If such effective date or Stock Price is not set forth in the table above, then:

(i) if such Stock Price is between two Stock Prices in the table above or the effective date is between two dates in the table above, then the applicable percentage will be determined by straight-line interpolation between the percentage set forth for the higher and lower Stock Prices in the table above or the earlier and later dates in the table above, based on a 365- or 366-day year, as applicable; and

(ii) if the Stock Price is greater than $(Y x 4) (subject to adjustment in the same manner as the Stock Prices set forth in the column headings of the table above are adjusted), or less than $Y (subject to adjustment in the same manner), per share, then such percentage will be deemed to be 100% (which, for the avoidance of doubt, means there will be no increase to the base Conversion Rate).

Notwithstanding anything to the contrary, in no event will the Conversion Rate be increased to an amount that exceeds 1,029.2716 shares of Common Stock per $1,000 principal amount of Notes, which amount is subject to adjustment in the same manner as, and at the same time and for the same events for which, the Conversion Rate is required to be adjusted pursuant to Section 14.05.

(c) Adjustment of Stock Prices. The Stock Prices in the first row (i.e., the column headers) of the table above will be adjusted in the same manner as, and at the same time and for the same events for which, the Conversion Price is adjusted as a result of the operation of the provisions described in Section 14.05.

(d) Notice of Make-Whole Fundamental Change. The Company will notify Holders of each Make-Whole Fundamental Change no later than the Business Day immediately following the effective date of such Make-Whole Fundamental Change.

Section 14.05 Adjustment of Conversion Rate. The Conversion Rate shall be adjusted from time to time by the Company if any of the following events occurs, except that the Company shall not make any adjustments to the Conversion Rate if each Holder of the Notes participates (other than in the case of (x) a share split or share combination or (y) a tender or exchange offer), at the same time and upon the same terms as holders of the Common Stock and solely as a result of holding the Notes, in any of the transactions described in this Section 14.05, without having to convert its Notes, as if such Holder held a number of shares of Common Stock equal to the Conversion Rate, multiplied by the principal amount (expressed in thousands) of Notes held by such Holder.

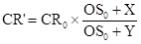

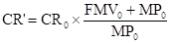

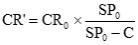

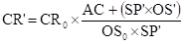

(a) If the Company exclusively issues shares of Common Stock as a dividend or distribution on shares of the Common Stock, or if the Company effects a share split or share combination, the Conversion Rate shall be adjusted based on the following formula:

108