Third Quarter 2025

October 30, 2025

1

Fellow

Shareholders,

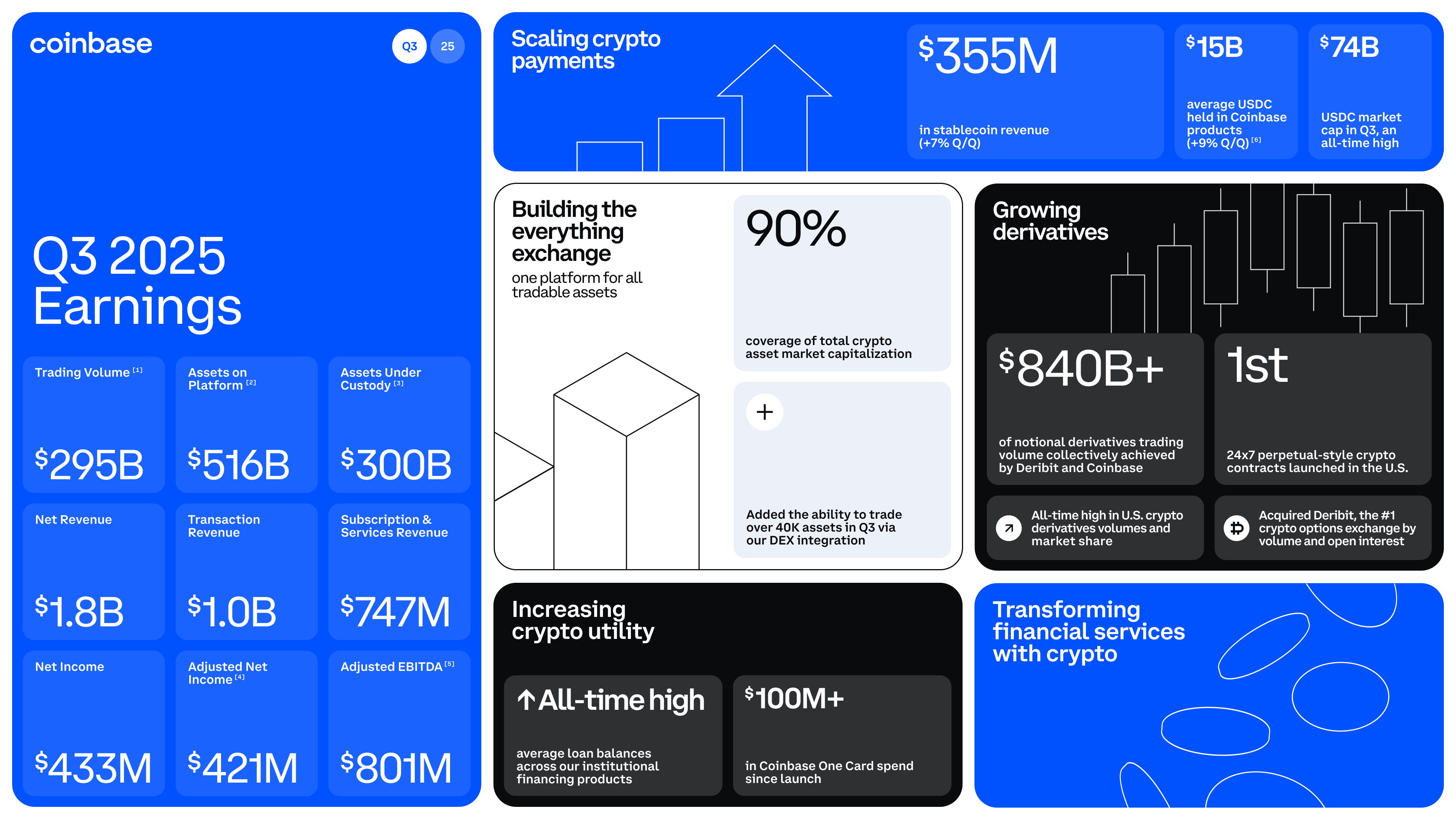

Q3 was a strong quarter for Coinbase. We drove solid financial results, maintained focus on shipping

innovative products, and continued building the foundation of the Everything Exchange.

We laid out our vision of an Everything Exchange last quarter, and made progress in Q3 by increasing the

number of tradable spot assets, expanding our derivatives offerings, and continuing to lay the groundwork for

additional pillars. By increasing tradable spot assets, our platform now covers approximately 90% of total crypto

asset market capitalization. Our derivatives business reached an all-time high share across several markets,

including U.S. crypto futures and global crypto options, with the launch of U.S. perpetuals and 24/7 futures

trading, and the close of the Deribit acquisition.

We are accelerating payments through stablecoin adoption, which we anticipate will continue given policy

tailwinds, and ongoing adoption from financial institutions and corporates for payment and treasury needs. In

Q3, USDC reached an all-time high of $74 billion in market capitalization, and average USDC held in Coinbase

products reached an all-time high of over $15 billion. Additionally, we continue to scale payments with USDC,

new partnerships, and crypto rewards for purchases through the CB1 Card.

With regulatory clarity accelerating, crypto rails are set to power more of global GDP, and we believe Coinbase

is positioned to lead. We’re progressing toward the Everything Exchange vision, and scaling payments by

advancing stablecoin adoption with USDC.

[1] Trading Volume is defined as the total U.S. dollar equivalent value of spot matched trades transacted between a buyer and seller through our platform during the

period of measurement.

[2] Assets on Platform is defined as the total U.S. dollar equivalent value of USDC and crypto assets held or managed on behalf of customers in digital wallets on our

platform, including our custody services but excluding assets for which the customer holds full or partial keys, calculated based on the market price on the date of

measurement.

[3] Assets under custody is defined as the total U.S. dollar equivalent value of USDC and crypto assets held separately on behalf of customers in digital wallets within

our cold storage custody services, calculated based on the market price on September 30, 2025.

[4] Adjusted Net Income is a non-GAAP financial measure that excludes $424 million in net pre-tax gains on our crypto investment portfolio (largely unrealized) and

$400 million in net pre-tax losses on other investments.

[5] Adjusted EBITDA is a non-GAAP financial measure.

[6] Includes corporate USDC balances and USDC held on behalf of customers in eligible Coinbase products.

Figures have been rounded for presentation purposes only. For additional financial information and a reconciliation between GAAP and non-GAAP results, please refer

to the reconciliation of GAAP to Non-GAAP results tables in this shareholder letter and our Form 10-Q filed with the SEC on October 30, 2025.

2

Financial Update

•Results. Total revenue in Q3 was $1.9 billion, up 25% Q/Q. Transaction revenue was $1.0 billion, up

37% Q/Q. Subscription and services revenue was $747 million, up 14% Q/Q. Total operating

expenses declined $134 million or 9% Q/Q to $1.4 billion. Technology & development, general &

administrative, and sales & marketing expenses collectively increased 14% to $1.1 billion, which

includes $30 million attributable to Deribit. Full-time employees increased 12% Q/Q to 4,795. Net

income was $433 million, Adjusted Net Income was $421 million, and Adjusted EBITDA was $801

million.

•Outlook. We expect October transaction revenue to be approximately $385 million. As always, we

continue to urge caution in extrapolating these results.

METRIC | Q4’25 OUTLOOK | COMMENTARY | ||||

Subscription and Services Revenue | $710-$790 million | Driven by growth in USDC market capitalization + Coinbase One subscribers, offset by interest rate cuts | ||||

Transaction Expenses | Mid-Teens as a percentage of net revenue | Dependent on revenue mix | ||||

Technology & Development + General & Administrative Expenses | $925-$975 million Including ~$220 million in stock-based compensation | Growth driven by costs related to Echo & Deribit acquisitions + headcount | ||||

Sales and Marketing Expenses | $215-$315 million Including ~$14 million in stock-based compensation | Range driven by performance marketing opportunities and USDC rewards | ||||

Product Update. In Q3, Coinbase continued advancing across all three phases of crypto adoption. As an

investment, we executed on the foundations of the Everything Exchange vision: expanding tradable spot

assets (including integrated DEX access), scaling U.S. perpetual futures, adding global options platform with

Deribit, and strengthening custody. As a financial service, we made it simple to pay, earn, borrow, and run

businesses onchain. And as a new app platform, we continue to drive sub-second, sub-cent transactions on

Base, best paired with stablecoins as trusted digital money for seamless payments. We continue to see strong

adoption across each phase, driving our mission to increase economic freedom worldwide.

Webcast Information

We will host a conference call to discuss the results for the third quarter 2025 on October 30, 2025 at 2:30 pm

PT. The live webcast of the call will be available at youtube.com/@coinbase/streams. A replay of the call, as

well as a transcript, will be available on our Investor Relations website at investor.coinbase.com.

3

Financial

Update

* Revised to include $10 million in

Technology and Development +

General and Administrative

expenses related to our acquisition

of Deribit, which closed August 14,

2025 and was excluded from initial

range of $800-850 million

disclosed on July 31, 2025. The

revised range excludes the impact

of acquisition-related amortization

which was not part of the August

14, 2025 guidance update.

Note: Figures presented may not

sum precisely due to rounding.

1 Starting in Q1’25, Custodial Fee

revenue has been condensed into

Other subscription and services

revenue and will no longer be

disclosed as a separate line item

as it now comprises a smaller

percentage of our subscription and

services revenue. Prior periods

have been recast to conform to

current period presentation.

Q3’25 Results

Select Metrics | ||||||||

METRICS ($M) | Q3’24 | Q4’24 | Q1’25 | Q2’25 | Q3’25 | |||

Net Revenue | 1,129 | 2,197 | 1,960 | 1,420 | 1,793 | |||

Net Income | 75 | 1,291 | 66 | 1,429 | 433 | |||

Adjusted EBITDA | 449 | 1,289 | 930 | 512 | 801 | |||

Q3’25 Coinbase Results vs. Outlook | ||||||||

METRIC | COINBASE Q3 OUTLOOK (Aug 2025) | Q3 ACTUALS | ||||||

Subscription and Services Revenue | $665-$745 million | $747 million | ||||||

Transaction Expenses as a percentage of net revenue | Mid-Teens as a percentage of net revenue Dependent on revenue mix | 14% | ||||||

Technology and Development + General and Administrative Expenses including stock-based compensation | $810-$860 million * Including $210 million in stock-based compensation and $10 million (ex. amortization) from Deribit | $849 million including $208 million in stock-based compensation | ||||||

Sales and Marketing Expenses including stock-based compensation | $190-$290 million Including ~$15 million in stock-based compensation | $260 million including $14 million in stock-based compensation | ||||||

Revenue Discussion

Total Revenue ($M) | |||||||

TOTAL REVENUE | Q3’24 | Q4’24 | Q1’25 | Q2’25 | Q3’25 | ||

Transaction Revenue | |||||||

Consumer, net | 483.3 | 1,347.1 | 1,095.5 | 649.9 | 843.5 | ||

Institutional, net | 55.3 | 141.3 | 98.9 | 60.8 | 135.0 | ||

Other transaction revenue, net | 34.0 | 67.6 | 67.8 | 53.5 | 67.7 | ||

Total Transaction Revenue | 572.5 | 1,556.0 | 1,262.2 | 764.3 | 1,046.3 | ||

Subscription and Services Revenue | |||||||

Stablecoin revenue | 246.9 | 225.9 | 297.5 | 332.5 | 354.7 | ||

Blockchain rewards | 154.8 | 214.9 | 196.6 | 144.5 | 184.6 | ||

Interest and finance fee income | 64.0 | 65.7 | 63.1 | 59.3 | 64.8 | ||

Other subscription and services revenue1 | 90.4 | 134.6 | 140.9 | 119.5 | 142.7 | ||

Total Subscription and Services Revenue | 556.1 | 641.1 | 698.1 | 655.8 | 746.7 | ||

Net Revenue | 1,128.6 | 2,197.0 | 1,960.3 | 1,420.1 | 1,793.0 | ||

Corporate interest and other income | 76.6 | 74.6 | 74.0 | 77.1 | 75.7 | ||

Total Revenue | 1,205.2 | 2,271.6 | 2,034.3 | 1,497.2 | 1,868.7 | ||

Transaction Revenue

Global crypto market spot trading volumes were up 38% Q/Q, and U.S. crypto market spot volumes were up

29% Q/Q. Total Q3 transaction revenue was $1.0 billion, up 37% Q/Q. Total Trading Volume was $295 billion,

up 24% Q/Q, underperforming the spot markets primarily driven by lower volume from stablecoin pairs.

Consumer Transaction Revenue. Consumer Trading Volume was $59 billion, up 37% Q/Q, outperforming the

U.S. spot markets. Consumer transaction revenue was $844 million, up 30% Q/Q. The mix of Advanced trading

volume relative to Simple trading increased in Q3. Unique token listings and rising prices in long tail assets

4

helped drive Advanced trading volumes and amplified our concerted efforts to attract and retain high priority

traders through a new white glove service offering.

Further, we made important progress in expanding tradable assets for our retail customers in Q3: more spot

assets through CEX listings and DEX integration, more derivatives through the launch of perpetual futures and

24/7 futures trading in the U.S.

Institutional Transaction Revenue. Institutional Trading Volume was $236 billion, up 22% Q/Q. Institutional

transaction revenue was $135 million, up 122% Q/Q. Several factors drove the increase in revenue, most

notably Deribit (closed on August 14), which contributed $52 million of revenue in Q3 driven by continued

growth of options trading leading to all-time high notional volumes. Deribit and Coinbase collectively achieved

over $840 billion of notional derivatives trading volume in Q3 on the back of innovative new products launched

to date. Given the momentum we are seeing across our growing portfolio of derivatives products, we have

begun to scale back rebates and incentives (which, as a reminder, is recognized as contra revenue).

Additionally, we saw strength in Coinbase Prime trading, driven by more active customers and deeper product

engagement, with a growing number of Prime customers now engaging with 3+ products.

Other Transaction Revenue. Other transaction revenue was $68 million, up 26% Q/Q primarily driven by an

increase in instant transfer activity which is typically correlated with the growth in Trading Volume. To a lesser

extent, Base revenue growth was driven by higher average ETH price and a higher number of transactions,

partially offset by lower average revenue per transaction as a result of our continued focus on scaling the

network. Base remains the #1 L2, and its speed, scalability, and cost efficiency has made it the trusted network

of choice for a growing number of enterprises and developers.

TRADING VOLUME ($B) | Q3’24 | Q4’24 | Q1’25 | Q2’25 | Q3’25 | ||

Consumer | 34 | 94 | 78 | 43 | 59 | ||

Institutional | 151 | 345 | 315 | 194 | 236 | ||

Total | 185 | 439 | 393 | 237 | 295 | ||

TRADING VOLUME (% OF TOTAL)1 | Q3’24 | Q4’24 | Q1’25 | Q2’25 | Q3’25 | ||

Bitcoin | 37% | 27% | 27% | 30% | 24% | ||

Ethereum | 15% | 10% | 11% | 15% | 22% | ||

XRP | 2% | 8% | 11% | 8% | 9% | ||

USDT | 15% | 15% | 13% | 6% | 3% | ||

Other crypto assets | 31% | 40% | 38% | 41% | 42% | ||

Total | 100% | 100% | 100% | 100% | 100% | ||

TRANSACTION REVENUE (% OF TOTAL)2 | Q3’24 | Q4’24 | Q1’25 | Q2’25 | Q3’25 | ||

Bitcoin | 35% | 27% | 26% | 34% | 24% | ||

Ethereum | 16% | 10% | 10% | 12% | 17% | ||

Solana | 11% | 7% | 10% | 7% | 7% | ||

XRP | 6% | 14% | 18% | 13% | 14% | ||

Other crypto assets | 32% | 42% | 36% | 34% | 38% | ||

Total | 100% | 100% | 100% | 100% | 100% | ||

Note: Figures presented may not

sum precisely due to rounding.

1 Spot Trading Volume is presented

on a matched basis, and is

categorized by the base rather

than the quote asset. The majority

of trading pairs on our platform

utilize USD/USDC as the quote

currency, and thus are not included

in the breakdown by asset in the

table.

2 Total transaction revenue

generated from trading on our

platform.

5

Subscription and Services Revenue

Q3 subscription and services revenue was $747 million, up 14% Q/Q. Strong native unit inflows drove another

quarter of all-time highs including average USDC balances, average loan balances across our institutional

financing products, and Assets Under Custody. We ended Q3 with $516 billion in total Assets on Platform.

Stablecoin revenue was $355 million in Q3, up 7% Q/Q. Average USDC balances held in Coinbase products

increased 9% Q/Q to $15 billion. Meanwhile, average off-platform USDC balances increased 12% Q/Q to $53

billion.

We believe Coinbase continues to be the best place to use stablecoins. USDC market capitalization increased

by approximately $12 billion from the end of Q2 to the end of Q3, and Coinbase customers accounted for the

largest portion of that balance growth. Our rewards program continued to drive USDC growth and adoption,

and we expanded the program to offer competitive rewards to our Institutional customers in Q3.

USDC Balances & Revenue | Q3’25 | |||

Average Market Cap ($B) | Coinbase Stablecoin Revenue ($M) | |||

USDC in Coinbase Products | 15 | 159 | ||

Off-platform USDC | 53 | 196 | ||

Total | 68 | 355 | ||

Blockchain rewards revenue was $185 million, up 28% Q/Q. Growth was primarily driven by the average prices

of ETH and SOL increasing 81% and 29%, respectively, in the quarter. Partially offsetting this was continued

decline to average rewards rates—an indicator of protocol maturity—which were down high single digits on

average for both ETH and SOL in Q3, as well as a slight decrease in SOL native units staked on our platform.

Interest and finance fee income was $65 million, up 9% Q/Q. Average loan balances across our institutional

financing products grew 25% Q/Q to reach a new all-time high of $1.2 billion in Q3, driven by an increasingly

diverse client base where we saw double digit growth in active customers in the quarter. We also saw growth in

interest income on custodial fiat in Q3 as average balances grew to $5.6 billion, partially offset by lower rates.

Other subscription and services revenue was $143 million, up 19% Q/Q driven by two primary factors:

•First, earn outs from ecosystem partners. As we work to drive crypto utility and build out the onchain

ecosystem, we may continue to partner with protocols to develop products in exchange for token earn

outs when certain milestones are reached. These payments can be significant depending on

performance, but are inherently episodic.

•Second, growth in Custodial fee revenue. Assets Under Custody grew to $300 billion as of the end of

Q3, another all-time high. We continued to see strong native unit inflows, in part due to our role as the

primary custodian for the vast majority of crypto ETFs. Additionally, asset prices (particularly BTC and

ETH) were a significant tailwind this quarter.

Expenses

Total Q3 operating expenses fell $134 million or 9% Q/Q to $1.4 billion. Technology & development, general &

administrative, and sales & marketing expenses collectively increased 14% Q/Q to $1.1 billion, largely driven

by growth in headcount and USDC rewards (in connection with growth of USDC balances in Coinbase

products); Deribit contributed $30 million (including $16 million of deal-related amortization). Full-time

employees increased 12% Q/Q to 4,795.

6

Note: Figures presented may not

sum precisely due to rounding.

Operating Expenses ($M) | |||||||

OPERATING EXPENSES | Q3’24 | Q4’24 | Q1’25 | Q2’25 | Q3’25 | ||

Transaction expense | 171.8 | 317.0 | 303.0 | 245.3 | 253.3 | ||

% of net revenue | 15% | 14% | 15% | 17% | 14% | ||

Technology and development | 377.4 | 368.7 | 355.4 | 387.3 | 430.6 | ||

Sales and marketing | 164.8 | 225.8 | 247.3 | 236.2 | 260.3 | ||

General and administrative | 330.4 | 362.5 | 394.3 | 353.7 | 418.4 | ||

Losses (gains) on crypto assets held for operations, net | (0.1) | (16.2) | 34.4 | (8.7) | (35.7) | ||

Other operating expenses (income), net | (8.6) | (20.3) | (5.9) | 308.0 | 61.3 | ||

Total operating expenses | 1,035.7 | 1,237.6 | 1,328.5 | 1,521.9 | 1,388.2 | ||

Full-time employees (end of quarter) | 3,672 | 3,772 | 3,959 | 4,279 | 4,795 | ||

Q3 transaction expenses were $253 million, up 3% Q/Q, driven by an increase in blockchain rewards fees

given higher average asset prices in the quarter, and also increased customer trading activity in the quarter.

Offsetting this was lower rebates and commissions as we scaled back the incentives program in our derivatives

business.

Technology and development expenses were $431 million, up 11% Q/Q, primarily driven by an increase in

headcount, including personnel from Deribit. To a lesser extent, we also saw higher variable software spend

related to ongoing infrastructure projects and amortization of certain costs related to our acquisition of Deribit.

General and administrative expenses were $418 million, up 18% Q/Q. A majority of the quarterly cost growth

was driven by headcount as we expanded our customer service and global compliance efforts.

Sales and marketing expenses were $260 million, up 10% Q/Q. The two largest drivers of the increase were

certain amortization costs related to our acquisition of Deribit, and higher USDC rewards as average customer

USDC balances held in Coinbase products reached an all-time high of $15.0 billion in Q3.

Other operating expenses were $61 million, down 80% Q/Q. This included $48 million related to the data theft

incident disclosed in May, which included voluntary customer reimbursements and direct legal costs. As a

reminder, in Q2, we recognized $307 million of expenses for the same.

Stock-based compensation expense was $222 million, up 13% Q/Q, and in-line with our outlook.

Our effective tax rate in Q3 was 14%. Our tax rate was lower than the U.S. statutory rate of 21% primarily due

to deductible stock-based compensation.

Net income in Q3 was $433 million. Adjusted Net Income was $421 million and Adjusted EBITDA was $801

million.

Share Count

Our weighted average fully diluted share count for Q3 was 292 million (including 263 million common shares

and 29 million dilutive shares), an increase of 13 million or 5% Q/Q. In Q3, we closed the acquisition of Deribit

which included consideration of nearly 11 million shares of Class A common stock.

Capital and Liquidity

At the end of Q3, we had $11.9 billion in $USD resources, increasing $2.6 billion or 28% Q/Q. The increase

was primarily driven by proceeds from our $3.0 billion convertible debt issuance in August, and an increase in

cash provided as a result of the increase in total revenue. Partially offsetting this was $688 million in cash

7

consideration paid for acquisitions, a majority of which was the net cash spend associated with Deribit. Net of

our $7.2 billion of long-term debt, we had $4.7 billion in $USD resources.

Total $USD Resources | TOTAL: $11,893M | ||||||||||||||||||||||||||||||||||||||||||

MONEY MARKET FUNDS $7,042M | CORPORATE CASH $1,524M | ||||||||||||||||||||||||||||||||||||||||||

$3,216M USDC* | $111M CORPORATE CASH HELD AT THIRD-PARTY VENUES | ||||||||||||||||||||||||||||||||||||||||||

*Net of USDC loaned or pledged as collateral. | Note: Figures presented may not sum precisely due to rounding. | ||||||||||||||||||||||||||||||||||||||||||

We consider our crypto assets held for investment and certain crypto assets held as collateral as other liquidity

resources available to us. In Q3, we increased our bitcoin holdings by $299 million, driven by weekly

purchases, for our crypto investment portfolio. As of September 30, 2025, the fair market value of our crypto

assets held for investment and our crypto assets held as collateral were $2.6 billion and $1.0 billion,

respectively. When including these crypto assets, total available resources totaled $15.5 billion.

Share Repurchase Program

In October 2024, our board of directors authorized and approved a share repurchase program, which provided

for the repurchase of up to $1.0 billion of our outstanding Class A common stock without expiration, and in

October 2025, our board of directors (i) increased the aggregate repurchase authorization under the program

from $1.0 billion to $2.0 billion and (ii) expanded the scope of the repurchases to include a portion of the

aggregate principal amount of our long-term debt. This program does not obligate us to repurchase any dollar

amount or number of shares of Class A common stock or debt and may be modified, suspended, or

discontinued at any time.

Collateralized Arrangements & Financing and Counterparty Risk

We maintained our longstanding commitment to operating and risk excellence in Q3. At the end of Q3, we had

$1.1 billion in total credit and counterparty risk (excluding banks), stemming from $916 million in collateralized

loans to customers and $217 million held at third-party venues (including $111 million in unrestricted cash). As

a reminder, our loans require at least 100% in collateral (including recent facilities extended to BTC miners),

and are subject to rigorous risk monitoring.

8

Q4’25 Outlook

Coinbase Q4 2025 Outlook | ||||

METRIC | OUTLOOK | |||

Subscription and Services Revenue | $710-$790 million | |||

Transaction Expenses | Mid-Teens as a percentage of net revenue Dependent on revenue mix | |||

Technology & Development + General & Administrative Expenses | $925-$975 million Including ~$220 million in stock-based compensation | |||

Sales and Marketing Expenses | $215-$315 million Including ~$14 million in stock-based compensation | |||

Transaction Revenue

We expect October transaction revenue to be approximately $385 million As always, we continue to urge

caution in extrapolating these results.

Subscription and Services Revenue

We expect Q4 subscription and services revenue to be within $710-$790 million. Our Q4 range reflects the

growth of both USDC market capitalization (which reached a new all-time high in October) and our Coinbase

One subscriber base, offset by market expectations of interest rate cuts.

Expenses

We expect technology & development and general & administrative expenses to be between $925-$975

million. Approximately half of the Q/Q increase is due to our acquisitions of Deribit and Echo; the remainder is

largely due to headcount, which we expect to grow at a slower rate in Q4 compared to Q3.

Sales and marketing expenses are expected to be in the range of $215-$315 million. Where we fall within the

range will largely be determined by (i) whether we continue to see attractive performance marketing

opportunities throughout the remainder of the year and (ii) USDC balances held in Coinbase products, which

drive USDC rewards.

Included within the expense outlook above is approximately $70 million of total depreciation and amortization

for Q4, reflecting an increase from historical averages driven by higher intangible amortization as a result of our

recent acquisitions.

9

Product Update

Building the future of money, step by step

We see crypto adoption unfolding in 3 phases: people first invest through trading, then use financial services,

and ultimately engage with a rich app ecosystem. Coinbase is building for every step. We provide a trusted

venue for individuals and institutions to trade and custody assets, the first step in bringing people onchain. We

deliver financial services that put those assets to work, from staking, rewards, and spending, to powering

businesses. And we provide the infrastructure that lets this economy scale, with Base Chain for fast, low-cost

transactions, and USDC as a trusted digital dollar. This quarter, we continued advancing across all three

phases, staying focused on our mission to increase economic freedom worldwide.

Crypto as an Investment: We are building the most trusted, comprehensive venue to access, price, and

execute trades across spot and derivatives, and we’re expanding it in line with our Everything Exchange vision

to bring all tradable assets onto a single platform. In Q3, we executed on the foundations of that vision:

expanding tradable spot assets (including integrated DEX access), scaling U.S. perpetual futures, adding

global options with Deribit, and growing custody.

Spot & Simple Trading: Expanding Access to the Assets Users Want

•Adding more assets is consistently among the top requests from customers. In Q3, we added the

ability to trade more than 40 thousand assets in the Consumer app via our decentralized exchange

(DEX) integration on Base (powered by an integrated self-custody wallet), and we now support

approximately 90% of total crypto asset market capitalization for trading on our platform. We believe

DEX assets help turbocharge our centralized exchange (CEX) by surfacing early demand and price

discovery. When assets meet our standards, they will move to our CEX, where they should benefit

from deeper liquidity, faster execution.

Derivatives: Scaling a Durable, Global Business

•Derivatives account for ~80% of global crypto trading volume, yet the U.S. market makes up only a

fraction of this volume. This presents a significant growth opportunity, and one against which we saw

significant market share gains in Q3. In July, we launched first of its kind CFTC-regulated crypto

perpetual futures in the U.S., trading 24/7 with up to 10x intra-day leverage, and became the first U.S.

regulated futures exchange to offer 24/7 trading in BTC, ETH, SOL, and XRP which together drove

our all-time high U.S. crypto derivatives market share.

•In August, we closed the Deribit acquisition, bringing the #1 crypto options exchange by volume and

open interest into Coinbase and creating the most comprehensive global crypto derivatives offering

across spot, futures, perpetuals, and options.

•We expanded our international derivatives total addressable market by adding new regulated routes

for growth and distribution in Brazil and India.

Custody at Scale: Coinbase as the Default Institutional Partner

•Assets Under Custody (AUC) reached an all-time high of $300 billion as did share of total crypto asset

market capitalization driven by strong inflows from ETFs and Corporate purchases.

•In October, we helped bring the first staking ETFs to the U.S. market with long-time partner Grayscale,

and continue to be the primary custodian for over 80% of U.S. BTC and ETH ETF assets as of

quarter-end.

Crypto as a Financial Service: Once assets are on Coinbase, the next step is utility. We're building trusted

products that help people use crypto the way they use money today, only faster, cheaper, and available 24/7. In

10

Q3, we made it simple to pay, earn, borrow, lend, and run businesses onchain. It’s how crypto starts to replace

and improve on traditional finance.

Financing: Powering Liquidity Across the Crypto Economy

•Institutional financing hit record highs with all-time high average loan balances and customer count

has achieved double-digit average quarterly growth over the past eight quarters, driven by corporates,

miners, market makers, and continued demand from hedge funds and asset managers.

•We launched cross-margining for institutional customers between U.S. futures on Coinbase

Derivatives Exchange (offered through Coinbase Financial Markets, our FCM) and spot on Coinbase

Exchange, delivering roughly 2x capital efficiency versus our nearest competitor in the U.S.

Building a Full-Stack Stablecoin Payments Platform

•We see payments as crypto’s next big use case, with stablecoins offering a new payments channel

enabling faster, cheaper, global transactions that are well suited for agentic commerce and micro

payments. In Q3, we took key steps toward that vision.

◦Began rollout of Payment APIs and B2B payments UI/API, a single integration to embed

stablecoin checkout, send 24/7 payouts, automate treasury, open virtual accounts, and settle

in USDC on Base, backed by Coinbase security, liquidity, and distribution.

◦Fully launched Embedded Wallets, enabling native, low-friction wallets inside apps to reduce

onboarding drop-off and eliminate app switching, so users can pay, earn, and hold value in-

app with instant USDC settlement on Base. When paired with our APIs, any app can go

onchain with one integration.

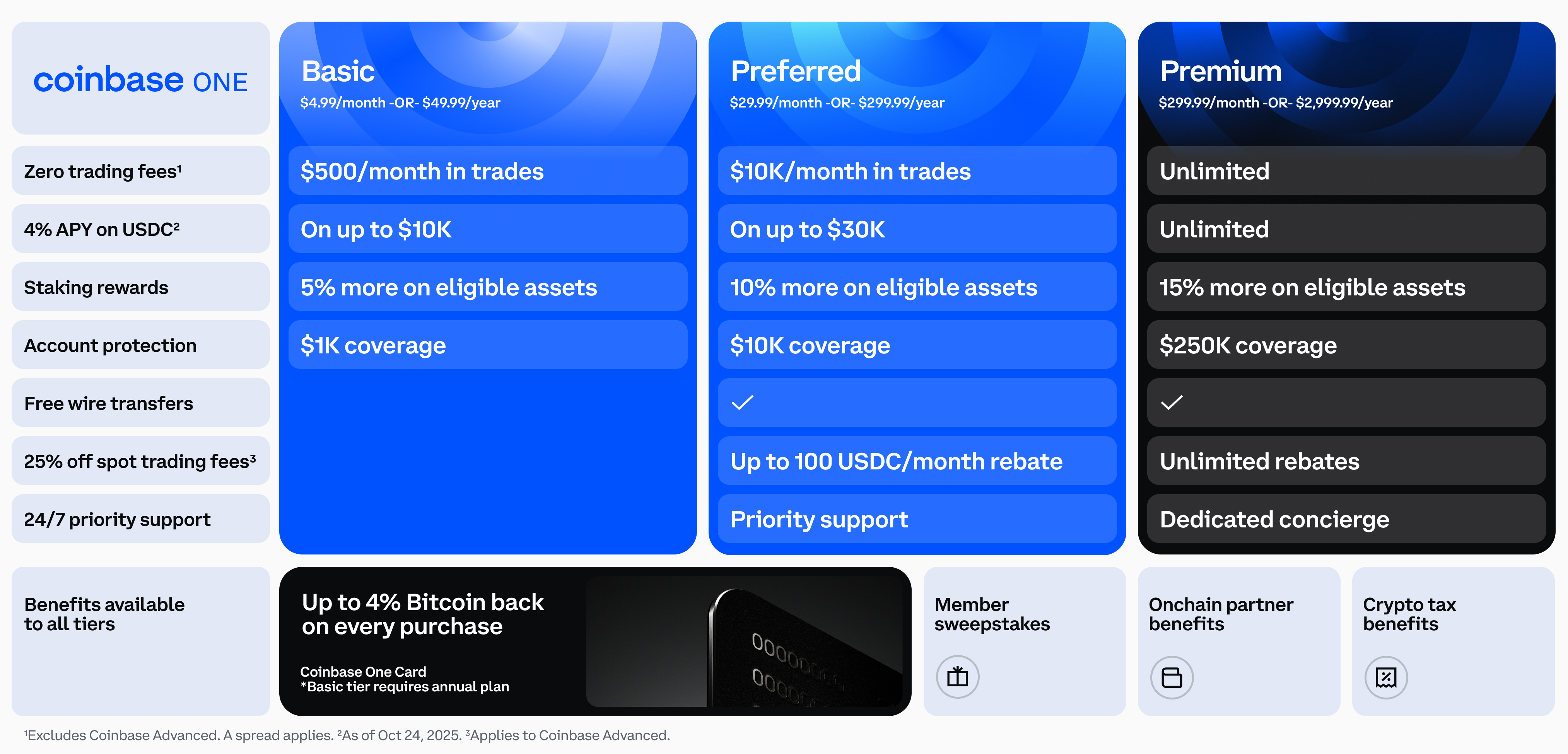

Coinbase One: Boosting Value and Increasing Options for Members

•We completed our rollout of Coinbase One Basic, our $4.99/month entry tier that delivers core

membership benefits like zero trading fees, boosted staking rewards, and access to exclusive onchain

partner offers. Early signals of traction have been promising. We’re also seeing significant interest

from international users.

•Coinbase One Card: Bringing Crypto Rewards to Fiat Payments

◦As we scale crypto payments, we’re also meeting customers where they are with Coinbase

One Card, a traditional credit card issued by AmEx that offers up to 4.0% cash back in the

form of bitcoin rewards that provides a simple on-ramp for newcomers and added value for

existing users.

◦Adoption is scaling, with more than $100 million in spend since launch, and everyday usage

is translating into platform engagement with CB1 card members depositing over $200 million

over the same period.

11

Crypto as an App Platform: The next chapter goes beyond financial services to a vibrant onchain app

ecosystem. It starts with Base Chain, a fast, low-cost L2 delivering sub-second, sub-cent transactions, paired

with stablecoins as trusted digital money for seamless payments. It comes to life in the Base App, the front

door to onchain where builders launch and users discover apps across trading, social, payments, messaging,

games, and more.

Scaling Base Chain: Fast, Cheap, Open, and Decentralized

•Network activity increased Q/Q, led by trading, social, payments, and lending apps. The ecosystem

now spans over 5 million tokens and 16 local-currency stablecoins.

•Flashblocks went live on mainnet, delivering ~200ms block times with sub-second, sub-cent

transactions, an important milestone in making the network even faster and cheaper.

•We introduced the Base and Solana bridge in testnet so people and builders can move assets

between the two networks more easily, with mainnet support coming in Q4.

Stablecoins: Trusted Onchain Money

•USDC market cap reached an all-time high of $74 billion in Q3. Market cap grew $12 billion from the

end of Q2 to the end of Q3, and Coinbase customers accounted for the largest portion of that balance

growth. USDC continues to outperform other major stablecoins with more than 2x YTD growth versus

the largest competitor.

•We believe Coinbase remains the best place to use stablecoins, with average USDC balances across

Coinbase products at $15 billion in Q3.

•We expect stablecoin adoption to continue to grow, propelled by the GENIUS Act passage,

strengthening institutional appetite, widening the pipeline with payment service providers, enterprises,

and banks.

Base App

•Base App entered beta in Q3, the onchain hub for trading, mini apps, social, chat, trading, and USDC

payments, bundled with Base Account (universal identity) and Base Pay (express USDC checkout).

While still early, we continue to see strong adoption.

12

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than

statements of historical fact are forward-looking statements. These statements include, but are not limited to, statements regarding our future operating results and

financial position, including for the fourth quarter ending December 31, 2025; anticipated future expenses and investments; the expected benefits and impacts of our

acquisition of Deribit; expectations relating to certain of our key financial and operating metrics; our business strategy and plans; expectations relating to legal and

regulatory proceedings; expectations relating to our industry, the regulatory environment, market conditions, trends and growth; expectations relating to customer

behaviors and preferences; our market position; potential market opportunities; and our objectives for future operations. The words “believe,” “may,” “will,” “estimate,”

“potential,” “continue,” “anticipate,” “intend,” “expect,” “could,” “would,” “project,” “plan,” “target,” and similar expressions are intended to identify forward-looking

statements. Forward-looking statements are based on management’s expectations, assumptions, and projections based on information available at the time the

statements were made. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, including, among others: our ability to

successfully execute our business and growth strategy and generate future profitability; market acceptance of our products and services; our ability to further

penetrate our existing customer base and expand our customer base; our ability to develop new products and services; our ability to expand internationally; failure to

obtain applicable regulatory approvals and satisfy other closing conditions in a timely manner or otherwise for any acquisition we make; the success of any

acquisitions or investments that we make; the effects of increased competition in our markets; our ability to stay in compliance with applicable laws and regulations;

stock price fluctuations; market conditions across the cryptoeconomy, including crypto asset price volatility; and general market, political, and economic conditions,

including interest rate fluctuations, inflation, tariffs, instability in the global banking system, economic downturns, and other global events, including regional wars and

conflicts and government shutdowns. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the

extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may

make. In light of these risks, uncertainties, and assumptions, our actual results could differ materially and adversely from those anticipated or implied in the forward-

looking statements. Further information on risks that could cause actual results to differ materially from forecasted results are, or will be included, in our filings we

make with the Securities and Exchange Commission (SEC) from time to time, including our Quarterly Report on Form 10-Q for the quarter ended September 30, 2025

filed with the SEC on October 30, 2025. Except as required by law, we assume no obligation to update these forward-looking statements, or to update the reasons if

actual results differ materially from those anticipated in the forward-looking statements.

13

Non-GAAP Financial Measures

Adjusted EBITDA

In addition to our results determined in accordance with GAAP, we believe Adjusted EBITDA, a non-GAAP financial performance measure, is useful information to help

investors evaluate our operating performance because it: enables investors to compare this measure and component adjustments to similar information provided by

peer companies and our past financial performance; provides additional company-specific adjustments for certain items that may be included in income from

operations but that we do not consider to be normal, recurring, operating expenses (or income) necessary to operate our business given our operations, revenue

generating activities, business strategy, industry, and regulatory environment; and provides investors with visibility to a measure management uses to evaluate our

ongoing operations and for internal planning and forecasting purposes. For example:

•We believe it is useful to exclude certain non-cash expenses, such as depreciation and amortization and stock-based compensation, from Adjusted

EBITDA because the amounts of such expenses can vary significantly from period to period and may not directly correlate to the underlying performance

of our business operations.

•We believe it is useful to exclude certain items that we do not consider to be normal, recurring, cash operating expenses and therefore, not reflective of our

ongoing business operations. For example, we exclude: (i) other expense (income), net, as the income and expenses recognized in this line item are not

part of our core operating activities and are considered non-operating activities under GAAP, (ii) gains and losses on crypto assets held for investment

because such investments are considered primarily long-term holdings, and (iii) losses directly related to the data theft incident announced on the Current

Report on Form 8-K we filed with the SEC on May 15, 2025 (the “Data Theft Incident”), including voluntary customer reimbursements, direct legal costs,

and reward payments, if any, in connection with the threat actor’s arrest and conviction. We do not plan on engaging in regular trading of crypto assets,

and, as an operating company, our investing activities in crypto are not part of our revenue generating activities, which are based on transactions on our

platform and the sales of subscriptions and services.

•We believe Adjusted EBITDA is useful to measure a company’s operating performance without regard to items such as stock-based compensation

expense, depreciation and amortization expense, interest expense, other expense (income), net, and provision for (benefit from) income taxes that can

vary substantially from company to company depending upon their financing, capital structures, and the method by which assets were acquired.

Adjusted Net Income and Adjusted Net Income per Share

In addition to our results determined in accordance with GAAP, we believe that Adjusted Net Income and Adjusted Net Income per Share, both non-GAAP financial

performance measures, are useful information to help investors evaluate our operating performance. We believe it is useful to exclude tax-effected gains and losses

on crypto assets held for investment from both Adjusted Net Income and Adjusted Net Income per Share because (i) such investments are considered primarily long-

term holdings, (ii) we do not plan on engaging in regular trading of crypto assets, and, (iii) as an operating company, our investing activities in crypto are not part of our

revenue generating activities, which are based on transactions on our platform and the sales of subscriptions and services. Additionally, we believe it is useful to

exclude tax-effected gains and losses on our marketable and strategic investments from Adjusted Net Income and Adjusted Net Income per Share because such

investments are not part of our core operating activities and are considered non-operating activities under GAAP.

Limitations of Non-GAAP Financial Measures

We believe that non-GAAP financial measures may be helpful to investors for the reasons noted above. However, non-GAAP financial measures are presented for

supplemental informational purposes only, have limitations as analytical tools, and should not be considered in isolation or as a substitute for financial information

presented in accordance with GAAP. In addition, other companies, including companies in our industry, may calculate non-GAAP financial measures differently or may

use other measures to evaluate their performance, all of which could reduce the usefulness of our disclosure of non-GAAP financial measures as a tool for

comparison.

Adjusted EBITDA

There are a number of limitations related to Adjusted EBITDA rather than net income, which is the nearest GAAP equivalent of Adjusted EBITDA. Some of these

limitations are that Adjusted EBITDA excludes:

•provision for (benefit from) income taxes;

•interest expense, or the cash requirements necessary to service interest or principal payments on our debt, which reduces cash available to us;

•depreciation and amortization expense and, although these are non-cash expenses, the assets being depreciated and amortized may have to be replaced

in the future;

14

•stock-based compensation expense, which has been, and will continue to be for the foreseeable future, a significant recurring expense for our business

and an important part of our compensation strategy;

•losses directly related to the Data Theft Incident;

•net gains or losses on our crypto assets held for investment; and

•other expense (income), net, which represents net gains or losses on investments and other financial instruments, and other non-operating income and

expense activity.

Adjusted Net Income and Adjusted Net Income per Share

There are limitations related to Adjusted Net Income and Adjusted Net Income per Share rather than net income and net income per share, which are the nearest

GAAP equivalents, respectively, including that Adjusted Net Income and Adjusted Net Income per Share each exclude the tax-effected impact of our crypto investment

gains/losses and of our marketable and strategic investments gains/losses.

Additional Information

For more information, including reconciliations of these non-GAAP financial measures to their nearest GAAP equivalents, please see the reconciliation of GAAP to

non-GAAP results tables in this shareholder letter. Investors are encouraged to review the related GAAP financial measure and the reconciliations, and not to rely on

any single financial measure to evaluate our business.

15

Coinbase Global, Inc.

Condensed Consolidated Balance Sheets

(In thousands, except per share data)

(unaudited)

September 30, | December 31, | ||

2025 | 2024 | ||

Assets | |||

Current assets: | |||

Cash and cash equivalents .................................................................................................. | $8,676,275 | $8,543,903 | |

Restricted cash and cash equivalents ................................................................................ | 78,867 | 38,519 | |

USDC ....................................................................................................................................... | 3,696,441 | 1,241,808 | |

Customer custodial funds ..................................................................................................... | 5,672,037 | 6,158,949 | |

Crypto assets held for operations ....................................................................................... | 161,145 | 82,781 | |

Loan receivables .................................................................................................................... | 859,056 | 475,370 | |

Crypto assets held as collateral .......................................................................................... | 1,017,382 | 767,484 | |

Crypto assets borrowed ........................................................................................................ | 346,008 | 261,052 | |

Accounts receivable, net ...................................................................................................... | 308,423 | 265,251 | |

Marketable investments ........................................................................................................ | 1,093,395 | — | |

Other current assets .............................................................................................................. | 184,160 | 277,536 | |

Total current assets .......................................................................................................... | 22,093,189 | 18,112,653 | |

Crypto assets held for investment ............................................................................................ | 2,597,277 | 1,552,995 | |

Strategic investments ................................................................................................................. | 401,728 | 374,161 | |

Deferred tax assets ..................................................................................................................... | 324,096 | 941,298 | |

Goodwill ........................................................................................................................................ | 4,004,112 | 1,139,670 | |

Intangible assets, net ................................................................................................................. | 1,417,823 | 46,804 | |

Other non-current assets ........................................................................................................... | 513,142 | 374,370 | |

Total assets .................................................................................................................. | $31,351,367 | $22,541,951 | |

Liabilities and Stockholders’ Equity | |||

Current liabilities: | |||

Customer custodial fund liabilities ....................................................................................... | $5,672,037 | $6,158,949 | |

Current portion of long-term debt ........................................................................................ | 1,268,081 | — | |

Crypto asset borrowings ....................................................................................................... | 386,823 | 300,110 | |

Obligation to return collateral ............................................................................................... | 1,026,945 | 792,125 | |

Accrued expenses and other current liabilities ................................................................. | 835,468 | 690,136 | |

Total current liabilities ...................................................................................................... | 9,189,354 | 7,941,320 | |

Long-term debt ............................................................................................................................ | 5,933,447 | 4,234,081 | |

Other non-current liabilities ....................................................................................................... | 205,342 | 89,708 | |

Total liabilities .................................................................................................................... | 15,328,143 | 12,265,109 | |

Commitments and contingencies | |||

Stockholders’ equity: | |||

Preferred stock, $0.00001 par value; 500,000 shares authorized and zero shares issued and outstanding at each of September 30, 2025 and December 31, 2024 ..... | — | — | |

Class A and B common stock, $0.00001 par value; 10,500,000 (Class A 10,000,000, Class B 500,000) shares authorized at September 30, 2025 and December 31, 2024; 268,736 (Class A 227,157, Class B 41,579) shares issued and outstanding at September 30, 2025 and 253,640 (Class A 209,762, Class B 43,878) shares issued and outstanding at December 31, 2024 .................................... | 3 | 2 | |

Additional paid-in capital ....................................................................................................... | 9,131,722 | 5,365,990 | |

Accumulated other comprehensive income (loss) ........................................................... | 3,538 | (50,051) | |

Retained earnings ................................................................................................................. | 6,887,961 | 4,960,901 | |

Total stockholders’ equity ................................................................................................ | 16,023,224 | 10,276,842 | |

Total liabilities and stockholders’ equity ................................................................... | $31,351,367 | $22,541,951 |

16

Coinbase Global, Inc.

Condensed Consolidated Statements of Operations

(In thousands, except per share data)

(unaudited)

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||

2025 | 2024 | 2025 | 2024 | ||||

Revenue: | |||||||

Net revenue ..................................................... | $1,792,984 | $1,128,597 | $5,173,399 | $4,096,216 | |||

Other revenue ................................................. | 75,709 | 76,596 | 226,797 | 196,175 | |||

Total revenue ............................................. | 1,868,693 | 1,205,193 | 5,400,196 | 4,292,391 | |||

Operating expenses: | |||||||

Transaction expense ...................................... | 253,318 | 171,781 | 801,605 | 580,665 | |||

Technology and development ....................... | 430,585 | 377,440 | 1,173,275 | 1,099,561 | |||

Sales and marketing ...................................... | 260,272 | 164,770 | 743,800 | 428,617 | |||

General and administrative ........................... | 418,446 | 330,387 | 1,166,499 | 937,738 | |||

Gains on crypto assets held for operations, net ................................................ | (35,740) | (142) | (10,077) | (55,484) | |||

Other operating expense (income), net ...... | 61,280 | (8,556) | 363,406 | 28,203 | |||

Total operating expenses ......................... | 1,388,161 | 1,035,680 | 4,238,508 | 3,019,300 | |||

Operating income ...................................... | 480,532 | 169,513 | 1,161,688 | 1,273,091 | |||

Interest expense .................................................. | 21,774 | 20,530 | 62,820 | 60,108 | |||

(Gains) losses on crypto assets held for investment, net ..................................................... | (423,903) | 120,507 | (189,305) | (210,902) | |||

Other expense (income), net ............................. | 380,518 | (40,105) | (1,120,199) | (21,883) | |||

Income before income taxes ................... | 502,143 | 68,581 | 2,408,372 | 1,445,768 | |||

Provision for (benefit from) income taxes ........ | 69,591 | (6,914) | 481,312 | 157,878 | |||

Net income ................................................. | $432,552 | $75,495 | $1,927,060 | $1,287,890 | |||

Net income attributable to common stockholders: | |||||||

Basic ................................................................. | $432,552 | $75,455 | $1,927,060 | $1,287,106 | |||

Diluted .............................................................. | $437,095 | $75,459 | $1,938,812 | $1,296,949 | |||

Net income per share: | |||||||

Basic ................................................................. | $1.65 | $0.30 | $7.49 | $5.23 | |||

Diluted .............................................................. | $1.50 | $0.28 | $6.85 | $4.76 | |||

Weighted-average shares of common stock used to compute net income per share: | |||||||

Basic ................................................................. | 262,831 | 248,834 | 257,332 | 245,986 | |||

Diluted .............................................................. | 291,958 | 267,440 | 283,165 | 272,239 | |||

Stock-based Compensation Expense

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||

2025 | 2024 | 2025 | 2024 | ||||

Technology and development ......................... | $127,253 | $155,411 | $352,585 | $428,863 | |||

Sales and marketing ........................................ | 13,921 | 18,720 | 43,359 | 52,034 | |||

General and administrative ............................. | 80,895 | 74,285 | 213,014 | 209,957 | |||

Total stock-based compensation expense . | $222,069 | $248,416 | $608,958 | $690,854 | |||

17

Coinbase Global, Inc.

Condensed Consolidated Statements of Cash Flows

(In thousands)

(unaudited)

Nine Months Ended September 30, | |||

2025 | 2024 | ||

Cash flows from operating activities | |||

Net income .................................................................................................................................... | $1,927,060 | $1,287,890 | |

Adjustments to reconcile net income to net cash (used in) provided by operating activities: | |||

Depreciation and amortization ................................................................................................. | 117,312 | 94,523 | |

Stock-based compensation expense ..................................................................................... | 608,958 | 690,854 | |

Deferred income taxes .............................................................................................................. | 486,498 | 61,075 | |

Gains on crypto assets held for operations, net ................................................................... | (10,077) | (55,484) | |

Gains on crypto assets held for investment, net ................................................................... | (189,305) | (210,902) | |

(Gains) losses on investments, net ......................................................................................... | (1,075,198) | 15,141 | |

Other operating activities, net .................................................................................................. | 6,830 | 31,745 | |

Net changes in operating assets and liabilities ..................................................................... | (2,510,846) | (322,616) | |

Net cash (used in) provided by operating activities ................................................................... | (638,768) | 1,592,226 | |

Cash flows from investing activities | |||

Fiat loans originated .................................................................................................................. | (1,246,352) | (1,270,063) | |

Proceeds from repayment of fiat loans .................................................................................. | 819,455 | 1,075,000 | |

Business combinations, net of cash acquired ....................................................................... | (687,634) | — | |

Purchases of crypto assets held for investment ................................................................... | (679,931) | (18,486) | |

Dispositions of crypto assets held for investment ................................................................ | 226,371 | 52,586 | |

Other investing activities, net ................................................................................................... | (84,292) | (72,006) | |

Net cash used in investing activities ............................................................................................ | (1,652,383) | (232,969) | |

Cash flows from financing activities | |||

Issuances of convertible senior notes, net ............................................................................ | 2,957,135 | 1,246,025 | |

Purchases of capped calls ....................................................................................................... | (224,250) | (104,110) | |

Customer custodial fund liabilities ........................................................................................... | (600,398) | (550,776) | |

Fiat received as collateral ......................................................................................................... | 499,417 | 525,699 | |

Fiat received as collateral returned ......................................................................................... | (514,494) | (410,438) | |

Taxes paid related to net share settlement of equity awards ............................................. | (308,803) | (117,225) | |

Other financing activities, net ................................................................................................... | 87,489 | 93,488 | |

Net cash provided by financing activities .................................................................................... | 1,896,096 | 682,663 | |

Net (decrease) increase in cash, cash equivalents, and restricted cash and cash equivalents ....................................................................................................................................... | (395,055) | 2,041,920 | |

Effect of exchange rates on cash, cash equivalents, and restricted cash and cash equivalents ....................................................................................................................................... | 89,868 | 19,664 | |

Cash, cash equivalents, and restricted cash and cash equivalents, beginning of period ... | 14,610,442 | 9,555,429 | |

Cash, cash equivalents, and restricted cash and cash equivalents, end of period .............. | $14,305,255 | $11,617,013 | |

18

Supplemental Disclosures of Cash Flow Information

Changes in operating assets and liabilities affecting cash were as follows (in thousands):

Nine Months Ended September 30, | |||

2025 | 2024 | ||

USDC .............................................................................................................................. | $(2,441,455) | $(294,104) | |

Income taxes, net .......................................................................................................... | (142,348) | (19,341) | |

Other current and non-current assets ........................................................................ | (64,958) | (40,826) | |

Other current and non-current liabilities .................................................................... | 137,915 | 31,655 | |

Net changes in operating assets and liabilities ..................................................... | $(2,510,846) | $(322,616) | |

The following is a reconciliation of cash, cash equivalents, and restricted cash and cash equivalents

(in thousands):

September 30, | |||

2025 | 2024 | ||

Cash and cash equivalents .............................................................................................. | $8,676,275 | $7,723,806 | |

Restricted cash and cash equivalents ........................................................................... | 78,867 | 31,881 | |

Customer custodial cash and cash equivalents ........................................................... | 5,550,113 | 3,861,326 | |

Total cash, cash equivalents, and restricted cash and cash equivalents .............. | $14,305,255 | $11,617,013 | |

The following is a supplemental schedule of non-cash investing and financing activities (in

thousands):

Nine Months Ended September 30, | |||

2025 | 2024 | ||

Non-cash consideration paid for business combinations ............................................ | $3,573,092 | $— | |

Crypto assets borrowed ................................................................................................... | 2,326,401 | 353,325 | |

Crypto assets borrowed repaid ....................................................................................... | 2,238,233 | 176,990 | |

Crypto assets received as collateral .............................................................................. | 1,988,879 | 2,791,949 | |

Crypto assets received as collateral returned .............................................................. | 1,789,861 | 2,439,342 | |

Crypto asset loan receivables originated ...................................................................... | 1,853,095 | 1,244,113 | |

Crypto asset loan receivables repaid ............................................................................. | 1,899,592 | 1,230,544 | |

Additions of crypto asset investments ............................................................................ | 176,645 | 5,981 | |

Cumulative-effect adjustment due to the adoption of ASU No. 2023-08 .................. | — | 561,489 | |

The following is a supplemental schedule of cash paid for income taxes (in thousands):

Nine Months Ended September 30, | |||

2025 | 2024 | ||

Cash paid during the period for income taxes, net of refunds | $147,999 | $— | |

Cash paid during the period for income taxes (prior to ASU No. 2023-09) | — | 113,107 | |

19

Reconciliations of Non-GAAP Financial Measures

Reconciliation of Net Income to Adjusted EBITDA

(in thousands) | Q3’24 | Q4’24 | Q1’25 | Q2’25 | Q3’25 |

Net income ....................................................................... | $75,495 | $1,291,176 | $65,608 | $1,428,900 | $432,552 |

Adjusted to exclude the following: | |||||

(Benefit from) provision for income taxes .............. | (6,914) | 205,700 | 16,848 | 394,873 | 69,591 |

Interest expense ......................................................... | 20,530 | 20,537 | 20,511 | 20,535 | 21,774 |

Depreciation and amortization ................................. | 30,695 | 32,995 | 33,333 | 33,901 | 50,078 |

Stock-based compensation expense ...................... | 248,416 | 221,984 | 190,729 | 196,160 | 222,069 |

Data Theft Incident losses ........................................ | — | — | — | 306,654 | 47,976 |

Losses (gains) on crypto assets held for investment, net ........................................................... | 120,507 | (476,153) | 596,651 | (362,053) | (423,903) |

Other (income) expense, net(1) ................................ | (40,105) | (7,191) | 6,188 | (1,506,905) | 380,518 |

Adjusted EBITDA .................................................... | $448,624 | $1,289,048 | $929,868 | $512,065 | $800,655 |

__________________

(1)See Note 15. Other expense (income), net to the Condensed Consolidated Financial Statements in our Quarterly Report on Form 10-Q for the

quarter ended on September 30, 2025 filed with the SEC on October 30, 2025 for additional details.

Reconciliation of Net Income to Adjusted Net Income and Net Income per Share to Adjusted Net

Income per Share

(in thousands, except per share amounts) | Q3’24 | Q4’24 | Q1’25 | Q2’25 | Q3’25 |

Net income ........................................................................... | $75,495 | $1,291,176 | $65,608 | $1,428,900 | $432,552 |

Adjusted to exclude the following: | |||||

Losses (gains) on crypto assets held for investment, net .............................................................. | 120,507 | (476,153) | 596,651 | (362,053) | (423,903) |

Losses (gains) on investments, net ............................ | 478 | (3,587) | (3,327) | (1,472,121) | 400,250 |

Tax effect of non-GAAP net income adjustments ..... | (28,674) | 119,852 | (134,821) | 438,482 | 11,845 |

Adjusted Net Income ............................................... | $167,806 | $931,288 | $524,111 | $33,208 | $420,744 |

Revised definition newly adjusts for: | |||||

(Losses) gains on investments, net ............................ | $(478) | $3,587 | $3,327 | $1,472,121 | $(400,250) |

Tax effect of non-GAAP net income adjustments related to investments .................................................. | 116 | (854) | (812) | (359,639) | 97,812 |

Adjusted Net Income, previous definition ............. | $167,444 | $934,021 | $526,626 | $1,145,690 | $118,306 |

Weighted-average shares outstanding used in per share calculations below: | |||||

Basic .................................................................................... | 248,834 | 251,506 | 253,878 | 255,188 | 262,831 |

Diluted .................................................................................. | 267,440 | 276,752 | 271,251 | 278,913 | 291,958 |

Net income per share(1): | |||||

Basic ..................................................................................... | $0.30 | $5.13 | $0.26 | $5.60 | $1.65 |

Diluted .................................................................................. | $0.28 | $4.68 | $0.24 | $5.14 | $1.50 |

Adjusted Net Income per Share: | |||||

Basic ..................................................................................... | $0.67 | $3.70 | $2.06 | $0.13 | $1.60 |

Diluted .................................................................................. | $0.63 | $3.37 | $1.93 | $0.12 | $1.44 |

__________________

(1)Net income per share is calculated using net income attributable to common stockholders. See Note 17. Net income per share to the

Condensed Consolidated Financial Statements in our Quarterly Report on Form 10-Q for the quarter ended on September 30, 2025 filed with

the SEC on October 30, 2025 for additional details.