I N V E S T O R U P D A T E | D E C E M B E R 1 1 , 2 0 2 5

Agenda Welcome and Agenda Built to Win & Built to Last Lori Flees, President & Chief Executive Officer Operational Excellence Linne Fulcher, Chief Operating Officer Franchise Advantage & Growth Drivers Adam Worsham, Chief Franchising Officer Clear Roadmap to Accelerating Growth and Driving Performance Kevin Willis, Chief Financial Officer Q&A Break 2

Safe Harbor 3 Forward-Looking Statements Certain statements herein, other than statements of historical fact, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements may include, without limitation, statements about the acquisition of Breeze Autocare, including its Oil Changers stores, and the integration of the Breeze Autocare business and the anticipated benefits and synergies of the acquisition; executing on the growth strategy to create shareholder value by driving the full potential in Valvoline’s core business, delivering sustainable network growth and innovating to meet the changing needs of customers and the car parc; realizing the benefits from acquisitions and refranchising transactions; and future opportunities for the stand-alone retail business; and any other statements regarding Valvoline's future operations, financial or operating results, capital allocation, debt leverage ratio, anticipated business levels, dividend policy, anticipated growth, market opportunities, strategies, competition, and other expectations and targets for future periods. Valvoline has identified some of these forward-looking statements with words such as “anticipates,” “believes,” “expects,” “estimates,” “is likely,” “predicts,” “projects,” “forecasts,” “may,” “will,” “should,” and “intends,” and the negative of these words or other comparable terminology. These forward-looking statements are based on Valvoline’s current expectations, estimates, projections, and assumptions as of the date such statements are made and are subject to risks and uncertainties that may cause results to differ materially from those expressed or implied in the forward-looking statements. Additional information regarding these risks and uncertainties are described in Valvoline’s filings with the Securities and Exchange Commission (the “SEC”), including in the “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Quantitative and Qualitative Disclosures about Market Risk” sections of Valvoline’s most recently filed periodic reports on Forms 10-K and 10-Q, which are available on Valvoline’s website at http://investors.valvoline.com/sec-filings or on the SEC’s website at http://www.sec.gov. Valvoline assumes no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future, unless required by law. Regulation G: Adjusted Results The information presented herein, regarding certain financial measures that do not conform to generally accepted accounting principles in the United States (U.S. GAAP), should not be construed as an alternative to the reported results determined in accordance with U.S. GAAP. Valvoline has included this non-GAAP information to assist in understanding the operating performance of the company. The non-GAAP information provided may not be consistent with the methodologies used by other companies. Information regarding Valvoline’s definitions, calculations and reconciliations of non-GAAP measures can be found in the tables attached to Valvoline’s earnings press releases dated November 19, 2025 and November 9, 2023, which are available at Valvoline’s website at https://investors.valvoline.com/financials/quarterly-results/. Data Sources See Appendix for additional information regarding certain financial information and data used in this Presentation.

4

Built to Win & Built to Last Lori Flees, President & Chief Executive Officer 5

Today’s Focus Where We Play and Why We Win • We are the category leader with a proven track record • We operate a differentiated model in an attractive market Our Flywheel for Growth, Margins, and Returns • We have a clear roadmap for delivering sustained above-market growth • We are focused on initiatives that improve margin, free cash flow, and returns Allocating Capital for Quality Growth and Returns • We have a balanced and disciplined capital allocation policy • We drive synergies capitalizing on a fragmented market with bolt-on acquisitions 6

Valvoline has a Legacy of Delivering Value Valvoline’s Legacy Began 1866 1986 1989 2016 2021 2023 TODAY 7

Valvoline has a Legacy of Delivering Value Valvoline’s Legacy Began First Company Quick Lube store acquired First Franchise Quick Lube store opened 1866 1986 1989 2016 2021 2023 TODAY 8 Celebrating 40 YEARS in Retail

Valvoline has a Legacy of Delivering Value Valvoline’s Legacy Began First Company Quick Lube store acquired First Franchise Quick Lube store opened Valvoline Goes Public 1,000th Quick Lube store opened 1866 1986 1989 2016 2021 2023 TODAY 9 Celebrating 10 YEARS since going public

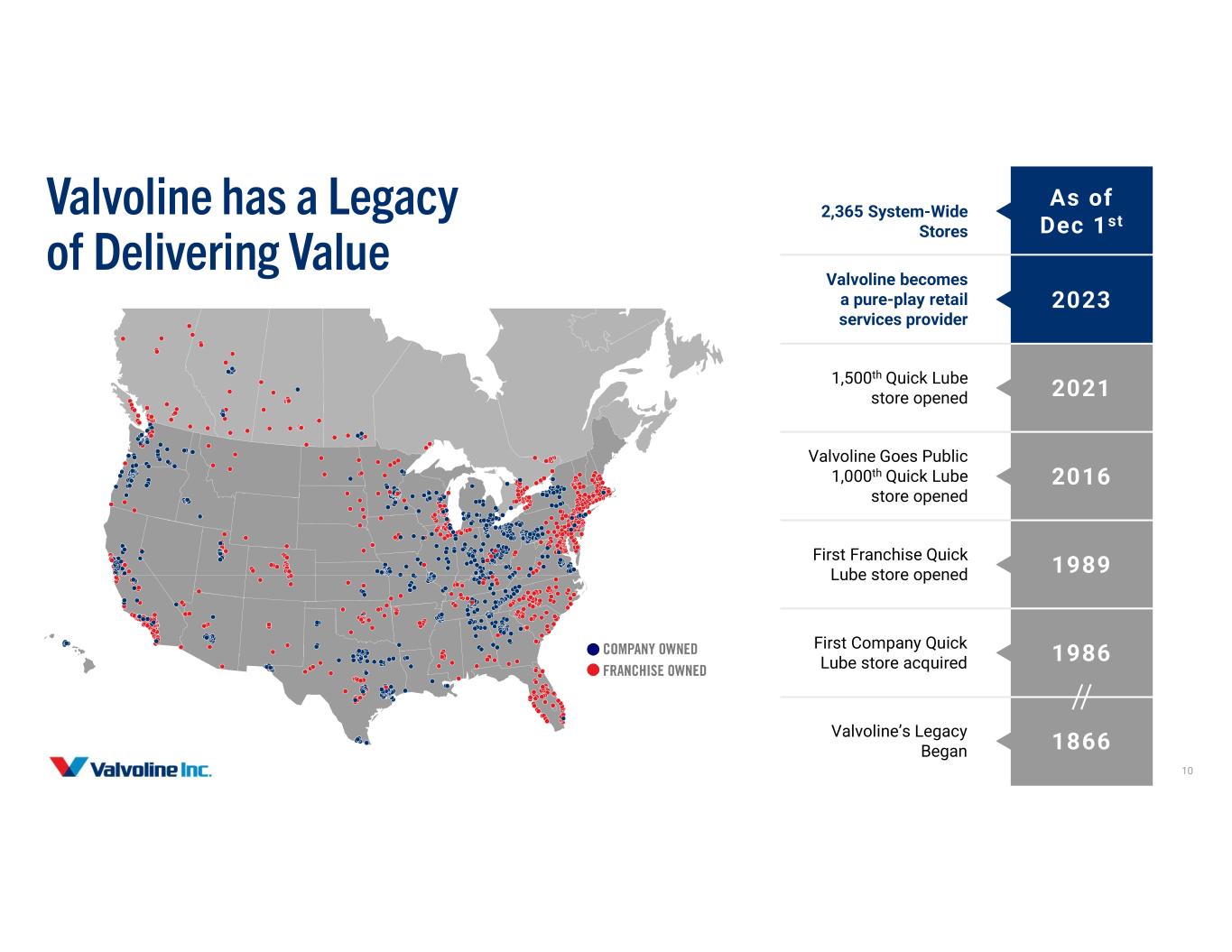

Valvoline has a Legacy of Delivering Value Valvoline’s Legacy Began First Company Quick Lube store acquired First Franchise Quick Lube store opened Valvoline Goes Public 1,000th Quick Lube store opened 1,500th Quick Lube store opened Valvoline becomes a pure-play retail services provider 2,365 System-Wide Stores 1866 1986 1989 2016 2021 2023 As of Dec 1st 10

A Proven, Highly Experienced Management Team in Place Leadership Experience Lori Flees President & CEO Laura Carpenter Chief Customer Officer Linne Fulcher Chief Operating Officer Brian Tabb Chief Development Officer Adam Worsham Chief Franchising Officer Kevin Willis Chief Financial Officer Julie O’Daniel Chief Legal Officer & Corporate Secretary Jon Caldwell Chief People Officer Hitesh Patel Chief Technology & Cybersecurity Officer YEARS OF EXPERIENCE (Retail and Valvoline) 11 28 35 18 17 25 18 9 19 11 Advance Auto Parts Best Buy McDonald’s Sleep Number WingStop Allstate Amazon GM Microsoft Walmart

Clear Purpose and Values Underpin our Vision People First Strive for Greatness Committed to Serve Do the Right Thing, Always To be the preferred destination in automotive services for customers, employees and franchisees We simplify vehicle care so customers can do what drives them Purpose Values Vision 12

Valvoline’s Growth Ambition New Store Growth System-wide SSS Growth Adjusted EPS Growth Adjusted EBITDA Margin Mid to High Teens +100 – 200 bps expansion > 7% 3 - 5% Committed to Delivering Attractive Returns (2026-2028) 13

And Maintaining Strong Capital Allocation Discipline Maintain a Strong Balance Sheet02 Expand our Reach with High Quality Network Growth01 Return Excess Cash to Shareholders03 14

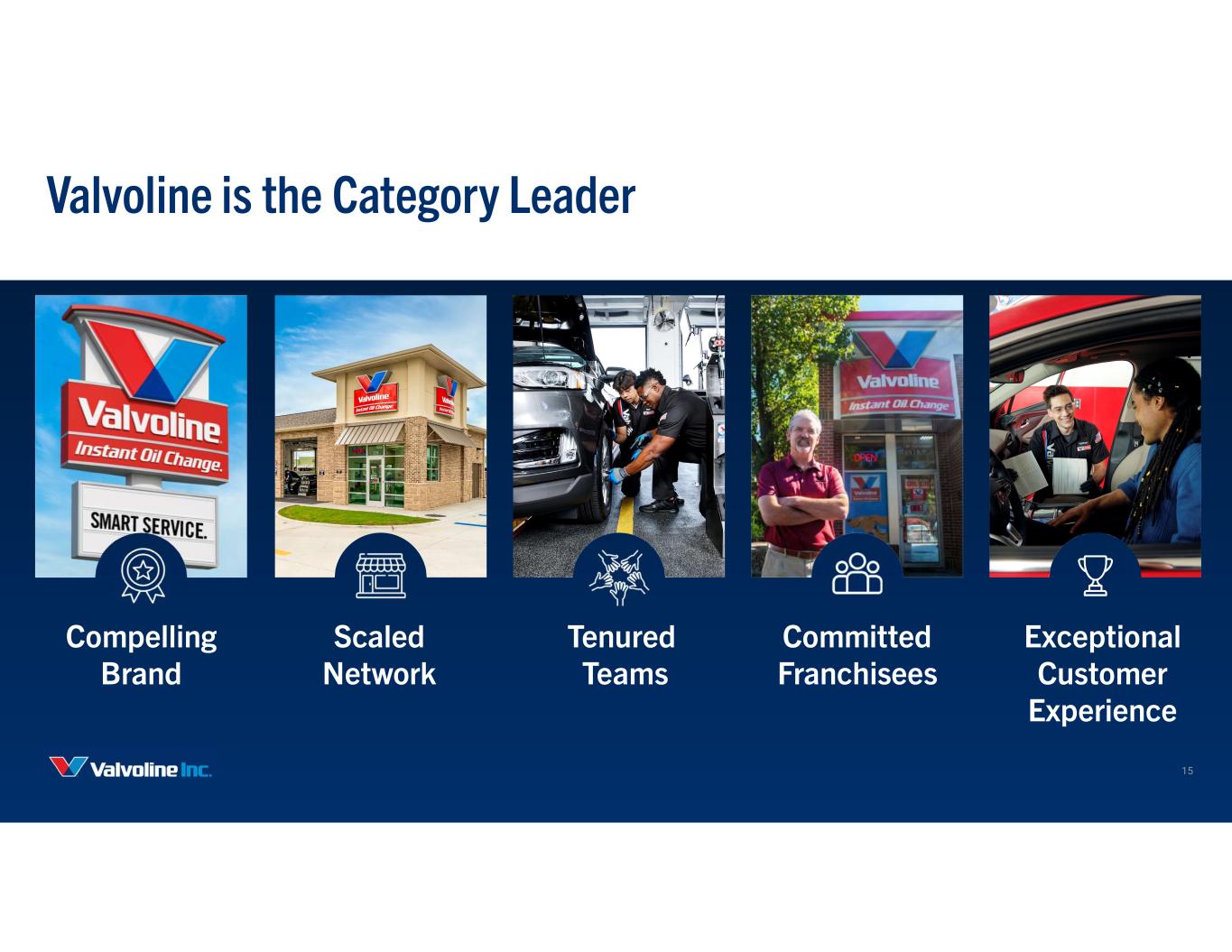

Valvoline is the Category Leader Compelling Brand Scaled Network Tenured Teams Committed Franchisees Exceptional Customer Experience 15

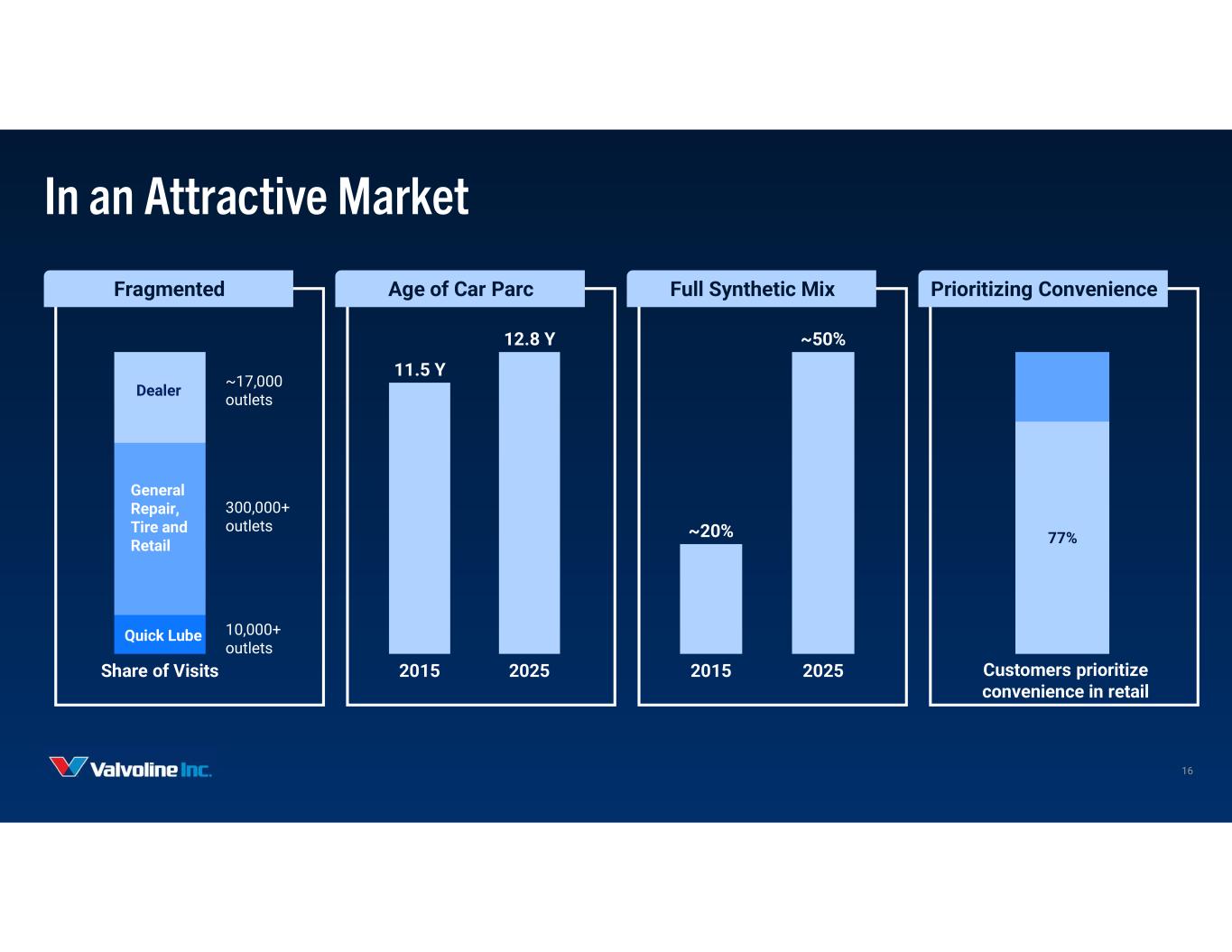

Share of Visits Fragmented 2015 2025 11.5 Y 12.8 Y Age of Car Parc Full Synthetic Mix Prioritizing Convenience 2015 2025 ~20% ~50% 77% Dealer General Repair, Tire and Retail Quick Lube Customers prioritize convenience in retail ~17,000 outlets 300,000+ outlets 10,000+ outlets In an Attractive Market 16

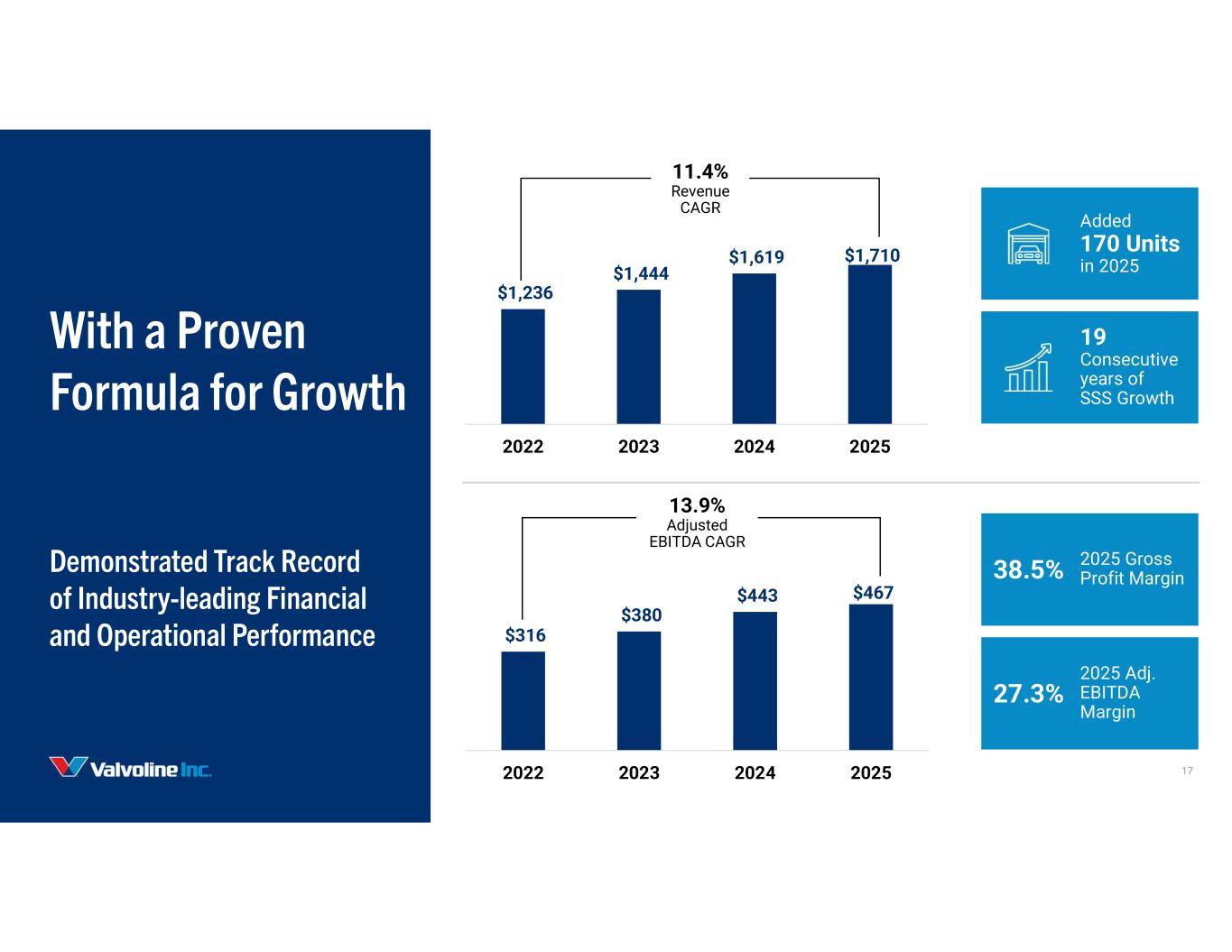

With a Proven Formula for Growth Demonstrated Track Record of Industry-leading Financial and Operational Performance $316 $380 $443 $467 2022 2023 2024 2025 $1,236 $1,444 $1,619 $1,710 2022 2023 2024 2025 13.9% Adjusted EBITDA CAGR Added 170 Units in 2025 19 Consecutive years of SSS Growth 2025 Gross Profit Margin38.5% 2025 Adj. EBITDA Margin 27.3% 11.4% Revenue CAGR 17

Enabled by Differentiated Assets and Capabilities 18 Strong Brand >80% Brand Awareness 84% of Customers are Repeat Visitors

Enabled by Differentiated Assets and Capabilities 19 Scalable Playbook 4.7 Out of Five Stars Customer Rating >80% Post-Service Net Promoter ScoreSM Strong Brand >80% Brand Awareness 84% of Customers are Repeat Visitors

Enabled by Differentiated Assets and Capabilities 20 5Y Average Tenure for Store Managers of Store Managers are Internally Promoted Unique Culture and Experienced Teams Scalable Playbook 4.7 Out of Five Stars Customer Rating Post-Service Net Promoter ScoreSM Strong Brand Brand Awareness 84% of Customers are Repeat Visitors >95% >80% >80%

Enabled by Differentiated Assets and Capabilities 21 Robust Data 27M Marketable Customer Database 130K Real Estate Model Data Points Evaluated 5Y Average Tenure for Store Managers >95% of Store Managers are Internally Promoted Unique Culture and Experienced Teams Scalable Playbook 4.7 Out of Five Stars Customer Rating >80% Post-Service Net Promoter ScoreSM Strong Brand >80% Brand Awareness 84% of Customers are Repeat Visitors

Enabled by Differentiated Assets and Capabilities B Tenured Franchise Partners 26Y Average Franchise Tenure >$1B Future Capital Commitments 22 Robust Data 27M Marketable Customer Database 130K Real Estate Model Data Points Evaluated 5Y Average Tenure for Store Managers >95% of Store Managers are Internally Promoted Unique Culture and Experienced Teams Scalable Playbook 4.7 Out of Five Stars Customer Rating >80% Post-Service Net Promoter ScoreSM Strong Brand >80% Brand Awareness 84% of Customers are Repeat Visitors

Delivering Shareholder Value through Strategic Focus Innovate for the Evolving Needs of Customers and the Car Parc Drive Full Potential of the Core Deliver Sustainable Network Growth Long-term Shareholder Value Creation 23

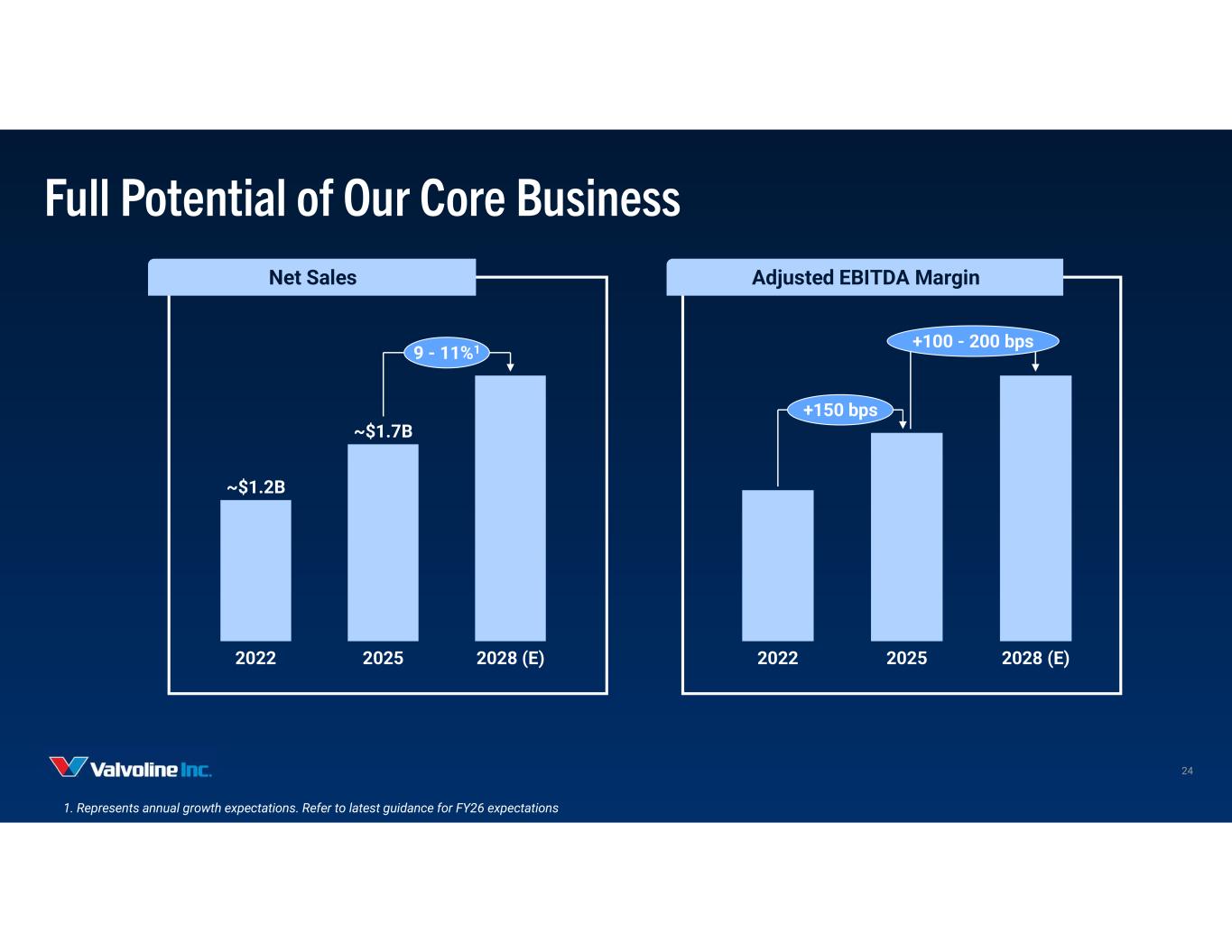

Net Sales Adjusted EBITDA Margin 2022 2025 2028 (E) ~$1.2B ~$1.7B 9 - 11%1 2022 2025 2028 (E) +150 bps +100 - 200 bps Full Potential of Our Core Business 24 1. Represents annual growth expectations. Refer to latest guidance for FY26 expectations

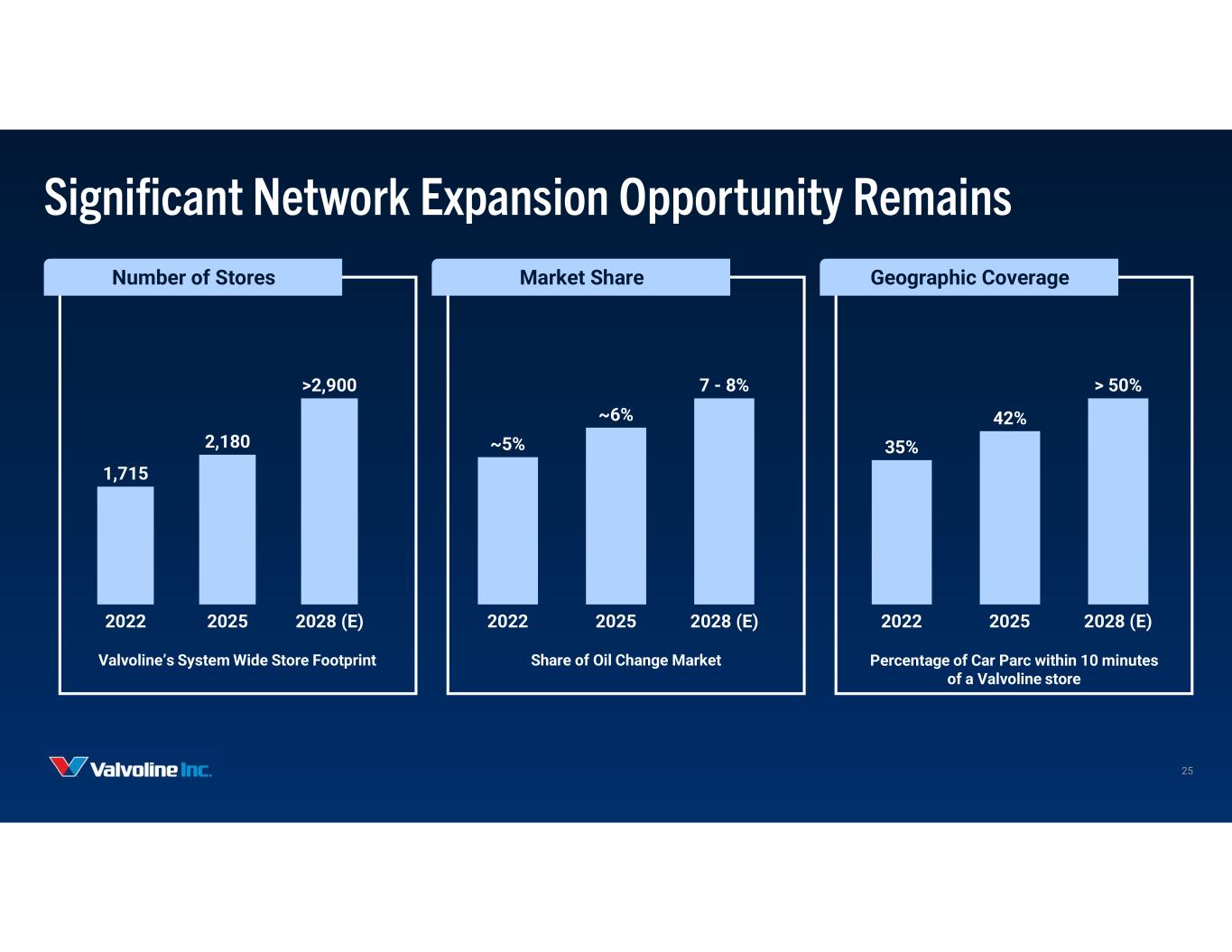

Significant Network Expansion Opportunity Remains 1,715 2,180 2022 2025 2028 (E) >2,900 2022 2025 2028 (E) ~5% ~6% 7 - 8% 2022 2025 2028 (E) 35% 42% > 50% Number of Stores Market Share Geographic Coverage Valvoline’s System Wide Store Footprint Share of Oil Change Market Percentage of Car Parc within 10 minutes of a Valvoline store 25

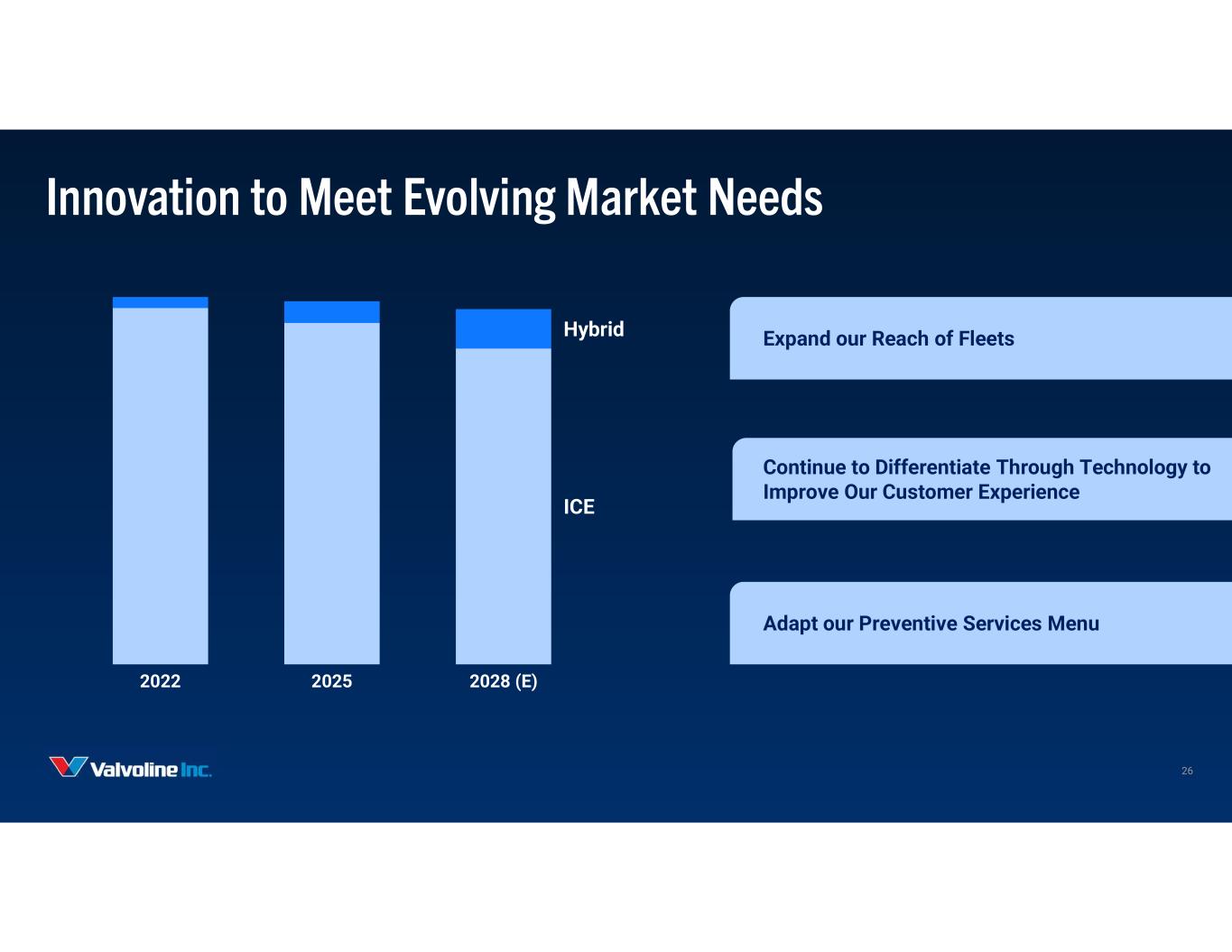

Expand our Reach of Fleets Continue to Differentiate Through Technology to Improve Our Customer Experience Adapt our Preventive Services Menu 2022 2025 2028 (E) ICE Hybrid Innovation to Meet Evolving Market Needs 26

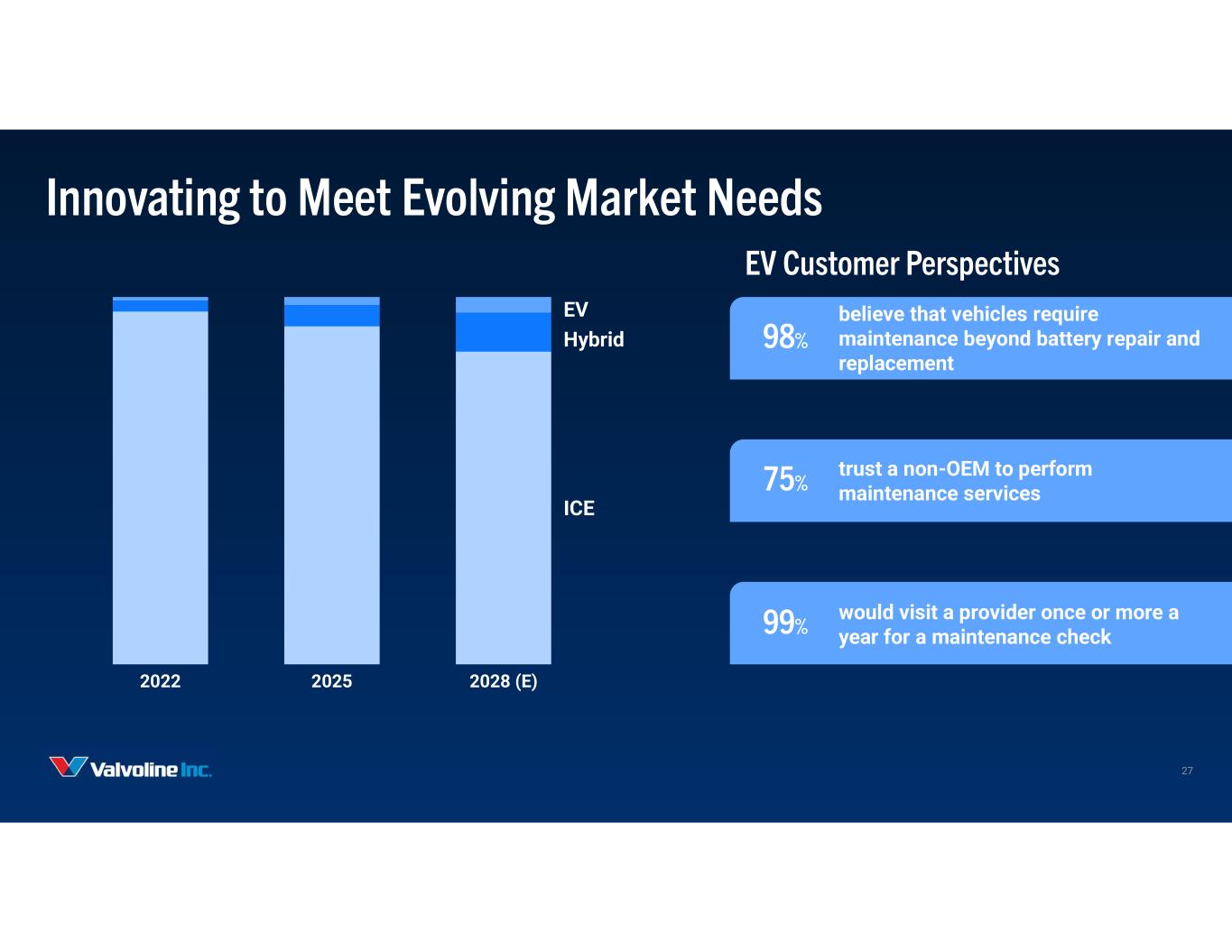

believe that vehicles require maintenance beyond battery repair and replacement 98% trust a non-OEM to perform maintenance services75% would visit a provider once or more a year for a maintenance check99% 2022 2025 2028 (E) ICE Hybrid EV Innovating to Meet Evolving Market Needs EV Customer Perspectives 27

Investment Thesis Established Category Leader Delivering Industry-Leading Growth1 Differentiated Capabilities Driving Margin Expansion and High Cash Generation2 Disciplined Capital Allocation to Deliver Attractive Shareholder Returns4 3 Significant Growth Runway in Highly Fragmented Market 28 I t t i

What You Will Hear Next Operational Excellence Operations Franchise Advantage & Growth Drivers Franchising Clear Roadmap to Accelerating Growth and Driving Performance Financials Built to Win and Built to Last 29

Operational Excellence Linne Fulcher, Chief Operating Officer 31

Key Takeaways Strong and Proven Track Record of Operational Excellence Enabled by a Differentiated Approach to People, Process, and Technology Operational Capabilities with Scale will Create Opportunities for Margin Expansion 32

Proven Record of Operational Excellence 2022 2023 2024 2025 7.3% CAGR 2022 2023 2024 2025 13.5% CAGR 2022 2023 2024 2025 +270 bps System-Wide Transactions System-Wide Store Sales Mature Store Profit Margin 33

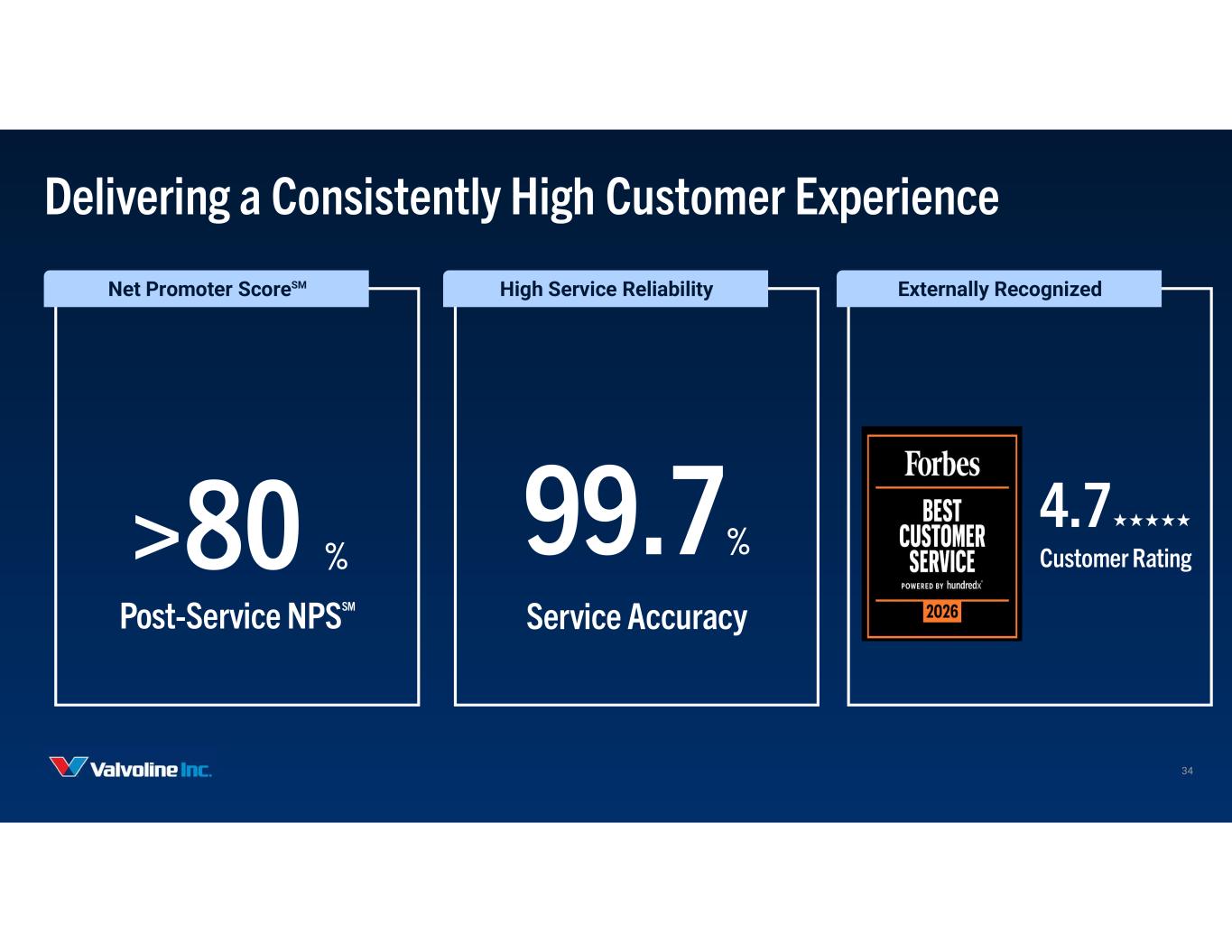

Delivering a Consistently High Customer Experience 99.7% Service Accuracy 4.7 Customer Rating Net Promoter ScoreSM High Service Reliability Externally Recognized >80 % Post-Service NPSSM 34

… which delivers a… Superior Customer Experience It starts with … People, Process, and Technology Differentiated Approach Leads to Strong Margin Capture … enabled by a … Proven Operating Model … and combined with… Scale Advantages … delivers exceptional… Margin Capture 35

It all Starts with Our People 36 Onboarding Embedded, Multiple Touchpoint Onboarding Training Award-winning, Multi- Modal Training Program Vamily Culture Engagement and Retention from Day One 36

Providing Them a Path to Growth 37 Service Center Manager Area Manager Market Manager Directors and VPs of Operations > 95 % 100% 100% 100% Internal Sourcing of Positions 37

SuperPro Drives Consistent Operational Execution in Store 38 Standardize Consistent and Scalable Customer Experience Execute Increased Throughput and Service Penetration Optimize Incremental Revenue and Margin Accretion 38

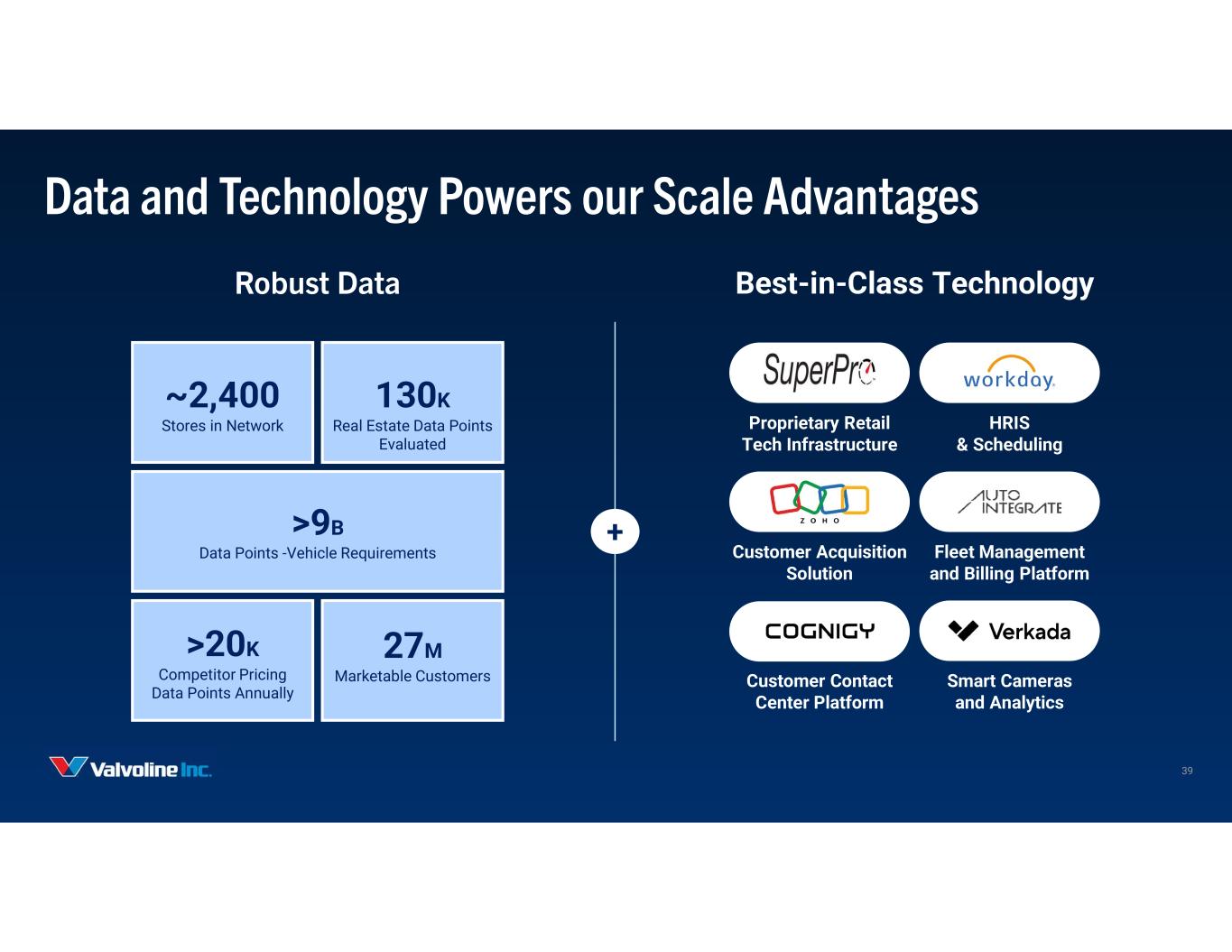

HRIS & Scheduling Proprietary Retail Tech Infrastructure Customer Acquisition Solution Customer Contact Center Platform Smart Cameras and Analytics Data and Technology Powers our Scale Advantages + ~2,400 Stores in Network 130K Real Estate Data Points Evaluated >9B Data Points -Vehicle Requirements >20K Competitor Pricing Data Points Annually 27M Marketable Customers Robust Data Best-in-Class Technology 39 Fleet Management and Billing Platform

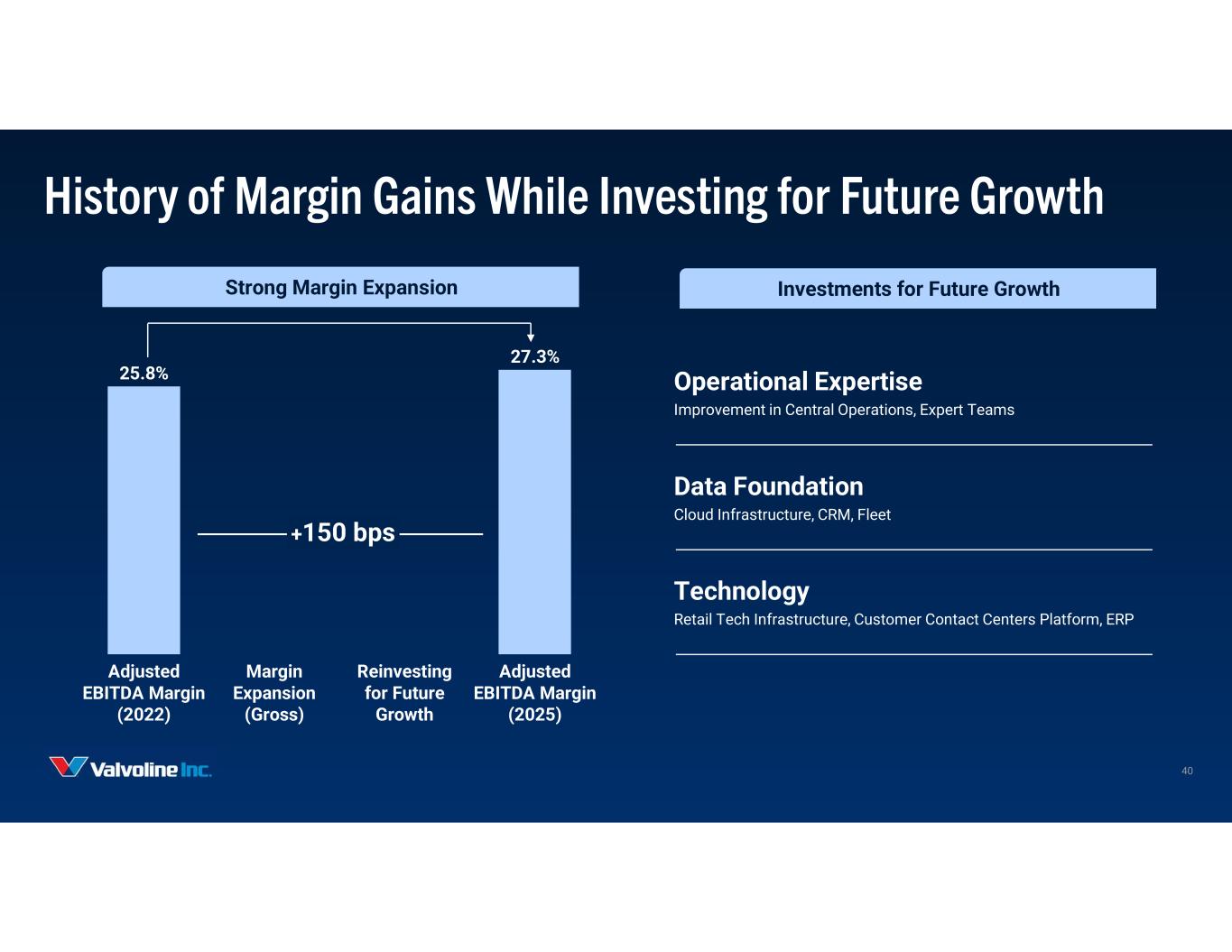

History of Margin Gains While Investing for Future Growth Adjusted EBITDA Margin (2022) Margin Expansion (Gross) Reinvesting for Future Growth Adjusted EBITDA Margin (2025) 25.8% 27.3% Operational Expertise Improvement in Central Operations, Expert Teams Data Foundation Cloud Infrastructure, CRM, Fleet Technology Retail Tech Infrastructure, Customer Contact Centers Platform, ERP +150 bps Strong Margin Expansion Investments for Future Growth 40

Multi-Year Margin Expansion to Come 1 2 3 4 Aging Car Parc and a Shift to Synthetic Operational Cost Efficiencies Improved Store and Network Portfolio Mix Scale Leverage for G&A Expenses 41

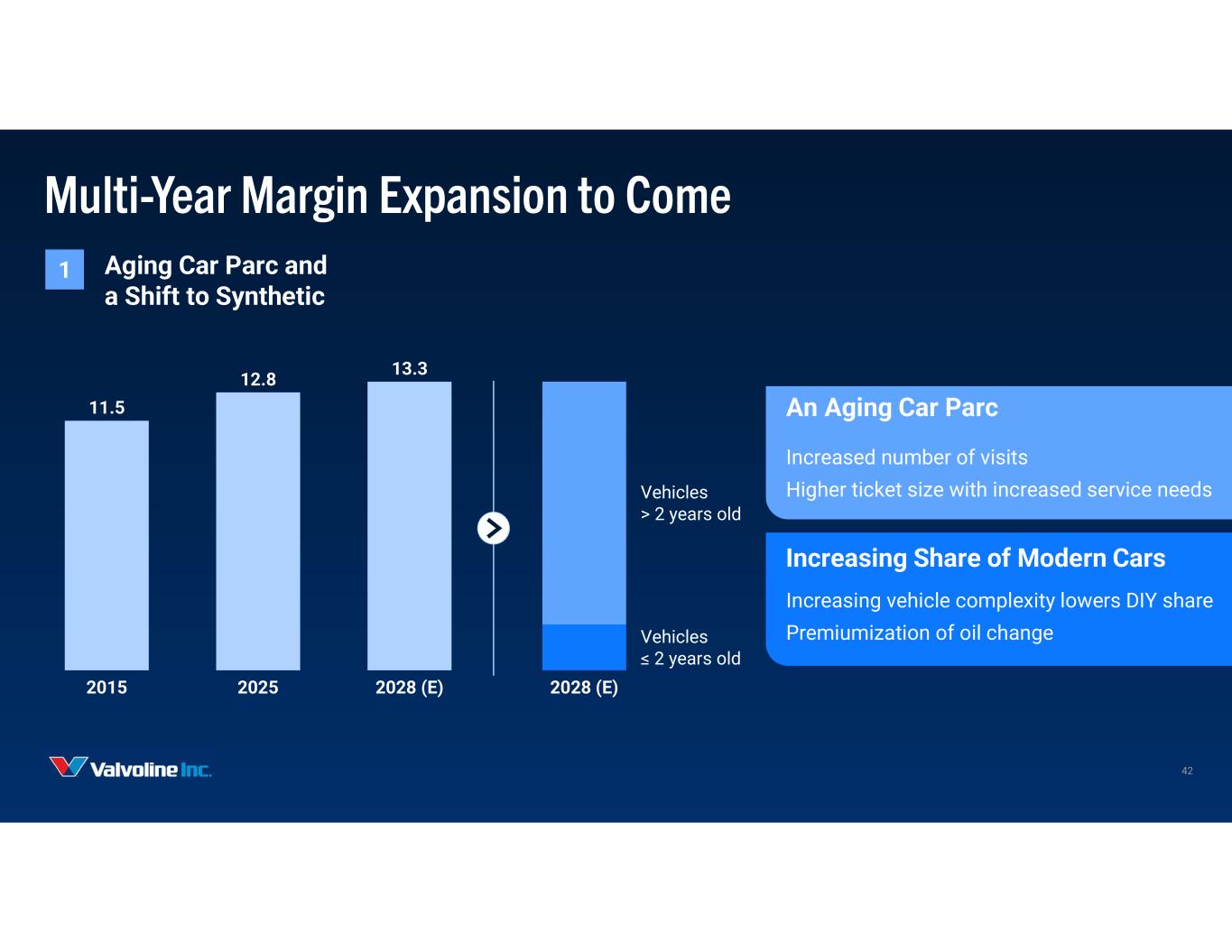

Multi-Year Margin Expansion to Come 1 Aging Car Parc and a Shift to Synthetic 11.5 12.8 13.3 2015 2025 2028 (E) 2028 (E) Vehicles > 2 years old Vehicles ≤ 2 years old An Aging Car Parc Increased number of visits Higher ticket size with increased service needs Increasing Share of Modern Cars Increasing vehicle complexity lowers DIY share Premiumization of oil change 42

Multi-Year Margin Expansion to Come Improving Service Penetration Store Expense Management SKU Optimization SuperPro Improvements Labor Optimization 43 2 Operational Efficiencies

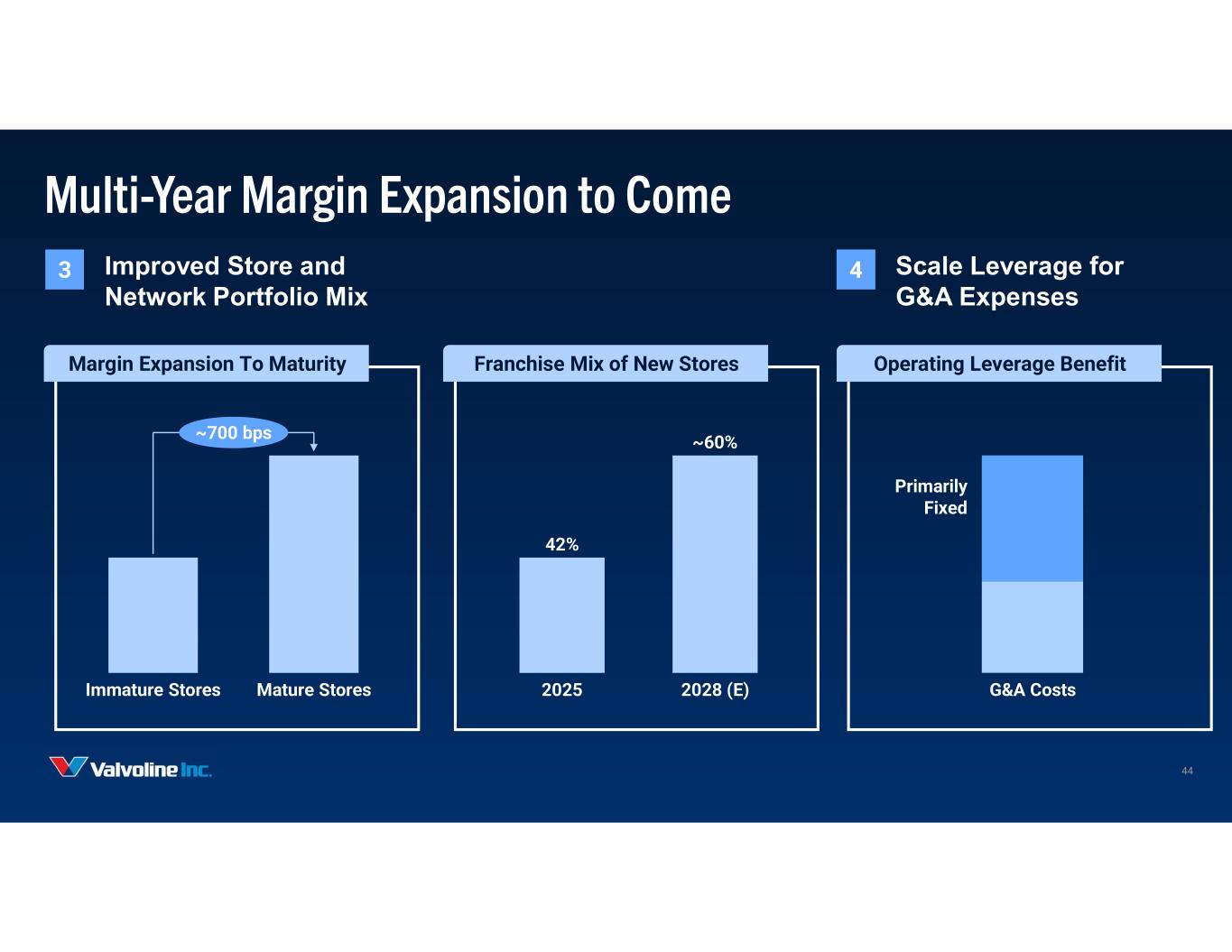

Multi-Year Margin Expansion to Come Margin Expansion To Maturity Franchise Mix of New Stores Operating Leverage Benefit 4 Scale Leverage for G&A Expenses Immature Stores Mature Stores ~700 bps 2025 2028 (E) 42% ~60% G&A Costs Primarily Fixed 44 3 Improved Store and Network Portfolio Mix

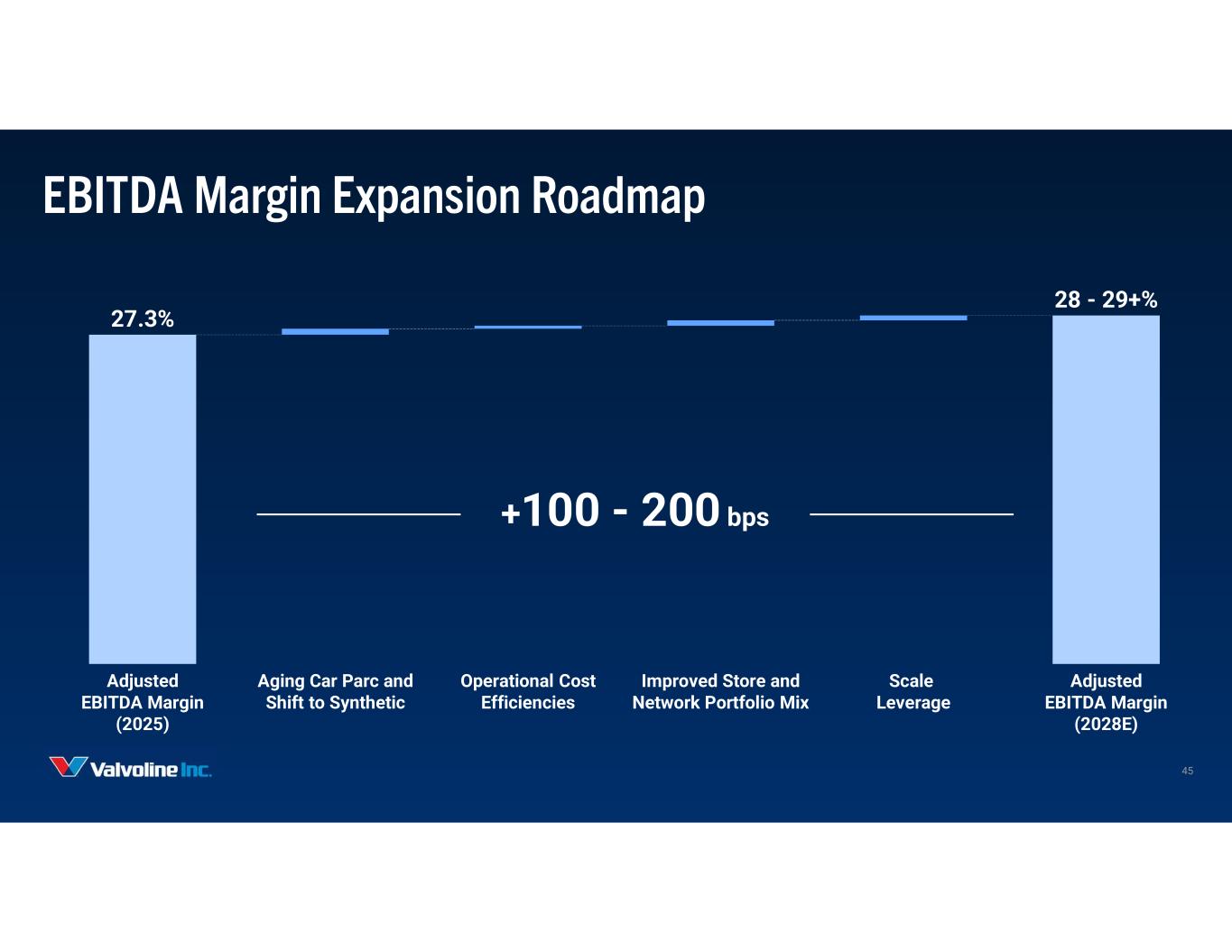

Adjusted EBITDA Margin (2025) Aging Car Parc and Shift to Synthetic Operational Cost Efficiencies Improved Store and Network Portfolio Mix Scale Leverage Adjusted EBITDA Margin (2028E) 27.3% 28 - 29+% EBITDA Margin Expansion Roadmap 45 +100 - 200 bps

Key Takeaways Strong and Proven Track Record of Operational Excellence 1 Enabled by a Differentiated Approach to People, Process, and Technology2 Operational Capabilities with Scale will Deliver Margin Expansion3 46 Key Takeaways

BREAK We Will Return Shortly

48

Franchise Advantage & Growth Drivers Adam Worsham, Chief Franchising Officer 49

Key Takeaways Strong Franchisee Partnerships have Delivered Consistently High-Quality Results Our Compelling Franchisee Value Proposition Has Enabled Significant Capital Commitments Scaled Franchise Model Multiplies Growth in a Capital Efficient Manner 50

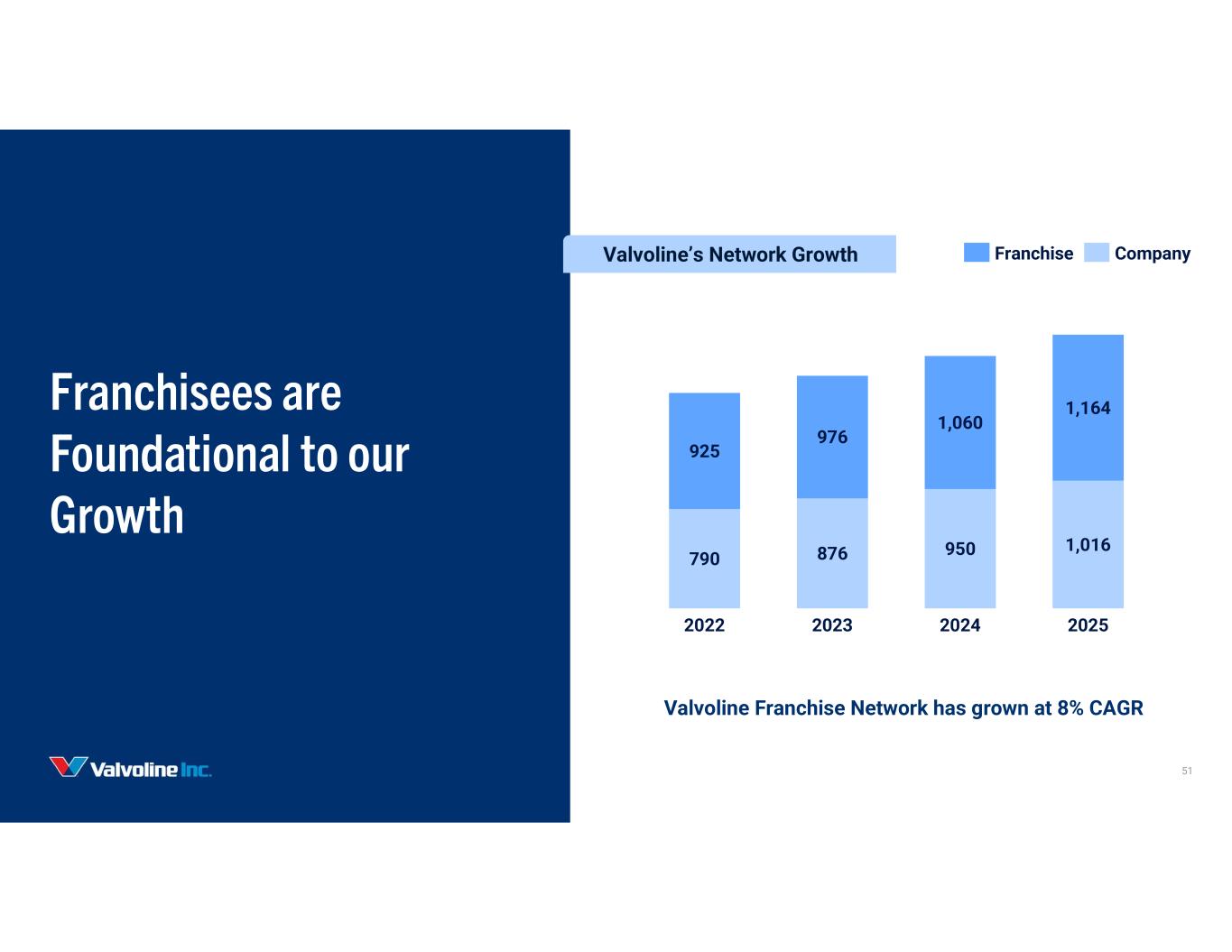

Franchisees are Foundational to our Growth 51 Valvoline Franchise Network has grown at 8% CAGR 790 876 950 1,016 925 976 1,060 1,164 2022 2023 2024 2025 Valvoline’s Network Growth Franchise Company

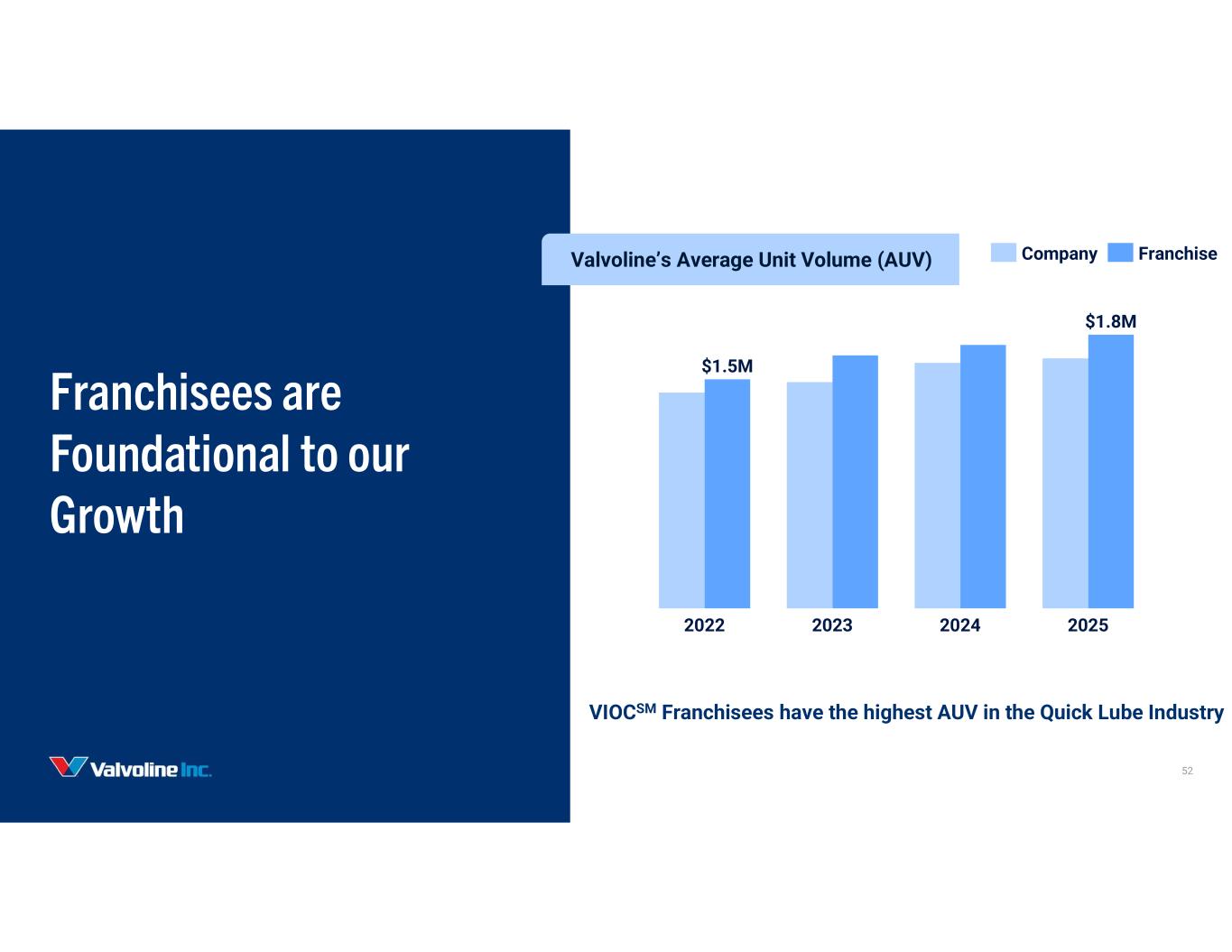

Franchisees are Foundational to our Growth 52 VIOCSM Franchisees have the highest AUV in the Quick Lube Industry $1.5M $1.8M 2022 2023 2024 2025 Valvoline’s Average Unit Volume (AUV) Company Franchise

Our Value Proposition: True Partnership High Value Brand Proprietary SuperPro Process & Technology Deep Marketing Expertise Attractive Unit Economics 53

Franchisor of Choice Delivering Best-in-Class Results > $1.8M AUV +40% vs Industry 19 Years Consecutive Same Store Sales Growth 83% of Franchise Customers give 5 out of 5 Star Rating 54

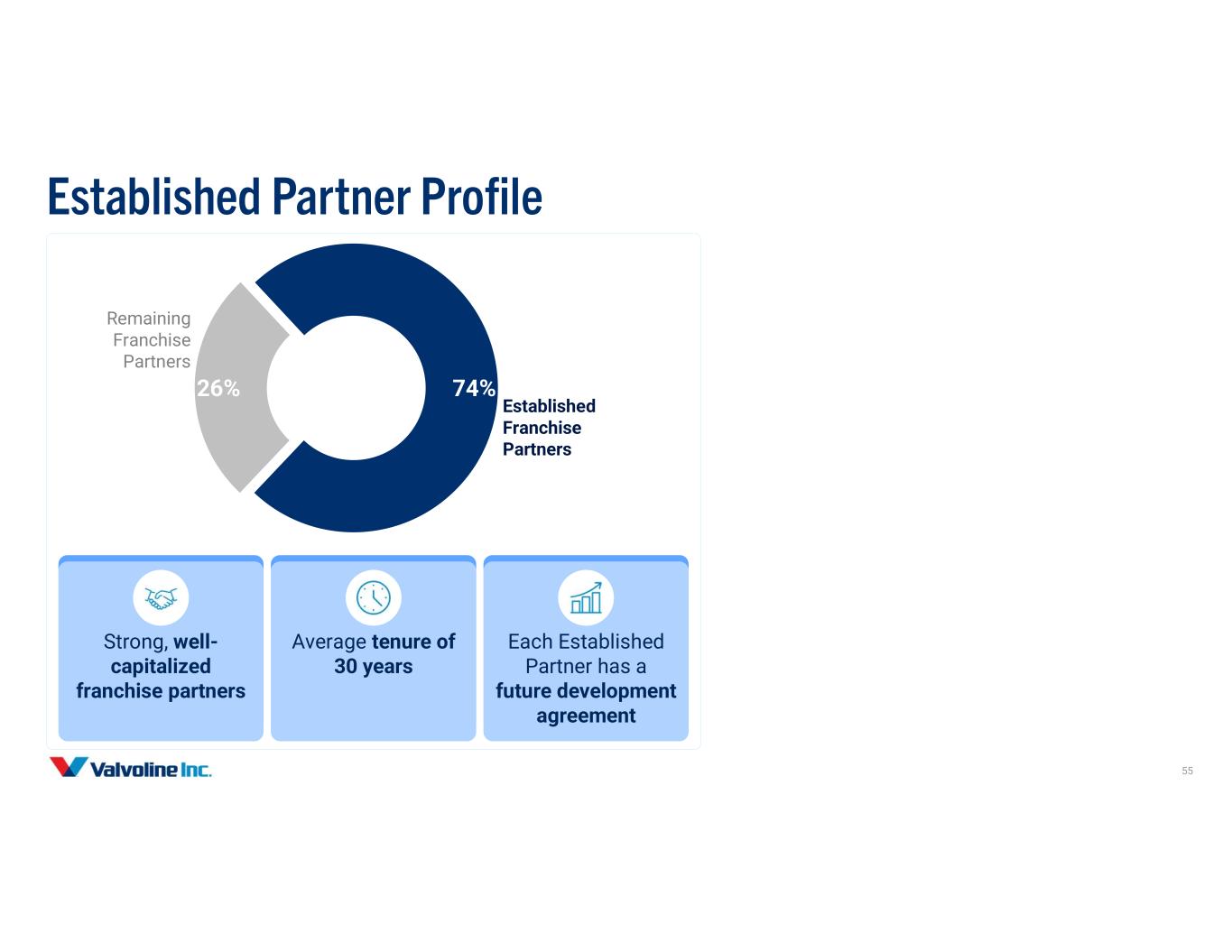

Established Partner Profile Strong, well- capitalized franchise partners Average tenure of 30 years Each Established Partner has a future development agreement 74%26% Established Franchise Partners Remaining Franchise Partners 55

Established Partner Profile Strong, well- capitalized franchise partners Average tenure of 30 years Each Established Partner has a future development agreement Oldest Valvoline franchise partner ~100 additional stores committed by 2030 Operates over 260 locations, with a strong presence in New England, Florida and California 74% Established Franchise Partners Remaining Franchise Partners 56

Established Partner Profile Strong, well- capitalized franchise partners Average tenure of 30 years Each Established Partner has a future development agreement 74% Established Franchise Partners Remaining Franchise Partners 57 Franchise Partner for ~30 Years and Carousel Capital acquired 78 QAS locations in July 2021 100 plus additional stores committed by 2030 Operates over 220 locations, with a strong presence in North & South Carolina, Colorado and Utah

New Franchise Partner Additions Newer partners are diversifying our networks These partners range from entrepreneurs to PE firms They will contribute 33% of the new commitments in the next five years Franchise Equity Partners entered the Valvoline system in December 2024 and operates over 44 locations in West Texas CMG has been our franchisee partner since March 2023, and operates locations in Southern Arizona and New Mexico ICV has been our franchisee partner since September 2024, and operates locations in Buffalo (NY) and Oklahoma 26% Established Franchise Partners Remaining Franchise Partners 58

Refranchising with Purpose Expand Capital Base with Quality Partner Create Development Momentum Objective Refranchised 67 stores since 2022 Focused on Territories with Incremental Growth Upside Scope $200M plus in Refranchising Proceeds Commitment to Triple Local Store Footprint Impact No Ongoing Plans for Further Refranchising To be Evaluated on a Case-by-Case Basis Future Refranchising + Franchisee Capital + Local Expertise = Incremental Stores and Higher Profit 59

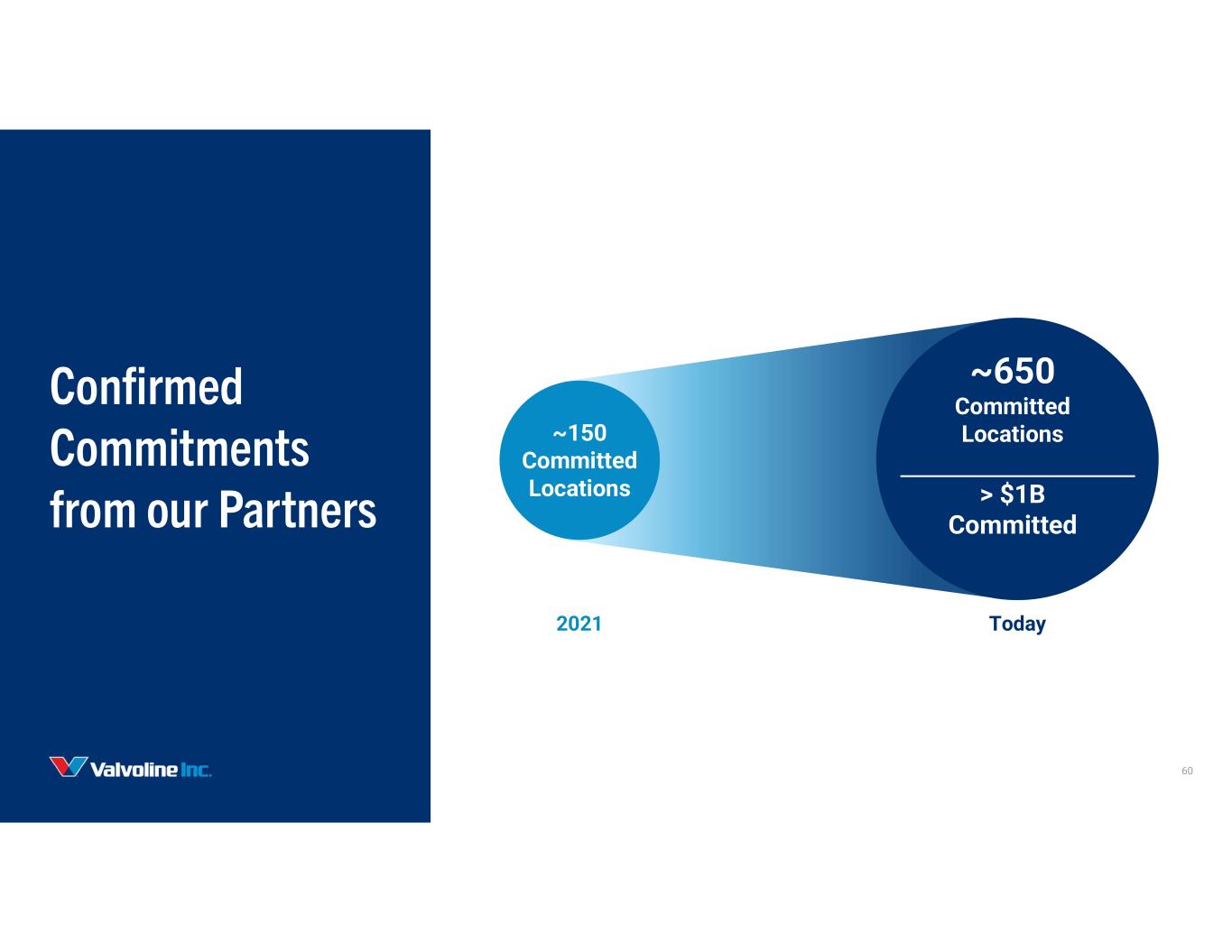

Confirmed Commitments from our Partners ~150 Committed Locations ~650 Committed Locations > $1B Committed 2021 Today 60

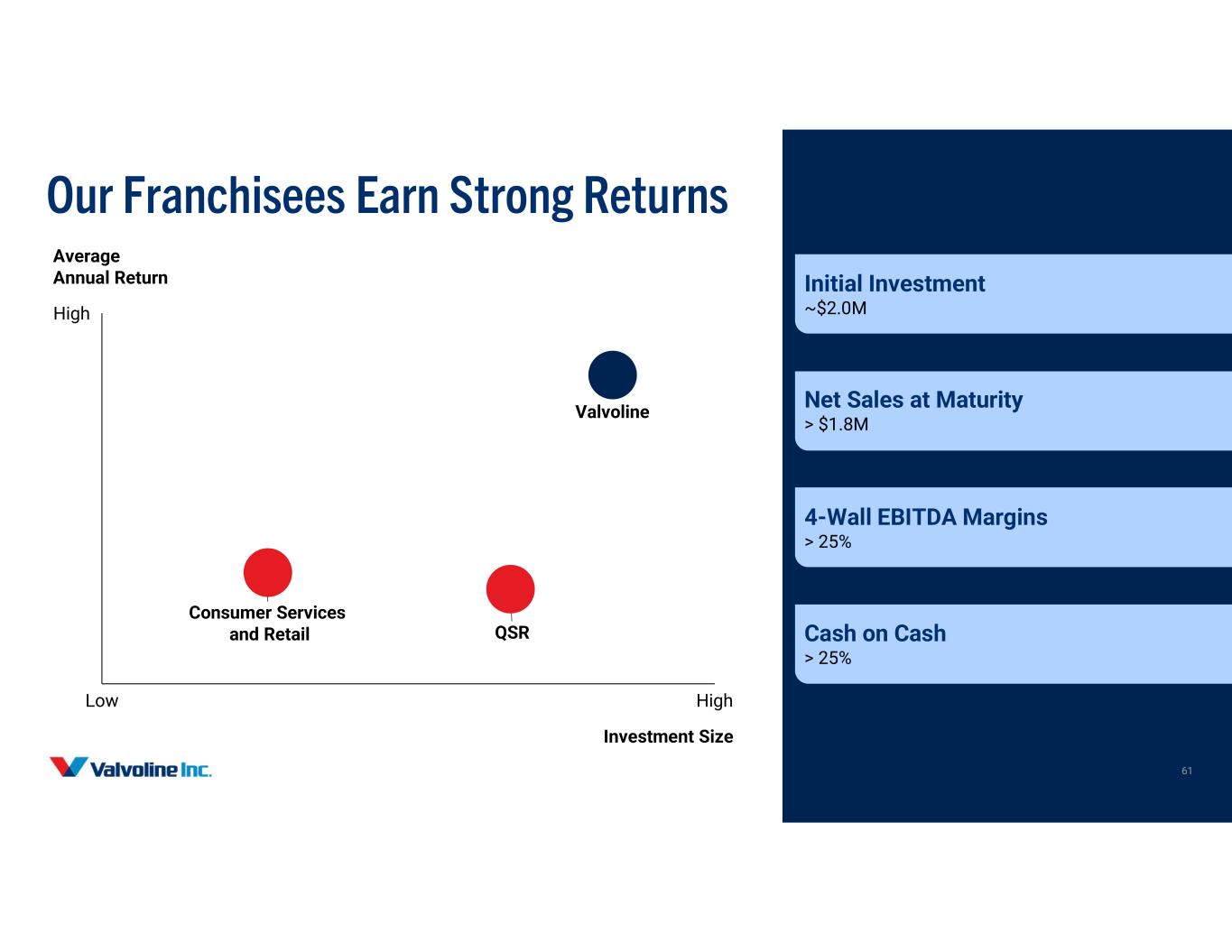

Our Franchisees Earn Strong Returns Initial Investment ~$2.0M Net Sales at Maturity > $1.8M 4-Wall EBITDA Margins > 25% Cash on Cash > 25% Low High High Investment Size Average Annual Return Valvoline QSR Consumer Services and Retail 61

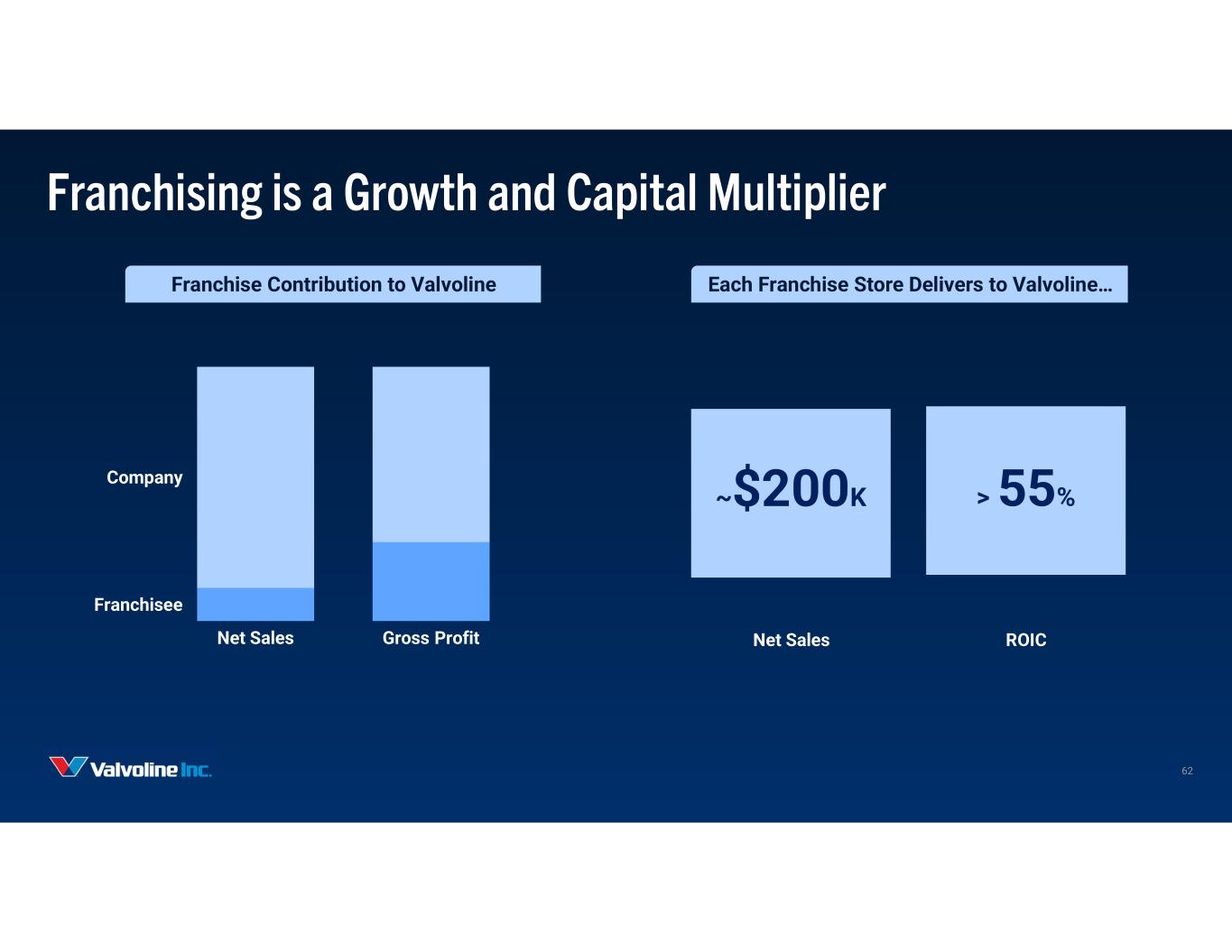

Franchising is a Growth and Capital Multiplier Franchise Contribution to Valvoline Each Franchise Store Delivers to Valvoline… Net Sales Gross Profit Franchisee Company Net Sales ~$200K 62 > 55% ROIC

Strong Franchise Partnerships have Delivered Consistently High-Quality Results1 Our Compelling Franchisee Value Proposition Has Enabled Significant Capital Commitments2 Scaled Franchise Model Multiplies Growth in a Capital Efficient Manner 3 Key Takeaways 63

Clear Roadmap to Accelerating Growth and Driving Performance Kevin Willis, Chief Financial Officer 64

Key Takeaways Uniquely Positioned for Shareholder Value Creation • We have a proven track record of consistently delivering exceptional results Clear Path to Achieving Our Commitments • We have a clear roadmap for delivering sustained above-market growth • We have the foundation in place to deliver attractive shareholder returns Disciplined Capital Allocation to Fuel Growth • We have a strong financial profile which delivers consistent returns • We will drive discipline on our capital allocation strategy to enhance growth and profit trajectory 65

Observations Since Joining Sizeable Opportunity to Continue Market Share Gain Leadership Team Is Purpose-built And Aligned To The Strategy Consistent Investments Made in the Last Three Years to Set Foundation for Future Profitable Growth Great Business hasn’t Translated into Stock Price Movement Robust Fundamentals with Unique Positioning1 2 3 4 5 Drive Enhanced Performance in the Core Business Deliver Sustainable and Profitable Network Expansion Relentless and Disciplined Execution of the Strategy Strengthen Disclosure and Engagement with Investors Key Priorities Sharp Focus on Higher Profitable Growth 66

Focused Long-term Strategy Drive Full Potential of the Core Measuring Success: • Same Store Sales Growth • EBITDA Margin Expansion • EPS and FCF Growth Deliver Sustainable Network Growth Measuring Success: • New Store Growth • Return on Invested Capital on New Builds Innovate for the Evolving Needs of Customers and the Car Parc Measuring Success: • Fleet Business Growth • Share of Hybrid Car Parc Long-term Shareholder Value Creation 67

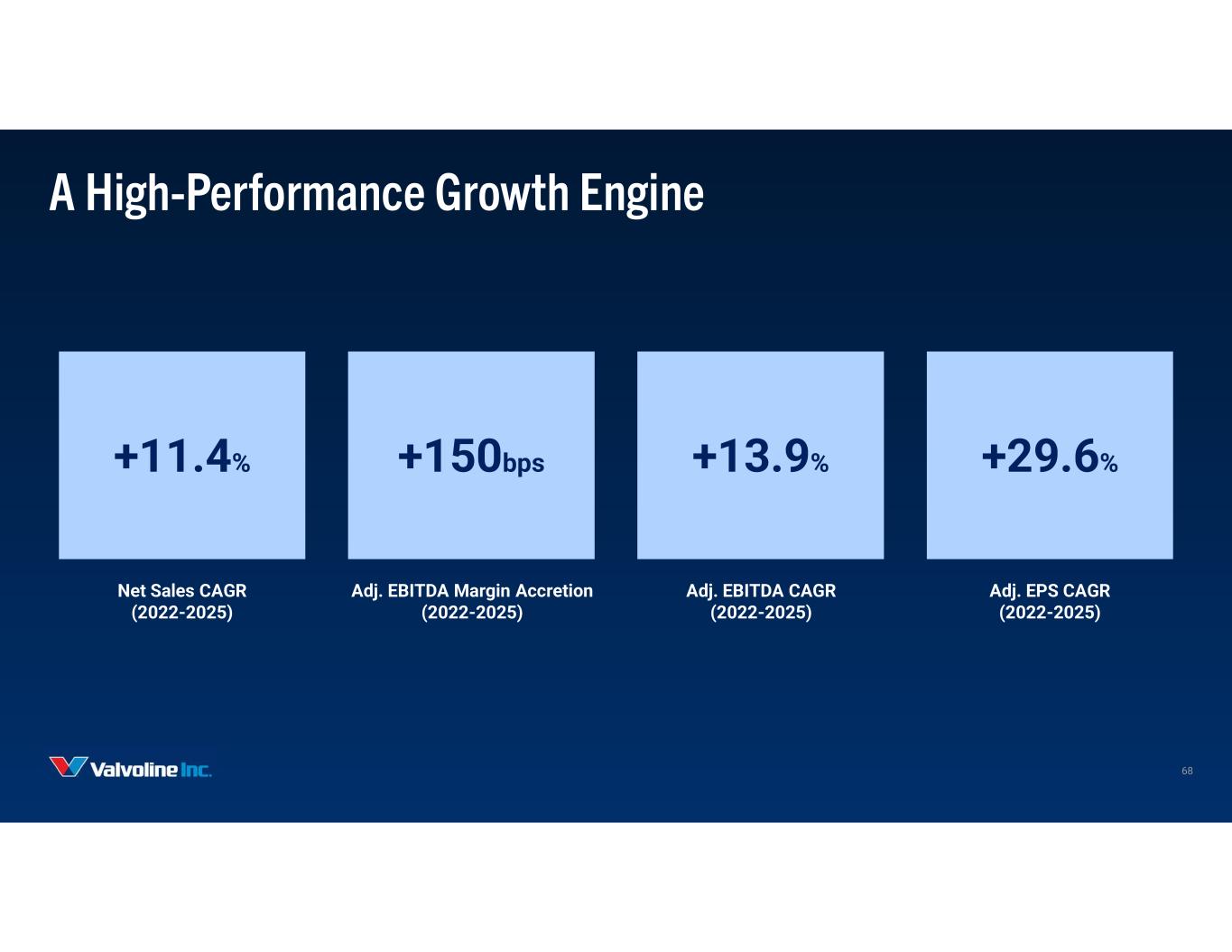

A High-Performance Growth Engine +11.4% Net Sales CAGR (2022-2025) +150bps +29.6% Adj. EBITDA Margin Accretion (2022-2025) Adj. EPS CAGR (2022-2025) +13.9% Adj. EBITDA CAGR (2022-2025) 68

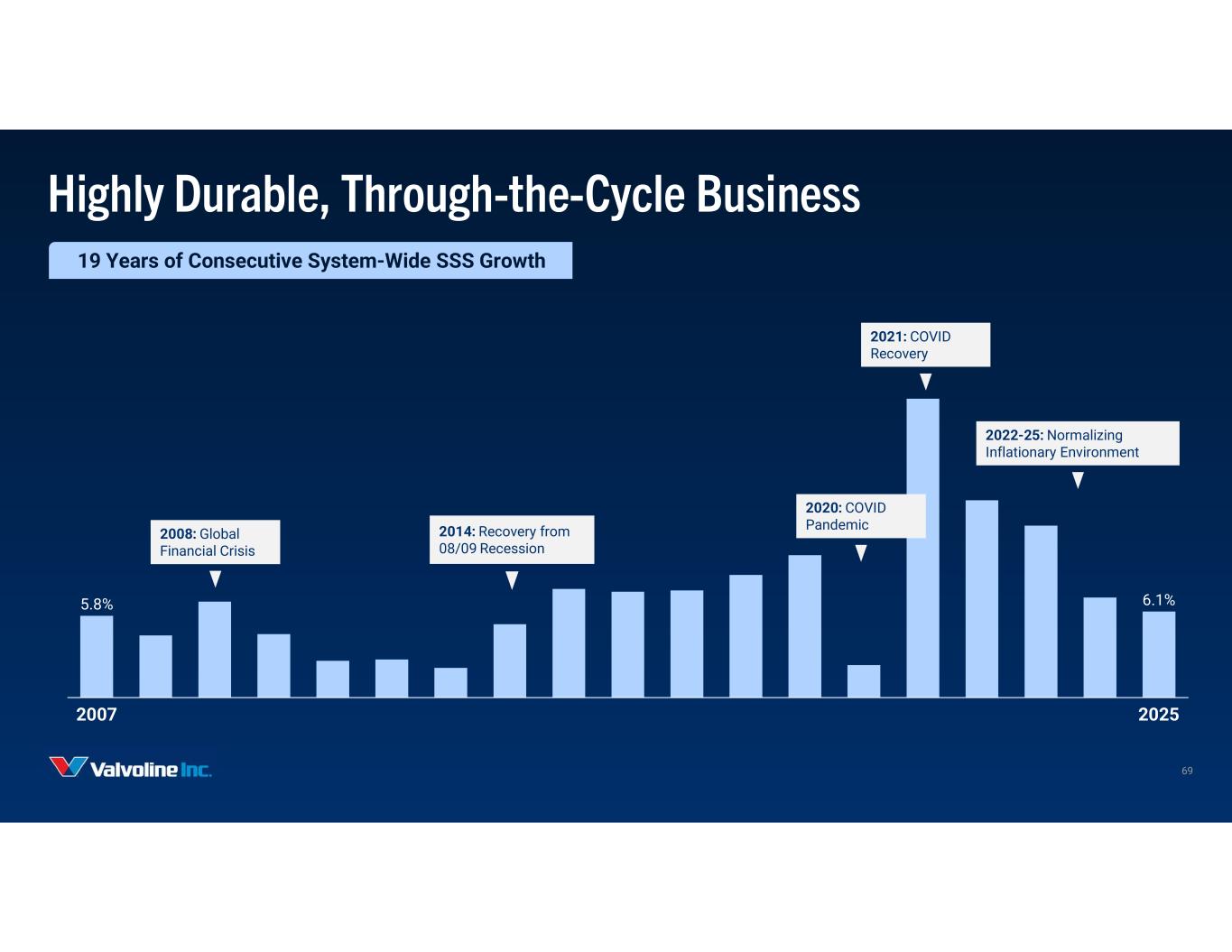

Highly Durable, Through-the-Cycle Business 2007 2025 5.8% 6.1% 2008: Global Financial Crisis 2020: COVID Pandemic 2021: COVID Recovery 2022-25: Normalizing Inflationary Environment 2014: Recovery from 08/09 Recession 19 Years of Consecutive System-Wide SSS Growth 69

Profitable Growth Remains the Key Theme for 2026 4 – 6%6.1%SSS Growth 330 - 360170System-wide Additions $2.0 - 2.1B$1.71BNet Revenues $525 - 550M$467MAdjusted EBITDA $1.60 - 1.70$1.59Adjusted EPS $250 - 280M$259MCapital Expenditures FY2025 FY2026 (Guidance) 70

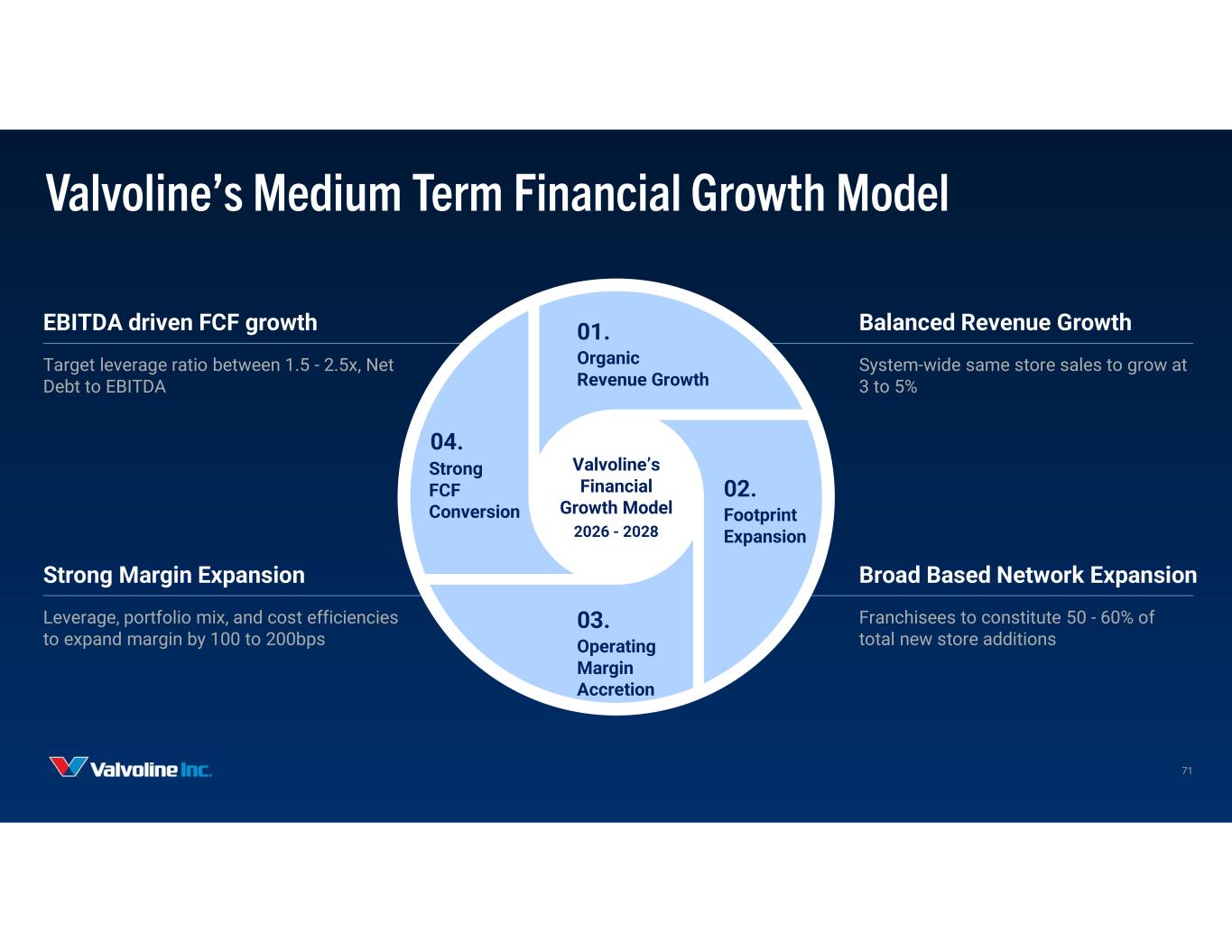

Valvoline’s Medium Term Financial Growth Model Balanced Revenue Growth System-wide same store sales to grow at 3 to 5% Broad Based Network Expansion Franchisees to constitute 50 - 60% of total new store additions Organic Revenue Growth 01. Operating Margin Accretion 03. Footprint Expansion 02. Strong FCF Conversion 04. EBITDA driven FCF growth Target leverage ratio between 1.5 - 2.5x, Net Debt to EBITDA Strong Margin Expansion Leverage, portfolio mix, and cost efficiencies to expand margin by 100 to 200bps Valvoline’s Financial Growth Model 2026 - 2028 71

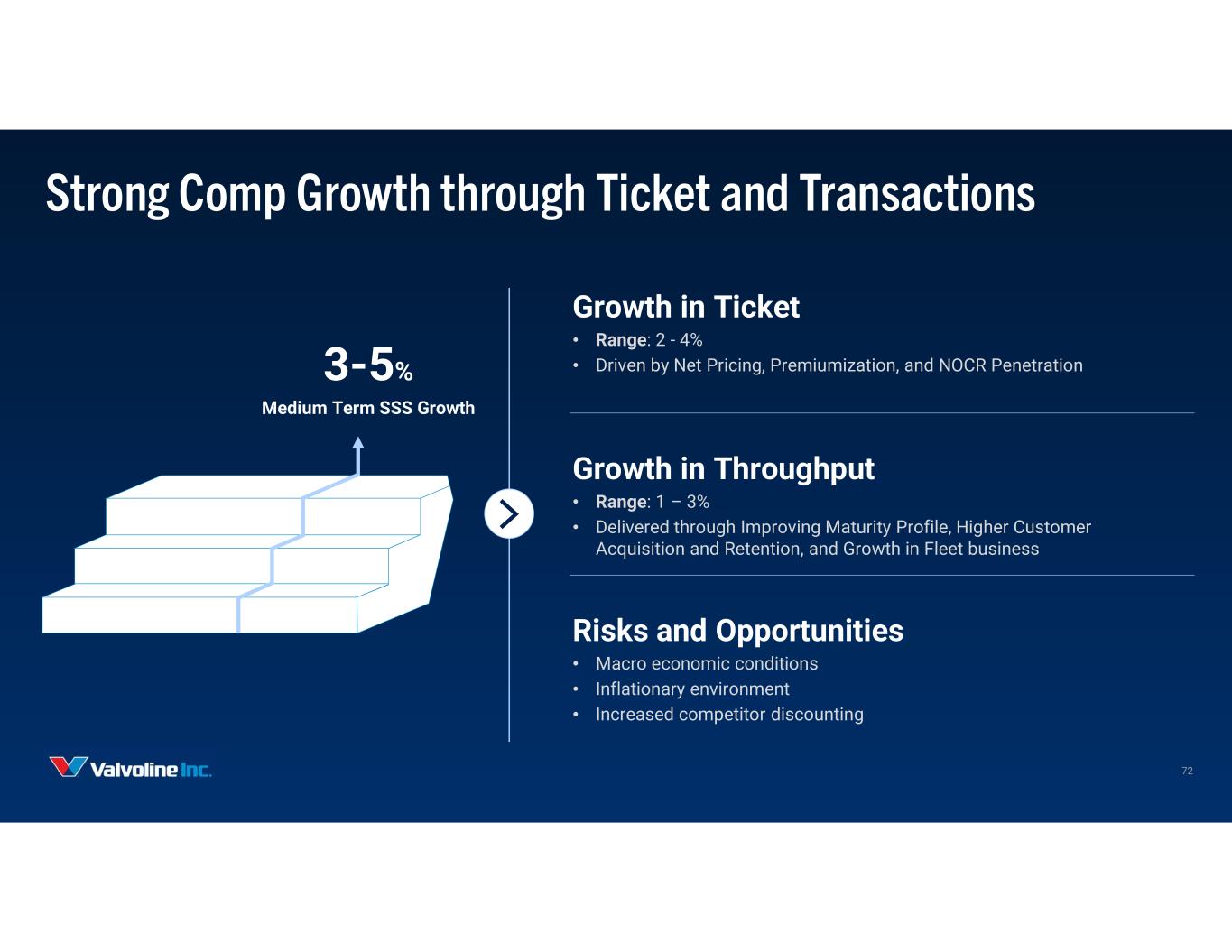

Strong Comp Growth through Ticket and Transactions Growth in Ticket • Range: 2 - 4% • Driven by Net Pricing, Premiumization, and NOCR Penetration Growth in Throughput • Range: 1 – 3% • Delivered through Improving Maturity Profile, Higher Customer Acquisition and Retention, and Growth in Fleet business Risks and Opportunities • Macro economic conditions • Inflationary environment • Increased competitor discounting 3-5% Medium Term SSS Growth 72

Delivering Against Store Growth Opportunity > 7% New Store Growth 50-60% Additions from Franchisees 73 Valvoline’s System-Wide Store Network 2,365 Dec. 2025 2028 (E) 203X >2,900 ~ 3,500

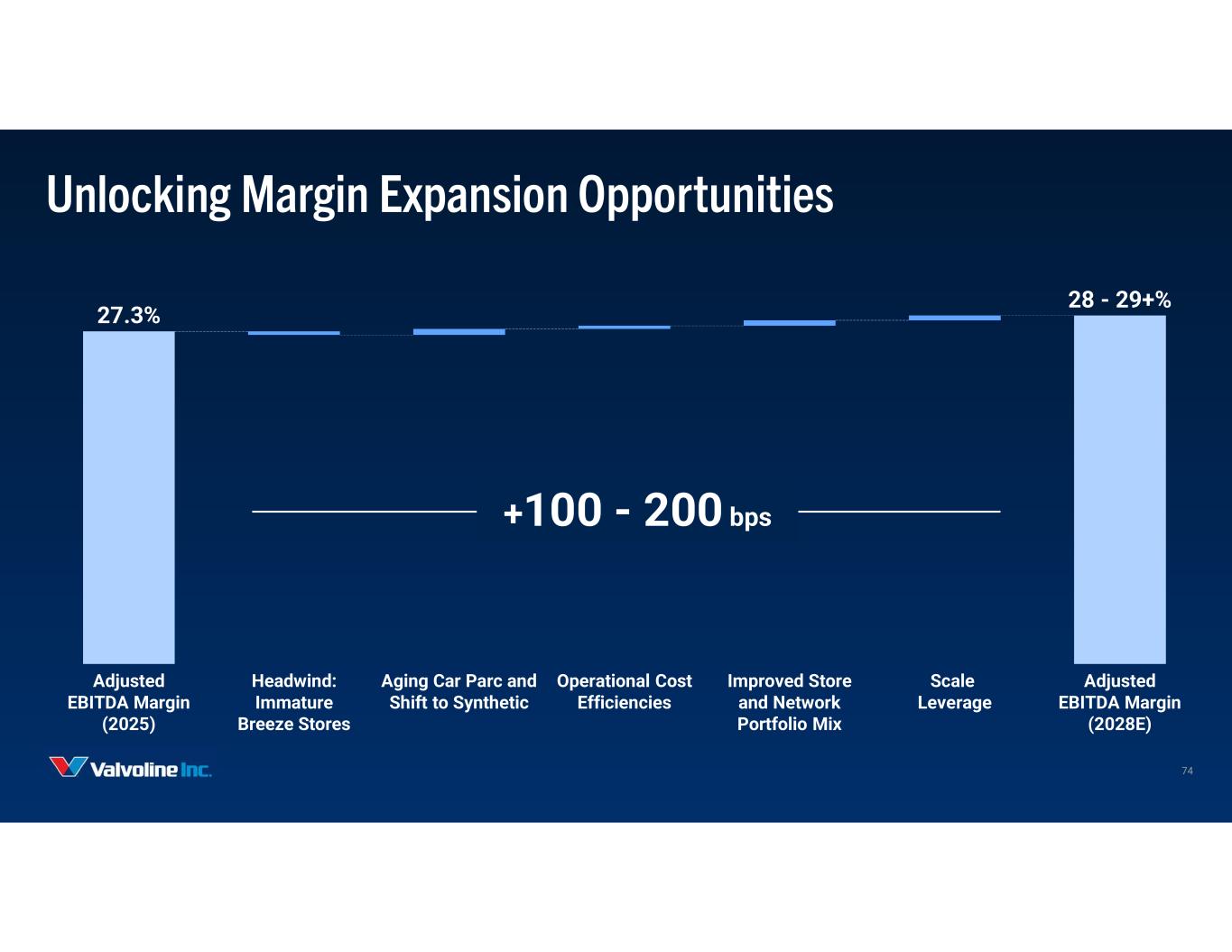

Unlocking Margin Expansion Opportunities Adjusted EBITDA Margin (2025) Headwind: Immature Breeze Stores Aging Car Parc and Shift to Synthetic Operational Cost Efficiencies Improved Store and Network Portfolio Mix Scale Leverage Adjusted EBITDA Margin (2028E) 27.3% 28 - 29+% +100 - 200 bps 74

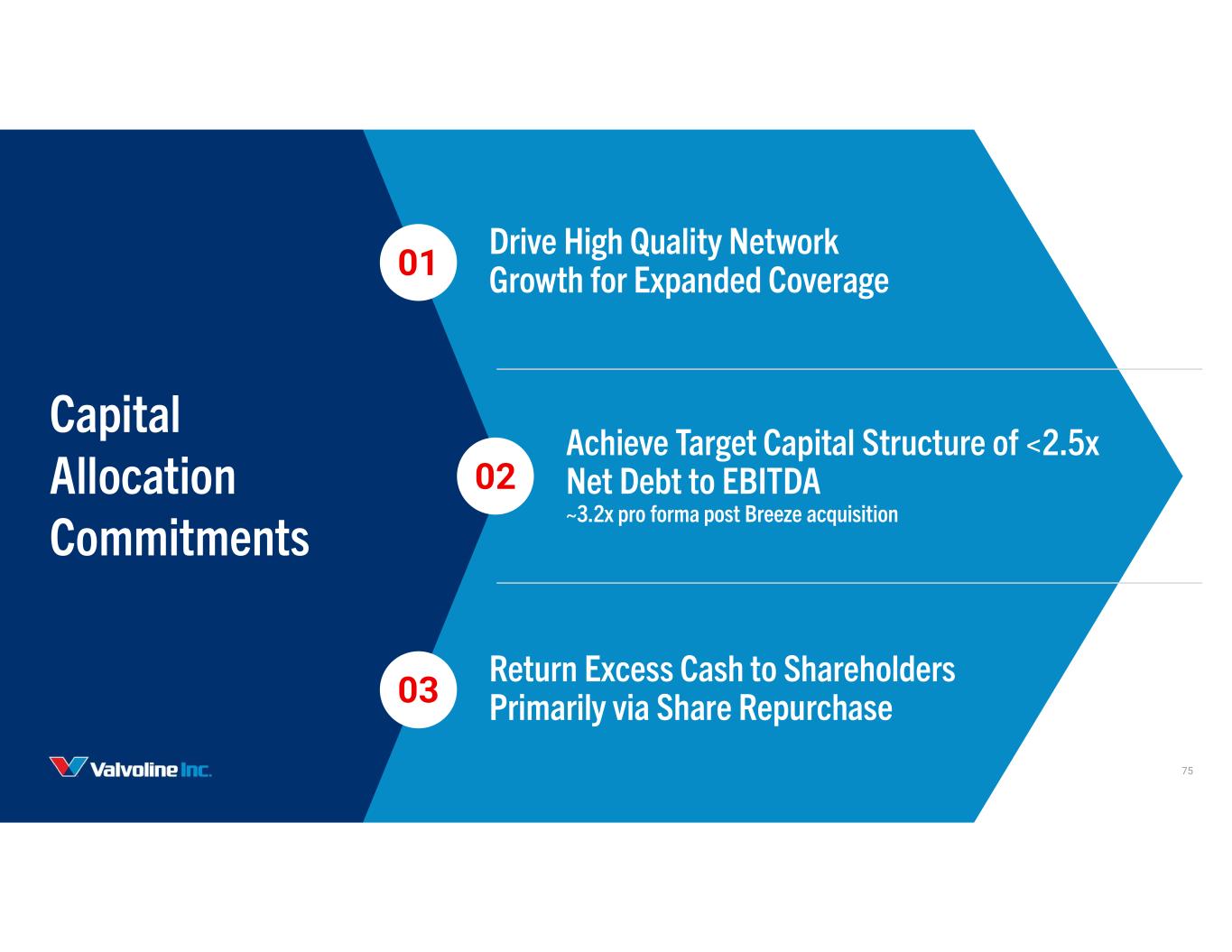

Capital Allocation Commitments Achieve Target Capital Structure of <2.5x Net Debt to EBITDA ~3.2x pro forma post Breeze acquisition 02 Drive High Quality Network Growth for Expanded Coverage01 Return Excess Cash to Shareholders Primarily via Share Repurchase03 75

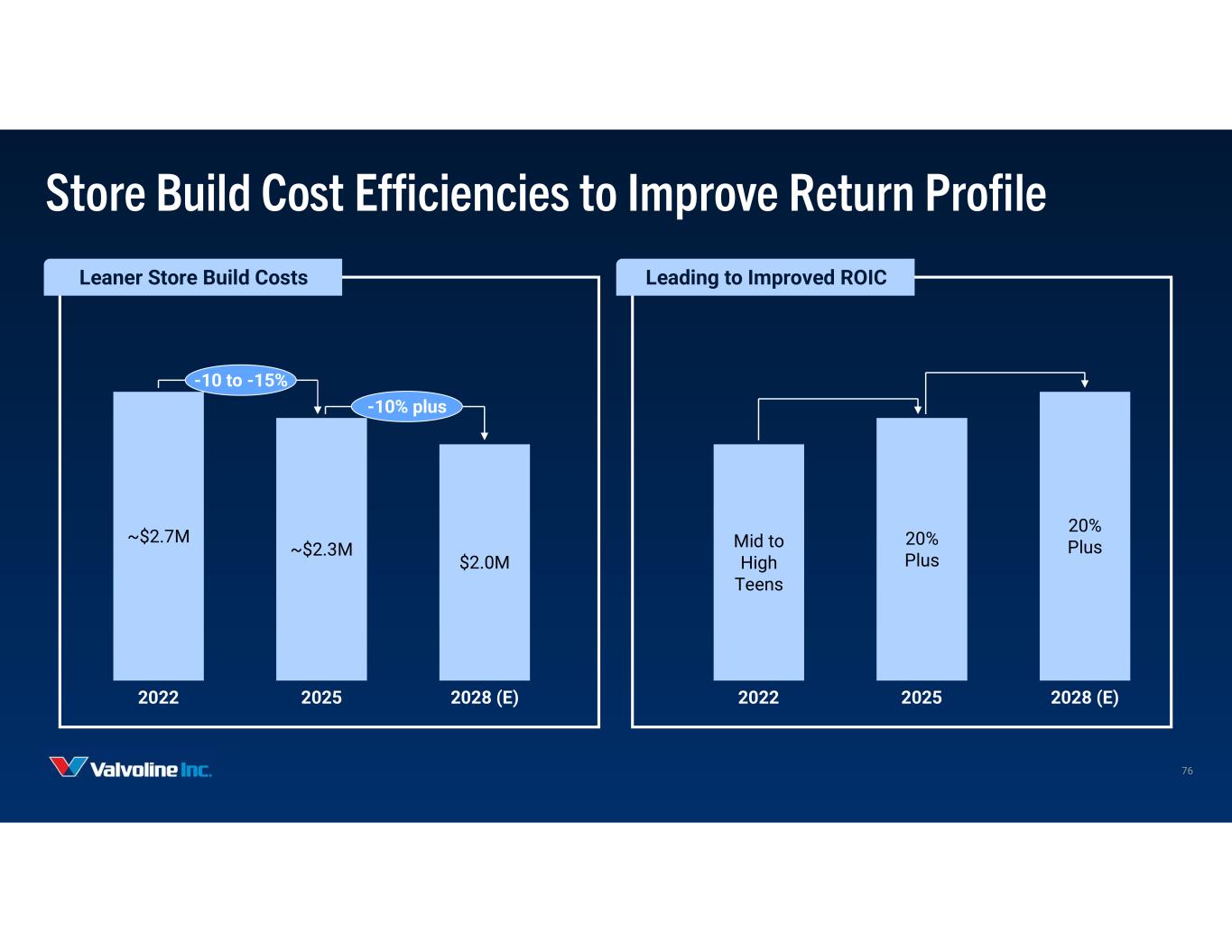

Store Build Cost Efficiencies to Improve Return Profile ~$2.7M ~$2.3M $2.0M 2022 2025 2028 (E) -10 to -15% -10% plus Mid to High Teens 20% Plus 20% Plus 2022 2025 2028 (E) Leaner Store Build Costs Leading to Improved ROIC 76

Valvoline has a Strong Track Record of Accretive Acquisitions ~40 stores Number of Stores Acquired across Multiple Brands 1.0x 1.8x Year 0 Year 4 EBITDA Profile for Acquired Stores 45% Purchase Multiple Reduction by Year 4 Case in Point – Multi Unit Acquisitions (2021) 77

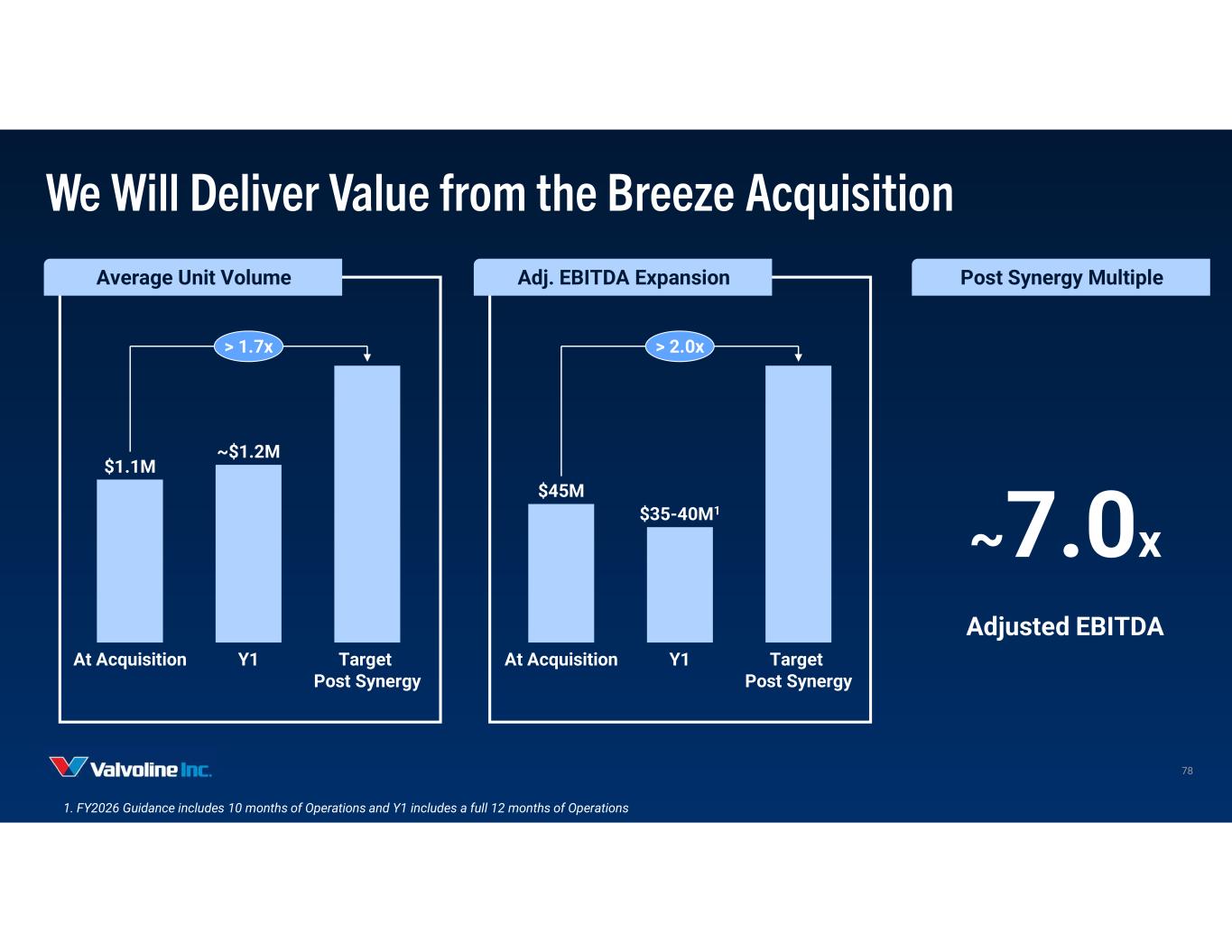

We Will Deliver Value from the Breeze Acquisition 1. FY2026 Guidance includes 10 months of Operations and Y1 includes a full 12 months of Operations Average Unit Volume Adj. EBITDA Expansion Post Synergy Multiple $1.1M ~$1.2M At Acquisition Y1 Target Post Synergy > 1.7x $45M At Acquisition Y1 Target Post Synergy $35-40M1 > 2.0x ~7.0x Adjusted EBITDA 78

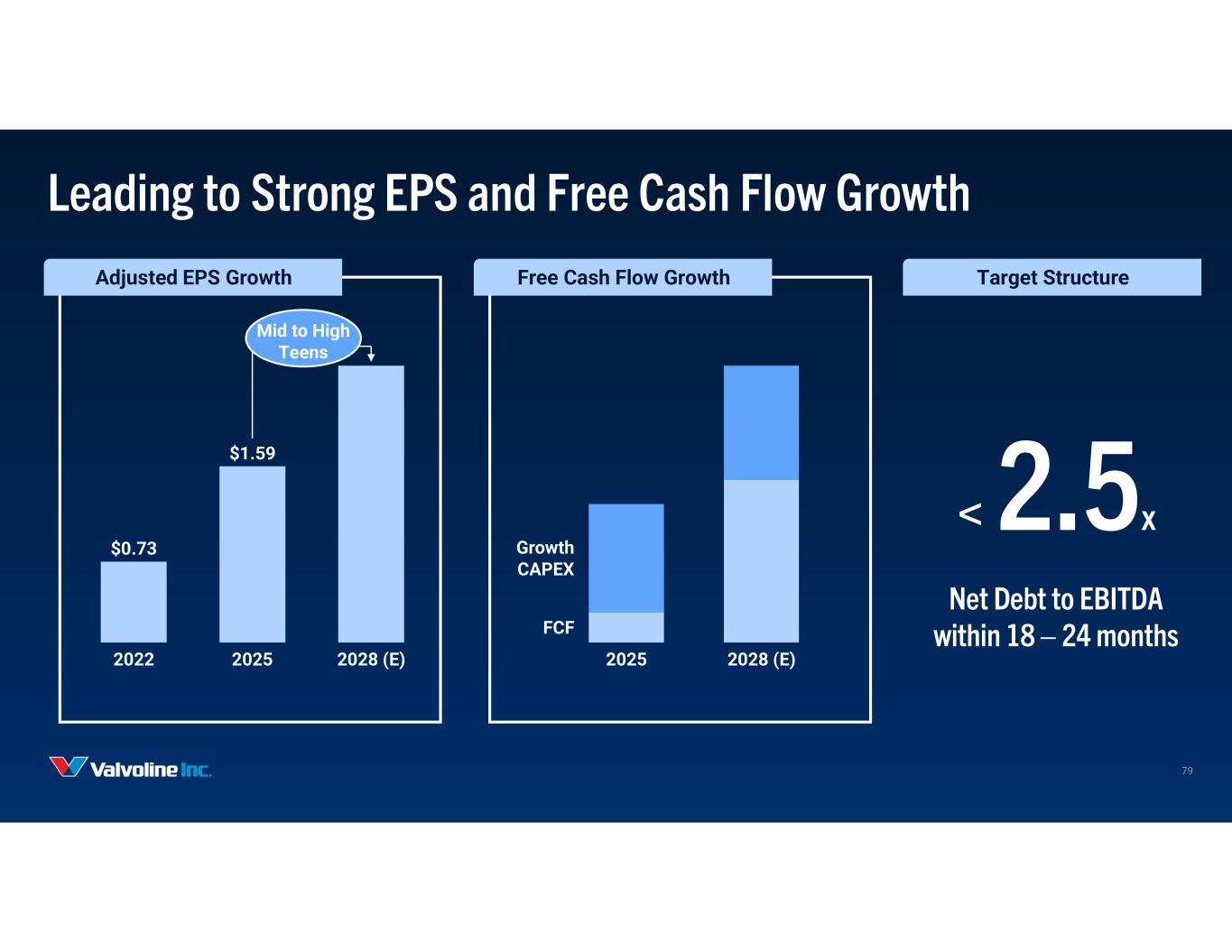

Leading to Strong EPS and Free Cash Flow Growth Adjusted EPS Growth Free Cash Flow Growth Target Structure $0.73 $1.59 2022 2025 2028 (E) < 2.5x Net Debt to EBITDA within 18 – 24 months 2025 2028 (E) FCF Growth CAPEX 79 Mid to High Teens

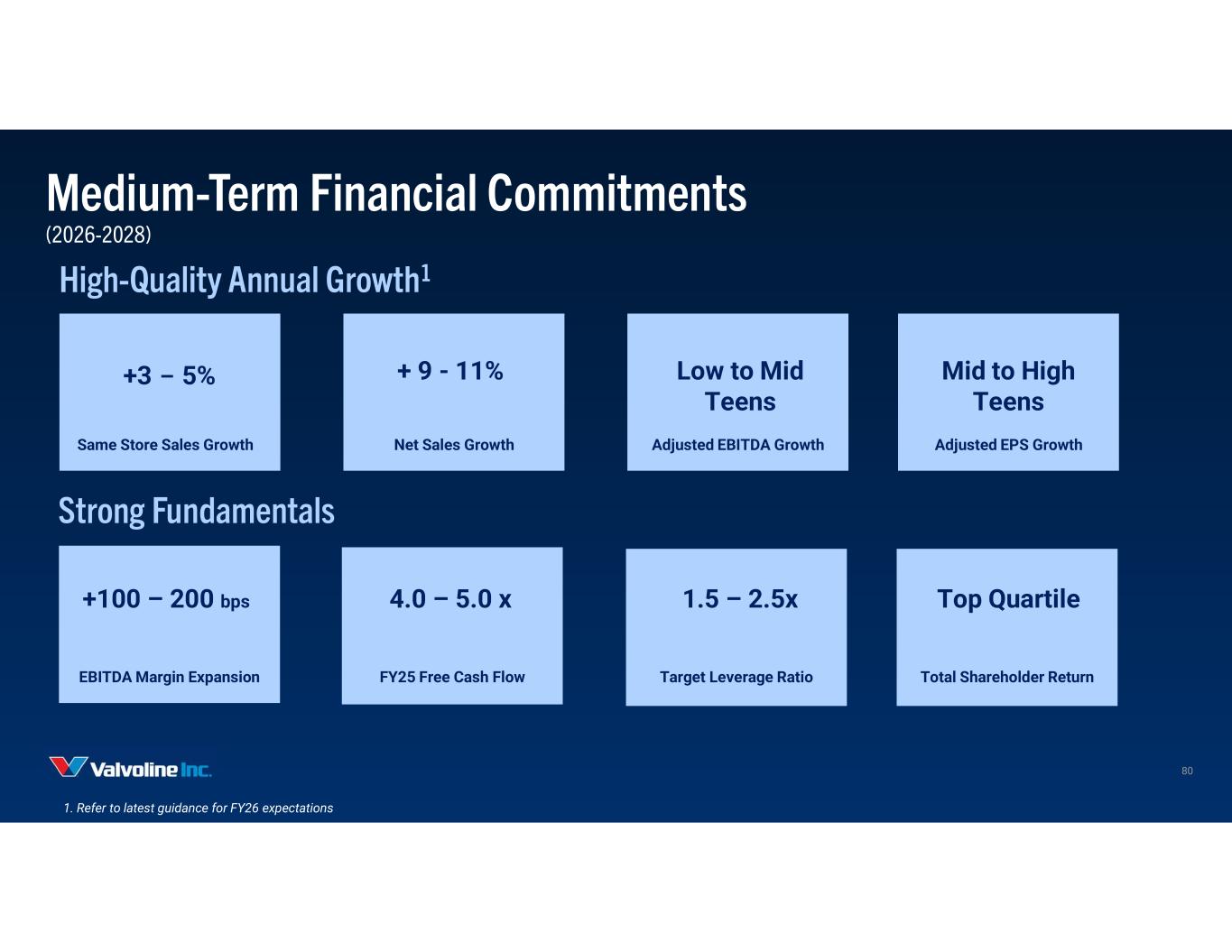

Medium-Term Financial Commitments (2026-2028) High-Quality Annual Growth1 EBITDA Margin Expansion FY25 Free Cash Flow Target Leverage Ratio Strong Fundamentals +3 – 5% Same Store Sales Growth + 9 - 11% Net Sales Growth Low to Mid Teens Adjusted EBITDA Growth Total Shareholder Return Adjusted EPS Growth Mid to High Teens +100 – 200 bps 4.0 – 5.0 x 1.5 – 2.5x Top Quartile 80 1. Refer to latest guidance for FY26 expectations

Investment Thesis Established Category Leader Delivering Industry-Leading Growth1 Differentiated Capabilities Driving Margin Expansion and High Cash Generation2 Disciplined Capital Allocation to Deliver Attractive Shareholder Returns4 3 Significant Growth Runway in Highly Fragmented Market 81 I t t i

82

83 Q&A

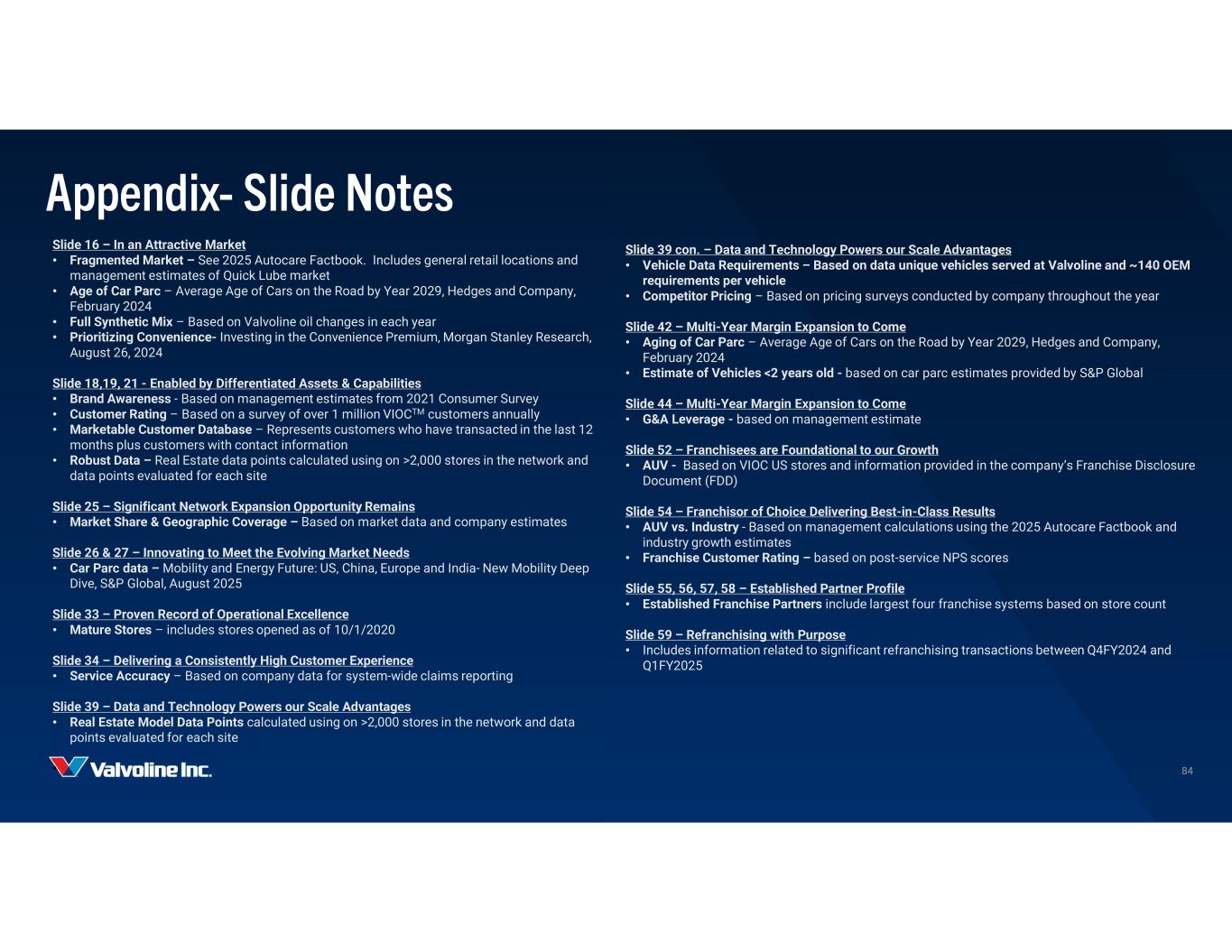

84 Appendix- Slide Notes Slide 16 – In an Attractive Market • Fragmented Market – See 2025 Autocare Factbook. Includes general retail locations and management estimates of Quick Lube market • Age of Car Parc – Average Age of Cars on the Road by Year 2029, Hedges and Company, February 2024 • Full Synthetic Mix – Based on Valvoline oil changes in each year • Prioritizing Convenience- Investing in the Convenience Premium, Morgan Stanley Research, August 26, 2024 Slide 18,19, 21 - Enabled by Differentiated Assets & Capabilities • Brand Awareness - Based on management estimates from 2021 Consumer Survey • Customer Rating – Based on a survey of over 1 million VIOCTM customers annually • Marketable Customer Database – Represents customers who have transacted in the last 12 months plus customers with contact information • Robust Data – Real Estate data points calculated using on >2,000 stores in the network and data points evaluated for each site Slide 25 – Significant Network Expansion Opportunity Remains • Market Share & Geographic Coverage – Based on market data and company estimates Slide 26 & 27 – Innovating to Meet the Evolving Market Needs • Car Parc data – Mobility and Energy Future: US, China, Europe and India- New Mobility Deep Dive, S&P Global, August 2025 Slide 33 – Proven Record of Operational Excellence • Mature Stores – includes stores opened as of 10/1/2020 Slide 34 – Delivering a Consistently High Customer Experience • Service Accuracy – Based on company data for system-wide claims reporting Slide 39 – Data and Technology Powers our Scale Advantages • Real Estate Model Data Points calculated using on >2,000 stores in the network and data points evaluated for each site • . Slide 39 con. – Data and Technology Powers our Scale Advantages • Vehicle Data Requirements – Based on data unique vehicles served at Valvoline and ~140 OEM requirements per vehicle • Competitor Pricing – Based on pricing surveys conducted by company throughout the year Slide 42 – Multi-Year Margin Expansion to Come • Aging of Car Parc – Average Age of Cars on the Road by Year 2029, Hedges and Company, February 2024 • Estimate of Vehicles <2 years old - based on car parc estimates provided by S&P Global Slide 44 – Multi-Year Margin Expansion to Come • G&A Leverage - based on management estimate Slide 52 – Franchisees are Foundational to our Growth • AUV - Based on VIOC US stores and information provided in the company’s Franchise Disclosure Document (FDD) Slide 54 – Franchisor of Choice Delivering Best-in-Class Results • AUV vs. Industry - Based on management calculations using the 2025 Autocare Factbook and industry growth estimates • Franchise Customer Rating – based on post-service NPS scores Slide 55, 56, 57, 58 – Established Partner Profile • Established Franchise Partners include largest four franchise systems based on store count Slide 59 – Refranchising with Purpose • Includes information related to significant refranchising transactions between Q4FY2024 and Q1FY2025

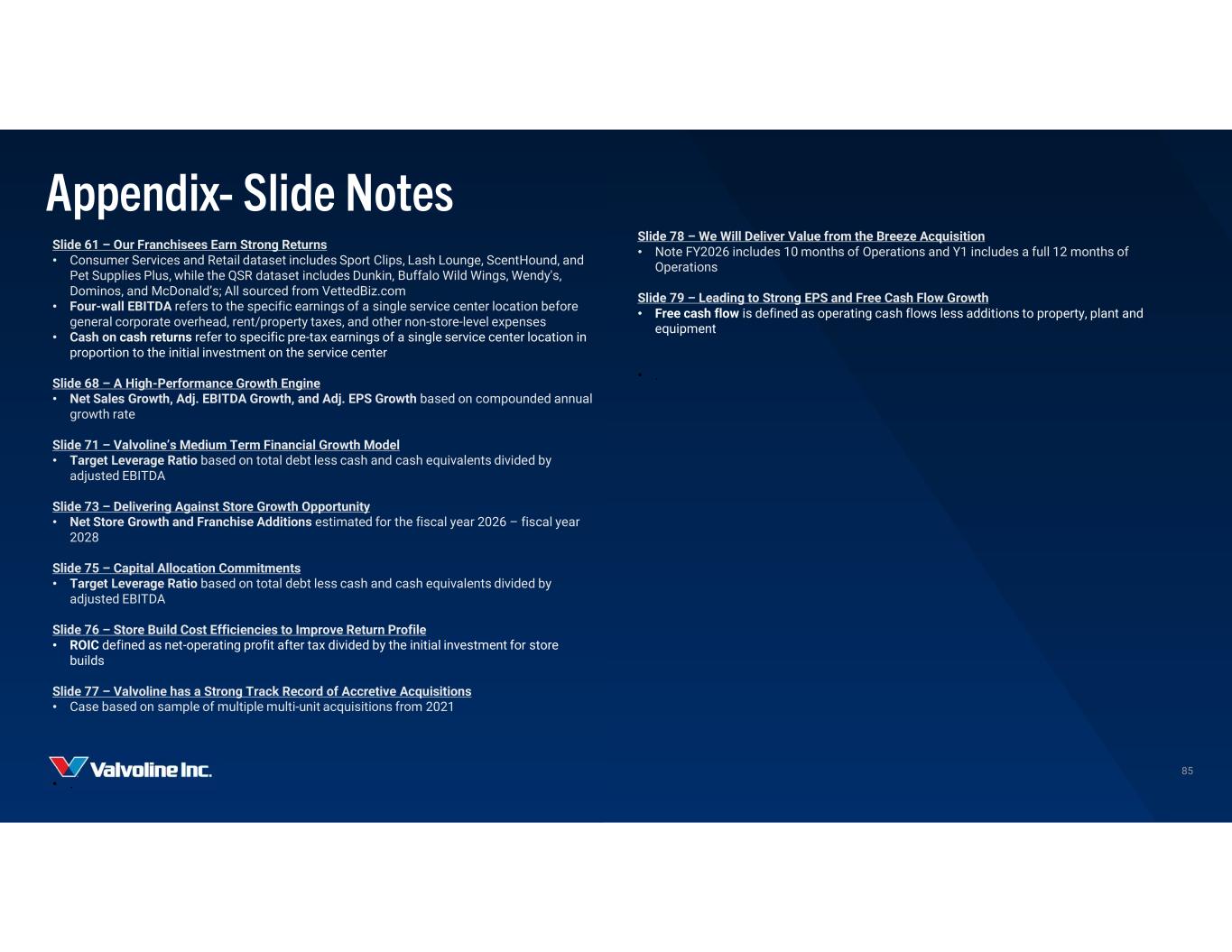

85 Appendix- Slide Notes Slide 61 – Our Franchisees Earn Strong Returns • Consumer Services and Retail dataset includes Sport Clips, Lash Lounge, ScentHound, and Pet Supplies Plus, while the QSR dataset includes Dunkin, Buffalo Wild Wings, Wendy's, Dominos, and McDonald’s; All sourced from VettedBiz.com • Four-wall EBITDA refers to the specific earnings of a single service center location before general corporate overhead, rent/property taxes, and other non-store-level expenses • Cash on cash returns refer to specific pre-tax earnings of a single service center location in proportion to the initial investment on the service center Slide 68 – A High-Performance Growth Engine • Net Sales Growth, Adj. EBITDA Growth, and Adj. EPS Growth based on compounded annual growth rate Slide 71 – Valvoline’s Medium Term Financial Growth Model • Target Leverage Ratio based on total debt less cash and cash equivalents divided by adjusted EBITDA Slide 73 – Delivering Against Store Growth Opportunity • Net Store Growth and Franchise Additions estimated for the fiscal year 2026 – fiscal year 2028 Slide 75 – Capital Allocation Commitments • Target Leverage Ratio based on total debt less cash and cash equivalents divided by adjusted EBITDA Slide 76 – Store Build Cost Efficiencies to Improve Return Profile • ROIC defined as net-operating profit after tax divided by the initial investment for store builds Slide 77 – Valvoline has a Strong Track Record of Accretive Acquisitions • Case based on sample of multiple multi-unit acquisitions from 2021 • . Slide 78 – We Will Deliver Value from the Breeze Acquisition • Note FY2026 includes 10 months of Operations and Y1 includes a full 12 months of Operations Slide 79 – Leading to Strong EPS and Free Cash Flow Growth • Free cash flow is defined as operating cash flows less additions to property, plant and equipment • .