May 07, 2025 Conduent Q1 2025 Financial Results

2 Forward-Looking Statements This document, any exhibits or attachments to this document, and other public statements we make may contain “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. The words “anticipate,” “believe,” “estimate,” “expect,” expectations," "in front of us," "plan," “intend,” “will,” “aim,” “should,” “could,” “forecast,” “target,” “may,” "continue to," "looking to continue," "endeavor," "if,” “growing,” “projected,” “potential,” “likely,” "see", "ahead", "further," "going forward," "on the horizon," "as we progress," "going to," "path from here forward," "think," "path to deliver," "from here," "on track," "remain" and similar expressions (including the negative and plural forms of such words and phrases), as they relate to us, are intended to identify forward-looking statements, but the absence of these words does not mean that a statement is not forward looking. All statements other than statements of historical fact included in this presentation or any attachment to this presentation are forward-looking statements, including, but not limited to, statements regarding our financial results, condition and outlook; changes in our operating results; general market and economic conditions; and our projected financial performance for the full year 2025, including all statements made under the sections captioned "Debt Maturity", “FY 2025 Outlook and Mid-Tern Outlook”, and "Segment Adjusted Revenue Trend" within this presentation. These statements reflect our current views with respect to future events and are subject to certain risks, uncertainties and assumptions many of which are outside of our control, that could cause actual results to differ materially from those expected or implied by such forward-looking statements contained in this document, any exhibits to this document and other public statements we make. Important factors and uncertainties that could cause our actual results to differ materially from those in our forward-looking statements include, but are not limited to: government appropriations and termination rights contained in our government contracts; the competitiveness of the markets in which we operate and our ability to renew commercial and government contracts, including contracts awarded through competitive bidding processes; our ability to recover capital and other investments in connection with our contracts; our reliance on third-party providers; risk and impact of geopolitical events and increasing geopolitical tensions (such as the war in the Ukraine and the conflict in the Middle East), macroeconomic conditions, natural disasters and other factors in a particular country or region on our workforce, customers and vendors; our ability to deliver on our contractual obligations properly and on time; changes in interest in outsourced business process services; claims of infringement of third-party intellectual property rights; our ability to estimate the scope of work or the costs of performance in our contracts; the loss of key senior management and our ability to attract and retain necessary technical personnel and qualified subcontractors; our failure to develop new service offerings and protect our intellectual property rights; our ability to modernize our information technology infrastructure and consolidate data centers; expectations relating to environmental, social and governance considerations; utilization of our stock repurchase program; risks related to our use of artificial intelligence; the failure to comply with laws relating to individually identifiable information and personal health information; the failure to comply with laws relating to processing certain financial transactions, including payment card transactions and debit or credit card transactions; breaches of our information systems or security systems or any service interruptions; risks related to hacking or other cybersecurity threats to our data systems, information systems and network infrastructure and other service interruptions, including relating to the cyber event that took place in January 2025, including Conduent’s investigation of such incident and mitigation and remediation efforts, the nature and extent of such incident, the potential disruption to our business or operations, the potential impact on Conduent’s reputation, and Conduent’s assessments of the likely financial and operational impacts of such incident; our ability to comply with data security standards; developments in various contingent liabilities that are not reflected on our balance sheet, including those arising as a result of being involved in a variety of claims, lawsuits, investigations and proceedings; risks related to recently completed divestitures including the (i) transfer of the Company’s BenefitWallet’s health savings account, medical savings account and flexible spending account portfolio, (ii) the sale of the Company’s Curbside Management and Public Safety Solutions businesses and (iii) the sale of the Company's Casualty Claims Solutions business, including but not limited to the Company’s ability to realize the benefits anticipated from such transactions, unexpected costs, liabilities or delays in connection with such transactions, and the significant transaction costs associated with such transactions; risk and impact of potential goodwill and other asset impairments; our significant indebtedness and the terms of such indebtedness; our failure to obtain or maintain a satisfactory credit rating and financial performance; our ability to obtain adequate pricing for our services and to improve our cost structure; our ability to collect our receivables, including those for unbilled services; a decline in revenues from, or a loss of, or a reduction in business from or failure of significant clients; fluctuations in our non-recurring revenue; increases in the cost of voice and data services or significant interruptions in such services; our ability to receive dividends or other payments from our subsidiaries; and other factors that are set forth in the “Risk Factors” section, the “Legal Proceedings” section, the “Management's Discussion and Analysis of Financial Condition and Results of Operations” section and other sections in our Annual Reports on Form 10-K, as well as in our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with or furnished to the Securities and Exchange Commission. Any forward-looking statements made by us in this presentation speak only as of the date on which they are made. We are under no obligation to, and expressly disclaim any obligation to, update or alter our forward-looking statements, whether because of new information, subsequent events or otherwise, except as required by law. Cautionary Statements

3 Non-GAAP Financial Measures We have reported our financial results in accordance with accounting principles generally accepted in the U.S. (U.S. GAAP). In addition, we have discussed our financial results using non-GAAP measures. We believe these non-GAAP measures allow investors to better understand the trends in our business and to better understand and compare our results. Accordingly, we believe it is necessary to adjust several reported amounts, determined in accordance with U.S. GAAP, to exclude the effects of certain items as well as their related tax effects. Management believes that these non-GAAP financial measures provide an additional means of analyzing the results of the current period against the corresponding prior period. However, these non-GAAP financial measures should be viewed in addition to, and not as a substitute for, our reported results prepared in accordance with U.S. GAAP. Our non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable U.S. GAAP measures and should be read only in conjunction with our Consolidated Financial Statements prepared in accordance with U.S. GAAP. Our management regularly uses our non-GAAP measures internally to understand, manage and evaluate our business and make operating decisions. Providing such non-GAAP financial measures to investors allows for a further level of transparency as to how management reviews and evaluates our business results and trends. These non-GAAP measures are among the primary factors management uses in planning for and forecasting future periods. Compensation of our executives is based in part on the performance of our business based on certain of these non-GAAP measures. Refer to the "Non-GAAP Financial Measures" and "Non-GAAP Reconciliations" sections in this document for a discussion of these non-GAAP measures and their reconciliation to the reported U.S. GAAP measures. Cautionary Statements

4 Q1 2025 Highlights (1) Refer to Appendix for complete Non-GAAP reconciliations of Adjusted Revenue, Adjusted EBITDA and Adjusted EBITDA Margin. (2) Full definition in the Appendix. (3) Trailing Twelve Months. Q1 Results / Metrics Highlights • Adj. Revenue(1): $751M • Adj. EBITDA(1): $37M • Adj. EBITDA Margin(1): 4.9% • New business signings ACV(2): $109M • Net ARR Activity Impact (TTM)(2,3): $116M • Strong start to the year • On course to achieve 2025 exit rates • Government Programs at both federal and state levels may represent tailwinds and/or opportunities (Fraud, Congestion Pricing) • Portfolio Optimization remains a priority for capital allocation and growth

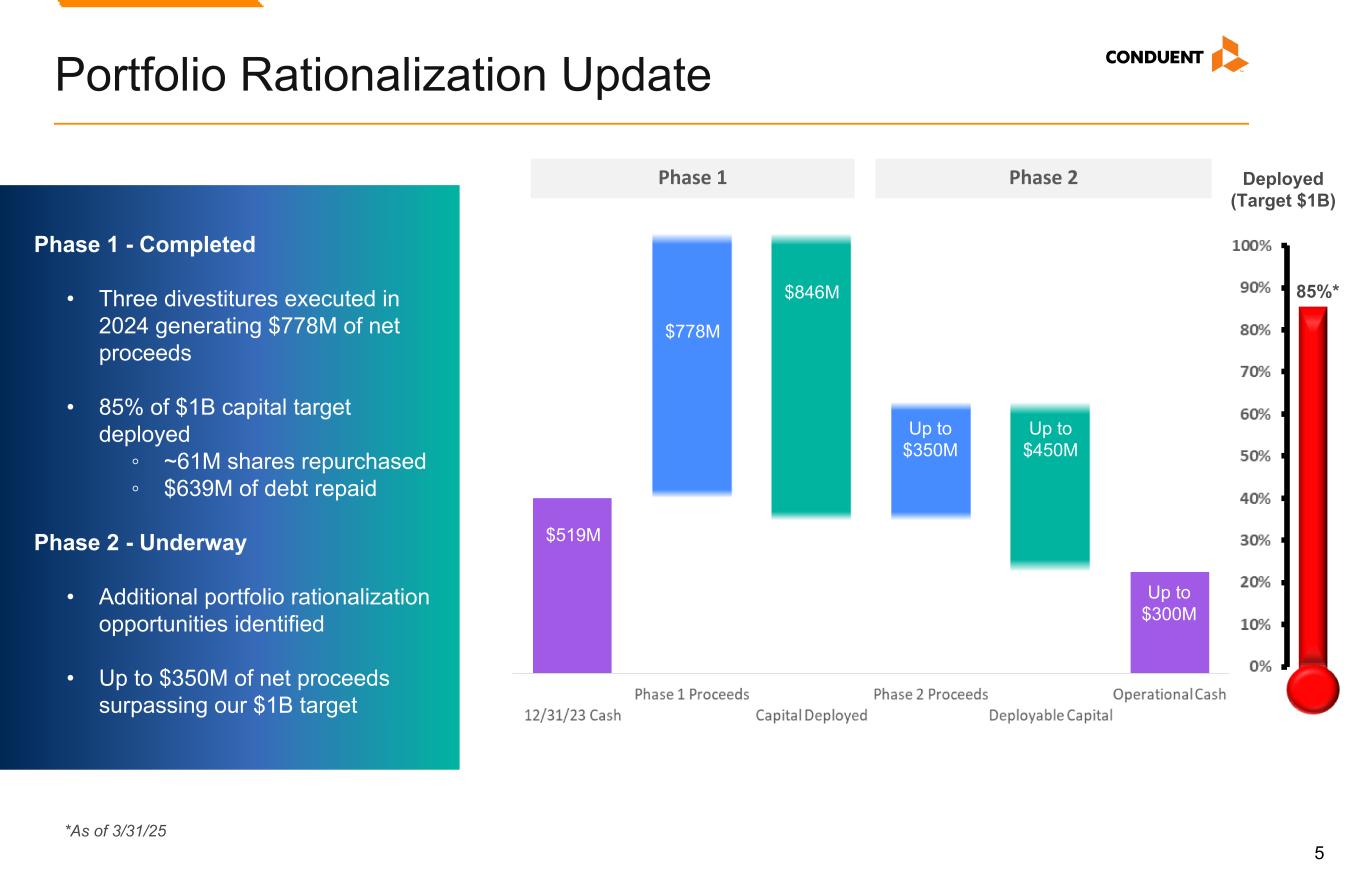

5 Portfolio Rationalization Update $519M Up to $300M $775M to $825M Approx. $1B 85%* Deployed (Target $1B) Phase 1 - Completed • Three divestitures executed in 2024 generating $778M of net proceeds • 85% of $1B capital target deployed ◦ ~61M shares repurchased ◦ $639M of debt repaid Phase 2 - Underway • Additional portfolio rationalization opportunities identified • Up to $350M of net proceeds surpassing our $1B target *As of 3/31/25 $778M $846M Up to $350M Up to $450M Phase 1 Phase 2

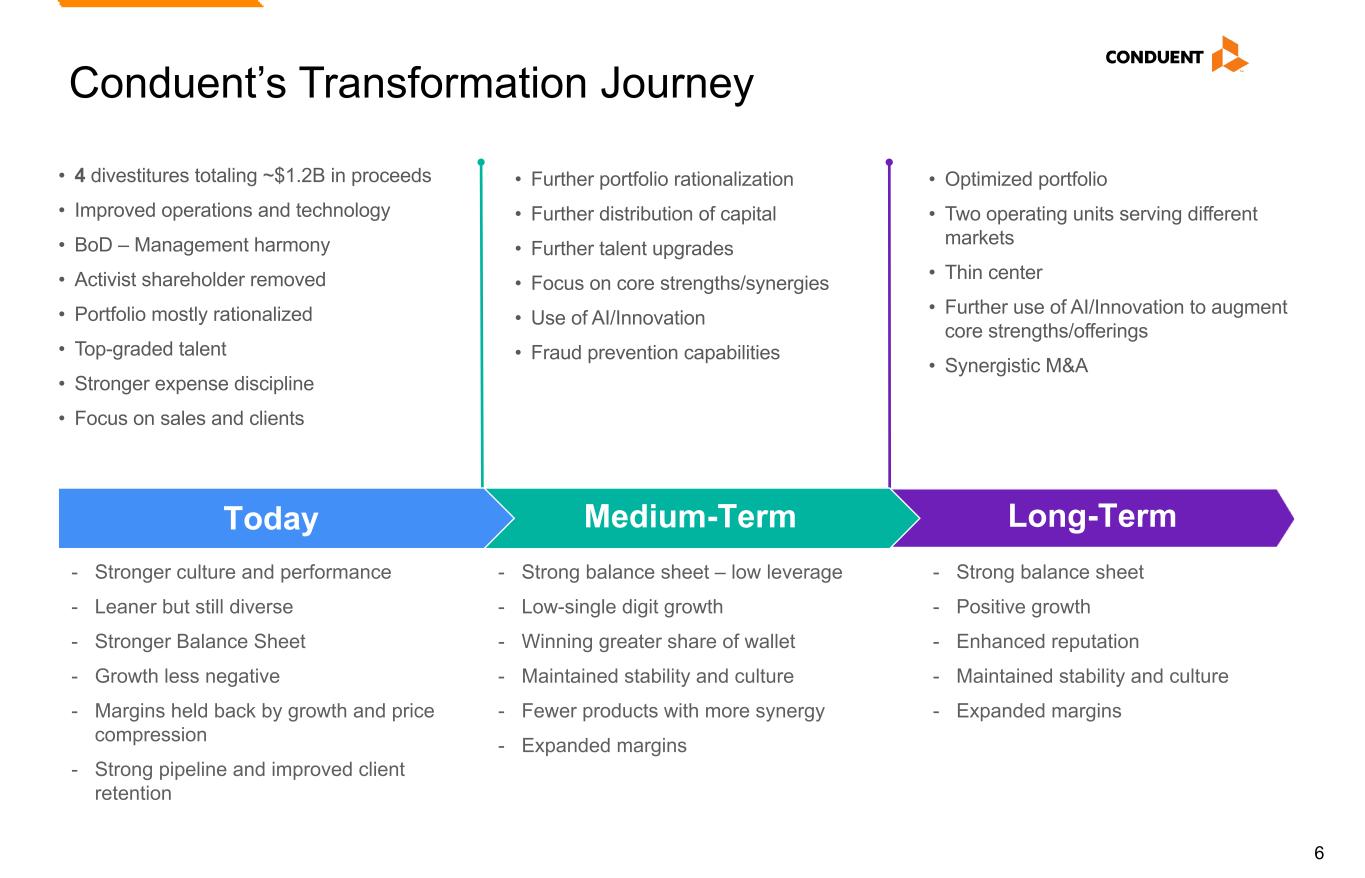

6 - Strong balance sheet – low leverage - Low-single digit growth - Winning greater share of wallet - Maintained stability and culture - Fewer products with more synergy - Expanded margins Conduent’s Transformation Journey 6 • Optimized portfolio • Two operating units serving different markets • Thin center • Further use of AI/Innovation to augment core strengths/offerings • Synergistic M&A - Stronger culture and performance - Leaner but still diverse - Stronger Balance Sheet - Growth less negative - Margins held back by growth and price compression - Strong pipeline and improved client retention Long-Term Medium-TermToday • 4 divestitures totaling ~$1.2B in proceeds • Improved operations and technology • BoD – Management harmony • Activist shareholder removed • Portfolio mostly rationalized • Top-graded talent • Stronger expense discipline • Focus on sales and clients • Further portfolio rationalization • Further distribution of capital • Further talent upgrades • Focus on core strengths/synergies • Use of AI/Innovation • Fraud prevention capabilities - Strong balance sheet - Positive growth - Enhanced reputation - Maintained stability and culture - Expanded margins

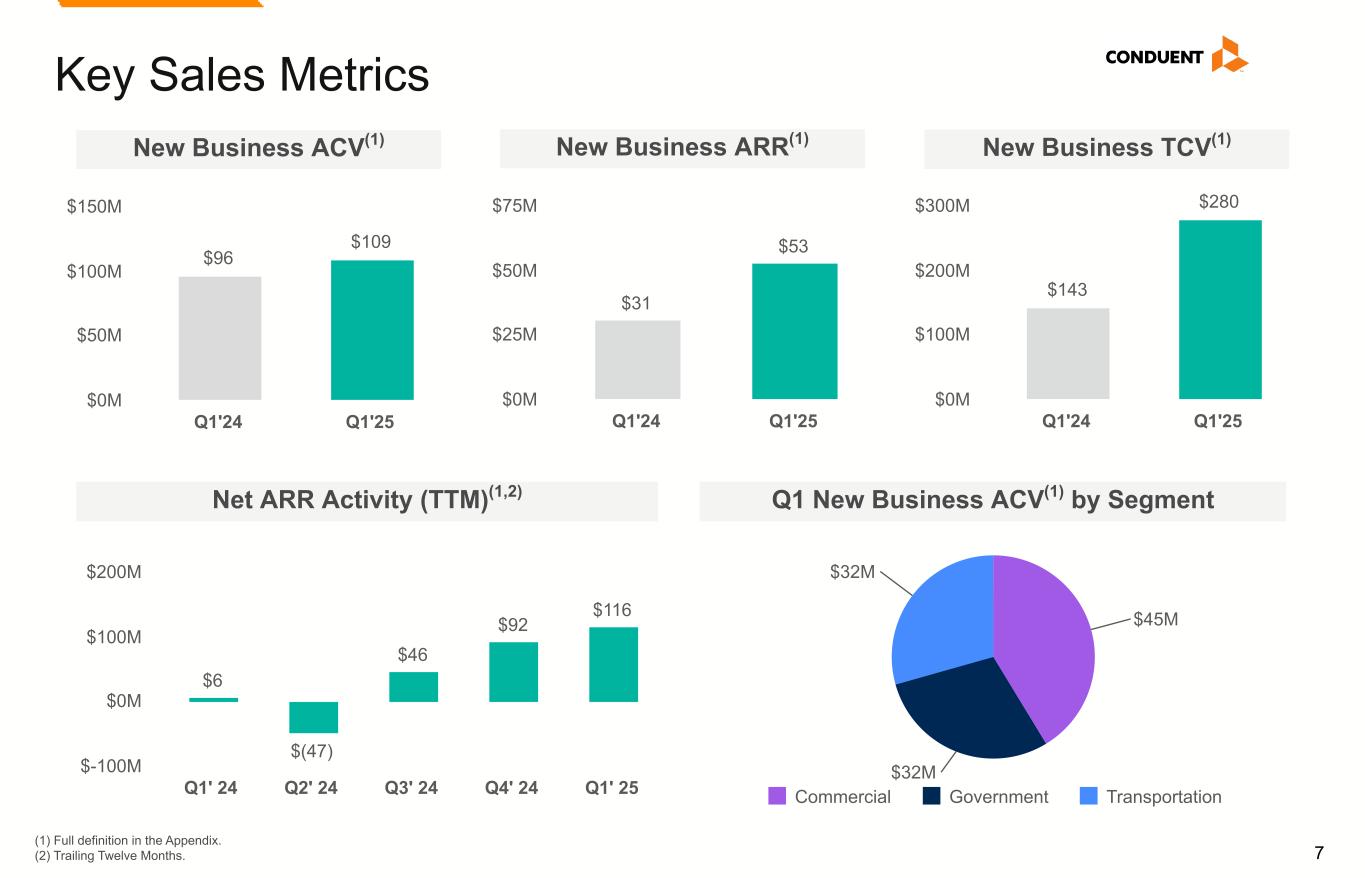

7 Key Sales Metrics New Business ACV(1) Q1 New Business ACV(1) by Segment (1) Full definition in the Appendix. (2) Trailing Twelve Months. $143 $280 Q1'24 Q1'25 $0M $100M $200M $300M New Business TCV(1) $31 $53 Q1'24 Q1'25 $0M $25M $50M $75M $45M $32M $32M Commercial Government Transportation Net ARR Activity (TTM)(1,2) $6 $(47) $46 $92 $116 Q1' 24 Q2' 24 Q3' 24 Q4' 24 Q1' 25 $-100M $0M $100M $200M $96 $109 Q1'24 Q1'25 $0M $50M $100M $150M New Business ARR(1)

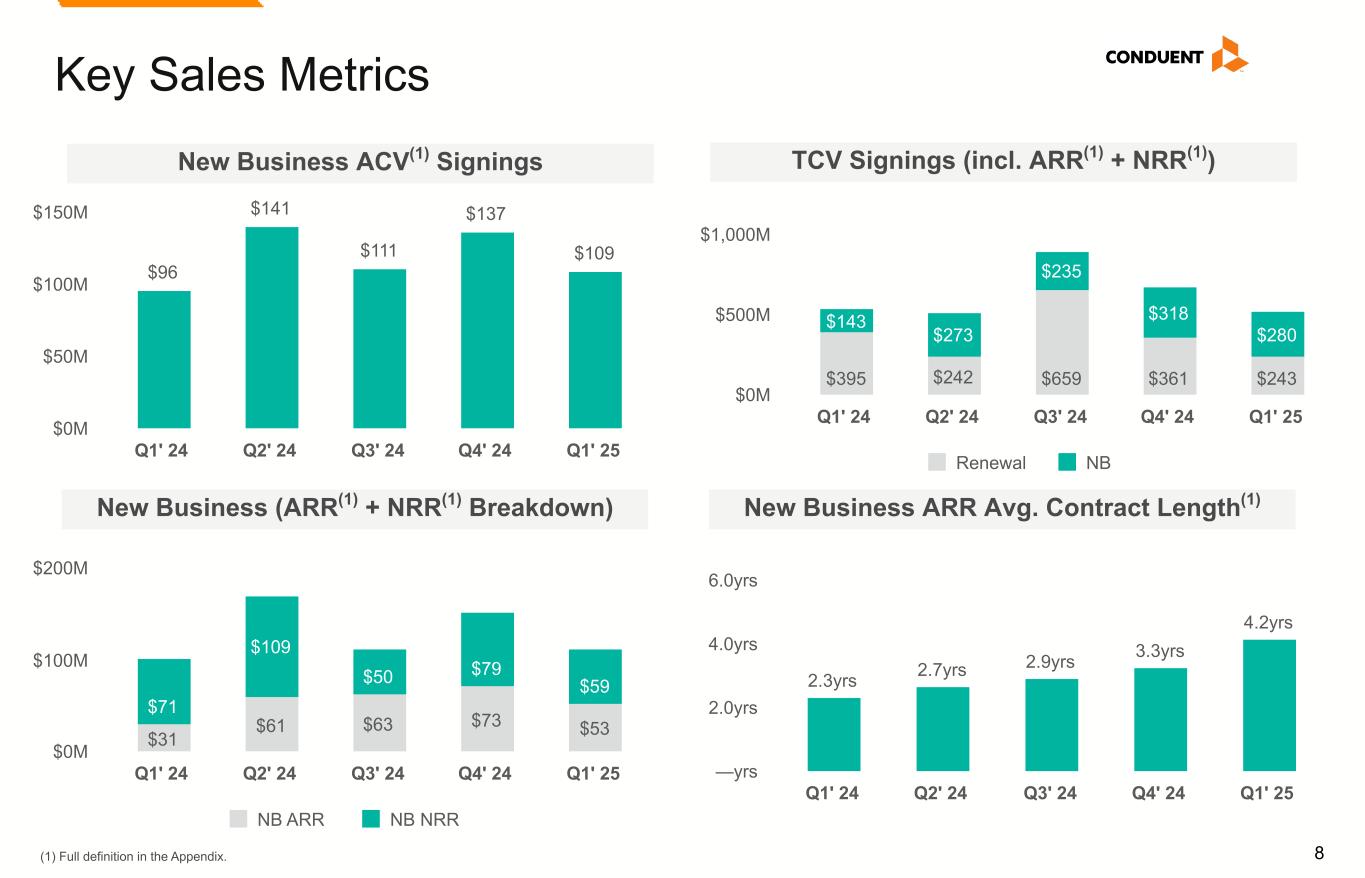

8 Key Sales Metrics TCV Signings (incl. ARR(1) + NRR(1)) $395 $242 $659 $361 $243 $143 $273 $235 $318 $280 Renewal NB Q1' 24 Q2' 24 Q3' 24 Q4' 24 Q1' 25 $0M $500M $1,000M New Business (ARR(1) + NRR(1) Breakdown) $31 $61 $63 $73 $53 $71 $109 $50 $79 $59 NB ARR NB NRR Q1' 24 Q2' 24 Q3' 24 Q4' 24 Q1' 25 $0M $100M $200M New Business ARR Avg. Contract Length(1) $96 $141 $111 $137 $109 Q1' 24 Q2' 24 Q3' 24 Q4' 24 Q1' 25 $0M $50M $100M $150M New Business ACV(1) Signings 2.3yrs 2.7yrs 2.9yrs 3.3yrs 4.2yrs Q1' 24 Q2' 24 Q3' 24 Q4' 24 Q1' 25 —yrs 2.0yrs 4.0yrs 6.0yrs (1) Full definition in the Appendix.

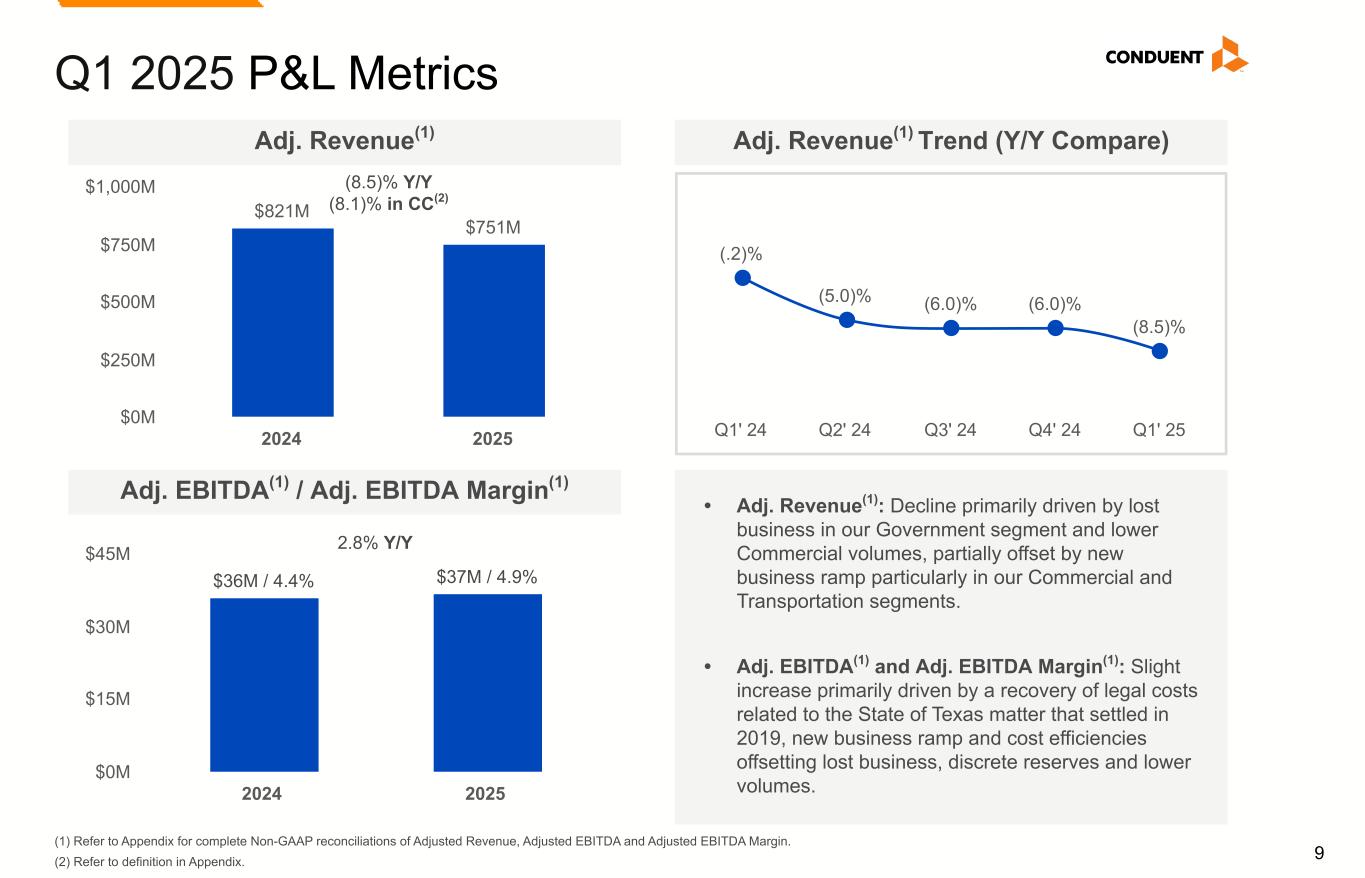

9 Q1 2025 P&L Metrics $821M $751M 2024 2025 $0M $250M $500M $750M $1,000M (8.5)% Y/Y (8.1)% in CC(2) Adj. Revenue(1) $36M / 4.4% $37M / 4.9% 2024 2025 $0M $15M $30M $45M Adj. EBITDA(1) / Adj. EBITDA Margin(1) 2.8% Y/Y • Adj. Revenue(1): Decline primarily driven by lost business in our Government segment and lower Commercial volumes, partially offset by new business ramp particularly in our Commercial and Transportation segments. • Adj. EBITDA(1) and Adj. EBITDA Margin(1): Slight increase primarily driven by a recovery of legal costs related to the State of Texas matter that settled in 2019, new business ramp and cost efficiencies offsetting lost business, discrete reserves and lower volumes. (.2)% (5.0)% (6.0)% (6.0)% (8.5)% Q1' 24 Q2' 24 Q3' 24 Q4' 24 Q1' 25 Adj. Revenue(1) Trend (Y/Y Compare) (1) Refer to Appendix for complete Non-GAAP reconciliations of Adjusted Revenue, Adjusted EBITDA and Adjusted EBITDA Margin. (2) Refer to definition in Appendix.

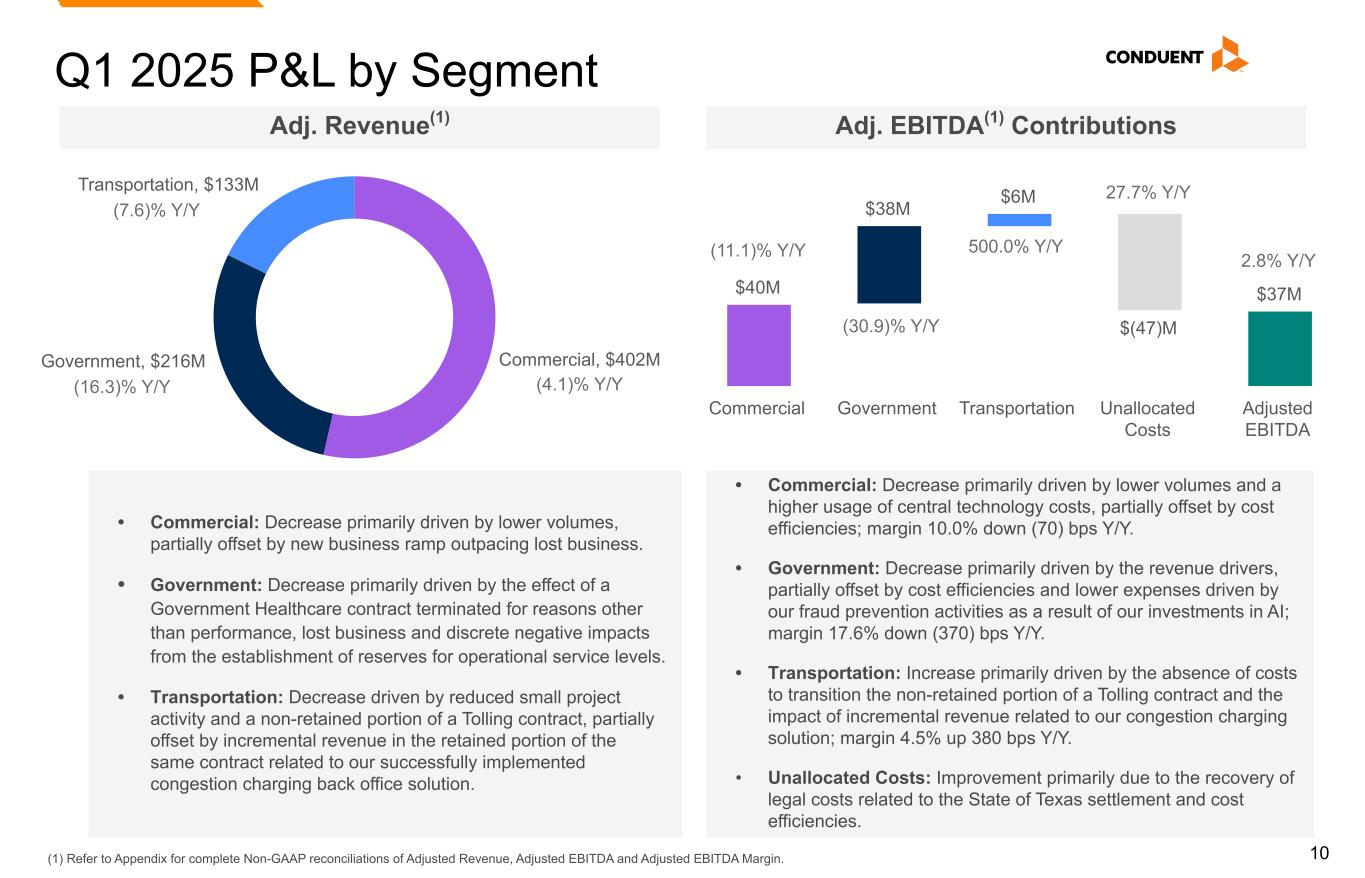

10 $40M $38M $6M $(47)M $37M Commercial Government Transportation Unallocated Costs Adjusted EBITDA Q1 2025 P&L by Segment (1) Refer to Appendix for complete Non-GAAP reconciliations of Adjusted Revenue, Adjusted EBITDA and Adjusted EBITDA Margin. Commercial, $402MGovernment, $216M Transportation, $133M (7.6)% Y/Y (16.3)% Y/Y (4.1)% Y/Y 500.0% Y/Y (30.9)% Y/Y (11.1)% Y/Y Adj. Revenue(1) Adj. EBITDA(1) Contributions 2.8% Y/Y 27.7% Y/Y • Commercial: Decrease primarily driven by lower volumes, partially offset by new business ramp outpacing lost business. • Government: Decrease primarily driven by the effect of a Government Healthcare contract terminated for reasons other than performance, lost business and discrete negative impacts from the establishment of reserves for operational service levels. • Transportation: Decrease driven by reduced small project activity and a non-retained portion of a Tolling contract, partially offset by incremental revenue in the retained portion of the same contract related to our successfully implemented congestion charging back office solution. • Commercial: Decrease primarily driven by lower volumes and a higher usage of central technology costs, partially offset by cost efficiencies; margin 10.0% down (70) bps Y/Y. • Government: Decrease primarily driven by the revenue drivers, partially offset by cost efficiencies and lower expenses driven by our fraud prevention activities as a result of our investments in AI; margin 17.6% down (370) bps Y/Y. • Transportation: Increase primarily driven by the absence of costs to transition the non-retained portion of a Tolling contract and the impact of incremental revenue related to our congestion charging solution; margin 4.5% up 380 bps Y/Y. • Unallocated Costs: Improvement primarily due to the recovery of legal costs related to the State of Texas settlement and cost efficiencies.

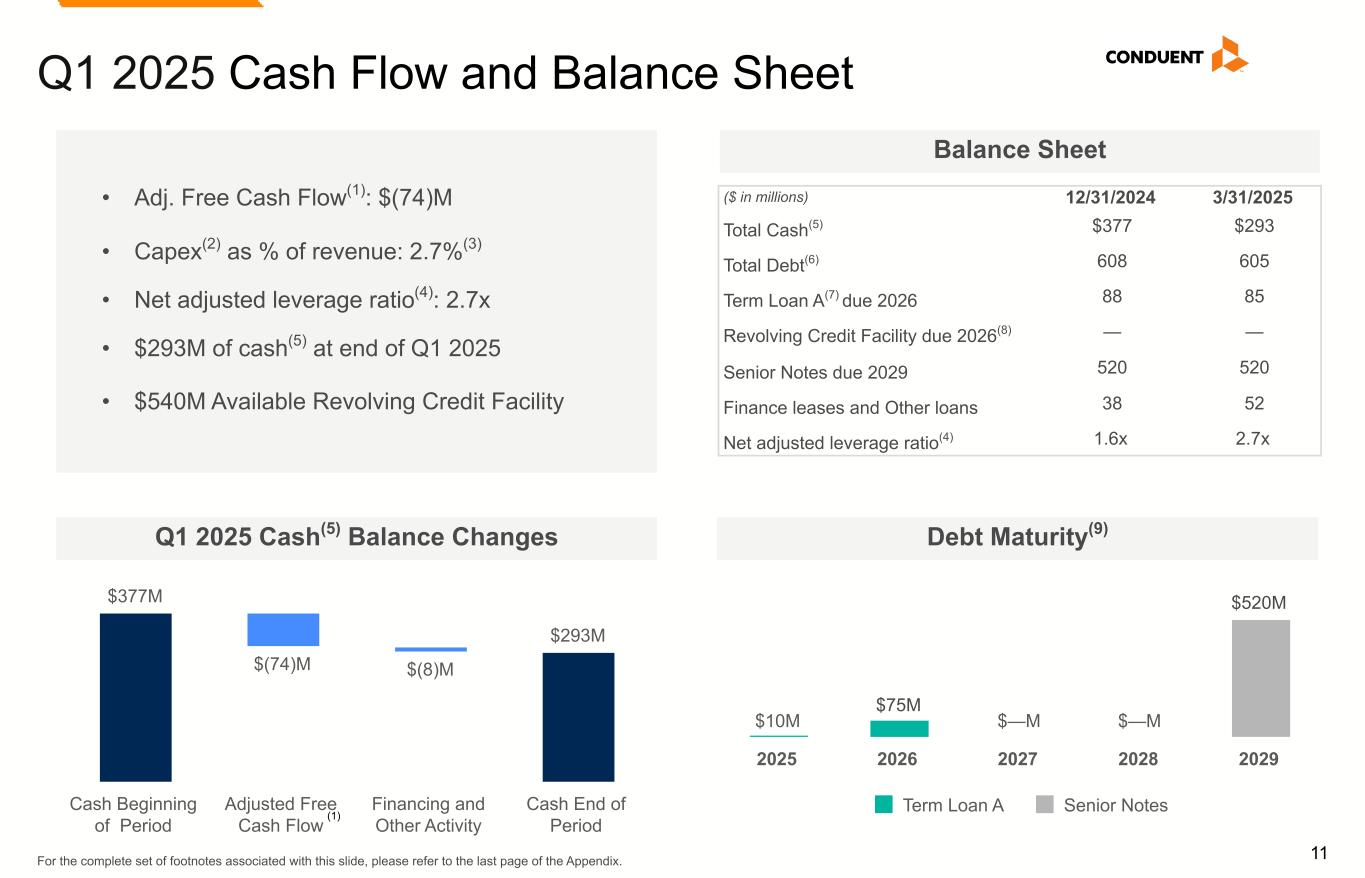

11 Q1 2025 Cash Flow and Balance Sheet Q1 2025 Cash(5) Balance Changes Balance Sheet For the complete set of footnotes associated with this slide, please refer to the last page of the Appendix. ($ in millions) 12/31/2024 3/31/2025 Total Cash(5) $377 $293 Total Debt(6) 608 605 Term Loan A(7) due 2026 88 85 Revolving Credit Facility due 2026(8) — — Senior Notes due 2029 520 520 Finance leases and Other loans 38 52 Net adjusted leverage ratio(4) 1.6x 2.7x Debt Maturity(9) $377M $(74)M $(8)M $293M Cash Beginning of Period Adjusted Free Cash Flow Financing and Other Activity Cash End of Period • Adj. Free Cash Flow(1): $(74)M • Capex(2) as % of revenue: 2.7%(3) • Net adjusted leverage ratio(4): 2.7x • $293M of cash(5) at end of Q1 2025 • $540M Available Revolving Credit Facility $10M $—M $—M Term Loan A Senior Notes 2025 2026 2027 2028 2029 $520M (1) $75M

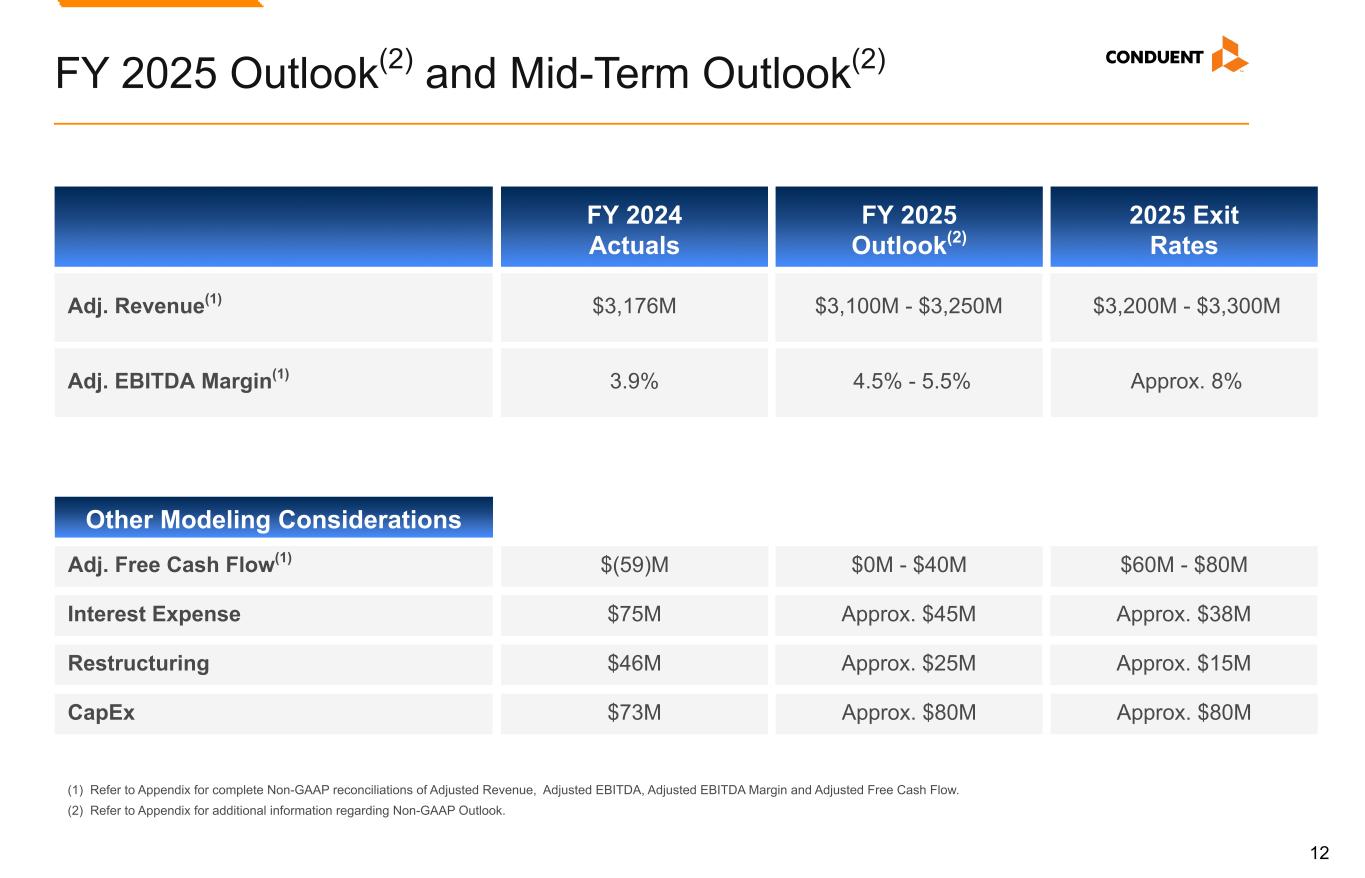

12 FY 2025 Outlook(2) and Mid-Term Outlook(2) (1) Refer to Appendix for complete Non-GAAP reconciliations of Adjusted Revenue, Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted Free Cash Flow. (2) Refer to Appendix for additional information regarding Non-GAAP Outlook. FY 2024 Actuals FY 2025 Outlook(2) $3,176MAdj. Revenue(1) Other Modeling Considerations Adj. EBITDA Margin(1) $3,100M - $3,250M Interest Expense Restructuring CapEx 3.9% 4.5% - 5.5% $75M Approx. $45M $46M $73M Approx. $25M Approx. $80M Adj. Free Cash Flow(1) $(59)M $0M - $40M 2025 Exit Rates $3,200M - $3,300M Approx. 8% Approx. $38M Approx. $15M Approx. $80M $60M - $80M

CEO Update

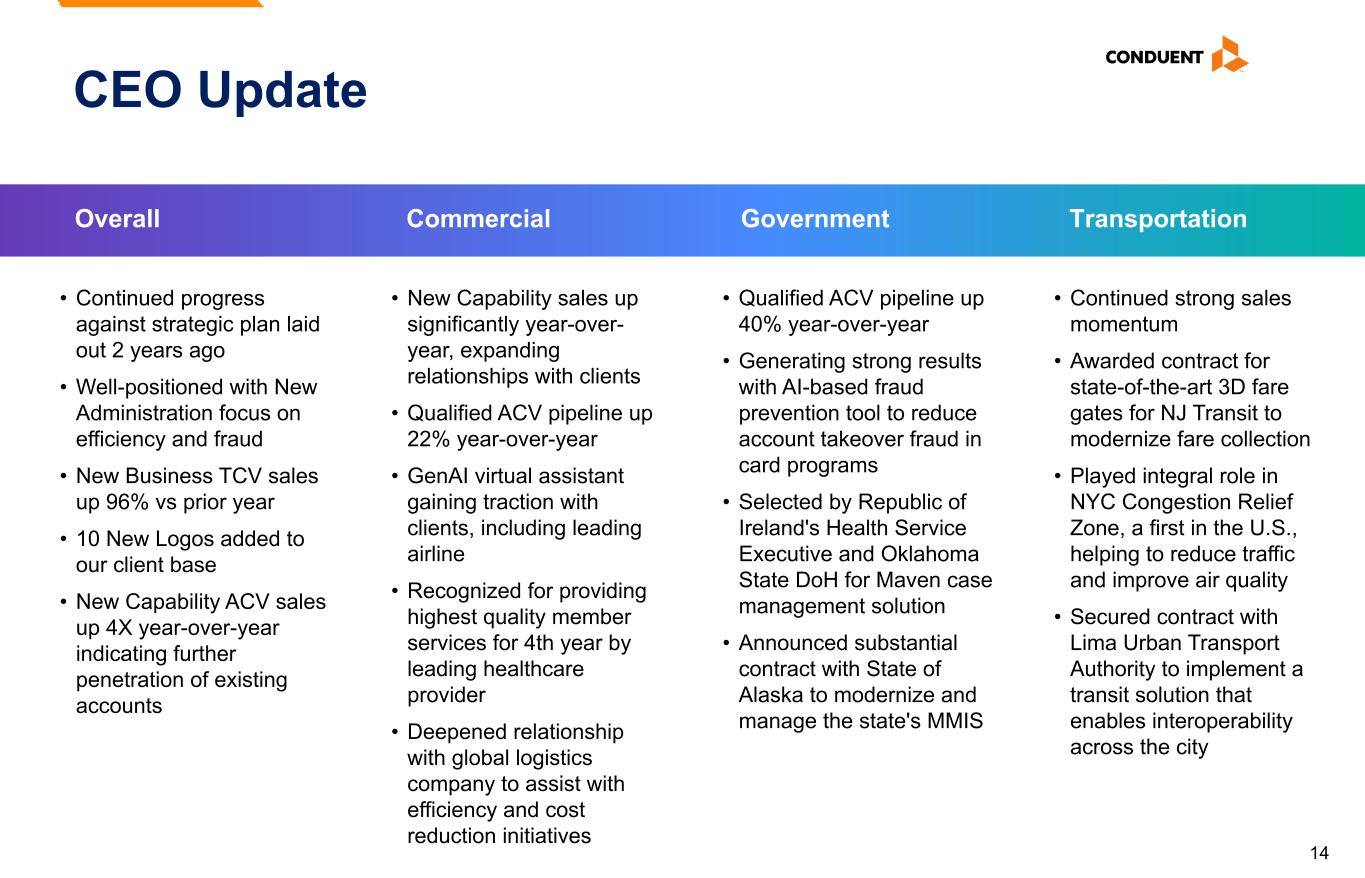

14 Overall Commercial Government Transportation CEO Update • Continued progress against strategic plan laid out 2 years ago • Well-positioned with New Administration focus on efficiency and fraud • New Business TCV sales up 96% vs prior year • 10 New Logos added to our client base • New Capability ACV sales up 4X year-over-year indicating further penetration of existing accounts • New Capability sales up significantly year-over- year, expanding relationships with clients • Qualified ACV pipeline up 22% year-over-year • GenAI virtual assistant gaining traction with clients, including leading airline • Recognized for providing highest quality member services for 4th year by leading healthcare provider • Deepened relationship with global logistics company to assist with efficiency and cost reduction initiatives • Qualified ACV pipeline up 40% year-over-year • Generating strong results with AI-based fraud prevention tool to reduce account takeover fraud in card programs • Selected by Republic of Ireland's Health Service Executive and Oklahoma State DoH for Maven case management solution • Announced substantial contract with State of Alaska to modernize and manage the state's MMIS • Continued strong sales momentum • Awarded contract for state-of-the-art 3D fare gates for NJ Transit to modernize fare collection • Played integral role in NYC Congestion Relief Zone, a first in the U.S., helping to reduce traffic and improve air quality • Secured contract with Lima Urban Transport Authority to implement a transit solution that enables interoperability across the city

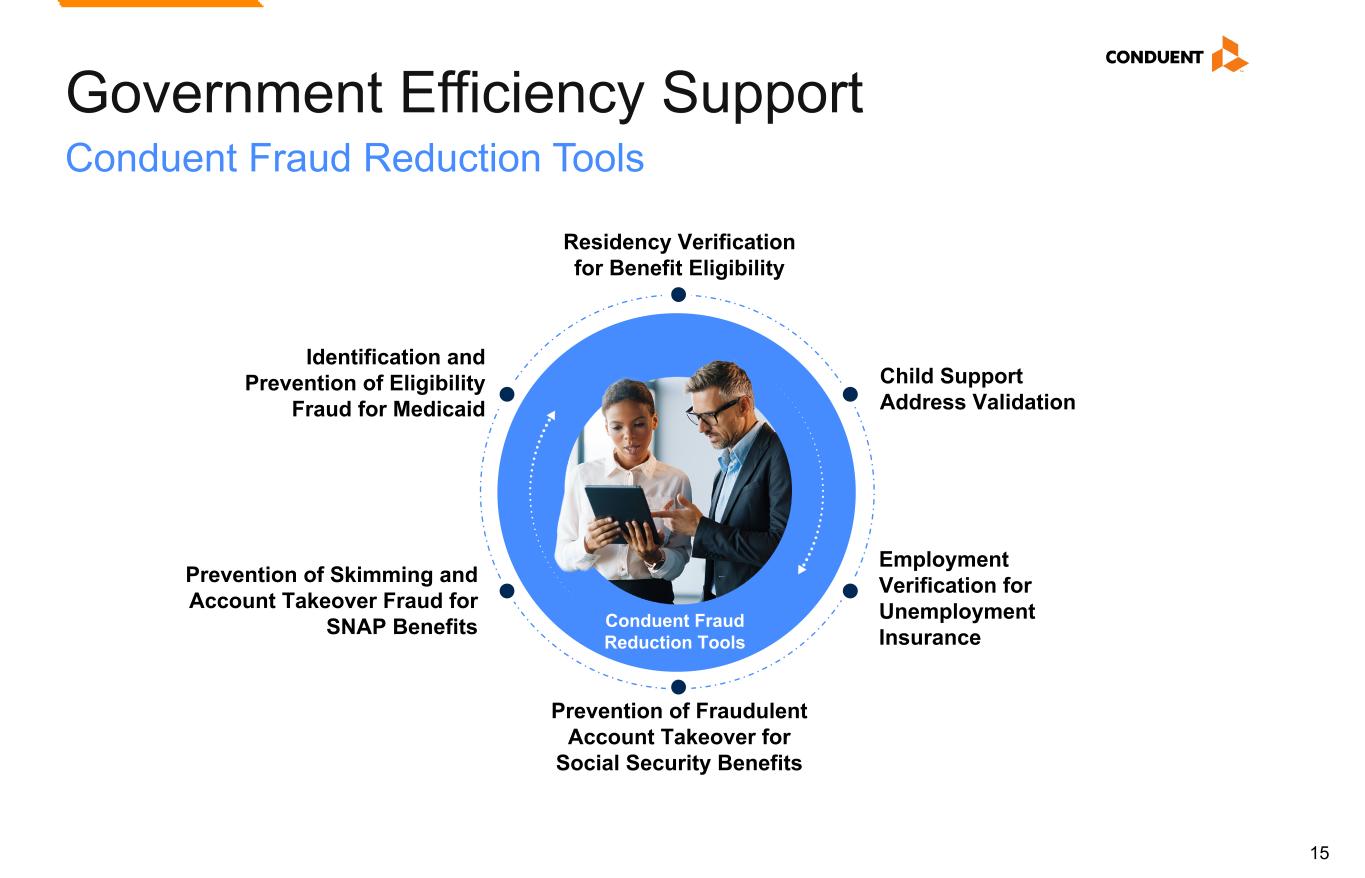

15 Conduent Fraud Reduction Tools Child Support Address Validation Prevention of Fraudulent Account Takeover for Social Security Benefits Residency Verification for Benefit Eligibility Employment Verification for Unemployment Insurance Prevention of Skimming and Account Takeover Fraud for SNAP Benefits Identification and Prevention of Eligibility Fraud for Medicaid Conduent Fraud Reduction Tools Government Efficiency Support Friday, May 02, 2025Conduent Confidential15

Appendix

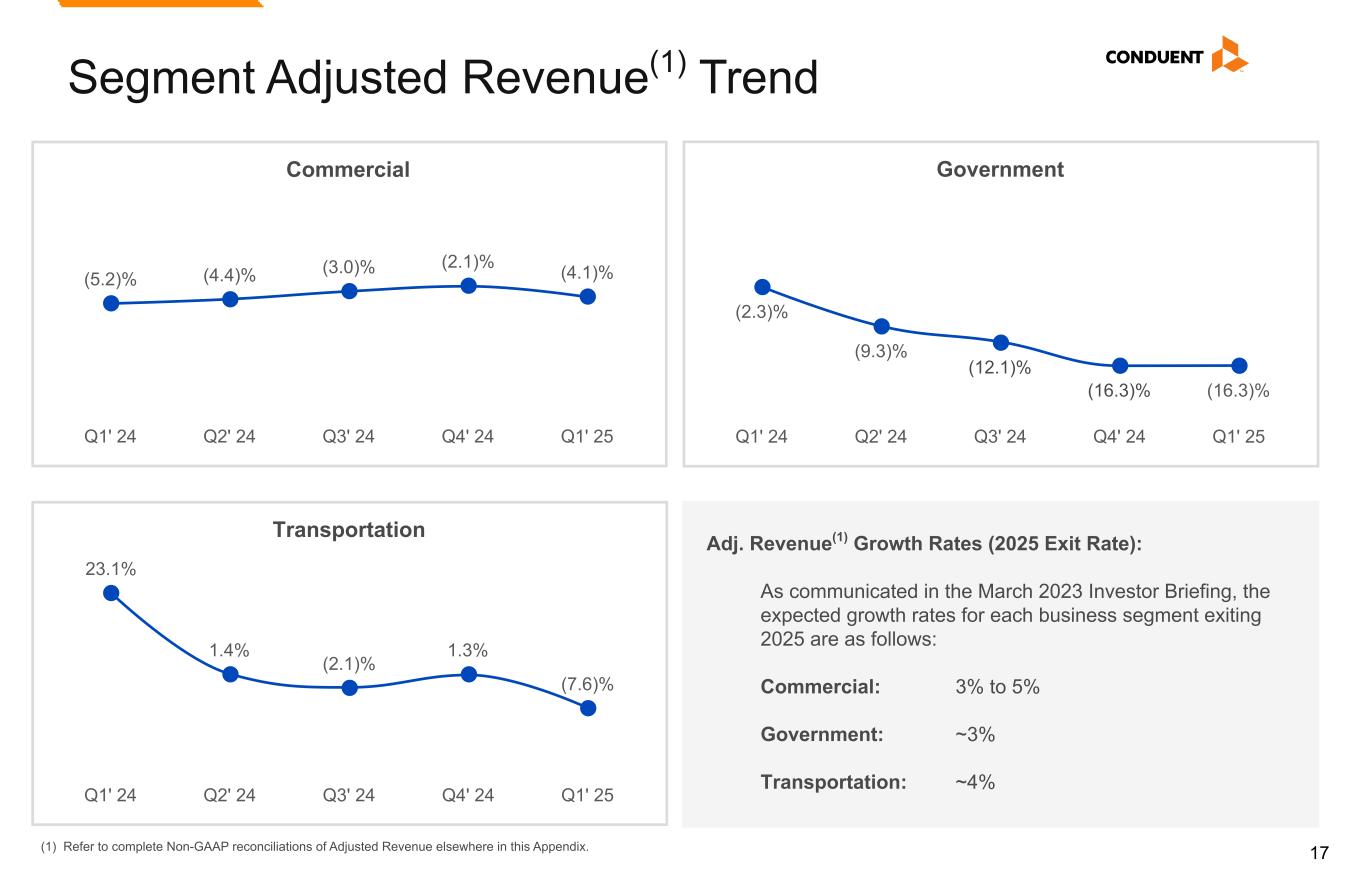

17 Government (2.3)% (9.3)% (12.1)% (16.3)% (16.3)% Q1' 24 Q2' 24 Q3' 24 Q4' 24 Q1' 25 Transportation 23.1% 1.4% (2.1)% 1.3% (7.6)% Q1' 24 Q2' 24 Q3' 24 Q4' 24 Q1' 25 Commercial (5.2)% (4.4)% (3.0)% (2.1)% (4.1)% Q1' 24 Q2' 24 Q3' 24 Q4' 24 Q1' 25 Segment Adjusted Revenue(1) Trend Adj. Revenue(1) Growth Rates (2025 Exit Rate): As communicated in the March 2023 Investor Briefing, the expected growth rates for each business segment exiting 2025 are as follows: Commercial: 3% to 5% Government: ~3% Transportation: ~4% (1) Refer to complete Non-GAAP reconciliations of Adjusted Revenue elsewhere in this Appendix.

18 Definitions New Business Total Contract Value (TCV): Estimated total future revenues from contracts signed during the period related to new logo, new service line or expansion with existing customers. New Business Non-Recurring Revenue (NRR): Metric measures the non-recurring revenue for any new business signing, includes: i. Signing value of any contract with term less than 12 months; ii. Signing value of project based revenue, not expected to continue long term. New Business Annual Recurring Revenue (ARR): Metric measures the revenue from recurring services provided to the client for any new business signing. ARR represents the recurring services provided to a customer with the opportunity for renewal at the end of the contract term. The calculation of ARR is (Total Contract Value less Non-Recurring Revenue) divided by the Contract Term. New Business Annual Contract Value (ACV): (New Business TCV / contract term) multiplied by 12. Renewal TCV Signings: Estimated total future revenues from contracts signed during the period related to renewals. Renewal Signings Annual Recurring Revenue (ARR): Metric measures the revenue from recurring services provided to the client for any renewal signing. ARR represents the recurring services provided to a customer with the opportunity for renewal at the end of the contract term. The calculation of ARR is: (Total Contract Value - Non-Recurring Revenue) / the Contract Term. Net ARR Activity Metric (TTM): Projected ARR for contracts signed in the prior 12 months, less the annualized impact of any client losses, contractual volume and price changes, and other known impacts for which the Company was notified in that same time period, which could positively or negatively impact results. The metric annualizes the net impact to revenue. Timing of revenue impact varies and may not be realized within the forward 12-month timeframe. The metric is for indicative purposes only. This metric excludes non-recurring revenue signings. This metric is not indicative of any specific 12 month timeframe. Total New Business Pipeline (Cumulative Pipeline): Total new business ACV pipeline of deals at or beyond the qualified prospect stage.This extends past the next twelve-month period to include total pipeline, excluding the impact of divested business as required. Implied New Business Average Contract Length: (New business TCV – New business NRR) / New business ARR = Implied New Business Average Contract Length. TTM: Trailing twelve months. CC: Constant Currency as defined in "Non-GAAP Financial Measures"

19 Non-GAAP Financial Measures We have reported our financial results in accordance with accounting principles generally accepted in the U.S. (U.S. GAAP). In addition, we have discussed our financial results using non-GAAP measures. We believe these non-GAAP measures allow investors to better understand the trends in our business and to better understand and compare our results. Accordingly, we believe it is necessary to adjust several reported amounts, determined in accordance with U.S. GAAP, to exclude the effects of certain items as well as their related tax effects. Management believes that these non-GAAP financial measures provide an additional means of analyzing the results of the current period against the corresponding prior period. However, these non-GAAP financial measures should be viewed in addition to, and not as a substitute for, the Company’s reported results prepared in accordance with U.S. GAAP. Our non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable U.S. GAAP measures and should be read only in conjunction with our Consolidated Financial Statements prepared in accordance with U.S. GAAP. Our management regularly uses our non-GAAP financial measures internally to understand, manage and evaluate our business and make operating decisions. Providing such non-GAAP financial measures to investors allows for a further level of transparency as to how management reviews and evaluates our business results and trends. These non-GAAP measures are among the primary factors management uses in planning for and forecasting future periods. Compensation of our executives is based in part on the performance of our business based on certain of these non-GAAP measures. Management cautions that amounts presented in accordance with Conduent's definition of non-GAAP financial measures may not be comparable to similar measures disclosed by other companies because not all companies calculate non-GAAP measures in the same manner. Reconciliations of the following non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with U.S. GAAP Reconciliations are provided below. These reconciliations also include the income tax effects for our non-GAAP performance measures in total, to the extent applicable. The income tax effects are calculated under the same accounting principles as applied to our reported pre-tax performance measures under ASC 740, which employs an annual effective tax rate method. The noted income tax effect for our non-GAAP performance measures is effectively the difference in income taxes for reported and adjusted pre-tax income calculated under the annual effective tax rate method. The tax effect of the non-GAAP adjustments was calculated based upon evaluation of the statutory tax treatment and the applicable statutory tax rate in the jurisdictions in which such charges were incurred. Adjusted Revenue, Adjusted Profit Before Tax. Adjusted Net Income (Loss), Adjusted Diluted Earnings per Share, Adjusted Weighted Average Common Shares Outstanding, and Adjusted Effective Tax Rate. We make adjustments to Revenue, Net Income (Loss) before Income Taxes for the following items, as applicable, to the particular financial measure, for the purpose of calculating Adjusted Revenue, Adjusted Net Income (Loss), Adjusted Profit Before Tax, Adjusted Diluted Earnings per Share, Adjusted Weighted Average Common Shares Outstanding, and Adjusted Effective Tax Rate: • Amortization of acquired intangible assets. The amortization of acquired intangible assets is driven by acquisition activity, which can vary in size, nature and timing as compared to other companies within our industry and from period to period. • Restructuring and related costs. Restructuring and related costs include restructuring and asset impairment charges as well as costs associated with our strategic transformation program. • (Gain) loss on divestitures and transaction costs, net. Represents (gain) loss on divested businesses and transaction costs. • Goodwill Impairment. This represents goodwill impairment charges arising from annual or interim goodwill testing. • Loss on extinguishment of debt. This represents write-off related debt issuance costs related to prepayments of debt. • Litigation settlements (recoveries), net. Litigation settlements (recoveries), net represents provisions for various matters subject to litigation. • Direct response costs - cyber event. This represents costs related to investigating, remediating and responding to the cyber event that occurred in January 2025. • Other charges (credits). This includes Other (income) expenses, net on the Consolidated Statements of Income (loss) and other adjustments. • Divestitures. Revenue and Adjusted EBITDA of divested businesses are excluded. The Company provides adjusted net income and adjusted EPS financial measures to assist our investors in evaluating our ongoing operating performance for the current reporting period and, where provided, over different reporting periods, by adjusting for certain items which may be recurring or non-recurring and which in our view do not necessarily reflect ongoing performance. We also internally use these measures to assess our operating performance, both absolutely and in comparison to other companies, and in evaluating or making selected compensation decisions. Management believes that the adjusted effective tax rate, provided as supplemental information, facilitates a comparison by investors of our actual effective tax rate with an adjusted effective tax rate which reflects the impact of the items which are excluded in providing adjusted net income and certain other identified items, and may provide added insight into our underlying business results and how effective tax rates impact our ongoing business. Non-GAAP Financial Measures

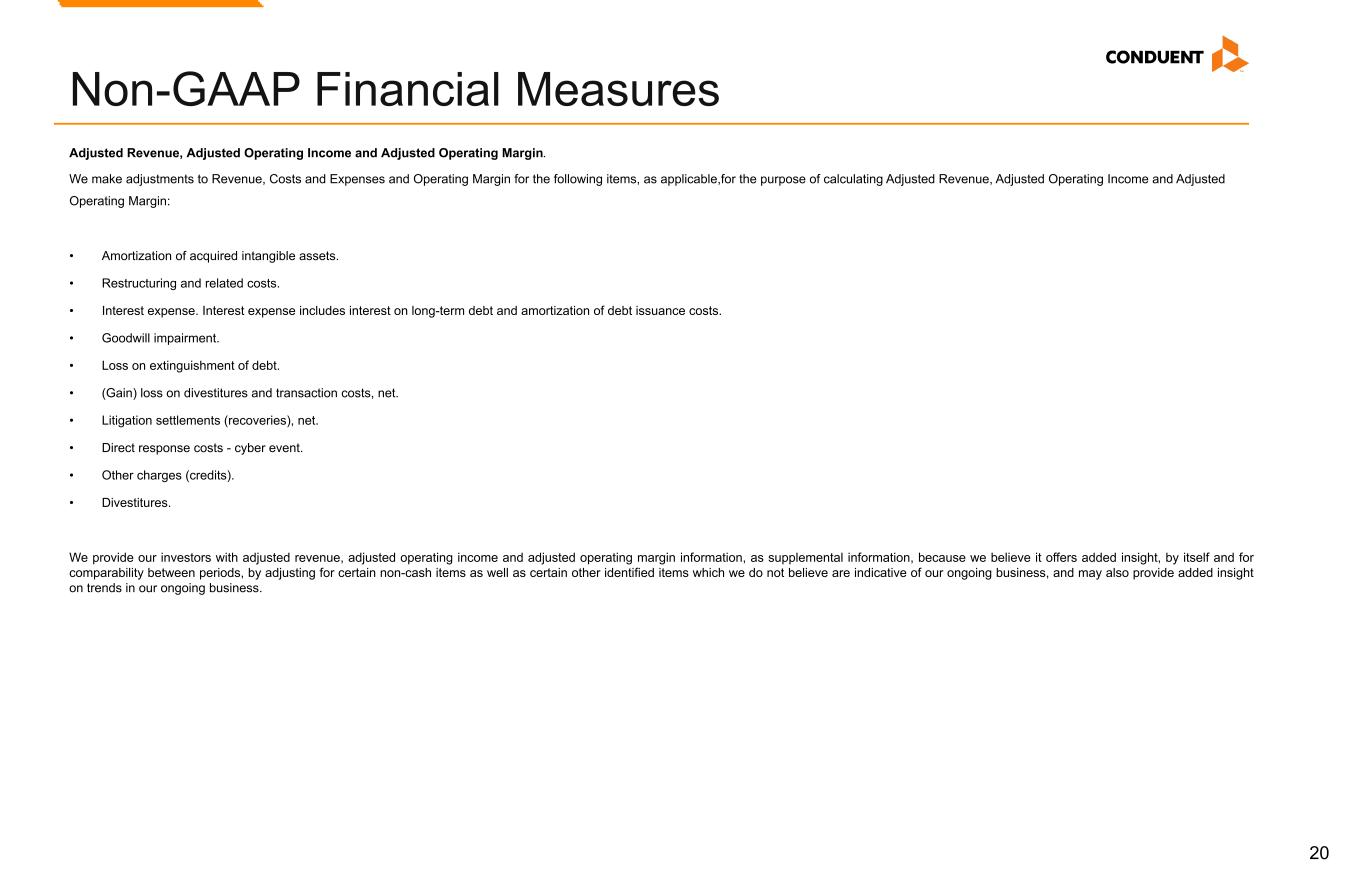

20 Adjusted Revenue, Adjusted Operating Income and Adjusted Operating Margin. We make adjustments to Revenue, Costs and Expenses and Operating Margin for the following items, as applicable,for the purpose of calculating Adjusted Revenue, Adjusted Operating Income and Adjusted Operating Margin: • Amortization of acquired intangible assets. • Restructuring and related costs. • Interest expense. Interest expense includes interest on long-term debt and amortization of debt issuance costs. • Goodwill impairment. • Loss on extinguishment of debt. • (Gain) loss on divestitures and transaction costs, net. • Litigation settlements (recoveries), net. • Direct response costs - cyber event. • Other charges (credits). • Divestitures. We provide our investors with adjusted revenue, adjusted operating income and adjusted operating margin information, as supplemental information, because we believe it offers added insight, by itself and for comparability between periods, by adjusting for certain non-cash items as well as certain other identified items which we do not believe are indicative of our ongoing business, and may also provide added insight on trends in our ongoing business. Non-GAAP Financial Measures

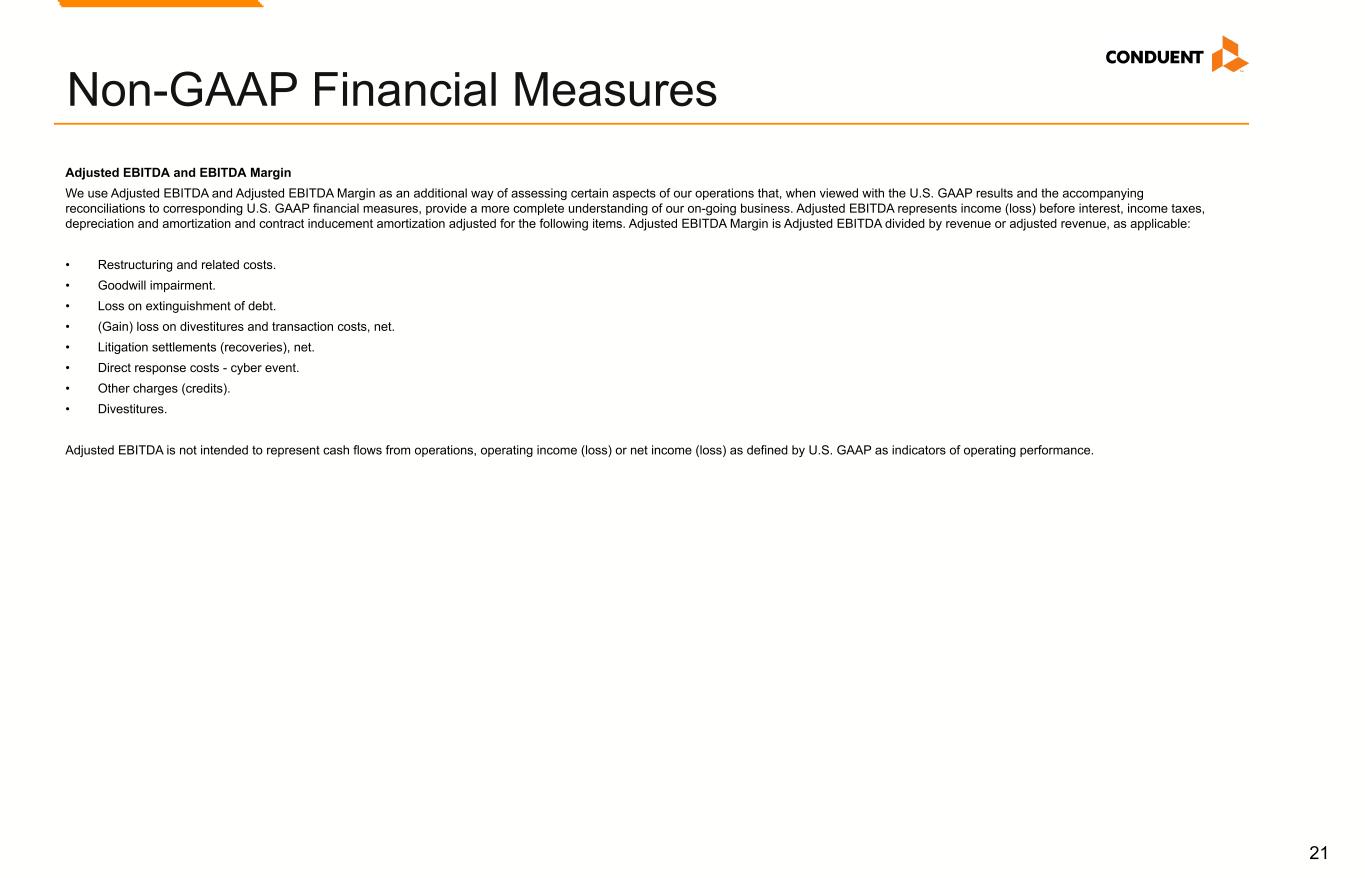

21 Adjusted EBITDA and EBITDA Margin We use Adjusted EBITDA and Adjusted EBITDA Margin as an additional way of assessing certain aspects of our operations that, when viewed with the U.S. GAAP results and the accompanying reconciliations to corresponding U.S. GAAP financial measures, provide a more complete understanding of our on-going business. Adjusted EBITDA represents income (loss) before interest, income taxes, depreciation and amortization and contract inducement amortization adjusted for the following items. Adjusted EBITDA Margin is Adjusted EBITDA divided by revenue or adjusted revenue, as applicable: • Restructuring and related costs. • Goodwill impairment. • Loss on extinguishment of debt. • (Gain) loss on divestitures and transaction costs, net. • Litigation settlements (recoveries), net. • Direct response costs - cyber event. • Other charges (credits). • Divestitures. Adjusted EBITDA is not intended to represent cash flows from operations, operating income (loss) or net income (loss) as defined by U.S. GAAP as indicators of operating performance. Non-GAAP Financial Measures

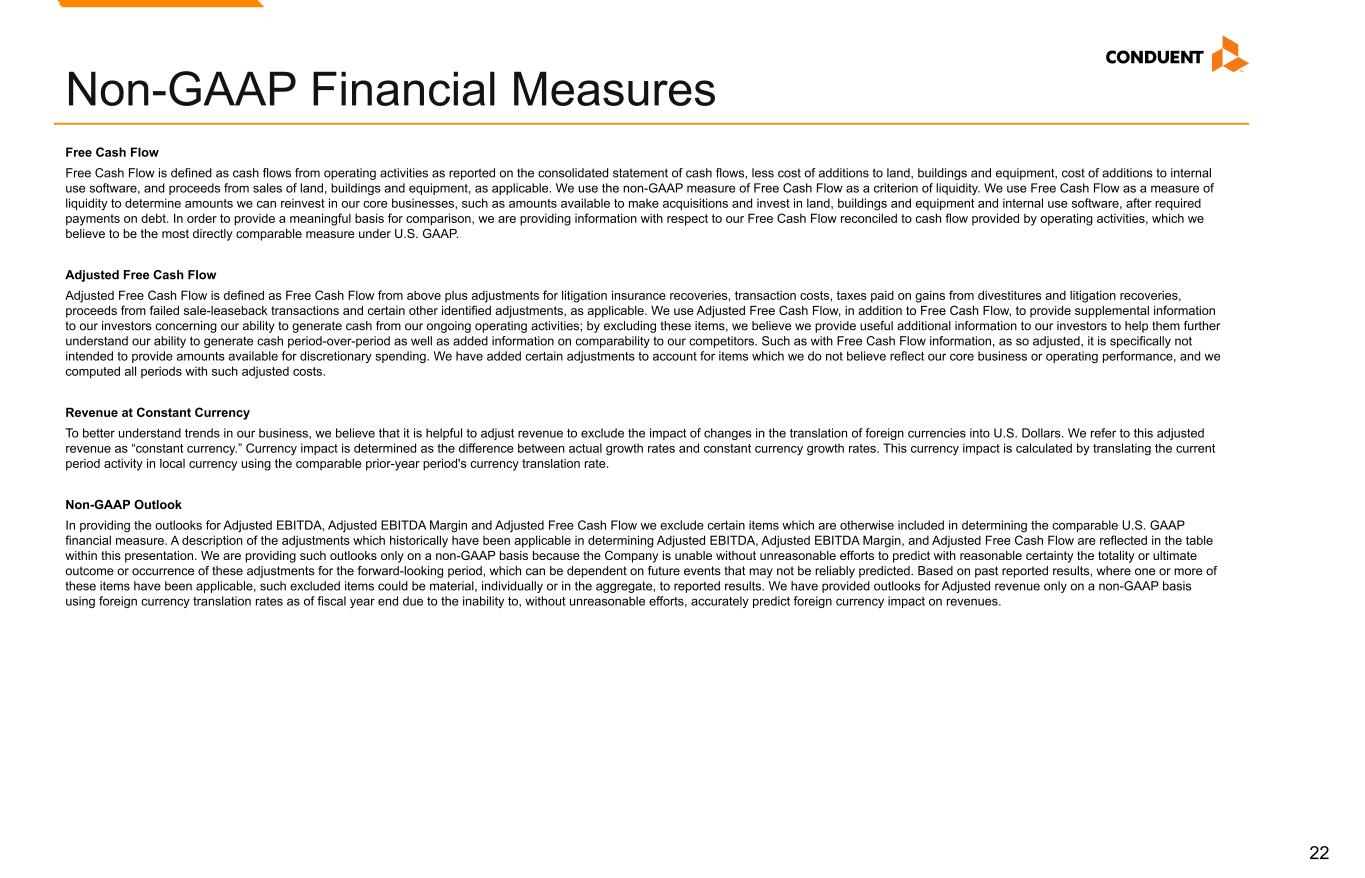

22 Free Cash Flow Free Cash Flow is defined as cash flows from operating activities as reported on the consolidated statement of cash flows, less cost of additions to land, buildings and equipment, cost of additions to internal use software, and proceeds from sales of land, buildings and equipment, as applicable. We use the non-GAAP measure of Free Cash Flow as a criterion of liquidity. We use Free Cash Flow as a measure of liquidity to determine amounts we can reinvest in our core businesses, such as amounts available to make acquisitions and invest in land, buildings and equipment and internal use software, after required payments on debt. In order to provide a meaningful basis for comparison, we are providing information with respect to our Free Cash Flow reconciled to cash flow provided by operating activities, which we believe to be the most directly comparable measure under U.S. GAAP. Adjusted Free Cash Flow Adjusted Free Cash Flow is defined as Free Cash Flow from above plus adjustments for litigation insurance recoveries, transaction costs, taxes paid on gains from divestitures and litigation recoveries, proceeds from failed sale-leaseback transactions and certain other identified adjustments, as applicable. We use Adjusted Free Cash Flow, in addition to Free Cash Flow, to provide supplemental information to our investors concerning our ability to generate cash from our ongoing operating activities; by excluding these items, we believe we provide useful additional information to our investors to help them further understand our ability to generate cash period-over-period as well as added information on comparability to our competitors. Such as with Free Cash Flow information, as so adjusted, it is specifically not intended to provide amounts available for discretionary spending. We have added certain adjustments to account for items which we do not believe reflect our core business or operating performance, and we computed all periods with such adjusted costs. Revenue at Constant Currency To better understand trends in our business, we believe that it is helpful to adjust revenue to exclude the impact of changes in the translation of foreign currencies into U.S. Dollars. We refer to this adjusted revenue as “constant currency.” Currency impact is determined as the difference between actual growth rates and constant currency growth rates. This currency impact is calculated by translating the current period activity in local currency using the comparable prior-year period's currency translation rate. Non-GAAP Outlook In providing the outlooks for Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted Free Cash Flow we exclude certain items which are otherwise included in determining the comparable U.S. GAAP financial measure. A description of the adjustments which historically have been applicable in determining Adjusted EBITDA, Adjusted EBITDA Margin, and Adjusted Free Cash Flow are reflected in the table within this presentation. We are providing such outlooks only on a non-GAAP basis because the Company is unable without unreasonable efforts to predict with reasonable certainty the totality or ultimate outcome or occurrence of these adjustments for the forward-looking period, which can be dependent on future events that may not be reliably predicted. Based on past reported results, where one or more of these items have been applicable, such excluded items could be material, individually or in the aggregate, to reported results. We have provided outlooks for Adjusted revenue only on a non-GAAP basis using foreign currency translation rates as of fiscal year end due to the inability to, without unreasonable efforts, accurately predict foreign currency impact on revenues. Non-GAAP Financial Measures

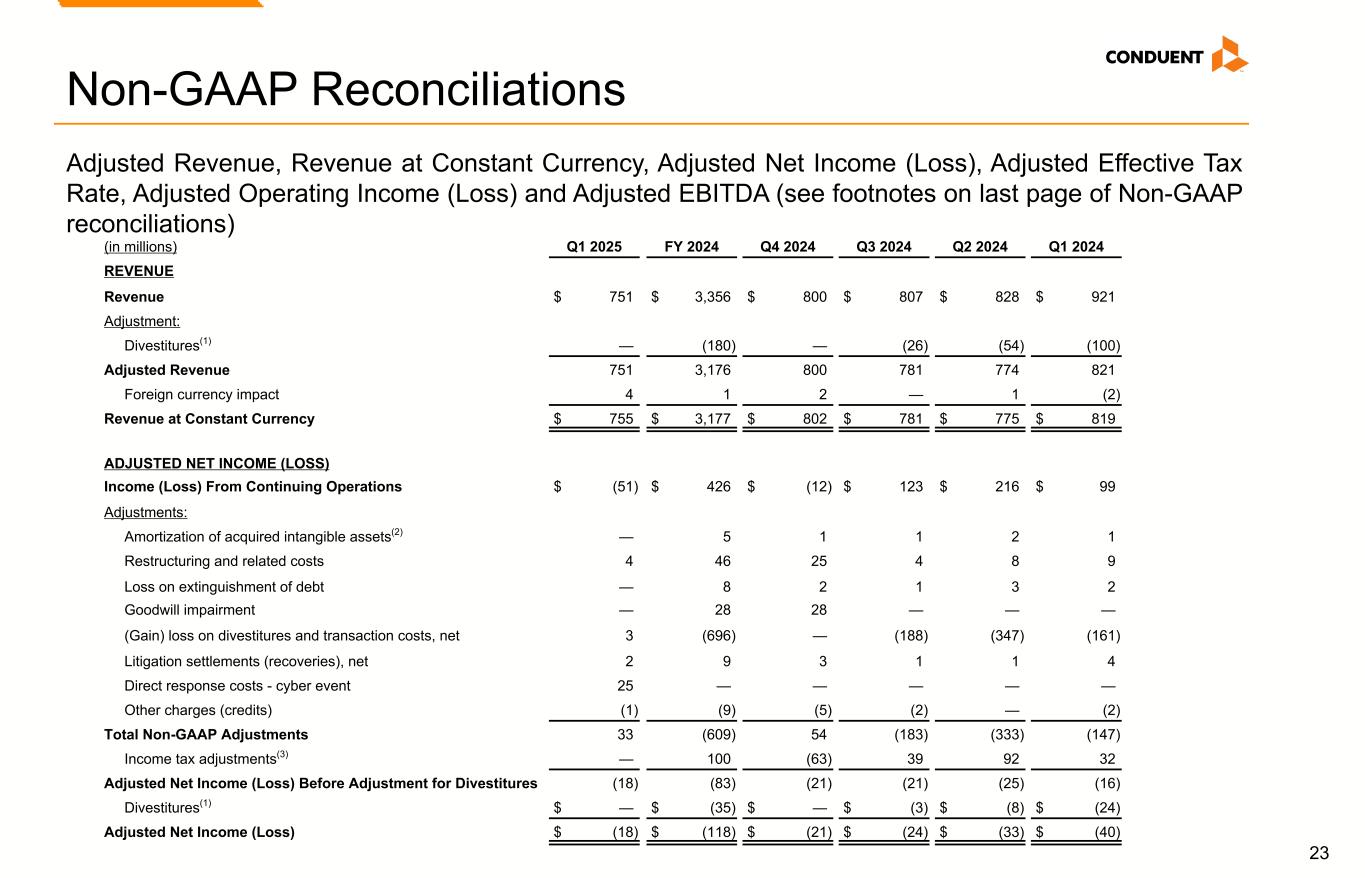

23 Non-GAAP Reconciliations (in millions) Q1 2025 FY 2024 Q4 2024 Q3 2024 Q2 2024 Q1 2024 REVENUE Revenue $ 751 $ 3,356 $ 800 $ 807 $ 828 $ 921 Adjustment: Divestitures(1) — (180) — (26) (54) (100) Adjusted Revenue 751 3,176 800 781 774 821 Foreign currency impact 4 1 2 — 1 (2) Revenue at Constant Currency $ 755 $ 3,177 $ 802 $ 781 $ 775 $ 819 ADJUSTED NET INCOME (LOSS) Income (Loss) From Continuing Operations $ (51) $ 426 $ (12) $ 123 $ 216 $ 99 Adjustments: Amortization of acquired intangible assets(2) — 5 1 1 2 1 Restructuring and related costs 4 46 25 4 8 9 Loss on extinguishment of debt — 8 2 1 3 2 Goodwill impairment — 28 28 — — — (Gain) loss on divestitures and transaction costs, net 3 (696) — (188) (347) (161) Litigation settlements (recoveries), net 2 9 3 1 1 4 Direct response costs - cyber event 25 — — — — — Other charges (credits) (1) (9) (5) (2) — (2) Total Non-GAAP Adjustments 33 (609) 54 (183) (333) (147) Income tax adjustments(3) — 100 (63) 39 92 32 Adjusted Net Income (Loss) Before Adjustment for Divestitures (18) (83) (21) (21) (25) (16) Divestitures(1) $ — $ (35) $ — $ (3) $ (8) $ (24) Adjusted Net Income (Loss) $ (18) $ (118) $ (21) $ (24) $ (33) $ (40) Adjusted Revenue, Revenue at Constant Currency, Adjusted Net Income (Loss), Adjusted Effective Tax Rate, Adjusted Operating Income (Loss) and Adjusted EBITDA (see footnotes on last page of Non-GAAP reconciliations)

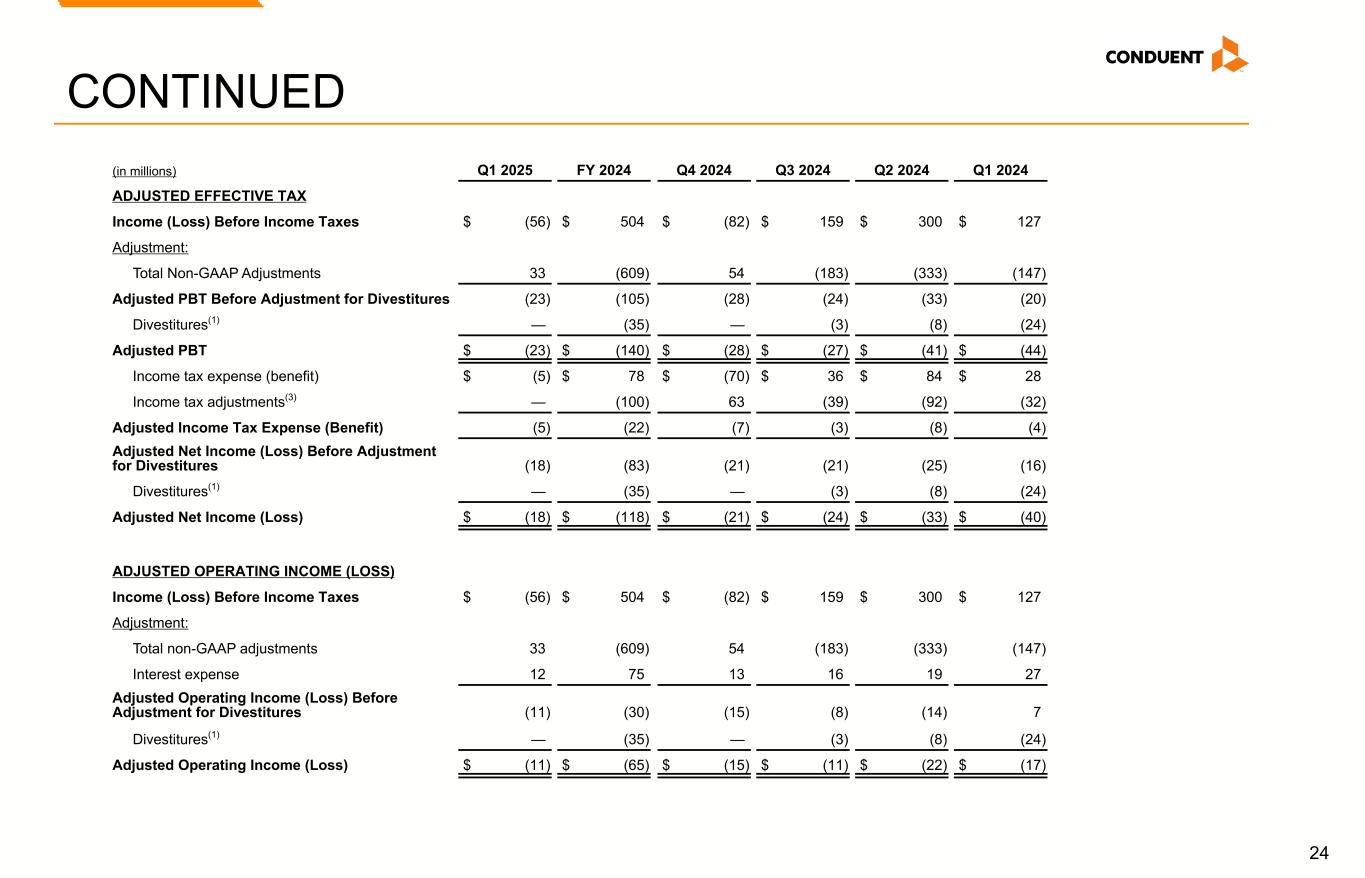

24 CONTINUED (in millions) Q1 2025 FY 2024 Q4 2024 Q3 2024 Q2 2024 Q1 2024 ADJUSTED EFFECTIVE TAX Income (Loss) Before Income Taxes $ (56) $ 504 $ (82) $ 159 $ 300 $ 127 Adjustment: Total Non-GAAP Adjustments 33 (609) 54 (183) (333) (147) Adjusted PBT Before Adjustment for Divestitures (23) (105) (28) (24) (33) (20) Divestitures(1) — (35) — (3) (8) (24) Adjusted PBT $ (23) $ (140) $ (28) $ (27) $ (41) $ (44) Income tax expense (benefit) $ (5) $ 78 $ (70) $ 36 $ 84 $ 28 Income tax adjustments(3) — (100) 63 (39) (92) (32) Adjusted Income Tax Expense (Benefit) (5) (22) (7) (3) (8) (4) Adjusted Net Income (Loss) Before Adjustment for Divestitures (18) (83) (21) (21) (25) (16) Divestitures(1) — (35) — (3) (8) (24) Adjusted Net Income (Loss) $ (18) $ (118) $ (21) $ (24) $ (33) $ (40) ADJUSTED OPERATING INCOME (LOSS) Income (Loss) Before Income Taxes $ (56) $ 504 $ (82) $ 159 $ 300 $ 127 Adjustment: Total non-GAAP adjustments 33 (609) 54 (183) (333) (147) Interest expense 12 75 13 16 19 27 Adjusted Operating Income (Loss) Before Adjustment for Divestitures (11) (30) (15) (8) (14) 7 Divestitures(1) — (35) — (3) (8) (24) Adjusted Operating Income (Loss) $ (11) $ (65) $ (15) $ (11) $ (22) $ (17)

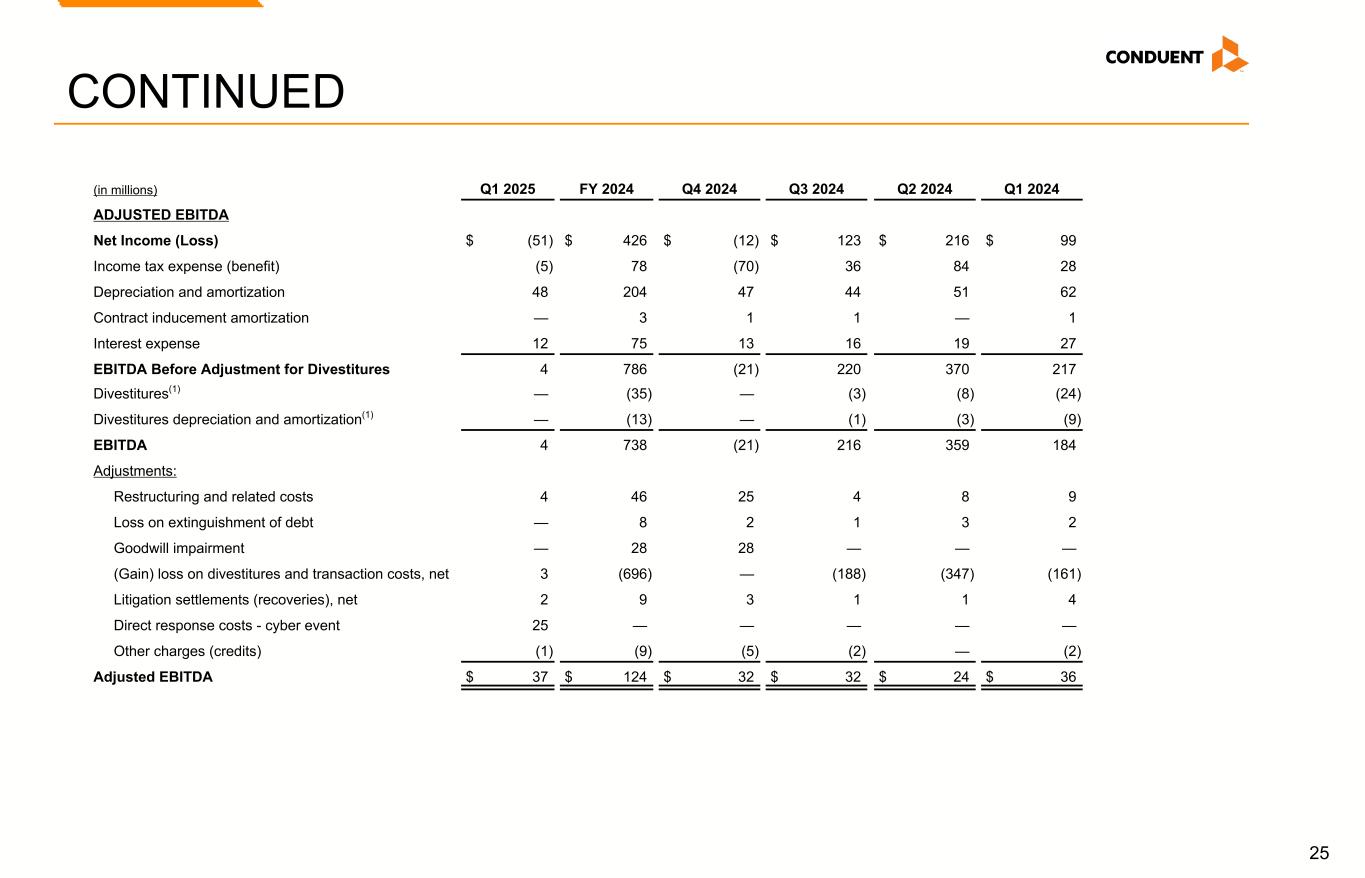

25 (in millions) Q1 2025 FY 2024 Q4 2024 Q3 2024 Q2 2024 Q1 2024 ADJUSTED EBITDA Net Income (Loss) $ (51) $ 426 $ (12) $ 123 $ 216 $ 99 Income tax expense (benefit) (5) 78 (70) 36 84 28 Depreciation and amortization 48 204 47 44 51 62 Contract inducement amortization — 3 1 1 — 1 Interest expense 12 75 13 16 19 27 EBITDA Before Adjustment for Divestitures 4 786 (21) 220 370 217 Divestitures(1) — (35) — (3) (8) (24) Divestitures depreciation and amortization(1) — (13) — (1) (3) (9) EBITDA 4 738 (21) 216 359 184 Adjustments: Restructuring and related costs 4 46 25 4 8 9 Loss on extinguishment of debt — 8 2 1 3 2 Goodwill impairment — 28 28 — — — (Gain) loss on divestitures and transaction costs, net 3 (696) — (188) (347) (161) Litigation settlements (recoveries), net 2 9 3 1 1 4 Direct response costs - cyber event 25 — — — — — Other charges (credits) (1) (9) (5) (2) — (2) Adjusted EBITDA $ 37 $ 124 $ 32 $ 32 $ 24 $ 36 CONTINUED

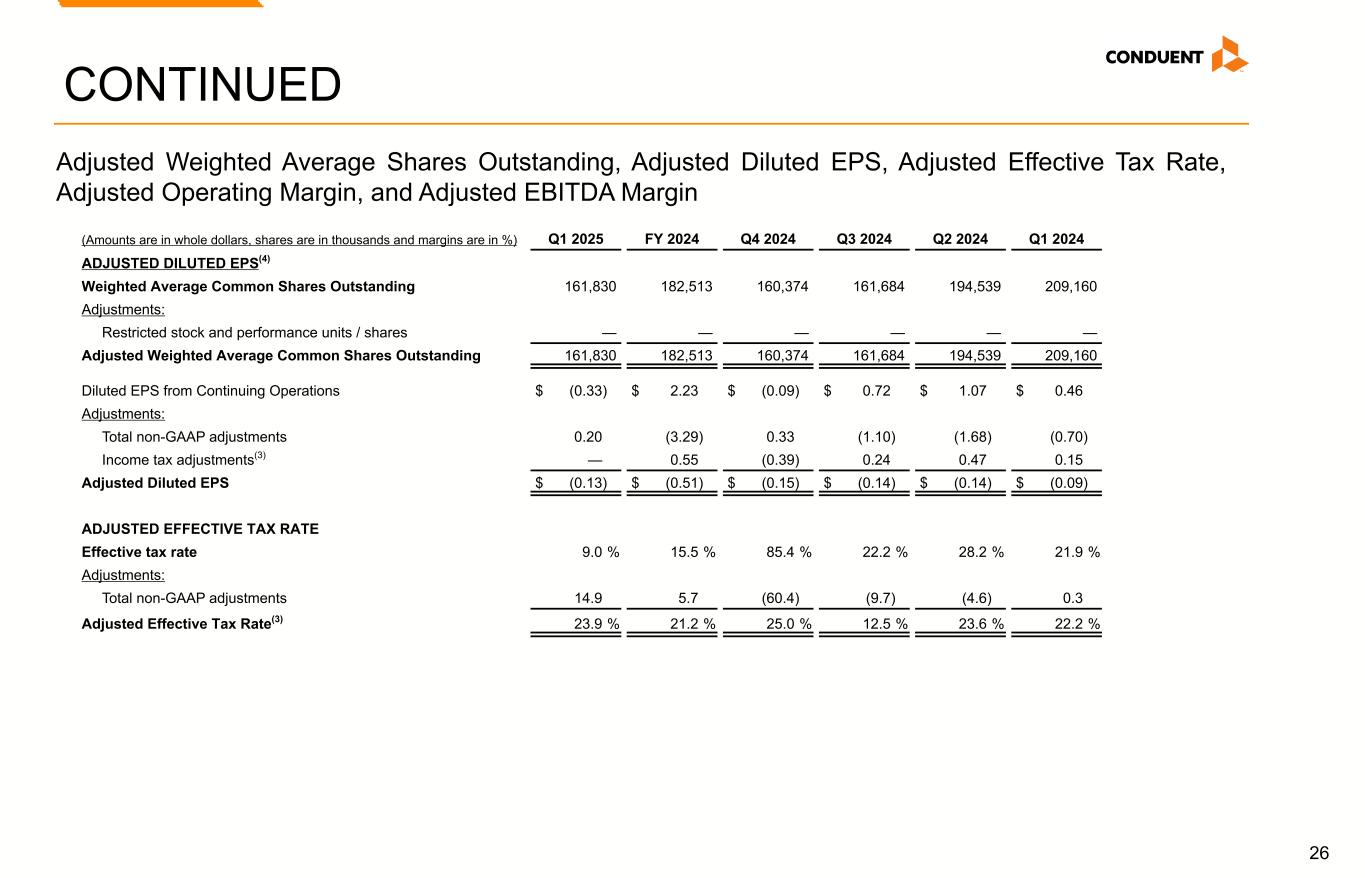

26 CONTINUED (Amounts are in whole dollars, shares are in thousands and margins are in %) Q1 2025 FY 2024 Q4 2024 Q3 2024 Q2 2024 Q1 2024 ADJUSTED DILUTED EPS(4) Weighted Average Common Shares Outstanding 161,830 182,513 160,374 161,684 194,539 209,160 Adjustments: Restricted stock and performance units / shares — — — — — — Adjusted Weighted Average Common Shares Outstanding 161,830 182,513 160,374 161,684 194,539 209,160 Diluted EPS from Continuing Operations $ (0.33) $ 2.23 $ (0.09) $ 0.72 $ 1.07 $ 0.46 Adjustments: Total non-GAAP adjustments 0.20 (3.29) 0.33 (1.10) (1.68) (0.70) Income tax adjustments(3) — 0.55 (0.39) 0.24 0.47 0.15 Adjusted Diluted EPS $ (0.13) $ (0.51) $ (0.15) $ (0.14) $ (0.14) $ (0.09) ADJUSTED EFFECTIVE TAX RATE Effective tax rate 9.0 % 15.5 % 85.4 % 22.2 % 28.2 % 21.9 % Adjustments: Total non-GAAP adjustments 14.9 5.7 (60.4) (9.7) (4.6) 0.3 Adjusted Effective Tax Rate(3) 23.9 % 21.2 % 25.0 % 12.5 % 23.6 % 22.2 % Adjusted Weighted Average Shares Outstanding, Adjusted Diluted EPS, Adjusted Effective Tax Rate, Adjusted Operating Margin, and Adjusted EBITDA Margin

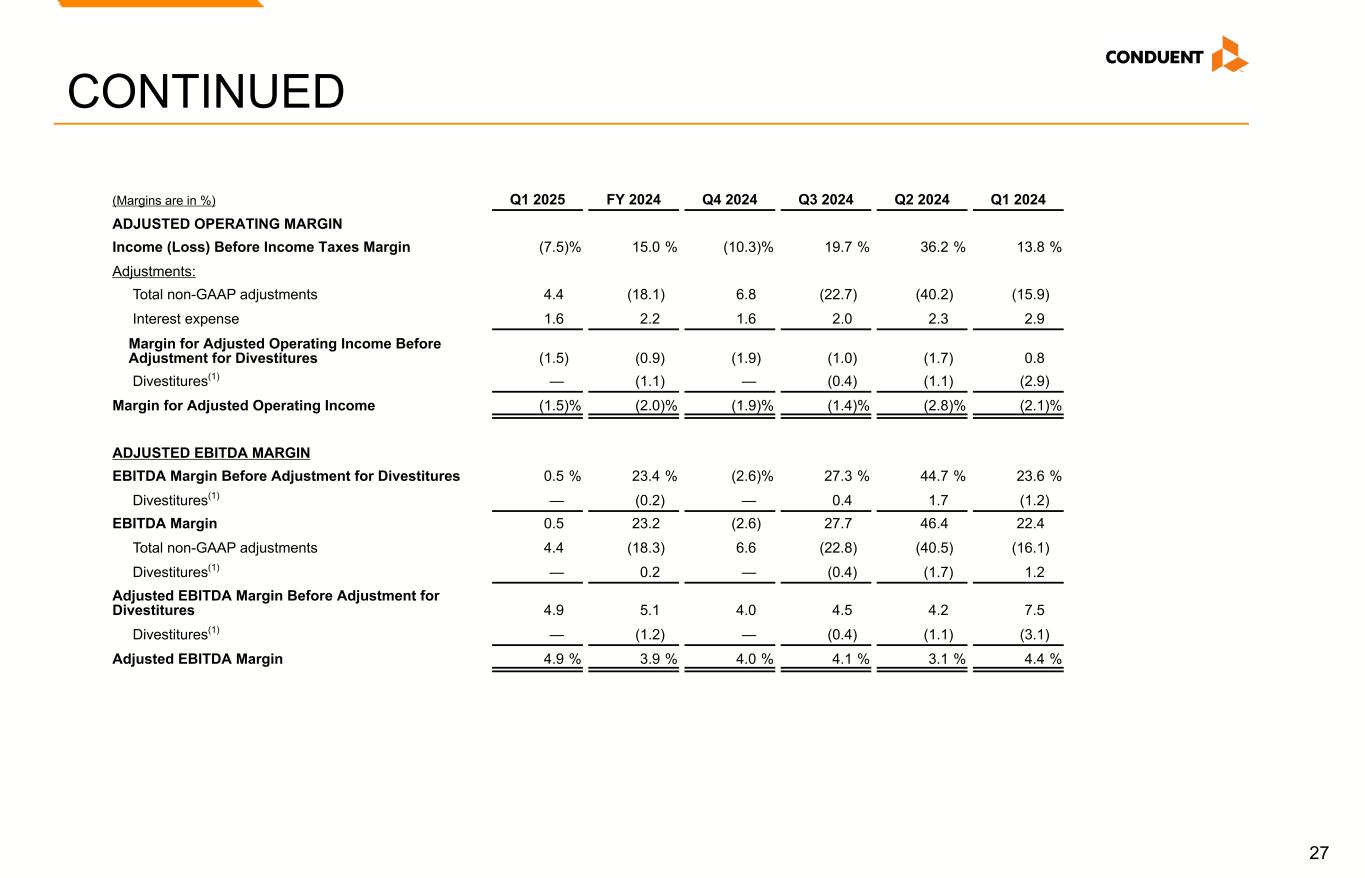

27 (Margins are in %) Q1 2025 FY 2024 Q4 2024 Q3 2024 Q2 2024 Q1 2024 ADJUSTED OPERATING MARGIN Income (Loss) Before Income Taxes Margin (7.5) % 15.0 % (10.3) % 19.7 % 36.2 % 13.8 % Adjustments: Total non-GAAP adjustments 4.4 (18.1) 6.8 (22.7) (40.2) (15.9) Interest expense 1.6 2.2 1.6 2.0 2.3 2.9 Margin for Adjusted Operating Income Before Adjustment for Divestitures (1.5) (0.9) (1.9) (1.0) (1.7) 0.8 Divestitures(1) — (1.1) — (0.4) (1.1) (2.9) Margin for Adjusted Operating Income (1.5) % (2.0) % (1.9) % (1.4) % (2.8) % (2.1) % ADJUSTED EBITDA MARGIN EBITDA Margin Before Adjustment for Divestitures 0.5 % 23.4 % (2.6) % 27.3 % 44.7 % 23.6 % Divestitures(1) — (0.2) — 0.4 1.7 (1.2) EBITDA Margin 0.5 23.2 (2.6) 27.7 46.4 22.4 Total non-GAAP adjustments 4.4 (18.3) 6.6 (22.8) (40.5) (16.1) Divestitures(1) — 0.2 — (0.4) (1.7) 1.2 Adjusted EBITDA Margin Before Adjustment for Divestitures 4.9 5.1 4.0 4.5 4.2 7.5 Divestitures(1) — (1.2) — (0.4) (1.1) (3.1) Adjusted EBITDA Margin 4.9 % 3.9 % 4.0 % 4.1 % 3.1 % 4.4 % CONTINUED

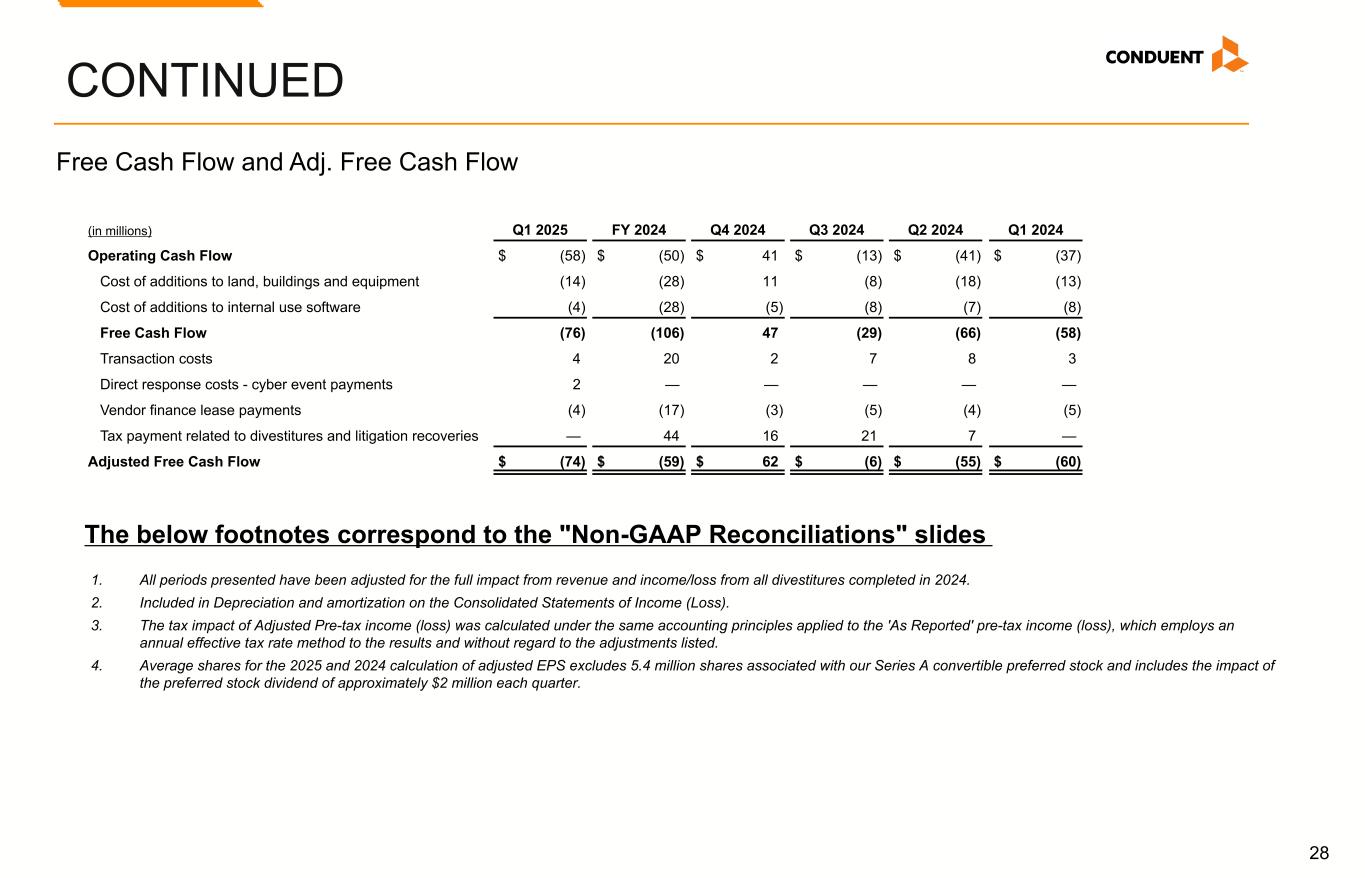

28 CONTINUED (in millions) Q1 2025 FY 2024 Q4 2024 Q3 2024 Q2 2024 Q1 2024 Operating Cash Flow $ (58) $ (50) $ 41 $ (13) $ (41) $ (37) Cost of additions to land, buildings and equipment (14) (28) 11 (8) (18) (13) Cost of additions to internal use software (4) (28) (5) (8) (7) (8) Free Cash Flow (76) (106) 47 (29) (66) (58) Transaction costs 4 20 2 7 8 3 Direct response costs - cyber event payments 2 — — — — — Vendor finance lease payments (4) (17) (3) (5) (4) (5) Tax payment related to divestitures and litigation recoveries — 44 16 21 7 — Adjusted Free Cash Flow $ (74) $ (59) $ 62 $ (6) $ (55) $ (60) Free Cash Flow and Adj. Free Cash Flow The below footnotes correspond to the "Non-GAAP Reconciliations" slides 1. All periods presented have been adjusted for the full impact from revenue and income/loss from all divestitures completed in 2024. 2. Included in Depreciation and amortization on the Consolidated Statements of Income (Loss). 3. The tax impact of Adjusted Pre-tax income (loss) was calculated under the same accounting principles applied to the 'As Reported' pre-tax income (loss), which employs an annual effective tax rate method to the results and without regard to the adjustments listed. 4. Average shares for the 2025 and 2024 calculation of adjusted EPS excludes 5.4 million shares associated with our Series A convertible preferred stock and includes the impact of the preferred stock dividend of approximately $2 million each quarter.

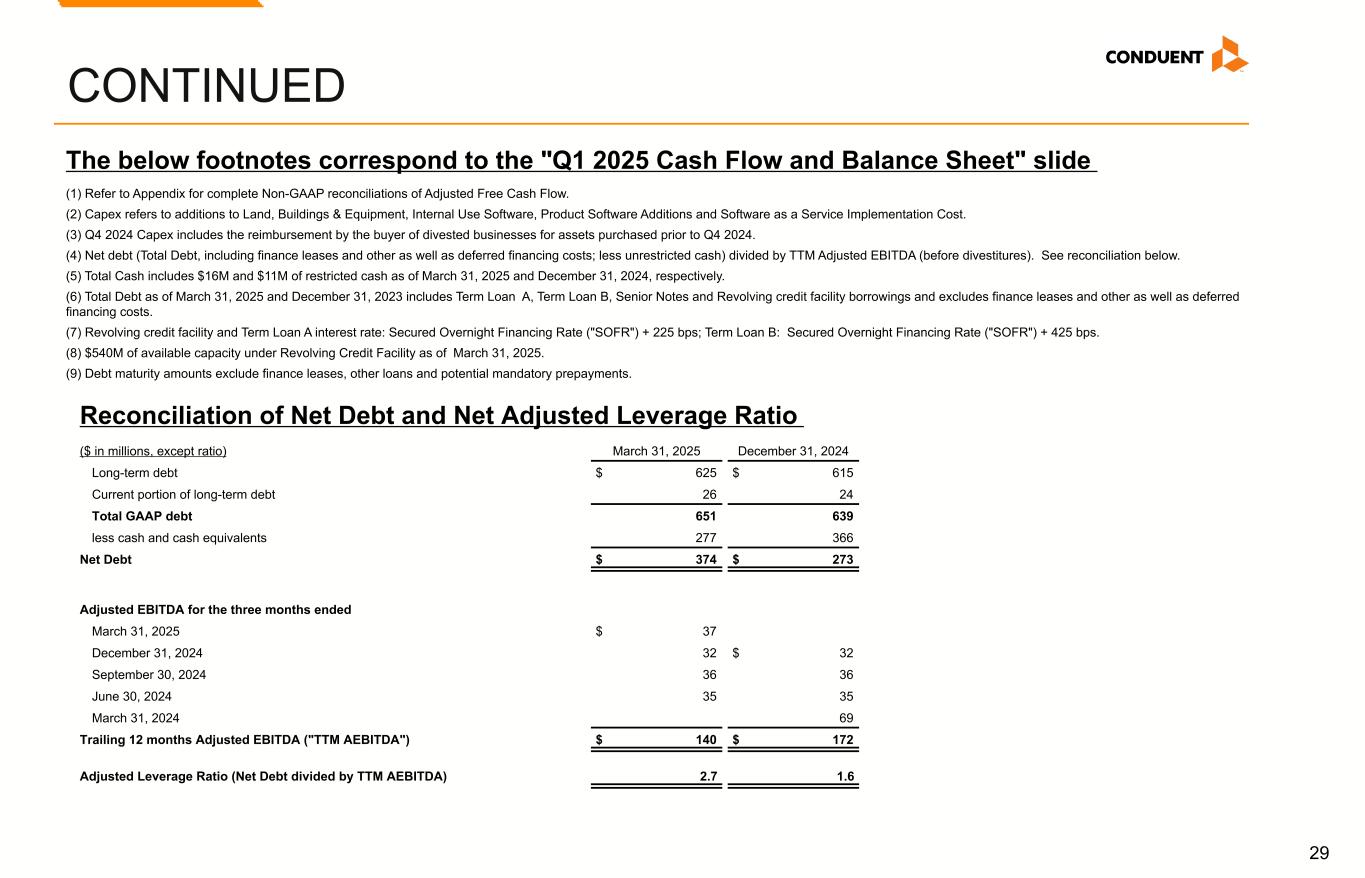

29 CONTINUED ($ in millions, except ratio) March 31, 2025 December 31, 2024 Long-term debt $ 625 $ 615 Current portion of long-term debt 26 24 Total GAAP debt 651 639 less cash and cash equivalents 277 366 Net Debt $ 374 $ 273 Adjusted EBITDA for the three months ended March 31, 2025 $ 37 December 31, 2024 32 $ 32 September 30, 2024 36 36 June 30, 2024 35 35 March 31, 2024 69 Trailing 12 months Adjusted EBITDA ("TTM AEBITDA") $ 140 $ 172 Adjusted Leverage Ratio (Net Debt divided by TTM AEBITDA) 2.7 1.6 (1) Refer to Appendix for complete Non-GAAP reconciliations of Adjusted Free Cash Flow. (2) Capex refers to additions to Land, Buildings & Equipment, Internal Use Software, Product Software Additions and Software as a Service Implementation Cost. (3) Q4 2024 Capex includes the reimbursement by the buyer of divested businesses for assets purchased prior to Q4 2024. (4) Net debt (Total Debt, including finance leases and other as well as deferred financing costs; less unrestricted cash) divided by TTM Adjusted EBITDA (before divestitures). See reconciliation below. (5) Total Cash includes $16M and $11M of restricted cash as of March 31, 2025 and December 31, 2024, respectively. (6) Total Debt as of March 31, 2025 and December 31, 2023 includes Term Loan A, Term Loan B, Senior Notes and Revolving credit facility borrowings and excludes finance leases and other as well as deferred financing costs. (7) Revolving credit facility and Term Loan A interest rate: Secured Overnight Financing Rate ("SOFR") + 225 bps; Term Loan B: Secured Overnight Financing Rate ("SOFR") + 425 bps. (8) $540M of available capacity under Revolving Credit Facility as of March 31, 2025. (9) Debt maturity amounts exclude finance leases, other loans and potential mandatory prepayments. The below footnotes correspond to the "Q1 2025 Cash Flow and Balance Sheet" slide Reconciliation of Net Debt and Net Adjusted Leverage Ratio

© 2025 Conduent, Inc. All rights reserved. Conduent and Conduent Agile Star are trademarks of Conduent, Inc. and/or its subsidiaries in the United States and/or other countries.