Shareholder Letter Q4 2025

Results Summary Coursera results for the three months and full year ended December 31, 2025. Figures may be rounded for presentation purposes. Segment gross profit is defined as segment revenue less content costs in our audited consolidated financial statements. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the Appendix. 1. Includes $11.9 million of merger and acquisition related transaction costs recorded in the three months and year ended December 31, 2025. 2. The years ended December 31, 2025 and 2024 include $5.2 million and $4.8 million in cash payments for restructuring related charges and $3.8 million and $3.4 million in cash payments for M&A related transaction costs. Restructuring related cash payments made during the three months ended December 31, 2025 and 2024 were $0 and $2.7 million, respectively. Cash payments of M&A transaction costs made during the three months ended December 31, 2025 and 2024 were $3.8 million and $0, respectively. The three months ended December 31, 2025 also included $4.7 million of catch-up payments to a content creator partner. Q4 2025 Shareholder Letter 2 Q4 2025 FY 2025 Key Financial Measures Revenue $196.9M ↑ 10% Y/Y $757.5M ↑ 9% Y/Y Net income (loss) 1 $(26.8)M (13.6)% Net loss margin, ↓ (150) bps Y/Y $(51.0)M (6.7)% Net loss margin, ↑ 470 bps Y/Y Adjusted EBITDA $11.2M 5.7% Adjusted EBITDA Margin, ↑ 40 bps Y/Y $63.5M 8.4% Adjusted EBITDA Margin, ↑ 240 bps Y/Y Net cash provided by operating activities 2 $5.8M ↓ (70)% Y/Y $108.7M ↑ 14% Y/Y Free Cash Flow 2 $(2.0)M ↓ (127)% Y/Y $78.5M ↑ 32% Y/Y Operating Segment Performance Consumer revenue $131.5M ↑ 12% Y/Y $502.2M ↑ 10% Y/Y Consumer gross profit $80.9M ↑ 15% Y/Y 61.5% gross profit margin, ↑ 150 bps Y/Y $308.3M ↑ 13% Y/Y 61.4% gross profit margin, ↑ 170 bps Y/Y Enterprise revenue $65.4M ↑ 5% Y/Y $255.3M ↑ 7% Y/Y Enterprise gross profit $45.6M ↑ 7% Y/Y 69.7% gross profit margin, ↑ 130 bps Y/Y $178.1M ↑ 9% Y/Y 69.8% gross profit margin, ↑ 120 bps Y/Y

To our shareholders, Q4 2025 Shareholder Letter 3 Coursera is reporting a strong fourth quarter and year of progress. In 2025, we focused on a clear set of priorities to build a more durable foundation for long-term growth: sharpening our execution, refining how we operate, and embedding faster, AI-native product innovation and data-driven decision making across the business. The past year marked the early phase of this work, and as the quarters progressed, we began to demonstrate tangible progress reflected in our results. For full year 2025, we grew revenue to $757 million, an increase of 9% year over year, more than doubling the four percent growth rate we shared in our initial April outlook. Net cash provided by operating activities was $109 million, up 14% year over year, and we generated a record $78 million of Free Cash Flow, up 32% over the prior year. Our results reflect a more focused, disciplined company that is translating strategy into faster execution. Growth was driven by both of our operating segments and led by continued momentum in our Consumer segment, with revenue increasing 12% year over year in the fourth quarter. This strength reflects improved execution across our core subscription and course offerings, supported by enhanced marketing, localization, and subscription capabilities, including Coursera Plus. We also welcomed a record 6.8 million new registered learners in Q4, the highest fourth-quarter additions in Coursera’s history, and more than 29 million learners over the full year. In December, we announced an agreement to combine with Udemy, a company and team we have long admired. This transaction is an important step in accelerating our strategy. By bringing together two highly complementary platforms, operating models, and cultures, we believe we can meaningfully increase our collective ability to invest, innovate, and execute at scale, offer greater value and choice to customers, and enhance our ability to address the global skilling opportunity. As we enter a new year, we are providing our initial guidance for the first quarter and full year 2026 on a standalone basis, detailed in the outlook section of this letter. For the full year, we expect revenue to be in the range of $805 to $815 million, representing growth of approximately 6% to 8% year over year. For Adjusted EBITDA, we expect a range of $70 to $76 million, representing an Adjusted EBITDA Margin of approximately 9% at the midpoint of the full year ranges. Our core growth priorities remain unchanged in 2026: Our efforts over the past year represent an important step forward as we continue to build a more agile, focused, and capable company. As we progress through the regulatory and shareholder approval processes related to the proposed combination with Udemy, we look forward to providing updates in the coming months. In the meantime, we remain focused on execution, enhancing Coursera’s ecosystem and the infrastructure that powers it to better serve our learners, customers, and instructors. Greg Hart President and Chief Executive Officer Coursera results for the three months and full year ended December 31, 2025. Numbers are rounded for presentation purposes. Refer to the Outlook section for a complete discussion of Q1 and full year 2026 guidance. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the Appendix. Reconciliations are not available on a forward-looking basis without unreasonable effort due to the uncertainty regarding, and the potential variability of, expenses that may be incurred in the future. Stock-based compensation expense- related charges, including employer payroll tax-related items on employee stock transactions, are impacted by the timing of employee stock transactions, the future fair market value of our common stock, and our future hiring and retention needs, all of which are difficult to predict and subject to constant change. Accelerating platform innovation with faster development cycles, data-driven insights, and AI-native experiences across Coursera. Expanding our offerings with leading instructors, new modalities, and verified assessments to meet rapidly evolving skill demands Enhancing discovery, personalization, and marketing capabilities to more effectively reach and serve learners and customers globally

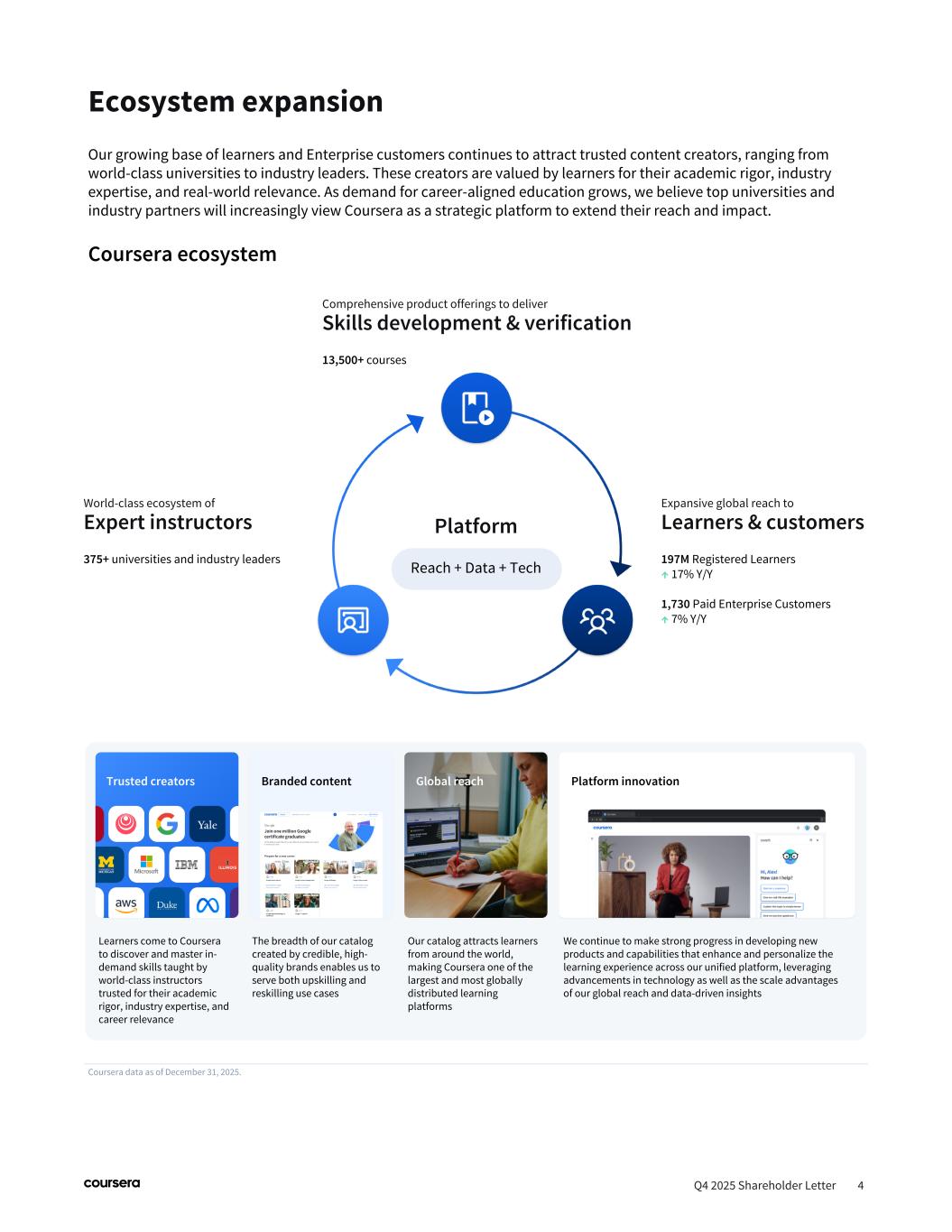

Ecosystem expansion Q4 2025 Shareholder Letter 4 Our growing base of learners and Enterprise customers continues to attract trusted content creators, ranging from world-class universities to industry leaders. These creators are valued by learners for their academic rigor, industry expertise, and real-world relevance. As demand for career-aligned education grows, we believe top universities and industry partners will increasingly view Coursera as a strategic platform to extend their reach and impact. Coursera ecosystem Coursera data as of December 31, 2025. Trusted creators Branded content Global reach Platform innovation Learners come to Coursera to discover and master in- demand skills taught by world-class instructors trusted for their academic rigor, industry expertise, and career relevance The breadth of our catalog created by credible, high- quality brands enables us to serve both upskilling and reskilling use cases Our catalog attracts learners from around the world, making Coursera one of the largest and most globally distributed learning platforms We continue to make strong progress in developing new products and capabilities that enhance and personalize the learning experience across our unified platform, leveraging advancements in technology as well as the scale advantages of our global reach and data-driven insights World-class ecosystem of Expert instructors 375+ universities and industry leaders Platform Reach + Data + Tech Expansive global reach to Learners & customers 197M Registered Learners ↑ 17% Y/Y 1,730 Paid Enterprise Customers ↑ 7% Y/Y Comprehensive product offerings to deliver Skills development & verification 13,500+ courses

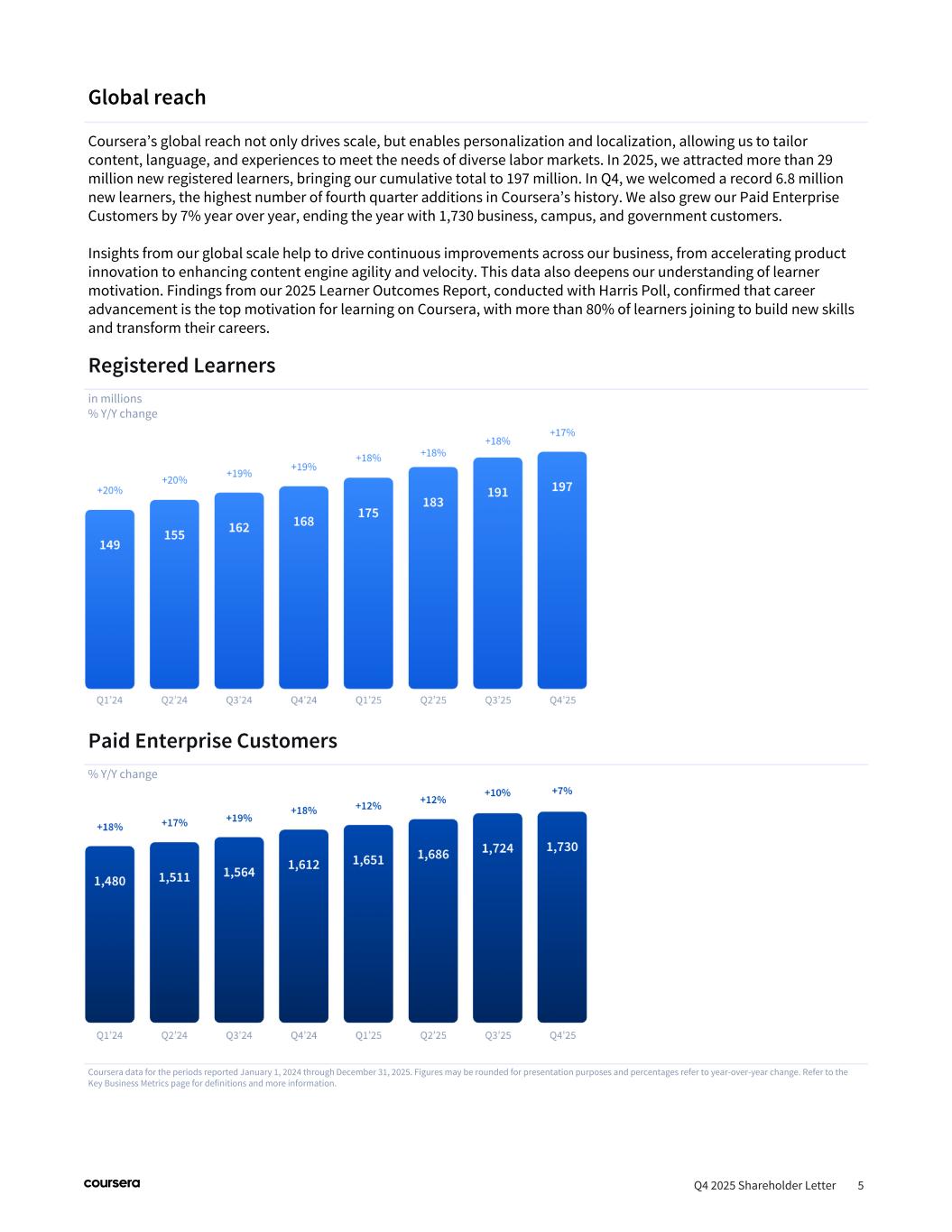

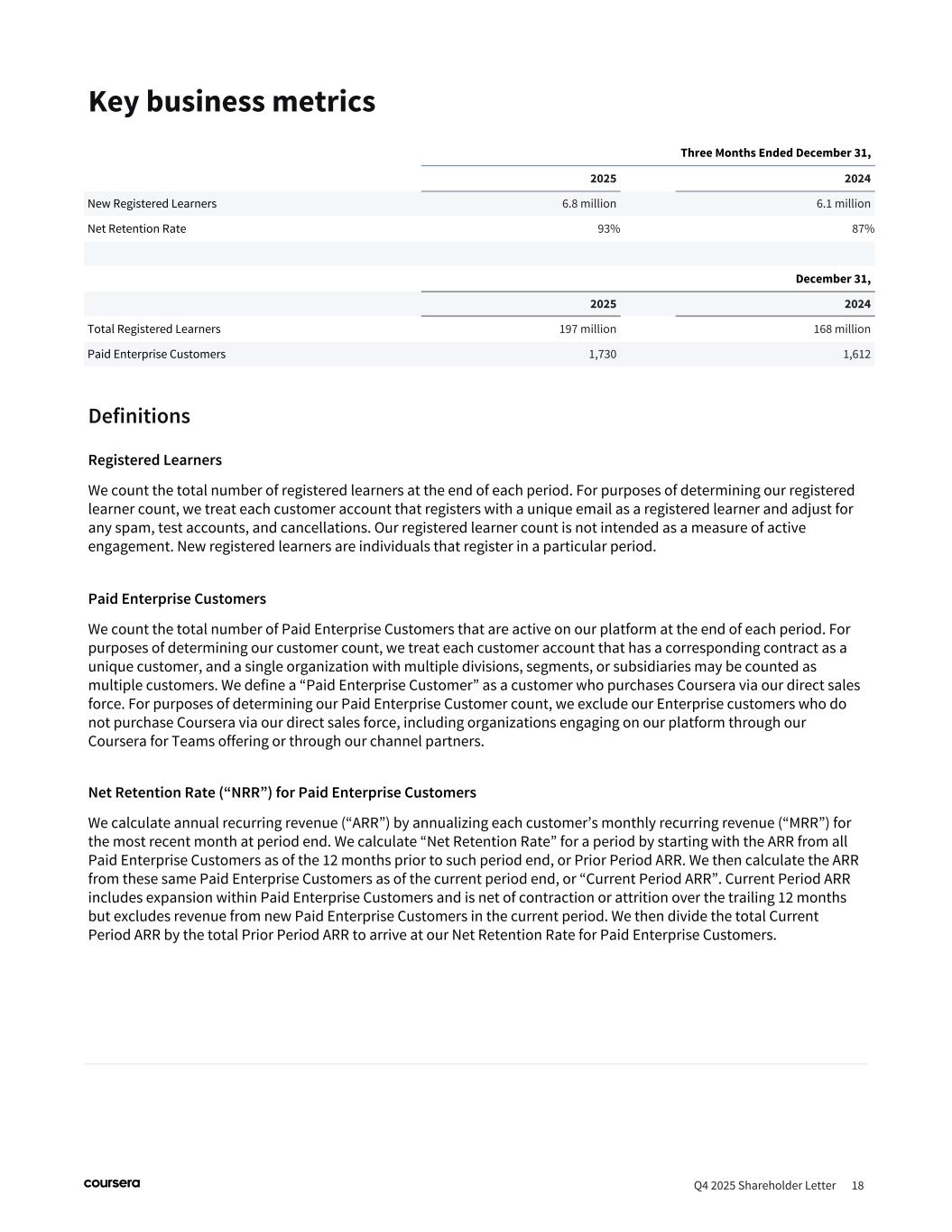

Q4 2025 Shareholder Letter 5 Paid Enterprise Customers % Y/Y change Registered Learners in millions % Y/Y change Coursera data for the periods reported January 1, 2024 through December 31, 2025. Figures may be rounded for presentation purposes and percentages refer to year-over-year change. Refer to the Key Business Metrics page for definitions and more information. Global reach Coursera’s global reach not only drives scale, but enables personalization and localization, allowing us to tailor content, language, and experiences to meet the needs of diverse labor markets. In 2025, we attracted more than 29 million new registered learners, bringing our cumulative total to 197 million. In Q4, we welcomed a record 6.8 million new learners, the highest number of fourth quarter additions in Coursera’s history. We also grew our Paid Enterprise Customers by 7% year over year, ending the year with 1,730 business, campus, and government customers. Insights from our global scale help to drive continuous improvements across our business, from accelerating product innovation to enhancing content engine agility and velocity. This data also deepens our understanding of learner motivation. Findings from our 2025 Learner Outcomes Report, conducted with Harris Poll, confirmed that career advancement is the top motivation for learning on Coursera, with more than 80% of learners joining to build new skills and transform their careers.

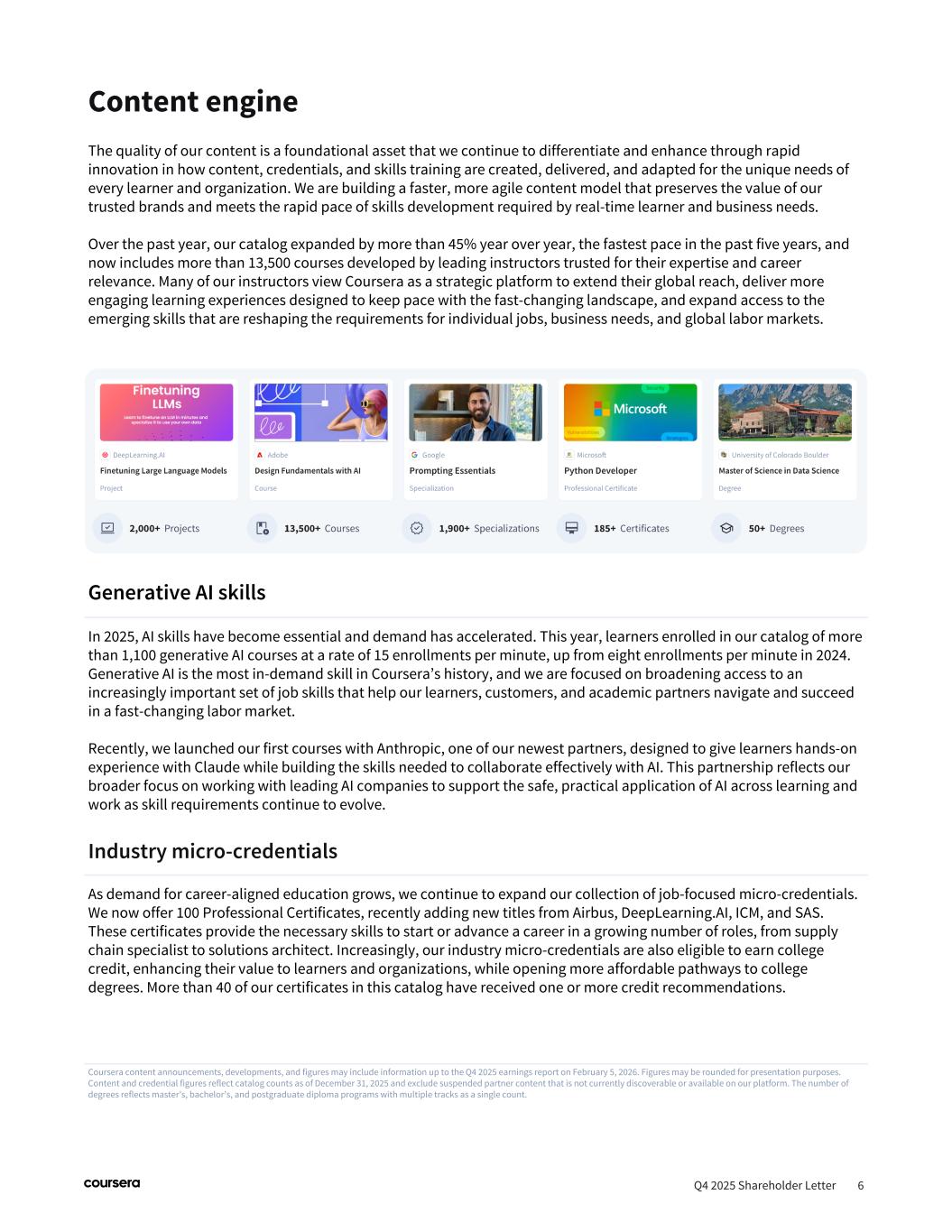

Content engine Coursera content announcements, developments, and figures may include information up to the Q4 2025 earnings report on February 5, 2026. Figures may be rounded for presentation purposes. Content and credential figures reflect catalog counts as of December 31, 2025 and exclude suspended partner content that is not currently discoverable or available on our platform. The number of degrees reflects master’s, bachelor’s, and postgraduate diploma programs with multiple tracks as a single count. Q4 2025 Shareholder Letter 6 The quality of our content is a foundational asset that we continue to differentiate and enhance through rapid innovation in how content, credentials, and skills training are created, delivered, and adapted for the unique needs of every learner and organization. We are building a faster, more agile content model that preserves the value of our trusted brands and meets the rapid pace of skills development required by real-time learner and business needs. Over the past year, our catalog expanded by more than 45% year over year, the fastest pace in the past five years, and now includes more than 13,500 courses developed by leading instructors trusted for their expertise and career relevance. Many of our instructors view Coursera as a strategic platform to extend their global reach, deliver more engaging learning experiences designed to keep pace with the fast-changing landscape, and expand access to the emerging skills that are reshaping the requirements for individual jobs, business needs, and global labor markets. Industry micro-credentials As demand for career-aligned education grows, we continue to expand our collection of job-focused micro-credentials. We now offer 100 Professional Certificates, recently adding new titles from Airbus, DeepLearning.AI, ICM, and SAS. These certificates provide the necessary skills to start or advance a career in a growing number of roles, from supply chain specialist to solutions architect. Increasingly, our industry micro-credentials are also eligible to earn college credit, enhancing their value to learners and organizations, while opening more affordable pathways to college degrees. More than 40 of our certificates in this catalog have received one or more credit recommendations. Generative AI skills In 2025, AI skills have become essential and demand has accelerated. This year, learners enrolled in our catalog of more than 1,100 generative AI courses at a rate of 15 enrollments per minute, up from eight enrollments per minute in 2024. Generative AI is the most in-demand skill in Coursera’s history, and we are focused on broadening access to an increasingly important set of job skills that help our learners, customers, and academic partners navigate and succeed in a fast-changing labor market. Recently, we launched our first courses with Anthropic, one of our newest partners, designed to give learners hands-on experience with Claude while building the skills needed to collaborate effectively with AI. This partnership reflects our broader focus on working with leading AI companies to support the safe, practical application of AI across learning and work as skill requirements continue to evolve.

Platform innovation Coursera product announcements, developments, and figures may include information up to the Q4 2025 earnings report on February 5, 2026. Q4 2025 Shareholder Letter 7 We believe Coursera’s next chapter of growth will be defined by innovation, and we are committed to accelerating our platform’s role in shaping the future of learning. AI is transforming the way learners discover Coursera, engage with our content, and verify their skills for career advancement. Over the past year, we have been focused on accelerating our ability to deliver more valuable experiences to learners and customers, while enhancing the value of our business by driving improvements in our conversion, engagement, and retention metrics over time. Learner journey Learners come to Coursera with a clear purpose: to build skills that help them advance their careers and adapt in a rapidly evolving labor market. In 2025, we made meaningful progress in refining the learner journey on Coursera, with improvements across search, discovery, and merchandising designed to better attract, convert, and retain learners. The scale and data of our platform create opportunities for more personalized and contextual guidance, allowing us to tailor content, language, and recommended pathways to support the career needs of learners across regions, roles, and levels of skill mastery. Over the past several months, we made targeted enhancements across the platform, including redesigning our homepage to improve how learners first experience Coursera and navigate through our funnel. We also launched new geo-pricing, marketing, and promotional capabilities to better serve our growing international learner base, with early indicators supporting paid conversion and Coursera Plus adoption. In Q4, we continued to experiment with natural language search, AI-powered discovery, and learner motivation, applying faster testing and iteration to improve relevance and drive stronger engagement over time. Search is fundamentally changing, and we intend to be at the forefront of understanding, experimenting, and shaping how learners discover and start their journey, leveraging the strengths that have drawn 197 million learners to our platform over the last decade.

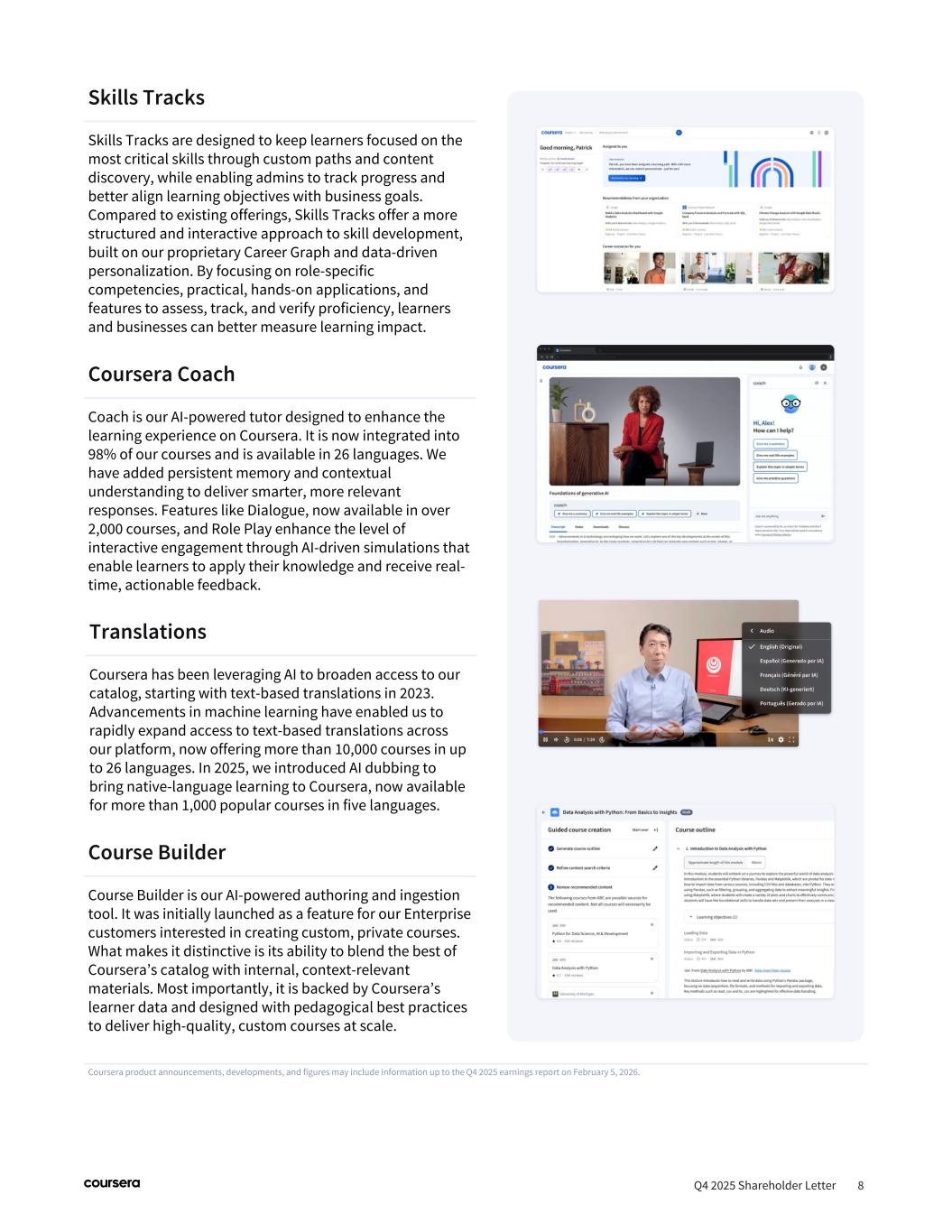

Coursera product announcements, developments, and figures may include information up to the Q4 2025 earnings report on February 5, 2026. Q4 2025 Shareholder Letter 8 Skills Tracks Skills Tracks are designed to keep learners focused on the most critical skills through custom paths and content discovery, while enabling admins to track progress and better align learning objectives with business goals. Compared to existing offerings, Skills Tracks offer a more structured and interactive approach to skill development, built on our proprietary Career Graph and data-driven personalization. By focusing on role-specific competencies, practical, hands-on applications, and features to assess, track, and verify proficiency, learners and businesses can better measure learning impact. Coursera Coach Coach is our AI-powered tutor designed to enhance the learning experience on Coursera. It is now integrated into 98% of our courses and is available in 26 languages. We have added persistent memory and contextual understanding to deliver smarter, more relevant responses. Features like Dialogue, now available in over 2,000 courses, and Role Play enhance the level of interactive engagement through AI-driven simulations that enable learners to apply their knowledge and receive real- time, actionable feedback. Translations Coursera has been leveraging AI to broaden access to our catalog, starting with text-based translations in 2023. Advancements in machine learning have enabled us to rapidly expand access to text-based translations across our platform, now offering more than 10,000 courses in up to 26 languages. In 2025, we introduced AI dubbing to bring native-language learning to Coursera, now available for more than 1,000 popular courses in five languages. Course Builder Course Builder is our AI-powered authoring and ingestion tool. It was initially launched as a feature for our Enterprise customers interested in creating custom, private courses. What makes it distinctive is its ability to blend the best of Coursera’s catalog with internal, context-relevant materials. Most importantly, it is backed by Coursera’s learner data and designed with pedagogical best practices to deliver high-quality, custom courses at scale.

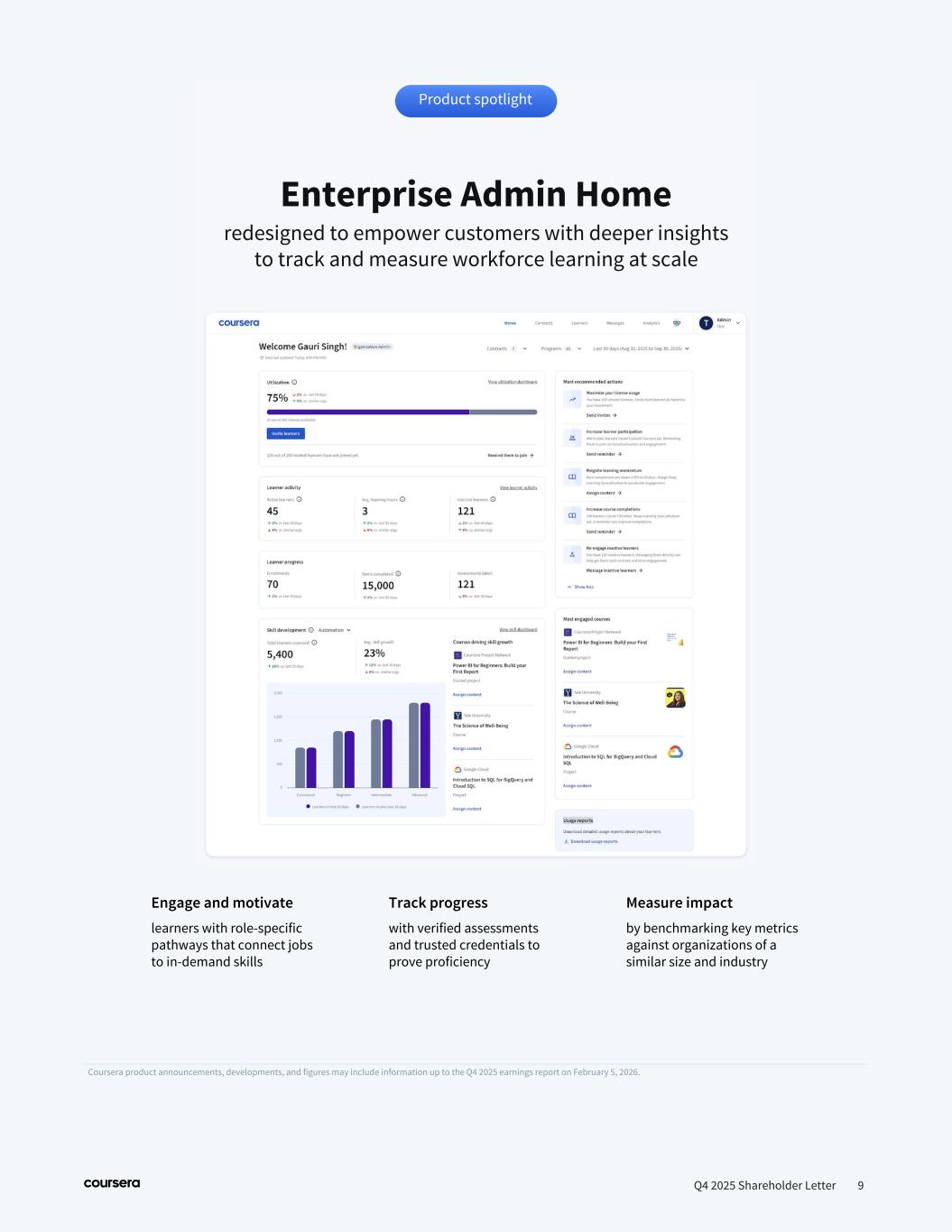

Enterprise Admin Home redesigned to empower customers with deeper insights to track and measure workforce learning at scale Q4 2025 Shareholder Letter 9 Coursera product announcements, developments, and figures may include information up to the Q4 2025 earnings report on February 5, 2026. Product spotlight Engage and motivate learners with role-specific pathways that connect jobs to in-demand skills Track progress with verified assessments and trusted credentials to prove proficiency Measure impact by benchmarking key metrics against organizations of a similar size and industry

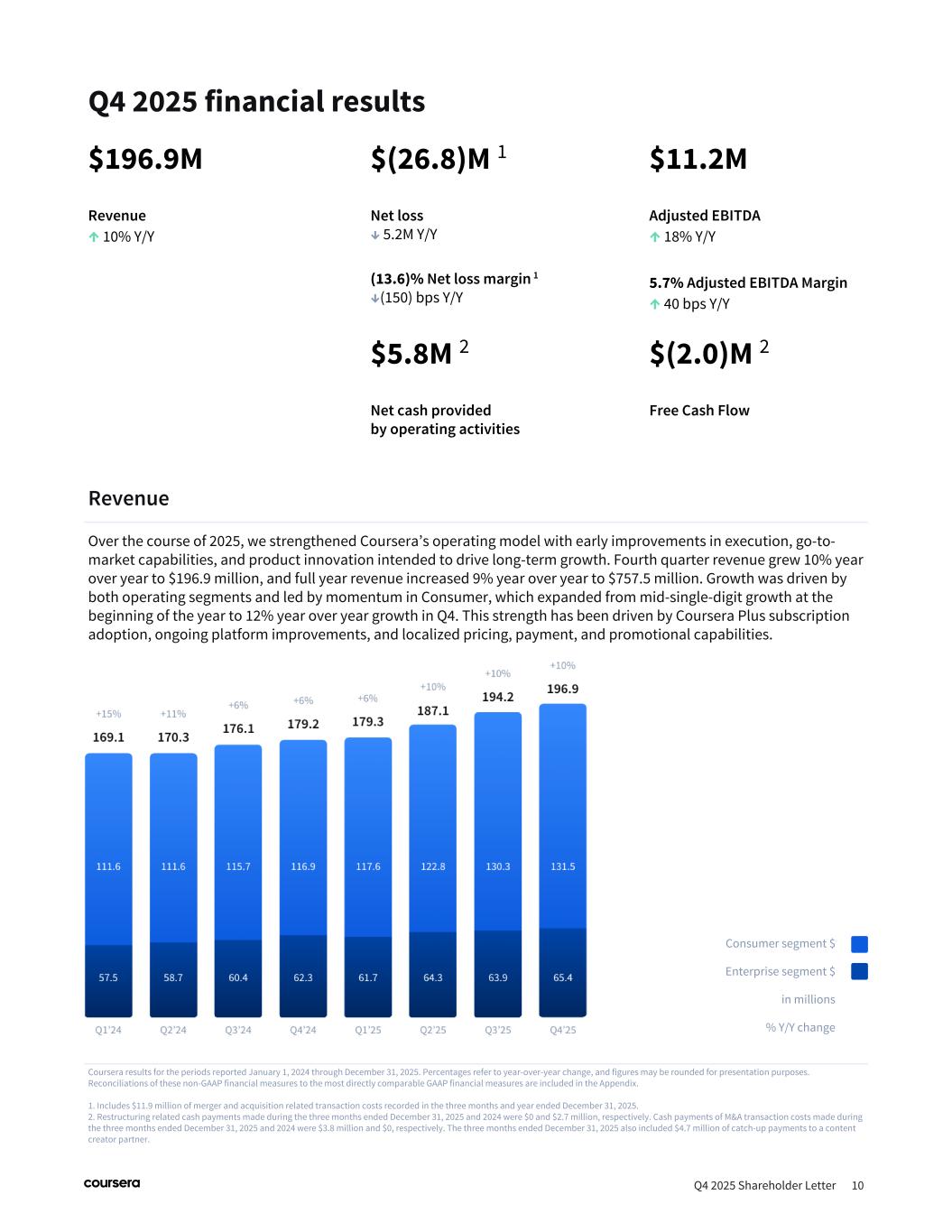

Q4 2025 financial results Q4 2025 Shareholder Letter 10 $196.9M Revenue ↑ 10% Y/Y $(26.8)M 1 Net loss ↓ 5.2M Y/Y (13.6)% Net loss margin 1 ↓(150) bps Y/Y $11.2M Adjusted EBITDA ↑ 18% Y/Y 5.7% Adjusted EBITDA Margin ↑ 40 bps Y/Y $5.8M 2 Net cash provided by operating activities $(2.0)M 2 Free Cash Flow Coursera results for the periods reported January 1, 2024 through December 31, 2025. Percentages refer to year-over-year change, and figures may be rounded for presentation purposes. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the Appendix. 1. Includes $11.9 million of merger and acquisition related transaction costs recorded in the three months and year ended December 31, 2025. 2. Restructuring related cash payments made during the three months ended December 31, 2025 and 2024 were $0 and $2.7 million, respectively. Cash payments of M&A transaction costs made during the three months ended December 31, 2025 and 2024 were $3.8 million and $0, respectively. The three months ended December 31, 2025 also included $4.7 million of catch-up payments to a content creator partner. Revenue Over the course of 2025, we strengthened Coursera’s operating model with early improvements in execution, go-to- market capabilities, and product innovation intended to drive long-term growth. Fourth quarter revenue grew 10% year over year to $196.9 million, and full year revenue increased 9% year over year to $757.5 million. Growth was driven by both operating segments and led by momentum in Consumer, which expanded from mid-single-digit growth at the beginning of the year to 12% year over year growth in Q4. This strength has been driven by Coursera Plus subscription adoption, ongoing platform improvements, and localized pricing, payment, and promotional capabilities. Consumer segment $ Enterprise segment $ in millions % Y/Y change

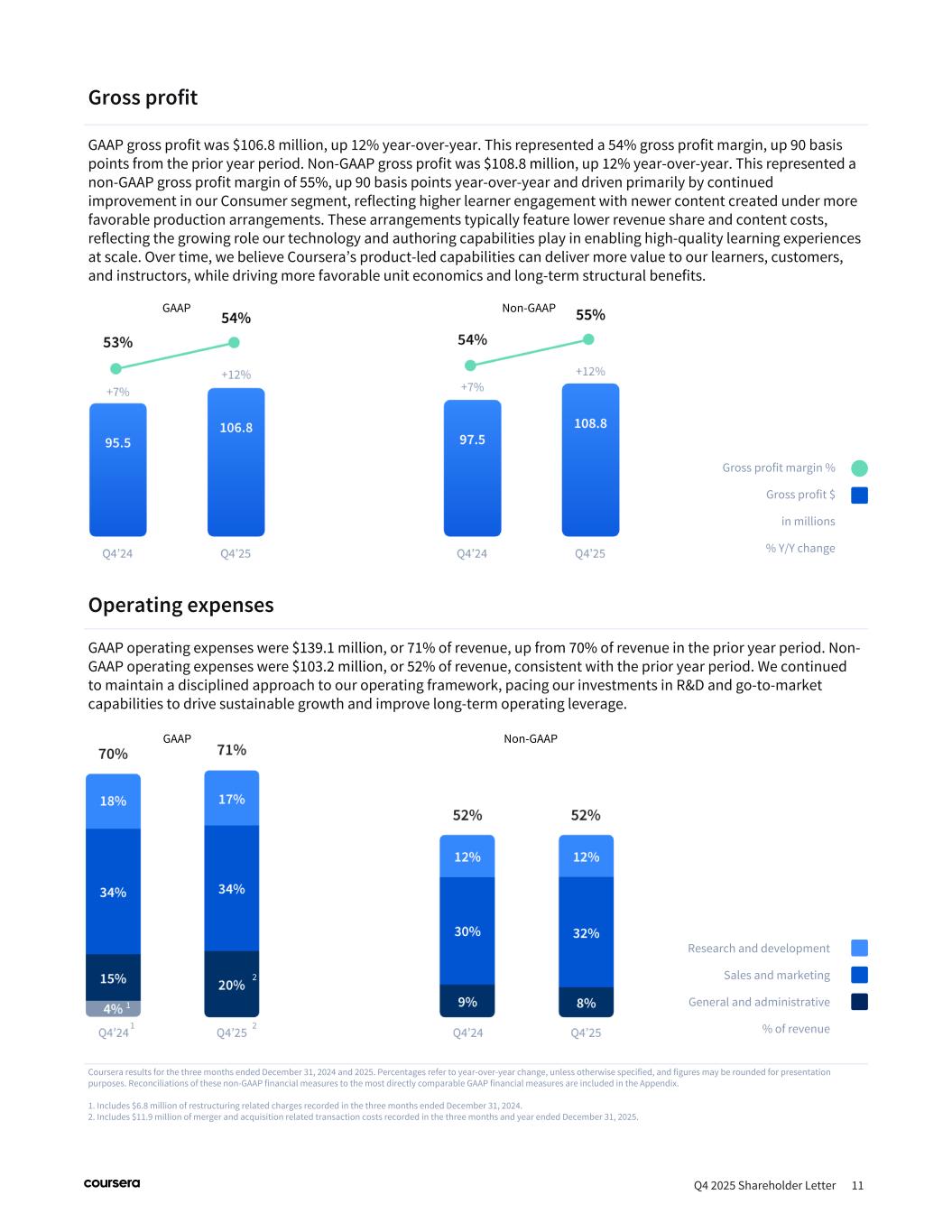

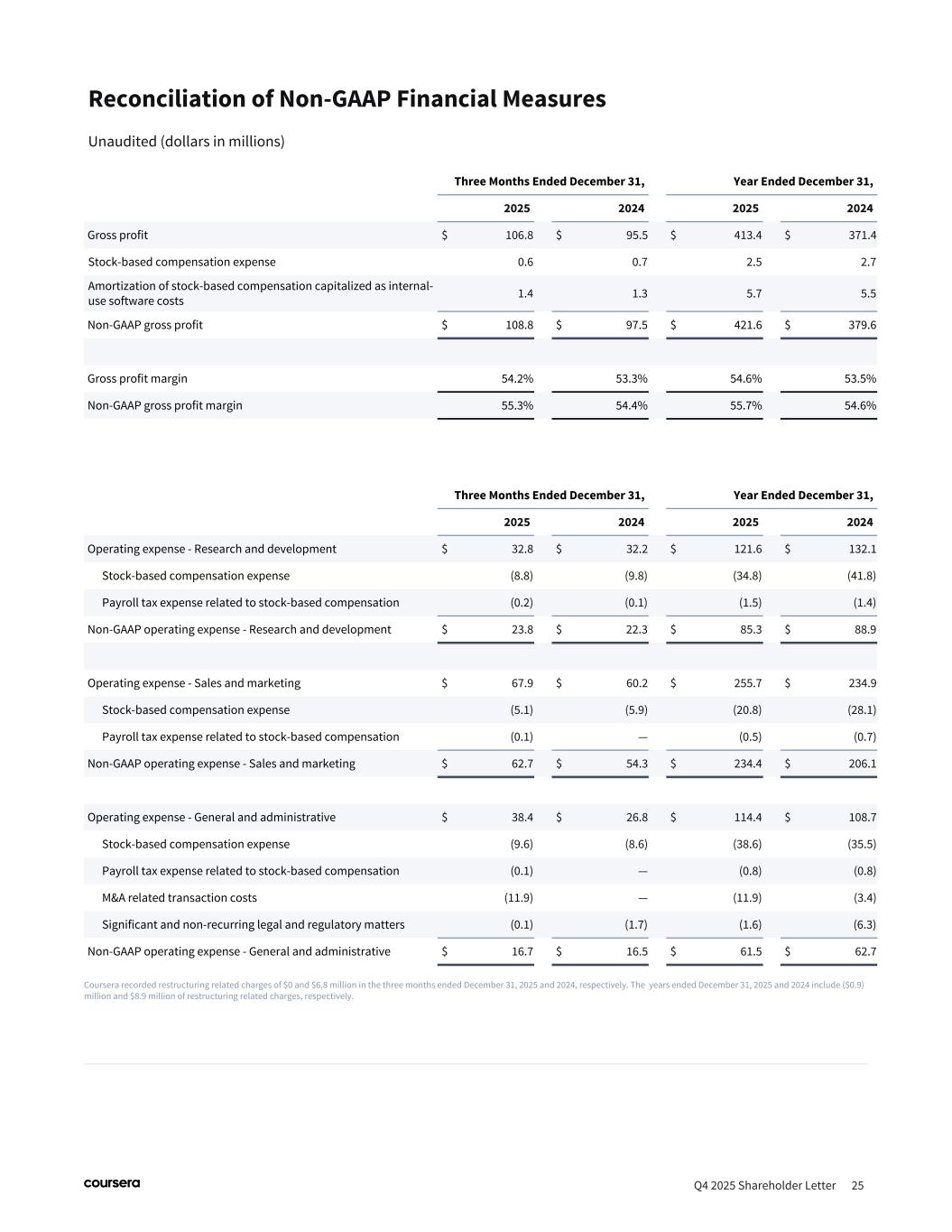

Q4 2025 Shareholder Letter 11 Gross profit GAAP gross profit was $106.8 million, up 12% year-over-year. This represented a 54% gross profit margin, up 90 basis points from the prior year period. Non-GAAP gross profit was $108.8 million, up 12% year-over-year. This represented a non-GAAP gross profit margin of 55%, up 90 basis points year-over-year and driven primarily by continued improvement in our Consumer segment, reflecting higher learner engagement with newer content created under more favorable production arrangements. These arrangements typically feature lower revenue share and content costs, reflecting the growing role our technology and authoring capabilities play in enabling high-quality learning experiences at scale. Over time, we believe Coursera’s product-led capabilities can deliver more value to our learners, customers, and instructors, while driving more favorable unit economics and long-term structural benefits. Coursera results for the three months ended December 31, 2024 and 2025. Percentages refer to year-over-year change, unless otherwise specified, and figures may be rounded for presentation purposes. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the Appendix. 1. Includes $6.8 million of restructuring related charges recorded in the three months ended December 31, 2024. 2. Includes $11.9 million of merger and acquisition related transaction costs recorded in the three months and year ended December 31, 2025. Operating expenses GAAP operating expenses were $139.1 million, or 71% of revenue, up from 70% of revenue in the prior year period. Non- GAAP operating expenses were $103.2 million, or 52% of revenue, consistent with the prior year period. We continued to maintain a disciplined approach to our operating framework, pacing our investments in R&D and go-to-market capabilities to drive sustainable growth and improve long-term operating leverage. Research and development Sales and marketing General and administrative % of revenue Gross profit margin % Gross profit $ in millions % Y/Y change GAAP Non-GAAP GAAP Non-GAAP 2 2 1 1

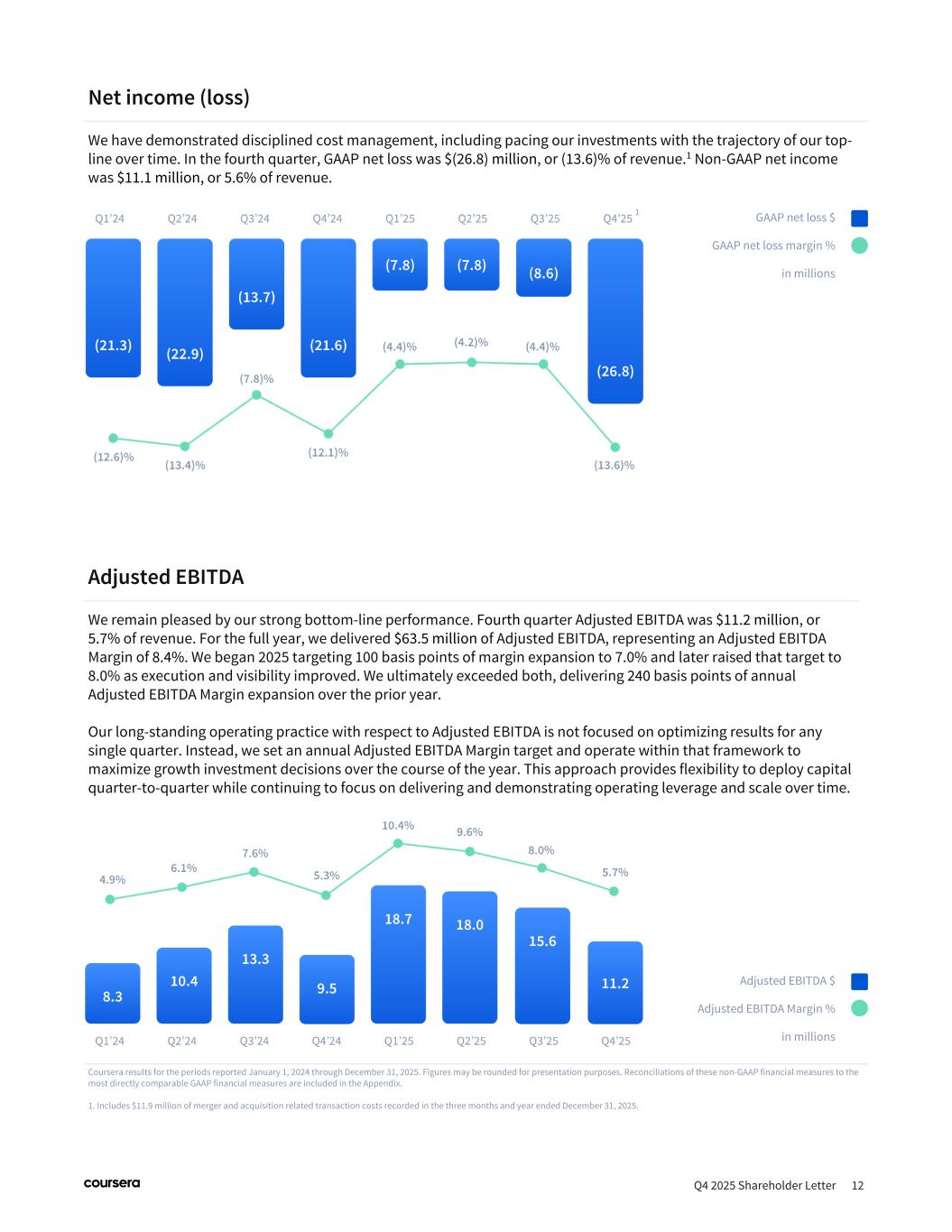

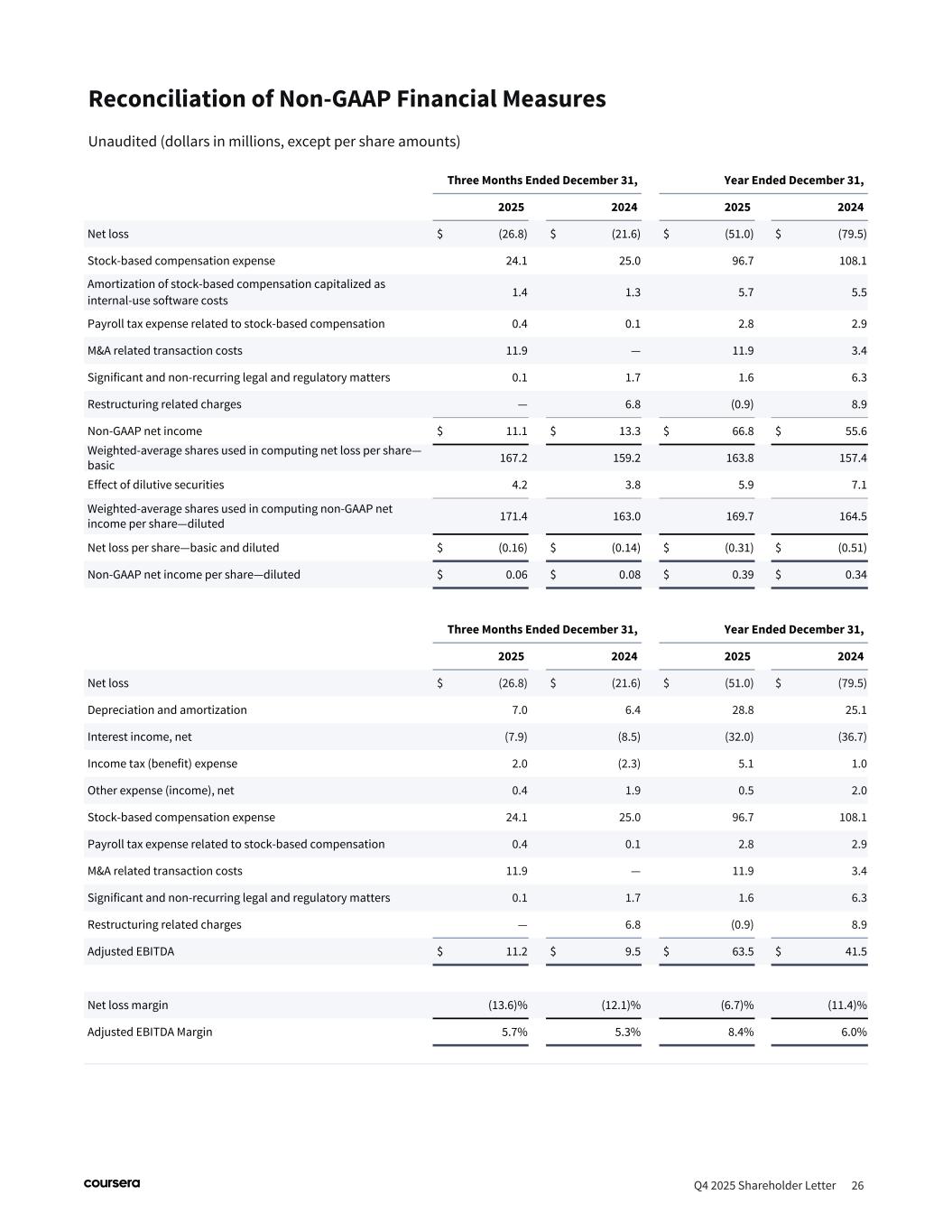

Net income (loss) We have demonstrated disciplined cost management, including pacing our investments with the trajectory of our top- line over time. In the fourth quarter, GAAP net loss was $(26.8) million, or (13.6)% of revenue.1 Non-GAAP net income was $11.1 million, or 5.6% of revenue. Q4 2025 Shareholder Letter 12 Coursera results for the periods reported January 1, 2024 through December 31, 2025. Figures may be rounded for presentation purposes. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the Appendix. 1. Includes $11.9 million of merger and acquisition related transaction costs recorded in the three months and year ended December 31, 2025. Adjusted EBITDA We remain pleased by our strong bottom-line performance. Fourth quarter Adjusted EBITDA was $11.2 million, or 5.7% of revenue. For the full year, we delivered $63.5 million of Adjusted EBITDA, representing an Adjusted EBITDA Margin of 8.4%. We began 2025 targeting 100 basis points of margin expansion to 7.0% and later raised that target to 8.0% as execution and visibility improved. We ultimately exceeded both, delivering 240 basis points of annual Adjusted EBITDA Margin expansion over the prior year. Our long-standing operating practice with respect to Adjusted EBITDA is not focused on optimizing results for any single quarter. Instead, we set an annual Adjusted EBITDA Margin target and operate within that framework to maximize growth investment decisions over the course of the year. This approach provides flexibility to deploy capital quarter-to-quarter while continuing to focus on delivering and demonstrating operating leverage and scale over time. GAAP net loss $ GAAP net loss margin % in millions Adjusted EBITDA $ Adjusted EBITDA Margin % in millions 1

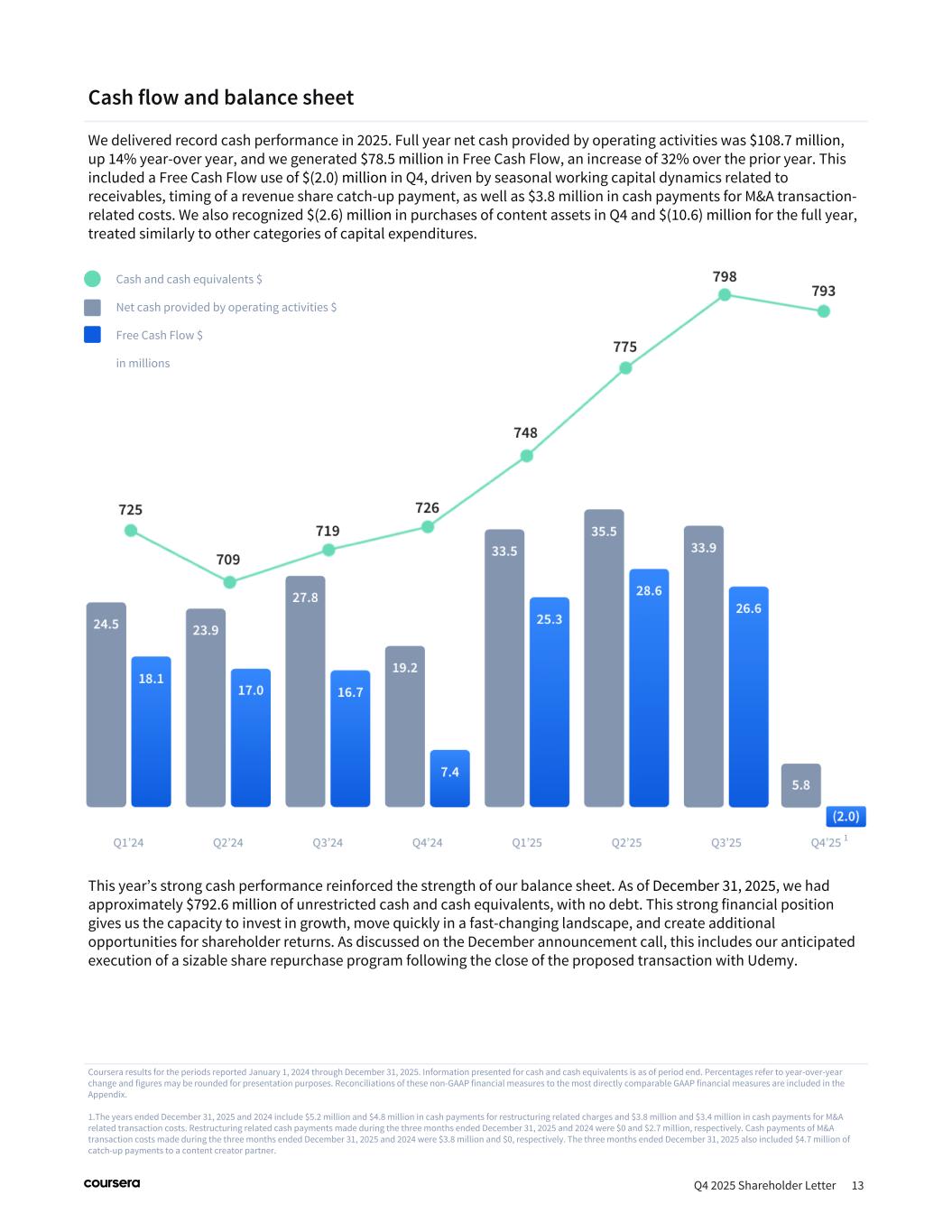

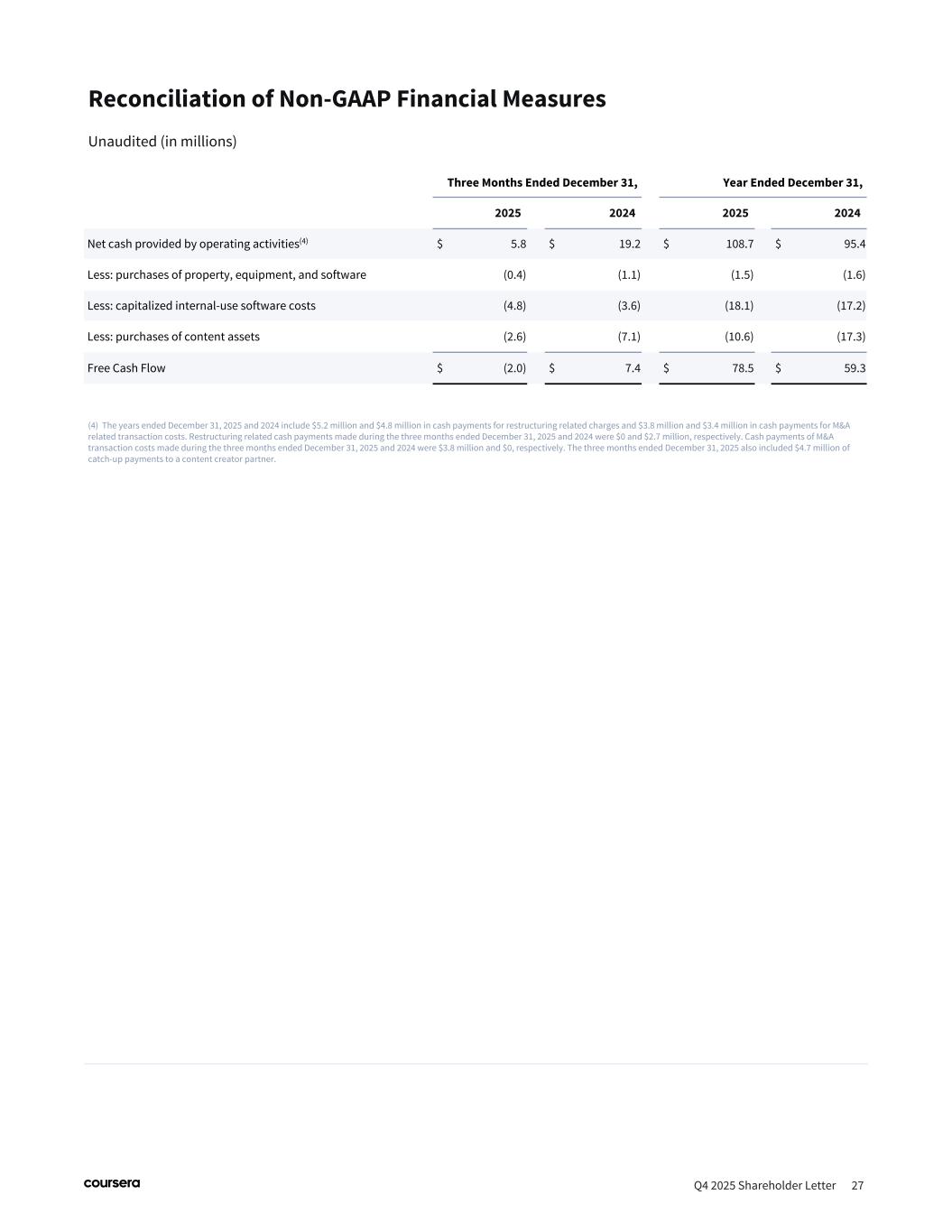

Cash flow and balance sheet We delivered record cash performance in 2025. Full year net cash provided by operating activities was $108.7 million, up 14% year-over year, and we generated $78.5 million in Free Cash Flow, an increase of 32% over the prior year. This included a Free Cash Flow use of $(2.0) million in Q4, driven by seasonal working capital dynamics related to receivables, timing of a revenue share catch-up payment, as well as $3.8 million in cash payments for M&A transaction- related costs. We also recognized $(2.6) million in purchases of content assets in Q4 and $(10.6) million for the full year, treated similarly to other categories of capital expenditures. Q4 2025 Shareholder Letter 13 Coursera results for the periods reported January 1, 2024 through December 31, 2025. Information presented for cash and cash equivalents is as of period end. Percentages refer to year-over-year change and figures may be rounded for presentation purposes. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the Appendix. 1.The years ended December 31, 2025 and 2024 include $5.2 million and $4.8 million in cash payments for restructuring related charges and $3.8 million and $3.4 million in cash payments for M&A related transaction costs. Restructuring related cash payments made during the three months ended December 31, 2025 and 2024 were $0 and $2.7 million, respectively. Cash payments of M&A transaction costs made during the three months ended December 31, 2025 and 2024 were $3.8 million and $0, respectively. The three months ended December 31, 2025 also included $4.7 million of catch-up payments to a content creator partner. This year’s strong cash performance reinforced the strength of our balance sheet. As of December 31, 2025, we had approximately $792.6 million of unrestricted cash and cash equivalents, with no debt. This strong financial position gives us the capacity to invest in growth, move quickly in a fast-changing landscape, and create additional opportunities for shareholder returns. As discussed on the December announcement call, this includes our anticipated execution of a sizable share repurchase program following the close of the proposed transaction with Udemy. Cash and cash equivalents $ Net cash provided by operating activities $ Free Cash Flow $ in millions 1

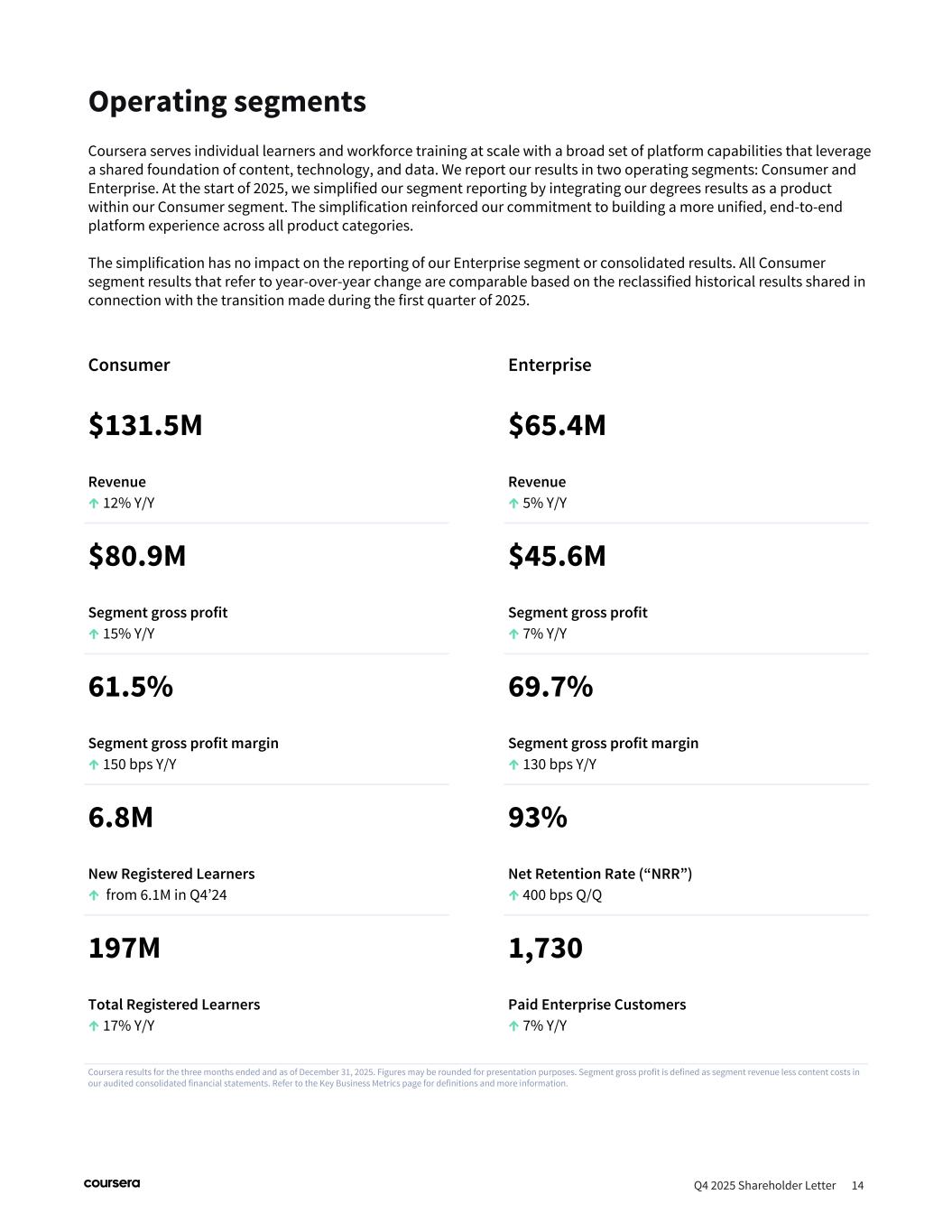

Operating segments Q4 2025 Shareholder Letter 14 Coursera serves individual learners and workforce training at scale with a broad set of platform capabilities that leverage a shared foundation of content, technology, and data. We report our results in two operating segments: Consumer and Enterprise. At the start of 2025, we simplified our segment reporting by integrating our degrees results as a product within our Consumer segment. The simplification reinforced our commitment to building a more unified, end-to-end platform experience across all product categories. The simplification has no impact on the reporting of our Enterprise segment or consolidated results. All Consumer segment results that refer to year-over-year change are comparable based on the reclassified historical results shared in connection with the transition made during the first quarter of 2025. Consumer Enterprise $131.5M Revenue ↑ 12% Y/Y $65.4M Revenue ↑ 5% Y/Y $80.9M Segment gross profit ↑ 15% Y/Y $45.6M Segment gross profit ↑ 7% Y/Y 61.5% Segment gross profit margin ↑ 150 bps Y/Y 69.7% Segment gross profit margin ↑ 130 bps Y/Y 6.8M New Registered Learners ↑ from 6.1M in Q4’24 93% Net Retention Rate (“NRR”) ↑ 400 bps Q/Q 197M Total Registered Learners ↑ 17% Y/Y 1,730 Paid Enterprise Customers ↑ 7% Y/Y Coursera results for the three months ended and as of December 31, 2025. Figures may be rounded for presentation purposes. Segment gross profit is defined as segment revenue less content costs in our audited consolidated financial statements. Refer to the Key Business Metrics page for definitions and more information.

Q4 2025 Shareholder Letter 15 Enterprise performance Enterprise revenue of $65.4 million was up 5% year over year, driven by our campus and business verticals, with demand trends and spending priorities varying by customer, region, and use case. Segment gross profit was $45.6 million, up 7% year over year. This represented a 69.7% gross profit margin, an improvement of 130 basis points from the prior year period. Margin expansion was driven by content engagement trends similar to those benefiting our Consumer segment. Consumer performance Consumer revenue of $131.5 million increased by 12% from the prior year period, driven by acceleration in our core Consumer subscription and courses category, powered by enhanced marketing capabilities, localized pricing, and strong demand for Coursera Plus. We added 6.8 million new registered learners in Q4, the highest number of fourth quarter additions in Coursera’s history. Segment gross profit was $80.9 million, up 15% year over year. This represented a 61.5% gross profit margin, which was up 150 basis points from the prior year and reflects increased learner engagement with content produced under more favorable revenue share arrangements. Coursera results for the periods reported January 1, 2024 through December 31, 2025. Percentages refer to year-over-year change. Figures may be rounded for presentation purposes. Segment gross profit is defined as segment revenue less content costs in our unaudited condensed consolidated financial statements. In Q3’24, Enterprise gross profit margin included a one-time benefit of approximately 150 basis points disclosed in the prior year period. Enterprise gross profit margin % Enterprise revenue $ in millions Consumer gross profit margin % Consumer revenue $ in millions

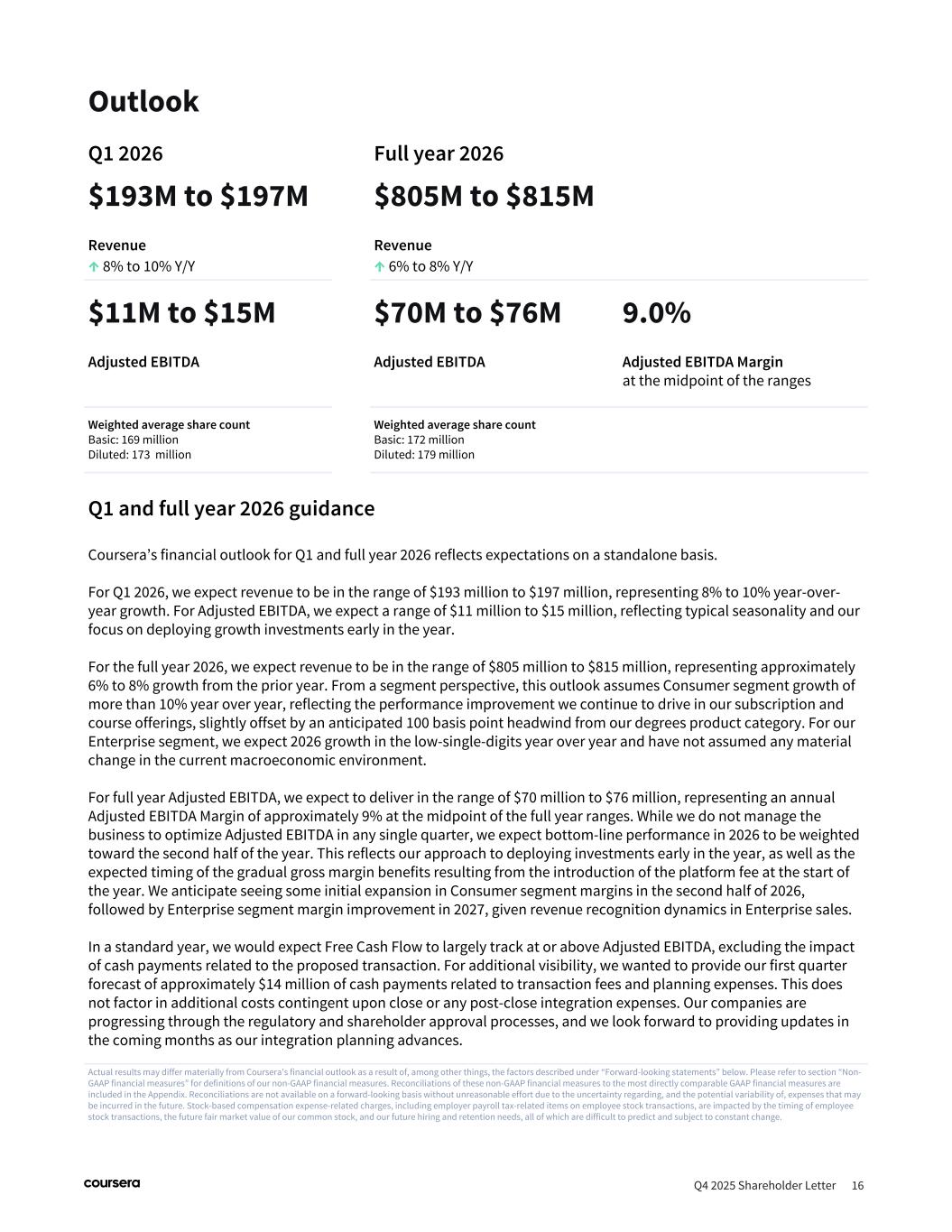

Q1 and full year 2026 guidance Coursera’s financial outlook for Q1 and full year 2026 reflects expectations on a standalone basis. For Q1 2026, we expect revenue to be in the range of $193 million to $197 million, representing 8% to 10% year-over- year growth. For Adjusted EBITDA, we expect a range of $11 million to $15 million, reflecting typical seasonality and our focus on deploying growth investments early in the year. For the full year 2026, we expect revenue to be in the range of $805 million to $815 million, representing approximately 6% to 8% growth from the prior year. From a segment perspective, this outlook assumes Consumer segment growth of more than 10% year over year, reflecting the performance improvement we continue to drive in our subscription and course offerings, slightly offset by an anticipated 100 basis point headwind from our degrees product category. For our Enterprise segment, we expect 2026 growth in the low-single-digits year over year and have not assumed any material change in the current macroeconomic environment. For full year Adjusted EBITDA, we expect to deliver in the range of $70 million to $76 million, representing an annual Adjusted EBITDA Margin of approximately 9% at the midpoint of the full year ranges. While we do not manage the business to optimize Adjusted EBITDA in any single quarter, we expect bottom-line performance in 2026 to be weighted toward the second half of the year. This reflects our approach to deploying investments early in the year, as well as the expected timing of the gradual gross margin benefits resulting from the introduction of the platform fee at the start of the year. We anticipate seeing some initial expansion in Consumer segment margins in the second half of 2026, followed by Enterprise segment margin improvement in 2027, given revenue recognition dynamics in Enterprise sales. In a standard year, we would expect Free Cash Flow to largely track at or above Adjusted EBITDA, excluding the impact of cash payments related to the proposed transaction. For additional visibility, we wanted to provide our first quarter forecast of approximately $14 million of cash payments related to transaction fees and planning expenses. This does not factor in additional costs contingent upon close or any post-close integration expenses. Our companies are progressing through the regulatory and shareholder approval processes, and we look forward to providing updates in the coming months as our integration planning advances. Outlook Actual results may differ materially from Coursera’s financial outlook as a result of, among other things, the factors described under “Forward-looking statements” below. Please refer to section “Non- GAAP financial measures” for definitions of our non-GAAP financial measures. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the Appendix. Reconciliations are not available on a forward-looking basis without unreasonable effort due to the uncertainty regarding, and the potential variability of, expenses that may be incurred in the future. Stock-based compensation expense-related charges, including employer payroll tax-related items on employee stock transactions, are impacted by the timing of employee stock transactions, the future fair market value of our common stock, and our future hiring and retention needs, all of which are difficult to predict and subject to constant change. Q4 2025 Shareholder Letter 16 Q1 2026 Full year 2026 $193M to $197M Revenue ↑ 8% to 10% Y/Y $805M to $815M Revenue ↑ 6% to 8% Y/Y $11M to $15M Adjusted EBITDA $70M to $76M Adjusted EBITDA 9.0% Adjusted EBITDA Margin at the midpoint of the ranges Weighted average share count Basic: 169 million Diluted: 173 million Weighted average share count Basic: 172 million Diluted: 179 million

Conference call details Q4 2025 Shareholder Letter 17 Coursera will hold a conference call to discuss its fourth quarter and full year 2025 performance on February 5, 2026, at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time). A live, audio-only webcast of the conference call and earnings release materials will be available to the public on our investor relations page at investor.coursera.com. For those unable to listen to the broadcast live, an archived replay will be accessible in the same location for one year. Disclosure information In compliance with disclosure obligations under Regulation FD, Coursera announces material information to the public through a variety of means, including filings with the Securities and Exchange Commission (“SEC”), press releases, company blog posts, public conference calls, and webcasts, as well as Coursera’s investor relations website. About Coursera Coursera was launched in 2012 by Andrew Ng and Daphne Koller with a mission to provide universal access to world- class learning. Today, it is one of the largest online learning platforms in the world, with 197 million registered learners as of December 31, 2025. Coursera partners with over 375 leading university and industry partners to offer a broad catalog of content and credentials, including courses, Specializations, Professional Certificates, and degrees. Coursera’s platform innovations — including generative AI-powered features like Coach, Role Play, and Course Builder, and role-based solutions like Skills Tracks — enable instructors, partners, and companies to deliver scalable, personalized, and verified learning. Institutions worldwide rely on Coursera to upskill and reskill their employees, students, and citizens in high-demand fields such as GenAI, data science, technology, and business, while learners globally turn to Coursera to master the skills they need to advance their careers. Coursera is a Delaware public benefit corporation and a B Corp. Contacts Investor Relations Cam Carey, VP of Investor Relations ir@coursera.org Media Arunav Sinha, VP of Global Communications press@coursera.org Transaction with Udemy On December 17, 2025, Coursera and Udemy, Inc. (NASDAQ: UDMY) entered into a definitive merger agreement pursuant to which Coursera will combine with Udemy in an all-stock transaction. The transaction has been unanimously approved by the Boards of Directors of both Coursera and Udemy. The transaction is subject to the receipt of required regulatory approvals, approval by Coursera and Udemy shareholders, and the satisfaction of other customary closing conditions. In connection with the transaction, Insight Venture Partners and New Enterprise Associates, key shareholders of Udemy and Coursera, respectively, as well as Andrew Ng, the Chairman of the Board of Directors of Coursera, have entered into support agreements and agreed to vote in favor of the transaction. Coursera and Udemy are advancing through the regulatory and shareholder approval processes. Please visit courseraandudemy.com for more information and updates about the transaction.

Key business metrics Q4 2025 Shareholder Letter 18 Definitions Registered Learners We count the total number of registered learners at the end of each period. For purposes of determining our registered learner count, we treat each customer account that registers with a unique email as a registered learner and adjust for any spam, test accounts, and cancellations. Our registered learner count is not intended as a measure of active engagement. New registered learners are individuals that register in a particular period. Paid Enterprise Customers We count the total number of Paid Enterprise Customers that are active on our platform at the end of each period. For purposes of determining our customer count, we treat each customer account that has a corresponding contract as a unique customer, and a single organization with multiple divisions, segments, or subsidiaries may be counted as multiple customers. We define a “Paid Enterprise Customer” as a customer who purchases Coursera via our direct sales force. For purposes of determining our Paid Enterprise Customer count, we exclude our Enterprise customers who do not purchase Coursera via our direct sales force, including organizations engaging on our platform through our Coursera for Teams offering or through our channel partners. Net Retention Rate (“NRR”) for Paid Enterprise Customers We calculate annual recurring revenue (“ARR”) by annualizing each customer’s monthly recurring revenue (“MRR”) for the most recent month at period end. We calculate “Net Retention Rate” for a period by starting with the ARR from all Paid Enterprise Customers as of the 12 months prior to such period end, or Prior Period ARR. We then calculate the ARR from these same Paid Enterprise Customers as of the current period end, or “Current Period ARR”. Current Period ARR includes expansion within Paid Enterprise Customers and is net of contraction or attrition over the trailing 12 months but excludes revenue from new Paid Enterprise Customers in the current period. We then divide the total Current Period ARR by the total Prior Period ARR to arrive at our Net Retention Rate for Paid Enterprise Customers. Three Months Ended December 31, 2025 2024 New Registered Learners 6.8 million 6.1 million Net Retention Rate 93 % 87 % December 31, 2025 2024 Total Registered Learners 197 million 168 million Paid Enterprise Customers 1,730 1,612

Non-GAAP financial measures Q4 2025 Shareholder Letter 19 We believe the presentation of these adjusted operating results provides useful supplemental information to investors and facilitates the analysis and comparison of our operating results across reporting periods. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the Appendix. In addition to financial information presented in accordance with GAAP, this shareholder letter includes non-GAAP gross profit, non-GAAP gross profit margin, non-GAAP net income, non-GAAP net income per share, non-GAAP operating expenses, Adjusted EBITDA, Adjusted EBITDA Margin, and Free Cash Flow, each of which is a non-GAAP financial measure. These are key measures used by our management to help us analyze our financial results, establish budgets and operational goals for managing our business, evaluate our performance, and make strategic decisions. Accordingly, we believe that these non-GAAP financial measures provide useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors. In addition, we believe these measures are useful for period-to-period comparisons of our business. We also believe that the presentation of these non-GAAP financial measures provides an additional tool for investors to use in comparing our core business and results of operations over multiple periods with other companies in our industry, many of which present similar non-GAAP financial measures to investors, and to analyze our cash performance. However, the non- GAAP financial measures presented may not be comparable to similarly titled measures reported by other companies due to differences in the way that these measures are calculated. These non-GAAP financial measures are presented for supplemental informational purposes only and should not be considered as a substitute for or in isolation from financial information presented in accordance with GAAP. These non-GAAP financial measures have limitations as analytical tools. Definitions Non-GAAP Gross Profit, Non-GAAP Gross Profit Margin, Non-GAAP Net Income, and Non-GAAP Net Income Per Share We define non-GAAP gross profit and non-GAAP net income as GAAP gross profit and GAAP net loss excluding: (1) stock- based compensation expense; (2) amortization of stock-based compensation expense capitalized as internal-use software costs; (3) payroll tax expense related to stock-based compensation; (4) merger and acquisition (“M&A”) related transaction costs; (5) costs and settlement (gains) losses related to significant and non-recurring legal and regulatory matters, net of insurance recoveries; and (6) restructuring related charges. Non-GAAP gross profit margin reflects non-GAAP gross profit as a percentage of revenue. Non-GAAP net income per share is calculated by dividing non-GAAP net income by the diluted weighted average shares of common stock outstanding. Non-GAAP Operating Expenses We define non-GAAP operating expenses as GAAP operating expenses excluding: (1) stock-based compensation expense; (2) payroll tax expense related to stock-based compensation; (3) M&A related transaction costs; and (4) costs and settlement (gains) losses related to significant and non-recurring legal and regulatory matters, net of insurance recoveries. Adjusted EBITDA and Adjusted EBITDA Margin We define Adjusted EBITDA as our GAAP net loss excluding: (1) depreciation and amortization; (2) interest income, net; (3) income tax expense; (4) other (income) expense, net; (5) stock-based compensation expense; (6) payroll tax expense related to stock-based compensation; (7) M&A related transaction costs; (8) costs and settlement (gains) losses related to significant and non-recurring legal and regulatory matters, net of insurance recoveries; and (9) restructuring related charges. We define Adjusted EBITDA Margin as Adjusted EBITDA divided by revenue. Free Cash Flow We define Free Cash Flow as net cash provided by operating activities, less capitalized internal-use software costs, purchases of content assets, and purchases of property, equipment, and software as we consider these capital expenditures necessary to support our ongoing operations.

Forward-looking statements Q4 2025 Shareholder Letter 20 This shareholder letter contains forward-looking statements that involve substantial risks and uncertainties. Any statements contained in this shareholder letter that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terms such as: “accelerate,” “anticipate, “believe,” “can,” “continue,” “could,” “demand,” “design,” “estimate,” “expand,” “expect,” “intend,” “may,” “might,” “mission,” “need,” “objective,” “ongoing,” “outlook,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would,” or the negative of these terms, or other comparable terminology intended to identify statements about the future. These forward-looking statements include, but are not limited to, statements regarding the proposed combination with Udemy, including the expected timing and benefits of such business combination and the outlook for Coursera’s and Udemy’s results of operations and financial condition (including potential synergies) following the business combination; our ability to grow with leverage and manage our cost structure; our market opportunity; the expansion of our market opportunity; the global demand to embrace new skills; our progress in our growth initiatives; our continued expansion of Coursera Coach, AI-powered translations and Course Builder; our commitment to creating more personalized, engaging, and AI-native learning experiences; our initiatives to strengthen our position as a trusted source for verified learning; our mission to provide universal access to world-class learning; the demand for online learning; the strength of our customer and content creator relationships; our intention to be at the forefront of shaping our learners’ learner journey; the demand from learners to use our offerings to master career advancing skills; anticipated features and benefits of our offerings; the anticipated utility of our non-GAAP financial measures; anticipated growth rates; our focus on deploying growth investments early in the year; our focus on a durable foundation for long-term growth; our belief that our annual Adjusted EBITDA Margin target provides the flexibility to deploy capital quarter-to-quarter while we continue to focus on delivering and demonstrating operating leverage and scale over time; and our financial outlook, future financial and operational performance, and expectations, including our financial outlook for the first quarter of 2026 and full year 2026; among others. These forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause our actual results, levels of activity, performance, or achievements to be materially different from the information expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, the following: our ability to attract, engage, and retain learners; our ability to increase sales of our offerings; our limited operating history; the relative nascency of online learning solutions and generative AI; risks related to market acceptance and demand for our offerings; our ability to maintain and expand our existing content creator relationships and to develop new partnerships with universities, industry leaders, and subject matter experts; our dependence on the supply of content created by our partners; risks related to our AI innovations and AI generally; risks related to the proposed business combination with Udemy, including the effect of the announcement of the business combination on the ability of Coursera or Udemy to retain and hire key personnel and maintain relationships with customers, vendors and others with whom Coursera or Udemy do business, or on Coursera’s or Udemy’s operating results and business generally; risks that the business combination disrupts current plans and operations and the potential difficulties in attracting and retaining qualified personnel as a result of the business combination; the outcome of any legal proceedings related to the business combination; the ability of the parties to consummate the proposed transaction on a timely basis or at all; the satisfaction of the conditions precedent to consummation of the proposed transaction, including the ability to secure regulatory approvals on the terms expected, at all or in a timely manner; the ability to successfully integrate Coursera’s and Udemy’s operations and business on a timely basis or otherwise in accordance with the standards and obligations applicable to the combined company as a public benefit corporation and as a B Corp.; Coursera’s and Udemy’s ability to implement our plans, forecasts and other expectations with respect to the combined company’s business after the completion of the transaction and realize expected synergies and other benefits of the combination within the expected timeframe or at all; the amount of the costs, fees, expenses and charges related to the proposed combination; fluctuations in the prices of Coursera or Udemy stock; potential business disruptions following the business combination; our ability to compete effectively; adverse impacts on our business and financial condition due to macroeconomic or market conditions; our ability to manage our growth; regulatory and/or policy matters or changes impacting us or our content creators; risks related to intellectual property; cybersecurity and privacy risks and regulations; potential disruptions to our platform; risks related to operations, regulatory, economic, and geopolitical conditions; current and future legal and regulatory matters; the impact of actions to improve operational efficiencies and operating costs; our history of net losses and ability to achieve or sustain profitability; natural disasters, public health crises, or other catastrophic events; and our status as a certified B Corp, as well as the risks and uncertainties discussed in our most recently filed annual and quarterly reports on Forms 10-K and 10-Q and subsequent filings and as detailed from time to time in our SEC filings. You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance, or events and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. Such forward-looking statements relate only to events as of the date of this press release. We undertake no obligation to update any forward-looking statements except to the extent required by law.

Q4 2025 Shareholder Letter 21 Appendix

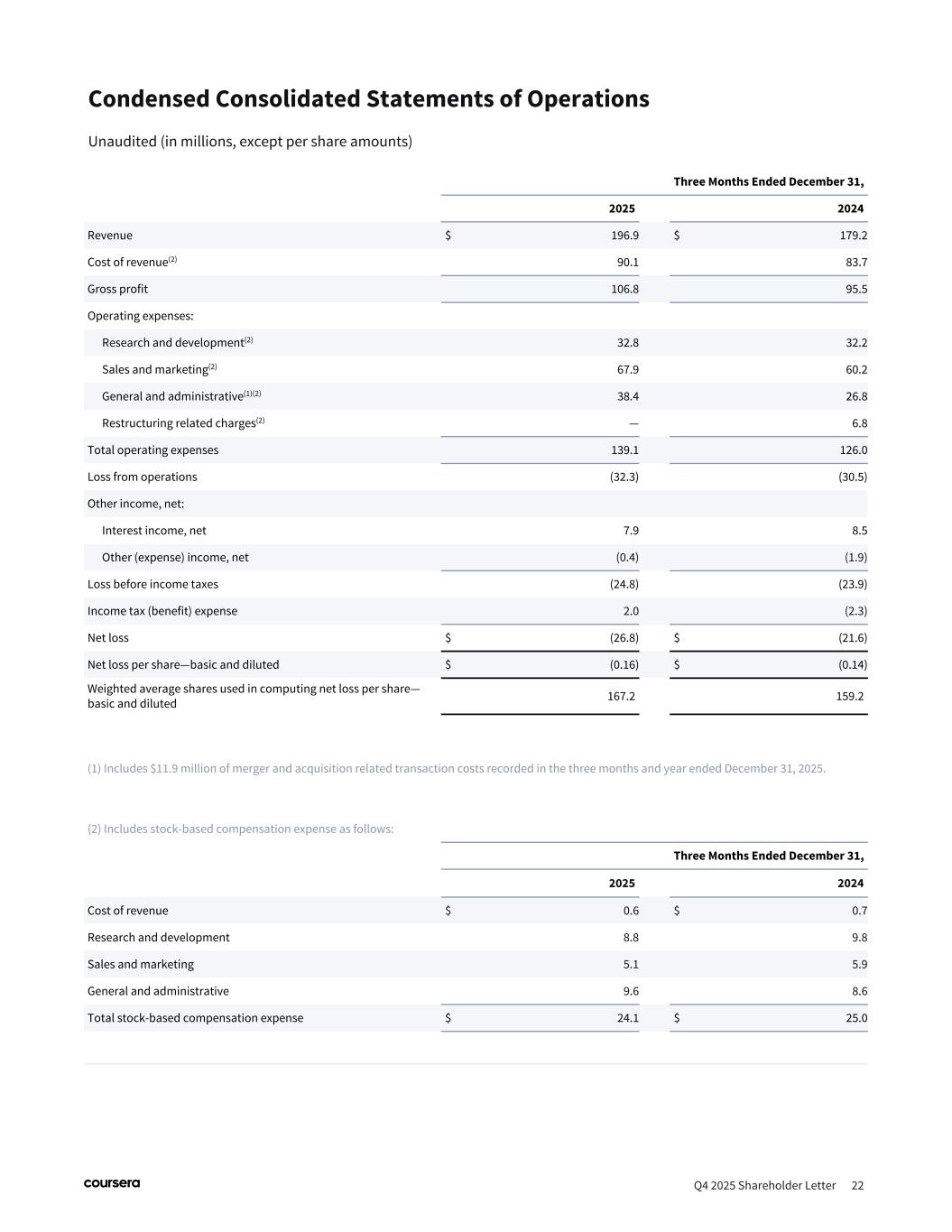

Condensed Consolidated Statements of Operations Unaudited (in millions, except per share amounts) Q4 2025 Shareholder Letter 22 Three Months Ended December 31, 2025 2024 Revenue $ 196.9 $ 179.2 Cost of revenue(2) 90.1 83.7 Gross profit 106.8 95.5 Operating expenses: Research and development(2) 32.8 32.2 Sales and marketing(2) 67.9 60.2 General and administrative(1)(2) 38.4 26.8 Restructuring related charges(2) — 6.8 Total operating expenses 139.1 126.0 Loss from operations (32.3) (30.5) Other income, net: Interest income, net 7.9 8.5 Other (expense) income, net (0.4) (1.9) Loss before income taxes (24.8) (23.9) Income tax (benefit) expense 2.0 (2.3) Net loss $ (26.8) $ (21.6) Net loss per share—basic and diluted $ (0.16) $ (0.14) Weighted average shares used in computing net loss per share— basic and diluted 167.2 159.2 (1) Includes $11.9 million of merger and acquisition related transaction costs recorded in the three months and year ended December 31, 2025. (2) Includes stock-based compensation expense as follows: Three Months Ended December 31, 2025 2024 Cost of revenue $ 0.6 $ 0.7 Research and development 8.8 9.8 Sales and marketing 5.1 5.9 General and administrative 9.6 8.6 Total stock-based compensation expense $ 24.1 $ 25.0

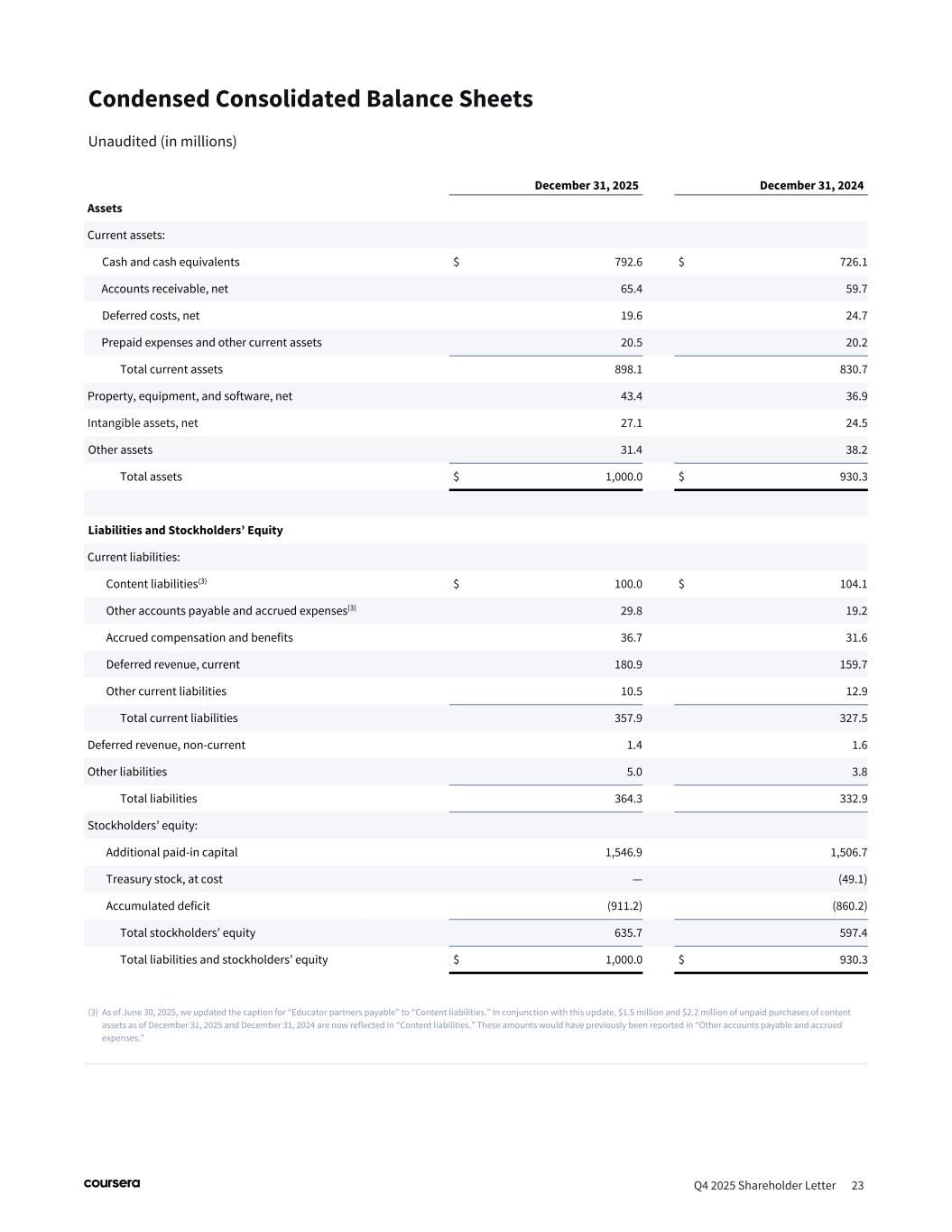

Condensed Consolidated Balance Sheets Unaudited (in millions) Q4 2025 Shareholder Letter 23 December 31, 2025 December 31, 2024 Assets Current assets: Cash and cash equivalents $ 792.6 $ 726.1 Accounts receivable, net 65.4 59.7 Deferred costs, net 19.6 24.7 Prepaid expenses and other current assets 20.5 20.2 Total current assets 898.1 830.7 Property, equipment, and software, net 43.4 36.9 Intangible assets, net 27.1 24.5 Other assets 31.4 38.2 Total assets $ 1,000.0 $ 930.3 Liabilities and Stockholders’ Equity Current liabilities: Content liabilities(3) $ 100.0 $ 104.1 Other accounts payable and accrued expenses(3) 29.8 19.2 Accrued compensation and benefits 36.7 31.6 Deferred revenue, current 180.9 159.7 Other current liabilities 10.5 12.9 Total current liabilities 357.9 327.5 Deferred revenue, non-current 1.4 1.6 Other liabilities 5.0 3.8 Total liabilities 364.3 332.9 Stockholders’ equity: Additional paid-in capital 1,546.9 1,506.7 Treasury stock, at cost — (49.1) Accumulated deficit (911.2) (860.2) Total stockholders’ equity 635.7 597.4 Total liabilities and stockholders’ equity $ 1,000.0 $ 930.3 (3) As of June 30, 2025, we updated the caption for “Educator partners payable” to “Content liabilities.” In conjunction with this update, $1.5 million and $2.2 million of unpaid purchases of content assets as of December 31, 2025 and December 31, 2024 are now reflected in “Content liabilities.” These amounts would have previously been reported in “Other accounts payable and accrued expenses.”

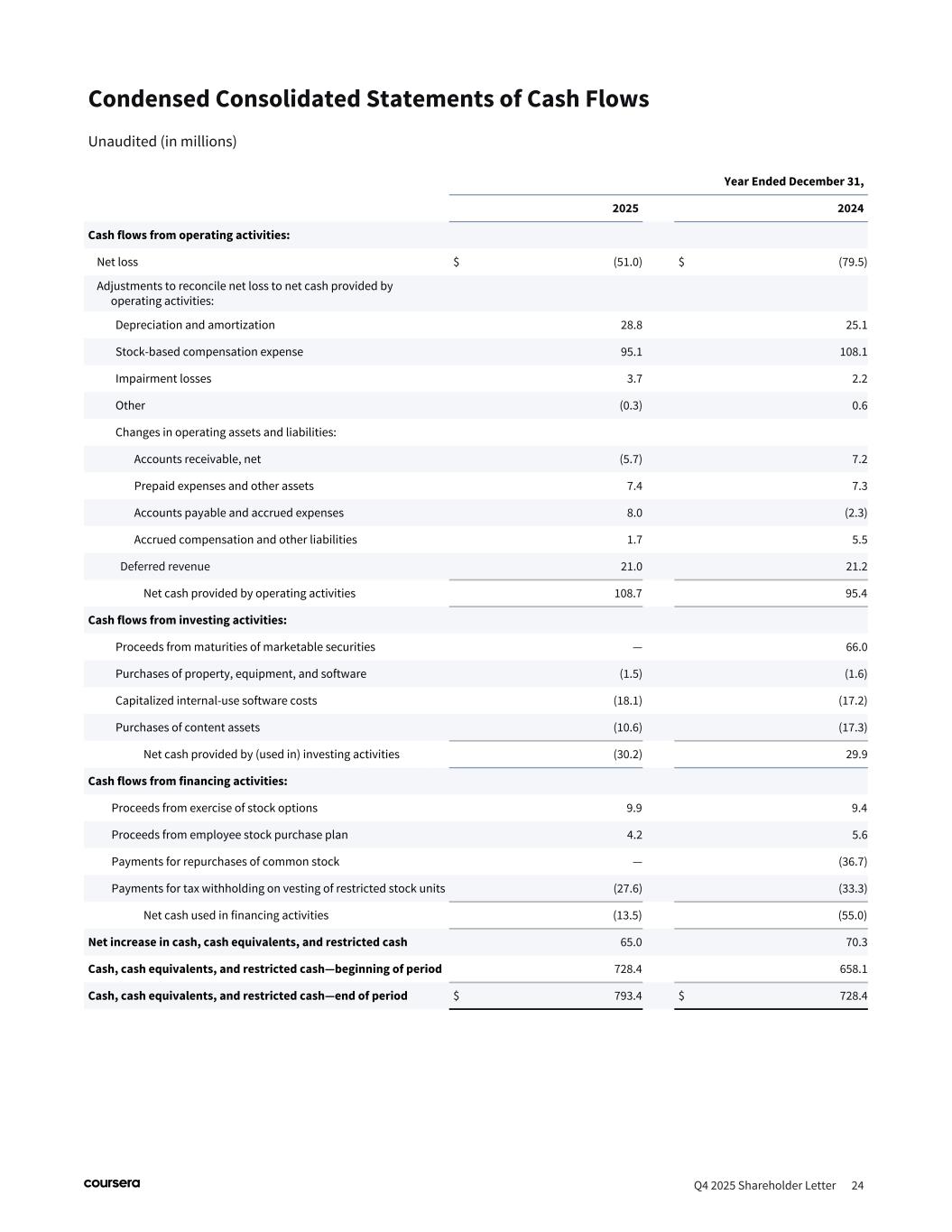

Condensed Consolidated Statements of Cash Flows Unaudited (in millions) Q4 2025 Shareholder Letter 24 Year Ended December 31, 2025 2024 Cash flows from operating activities: Net loss $ (51.0) $ (79.5) Adjustments to reconcile net loss to net cash provided by operating activities: Depreciation and amortization 28.8 25.1 Stock-based compensation expense 95.1 108.1 Impairment losses 3.7 2.2 Other (0.3) 0.6 Changes in operating assets and liabilities: Accounts receivable, net (5.7) 7.2 Prepaid expenses and other assets 7.4 7.3 Accounts payable and accrued expenses 8.0 (2.3) Accrued compensation and other liabilities 1.7 5.5 Deferred revenue 21.0 21.2 Net cash provided by operating activities 108.7 95.4 Cash flows from investing activities: Proceeds from maturities of marketable securities — 66.0 Purchases of property, equipment, and software (1.5) (1.6) Capitalized internal-use software costs (18.1) (17.2) Purchases of content assets (10.6) (17.3) Net cash provided by (used in) investing activities (30.2) 29.9 Cash flows from financing activities: Proceeds from exercise of stock options 9.9 9.4 Proceeds from employee stock purchase plan 4.2 5.6 Payments for repurchases of common stock — (36.7) Payments for tax withholding on vesting of restricted stock units (27.6) (33.3) Net cash used in financing activities (13.5) (55.0) Net increase in cash, cash equivalents, and restricted cash 65.0 70.3 Cash, cash equivalents, and restricted cash—beginning of period 728.4 658.1 Cash, cash equivalents, and restricted cash—end of period $ 793.4 $ 728.4

Three Months Ended December 31, Year Ended December 31, 2025 2024 2025 2024 Operating expense - Research and development $ 32.8 $ 32.2 $ 121.6 $ 132.1 Stock-based compensation expense (8.8) (9.8) (34.8) (41.8) Payroll tax expense related to stock-based compensation (0.2) (0.1) (1.5) (1.4) Non-GAAP operating expense - Research and development $ 23.8 $ 22.3 $ 85.3 $ 88.9 Operating expense - Sales and marketing $ 67.9 $ 60.2 $ 255.7 $ 234.9 Stock-based compensation expense (5.1) (5.9) (20.8) (28.1) Payroll tax expense related to stock-based compensation (0.1) — (0.5) (0.7) Non-GAAP operating expense - Sales and marketing $ 62.7 $ 54.3 $ 234.4 $ 206.1 Operating expense - General and administrative $ 38.4 $ 26.8 $ 114.4 $ 108.7 Stock-based compensation expense (9.6) (8.6) (38.6) (35.5) Payroll tax expense related to stock-based compensation (0.1) — (0.8) (0.8) M&A related transaction costs (11.9) — (11.9) (3.4) Significant and non-recurring legal and regulatory matters (0.1) (1.7) (1.6) (6.3) Non-GAAP operating expense - General and administrative $ 16.7 $ 16.5 $ 61.5 $ 62.7 Reconciliation of Non-GAAP Financial Measures Unaudited (dollars in millions) Q4 2025 Shareholder Letter 25 Three Months Ended December 31, Year Ended December 31, 2025 2024 2025 2024 Gross profit $ 106.8 $ 95.5 $ 413.4 $ 371.4 Stock-based compensation expense 0.6 0.7 2.5 2.7 Amortization of stock-based compensation capitalized as internal- use software costs 1.4 1.3 5.7 5.5 Non-GAAP gross profit $ 108.8 $ 97.5 $ 421.6 $ 379.6 Gross profit margin 54.2 % 53.3 % 54.6 % 53.5 % Non-GAAP gross profit margin 55.3 % 54.4 % 55.7 % 54.6 % Coursera recorded restructuring related charges of $0 and $6.8 million in the three months ended December 31, 2025 and 2024, respectively. The years ended December 31, 2025 and 2024 include ($0.9) million and $8.9 million of restructuring related charges, respectively.

Three Months Ended December 31, Year Ended December 31, 2025 2024 2025 2024 Net loss $ (26.8) $ (21.6) $ (51.0) $ (79.5) Stock-based compensation expense 24.1 25.0 96.7 108.1 Amortization of stock-based compensation capitalized as internal-use software costs 1.4 1.3 5.7 5.5 Payroll tax expense related to stock-based compensation 0.4 0.1 2.8 2.9 M&A related transaction costs 11.9 — 11.9 3.4 Significant and non-recurring legal and regulatory matters 0.1 1.7 1.6 6.3 Restructuring related charges — 6.8 (0.9) 8.9 Non-GAAP net income $ 11.1 $ 13.3 $ 66.8 $ 55.6 Weighted-average shares used in computing net loss per share— basic 167.2 159.2 163.8 157.4 Effect of dilutive securities 4.2 3.8 5.9 7.1 Weighted-average shares used in computing non-GAAP net income per share—diluted 171.4 163.0 169.7 164.5 Net loss per share—basic and diluted $ (0.16) $ (0.14) $ (0.31) $ (0.51) Non-GAAP net income per share—diluted $ 0.06 $ 0.08 $ 0.39 $ 0.34 Reconciliation of Non-GAAP Financial Measures Unaudited (dollars in millions, except per share amounts) Q4 2025 Shareholder Letter 26 Three Months Ended December 31, Year Ended December 31, 2025 2024 2025 2024 Net loss $ (26.8) $ (21.6) $ (51.0) $ (79.5) Depreciation and amortization 7.0 6.4 28.8 25.1 Interest income, net (7.9) (8.5) (32.0) (36.7) Income tax (benefit) expense 2.0 (2.3) 5.1 1.0 Other expense (income), net 0.4 1.9 0.5 2.0 Stock-based compensation expense 24.1 25.0 96.7 108.1 Payroll tax expense related to stock-based compensation 0.4 0.1 2.8 2.9 M&A related transaction costs 11.9 — 11.9 3.4 Significant and non-recurring legal and regulatory matters 0.1 1.7 1.6 6.3 Restructuring related charges — 6.8 (0.9) 8.9 Adjusted EBITDA $ 11.2 $ 9.5 $ 63.5 $ 41.5 Net loss margin (13.6) % (12.1) % (6.7) % (11.4) % Adjusted EBITDA Margin 5.7 % 5.3 % 8.4 % 6.0 %

Reconciliation of Non-GAAP Financial Measures Unaudited (in millions) Q4 2025 Shareholder Letter 27 Three Months Ended December 31, Year Ended December 31, 2025 2024 2025 2024 Net cash provided by operating activities(4) $ 5.8 $ 19.2 $ 108.7 $ 95.4 Less: purchases of property, equipment, and software (0.4) (1.1) (1.5) (1.6) Less: capitalized internal-use software costs (4.8) (3.6) (18.1) (17.2) Less: purchases of content assets (2.6) (7.1) (10.6) (17.3) Free Cash Flow $ (2.0) $ 7.4 $ 78.5 $ 59.3 (4) The years ended December 31, 2025 and 2024 include $5.2 million and $4.8 million in cash payments for restructuring related charges and $3.8 million and $3.4 million in cash payments for M&A related transaction costs. Restructuring related cash payments made during the three months ended December 31, 2025 and 2024 were $0 and $2.7 million, respectively. Cash payments of M&A transaction costs made during the three months ended December 31, 2025 and 2024 were $3.8 million and $0, respectively. The three months ended December 31, 2025 also included $4.7 million of catch-up payments to a content creator partner.