Please wait

.3

| | | | | | | | |

| Management Discussion and Analysis |

| | | | | | | | | | | | | | |

| | | | |

| Contents |

| About Fortis | 1 | | Cash Flow Summary | 15 |

| Performance at a Glance | 2 | | Contractual Obligations | 16 |

| The Industry | 5 | | Capital Structure and Credit Ratings | 17 |

| Operating Results | 5 | | Capital Plan | 18 |

| Business Unit Performance | 6 | | Business Risks | 21 |

| ITC | 7 | | Accounting Matters | 29 |

| UNS Energy | 7 | | Financial Instruments | 32 |

| Central Hudson | 8 | | Long-Term Debt and Other | 32 |

| FortisBC Energy | 8 | | Derivatives | 32 |

| FortisAlberta | 8 | | Selected Annual Financial Information | 34 |

| FortisBC Electric | 9 | | Fourth Quarter Results | 35 |

| Other Electric | 9 | | Summary of Quarterly Results | 37 |

| Corporate and Other | 10 | | Related-Party and Inter-Company Transactions | 38 |

| Non-U.S. GAAP Financial Measures | 10 | | Management's Evaluation of Controls and Procedures | 38 |

| Regulatory Highlights | 11 | | Outlook | 38 |

| Financial Position | 13 | | Forward-Looking Information | 39 |

| Liquidity and Capital Resources | 13 | | Glossary | 40 |

| Cash Flow Requirements | 13 | | Annual Consolidated Financial Statements | F-1 |

| | | | |

Dated February 11, 2026

This MD&A has been prepared in accordance with National Instrument 51-102 - Continuous Disclosure Obligations. It should be read in conjunction with the 2025 Annual Financial Statements and is subject to the cautionary statement and disclaimer provided under "Forward-Looking Information" on page 39. Further information about Fortis, including its Annual Information Form, can be accessed at www.fortisinc.com, www.sedarplus.ca, or www.sec.gov.

Financial information herein has been prepared in accordance with U.S. GAAP (except for indicated Non-U.S. GAAP Financial Measures) and, unless otherwise specified, is presented in Canadian dollars based, as applicable, on the following U.S. dollar-to-Canadian dollar exchange rates: (i) average of 1.40 and 1.37 for the years ended December 31, 2025 and 2024, respectively; (ii) 1.37 and 1.44 as at December 31, 2025 and 2024, respectively; (iii) average of 1.39 and 1.40 for the quarters ended December 31, 2025 and 2024, respectively; and (iv) 1.35 for all forecast periods. Certain terms used in this MD&A are defined in the "Glossary" on page 40.

ABOUT FORTIS

Fortis (TSX/NYSE: FTS) is a diversified leader in the North American regulated electric and gas utility industry, with revenue of $12 billion in 2025 and total assets of $75 billion as at December 31, 2025. The Corporation's 9,900 employees serve 3.5 million utility customers in five Canadian provinces, ten U.S. states and the Caribbean. As at December 31, 2025, 65% of the Corporation's assets were located in the U.S., 33% in Canada and the remaining 2% in the Caribbean. Operations in the U.S. accounted for 58% of the Corporation's 2025 revenue, with the remaining 38% in Canada, and 4% in the Caribbean.

Fortis is principally an energy delivery company, with approximately 95% of its assets related to transmission and distribution. The business is characterized by low-risk, stable and predictable earnings and cash flows. Earnings, EPS and TSR are the primary measures of financial performance.

| | | | | | | | | | | |

| FORTIS INC. | DECEMBER 31, 2025 | 1 |

| | | | | | | | |

| Management Discussion and Analysis |

Fortis' regulated utility businesses are: ITC (electric transmission - Michigan, Iowa, Minnesota, Illinois, Missouri, Kansas, Oklahoma and Wisconsin); UNS Energy (integrated electric and natural gas distribution - Arizona); Central Hudson (electric transmission and distribution, and natural gas distribution - New York State); FortisBC Energy (natural gas transmission and distribution - British Columbia); FortisAlberta (electric distribution - Alberta); FortisBC Electric (integrated electric - British Columbia); Newfoundland Power (integrated electric - Newfoundland and Labrador); Maritime Electric (integrated electric - Prince Edward Island); FortisOntario (integrated electric - Ontario); and Caribbean Utilities (integrated electric - Grand Cayman). The Corporation also owns a 39% equity investment in Wataynikaneyap Power (electric transmission - Ontario). Fortis sold FortisTCI (integrated electric - Turks and Caicos Islands) on September 2, 2025 and its 33% equity investment in Belize Electricity (integrated electric - Belize) on October 31, 2025.

The Corporation's only non-regulated business was Fortis Belize (three hydroelectric generation facilities - Belize), which was also sold on October 31, 2025.

Fortis has a unique operating model with a small corporate office in St. John's, Newfoundland and Labrador and business units that operate on a substantially autonomous basis. Each utility has its own management team and board of directors, with most having a majority of independent board members, which provides effective oversight within the broad parameters of Fortis policies and best practices. Subsidiary autonomy supports constructive relationships with regulators, policy makers, customers and communities. Fortis believes this model enhances accountability, opportunity and performance across the Corporation's businesses, and positions Fortis well for future investment opportunities.

Fortis is focused on providing safe, reliable and cost-effective service to customers. In addition, management is focused on delivering long-term profitable growth for shareholders through the execution of its capital plan and the pursuit of investment opportunities within and proximate to its service territories.

Additional information about the Corporation's business and reporting units is provided in Note 1 in the 2025 Annual Financial Statements.

| | | | | | | | | | | | | | | | | |

| PERFORMANCE AT A GLANCE | | | | | |

| Key Financial Metrics | | | | | |

| ($ millions, except as indicated) | 2025 | | | 2024 | | | Variance |

| Common Equity Earnings | | | | | |

| Actual | 1,714 | | | 1,606 | | | 108 | |

Adjusted (1) | 1,777 | | | 1,626 | | | 151 | |

Basic EPS ($) | | | | | |

| Actual | 3.40 | | | 3.24 | | | 0.16 | |

Adjusted (1) | 3.53 | | | 3.28 | | | 0.25 | |

Dividends | | | | | |

Paid per common share ($) | 2.49 | | | 2.39 | | | 0.10 | |

Actual Payout Ratio (%) | 73.1 | | | 73.6 | | | (0.5) | |

Adjusted Payout Ratio (%) (1) | 70.4 | | | 72.7 | | | (2.3) | |

Weighted average number of common shares outstanding (# millions) | 503.5 | | | 495.0 | | | 8.5 | |

Operating Cash Flow | 4,062 | | | 3,882 | | | 180 | |

Capital Expenditures (1) | 5,614 | | | 5,247 | | | 367 | |

(1)See "Non-U.S. GAAP Financial Measures" on page 10

Earnings and EPS

Common Equity Earnings increased by $108 million, or $0.16 per common share, compared to 2024. Earnings growth in 2025 was impacted by $63 million of losses associated with the dispositions of FortisTCI, Fortis Belize and Belize Electricity, approximately half of which related to income taxes. In addition, results for 2024 were unfavourably impacted by $20 million associated with the retroactive impact of a reduction in the MISO base ROE at ITC as approved by FERC.

Excluding the above-noted items, Common Equity Earnings increased by $151 million, or $0.25 per common share, compared to 2024. The increase was primarily due to Rate Base growth across the utilities, including AFUDC associated with Major Capital Projects. Growth in earnings was also due to the rebasing of costs effective July 1, 2024 at Central Hudson, unrealized gains on derivative contracts, and the favourable impact of changes in the U.S. dollar-to-Canadian dollar exchange rate. The increase was partially offset by: (i) higher costs associated with Rate Base growth not yet reflected in customer rates, lower retail electricity sales due to milder weather, and lower margins on wholesale electricity sales at UNS Energy; (ii) the expiration of a regulatory incentive at FortisAlberta; and (iii) higher stock-based compensation and holding company finance costs. Lower earnings from FortisTCI and Fortis Belize, net of finance cost savings associated with the proceeds received on the dispositions, also unfavourably impacted results. The change in EPS also reflected an increase in the weighted average number of common shares outstanding, largely associated with the Corporation's DRIP.

| | | | | | | | | | | |

| FORTIS INC. | DECEMBER 31, 2025 | 2 |

| | | | | | | | |

| Management Discussion and Analysis |

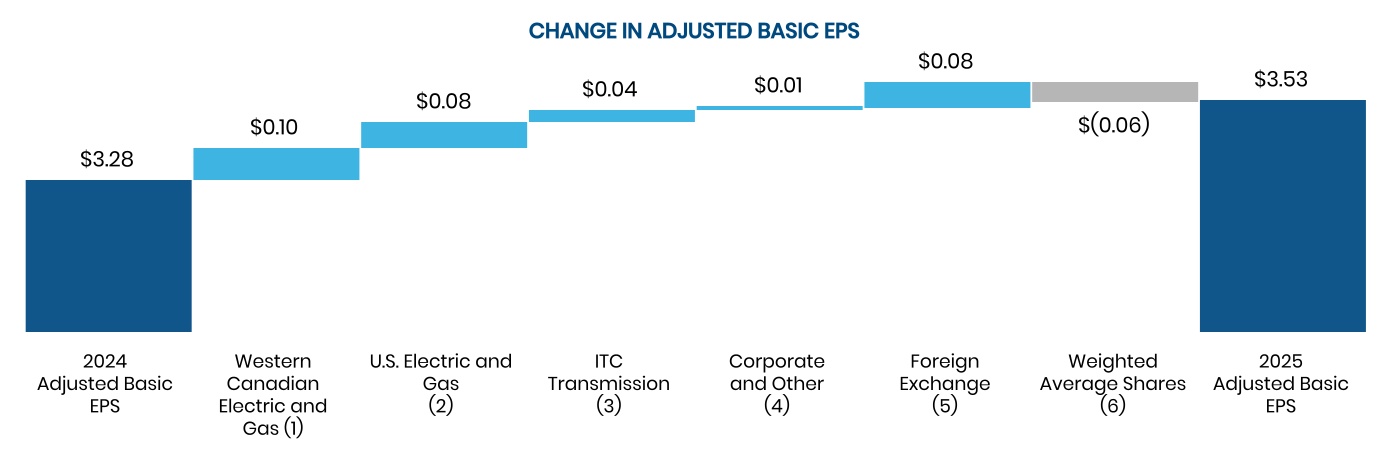

Adjusted Common Equity Earnings and Adjusted Basic EPS, which exclude the losses associated with dispositions in 2025 and the retroactive ROE adjustment at ITC in 2024, as discussed previously, increased by $151 million and $0.25, respectively. Refer to "Non-U.S. GAAP Financial Measures" on page 10 for a reconciliation of these measures. The change in Adjusted Basic EPS is illustrated in the following chart.

(1) Includes FortisBC Energy, FortisAlberta and FortisBC Electric. Reflects Rate Base growth, including AFUDC associated with FortisBC Energy's investment in the Eagle Mountain Pipeline project, partially offset by the expiration of the PBR efficiency carry-over mechanism at the end of 2024 at FortisAlberta.

(2) Includes UNS Energy and Central Hudson. Reflects higher earnings at Central Hudson primarily due to Rate Base growth, the rebasing of costs effective July 1, 2024, and a change in a regulatory deferral for uncollectible accounts as approved in the order on the 2025 general rate application. Also reflects lower earnings at UNS Energy due to higher costs associated with Rate Base growth not yet reflected in customer rates, lower retail electricity sales due to milder weather, and lower margin on wholesale sales, partially offset by higher transmission revenue and AFUDC

(3) Reflects Rate Base growth, partially offset by higher non-recoverable stock-based compensation and holding company finance costs

(4) Reflects unrealized gains on foreign exchange contracts and total return swaps, partially offset by higher holding company finance and stock-based compensation costs

(5) Reflects average foreign exchange rate of 1.40 in 2025 compared to 1.37 in 2024, and the revaluation of U.S. dollar denominated short-term liabilities

(6) Weighted average shares of 503.5 million in 2025 compared to 495.0 million in 2024

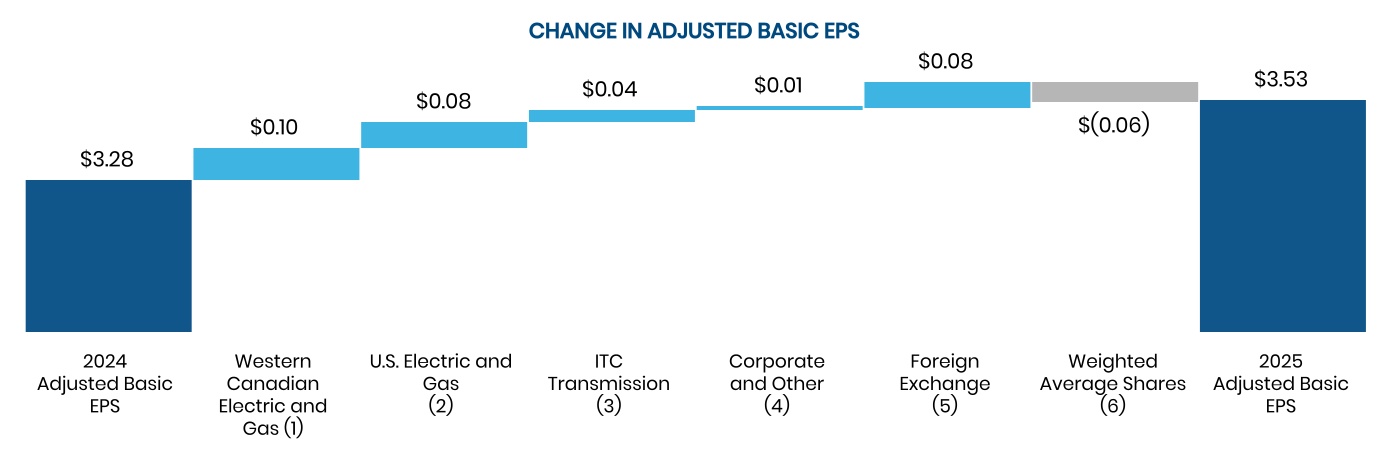

Dividends

Fortis paid a dividend of $0.64 per common share in the fourth quarter of 2025, up 4.1% from 0.615 paid in each of the previous four quarters. This marked the Corporation's 52nd consecutive year of increases in dividends paid. The Adjusted Payout Ratio was 70% in 2025 and the Actual Payout Ratio averaged 73% over the three-year period of 2023 through 2025.

Fortis is targeting annual dividend growth of approximately 4-6% through 2030. See "Outlook" on page 38.

Growth in dividends and changes in the market price of the Corporation's common shares have yielded the following TSRs.

| | | | | | | | | | | | | | | | | | | | | | | |

TSR (1) (%) | 1-Year | | 5-Year | | 10-Year | | 20-Year |

| Fortis | 23.9 | | | 10.7 | | | 10.8 | | | 9.5 | |

(1)Annualized TSR per Bloomberg, as at December 31, 2025

| | | | | | | | | | | |

| FORTIS INC. | DECEMBER 31, 2025 | 3 |

| | | | | | | | |

| Management Discussion and Analysis |

Operating Cash Flow

The $180 million increase in Operating Cash Flow was due to higher cash earnings, reflecting Rate Base growth, new customer delivery rates at Central Hudson as approved by the PSC, and the sale of investment tax credits at UNS Energy. The timing of transmission charges at FortisAlberta and the higher U.S. dollar-to-Canadian dollar exchange rate also contributed to growth in Operating Cash Flow. The increase was partially offset by: (i) the timing of flow-through costs at UNS Energy associated with higher PPFAC collections in 2024, and at FortisBC Energy related to the consumer carbon tax which was effectively repealed in 2025; (ii) the receipt of a tax refund at FortisBC Energy in 2024; and (iii) higher interest payments.

Capital Expenditures

Capital Expenditures in 2025 were $5.6 billion, consistent with expectations and $0.4 billion higher than 2024. The increase compared to 2024 was largely related to: (i) investments in Major Capital Projects, including projects within the first tranche of the MISO LRTP and the Big Cedar Load Expansion project at ITC, as well as the Vail-to-Tortolita and Black Mountain Gas Generation projects at UNS Energy; (ii) incremental transmission and distribution investments across the Corporation's utilities; and (iii) the impact of the higher U.S. dollar-to-Canadian dollar exchange rate. The increase was partially offset by FortisBC Energy's investment in the Eagle Mountain Pipeline project in 2024. Construction of the project in 2025 was largely funded by CIACs rather than investments by FortisBC Energy.

Capital Expenditures is a Non-U.S. GAAP Financial Measure. Refer to "Non-U.S. GAAP Financial Measures" on page 10 and in the "Glossary" on page 40.

New Five-Year Capital Plan

The Corporation's 2026-2030 Capital Plan of $28.8 billion is the largest in the Corporation's history and is $2.8 billion higher than the previous five-year plan. The increase is primarily driven by higher FERC regulated transmission investments associated with new interconnections, the MISO LRTP and baseline reliability projects at ITC. It also includes incremental capital at UNS Energy, reflecting an increase in transmission and distribution investments to serve load growth, increase reliability, and provide a path for connecting future generation resources. Planned generation investments in Arizona have also been updated to reflect the Springerville Natural Gas Conversion project. Customer growth and reliability investments across our utilities, as well as a higher assumed U.S. dollar-to-Canadian dollar exchange rate also contributed to the increase in the five-year plan. For a detailed discussion of the Corporation's capital expenditure program, see "Capital Plan" on page 18.

The Capital Plan is expected to be funded primarily by cash from operations and regulated utility debt. Common equity is expected to be provided by the Corporation's DRIP, assuming current participation levels. The Corporation's $500 million ATM Program has not been utilized to date and remains available for funding flexibility as required.

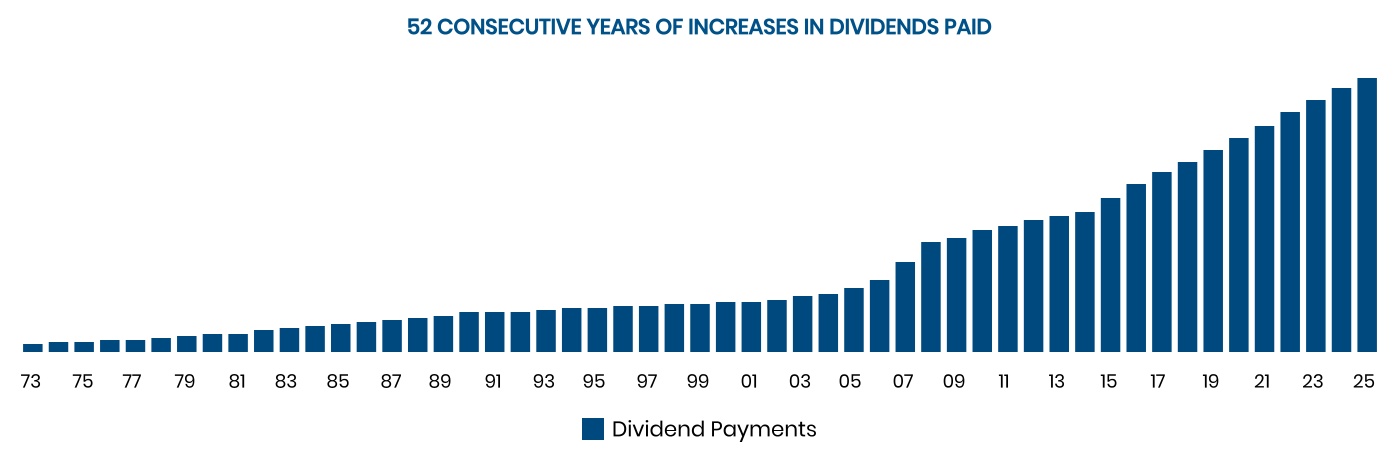

The five-year Capital Plan is expected to increase midyear Rate Base from $42.4 billion in 2025 to $57.9 billion by 2030, translating into a five-year CAGR of 7.0%.

PROJECTED RATE BASE (1)

Beyond the five-year Capital Plan, opportunities to expand and extend growth include: further expansion of the electric transmission grid in the U.S. to support load growth and facilitate the interconnection of new energy resources; transmission investments associated with the MISO LRTP as well as regional transmission in New York; grid resiliency and climate adaptation investments; investments in renewable gas and LNG infrastructure in British Columbia; and energy infrastructure investments to support the acceleration of load growth across our jurisdictions.

| | | | | | | | | | | |

| FORTIS INC. | DECEMBER 31, 2025 | 4 |

| | | | | | | | |

| Management Discussion and Analysis |

THE INDUSTRY

The North American utility industry is undergoing significant transformation, driven by energy security and climate adaptation priorities, as well as projected growth in load driven by data centers, manufacturing and electrification. Together, these factors are creating substantial investment opportunities across the sector.

Policy makers and regulators at the federal, state, and provincial levels are increasingly prioritizing matters of energy security. The convergence of policy directives and forecasted load growth has resulted in opportunities to invest in renewable and natural gas generation, energy storage systems and transmission infrastructure. Continued electrification of heating and transportation represents another opportunity to expand the output and efficiency of the grid.

Grid resilience remains a focus with increased frequency and intensity of weather events such as extreme temperatures, hurricanes, wildfires, floods and storms. With electricity expected to represent a larger portion of society's energy mix, investments in resiliency are necessary to improve the grid's ability to withstand and recover from weather events.

Diversity of energy supply and enhanced integration of energy systems are vital to deliver the resilience, energy, and capacity needed to support economic growth and energy demand. Electric transmission is a critical enabler of load growth, interconnecting large-scale generation while improving system resilience. Natural gas generation provides a reliable source of energy and capacity necessary to meet growing energy needs. Natural gas investments, as well as energy storage solutions, will enable the adoption of additional renewable energy.

Fortis' culture of innovation underlies a continuous drive to find better ways to safely, reliably and affordably deliver the energy and services that customers need. Energy delivery systems are becoming more intelligent, with advanced meters, remote sensing, and grid automation. Energy management capabilities are expanding through emerging storage, demand response, and distributed energy management systems. More capable operational technology provides utilities with detailed usage data, advanced system control, enhanced inspection techniques, and predictive capabilities. In addition, investments in AI look to unlock potential in the data collected by the Corporation's utilities. With increased digitization and an ever-changing threat landscape, investments in cyber and physical security continue to be high priorities. These technological advancements and challenges offer strategic investment opportunities for Fortis' utilities.

A focus on customer experience is important for utilities as customer expectations evolve. Customers want to make informed energy choices and become active participants in the delivery of their energy. They also expect personalized service, customized self-service offerings, and real‑time, digital communication. At the same time, customer affordability is critical and remains a priority across Fortis' utilities. In response, our utilities are enhancing customer information systems, adopting digital technologies including AI, and advancing new and modern approaches to customer experience.

The Corporation's culture and decentralized structure support our utilities' efforts to meet changing customer expectations, address customer affordability, and work constructively with regulators and other stakeholders on policy, energy and service solutions. Fortis is well-positioned to support energy security, climate adaptation, and load growth across the Corporation's footprint.

| | | | | | | | | | | | | | | | | | | | | | | |

| OPERATING RESULTS | | | | | | | |

| | | | | Variance |

| ($ millions) | 2025 | | | 2024 | | | FX | | Other |

| Revenue | 12,170 | | | 11,508 | | | 142 | | | 520 | |

| Energy supply costs | 3,371 | | | 3,249 | | | 36 | | | 86 | |

| Operating expenses | 3,250 | | | 3,040 | | | 40 | | | 170 | |

| Depreciation and amortization | 2,057 | | | 1,927 | | | 21 | | | 109 | |

| | | | | | | |

| Other income, net | 340 | | | 288 | | | 13 | | | 39 | |

| Finance charges | 1,478 | | | 1,406 | | | 17 | | | 55 | |

| Income tax expense | 393 | | | 346 | | | 2 | | | 45 | |

| | | | | | | |

| | | | | | | |

| Net earnings | 1,961 | | | 1,828 | | | 39 | | | 94 | |

| | | | | | | |

| Net earnings attributable to: | | | | | | | |

| Non-controlling interests | 162 | | | 148 | | | 2 | | | 12 | |

| Preference equity shareholders | 85 | | | 74 | | | — | | | 11 | |

| Common equity shareholders | 1,714 | | | 1,606 | | | 37 | | | 71 | |

| Net earnings | 1,961 | | | 1,828 | | | 39 | | | 94 | |

| | | | | | | | | | | |

| FORTIS INC. | DECEMBER 31, 2025 | 5 |

| | | | | | | | |

| Management Discussion and Analysis |

Revenue

The increase in revenue, net of foreign exchange, was due to: (i) Rate Base growth; (ii) higher flow-through costs in customer rates; and (iii) the implementation of new customer delivery rates at Central Hudson as approved by the PSC. The increase was also due to the retroactive impact of a reduction in the MISO base ROE at ITC in 2024 as approved by FERC. The increase was partially offset by lower retail electricity sales due to milder weather, and lower wholesale sales revenue due to a reduction in short-term wholesale sales and lower pricing driven by market conditions at UNS Energy.

Energy Supply Costs

The increase in energy supply costs, net of foreign exchange, was primarily due to the flow through of higher commodity costs at FortisBC Energy and Central Hudson, partially offset by lower sales and the flow through of lower commodity costs at UNS Energy.

Operating Expenses

The increase in operating expenses, net of foreign exchange, was primarily due to general inflationary and employee-related cost increases and higher stock-based compensation costs.

Depreciation and Amortization

The increase in depreciation and amortization, net of foreign exchange, was due to continued investment in energy infrastructure at the Corporation's regulated utilities.

Other Income, Net

The increase in other income, net of foreign exchange, was due to higher AFUDC at UNS Energy and FortisBC Energy as well as unrealized gains on foreign exchange contracts and total return swaps. The increase was partially offset by the pre-tax loss on the disposition of Fortis Belize and Belize Electricity, as well as a reduction in interest income due to lower interest on short-term deposits and regulatory deferrals.

Finance Charges

The increase in finance charges, net of foreign exchange, was primarily due to higher debt levels to support the Corporation's Capital Plan.

Income Tax Expense

The increase in income tax expense, net of foreign exchange, was driven by income tax associated with the repatriation of proceeds on the dispositions of FortisTCI, Fortis Belize, and Belize Electricity, as well as higher earnings before income taxes.

Net Earnings

See "Performance at a Glance - Earnings and EPS" on page 2.

| | | | | | | | | | | | | | | | | | | | | | | |

| BUSINESS UNIT PERFORMANCE | | | | | | | |

| Common Equity Earnings | | | | | Variance |

| ($ millions) | 2025 | | | 2024 | | | FX (1) | | Other |

| Regulated Utilities | | | | | | | |

| ITC | 592 | | | 542 | | | 11 | | | 39 | |

| UNS Energy | 437 | | | 448 | | | 8 | | | (19) | |

| Central Hudson | 191 | | | 128 | | | 3 | | | 60 | |

| FortisBC Energy | 336 | | | 293 | | | — | | | 43 | |

| FortisAlberta | 182 | | | 181 | | | — | | | 1 | |

| FortisBC Electric | 75 | | | 72 | | | — | | | 3 | |

Other Electric (2) | 167 | | | 163 | | | 1 | | | 3 | |

| 1,980 | | | 1,827 | | | 23 | | | 130 | |

| Non-Regulated | | | | | | | |

Corporate and Other (3) | (266) | | | (221) | | | 14 | | | (59) | |

| Common Equity Earnings | 1,714 | | | 1,606 | | | 37 | | | 71 | |

(1)The reporting currency of ITC, UNS Energy, Central Hudson, Caribbean Utilities, FortisTCI and Fortis Belize is the U.S. dollar. The reporting currency of Belize Electricity is the Belizean dollar, which is pegged to the U.S. dollar at BZ$2.00=US$1.00. Certain corporate and non-regulated holding company transactions, included in the Corporate and Other segment, are denominated in U.S. dollars

(2)Consists of the utility operations in eastern Canada and the Caribbean: Newfoundland Power; Maritime Electric; FortisOntario; Wataynikaneyap Power; and Caribbean Utilities. Also includes FortisTCI up to the September 2, 2025 date of disposition and Belize Electricity up to the October 31, 2025 date of disposition

(3)Consists of non-regulated holding company expenses, earnings from non-regulated long-term contracted generation assets in Belize up to the October 31, 2025 date of disposition, and losses on the dispositions of FortisTCI, Fortis Belize and Belize Electricity in 2025

| | | | | | | | | | | |

| FORTIS INC. | DECEMBER 31, 2025 | 6 |

| | | | | | | | |

| Management Discussion and Analysis |

| | | | | | | | | | | | | | | | | | | | | | | |

| ITC | | | | | Variance |

| ($ millions) | 2025 | | | 2024 | | | FX | | Other |

Revenue (1) | 2,495 | | | 2,229 | | | 44 | | | 222 | |

Earnings (1) | 592 | | | 542 | | | 11 | | | 39 | |

(1)Revenue represents 100% of ITC. Earnings represent the Corporation's 80.1% controlling ownership interest in ITC and reflect consolidated purchase price accounting adjustments.

Revenue

The increase in revenue, net of foreign exchange, was primarily due to Rate Base growth and higher flow-through costs in customer rates. The increase was also due to the recognition of a refund liability in 2024 associated with a decrease in the MISO base ROE from 10.02% to 9.98%, as approved by FERC in October 2024, for the 15-month period from November 2013 through February 2015 and prospectively from September 2016.

Earnings

The increase in earnings, net of foreign exchange, was primarily due to Rate Base growth. Growth in earnings was also due to FERC's approval of a reduction in the MISO base ROE in 2024, as discussed above, which resulted in a $20 million unfavourable impact to earnings in that year associated with the retroactive impact to prior periods. The increase in earnings was partially offset by higher non-recoverable stock-based compensation and holding company finance costs.

| | | | | | | | | | | | | | | | | | | | | | | |

| UNS Energy | | | | | Variance |

| ($ millions, except as indicated) | 2025 | | | 2024 | | | FX | | Other |

Retail electricity sales (GWh) | 10,734 | | | 10,870 | | | — | | | (136) | |

Wholesale electricity sales (GWh) (1) | 5,034 | | | 5,810 | | | — | | | (776) | |

Gas sales (PJ) | 16 | | | 17 | | | — | | | (1) | |

Revenue | 2,913 | | | 3,007 | | | 58 | | | (152) | |

Earnings | 437 | | | 448 | | | 8 | | | (19) | |

(1) Primarily short-term wholesale sales

Sales

The decrease in retail electricity sales was primarily due to lower average use associated with milder temperatures in comparison to 2024.

The decrease in wholesale electricity sales was driven by lower short-term wholesale sales reflecting unfavourable market conditions as well as outages at certain of the company's generation facilities, resulting in lower generation levels. Revenue from short-term wholesale sales, which relate to contracts that are less than one-year in duration, is primarily credited to customers through the PPFAC mechanism and, therefore, does not materially impact earnings.

Gas sales were relatively consistent with 2024.

Revenue

The decrease in revenue, net of foreign exchange, was primarily due to: (i) the recovery of overall lower fuel and non-fuel costs through the normal operation of regulatory mechanisms; (ii) lower electricity sales, discussed above; and (iii) lower pricing on wholesale sales. The decrease was partially offset by higher transmission revenue.

Earnings

The decrease in earnings, net of foreign exchange, was primarily due to: (i) higher costs associated with Rate Base growth not yet reflected in customer rates; (ii) lower retail electricity sales due to milder weather; and (iii) lower margin on wholesale sales, reflecting less favourable market conditions. The decrease was partially offset by higher transmission revenue and AFUDC.

| | | | | | | | | | | |

| FORTIS INC. | DECEMBER 31, 2025 | 7 |

| | | | | | | | |

| Management Discussion and Analysis |

| | | | | | | | | | | | | | | | | | | | | | | |

| Central Hudson | | | | | Variance |

| ($ millions, except as indicated) | 2025 | | | 2024 | | | FX | | Other |

Electricity sales (GWh) | 5,092 | | | 5,060 | | | — | | | 32 | |

Gas sales (PJ) | 30 | | | 25 | | | — | | | 5 | |

Revenue | 1,620 | | | 1,372 | | | 29 | | | 219 | |

Earnings | 191 | | | 128 | | | 3 | | | 60 | |

Sales

The increase in electricity sales was due to higher average consumption by residential customers due to colder weather.

The increase in gas sales was due to higher average consumption by industrial customers.

Changes in electricity and gas sales at Central Hudson are subject to regulatory revenue decoupling mechanisms and, therefore, do not materially impact earnings.

Revenue

The increase in revenue, net of foreign exchange, was due to the flow-through of higher energy supply costs, Rate Base growth, and higher customer delivery rates as approved by the PSC.

Earnings

The increase in earnings, net of foreign exchange, was primarily due to: (i) Rate Base growth; (ii) the rebasing of customer rates effective July 1, 2024, which reflected a higher allowed ROE and improved recovery of costs; and (iii) a change in the timing of recognition of a regulatory deferral for uncollectible accounts, as approved in the order on the 2025 general rate application. This increase was partially offset by higher contributions made to a customer benefit fund in 2025.

| | | | | | | | | | | | | | | | | |

| FortisBC Energy | | | | | |

| ($ millions, except as indicated) | 2025 | | | 2024 | | | Variance |

Gas sales (PJ) | 217 | | | 220 | | | (3) | |

Revenue | 1,874 | | | 1,665 | | | 209 | |

Earnings | 336 | | | 293 | | | 43 | |

Sales

The decrease in gas sales was due to lower average consumption by transportation and residential customers, partially offset by higher average consumption by industrial customers. Lower average consumption by residential customers was primarily due to milder weather in the fourth quarter of 2025.

Revenue

The increase in revenue was primarily due to: (i) the normal operation of regulatory mechanisms; (ii) Rate Base growth; and (iii) a higher cost of natural gas recovered from customers.

Earnings

The increase in earnings was primarily due to Rate Base growth, including higher AFUDC associated with FortisBC Energy's investment in the Eagle Mountain Pipeline project.

FortisBC Energy earns approximately the same margin regardless of whether a customer contracts for the purchase and delivery of natural gas or only for delivery. Due to regulatory deferral mechanisms, changes in consumption levels and commodity costs do not materially impact earnings.

| | | | | | | | | | | | | | | | | |

| FortisAlberta | | | | | |

| ($ millions, except as indicated) | 2025 | | | 2024 | | | Variance |

Electricity deliveries (GWh) | 17,561 | | | 17,324 | | | 237 | |

Revenue | 829 | | | 817 | | | 12 | |

Earnings | 182 | | | 181 | | | 1 | |

| | | | | | | | | | | |

| FORTIS INC. | DECEMBER 31, 2025 | 8 |

| | | | | | | | |

| Management Discussion and Analysis |

Deliveries

The increase in electricity deliveries was primarily due to higher average consumption by industrial customers, largely reflecting activity in the energy sector. Customer additions, as well as higher average consumption by residential customers due to warmer weather in the second quarter of 2025, also contributed to the increase.

As approximately 85% of FortisAlberta's revenue is derived from fixed or largely fixed billing determinants, changes in quantities of energy delivered are not entirely correlated with changes in revenue. Revenue is a function of numerous variables, many of which are independent of actual energy deliveries. Significant variations in weather conditions, however, can impact revenue and earnings.

Revenue and Earnings

The increase in revenue and earnings was due to Rate Base growth and customer additions, partially offset by: (i) the expiration of the PBR efficiency carry-over mechanism, as this regulatory incentive was only available through 2024; (ii) favourable non-recurring true-ups recorded in 2024 associated with the finalization of prior period Rate Base balances; and (iii) a reduction in the allowed ROE from 9.28% to 8.97% effective January 1, 2025, due to the automatic adjustment mechanism.

| | | | | | | | | | | | | | | | | |

| FortisBC Electric | | | | | |

| ($ millions, except as indicated) | 2025 | | | 2024 | | | Variance |

Electricity sales (GWh) | 3,619 | | | 3,513 | | | 106 | |

Revenue | 557 | | | 545 | | | 12 | |

Earnings | 75 | | | 72 | | | 3 | |

Sales

The increase in electricity sales was due to higher average consumption by industrial and commercial customers, partially offset by lower average consumption by residential customers due to milder weather in the second half of 2025.

Revenue

The increase in revenue was primarily due to higher electricity sales, higher energy supply costs recovered from customers and Rate Base growth.

Earnings

The increase in earnings was primarily due to Rate Base growth.

Due to regulatory deferral mechanisms, changes in consumption levels do not materially impact earnings.

| | | | | | | | | | | | | | | | | | | | | | | |

| Other Electric | | | | | Variance |

| ($ millions, except as indicated) | 2025 | | | 2024 | | | FX | | Other |

Electricity sales (GWh) | 9,918 | | | 9,879 | | | — | | | 39 | |

Revenue | 1,851 | | | 1,838 | | | 10 | | | 3 | |

Earnings | 167 | | | 163 | | | 1 | | | 3 | |

Sales

The increase in electricity sales was due to higher average consumption by residential and commercial customers, as well as customer additions. Higher average consumption by residential customers was largely due to the conversion of home heating systems from oil to electric in Eastern Canada. The increase was partially offset by the impact of the September 2025 disposition of FortisTCI.

Revenue

The increase in revenue, net of foreign exchange, was primarily due to Rate Base growth and higher electricity sales, as well as the July 1, 2025 electricity rate change at Newfoundland Power. The increase was partially offset by the disposition of FortisTCI, the flow-through of lower energy supply costs recovered from customers and the operation of regulatory deferral mechanisms at Newfoundland Power.

Earnings

The increase in earnings, net of foreign exchange, was primarily due to Rate Base growth and higher electricity sales, partially offset by the September 2025 disposition of FortisTCI.

| | | | | | | | | | | |

| FORTIS INC. | DECEMBER 31, 2025 | 9 |

| | | | | | | | |

| Management Discussion and Analysis |

| | | | | | | | | | | | | | | | | | | | | | | |

| Corporate and Other | | | | | Variance |

| ($ millions) | 2025 | | | 2024 | | | FX | | Other |

Electricity sales (GWh) (1) | 167 | | | 215 | | | — | | | (48) | |

Revenue (1) | 31 | | | 35 | | | 1 | | | (5) | |

Net loss (2) | (266) | | | (221) | | | 14 | | | (59) | |

(1) Reflects Fortis Belize up to the October 31, 2025 date of disposition

(2) Includes non-regulated holding company expenses, earnings for Fortis Belize up to the October 31, 2025 date of disposition, and losses on the dispositions of FortisTCI, Fortis Belize and Belize Electricity in 2025

Sales and Revenue

The decrease in electricity sales and revenue was due to the impact of the October 2025 disposition of Fortis Belize.

Net Loss

The increase in net loss was driven by $63 million of losses associated with the dispositions of FortisTCI, Fortis Belize and Belize Electricity, approximately half of which related to income taxes.

Excluding the impact of the dispositions, the net loss decreased by $4 million due to unrealized gains on foreign exchange contracts in 2025, as compared to unrealized losses in 2024, as well as higher unrealized gains on total return swaps, partially offset by higher finance and stock-based compensation costs. Lower earnings contribution from Fortis Belize due to the October 2025 disposition also unfavourably impacted the net loss.

The favourable foreign exchange impact was primarily due to foreign exchange gains in 2025, as compared to losses in 2024, associated with the revaluation of U.S. dollar denominated short-term liabilities.

NON-U.S. GAAP FINANCIAL MEASURES

Adjusted Common Equity Earnings, Adjusted Basic EPS, Adjusted Payout Ratio and Capital Expenditures are Non-U.S. GAAP Financial Measures and may not be comparable with similar measures used by other entities. They are presented because management and external stakeholders use them in evaluating the Corporation's financial performance.

Net earnings attributable to common equity shareholders (i.e., Common Equity Earnings) and basic EPS are the most directly comparable U.S. GAAP measures to Adjusted Common Equity Earnings and Adjusted Basic EPS, respectively. The Actual Payout Ratio calculated using Common Equity Earnings is the most comparable U.S. GAAP measure to the Adjusted Payout Ratio. These adjusted measures reflect the removal of items that management excludes in its key decision-making processes and evaluation of operating results.

Capital Expenditures include additions to property, plant and equipment and additions to intangible assets, as shown on the consolidated statements of cash flows, less CIACs received by FortisBC Energy associated with the Eagle Mountain Pipeline project. The CIACs received for this Major Capital Project are significant and presentation of Capital Expenditures net of CIACs better aligns with the Rate Base growth associated with this project. Capital Expenditures for 2024 also included Fortis' 39% share of capital spending for the Wataynikaneyap Transmission Power project, consistent with Fortis' evaluation of operating results and its role as project manager during the construction of the project.

| | | | | | | | | | | |

| FORTIS INC. | DECEMBER 31, 2025 | 10 |

| | | | | | | | |

| Management Discussion and Analysis |

| | | | | | | | | | | | | | | | | |

| Non-U.S. GAAP Reconciliation | | | | | |

| ($ millions, except as indicated) | 2025 | | | 2024 | | | Variance |

Adjusted Common Equity Earnings, Adjusted Basic EPS and Adjusted Payout Ratio | | | | | |

| Common Equity Earnings | 1,714 | | | 1,606 | | | 108 | |

| Adjusting items: | | | | | |

Dispositions (1) | 63 | | | — | | | 63 | |

| | | | | |

| | | | | |

October 2024 MISO base ROE decision (2) | — | | | 20 | | | (20) | |

| Adjusted Common Equity Earnings | 1,777 | | | 1,626 | | | 151 | |

Adjusted Basic EPS (3) ($) | 3.53 | | | 3.28 | | | 0.25 | |

Adjusted Payout Ratio (4) (%) | 70.4 | | | 72.7 | | | (2.3) | |

| | | | | |

| Capital Expenditures | | | | | |

| Additions to property, plant and equipment | 5,942 | | | 5,012 | | | 930 | |

| Additions to intangible assets | 292 | | | 206 | | | 86 | |

| Adjusting items: | | | | | |

Eagle Mountain Pipeline Project (5) | (620) | | | — | | | (620) | |

Wataynikaneyap Transmission Power Project (6) | — | | | 29 | | | (29) | |

| Capital Expenditures | 5,614 | | | 5,247 | | | 367 | |

(1) Represents losses on the dispositions of FortisTCI, Fortis Belize and the Corporation's 33% ownership in Belize Electricity, inclusive of income tax expense of $31 million, included in the Corporate and Other segment

(2) Represents the prior period impact of FERC's October 2024 MISO base ROE decision, net of income tax recovery of $7 million, included in the ITC segment

(3) Calculated using Adjusted Common Equity Earnings divided by weighted average common shares of 503.5 million in 2025 (2024 - 495.0 million)

(4) Calculated using dividends paid per common share of $2.49 in 2025 (2024 - $2.39) divided by Adjusted Basic EPS

(5) Represents CIACs received for the Eagle Mountain Pipeline project, included in the FortisBC Energy segment

(6) Represents Fortis' 39% share of capital spending for the Wataynikaneyap Transmission Power project, included in the Other Electric segment. Construction was completed in the second quarter of 2024

REGULATORY HIGHLIGHTS

General

The earnings of the Corporation's regulated utilities are determined under COS regulation, with some using PBR mechanisms.

Under COS regulation, the regulator sets customer rates to permit a reasonable opportunity for the timely recovery of the estimated costs of providing service, including a fair rate of return on a deemed or targeted capital structure applied to an approved Rate Base. PBR mechanisms generally apply a formula that incorporates inflation and assumed productivity improvements for a set term.

The ability to recover prudently incurred costs of providing service and earn the regulator‑approved ROE or ROA may depend on achieving the forecasts established in the rate-setting process. There can be varying degrees of regulatory lag between when costs are incurred and when they are recovered in customer rates. As well, the Corporation's regulated utilities, where applicable, are permitted by their respective regulators to flow through to customers, without markup, the cost of natural gas, fuel and/or purchased power through base customer rates and/or the use of rate stabilization and other mechanisms.

Transmission operations in the U.S. are regulated federally by FERC. Remaining utility operations in the U.S. and Canada are regulated by state or provincial regulators. Utility operations in the Cayman Islands are regulated by the country's regulatory authority.

Additional information about regulation and the regulatory matters discussed below is provided in Note 2 in the 2025 Annual Financial Statements. Also refer to "Business Risks - Utility Regulation" on page 22.

| | | | | | | | | | | |

| FORTIS INC. | DECEMBER 31, 2025 | 11 |

| | | | | | | | |

| Management Discussion and Analysis |

Significant Regulatory Matters

ITC

Transmission Incentives: In 2021, FERC issued a supplemental NOPR on transmission incentives modifying the proposal in the initial NOPR released by FERC in 2020. The supplemental NOPR proposes to eliminate the 50-basis point RTO ROE incentive adder for RTO members that have been members for longer than three years. Although the timing and outcome of this proceeding are unknown, every 10-basis point change in ROE at ITC impacts Fortis' annual EPS by approximately $0.01.

UNS Energy

TEP General Rate Application: In June 2025, TEP filed a general rate application with the ACC requesting new rates effective September 1, 2026 using a December 31, 2024 test year, with post-test year adjustments through June 30, 2025. The application includes a proposal to phase-out or eliminate certain adjustor mechanisms, and requests an annual formulaic rate adjustment mechanism consistent with the ACC's approval of a formula rate policy statement in 2024.

The Residential Utility Consumer Office has challenged the ACC's authority to implement a formula rate framework through a policy statement, and in November 2025, the Arizona Court of Appeals ruled that the Residential Utility Consumer Office may proceed with its challenge. The timing and outcome of these regulatory and legal proceedings are unknown. The ACC has previously approved adjustor mechanisms, including formula-based mechanisms, in rate cases.

UNS Gas General Rate Application: In January 2026, an ACC Administrative Law Judge issued a Recommended Opinion and Order recommending an allowed ROE of 9.57% and a 56% common equity component of capital structure. The order also recommended an annual formulaic rate adjustment mechanism including a range of +/- 40 basis points around the allowed return, a 5% efficiency credit to incremental revenue requirement, and the exclusion of post-test year adjustments. Should the annual formulaic mechanism not be approved, the order recommended the use of adjustor mechanisms for the timely recovery of infrastructure investments and income tax changes. The Recommended Opinion and Order proposes implementation of new rates by March 1, 2026. The rate application remains subject to ACC approval which is anticipated in February 2026.

FortisAlberta

Third PBR Term Decision: In 2023, the AUC issued a decision establishing the parameters for the third PBR term for the period of 2024 through 2028. FortisAlberta sought permission to appeal the decision to the Court of Appeal on the basis that the AUC erred in its decision to determine capital funding using 2018-2022 historical capital investments without consideration for funding of new capital programs included in the company's 2023 COS revenue requirement as approved by the AUC. In March 2025, the Court of Appeal granted FortisAlberta permission to appeal, which was heard in January 2026. A decision is expected in the third quarter of 2026.

| | | | | | | | | | | |

| FORTIS INC. | DECEMBER 31, 2025 | 12 |

| | | | | | | | |

| Management Discussion and Analysis |

FINANCIAL POSITION

| | | | | | | | | | | |

Significant Changes between December 31, 2025 and 2024 |

| | | |

| Balance Sheet Account | Variance | |

| ($ millions) | FX | Other | Explanation |

| Cash and cash equivalents | (19) | | 166 | | Primarily due to the timing of capital and operating requirements at UNS Energy, and unused proceeds from the disposition of Fortis Belize and Belize Electricity. Balances on hand have been invested in interest-bearing accounts and will be utilized in 2026. |

| Accounts receivable and other current assets | (53) | | (138) | | Primarily reflects a decrease in accounts receivable associated with collection efforts at Central Hudson, as well as a shift in long-term receivables associated with deferred payment agreements to other assets. |

| | | |

| Other assets | (60) | | 189 | | Primarily due to an increase in employee future benefits assets, driven by investment returns on DBP and OPEB plans, and an increase in long-term receivables associated with deferred payment agreements at Central Hudson. |

| Regulatory assets (current and long-term) | (62) | | 453 | | Due to changes associated with various regulatory mechanisms including an increase in deferred income taxes, deferred energy management costs, and the normal operation of rate stabilization accounts. |

| Property, plant and equipment, net | (1,516) | | 2,946 | | Due to capital expenditures, partially offset by depreciation expense and CIACs, as well as the dispositions of FortisTCI and Fortis Belize. |

| Intangible assets, net | (56) | | 118 | | Largely reflects investments in computer software across the utilities. |

| | | |

| Short-term borrowings | (4) | | 318 | | Reflects the issuance of commercial paper at ITC to finance working capital requirements. |

| Accounts payable & other current liabilities | (73) | | 223 | | Primarily due to an increase in deposits associated with the construction of the Eagle Mountain Pipeline project at FortisBC Energy. |

| | | |

| | | |

| Deferred income taxes | (152) | | 424 | | Primarily due to higher temporary differences associated with ongoing capital investments. |

| Long-term debt (including current portion) | (985) | | 1,640 | | Due to debt issuances in support of the Corporation's Capital Plan, partially offset by debt and credit facility repayments and the disposition of FortisTCI. |

| | | |

| Shareholders' equity | (943) | | 945 | | Due primarily to: (i) Common Equity Earnings for 2025, less dividends declared on common shares; and (ii) the issuance of common shares, largely under the DRIP. |

| | | |

LIQUIDITY AND CAPITAL RESOURCES

Cash Flow Requirements

At the subsidiary level, it is expected that operating expenses and interest costs will be paid from Operating Cash Flow, with varying levels of residual cash flow available for capital expenditures and/or dividend payments to Fortis. Remaining capital expenditures are expected to be financed primarily from borrowings under credit facilities, long-term debt offerings and equity injections from Fortis. Borrowings under credit facilities may be required periodically to support seasonal working capital requirements.

Cash required of Fortis to support subsidiary growth is generally derived from borrowings under the Corporation's credit facilities, the operation of the DRIP, as well as issuances of long-term debt, preference equity, and common shares including any issued through the ATM Program. The subsidiaries pay dividends to Fortis and receive equity injections from Fortis when required. Both Fortis and its subsidiaries initially borrow through their credit facilities and periodically replace these borrowings with long-term financing. Financing needs also arise to refinance maturing debt.

| | | | | | | | | | | |

| FORTIS INC. | DECEMBER 31, 2025 | 13 |

| | | | | | | | |

| Management Discussion and Analysis |

Credit facilities are syndicated primarily with large banks in Canada and the U.S., with no one bank holding more than approximately 20% of the Corporation's total revolving credit facilities. Approximately $5.4 billion of the total credit facilities are committed with maturities ranging from 2027 through 2030. Available credit facilities are summarized in the following table.

| | | | | | | | | | | | | | | | | | | | | | | |

| Credit Facilities | | | | | | | |

| As at December 31 | Regulated | | Corporate | | | | |

($ millions) | Utilities | | and Other | | 2025 | | 2024 | |

Total credit facilities (1) | 4,196 | | | 1,577 | | | 5,773 | | | 6,342 | |

| Credit facilities utilized: | | | | | | | |

| Short-term borrowings | (412) | | | — | | | (412) | | | (98) | |

Long-term debt (including current portion) | (1,515) | | | — | | | (1,515) | | | (2,216) | |

| Letters of credit outstanding | (83) | | | (22) | | | (105) | | | (102) | |

| Credit facilities unutilized | 2,186 | | | 1,555 | | | 3,741 | | | 3,926 | |

(1)Additional information about the Corporation's credit facilities is provided in Note 14 in the 2025 Annual Financial Statements

In April 2025, FortisAlberta increased its operating credit facility from $250 million to $300 million and extended the maturity to April 2030.

In May 2025, the Corporation amended its $1.3 billion revolving term committed credit facility to extend the maturity to July 2030.

In September 2025, FortisUS Inc., a holding company subsidiary of Fortis, extended the maturity on its unsecured US$150 million revolving term credit facility to October 2027. Also in September 2025, the Corporation fully repaid its unsecured US$250 million non-revolving term credit facility.

The Corporation's ability to service debt and pay dividends is dependent on the financial results of, and the related cash payments from, its subsidiaries. Certain regulated subsidiaries are subject to restrictions that limit their ability to distribute cash to Fortis, including restrictions by certain regulators limiting annual dividends and restrictions by certain lenders limiting debt to total capitalization. There are also practical limitations on using the net assets of the regulated subsidiaries to pay dividends, based on management's intent to maintain the subsidiaries' regulator-approved capital structures. Fortis does not expect that maintaining such capital structures will impact its ability to pay dividends in the foreseeable future.

As at December 31, 2025, consolidated fixed-term debt maturities/repayments are expected to average $1.7 billion annually over the next five years, with a maximum of $2.4 billion due in any one year. Approximately 74% of the Corporation's consolidated long-term debt, excluding credit facility borrowings, had maturities beyond five years.

In December 2024, Fortis filed a short-form base shelf prospectus with a 25-month life under which it may issue common or preference shares, subscription receipts, or debt securities in an aggregate principal amount of up to $2.0 billion. Fortis also reestablished the ATM Program pursuant to the short-form base shelf prospectus, which allows the Corporation to issue up to $500 million of common shares from treasury to the public from time to time, at the Corporation's discretion, effective until January 10, 2027. As at December 31, 2025, $500 million remained available under the ATM Program and $1.5 billion remained available under the short-form base shelf prospectus.

Fortis is well positioned with strong liquidity. This combination of available credit facilities and manageable annual debt maturities/repayments provides flexibility in the timing of access to capital markets. Given current credit ratings and capital structures, the Corporation and its subsidiaries currently expect to continue to have reasonable access to long-term capital.

Fortis and its subsidiaries were in compliance with debt covenants as at December 31, 2025 and are expected to remain compliant.

| | | | | | | | | | | |

| FORTIS INC. | DECEMBER 31, 2025 | 14 |

| | | | | | | | |

| Management Discussion and Analysis |

| | | | | | | | | | | | | | | | | |

| Cash Flow Summary | | | | | |

| Summary of Cash Flows | | | | | |

| Years ended December 31 | | | | | |

| ($ millions) | 2025 | | | 2024 | | | Variance |

| Cash and cash equivalents, beginning of year | 220 | | | 625 | | | (405) | |

| Cash from (used in): | | | | | |

| Operating activities | 4,062 | | | 3,882 | | | 180 | |

| Investing activities | (5,357) | | | (5,395) | | | 38 | |

| Financing activities | 1,461 | | | 1,064 | | | 397 | |

| Effect of exchange rate changes on cash and cash equivalents | (19) | | | 44 | | | (63) | |

| | | | | |

| Cash and cash equivalents, end of year | 367 | | | 220 | | | 147 | |

Operating Activities

See "Performance at a Glance - Operating Cash Flow" on page 4.

Investing Activities

Cash used in investing activities was $38 million lower than 2024 primarily due to proceeds received on the dispositions of FortisTCI, Fortis Belize and Belize Electricity, partially offset by: (i) higher Capital Expenditures, net of CIACs; (ii) higher demand side management expenditures at FortisBC; and (iii) the higher U.S. dollar-to-Canadian dollar exchange rate.

Financing Activities

Cash flows related to financing activities will fluctuate largely as a result of changes in the subsidiaries' capital expenditures and the amount of Operating Cash Flow available to fund those capital expenditures, which together impact the amount of funding required from debt and common equity issuances. See "Cash Flow Requirements" on page 13. The increase in cash from financing activities in 2025 primarily reflected an increase in borrowings to support capital investments.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Debt Financing | Month

Issued | | Interest Rate (%) | | Maturity | | Amount ($ millions) | | Use of Proceeds |

| Significant Long-Term Debt Issuances | | | | |

Year ended December 31, 2025

| | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| UNS Energy | | | | | | | | | |

| Unsecured senior notes | February | | 5.90 | | | 2055 | | US $300 | | | (1) (2) 3) |

| Unsecured senior notes | October | | 5.38 | | | 2035 | | US $50 | | | (1) (3) |

| Central Hudson | | | | | | | | | |

| Unsecured senior notes | April | | (4) | | (4) | | US $70 | | | (1) (3) |

| Unsecured senior notes | November | | (5) | | (5) | | US $80 | | | (3) |

| FortisBC Energy | | | | | | | | | |

| Unsecured debentures | October | | 3.38 | | | 2030 | | 200 | | | (1) |

| FortisAlberta | | | | | | | | | |

| Unsecured senior debentures | July | | 4.76 | | | 2055 | | 200 | | | (1) (2) (3) |

| Newfoundland Power | | | | | | | | | |

| First mortgage bonds | August | | 4.91 | | | 2055 | | 120 | | | (1) (2) (3) |

| | | | | | | | | |

| Maritime Electric | | | | | | | | | |

| First mortgage bonds | July | | 4.94 | | | 2055 | | 120 | | | (1) (2) |

| Fortis | | | | | | | | | |

| Unsecured senior notes | March | | 4.09 | | | 2032 | | 600 | | | (1) (3) |

| Unsecured subordinated notes | September | | 5.10 | | | 2055 | | 750 | | | (1) (3) |

(1) Repay credit facility borrowings (2) Fund capital expenditures

(3) General corporate purposes

(4) Comprised of US$20 million at 5.61% due in 2035, US$30 million at 5.81% due in 2040 and US$20 million at 6.01% due in 2045

(5) Comprised of US$15 million at 5.25% due in 2035 and US$65 million at 5.90% due in 2045

| | | | | | | | | | | |

| FORTIS INC. | DECEMBER 31, 2025 | 15 |

| | | | | | | | |

| Management Discussion and Analysis |

As shown in the table above, Fortis issued fixed-to-fixed rate unsecured hybrid subordinated notes in 2025. The interest rate will be reset on December 4, 2030, and every five years thereafter, equal to the then five-year Government of Canada bond yield plus 2.09% provided that the interest rate will not be below the initial interest rate of 5.10%. The subordinated notes receive 50% equity treatment from credit rating agencies.

In January 2026, ITC issued US$250 million of secured senior notes consisting of US$125 million 10-year, 5.08% notes and US$125 million 20-year, 5.71% notes. Proceeds were used to repay credit facility borrowings, fund capital expenditures and for general corporate purposes.

| | | | | | | | | | | | | | | | | |

| Common Equity Financing | | | | | |

| Common Equity Issuances and Dividends Paid |

| Years ended December 31 |

| ($ millions, except as indicated) | 2025 | | | 2024 | | | Variance |

| Common shares issued: | | | | | |

Cash (1) | 60 | | | 46 | | | 14 | |

Non-cash (2) | 463 | | | 435 | | | 28 | |

| Total common shares issued | 523 | | | 481 | | | 42 | |

Number of common shares issued (# millions) | 8.0 | | | 8.7 | | (0.7) | |

| Common share dividends paid: | | | | | |

| Cash | (788) | | | (744) | | | (44) | |

Non-cash (3) | (461) | | | (434) | | | (27) | |

| Total common share dividends paid | (1,249) | | | (1,178) | | | (71) | |

Dividends paid per common share ($) | 2.49 | | 2.39 | | | 0.10 | |

(1) Includes common shares issued under stock option and employee share purchase plans

(2) Common shares issued under the DRIP and stock option plan

(3) Common share dividends reinvested under the DRIP

On December 4, 2025 and February 11, 2026, Fortis declared a dividend of $0.64 per common share payable on March 1, 2026 and June 1, 2026, respectively. The payment of dividends is at the discretion of the Board and depends on the Corporation's financial condition and other factors.

On June 1, 2025, the annual fixed dividend per share for the First Preference Shares, Series H reset from $0.4588 to $1.0458 for the five-year period up to but excluding June 1, 2030. Also on June 1, 2025, 11,298 First Preference Shares, Series H were converted on a one-for-one basis into First Preference Shares, Series I and 248,830 First Preference Shares, Series I were converted on a one-for-one basis into First Preference Shares, Series H.

| | | | | | | | | | | | | | | | | | | | | | | |

| Contractual Obligations | | | | | | | |

| | | | | |

As at December 31, 2025 | | |

| ($ millions) | Total | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Thereafter |

| Long-term debt: | | | | | | | |

Principal (1) | 34,057 | | 3,146 | | 2,389 | | 1,880 | | 943 | | 1,714 | | 23,985 | |

| Interest | 20,627 | | 1,423 | | 1,338 | | 1,253 | | 1,213 | | 1,168 | | 14,232 | |

Finance leases (2) | 1,125 | | 38 | | 37 | | 38 | | 38 | | 38 | | 936 | |

Other obligations (3) | 562 | | 188 | | 123 | | 128 | | 23 | | 23 | | 77 | |

Other commitments: (4) | | | | | | | |

| Gas and fuel purchase obligations | 6,592 | | 908 | | 689 | | 586 | | 491 | | 416 | | 3,502 | |

| Renewable power purchase agreements | 2,374 | | 158 | | 174 | | 173 | | 165 | | 173 | | 1,531 | |

| Waneta Expansion capacity agreement | 2,307 | | 58 | | 59 | | 60 | | 61 | | 63 | | 2,006 | |

| Power purchase obligations | 1,135 | | 251 | | 156 | | 129 | | 127 | | 124 | | 348 | |

| | | | | | | |

| ITC easement agreement | 342 | | 14 | | 14 | | 14 | | 14 | | 14 | | 272 | |

| UNS Energy EPC agreement | 269 | | 110 | | 143 | | 16 | | — | | — | | — | |

| Debt collection agreement | 96 | | 3 | | 3 | | 3 | | 3 | | 3 | | 81 | |

| Renewable energy credit purchase agreements | 50 | | 18 | | 6 | | 6 | | 5 | | 5 | | 10 | |

| Other | 122 | | 27 | | 12 | | 9 | | 9 | | 2 | | 63 | |

| 69,658 | | 6,342 | | 5,143 | | 4,295 | | 3,092 | | 3,743 | | 47,043 | |

(1)Amounts not reduced by unamortized deferred financing and discount costs of $188 million. Additional information is provided in Note 14 of the 2025 Annual Financial Statements

(2)Additional information is provided in Note 15 of the 2025 Annual Financial Statements

(3)Primarily includes commitments with respect to long-term compensation and employee future benefit arrangements

(4)Represents unrecorded commitments. Additional information is provided in Note 27 of the 2025 Annual Financial Statements

| | | | | | | | | | | |

| FORTIS INC. | DECEMBER 31, 2025 | 16 |

| | | | | | | | |

| Management Discussion and Analysis |

Other Commitments

The Corporation's utilities are obligated to provide service to customers within their respective service territories. Capital Expenditures are forecast to be approximately $5.6 billion for 2026 and approximately $28.8 billion for the five-year 2026-2030 Capital Plan. See "Capital Plan" on page 18.

Under a funding framework with the Governments of Ontario and Canada, Fortis has met the minimum equity capital contribution requirement of approximately $165 million to Wataynikaneyap Power, based on Fortis' proportionate 39% ownership interest and the final regulatory-approved capital cost of the related project. Wataynikaneyap Power has construction financing loan agreements in place and it is expected that long-term operating financing will replace the construction financing. In the event a lender under the loan agreements realizes security on the loans, Fortis may be required to make additional equity capital contributions, which may be in excess of the amount otherwise required of Fortis under the funding framework, to a maximum total funding of $235 million.

UNS Energy has joint generation performance guarantees with participants at Four Corners and Luna, with agreements expiring in 2041 and 2046 respectively, and at San Juan and Navajo through decommissioning. The participants have guaranteed that in the event of payment default, each non-defaulting participant will bear its proportionate share of expenses otherwise payable by the defaulting participant. In exchange, the non-defaulting participants are entitled to receive their proportionate share of the generation capacity of the defaulting participant. In the case of San Juan and Navajo, participants would seek financial recovery from the defaulting party. There is no maximum amount under these guarantees, except for a maximum of $343 million for Four Corners. As at December 31, 2025, there was no obligation under these guarantees.

TEP has entered into an energy supply agreement to serve a customer expected to be located in TEP's service territory. The agreement, requiring potential power demand of approximately 300 MW, was approved by the ACC in December 2025 but remains subject to other contractual contingencies. The energy supply agreement provides additional consumer protections such as establishing minimum monthly payment obligations that apply irrespective of customer energy use, termination fees supported by financial assurance mechanisms, and imposing credit standards designed to mitigate the risk of default. The initial phase of the data center campus is expected to be operational as early as 2027, with a ramp schedule through 2029. TEP currently expects to serve the customer from its existing and planned capacity, including solar and battery storage projects currently in development.

TEP and UNS Electric have entered into long-term gas transportation precedent agreements to secure reliable access to natural gas. The agreements support the development of a new pipeline to be owned and operated by a third-party. Subject to the receipt of required regulatory approvals and other conditions, the pipeline is expected to be in service in 2029. Once the pipeline enters commercial operation, TEP and UNS Electric will enter into gas transportation service agreements with estimated purchase commitments of US$1.9 billion over 25 years.

Off-Balance Sheet Arrangements

With the exception of letters of credit outstanding of $105 million as at December 31, 2025, the unrecorded commitments in the table above and the "Other Commitments" discussed above, the Corporation had no off-balance sheet arrangements.

Capital Structure and Credit Ratings

Fortis requires ongoing access to capital and, therefore, targets a consolidated long-term capital structure that will enable it to maintain investment-grade credit ratings. The regulated utilities maintain their own capital structures in line with those reflected in customer rates.

| | | | | | | | | | | | | | | | | | | | | | | |

Consolidated Capital Structure | 2025 | | 2024 |

| As at December 31 | ($ millions) | | (%) | | ($ millions) | | (%) |

Debt (1) | 34,262 | | | 57.0 | | | 33,435 | | | 56.4 | |

Preference shares | 1,623 | | | 2.7 | | | 1,623 | | | 2.7 | |

Common shareholders' equity and non-controlling interests (2) | 24,246 | | | 40.3 | | | 24,230 | | | 40.9 | |

| 60,131 | | | 100.0 | | | 59,288 | | | 100.0 | |

(1)Includes long-term debt and finance leases, including current portion, and short-term borrowings, net of cash

(2)Includes shareholders' equity, excluding preference shares, and non-controlling interests. Non-controlling interests represented 3.4% as at December 31, 2025 (December 31, 2024 - 3.4%)

Outstanding Share Data

As at February 11, 2026, the Corporation had issued and outstanding 507.4 million common shares and the following First Preference Shares: 5.0 million Series F; 9.2 million Series G; 7.9 million Series H; 2.1 million Series I; 8.0 million Series J; 10.0 million Series K; and 24.0 million Series M.

The common shares of the Corporation have voting rights. The Corporation's first preference shares do not have voting rights unless and until Fortis fails to pay eight quarterly dividends, whether or not consecutive or declared.

If all outstanding stock options were converted as at February 11, 2026, an additional 0.9 million common shares would be issued and outstanding.

| | | | | | | | | | | |

| FORTIS INC. | DECEMBER 31, 2025 | 17 |

| | | | | | | | |

| Management Discussion and Analysis |

Credit Ratings

The Corporation's credit ratings shown below reflect its low business risk profile, diversity of operations, the stand-alone nature and financial separation of each regulated subsidiary, and the level of holding company debt.

| | | | | | | | | | | | | | | | | |

As at December 31, 2025 | Rating | | Type | | Outlook |

| S&P | A- | | Issuer | | Stable |

| BBB+ | | Unsecured debt | | |

| Fitch | BBB+ | | Issuer | | Stable |

| BBB+ | | Unsecured debt | | |

| Morningstar DBRS | A (low) | | Issuer | | Stable |

| A (low) | | Unsecured debt | | Stable |

In May 2025, Fitch assigned first time issuer and senior unsecured debt ratings of BBB+ to the Corporation with a stable outlook.

In November 2025, S&P confirmed the Corporation's A- issuer and BBB+ senior unsecured debt credit ratings and revised the outlook for the Corporation and certain of its subsidiaries from negative to stable. S&P noted that the change in outlook reflects improvement in the Corporation's FFO to debt ratio and developments at the subsidiaries to mitigate physical risks, namely wildfires.

In January 2026, Moody’s Investor Services, Inc. withdrew its ratings for Fortis at the Corporation's request. The withdrawal does not impact the subsidiary credit ratings.

Capital Plan

Capital investment in energy infrastructure is required to ensure the continued and enhanced performance, reliability and safety of the electricity and gas systems, to meet customer growth, and to facilitate the interconnection of new energy resources.

Capital Expenditures in 2025 were $5.6 billion, consistent with expectations and $0.4 billion higher than 2024. The increase compared to 2024 was largely related to: (i) investments in Major Capital Projects, including projects within the first tranche of the MISO LRTP and the Big Cedar Load Expansion project at ITC, as well as the Vail-to-Tortolita and Black Mountain Gas Generation projects at UNS Energy; (ii) incremental transmission and distribution investments across the Corporation's utilities; and (iii) the impact of the higher U.S. dollar-to-Canadian dollar exchange rate. The increase was partially offset by FortisBC Energy's investment in the Eagle Mountain Pipeline project in 2024. Construction of the project in 2025 was largely funded by CIACs rather than investments by FortisBC Energy.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2025 Capital Expenditures (1)(2) |

| Regulated Utilities | | Total

Regulated

Utilities | | Non-Regulated Corporate and Other | | Total |

| ($ millions, except as indicated) | ITC | | UNS

Energy | | Central

Hudson | | FortisBC

Energy | | Fortis

Alberta | | FortisBC

Electric | | Other Electric | | | |

| Total | 1,840 | | | 1,365 | | | 481 | | | 650 | | | 598 | | | 186 | | | 491 | | | 5,611 | | | 3 | | | 5,614 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Forecast 2026 Capital Expenditures (2)(3) |

| Regulated Utilities | | Total

Regulated

Utilities | | Non-Regulated Corporate and Other | | Total |

| ($ millions, except as indicated) | ITC | | UNS Energy | | Central Hudson | | FortisBC Energy | | Fortis Alberta | | FortisBC Electric | | Other Electric | | | |

| Total | 1,874 | | | 1,281 | | | 466 | | | 712 | | | 614 | | | 207 | | | 462 | | | 5,616 | | | — | | | 5,616 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2026-2030 Capital Plan (2)(3) |

| ($ billions) | 2026 | | 2027 | | 2028 | | 2029 | | 2030 | | Total |

| Five-year Capital Plan | 5.6 | | | 5.9 | | | 5.6 | | | 6.2 | | | 5.5 | | | 28.8 | |

(1)See "Non-U.S. GAAP Financial Measures" on page 10. Reflects a U.S. dollar-to-Canadian dollar exchange rate of 1.40 for 2025

(2)Excludes the non-cash equity component of AFUDC

(3)Reflects an assumed U.S. dollar-to-Canadian dollar exchange rate of 1.35. On average, a five-cent increase or decrease in the U.S. dollar relative to the Canadian dollar would increase or decrease the 2026-2030 Capital Plan by approximately $0.7 billion over the five-year planning period

| | | | | | | | | | | |

| FORTIS INC. | DECEMBER 31, 2025 | 18 |

| | | | | | | | |

| Management Discussion and Analysis |

The 2026-2030 Capital Plan is $2.8 billion higher than the previous five-year plan. The increase is primarily driven by higher FERC regulated transmission investments associated with new interconnections, the MISO LRTP and baseline reliability projects at ITC. It also includes incremental capital at UNS Energy, reflecting an increase in transmission and distribution investments to serve load growth, increase reliability, and provide a path for connecting future generation resources. Planned generation investments in Arizona have also been updated to reflect the Springerville Natural Gas Conversion project. Customer growth and reliability investments across our utilities also contributed to the increase, and the higher assumed U.S. dollar-to-Canadian dollar exchange rate of 1.35 resulted in approximately $0.6 billion of additional capital as compared to the previous plan.

Investments in the 2026-2030 Capital Plan are categorized as: (i) 46% transmission; (ii) 31% distribution; (iii) 7% generation; (iv) 5% renewable gas and LNG; and (v) 11% other, largely related to information technology and facility investments. The five-year Capital Plan is low risk and highly executable, with only 21% relating to Major Capital Projects. Geographically, 63% of planned expenditures are expected in the U.S., including 34% at ITC, with 35% in Canada and the remaining 2% in the Caribbean.

The Capital Plan is expected to be funded primarily by cash from operations and regulated utility debt. Common equity is expected to be provided by the Corporation's DRIP, assuming current participation levels. The Corporation's $500 million ATM Program has not been utilized to date and remains available for funding flexibility as required.

Planned capital expenditures are based on detailed forecasts of energy demand as well as labour and material costs, including inflation, supply chain availability, general economic conditions, foreign exchange rates, new or revised tariffs and other factors. The Corporation continues to monitor government policy on foreign trade, including the imposition of tariffs and the potential impacts on the supply chain, commodity prices, the cost of energy and general economic conditions. These factors could change and cause actual expenditures to differ from forecast.

| | | | | | | | | | | | | | | | | |

Midyear Rate Base (1) |

| ($ billions) | 2025(2) | | 2026(2) | | 2030(2) |

| ITC | 13.9 | | | 14.6 | | | 19.8 | |

| UNS Energy | 8.4 | | | 8.9 | | | 11.5 | |

| Central Hudson | 3.7 | | | 4.0 | | | 5.0 | |

| FortisBC Energy | 6.5 | | | 6.8 | | | 8.8 | |

| FortisAlberta | 4.7 | | | 4.8 | | | 5.9 | |

| FortisBC Electric | 1.8 | | | 1.9 | | | 2.3 | |

| Other Electric | 3.4 | | | 3.7 | | | 4.6 | |

| Total | 42.4 | | | 44.7 | | | 57.9 | |

(1) Simple average of Rate Base at beginning and end of the year

(2) Reflects a U.S. dollar-to-Canadian dollar average exchange rate of 1.40 for 2025. 2026 and 2030 reflect an assumed U.S. dollar-to-Canadian dollar exchange rate of 1.35 consistent with the Corporation's 2026-2030 Capital Plan. On average, Fortis estimates that a five-cent increase or decrease in the U.S. dollar relative to the Canadian dollar would increase or decrease Rate Base by approximately $1.4 billion over the five-year planning period

Total midyear Rate Base is forecast to grow to $57.9 billion by 2030 underpinned by the five-year Capital Plan, translating to a CAGR of 7.0%.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Major Capital Projects | | | | | | | Plan | | Expected | |

| ($ millions) | Pre-2025 | | Actual 2025 | | | | 2026-2030 | | Completion | |

ITC | | | | | | | | | | |

| MISO LRTP Tranche 1 | 89 | | | 173 | | | | | 1,812 | | | 2030 | | |

| MISO LRTP Tranche 2.1 | — | | | 8 | | | | | 529 | | | Post-2030 | |

| Big Cedar Load Expansion | 5 | | | 172 | | | | | 394 | | | 2028 | | |

UNS Energy | | | | | | | | | | |

| TEP Transmission Project | — | | | — | | | | | 608 | | | 2029 | | |

| Springerville Natural Gas Conversion | — | | | — | | | | | 238 | | | 2030 | | |

| Black Mountain Gas Generation | 1 | | | 58 | | | | | 339 | | | 2028 | | |

| Vail-to-Tortolita Transmission Project | 199 | | | 144 | | | | | 147 | | | 2027 | | |

| Roadrunner Reserve Battery Storage Project | 116 | | | 345 | | | | | 3 | | | 2026 | | |

| FortisBC Energy | | | | | | | | | | |

| Tilbury LNG Storage Expansion | 35 | | | 5 | | | | | 627 | | | Post-2030 | |

| AMI Project | 37 | | | 136 | | | | | 570 | | | 2028 | | |

| Tilbury 1B Project | 49 | | | 12 | | | | | 342 | | | 2030 | | |

Eagle Mountain Pipeline Project (1) | 436 | | | 14 | | | | | 274 | | | 2027 | | |

| Total | | | 1,067 | | | | | 5,883 | | | | |

(1)Net of customer contributions

| | | | | | | | | | | |

| FORTIS INC. | DECEMBER 31, 2025 | 19 |

| | | | | | | | |

| Management Discussion and Analysis |

MISO LRTP - Tranches 1 and 2.1

Six projects included in the first tranche of the MISO LRTP portfolio run through ITC's MISO operating companies' service territories. A majority of ITC's planned investment associated with these projects has been reflected in the 2026-2030 Capital Plan.

ITC has reflected investments of approximately $0.5 billion (US$0.4 billion) in the Corporation's 2026-2030 Capital Plan associated with MISO LRTP tranche 2.1 projects located in Michigan and Minnesota where ROFRs are in effect and for projects requiring system upgrades in Iowa which are not subject to a competitive bidding process. Significant additional investment opportunities remain for tranche 2.1 (see "Additional Investment Opportunities" on page 21).

In July 2025, certain state regulatory commissions in the MISO region filed a complaint at FERC challenging the manner in which MISO developed the tranche 2.1 portfolio. The timing and outcome of this filing, and any potential impact on the Capital Plan, are unknown.

Big Cedar Load Expansion

The project consists of two phases and includes transmission upgrades to serve up to 1,600 MW of new data center load at the Big Cedar Industrial Center. The first phase of the project requires transmission upgrades to support 800 MW of new load with a targeted in-service date of 2027, and phase two requires an additional 800 MW with an expected in-service date of 2028.

TEP Transmission Project