1 EARNINGS PRESENTATION 2Q 2025 August 7, 2025

2 This presentation may contain forward-looking statements within the meaning of the federal securities laws, including statements relating to (i) our strategy, outlook and growth prospects, (ii) our operational and financial targets and (iii) general economic trends and trends in our industry and markets. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and contingencies, many of which are beyond the Company’s control, and may cause the Company’s actual results to differ significantly from those expressed in any forward-looking statement. Factors that might cause such a difference include, without limitation, difficult market and political conditions, including those resulting from inflation, high interest rates, a general economic slowdown or a recession; our ability to raise capital from investors for our Company, our funds and the companies that we manage; the performance of our funds and investments relative to our expectations and the highly variable nature of our revenues, earnings and cash flow; our exposure to risks inherent in the ownership and operation of infrastructure and digital infrastructure assets, including our reliance on third-party suppliers to provide power, network connectivity and certain other services to our managed companies; our exposure to business risks in Europe, Asia, Latin America and other foreign markets; our ability to increase assets under management and expand our existing and new investment strategies while maintaining consistent standards and controls; our ability to appropriately manage conflicts of interest; our ability to expand into new investment strategies, geographic markets and businesses, including through acquisitions in the infrastructure and investment management industries; the impact of climate change and regulatory or societal efforts associated with environmental, social and governance matters; our ability to maintain effective information and cybersecurity policies, procedures and capabilities and the impact of any cybersecurity incident affecting our systems or network or the system and network of any of our managed companies or service providers; the ability of our portfolio companies to attract and retain key customers and to provide reliable services without disruption; any litigation and contractual claims against us and our affiliates, including potential settlement and litigation of such claims; our ability to obtain and maintain financing arrangements, including securitizations, on favorable or comparable terms or at all; the general volatility of the securities markets in which we participate; the market value of our assets and effects of hedging instruments on our assets; the impact of legislative, regulatory and competitive changes, including those related to privacy and data protection and new Securities and Exchange Commission (“SEC”) rules governing investment advisers; whether we will be able to utilize existing tax attributes to offset taxable income to the extent contemplated; our ability to maintain our exemption from registration as an investment company under the Investment Company Act of 1940, as amended; changes in our board of directors or management team, and availability of qualified personnel; our ability to make or maintain distributions to our stockholders; our understanding of and ability to successfully navigate the competitive landscape in which we and our managed companies operate; and other risks and uncertainties, including those detailed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024 under the heading “Risk Factors,” as such factors may be updated from time to time in the Company’s subsequent periodic filings with the SEC. All forward-looking statements reflect the Company’s good faith beliefs, assumptions and expectations, but they are not guarantees of future performance. Additional information about these and other factors can be found in the Company’s reports filed from time to time with the SEC. While the Company believes that the portfolio companies of its funds or investment vehicles will offer services to support companies engaged in artificial intelligence development and related products ("AI Technologies"), AI Technologies and their current and potential future applications, as well as the legal and regulatory frameworks within which they operate, continue to rapidly evolve, and it is impossible to predict the full extent of current or future technology needs and the risks related thereto. The risk exists that portfolio companies' current technology infrastructure, systems, or products may become obsolete or less competitive due to the emergence of new technologies, innovations, or industry standards. The Company cautions investors not to unduly rely on any forward-looking statements. The forward-looking statements speak only as of the date of this presentation. The Company is under no duty to update any of these forward-looking statements after the date of this presentation, nor to conform prior statements to actual results or revised expectations, and the Company does not intend to do so. This presentation is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities of the Company or any investment vehicle managed or advised thereby. This information is not intended to be indicative of future results. Actual performance of the Company may vary materially. The appendices herein contain important information that is material to an understanding of this presentation, including information regarding certain non-GAAP financial measures, and you should read this presentation only with and in context of the appendices. CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

3 DBRG REPORTS SECOND QUARTER 2025 RESULTS Boca Raton, August 7th, 2025 - DigitalBridge Group, Inc. (NYSE: DBRG) and subsidiaries (collectively, “DigitalBridge,” or the “Company”) today announced financial results for the second quarter ended June 30, 2025. The Company reported second quarter 2025 GAAP net income attributable to common stockholders of $17 million, or $0.10 per share, and Distributable Earnings of negative $18.6 million, or $0.10 loss per share. Common and Preferred Dividends On August 5, 2025, the Company’s Board of Directors declared a cash dividend of $0.01 per common share to be paid on October 15, 2025 to shareholders of record at the close of business on September 30, 2025; and declared cash dividends with respect to each series of the Company’s cumulative redeemable perpetual preferred stock in accordance with the terms of such series, as follows: Series H preferred stock: $0.4453125 per share; Series I preferred stock: $0.446875 per share; and Series J preferred stock: $0.4453125 per share, which will be paid on October 15, 2025 to the respective stockholders of record on October 10, 2025. Second Quarter 2025 Conference Call The Company will conduct an earnings conference call and presentation to discuss the second quarter 2025 financial results on Thursday, August 7, 2025, at 8:00 a.m. Eastern Time (ET). The earnings presentation will be broadcast live over the Internet and a webcast link can be accessed on the Shareholders section of the Company’s website at ir.digitalbridge.com/events. To participate in the event by telephone, please dial (844) 826-3035 ten minutes prior to the start time (to allow time for registration). International callers should dial (412) 317-5195. For those unable to participate during the live call, a replay will be available starting August 7, 2025, at 12:00 p.m. ET. To access the replay, dial (844) 512-2921 (U.S.), and use conference ID 10200580. International callers should dial (412) 317-6671 and enter the same conference ID number. We delivered another solid quarter of growth in the second quarter with fee related earnings up double digits, aligned with our objectives for the year as operating margins continue to scale. We are capitalizing on the powerful secular tailwinds driven by AI, which are demanding an unprecedented build-out of data centers and the energy that powers them. Our recent landmark investments, including the acquisition of Yondr and the launch of our Takanock power infrastructure platform, uniquely position us to provide the full spectrum of large-scale, critical solutions customers need to meet this historic demand. Marc Ganzi Chief Executive Officer “ ”

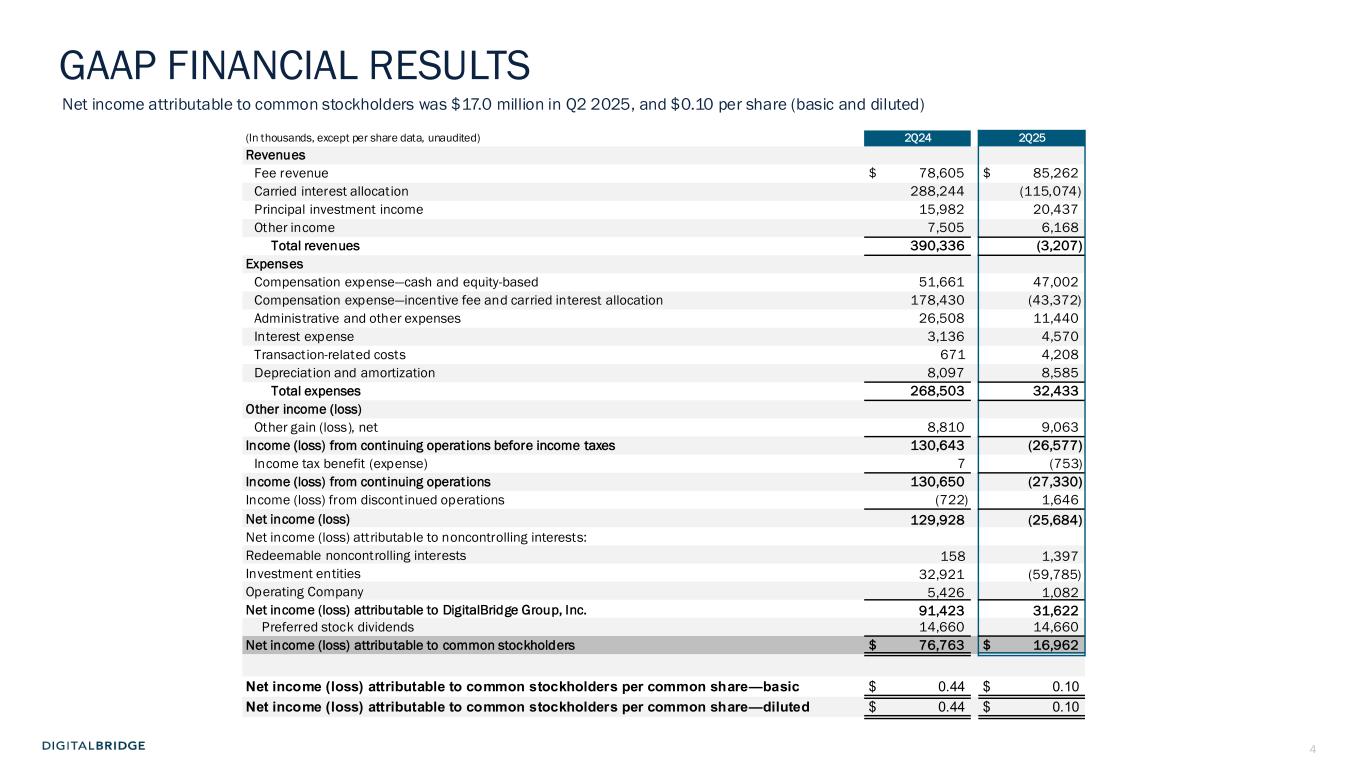

4 (In thousands, except per share data, unaudited) 2Q24 2Q25 Revenues Fee revenue $ 78,605 $ 85,262 Carried interest allocation 288,244 (115,074) Principal investment income 15,982 20,437 Other income 7,505 6,168 Total revenues 390,336 (3,207) Expenses Compensation expense—cash and equity-based 51,661 47,002 Compensation expense—incentive fee and carried interest allocation 178,430 (43,372) Administrative and other expenses 26,508 11,440 Interest expense 3,136 4,570 Transaction-related costs 671 4,208 Depreciation and amortization 8,097 8,585 Total expenses 268,503 32,433 Other income (loss) Other gain (loss), net 8,810 9,063 Income (loss) from continuing operations before income taxes 130,643 (26,577) Income tax benefit (expense) 7 (753) Income (loss) from continuing operations 130,650 (27,330) Income (loss) from discontinued operations (722) 1,646 Net income (loss) 129,928 (25,684) Net income (loss) attributable to noncontrolling interests: Redeemable noncontrolling interests 158 1,397 Investment entities 32,921 (59,785) Operating Company 5,426 1,082 Net income (loss) attributable to DigitalBridge Group, Inc. 91,423 31,622 Preferred stock dividends 14,660 14,660 Net income (loss) attributable to common stockholders $ 76,763 $ 16,962 Net income (loss) attributable to common stockholders per common share—basic $ 0.44 $ 0.10 Net income (loss) attributable to common stockholders per common share—diluted $ 0.44 $ 0.10 GAAP FINANCIAL RESULTS Net income attributable to common stockholders was $17.0 million in Q2 2025, and $0.10 per share (basic and diluted)

5 AGENDA BUSINESS UPDATES E C T IO N 1 FINANCIAL RESULTSS E C T IO N 2 3 EXECUTING THE DIGITAL PLAYBOOKS E C T IO N

6 1 BUSINESS UPDATE

7 BUSINESS UPDATE Building AI factories, continuing to scale and power our leading data center footprint ▪ Closed on multi-billion Yondr data center acquisition, with 400MW+ in place and potential for 1GW+. ▪ Digital Energy investment in Takanock powered- land strategy in partnership with ArcLight. ▪ Significant financings at Switch and Vantage data center platforms to support strong bookings and significant capacity expansion. Solid Revenue and Earnings Growth Continues ▪ Fee Revenues of $85 million grew +8% YoY in 2Q25, supported by new FEEUM activation from the DBP Flagship series. ▪ Fee-Related Earnings (FRE) of $32 million grew +23% YoY in 2Q25. ▪ Continued margin improvement with revenues outpacing expenses, which were nearly flat YoY. $$$ In 2Q25, DBRG continued to deliver strong financial results and fundraising aligned with our objectives for the year, while continuing to scale our AI ecosystem footprint New capital formation of $2.5B YTD, $1.3B in 2Q, on track with 2025 targets INVESTSCALE FUNDRAISE INVEST FUNDRAISE SCALE - DBRG YTD 2025 $2.5 billion ▪ Well positioned entering historically strong 2H.

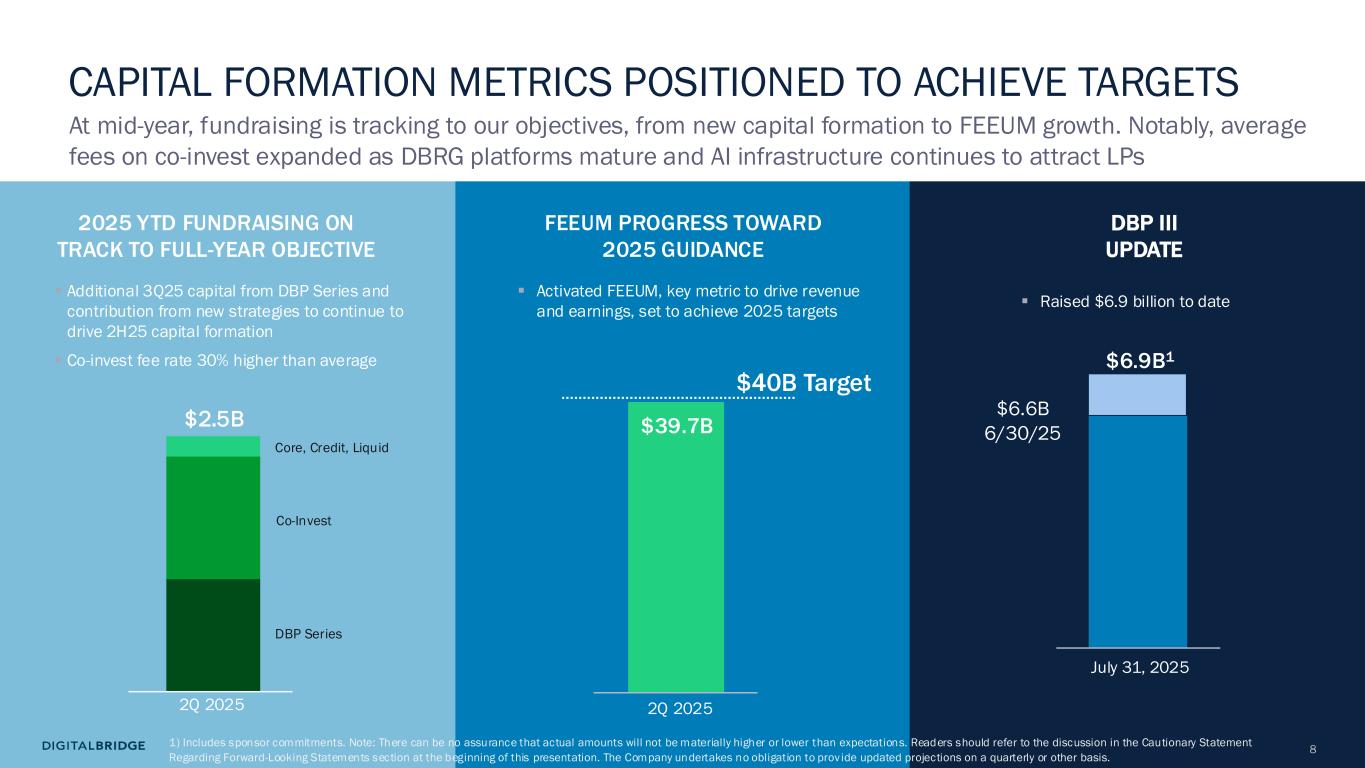

8 2025 YTD FUNDRAISING ON TRACK TO FULL-YEAR OBJECTIVE FEEUM PROGRESS TOWARD 2025 GUIDANCE $40B Target DBP III UPDATE $39.7B $2.5B 2Q 2025 July 31, 2025 DBP Series Co-Invest Core, Credit, Liquid 2Q 2025 $6.6B 6/30/25 $6.9B1 $2.5B CAPITAL FORMATION METRICS POSITIONED TO ACHIEVE TARGETS ▪ Additional 3Q25 capital from DBP Series and contribution from new strategies to continue to drive 2H25 capital formation ▪ Co-invest fee rate 30% higher than average At mid-year, fundraising is tracking to our objectives, from new capital formation to FEEUM growth. Notably, average fees on co-invest expanded as DBRG platforms mature and AI infrastructure continues to attract LPs ▪ Activated FEEUM, key metric to drive revenue and earnings, set to achieve 2025 targets ▪ Raised $6.9 billion to date 1) Includes sponsor commitments. Note: There can be no assurance that actual amounts will not be materially higher or lower than expectations. Readers should refer to the discussion in the Cautionary Statement Regarding Forward-Looking Statements section at the beginning of this presentation. The Company undertakes no obligation to prov ide updated projections on a quarterly or other basis.

9 INVEST Investing in exciting new digital platforms poised for growth while continuing to fuel the expansion of our existing, market-leading portfolio companies $20B 1 GW+ Potential Capacity DATA CENTER - PRIVATE CLOUD Capital Committed from DigitalBridge and ArcLight Data Center Power Infra $500M Serving HYPERSCALE DATA CENTERS INVEST FUNDRAISE SCALE - DBRG Current Leased Capacity 420 MW HYPERSCALE DATA CENTERS Raised in Debt across NA, Europe and APAC during Q2’25 HYPERSCALE DATA CENTERS $7B+ AI and Cloud Infra Growth EXISTING PORTFOLIO – FINANCING CAPITAL TO FUEL GROWTH NEW PLATFORMS Capital raised since 2024 to accelerate growth, reduce borrowing costs and retire acquisition-related debt

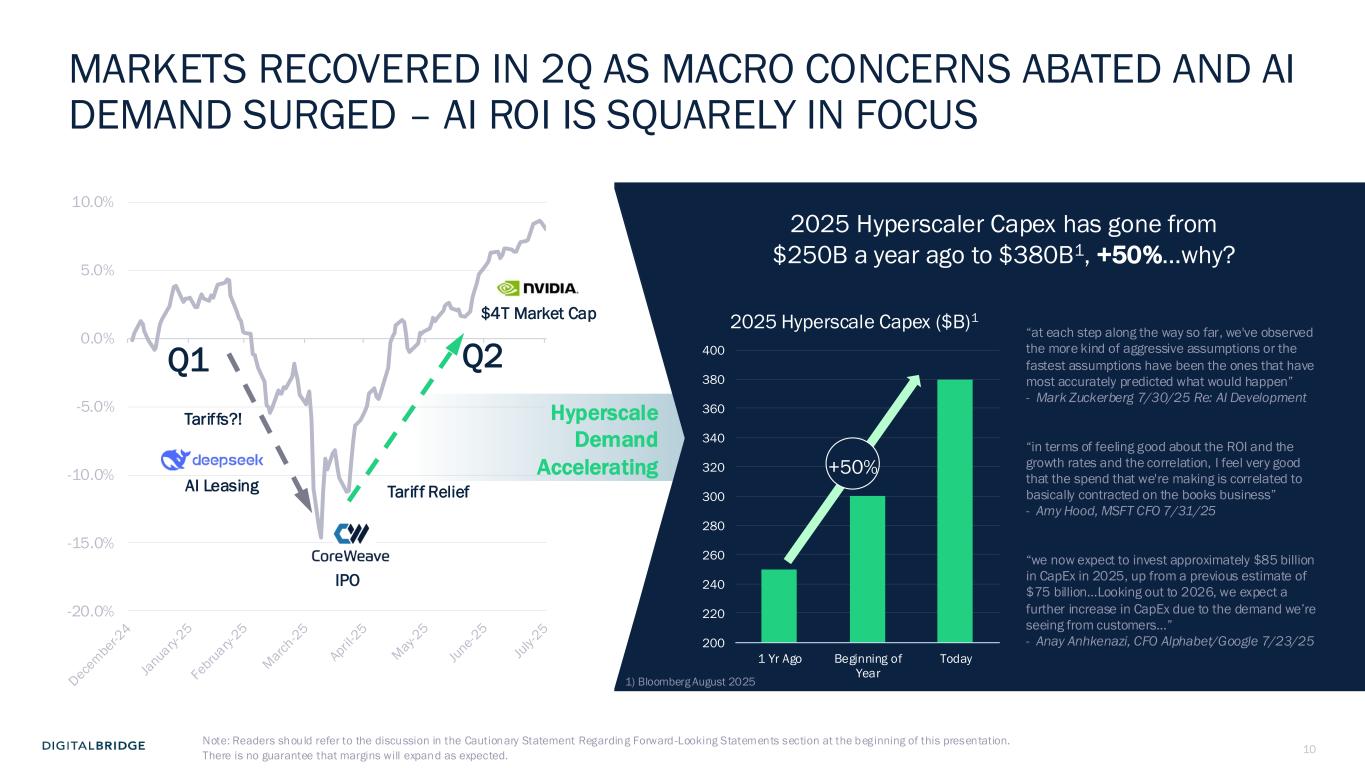

10 -20.0% -15.0% -10.0% -5.0% 0.0% 5.0% 10.0% MARKETS RECOVERED IN 2Q AS MACRO CONCERNS ABATED AND AI DEMAND SURGED – AI ROI IS SQUARELY IN FOCUS Q1 Q2 IPO $4T Market Cap Tariffs?! Tariff Relief “at each step along the way so far, we've observed the more kind of aggressive assumptions or the fastest assumptions have been the ones that have most accurately predicted what would happen” - Mark Zuckerberg 7/30/25 Re: AI Development “in terms of feeling good about the ROI and the growth rates and the correlation, I feel very good that the spend that we're making is correlated to basically contracted on the books business” - Amy Hood, MSFT CFO 7/31/25 “we now expect to invest approximately $85 billion in CapEx in 2025, up from a previous estimate of $75 billion…Looking out to 2026, we expect a further increase in CapEx due to the demand we’re seeing from customers…” - Anay Anhkenazi, CFO Alphabet/Google 7/23/25 AI Leasing Hyperscale Demand Accelerating 2025 Hyperscaler Capex has gone from $250B a year ago to $380B1, +50%...why? 200 220 240 260 280 300 320 340 360 380 400 1 Yr Ago Beginning of Year Today 2025 Hyperscale Capex ($B)1 +50% 1) Bloomberg August 2025 Note: Readers should refer to the discussion in the Cautionary Statement Regarding Forward -Looking Statements section at the beginning of this presentation. There is no guarantee that margins will expand as expected.

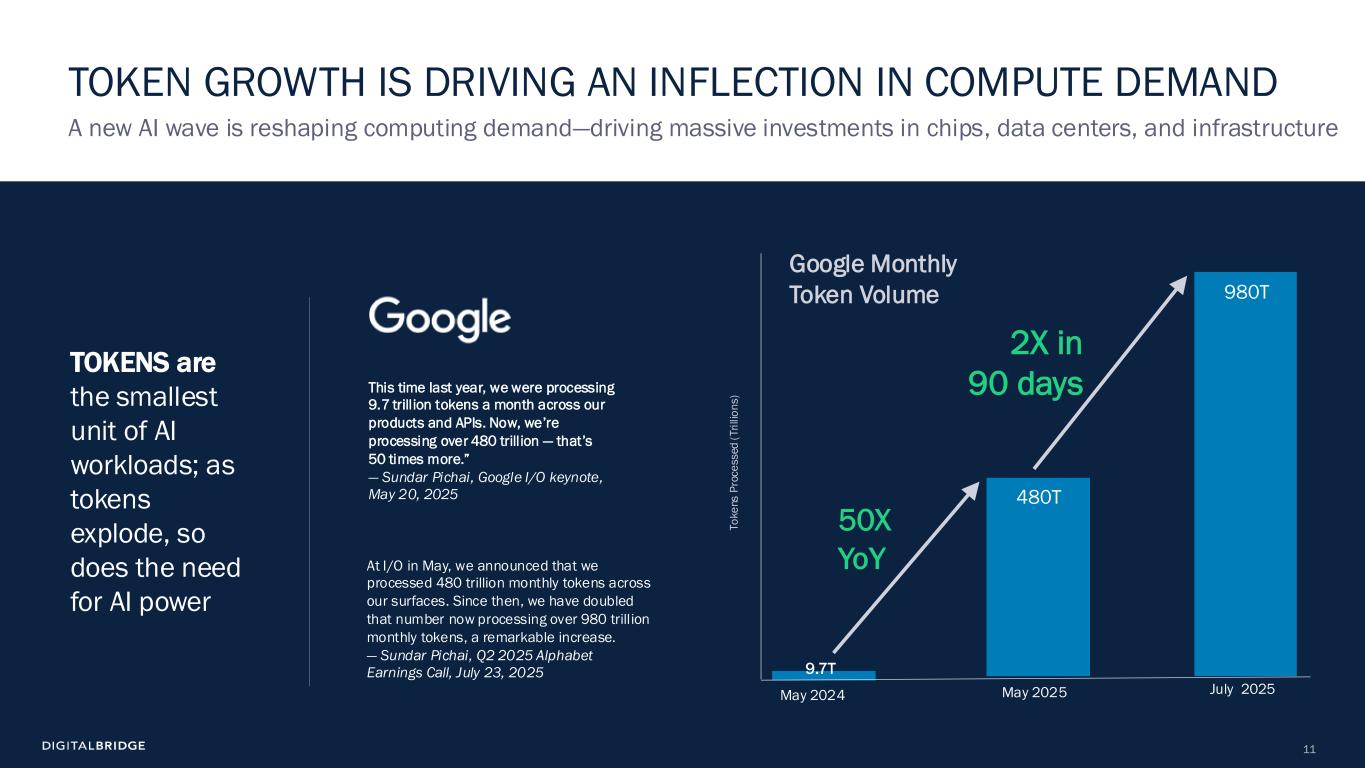

11 This time last year, we were processing 9.7 trillion tokens a month across our products and APIs. Now, we’re processing over 480 trillion — that’s 50 times more.” — Sundar Pichai, Google I/O keynote, May 20, 2025 A new AI wave is reshaping computing demand—driving massive investments in chips, data centers, and infrastructure TOKEN GROWTH IS DRIVING AN INFLECTION IN COMPUTE DEMAND Google Monthly Token Volume At I/O in May, we announced that we processed 480 trillion monthly tokens across our surfaces. Since then, we have doubled that number now processing over 980 trillion monthly tokens, a remarkable increase. — Sundar Pichai, Q2 2025 Alphabet Earnings Call, July 23, 2025 50X YoY May 2025May 2024 T o k e n s P ro c e s s e d ( T ri ll io n s ) July 2025 980T 480T 9.7T 2X in 90 days TOKENS are the smallest unit of AI workloads; as tokens explode, so does the need for AI power

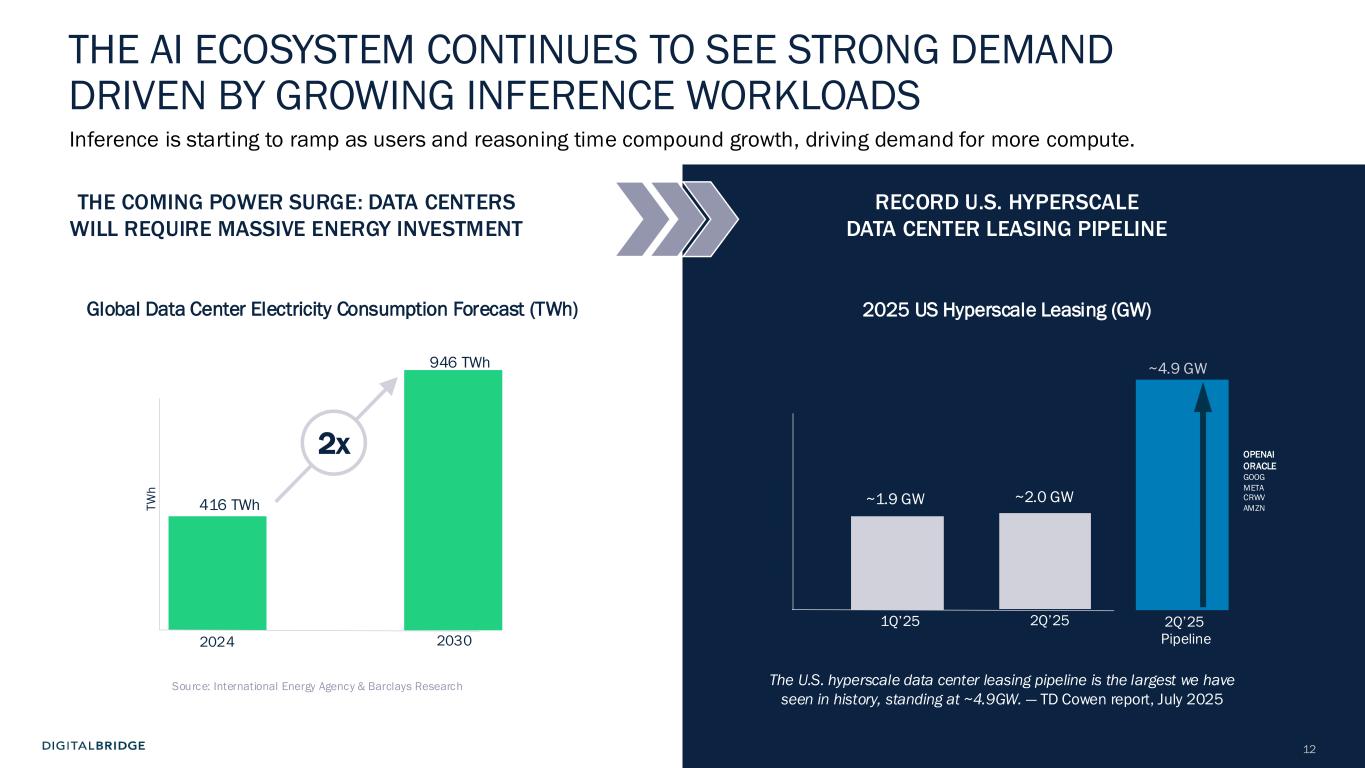

12 1Q’25 2Q’25 G W (C A P A C IT Y ) 2Q’25 Pipeline RECORD U.S. HYPERSCALE DATA CENTER LEASING PIPELINE The U.S. hyperscale data center leasing pipeline is the largest we have seen in history, standing at ~4.9GW. — TD Cowen report, July 2025 2025 US Hyperscale Leasing (GW) OPENAI ORACLE GOOG META CRWV AMZN ~2.0 GW ~4.9 GW ~1.9 GW THE COMING POWER SURGE: DATA CENTERS WILL REQUIRE MASSIVE ENERGY INVESTMENT 2024 2030 Source: International Energy Agency & Barclays Research T W h Global Data Center Electricity Consumption Forecast (TWh) 946 TWh 416 TWh THE AI ECOSYSTEM CONTINUES TO SEE STRONG DEMAND DRIVEN BY GROWING INFERENCE WORKLOADS Inference is starting to ramp as users and reasoning time compound growth, driving demand for more compute. 2x

13 2 FINANCIAL UPDATE

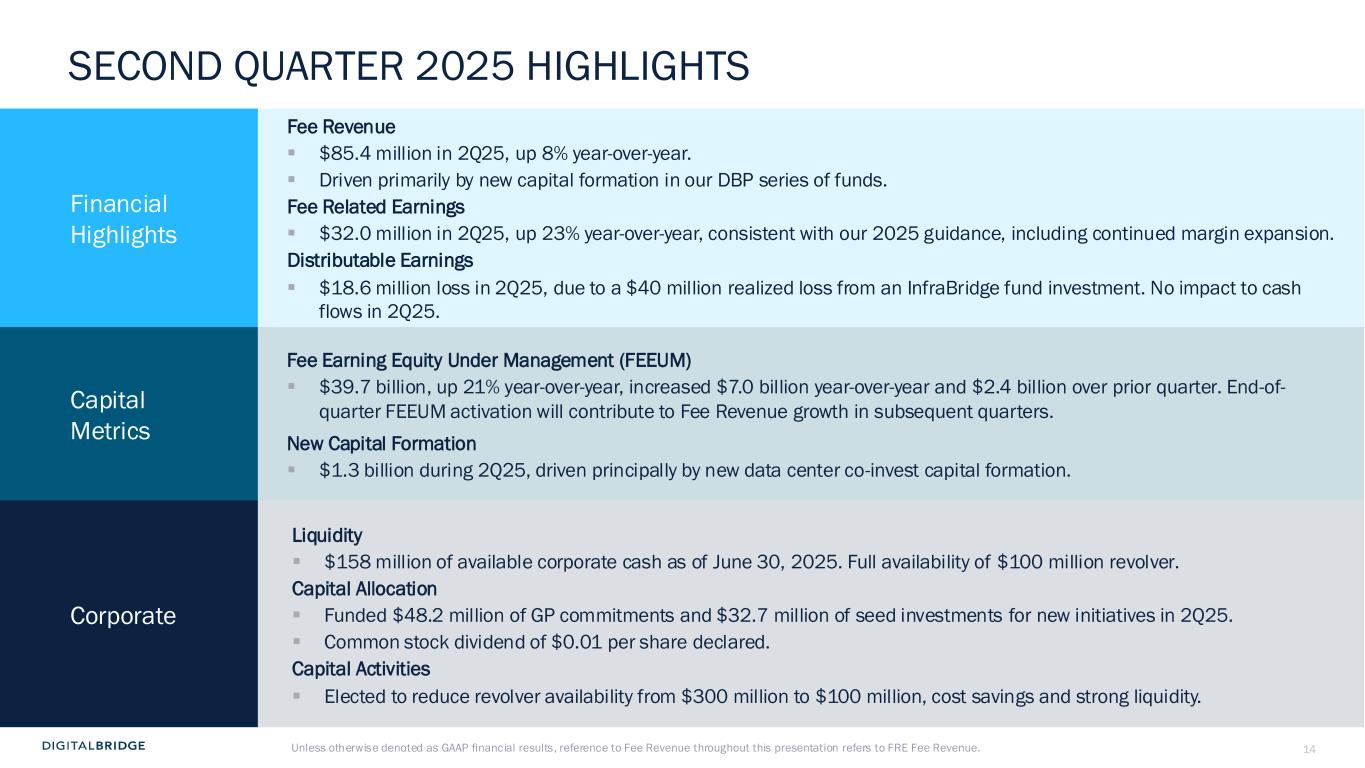

14 SECOND QUARTER 2025 HIGHLIGHTS Financial Highlights Fee Revenue ▪ $85.4 million in 2Q25, up 8% year-over-year. ▪ Driven primarily by new capital formation in our DBP series of funds. Fee Related Earnings ▪ $32.0 million in 2Q25, up 23% year-over-year, consistent with our 2025 guidance, including continued margin expansion. Distributable Earnings ▪ $18.6 million loss in 2Q25, due to a $40 million realized loss from an InfraBridge fund investment. No impact to cash flows in 2Q25. Capital Metrics Fee Earning Equity Under Management (FEEUM) ▪ $39.7 billion, up 21% year-over-year, increased $7.0 billion year-over-year and $2.4 billion over prior quarter. End-of- quarter FEEUM activation will contribute to Fee Revenue growth in subsequent quarters. New Capital Formation ▪ $1.3 billion during 2Q25, driven principally by new data center co-invest capital formation. Corporate Liquidity ▪ $158 million of available corporate cash as of June 30, 2025. Full availability of $100 million revolver. Capital Allocation ▪ Funded $48.2 million of GP commitments and $32.7 million of seed investments for new initiatives in 2Q25. ▪ Common stock dividend of $0.01 per share declared. Capital Activities ▪ Elected to reduce revolver availability from $300 million to $100 million, cost savings and strong liquidity. Unless otherwise denoted as GAAP financial results, reference to Fee Revenue throughout this presentation refers to FRE Fee Revenue.

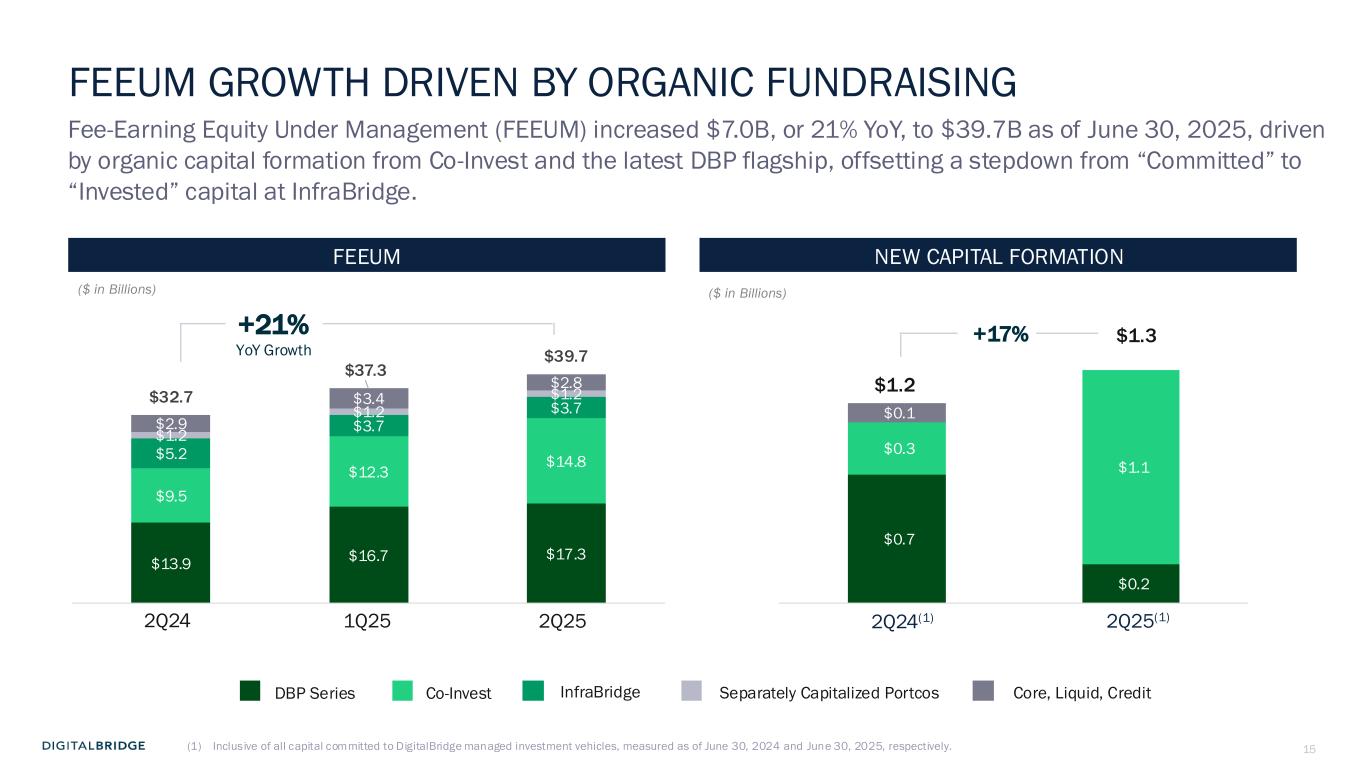

15 $0.7 $0.2 $0.3 $1.1 $0.1 FEEUM GROWTH DRIVEN BY ORGANIC FUNDRAISING Fee-Earning Equity Under Management (FEEUM) increased $7.0B, or 21% YoY, to $39.7B as of June 30, 2025, driven by organic capital formation from Co-Invest and the latest DBP flagship, offsetting a stepdown from “Committed” to “Invested” capital at InfraBridge. DBP Series Separately Capitalized PortcosCo-Invest NEW CAPITAL FORMATIONFEEUM InfraBridge Core, Liquid, Credit +21% YoY Growth ($ in Billions) ($ in Billions) (1) Inclusive of all capital committed to DigitalBridge managed investment vehicles, measured as of June 30, 2024 and June 30, 2025, respectively. 2Q25(1) $1.3 2Q24(1) $1.2 +17% 1Q25 2Q252Q24 $13.9 $16.7 $17.3 $9.5 $12.3 $14.8 $5.2 $3.7 $3.7 $1.2 $1.2 $1.2 $2.9 $3.4 $2.8 $32.7 $37.3 $39.7

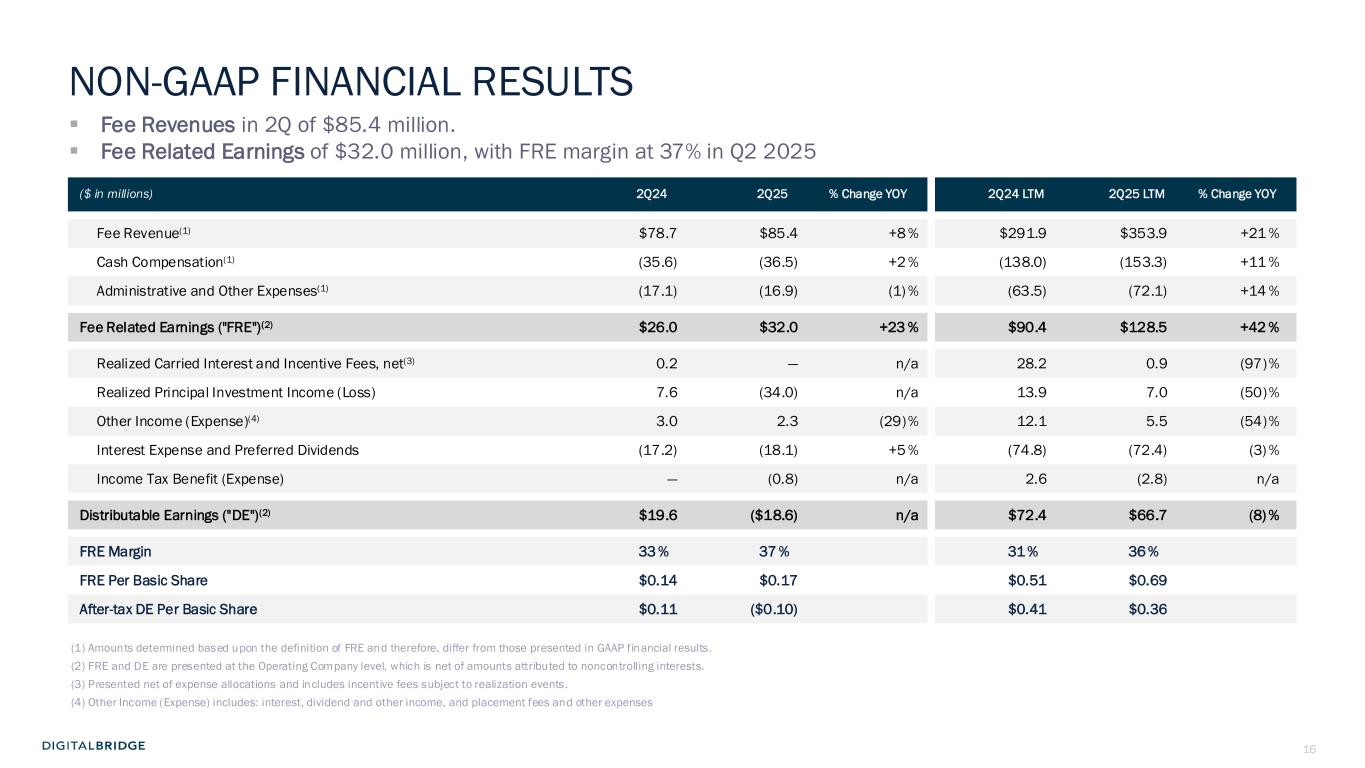

16 ($ in millions) 2Q24 2Q25 % Change YOY 2Q24 LTM 2Q25 LTM % Change YOY Fee Revenue(1) $78.7 $85.4 +8 % $291.9 $353.9 +21 % Cash Compensation(1) (35.6) (36.5) +2 % (138.0) (153.3) +11 % Administrative and Other Expenses(1) (17.1) (16.9) (1) % (63.5) (72.1) +14 % Fee Related Earnings ("FRE")(2) $26.0 $32.0 +23 % $90.4 $128.5 +42 % Realized Carried Interest and Incentive Fees, net(3) 0.2 — n/a 28.2 0.9 (97)% Realized Principal Investment Income (Loss) 7.6 (34.0) n/a 13.9 7.0 (50)% Other Income (Expense)(4) 3.0 2.3 (29)% 12.1 5.5 (54)% Interest Expense and Preferred Dividends (17.2) (18.1) +5 % (74.8) (72.4) (3) % Income Tax Benefit (Expense) — (0.8) n/a 2.6 (2.8) n/a Distributable Earnings ("DE")(2) $19.6 ($18.6) n/a $72.4 $66.7 (8) % FRE Margin 33 % 37 % 31 % 36 % FRE Per Basic Share $0.14 $0.17 $0.51 $0.69 After-tax DE Per Basic Share $0.11 ($0.10) $0.41 $0.36 (1) Amounts determined based upon the definition of FRE and therefore, differ from those presented in GAAP financial results. (2) FRE and DE are presented at the Operating Company level, which is net of amounts attributed to noncontrolling interests. (3) Presented net of expense allocations and includes incentive fees subject to realization events. (4) Other Income (Expense) includes: interest, dividend and other income, and placement fees and other expenses ▪ Fee Revenues in 2Q of $85.4 million. ▪ Fee Related Earnings of $32.0 million, with FRE margin at 37% in Q2 2025 NON-GAAP FINANCIAL RESULTS

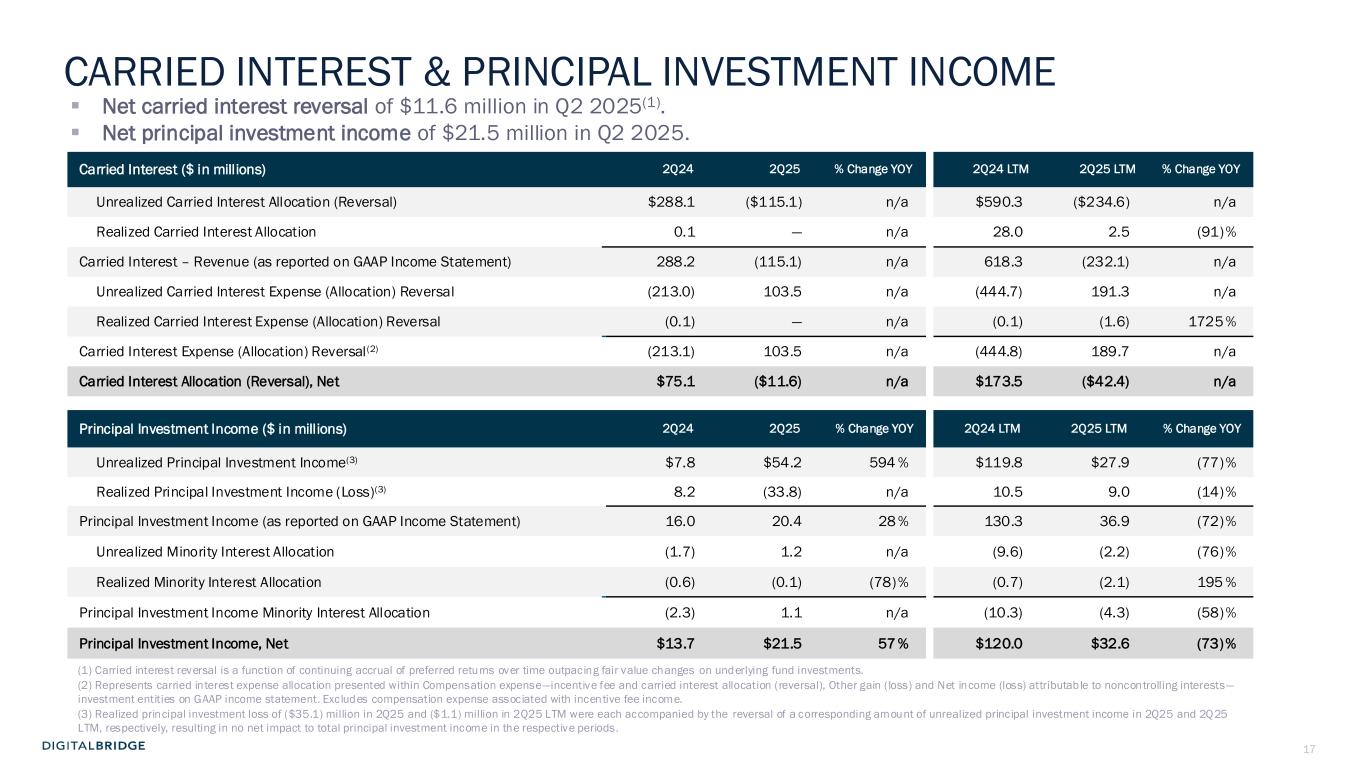

17 Carried Interest ($ in millions) 2Q24 2Q25 % Change YOY 2Q24 LTM 2Q25 LTM % Change YOY Unrealized Carried Interest Allocation (Reversal) $288.1 ($115.1) n/a $590.3 ($234.6) n/a Realized Carried Interest Allocation 0.1 — n/a 28.0 2.5 (91)% Carried Interest – Revenue (as reported on GAAP Income Statement) 288.2 (115.1) n/a 618.3 (232.1) n/a Unrealized Carried Interest Expense (Allocation) Reversal (213.0) 103.5 n/a (444.7) 191.3 n/a Realized Carried Interest Expense (Allocation) Reversal (0.1) — n/a (0.1) (1.6) 1725 % Carried Interest Expense (Allocation) Reversal(2) (213.1) 103.5 n/a (444.8) 189.7 n/a Carried Interest Allocation (Reversal), Net $75.1 ($11.6) n/a $173.5 ($42.4) n/a Principal Investment Income ($ in millions) 2Q24 2Q25 % Change YOY 2Q24 LTM 2Q25 LTM % Change YOY Unrealized Principal Investment Income(3) $7.8 $54.2 594 % $119.8 $27.9 (77)% Realized Principal Investment Income (Loss)(3) 8.2 (33.8) n/a 10.5 9.0 (14)% Principal Investment Income (as reported on GAAP Income Statement) 16.0 20.4 28 % 130.3 36.9 (72)% Unrealized Minority Interest Allocation (1.7) 1.2 n/a (9.6) (2.2) (76)% Realized Minority Interest Allocation (0.6) (0.1) (78)% (0.7) (2.1) 195 % Principal Investment Income Minority Interest Allocation (2.3) 1.1 n/a (10.3) (4.3) (58)% Principal Investment Income, Net $13.7 $21.5 57 % $120.0 $32.6 (73)% (1) Carried interest reversal is a function of continuing accrual of preferred returns over time outpacing fair value changes on underlying fund investments. (2) Represents carried interest expense allocation presented within Compensation expense—incentive fee and carried interest allocation (reversal), Other gain (loss) and Net income (loss) attributable to noncontrolling interests— investment entities on GAAP income statement. Excludes compensation expense associated with incentive fee income. (3) Realized principal investment loss of ($35.1) million in 2Q25 and ($1.1) million in 2Q25 LTM were each accompanied by the reversal of a corresponding amount of unrealized principal investment income in 2Q25 and 2Q25 LTM, respectively, resulting in no net impact to total principal investment income in the respective periods. ▪ Net carried interest reversal of $11.6 million in Q2 2025(1). ▪ Net principal investment income of $21.5 million in Q2 2025. CARRIED INTEREST & PRINCIPAL INVESTMENT INCOME

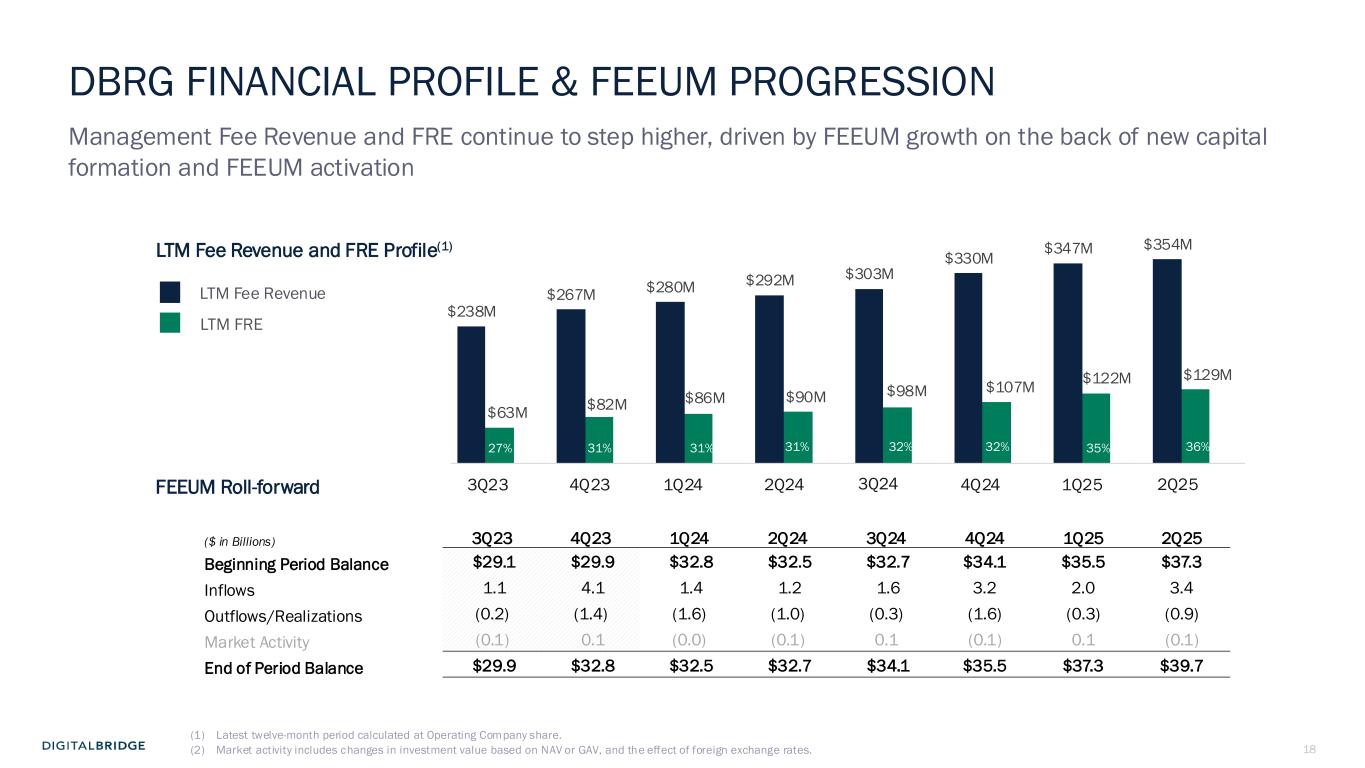

18 DBRG FINANCIAL PROFILE & FEEUM PROGRESSION Management Fee Revenue and FRE continue to step higher, driven by FEEUM growth on the back of new capital formation and FEEUM activation LTM Fee Revenue LTM FRE ($ in Billions) 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 Beginning Period Balance $29.1 $29.9 $32.8 $32.5 $32.7 $34.1 $35.5 $37.3 Inflows 1.1 4.1 1.4 1.2 1.6 3.2 2.0 3.4 Outflows/Realizations (0.2) (1.4) (1.6) (1.0) (0.3) (1.6) (0.3) (0.9) Market Activity (0.1) 0.1 (0.0) (0.1) 0.1 (0.1) 0.1 (0.1) End of Period Balance $29.9 $32.8 $32.5 $32.7 $34.1 $35.5 $37.3 $39.7 LTM Fee Revenue and FRE Profile(1) FEEUM Roll-forward (1) Latest twelve-month period calculated at Operating Company share. (2) Market activity includes changes in investment value based on NAV or GAV, and the effect of foreign exchange rates. $238M $267M $280M $292M $303M $330M $347M $354M $63M $82M $86M $90M $98M $107M $122M $129M 27% 31% 31% 31% 32% 32% 35% 36% 2Q251Q254Q243Q242Q241Q244Q233Q23

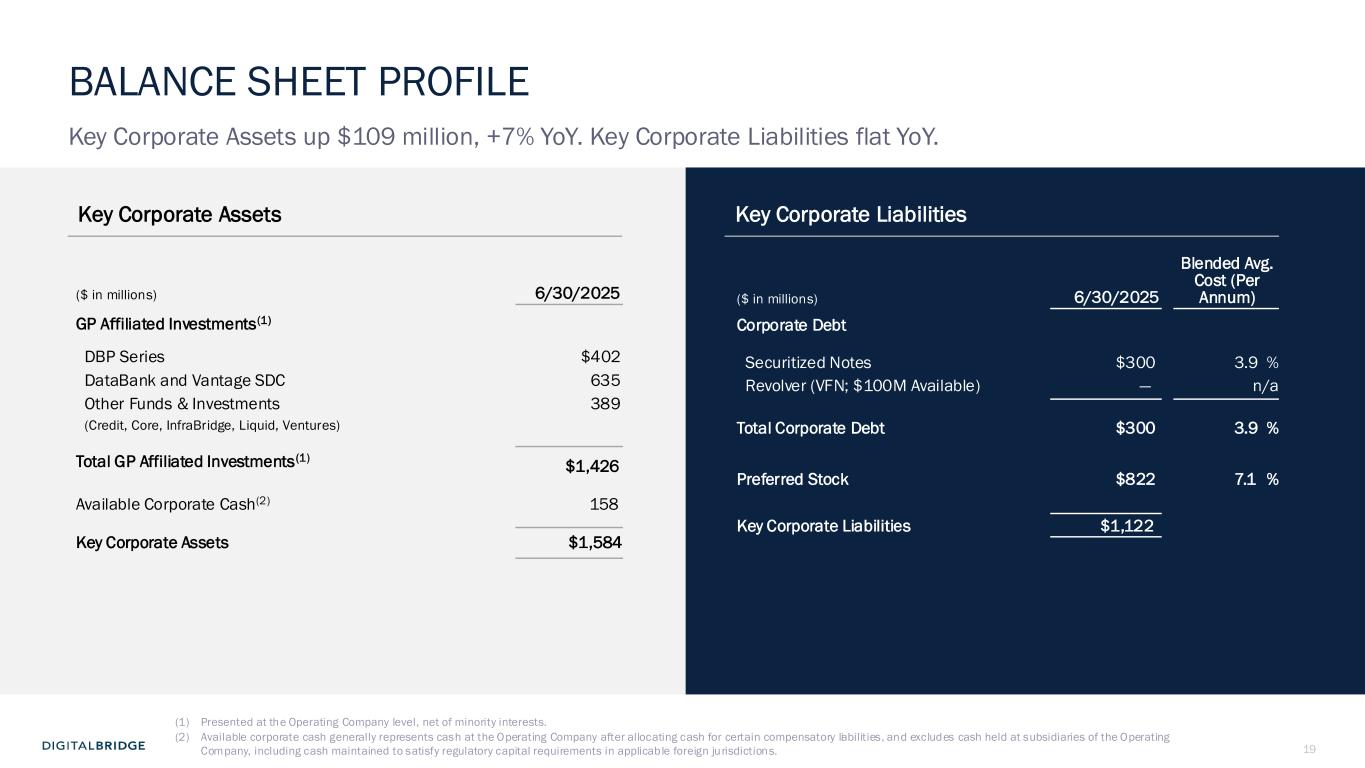

19 Key Corporate Assets Key Corporate Liabilities ($ in millions) 6/30/2025 GP Affiliated Investments(1) DBP Series $402 DataBank and Vantage SDC 635 Other Funds & Investments 389 (Credit, Core, InfraBridge, Liquid, Ventures) Total GP Affiliated Investments(1) $1,426 Available Corporate Cash(2) 158 Key Corporate Assets $1,584 ($ in millions) 6/30/2025 Blended Avg. Cost (Per Annum) Corporate Debt Securitized Notes $300 3.9 % Revolver (VFN; $100M Available) — n/a Total Corporate Debt $300 3.9 % Preferred Stock $822 7.1 % Key Corporate Liabilities $1,122 (1) Presented at the Operating Company level, net of minority interests. (2) Available corporate cash generally represents cash at the Operating Company after allocating cash for certain compensatory liabilities, and excludes cash held at subsidiaries of the Operating Company, including cash maintained to satisfy regulatory capital requirements in applicable foreign jurisdictions. BALANCE SHEET PROFILE Key Corporate Assets up $109 million, +7% YoY. Key Corporate Liabilities flat YoY.

20 3 EXECUTING THE DIGITAL PLAYBOOK

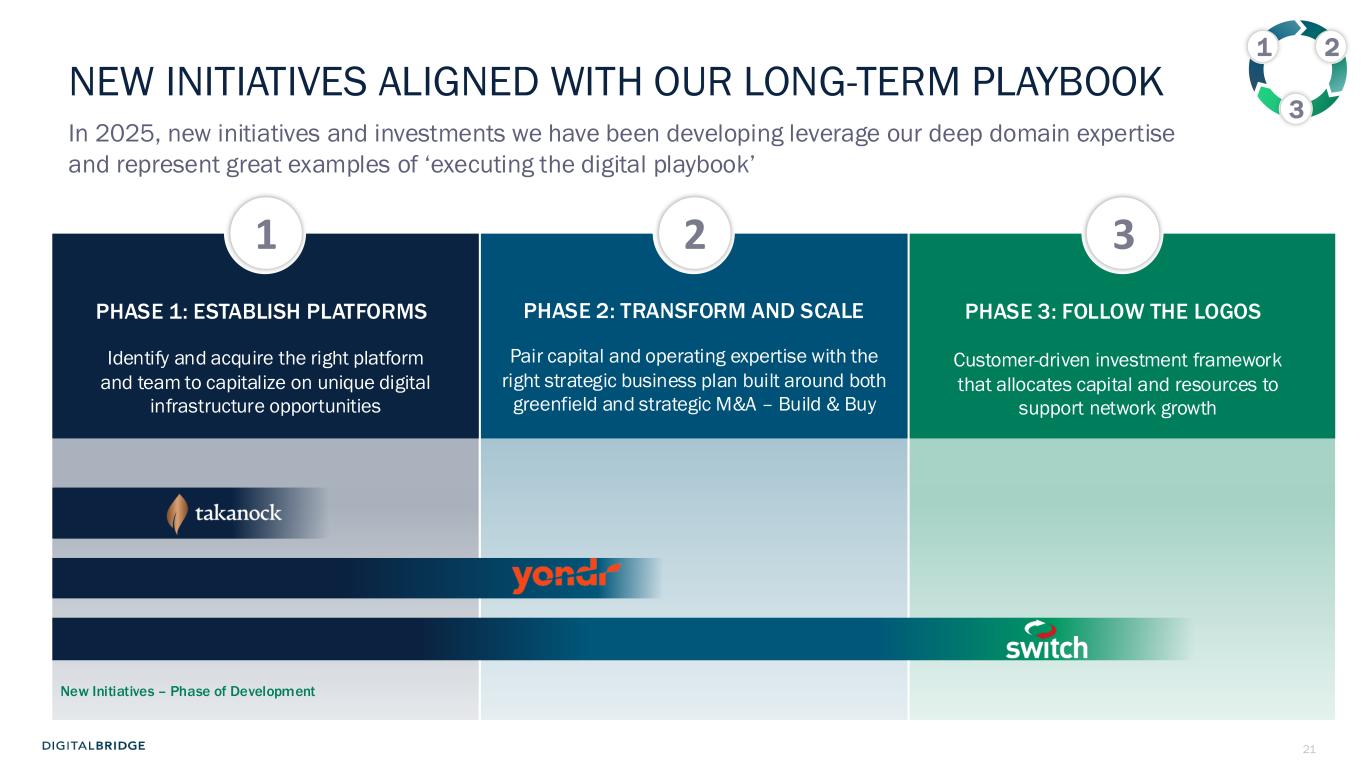

21 Pair capital and operating expertise with the right strategic business plan built around both greenfield and strategic M&A – Build & Buy Customer-driven investment framework that allocates capital and resources to support network growth PHASE 1: ESTABLISH PLATFORMS PHASE 2: TRANSFORM AND SCALE PHASE 3: FOLLOW THE LOGOS Identify and acquire the right platform and team to capitalize on unique digital infrastructure opportunities NEW INITIATIVES ALIGNED WITH OUR LONG-TERM PLAYBOOK In 2025, new initiatives and investments we have been developing leverage our deep domain expertise and represent great examples of ‘executing the digital playbook’ 1 2 3 1 2 3 New Initiatives – Phase of Development

22 Leading alternative asset manager serving the power and electrification infrastructure sectors ▪ Founded in 2001, today an established leader in managing and operating electric power, renewables, battery storage and natural gas infrastructure ▪ Providing investors advantaged access to real assets indispensable to the energy transition and digital economy Leading global alternative asset manager dedicated to digital infrastructure ▪ 30-year track record building mission-critical digital infrastructure for leading technology companies ▪ 8 global data center platforms with 5.4GW in place or development today. Land and power bank of 20.9GW Two leading investors with deep, complementary sector expertise partner to support the launch of Takanock as AI and Energy sectors converge. Straight out of ‘Backing Great Teams’ playbook THE DIGITAL POWER OPPORTUNITY: DIGITALBRIDGE X ARCLIGHT ▪ AUM: $106 billion ▪ 45+ Digital Portfolio Companies ▪ Builders of mission-critical digital infrastructure in partnership with the largest enterprises and technology companies in the world INFRA PARTNER TO THE DIGITAL ECONOMY 1 2 3 ▪ $80B Total Enterprise Value of Investments ▪ 65GW Power Infrastructure Owned ▪ 47K Pipeline Miles Owned POWERING THE DIGITAL ECONOMY

23 Business Model Develops shovel-ready powered land and onsite power generation solutions enabling hyperscale data centers to deploy faster in power-constrained markets. Solution ▪ Patent pending utility yard design ▪ Highly reliable (99.999%) on-site power ▪ Enables faster grid connection timelines ▪ Eliminates need for diesel generators Markets ▪ Focus on Tier I and Tier II markets ▪ Northern Virginia, Phoenix, and more Differentiators ▪ Faster time-to-power ▪ Fully entitled sites Leadership: CEO Kenneth Davies (ex-Google/Microsoft) Strategic Edge: ▪ Accelerates time to power ▪ Prime power and backup ▪ Flexible commercial structures ▪ Fully-integrated model (land + power) Selected Near-Term Project • Phoenix, AZ: 1H’28 Ready-for-Service Aggregate commitment to invest up to $500M in data center power infrastructure solutions provider 27-July-2025 TAKANOCK OVERVIEW Footprint: Takanock by the Numbers 1 2 3 Playbook: Backing Great Teams

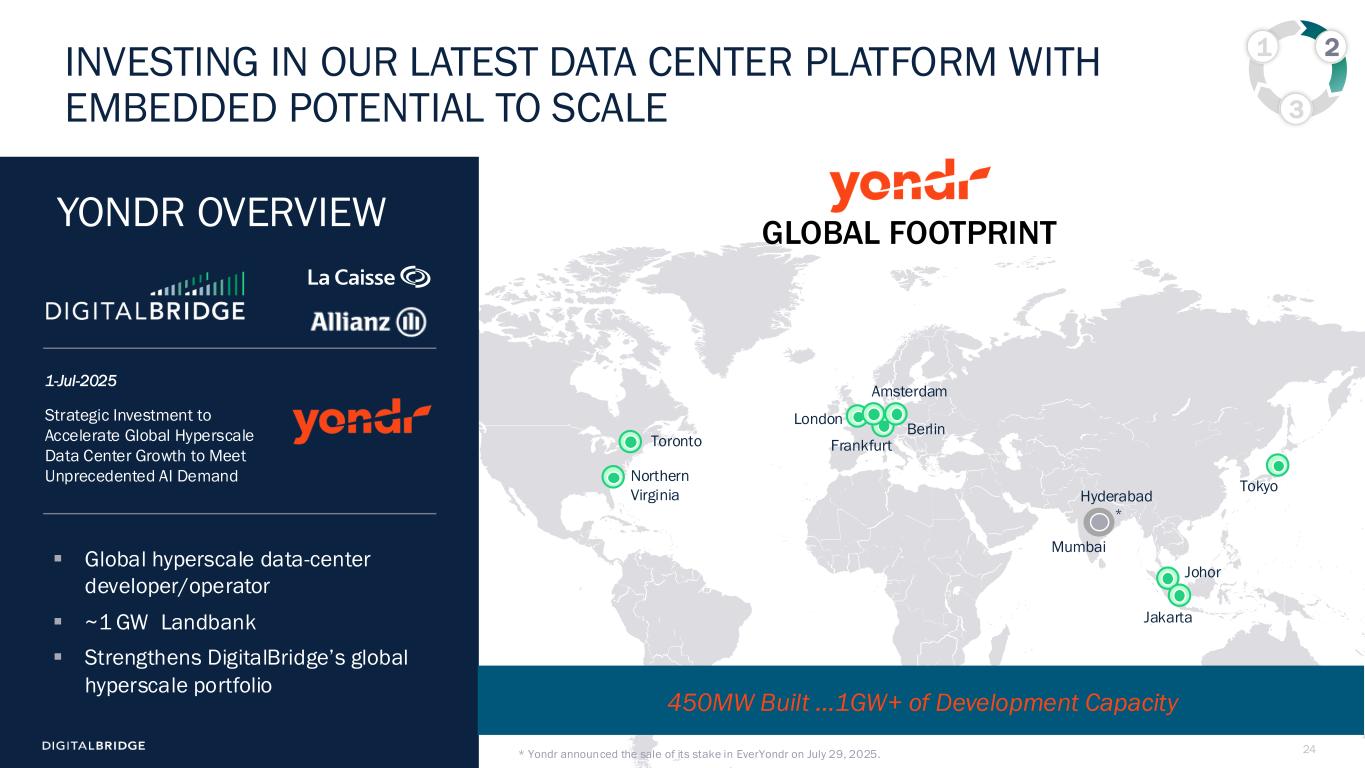

24 1 2 3 INVESTING IN OUR LATEST DATA CENTER PLATFORM WITH EMBEDDED POTENTIAL TO SCALE Toronto Northern Virginia London Amsterdam Frankfurt Johor 450MW Built …1GW+ of Development Capacity Strategic Investment to Accelerate Global Hyperscale Data Center Growth to Meet Unprecedented AI Demand 1-Jul-2025 ▪ Global hyperscale data-center developer/operator ▪ ~1 GW Landbank ▪ Strengthens DigitalBridge’s global hyperscale portfolio YONDR OVERVIEW GLOBAL FOOTPRINT Berlin Mumbai Hyderabad Tokyo Jakarta * Yondr announced the sale of its stake in EverYondr on July 29, 2025. *

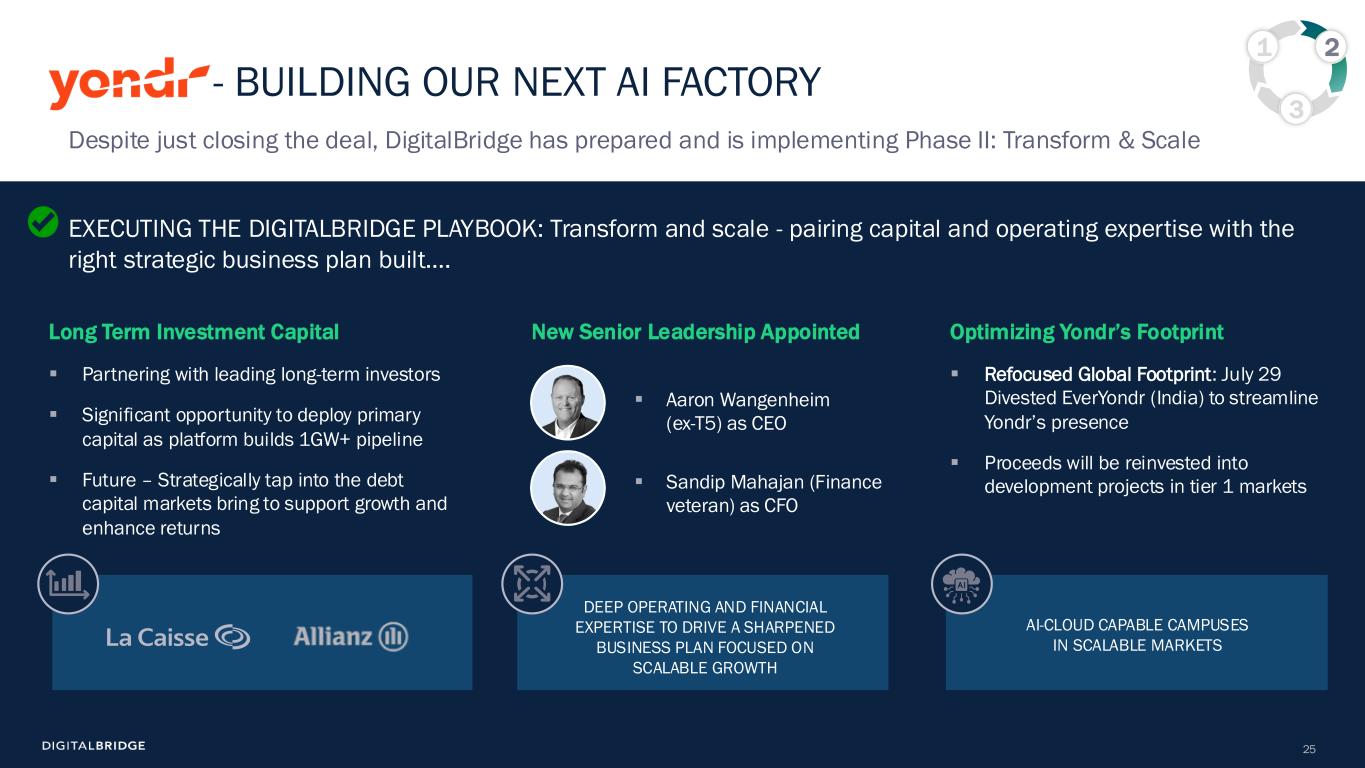

25 - BUILDING OUR NEXT AI FACTORY EXECUTING THE DIGITALBRIDGE PLAYBOOK: Transform and scale - pairing capital and operating expertise with the right strategic business plan built…. Optimizing Yondr’s Footprint ▪ Refocused Global Footprint: July 29 Divested EverYondr (India) to streamline Yondr’s presence ▪ Proceeds will be reinvested into development projects in tier 1 markets 1 2 3 New Senior Leadership Appointed ▪ Aaron Wangenheim (ex-T5) as CEO ▪ Sandip Mahajan (Finance veteran) as CFO AI-CLOUD CAPABLE CAMPUSES IN SCALABLE MARKETS DEEP OPERATING AND FINANCIAL EXPERTISE TO DRIVE A SHARPENED BUSINESS PLAN FOCUSED ON SCALABLE GROWTH Long Term Investment Capital ▪ Partnering with leading long-term investors ▪ Significant opportunity to deploy primary capital as platform builds 1GW+ pipeline ▪ Future – Strategically tap into the debt capital markets bring to support growth and enhance returns Despite just closing the deal, DigitalBridge has prepared and is implementing Phase II: Transform & Scale

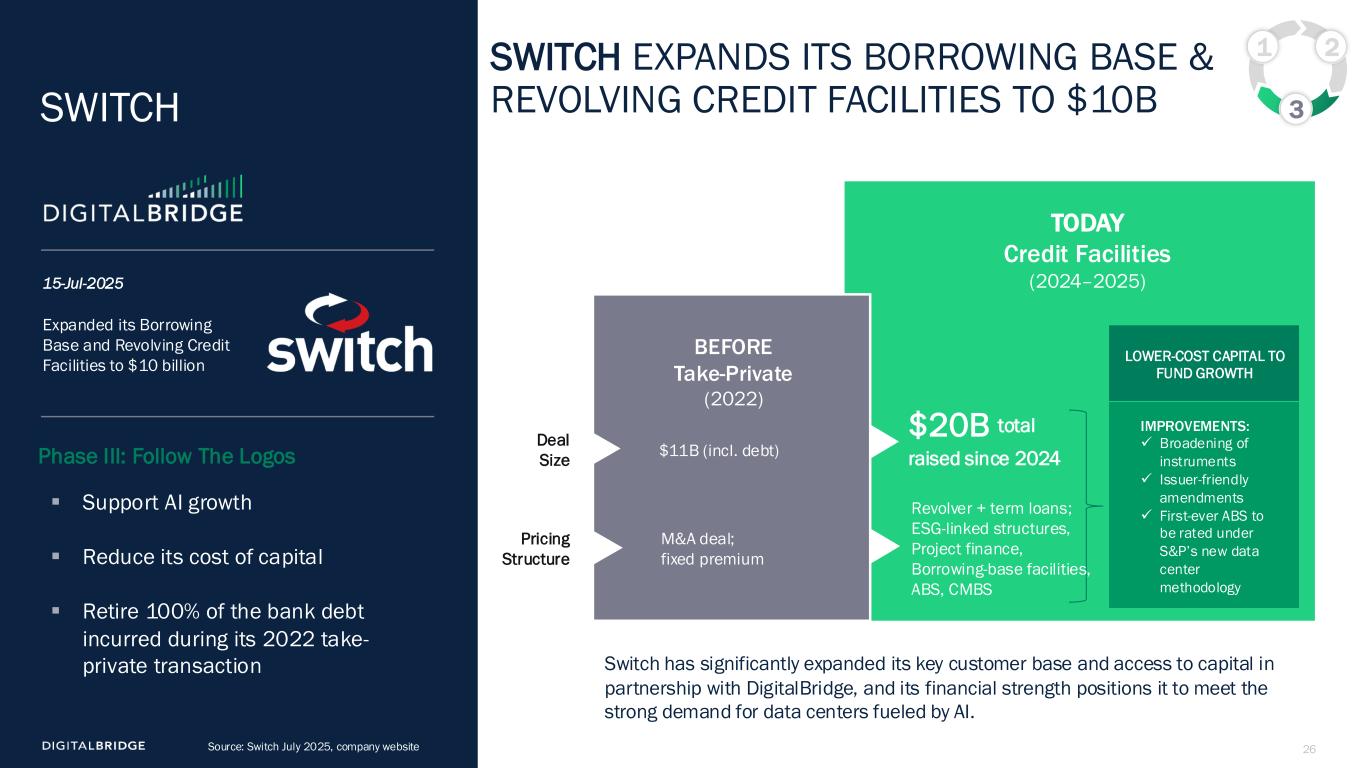

26 SWITCH EXPANDS ITS BORROWING BASE & REVOLVING CREDIT FACILITIES TO $10B Source: Switch July 2025, company website IMPROVEMENTS: ✓ Broadening of instruments ✓ Issuer-friendly amendments ✓ First-ever ABS to be rated under S&P’s new data center methodology Switch has significantly expanded its key customer base and access to capital in partnership with DigitalBridge, and its financial strength positions it to meet the strong demand for data centers fueled by AI. Expanded its Borrowing Base and Revolving Credit Facilities to $10 billion 15-Jul-2025 ▪ Support AI growth ▪ Reduce its cost of capital ▪ Retire 100% of the bank debt incurred during its 2022 take- private transaction SWITCH TODAY Credit Facilities (2024–2025) LOWER-COST CAPITAL TO FUND GROWTH 1 2 3 $20B total raised since 2024 Revolver + term loans; ESG-linked structures, Project finance, Borrowing-base facilities, ABS, CMBS BEFORE Take-Private (2022) Deal Size Pricing Structure $11B (incl. debt) M&A deal; fixed premium Phase III: Follow The Logos

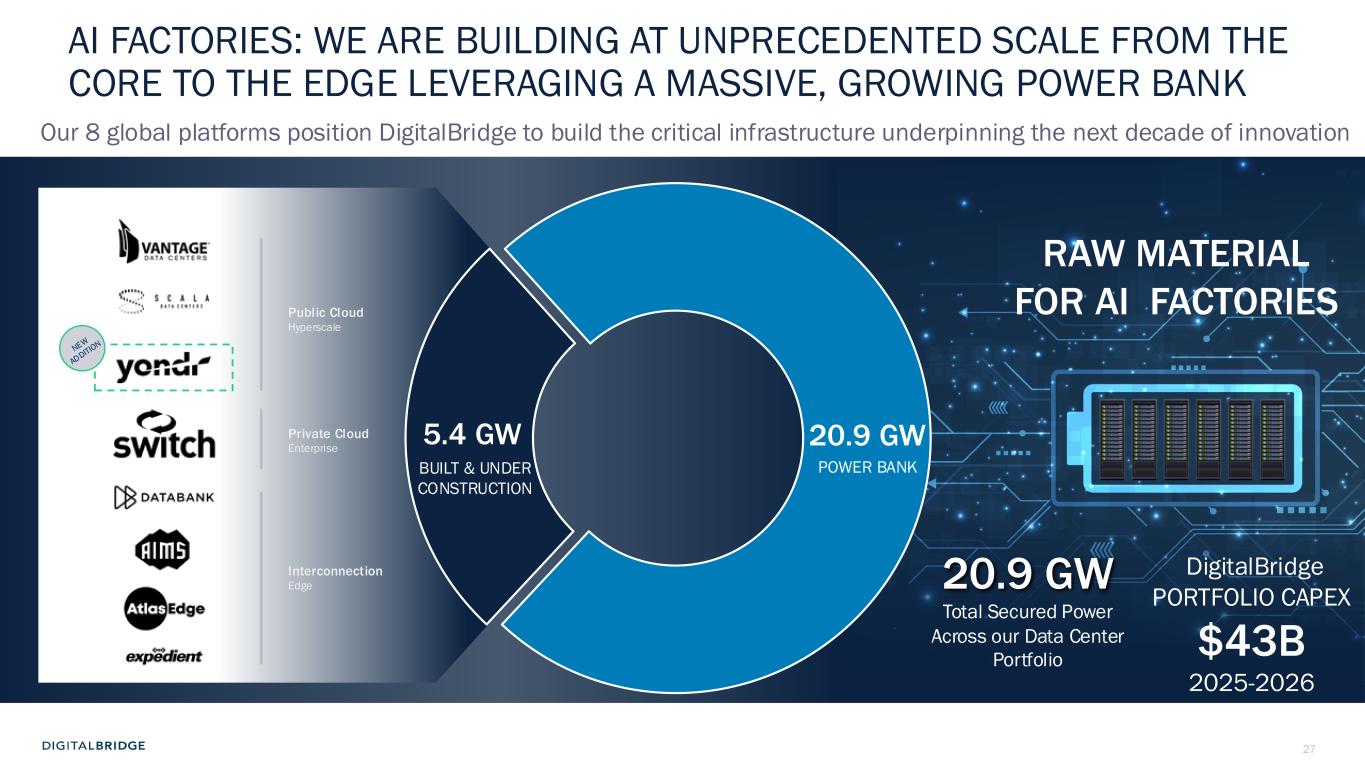

27 20.9 GW 5.4 GW BUILT & UNDER CONSTRUCTION 20.9 GW POWER BANK AI FACTORIES: WE ARE BUILDING AT UNPRECEDENTED SCALE FROM THE CORE TO THE EDGE LEVERAGING A MASSIVE, GROWING POWER BANK Total Secured Power Across our Data Center Portfolio RAW MATERIAL FOR AI FACTORIES DigitalBridge PORTFOLIO CAPEX $43B 2025-2026 Our 8 global platforms position DigitalBridge to build the critical infrastructure underpinning the next decade of innovation Public Cloud Hyperscale Private Cloud Enterprise Interconnection Edge

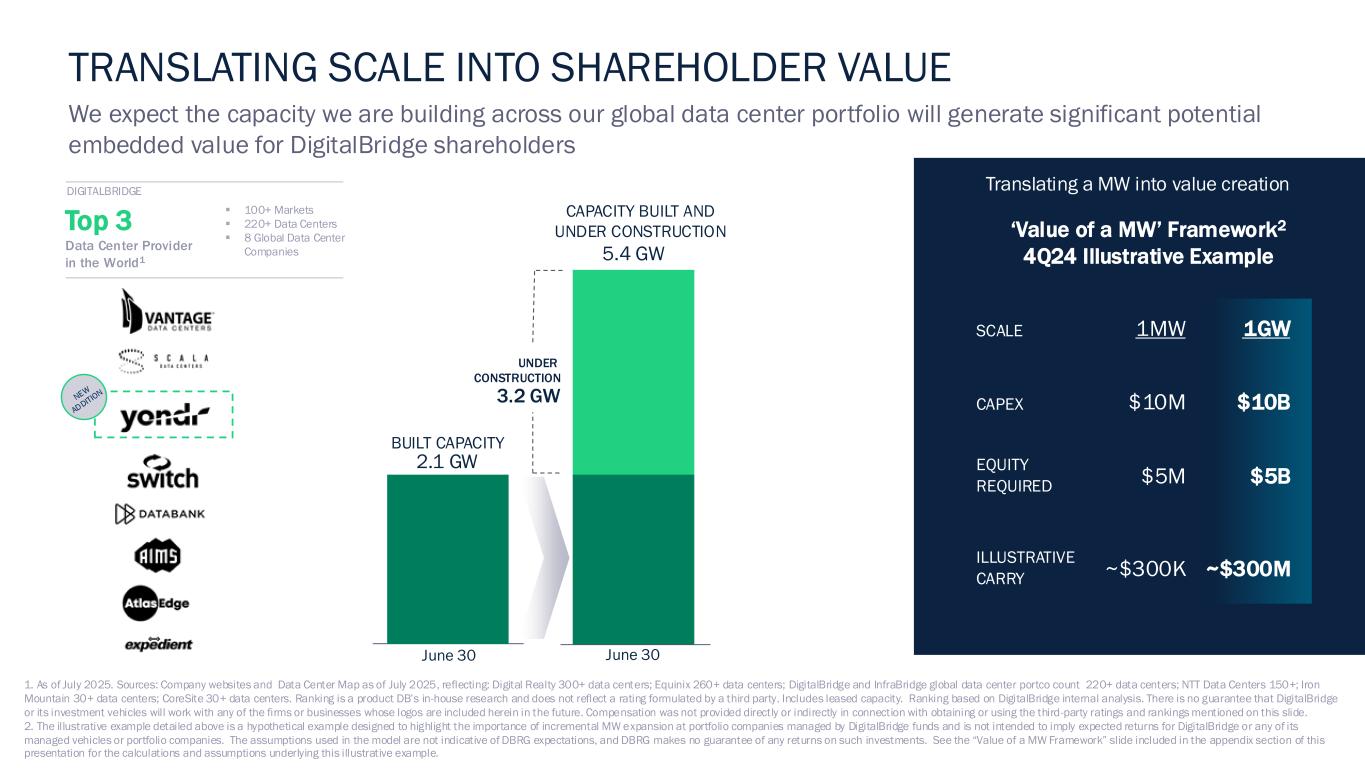

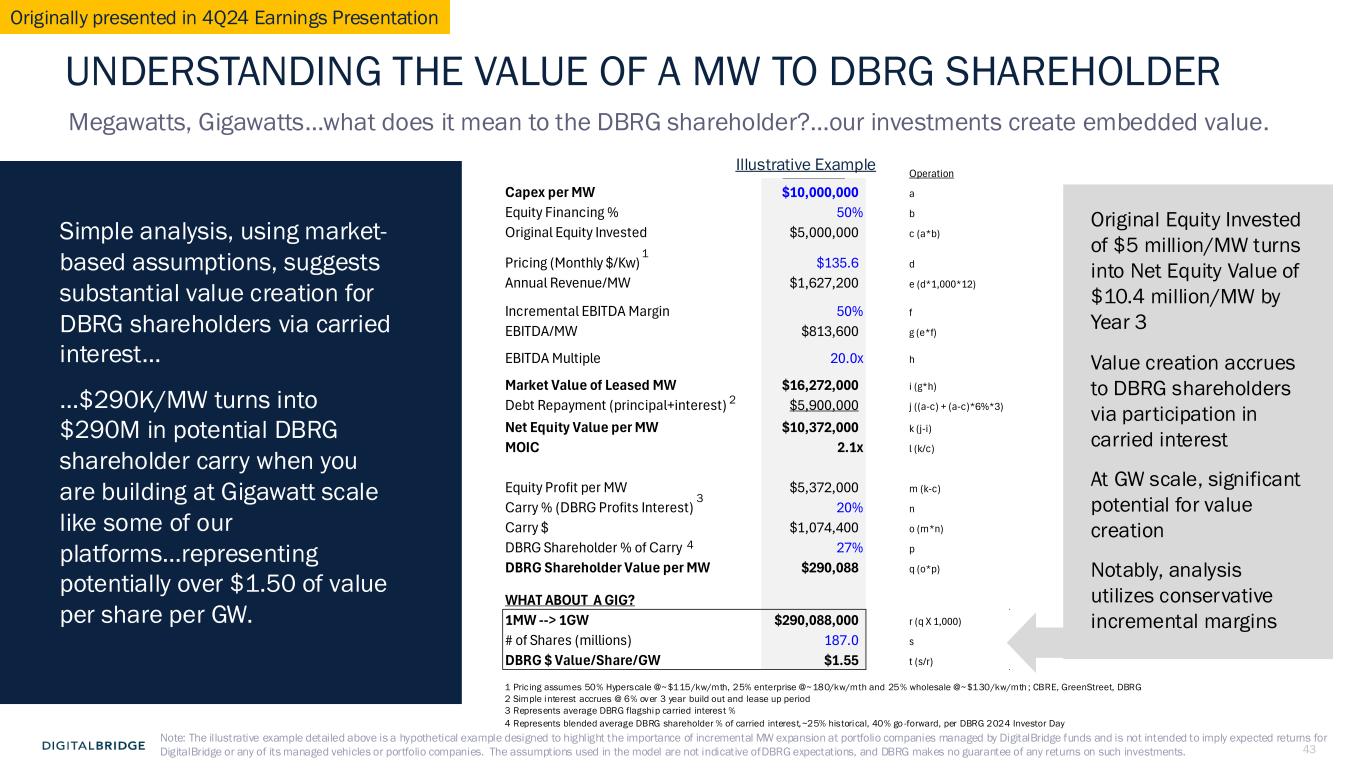

28 ‘Value of a MW’ Framework2 4Q24 Illustrative Example ▪ 100+ Markets ▪ 220+ Data Centers ▪ 8 Global Data Center Companies Top 3 Data Center Provider in the World1 SCALE 1MW 1GW CAPEX $10M $10B EQUITY REQUIRED $5M $5B ILLUSTRATIVE CARRY ~$300K ~$300M June 30 BUILT CAPACITY June 30 5.4 GW 2.1 GW UNDER CONSTRUCTION 3.2 GW CAPACITY BUILT AND UNDER CONSTRUCTION 1. As of July 2025. Sources: Company websites and Data Center Map as of July 2025, reflecting: Digital Realty 300+ data centers; Equinix 260+ data centers; DigitalBridge and InfraBridge global data center portco count 220+ data centers; NTT Data Centers 150+; Iron Mountain 30+ data centers; CoreSite 30+ data centers. Ranking is a product DB’s in-house research and does not reflect a rating formulated by a third party. Includes leased capacity. Ranking based on DigitalBridge internal analysis. There is no guarantee that DigitalBridge or its investment vehicles will work with any of the firms or businesses whose logos are included herein in the future. Compensation was not provided directly or indirectly in connection with obtaining or using the third-party ratings and rankings mentioned on this slide. 2. The illustrative example detailed above is a hypothetical example designed to highlight the importance of incremental MW expansion at portfolio companies managed by DigitalBridge funds and is not intended to imply expected returns for DigitalBridge or any of its managed vehicles or portfolio companies. The assumptions used in the model are not indicative of DBRG expectations, and DBRG makes no guarantee of any returns on such investments. See the “Value of a MW Framework” slide included in the appendix section of this presentation for the calculations and assumptions underlying this illustrative example. TRANSLATING SCALE INTO SHAREHOLDER VALUE We expect the capacity we are building across our global data center portfolio will generate significant potential embedded value for DigitalBridge shareholders Translating a MW into value creationDIGITALBRIDGE

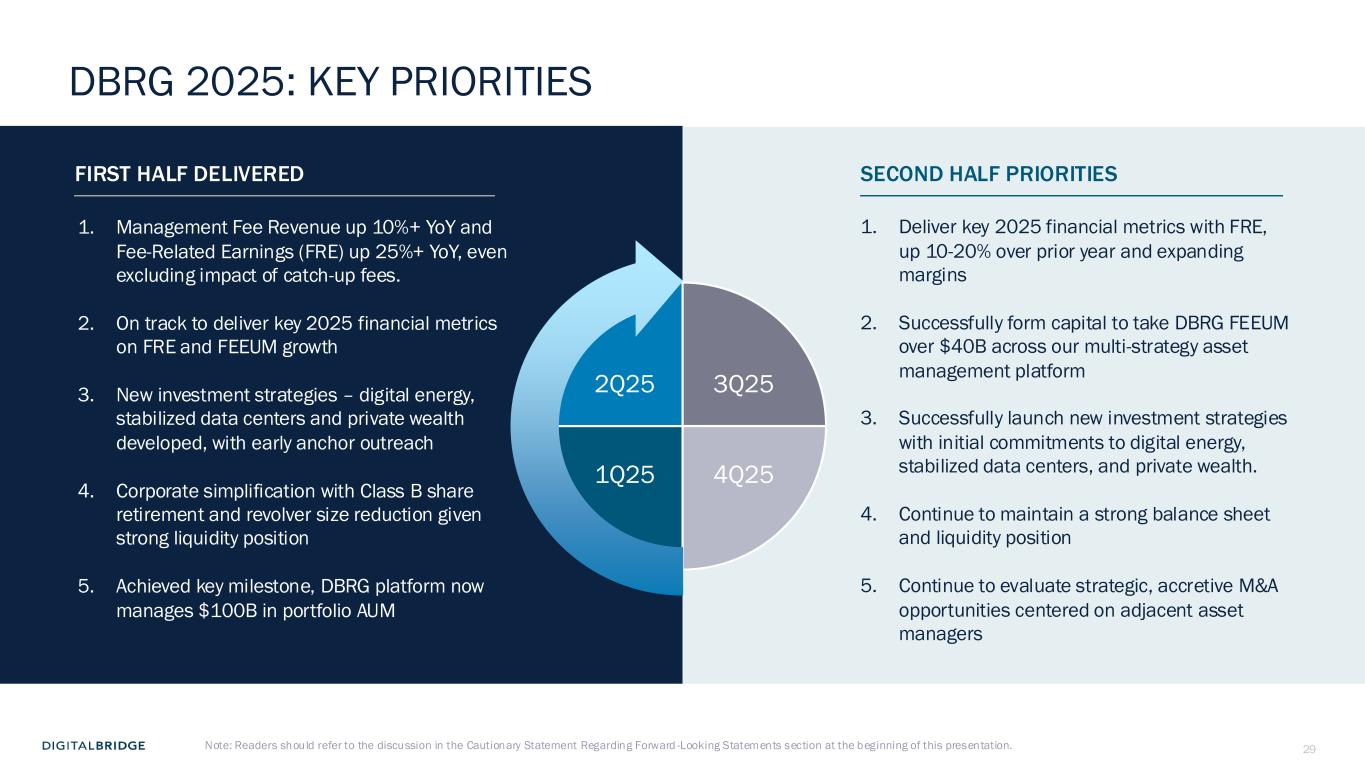

29 FIRST HALF DELIVERED SECOND HALF PRIORITIES DBRG 2025: KEY PRIORITIES 1. Management Fee Revenue up 10%+ YoY and Fee-Related Earnings (FRE) up 25%+ YoY, even excluding impact of catch-up fees. 2. On track to deliver key 2025 financial metrics on FRE and FEEUM growth 3. New investment strategies – digital energy, stabilized data centers and private wealth developed, with early anchor outreach 4. Corporate simplification with Class B share retirement and revolver size reduction given strong liquidity position 5. Achieved key milestone, DBRG platform now manages $100B in portfolio AUM 1. Deliver key 2025 financial metrics with FRE, up 10-20% over prior year and expanding margins 2. Successfully form capital to take DBRG FEEUM over $40B across our multi-strategy asset management platform 3. Successfully launch new investment strategies with initial commitments to digital energy, stabilized data centers, and private wealth. 4. Continue to maintain a strong balance sheet and liquidity position 5. Continue to evaluate strategic, accretive M&A opportunities centered on adjacent asset managers Note: Readers should refer to the discussion in the Cautionary Statement Regarding Forward -Looking Statements section at the beginning of this presentation. 1Q25 2Q25 4Q25 3Q25

30 4 Q&A SESSION

31 5 SUPPLEMENTAL FINANCIAL DATA

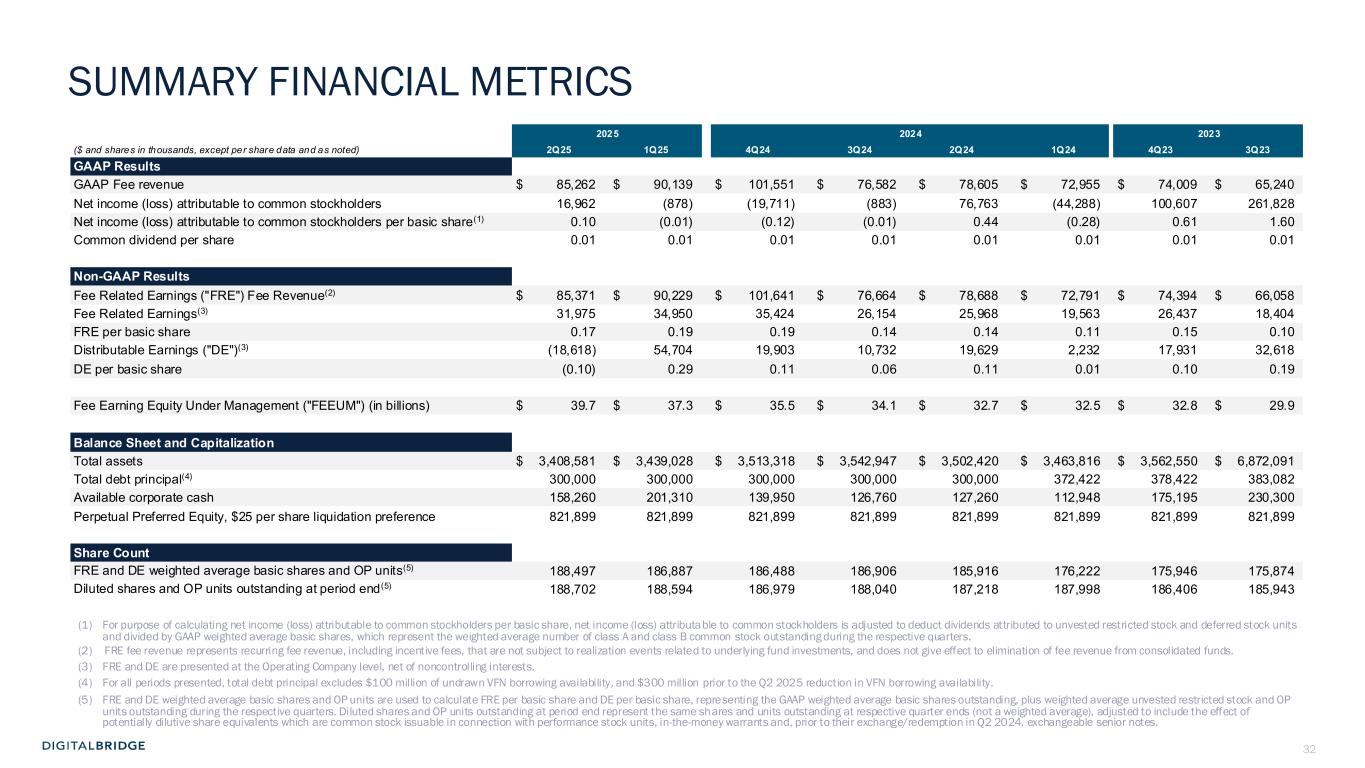

32 2025 2024 2023 ($ and shares in thousands, except per share data and as noted) 2Q25 1Q25 4Q24 3Q24 2Q24 1Q24 4Q23 3Q23 GAAP Results GAAP Fee revenue $ 85,262 $ 90,139 $ 101,551 $ 76,582 $ 78,605 $ 72,955 $ 74,009 $ 65,240 Net income (loss) attributable to common stockholders 16,962 (878) (19,711) (883) 76,763 (44,288) 100,607 261,828 Net income (loss) attributable to common stockholders per basic share(1) 0.10 (0.01) (0.12) (0.01) 0.44 (0.28) 0.61 1.60 Common dividend per share 0.01 0.01 0.01 0.01 0.01 0.01 0.01 0.01 Non-GAAP Results Fee Related Earnings ("FRE") Fee Revenue(2) $ 85,371 $ 90,229 $ 101,641 $ 76,664 $ 78,688 $ 72,791 $ 74,394 $ 66,058 Fee Related Earnings(3) 31,975 34,950 35,424 26,154 25,968 19,563 26,437 18,404 FRE per basic share 0.17 0.19 0.19 0.14 0.14 0.11 0.15 0.10 Distributable Earnings ("DE")(3) (18,618) 54,704 19,903 10,732 19,629 2,232 17,931 32,618 DE per basic share (0.10) 0.29 0.11 0.06 0.11 0.01 0.10 0.19 Fee Earning Equity Under Management ("FEEUM") (in billions) $ 39.7 $ 37.3 $ 35.5 $ 34.1 $ 32.7 $ 32.5 $ 32.8 $ 29.9 Balance Sheet and Capitalization Total assets $ 3,408,581 $ 3,439,028 $ 3,513,318 $ 3,542,947 $ 3,502,420 $ 3,463,816 $ 3,562,550 $ 6,872,091 Total debt principal(4) 300,000 300,000 300,000 300,000 300,000 372,422 378,422 383,082 Available corporate cash 158,260 201,310 139,950 126,760 127,260 112,948 175,195 230,300 Perpetual Preferred Equity, $25 per share liquidation preference 821,899 821,899 821,899 821,899 821,899 821,899 821,899 821,899 Share Count FRE and DE weighted average basic shares and OP units(5) 188,497 186,887 186,488 186,906 185,916 176,222 175,946 175,874 Diluted shares and OP units outstanding at period end(5) 188,702 188,594 186,979 188,040 187,218 187,998 186,406 185,943 (1) For purpose of calculating net income (loss) attributable to common stockholders per basic share, net income (loss) attributable to common stockholders is adjusted to deduct dividends attributed to unvested restricted stock and deferred stock units and divided by GAAP weighted average basic shares, which represent the weighted average number of class A and class B common stock outstanding during the respective quarters. (2) FRE fee revenue represents recurring fee revenue, including incentive fees, that are not subject to realization events related to underlying fund investments, and does not give effect to elimination of fee revenue from consolidated funds. (3) FRE and DE are presented at the Operating Company level, net of noncontrolling interests. (4) For all periods presented, total debt principal excludes $100 million of undrawn VFN borrowing availability, and $300 million prior to the Q2 2025 reduction in VFN borrowing availability. (5) FRE and DE weighted average basic shares and OP units are used to calculate FRE per basic share and DE per basic share, representing the GAAP weighted average basic shares outstanding, plus weighted average unvested restricted stock and OP units outstanding during the respective quarters. Diluted shares and OP units outstanding at period end represent the same shares and units outstanding at respective quarter ends (not a weighted average), adjusted to include the effect of potentially dilutive share equivalents which are common stock issuable in connection with performance stock units, in-the-money warrants and, prior to their exchange/redemption in Q2 2024, exchangeable senior notes. SUMMARY FINANCIAL METRICS

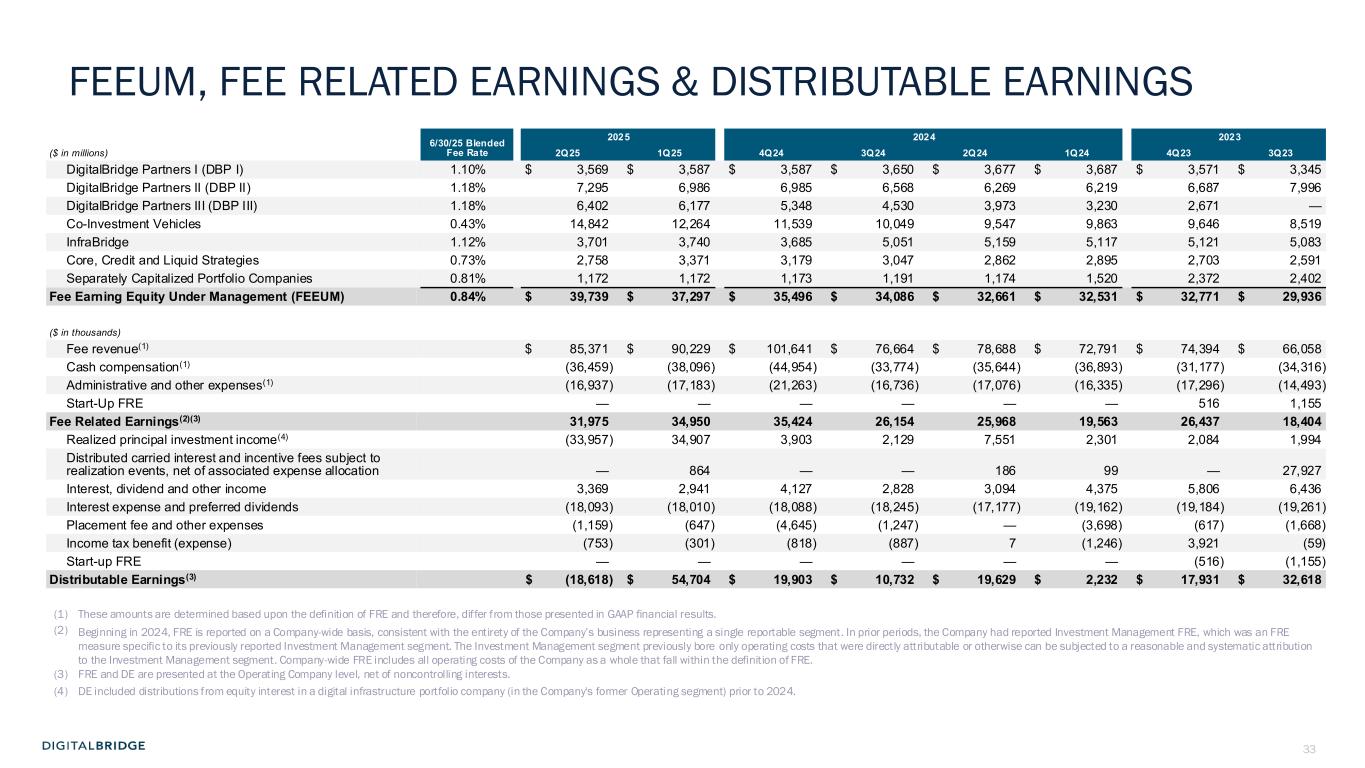

33 6/30/25 Blended Fee Rate 2025 2024 2023 ($ in millions) 2Q25 1Q25 4Q24 3Q24 2Q24 1Q24 4Q23 3Q23 DigitalBridge Partners I (DBP I) 1.10% $ 3,569 $ 3,587 $ 3,587 $ 3,650 $ 3,677 $ 3,687 $ 3,571 $ 3,345 DigitalBridge Partners II (DBP II) 1.18% 7,295 6,986 6,985 6,568 6,269 6,219 6,687 7,996 DigitalBridge Partners III (DBP III) 1.18% 6,402 6,177 5,348 4,530 3,973 3,230 2,671 — Co-Investment Vehicles 0.43% 14,842 12,264 11,539 10,049 9,547 9,863 9,646 8,519 InfraBridge 1.12% 3,701 3,740 3,685 5,051 5,159 5,117 5,121 5,083 Core, Credit and Liquid Strategies 0.73% 2,758 3,371 3,179 3,047 2,862 2,895 2,703 2,591 Separately Capitalized Portfolio Companies 0.81% 1,172 1,172 1,173 1,191 1,174 1,520 2,372 2,402 Fee Earning Equity Under Management (FEEUM) 0.84% $ 39,739 $ 37,297 $ 35,496 $ 34,086 $ 32,661 $ 32,531 $ 32,771 $ 29,936 ($ in thousands) Fee revenue(1) $ 85,371 $ 90,229 $ 101,641 $ 76,664 $ 78,688 $ 72,791 $ 74,394 $ 66,058 Cash compensation(1) (36,459) (38,096) (44,954) (33,774) (35,644) (36,893) (31,177) (34,316) Administrative and other expenses(1) (16,937) (17,183) (21,263) (16,736) (17,076) (16,335) (17,296) (14,493) Start-Up FRE — — — — — — 516 1,155 Fee Related Earnings(2)(3) 31,975 34,950 35,424 26,154 25,968 19,563 26,437 18,404 Realized principal investment income(4) (33,957) 34,907 3,903 2,129 7,551 2,301 2,084 1,994 Distributed carried interest and incentive fees subject to realization events, net of associated expense allocation — 864 — — 186 99 — 27,927 Interest, dividend and other income 3,369 2,941 4,127 2,828 3,094 4,375 5,806 6,436 Interest expense and preferred dividends (18,093) (18,010) (18,088) (18,245) (17,177) (19,162) (19,184) (19,261) Placement fee and other expenses (1,159) (647) (4,645) (1,247) — (3,698) (617) (1,668) Income tax benefit (expense) (753) (301) (818) (887) 7 (1,246) 3,921 (59) Start-up FRE — — — — — — (516) (1,155) Distributable Earnings(3) $ (18,618) $ 54,704 $ 19,903 $ 10,732 $ 19,629 $ 2,232 $ 17,931 $ 32,618 (1) These amounts are determined based upon the definition of FRE and therefore, differ from those presented in GAAP financial results. (2) Beginning in 2024, FRE is reported on a Company-wide basis, consistent with the entirety of the Company’s business representing a single reportable segment. In prior periods, the Company had reported Investment Management FRE, which was an FRE measure specific to its previously reported Investment Management segment. The Investment Management segment previously bore only operating costs that were directly attributable or otherwise can be subjected to a reasonable and systematic attribution to the Investment Management segment. Company-wide FRE includes all operating costs of the Company as a whole that fall within the definition of FRE. (3) FRE and DE are presented at the Operating Company level, net of noncontrolling interests. (4) DE included distributions from equity interest in a digital infrastructure portfolio company (in the Company's former Operating segment) prior to 2024. FEEUM, FEE RELATED EARNINGS & DISTRIBUTABLE EARNINGS

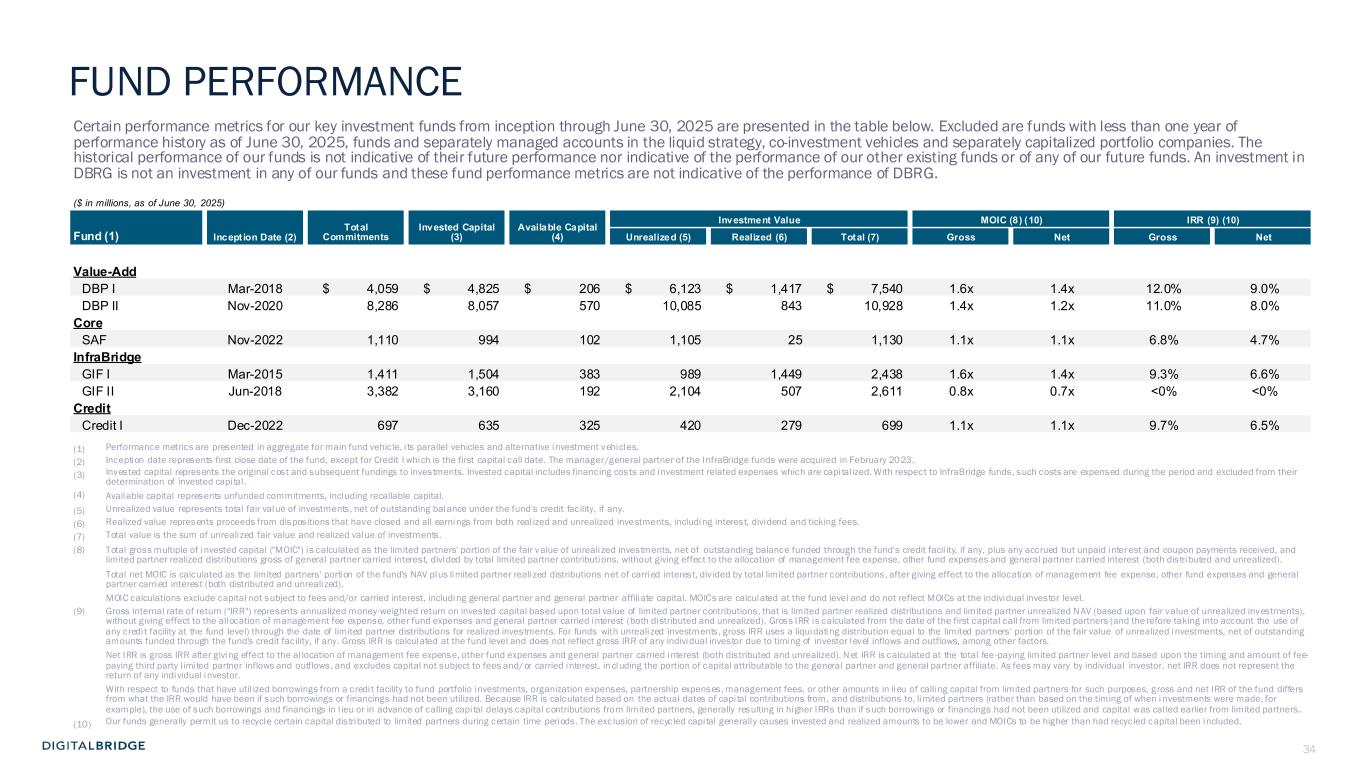

34 Certain performance metrics for our key investment funds from inception through June 30, 2025 are presented in the table below. Excluded are funds with less than one year of performance history as of June 30, 2025, funds and separately managed accounts in the liquid strategy, co-investment vehicles and separately capitalized portfolio companies. The historical performance of our funds is not indicative of their future performance nor indicative of the performance of our other existing funds or of any of our future funds. An investment in DBRG is not an investment in any of our funds and these fund performance metrics are not indicative of the performance of DBRG. ($ in millions, as of June 30, 2025) Incept ion Date (2) Total Commitments Invested Capital (3) Available Capital (4) Investment Value MOIC (8) (10) IRR (9) (10) Fund (1) Unrealized (5) Realized (6) Total (7) Gross Net Gross Net Value-Add DBP I Mar-2018 $ 4,059 $ 4,825 $ 206 $ 6,123 $ 1,417 $ 7,540 1.6x 1.4x 12.0% 9.0% DBP II Nov-2020 8,286 8,057 570 10,085 843 10,928 1.4x 1.2x 11.0% 8.0% Core SAF Nov-2022 1,110 994 102 1,105 25 1,130 1.1x 1.1x 6.8% 4.7% InfraBridge GIF I Mar-2015 1,411 1,504 383 989 1,449 2,438 1.6x 1.4x 9.3% 6.6% GIF II Jun-2018 3,382 3,160 192 2,104 507 2,611 0.8x 0.7x <0% <0% Credit Credit I Dec-2022 697 635 325 420 279 699 1.1x 1.1x 9.7% 6.5% (1) Performance metrics are presented in aggregate for main fund vehicle, i ts parallel vehicles and alternative investment vehicles. (2) Inception date represents first close date of the fund, except for Credit I which is the first capital call date. The manager/general partner of the InfraBridge funds were acquired in February 2023. (3) Invested capital represents the original cost and subsequent fundings to investments. Invested capital includes financing costs and investment related expenses which are capi tal ized. With respect to InfraBridge funds, such costs are expensed during the period and excluded from their determination of invested capi tal . (4) Available capital represents unfunded commitments, including recallable capital. (5) Unrealized value represents total fair value of investments, net of outstanding balance under the fund’s credit facility, if any. (6) Realized value represents proceeds from dispositions that have closed and all earnings from both real ized and unrealized investments, including interest, dividend and ticking fees. (7) Total value is the sum of unrealized fair value and realized value of investments. (8) Total gross multiple of invested capital ("MOIC") is calculated as the limited partners' portion of the fair value of unreali zed investments, net of outstanding balance funded through the fund's credit facil ity, if any, plus any accrued but unpaid inter est and coupon payments received, and limited partner realized distributions gross of general partner carried interest, divided by total limited partner contributions, without giving effect to the allocation of management fee expense, other fund expenses and general partner carried interest (both distributed and unrealized). Total net MOIC is calculated as the limited partners' portion of the fund's NAV plus limited partner realized distributions net of carried interest, div ided by total limited partner contributions, after giving effect to the allocation of management fee expense, other fund expenses and general partner carried interest (both distributed and unrealized). MOIC calculations exclude capital not subject to fees and/or carried interest, including general partner and general partner affiliate capital. MOICs are calculated at the fund level and do not reflect MOICs at the individual investor level. (9) Gross internal rate of return ("IRR") represents annualized money-weighted return on invested capital based upon total value of limited partner contributions, that is limited partner realized distributions and limited partner unrealized NAV (based upon fair value of unrealized investments), without giving effect to the allocation of management fee expense, other fund expenses and general partner carried interest (both distributed and unrealized). Gross IRR is calculated from the date of the first capital call from limited partners (and the refore taking into account the use of any credi t facility at the fund level) through the date of limited partner distributions for realized investments. For funds with unrealized investments, gross IRR uses a liquidating distribution equal to the limited partners' portion of the fair value of unrealized investments, net of outstanding amounts funded through the fund's credit facility, if any. Gross IRR is calculated at the fund level and does not reflect gross IRR of any individual investor due to timing of investor level inflows and outflows, among other factors. Net IRR is gross IRR after giving effect to the al location of management fee expense, other fund expenses and general partner carried interest (both distributed and unrealized). Net IRR is calculated at the total fee -paying limited partner level and based upon the timing and amount of fee- paying third party l imited partner inflows and outflows, and excludes capital not subject to fees and/or carried interest, in cluding the portion of capital attributable to the general partner and general partner affiliate. As fees may vary by individual investor, net IRR does not represent the return of any individual investor. With respect to funds that have util ized borrowings from a credi t facility to fund portfolio investments, organization expenses, partnership expenses, management fees, or other amounts in lieu of calling capital from limited partners for such purposes, gross and net IRR of the fund differs from what the IRR would have been if such borrowings or financings had not been utilized. Because IRR is calculated based on the actual dates of capi tal contributions from, and distributions to, limited partners (rather than based on the timing of when i nvestments were made, for example), the use of such borrowings and financings in l ieu or in advance of calling capi tal delays capital contributions from limited partners, generally resulting in higher IRRs than if such borrowings or financings had not been utilized and capital was cal led earlier from limited partners.. (10) Our funds generally permit us to recycle certain capital distributed to limited partners during certain time periods. The exc lusion of recycled capi tal generally causes invested and realized amounts to be lower and MOICs to be higher than had recycled capital been included. FUND PERFORMANCE

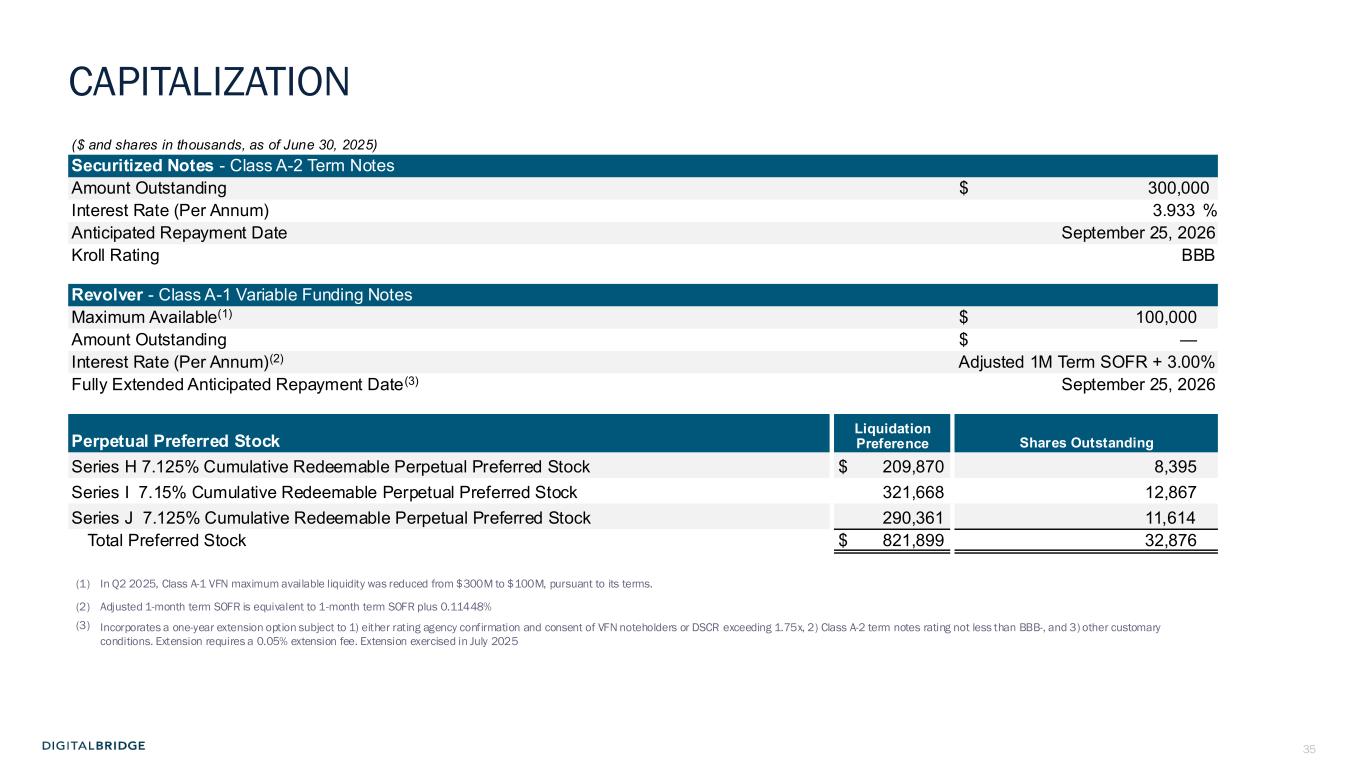

35 ($ and shares in thousands, as of June 30, 2025) Securitized Notes - Class A-2 Term Notes Amount Outstanding $ 300,000 Interest Rate (Per Annum) 3.933 % Anticipated Repayment Date September 25, 2026 Kroll Rating BBB Revolver - Class A-1 Variable Funding Notes Maximum Available(1) $ 100,000 Amount Outstanding $ — Interest Rate (Per Annum)(2) Adjusted 1M Term SOFR + 3.00% Fully Extended Anticipated Repayment Date(3) September 25, 2026 Liquidation Preference Shares OutstandingPerpetual Preferred Stock Series H 7.125% Cumulative Redeemable Perpetual Preferred Stock $ 209,870 8,395 Series I 7.15% Cumulative Redeemable Perpetual Preferred Stock 321,668 12,867 Series J 7.125% Cumulative Redeemable Perpetual Preferred Stock 290,361 11,614 Total Preferred Stock $ 821,899 32,876 (1) In Q2 2025, Class A-1 VFN maximum available liquidity was reduced from $300M to $100M, pursuant to its terms. (2) Adjusted 1-month term SOFR is equivalent to 1-month term SOFR plus 0.11448% (3) Incorporates a one-year extension option subject to 1) either rating agency confirmation and consent of VFN noteholders or DSCR exceeding 1.75x, 2) Class A-2 term notes rating not less than BBB-, and 3) other customary conditions. Extension requires a 0.05% extension fee. Extension exercised in July 2025 CAPITALIZATION

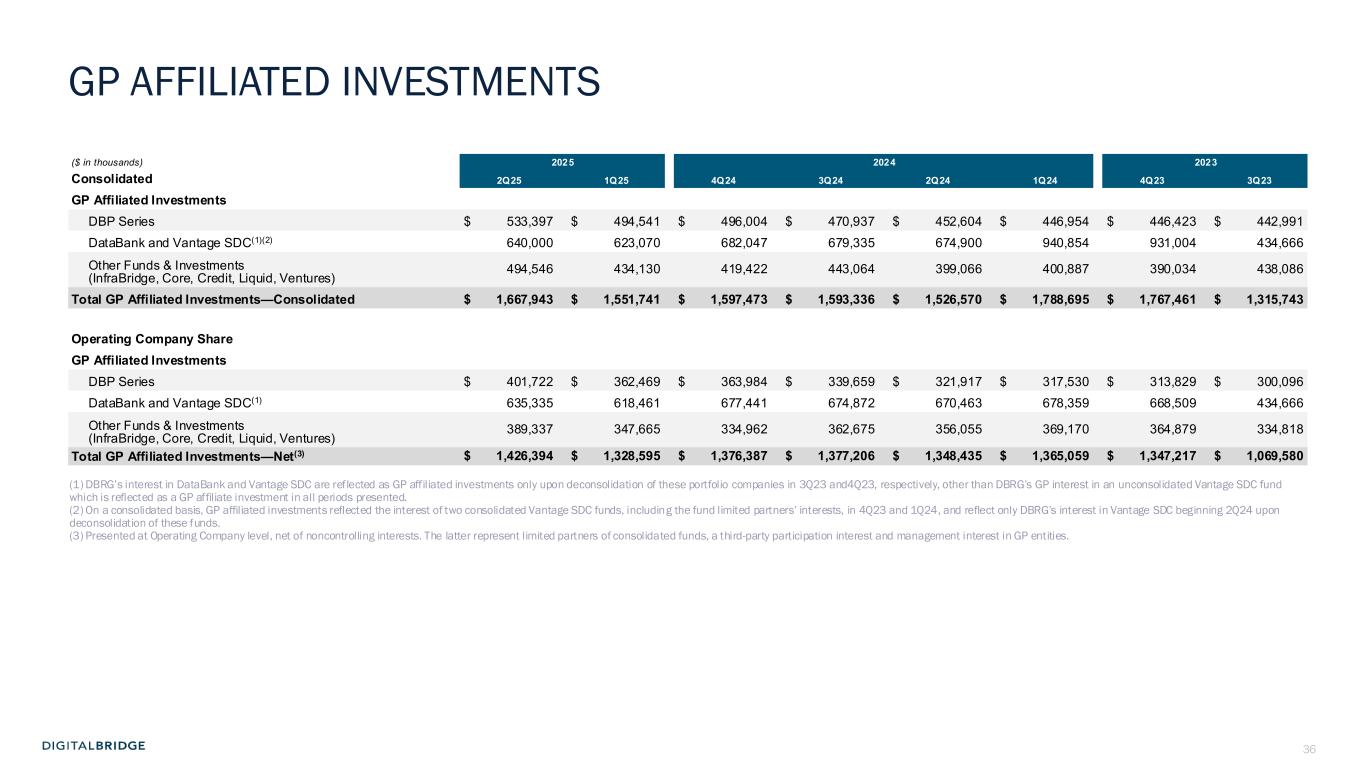

36 ($ in thousands) 2025 2024 2023 Consolidated 2Q25 1Q25 4Q24 3Q24 2Q24 1Q24 4Q23 3Q23 GP Affiliated Investments DBP Series $ 533,397 $ 494,541 $ 496,004 $ 470,937 $ 452,604 $ 446,954 $ 446,423 $ 442,991 DataBank and Vantage SDC(1)(2) 640,000 623,070 682,047 679,335 674,900 940,854 931,004 434,666 Other Funds & Investments (InfraBridge, Core, Credit, Liquid, Ventures) 494,546 434,130 419,422 443,064 399,066 400,887 390,034 438,086 Total GP Affiliated Investments—Consolidated $ 1,667,943 $ 1,551,741 $ 1,597,473 $ 1,593,336 $ 1,526,570 $ 1,788,695 $ 1,767,461 $ 1,315,743 Operating Company Share GP Affiliated Investments DBP Series $ 401,722 $ 362,469 $ 363,984 $ 339,659 $ 321,917 $ 317,530 $ 313,829 $ 300,096 DataBank and Vantage SDC(1) 635,335 618,461 677,441 674,872 670,463 678,359 668,509 434,666 Other Funds & Investments (InfraBridge, Core, Credit, Liquid, Ventures) 389,337 347,665 334,962 362,675 356,055 369,170 364,879 334,818 Total GP Affiliated Investments—Net(3) $ 1,426,394 $ 1,328,595 $ 1,376,387 $ 1,377,206 $ 1,348,435 $ 1,365,059 $ 1,347,217 $ 1,069,580 (1) DBRG’s interest in DataBank and Vantage SDC are reflected as GP affiliated investments only upon deconsolidation of these portfolio companies in 3Q23 and4Q23, respectively, other than DBRG’s GP interest in an unconsolidated Vantage SDC fund which is reflected as a GP affiliate investment in all periods presented. (2) On a consolidated basis, GP affiliated investments reflected the interest of two consolidated Vantage SDC funds, including the fund limited partners’ interests, in 4Q23 and 1Q24, and reflect only DBRG’s interest in Vantage SDC beginning 2Q24 upon deconsolidation of these funds. (3) Presented at Operating Company level, net of noncontrolling interests. The latter represent limited partners of consolidated funds, a third-party participation interest and management interest in GP entities. GP AFFILIATED INVESTMENTS

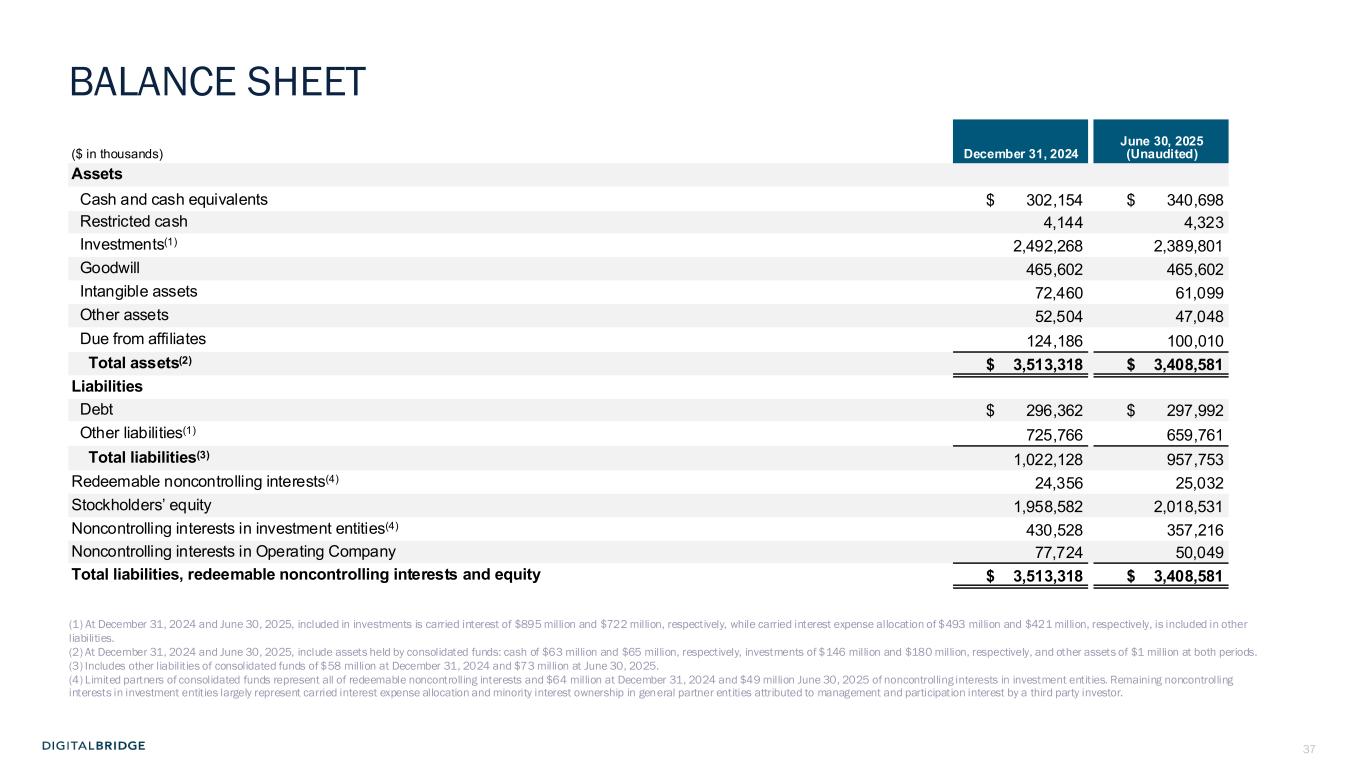

37 ($ in thousands) December 31, 2024 June 30, 2025 (Unaudited) Assets Cash and cash equivalents $ 302,154 $ 340,698 Restricted cash 4,144 4,323 Investments(1) 2,492,268 2,389,801 Goodwill 465,602 465,602 Intangible assets 72,460 61,099 Other assets 52,504 47,048 Due from affiliates 124,186 100,010 Total assets(2) $ 3,513,318 $ 3,408,581 Liabilities Debt $ 296,362 $ 297,992 Other liabilities(1) 725,766 659,761 Total liabilities(3) 1,022,128 957,753 Redeemable noncontrolling interests(4) 24,356 25,032 Stockholders’ equity 1,958,582 2,018,531 Noncontrolling interests in investment entities(4) 430,528 357,216 Noncontrolling interests in Operating Company 77,724 50,049 Total liabilities, redeemable noncontrolling interests and equity $ 3,513,318 $ 3,408,581 (1) At December 31, 2024 and June 30, 2025, included in investments is carried interest of $895 million and $722 million, respectively, while carried interest expense allocation of $493 million and $421 million, respectively, is included in other liabilities. (2) At December 31, 2024 and June 30, 2025, include assets held by consolidated funds: cash of $63 million and $65 million, respectively, investments of $146 million and $180 million, respectively, and other assets of $1 million at both periods. (3) Includes other liabilities of consolidated funds of $58 million at December 31, 2024 and $73 million at June 30, 2025. (4) Limited partners of consolidated funds represent all of redeemable noncontrolling interests and $64 million at December 31, 2024 and $49 million June 30, 2025 of noncontrolling interests in investment entities. Remaining noncontrolling interests in investment entities largely represent carried interest expense allocation and minority interest ownership in general partner entities attributed to management and participation interest by a third party investor. BALANCE SHEET

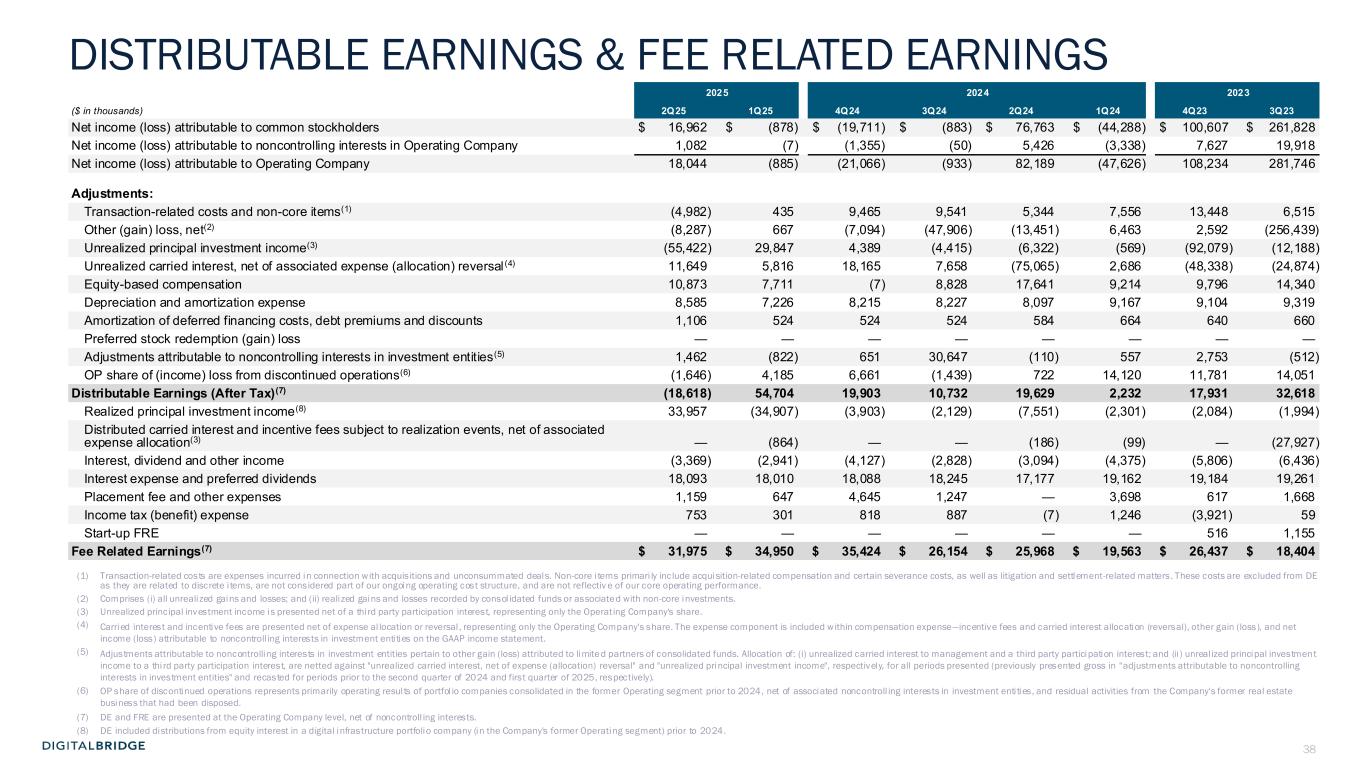

38 2025 2024 2023 ($ in thousands) 2Q25 1Q25 4Q24 3Q24 2Q24 1Q24 4Q23 3Q23 Net income (loss) attributable to common stockholders $ 16,962 $ (878) $ (19,711) $ (883) $ 76,763 $ (44,288) $ 100,607 $ 261,828 Net income (loss) attributable to noncontrolling interests in Operating Company 1,082 (7) (1,355) (50) 5,426 (3,338) 7,627 19,918 Net income (loss) attributable to Operating Company 18,044 (885) (21,066) (933) 82,189 (47,626) 108,234 281,746 Adjustments: Transaction-related costs and non-core items(1) (4,982) 435 9,465 9,541 5,344 7,556 13,448 6,515 Other (gain) loss, net(2) (8,287) 667 (7,094) (47,906) (13,451) 6,463 2,592 (256,439) Unrealized principal investment income(3) (55,422) 29,847 4,389 (4,415) (6,322) (569) (92,079) (12,188) Unrealized carried interest, net of associated expense (allocation) reversal (4) 11,649 5,816 18,165 7,658 (75,065) 2,686 (48,338) (24,874) Equity-based compensation 10,873 7,711 (7) 8,828 17,641 9,214 9,796 14,340 Depreciation and amortization expense 8,585 7,226 8,215 8,227 8,097 9,167 9,104 9,319 Amortization of deferred financing costs, debt premiums and discounts 1,106 524 524 524 584 664 640 660 Preferred stock redemption (gain) loss — — — — — — — — Adjustments attributable to noncontrolling interests in investment entities(5) 1,462 (822) 651 30,647 (110) 557 2,753 (512) OP share of (income) loss from discontinued operations(6) (1,646) 4,185 6,661 (1,439) 722 14,120 11,781 14,051 Distributable Earnings (After Tax)(7) (18,618) 54,704 19,903 10,732 19,629 2,232 17,931 32,618 Realized principal investment income(8) 33,957 (34,907) (3,903) (2,129) (7,551) (2,301) (2,084) (1,994) Distributed carried interest and incentive fees subject to realization events, net of associated expense allocation(3) — (864) — — (186) (99) — (27,927) Interest, dividend and other income (3,369) (2,941) (4,127) (2,828) (3,094) (4,375) (5,806) (6,436) Interest expense and preferred dividends 18,093 18,010 18,088 18,245 17,177 19,162 19,184 19,261 Placement fee and other expenses 1,159 647 4,645 1,247 — 3,698 617 1,668 Income tax (benefit) expense 753 301 818 887 (7) 1,246 (3,921) 59 Start-up FRE — — — — — — 516 1,155 Fee Related Earnings(7) $ 31,975 $ 34,950 $ 35,424 $ 26,154 $ 25,968 $ 19,563 $ 26,437 $ 18,404 (1) Transaction-related costs are expenses incurred in connection with acquisitions and unconsummated deals. Non-core i tems primari ly include acquisition-related compensation and certain severance costs, as well as litigation and settlement-related matters. These costs are excluded from DE as they are related to discrete i tems, are not considered part of our ongoing operating cost structure, and are not reflectiv e of our core operating performance. (2) Comprises (i) all unrealized gains and losses; and (ii) realized gains and losses recorded by consol idated funds or associate d with non-core investments. (3) Unrealized principal investment income is presented net of a thi rd party participation interest, representing only the Operating Company's share. (4) Carried interest and incentive fees are presented net of expense al location or reversal , representing only the Operating Company's share. The expense component is included within compensation expense—incentive fees and carried interest allocation (reversal), other gain (loss), and net income (loss) attributable to noncontroll ing interests in investment enti ties on the GAAP income statement. (5) Adjustments attributable to noncontrolling interests in investment entities pertain to other gain (loss) attributed to limite d partners of consolidated funds. Allocation of: (i) unrealized carried interest to management and a third party participation interest; and (ii ) unreal ized principal investment income to a thi rd party participation interest, are netted against "unrealized carried interest, net of expense (allocation) reversal" and "unrealized principal investment income", respectively, for all periods presented (previously presented gross in "adjustments attributable to noncontrolling interests in investment entities" and recasted for periods prior to the second quarter of 2024 and first quarter of 2025, respectively). (6) OP share of discontinued operations represents primarily operating resul ts of portfol io companies consolidated in the former Operating segment prior to 2024, net of associated noncontroll ing interests in investment enti ties, and residual activities from the Company's former real estate business that had been disposed. (7) DE and FRE are presented at the Operating Company level, net of noncontroll ing interests. (8) DE included distributions from equity interest in a digital infrastructure portfolio company (in the Company's former Operating segment) prior to 2024. DISTRIBUTABLE EARNINGS & FEE RELATED EARNINGS

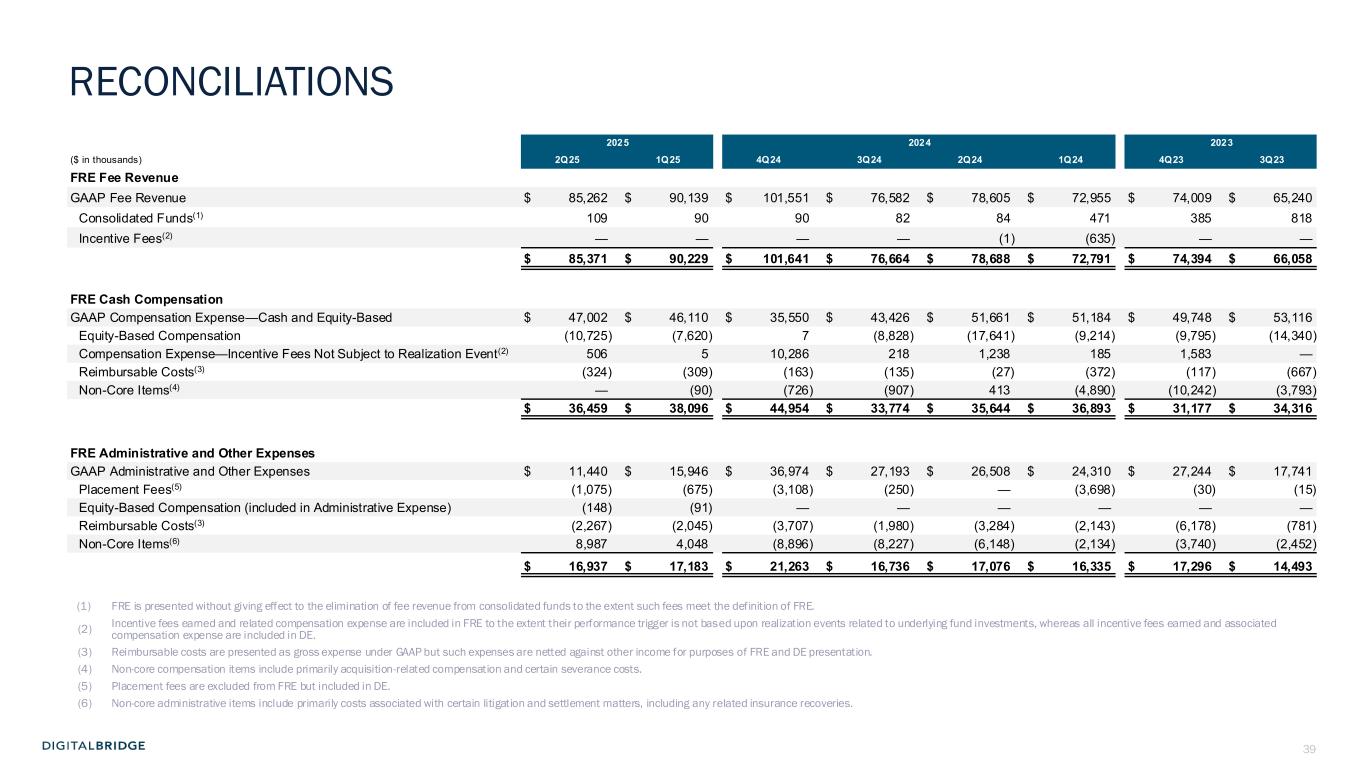

39 2025 2024 2023 ($ in thousands) 2Q25 1Q25 4Q24 3Q24 2Q24 1Q24 4Q23 3Q23 FRE Fee Revenue GAAP Fee Revenue $ 85,262 $ 90,139 $ 101,551 $ 76,582 $ 78,605 $ 72,955 $ 74,009 $ 65,240 Consolidated Funds(1) 109 90 90 82 84 471 385 818 Incentive Fees(2) — — — — (1) (635) — — $ 85,371 $ 90,229 $ 101,641 $ 76,664 $ 78,688 $ 72,791 $ 74,394 $ 66,058 FRE Cash Compensation GAAP Compensation Expense—Cash and Equity-Based $ 47,002 $ 46,110 $ 35,550 $ 43,426 $ 51,661 $ 51,184 $ 49,748 $ 53,116 Equity-Based Compensation (10,725) (7,620) 7 (8,828) (17,641) (9,214) (9,795) (14,340) Compensation Expense—Incentive Fees Not Subject to Realization Event(2) 506 5 10,286 218 1,238 185 1,583 — Reimbursable Costs(3) (324) (309) (163) (135) (27) (372) (117) (667) Non-Core Items(4) — (90) (726) (907) 413 (4,890) (10,242) (3,793) $ 36,459 $ 38,096 $ 44,954 $ 33,774 $ 35,644 $ 36,893 $ 31,177 $ 34,316 FRE Administrative and Other Expenses GAAP Administrative and Other Expenses $ 11,440 $ 15,946 $ 36,974 $ 27,193 $ 26,508 $ 24,310 $ 27,244 $ 17,741 Placement Fees(5) (1,075) (675) (3,108) (250) — (3,698) (30) (15) Equity-Based Compensation (included in Administrative Expense) (148) (91) — — — — — — Reimbursable Costs(3) (2,267) (2,045) (3,707) (1,980) (3,284) (2,143) (6,178) (781) Non-Core Items(6) 8,987 4,048 (8,896) (8,227) (6,148) (2,134) (3,740) (2,452) $ 16,937 $ 17,183 $ 21,263 $ 16,736 $ 17,076 $ 16,335 $ 17,296 $ 14,493 (1) FRE is presented without giving effect to the elimination of fee revenue from consolidated funds to the extent such fees meet the definition of FRE. (2) Incentive fees earned and related compensation expense are included in FRE to the extent their performance trigger is not based upon realization events related to underlying fund investments, whereas all incentive fees earned and associated compensation expense are included in DE. (3) Reimbursable costs are presented as gross expense under GAAP but such expenses are netted against other income for purposes of FRE and DE presentation. (4) Non-core compensation items include primarily acquisition-related compensation and certain severance costs. (5) Placement fees are excluded from FRE but included in DE. (6) Non-core administrative items include primarily costs associated with certain litigation and settlement matters, including any related insurance recoveries. RECONCILIATIONS

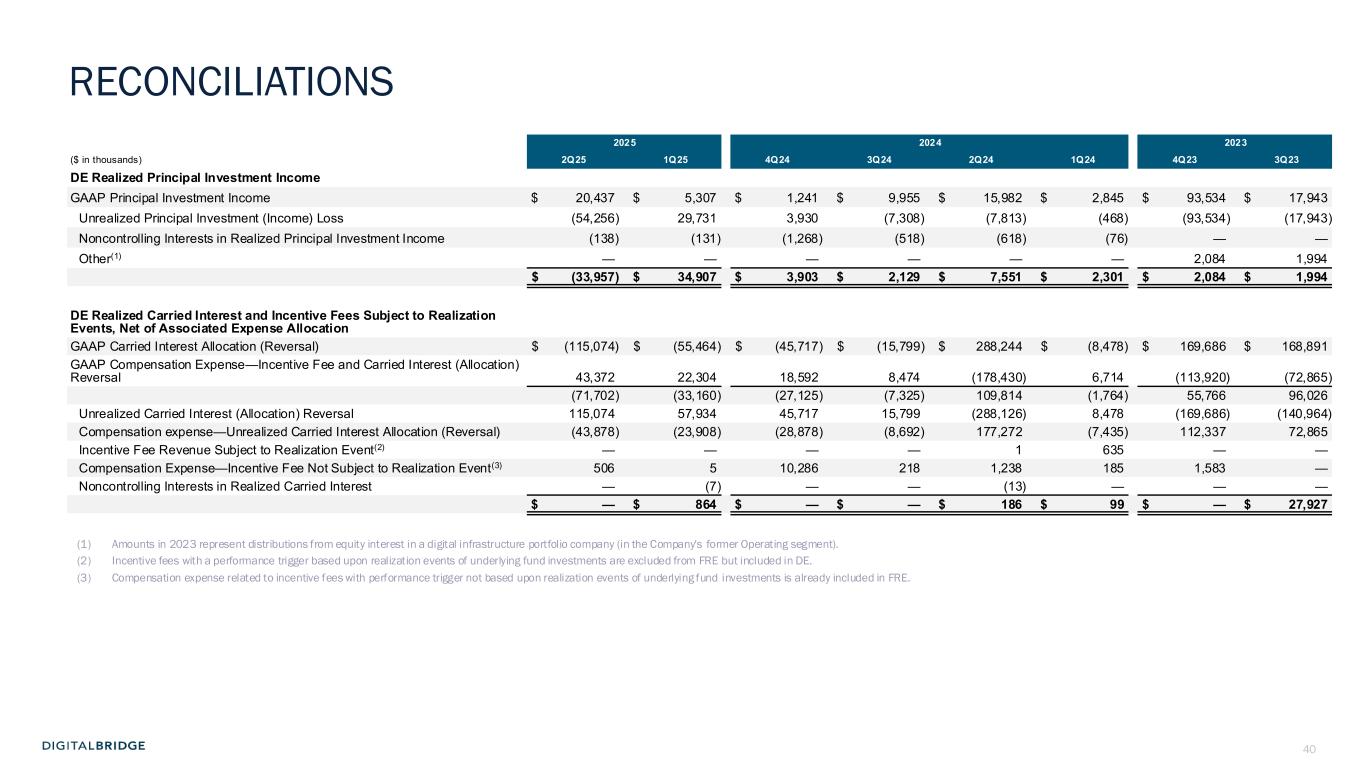

40 2025 2024 2023 ($ in thousands) 2Q25 1Q25 4Q24 3Q24 2Q24 1Q24 4Q23 3Q23 DE Realized Principal Investment Income GAAP Principal Investment Income $ 20,437 $ 5,307 $ 1,241 $ 9,955 $ 15,982 $ 2,845 $ 93,534 $ 17,943 Unrealized Principal Investment (Income) Loss (54,256) 29,731 3,930 (7,308) (7,813) (468) (93,534) (17,943) Noncontrolling Interests in Realized Principal Investment Income (138) (131) (1,268) (518) (618) (76) — — Other(1) — — — — — — 2,084 1,994 $ (33,957) $ 34,907 $ 3,903 $ 2,129 $ 7,551 $ 2,301 $ 2,084 $ 1,994 DE Realized Carried Interest and Incentive Fees Subject to Realization Events, Net of Associated Expense Allocation GAAP Carried Interest Allocation (Reversal) $ (115,074) $ (55,464) $ (45,717) $ (15,799) $ 288,244 $ (8,478) $ 169,686 $ 168,891 GAAP Compensation Expense—Incentive Fee and Carried Interest (Allocation) Reversal 43,372 22,304 18,592 8,474 (178,430) 6,714 (113,920) (72,865) (71,702) (33,160) (27,125) (7,325) 109,814 (1,764) 55,766 96,026 Unrealized Carried Interest (Allocation) Reversal 115,074 57,934 45,717 15,799 (288,126) 8,478 (169,686) (140,964) Compensation expense—Unrealized Carried Interest Allocation (Reversal) (43,878) (23,908) (28,878) (8,692) 177,272 (7,435) 112,337 72,865 Incentive Fee Revenue Subject to Realization Event(2) — — — — 1 635 — — Compensation Expense—Incentive Fee Not Subject to Realization Event(3) 506 5 10,286 218 1,238 185 1,583 — Noncontrolling Interests in Realized Carried Interest — (7) — — (13) — — — $ — $ 864 $ — $ — $ 186 $ 99 $ — $ 27,927 (1) Amounts in 2023 represent distributions from equity interest in a digital infrastructure portfolio company (in the Company's former Operating segment). (2) Incentive fees with a performance trigger based upon realization events of underlying fund investments are excluded from FRE but included in DE. (3) Compensation expense related to incentive fees with performance trigger not based upon realization events of underlying fund investments is already included in FRE. RECONCILIATIONS

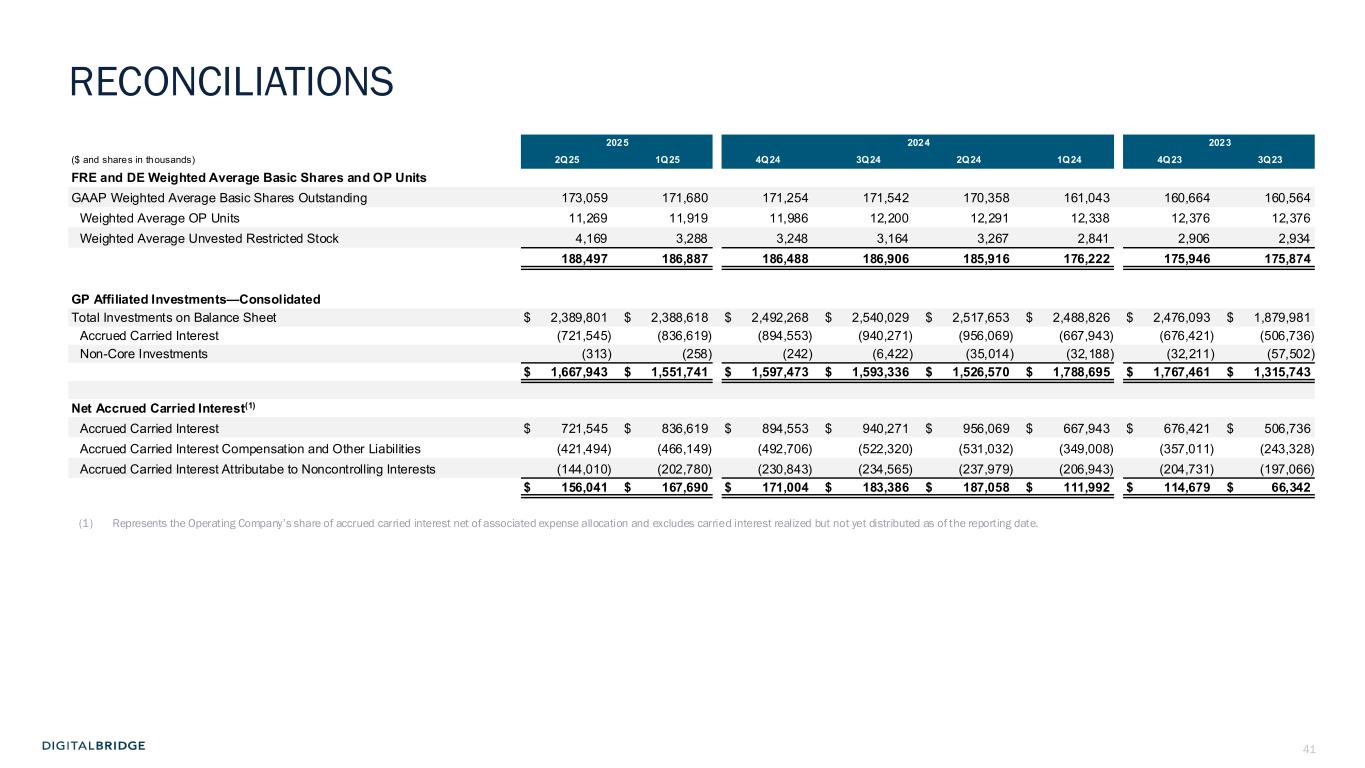

41 2025 2024 2023 ($ and shares in thousands) 2Q25 1Q25 4Q24 3Q24 2Q24 1Q24 4Q23 3Q23 FRE and DE Weighted Average Basic Shares and OP Units GAAP Weighted Average Basic Shares Outstanding 173,059 171,680 171,254 171,542 170,358 161,043 160,664 160,564 Weighted Average OP Units 11,269 11,919 11,986 12,200 12,291 12,338 12,376 12,376 Weighted Average Unvested Restricted Stock 4,169 3,288 3,248 3,164 3,267 2,841 2,906 2,934 188,497 186,887 186,488 186,906 185,916 176,222 175,946 175,874 GP Affiliated Investments—Consolidated Total Investments on Balance Sheet $ 2,389,801 $ 2,388,618 $ 2,492,268 $ 2,540,029 $ 2,517,653 $ 2,488,826 $ 2,476,093 $ 1,879,981 Accrued Carried Interest (721,545) (836,619) (894,553) (940,271) (956,069) (667,943) (676,421) (506,736) Non-Core Investments (313) (258) (242) (6,422) (35,014) (32,188) (32,211) (57,502) $ 1,667,943 $ 1,551,741 $ 1,597,473 $ 1,593,336 $ 1,526,570 $ 1,788,695 $ 1,767,461 $ 1,315,743 Net Accrued Carried Interest(1) Accrued Carried Interest $ 721,545 $ 836,619 $ 894,553 $ 940,271 $ 956,069 $ 667,943 $ 676,421 $ 506,736 Accrued Carried Interest Compensation and Other Liabilities (421,494) (466,149) (492,706) (522,320) (531,032) (349,008) (357,011) (243,328) Accrued Carried Interest Attributabe to Noncontrolling Interests (144,010) (202,780) (230,843) (234,565) (237,979) (206,943) (204,731) (197,066) $ 156,041 $ 167,690 $ 171,004 $ 183,386 $ 187,058 $ 111,992 $ 114,679 $ 66,342 (1) Represents the Operating Company’s share of accrued carried interest net of associated expense allocation and excludes carried interest realized but not yet distributed as of the reporting date. RECONCILIATIONS

42 6 APPENDIX

43 BaseCase Operation Capex per MW $10,000,000 a Equity Financing % 50% b Original Equity Invested $5,000,000 c (a*b) Pricing (Monthly $/Kw) $135.6 d Annual Revenue/MW $1,627,200 e (d*1,000*12) Incremental EBITDA Margin 50% f EBITDA/MW $813,600 g (e*f) EBITDA Multiple 20.0x h Market Value of Leased MW $16,272,000 i (g*h) Debt Repayment (principal+interest) $5,900,000 j ((a-c) + (a-c)*6%*3) Net Equity Value per MW $10,372,000 k (j-i) MOIC 2.1x l (k/c) Equity Profit per MW $5,372,000 m (k-c) Carry % (DBRG Profits Interest) 20% n Carry $ $1,074,400 o (m*n) DBRG Shareholder % of Carry 27% p DBRG Shareholder Value per MW $290,088 q (o*p) WHAT ABOUT A GIG? 1MW --> 1GW $290,088,000 r (q X 1,000) # of Shares (millions) 187.0 s DBRG $ Value/Share/GW $1.55 t (s/r) UNDERSTANDING THE VALUE OF A MW TO DBRG SHAREHOLDER Megawatts, Gigawatts…what does it mean to the DBRG shareholder?…our investments create embedded value. Simple analysis, using market- based assumptions, suggests substantial value creation for DBRG shareholders via carried interest… …$290K/MW turns into $290M in potential DBRG shareholder carry when you are building at Gigawatt scale like some of our platforms…representing potentially over $1.50 of value per share per GW. 1 Pricing assumes 50% Hyperscale @~$115/kw/mth, 25% enterprise @~180/kw/mth and 25% wholesale @~$130/kw/mth ; CBRE, GreenStreet, DBRG 2 Simple interest accrues @ 6% over 3 year build out and lease up period 3 Represents average DBRG flagship carried interest % 4 Represents blended average DBRG shareholder % of carried interest,~25% historical, 40% go -forward, per DBRG 2024 Investor Day 1 2 4 3 Illustrative Example Original Equity Invested of $5 million/MW turns into Net Equity Value of $10.4 million/MW by Year 3 Value creation accrues to DBRG shareholders via participation in carried interest At GW scale, significant potential for value creation Notably, analysis utilizes conservative incremental margins Note: The illustrative example detailed above is a hypothetical example designed to highlight the importance of incremental MW expansion at portfolio companies managed by DigitalBridge funds and is not intended to imply expected returns for DigitalBridge or any of its managed vehicles or portfolio companies. The assumptions used in the model are not indicative ofDBRG expectations, and DBRG makes no guarantee of any returns on such investments. Originally presented in 4Q24 Earnings Presentation

44 This presentation contains the following non-GAAP financial measures attributable to the Operating Company: Fee Related Earnings (“FRE”) and Distributable Earnings (“DE”). FRE and DE are common metrics utilized in the investment management sector. We present FRE and DE at the Operating Company level, which is net of amounts attributed to noncontrolling interests, composed largely of the limited partners' share of our consolidated funds and Wafra's share of earnings attributed to our general partner interest in certain funds. For the same reasons, the Company believes these non-GAAP measures are useful to the Company’s investors and analysts. As we evaluate profitability based upon continuing operations, these non-GAAP measures exclude results from discontinued operations. We believe the non-GAAP financial measures of FRE and DE supplement and enhance the overall understanding of our underlying financial performance and trends, and facilitate comparison among current, past and future periods and to other companies in similar lines of business. We use FRE and DE in evaluating the Company’s ongoing business performance and in making operating decisions. For the same reasons, we believe FRE and DE are useful financial measures to the Company’s investors and analysts. These non-GAAP financial measures should be considered as a supplement to and not an alternative or in lieu of GAAP net income (loss) as measures of operating performance, or to cash flows from operating activities as indicators of liquidity. Our calculation of these non-GAAP measures may differ from methodologies utilized by other companies for similarly titled performance measures and, as a result, may not be fully comparable to those calculated by our peers. Fee-Related Earnings (“FRE”): Beginning in 2024, FRE is reported on a Company-wide basis, consistent with the entirety of the Company's business representing a single reportable segment. In prior periods, the Company had reported Investment Management FRE, which was an FRE measure specific to its previously reported Investment Management segment. The Investment Management segment previously bore only operating costs that were directly attributable or otherwise can be subjected to a reasonable and systematic attribution to the investment management business. Company-wide FRE includes all operating costs of the Company as a whole that fall within the definition of FRE. FRE is used to assess the extent to which direct base compensation and core operating expenses are covered by recurring fee revenues in our investment management business. FRE represents recurring fee revenue, including incentive fees that are not subject to realization events related to underlying fund investments, net of compensation and administrative expenses. Such expenses generally exclude non-cash equity-based compensation, carried interest compensation, and placement fee expense. Also, consistent with DE, FRE excludes non-core items, and presents costs reimbursable by our managed funds on a net basis (as opposed to a gross-up of other income and administrative expenses). Where applicable, FRE is adjusted for Start-Up FRE as defined below. Fee revenues earned from consolidated funds are eliminated in consolidation. However, because the fees are funded by and earned from third party investors in these consolidated funds who represent noncontrolling interests, our allocated share of net income from the consolidated funds is increased by the amount of fees that are eliminated. The elimination of these fees, therefore, does not affect net income (loss) attributable to DBRG. Accordingly, FRE is presented without giving effect to the elimination of fee revenue to the extent such fees meet the definition of FRE. FRE does not include distributed carried interest as these are not recurring revenues and are subject to variability given that they are dependent upon realization events related to underlying fund investments. Placement fees are also excluded from FRE as they are inconsistent in amount and frequency depending upon timing of fundraising for our funds. Other items excluded from FRE include realized principal investment income (loss); and interest, dividend and other income, all of which are not core to the investment management fee service business. To reflect a stabilized investment management business, FRE is further adjusted to exclude Start-Up FRE, where applicable. Start-Up FRE is FRE associated with new investment strategies that have 1) not yet held a first close raising FEEUM; or 2) not yet achieved break-even FRE only for investment products that may be terminated solely at the Company’s discretion. The Company regularly evaluates new investment strategies and exclude Start-Up FRE until such time a new strategy is determined to form part of the Company’s core investment management business. We believe that FRE is a useful measure to investors as it reflects the Company’s profitability based upon recurring fee streams that are not subject to realization events related to underlying fund investments, and without the effects of income taxes, leverage, non-cash expenses, income (loss) items that are unrealized and other items that may not be indicative of core operating results in an investment management fee service business. IMPORTANT NOTE REGARDING NON-GAAP FINANCIAL MEASURES

45 Distributable Earnings (“DE”): DE generally represents net realized earnings of the Company and is an indicative measure used by the Company to assess ongoing operating performance and in making decisions related to distributions and reinvestments. Accordingly, we believe DE provides investors and analysts transparency into the measure of performance used by the Company in its decision making. DE is an after-tax measure that reflects the ongoing operating performance of the Company’s core business by including earnings that are realized and generally excluding non-cash expenses, other income (loss) items that are unrealized and items that may not be indicative of core operating results. Realized earnings included in DE are generally comprised of fee revenue, including all incentive fees, realized principal investment income (loss), distributed carried interest, interest and dividend income. Income (loss) on principal investments is realized generally when all or a portion of an investment is disposed, redeemed or repaid or if the Company no longer retains control, or when the Company receives income such as dividends, interest or other distributions of earnings. The following items are excluded from DE: transaction-related costs; non-core items; other gain (loss); unrealized principal investment income (loss); non-cash depreciation and amortization expense, non-cash impairment charges (if any); amortization of deferred financing costs, debt premiums and discounts; our share of unrealized carried interest allocation, net of associated expense; non-cash equity-based compensation costs; and preferred stock redemption gain (loss). Transaction-related costs are incurred in connection with acquisitions and costs of unconsummated transactions. Non-core items primarily include acquisition-related compensation and certain severance costs, as well as litigation and settlement-related matters, which are presented within compensation expense—cash and equity-based, administrative and other expenses, and other gain (loss), net on the GAAP income statement. These costs, along with certain other gain (loss) amounts, are excluded from DE as they are related to discrete items, are not considered part of our ongoing operating cost structure, and are not reflective of our core operating performance. Other items excluded from DE are generally non-cash in nature, including income (loss) items that are unrealized, or otherwise do not represent current or future cash obligations such as amortization of deferred financing costs. These items are excluded from DE as they do not contribute to the measurement of DE as a net realized earnings measure that is used in decision making related to distributions and reinvestments. Income taxes applied in the determination of DE generally represents GAAP income tax related to continued operations, and inc ludes the benefit of deductions available to the Company on certain expense items excluded from DE (for example, equity-based compensation). As the income tax benefit arising from these excluded expense items do affect actual income tax paid or payable by the Company in any one period, the Company believes their inclusion in DE is appropriate to more accurately reflect amounts available for distribution. IMPORTANT NOTE REGARDING NON-GAAP FINANCIAL MEASURES (CONTINUED)

46 Assets Under Management (“AUM”) AUM represents the total capital for which we provide investment management services and general partner capital. AUM is gene rally composed of third party capital managed by the Company and its affiliates, including capital that is not yet fee earning, or not subject to fees and/or carried interest; and our general partner and general partner affiliate capital committed to our funds. AUM is largely based upon invested capital as of the reporting date, including capital funded through third party financing; and committed capital for funds in their commitment stage. Our AUM is not based upon any definition that may be set forth in the governing documents of our managed funds or other investment vehicles, and not calculated pursuant to any regulatory definition. Fee-Earning Equity Under Management (“FEEUM”) FEEUM represents the total capital managed by the Company and its affiliates that earns management fees and/or incentive fees or carried interest. FEEUM is generally based upon committed capital, invested capital, net asset value (“NAV“) or gross asset value (“GAV“), pursuant to the terms of each underlying investment management agreement. Fee Related Earnings Margin ("FRE Margin") FRE Margin % represents FRE divided by FRE fee revenue. GP Affiliated Investments GP Affiliated Investments represent principal investments in DBRG’s sponsored funds as general partner and as an affiliate of the general partner, and to a lesser extent, other investments associated with DBRG’s investment management business, including warehoused investments and CLO subordinated notes, but excluding carried interest allocation. Investments that are considered to be non-core to DBRG’s investment management business are excluded. Operating Company or OP DigitalBridge Operating Company, LLC, the operating partnership through which DBRG conducts all of its activities and holds substantially all of its assets and liabilities. OP share Represents the Company’s interest through the Operating Company and excludes redeemable noncontrolling interests and noncontrolling interests in investment entities. DEFINITIONS

47