INFORMATION REGARDING THIS SOLICITATION

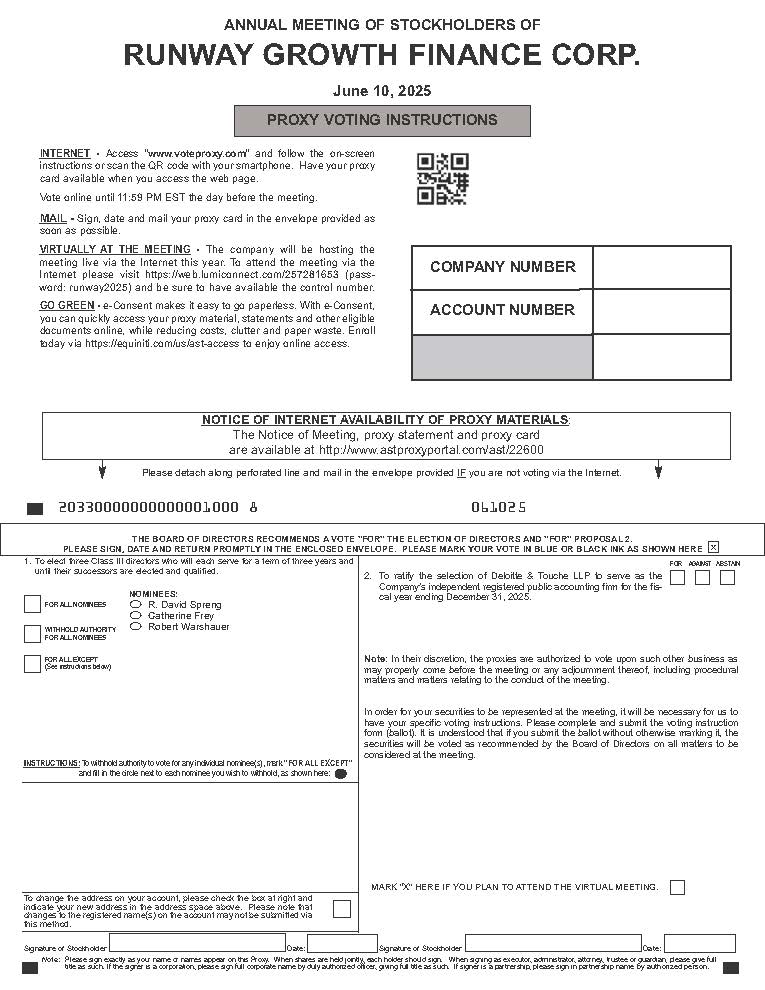

The Company will bear the expense of the solicitation of proxies for the Annual Meeting, including the cost of preparing, mailing and/or posting to the internet this proxy statement, the Annual Report and the Notice of Internet Availability of Proxy Materials. We have requested that brokers, nominees, fiduciaries and other persons holding shares in their names, or in the name of their nominees, which are beneficially owned by others, forward the proxy materials to, and obtain proxies from, such beneficial owners. We will reimburse such persons for their reasonable expenses in so doing.

In addition to the solicitation of proxies by the use of the mail, proxies may be solicited in person (i.e., virtually) and by telephone or facsimile transmission by directors, officers or regular employees of the Company or our investment advisor, Runway Growth Capital LLC (the “Adviser”), for which no director, officer, regular employee or the Adviser will receive any additional or special compensation.

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement and annual report addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies.

A number of brokerages and other institutional holders of record have implemented householding. A single proxy statement will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. If you have received notice from your broker that it will be householding communications to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy statement, please notify your broker. Stockholders who currently receive multiple copies of the proxy statement at their addresses and would like to request information about householding of their communications should contact their brokers or other intermediary holder of record. You can notify us by sending a written request to: Thomas B. Raterman, Corporate Secretary, Runway Growth Finance Corp., 205 N. Michigan Ave, Suite 4200, Chicago, Illinois 60601, or by calling (312) 698-6902. In addition, we will promptly deliver, upon written or oral request to the address or telephone number above, a separate copy of the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2024 and proxy statement to a stockholder at a shared address to which a single copy of the documents was delivered.

If you have any questions about the Annual Meeting, these proxy materials or your ownership of our common stock, please contact Thomas B. Raterman c/o Runway Growth Finance Corp., 205 N. Michigan Ave, Suite 4200, Chicago, Illinois 60601, Telephone: (312) 698-6902.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of April 24, 2025, the beneficial ownership of our common stock by each of our current directors, each of our executive officers, each person known to us to beneficially own 5% or more of the outstanding shares of our common stock, and all of our executive officers and directors as a group.

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the securities. Shares of common stock subject to options or warrants that are currently exercisable or exercisable within 60 days of April 24, 2025 are deemed to be outstanding and beneficially owned by the person holding such options or warrants. Such shares, however, are not deemed outstanding for the purposes of computing the percentage ownership of any other person. There is no common stock subject to options or warrants that are currently exercisable or exercisable within 60 days of April 24, 2025. Percentage of ownership is based on 37,347,428 shares of common stock outstanding as of April 24, 2025.

Unless otherwise indicated, to our knowledge, each stockholder listed below has sole voting and investment power with respect to the shares beneficially owned by the stockholder, except to the extent authority is shared by their spouses under applicable law. Unless otherwise indicated, the address of all executive officers and directors (as defined below) is c/o Runway Growth Finance Corp., 205 N. Michigan Ave, Suite 4200, Chicago, Illinois 60601.