PROPOSALS TO BE VOTED ON

PROPOSAL 1: Election of Directors

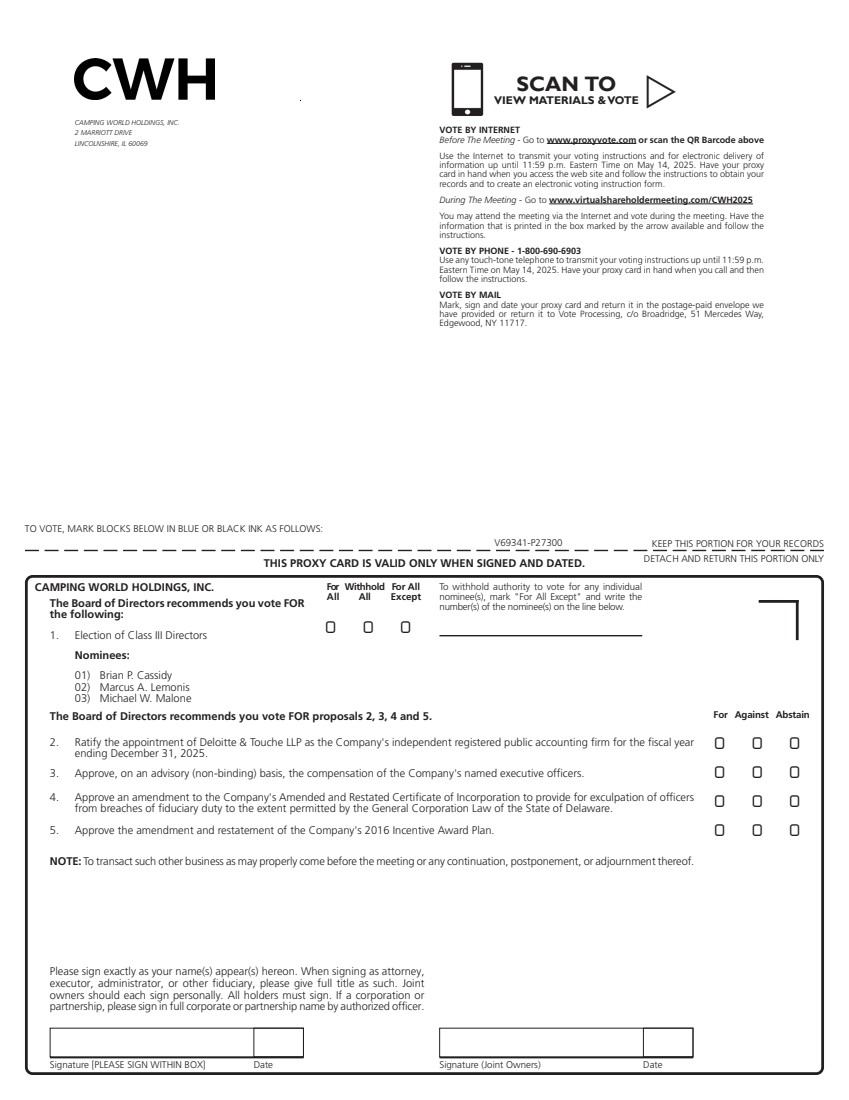

At the Annual Meeting, three (3) Class III Directors are to be elected to hold office until the Annual Meeting of Stockholders to be held in 2028 and until such director’s successor is elected and qualified or until such director’s earlier death, resignation or removal.

We currently have eight (8) directors on our Board. The proposal regarding the election of directors requires the approval of a plurality of the votes cast. This means that the three nominees receiving the highest number of affirmative “FOR” votes will be elected as Class III Directors. Votes withheld and broker non-votes will have no effect on the outcome of the vote on this proposal.

Our Board is currently divided into three classes with staggered, three-year terms. At each annual meeting of stockholders, the successor to each director whose term then expires will be elected to serve from the time of election and qualification until the third annual meeting of stockholders following election or such director’s death, resignation or removal, whichever is earliest to occur. The current class structure is as follows: Class III, whose term currently expires at the 2025 Annual Meeting of Stockholders and whose subsequent term will expire at the 2028 Annual Meeting of Stockholders; Class I, whose term will expire at the 2026 Annual Meeting of Stockholders; and Class II whose term will expire at the 2027 Annual Meeting of Stockholders. The current Class I Directors are Mary J. George and K. Dillon Schickli; the current Class II Directors are Andris A. Baltins, Kathleen S. Lane and Brent L. Moody; and the current Class III Directors are Brian P. Cassidy, Marcus A. Lemonis and Michael W. Malone. Under the Voting Agreement (as defined under “Corporate Governance—Voting Agreement”), ML Acquisition has been deemed to have designated Messrs. Baltins and Schickli and ML RV Group has been deemed to have designated Mr. Lemonis, for the applicable elections to our Board. Also under the Voting Agreement, Crestview Advisors L.L.C. (“Crestview”) has been deemed to have designated Mr. Cassidy for election to our Board. As a result of the Voting Agreement and the aggregate voting power of the parties to the agreement, we expect that the parties to the agreement acting in conjunction will control the election of directors at Camping World. For more information, see “Corporate Governance—Voting Agreement”.

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote the shares of Common Stock represented by the proxy for the election as Class III Directors the persons whose names and biographies appear below. All of the persons whose names and biographies appear below are currently serving as our directors. In the event any of the nominees should become unable to serve or for good cause will not serve as a director, it is intended that votes will be cast for a substitute nominee designated by the Board or the Board may elect to reduce its size. The Board has no reason to believe that the nominees named below will be unable to serve if elected. Each of the nominees has consented to being named in this proxy statement and to serve if elected.

VOTE REQUIRED

The proposal regarding the election of directors requires the approval of a plurality of the votes cast. This means that the three nominees receiving the highest number of affirmative “FOR” votes will be elected as Class III Directors. Votes withheld and broker non-votes will have no effect on the outcome of the vote on this proposal.

RECOMMENDATION OF THE BOARD OF DIRECTORS

|

| The Board of Directors unanimously recommends a vote FOR the election of the below Class III Director nominees. |

9