SCHEDULE 4

EXISTING SERVICE AGREEMENTS

PURCHASE AND SALE AGREEMENT

dated

February 3, 2026

by and between

MDR FRANKLIN SQUARE, LLC,

as SELLER

and

PC ACQUISITIONS, LLC,

as PURCHASER

Article I SALE OF THE PROPERTY1

1.1Sale of Property1

1.2No Representations2

1.3No Reliance2

1.4Acceptance of Deed2

1.5“AS IS”3

1.6Seller Release from Liability3

1.7Purchaser’s Waiver of Objections4

1.8Survival4

Article II PURCHASE PRICE4

2.1Purchase Price4

Article III DEPOSIT AND OPENING OF ESCROW4

3.1Deposit4

3.2Interest Bearing5

3.3Application5

3.4Independent Consideration5

Article IV CONDITIONS TO CLOSING5

4.1Conditions to Purchaser’s Obligation to Purchase5

4.2Conditions to Seller’s Obligation to Sell7

4.3No Financing Contingency8

Article V THE CLOSING8

5.1Date and Manner of Closing8

5.2Closing8

Article VI DUE DILIGENCE PERIOD8

6.1Approval of Documents and Materials8

6.2Reliability of Information9

6.3Completion of Due Diligence Period9

6.4Assumed Service Agreements9

Article VII9

7.1Access9

Article VIII TITLE AND SURVEY10

8.1Title and Survey10

8.2Title Updates10

8.3Encumbrances11

8.4Seller’s Failure to Remove11

Article IX RISK OF LOSS11

9.1Casualty11

9.2Condemnation11

Article X OPERATION OF THE PROPERTY12

i

10.1Operations12

10.2Tenant Defaults; Proceedings12

10.3Services Agreements; Leases12

10.4Tenant Inducement Costs13

Article XI CLOSING PRORATIONS AND ADJUSTMENTS; PAYMENT OF CLOSING COSTS13

11.1General13

11.2Prorations13

11.3Rents14

11.4Security Deposits16

11.5Final Adjustment After Closing16

Article XII DEFAULT17

12.1Default by Purchaser17

12.2Default by Seller17

Article XIII REPRESENTATIONS AND WARRANTIES17

13.1Seller’s Representations17

13.2Definition of Seller’s Knowledge19

13.3Purchaser’s Representations, Warranties, and Covenants20

Article XIV ESCROW PROVISIONS21

14.1Escrow Provisions21

Article XV GENERAL PROVISIONS22

15.1No Agreement Lien22

15.2Confidentiality22

15.3Headings22

15.4Brokers22

15.5Modifications23

15.6Notices23

15.7Assignment24

15.8Further Assurances24

15.9Governing Law24

15.10Non-Business Days.24

15.11Offer Only24

15.12Counterparts24

15.13E-mail or PDF Signatures24

15.14Entire Agreement; Severability24

15.15No Waiver25

15.16Limitation of Liability25

15.17Waiver of Jury Trial25

15.18Successors and Assigns25

15.19No Partnership or Joint Venture25

15.20No Recordation26

15.21Designation Agreement26

15.22Survival26

15.23Third Party Beneficiaries27

15.24Exclusivity27

15.25Access to Records Following Closing27

ii

PURCHASE AND SALE AGREEMENT

This Purchase and Sale Agreement (this “Agreement”) is dated and made as of February 3, 2026 (the “Effective Date”) by and between MDR FRANKLIN SQUARE, LLC, a Delaware limited liability company (“Seller”), having an address at P.O. Box 8436, Richmond, Virginia 23226, and PC ACQUISITIONS, LLC, a North Carolina limited liability company, having an address at 4539 Hedgemore Drive, Suite 104, Charlotte, North Carolina 28209 (“Purchaser”). Purchaser and Seller are sometimes collectively referred to herein as the “Parties” and individually as a “Party”.

RECITALS

A.Seller desires to sell and Purchaser desires to purchase all of Seller’s right, title and interest in and to the Property, upon the terms and conditions set forth in this Agreement.

B.Certain rules of construction for interpreting this Agreement are set forth on Schedule 1 attached hereto which is hereby incorporated in and constitutes part of this Agreement.

NOW, THEREFORE, in consideration of the mutual covenants and provisions contained in this Agreement, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereby agree as set forth below.

1

Notwithstanding the forgoing, the term “Property” or “Personal Property” shall not include, and specifically excludes, all confidential information and proprietary information unrelated and not reasonably applicable to the ongoing operation of the Property. Further, Seller shall not be required to disclose (i) any internal valuations, internal memorandums, internal communications (including all communications regarding the sale of the Property or negotiations therefor or regarding other internal matters pertaining to Seller), except to the extent required to confirm the Seller Representations or as is customarily provided with due diligence materials in comparable transactions, (ii) internal or third party appraisals and/or (iii) any information prepared by Seller’s legal counsel or attorney-client privileged communications (collectively, hereinafter referred to as the “Withheld Materials”).

2

except those, if any, which are herein specifically stated to survive the delivery of the Deed. No agreement or representation or warranty made in this Agreement by Seller will survive the Closing and the delivery of the Deed, unless expressly provided otherwise herein.

3

to the Property, compliance with any applicable federal, state or local law, rule or regulations or common law with respect to the Property, or the Property’s suitability for any purposes whatsoever, and any information furnished by the Released Parties in connection with this Agreement. The release and waiver set forth in this Section 1.6 is not intended and shall not be construed as (x) affecting or impairing any rights or remedies that Purchaser may have against Seller as a result of a breach of any of Seller’s Representations or any of Seller’s obligations under this Agreement which expressly survive the Closing, or (y) shifting to Purchaser any obligation, responsibility or liability that Purchaser would not otherwise have under this Agreement, at law, in equity or otherwise, including, without limitation, any liability for third party claims accruing prior to Closing; or (z) waiving or impairing any rights of subrogation or contribution Purchaser may have with respect to third party claims accruing prior to Closing.

4

following the due date therefor and prior to Escrow Agent’s receipt of such Deposit, terminate this Agreement, in which case this Agreement shall be null and void ab initio and thereafter neither party shall have any further rights or obligations to the other hereunder, except as otherwise set forth in this Agreement. The Deposit shall only become non-refundable to Purchaser in accordance with the express terms of this Agreement.

5

6

7

8

ACCESS AND INSPECTIONS

9

10

11

12

written notice from Purchaser, specifically setting forth the areas of objection within ten (10) days following receipt by Purchaser of the proposed New Service Agreement.

13

The provisions of this Section 11.2 shall survive the Closing and the delivery of the Deed.

14

15

16

17

Section 15.22 and in accordance therewith. Purchaser’s remedies in the instance that any of Seller’s Representations are untrue as of the Closing Date are limited to those set forth in Article XII.

18

19

thereof pertains, or to impose upon such Designated Representative of Seller any individual personal liability. As used herein, the term “Designated Representative of Seller” refers to C. Brent Winn, Jr., who is Chief Financial Officer of Medalist Diversified REIT, Inc., which is the General Partner of Medalist Diversified Holdings, LP, which is the Sole Member of Seller. The Designated Representative of Seller has knowledge of the matters which are the subject of Seller’s representations and warranties in Section 13.1 above.

20

21

(a)Seller hereby represents to Purchaser that Seller has not engaged any broker in connection with the sale and purchase of the Property except for JLL (the “Seller’s Broker”). Seller is

22

obligated to pay any and all brokerage commissions payable to Seller’s Broker, in accordance with a separate agreement between it and the Seller’s Broker. Seller agrees to indemnify and hold Purchaser harmless from the claims of any other party claiming a commission due it by reason of an agreement with Seller.

(b)Purchaser hereby represents to Seller that Purchaser has not engaged any broker in connection with the sale and purchase of the Property. Purchaser agrees to indemnify and hold Seller harmless from the claims of any other party claiming a commission due it by reason of an agreement with Purchaser.

(c) The provisions of this Section 15.4 will survive the Closing and the delivery of the Deed or termination of this Agreement.

To Seller: | MDR Franklin Square, LLC |

P.O. Box 8436

Richmond, Virginia 23226

Attention: Brent Winn, Chief Financial Officer

Email: bwinn@medalistreit.com

With a copy to: | Maynard Nexsen PC |

4141 Parklake Ave., Suite 200

Raleigh, North Carolina 27612

Attention: Alex Serkes

Email: ASerkes@maynardnexsen.com

To Purchaser:PC Acquisitions, LLC

4539 Hedgemore Drive, Suite 104

Charlotte, North Carolina 28209

Attention: Michael Threlkeld

Email: michael@piedmontcapitalre.com

With a copy to:Nelson Mullins Riley & Scarborough LLP

301 South College Street, Suite 2300

Charlotte, North Carolina 28202

Attention: James M. Tucker, Esq.

Email:james.tucker@nelsonmullins.com

All Notices given in accordance with this Section will be deemed to have been received three (3) business days after having been deposited in any mail depository regularly maintained by the United States

23

Postal Service, if sent by certified mail, on the date delivered if by personal delivery or electronic mail (without notice of delivery rejection or kickback), or one (1) business day after having been deposited with a nationally recognized overnight delivery service, if sent by overnight delivery, or on the date delivery is refused, as indicated on the return receipt or the delivery records of the delivery service, as applicable. Notices given by counsel to a party in accordance with the above shall be deemed given by such party.

24

parties, nor any representations made by either party relative to the subject matter hereof, which are not expressly set forth herein. If any portion of this Agreement becomes or is held to be illegal, null or void or against public policy, for any reason, the remaining portions of this Agreement will not be affected thereby and will remain in force and effect to the fullest extent permissible by law.

25

The provisions of this Section 15.21 will survive the Closing and the delivery of the Deed.

26

Purchaser gives Seller written notice of such a breach and Seller notifies Purchaser of Seller’s commencement of a cure, commences to cure and thereafter terminates such cure effort, Purchaser shall have an additional thirty (30) days from the date of such termination within which to commence an action at law for damages as a consequence of Seller’s failure to cure. The Survival Period referred to herein shall apply to known as well as unknown breaches of such covenants, indemnities, warranties or representations. Purchaser’s waiver(s) and release(s) set forth in Sections 1.6 and 1.7 shall apply fully to liabilities under such covenants, indemnities, representations and warranties and is hereby incorporated by this reference. Purchaser specifically acknowledges that such termination of liability represents a material element of the consideration to Seller. The limitation as to Seller’s liability in this Section 15.22 does not apply to Seller’s or Purchaser’s liability with respect to prorations and adjustments under Article XI.

Notwithstanding any contrary provision of this Agreement, if Seller becomes aware during the pendency of this Agreement prior to Closing of any matters which make any of its representations or warranties untrue in any material respect, Seller shall promptly disclose such matters to Purchaser in writing. In the event that Seller so discloses any matters which make any Seller’s representations and warranties so untrue in any material respect or in the event that Purchaser otherwise becomes aware during the pendency of this Agreement prior to Closing of any matters which so make any of Seller’s representations or warranties untrue in any material respect, Seller shall bear no liability for such matters (provided that such untruth is not the result of Seller’s breach of any express covenant set forth in this Agreement), but shall have the opportunity to cure such matters prior to Closing. If Seller fails to cure such matters prior to Closing, or indicates to Purchaser that it does not intend to cure such matters prior to Closing, then Purchaser shall have the right to elect in writing on or before the Closing Date, (i) to waive such matters and complete the purchase of the Property without reduction of the Purchase Price in accordance with the terms of this Agreement, or (ii) as to any matters disclosed following the expiration of the Due Diligence Period, to terminate this Agreement if the failure of such representations or warranties would, individually or in the aggregate, result in an adverse impact or cost on or to the Property or Purchaser.

No claim for a breach of any of Seller’s Representations shall be actionable or payable if such breach is due to or is based on a condition, state of facts or other matter that was known to Purchaser or disclosed to Purchaser or its Affiliate in this Agreement, the Property Information Documents, the Closing Documents or an estoppel certificate, in each case, with reasonable specificity, or in writing delivered to Purchaser or its Affiliate prior to Closing.

27

reasonable manner in connection with any reconciliation or audit of tenant expenses, and such obligation shall survive Closing for a period of one (1) year following Closing.

[The Remainder of the Page is Intentionally Blank]

28

IN WITNESS WHEREOF, this Agreement has been duly executed and delivered by the parties hereto, as of the Effective Date.

a Delaware limited liability company

By: MEDALIST DIVERSIFIED HOLDINGS, LP

a Delaware limited partnership

Its: Sole Member

By: MEDALIST DIVERSIFIED REIT, INC.

a Maryland corporation

Its: General Partner

By: | /s/ C. Brent Winn, Jr. |

Name: | C. Brent Winn, Jr. |

Its: | Chief Financial Officer |

PURCHASER:

PC ACQUISITIONS, LLC,

a North Carolina limited liability company

By: | /s/ Chris Lingerfelt |

Name: | Chris Lingerfelt |

Its: | Partner |

AGREEMENT OF ESCROW AGENT

The undersigned has executed this Agreement solely to confirm its agreement to (a) hold the Escrow Funds in escrow in accordance with the provisions hereof and (b) comply with the provisions of Article XIV and Section 15.21.

CHICAGO TITLE INSURANCE COMPANY

By: ____________________________

Name: __________________________

Title: ___________________________

SCHEDULE AND EXHIBITS

Schedule 1 | Rules of Construction |

Schedule 2 | Existing Tenants & Leases |

Schedule 3 | Intellectual Property Rights |

Schedule 4 | Existing Service Agreements |

Schedule 5 | Reserved |

Schedule 6 | Seller Tenant Inducement Costs |

Schedule 7 | Reserved |

Schedule 8 | Deferred Rents |

Schedule 9 | Existing Security Deposits |

Schedule 10 | Pending Litigation Matters |

| |

Exhibit A | Legal Description |

Exhibit B | Form of Deed |

Exhibit C | Form of Assignment and Assumption Agreement |

Exhibit D | Form of FIRPTA Certificate |

Exhibit E | Form of Bill of Sale |

Exhibit F | Form of Tenant Estoppel Certificate |

Exhibit G | Form of Tenant Notice Letter |

Exhibit H | Access Agreement |

SCHEDULE 1

RULES OF CONSTRUCTION

(a)References in this Agreement to numbered Articles and Sections are references to the Articles and Sections of this Agreement. References to any numbered or lettered Exhibits or Schedules are references to the Exhibits or Schedules attached to this Agreement, all of which are incorporated in and constitute a part of this Agreement. Article, Section, Exhibit and Schedule captions are for reference only and do not describe or limit the substance, scope or intent of the individual Articles, Sections, Exhibits or Schedules.

(b)The terms “include”, “including” and similar terms are construed as if followed by the phrase “without limitation” unless such words or the words “but not limited to” already immediately follow.

(c)The terms “Land”, “Improvements”, “Fixtures and Personal Property” and “Property” are construed as if followed by the phrase “or any part thereof”.

(d)The singular of any word includes the plural and the plural includes the singular. The use of any gender includes all genders.

(e)The terms “person”, “party” and “entity” include natural persons, firms, partnerships, limited liability companies and partnerships, corporations and any other public or private legal entity.

(f)The term “provisions” includes terms, covenants, conditions, agreements and requirements.

(g)The term “amend” includes modify, supplement, renew, extend, replace or substitute and the term “amendment” includes modification, supplement, renewal, extension, replacement and substitution.

(h)Reference to any specific law or to any document or agreement, includes any future amendments, modifications, supplements and replacements to the law, document or agreement, as the case may be.

(i)No inference or construction or construction in favor of or against a party may be drawn from the fact that the party drafted this Agreement but shall be construed as if both parties prepared this Agreement.

(j)All obligations, rights, remedies and waivers contained in this Agreement will be construed as being limited only to the extent required to be enforceable under the Law.

(k)The term “business day” means any day other than Saturday or Sunday or legal holiday in the State of North Carolina.

SCHEDULE 2

EXISTING TENANTS & LEASES

| 1. | Commercial Lease between Seller and Allen Tate, Inc. dated October 18, 2018. |

| a. | Letter Notice re: Expansion Option dated November 18, 2022. |

| b. | Sublease Agreement between Allen Tate Real Estate, LLC, as Tenant, and Howard Hanna Financial Services, Inc. dba: Howard Hanna Mortgage Services, as Subtenant, dated March 6, 2023. |

| c. | Lease Modification Agreement No. 1 dated February 28, 2024. |

| d. | Lease Modification Agreement No. 2 dated July 3, 2024. |

| 2. | Commercial Lease between Seller and Gastonia ATP, LLC d/b/a Altitude Trampoline Park dated May 8, 2018. |

| a. | First Amendment to Commercial Lease dated June 11, 2018. |

| b. | First Amendment to Commercial Lease dated February 5, 2020. |

| c. | Second Amendment to Commercial Lease dated December 3, 2020. |

| 3. | U.S. Government Lease No. DACA215260100700 between Landlord and The United States of America dated January 28, 2026. |

| 4. | Lease Agreement between The Ghazi Company, LLC and Ish Moore, Inc. dba Ashley Furniture Home Store dated December 30, 2005. |

| a. | Assignment and Assumption of Lease Agreement between The Ghazi Company, LLC and Virginia Avenue, LLC dated January 30, 2006. |

| b. | Rent Rebate Agreement between Virginia Avenue, LLC and Ish Moore, Inc. dated August _____, 2007. |

| c. | Letter Notice dated March 26, 2012. |

| d. | Amendment to Lease dated October 23, 2020. |

| e. | Lease Amendment No. 2 dated June 26, 2025. |

| f. | Landlord Subordination Agreement. |

| 5. | Commercial Lease between Seller and Tom and Han Truong dba Celena Salon Spa dated June 2, 2015. |

| a. | Renewal Letter dated October 20, 2020. |

| b. | First Amendment to Commercial Lease dated July 2, 2025. |

| c. | Assignment, Assumption and Consent Agreement between Seller, Tom Truong and Hahn Truong dba Celena Salon Spa, and M&C Nails and Spa, LLC dated November 18, 2025. |

| 6. | Commercial Lease between Virginia Avenue, LLC and Cycle Gear, Inc. dba Cycle Gear dated August 23, 2007. |

| a. | Letter Notice dated March 26, 2012. |

| b. | First Amendment to Commercial Lease dated May 14, 2014. |

| c. | Letter Notice dated June 15, 2020. |

| d. | Second Amendment of Lease dated September 12, 2024. |

| 7. | Commercial Lease between Seller and Eyemart Express LLC dated December 4, 2019. |

| a. | Term Expiration Agreement dated August 21, 2020. |

| b. | First Amendment to Commercial Lease dated January 2, 2025. |

| 8. | Commercial Lease between Seller and Fresh Dental LLC dated October 10, 2017. |

| a. | Landlord’s Waiver dated December 8, 2017. |

| b. | Assignment and Assumption of Lease dated July 30, 2020 between Fresh Dental Partners LLC, GD NC Manager, LLC, Ganglani DMD, PLLC, and Seller. |

| c. | Lease Amendment No. 1 dated October 6, 2025. |

| 9. | Commercial Lease between Seller and Gaston County Farm Bureau, Inc. dated November 29, 2016. |

| a. | Renewal Letter dated June 28, 2023. |

| b. | Lease Renewal No. 1 dated December 2, 2023. |

| c. | Confirmation of Lease Dates Agreement dated December 13, 2023. |

| 10. | Shopping Center Lease between Seller and IVXpress, Inc. dated October 16, 2024. |

| a. | Letter of Acceptance of Premises and Commencement Agreement dated November 1, 2024. |

| 11. | Shopping Center Lease between Seller and IvyRehab Gastonia South LLC dated May 20, 2025. |

| a. | Lease Modification No. 1 dated June 18, 2025. |

| 12. | Commercial Lease between Seller and Kure Corp. dated August 5, 2014. |

| a. | Letter Notice re: Commencement Date dated December 15, 2014. |

| b. | Lease Modification No. 1 dated September 9, 2024. |

| 13. | Commercial Lease between Seller and Lendmark Financial Services LLC dated March 20, 2014. |

| a. | Letter Notice re: Commencement Date dated May 21, 2014. |

| b. | Renewal Letter dated November 7, 2018. |

| c. | Lease Modification No. 1 dated November 12, 2023. |

| 14. | Lease Agreement between The Ghazi Company, LLC and Moe’s Southwest Grill, LLC dated January 19, 2006. |

| a. | Assignment and Assumption of Lease Agreement between The Ghazi Company, LLC and Virginia Avenue, LLC dated January 30, 2006. |

| b. | Assignment of Lease Agreement between Moe’s Southwest Grill, LLC and Paragon Capital, LLC dated August 28, 2007. |

| c. | Assignment and Amendment of Lease between Paragon Capital, LLC, Brandstormers, LLC, and Virginia Avenue, LLC dated February 25, 2010. |

| d. | Notice Letter dated March 26, 2012. |

| e. | Extension Letter dated October 18, 2018. |

| f. | Assignment and Assumption of Lease and Landlord Consent and Second Modification of Lease Agreement between Seller, Brandstormers, LLC, and Sterling Restaurants, LLC. |

| g. | Amendment to Lease dated July 19, 2020. |

| h. | Landlord’s Lien Waiver dated November 17, 2024. |

| 15. | Commercial Lease between Seller and Ready Set Glow, LLC dba Monster Mini Golf dated April 21, 2022. |

| a. | First Amendment to Commercial Lease dated January 4, 2023. |

| 16. | Commercial Lease between Seller and Franklin Square Suites LLC dba My Salon Suite dated June 3, 2022. |

| a. | Waiver of Landlord’s Lien dated July 11, 2024. |

| 17. | Commercial Lease between Seller and Panagiotis Xenakis PEE GEE Gastonia, Inc. t/a Showmars dated October 11, 2016. |

| 18. | Temporary License Agreement between Seller and Main Source Trading Corp. dated October 24, 2025. |

| 19. | Shopping Center Lease between Seller and RnR Royal Ruby, LLC dated March 1, 2025. |

| a. | Shopping Center Lease Addendum dated March 17, 2025. |

| 20. | Commercial Lease between Seller and Simulate Golf, LLC dated January 12, 2023. |

| a. | Lease Modification No. 1 dated January 14, 2025. |

| 21. | Lease Agreement between Virginia Avenue, LLC and Thai House, Inc. dated April 9, 2008. |

| a. | Letter Notice dated March 26, 2012. |

| b. | Letter Notice dated June 26, 2012. |

| c. | Letter Notice dated June 9, 2014. |

| d. | First Amendment to Lease Agreement dated October 1, 2015. |

| e. | Letter Notice dated May 11, 2018. |

| f. | Assignment of Lease between Seller, Thai House, Inc., and OG Tha Gyee, LLC dated March 4, 2019. |

| g. | Consent to Assignment and Assignment of Lease between OG Tha Gyee, LLC dba Kitchen Mae Kong, Pan Pwint Family, LLC dba Thai Table, and Seller dated January 22, 2025. |

| h. | Lease Modification No. 1 dated April 23, 2025. |

| 22. | Lease Agreement between Virginia Avenue, LLC and Hoot Owl Ventures, LLC dated May 28, 2013. |

| a. | Renewal Letter dated March 1, 2019. |

| b. | Lease Modification Agreement No. 1 dated September 18, 2023. |

SCHEDULE 3

INTELLECTUAL PROPERTY RIGHTS

None.

SCHEDULE 4

EXISTING SERVICE AGREEMENTS

SCHEDULE 5

RESERVED

SCHEDULE 6

SELLER TENANT INDUCEMENT COSTS

None.

SCHEDULE 7

RESERVED

SCHEDULE 8

DEFERRED RENTS

None.

SCHEDULE 9

EXISTING SECURITY DEPOSITS

| 1. | My Salon Suites - $2,410.83. |

| 2. | Fresh Dental - $4,129.58. |

| 3. | Hoot Owl Ventures - $2,303.75. |

| 4. | Ivy Rehab Gastonia South - $5,399.34. |

| 5. | Lendmark Financial Services - $3,108.08. |

| 6. | M&C Nails and Spa - $10,000.00. |

| 7. | MVRB2 - $3,666.67. |

| 8. | Showmars - $5,458.33. |

| 9. | Thai Table - $18,516.00. |

| 10. | Monster Mini Golf - $18,347.96. |

| 11. | RNR Café/Gifts - $2,276.51. |

| 12. | Simulate Golf - $2,410.83. |

SCHEDULE 10

PENDING LITIGATION MATTERS

None.

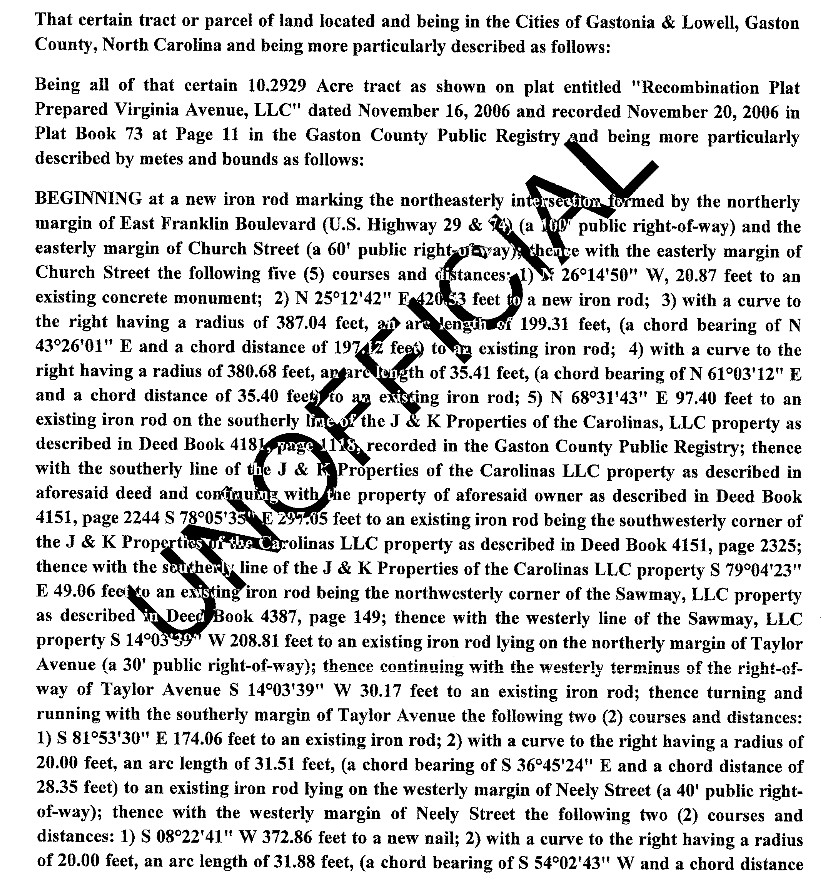

EXHIBIT A

LEGAL DESCRIPTION

Lying and being situate in Gaston County, North Carolina, and being more particularly described as follows:

EXHIBIT B

FORM OF SPECIAL WARRANTY DEED

Excise Tax: $________

Parcel Identifier Nos.: 0414-37-3195

Mail after recording to: Nelson Mullins LLP, James M. Tucker, Esq., One Wells Fargo, 301 South College Street, Suite 2300, Charlotte, North Carolina 28202

This instrument was prepared by: Nelson Mullins LLP, James M. Tucker, Esq., One Wells Fargo, 301 South College Street, Suite 2300, Charlotte, North Carolina 28202

THIS DEED made effective as of the ____ day of _____________, 20__, by and between:

GRANTORGRANTEE

MDR FRANKLIN SQUARE, LLC, a Delaware limited liability company P.O. Box 8436 Richmond, VA 23226 | __________________________________, a _________________________________ 4539 Hedgemore Drive, Suite 104 Charlotte, North Carolina 28209 |

The designation Grantor and Grantee as used herein shall include said parties, their heirs, successors, and assigns, and shall include singular, plural, masculine, feminine or neuter as required by context.

WITNESSETH, that the Grantor, for a valuable consideration paid by the Grantee, the receipt of which is hereby acknowledged, has and by these presents does grant, bargain, sell and convey unto the Grantee in fee simple, all that certain lot or parcel of land situated in Gaston County, North Carolina and more particularly described as follows (the “Property”):

See “Exhibit A” attached hereto and incorporated herein by this reference.

No portion of the Property herein conveyed includes the primary residence of Grantor.

The Property was acquired by the Grantor by instrument recorded in Book 4908 at Page 2252 with the Gaston County Register of Deeds.

TO HAVE AND TO HOLD the aforesaid lot or parcel of land and all privileges, estates, interests and appurtenances thereto belonging to the Grantee in fee simple.

And the Grantor covenants with the Grantee, that Grantor has done nothing to impair such title as Grantor received, and Grantor will warrant and defend the title against the lawful claims of all persons claiming by, under or through Grantor, other than the following exceptions:

See “Exhibit B” attached hereto and incorporated herein by this reference.

[THE REMAINDER OF THE PAGE IS INTENTIONALLY BLANK]

IN WITNESS WHEREOF, the Grantor has executed the foregoing as of the day and year first above written.

GRANTOR:

MDR FRANKLIN SQUARE, LLC,

a Delaware limited liability company

By: MEDALIST DIVERSIFIED HOLDINGS, LP

a Delaware limited partnership

Its: Sole Member

By: MEDALIST DIVERSIFIED REIT, INC.

a Maryland corporation

Its: General Partner

By: ___________________________________

Name: C. Brent Winn, Jr.

Its: Chief Financial Officer

STATE OF ______________)

COUNTY OF ____________ )

I certify that the following person(s) personally appeared before me this day, each acknowledging to me that he or she signed the foregoing document: ____________________________________

name(s) of principal(s)

Date:____________________, 2026_________________________________________

(official signature of Notary)

_____________________________, Notary Public

(Notary’s printed or typed name)

(Official Seal)My commission expires: _____________________

Exhibit “A”

TO SPECIAL WARRANTY DEED

[Legal Description]

Lying and being situate in Gaston County, North Carolina, and being more particularly described as follows:

Exhibit “B”

TO SPECIAL WARRANTY DEED

[List of Permitted Exceptions]

1. | Taxes or assessments for the year 20__, and subsequent years, not yet due or payable. |

2. | [TO BE COMPLETED] |

EXHIBIT C

ASSIGNMENT AND ASSUMPTION AGREEMENT

This ASSIGNMENT AND ASSUMPTION AGREEMENT (this “Assignment”), is entered as of _______________, 2026 by and between MDR FRANKLIN SQUARE, LLC, a Delaware limited liability company (“Assignor”) and __________, a __________ (“Assignee”).

WHEREAS, in accordance with that certain Purchase and Sale Agreement (as amended and assigned, the “Agreement”) dated as of ____________, 2026, between Assignor, as Seller, and Assignee, as Purchaser, Assignor has agreed to convey to Assignee that certain Property located in Gaston County, North Carolina, and as more particularly described on Exhibit A to the Agreement (capitalized terms used in this Assignment and not specifically defined herein will have the meanings ascribed to them in the Agreement); and

WHEREAS, Assignor desires to assign its interests in and Assignee desires to accept the assignment of Assignor’s interest in the Leases and Service Agreements and various tangible and intangible property affecting the Property, on the terms and conditions provided herein including Assignee’s assumption of Assignor’s obligations under the Leases and Service Agreements; and

NOW, THEREFORE, IN CONSIDERATION of the purchase of the Property by Assignee from Assignor, and for $10.00 and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1.Assignment of Leases. Assignor hereby assigns and transfers to Assignee as of the date hereof all of Assignor’s right, title and interest in and to the Leases described on Exhibit A attached hereto and made a part hereof including any security deposits thereunder held by Assignor and any lease guaranties pertaining to the Leases. Assignee hereby accepts the assignment of all of Assignor’s right, title and interest in and to the Leases, and assumes (i) all the obligations of Assignor under and arising out of the Leases which are applicable to the period from and after the date hereof and (ii) the obligations of Assignor respecting the security deposits turned over to Assignee and Assignee will hold Assignor harmless and free from any liability with reference to the security deposits to the extent same are received by or credited to Assignee.

2.Assignment of Service Agreements. Assignor hereby assigns and transfers to Assignee as of the date hereof all of Assignor’s right, title and interest in and to the Service Agreements with the service providers described on Exhibit B attached hereto and made a part thereof. Assignee hereby accepts the assignment of all of Assignor’s right, title and interest in and to said Service Agreements, and assumes all the obligations of Assignor under and arising out of the Service Agreements which are applicable to the period from and after the date hereof.

3.Assignment of Intangible Property. Assignor hereby assigns and transfers to Assignee as of the date hereof, to the extent assignable, all of Assignor’s right, title and interest in and to the Intangible Property. Assignee hereby accepts the assignment of all of Assignor’s right, title and interest in and to the Intangible Property, and assumes all the obligations of Assignor under and arising out of the Intangible Property that are applicable to the period from and after the date hereof.

4.Non-recourse to Assignor. The assignments and transfers of Assignor made pursuant to this Agreement and Assignee’s acceptance of the same are without any representation (other than the representation of due execution set forth in Section 5 hereof) or warranty by Assignor and without any right of recourse against Assignor.

5.Successors and Assigns. All of the covenants, terms and conditions set forth herein shall be binding upon and inure to the benefit of the parties hereto and their respective heirs, successors and assigns.

6.Authority. Assignor and Assignee covenant and represent to each other that they have the power and authority to enter into this Agreement and that the persons duly executing this Agreement on behalf of Assignor and Assignee, respectively, have the requisite power and authority to do so.

7.Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which taken together shall constitute one and the same instrument.

[The Remainder of the Page is Intentionally Blank]

IN WITNESS WHEREOF, the parties hereto have executed this Assignment as of the date first above written.

ASSIGNOR:

MDR FRANKLIN SQUARE, LLC,

a Delaware limited liability company

By: MEDALIST DIVERSIFIED HOLDINGS, LP

a Delaware limited partnership

Its: Sole Member

By: MEDALIST DIVERSIFIED REIT, INC.

a Maryland corporation

Its: General Partner

By: ___________________________________

Name: C. Brent Winn, Jr.

Its: Chief Financial Officer

[Signatures Continue on the Following Page]

ASSIGNEE:

_______________________________,

_______________________________

By: ____________________________

Name: __________________________

Title: ___________________________

EXHIBIT D

FIRPTA CERTIFICATE

CERTIFICATE REGARDING FOREIGN INVESTMENT

IN REAL PROPERTY TAX ACT

(ENTITY TRANSFEROR)

Section 1445 of the Internal Revenue Code provides that a transferee (purchaser) of a U.S. real property interest must withhold tax if the transferor (seller) is a foreign person. For U.S. tax purposes (including section 1445), the owner of a disregarded entity (which has legal title to a U.S. real property interest under local law) will be the transferor of the property and not the disregarded entity. To inform the transferee (purchaser) that withholding of tax is not required upon the disposition of a U.S. real property interest by MDR FRANKLIN SQUARE, LLC, a Delaware limited liability company (“Transferor”) the undersigned hereby certifies, in the capacity stated below, but not in his or her individual capacity, the following on behalf of Transferor:

1.Transferor is not a foreign corporation, foreign partnership, foreign trust, or foreign estate (as those terms are defined in the Internal Revenue Code and Income Tax Regulations).

2.Transferor’s Federal Employer Identification Number is ____________.

3.Transferor’s office address is: P.O. Box 8436, Richmond, Virginia 23226.

4.The address or description of the property which is the subject matter of the disposition is:

Transferor understands that this certification may be disclosed to the Internal Revenue Service by transferee and that any false statement contained herein could be punished by fine, imprisonment, or both.

Transferor declares that it has examined this certification and to the best of its knowledge and belief, it is true, correct and complete, and further declares that the individual executing this certification on behalf of Transferor has full authority to do so.

[The Remainder of the Page is Intentionally Blank]

TRANSFEROR:

MDR FRANKLIN SQUARE, LLC,

a Delaware limited liability company

By: MEDALIST DIVERSIFIED HOLDINGS, LP

a Delaware limited partnership

Its: Sole Member

By: MEDALIST DIVERSIFIED REIT, INC.

a Maryland corporation

Its: General Partner

By: ___________________________________

Name: C. Brent Winn, Jr.

Its: Chief Financial Officer

DATED: _____________, 2026

EXHIBIT E

BILL OF SALE

This BILL OF SALE (this “Bill of Sale”), is made as of _________, 2026 by MDR FRANKLIN SQUARE, LLC, a Delaware limited liability company (“Seller”), in favor of , a (as successor-in-interest to PC Acquisitions, LLC, a North Carolina limited liability company) (“Purchaser”).

W I T N E S S E T H:

WHEREAS, Seller and Purchaser entered into that certain Purchase and Sale Agreement, dated as of , 2026 (the “Agreement”). Any term with its initial letter capitalized and not otherwise defined herein shall have the meaning set forth in the Agreement.

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Seller does hereby absolutely and unconditionally give, grant, bargain, sell, transfer, set over, assign, convey, release, confirm and deliver to Purchaser all of Seller’s right, title and interest in and to the Fixtures and Personal Property without representation or warranty of any kind whatsoever except as set forth in and subject to the terms of the Agreement.

WITH RESPECT TO ALL MATTERS TRANSFERRED, WHETHER TANGIBLE OR INTANGIBLE, PERSONAL OR REAL, SELLER EXPRESSLY DISCLAIMS A WARRANTY OF MERCHANTABILITY AND WARRANTY FOR FITNESS FOR A PARTICULAR USE OR ANY OTHER WARRANTY EXPRESSED OR IMPLIED THAT MAY ARISE BY OPERATION OF LAW OR UNDER THE UNIFORM COMMERCIAL CODE FOR THE STATE IN WHICH THE PROPERTY IS LOCATED (OR ANY OTHER STATE).

This Bill of Sale shall be binding upon and inure to the benefit of the successors, assigns, personal representatives, heirs and legatees of Purchaser and Seller.

This Bill of Sale shall be governed by, interpreted under, and construed and enforceable in accordance with, the laws of the State of North Carolina.

[The Remainder of the Page is Intentionally Blank]

IN WITNESS WHEREOF, Seller has executed this Bill of Sale as of the date first above written.

SELLER:

MDR FRANKLIN SQUARE, LLC,

a Delaware limited liability company

By: MEDALIST DIVERSIFIED HOLDINGS, LP

a Delaware limited partnership

Its: Sole Member

By: MEDALIST DIVERSIFIED REIT, INC.

a Maryland corporation

Its: General Partner

By: ___________________________________

Name: C. Brent Winn, Jr.

Its: Chief Financial Officer

EXHIBIT F

TENANT ESTOPPEL CERTIFICATE

TO: | MDR Franklin Square, LLC (“Landlord”) |

Attn: Brent Winn

P.O. Box 8436

Richmond, Virginia 23226

and:PC Acquisitions, LLC (“Purchaser”)

Attn: Michael Thelkeld

4539 Hedgemore Drive

Suite 104, Charlotte, North Carolina 28209

RE:Shops at Franklin Square (the “Shopping Center”)

Property Address: ______________ Suite No. _______ (the “Premises”):

Lease Agreement dated_________

Between MDR Franklin Square, LLC, a Delaware limited liability company, as Landlord, and _______________________, as Tenant (as amended, modified or supplemented by the items set forth on Annex I, the “Lease”)

The undersigned tenant (“Tenant”) hereby certifies to Purchaser and Landlord as follows:

1.The Premises consists of a total of _____ rentable square feet.

2.The Lease is in full force and effect, Tenant is the current Tenant under the Lease, and the Lease has not been canceled, modified, assigned, extended or amended except as set forth on Annex 1, attached hereto.

3.The Commencement Date for the Lease occurred on MM/DD/YYYY, and the Lease terminates on MM/DD/YYYY, subject to the following Tenant renewal options and/or early termination rights, if any: __________________

4.The fixed minimum rent presently being paid by Tenant is $___ per square foot, or $______ per month and has been paid through ____, 2026. Tenant has not prepaid Minimum Rent or any of the additional charges payable by Tenant as set forth in Section 5 hereof (“Additional Rent”), except $___. The amount of the security deposit is $____. Tenant commenced payment of Minimum Rent and Additional Rent under the Lease on MM/DD/YYYY.

5.Tenant acknowledges the following are the current additional monthly payments due to the Landlord pursuant to the Lease, subject to any applicable reconciliation for charges based on estimates pursuant to the terms of the Lease:

CAM:$_____

Taxes:$_____

Insurance:$_____

Marketing:$_____

Other:$_____

6.All work to be performed for Tenant under the Lease has been performed and completed as required by the Lease and has been accepted by Tenant, and Tenant is currently occupying the Premises. Tenant does not have any unused improvement allowance, except ______. There is no free rent and no other funds owed to Tenant under the Lease, except ______.

7.As of the date of this Tenant Estoppel Certificate, (i) to Tenant’s knowledge, Landlord is not in default under any of the terms, conditions or covenants of the Lease to be performed or complied with by Landlord, and no event has occurred and no circumstance exists which, with the passage of time or the giving of notice by Tenant, or both, would constitute such a default, (ii) Tenant is not in default under any of the terms, conditions or covenants of the Lease to be performed or complied with by Tenant, and no event has occurred and no circumstance exists which, with the passage of time or the giving of notice by Landlord, or both, would constitute such a default, (iii) to Tenant’s knowledge, Tenant has no existing defenses, offsets or credits against the payment of Rent and other sums due or to become due under the Lease or against the performance of any other of Tenant’s obligations under the Lease or any claims against the Landlord, and (iv) Tenant has no right or claim under the Lease arising from any pandemic or any pandemic-related governmental mandates or regulations.

8.Except as set forth on Annex 1, there are no agreements, written or oral, between Tenant and the Landlord with respect to the Lease, the Premises, parking and/or the Shopping Center.

9.Tenant has no option or right of first refusal to purchase the Premises or the Shopping Center. Tenant has no right to lease additional or different space in the Shopping Center.

10.Tenant has not entered into any sublease, assignment, or any other agreement transferring any of its interest in the Lease or the Premises, except as follows: _____.

The statements contained herein may be relied upon by the Landlord, the Purchaser, and the Purchaser’s lender.

If a blank in this document is not filled in, the blank will be deemed to read “none”.

Capitalized terms used but not otherwise defined herein shall have the meaning given to such terms in the Lease.

If Tenant is a corporation or other entity, the undersigned signatory is duly appointed officer or other signatory and has the authority to bind the Tenant.

Dated this _____ day of _______, 2026.

TENANT:

__________________,

_____________________________

By: ____________________________

Name: __________________________

Title: ___________________________

Annex 1

The Lease

EXHIBIT G

TENANT NOTICE LETTER

_________________

_________________

_________________

TO:All Tenants at Shops at Franklin Square (the “Property”)

RE:Notification Regarding Change of Ownership

This letter is to notify you as a Tenant at the referenced Property, that the Property has been sold by MDR Franklin Square, LLC, a Delaware limited liability company (“Seller”), to _______________________ (“Purchaser”). As of the date hereof, your Lease has been assigned by Seller to Purchaser. Consequently, Purchaser is now your landlord. From the date of this letter, any and all unpaid rent as well as all future rent, or any other amounts due under the terms of your Lease, shall be paid to Purchaser. You will receive a separate notice from Purchaser setting forth instructions regarding where all future rent payments under the lease shall be made. All other formal communications and inquiries in connection with your Lease should be delivered to Purchaser at the following address:

______________________________

______________________________

_______________________________

________________________________

As part of the sale, all refundable tenant deposits, if any, actually held by Seller with respect to the Property have been transferred to, and Seller’s obligations with respect to such deposits have been assumed by, Purchaser as of the date of this letter. Purchaser is now responsible to account to you under the Lease and at law for the deposit(s) transferred by Seller. Any and all payments of rent (or other sums due under your Lease) hereafter paid to any party other than Purchaser shall not relieve you of the obligation of making said payment to Purchaser.

SELLER:

MDR FRANKLIN SQUARE, LLC,

a Delaware limited liability company

By: ____________________________

Name: C. Brent Winn, Jr.

Title: Authorized Signatory

[Signatures Continue on the Following Page]

PURCHASER:

______________________________,

______________________________

By: ____________________________

Name: __________________________

Title: ___________________________

EXHIBIT H

ACCESS AGREEMENT

~ See Attached ~