First Quarter 2026 Earnings Presentation and Business Update February 3, 2026

2© Atkore This presentation is provided for general informational purposes only and it does not include every item which may be of interest, nor does it purport to present full and fair disclosure with respect to Atkore Inc. (the “Company” or “Atkore”) or its operational and financial information. Atkore expressly disclaims any current intention to update any forward-looking statements contained in this presentation as a result of new information or future events or developments or otherwise, except as required by federal securities laws. This presentation is not a prospectus and is not an offer to sell securities. This presentation contains forward-looking statements that are subject to known and unknown risks and uncertainties, many of which are beyond our control. All statements other than statements of historical fact included in this presentation are forward-looking statements. Forward-looking statements appearing throughout this presentation include, without limitation, statements regarding our intentions, beliefs, assumptions or current expectations concerning, among other things, financial position; results of operations; cash flows; prospects; growth strategies or expectations; customer retention; the outcome (by judgment or settlement) and costs of legal, administrative or regulatory proceedings, investigations or inspections, including, without limitation, collective, representative or any other litigation; and the impact of prevailing economic conditions. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “believes,” “expects,” “may,” “will,” “shall,” “should,” “would,” “could,” “seeks,” “aims,” “projects,” “is optimistic,” “intends,” “plans,” “estimates,” “anticipates” and other comparable terms. We caution you that forward-looking statements are not guarantees of future performance or outcomes and that actual performance and outcomes, including, without limitation, our actual results of operations, financial condition and liquidity, and the development of the market in which we operate, may differ materially from those made in or suggested by the forward-looking statements contained in this presentation. In addition, even if our results of operations, financial condition and cash flows, and the development of the market in which we operate, are consistent with the forward-looking statements contained in this presentation, those results or developments may not be indicative of results or developments in subsequent periods. A number of important factors, including, without limitation, the risks and uncertainties disclosed in the Company’s filings with the U.S. Securities and Exchange Commission, including but not limited to the Company’s most recent Annual Report on Form 10-K and reports on Form 10-Q and Form 8-K could cause actual results and outcomes to differ materially from those reflected in the forward-looking statements. Because of these risks, we caution that you should not place undue reliance on any of our forward-looking statements. New risks and uncertainties arise from time to time, and it is impossible for us to predict those events or how they may affect us. Further, any forward-looking statement speaks only as of the date on which it is made. We undertake no obligation to revise the forward-looking statements in this presentation after the date of this presentation. Market data and industry information used throughout this presentation are based on management’s knowledge of the industry and the good faith estimates of management. We also relied, to the extent available, upon management’s review of independent industry surveys, forecasts and publications and other publicly available information prepared by a number of third-party sources. All of the market data and industry information used in this presentation involves a number of assumptions and limitations which we believe to be reasonable, but you are cautioned not to give undue weight to such estimates. Although we believe that these sources are reliable, we cannot guarantee the accuracy or completeness of this information, and we have not independently verified this information. While we believe the estimated market position, market opportunity and market size information included in this presentation are generally reliable, such information, which is derived in part from management’s estimates and beliefs, is inherently uncertain and imprecise. Projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are subject to a high degree of uncertainty and risk due to a variety of factors, including those described above. These and other factors could cause results to differ materially from those expressed in our estimates and beliefs and in the estimates prepared by independent parties. This presentation should be read along with the historical financial statements of Atkore, including the most recent audited financial statements. Historical results may not be indicative of future results. We use non-GAAP financial measures to help us describe our operating and financial performance. These measures may include Adjusted EBITDA, Adjusted EBITDA margin (Adjusted EBITDA over Net sales), Net debt (total debt less cash and cash equivalents), Adjusted Net Income Per Diluted Share (also referred to as “Adjusted Diluted EPS”), Leverage ratio (net debt or total debt less cash and cash equivalents, over Adjusted EBITDA on trailing twelve month (“TTM”) basis), Free Cash Flow (net cash provided by operating activities less capital expenditures) and Return on Capital to help us describe our operating and financial performance. These non-GAAP financial measures are commonly used in our industry and have certain limitations and should not be construed as alternatives to net income, total debt, net cash provided by operating activities, return on assets, and other income data measures as determined in accordance with generally accepted accounting principles in the United States, or GAAP, or as better indicators of operating performance. These non-GAAP financial measures as defined by us may not be comparable to similarly-titled non-GAAP measures presented by other companies. Our presentation of such non-GAAP financial measures should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. See the appendix to this presentation for a reconciliation of the non-GAAP financial measures presented herein to the most comparable financial measures as determined in accordance with GAAP. Fiscal Periods - The Company has a fiscal year that ends on September 30th. It is the Company's practice to establish quarterly closings using a 4-5-4 calendar. The Company's fiscal quarters typically end on the last Friday in December, March and June. Cautionary Statements

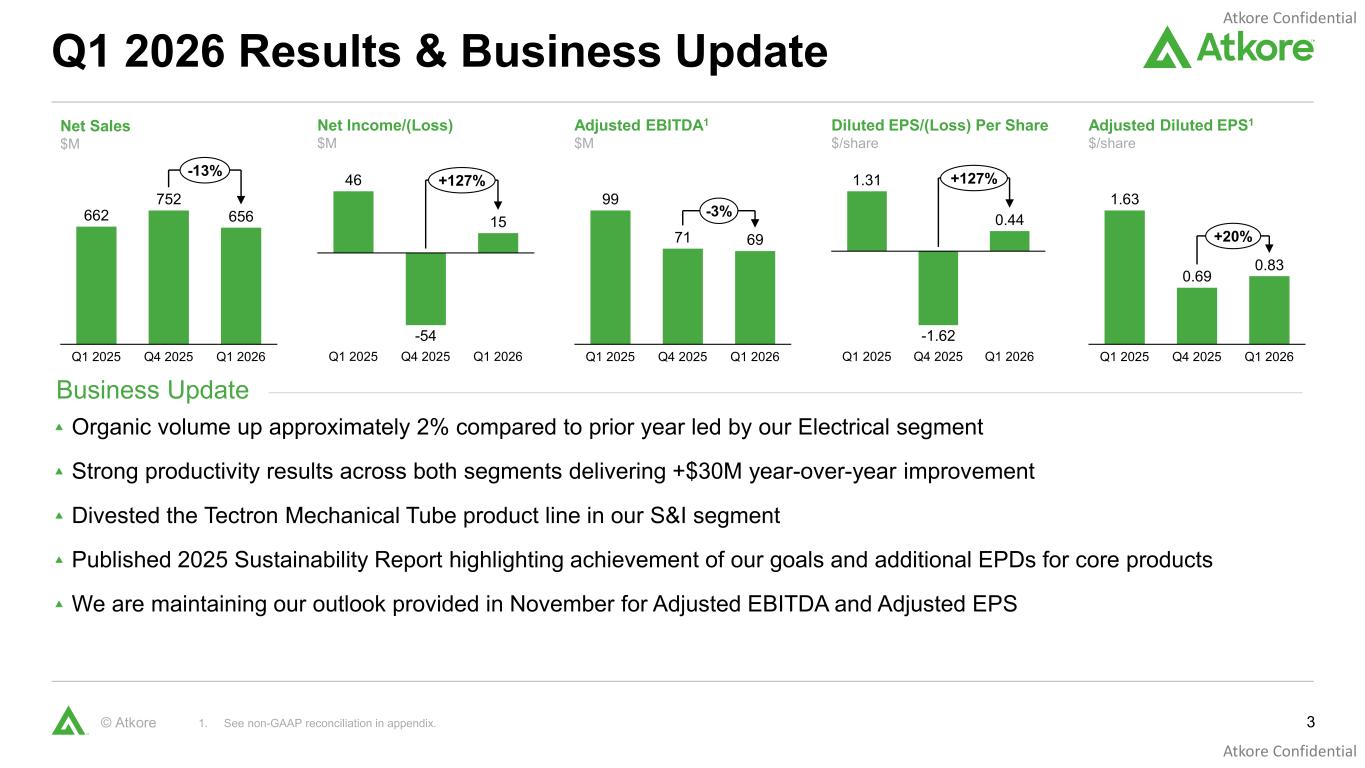

3© Atkore Q1 2026 Results & Business Update 1. See non-GAAP reconciliation in appendix. 662 752 656 Q1 2025 Q4 2025 Q1 2026 -13% 46 -54 15 Q1 2025 Q4 2025 Q1 2026 +127% 99 71 69 Q1 2025 Q4 2025 Q1 2026 -3% 1.63 0.69 0.83 Q1 2025 Q4 2025 Q1 2026 +20% Net Sales $M Net Income/(Loss) $M Adjusted EBITDA1 $M Adjusted Diluted EPS1 $/share 1.31 -1.62 0.44 Q1 2025 Q4 2025 Q1 2026 +127% Diluted EPS/(Loss) Per Share $/share Organic volume up approximately 2% compared to prior year led by our Electrical segment Strong productivity results across both segments delivering +$30M year-over-year improvement Divested the Tectron Mechanical Tube product line in our S&I segment Published 2025 Sustainability Report highlighting achievement of our goals and additional EPDs for core products We are maintaining our outlook provided in November for Adjusted EBITDA and Adjusted EPS Business Update

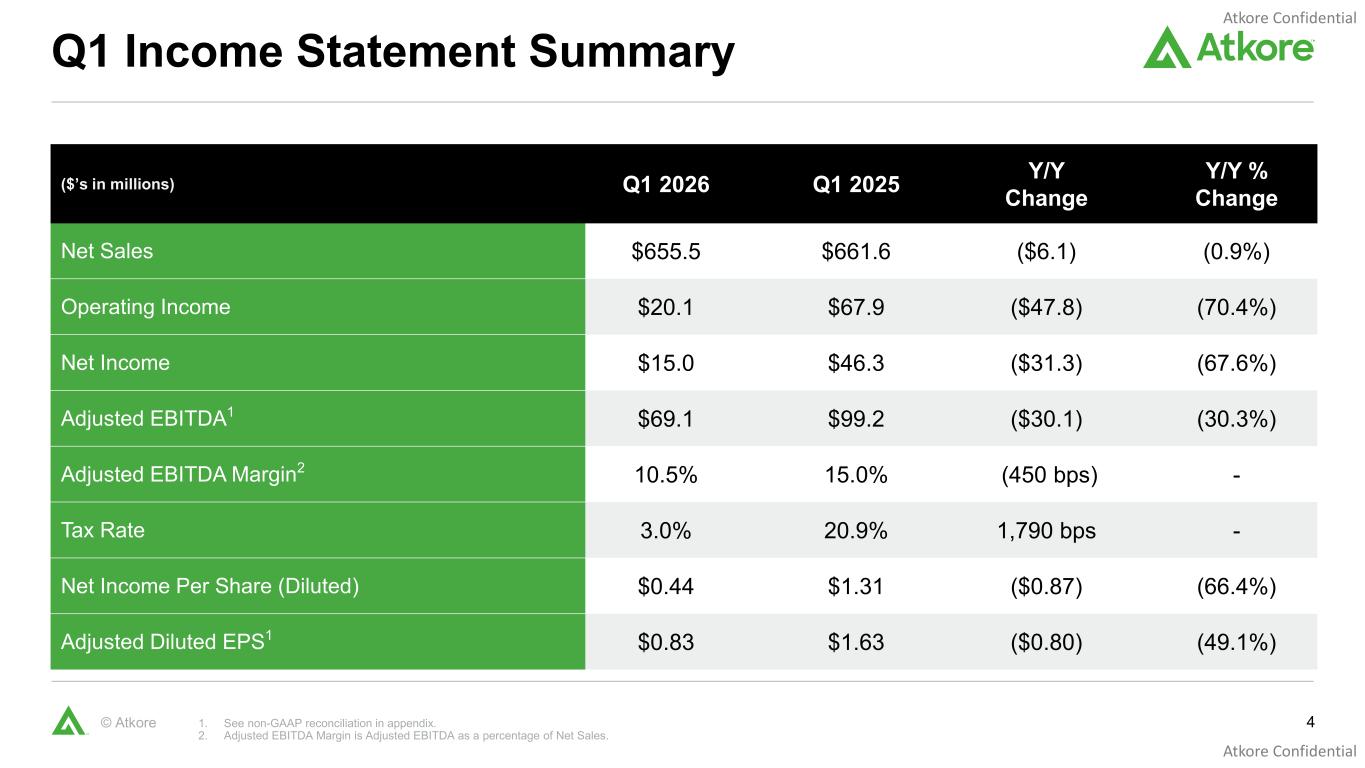

4© Atkore Q1 Income Statement Summary 1. See non-GAAP reconciliation in appendix. 2. Adjusted EBITDA Margin is Adjusted EBITDA as a percentage of Net Sales. ($’s in millions) Q1 2026 Q1 2025 Y/Y Change Y/Y % Change Net Sales $655.5 $661.6 ($6.1) (0.9%) Operating Income $20.1 $67.9 ($47.8) (70.4%) Net Income $15.0 $46.3 ($31.3) (67.6%) Adjusted EBITDA1 $69.1 $99.2 ($30.1) (30.3%) Adjusted EBITDA Margin2 10.5% 15.0% (450 bps) - Tax Rate 3.0% 20.9% 1,790 bps - Net Income Per Share (Diluted) $0.44 $1.31 ($0.87) (66.4%) Adjusted Diluted EPS1 $0.83 $1.63 ($0.80) (49.1%)

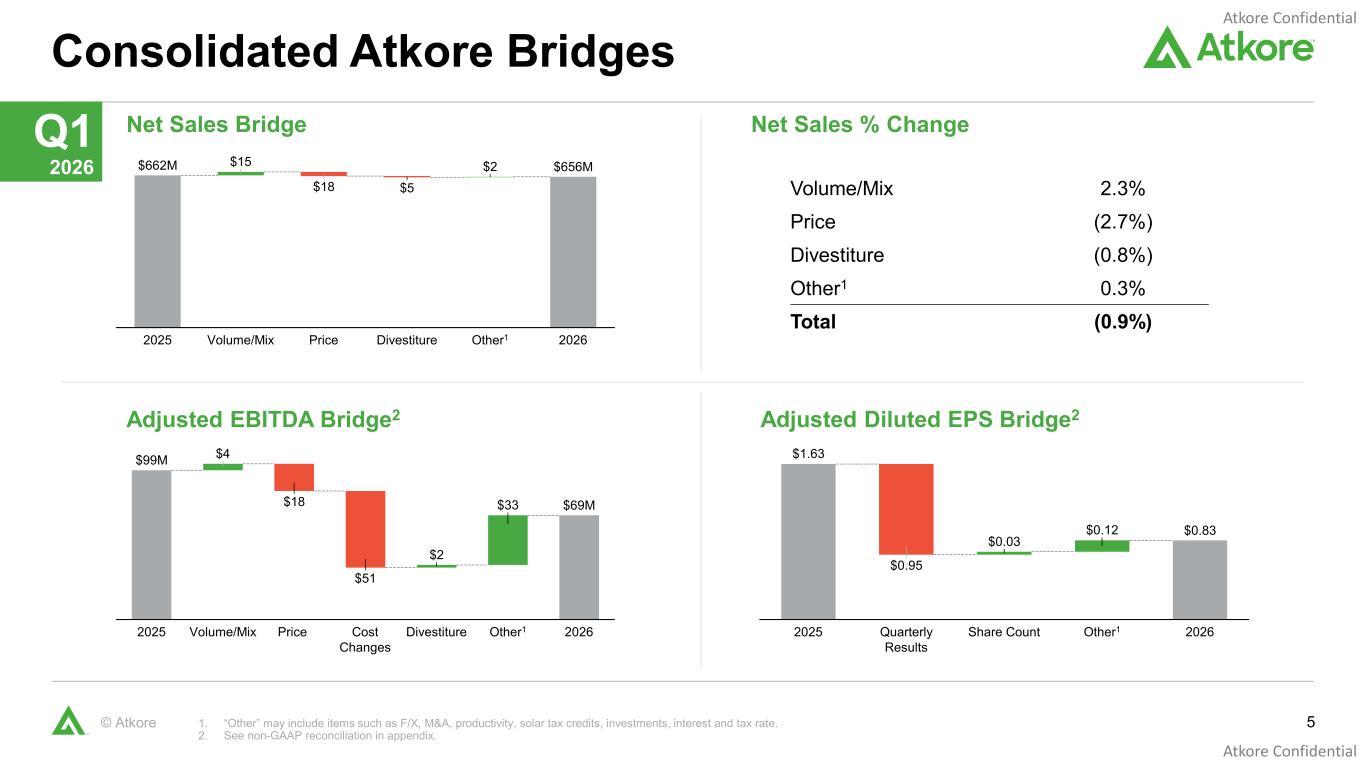

5© Atkore Consolidated Atkore Bridges 1. “Other” may include items such as F/X, M&A, productivity, solar tax credits, investments, interest and tax rate. 2. See non-GAAP reconciliation in appendix. Adjusted EBITDA Bridge2 Net Sales BridgeQ1 2026 $15 $18 $5 $2 2025 Volume/Mix Price Divestiture Other1 2026 $662M $656M $4 $18 $51 $2 $33 2025 Volume/Mix Price Cost Changes Divestiture Other1 2026 $99M $69M Net Sales % Change $1.63 $0.83 $0.95 $0.03 $0.12 2025 Quarterly Results Share Count Other1 2026 Adjusted Diluted EPS Bridge2 Volume/Mix 2.3% Price (2.7%) Divestiture (0.8%) Other1 0.3% Total (0.9%)

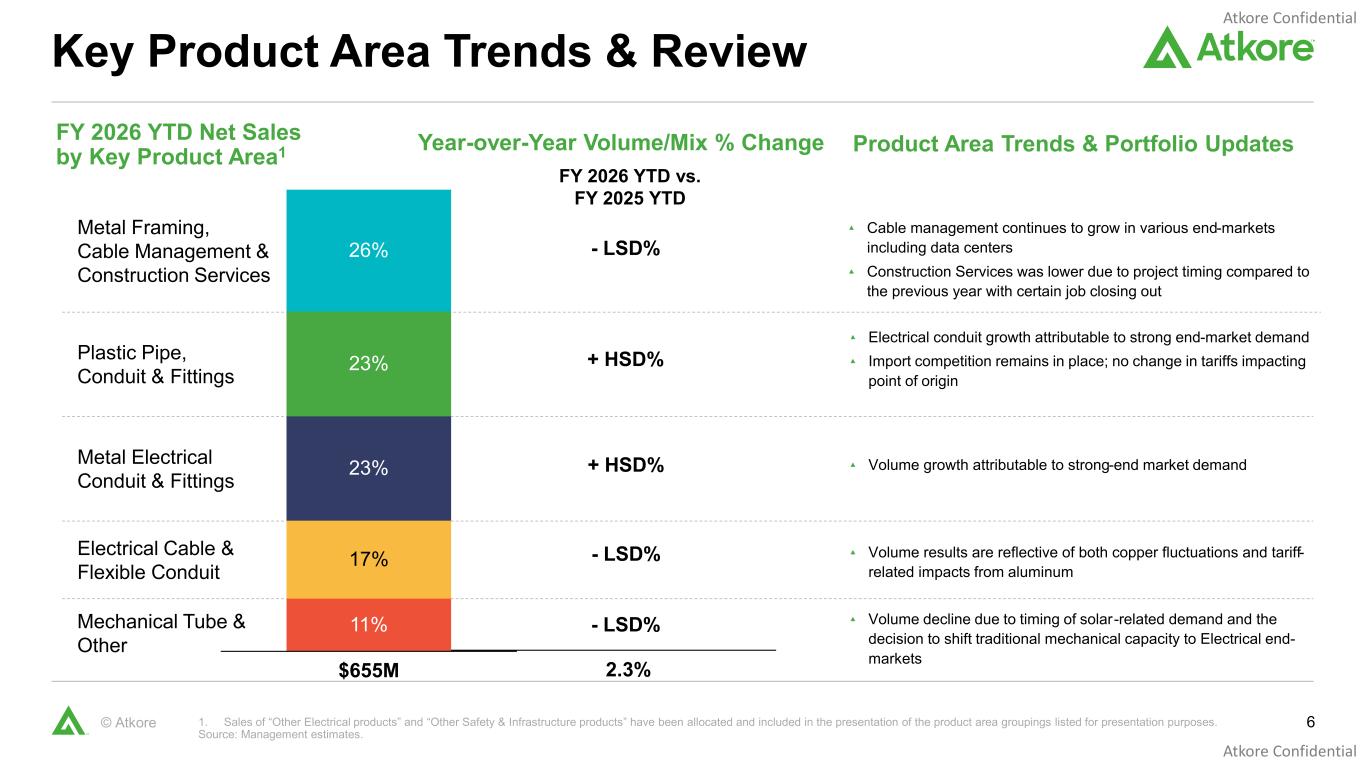

6© Atkore FY 2026 YTD Net Sales by Key Product Area1 Key Product Area Trends & Review 1. Sales of “Other Electrical products” and “Other Safety & Infrastructure products” have been allocated and included in the presentation of the product area groupings listed for presentation purposes. Source: Management estimates. FY 2026 YTD vs. FY 2025 YTD - LSD% + HSD% + HSD% - LSD% - LSD% 2.3% Mechanical Tube & Other Cable management continues to grow in various end-markets including data centers Construction Services was lower due to project timing compared to the previous year with certain job closing out Volume growth attributable to strong-end market demand Electrical conduit growth attributable to strong end-market demand Import competition remains in place; no change in tariffs impacting point of origin Volume results are reflective of both copper fluctuations and tariff- related impacts from aluminum Volume decline due to timing of solar-related demand and the decision to shift traditional mechanical capacity to Electrical end- markets Product Area Trends & Portfolio Updates Year-over-Year Volume/Mix % Change 26% 23% 23% 17% 11% $655M Metal Framing, Cable Management & Construction Services Plastic Pipe, Conduit & Fittings Metal Electrical Conduit & Fittings Electrical Cable & Flexible Conduit

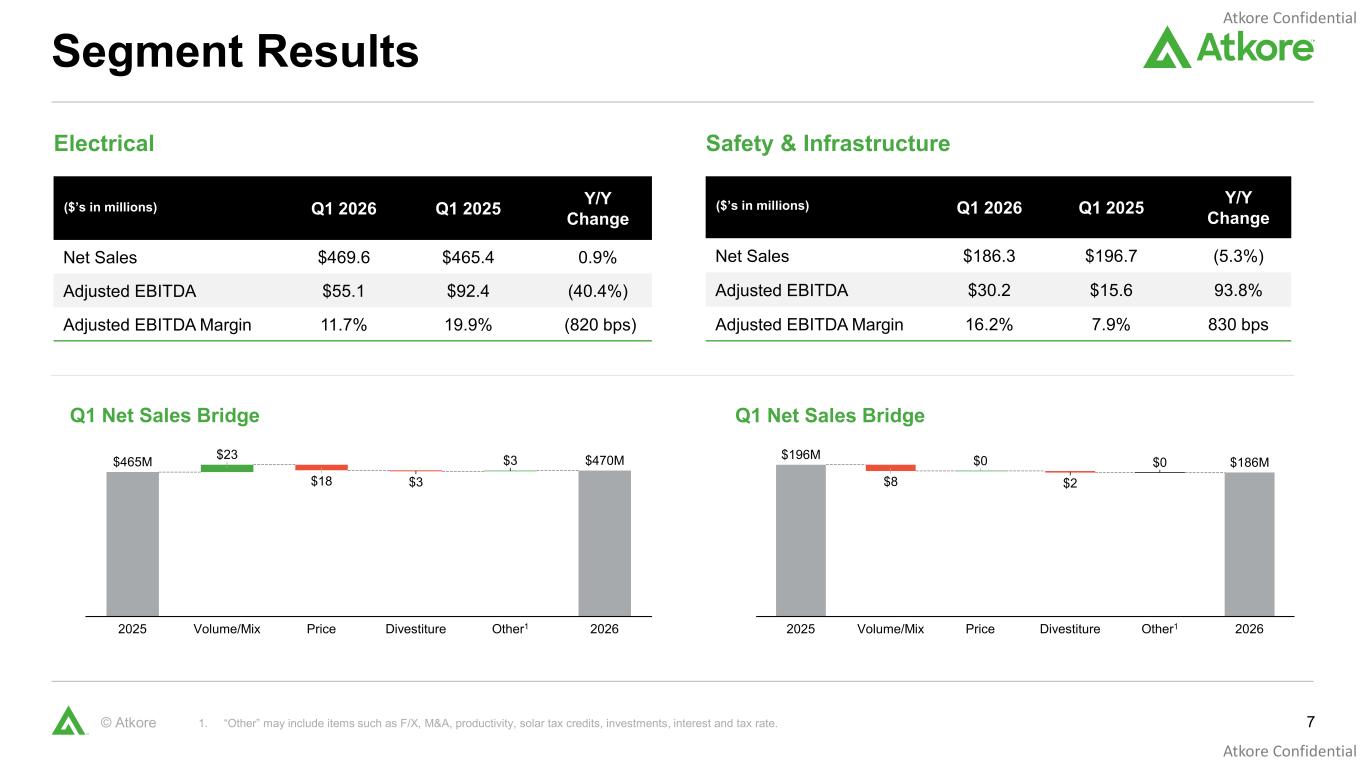

7© Atkore Segment Results $23 $18 $3 2025 Volume/Mix Price Divestiture $3 Other1 2026 $465M $470M Q1 Net Sales Bridge $8 $2 2025 Volume/Mix $0 Price Divestiture $0 Other1 2026 $196M $186M Q1 Net Sales Bridge Electrical Safety & Infrastructure ($’s in millions) Q1 2026 Q1 2025 Y/Y Change Net Sales $469.6 $465.4 0.9% Adjusted EBITDA $55.1 $92.4 (40.4%) Adjusted EBITDA Margin 11.7% 19.9% (820 bps) ($’s in millions) Q1 2026 Q1 2025 Y/Y Change Net Sales $186.3 $196.7 (5.3%) Adjusted EBITDA $30.2 $15.6 93.8% Adjusted EBITDA Margin 16.2% 7.9% 830 bps 1. “Other” may include items such as F/X, M&A, productivity, solar tax credits, investments, interest and tax rate.

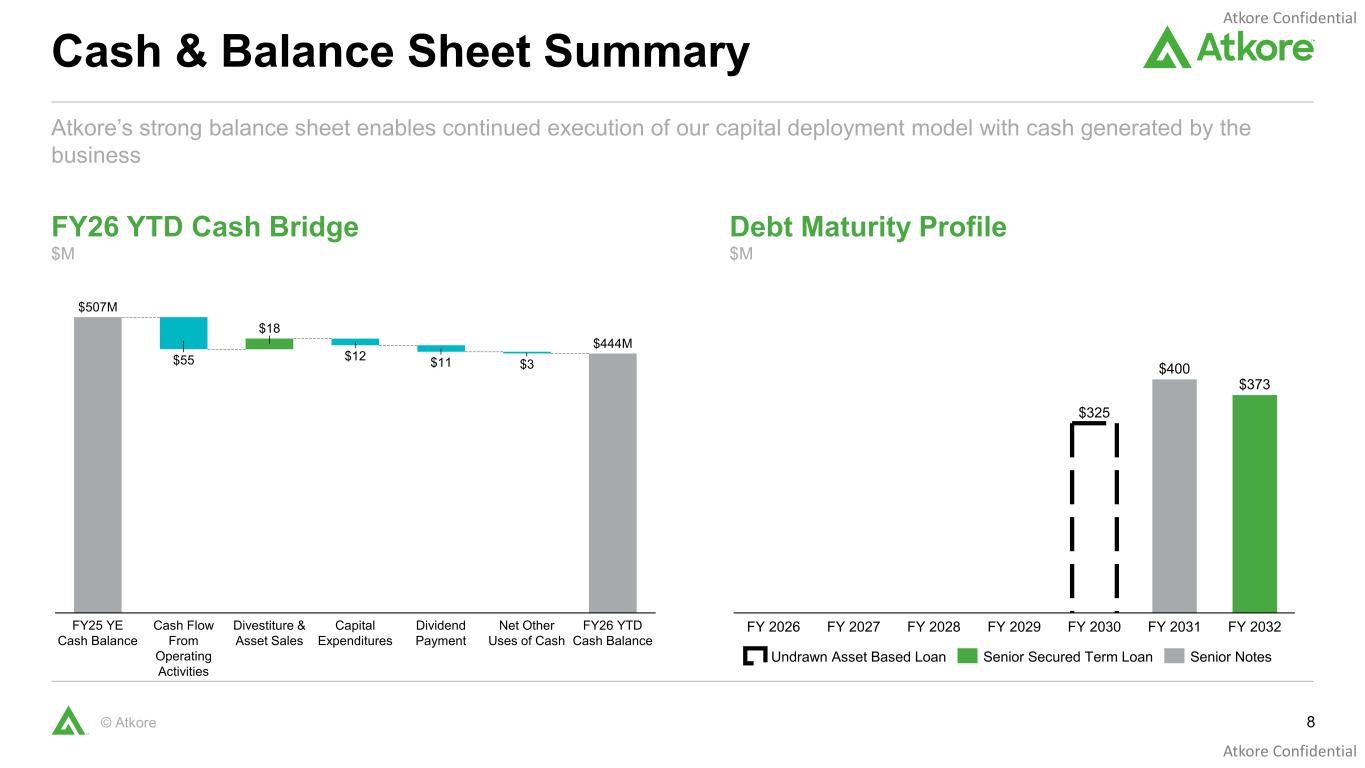

8© Atkore FY26 YTD Cash Bridge $M Cash & Balance Sheet Summary $55 $18 $12 $11 $3 FY25 YE Cash Balance Cash Flow From Operating Activities Divestiture & Asset Sales Capital Expenditures Dividend Payment Net Other Uses of Cash FY26 YTD Cash Balance $507M $444M Debt Maturity Profile $M $325 $400 $373 FY 2026 FY 2027 FY 2028 FY 2029 FY 2030 FY 2031 FY 2032 Undrawn Asset Based Loan Senior Secured Term Loan Senior Notes Atkore’s strong balance sheet enables continued execution of our capital deployment model with cash generated by the business

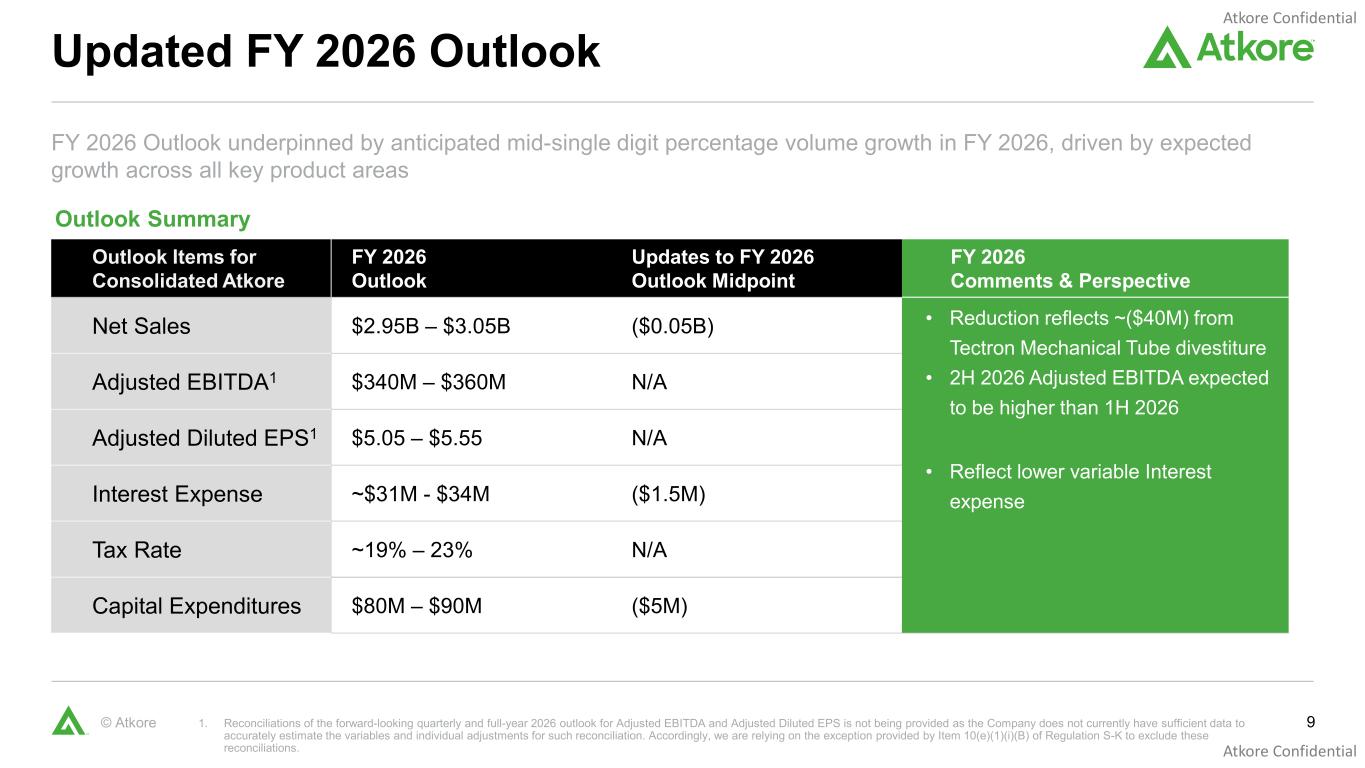

9© Atkore Updated FY 2026 Outlook Outlook Summary 1. Reconciliations of the forward-looking quarterly and full-year 2026 outlook for Adjusted EBITDA and Adjusted Diluted EPS is not being provided as the Company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such reconciliation. Accordingly, we are relying on the exception provided by Item 10(e)(1)(i)(B) of Regulation S-K to exclude these reconciliations. Outlook Items for Consolidated Atkore FY 2026 Outlook Updates to FY 2026 Outlook Midpoint FY 2026 Comments & Perspective Net Sales $2.95B – $3.05B ($0.05B) • Reduction reflects ~($40M) from Tectron Mechanical Tube divestiture • 2H 2026 Adjusted EBITDA expected to be higher than 1H 2026 • Reflect lower variable Interest expense Adjusted EBITDA1 $340M – $360M N/A Adjusted Diluted EPS1 $5.05 – $5.55 N/A Interest Expense ~$31M - $34M ($1.5M) Tax Rate ~19% – 23% N/A Capital Expenditures $80M – $90M ($5M) FY 2026 Outlook underpinned by anticipated mid-single digit percentage volume growth in FY 2026, driven by expected growth across all key product areas

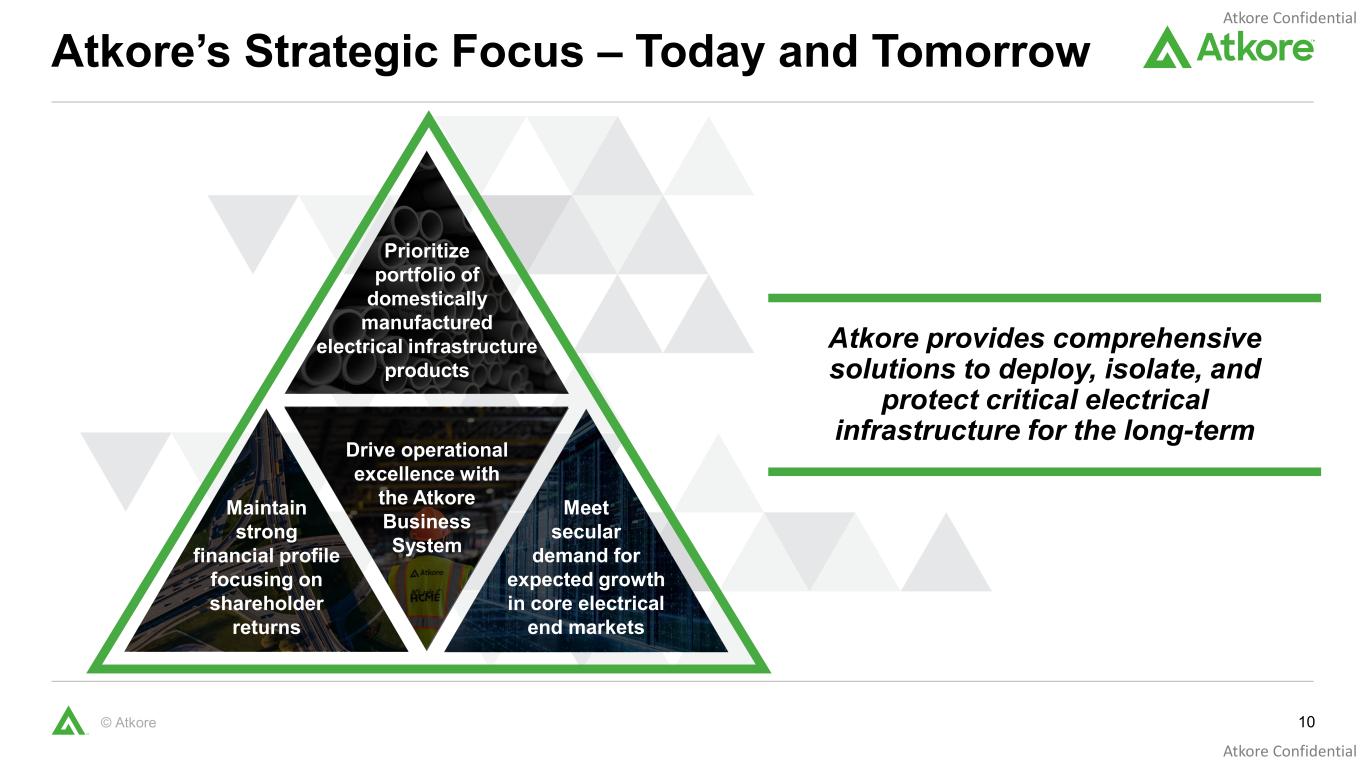

10© Atkore Atkore’s Strategic Focus – Today and Tomorrow Atkore provides comprehensive solutions to deploy, isolate, and protect critical electrical infrastructure for the long-term Drive operational excellence with the Atkore Business System Meet secular demand for expected growth in core electrical end markets Maintain strong financial profile focusing on shareholder returns Prioritize portfolio of domestically manufactured electrical infrastructure products

11© Atkore Appendix

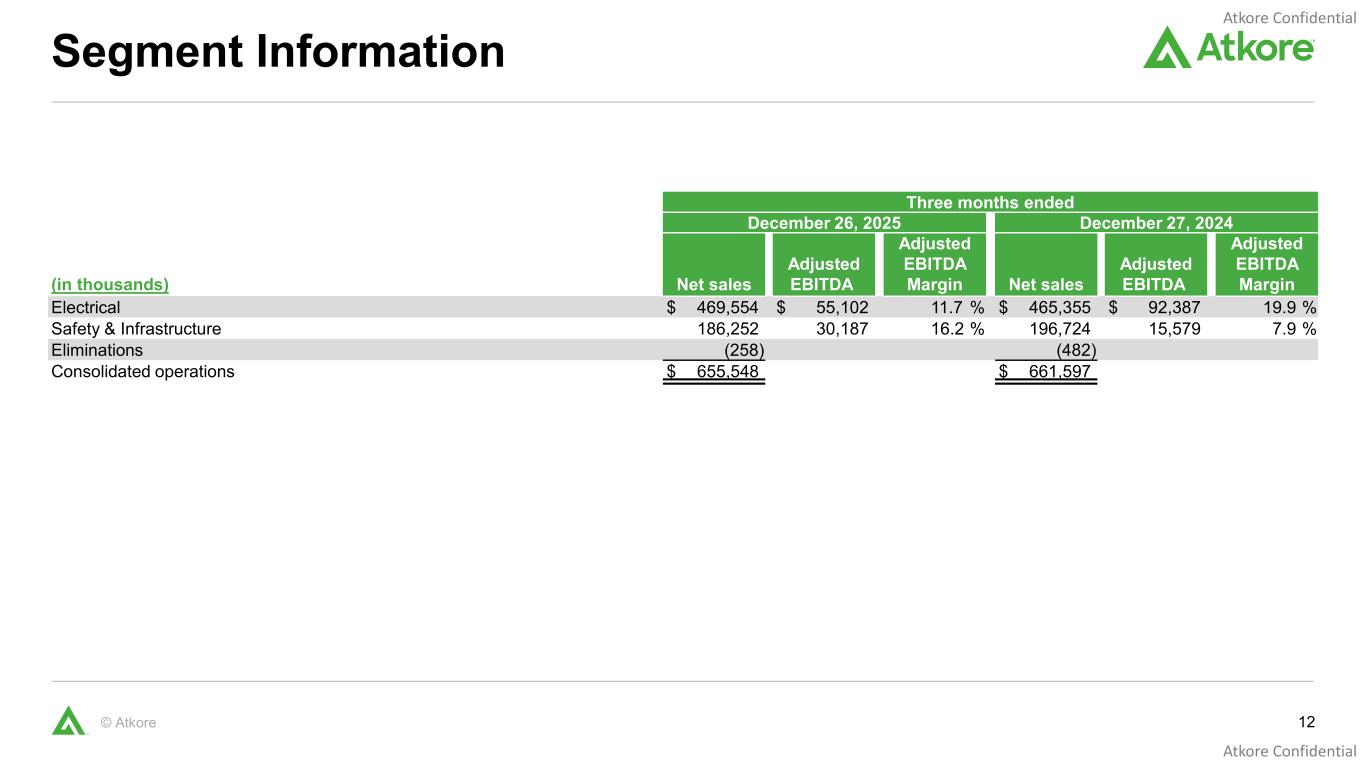

12© Atkore Segment Information Three months ended December 26, 2025 December 27, 2024 (in thousands) Net sales Adjusted EBITDA Adjusted EBITDA Margin Net sales Adjusted EBITDA Adjusted EBITDA Margin Electrical $ 469,554 $ 55,102 11.7 % $ 465,355 $ 92,387 19.9 % Safety & Infrastructure 186,252 30,187 16.2 % 196,724 15,579 7.9 % Eliminations (258) (482) Consolidated operations $ 655,548 $ 661,597

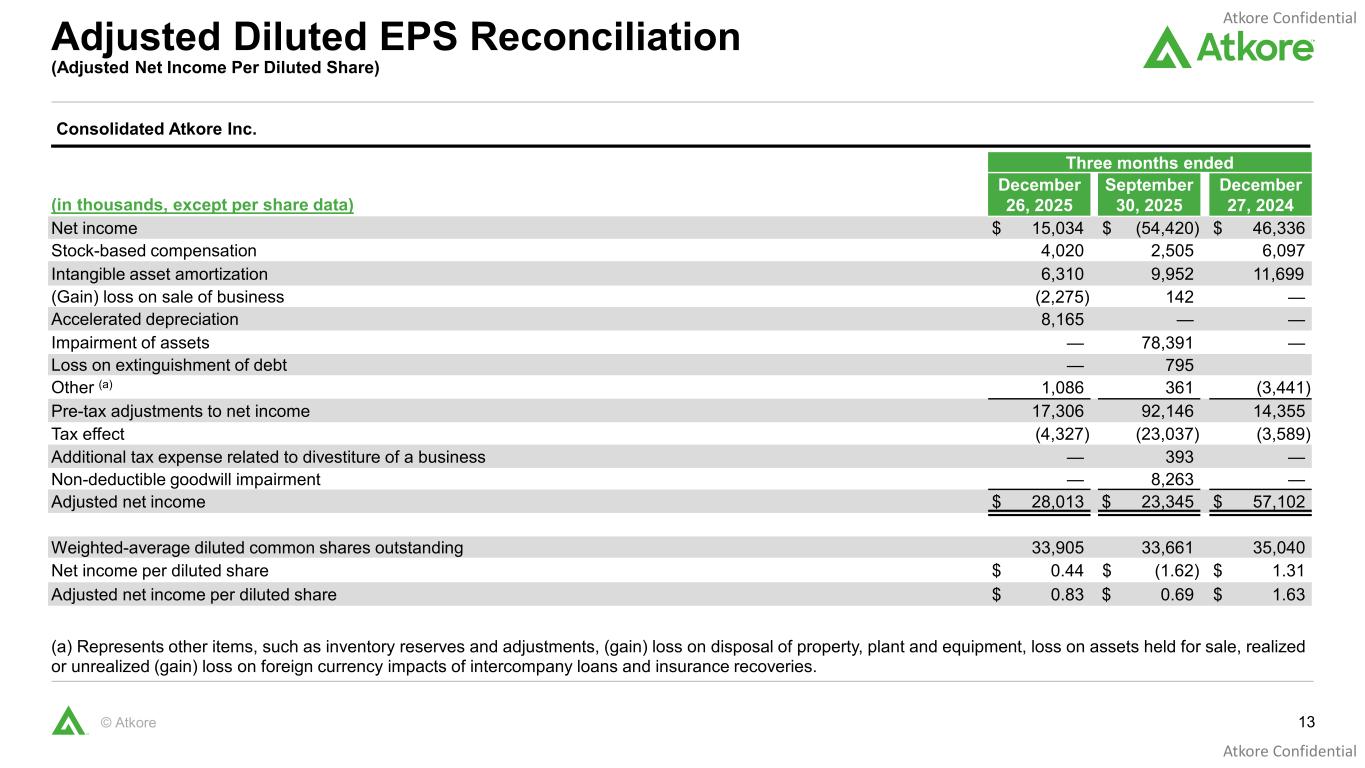

13© Atkore Adjusted Diluted EPS Reconciliation (Adjusted Net Income Per Diluted Share) Consolidated Atkore Inc. Three months ended (in thousands, except per share data) December 26, 2025 September 30, 2025 December 27, 2024 Net income $ 15,034 $ (54,420) $ 46,336 Stock-based compensation 4,020 2,505 6,097 Intangible asset amortization 6,310 9,952 11,699 (Gain) loss on sale of business (2,275) 142 — Accelerated depreciation 8,165 — — Impairment of assets — 78,391 — Loss on extinguishment of debt — 795 Other (a) 1,086 361 (3,441) Pre-tax adjustments to net income 17,306 92,146 14,355 Tax effect (4,327) (23,037) (3,589) Additional tax expense related to divestiture of a business — 393 — Non-deductible goodwill impairment — 8,263 — Adjusted net income $ 28,013 $ 23,345 $ 57,102 Weighted-average diluted common shares outstanding 33,905 33,661 35,040 Net income per diluted share $ 0.44 $ (1.62) $ 1.31 Adjusted net income per diluted share $ 0.83 $ 0.69 $ 1.63 (a) Represents other items, such as inventory reserves and adjustments, (gain) loss on disposal of property, plant and equipment, loss on assets held for sale, realized or unrealized (gain) loss on foreign currency impacts of intercompany loans and insurance recoveries.

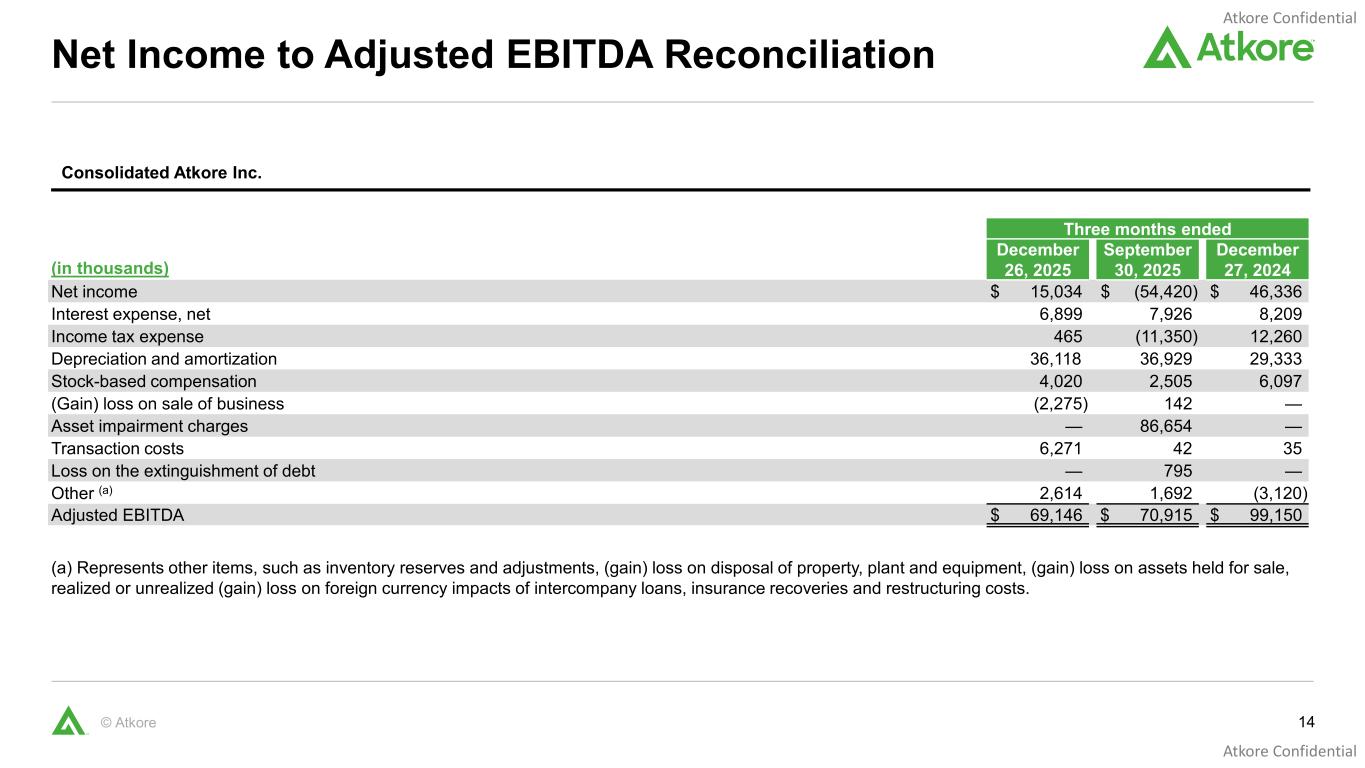

14© Atkore Net Income to Adjusted EBITDA Reconciliation Consolidated Atkore Inc. Three months ended (in thousands) December 26, 2025 September 30, 2025 December 27, 2024 Net income $ 15,034 $ (54,420) $ 46,336 Interest expense, net 6,899 7,926 8,209 Income tax expense 465 (11,350) 12,260 Depreciation and amortization 36,118 36,929 29,333 Stock-based compensation 4,020 2,505 6,097 (Gain) loss on sale of business (2,275) 142 — Asset impairment charges — 86,654 — Transaction costs 6,271 42 35 Loss on the extinguishment of debt — 795 — Other (a) 2,614 1,692 (3,120) Adjusted EBITDA $ 69,146 $ 70,915 $ 99,150 (a) Represents other items, such as inventory reserves and adjustments, (gain) loss on disposal of property, plant and equipment, (gain) loss on assets held for sale, realized or unrealized (gain) loss on foreign currency impacts of intercompany loans, insurance recoveries and restructuring costs.

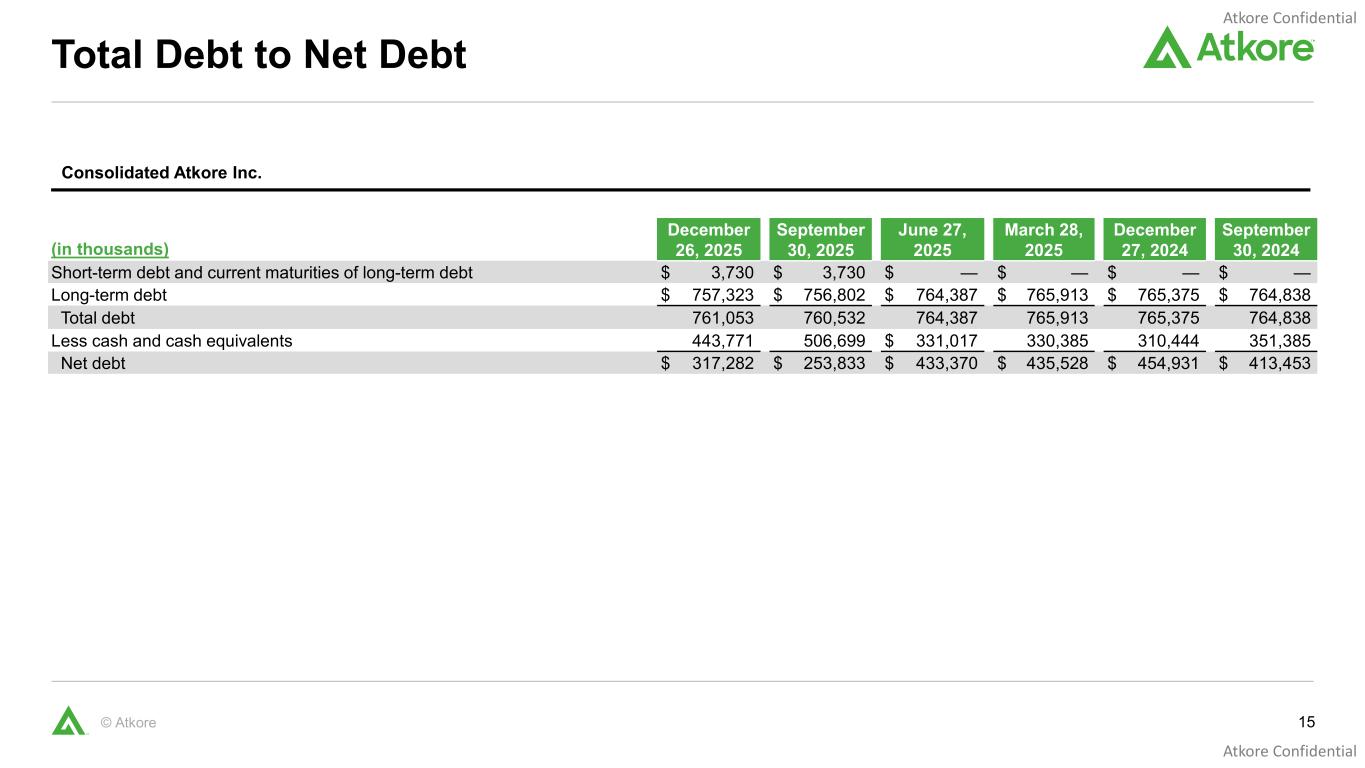

15© Atkore Total Debt to Net Debt Consolidated Atkore Inc. (in thousands) December 26, 2025 September 30, 2025 June 27, 2025 March 28, 2025 December 27, 2024 September 30, 2024 Short-term debt and current maturities of long-term debt $ 3,730 $ 3,730 $ — $ — $ — $ — Long-term debt $ 757,323 $ 756,802 $ 764,387 $ 765,913 $ 765,375 $ 764,838 Total debt 761,053 760,532 764,387 765,913 765,375 764,838 Less cash and cash equivalents 443,771 506,699 $ 331,017 330,385 310,444 351,385 Net debt $ 317,282 $ 253,833 $ 433,370 $ 435,528 $ 454,931 $ 413,453

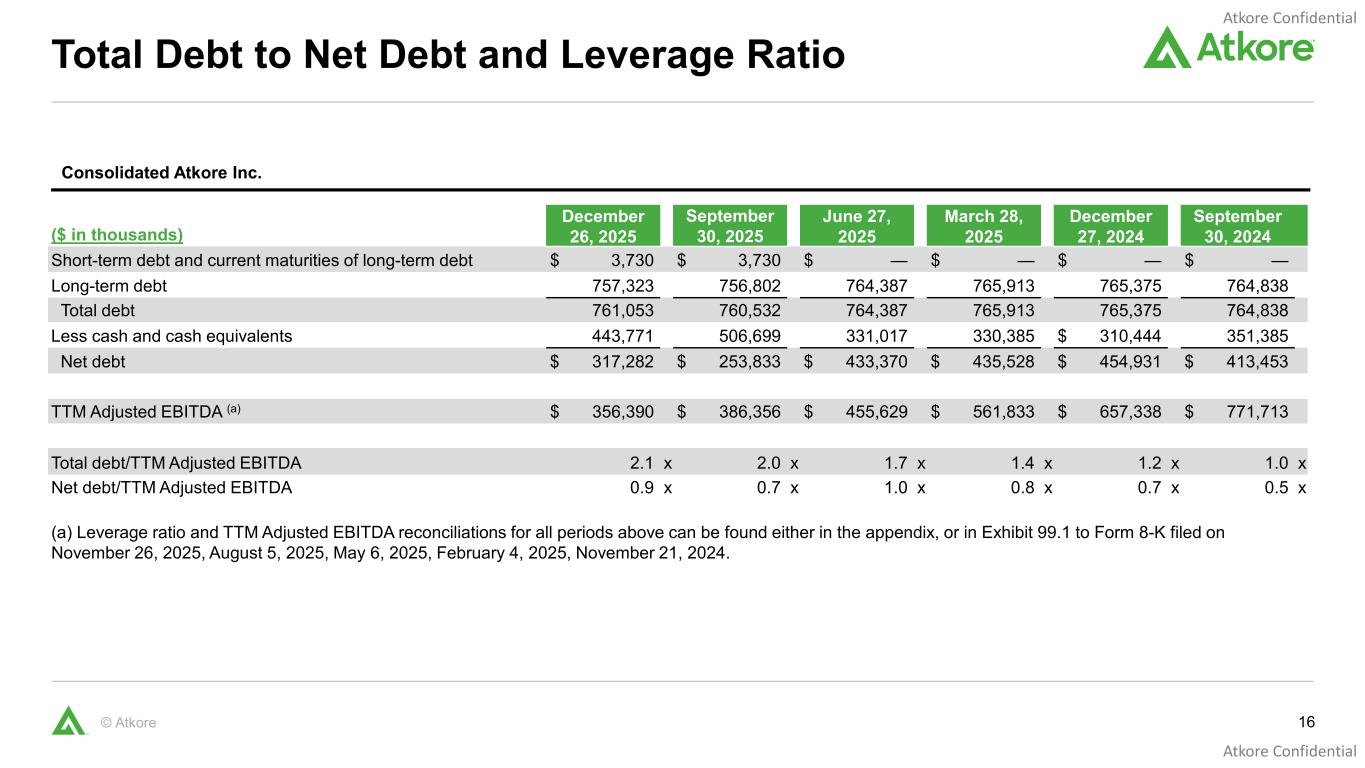

16© Atkore Total Debt to Net Debt and Leverage Ratio Consolidated Atkore Inc. ($ in thousands) December 26, 2025 September 30, 2025 June 27, 2025 March 28, 2025 December 27, 2024 September 30, 2024 Short-term debt and current maturities of long-term debt $ 3,730 $ 3,730 $ — $ — $ — $ — Long-term debt 757,323 756,802 764,387 765,913 765,375 764,838 Total debt 761,053 760,532 764,387 765,913 765,375 764,838 Less cash and cash equivalents 443,771 506,699 331,017 330,385 $ 310,444 351,385 Net debt $ 317,282 $ 253,833 $ 433,370 $ 435,528 $ 454,931 $ 413,453 TTM Adjusted EBITDA (a) $ 356,390 $ 386,356 $ 455,629 $ 561,833 $ 657,338 $ 771,713 Total debt/TTM Adjusted EBITDA 2.1 x 2.0 x 1.7 x 1.4 x 1.2 x 1.0 x Net debt/TTM Adjusted EBITDA 0.9 x 0.7 x 1.0 x 0.8 x 0.7 x 0.5 x (a) Leverage ratio and TTM Adjusted EBITDA reconciliations for all periods above can be found either in the appendix, or in to Form 8-K filed on November 26, 2025, August 5, 2025, May 6, 2025, February 4, 2025, November 21, 2024.

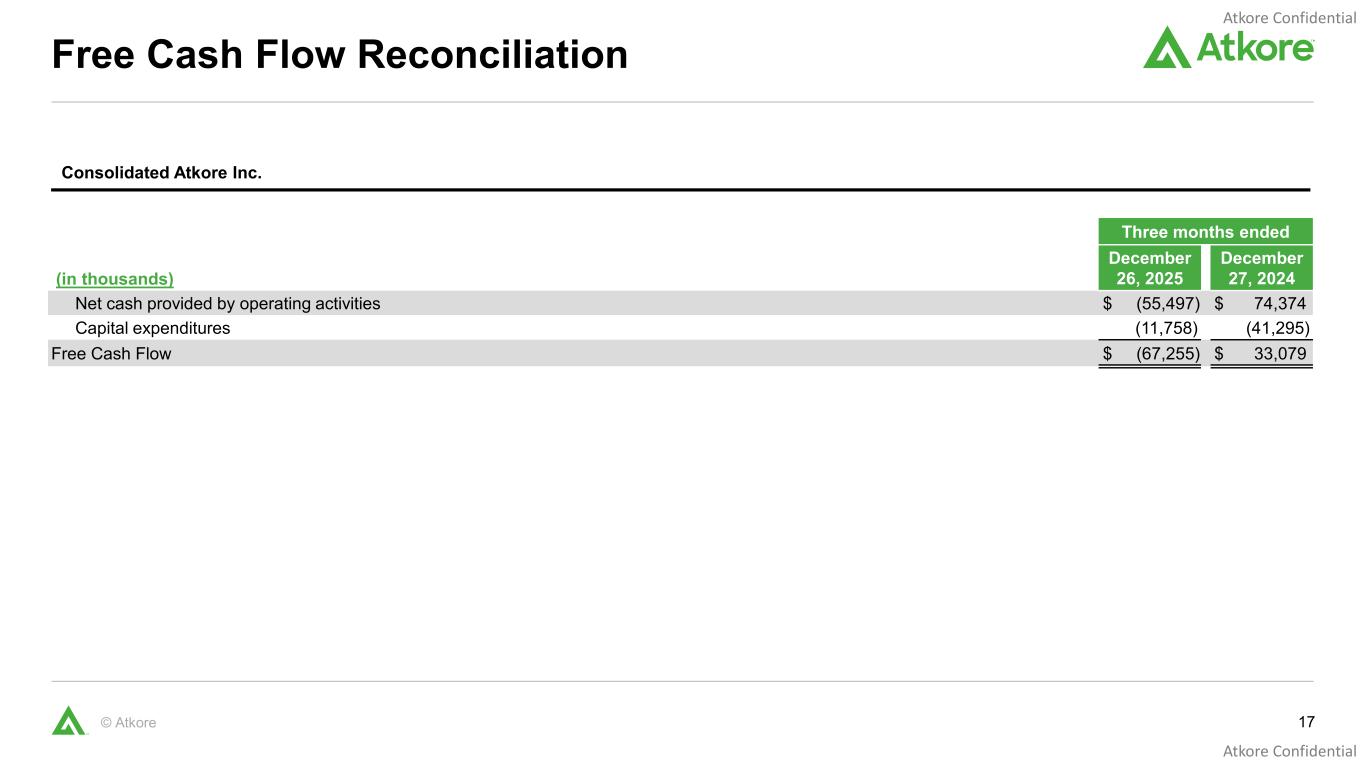

17© Atkore Free Cash Flow Reconciliation Consolidated Atkore Inc. Three months ended (in thousands) December 26, 2025 December 27, 2024 Net cash provided by operating activities $ (55,497) $ 74,374 Capital expenditures (11,758) (41,295) Free Cash Flow $ (67,255) $ 33,079

18© Atkore Abbreviations listed in alphanumeric order Glossary of Terms Abbreviation Description 1H First Half 2H Second Half ABS Atkore Business System Adj. Adjusted B Billion Capex Capital Expenditures CY Calendar Year DD% Double Digit Percentage EBITDA Earnings Before Interest, Taxes, Depreciation, & Amortization EPD Environmental Product Declaration EPS Earnings Per Share ESG Environment, Social, and Governance Est. Estimated Excl. Excluding FX or F/X Foreign Exchange FY Fiscal Year HDPE High Density Polyethylene HSD% High Single Digit Percentage IRA Inflation Reduction Act K Thousand Abbreviation Description LDD% Low Double Digit Percentage LSD% Low Single Digit Percentage M Million M&A Mergers & Acquisitions MSD% Mid Single Digit Percentage N/A Not Applicable PVC Polyvinyl Chloride Q1 First Fiscal Quarter Q2 Second Fiscal Quarter Q3 Third Fiscal Quarter Q4 Fourth Fiscal Quarter RSC Regional Service Center S&I Safety & Infrastructure TTM Trailing Twelve Months UK United Kingdom U.S. United States of America USD United States Dollar #X Number of Times YE Year End YTD Year to Date

19© Atkore atkore.com