Adient – PUBLIC Wolfe Research Auto, Auto Tech and Semiconductor Conference 2026 February 11, 2026

Adient – PUBLIC Adient has made statements in this document that are forward-looking and, therefore, are subject to risks and uncertainties. All statements in this document other than statements of historical fact are statements that are, or could be, deemed “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. In this document, statements regarding Adient’s expectations for its deleveraging activities, the timing, benefits and outcomes of those activities, as well as its future financial position, sales, costs, earnings, cash flows, other measures of results of operations, capital expenditures or debt levels and plans, objectives, market position, outlook, targets, guidance or goals are forward-looking statements. Words such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “should,” “forecast,” “project” or “plan” or terms of similar meaning are also generally intended to identify forward-looking statements. Adient cautions that these statements are subject to numerous important risks, uncertainties, assumptions and other factors, some of which are beyond Adient’s control, that could cause Adient’s actual results to differ materially from those expressed or implied by such forward-looking statements, including, among others, risks related to: the effects of local and national economic, credit and capital market conditions (including the persistence of high interest rates, vehicle affordability and volatile currency exchange rates) on the global economy, increased competitive pressures in the EMEA and Asia regions from Chinese OEMs, uncertainties in U.S. administrative policy regarding trade agreements, tariffs and other international trade relations, automotive vehicle production levels, mix and schedules, as well as the concentration of exposure to certain automotive manufacturers particularly new entrants in the China market, shifts in market shares among vehicles, vehicle segments or away from vehicles on which Adient has significant content, changes in consumer demand, risks associated with Adient’s joint ventures, volatile energy markets, Adient’s ability and timing of customer recoveries for increased input costs, the availability of raw materials and component products (including components required by Adient’s customers for the manufacture of vehicles), risks associated with warranty and product recall and product liability exposures, geopolitical uncertainties such as the Ukraine and Middle East conflicts and the impact on the regional and global economies and additional pressure on supply chain and vehicle production, the ability of Adient to effectively launch new business at forecast and profitable levels, the ability of Adient to successfully identify suitable opportunities for organic investment and/or acquisitions and to integrate such investments and/or acquisitions;, work stoppages, including due to strikes, supply chain disruptions and similar events, wage inflationary pressures due to labor shortages and new labor negotiations, the ability of Adient to execute its restructuring plans and achieve the desired benefit, the ability of Adient to meet debt service requirements and, terms of future financing, the impact of global tax reform legislation, the impact of more aggressive positions taken by tax authorities, potential adjustment of the value of deferred tax assets, global climate change and related emphasis on sustainability matters by various stakeholders, and the ability of Adient to achieve its sustainability-related goals, cancellation of, or changes to, commercial arrangements, and the ability of Adient to identify, recruit and retain key leadership. A detailed discussion of risks related to Adient’s business is included in the section entitled “Risk Factors” in Adient’s Annual Report on Form 10-K for the fiscal year ended September 30, 2025 filed with the U.S. Securities and Exchange Commission (the “SEC”) on November 18, 2025, and in subsequent reports filed with or furnished to the SEC, available at www.sec.gov. Potential investors and others should consider these factors in evaluating the forward-looking statements and should not place undue reliance on such statements. The forward-looking statements included in this document are made only as of the date of this document, unless otherwise specified, and, except as required by law, Adient assumes no obligation, and disclaims any obligation, to update such statements to reflect events or circumstances occurring after the date of this document. In addition, this document includes certain projections provided by Adient with respect to the anticipated future performance of Adient’s businesses. Such projections reflect various assumptions of Adient’s management concerning the future performance of Adient’s businesses, which may or may not prove to be correct. The actual results may vary from the anticipated results and such variations may be material. Adient does not undertake any obligation to update the projections to reflect events or circumstances or changes in expectations after the date of this document or to reflect the occurrence of subsequent events. No representations or warranties are made as to the accuracy or reasonableness of such assumptions, or the projections based thereon. This document also contains non-GAAP financial information because Adient’s management believes it may assist investors in evaluating Adient’s on-going operations. Adient believes these non-GAAP disclosures provide important supplemental information to management and investors regarding financial and business trends relating to Adient’s financial condition and results of operations. Investors should not consider these non-GAAP measures as alternatives to the related GAAP measures. For complete details and to see reconciliations of non-GAAP measures to their most directly comparable GAAP measures, visit the events section of the Adient investor website at www.investors.adient.com/events-and-presentations/events to download the full press release and earnings presentation. This document also contains the key performance indicator of business performance, which is defined as the difference in period-over-period Adjusted EBITDA excluding production volume/mix, equity income, foreign exchange and net commodity pricing. Management believes this key performance indicator encompasses the significant drivers of the performance of the business that are within management’s ability to influence and may assist investors in evaluating Adient’s on-going operations and provide important supplemental information regarding financial and business trends relating to Adient’s financial condition and results of operations. Investors should not consider this key performance indicator as an alternative to our GAAP financial results. Important Information Wolfe Research Autos Conference 2

Adient – PUBLIC Agenda > Business Update Mark Oswald Executive VP and CFO Jim Conklin Executive VP Americas > Q&A Wolfe Research Autos Conference 3

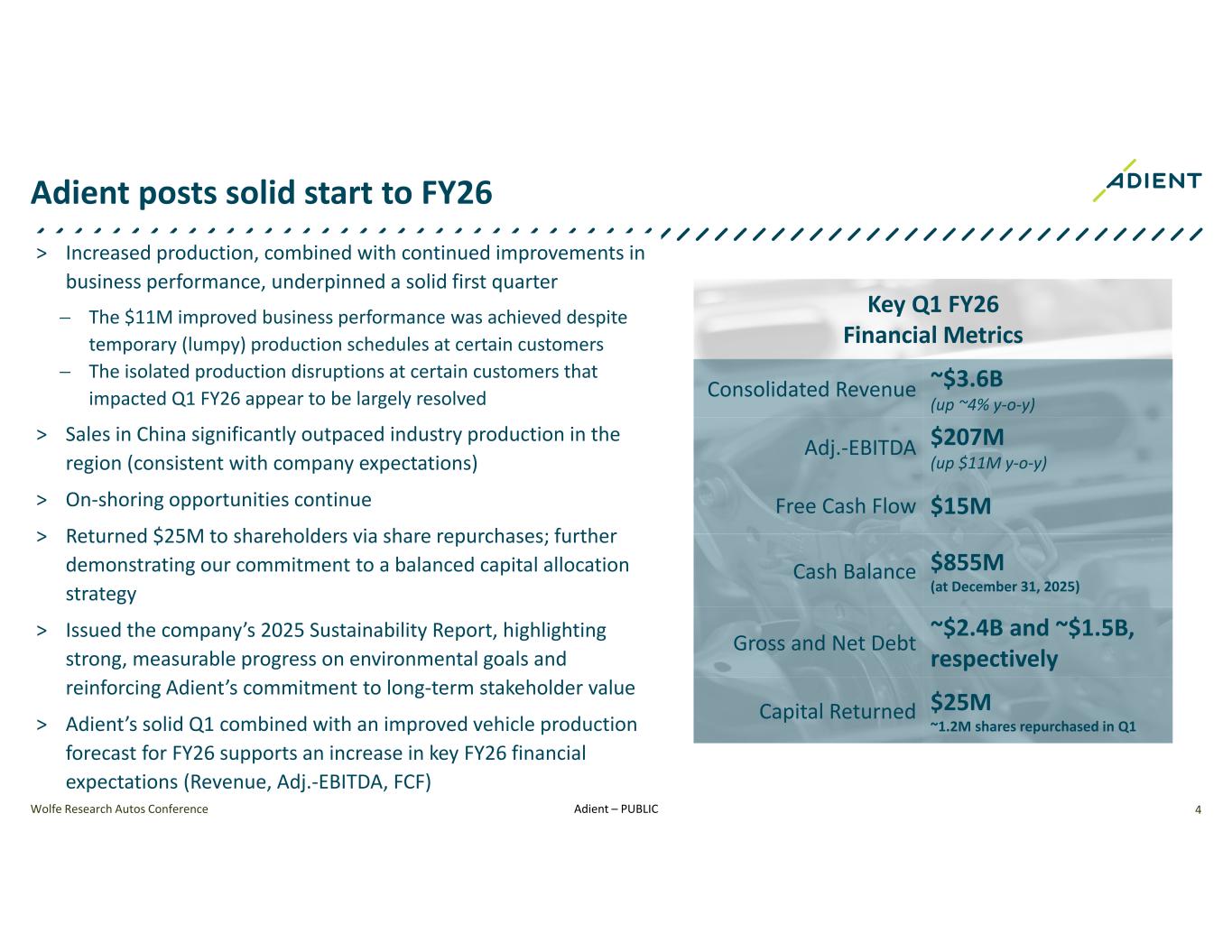

Adient – PUBLIC > Increased production, combined with continued improvements in business performance, underpinned a solid first quarter − The $11M improved business performance was achieved despite temporary (lumpy) production schedules at certain customers − The isolated production disruptions at certain customers that impacted Q1 FY26 appear to be largely resolved > Sales in China significantly outpaced industry production in the region (consistent with company expectations) > On-shoring opportunities continue > Returned $25M to shareholders via share repurchases; further demonstrating our commitment to a balanced capital allocation strategy > Issued the company’s 2025 Sustainability Report, highlighting strong, measurable progress on environmental goals and reinforcing Adient’s commitment to long-term stakeholder value > Adient’s solid Q1 combined with an improved vehicle production forecast for FY26 supports an increase in key FY26 financial expectations (Revenue, Adj.-EBITDA, FCF) Wolfe Research Autos Conference 4 Adient posts solid start to FY26 Key Q1 FY26 Financial Metrics ~$3.6B (up ~4% y-o-y) Consolidated Revenue $207M (up $11M y-o-y) Adj.-EBITDA $15MFree Cash Flow $855M (at December 31, 2025) Cash Balance ~$2.4B and ~$1.5B, respectivelyGross and Net Debt $25M ~1.2M shares repurchased in Q1 Capital Returned

Adient – PUBLIC 5 Adient operating model allows us to drive shareholder value Consistently strong execution, delivering on our operational and financial commitments Well-positioned for growth Driving value to our customers, reinforcing supplier of choice status Executing on our balanced capital allocation approach Remaining focused to ensure sustainable value for all Adient’s stakeholders Wolfe Research Autos Conference

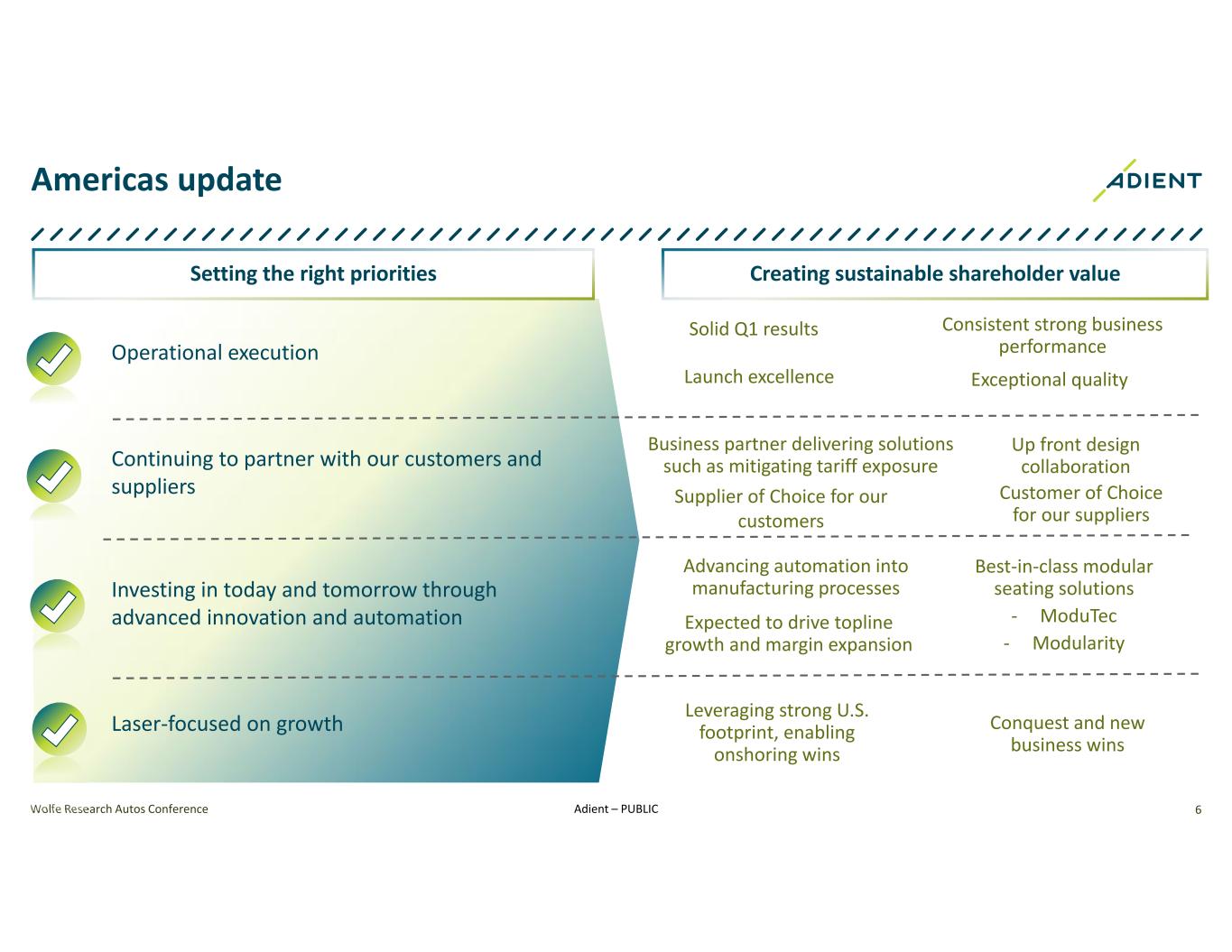

Adient – PUBLICWolfe Research Autos Conference 6 Americas update Setting the right priorities Operational execution Continuing to partner with our customers and suppliers Investing in today and tomorrow through advanced innovation and automation Laser-focused on growth Creating sustainable shareholder value Solid Q1 results Launch excellence Consistent strong business performance Exceptional quality Expected to drive topline growth and margin expansion Best-in-class modular seating solutions - ModuTec - Modularity Leveraging strong U.S. footprint, enabling onshoring wins Conquest and new business wins Customer of Choice for our suppliers Advancing automation into manufacturing processes Up front design collaboration Business partner delivering solutions such as mitigating tariff exposure Supplier of Choice for our customers

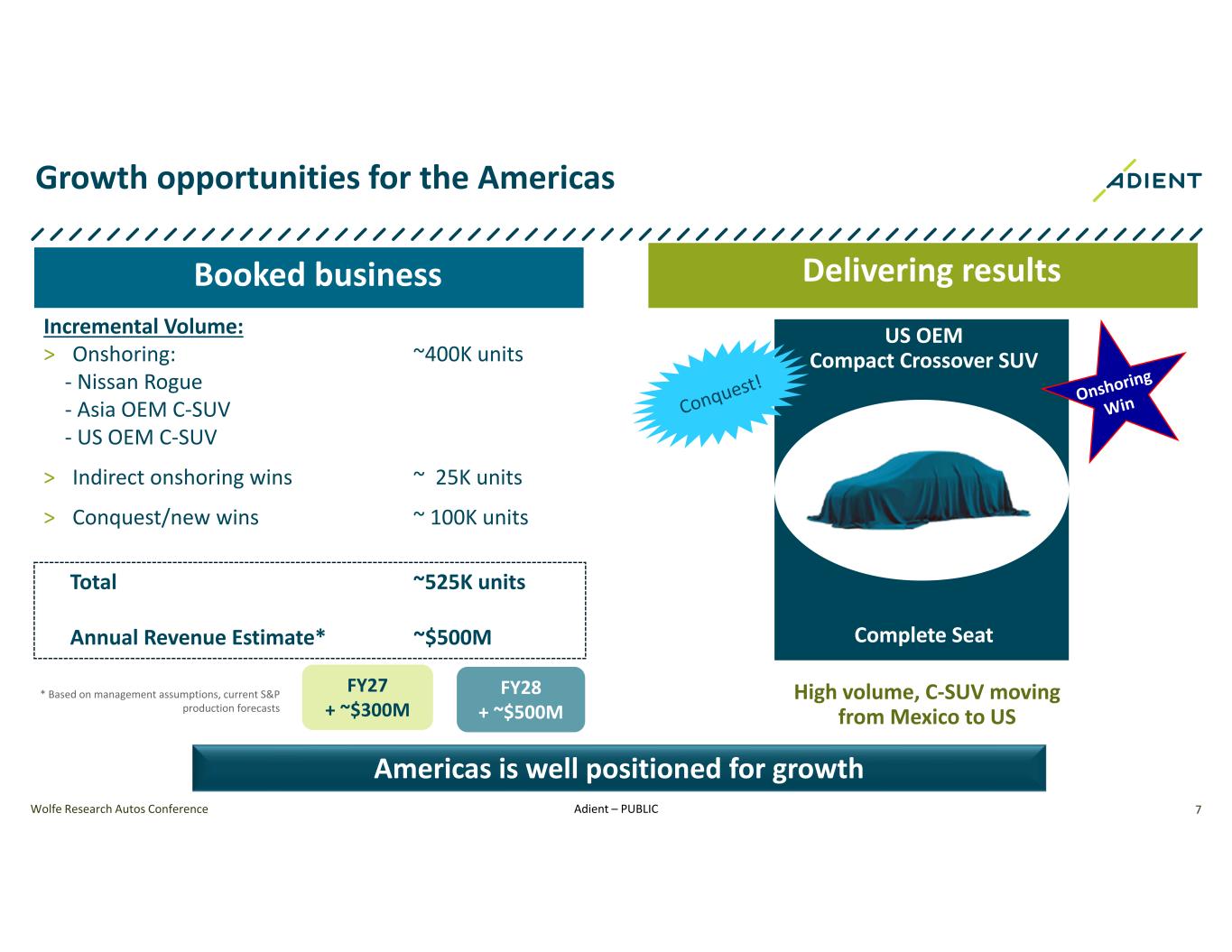

Adient – PUBLIC US OEM Compact Crossover SUV Complete Seat Wolfe Research Autos Conference 7 Growth opportunities for the Americas * Based on management assumptions, current S&P production forecasts Americas is well positioned for growth Incremental Volume: > Onshoring: ~400K units - Nissan Rogue - Asia OEM C-SUV - US OEM C-SUV > Indirect onshoring wins ~ 25K units > Conquest/new wins ~ 100K units Total ~525K units Annual Revenue Estimate* ~$500M Booked business Delivering results FY27 + ~$300M FY28 + ~$500M High volume, C-SUV moving from Mexico to US

Adient – PUBLIC Q&A