| Three Months Ended June 30, | ||||||||||||||

| (in millions, except per share data) | 2025 | 2024 | ||||||||||||

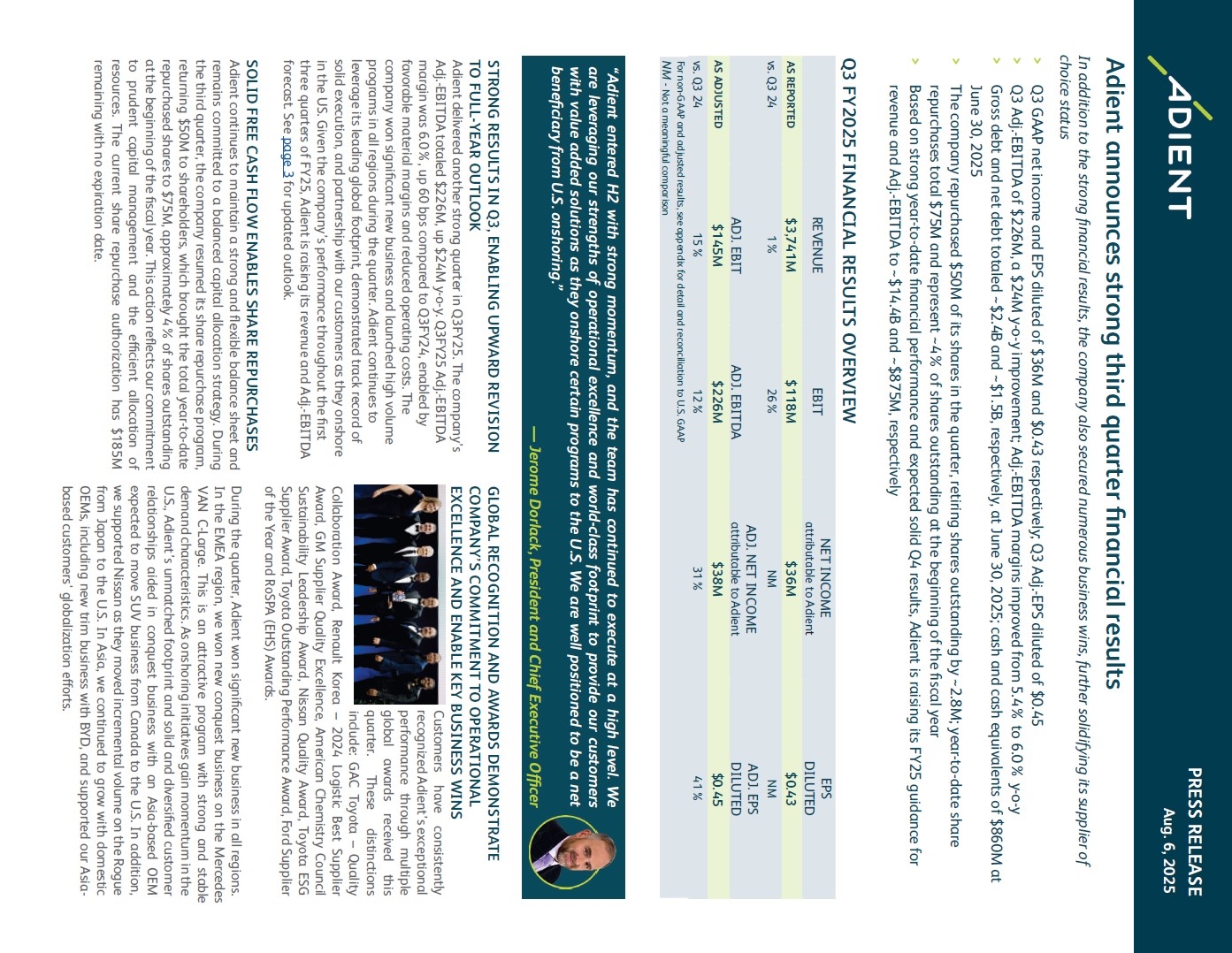

| Net sales | $ | 3,741 | $ | 3,716 | ||||||||||

| Cost of sales | 3,504 | 3,509 | ||||||||||||

| Gross profit | 237 | 207 | ||||||||||||

| Selling, general and administrative expenses | 129 | 121 | ||||||||||||

| Restructuring and impairment costs | 7 | 16 | ||||||||||||

| Equity income | 17 | 24 | ||||||||||||

| Earnings before interest and income taxes | 118 | 94 | ||||||||||||

| Net financing charges | 51 | 48 | ||||||||||||

| Other pension expense | 1 | 1 | ||||||||||||

| Income before income taxes | 66 | 45 | ||||||||||||

| Income tax provision | 7 | 40 | ||||||||||||

| Net income | 59 | 5 | ||||||||||||

| Income attributable to noncontrolling interests | 23 | 16 | ||||||||||||

| Net income (loss) attributable to Adient | $ | 36 | $ | (11) | ||||||||||

| Diluted earnings (loss) per share | $ | 0.43 | $ | (0.12) | ||||||||||

| Shares outstanding at period end | 81.2 | 87.2 | ||||||||||||

| Diluted weighted average shares | 83.7 | 88.6 | ||||||||||||

| June 30, | September 30, | |||||||||||||

| (in millions) | 2025 | 2024 | ||||||||||||

| Assets | ||||||||||||||

| Cash and cash equivalents | $ | 860 | $ | 945 | ||||||||||

Accounts receivable - net | 1,826 | 1,896 | ||||||||||||

| Inventories | 726 | 758 | ||||||||||||

| Other current assets | 610 | 487 | ||||||||||||

| Current assets | 4,022 | 4,086 | ||||||||||||

| Property, plant and equipment - net | 1,389 | 1,410 | ||||||||||||

| Goodwill | 1,804 | 2,164 | ||||||||||||

| Other intangible assets - net | 329 | 371 | ||||||||||||

| Investments in partially-owned affiliates | 294 | 338 | ||||||||||||

| Assets held for sale | 13 | 8 | ||||||||||||

| Other noncurrent assets | 985 | 974 | ||||||||||||

| Total assets | $ | 8,836 | $ | 9,351 | ||||||||||

| Liabilities and Shareholders' Equity | ||||||||||||||

| Short-term debt | $ | 9 | $ | 9 | ||||||||||

| Accounts payable and accrued expenses | 2,898 | 2,910 | ||||||||||||

| Other current liabilities | 691 | 759 | ||||||||||||

| Current liabilities | 3,598 | 3,678 | ||||||||||||

| Long-term debt | 2,385 | 2,396 | ||||||||||||

| Other noncurrent liabilities | 693 | 743 | ||||||||||||

| Redeemable noncontrolling interests | 86 | 91 | ||||||||||||

| Shareholders' equity attributable to Adient | 1,785 | 2,134 | ||||||||||||

| Noncontrolling interests | 289 | 309 | ||||||||||||

| Total liabilities and shareholders' equity | $ | 8,836 | $ | 9,351 | ||||||||||

| Three Months Ended June 30, | ||||||||||||||

| (in millions) | 2025 | 2024 | ||||||||||||

| Operating Activities | ||||||||||||||

| Net income (loss) attributable to Adient | $ | 36 | $ | (11) | ||||||||||

| Income attributable to noncontrolling interests | 23 | 16 | ||||||||||||

| Net income | 59 | 5 | ||||||||||||

| Adjustments to reconcile net income to cash provided (used) by operating activities: | ||||||||||||||

| Depreciation | 71 | 71 | ||||||||||||

| Amortization of intangibles | 12 | 12 | ||||||||||||

| Pension and postretirement benefit expense | 2 | 3 | ||||||||||||

| Pension and postretirement contributions, net | (2) | (5) | ||||||||||||

| Equity in earnings of partially-owned affiliates, net of dividends received | 2 | 1 | ||||||||||||

| Deferred income taxes | (16) | 14 | ||||||||||||

| Equity-based compensation | 10 | 5 | ||||||||||||

| Other | (5) | 2 | ||||||||||||

| Changes in assets and liabilities: | ||||||||||||||

| Receivables | 117 | 60 | ||||||||||||

| Inventories | 20 | 13 | ||||||||||||

| Other assets | (62) | — | ||||||||||||

| Accounts payable and accrued liabilities | (28) | (27) | ||||||||||||

| Accrued income taxes | (8) | 4 | ||||||||||||

| Cash provided by operating activities | 172 | 158 | ||||||||||||

| Investing Activities | ||||||||||||||

| Capital expenditures | (57) | (70) | ||||||||||||

| Sale of property, plant and equipment | 8 | — | ||||||||||||

| Cash used by investing activities | (49) | (70) | ||||||||||||

| Financing Activities | ||||||||||||||

| Increase (decrease) in short-term debt | (2) | 3 | ||||||||||||

| Repayment of long-term debt | (2) | (2) | ||||||||||||

| Share repurchases | (50) | (75) | ||||||||||||

| Dividends paid to noncontrolling interests | (9) | (18) | ||||||||||||

| Cash used by financing activities | (63) | (92) | ||||||||||||

| Effect of exchange rate changes on cash and cash equivalents | 46 | (11) | ||||||||||||

| Increase (decrease) in cash and cash equivalents | $ | 106 | $ | (15) | ||||||||||

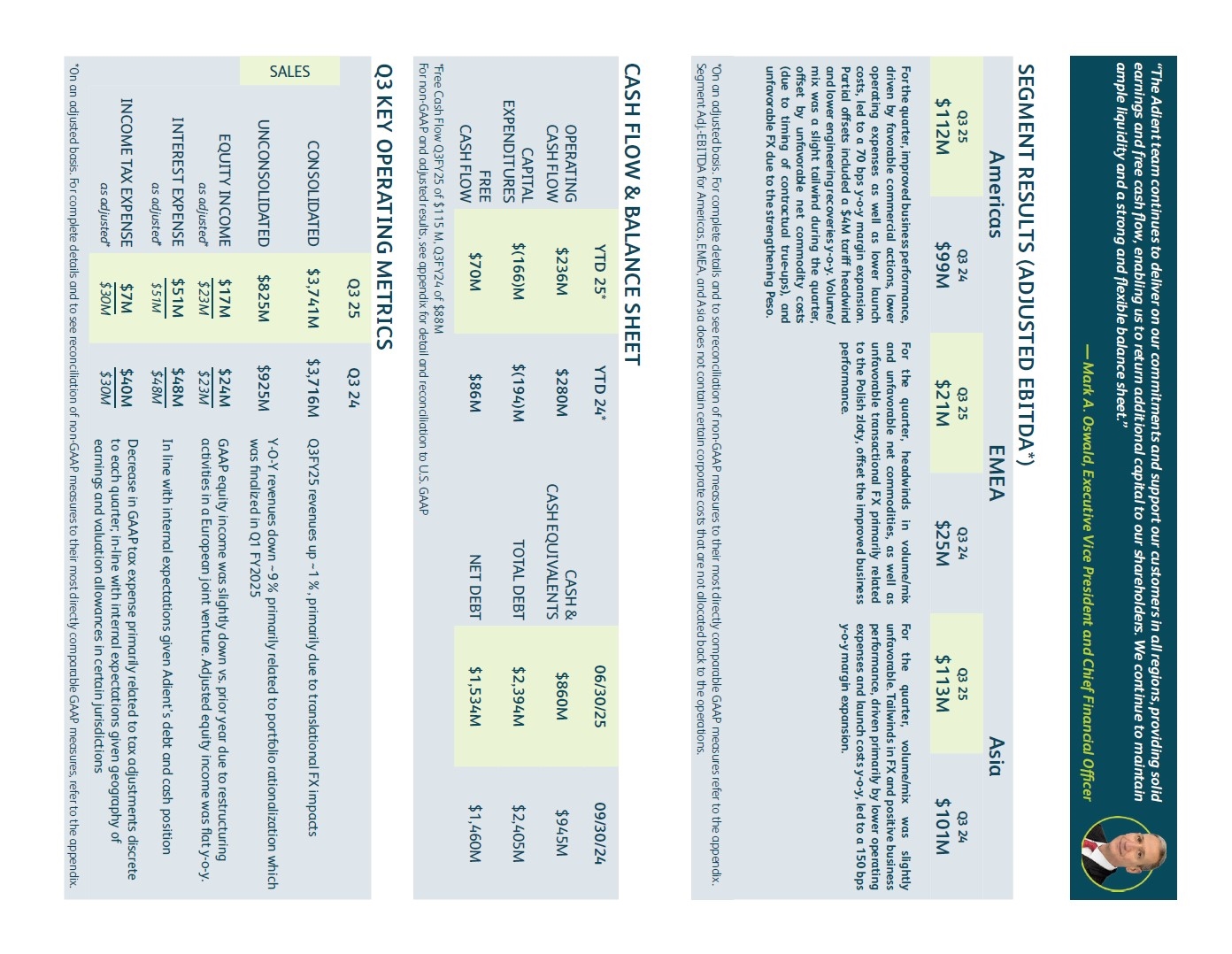

| (in millions) | Three months ended June 30, 2025 | |||||||||||||||||||||||||||||||

| Americas | EMEA | Asia | Corporate/Eliminations | Consolidated | ||||||||||||||||||||||||||||

| Net sales | $ | 1,760 | $ | 1,268 | $ | 721 | $ | (8) | $ | 3,741 | ||||||||||||||||||||||

| Adjusted EBITDA | $ | 112 | $ | 21 | $ | 113 | $ | (20) | $ | 226 | ||||||||||||||||||||||

| Adjusted EBITDA margin | 6.4 | % | 1.7 | % | 15.7 | % | N/A | 6.0 | % | |||||||||||||||||||||||

| Three months ended June 30, 2024 | ||||||||||||||||||||||||||||||||

| Americas | EMEA | Asia | Corporate/Eliminations | Consolidated | ||||||||||||||||||||||||||||

| Net sales | $ | 1,737 | $ | 1,288 | $ | 712 | $ | (21) | $ | 3,716 | ||||||||||||||||||||||

| Adjusted EBITDA | $ | 99 | $ | 25 | $ | 101 | $ | (23) | $ | 202 | ||||||||||||||||||||||

| Adjusted EBITDA margin | 5.7 | % | 1.9 | % | 14.2 | % | N/A | 5.4 | % | |||||||||||||||||||||||

| Three Months Ended June 30, | ||||||||||||||

| (in millions) | 2025 | 2024 | ||||||||||||

| Adjusted EBITDA | ||||||||||||||

| Americas | $ | 112 | $ | 99 | ||||||||||

| EMEA | 21 | 25 | ||||||||||||

| Asia | 113 | 101 | ||||||||||||

| Subtotal | 246 | 225 | ||||||||||||

Corporate-related costs (1) | (20) | (23) | ||||||||||||

Restructuring and impairment costs (2) | (7) | (16) | ||||||||||||

Purchase accounting amortization (3) | (12) | (12) | ||||||||||||

Restructuring related activities (4) | (7) | (4) | ||||||||||||

| Equity based compensation | (10) | (5) | ||||||||||||

| Depreciation | (71) | (71) | ||||||||||||

Other items (5) | (1) | — | ||||||||||||

| Earnings before interest and income taxes | $ | 118 | $ | 94 | ||||||||||

| Net financing charges | (51) | (48) | ||||||||||||

| Other pension expense | (1) | (1) | ||||||||||||

| Income before income taxes | $ | 66 | $ | 45 | ||||||||||

| Three Months Ended June 30, | ||||||||||||||

| (in millions, except per share data) | 2025 | 2024 | ||||||||||||

| Income available to shareholders | ||||||||||||||

| Net income (loss) attributable to Adient | $ | 36 | $ | (11) | ||||||||||

| Weighted average shares outstanding | ||||||||||||||

| Basic weighted average shares outstanding | 83.5 | 88.6 | ||||||||||||

| Effect of dilutive securities: | ||||||||||||||

| Unvested restricted stock and unvested performance share awards | 0.2 | — | ||||||||||||

| Diluted weighted average shares outstanding | 83.7 | 88.6 | ||||||||||||

| Earnings (loss) per share: | ||||||||||||||

| Basic | $ | 0.43 | $ | (0.12) | ||||||||||

| Diluted | $ | 0.43 | $ | (0.12) | ||||||||||

| (a) | Adjusted EBIT is defined as earnings before income taxes and noncontrolling interests excluding net financing charges, restructuring, impairment and related costs, purchase accounting amortization, transaction gains/losses, other significant non-recurring items, and net mark-to-market adjustments on pension and postretirement plans. Adjusted EBIT margin is adjusted EBIT as a percentage of net sales. | ||||

| (b) | Adjusted EBITDA is defined as adjusted EBIT excluding depreciation and equity based compensation. Certain corporate-related costs are not allocated to the business segments in determining adjusted EBITDA. Adjusted EBITDA margin is adjusted EBITDA as a percentage of net sales. | ||||

| (c) | Adjusted net income attributable to Adient is defined as net income (loss) attributable to Adient excluding restructuring, impairment and related costs, purchase accounting amortization, transaction gains/losses, other significant non-recurring items, net mark-to-market adjustments on pension and postretirement plans, the tax impact of these items and other discrete tax charges/benefits. | ||||

| (d) | Adjusted income tax expense is defined as income tax expense adjusted for the tax effect of the adjustments to income before income taxes and other discrete tax changes/benefits. Adjusted effective tax rate is defined as adjusted income tax provision as a percentage of adjusted income before income taxes. | ||||

| (e) | Adjusted diluted earnings per share is defined as adjusted net income attributable to Adient divided by diluted weighted average shares. | ||||

| (f) | Adjusted equity income is defined as equity income excluding amortization of Adient's intangible assets related to its non-consolidated joint ventures and other unusual or non-recurring items impacting equity income. | ||||

| (g) | Adjusted interest expense is defined as net financing charges excluding unusual or one-time items impacting interest expense. | ||||

| (h) | Free cash flow is defined as cash provided by operating activities less capital expenditures. | ||||

| (i) | Net debt is calculated as total debt (short-term and long-term) less cash and cash equivalents. | ||||

| (j) | Net leverage ratio is calculated as net debt divided by adjusted EBITDA for the last four quarters. | ||||

| Three Months Ended June 30, | ||||||||||||||

| (in millions) | 2025 | 2024 | ||||||||||||

| Net income | $ | 59 | $ | 5 | ||||||||||

| Net financing charges | 51 | 48 | ||||||||||||

| Other pension expense | 1 | 1 | ||||||||||||

| Income tax expense | 7 | 40 | ||||||||||||

| Earnings before interest and income taxes (EBIT) | $ | 118 | $ | 94 | ||||||||||

| EBIT adjustments: | ||||||||||||||

Restructuring and impairment costs (2) | 7 | 16 | ||||||||||||

Purchase accounting amortization (3) | 12 | 12 | ||||||||||||

Restructuring related activities (4) | 7 | 4 | ||||||||||||

Other items (5) | 1 | — | ||||||||||||

| EBIT adjustments total | 27 | 32 | ||||||||||||

| Adjusted EBIT | $ | 145 | $ | 126 | ||||||||||

| EBITDA adjustments: | ||||||||||||||

| Depreciation | 71 | 71 | ||||||||||||

| Equity based compensation | 10 | 5 | ||||||||||||

| Adjusted EBITDA | $ | 226 | $ | 202 | ||||||||||

| Net sales | $ | 3,741 | $ | 3,716 | ||||||||||

| Net income as % of net sales | 1.6 | % | 0.1 | % | ||||||||||

| EBIT as % of net sales | 3.2 | % | 2.5 | % | ||||||||||

| Adjusted EBIT as % of net sales | 3.9 | % | 3.4 | % | ||||||||||

| Adjusted EBITDA as % of net sales | 6.0 | % | 5.4 | % | ||||||||||

| Three Months Ended June 30, | ||||||||||||||

| (in millions) | 2025 | 2024 | ||||||||||||

| Net income (loss) attributable to Adient | $ | 36 | $ | (11) | ||||||||||

| Net income adjustments: | ||||||||||||||

| EBIT adjustments total - see table (a) & (b) | 27 | 32 | ||||||||||||

| Tax impact of EBIT adjustments and other tax items - see table (d) | (23) | 10 | ||||||||||||

Impact of adjustments on noncontrolling interests (6) | (2) | (2) | ||||||||||||

| Net income adjustments total | 2 | 40 | ||||||||||||

| Adjusted net income attributable to Adient | $ | 38 | $ | 29 | ||||||||||

| Three months ended June 30, | ||||||||||||||||||||||||||||||||||||||

| 2025 | 2024 | |||||||||||||||||||||||||||||||||||||

| (in millions, except effective tax rate) | Income before income taxes | Income tax expense (benefit) | Effective tax rate | Income before income taxes | Income tax expense (benefit) | Effective tax rate | ||||||||||||||||||||||||||||||||

| As reported | $ | 66 | $ | 7 | 10.6 | % | $ | 45 | $ | 40 | 88.9 | % | ||||||||||||||||||||||||||

| Adjustments | ||||||||||||||||||||||||||||||||||||||

| EBIT adjustments - see table (a) & (b) | 27 | 1 | 3.7 | % | 32 | 5 | 15.6 | % | ||||||||||||||||||||||||||||||

| Tax audit closures and statute expirations | — | 16 | nm | — | — | nm | ||||||||||||||||||||||||||||||||

| FX remeasurements of tax balances | — | 7 | nm | — | (15) | nm | ||||||||||||||||||||||||||||||||

| Other | — | (1) | nm | — | — | nm | ||||||||||||||||||||||||||||||||

| Subtotal of adjustments | 27 | 23 | 85.2 | % | 32 | (10) | (31.3) | % | ||||||||||||||||||||||||||||||

| As adjusted | $ | 93 | $ | 30 | 32.3 | % | $ | 77 | $ | 30 | 39.0 | % | ||||||||||||||||||||||||||

| Three Months Ended June 30, | ||||||||||||||

| (in millions, except per share data) | 2025 | 2024 | ||||||||||||

| Numerator: | ||||||||||||||

| Adjusted net income attributable to Adient - see table (c) | $ | 38 | $ | 29 | ||||||||||

| Denominator: | ||||||||||||||

| Basic weighted average shares outstanding | 83.5 | 88.6 | ||||||||||||

| Effect of dilutive securities: | ||||||||||||||

| Unvested restricted stock and unvested performance share awards | 0.2 | 0.7 | ||||||||||||

| Diluted weighted average shares outstanding | 83.7 | 89.3 | ||||||||||||

| Adjusted diluted earnings per share | $ | 0.45 | $ | 0.32 | ||||||||||

| Three Months Ended June 30, | ||||||||||||||

| 2025 | 2024 | |||||||||||||

| Diluted earnings (loss) per share as reported | $ | 0.43 | $ | (0.12) | ||||||||||

| EBIT adjustments total | 0.31 | 0.35 | ||||||||||||

| Tax impact of EBIT adjustments and other tax items | (0.27) | 0.11 | ||||||||||||

| Impact of adjustments on noncontrolling interests | (0.02) | (0.02) | ||||||||||||

| Adjusted diluted earnings per share | $ | 0.45 | $ | 0.32 | ||||||||||

| Three Months Ended June 30, | ||||||||||||||

| (in millions) | 2025 | 2024 | ||||||||||||

| Equity income | $ | 17 | $ | 24 | ||||||||||

| Equity income adjustments: | ||||||||||||||

| Restructuring charges at an affiliate | 6 | — | ||||||||||||

| One-time divestiture related impact at an affiliate | — | (1) | ||||||||||||

| Equity income adjustments total | 6 | (1) | ||||||||||||

| Adjusted equity income | $ | 23 | $ | 23 | ||||||||||

| Three Months Ended June 30, | ||||||||||||||

| (in millions) | 2025 | 2024 | ||||||||||||

| Net financing charges | $ | 51 | $ | 48 | ||||||||||

| Interest expense adjustments: | ||||||||||||||

| None | — | — | ||||||||||||

| Interest expense adjustments total | — | — | ||||||||||||

| Adjusted net financing charges | $ | 51 | $ | 48 | ||||||||||

| Three Months Ended June 30, | Nine Months Ended June 30, | |||||||||||||||||||||||||

| (in millions) | 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||||

| Operating cash flow | $ | 172 | $ | 158 | $ | 236 | $ | 280 | ||||||||||||||||||

| Capital expenditures | (57) | (70) | (166) | (194) | ||||||||||||||||||||||

| Free cash flow | $ | 115 | $ | 88 | $ | 70 | $ | 86 | ||||||||||||||||||

| Three Months Ended June 30, | Nine Months Ended June 30, | |||||||||||||||||||||||||

| (in millions) | 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||||

| Adjusted EBITDA | $ | 226 | $ | 202 | $ | 655 | $ | 645 | ||||||||||||||||||

| Adjusted equity income | (23) | (23) | (63) | (67) | ||||||||||||||||||||||

| Dividends from partially owned affiliates | 20 | 25 | 72 | 46 | ||||||||||||||||||||||

| Restructuring (cash) | (34) | (12) | (101) | (33) | ||||||||||||||||||||||

| Net customer tooling | (31) | (15) | (49) | (13) | ||||||||||||||||||||||

| Trade working capital (Net AR/AP + Inventory) | 42 | 11 | 50 | 46 | ||||||||||||||||||||||

| Accrued compensation | 53 | 9 | 22 | (41) | ||||||||||||||||||||||

| Interest paid | (55) | (56) | (142) | (153) | ||||||||||||||||||||||

| Tax refund/taxes paid | (31) | (24) | (70) | (76) | ||||||||||||||||||||||

| Non-income related taxes (VAT) | (34) | (1) | (52) | (22) | ||||||||||||||||||||||

| Commercial settlements | 41 | 22 | 13 | 14 | ||||||||||||||||||||||

| Net capitalized engineering | (23) | 5 | (35) | (6) | ||||||||||||||||||||||

| Other | 21 | 15 | (64) | (60) | ||||||||||||||||||||||

| Operating cash flow | 172 | 158 | 236 | 280 | ||||||||||||||||||||||

| Capital expenditures | (57) | (70) | (166) | (194) | ||||||||||||||||||||||

| Free cash flow | $ | 115 | $ | 88 | $ | 70 | $ | 86 | ||||||||||||||||||

| June 30, | September 30, | |||||||||||||

| (in millions) | 2025 | 2024 | ||||||||||||

| Numerator: | ||||||||||||||

| Short-term debt | $ | — | $ | 1 | ||||||||||

| Current portion of long-term debt | 9 | 8 | ||||||||||||

| Long-term debt | 2,385 | 2,396 | ||||||||||||

| Total debt | 2,394 | 2,405 | ||||||||||||

| Less: cash and cash equivalents | 860 | 945 | ||||||||||||

| Net debt | $ | 1,534 | $ | 1,460 | ||||||||||

| Denominator: | ||||||||||||||

| Adjusted EBITDA - last four quarters | ||||||||||||||

| Q1 2024 | na | $ | 216 | |||||||||||

| Q2 2024 | na | 227 | ||||||||||||

| Q3 2024 | na | 202 | ||||||||||||

| Q4 2024 | 235 | 235 | ||||||||||||

| Q1 2025 | 196 | na | ||||||||||||

| Q2 2025 | 233 | na | ||||||||||||

| Q3 2025 - see table (a) & (b) | 226 | na | ||||||||||||

| Last four quarters | $ | 890 | $ | 880 | ||||||||||

| Net leverage ratio | 1.72 | 1.66 | ||||||||||||

| Three Months Ended June 30, | ||||||||||||||

| (in millions) | 2025 | 2024 | ||||||||||||

| Restructuring related charges | $ | (7) | $ | (4) | ||||||||||

| Restructuring charges at an affiliate | (6) | — | ||||||||||||

| Gain of sale of restructured facility | 6 | — | ||||||||||||

| $ | (7) | $ | (4) | |||||||||||

| Three Months Ended June 30, | ||||||||||||||

| (in millions) | 2025 | 2024 | ||||||||||||

| One-time divestiture related impact at an affiliate | $ | — | $ | 1 | ||||||||||

| Transaction costs | (1) | (1) | ||||||||||||

| $ | (1) | $ | — | |||||||||||