025 Gartner® Magic Quadrant™ for Marketing Work Management Platforms1 1- Gartner® Magic Quadrant™ for Marketing Work Management Platforms, Michael McCune, Rachel Dooley, Lacretia Marsh, Amy Jenkins, Kate Fridley, Anja Naski, 1 December 2025 2- Gartner®, Magic Quadrant™ for Collaborative Work Management, Nikos Drakos, Joe Mariano, Lacy Lei, Hironori Hayashi, 28 October 2025 Gartner does not endorse any company, vendor, product or service depicted in its publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner publications consist of the opinions of Gartner’s business and technology insights organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this publication, including any warranties of merchantability or fitness for a particular purpose. The Gartner content described herein (the “Gartner Content”) represents research opinion or viewpoints published, as part of a syndicated subscription service, by Gartner, Inc. ("Gartner"), and is not a representation of fact. Gartner Content speaks as of its original publication date (and not as of the date of this Shareholder Letter), and the opinions expressed in the Gartner Content are subject to change without notice. GARTNER and MAGIC QUADRANT are trademarks of Gartner, Inc. and its affiliates. But wait, there’s more In Q2, it was awesome to see our work recognized outside our four walls. Atlassian was named-

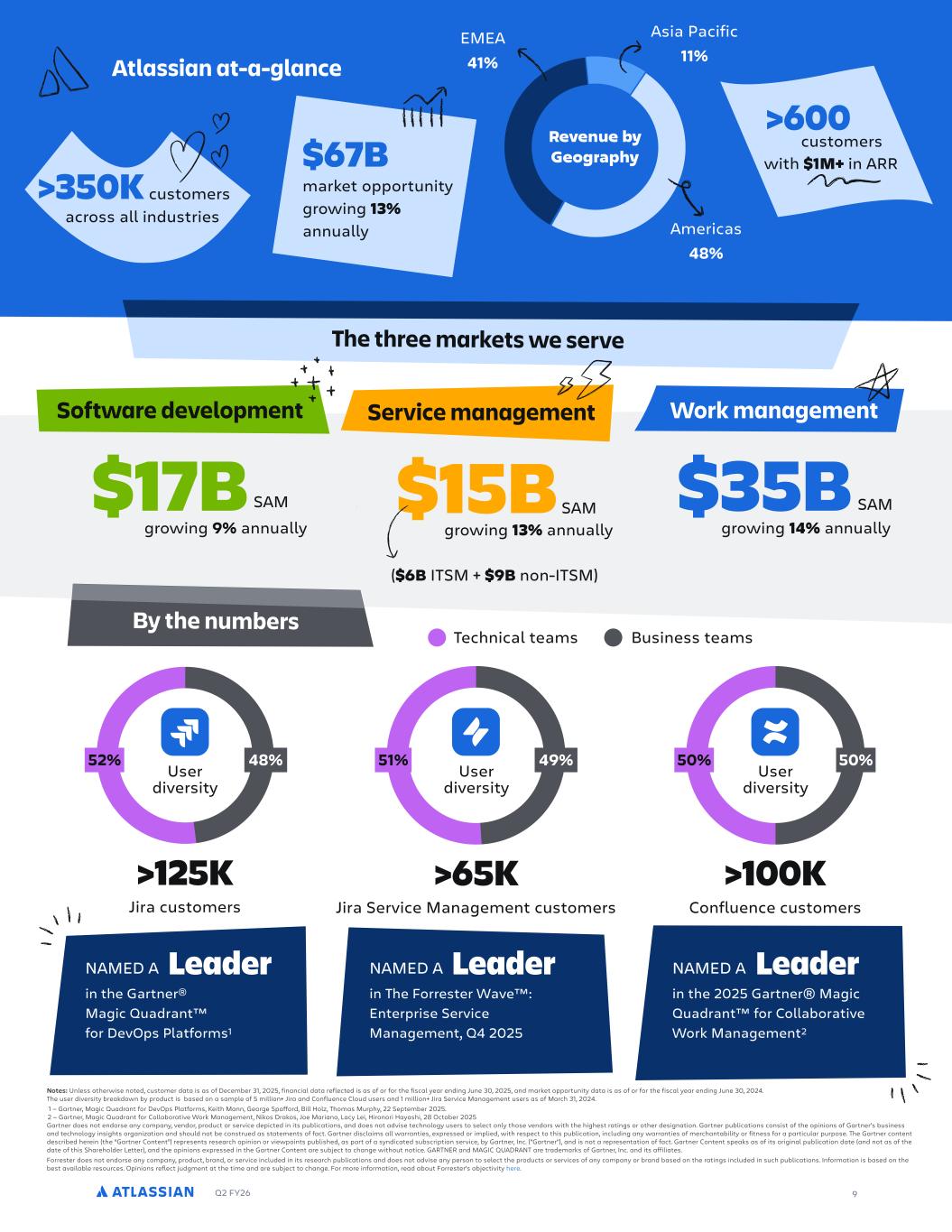

Q2 FY26 9 Confluence customers >100K Jira Service Management customers >65K in the Gartner® Magic Quadrant™ for DevOps Platforms1 LeaderNAMED A in The Forrester Wave™: Enterprise Service Management, Q4 2025 LeaderNAMED A 52% 48% Jira customers >125K Technical teams Business teams 51% 49% 50% 50% Atlassian at-a-glance The three markets we serve $67B market opportunity growing 13% annually across all industries >350K customers >600 customers with $1M+ in ARR Americas 48% EMEA 41% Asia Pacific 11% Revenue by Geography Notes: Unless otherwise noted, customer data is as of December 31, 2025, financial data reflected is as of or for the fiscal year ending June 30, 2025, and market opportunity data is as of or for the fiscal year ending June 30, 2024. The user diversity breakdown by product is based on a sample of 5 million+ Jira and Confluence Cloud users and 1 million+ Jira Service Management users as of March 31, 2024. 1 — Gartner, Magic Quadrant for DevOps Platforms, Keith Mann, George Spafford, Bill Holz, Thomas Murphy, 22 September 2025. 2 — Gartner, Magic Quadrant for Collaborative Work Management, Nikos Drakos, Joe Mariano, Lacy Lei, Hironori Hayashi, 28 October 2025 Gartner does not endorse any company, vendor, product or service depicted in its publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner publications consist of the opinions of Gartner’s business and technology insights organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this publication, including any warranties of merchantability or fitness for a particular purpose. The Gartner content described herein (the “Gartner Content”) represents research opinion or viewpoints published, as part of a syndicated subscription service, by Gartner, Inc. ("Gartner"), and is not a representation of fact. Gartner Content speaks as of its original publication date (and not as of the date of this Shareholder Letter), and the opinions expressed in the Gartner Content are subject to change without notice. GARTNER and MAGIC QUADRANT are trademarks of Gartner, Inc. and its affiliates. Forrester does not endorse any company, product, brand, or service included in its research publications and does not advise any person to select the products or services of any company or brand based on the ratings included in such publications. Information is based on the best available resources. Opinions reflect judgment at the time and are subject to change. For more information, read about Forrester’s objectivity here . User diversity User diversity User diversity Software development growing 9% annually $17B SAM Work management growing 14% annually $35B SAM Service management growing 13% annually $15B SAM ($6B ITSM + $9B non-ITSM) By the numbers in the 2025 Gartner® Magic Quadrant™ for Collaborative Work Management2 LeaderNAMED A

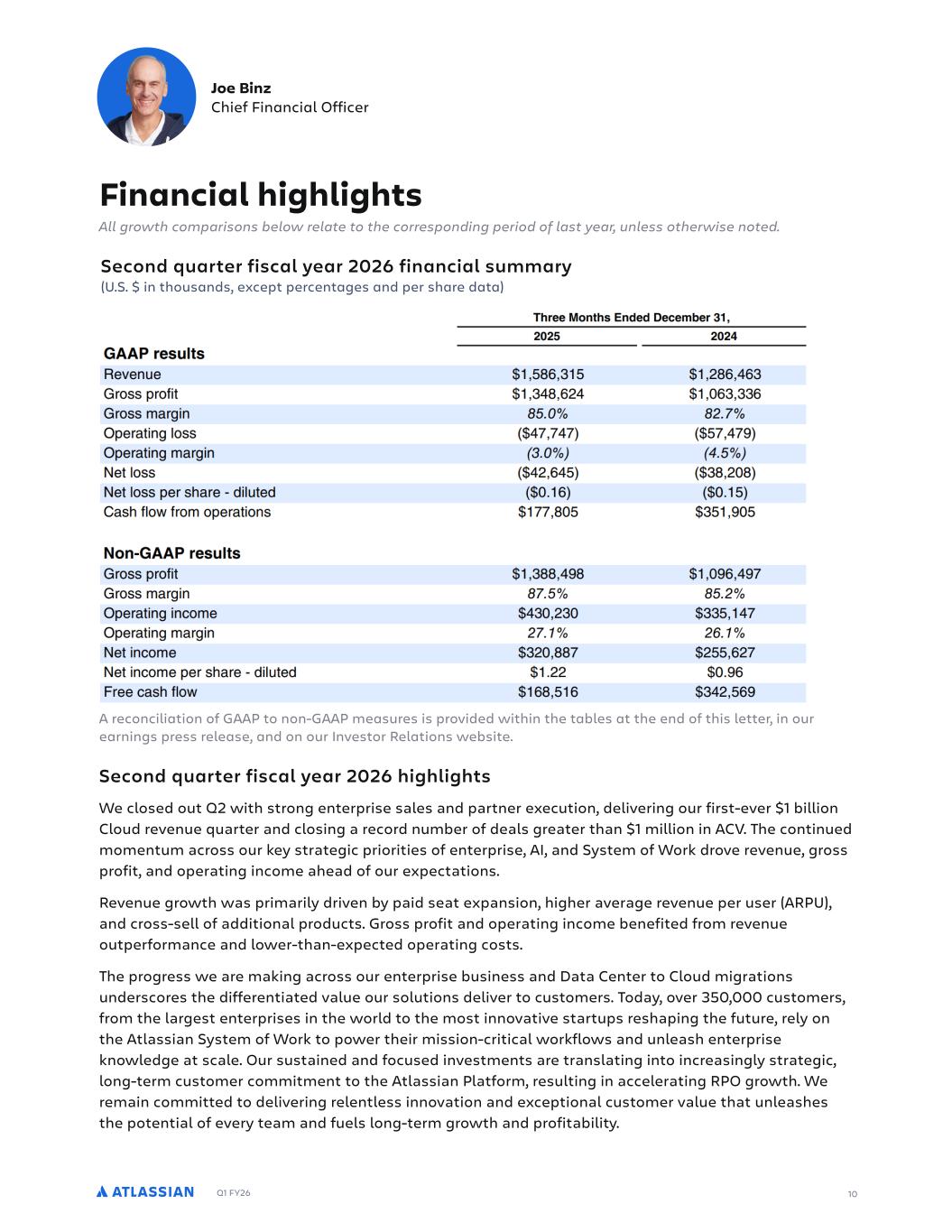

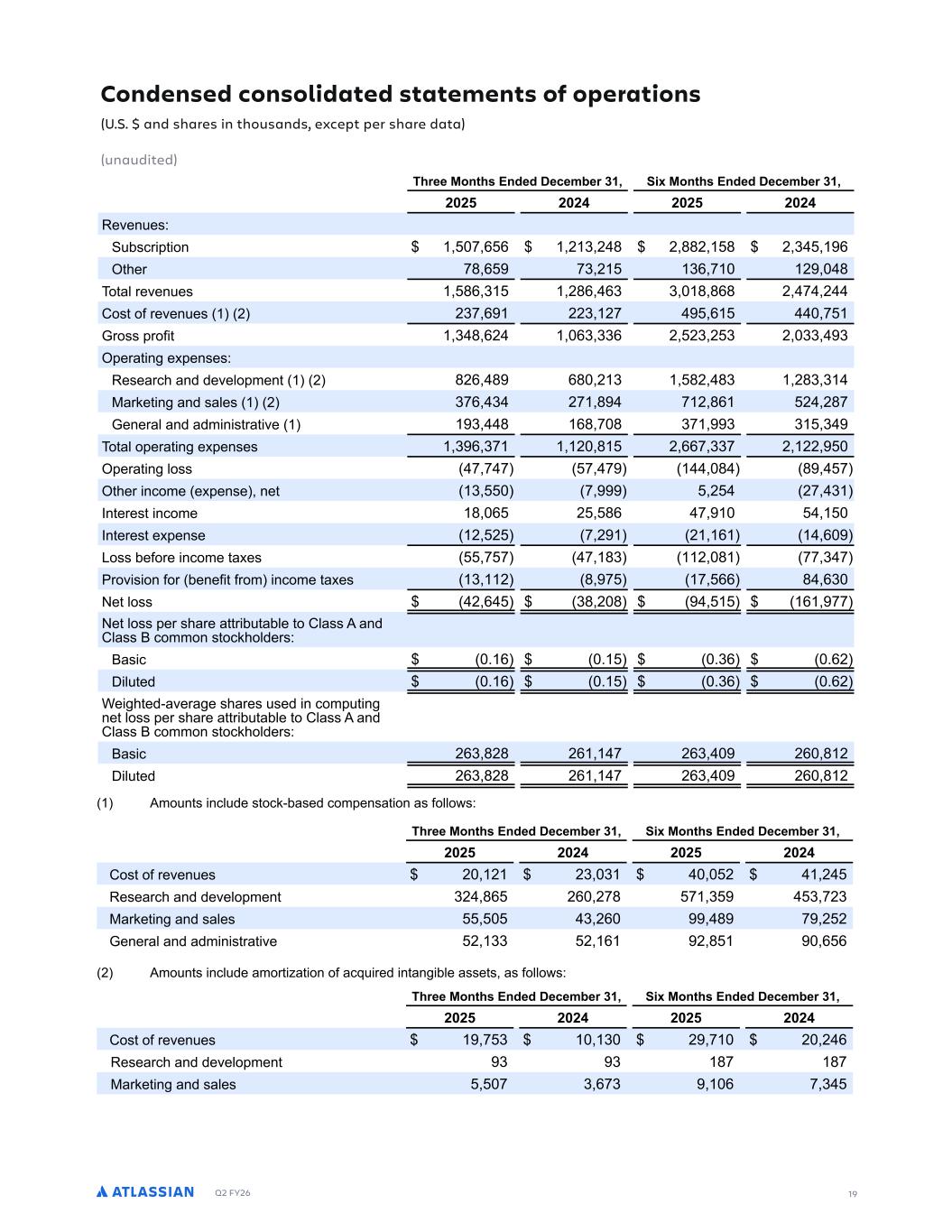

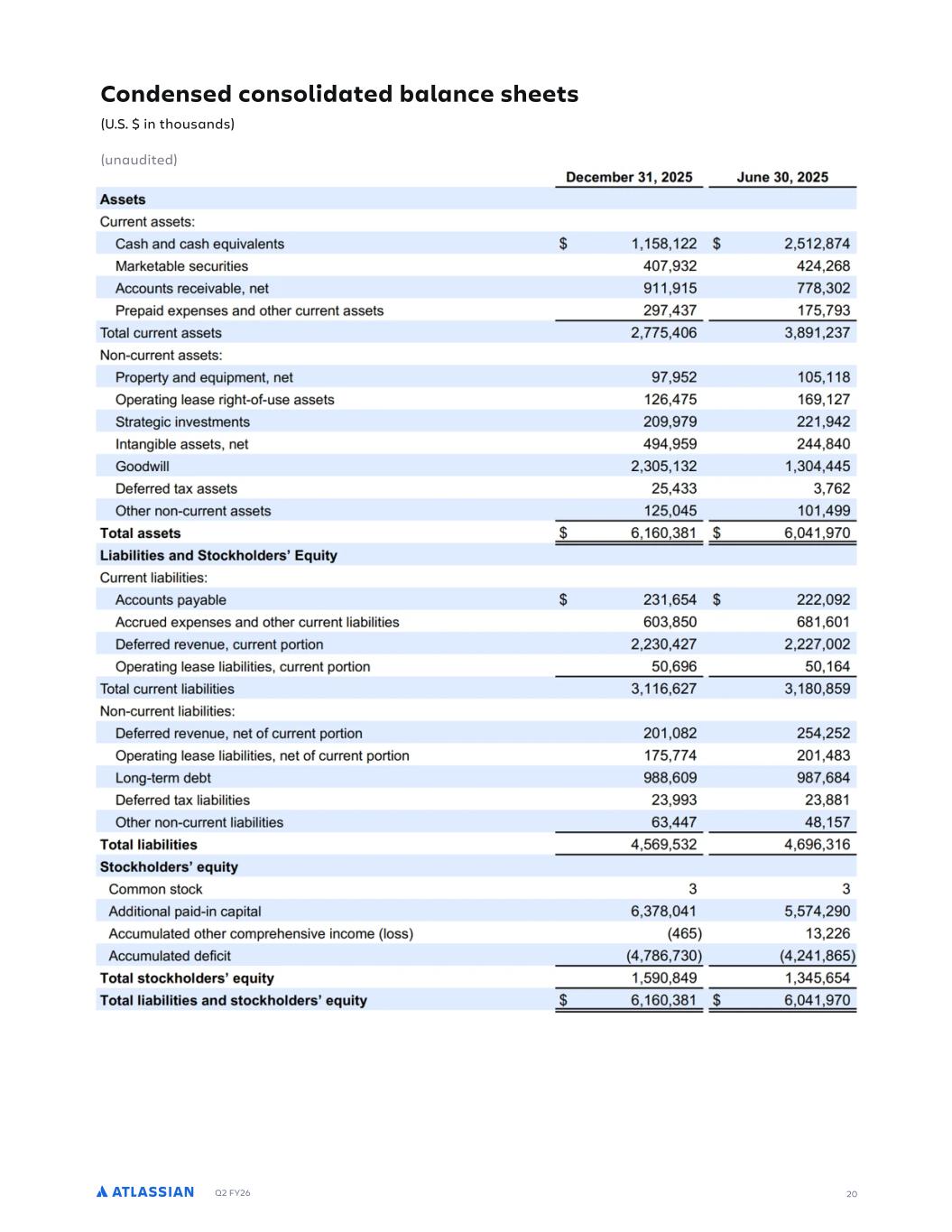

Q1 FY26 10 A reconciliation of GAAP to non-GAAP measures is provided within the tables at the end of this letter, in our earnings press release, and on our Investor Relations website. Joe Binz Chief Financial Officer Financial highlights All growth comparisons below relate to the corresponding period of last year, unless otherwise noted. Second quarter fiscal year 2026 highlights We closed out Q2 with strong enterprise sales and partner execution, delivering our first-ever $1 billion Cloud revenue quarter and closing a record number of deals greater than $1 million in ACV. The continued momentum across our key strategic priorities of enterprise, AI, and System of Work drove revenue, gross profit, and operating income ahead of our expectations. Revenue growth was primarily driven by paid seat expansion, higher average revenue per user (ARPU), and cross-sell of additional products. Gross profit and operating income benefited from revenue outperformance and lower-than-expected operating costs. The progress we are making across our enterprise business and Data Center to Cloud migrations underscores the differentiated value our solutions deliver to customers. Today, over 350,000 customers, from the largest enterprises in the world to the most innovative startups reshaping the future, rely on the Atlassian System of Work to power their mission-critical workflows and unleash enterprise knowledge at scale. Our sustained and focused investments are translating into increasingly strategic, long-term customer commitment to the Atlassian Platform, resulting in accelerating RPO growth. We remain committed to delivering relentless innovation and exceptional customer value that unleashes the potential of every team and fuels long-term growth and profitability. Second quarter fiscal year 2026 financial summary (U.S. $ in thousands, except percentages and per share data)

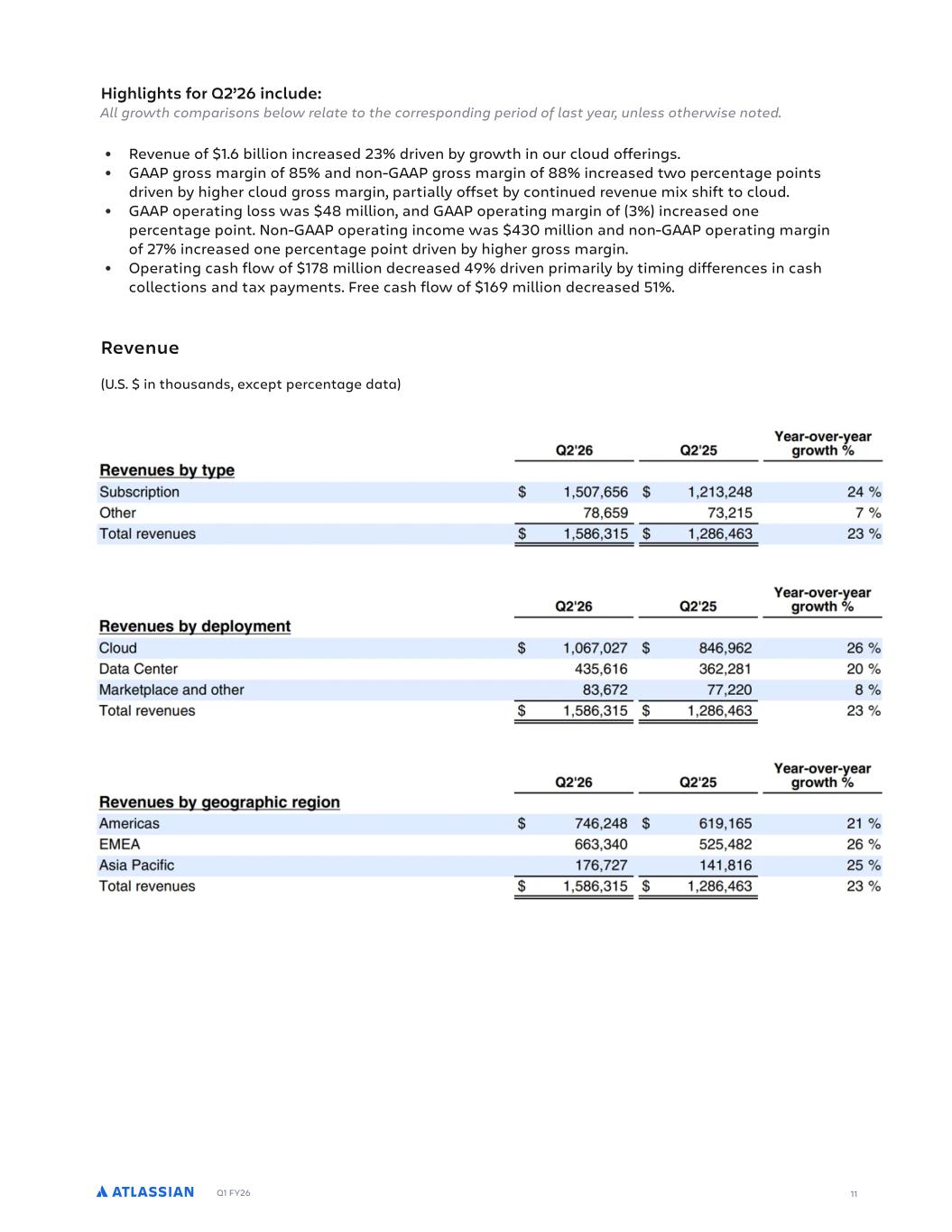

Q1 FY26 Highlights for Q2’26 include: All growth comparisons below relate to the corresponding period of last year, unless otherwise noted. • Revenue of $1.6 billion increased 23% driven by growth in our cloud offerings. • GAAP gross margin of 85% and non-GAAP gross margin of 88% increased two percentage points driven by higher cloud gross margin, partially offset by continued revenue mix shift to cloud. • GAAP operating loss was $48 million, and GAAP operating margin of (3%) increased one percentage point. Non-GAAP operating income was $430 million and non-GAAP operating margin of 27% increased one percentage point driven by higher gross margin. • Operating cash flow of $178 million decreased 49% driven primarily by timing differences in cash collections and tax payments. Free cash flow of $169 million decreased 51%. Revenue (U.S. $ in thousands, except percentage data) 11

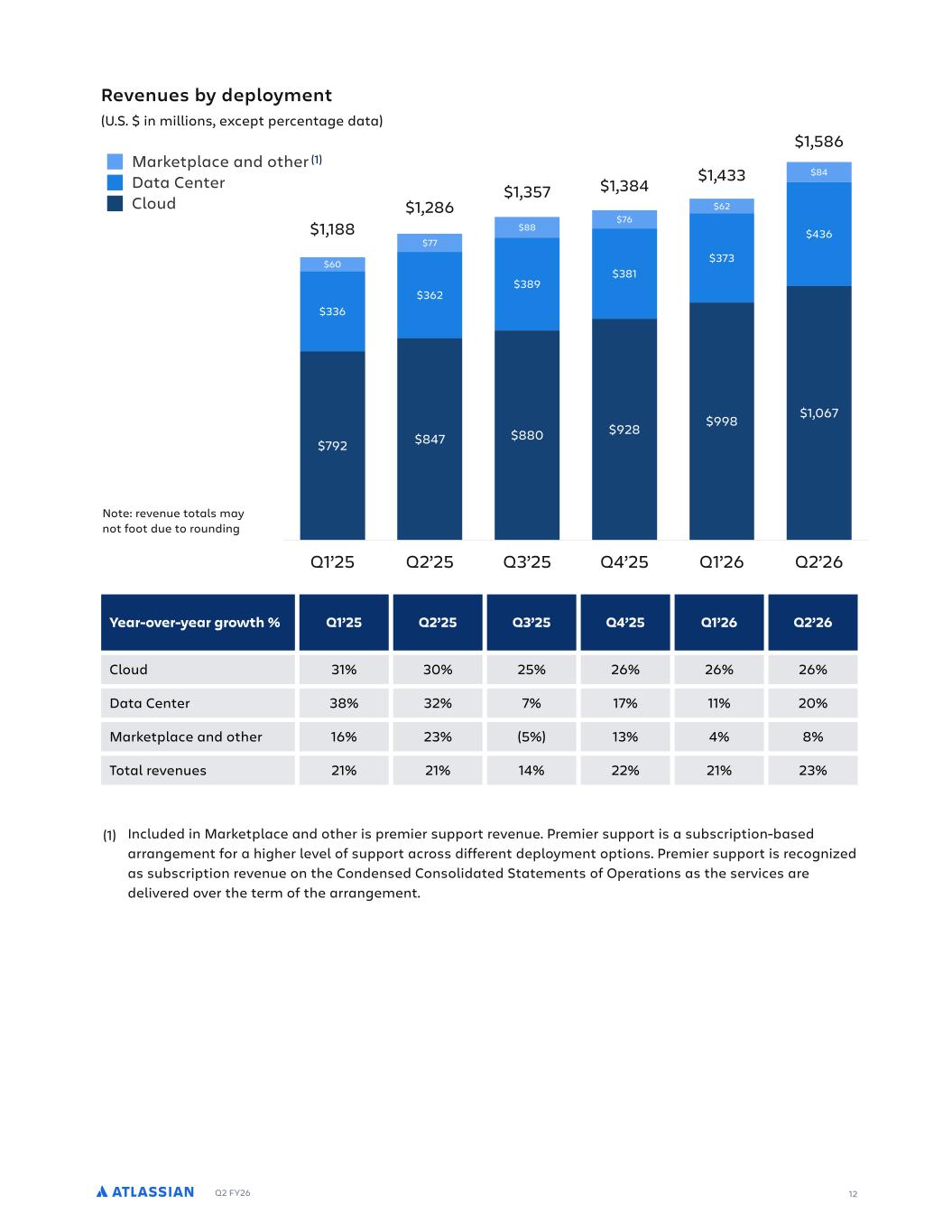

Q2 FY26 12 Revenues by deployment (U.S. $ in millions, except percentage data) Included in Marketplace and other is premier support revenue. Premier support is a subscription-based arrangement for a higher level of support across different deployment options. Premier support is recognized as subscription revenue on the Condensed Consolidated Statements of Operations as the services are delivered over the term of the arrangement. (1) 3 Note: revenue totals may not foot due to rounding Q1’25 Q2’25 Q3’25 Q4’25 Q1’26 Q2’26 $84 $62 $76 $88 $77 $60 $436 $373 $381 $389 $362 $336 $1,067$998$928$880$847$792 Cloud Data Center Marketplace and other $1,586 $1,433$1,384$1,357 $1,286 $1,188 (1) Year-over-year growth % Q1’25 Q2’25 Q3’25 Q4’25 Q1’26 Q2’26 Cloud 31% 30% 25% 26% 26% 26% Data Center 38% 32% 7% 17% 11% 20% Marketplace and other 16% 23% (5%) 13% 4% 8% Total revenues 21% 21% 14% 22% 21% 23%

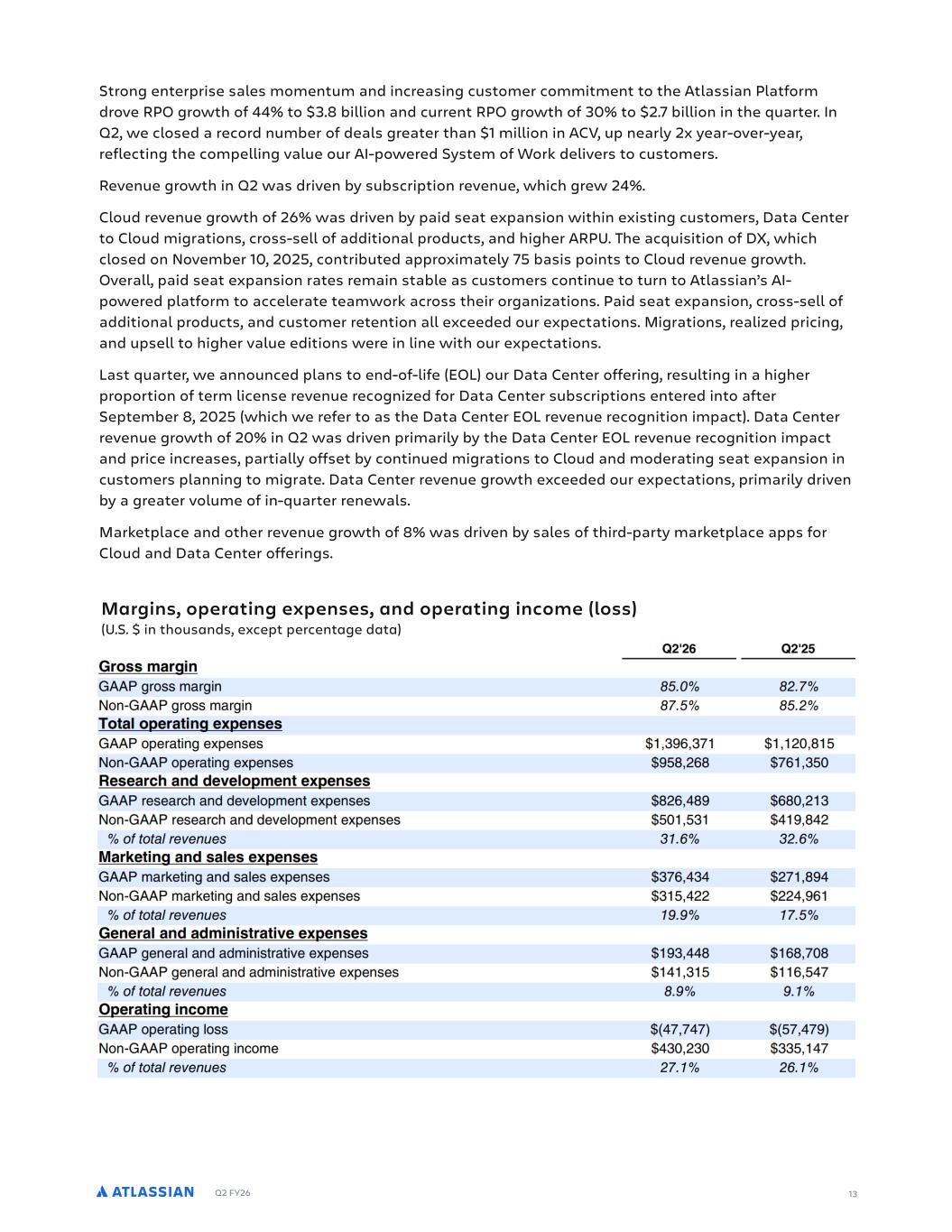

Q2 FY26 13 Strong enterprise sales momentum and increasing customer commitment to the Atlassian Platform drove RPO growth of 44% to $3.8 billion and current RPO growth of 30% to $2.7 billion in the quarter. In Q2, we closed a record number of deals greater than $1 million in ACV, up nearly 2x year-over-year, reflecting the compelling value our AI-powered System of Work delivers to customers. Revenue growth in Q2 was driven by subscription revenue, which grew 24%. Cloud revenue growth of 26% was driven by paid seat expansion within existing customers, Data Center to Cloud migrations, cross-sell of additional products, and higher ARPU. The acquisition of DX, which closed on November 10, 2025, contributed approximately 75 basis points to Cloud revenue growth. Overall, paid seat expansion rates remain stable as customers continue to turn to Atlassian’s AI- powered platform to accelerate teamwork across their organizations. Paid seat expansion, cross-sell of additional products, and customer retention all exceeded our expectations. Migrations, realized pricing, and upsell to higher value editions were in line with our expectations. Last quarter, we announced plans to end-of-life (EOL) our Data Center offering, resulting in a higher proportion of term license revenue recognized for Data Center subscriptions entered into after September 8, 2025 (which we refer to as the Data Center EOL revenue recognition impact). Data Center revenue growth of 20% in Q2 was driven primarily by the Data Center EOL revenue recognition impact and price increases, partially offset by continued migrations to Cloud and moderating seat expansion in customers planning to migrate. Data Center revenue growth exceeded our expectations, primarily driven by a greater volume of in-quarter renewals. Marketplace and other revenue growth of 8% was driven by sales of third-party marketplace apps for Cloud and Data Center offerings. Margins, operating expenses, and operating income (loss) (U.S. $ in thousands, except percentage data)

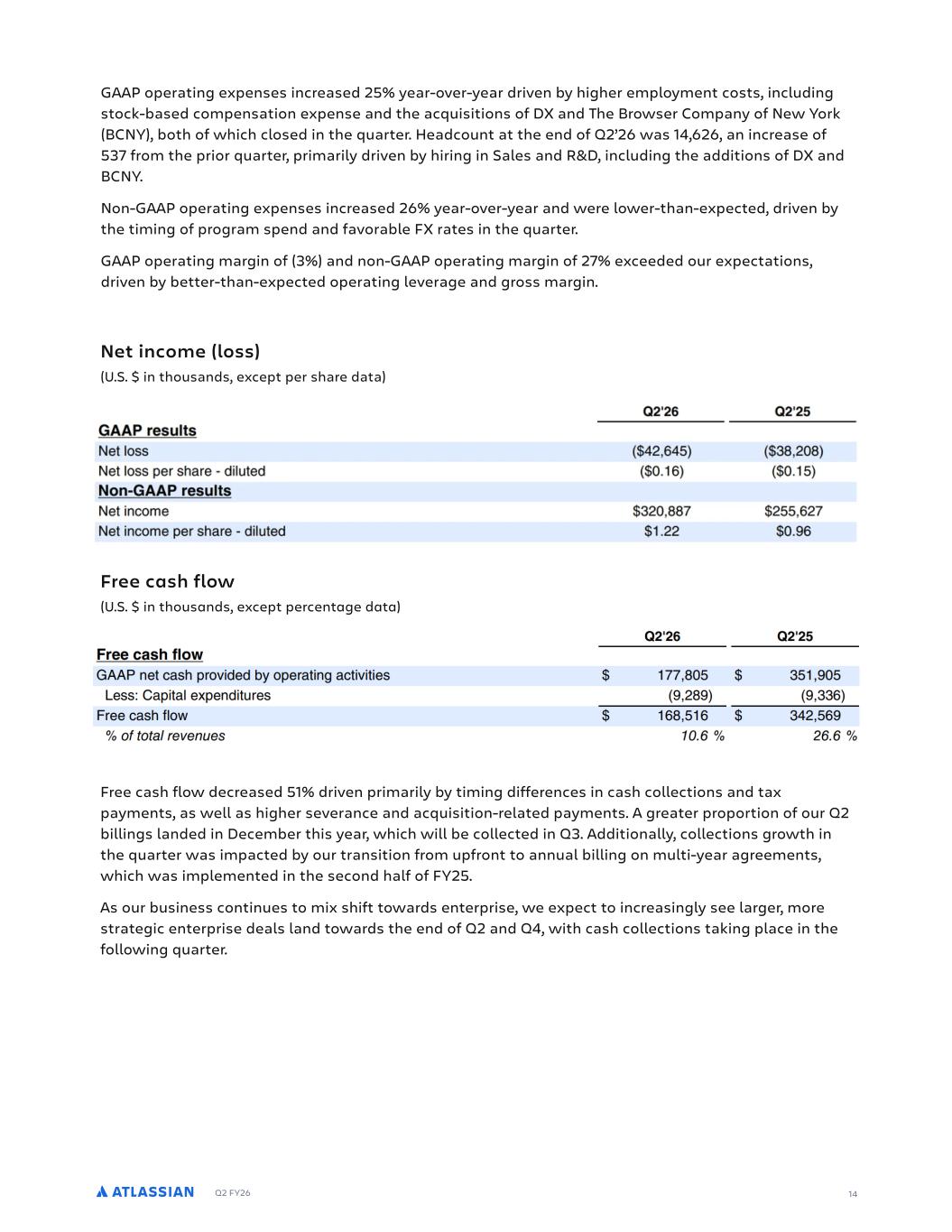

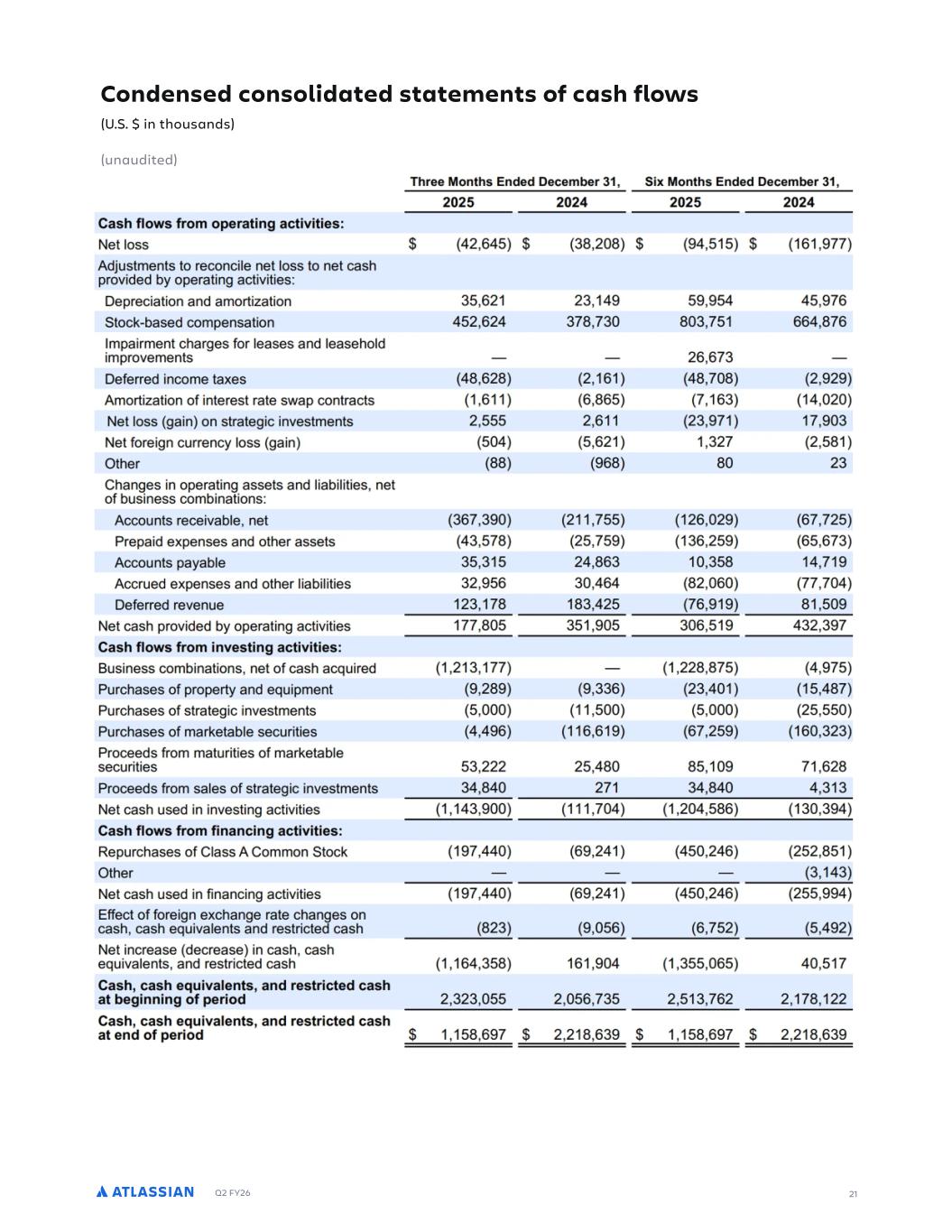

Q2 FY26 14 GAAP operating expenses increased 25% year-over-year driven by higher employment costs, including stock-based compensation expense and the acquisitions of DX and The Browser Company of New York (BCNY), both of which closed in the quarter. Headcount at the end of Q2’26 was 14,626, an increase of 537 from the prior quarter, primarily driven by hiring in Sales and R&D, including the additions of DX and BCNY. Non-GAAP operating expenses increased 26% year-over-year and were lower-than-expected, driven by the timing of program spend and favorable FX rates in the quarter. GAAP operating margin of (3%) and non-GAAP operating margin of 27% exceeded our expectations, driven by better-than-expected operating leverage and gross margin. Net income (loss) (U.S. $ in thousands, except per share data) Free cash flow (U.S. $ in thousands, except percentage data) Free cash flow decreased 51% driven primarily by timing differences in cash collections and tax payments, as well as higher severance and acquisition-related payments. A greater proportion of our Q2 billings landed in December this year, which will be collected in Q3. Additionally, collections growth in the quarter was impacted by our transition from upfront to annual billing on multi-year agreements, which was implemented in the second half of FY25. As our business continues to mix shift towards enterprise, we expect to increasingly see larger, more strategic enterprise deals land towards the end of Q2 and Q4, with cash collections taking place in the following quarter.

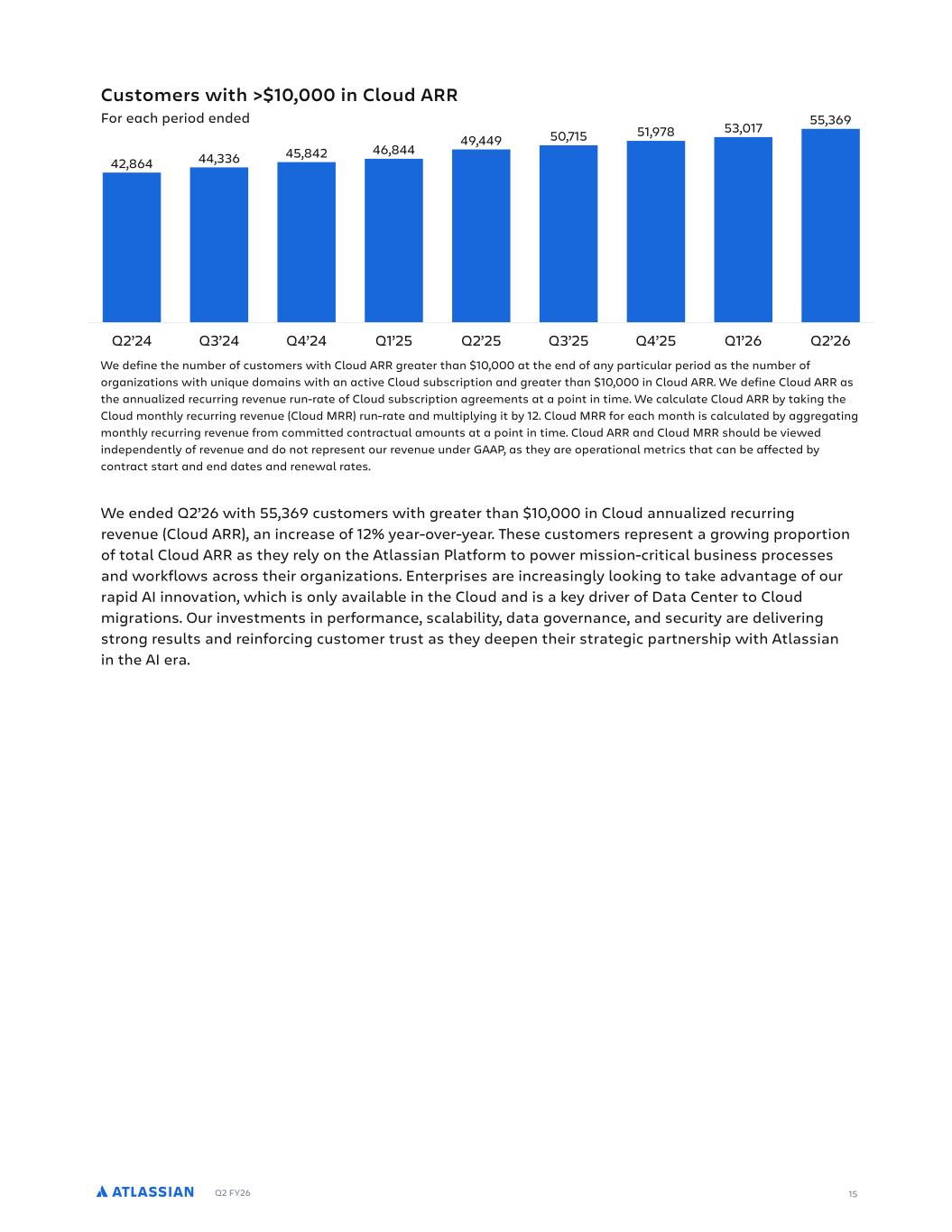

Q2 FY26 Q2 FY26 16 We define the number of customers with Cloud ARR greater than $10,000 at the end of any particular period as the number of organizations with unique domains with an active Cloud subscription and greater than $10,000 in Cloud ARR. We define Cloud ARR as the annualized recurring revenue run-rate of Cloud subscription agreements at a point in time. We calculate Cloud ARR by taking the Cloud monthly recurring revenue (Cloud MRR) run-rate and multiplying it by 12. Cloud MRR for each month is calculated by aggregating monthly recurring revenue from committed contractual amounts at a point in time. Cloud ARR and Cloud MRR should be viewed independently of revenue and do not represent our revenue under GAAP, as they are operational metrics that can be affected by contract start and end dates and renewal rates. Q2’24 Q3’24 Q4’24 Q1’25 Q2’25 Q3’25 Q4’25 Q1’26 Q2’26 55,36953,01751,97850,71549,44946,84445,84244,33642,864 Customers with >$10,000 in Cloud ARR For each period ended We ended Q2’26 with 55,369 customers with greater than $10,000 in Cloud annualized recurring revenue (Cloud ARR), an increase of 12% year-over-year. These customers represent a growing proportion of total Cloud ARR as they rely on the Atlassian Platform to power mission-critical business processes and workflows across their organizations. Enterprises are increasingly looking to take advantage of our rapid AI innovation, which is only available in the Cloud and is a key driver of Data Center to Cloud migrations. Our investments in performance, scalability, data governance, and security are delivering strong results and reinforcing customer trust as they deepen their strategic partnership with Atlassian in the AI era. 15

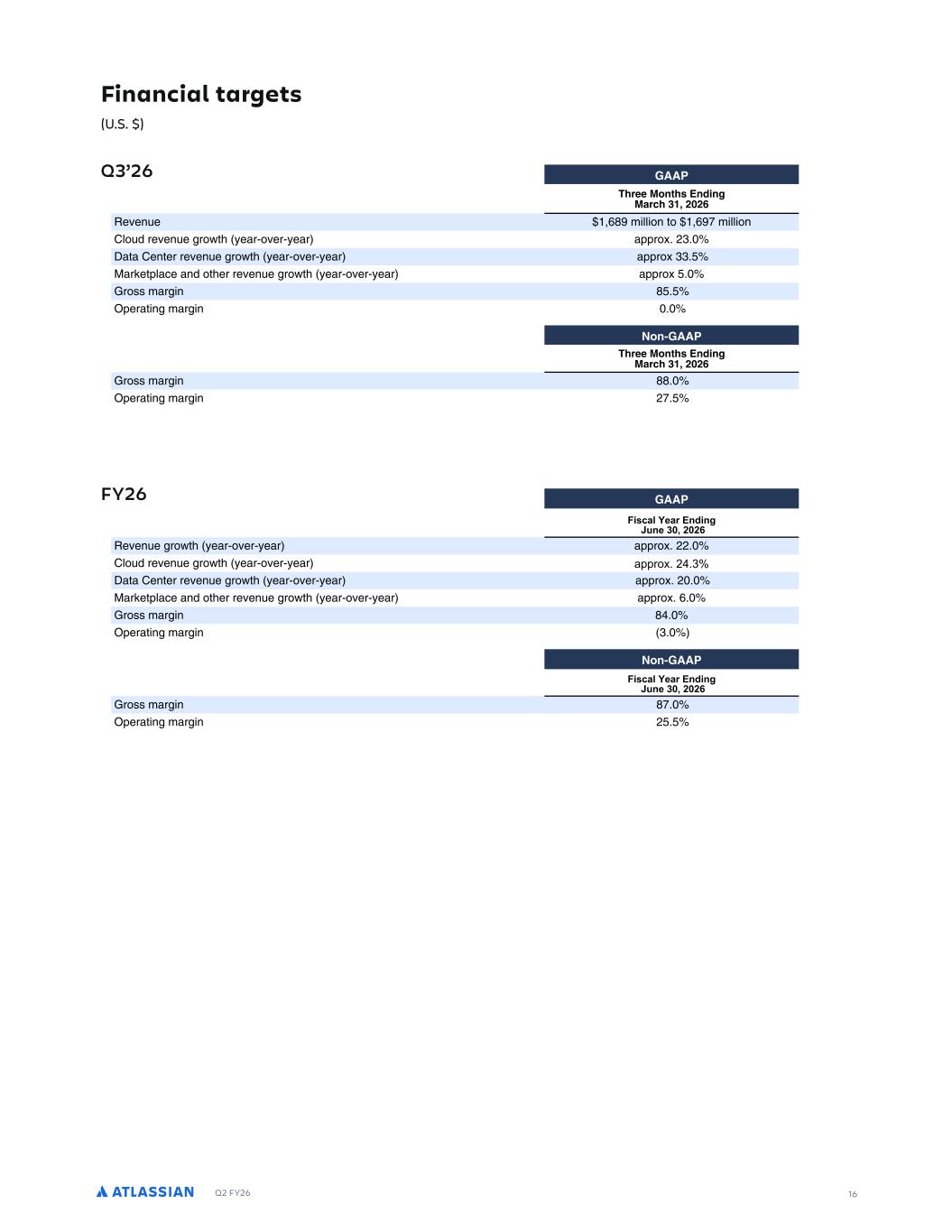

Q2 FY26 Financial targets (U.S. $) Q3’26 FY26 5MQEQGMEO AEU IW 600 ALUII :RQWL 4QHMQ :EUGL ($ )')- FQbQ aQ )$.01 YU U )$.1/ YU U 7 aP QbQ aQ S c T eQM % bQ %eQM M d + ( 8M M 7Q Q QbQ aQ S c T eQM % bQ %eQM M d ++ - AM WQ MOQ M P TQ QbQ aQ S c T eQM % bQ %eQM M d - ( ; YM SU 0- - C Q M U S YM SU ( ( RQ%600 ALUII :RQWL 4QHMQ :EUGL ($ )')- ; YM SU 00 ( C Q M U S YM SU / - 600 5 TECM BGCS 4OF O 7 OG ) ( (, FQbQ aQ S c T eQM % bQ %eQM M d ( 7 aP QbQ aQ S c T eQM % bQ %eQM B SP % ( %) 8M M 7Q Q QbQ aQ S c T eQM % bQ %eQM M d ( ( AM WQ MOQ M P TQ QbQ aQ S c T eQM % bQ %eQM M d . ( ; YM SU 0, ( C Q M U S YM SU + ( RQ%600 5 TECM BGCS 4OF O 7 OG ) ( (, ; YM SU 0/ ( C Q M U S YM SU - - - 5MQEQGMEO AEU IW 600 ALUII :RQWL 4QHMQ :EUGL ($ )')- FQbQ aQ )$.01 YU U )$.1/ YU U 7 aP QbQ aQ S c T eQM % bQ %eQM M d + ( 8M M 7Q Q QbQ aQ S c T eQM % bQ %eQM M d ++ - AM WQ MOQ M P TQ QbQ aQ S c T eQM % bQ %eQM M d - ( ; YM SU 0- - C Q M U S YM SU ( ( RQ%600 ALUII :RQWL 4QHMQ :EUGL ($ )')- ; YM SU 00 ( C Q M U S YM SU / - 600 5 TECM BGCS 4OF O 7 OG ) ( (, FQbQ aQ S c T eQM % bQ %eQM M d ( 7 aP QbQ aQ S c T eQM % bQ %eQM B SP % ( %) 8M M 7Q Q QbQ aQ S c T eQM % bQ %eQM M d ( ( AM WQ MOQ M P TQ QbQ aQ S c T eQM % bQ %eQM M d . ( ; YM SU 0, ( C Q M U S YM SU + ( RQ%600 5 TECM BGCS 4OF O 7 OG ) ( (, ; YM SU 0/ ( C Q M U S YM SU - - - 16

Q2 FY26 17 FY26 Outlook TOTAL REVENUE Given our strong enterprise sales execution and performance in Q2, as well as the acquisition of DX, we have increased our FY26 total company revenue growth outlook to approximately 22.0%. In setting our outlook, we continue to take what we believe is a prudent and risk-adjusted approach consistent with the prior quarter and year. Our guidance continues to contemplate negative impacts to key growth drivers across our business, such as paid seat expansion, cross-sell, upsell, and customer retention, given the uncertainty in the macroeconomic environment and the ongoing evolution of our enterprise go-to-market sales motion. We continue to make steady progress against our strategic priorities by delivering strong innovation and differentiated value across our product portfolio through the Atlassian System of Work, which reinforces the confidence we have in our ability to drive durable revenue growth at scale. Further detail and expected trends are provided below: CLOUD REVENUE We are increasing our FY26 Cloud revenue growth outlook to approximately 24.3%, of which we expect DX to contribute approximately 1 percentage point. We continue to expect migrations to drive a mid-to-high single-digit contribution to Cloud revenue growth in FY26 and for Data Center customers to migrate to Cloud over a multi-year period and adopt hybrid deployment strategies that allow them to migrate their teams over time. DATA CENTER REVENUE We expect Data Center revenue growth of approximately 20.0% year-over-year in FY26 driven by the Data Center EOL revenue recognition impact and price increases, partially offset by continued Data Center to Cloud migrations and moderating seat expansion in customers planning to migrate. In terms of seasonality, we expect growth rates to be higher in Q3 driven by a larger expiry base, and lower in Q4 driven by increasing migrations to Cloud. As a reminder, Data Center revenue growth rates will vary quarter-to-quarter based on the volume of Cloud migrations and the number of large deals. As we look ahead to FY27, we expect Data Center revenue growth to meaningfully decelerate as we lap the FY26 benefit of the Data Center EOL revenue recognition impact. Additionally, we expect increasing migrations to Cloud and moderating seat expansion, which will drive additional headwinds to FY27 Data Center revenue growth. MARKETPLACE AND OTHER REVENUE We expect Marketplace and other revenue growth of approximately 6.0% year-over-year in FY26 driven by sales of third-party marketplace apps for our Cloud and Data Center offerings. As a reminder, there is currently a lower Marketplace take rate on third-party Cloud apps relative to Data Center apps.

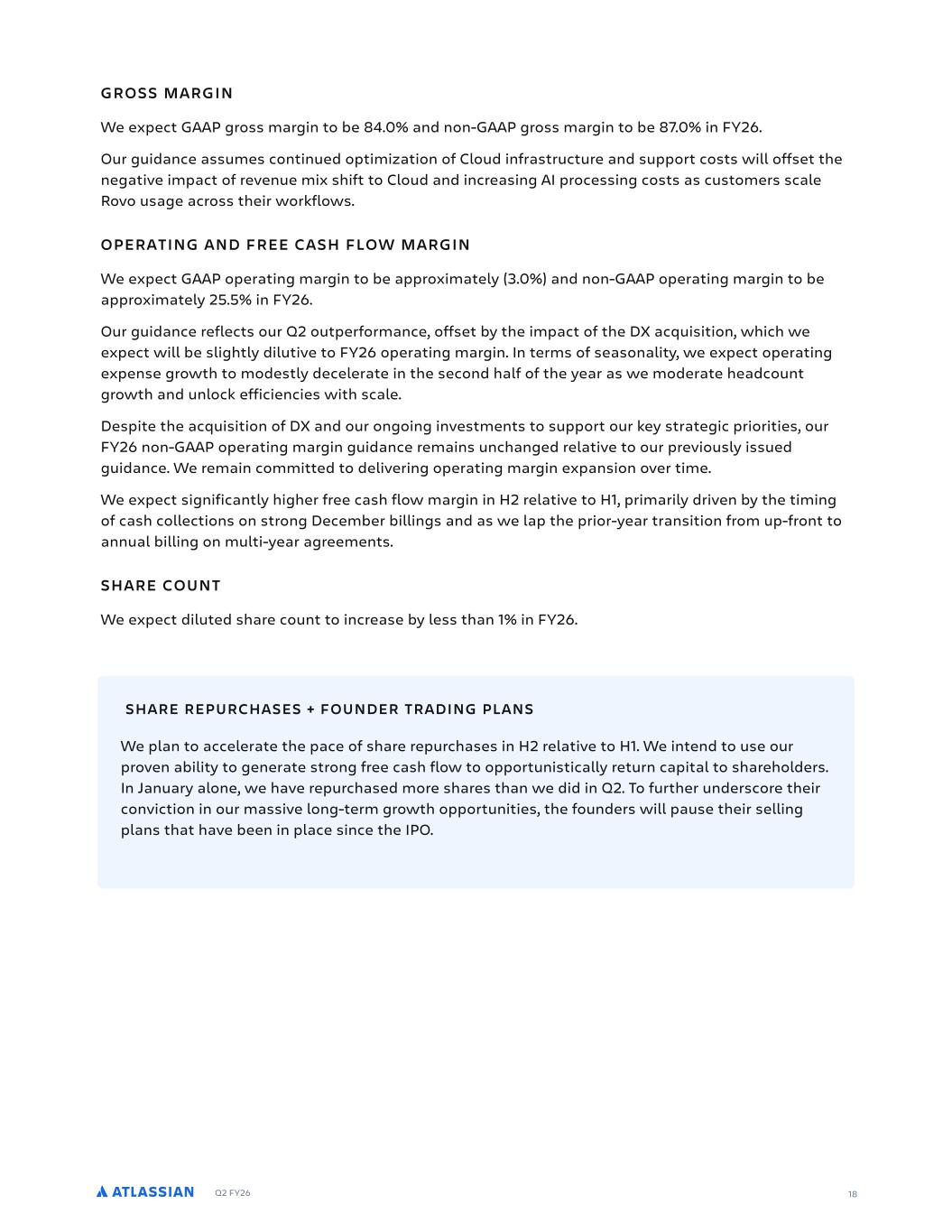

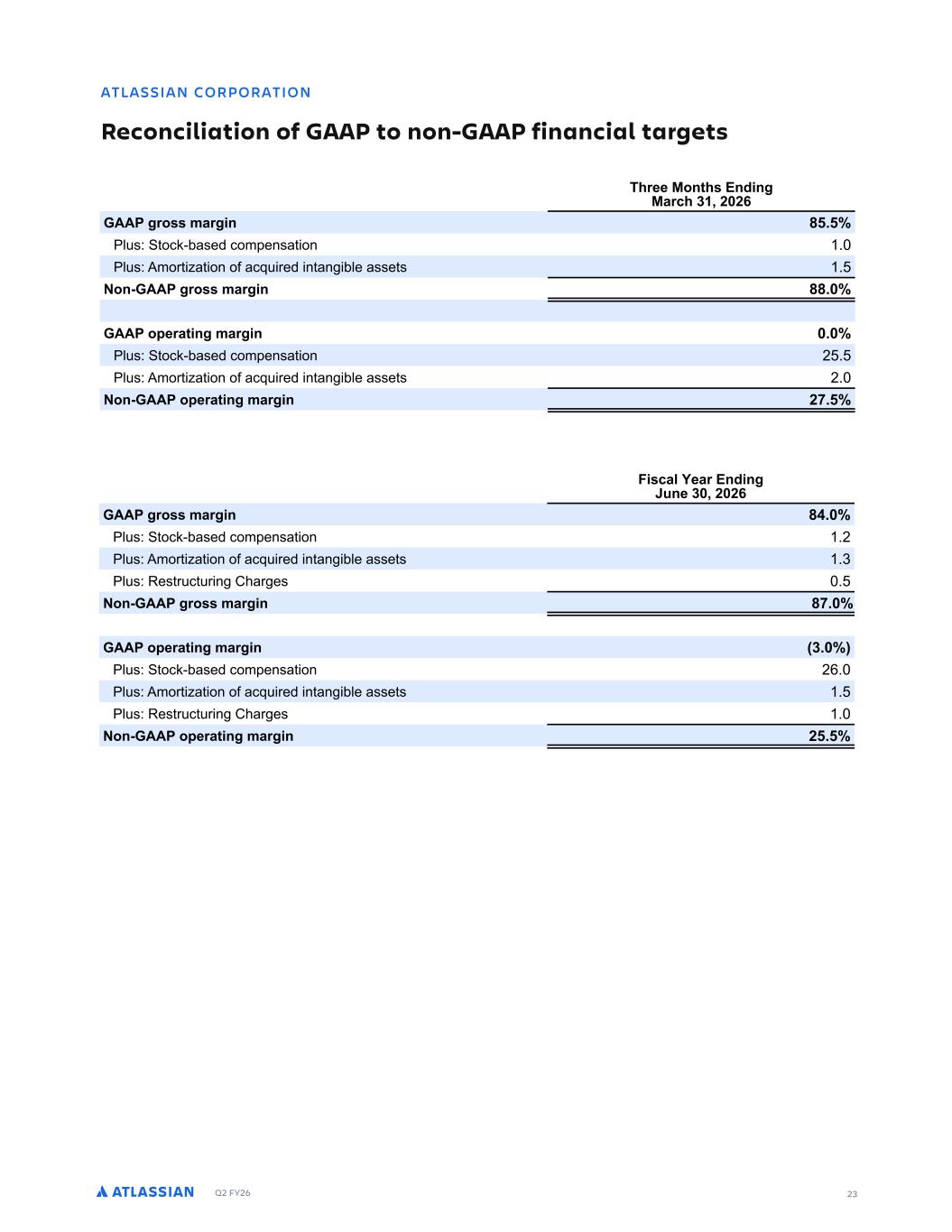

Q2 FY26 GROSS MARGIN We expect GAAP gross margin to be 84.0% and non-GAAP gross margin to be 87.0% in FY26. Our guidance assumes continued optimization of Cloud infrastructure and support costs will offset the negative impact of revenue mix shift to Cloud and increasing AI processing costs as customers scale Rovo usage across their workflows. OPERATING AND FREE CASH FLOW MARGIN We expect GAAP operating margin to be approximately (3.0%) and non-GAAP operating margin to be approximately 25.5% in FY26. Our guidance reflects our Q2 outperformance, offset by the impact of the DX acquisition, which we expect will be slightly dilutive to FY26 operating margin. In terms of seasonality, we expect operating expense growth to modestly decelerate in the second half of the year as we moderate headcount growth and unlock efficiencies with scale. Despite the acquisition of DX and our ongoing investments to support our key strategic priorities, our FY26 non-GAAP operating margin guidance remains unchanged relative to our previously issued guidance. We remain committed to delivering operating margin expansion over time. We expect significantly higher free cash flow margin in H2 relative to H1, primarily driven by the timing of cash collections on strong December billings and as we lap the prior-year transition from up-front to annual billing on multi-year agreements. SHARE COUNT We expect diluted share count to increase by less than 1% in FY26. 18 We plan to accelerate the pace of share repurchases in H2 relative to H1. We intend to use our proven ability to generate strong free cash flow to opportunistically return capital to shareholders. In January alone, we have repurchased more shares than we did in Q2. To further underscore their conviction in our massive long-term growth opportunities, the founders will pause their selling plans that have been in place since the IPO. SHARE REPURCHASES + FOUNDER TRADING PLANS

Q2 FY26 0UMCTT CO 2PS PSCU PO 2POFGOTGF 2POTPM FCUGF UCUGNGOUT P GSCU POT % % COF TJCSGT O UJP TCOFT GYEG U GS TJCSG FCUC OC F UGF JSGG POUJT 4OFGF 3GEGNDGS ) Y POUJT 4OFGF 3GEGNDGS ) ( ( ( ( ( ( ( ( FWFO FT0 CTDS PO - , , ( ) ( . ( ..( . ( ) , IFS -. , -) ( ), - ( . P BM SFWFO FT ., ) (., ,) ) . .,. ( - ( 3PT PG SFWFO FT ( ()- , (() (- , - 7SPTT SPG ) . ,( ,) )), ( () ( ) ( )) ) FSB O F FOTFT0 FTFBSDI BOE EFWFMP NFO ( .(, . ,. ( ) .( .) (.) ) :BSLF O BOE TBMFT ( )-, ) (- . - ( ., ( (.- 7FOFSBM BOE BEN O T SB WF ) . ,. - . )- ) ) ) P BM P FSB O F FOTFT ) , )- ( . ( ,,- ))- ( (( FSB O MPTT - - - - - . . - IFS ODPNF F FOTF OF ) - ( (- ) 8O FSFT ODPNF . , ( ., - 8O FSFT F FOTF ( ( - ( ( , , 9PTT CFGPSF ODPNF B FT - - - .) ( . -- ) - SPW T PO GPS CFOFG GSPN ODPNF B FT ) ( . - - ,, . ,) F MPTT ( , ). ( . , -- F MPTT FS TIBSF B S C BCMF P 3MBTT 1 BOE 3MBTT 2 DPNNPO T PDLIPMEFST0 2BT D % , % %), %,( 4 M FE % , % %), %,( AF I FE$BWFSB F TIBSFT TFE O DPN O OF MPTT FS TIBSF B S C BCMF P 3MBTT 1 BOE 3MBTT 2 DPNNPO T PDLIPMEFST0 2BT D (,) .(. (, - (,) (, . ( 4 M FE (,) .(. (, - (,) (, . ( 1NP O T ODM EF T PDL$CBTFE DPN FOTB PO BT GPMMP T0 JSGG POUJT 4OFGF 3GEGNDGS ) Y POUJT 4OFGF 3GEGNDGS ) ( ( ( ( ( ( ( ( 3PT PG SFWFO FT ( ( () ) ( ( FTFBSDI BOE EFWFMP NFO )( ., (, (-. - ) ) -() :BSLF O BOE TBMFT ) (, . - ( ( 7FOFSBM BOE BEN O T SB WF ( )) ( , ( . , , ( 1NP O T ODM EF BNPS B PO PG BDR SFE O BO CMF BTTF T BT GPMMP T0 JSGG POUJT 4OFGF 3GEGNDGS ) Y POUJT 4OFGF 3GEGNDGS ) ( ( ( ( ( ( ( ( 3PT PG SFWFO FT - ) ) ( - ( ( , FTFBSDI BOE EFWFMP NFO ) ) .- .- :BSLF O BOE TBMFT - ) ,-) , - ) , Condensed consolidated statements of operations (U.S. $ and shares in thousands, except per share data) (unaudited) 19

Q2 FY26 Condensed consolidated balance sheets (U.S. $ in thousands) (unaudited) 20

Q2 FY26 Condensed consolidated statements of cash flows (U.S. $ in thousands) (unaudited) 21

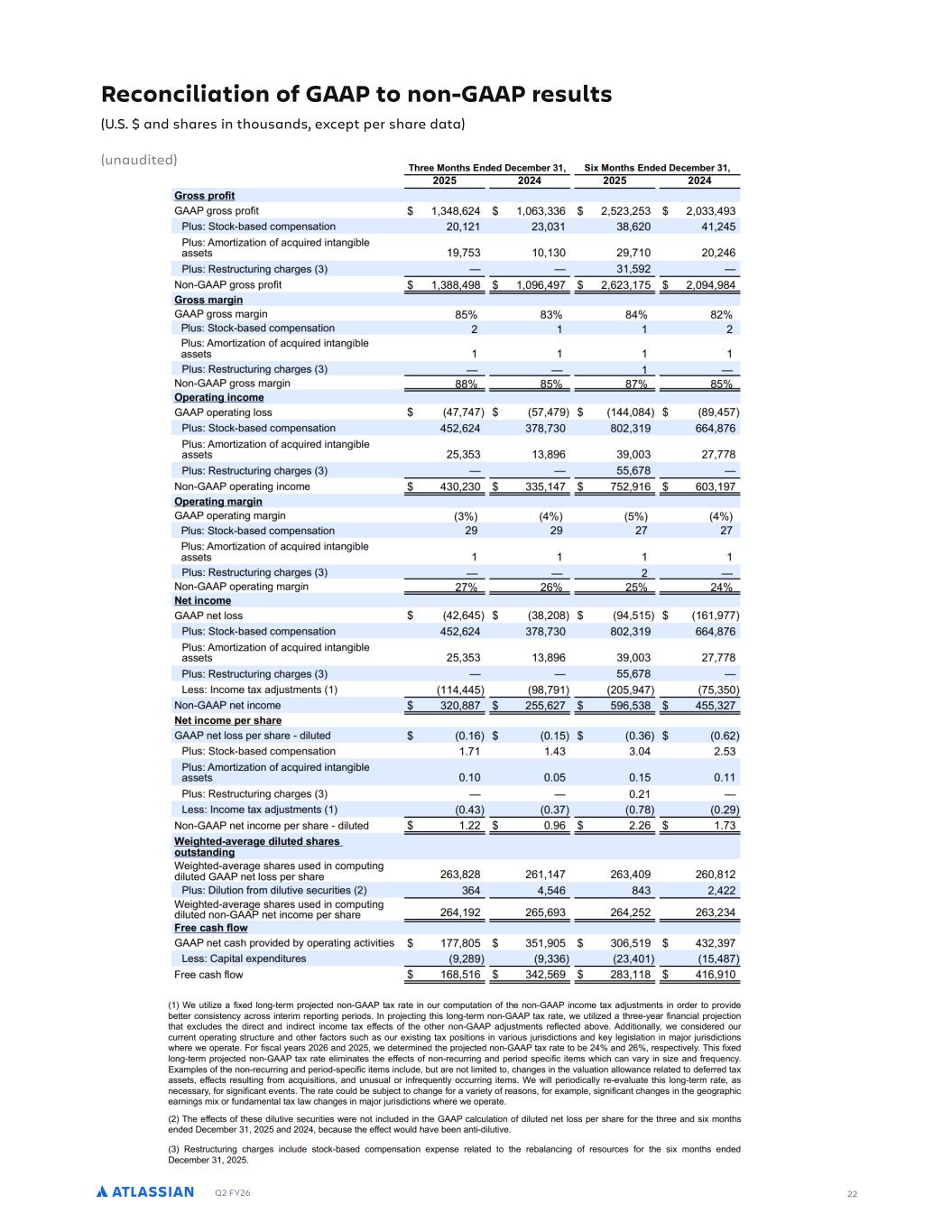

Q2 FY26 Reconciliation of GAAP to non-GAAP results (U.S. $ and shares in thousands, except per share data) (unaudited) 22

Q2 FY26 23 ATLASSIAN CORPORATION Reconciliation of GAAP to non-GAAP financial targets 0UMCTT CO 2PS PSCU PO GEPOE M CU PO P 600 UP :PO$600 5 OCOE CM CS GUT JSGG POUJT 4OF O CSEJ ) ( (, 600 SPTT NCS O . % M T0 PDL$CBTFE DPN FOTB PO % M T0 1NPS B PO PG BDR SFE O BO CMF BTTF T % :PO$600 SPTT NCS O ..% 600 P GSCU O NCS O % M T0 PDL$CBTFE DPN FOTB PO ( % M T0 1NPS B PO PG BDR SFE O BO CMF BTTF T (% :PO$600 P GSCU O NCS O (-% 5 TECM BGCS 4OF O 7 OG ) ( (, 600 SPTT NCS O . % M T0 PDL$CBTFE DPN FOTB PO %( M T0 1NPS B PO PG BDR SFE O BO CMF BTTF T %) M T0 FT S D S O 3IBS FT % :PO$600 SPTT NCS O .-% 600 P GSCU O NCS O )% M T0 PDL$CBTFE DPN FOTB PO (,% M T0 1NPS B PO PG BDR SFE O BO CMF BTTF T % M T0 FT S D S O 3IBS FT % :PO$600 P GSCU O NCS O ( % (

Q2 FY26 24 FORWARD-LOOKING STATEMENTS This shareholder letter contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, which statements involve substantial risks and uncertainties. In some cases, you can identify these statements by forward-looking words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intend,” “could,” “should,” “estimate,” or “continue,” and similar expressions or variations, but these words are not the exclusive means for identifying such statements. All statements other than statements of historical fact could be deemed forward-looking, including but not limited to risks and uncertainties related to statements about our platform, offerings and capabilities and planned offering and capabilities, AI solutions and capabilities, the broader market, System of Work, investments and expenses, customers, Cloud migrations, macroeconomic environment, anticipated growth, market position and opportunity, competition, business plans and long term strategies, share buyback plans, founder trading plans, strategic acquisitions, enterprise sales, outlook and results, other key strategic areas, and our financial targets such as total revenue, Cloud, Data Center, and Marketplace and other revenue and GAAP and non-GAAP financial measures including gross margin, operating margin, and share count. We undertake no obligation to update any forward-looking statements made in this shareholder letter to reflect events or circumstances after the date of this shareholder letter or to reflect new information or the occurrence of unanticipated events, except as required by law. The achievement or success of the matters covered by such forward-looking statements involves known and unknown risks, uncertainties and assumptions. If any such risks or uncertainties materialize or if any of the assumptions prove incorrect, our results could differ materially from the results expressed or implied by the forward-looking statements we make. You should not rely upon forward-looking statements as predictions of future events. Forward-looking statements represent our management’s beliefs and assumptions only as of the date such statements are made. Further information on that could affect our financial results is included in filings we make with the Securities and Exchange Commission (the SEC) from time to time, including the section titled “Risk Factors” in our most recently filed Forms 10-K and 10-Q. These documents are available on the SEC Filings section of the Investor Relations section of our website at: https://investors.atlassian.com. ABOUT NON-GAAP FINANCIAL MEASURES AND OTHER FINANCIAL MEASURES In addition to the measures presented in our condensed consolidated financial statements, we regularly review other measures that are not presented in accordance with GAAP, defined as non-GAAP financial measures by the SEC, to evaluate our business, measure our performance, identify trends, prepare financial forecasts and make strategic decisions. The key measures we consider are non-GAAP gross profit and non-GAAP gross margin, non-GAAP operating income and non-GAAP operating margin, non-GAAP net income, non-GAAP net income per diluted share and free cash flow (collectively, the Non-GAAP Financial Measures). These Non-GAAP Financial Measures, which may be different from similarly titled non-GAAP measures used by other companies, provide supplemental information regarding our operating performance on a non-GAAP basis that excludes certain gains, losses and charges of a non-cash nature or that occur relatively infrequently and/or that management considers to be unrelated to our core operations. Management believes that tracking and presenting these Non-GAAP Financial Measures provides management, our board of directors, investors and the analyst community with the ability to better evaluate matters such as: our ongoing core operations, including comparisons between periods and against other companies in our industry; our ability to generate cash to service our debt and fund our operations; and the underlying business trends that are affecting our performance. Our Non-GAAP Financial Measures include: • Non-GAAP gross profit and Non-GAAP gross margin. Excludes expenses related to stock-based compensation, and amortization of acquired intangible assets. • Non-GAAP operating income and non-GAAP operating margin. Excludes expenses related to stock-based compensation, and amortization of acquired intangible assets. • Non-GAAP net income and non-GAAP net income per diluted share. Excludes expenses related to stock-based compensation, amortization of acquired intangible assets, gain on a non-cash sale of a controlling interest of a subsidiary, and the related income tax adjustments. • Free cash flow. Free cash flow is defined as net cash provided by operating activities less capital expenditures, which consists of purchases of property and equipment. We understand that although these Non-GAAP Financial Measures are frequently used by investors and the analyst community in their evaluation of our financial performance, these measures have limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP. We compensate for such limitations by reconciling these Non-GAAP Financial Measures to the most comparable GAAP financial measures. We encourage you to review the tables in this shareholder letter titled “Reconciliation of GAAP to Non-GAAP Results” and “Reconciliation of GAAP to Non-GAAP Financial Targets” that present such reconciliations. We calculate net revenue retention rate (NRR) at a point in time by dividing monthly recurring revenue (MRR) at the end of a reporting period (Current Period MRR) by the MRR for the same group of customers at the end of the prior 12-month period. Current Period MRR includes existing customer expansion net of existing customer contraction and attrition but excludes MRR from new customers in the current period. ABOUT ATLASSIAN Atlassian unleashes the potential of every team. A recognized leader in software development, work management, and enterprise service management software, Atlassian enables enterprises to connect their business and technology teams with an AI-powered system of work that unlocks productivity at scale. Atlassian’s collaboration software powers over 80% of the Fortune 500 and 350,000+ customers worldwide - including NASA, Rivian, Deutsche Bank, United Airlines, and Bosch - who rely on our solutions to drive work forward. Investor relations contact: Martin Lam, IR@atlassian.com Media contact: M-C Maple, press@atlassian.com