February 5, 2026 Q4’25 Earnings

2Bloom Energy Proprietary & Confidential Forward-looking Statements and Non-GAAP Financial Measures This presentation may contain certain forward-looking statements relating to future events and expectations, including our expectation regarding the increased adoption of onsite power; that the Bloom platform will become the standard for onsite power and our positioning for long-term, profitable growth and estimates and projections for our business outlook for the 2026 fiscal year, each of which is based on current expectations, estimates, and projections about our industry, management’s beliefs, and certain assumptions made by management based on information currently available to management at the time they are made. These forward-looking statements are made pursuant to the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995 and relate to the Company’s performance on a going forward basis. Readers are cautioned that these forward-looking statements are only predictions and may differ materially from actual results, performance, and/or trends. In addition to general industry and global economic conditions, factors that could cause actual results, performance, and/or trends to differ materially from those discussed in the forward-looking statements made in this press release include, but are not limited to: (1) the emerging nature distributed energy generation and rapidly evolving market trends; (2) the significant upfront costs of Bloom’s Energy Servers and Bloom’s ability to secure financing for its products; (3) Bloom’s ability to drive cost reductions and to successfully mitigate against potential price increases; (4) Bloom’s ability to service its existing debt obligations; (5) Bloom’s ability to be successful in new markets; (6) the risk of manufacturing defects; (7) the accuracy of Bloom’s estimates regarding the useful life of its Energy Servers, (8) delays in the development and introduction of new products or updates to existing products; (9) supply constraints; (10) the availability of rebates, tax credits and other tax benefits; (11) the impact of the Inflation Reduction Act of 2022 and the One Big Beautiful Bill Act; (12) changes in the regulatory landscape; (13) Bloom’s lengthy sales and installation cycle, construction, utility interconnection and other delays related to the installation of its Energy Servers; (14) business and economic conditions and growth trends in commercial and industrial energy markets; (15) trade policies including tariffs; (16) the overall electricity generation market; (17) our ability to increase production capacity for our products in a timely and cost-effective manner; (18) any actual or perceived slowdown in the adoption of AI resulting in a slower expansion of AI data centers; (19) Bloom’s ability to protect its intellectual property; (20) the ability of current product and service backlog to ultimately be recognizable as revenue and/or (21) the risks relating to forward-looking statements and other “Risk Factors” identified from time to time in our filings with the Securities and Exchange Commission (“SEC”), including our Annual Report on Form 10-K for the fiscal year ended December 31, 2024, and subsequently filed reports, including on Form 10-Q, which filings are available from the SEC. Bloom assumes no obligation to, and does not currently intend to, update information contained in these forward-looking statements, whether as a result of new information, future events or developments, or otherwise. The Investor Relations section of Bloom’s website at investor.bloomenergy.com contains a significant amount of information about Bloom Energy, including financial and other information for investors. Bloom encourages investors to visit this website from time to time, as information is updated and new information is posted.

3Bloom Energy Proprietary & Confidential To Make Clean, Reliable Energy Affordable for Everyone in the World. Bloom’s Mission

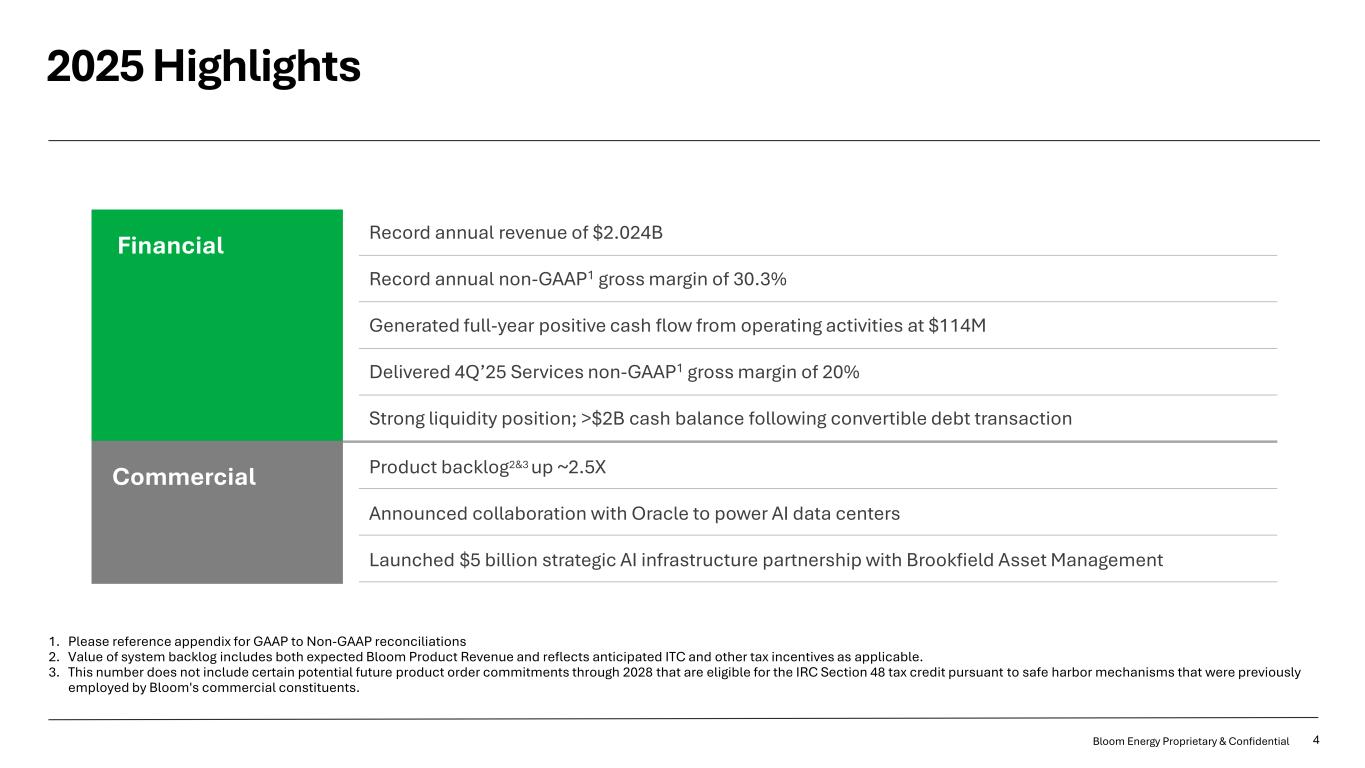

4Bloom Energy Proprietary & Confidential Financial Commercial 2025 Highlights 1. Please reference appendix for GAAP to Non-GAAP reconciliations 2. Value of system backlog includes both expected Bloom Product Revenue and reflects anticipated ITC and other tax incentives as applicable. 3. This number does not include certain potential future product order commitments through 2028 that are eligible for the IRC Section 48 tax credit pursuant to safe harbor mechanisms that were previously employed by Bloom's commercial constituents. Record annual revenue of $2.024B Record annual non-GAAP1 gross margin of 30.3% Generated full-year positive cash flow from operating activities at $114M Delivered 4Q’25 Services non-GAAP1 gross margin of 20% Strong liquidity position; >$2B cash balance following convertible debt transaction Product backlog2&3 up ~2.5X Announced collaboration with Oracle to power AI data centers Launched $5 billion strategic AI infrastructure partnership with Brookfield Asset Management

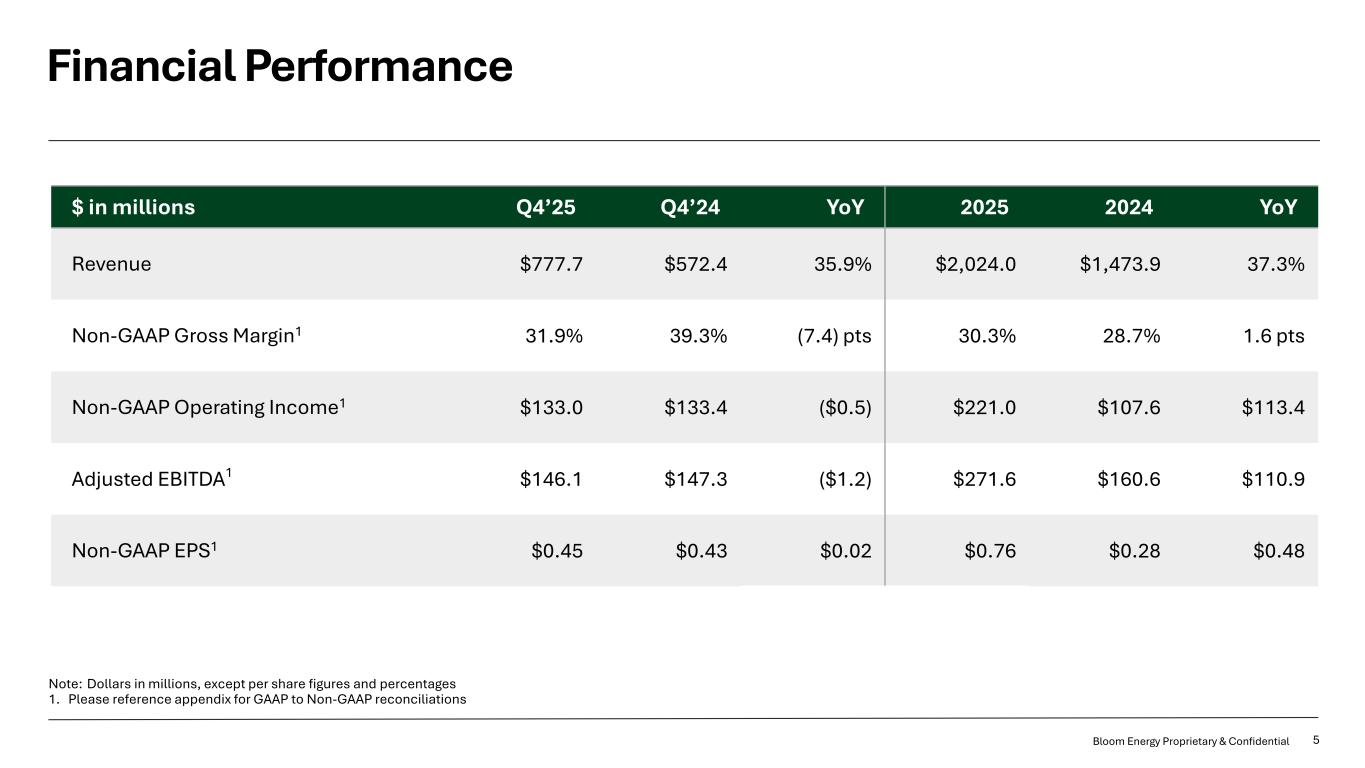

5Bloom Energy Proprietary & Confidential Financial Performance Note: Dollars in millions, except per share figures and percentages 1. Please reference appendix for GAAP to Non-GAAP reconciliations $ in millions Q4’25 Q4’24 YoY 2025 2024 YoY Revenue $777.7 $572.4 35.9% $2,024.0 $1,473.9 37.3% Non-GAAP Gross Margin1 31.9% 39.3% (7.4) pts 30.3% 28.7% 1.6 pts Non-GAAP Operating Income1 $133.0 $133.4 ($0.5) $221.0 $107.6 $113.4 Adjusted EBITDA1 $146.1 $147.3 ($1.2) $271.6 $160.6 $110.9 Non-GAAP EPS1 $0.45 $0.43 $0.02 $0.76 $0.28 $0.48

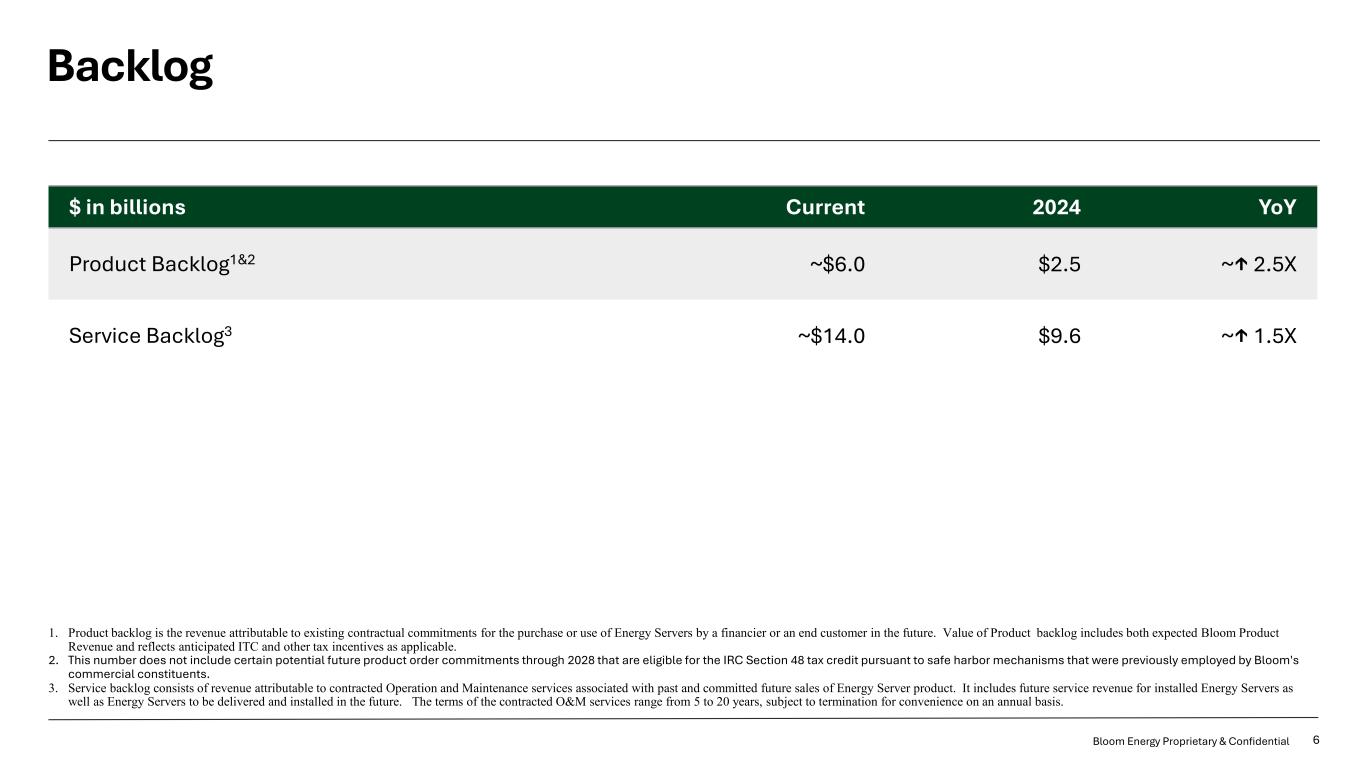

6Bloom Energy Proprietary & Confidential Backlog $ in billions Current 2024 YoY Product Backlog1&2 ~$6.0 $2.5 ~↑ 2.5X Service Backlog3 ~$14.0 $9.6 ~↑ 1.5X 1. Product backlog is the revenue attributable to existing contractual commitments for the purchase or use of Energy Servers by a financier or an end customer in the future. Value of Product backlog includes both expected Bloom Product Revenue and reflects anticipated ITC and other tax incentives as applicable. 2. This number does not include certain potential future product order commitments through 2028 that are eligible for the IRC Section 48 tax credit pursuant to safe harbor mechanisms that were previously employed by Bloom's commercial constituents. 3. Service backlog consists of revenue attributable to contracted Operation and Maintenance services associated with past and committed future sales of Energy Server product. It includes future service revenue for installed Energy Servers as well as Energy Servers to be delivered and installed in the future. The terms of the contracted O&M services range from 5 to 20 years, subject to termination for convenience on an annual basis.

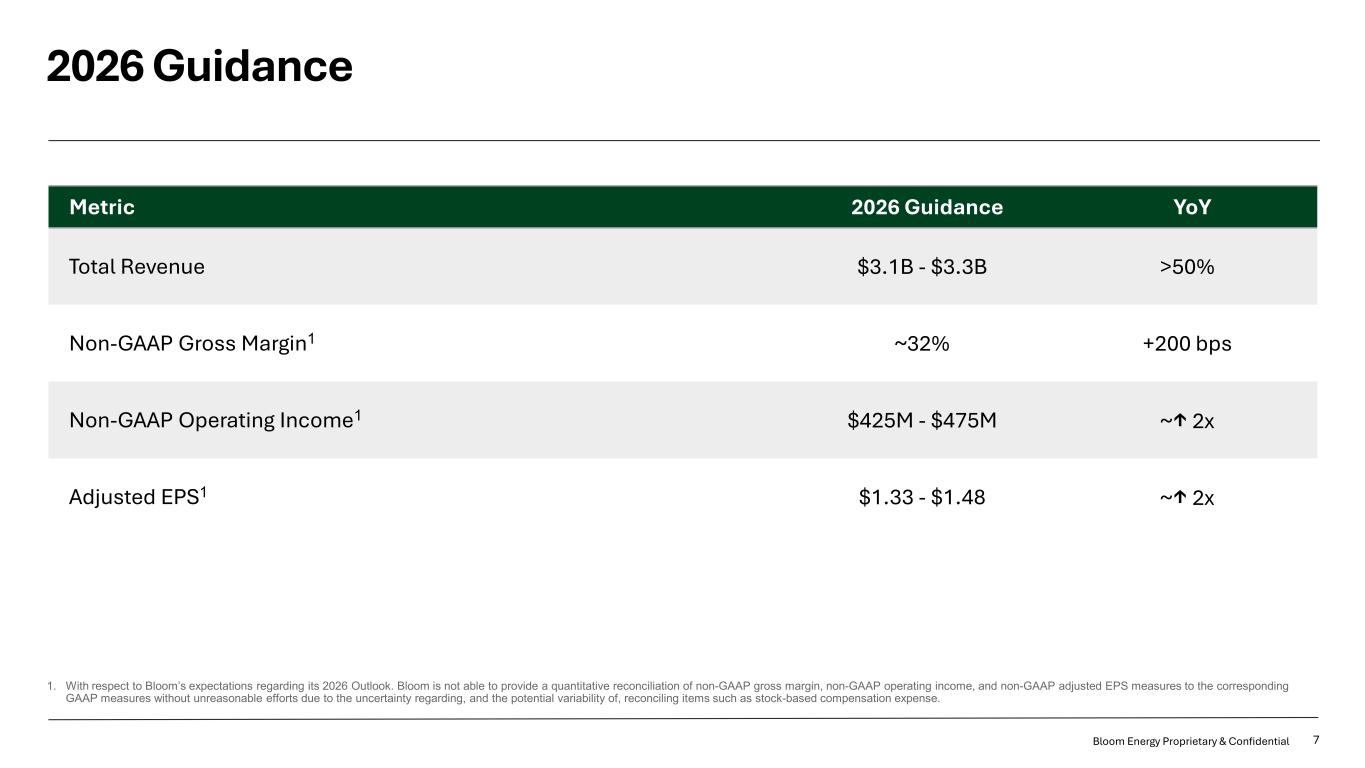

7Bloom Energy Proprietary & Confidential 2026 Guidance Metric 2026 Guidance YoY Total Revenue $3.1B - $3.3B >50% Non-GAAP Gross Margin1 ~32% +200 bps Non-GAAP Operating Income1 $425M - $475M ~↑ 2x Adjusted EPS1 $1.33 - $1.48 ~↑ 2x 1. With respect to Bloom’s expectations regarding its 2026 Outlook. Bloom is not able to provide a quantitative reconciliation of non-GAAP gross margin, non-GAAP operating income, and non-GAAP adjusted EPS measures to the corresponding GAAP measures without unreasonable efforts due to the uncertainty regarding, and the potential variability of, reconciling items such as stock-based compensation expense.

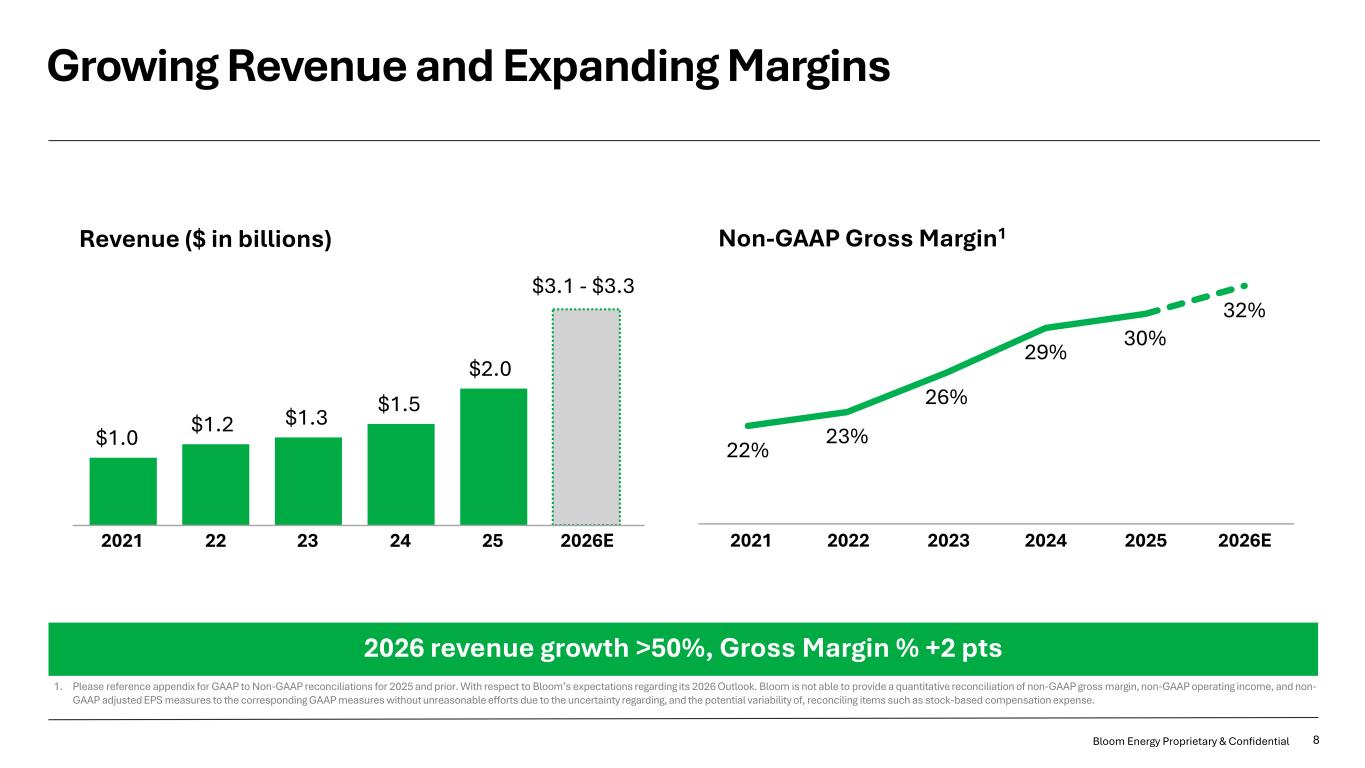

8Bloom Energy Proprietary & Confidential 2026 revenue growth >50%, Gross Margin % +2 pts Growing Revenue and Expanding Margins 1. Please reference appendix for GAAP to Non-GAAP reconciliations for 2025 and prior. With respect to Bloom’s expectations regarding its 2026 Outlook. Bloom is not able to provide a quantitative reconciliation of non-GAAP gross margin, non-GAAP operating income, and non- GAAP adjusted EPS measures to the corresponding GAAP measures without unreasonable efforts due to the uncertainty regarding, and the potential variability of, reconciling items such as stock-based compensation expense. Revenue ($ in billions) 2021 2022 2023 2024 2025 2026E Non-GAAP Gross Margin1 242021 2026E22 23 25 $1.0 $1.2 $1.3 $1.5 $2.0 $3.1 - $3.3 22% 23% 26% 29% 30% 32%

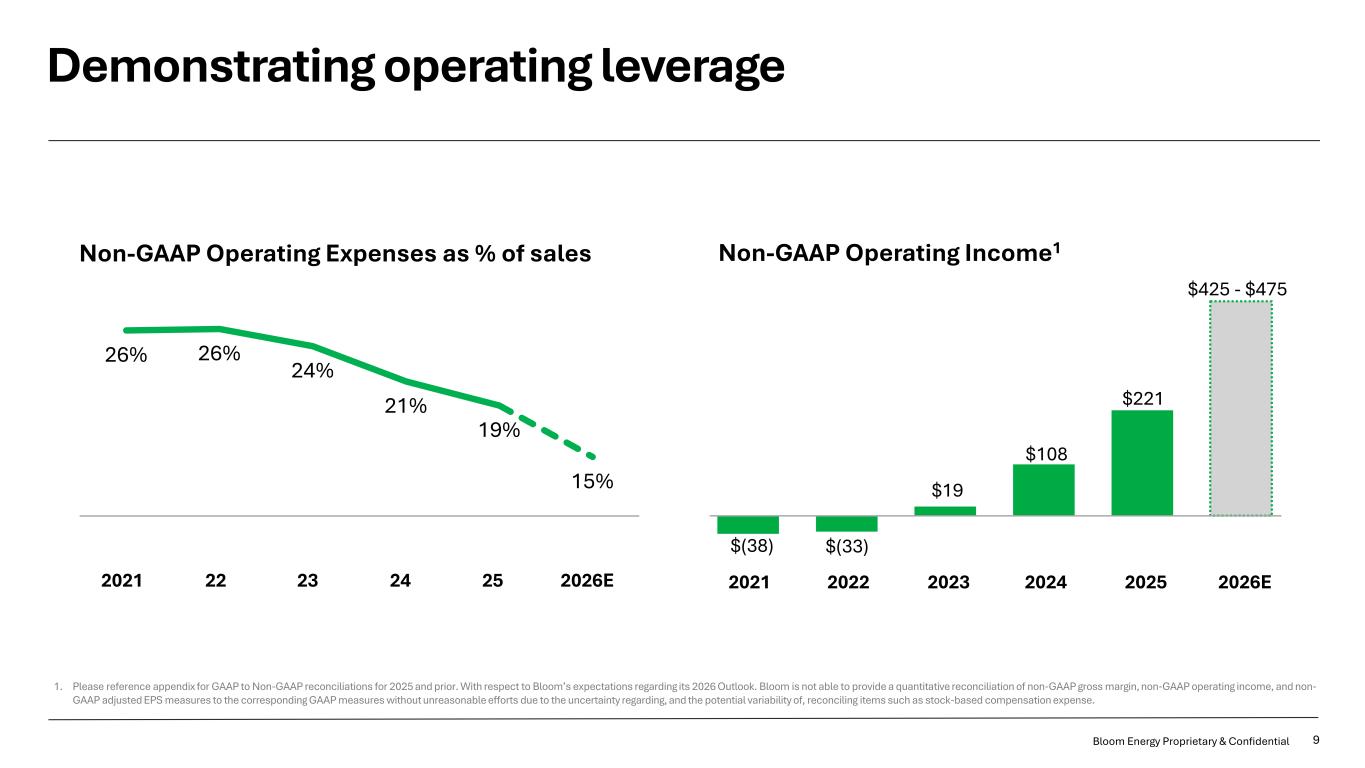

9Bloom Energy Proprietary & Confidential Demonstrating operating leverage Non-GAAP Operating Expenses as % of sales 2021 2022 2023 2024 2025 2026E Non-GAAP Operating Income1 242021 2026E22 23 25 26% 26% 24% 21% 19% 15% $(38) $(33) $19 $108 $221 $425 - $475 1. Please reference appendix for GAAP to Non-GAAP reconciliations for 2025 and prior. With respect to Bloom’s expectations regarding its 2026 Outlook. Bloom is not able to provide a quantitative reconciliation of non-GAAP gross margin, non-GAAP operating income, and non- GAAP adjusted EPS measures to the corresponding GAAP measures without unreasonable efforts due to the uncertainty regarding, and the potential variability of, reconciling items such as stock-based compensation expense.

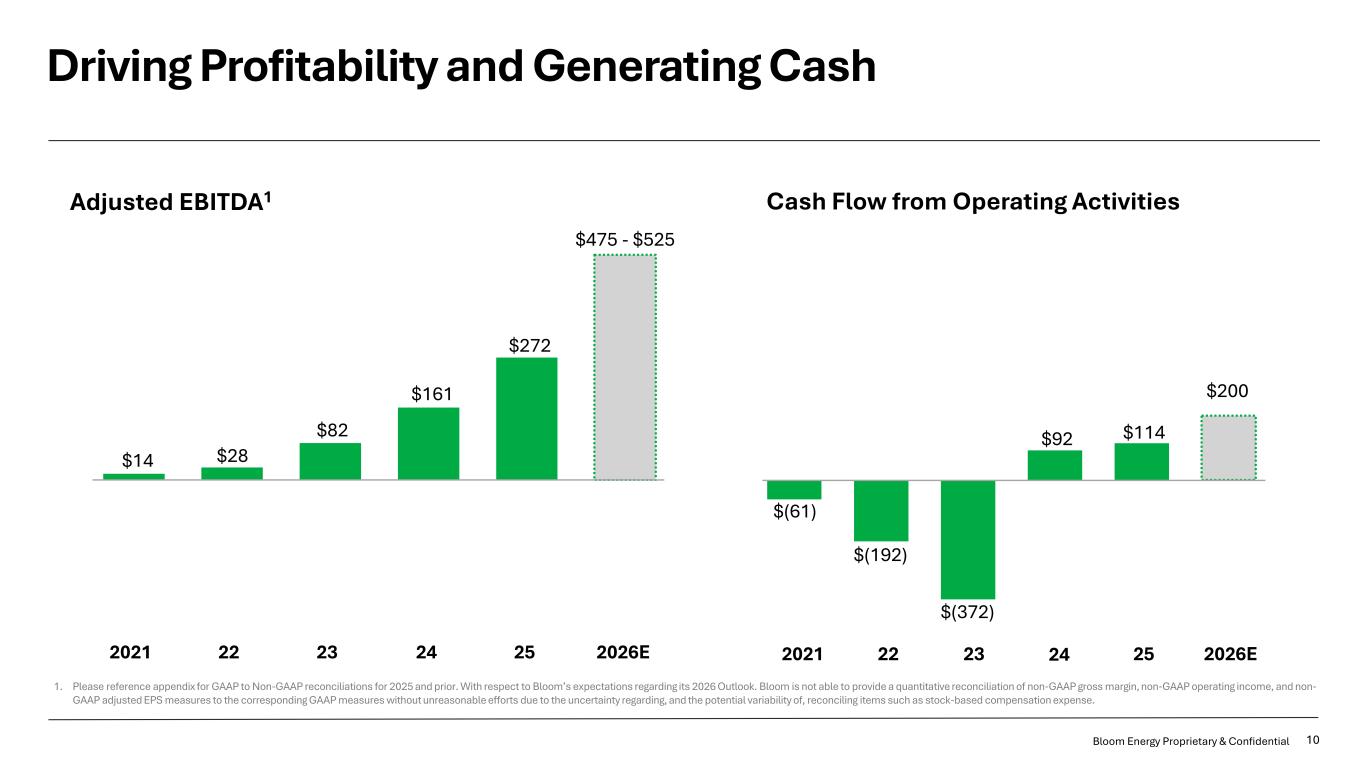

10Bloom Energy Proprietary & Confidential Driving Profitability and Generating Cash 242021 2026E22 23 242021 2026E22 2325 25 $14 $28 $82 $161 $272 $475 - $525 $(61) $(192) $(372) $92 $114 $200 Adjusted EBITDA1 Cash Flow from Operating Activities 1. Please reference appendix for GAAP to Non-GAAP reconciliations for 2025 and prior. With respect to Bloom’s expectations regarding its 2026 Outlook. Bloom is not able to provide a quantitative reconciliation of non-GAAP gross margin, non-GAAP operating income, and non- GAAP adjusted EPS measures to the corresponding GAAP measures without unreasonable efforts due to the uncertainty regarding, and the potential variability of, reconciling items such as stock-based compensation expense.

Q4 2025 Appendix

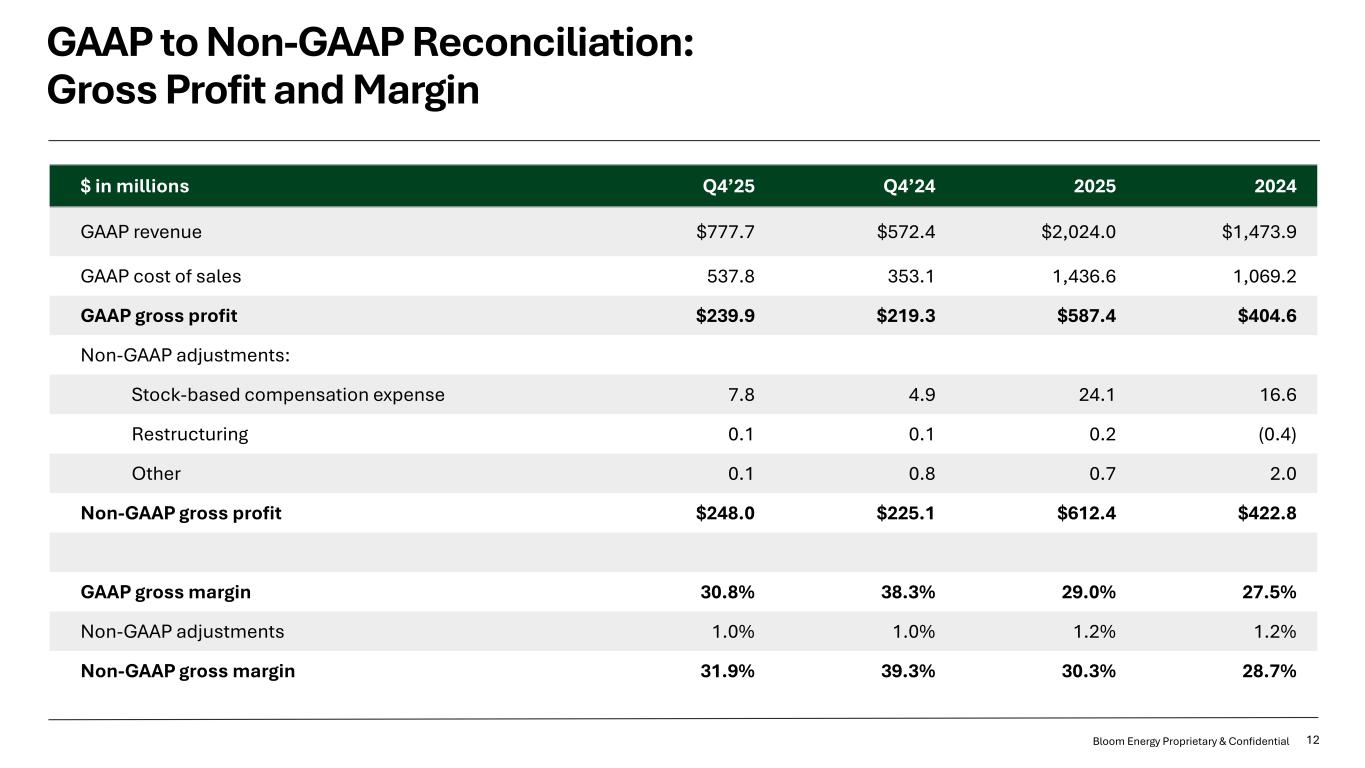

12Bloom Energy Proprietary & Confidential GAAP to Non-GAAP Reconciliation: Gross Profit and Margin $ in millions Q4’25 Q4’24 2025 2024 GAAP revenue $777.7 $572.4 $2,024.0 $1,473.9 GAAP cost of sales 537.8 353.1 1,436.6 1,069.2 GAAP gross profit $239.9 $219.3 $587.4 $404.6 Non-GAAP adjustments: Stock-based compensation expense 7.8 4.9 24.1 16.6 Restructuring 0.1 0.1 0.2 (0.4) Other 0.1 0.8 0.7 2.0 Non-GAAP gross profit $248.0 $225.1 $612.4 $422.8 GAAP gross margin 30.8% 38.3% 29.0% 27.5% Non-GAAP adjustments 1.0% 1.0% 1.2% 1.2% Non-GAAP gross margin 31.9% 39.3% 30.3% 28.7%

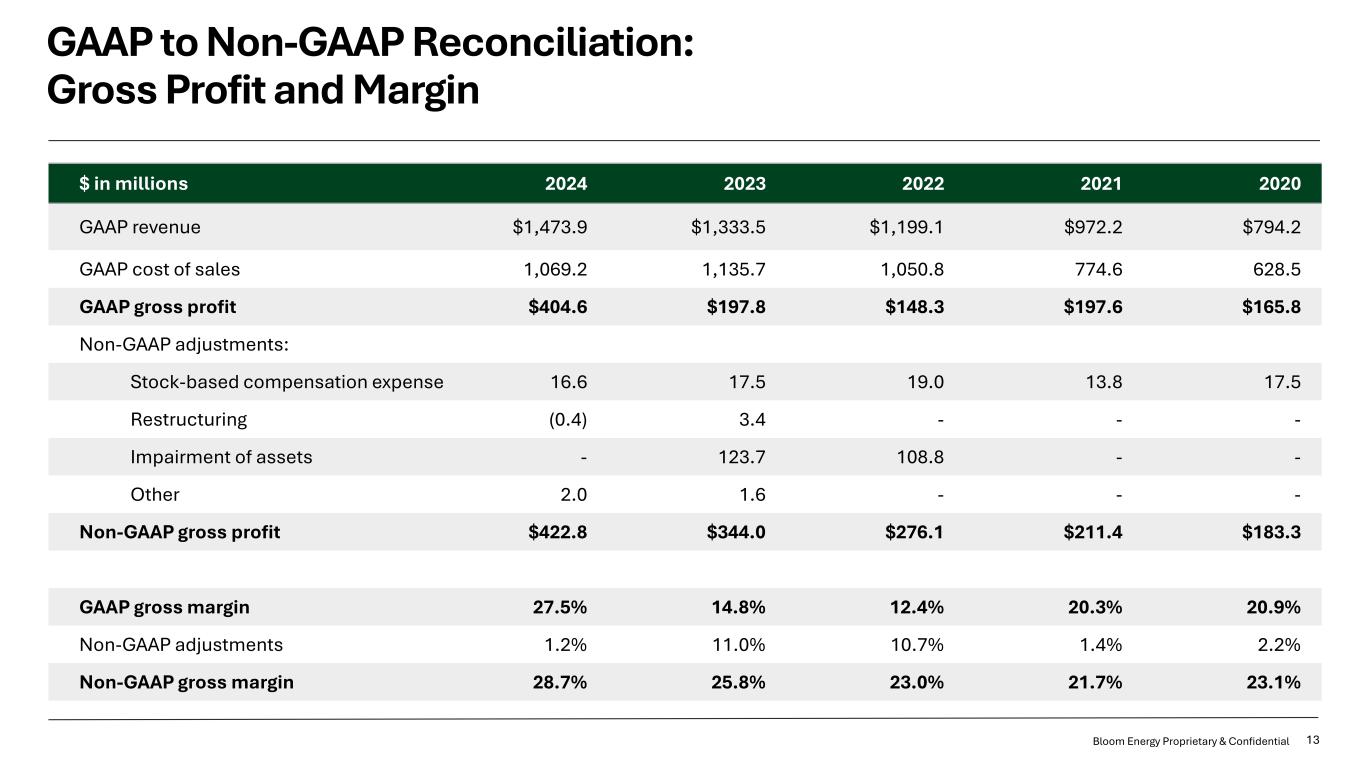

13Bloom Energy Proprietary & Confidential GAAP to Non-GAAP Reconciliation: Gross Profit and Margin $ in millions 2024 2023 2022 2021 2020 GAAP revenue $1,473.9 $1,333.5 $1,199.1 $972.2 $794.2 GAAP cost of sales 1,069.2 1,135.7 1,050.8 774.6 628.5 GAAP gross profit $404.6 $197.8 $148.3 $197.6 $165.8 Non-GAAP adjustments: Stock-based compensation expense 16.6 17.5 19.0 13.8 17.5 Restructuring (0.4) 3.4 - - - Impairment of assets - 123.7 108.8 - - Other 2.0 1.6 - - - Non-GAAP gross profit $422.8 $344.0 $276.1 $211.4 $183.3 GAAP gross margin 27.5% 14.8% 12.4% 20.3% 20.9% Non-GAAP adjustments 1.2% 11.0% 10.7% 1.4% 2.2% Non-GAAP gross margin 28.7% 25.8% 23.0% 21.7% 23.1%

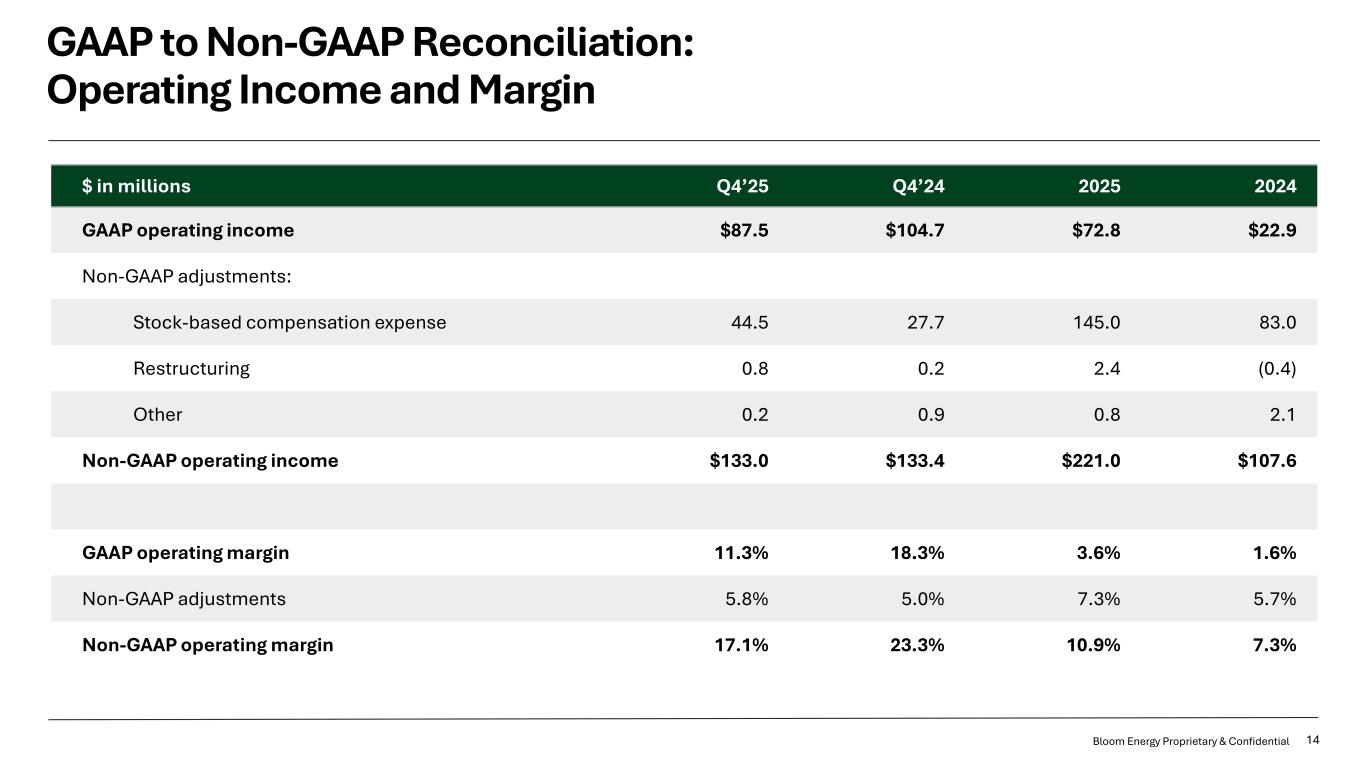

14Bloom Energy Proprietary & Confidential GAAP to Non-GAAP Reconciliation: Operating Income and Margin $ in millions Q4’25 Q4’24 2025 2024 GAAP operating income $87.5 $104.7 $72.8 $22.9 Non-GAAP adjustments: Stock-based compensation expense 44.5 27.7 145.0 83.0 Restructuring 0.8 0.2 2.4 (0.4) Other 0.2 0.9 0.8 2.1 Non-GAAP operating income $133.0 $133.4 $221.0 $107.6 GAAP operating margin 11.3% 18.3% 3.6% 1.6% Non-GAAP adjustments 5.8% 5.0% 7.3% 5.7% Non-GAAP operating margin 17.1% 23.3% 10.9% 7.3%

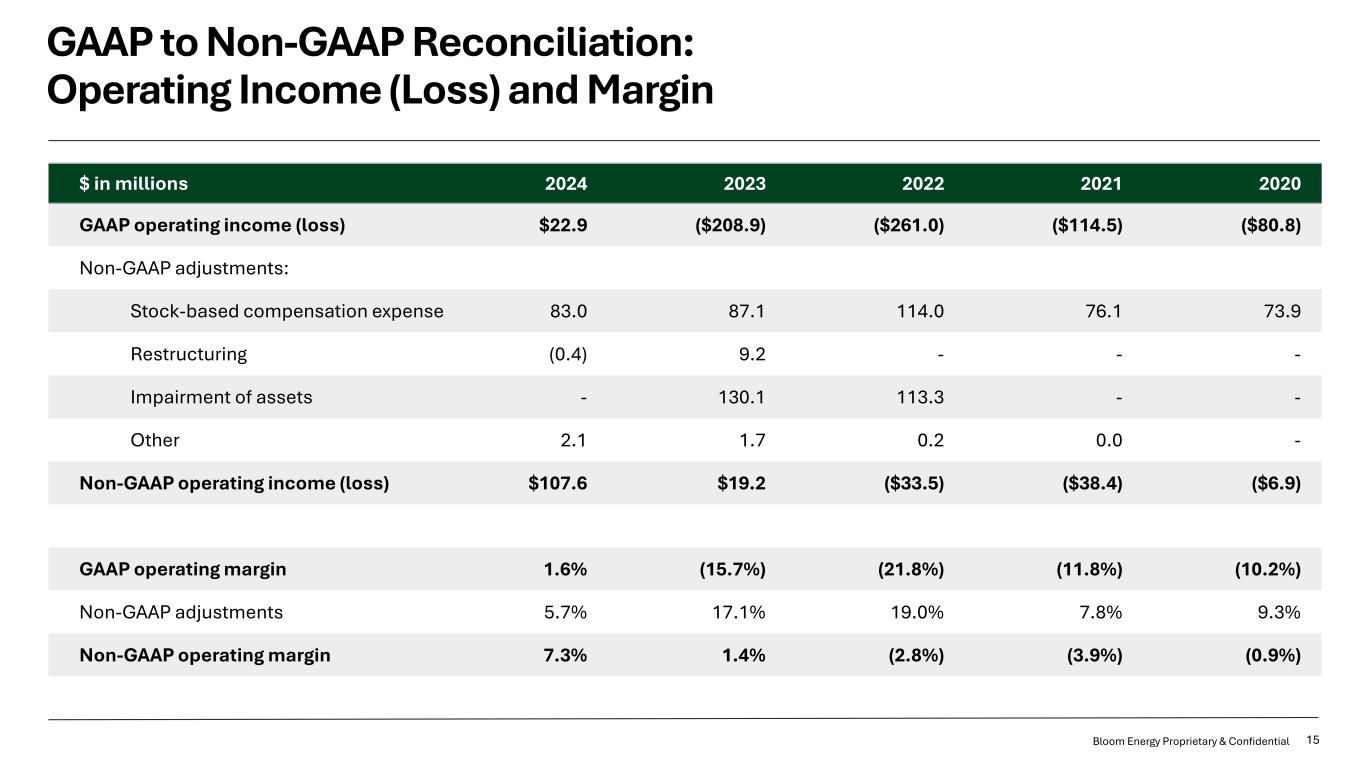

15Bloom Energy Proprietary & Confidential GAAP to Non-GAAP Reconciliation: Operating Income (Loss) and Margin $ in millions 2024 2023 2022 2021 2020 GAAP operating income (loss) $22.9 ($208.9) ($261.0) ($114.5) ($80.8) Non-GAAP adjustments: Stock-based compensation expense 83.0 87.1 114.0 76.1 73.9 Restructuring (0.4) 9.2 - - - Impairment of assets - 130.1 113.3 - - Other 2.1 1.7 0.2 0.0 - Non-GAAP operating income (loss) $107.6 $19.2 ($33.5) ($38.4) ($6.9) GAAP operating margin 1.6% (15.7%) (21.8%) (11.8%) (10.2%) Non-GAAP adjustments 5.7% 17.1% 19.0% 7.8% 9.3% Non-GAAP operating margin 7.3% 1.4% (2.8%) (3.9%) (0.9%)

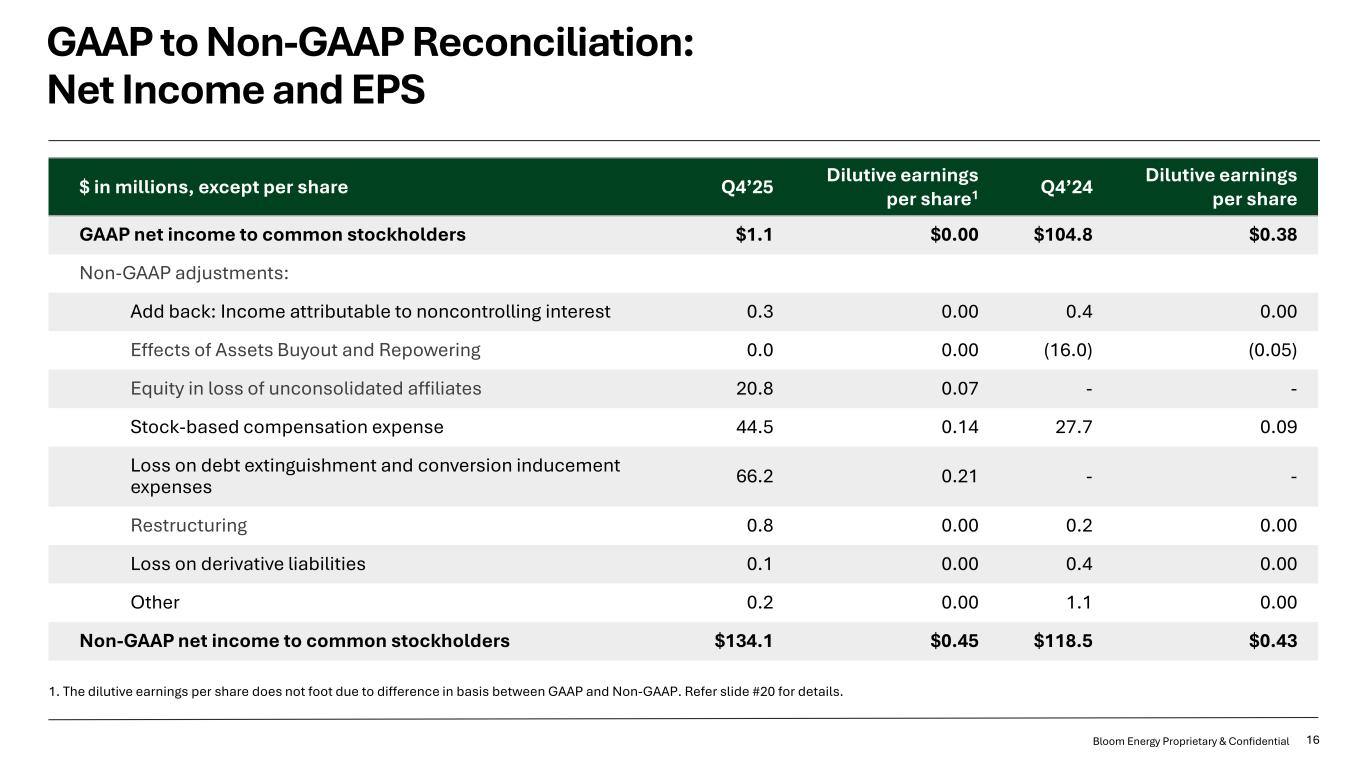

16Bloom Energy Proprietary & Confidential GAAP to Non-GAAP Reconciliation: Net Income and EPS 1. The dilutive earnings per share does not foot due to difference in basis between GAAP and Non-GAAP. Refer slide #20 for details. $ in millions, except per share Q4’25 Dilutive earnings per share1 Q4’24 Dilutive earnings per share GAAP net income to common stockholders $1.1 $0.00 $104.8 $0.38 Non-GAAP adjustments: Add back: Income attributable to noncontrolling interest 0.3 0.00 0.4 0.00 Effects of Assets Buyout and Repowering 0.0 0.00 (16.0) (0.05) Equity in loss of unconsolidated affiliates 20.8 0.07 - - Stock-based compensation expense 44.5 0.14 27.7 0.09 Loss on debt extinguishment and conversion inducement expenses 66.2 0.21 - - Restructuring 0.8 0.00 0.2 0.00 Loss on derivative liabilities 0.1 0.00 0.4 0.00 Other 0.2 0.00 1.1 0.00 Non-GAAP net income to common stockholders $134.1 $0.45 $118.5 $0.43

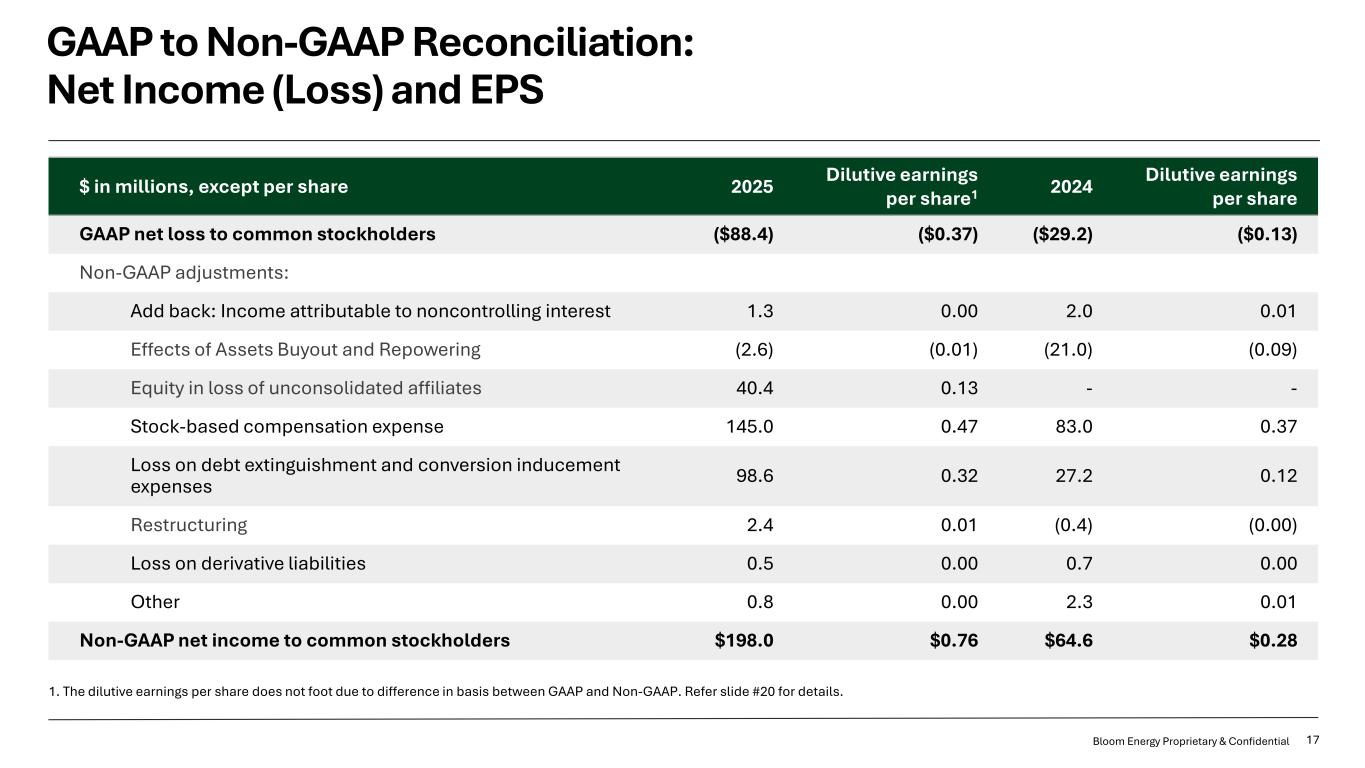

17Bloom Energy Proprietary & Confidential GAAP to Non-GAAP Reconciliation: Net Income (Loss) and EPS 1. The dilutive earnings per share does not foot due to difference in basis between GAAP and Non-GAAP. Refer slide #20 for details. $ in millions, except per share 2025 Dilutive earnings per share1 2024 Dilutive earnings per share GAAP net loss to common stockholders ($88.4) ($0.37) ($29.2) ($0.13) Non-GAAP adjustments: Add back: Income attributable to noncontrolling interest 1.3 0.00 2.0 0.01 Effects of Assets Buyout and Repowering (2.6) (0.01) (21.0) (0.09) Equity in loss of unconsolidated affiliates 40.4 0.13 - - Stock-based compensation expense 145.0 0.47 83.0 0.37 Loss on debt extinguishment and conversion inducement expenses 98.6 0.32 27.2 0.12 Restructuring 2.4 0.01 (0.4) (0.00) Loss on derivative liabilities 0.5 0.00 0.7 0.00 Other 0.8 0.00 2.3 0.01 Non-GAAP net income to common stockholders $198.0 $0.76 $64.6 $0.28

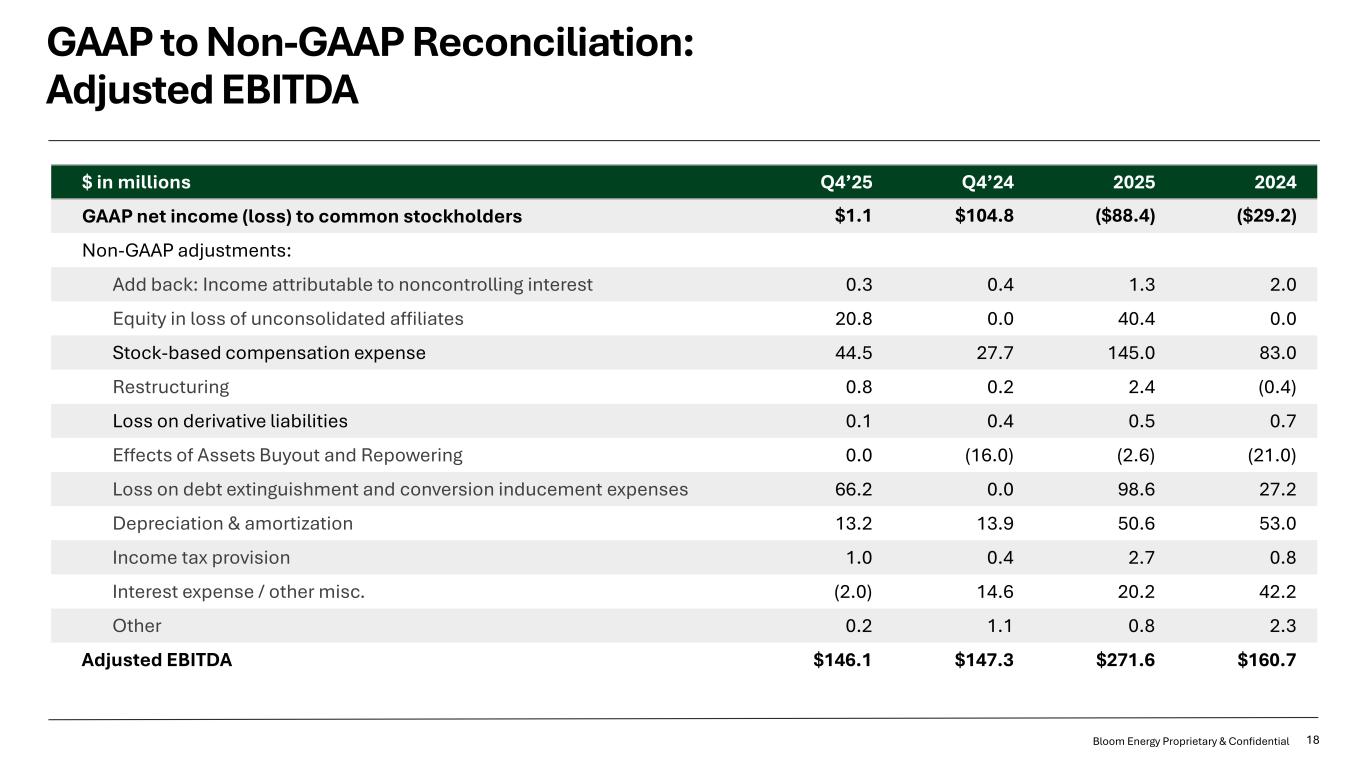

18Bloom Energy Proprietary & Confidential GAAP to Non-GAAP Reconciliation: Adjusted EBITDA $ in millions Q4’25 Q4’24 2025 2024 GAAP net income (loss) to common stockholders $1.1 $104.8 ($88.4) ($29.2) Non-GAAP adjustments: Add back: Income attributable to noncontrolling interest 0.3 0.4 1.3 2.0 Equity in loss of unconsolidated affiliates 20.8 0.0 40.4 0.0 Stock-based compensation expense 44.5 27.7 145.0 83.0 Restructuring 0.8 0.2 2.4 (0.4) Loss on derivative liabilities 0.1 0.4 0.5 0.7 Effects of Assets Buyout and Repowering 0.0 (16.0) (2.6) (21.0) Loss on debt extinguishment and conversion inducement expenses 66.2 0.0 98.6 27.2 Depreciation & amortization 13.2 13.9 50.6 53.0 Income tax provision 1.0 0.4 2.7 0.8 Interest expense / other misc. (2.0) 14.6 20.2 42.2 Other 0.2 1.1 0.8 2.3 Adjusted EBITDA $146.1 $147.3 $271.6 $160.7

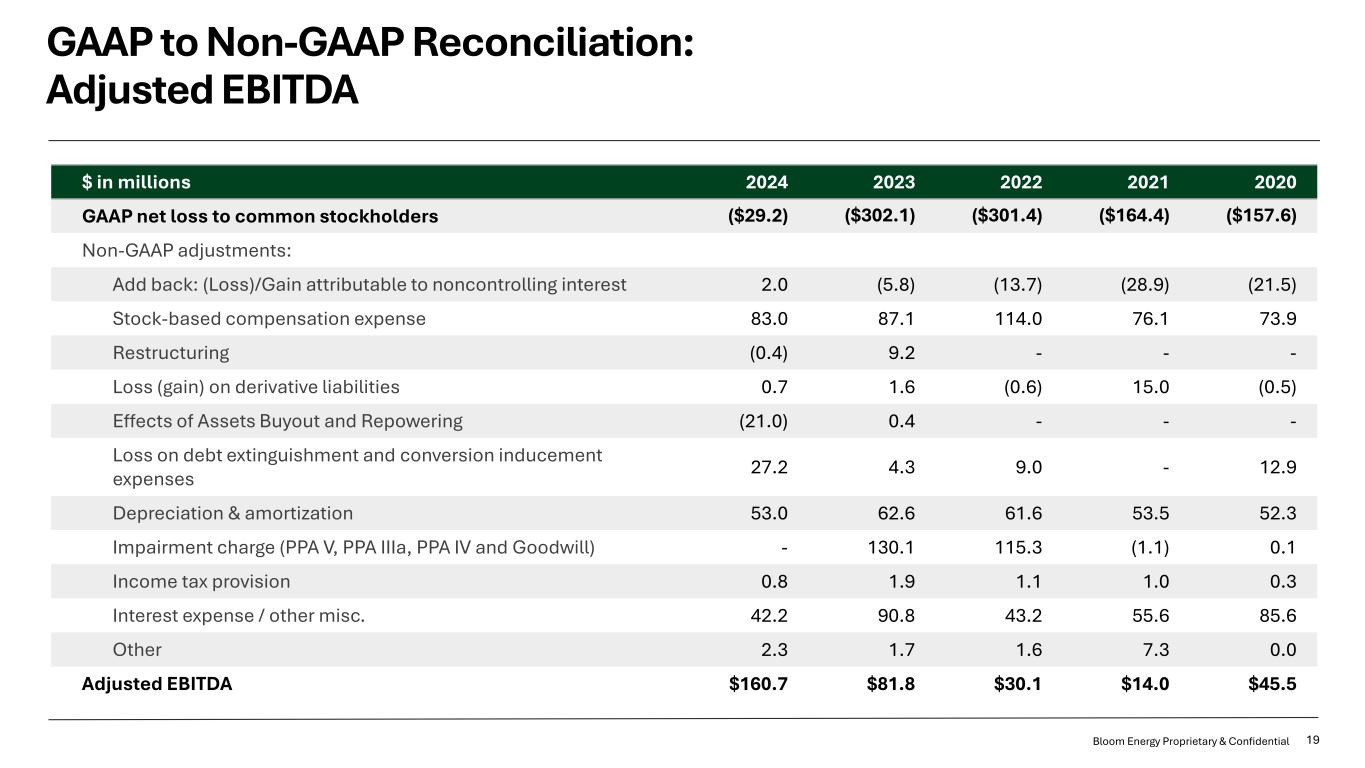

19Bloom Energy Proprietary & Confidential GAAP to Non-GAAP Reconciliation: Adjusted EBITDA $ in millions 2024 2023 2022 2021 2020 GAAP net loss to common stockholders ($29.2) ($302.1) ($301.4) ($164.4) ($157.6) Non-GAAP adjustments: Add back: (Loss)/Gain attributable to noncontrolling interest 2.0 (5.8) (13.7) (28.9) (21.5) Stock-based compensation expense 83.0 87.1 114.0 76.1 73.9 Restructuring (0.4) 9.2 - - - Loss (gain) on derivative liabilities 0.7 1.6 (0.6) 15.0 (0.5) Effects of Assets Buyout and Repowering (21.0) 0.4 - - - Loss on debt extinguishment and conversion inducement expenses 27.2 4.3 9.0 - 12.9 Depreciation & amortization 53.0 62.6 61.6 53.5 52.3 Impairment charge (PPA V, PPA IIIa, PPA IV and Goodwill) - 130.1 115.3 (1.1) 0.1 Income tax provision 0.8 1.9 1.1 1.0 0.3 Interest expense / other misc. 42.2 90.8 43.2 55.6 85.6 Other 2.3 1.7 1.6 7.3 0.0 Adjusted EBITDA $160.7 $81.8 $30.1 $14.0 $45.5

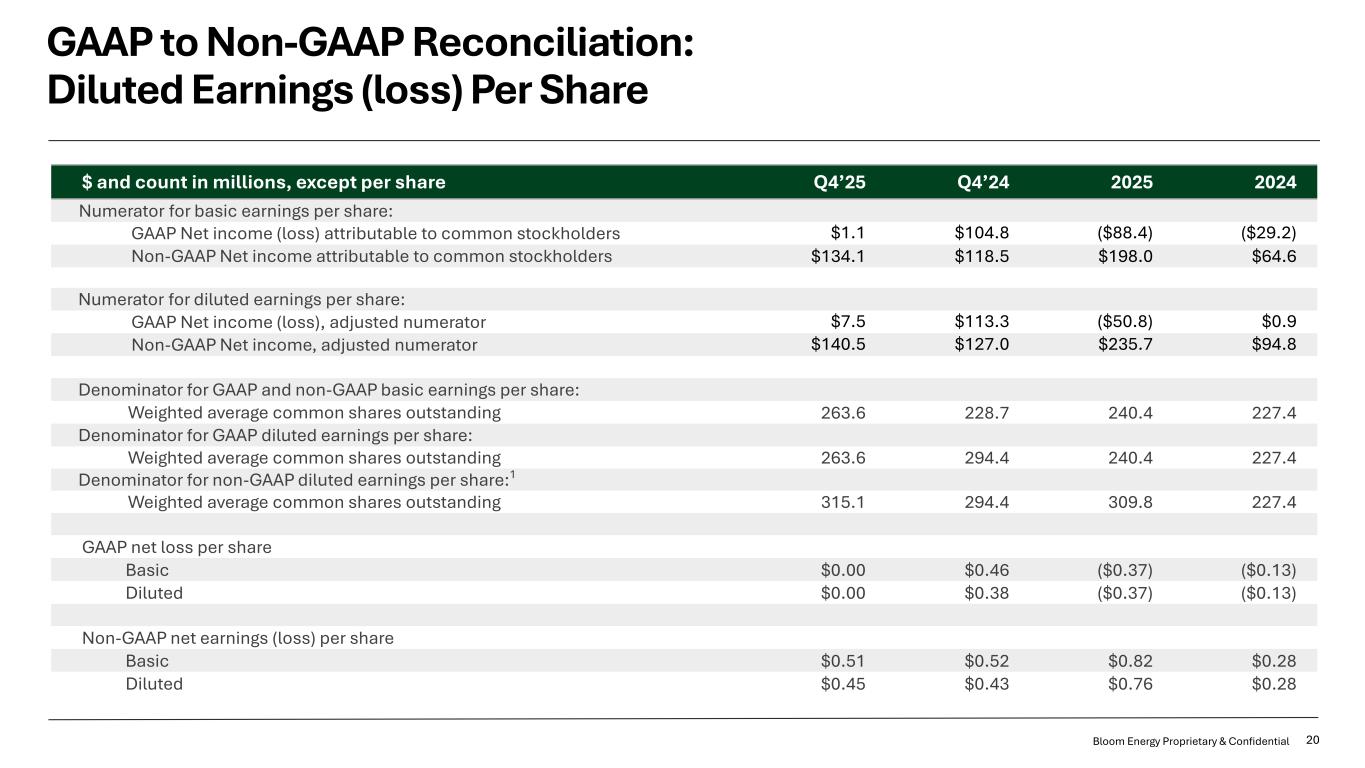

20Bloom Energy Proprietary & Confidential GAAP to Non-GAAP Reconciliation: Diluted Earnings (loss) Per Share $ and count in millions, except per share Q4’25 Q4’24 2025 2024 Numerator for basic earnings per share: GAAP Net income (loss) attributable to common stockholders $1.1 $104.8 ($88.4) ($29.2) Non-GAAP Net income attributable to common stockholders $134.1 $118.5 $198.0 $64.6 Numerator for diluted earnings per share: GAAP Net income (loss), adjusted numerator $7.5 $113.3 ($50.8) $0.9 Non-GAAP Net income, adjusted numerator $140.5 $127.0 $235.7 $94.8 Denominator for GAAP and non-GAAP basic earnings per share: Weighted average common shares outstanding 263.6 228.7 240.4 227.4 Denominator for GAAP diluted earnings per share: Weighted average common shares outstanding 263.6 294.4 240.4 227.4 Denominator for non-GAAP diluted earnings per share:1 Weighted average common shares outstanding 315.1 294.4 309.8 227.4 GAAP net loss per share Basic $0.00 $0.46 ($0.37) ($0.13) Diluted $0.00 $0.38 ($0.37) ($0.13) Non-GAAP net earnings (loss) per share Basic $0.51 $0.52 $0.82 $0.28 Diluted $0.45 $0.43 $0.76 $0.28

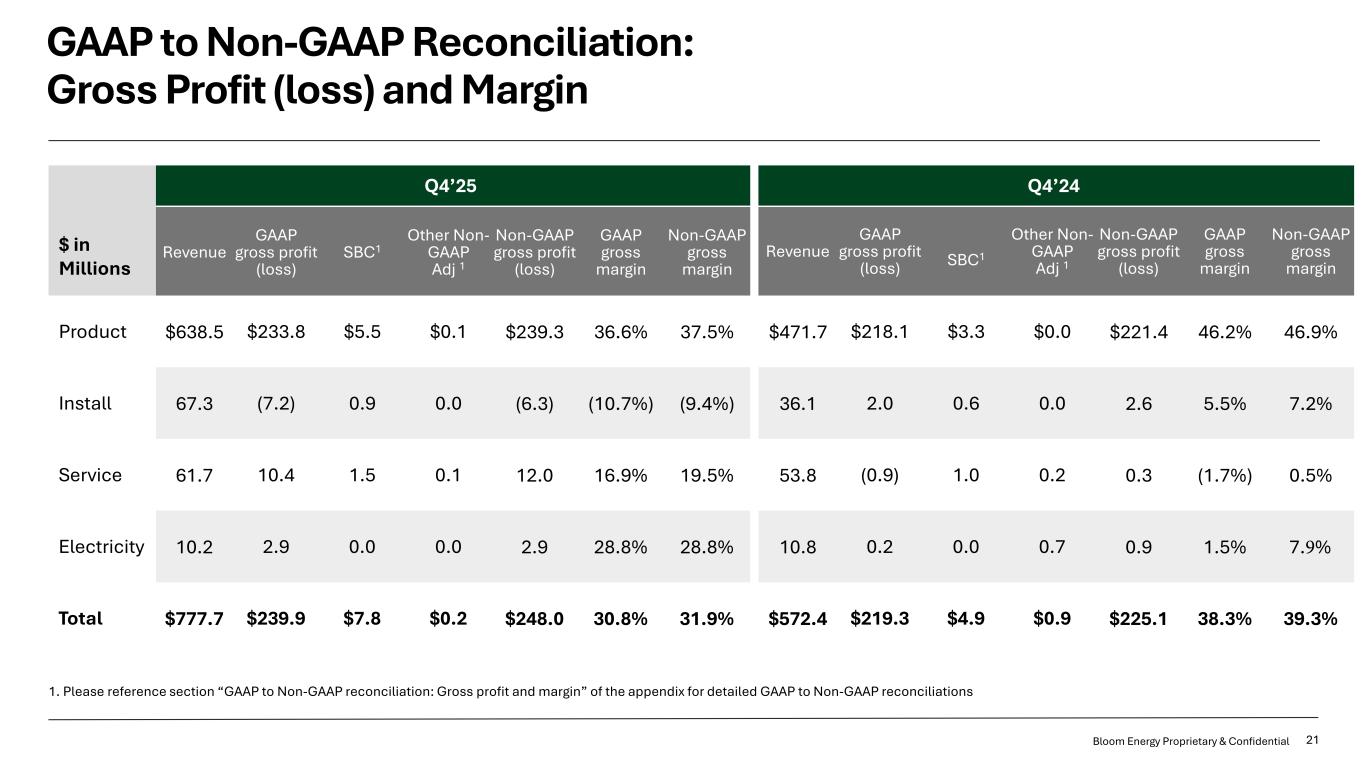

21Bloom Energy Proprietary & Confidential GAAP to Non-GAAP Reconciliation: Gross Profit (loss) and Margin 1. Please reference section “GAAP to Non-GAAP reconciliation: Gross profit and margin” of the appendix for detailed GAAP to Non-GAAP reconciliations Q4’25 Q4’24 $ in Millions Revenue GAAP gross profit (loss) SBC1 Other Non- GAAP Adj 1 Non-GAAP gross profit (loss) GAAP gross margin Non-GAAP gross margin Revenue GAAP gross profit (loss) SBC1 Other Non- GAAP Adj 1 Non-GAAP gross profit (loss) GAAP gross margin Non-GAAP gross margin Product $638.5 $233.8 $5.5 $0.1 $239.3 36.6% 37.5% $471.7 $218.1 $3.3 $0.0 $221.4 46.2% 46.9% Install 67.3 (7.2) 0.9 0.0 (6.3) (10.7%) (9.4%) 36.1 2.0 0.6 0.0 2.6 5.5% 7.2% Service 61.7 10.4 1.5 0.1 12.0 16.9% 19.5% 53.8 (0.9) 1.0 0.2 0.3 (1.7%) 0.5% Electricity 10.2 2.9 0.0 0.0 2.9 28.8% 28.8% 10.8 0.2 0.0 0.7 0.9 1.5% 7.9% Total $777.7 $239.9 $7.8 $0.2 $248.0 30.8% 31.9% $572.4 $219.3 $4.9 $0.9 $225.1 38.3% 39.3%

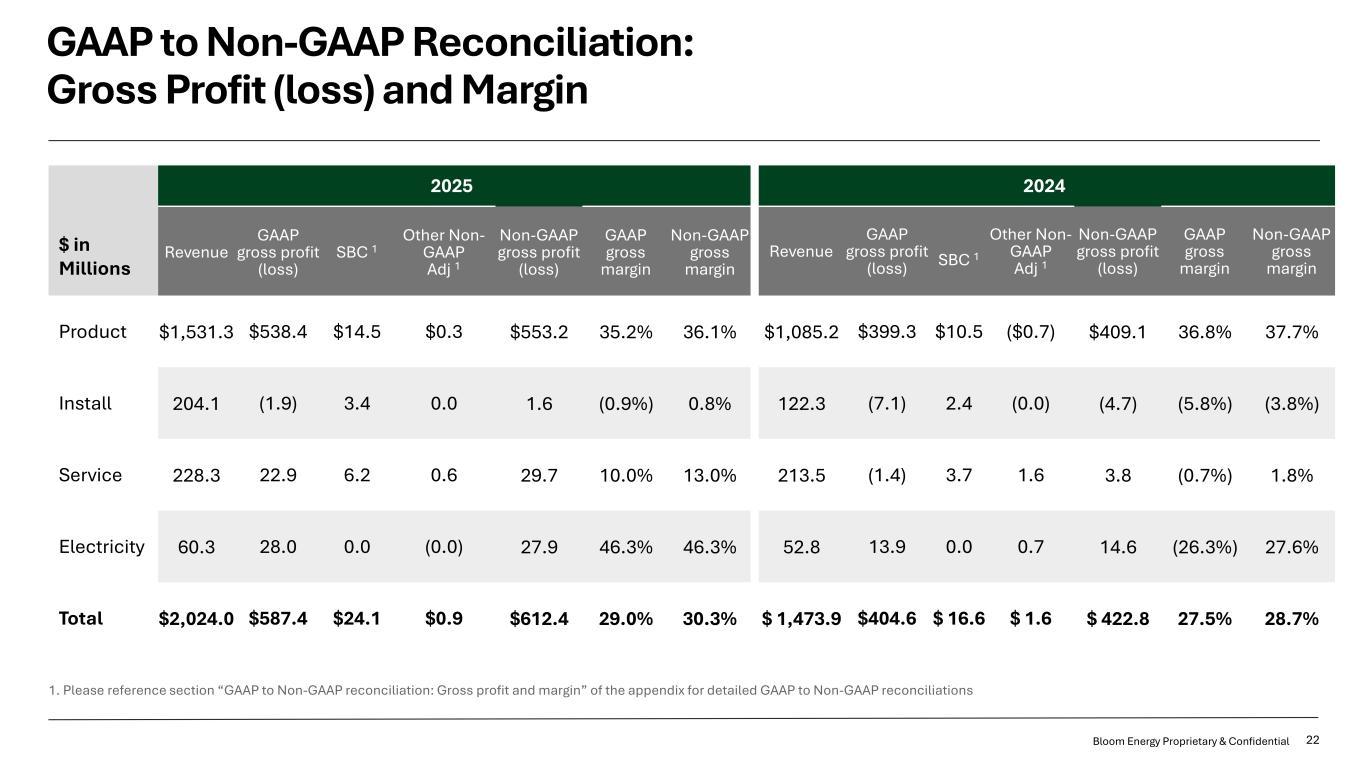

22Bloom Energy Proprietary & Confidential GAAP to Non-GAAP Reconciliation: Gross Profit (loss) and Margin 1. Please reference section “GAAP to Non-GAAP reconciliation: Gross profit and margin” of the appendix for detailed GAAP to Non-GAAP reconciliations 2025 2024 $ in Millions Revenue GAAP gross profit (loss) SBC 1 Other Non- GAAP Adj 1 Non-GAAP gross profit (loss) GAAP gross margin Non-GAAP gross margin Revenue GAAP gross profit (loss) SBC 1 Other Non- GAAP Adj 1 Non-GAAP gross profit (loss) GAAP gross margin Non-GAAP gross margin Product $1,531.3 $538.4 $14.5 $0.3 $553.2 35.2% 36.1% $1,085.2 $399.3 $10.5 ($0.7) $409.1 36.8% 37.7% Install 204.1 (1.9) 3.4 0.0 1.6 (0.9%) 0.8% 122.3 (7.1) 2.4 (0.0) (4.7) (5.8%) (3.8%) Service 228.3 22.9 6.2 0.6 29.7 10.0% 13.0% 213.5 (1.4) 3.7 1.6 3.8 (0.7%) 1.8% Electricity 60.3 28.0 0.0 (0.0) 27.9 46.3% 46.3% 52.8 13.9 0.0 0.7 14.6 (26.3%) 27.6% Total $2,024.0 $587.4 $24.1 $0.9 $612.4 29.0% 30.3% $ 1,473.9 $404.6 $ 16.6 $ 1.6 $ 422.8 27.5% 28.7%

Thank You