Founded in 2011 | Located in El Monte, CA | NASDAQ:FLGT Investor Presentation November 7, 2025

Disclaimer Forward-Looking Statements and Market Data This presentation contains forward-looking statements, which are statements other than those of historical facts and which represent the estimates and expectations of Fulgent Genetics, Inc. (the “Company” or “Fulgent”) about future events based on current views and assumptions. Examples of forward-looking statements made in this presentation include, among others, those related to long-term upside or value, management of risk, anticipated growth and positioning, addressable market estimates, the Company’s mission, vision and strategies, the success of its business model and strategy, anticipated future revenue and guidance, evaluations and judgments regarding the Company’s business, products, technologies, competitive landscape, scalability, plans regarding development and launch of potential future products, and any businesses the Company may seek to acquire or has acquired or has invested in or may seek to invest in, including statements regarding Fulgent Pharma Holdings, Inc. (“Fulgent Pharma”), Inform Diagnostics, CSI Laboratories, and any potential synergies, or transformation of the Company’s business, long-term visions and strategies, the clinical development of Fulgent Pharma’s pipeline and related statements and assumptions regarding development timelines, any potentially accelerated pathway for regulatory approval, the potential safety and efficacy of the nanodrug delivery platform and any related therapeutic candidates, the potential market size for these candidates and platforms and the value of available data, including genomic data, the Company’s research and development efforts, including any implications that the results of earlier clinical trials will be representative or consistent with later clinical trials, the expected timing or timing of enrollment for these clinical trials or that interim or preliminary data will be representative of the final data or results of these trials, and guidance regarding the Company’s future performance and results of operations, including any cash or cash equivalent resource projections. The Company’s views and assumptions on which these forward-looking statements are based may prove to be incorrect. As a result, matters discussed in any forward-looking statements are subject to risks, uncertainties and changes in circumstances that may cause actual results to differ materially from those discussed or implied by any forward-looking statements. Important factors that could cause actual results to differ materially from those implied by forward-looking statements are disclosed under “Risk Factors” and “Management's Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s reports filed with the Securities and Exchange Commission ("SEC"), including its annual report on Form 10-K filed on February 28, 2025, and other reports it files from time to time. Because of these factors, you should not rely upon forward-looking statements as predictions of future events. The forward-looking statements in this presentation are made only as of the date hereof, and, except as required by law, the Company assumes no obligation to update any forward-looking statements in the future. The Company’s reports filed with the SEC, including its annual report on Form 10-K for the year ended December 31, 2024, filed with the SEC on February 28, 2025, and the other reports it files from time to time, including subsequently filed annual, quarterly and current reports, are made available on the Company’s website upon their filing with the SEC. These reports contain more information about the Company, its business and the risks affecting its business, as well as its results of operations for the periods covered by the financial results included in this presentation. This presentation also includes market data and forecasts with respect to the industry in which the Company operates. In some cases, the Company relies upon and refers to market data and certain industry forecasts that have been obtained from third-party surveys, market research, consultant surveys, publicly available information and industry publications that the Company believes to be reliable. These data and estimates involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Non-GAAP Financial Measures This presentation contains certain supplemental financial measures that are not calculated pursuant to U.S. generally accepted accounting principles (“GAAP”). These non-GAAP measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. A reconciliation of non-GAAP measures to GAAP measures is contained in this presentation. Fulgent believes this information is useful to investors because it provides a basis for measuring the performance of the Company’s business, excluding certain income or expense items that management believes are not directly attributable to the Company’s operating results. The Company does not provide reconciliations of forward-looking non-GAAP measures to GAAP measures, due to the inability to predict the amount and timing of impacts outside of the Company's control on certain items, particularly items related to equity-based compensation, tax effects and potential impairments, among other items, which could be material. Reconciling such items would require unreasonable efforts.

Leadership Team Seasoned legal and privacy professional with nearly two decades of legal experience Privacy Law Specialist; Certified Information Privacy Manager; Certified Information Privacy Professional and an Advisory Board Member with the International Association of Privacy Professionals J.D. from Duke University School of Law Brandon Perthuis Chief Commercial Officer Natalie Prescott General Counsel & Chief Privacy Officer Ming Hsieh Chief Executive Officer Dr. Harry Gao Lab Director and Chief Scientific Officer James Xie President and Chief Operating Officer Paul Kim Chief Financial Officer Extensive experience leading genetic testing commercialization programs since 2003 Previously VP of Sales and Marketing of the Medical Genetics Laboratory at Baylor College of Medicine Prior to Baylor, held senior roles at PerkinElmer, Inc. and Spectral Genomics, Inc. B.S. in Biomedical Science Responsible for managing all global operations, product vision and product engineering Served as an SVP of Cogent Systems, Inc. B.A. in Engineering, M.S. in Industrial Engineering and an M.S. in Computer Science Experienced financial leader and Certified Public Accountant Previously CFO of Cogent Systems, Inc.; sold to 3M for $943M in 2010 B.A. in Economics from University of California at Berkeley Previously Lab Director at City of Hope Clinical molecular genetics training fellowship and post-doctoral fellowship at Harvard Medical School M.S. in Immunology, and M.D. and Ph.D. in Microbiology, Immunology, and Medical Genetics Experienced operational leader, entrepreneur and philanthropist Previously CEO, President, and Chairman of Cogent Systems, Inc. Member of the National Academy of Engineering; Fellow of the National Academy of Inventors; Trustee of USC Dr. Ray Yin President, Pharma Founder & CEO, ANP Technologies, Inc. Former Team Leader of Nanobiotechnology for Chem/Bio Defense, U.S. Army Research Laboratory Holder of 46 drug delivery/detection patents Ph.D. in Chemistry, University of Southern California

About Fulgent We are a premier global, technology-based genetic testing company focused on transforming patient care in oncology, infectious and rare diseases, and reproductive health. Mission Develop flexible and affordable diagnostics and therapeutics that improve the everyday lives of those around us. Core Values Innovation Customer Service and Commitment Quality and Efficiency Our People Strategy Leverage our proprietary technology platform for broad application Further clinical/regulatory program for Pharma Operational excellence Disciplined M&A

Laboratory Services

Well-positioned to execute on a growth strategy that includes organic and inorganic initiatives, including: Transformational acquisition of Inform Diagnostics Ramping of CSI Labs Scaling partnerships Potential future acquisitions with a strategy of short- and long-term ROI, tangible synergies, and efficient capital deployment 1 2 3 $84M Q3 Revenue +17% Q3 Year-over-Year Revenue Increase 18,400+ GENES | 900+ PANELS CUSTOMIZABLE OFFERINGS Positioned for Growth Proprietary technology platform allows for rapid scaling of a broad, flexible test menu Next-generation sequencing (NGS) platform complemented with growing portfolio of emerging testing technologies with a focus on oncology 6

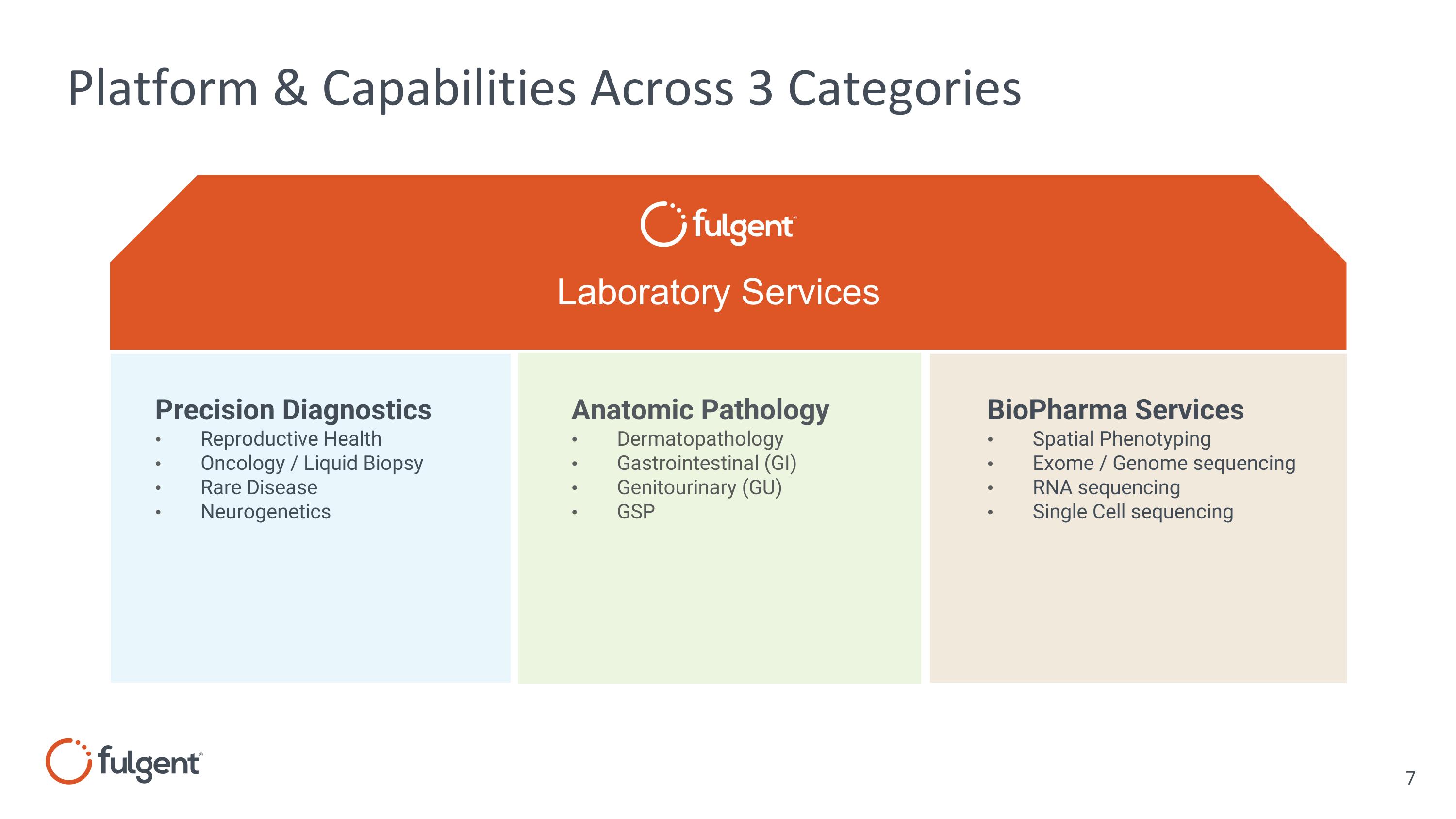

Platform & Capabilities Across 3 Categories Precision Diagnostics Reproductive Health Oncology / Liquid Biopsy Rare Disease Neurogenetics Laboratory Services Anatomic Pathology Dermatopathology Gastrointestinal (GI) Genitourinary (GU) GSP BioPharma Services Spatial Phenotyping Exome / Genome sequencing RNA sequencing Single Cell sequencing

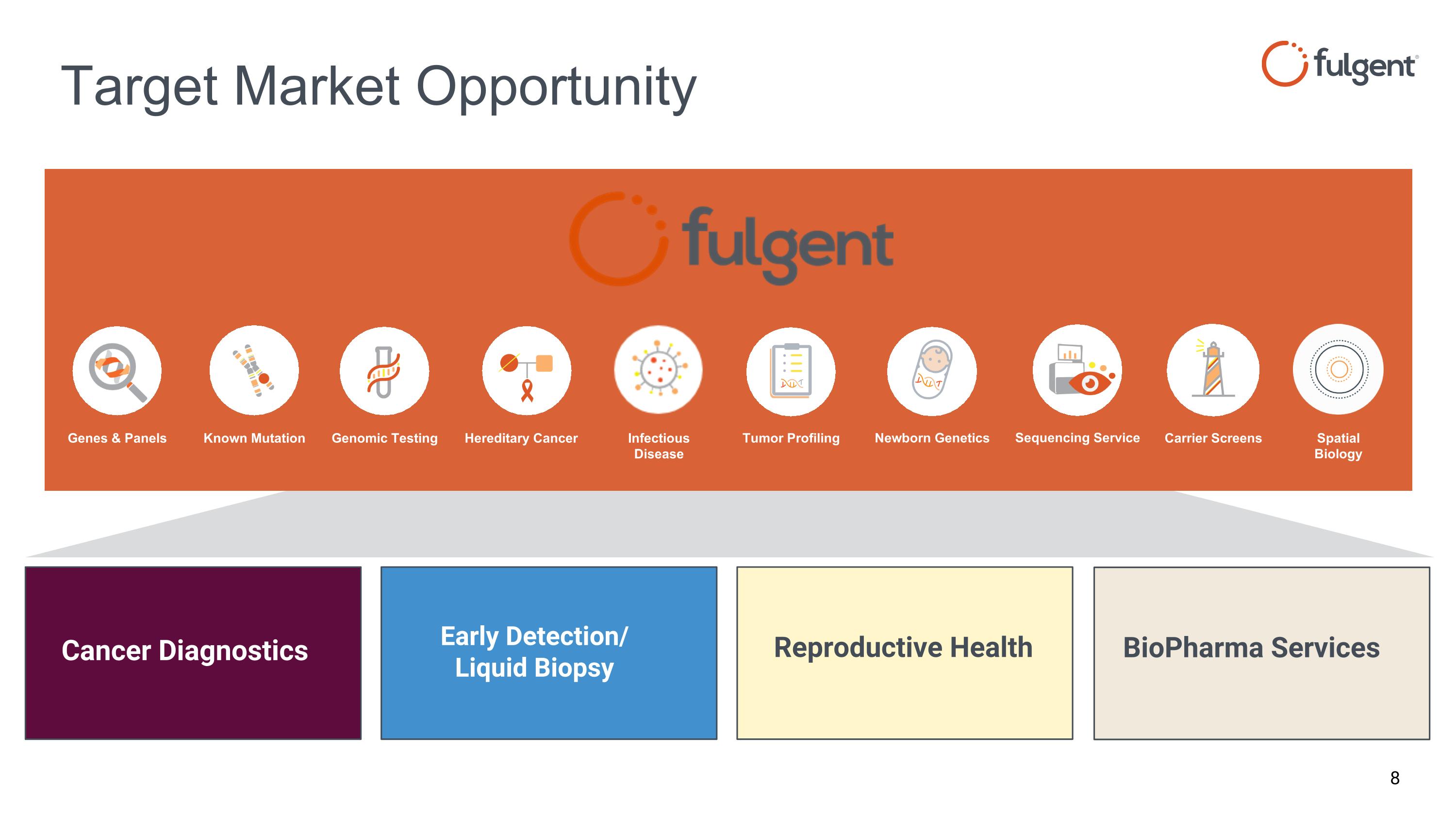

Target Market Opportunity Cancer Diagnostics Early Detection/ Liquid Biopsy Reproductive Health BioPharma Services Genes & Panels Tumor Profiling Known Mutation Newborn Genetics Hereditary Cancer Carrier Screens Genomic Testing Sequencing Service Infectious Disease Spatial Biology

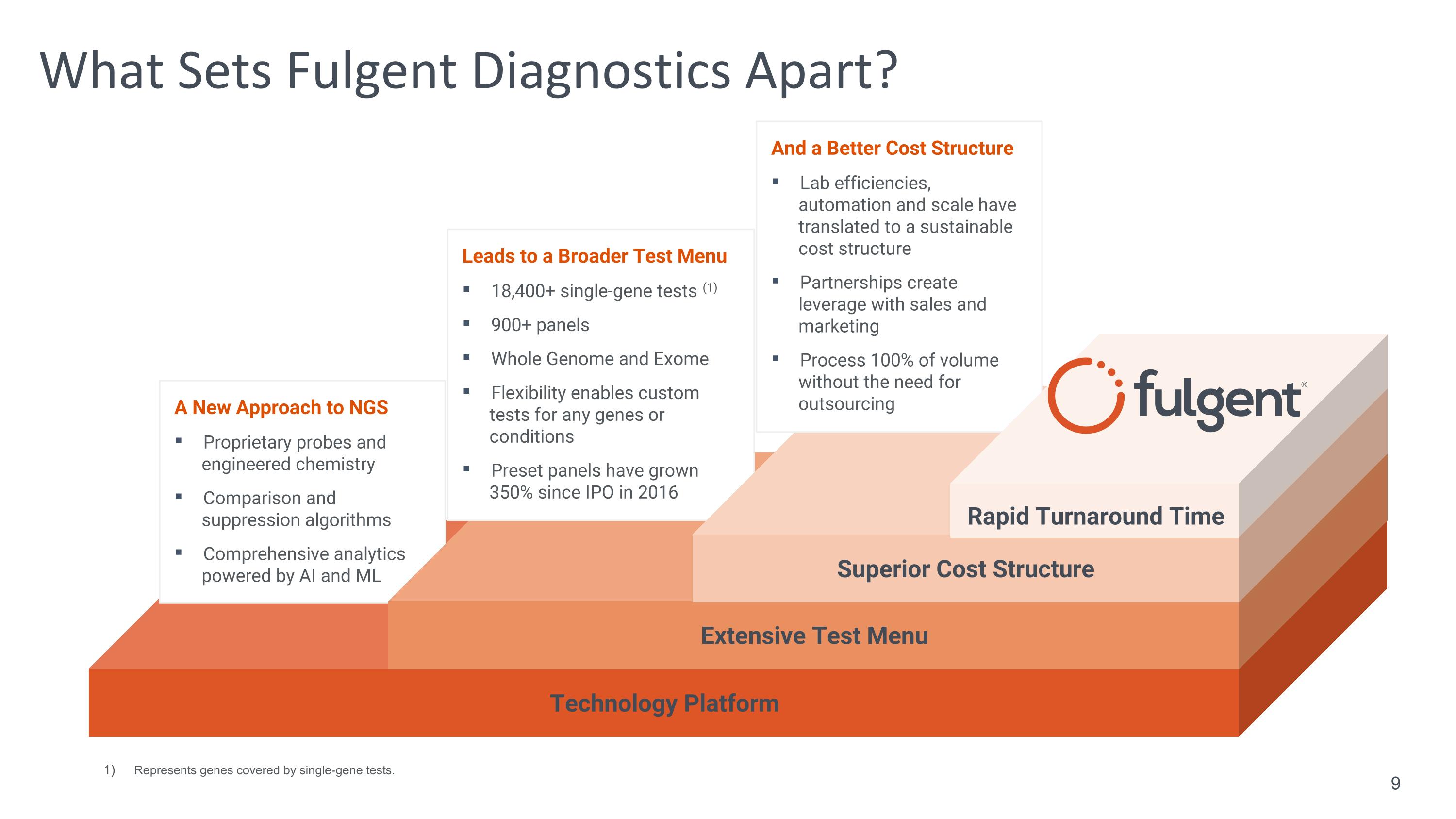

What Sets Fulgent Diagnostics Apart? Technology Platform A New Approach to NGS Proprietary probes and engineered chemistry Comparison and suppression algorithms Comprehensive analytics powered by AI and ML Extensive Test Menu Leads to a Broader Test Menu 18,400+ single-gene tests (1) 900+ panels Whole Genome and Exome Flexibility enables custom tests for any genes or conditions Preset panels have grown 350% since IPO in 2016 Superior Cost Structure And a Better Cost Structure Lab efficiencies, automation and scale have translated to a sustainable cost structure Partnerships create leverage with sales and marketing Process 100% of volume without the need for outsourcing Rapid Turnaround Time Represents genes covered by single-gene tests. 9

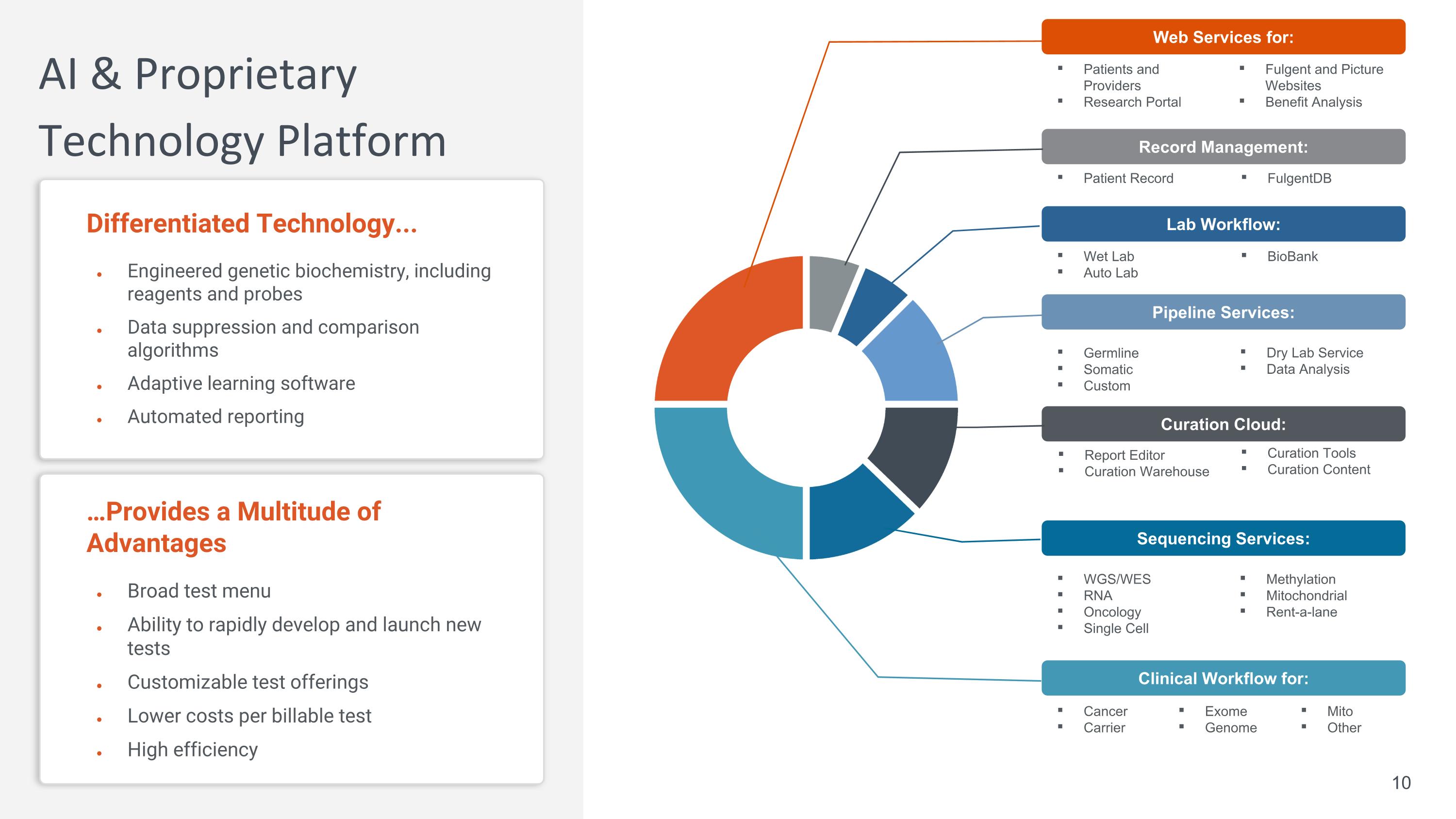

Patients and Providers Research Portal …Provides a Multitude of Advantages Broad test menu Ability to rapidly develop and launch new tests Customizable test offerings Lower costs per billable test High efficiency AI & Proprietary Technology Platform Differentiated Technology... Engineered genetic biochemistry, including reagents and probes Data suppression and comparison algorithms Adaptive learning software Automated reporting Web Services for: Clinical Workflow for: Cancer Carrier Exome Genome Methylation Mitochondrial Rent-a-lane Sequencing Services: WGS/WES RNA Oncology Single Cell Pipeline Services: Curation Tools Curation Content Curation Cloud: Report Editor Curation Warehouse Dry Lab Service Data Analysis Germline Somatic Custom Lab Workflow: Wet Lab Auto Lab Record Management: Patient Record BioBank FulgentDB Fulgent and Picture Websites Benefit Analysis Mito Other 10

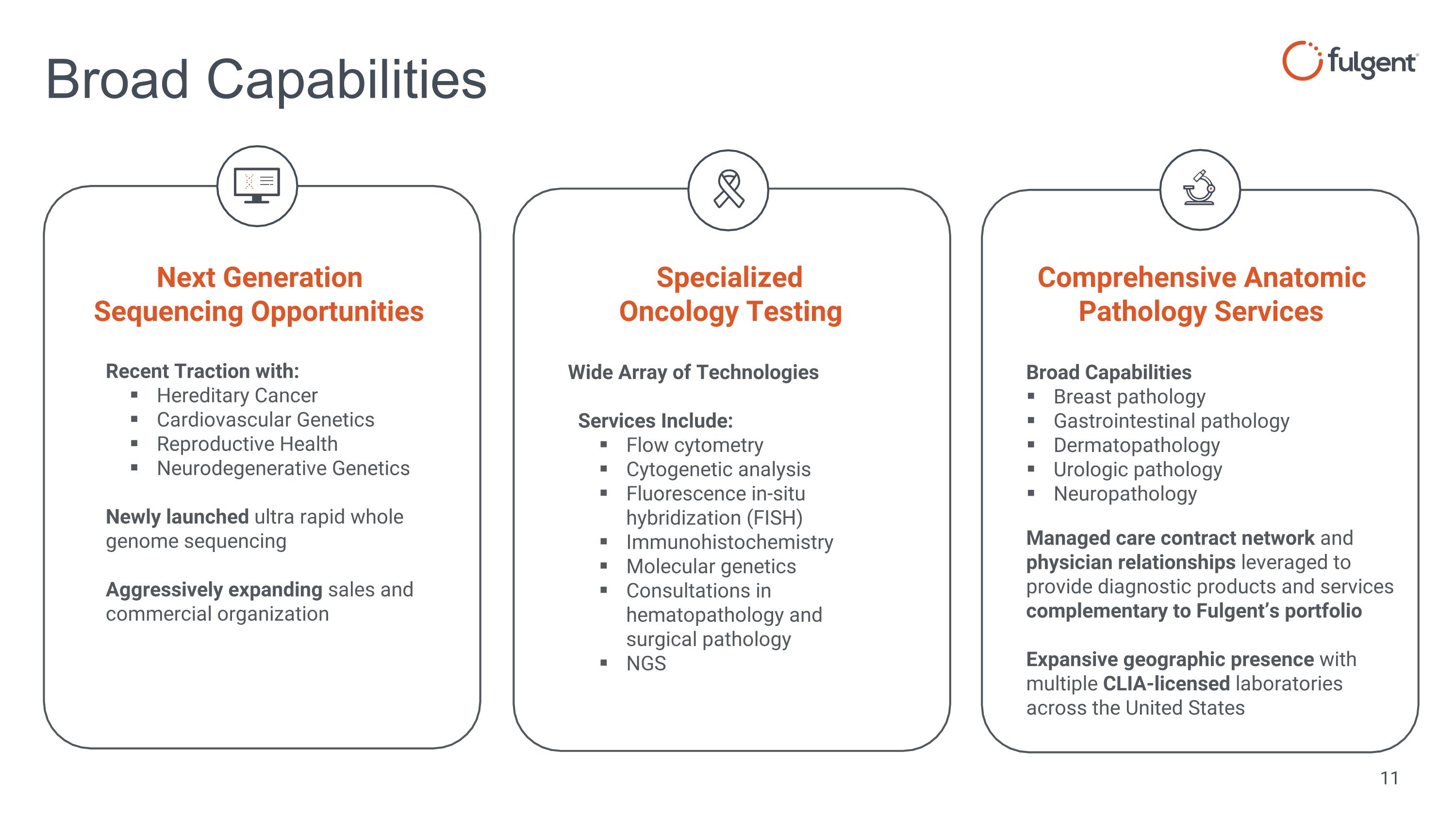

Recent Traction with: Hereditary Cancer Cardiovascular Genetics Reproductive Health Neurodegenerative Genetics Newly launched ultra rapid whole genome sequencing Aggressively expanding sales and commercial organization Wide Array of Technologies Services Include: Flow cytometry Cytogenetic analysis Fluorescence in-situ hybridization (FISH) Immunohistochemistry Molecular genetics Consultations in hematopathology and surgical pathology NGS Broad Capabilities Broad Capabilities Breast pathology Gastrointestinal pathology Dermatopathology Urologic pathology Neuropathology Managed care contract network and physician relationships leveraged to provide diagnostic products and services complementary to Fulgent’s portfolio Expansive geographic presence with multiple CLIA-licensed laboratories across the United States Next Generation Sequencing Opportunities Specialized Oncology Testing Comprehensive Anatomic Pathology Services

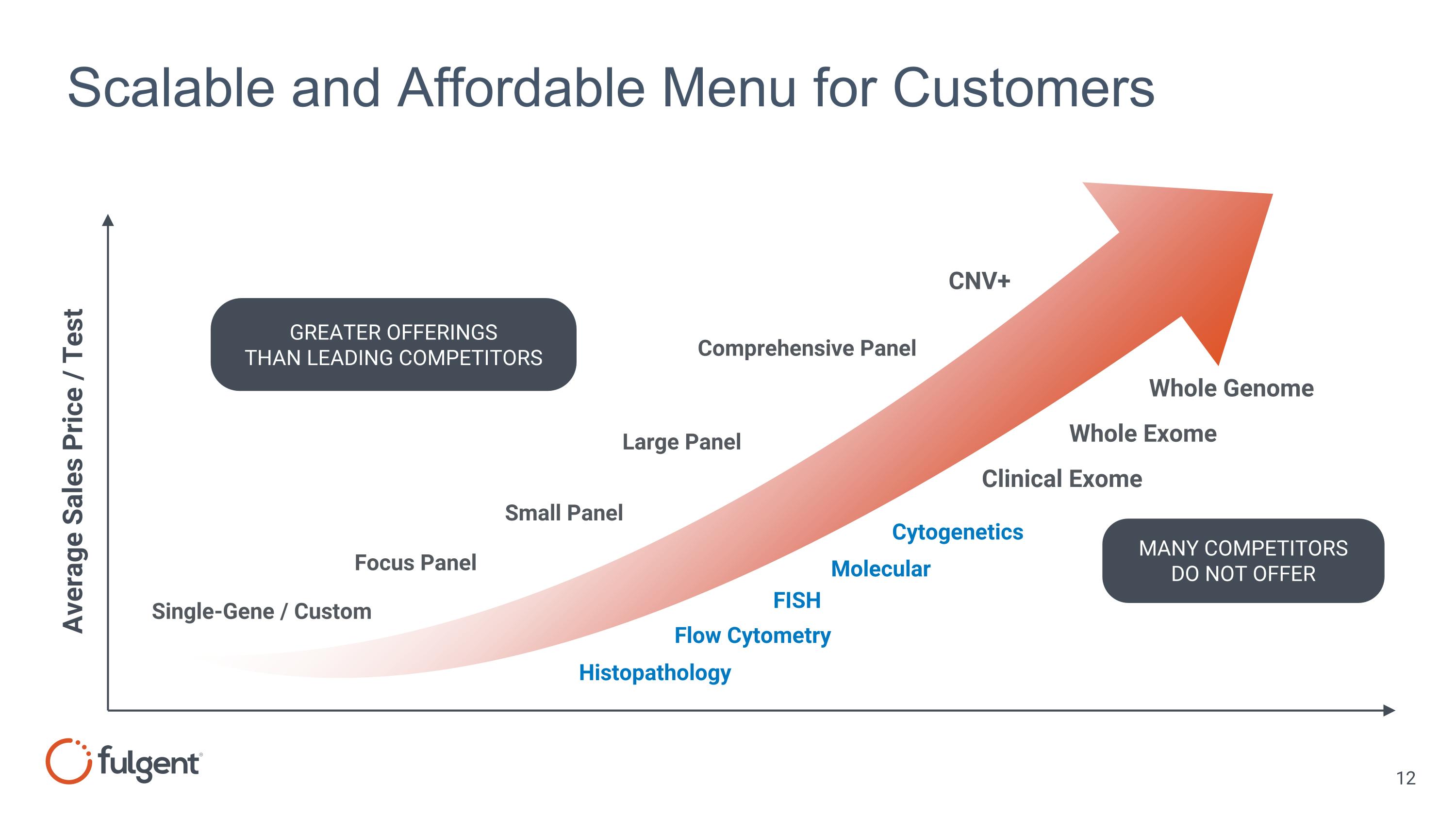

Scalable and Affordable Menu for Customers Large Panel Small Panel Focus Panel Single-Gene / Custom Comprehensive Panel Average Sales Price / Test Whole Genome Whole Exome Clinical Exome GREATER OFFERINGS THAN LEADING COMPETITORS CNV+ MANY COMPETITORS DO NOT OFFER Flow Cytometry FISH Histopathology Cytogenetics Molecular

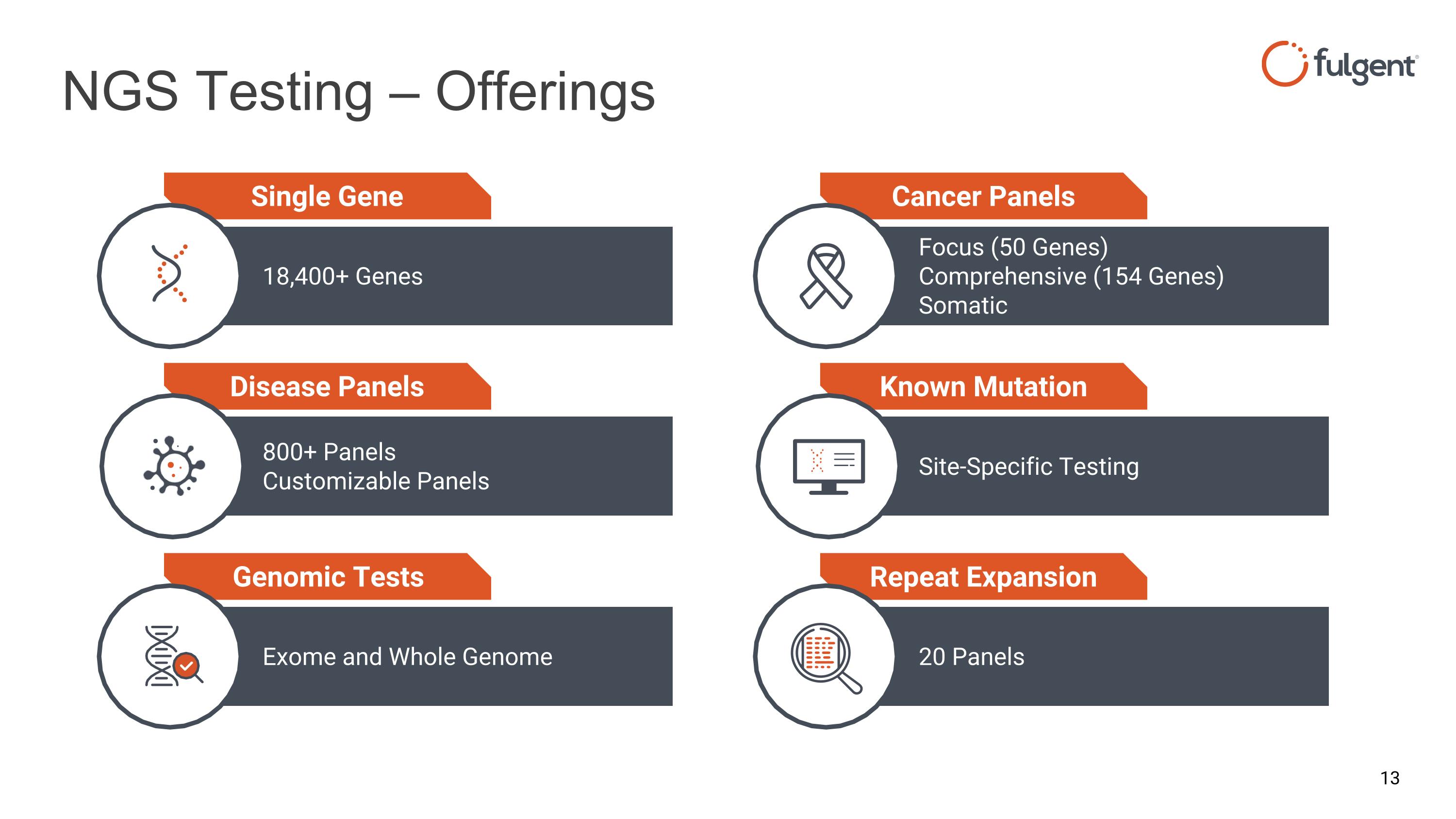

NGS Testing – Offerings Site-Specific Testing Known Mutation Focus (50 Genes) Comprehensive (154 Genes) Somatic Cancer Panels 20 Panels Repeat Expansion 18,400+ Genes Single Gene 800+ Panels Customizable Panels Disease Panels Exome and Whole Genome Genomic Tests

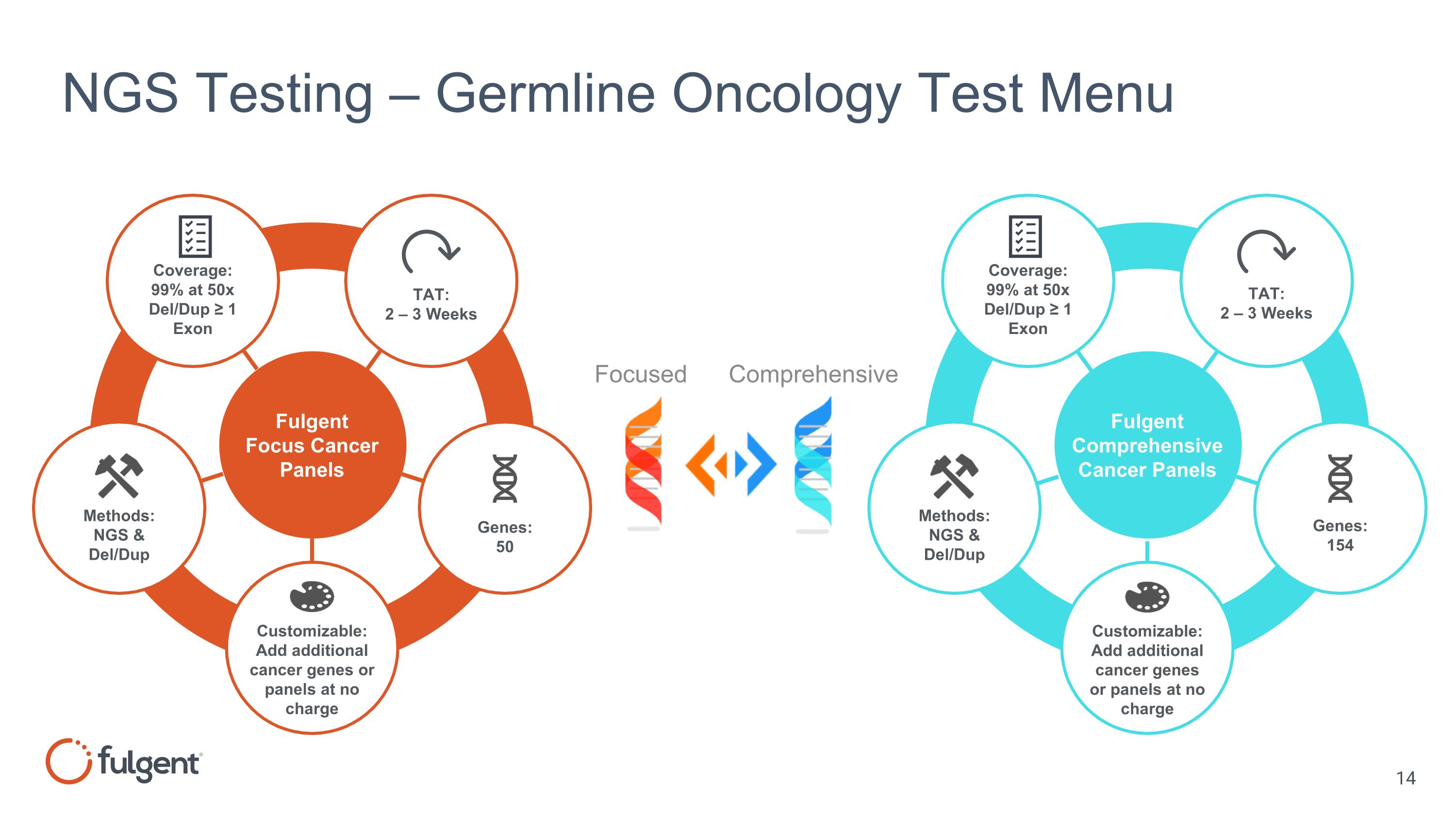

NGS Testing – Germline Oncology Test Menu Fulgent Focus Cancer Panels Fulgent Comprehensive Cancer Panels Customizable: Add additional cancer genes or panels at no charge Genes: 50 Methods: NGS & Del/Dup Coverage: 99% at 50x Del/Dup ≥ 1 Exon TAT: 2 – 3 Weeks Customizable: Add additional cancer genes or panels at no charge Methods: NGS & Del/Dup Genes: 154 Coverage: 99% at 50x Del/Dup ≥ 1 Exon TAT: 2 – 3 Weeks Focused Comprehensive

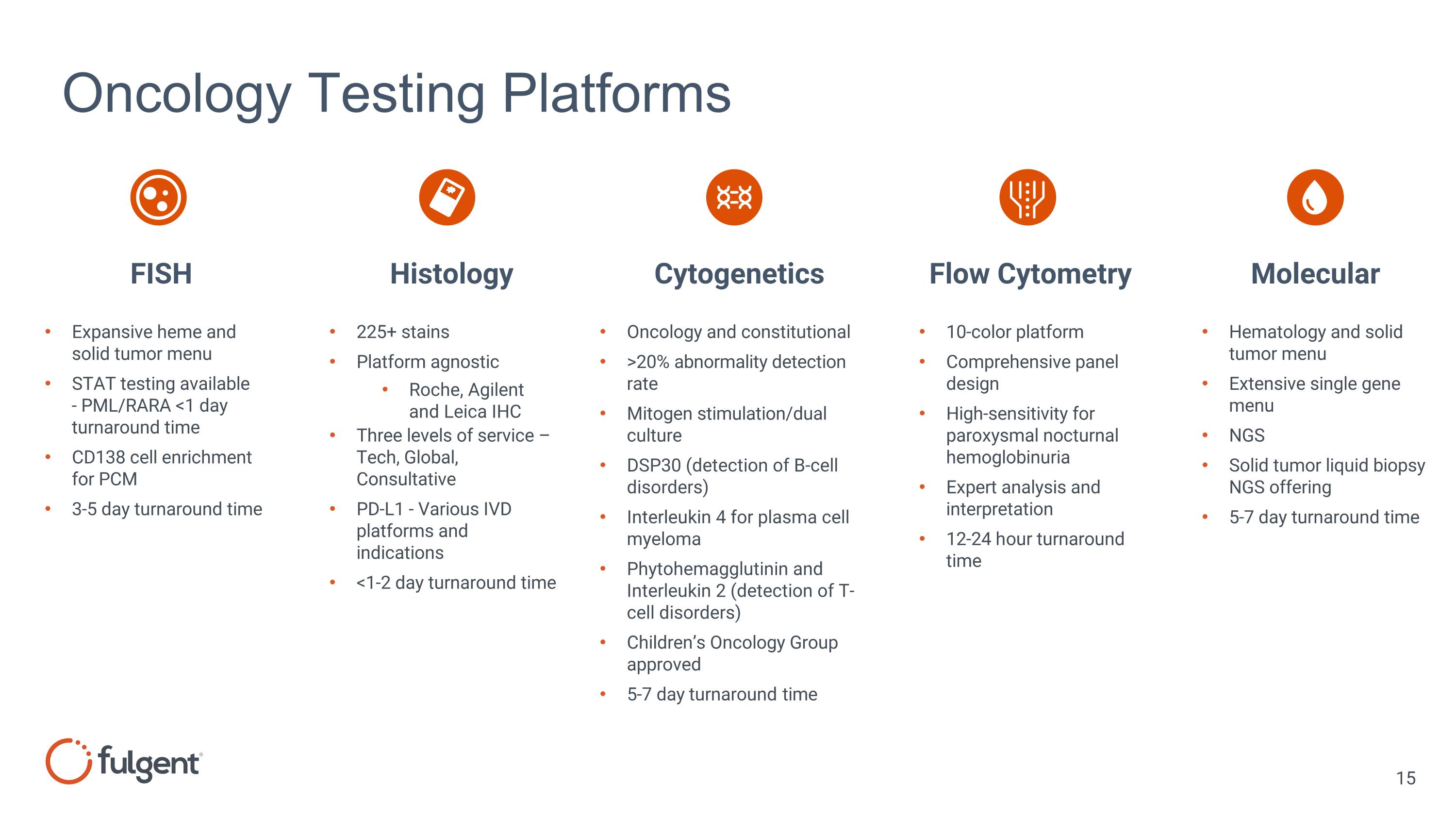

Oncology Testing Platforms Expansive heme and solid tumor menu STAT testing available - PML/RARA <1 day turnaround time CD138 cell enrichment for PCM 3-5 day turnaround time 225+ stains Platform agnostic Roche, Agilent and Leica IHC Three levels of service – Tech, Global, Consultative PD-L1 - Various IVD platforms and indications <1-2 day turnaround time Hematology and solid tumor menu Extensive single gene menu NGS Solid tumor liquid biopsy NGS offering 5-7 day turnaround time Oncology and constitutional >20% abnormality detection rate Mitogen stimulation/dual culture DSP30 (detection of B-cell disorders) Interleukin 4 for plasma cell myeloma Phytohemagglutinin and Interleukin 2 (detection of T-cell disorders) Children’s Oncology Group approved 5-7 day turnaround time FISH Histology Cytogenetics Flow Cytometry Molecular 10-color platform Comprehensive panel design High-sensitivity for paroxysmal nocturnal hemoglobinuria Expert analysis and interpretation 12-24 hour turnaround time

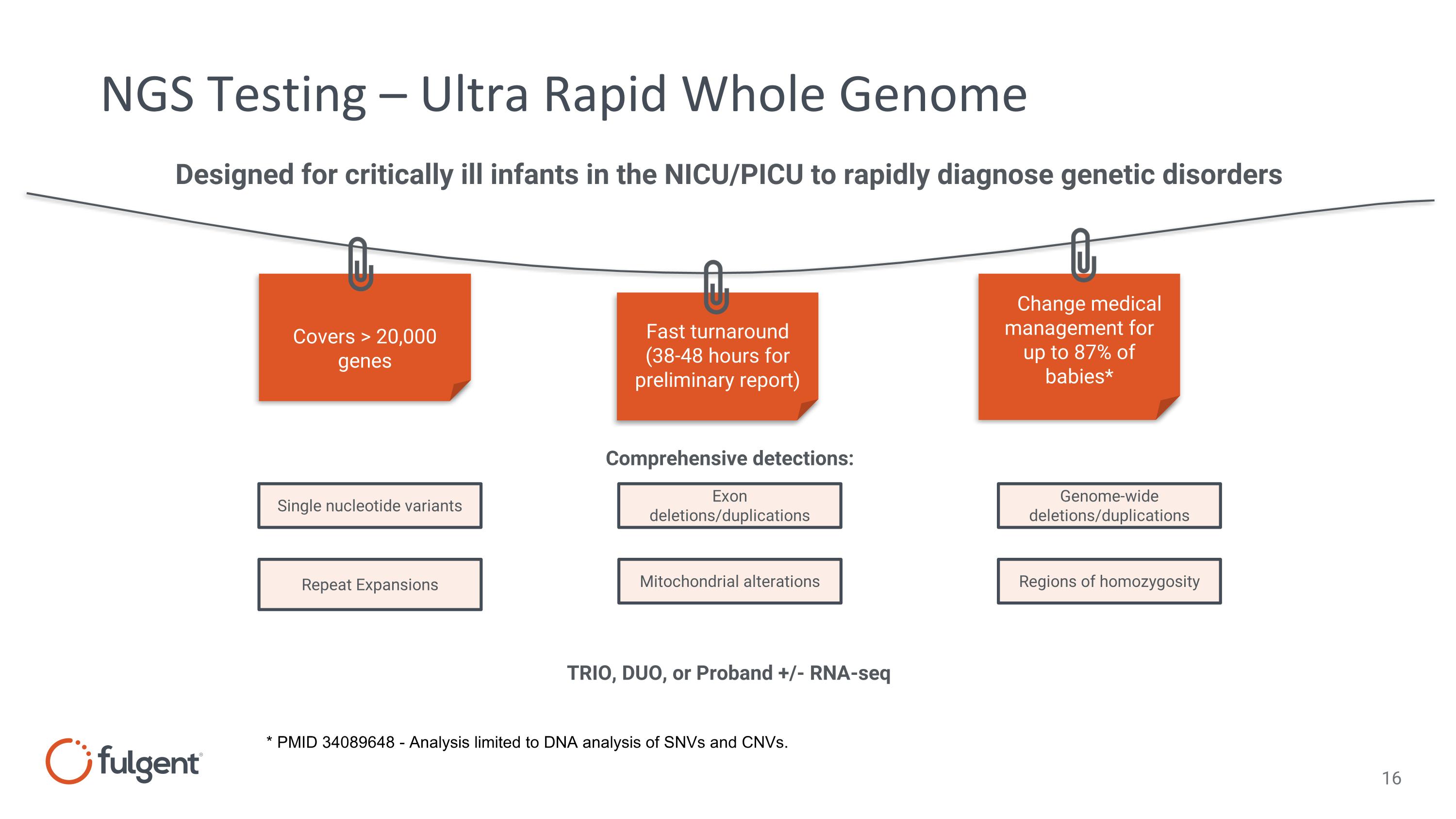

NGS Testing – Ultra Rapid Whole Genome Covers > 20,000 genes Fast turnaround (38-48 hours for preliminary report) Change medical management for up to 87% of babies* Designed for critically ill infants in the NICU/PICU to rapidly diagnose genetic disorders Single nucleotide variants Repeat Expansions Exon deletions/duplications Mitochondrial alterations Genome-wide deletions/duplications Comprehensive detections: TRIO, DUO, or Proband +/- RNA-seq Regions of homozygosity * PMID 34089648 - Analysis limited to DNA analysis of SNVs and CNVs.

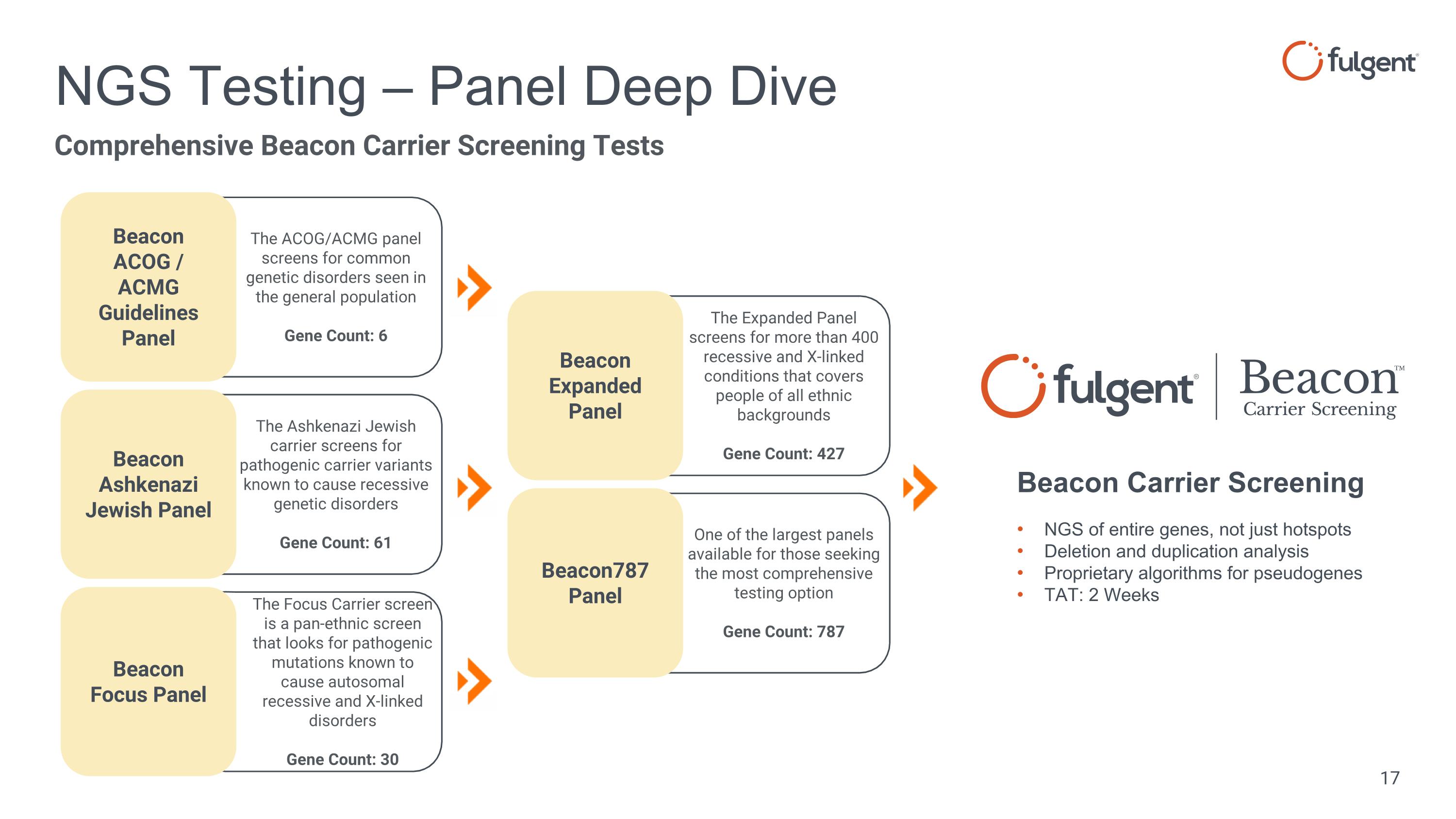

The Focus Carrier screen is a pan-ethnic screen that looks for pathogenic mutations known to cause autosomal recessive and X-linked disorders Gene Count: 30 The Ashkenazi Jewish carrier screens for pathogenic carrier variants known to cause recessive genetic disorders Gene Count: 61 The ACOG/ACMG panel screens for common genetic disorders seen in the general population Gene Count: 6 One of the largest panels available for those seeking the most comprehensive testing option Gene Count: 787 The Expanded Panel screens for more than 400 recessive and X-linked conditions that covers people of all ethnic backgrounds Gene Count: 427 NGS Testing – Panel Deep Dive NGS of entire genes, not just hotspots Deletion and duplication analysis Proprietary algorithms for pseudogenes TAT: 2 Weeks Beacon Carrier Screening Beacon ACOG / ACMG Guidelines Panel Beacon Ashkenazi Jewish Panel Beacon Focus Panel Beacon Expanded Panel Beacon787 Panel Comprehensive Beacon Carrier Screening Tests

Therapeutic Development

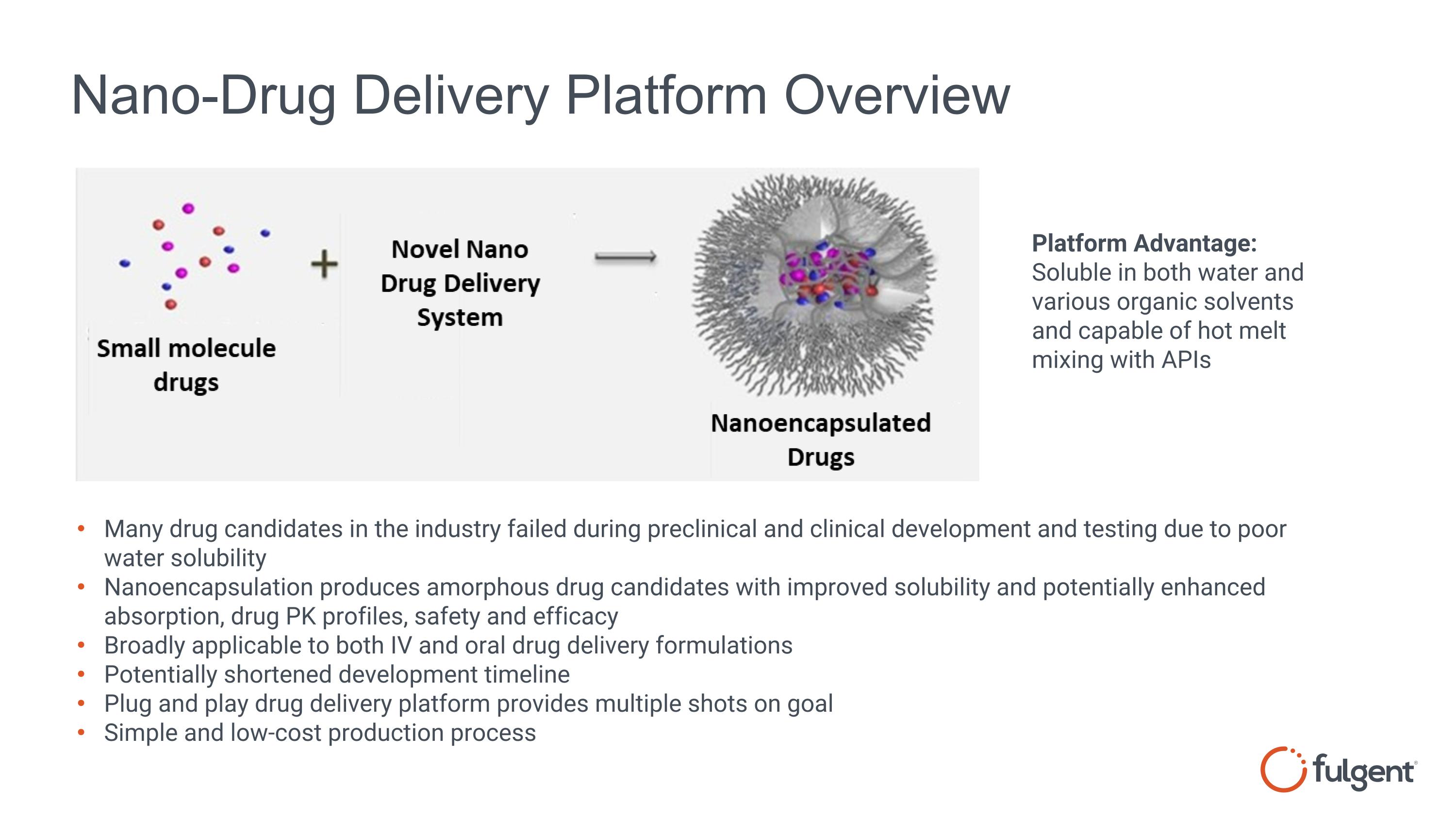

Nano-Drug Delivery Platform Overview Many drug candidates in the industry failed during preclinical and clinical development and testing due to poor water solubility Nanoencapsulation produces amorphous drug candidates with improved solubility and potentially enhanced absorption, drug PK profiles, safety and efficacy Broadly applicable to both IV and oral drug delivery formulations Potentially shortened development timeline Plug and play drug delivery platform provides multiple shots on goal Simple and low-cost production process Platform Advantage: Soluble in both water and various organic solvents and capable of hot melt mixing with APIs

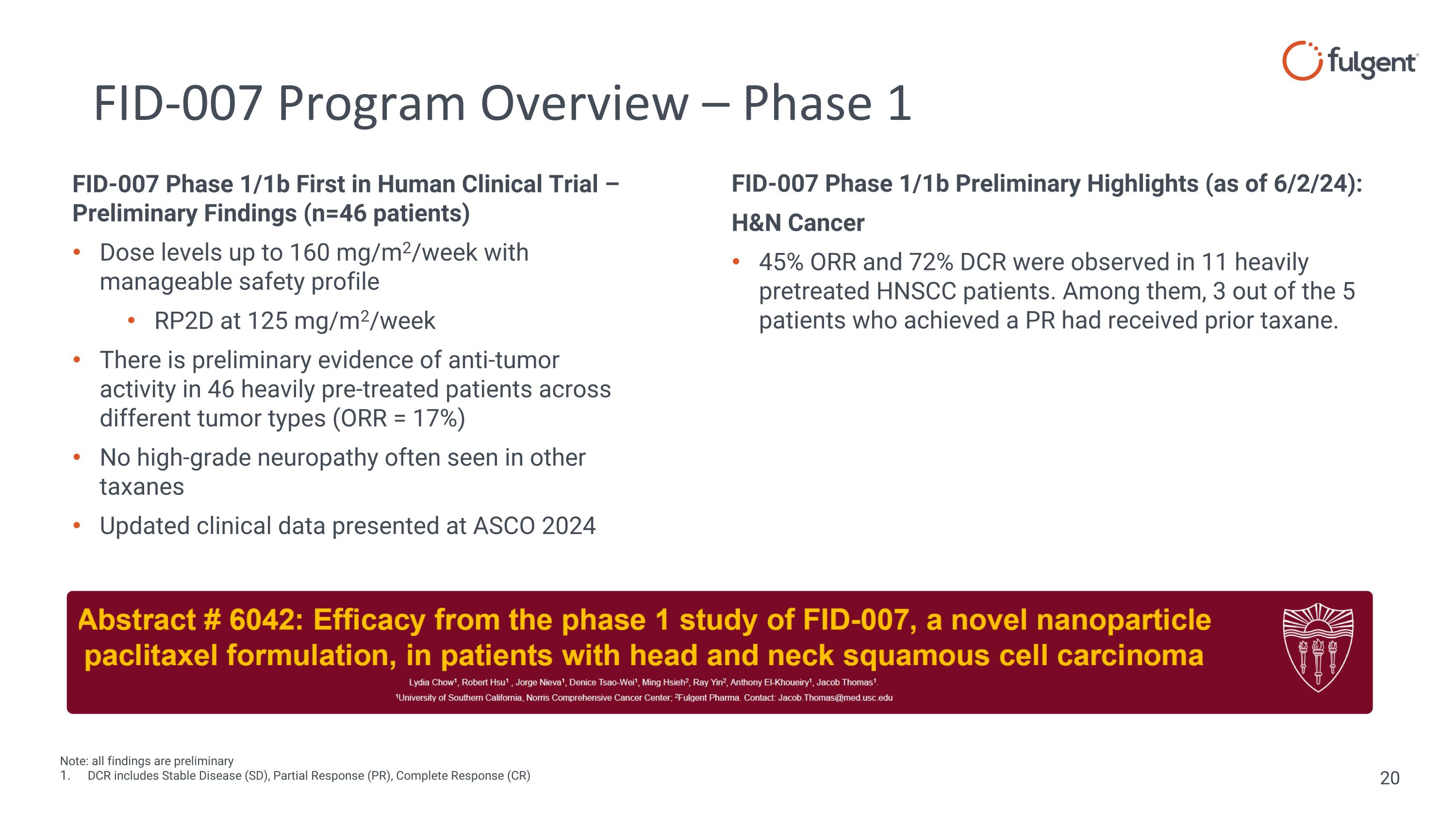

FID-007 Program Overview – Phase 1 Note: all findings are preliminary DCR includes Stable Disease (SD), Partial Response (PR), Complete Response (CR) FID-007 Phase 1/1b Preliminary Highlights (as of 6/2/24): H&N Cancer 45% ORR and 72% DCR were observed in 11 heavily pretreated HNSCC patients. Among them, 3 out of the 5 patients who achieved a PR had received prior taxane. FID-007 Phase 1/1b First in Human Clinical Trial – Preliminary Findings (n=46 patients) Dose levels up to 160 mg/m2/week with manageable safety profile RP2D at 125 mg/m2/week There is preliminary evidence of anti-tumor activity in 46 heavily pre-treated patients across different tumor types (ORR = 17%) No high-grade neuropathy often seen in other taxanes Updated clinical data presented at ASCO 2024

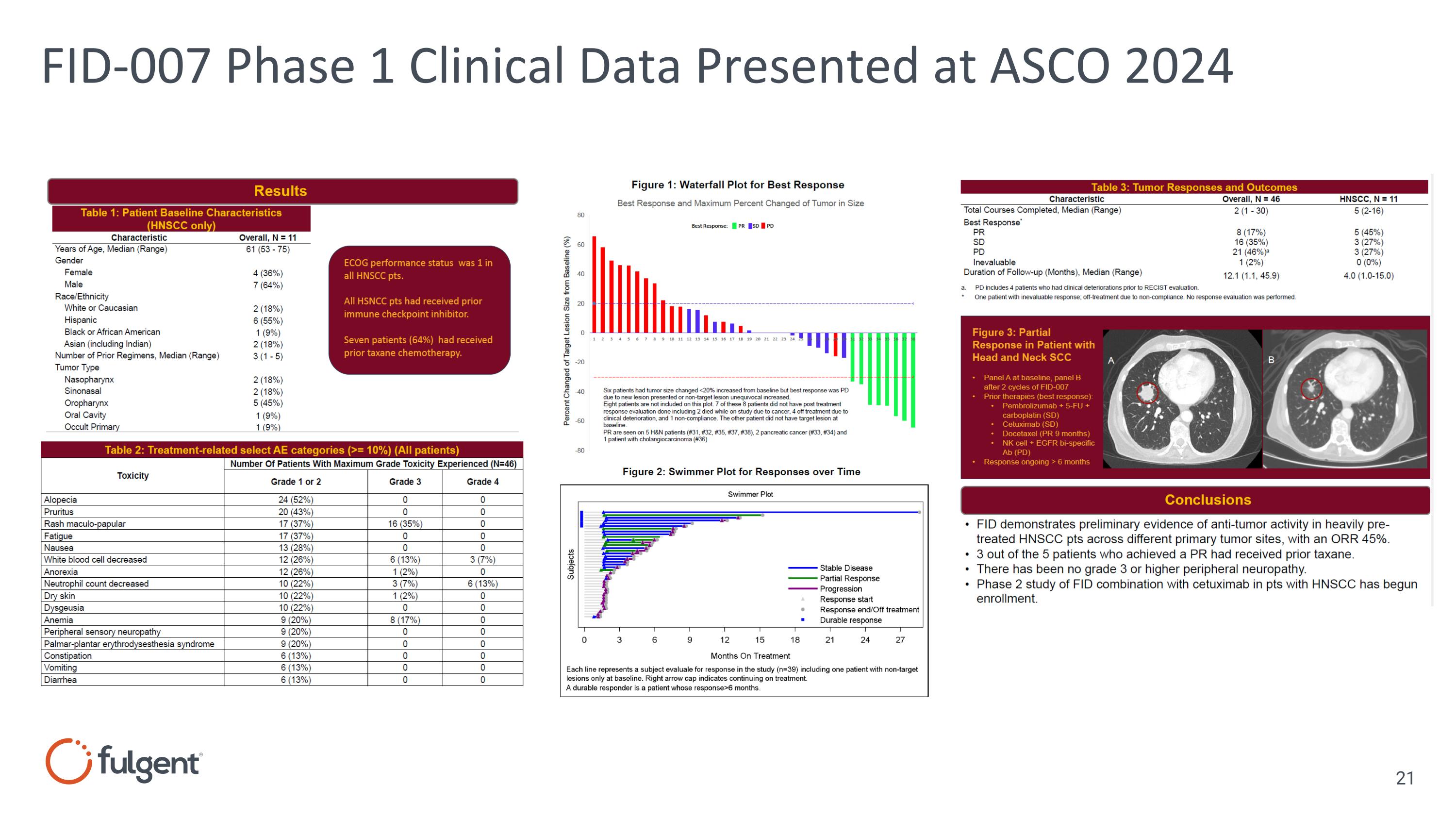

FID-007 Phase 1 Clinical Data Presented at ASCO 2024

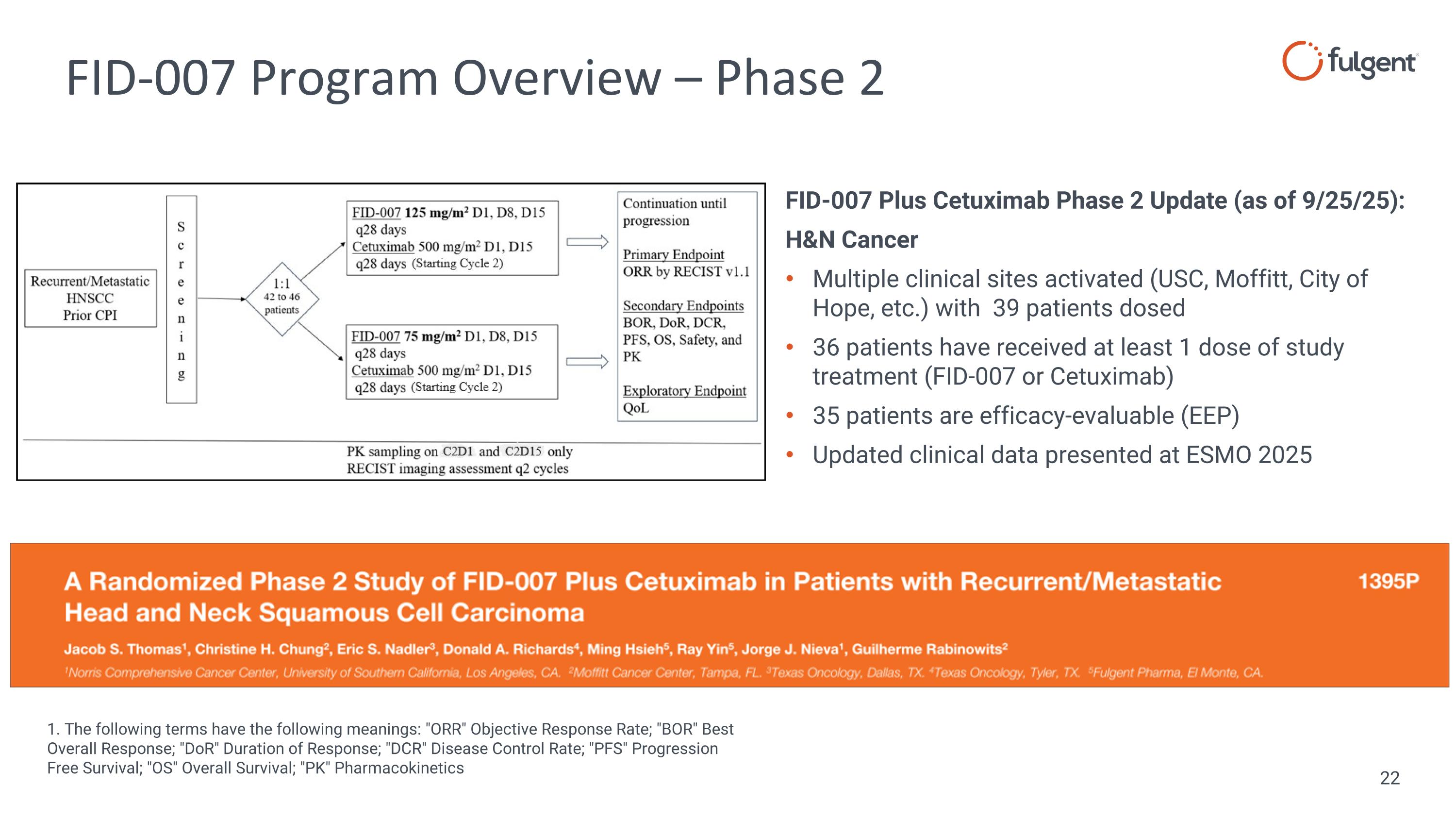

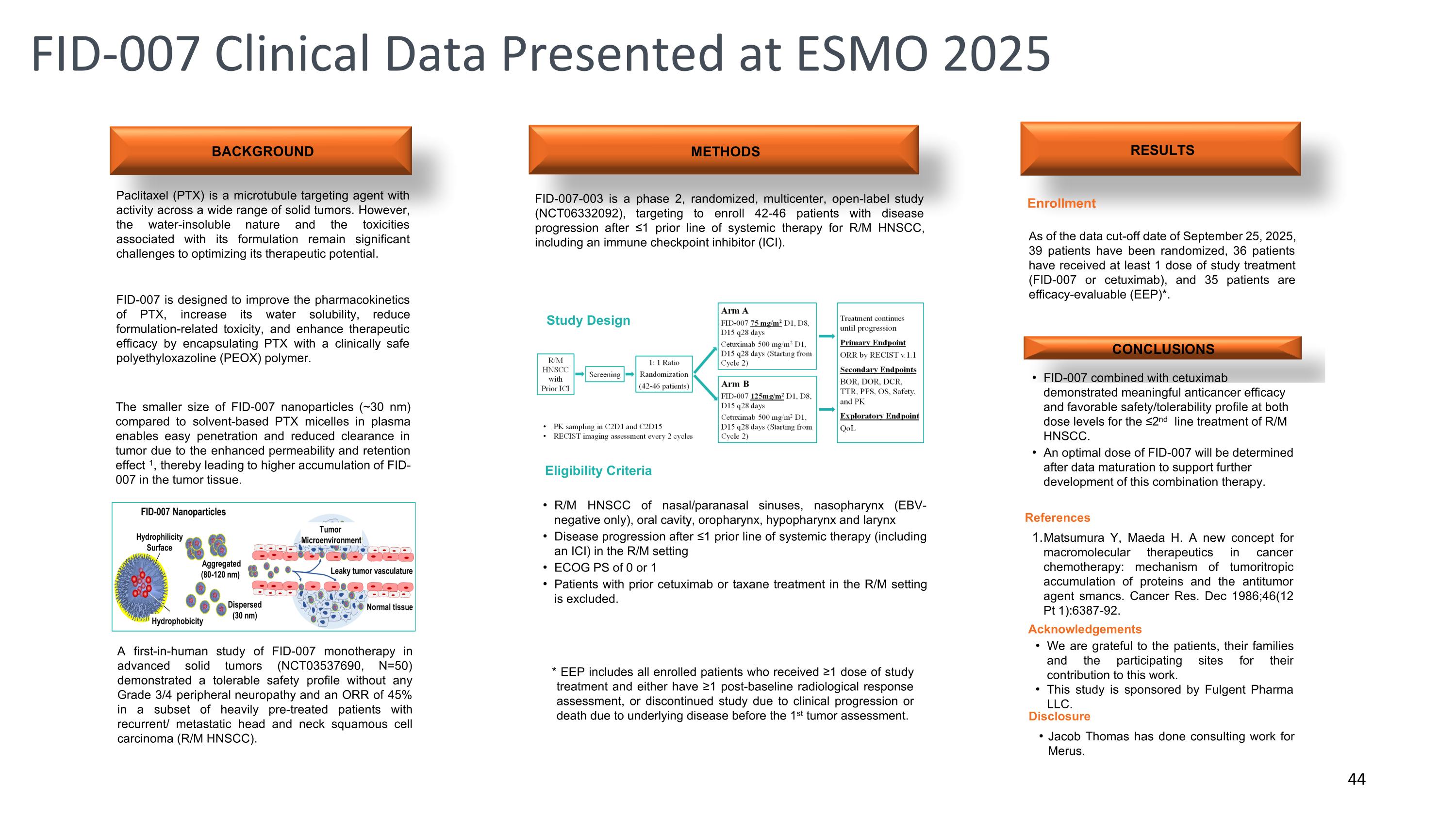

FID-007 Program Overview – Phase 2 FID-007 Plus Cetuximab Phase 2 Update (as of 9/25/25): H&N Cancer Multiple clinical sites activated (USC, Moffitt, City of Hope, etc.) with 39 patients dosed 36 patients have received at least 1 dose of study treatment (FID-007 or Cetuximab) 35 patients are efficacy-evaluable (EEP) Updated clinical data presented at ESMO 2025 1. The following terms have the following meanings: "ORR" Objective Response Rate; "BOR" Best Overall Response; "DoR" Duration of Response; "DCR" Disease Control Rate; "PFS" Progression Free Survival; "OS" Overall Survival; "PK" Pharmacokinetics

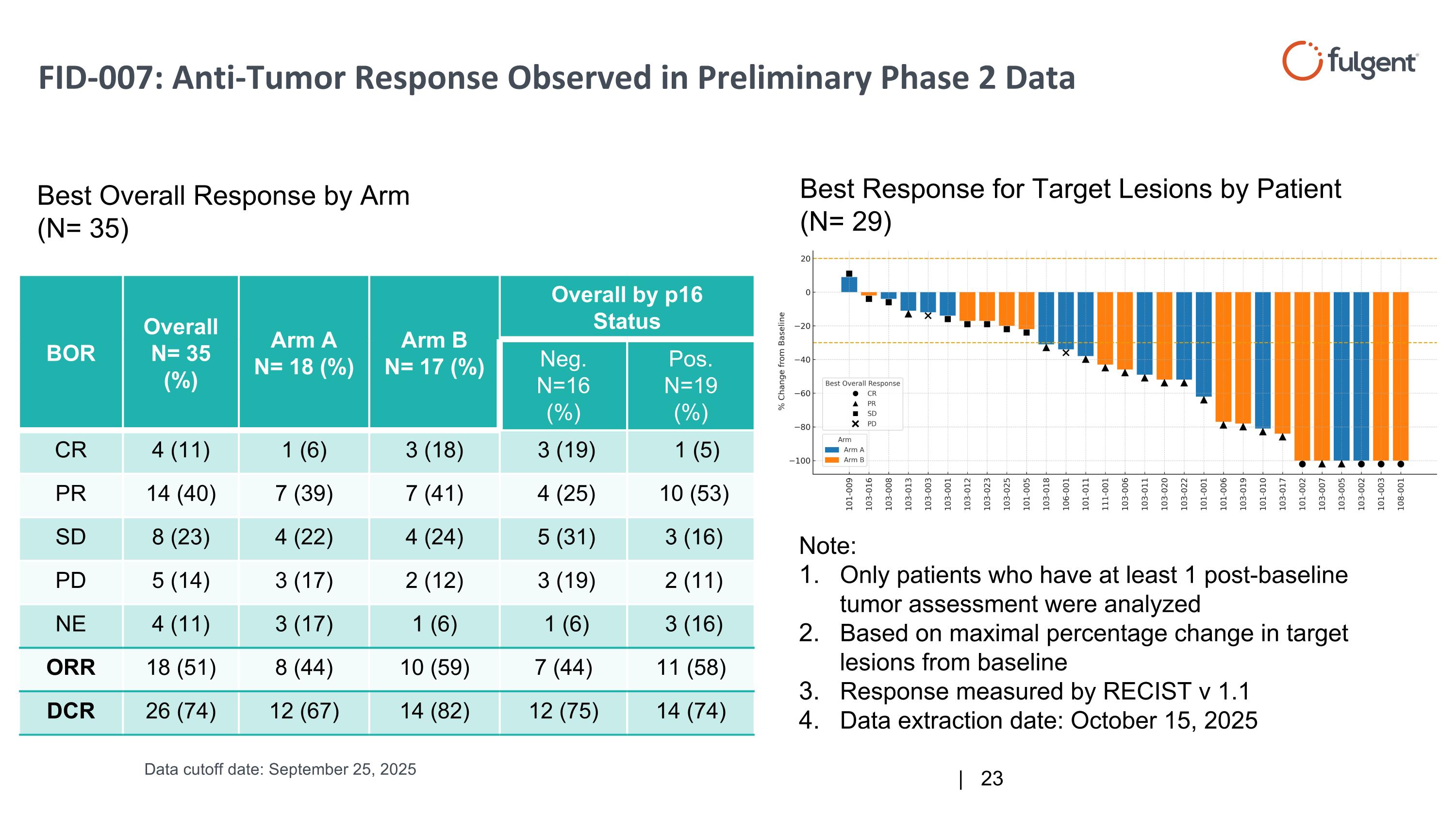

BOR Overall N= 35 (%) Arm A N= 18 (%) Arm B N= 17 (%) Overall by p16 Status Neg. N=16 (%) Pos. N=19 (%) CR 4 (11) 1 (6) 3 (18) 3 (19) 1 (5) PR 14 (40) 7 (39) 7 (41) 4 (25) 10 (53) SD 8 (23) 4 (22) 4 (24) 5 (31) 3 (16) PD 5 (14) 3 (17) 2 (12) 3 (19) 2 (11) NE 4 (11) 3 (17) 1 (6) 1 (6) 3 (16) ORR 18 (51) 8 (44) 10 (59) 7 (44) 11 (58) DCR 26 (74) 12 (67) 14 (82) 12 (75) 14 (74) Best Overall Response by Arm (N= 35) Best Response for Target Lesions by Patient (N= 29) Note: Only patients who have at least 1 post-baseline tumor assessment were analyzed Based on maximal percentage change in target lesions from baseline Response measured by RECIST v 1.1 Data extraction date: October 15, 2025 FID-007: Anti-Tumor Response Observed in Preliminary Phase 2 Data Data cutoff date: September 25, 2025

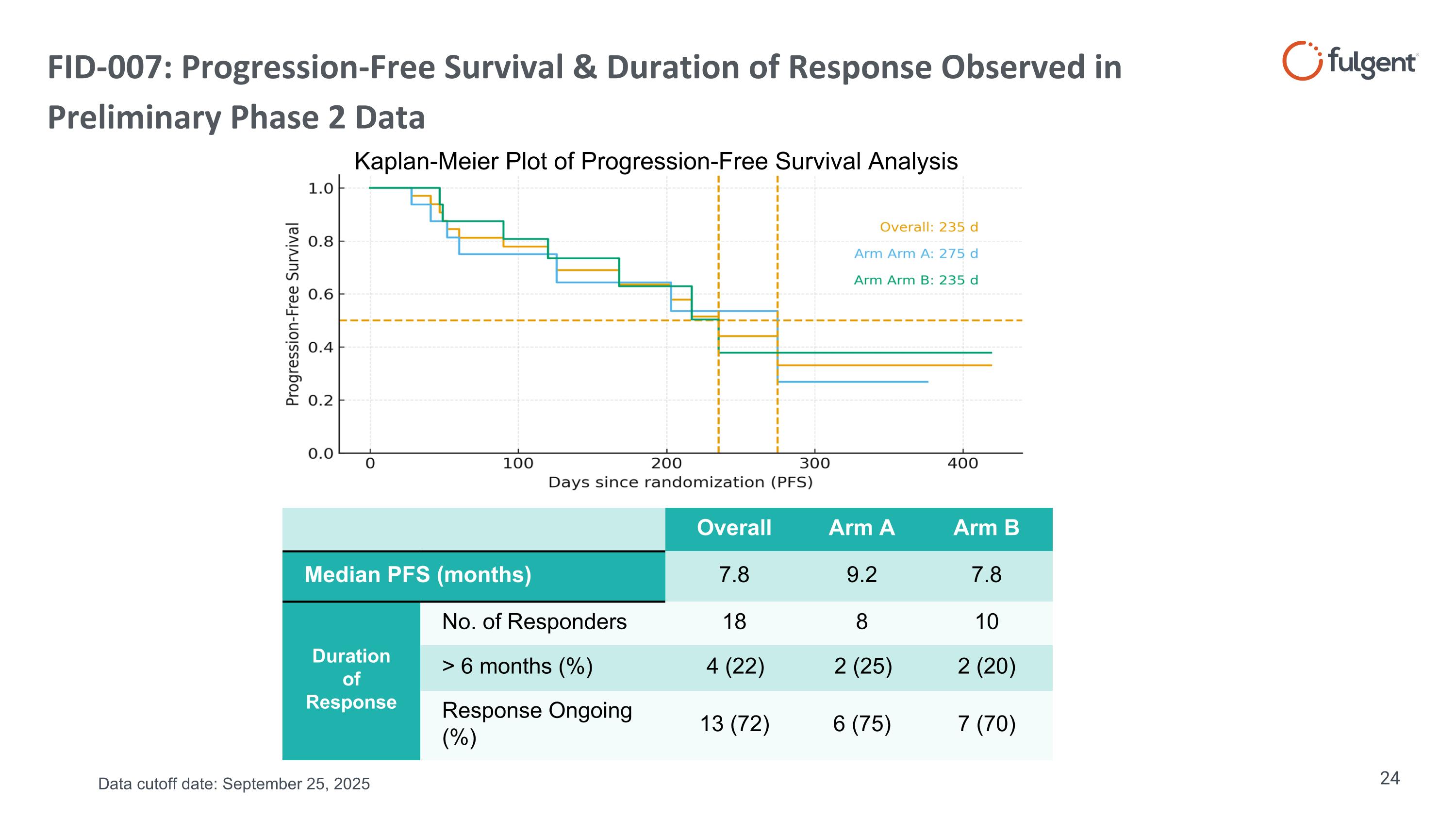

FID-007: Progression-Free Survival & Duration of Response Observed in Preliminary Phase 2 Data Overall Arm A Arm B Median PFS (months) 7.8 9.2 7.8 Duration of Response No. of Responders 18 8 10 > 6 months (%) 4 (22) 2 (25) 2 (20) Response Ongoing (%) 13 (72) 6 (75) 7 (70) Kaplan-Meier Plot of Progression-Free Survival Analysis Data cutoff date: September 25, 2025

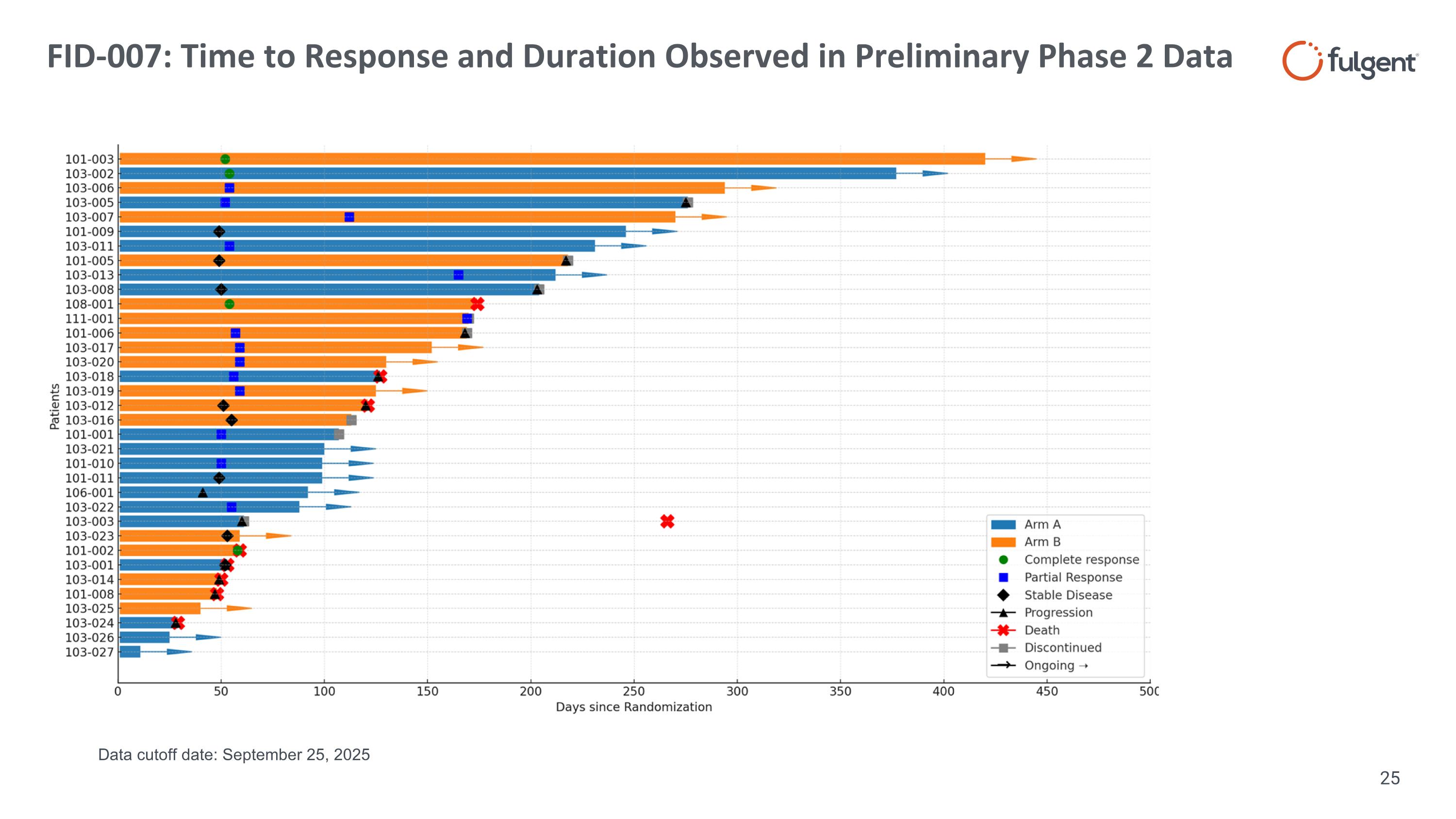

FID-007: Time to Response and Duration Observed in Preliminary Phase 2 Data Data cutoff date: September 25, 2025

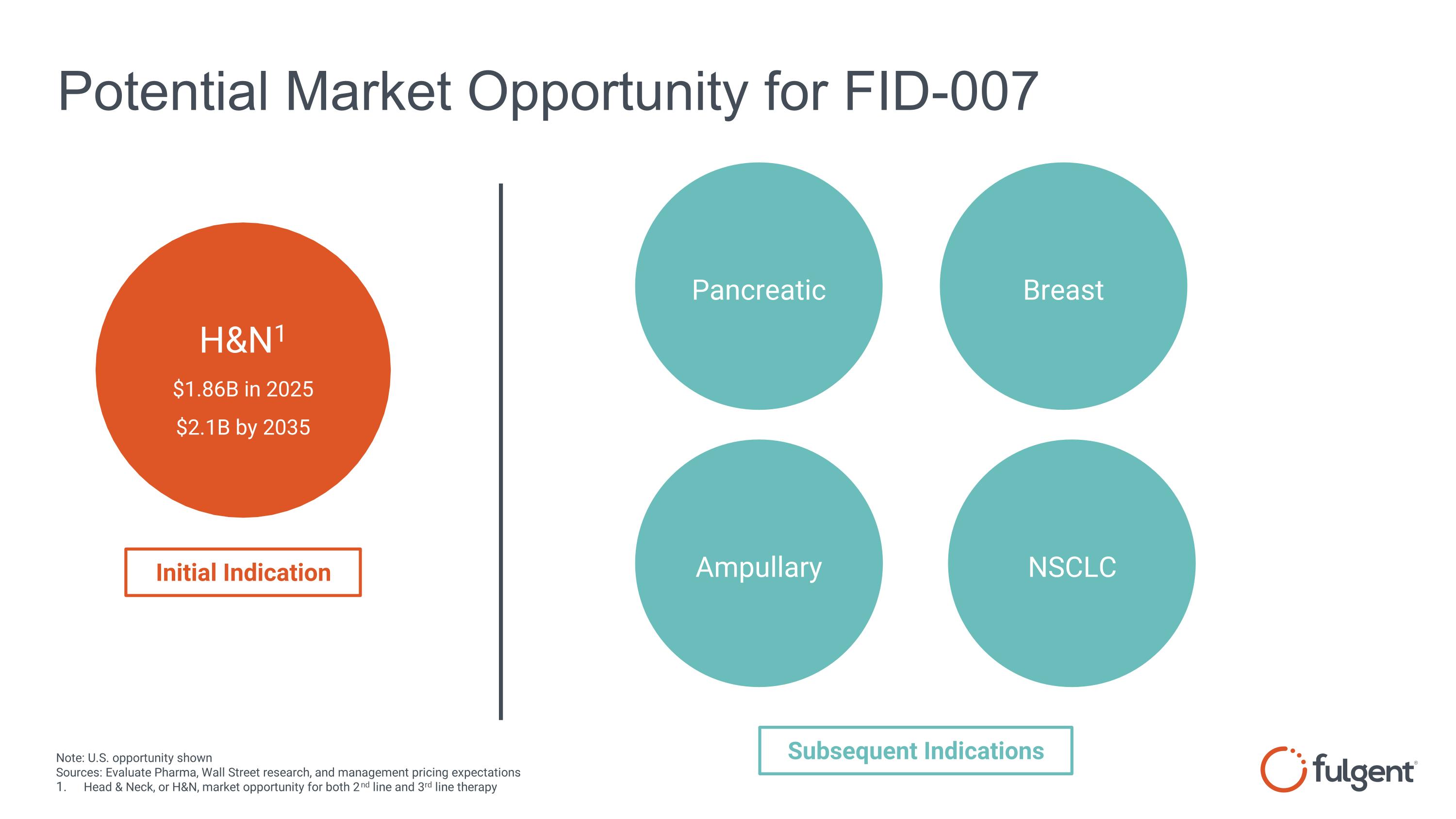

Potential Market Opportunity for FID-007 Pancreatic H&N1 $1.86B in 2025 $2.1B by 2035 Note: U.S. opportunity shown Sources: Evaluate Pharma, Wall Street research, and management pricing expectations Head & Neck, or H&N, market opportunity for both 2nd line and 3rd line therapy Initial Indication Subsequent Indications Breast Ampullary NSCLC

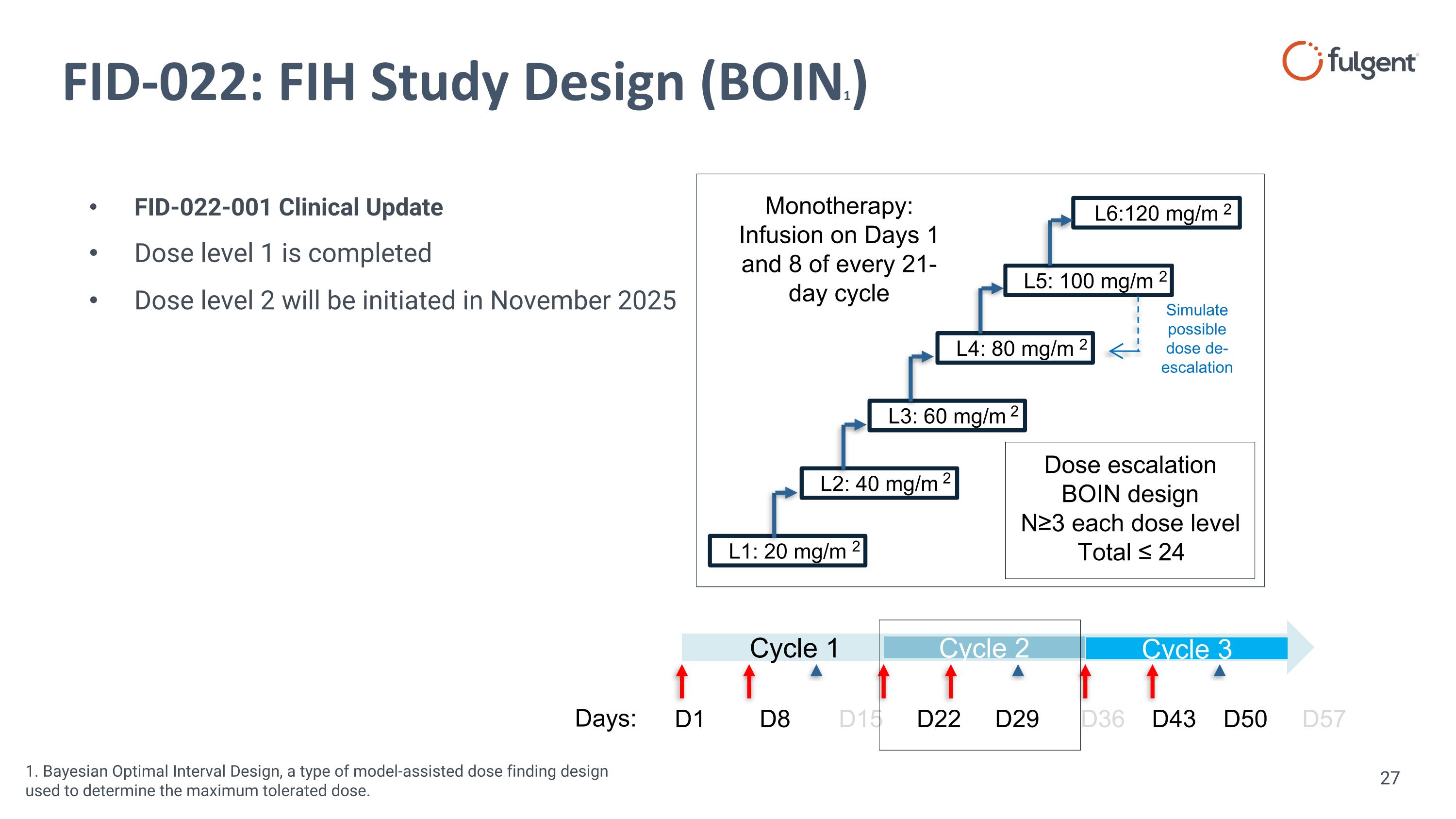

FID-022: FIH Study Design (BOIN1) L1: 20 mg/m L5: 100 mg/m L4: 80 mg/m L3: 60 mg/m L2: 40 mg/m L6:120 mg/m Dose escalation BOIN design N≥3 each dose level Total ≤ 24 Monotherapy: Infusion on Days 1 and 8 of every 21-day cycle Simulate possible dose de-escalation 2 2 2 2 2 2 Cycle 1 Cycle 2 D1 D8 D15 D22 D29 D36 D43 D50 D57 Cycle 3 FID-022-001 Clinical Update Dose level 1 is completed Dose level 2 will be initiated in November 2025 1. Bayesian Optimal Interval Design, a type of model-assisted dose finding design used to determine the maximum tolerated dose. Days:

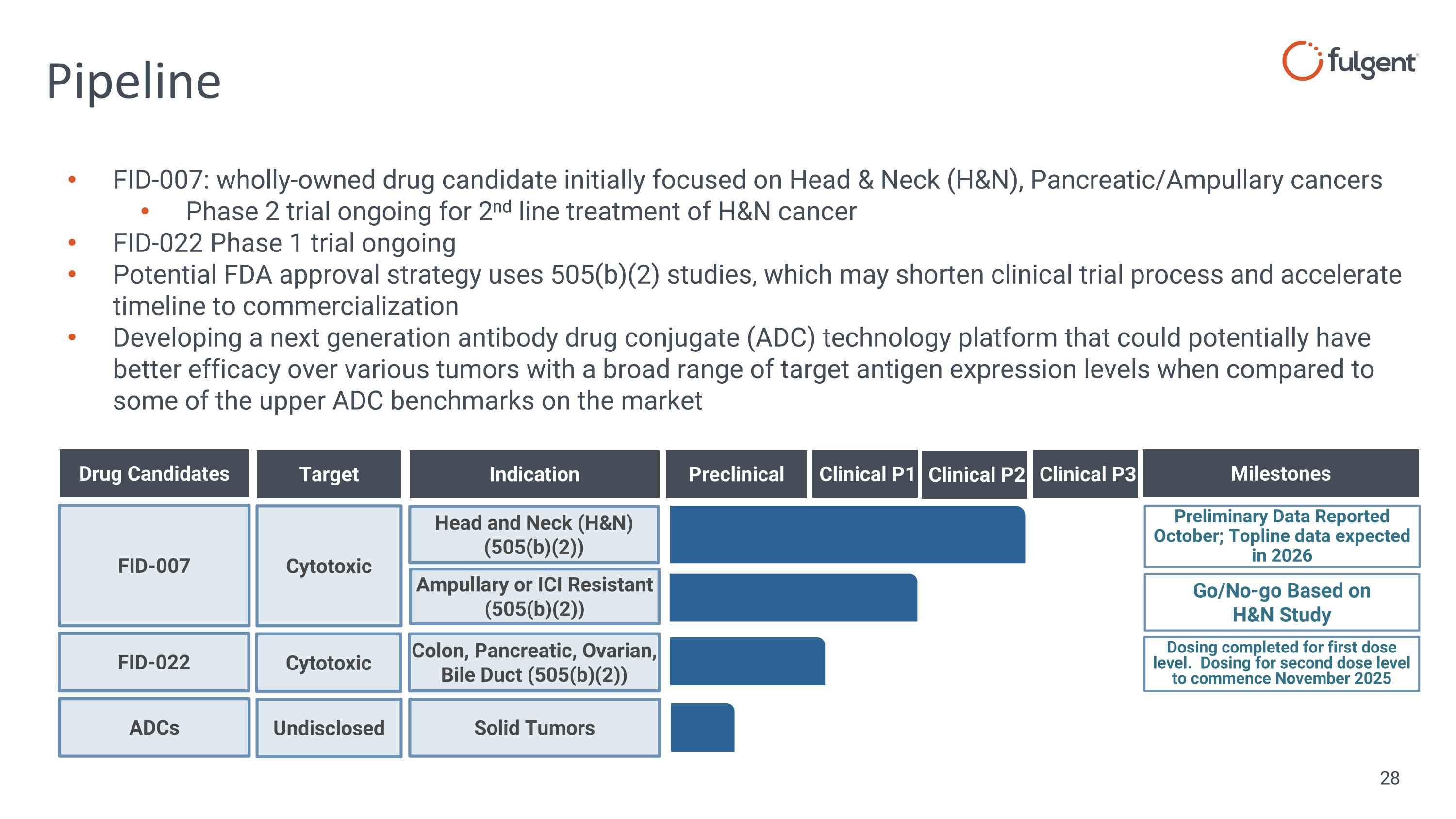

Pipeline FID-007: wholly-owned drug candidate initially focused on Head & Neck (H&N), Pancreatic/Ampullary cancers Phase 2 trial ongoing for 2nd line treatment of H&N cancer FID-022 Phase 1 trial ongoing Potential FDA approval strategy uses 505(b)(2) studies, which may shorten clinical trial process and accelerate timeline to commercialization Developing a next generation antibody drug conjugate (ADC) technology platform that could potentially have better efficacy over various tumors with a broad range of target antigen expression levels when compared to some of the upper ADC benchmarks on the market FID-007 Drug Candidates Preclinical Target Indication Milestones Cytotoxic Head and Neck (H&N) (505(b)(2)) Preliminary Data Reported October; Topline data expected in 2026 Ampullary or ICI Resistant (505(b)(2)) Go/No-go Based on H&N Study Clinical P1 Clinical P2 Clinical P3 FID-022 Cytotoxic Colon, Pancreatic, Ovarian, Bile Duct (505(b)(2)) Dosing completed for first dose level. Dosing for second dose level to commence November 2025 ADCs Undisclosed Solid Tumors

Financials

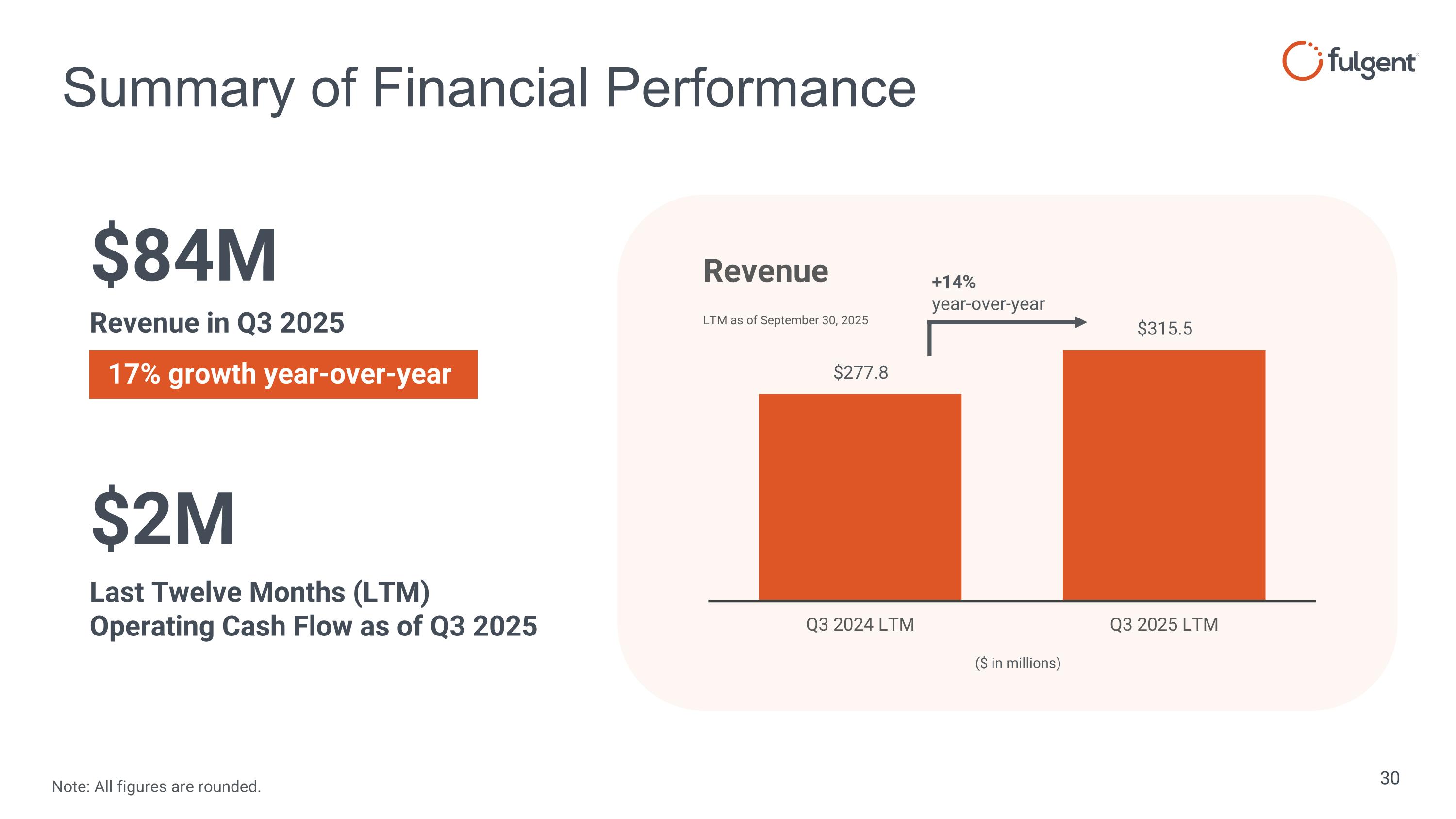

Summary of Financial Performance $84M Revenue in Q3 2025 $2M Last Twelve Months (LTM) Operating Cash Flow as of Q3 2025 +14% year-over-year ($ in millions) 17% growth year-over-year Note: All figures are rounded.

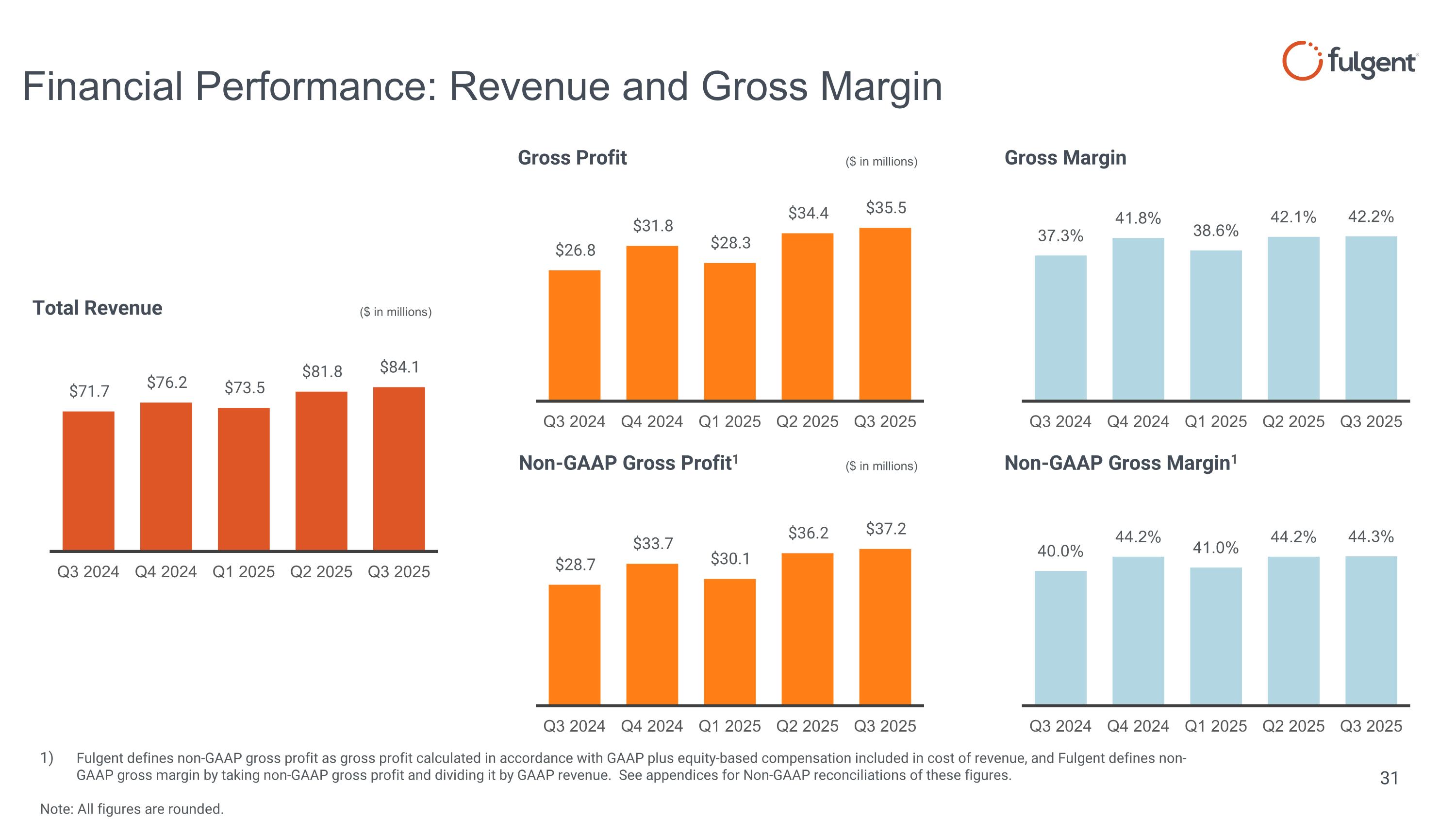

($ in millions) ($ in millions) ($ in millions) Fulgent defines non-GAAP gross profit as gross profit calculated in accordance with GAAP plus equity-based compensation included in cost of revenue, and Fulgent defines non-GAAP gross margin by taking non-GAAP gross profit and dividing it by GAAP revenue. See appendices for Non-GAAP reconciliations of these figures. Note: All figures are rounded. Financial Performance: Revenue and Gross Margin

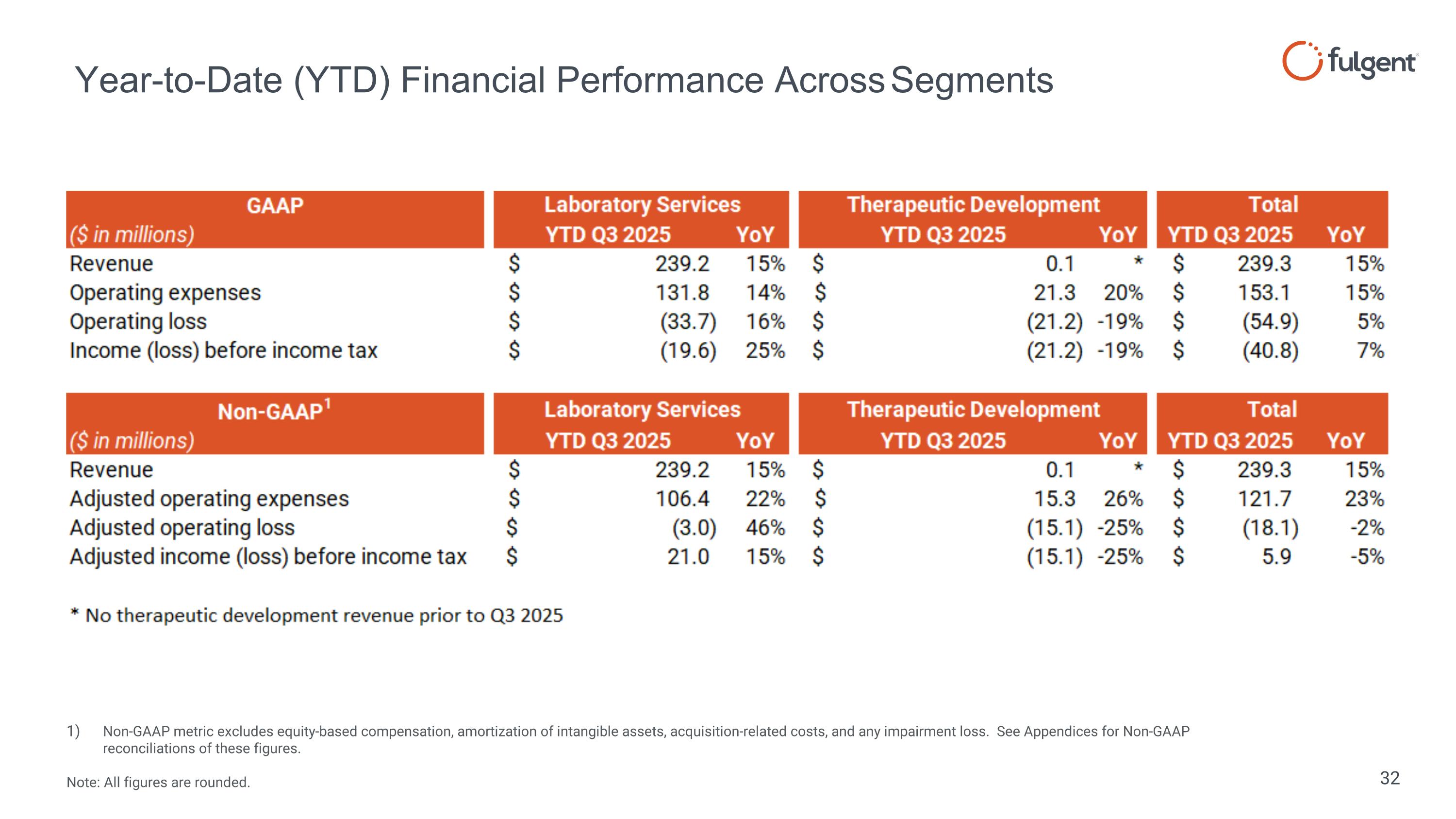

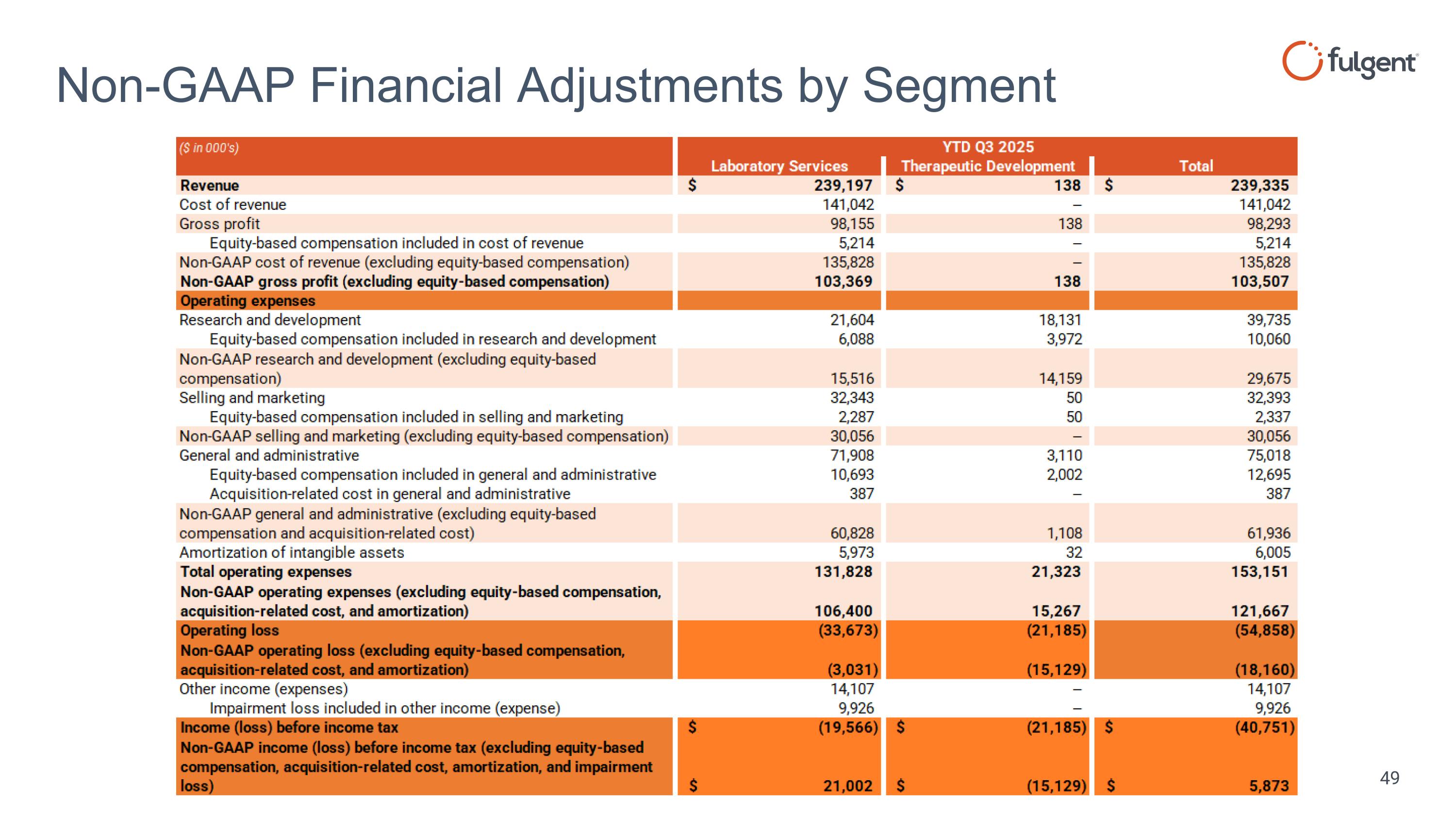

Year-to-Date (YTD) Financial Performance Across Segments Non-GAAP metric excludes equity-based compensation, amortization of intangible assets, acquisition-related costs, and any impairment loss. See Appendices for Non-GAAP reconciliations of these figures. Note: All figures are rounded.

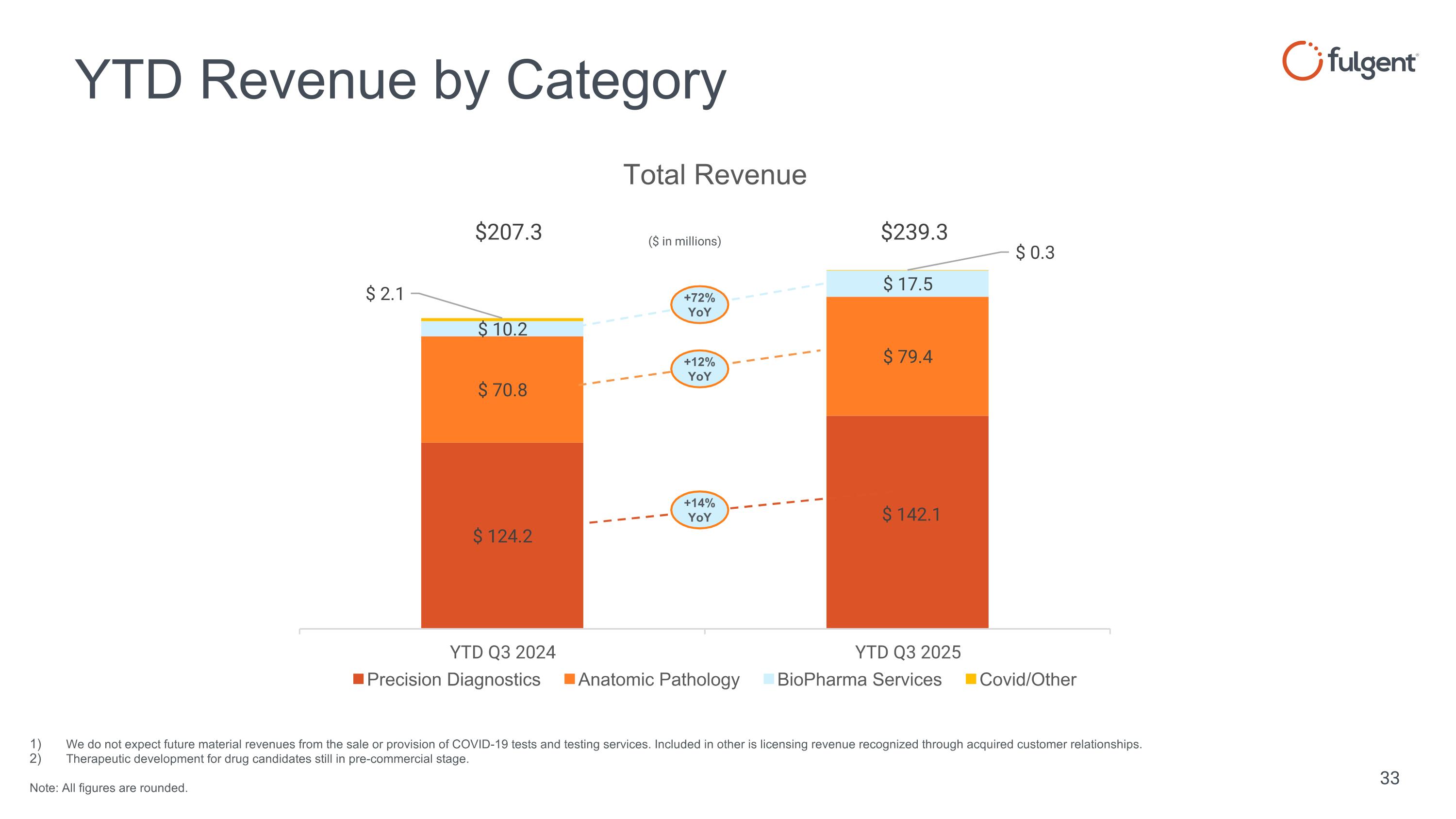

YTD Revenue by Category We do not expect future material revenues from the sale or provision of COVID-19 tests and testing services. Included in other is licensing revenue recognized through acquired customer relationships. Therapeutic development for drug candidates still in pre-commercial stage. Note: All figures are rounded. ($ in millions) +14% YoY +72% YoY +12% YoY $207.3 $239.3

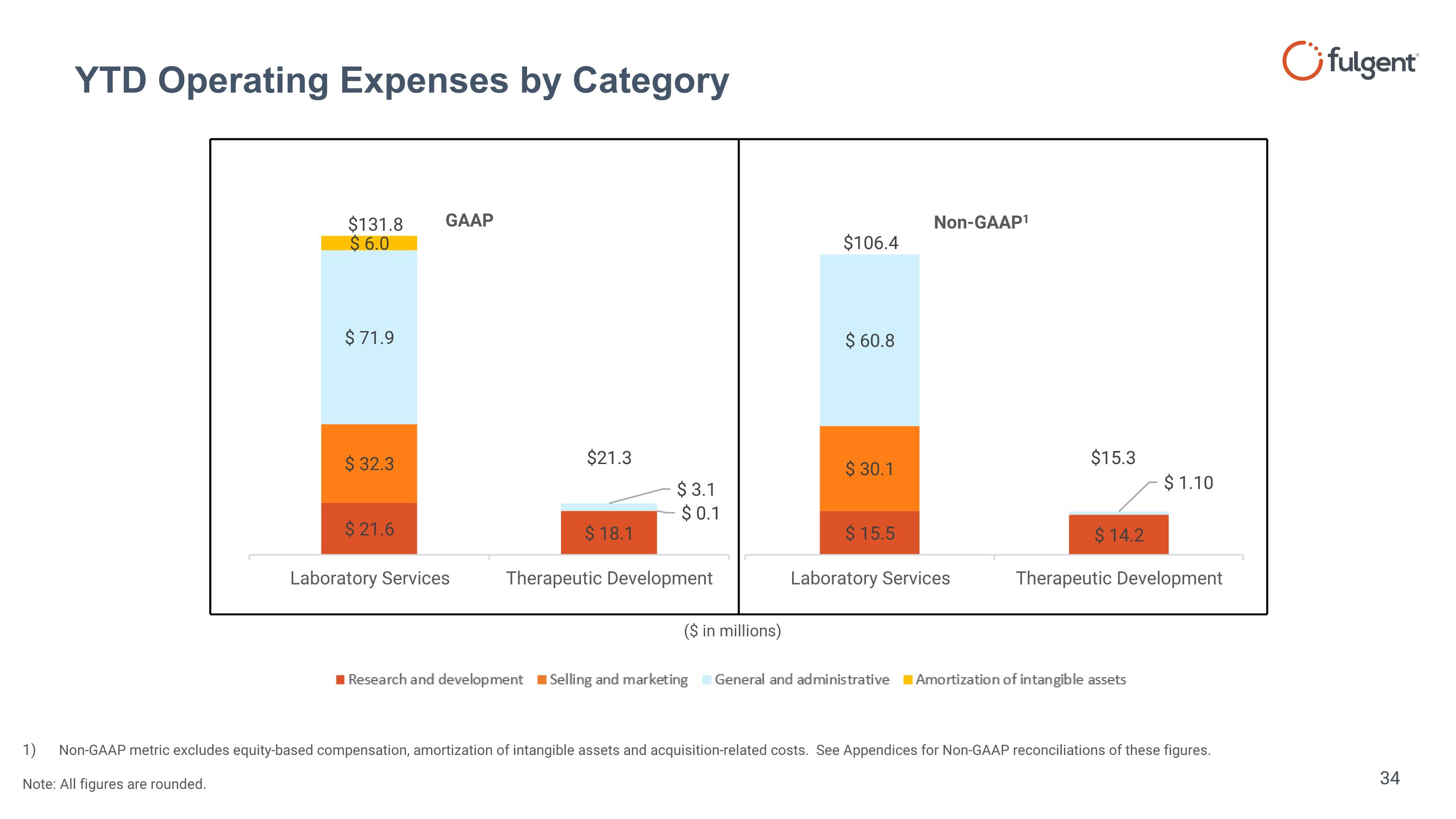

YTD Operating Expenses by Category Non-GAAP metric excludes equity-based compensation, amortization of intangible assets and acquisition-related costs. See Appendices for Non-GAAP reconciliations of these figures. Note: All figures are rounded. ($ in millions) $15.3 $131.8 $21.3 $106.4

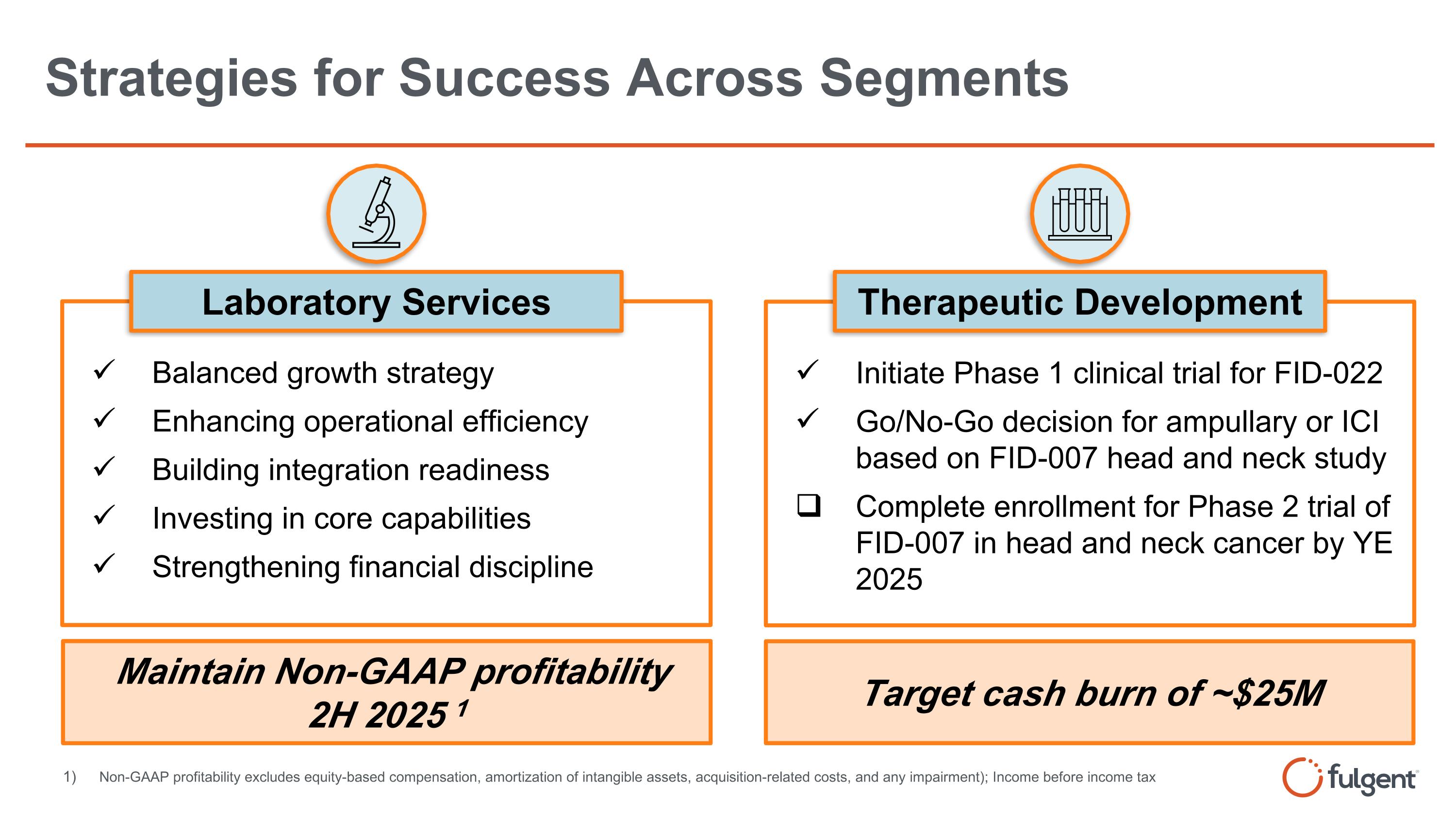

Strategies for Success Across Segments Balanced growth strategy Enhancing operational efficiency Building integration readiness Investing in core capabilities Strengthening financial discipline Maintain Non-GAAP profitability 2H 2025 1 Laboratory Services Initiate Phase 1 clinical trial for FID-022 Go/No-Go decision for ampullary or ICI based on FID-007 head and neck study Complete enrollment for Phase 2 trial of FID-007 in head and neck cancer by YE 2025 Therapeutic Development Target cash burn of ~$25M Non-GAAP profitability excludes equity-based compensation, amortization of intangible assets, acquisition-related costs, and any impairment); Income before income tax

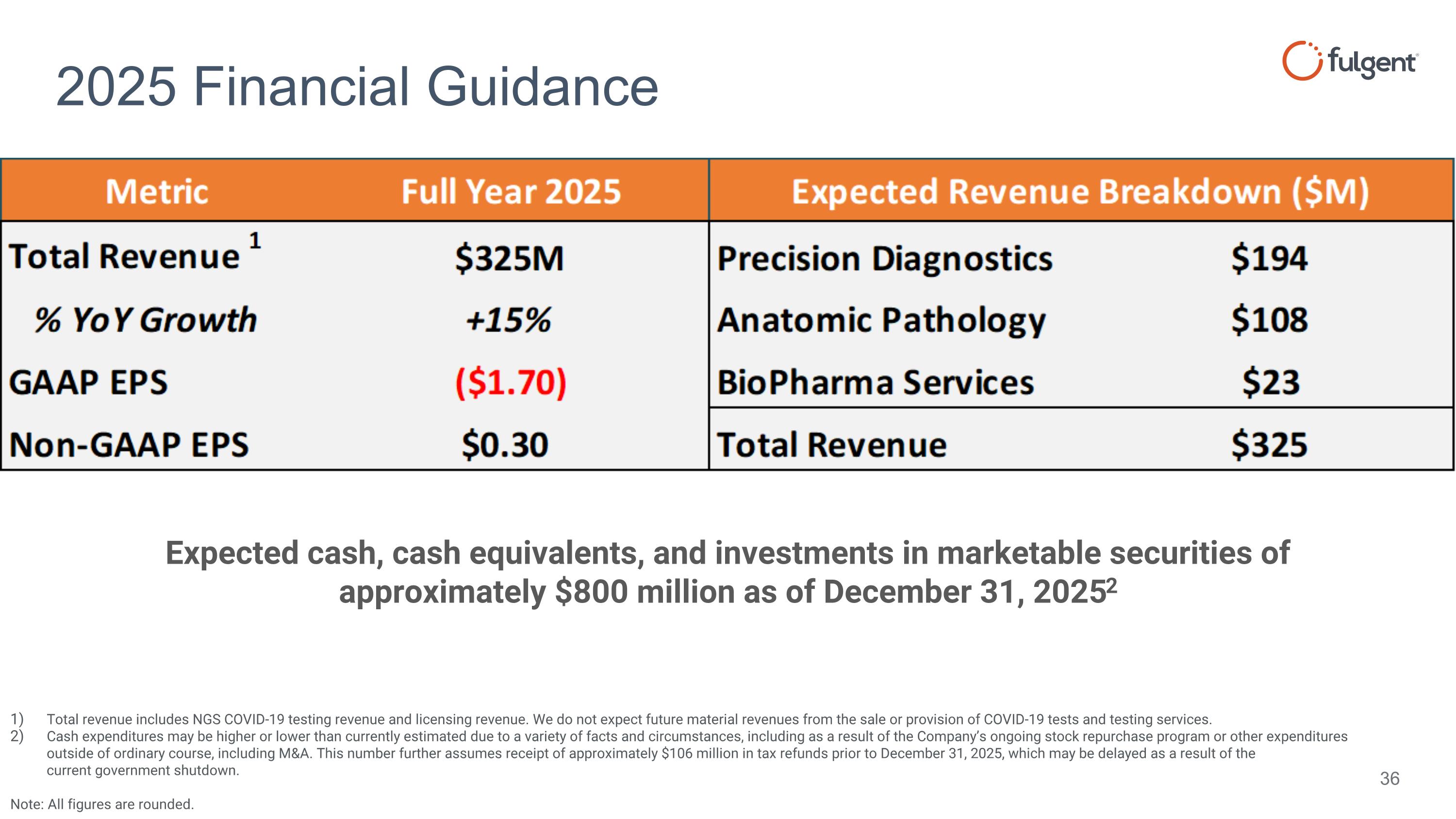

2025 Financial Guidance Expected cash, cash equivalents, and investments in marketable securities of approximately $800 million as of December 31, 20252 Total revenue includes NGS COVID-19 testing revenue and licensing revenue. We do not expect future material revenues from the sale or provision of COVID-19 tests and testing services. Cash expenditures may be higher or lower than currently estimated due to a variety of facts and circumstances, including as a result of the Company’s ongoing stock repurchase program or other expenditures outside of ordinary course, including M&A. This number further assumes receipt of approximately $106 million in tax refunds prior to December 31, 2025, which may be delayed as a result of the current government shutdown. Note: All figures are rounded.

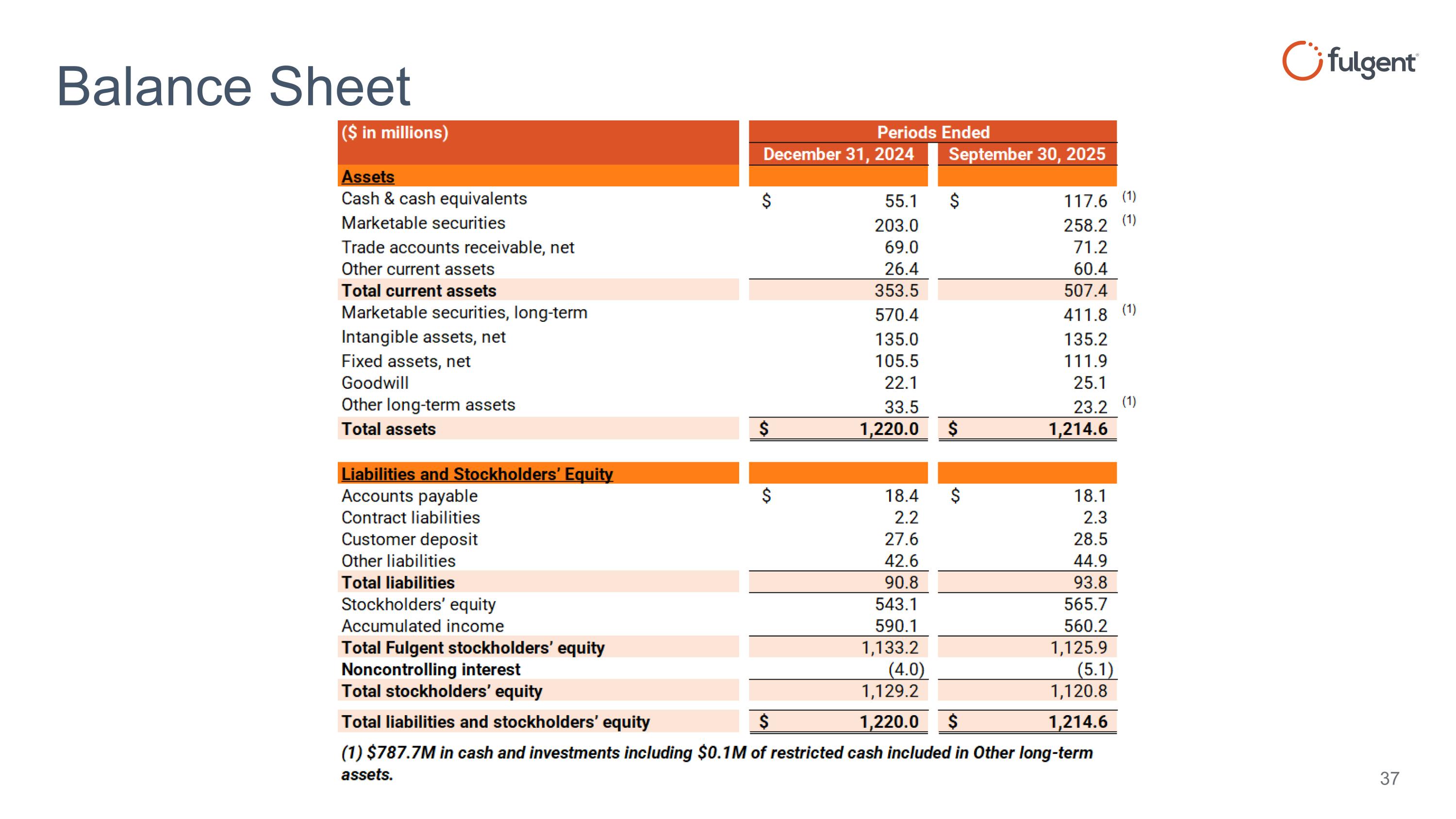

Balance Sheet

Appendix

Prenatal Screening for Genetic Conditions

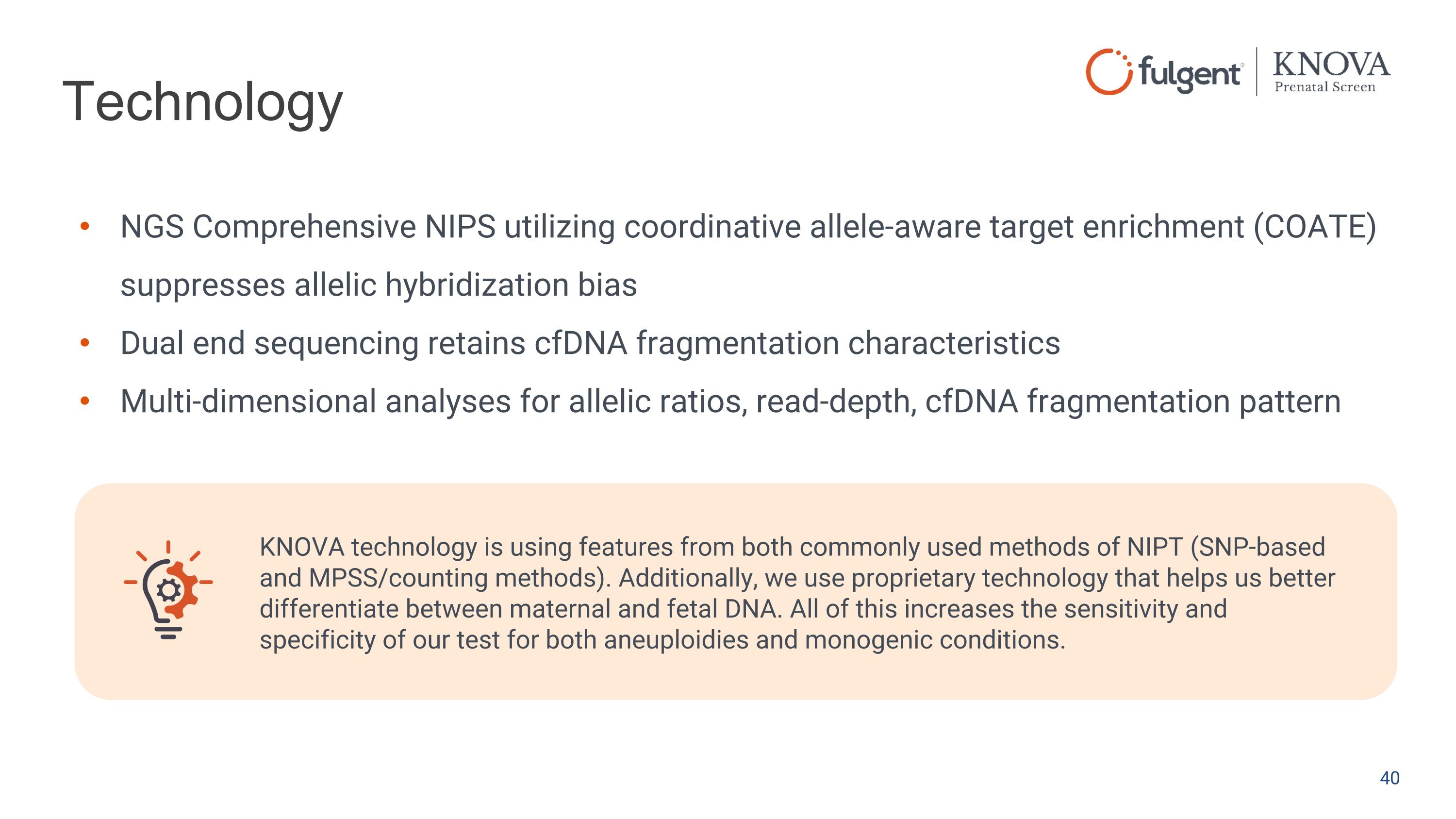

Technology NGS Comprehensive NIPS utilizing coordinative allele-aware target enrichment (COATE) suppresses allelic hybridization bias Dual end sequencing retains cfDNA fragmentation characteristics Multi-dimensional analyses for allelic ratios, read-depth, cfDNA fragmentation pattern KNOVA technology is using features from both commonly used methods of NIPT (SNP-based and MPSS/counting methods). Additionally, we use proprietary technology that helps us better differentiate between maternal and fetal DNA. All of this increases the sensitivity and specificity of our test for both aneuploidies and monogenic conditions.

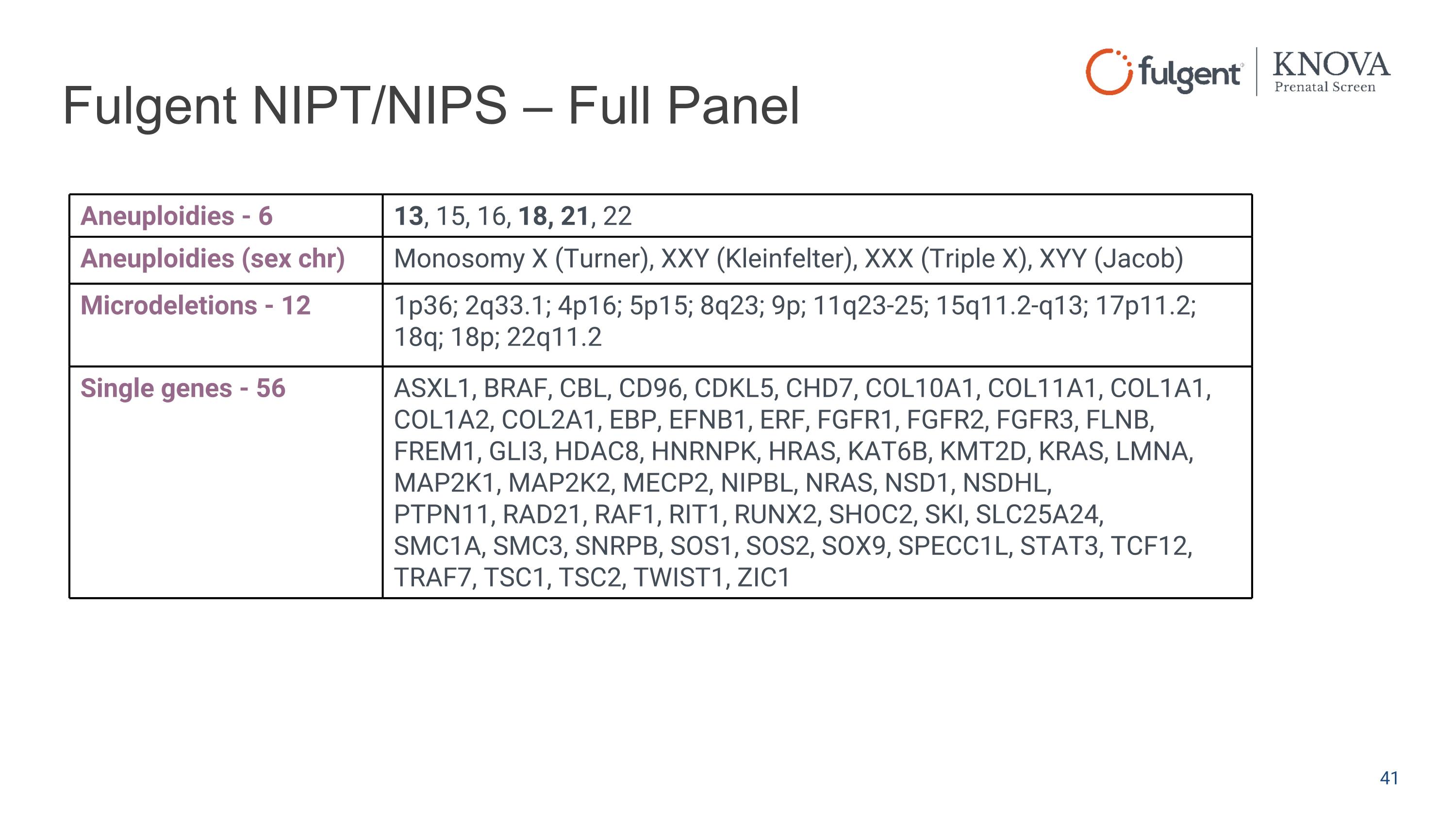

Fulgent NIPT/NIPS – Full Panel Aneuploidies - 6 13, 15, 16, 18, 21, 22 Aneuploidies (sex chr) Monosomy X (Turner), XXY (Kleinfelter), XXX (Triple X), XYY (Jacob) Microdeletions - 12 1p36; 2q33.1; 4p16; 5p15; 8q23; 9p; 11q23-25; 15q11.2-q13; 17p11.2; 18q; 18p; 22q11.2 Single genes - 56 ASXL1, BRAF, CBL, CD96, CDKL5, CHD7, COL10A1, COL11A1, COL1A1, COL1A2, COL2A1, EBP, EFNB1, ERF, FGFR1, FGFR2, FGFR3, FLNB, FREM1, GLI3, HDAC8, HNRNPK, HRAS, KAT6B, KMT2D, KRAS, LMNA, MAP2K1, MAP2K2, MECP2, NIPBL, NRAS, NSD1, NSDHL, PTPN11, RAD21, RAF1, RIT1, RUNX2, SHOC2, SKI, SLC25A24, SMC1A, SMC3, SNRPB, SOS1, SOS2, SOX9, SPECC1L, STAT3, TCF12, TRAF7, TSC1, TSC2, TWIST1, ZIC1

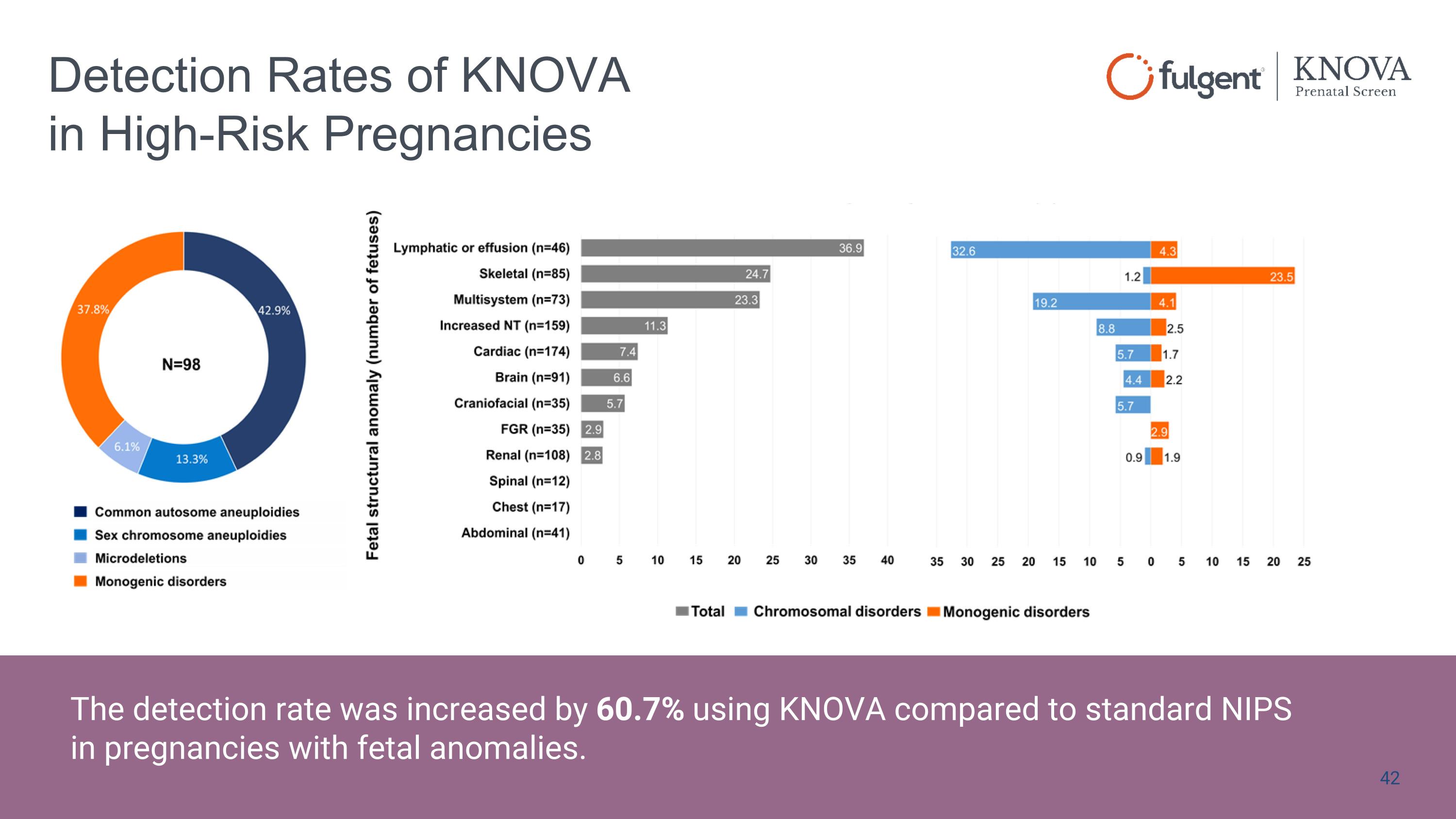

Detection Rates of KNOVA in High-Risk Pregnancies Aneuploidies - 6 13, 15, 16, 18, 21, 22 Aneuploidies (sex chr) Monosomy X (Turner), XXY (Kleinfelter), XXX (Triple X), XYY (Jacob) Microdeletions - 12 1p36; 2q33.1; 4p16; 5p15; 8q23; 9p; 11q23-25; 15q11.2-q13; 17p11.2; 18q; 18p; 22q11.2 Single genes - 56 ASXL1, BRAF, CBL, CD96, CDKL5, CHD7, COL10A1, COL11A1, COL1A1, COL1A2, COL2A1, EBP, EFNB1, ERF, FGFR1, FGFR2, FGFR3, FLNB, FREM1, GLI3, HDAC8, HNRNPK, HRAS, KAT6B, KMT2D, KRAS, LMNA, MAP2K1, MAP2K2, MECP2, NIPBL, NRAS, NSD1, NSDHL, PTPN11, RAD21, RAF1, RIT1, RUNX2, SHOC2, SKI, SLC25A24, SMC1A, SMC3, SNRPB, SOS1, SOS2, SOX9, SPECC1L, STAT3, TCF12, TRAF7, TSC1, TSC2, TWIST1, ZIC1 The detection rate was increased by 60.7% using KNOVA compared to standard NIPS in pregnancies with fetal anomalies.

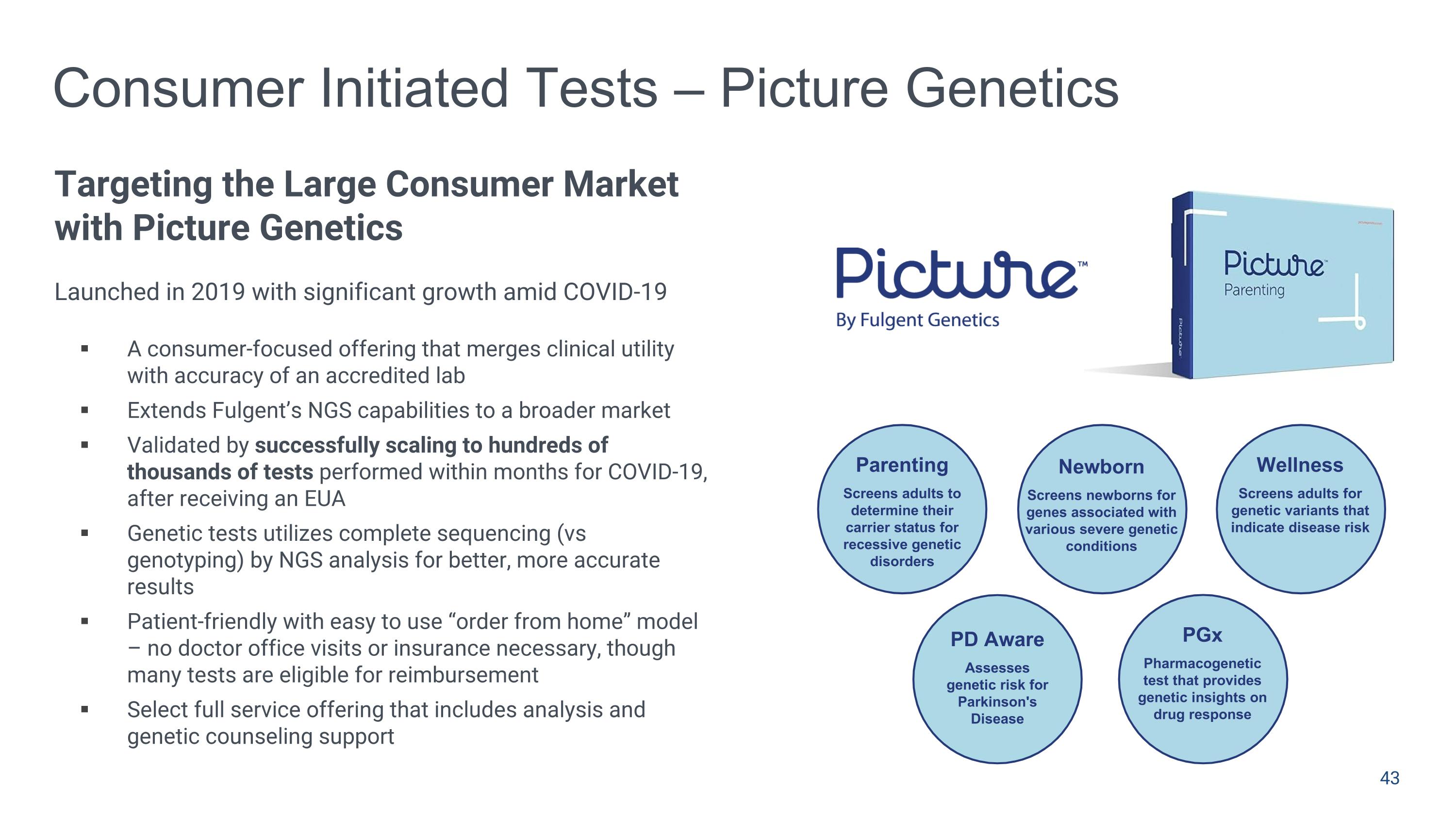

Parenting Screens adults to determine their carrier status for recessive genetic disorders Newborn Screens newborns for genes associated with various severe genetic conditions Wellness Screens adults for genetic variants that indicate disease risk PD Aware Assesses genetic risk for Parkinson's Disease Consumer Initiated Tests – Picture Genetics Targeting the Large Consumer Market with Picture Genetics Launched in 2019 with significant growth amid COVID-19 A consumer-focused offering that merges clinical utility with accuracy of an accredited lab Extends Fulgent’s NGS capabilities to a broader market Validated by successfully scaling to hundreds of thousands of tests performed within months for COVID-19, after receiving an EUA Genetic tests utilizes complete sequencing (vs genotyping) by NGS analysis for better, more accurate results Patient-friendly with easy to use “order from home” model – no doctor office visits or insurance necessary, though many tests are eligible for reimbursement Select full service offering that includes analysis and genetic counseling support PGx Pharmacogenetic test that provides genetic insights on drug response

BACKGROUND RESULTS Paclitaxel (PTX) is a microtubule targeting agent with activity across a wide range of solid tumors. However, the water-insoluble nature and the toxicities associated with its formulation remain significant challenges to optimizing its therapeutic potential. METHODS FID-007-003 is a phase 2, randomized, multicenter, open-label study (NCT06332092), targeting to enroll 42-46 patients with disease progression after ≤1 prior line of systemic therapy for R/M HNSCC, including an immune checkpoint inhibitor (ICI). CONCLUSIONS FID-007 combined with cetuximab demonstrated meaningful anticancer efficacy and favorable safety/tolerability profile at both dose levels for the ≤2nd line treatment of R/M HNSCC. An optimal dose of FID-007 will be determined after data maturation to support further development of this combination therapy. Acknowledgements We are grateful to the patients, their families and the participating sites for their contribution to this work. This study is sponsored by Fulgent Pharma LLC. R/M HNSCC of nasal/paranasal sinuses, nasopharynx (EBV- negative only), oral cavity, oropharynx, hypopharynx and larynx Disease progression after ≤1 prior line of systemic therapy (including an ICI) in the R/M setting ECOG PS of 0 or 1 Patients with prior cetuximab or taxane treatment in the R/M setting is excluded. Study Design Disclosure Jacob Thomas has done consulting work for Merus. As of the data cut-off date of September 25, 2025, 39 patients have been randomized, 36 patients have received at least 1 dose of study treatment (FID-007 or cetuximab), and 35 patients are efficacy-evaluable (EEP)*. * EEP includes all enrolled patients who received ≥1 dose of study treatment and either have ≥1 post-baseline radiological response assessment, or discontinued study due to clinical progression or death due to underlying disease before the 1st tumor assessment. Enrollment Eligibility Criteria References Matsumura Y, Maeda H. A new concept for macromolecular therapeutics in cancer chemotherapy: mechanism of tumoritropic accumulation of proteins and the antitumor agent smancs. Cancer Res. Dec 1986;46(12 Pt 1):6387-92. A first-in-human study of FID-007 monotherapy in advanced solid tumors (NCT03537690, N=50) demonstrated a tolerable safety profile without any Grade 3/4 peripheral neuropathy and an ORR of 45% in a subset of heavily pre-treated patients with recurrent/ metastatic head and neck squamous cell carcinoma (R/M HNSCC). The smaller size of FID-007 nanoparticles (~30 nm) compared to solvent-based PTX micelles in plasma enables easy penetration and reduced clearance in tumor due to the enhanced permeability and retention effect 1, thereby leading to higher accumulation of FID-007 in the tumor tissue. FID-007 is designed to improve the pharmacokinetics of PTX, increase its water solubility, reduce formulation-related toxicity, and enhance therapeutic efficacy by encapsulating PTX with a clinically safe polyethyloxazoline (PEOX) polymer. FID-007 Clinical Data Presented at ESMO 2025 44

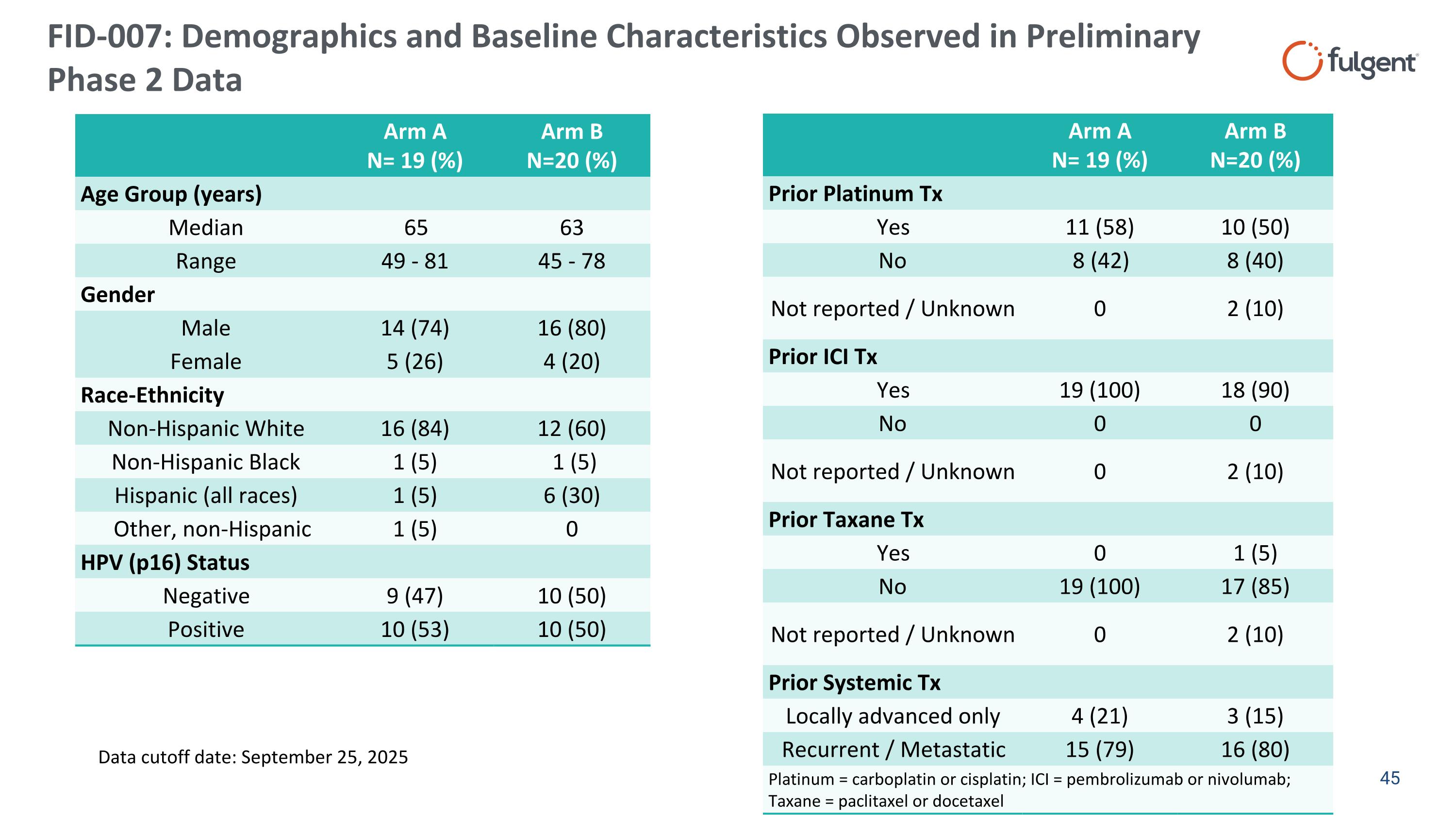

FID-007: Demographics and Baseline Characteristics Observed in Preliminary Phase 2 Data Arm A N= 19 (%) Arm B N=20 (%) Age Group (years) Median 65 63 Range 49 - 81 45 - 78 Gender Male 14 (74) 16 (80) Female 5 (26) 4 (20) Race-Ethnicity Non-Hispanic White 16 (84) 12 (60) Non-Hispanic Black 1 (5) 1 (5) Hispanic (all races) 1 (5) 6 (30) Other, non-Hispanic 1 (5) 0 HPV (p16) Status Negative 9 (47) 10 (50) Positive 10 (53) 10 (50) Arm A N= 19 (%) Arm B N=20 (%) Prior Platinum Tx Yes 11 (58) 10 (50) No 8 (42) 8 (40) Not reported / Unknown 0 2 (10) Prior ICI Tx Yes 19 (100) 18 (90) No 0 0 Not reported / Unknown 0 2 (10) Prior Taxane Tx Yes 0 1 (5) No 19 (100) 17 (85) Not reported / Unknown 0 2 (10) Prior Systemic Tx Locally advanced only 4 (21) 3 (15) Recurrent / Metastatic 15 (79) 16 (80) Platinum = carboplatin or cisplatin; ICI = pembrolizumab or nivolumab; Taxane = paclitaxel or docetaxel Data cutoff date: September 25, 2025

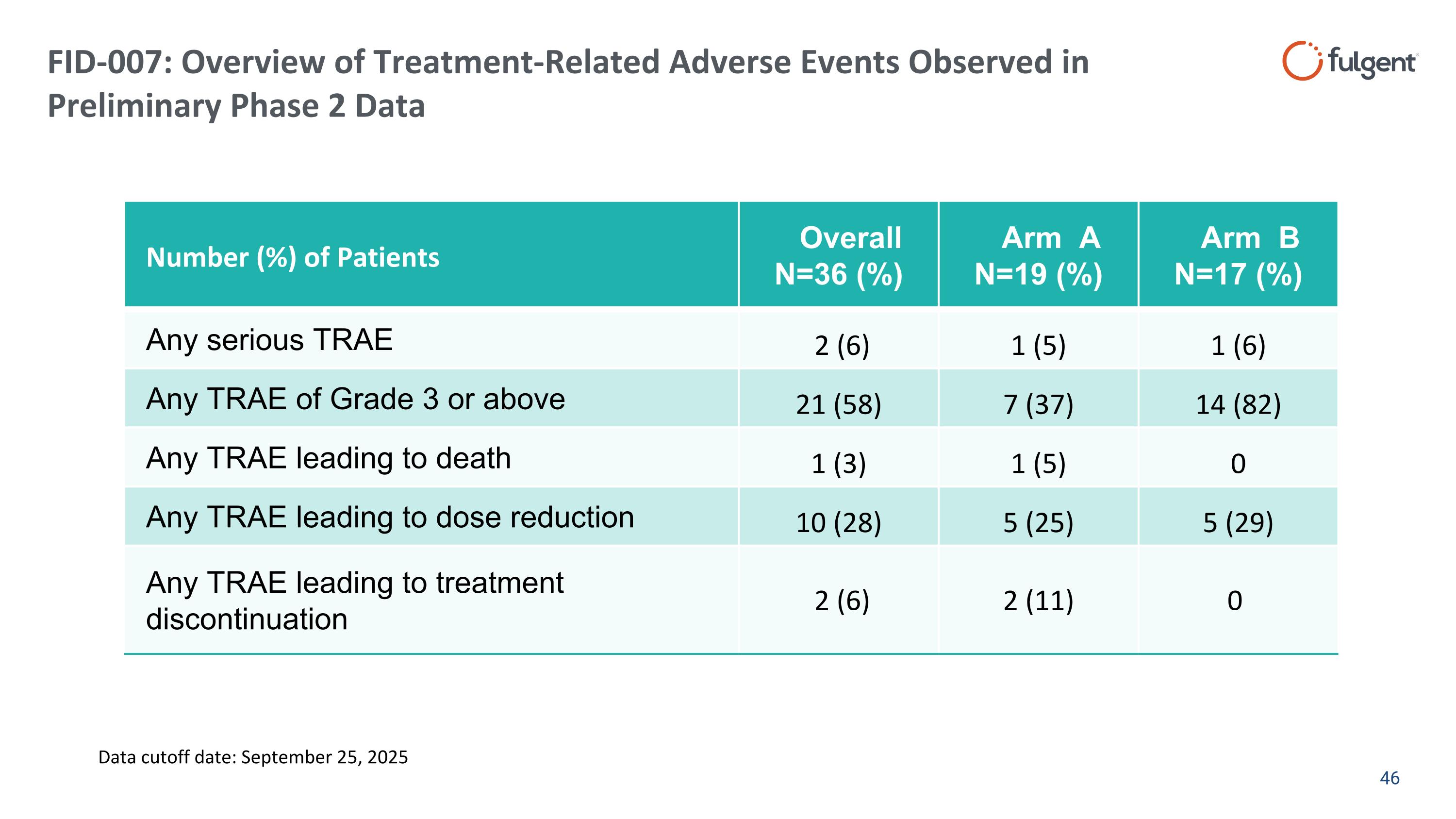

FID-007: Overview of Treatment-Related Adverse Events Observed in Preliminary Phase 2 Data Number (%) of Patients Overall N=36 (%) Arm A N=19 (%) Arm B N=17 (%) Any serious TRAE 2 (6) 1 (5) 1 (6) Any TRAE of Grade 3 or above 21 (58) 7 (37) 14 (82) Any TRAE leading to death 1 (3) 1 (5) 0 Any TRAE leading to dose reduction 10 (28) 5 (25) 5 (29) Any TRAE leading to treatment discontinuation 2 (6) 2 (11) 0 Data cutoff date: September 25, 2025

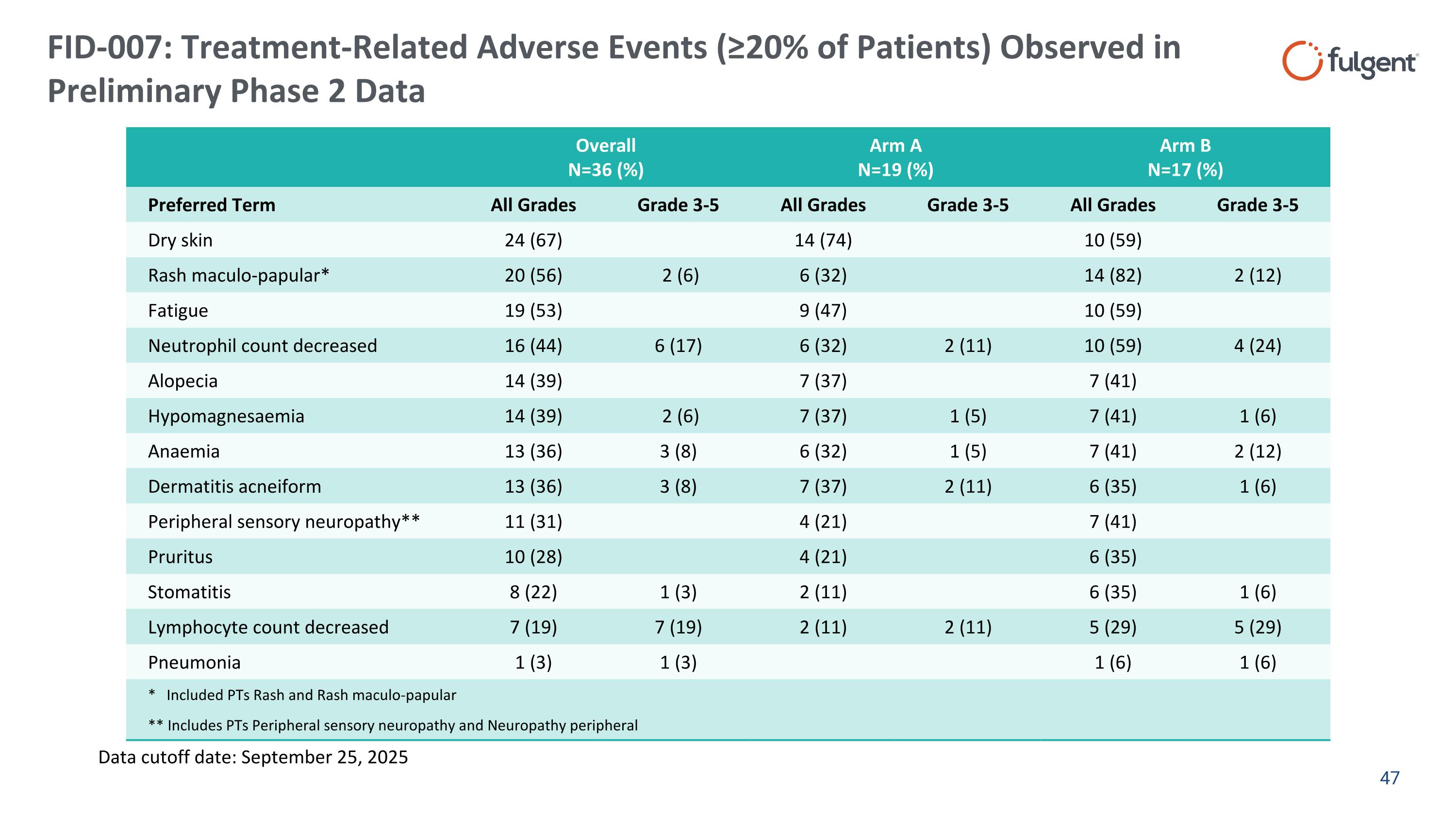

FID-007: Treatment-Related Adverse Events (≥20% of Patients) Observed in Preliminary Phase 2 Data Overall N=36 (%) Arm A N=19 (%) Arm B N=17 (%) Preferred Term All Grades Grade 3-5 All Grades Grade 3-5 All Grades Grade 3-5 Dry skin 24 (67) 14 (74) 10 (59) Rash maculo-papular* 20 (56) 2 (6) 6 (32) 14 (82) 2 (12) Fatigue 19 (53) 9 (47) 10 (59) Neutrophil count decreased 16 (44) 6 (17) 6 (32) 2 (11) 10 (59) 4 (24) Alopecia 14 (39) 7 (37) 7 (41) Hypomagnesaemia 14 (39) 2 (6) 7 (37) 1 (5) 7 (41) 1 (6) Anaemia 13 (36) 3 (8) 6 (32) 1 (5) 7 (41) 2 (12) Dermatitis acneiform 13 (36) 3 (8) 7 (37) 2 (11) 6 (35) 1 (6) Peripheral sensory neuropathy** 11 (31) 4 (21) 7 (41) Pruritus 10 (28) 4 (21) 6 (35) Stomatitis 8 (22) 1 (3) 2 (11) 6 (35) 1 (6) Lymphocyte count decreased 7 (19) 7 (19) 2 (11) 2 (11) 5 (29) 5 (29) Pneumonia 1 (3) 1 (3) 1 (6) 1 (6) * Included PTs Rash and Rash maculo-papular ** Includes PTs Peripheral sensory neuropathy and Neuropathy peripheral Data cutoff date: September 25, 2025

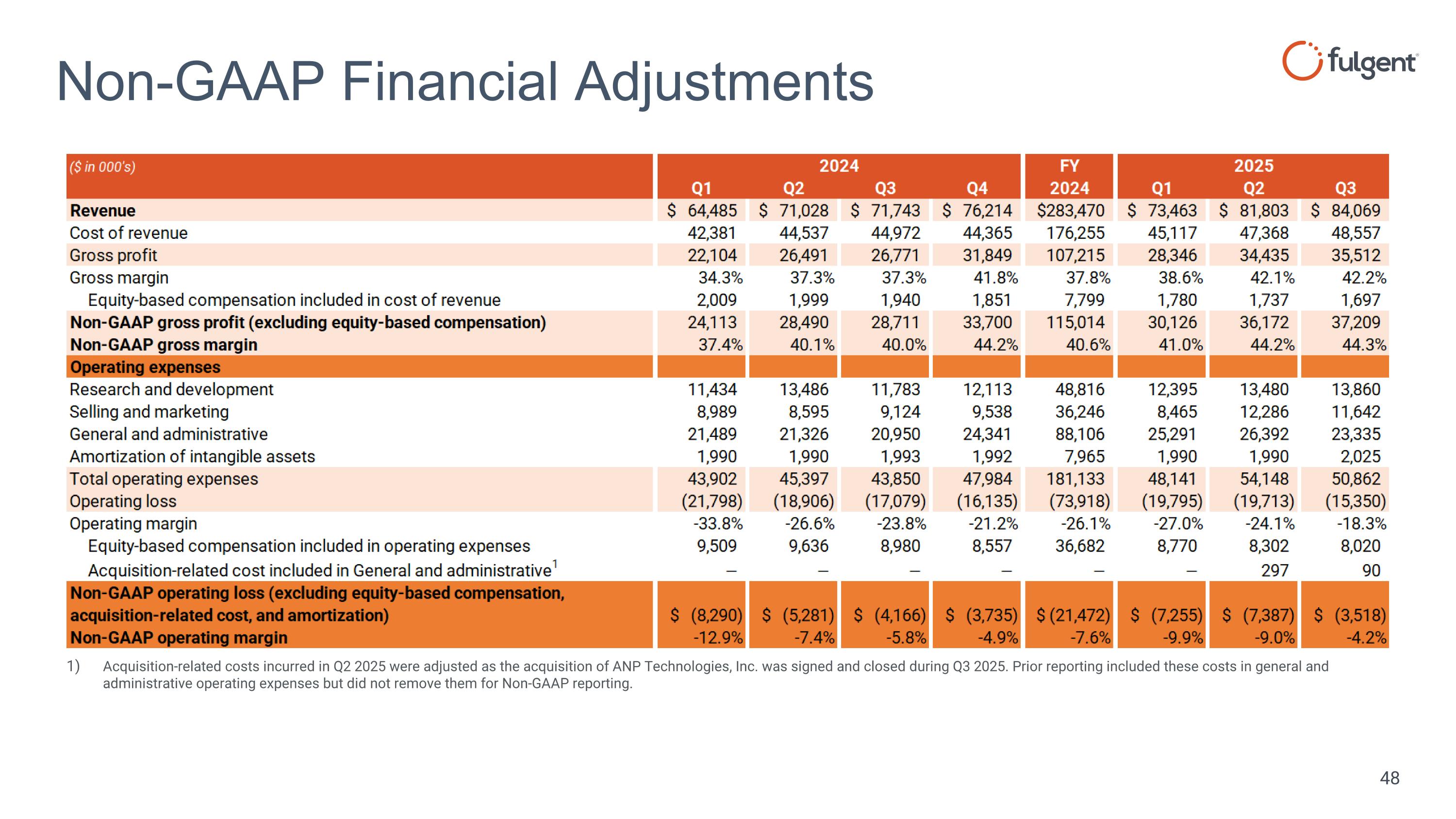

Non-GAAP Financial Adjustments Acquisition-related costs incurred in Q2 2025 were adjusted as the acquisition of ANP Technologies, Inc. was signed and closed during Q3 2025. Prior reporting included these costs in general and administrative operating expenses but did not remove them for Non-GAAP reporting.

Non-GAAP Financial Adjustments by Segment

Thank You

Founded in 2011 | Located in El Monte, CA | NASDAQ:FLGT