Contract No.: (2025) Hu Yin Dai Zi No. 202412-266 RMB/Foreign Currency Working Capital Loan Contract (Applicable to RMB or foreign currency loans provided to foreign companies and foreign currency loans provided to domestic companies only; Version 5.0, 2024)

1 Instructions for Completion I. Please complete this Contract using a blue-black or black signature pen or fountain pen. II. This Contract shall be completed in full, clearly and neatly. III. The currency shall be completed in Chinese, rather than currency symbol. The currency in Chinese shall be added before the amount in words, and the currency symbol shall be added before the amount in figures. In particular: If Party A is an entity incorporated in the People’s Republic of China (for the purpose of this Contract, excluding the Hong Kong Special Administrative Region, the Macau Special Administrative Region and Taiwan Region), the currency hereunder must be a foreign currency; If Party A is an entity incorporated outside the People’s Republic of China, the currency hereunder may be RMB or a foreign currency depending on the actual business arrangement. IV. Any blank space in this Contract that is excessive or not completed may be crossed with a broken line or oblique line, stamped with a “Blank Below” seal, or completed with “Blank Below”. V. Before signing this Contract, Party A shall carefully read and fully understand the terms of this Contract, and be aware of the relevant legal consequences. By signing this Contract, Party A consents to and accepts all terms of this Contract.

2 RMB/Foreign Currency Working Capital Loan Contract (Applicable to RMB or foreign currency loans provided to foreign companies and foreign currency loans provided to domestic companies only; Version 5.0, 2024) Borrower: ACM Research, Inc. (“Party A”) Domicile: Corporation Service Company, 2711 Centerville Road, Suite 400, in the City of Wilmington, County of New Castle, Delaware 19808 Authorized representative: Mr. Hui WANG Bank: Business Department of Shanghai Branch, China CITIC Bank Account number: 8110200193101673721 Lender: China CITIC Bank Corporation Limited Shanghai Branch (“Party B”) Domicile: No. 138 Shiboguan Road, Pudong New Area, Shanghai Legal representative/Person in charge: Yuanxin ZHAO Place of signature: Shanghai Date of signature: __ (day) __ (month), __ (year) Pursuant to the Civil Code of the People’s Republic of China, the General Provisions on Lending, the Administrative Measures for Working Capital Loans, and other applicable laws, rules and regulations, through consultation on an equal footing, the Parties hereby enter into this Contract. Section 1 Type of loan 1.1 Subject to the terms of this Contract, Party B agrees to provide Party A with a working capital loan. Section 2 Amount (principal, the same as below) and term of the loan 2.1 The currency of the loan hereunder shall be Renminbi (RMB), and the amount of the

3 loan shall be RMB Two Hundred Million Only (in words), i.e., RMB 200,000,000.00 (in figures). 2.2 The loan term hereunder shall be from __ (day) __ (month), __ (year) till __ (day) __ (month), __ (year). 2.3 The actual loan term, actual drawdown date, amount of loan, and initial loan interest rate shall be subject to the term, date, amount, and interest rate specified in the corporate loan note (receipt for loan) issued hereunder. Such corporate loan note (receipt for loan) shall constitute an integral part of this Contract and shall have equal legal effect as this Contract. 2.4 This Contract □ is applicable / is not applicable (please tick the □ with a “√”) to the following provisions: This Contract is a specific business contract under the Comprehensive Facility Contract (Contract No.: [/]), and forms a complete contract system with and is not severable from the Comprehensive Facility Contract. The loan hereunder utilizes the comprehensive credit line available under the Comprehensive Facility Contract. The definitions and other relevant provisions contained in the Comprehensive Facility Contract apply to this Contract; provided, however, in the event of any discrepancy, the definitions and relevant provisions contained herein shall prevail. Section 3 Purpose of the loan 3.1 The loan proceeds hereunder shall be applied: [for the day-to-day business operation, rather than as a security deposit for any other financing]. Without the written consent of Party B, Party A shall not change the purpose of the loan, by applying the loan proceeds towards the distribution of dividends to its shareholders, investment in financial assets, fixed assets, real properties, equities, futures, securities, trusts, funds, guarantees, options, micro-lending or other assets, or private lending, illegal fund-raising or other fields or purposes prohibited by the applicable policies, or any production or business field or purpose banned by the country, or otherwise misappropriate the loan proceeds. If Party A violates the foregoing provision, Party A shall indemnify Party B for any loss arising therefrom. Party B shall not be liable for any consequence arising out of any change in the purpose of the loan by Party A without the written consent of Party B, or use of the loan proceeds by Party A in violation of the General Provisions on Lending, the Administrative Measures for Working Capital Loans, or other applicable laws and regulations. Section 4 Loan interest rate and interest settlement 4.1 Loan interest rate

4 4.1.1 Loan interest rate if the currency of the loan is RMB 4.1.1.1 If the loan interest rate hereunder is a simple interest rate per annum, and the interval between the actual drawdown date and the date of this Contract is not more than six months, the loan interest rate shall be determined in accordance with Clause [○2 ] below: ① Loan interest rate = pricing base rate on the date of this Contract + [/] basic points (1 basic point = 0.01%). ② Loan interest rate = pricing base rate on the actual drawdown date + [50] basic points (1 basic point = 0.01%). If the interval between the actual single drawdown date and the date of this Contract is more than six months, Party B shall have the right to adjust the loan interest rate pursuant to its interest rate policy then in effect, provided that the method of adjustment to the loan interest rate shall be reaffirmed upon by the Parties in writing, and the initial interest rate shall be set forth in the corporate loan note (receipt for loan). 4.1.1.2 The interest rate for the loan hereunder shall be adjusted in accordance with Clause [(2)] below: (1) The loan interest rate shall be fixed and remain unchanged during the loan term. (2) The loan interest rate shall be floating, and adjusted in accordance with Clause [A] below. The loan interest rate as adjusted shall be the pricing base rate on the interest rate adjustment date (or if the interest rate adjustment date is a day in which the pricing base rate is published, at the end of that day), plus the basic points set out in Section 4.1.1.1. A. From the actual drawdown date, the interest rate shall be adjusted every [one] (□ month/□ quarter/□ half-year/□ year). An interest rate adjustment date shall be the numerically corresponding day of the actual drawdown date in the month in which the interest rate is adjusted, or if there is no numerically corresponding day in that month, the last day of that month. B. From the actual drawdown date, the interest rate shall be adjusted on __ (day) __ (month), __ (year) for the first time (the first interest rate adjustment date), and thereafter adjusted every [/] (□ month/□ quarter/□ half-year/□ year). A subsequent interest rate adjustment date shall be the numerically corresponding day of the first interest rate adjustment date in the month in which the interest rate is adjusted, or if there is no numerically corresponding day in that month, the last day of that month. C. Fixed-date adjustment, i.e., the loan interest rate shall be adjusted on __ (day) __ (month), __ (year) (such as July 1) of each year during the loan term. (3) If the interest rate is floating, the pricing base rate applicable at the date of this Contract, the actual drawdown date and each interest rate adjustment date shall be determined in accordance with Clause [○1 ] below:

5 ① The latest loan prime rate for the [one-year] (one-year/over five-year) term published by the National Interbank Funding Center at the current time. ② The Shanghai Interbank Offered Rate for the [/] (overnight/ one-week/ two- week/ one-month/ two-month/ three-month/ six-month/ nine-month/ one- year) term, as published by the National Interbank Funding Center on the preceding business day. ③ In such other manner as agreed upon by the Parties: [/]. (4) If the interest rate is fixed, the pricing base rate applicable at the date of this Contract, the actual drawdown date and each interest rate adjustment date shall be the latest loan prime rate for the [/] (one-year/five-year) term published by the National Interbank Funding Center at the current time. (5) If the pricing base rate is cancelled by the country or ceases to be published on the market, or the current loan interest rate cannot cover the cost of funds of Party B, Party B shall have the right to adjust the loan interest rate in accordance with the interest rate policy of the country then in effect, on the principles of fairness and good faith, and taking into account the industry practices, status of interest rate and other factors, by giving notice to Party A. If Party A objects to any such adjustment, Party A shall consult with Party B. If the Parties fail to reach an agreement within five business days from the date of delivery of such notice by Party B, Party B shall have the right to declare the loan hereunder to be immediately due and payable, in which case Party A shall immediately repay the outstanding loan and interest. (6) The methods of adjustment of interest rate set forth in Section 4.1.1 shall also apply to the default interest and compound interest, if any. 4.1.2 Loan interest rate if the currency of the loan is a foreign currency The loan interest rate hereunder shall be an annual interest rate, and determined in accordance with Clause [/] (A/B/C/D) below if the interval between the actual single drawdown date and the date of this Contract is not more than six months: A. The loan interest rate shall be the base rate for the currency (which is [/]) on each drawdown date the effective date of this Contract, as the pricing benchmark, [/] (plus/minus) a spread of [/] basic points (1 basic point = 0.01%, the same below), which spread shall remain unchanged during the term of this Contract. Each drawdown date the effective date of this Contract shall be the first interest rate determination date, and thereafter the interest rate shall be adjusted in accordance with Clause [/] below: (1) The loan interest rate shall be fixed and remain unchanged during the loan term. (2) The loan interest rate shall be floating, adjusted in line with the changes in the pricing benchmark throughout the loan term, with interest accrued in

6 sections, as specified in Clause [/] below. The applicable pricing benchmark for the adjusted loan shall be the pricing benchmark applicable on the rate adjustment date. ① From the actual drawdown date, the interest rate adjustment cycle shall be determined based on the term of the base rate selected for determining the loan interest rate hereunder. An interest rate adjustment date shall be the numerically corresponding day of the actual drawdown date in the month in which the interest rate is adjusted, or if there is no numerically corresponding day in that month, the last day of that month. ② From the actual drawdown date, the interest rate shall be adjusted on __ (day) __ (month), __ (year) for the first time (the first interest rate adjustment date), and thereafter adjusted based on the term of the base rate selected for determining the interest rate for lending/financing/transaction. A subsequent interest rate adjustment date shall be the numerically corresponding day of the first interest rate adjustment date in the month in which the interest rate is adjusted, or if there is no numerically corresponding day in that month, the last day of that month. At each interest rate determination date referred to above (i.e. the first interest rate determination date and each subsequent interest rate adjustment date), the applicable pricing benchmark shall be determined in accordance with Section 4.3.2.1, or if it is negative, be deemed zero. B. At each interest accrual day during the interest period (i.e. each calendar day during the loan term, the same as below), the applicable overnight interest rate for the currency shall be the pricing benchmark [/] (plus/minus) a spread of [/] basic points, which spread shall remain unchanged during the term of this Contract. The interest rate applicable at each interest accrual day shall be determined by Party B based on the pricing benchmark on that date and the spread referred to above. The pricing benchmark applicable at each interest accrual day shall be determined as follows: the first interest rate determination date shall be each drawdown date the effective date of this Contract, and each interest accrual day after the first interest rate determination date shall be a subsequent interest rate determination date. At each interest rate determination date referred to above, the applicable pricing benchmark shall be determined in accordance with Section 4.3.2.2, or if it is negative, be deemed zero. C. The interest rate shall be fixed at [/]% per annum, and remain unchanged during the term of this Contract. D. Others: [/] The methods of adjustment of interest rate set forth in Section 4.1.2 shall also apply to the default interest and compound interest, if any.

7 4.2 Interest accrual and settlement 4.2.1 Accrual of interest 4.2.1.1 Accrual of interest if the currency of the loan is RMB Interest shall accrue on the loan hereunder from the actual drawdown date. The interest payable by Party A for the loan hereunder shall be calculated using the following formula: interest payable by Party A = actual outstanding loan * actual number of days in the interest period * annual interest rate/ 360 days. In the event of any change in the actual outstanding loan during an interest period, the interest shall be accrued according to the number of days in each section of that interest period in which the outstanding loan remains unchanged. 4.2.1.2 Accrual of interest if the currency of the loan is a foreign currency 4.2.1.2.1 If the interest rate is determined in accordance with Clause A or C of Section 4.1.2, interest shall accrue at a simple interest rate from the actual drawdown date, in accordance with Clause [/] below: (1) Actual/360, where the interest shall be calculated using the following formula: interest = actual outstanding loan * actual number of days in the interest period * annual interest rate/ 360 days. (2) Actual/365, where the interest shall be calculated using the following formula: interest = actual outstanding loan * actual number of days in the interest period * annual interest rate/ 365 days. (3) 30/360, where the interest shall be calculated using the following formula: monthly interest = actual outstanding loan * 30 days * annual interest rate/ 360 days. (4) 30/365, where the interest shall be calculated using the following formula: monthly interest = actual outstanding loan * 30 days * annual interest rate/ 365 days. 4.2.1.2.2 If the interest rate is determined in accordance with Clause B of Section 4.1.2, interest shall accrue on a daily basis from the actual drawdown date in accordance with Clause [/] below: (1) If interest accrues at a simple interest rate, the interest shall be calculated using the following formula: interest accrued each day during the interest period = actual outstanding loan * interest rate applicable on that day. (2) With respect to the portion of interest calculated using the pricing benchmark, such portion of interest accrued each business day = (actual principal of the loan + aggregate interest accrued and unpaid as of the preceding day, calculated using the pricing benchmark) * interest rate applicable on that day. Interest on any non-business day shall still accrue at a simple interest rate. The portion of interest calculated using the spread shall accrue at a simple interest rate as

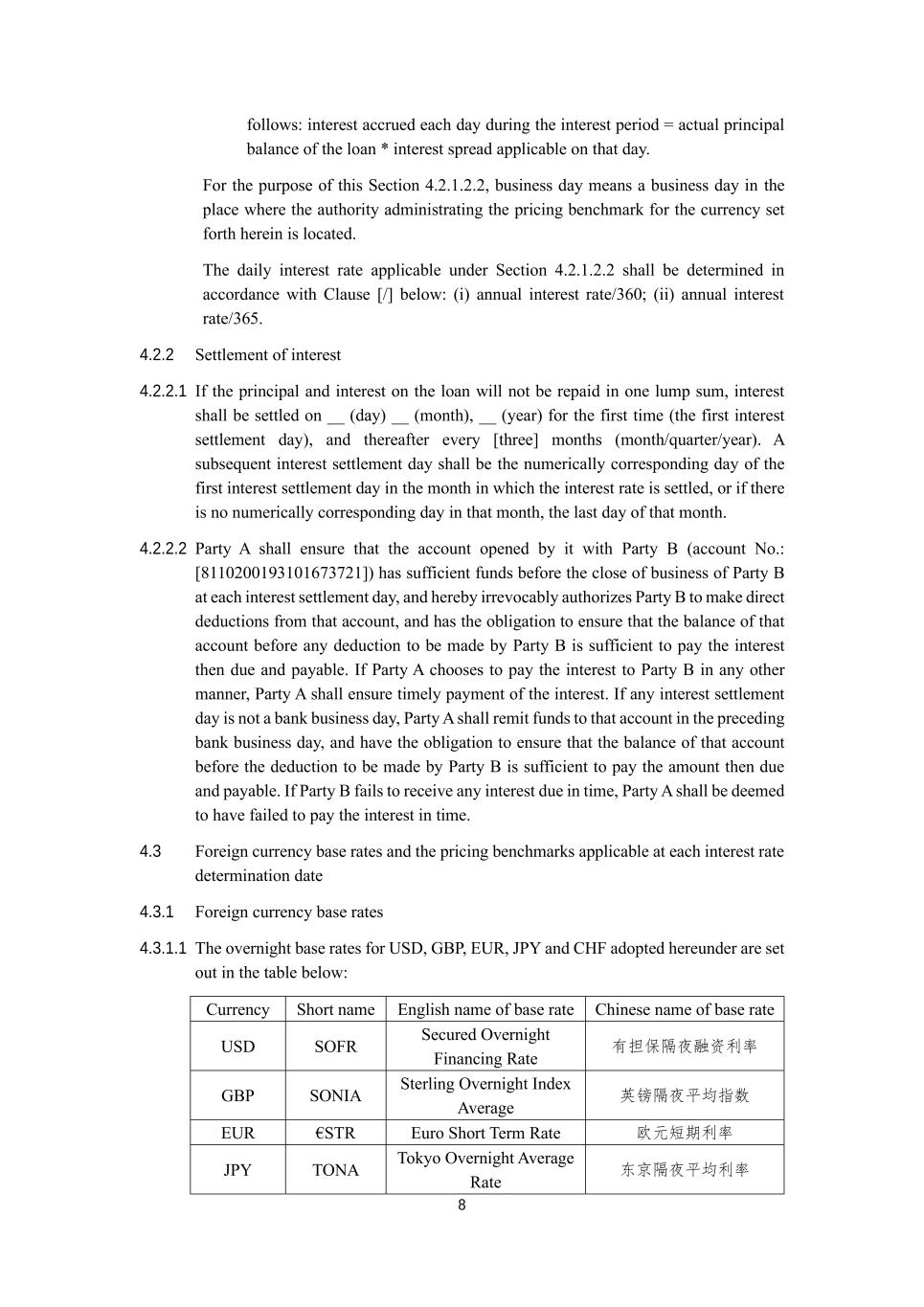

8 follows: interest accrued each day during the interest period = actual principal balance of the loan * interest spread applicable on that day. For the purpose of this Section 4.2.1.2.2, business day means a business day in the place where the authority administrating the pricing benchmark for the currency set forth herein is located. The daily interest rate applicable under Section 4.2.1.2.2 shall be determined in accordance with Clause [/] below: (i) annual interest rate/360; (ii) annual interest rate/365. 4.2.2 Settlement of interest 4.2.2.1 If the principal and interest on the loan will not be repaid in one lump sum, interest shall be settled on __ (day) __ (month), __ (year) for the first time (the first interest settlement day), and thereafter every [three] months (month/quarter/year). A subsequent interest settlement day shall be the numerically corresponding day of the first interest settlement day in the month in which the interest rate is settled, or if there is no numerically corresponding day in that month, the last day of that month. 4.2.2.2 Party A shall ensure that the account opened by it with Party B (account No.: [8110200193101673721]) has sufficient funds before the close of business of Party B at each interest settlement day, and hereby irrevocably authorizes Party B to make direct deductions from that account, and has the obligation to ensure that the balance of that account before any deduction to be made by Party B is sufficient to pay the interest then due and payable. If Party A chooses to pay the interest to Party B in any other manner, Party A shall ensure timely payment of the interest. If any interest settlement day is not a bank business day, Party A shall remit funds to that account in the preceding bank business day, and have the obligation to ensure that the balance of that account before the deduction to be made by Party B is sufficient to pay the amount then due and payable. If Party B fails to receive any interest due in time, Party A shall be deemed to have failed to pay the interest in time. 4.3 Foreign currency base rates and the pricing benchmarks applicable at each interest rate determination date 4.3.1 Foreign currency base rates 4.3.1.1 The overnight base rates for USD, GBP, EUR, JPY and CHF adopted hereunder are set out in the table below: Currency Short name English name of base rate Chinese name of base rate USD SOFR Secured Overnight Financing Rate 有担保隔夜融资利率 GBP SONIA Sterling Overnight Index Average 英镑隔夜平均指数 EUR €STR Euro Short Term Rate 欧元短期利率 JPY TONA Tokyo Overnight Average Rate 东京隔夜平均利率

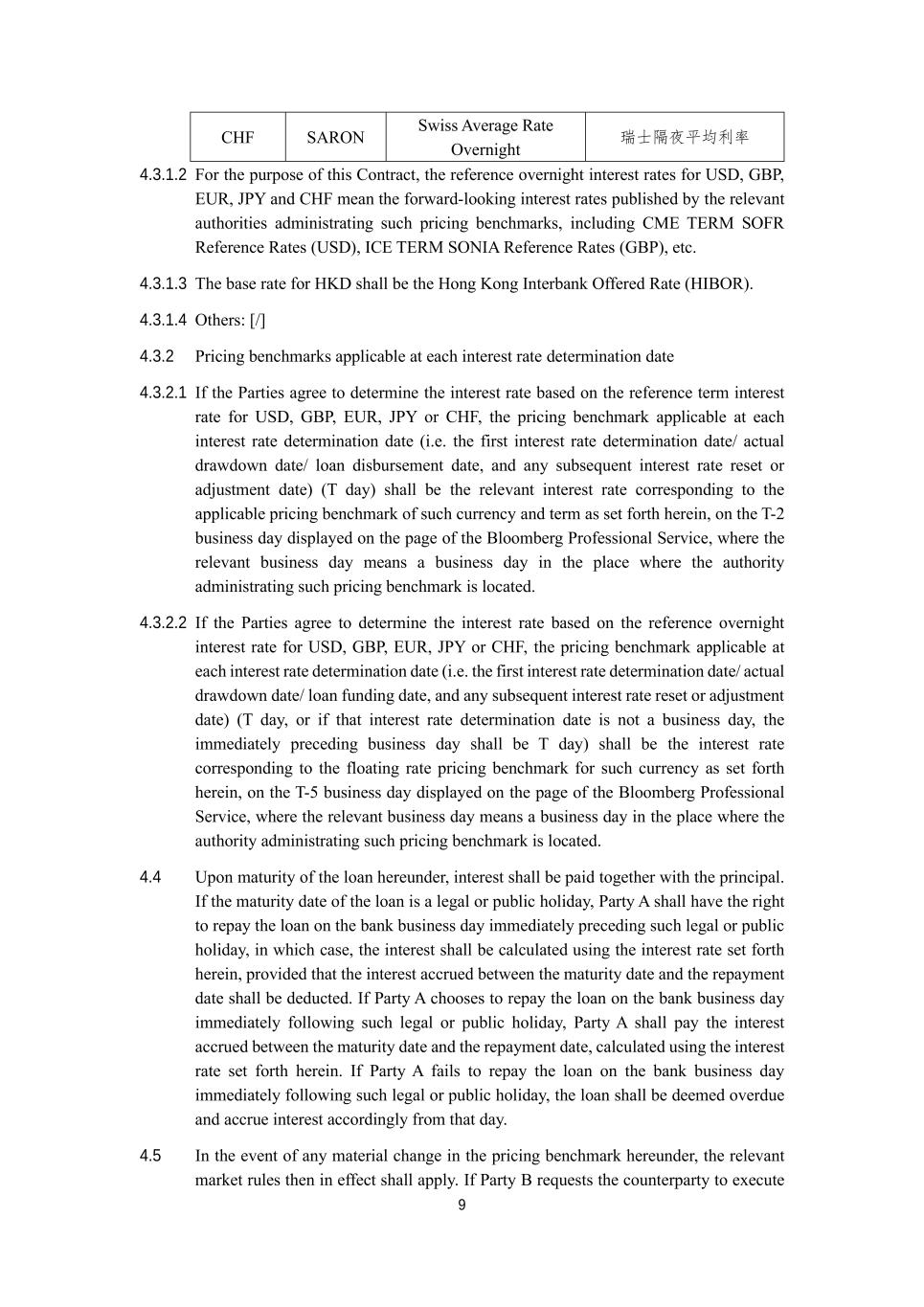

9 CHF SARON Swiss Average Rate Overnight 瑞士隔夜平均利率 4.3.1.2 For the purpose of this Contract, the reference overnight interest rates for USD, GBP, EUR, JPY and CHF mean the forward-looking interest rates published by the relevant authorities administrating such pricing benchmarks, including CME TERM SOFR Reference Rates (USD), ICE TERM SONIA Reference Rates (GBP), etc. 4.3.1.3 The base rate for HKD shall be the Hong Kong Interbank Offered Rate (HIBOR). 4.3.1.4 Others: [/] 4.3.2 Pricing benchmarks applicable at each interest rate determination date 4.3.2.1 If the Parties agree to determine the interest rate based on the reference term interest rate for USD, GBP, EUR, JPY or CHF, the pricing benchmark applicable at each interest rate determination date (i.e. the first interest rate determination date/ actual drawdown date/ loan disbursement date, and any subsequent interest rate reset or adjustment date) (T day) shall be the relevant interest rate corresponding to the applicable pricing benchmark of such currency and term as set forth herein, on the T-2 business day displayed on the page of the Bloomberg Professional Service, where the relevant business day means a business day in the place where the authority administrating such pricing benchmark is located. 4.3.2.2 If the Parties agree to determine the interest rate based on the reference overnight interest rate for USD, GBP, EUR, JPY or CHF, the pricing benchmark applicable at each interest rate determination date (i.e. the first interest rate determination date/ actual drawdown date/ loan funding date, and any subsequent interest rate reset or adjustment date) (T day, or if that interest rate determination date is not a business day, the immediately preceding business day shall be T day) shall be the interest rate corresponding to the floating rate pricing benchmark for such currency as set forth herein, on the T-5 business day displayed on the page of the Bloomberg Professional Service, where the relevant business day means a business day in the place where the authority administrating such pricing benchmark is located. 4.4 Upon maturity of the loan hereunder, interest shall be paid together with the principal. If the maturity date of the loan is a legal or public holiday, Party A shall have the right to repay the loan on the bank business day immediately preceding such legal or public holiday, in which case, the interest shall be calculated using the interest rate set forth herein, provided that the interest accrued between the maturity date and the repayment date shall be deducted. If Party A chooses to repay the loan on the bank business day immediately following such legal or public holiday, Party A shall pay the interest accrued between the maturity date and the repayment date, calculated using the interest rate set forth herein. If Party A fails to repay the loan on the bank business day immediately following such legal or public holiday, the loan shall be deemed overdue and accrue interest accordingly from that day. 4.5 In the event of any material change in the pricing benchmark hereunder, the relevant market rules then in effect shall apply. If Party B requests the counterparty to execute

10 a supplemental agreement to specify the relevant matters, Party A shall cooperate with such request, failing which, Party B shall have the right to declare the loan immediately due and payable. Section 5 Disbursement and payment of the loan proceeds 5.1 Conditions precedent to the first drawdown Party A shall satisfy all of the following conditions upon the first drawdown hereunder: [/] 5.2 Conditions precedent to each drawdown With respect to each drawdown hereunder (including the first drawdown), Party A shall also satisfy the following conditions: (1) Party A shall have not violated any provision of this Contract, the security documents and other related documents, and not be subject to any legal or regulatory restriction or sanction; (2) the security documents shall remain in effect, and there shall have been no actual or threatened adverse change in the security that, in the opinion of Party B, might affect the recovery of debts hereunder; (3) the collateral or security under the security documents shall have not been attached, and confirmation of claims or other similar event shall have not occurred under the maximum amount guarantee; (4) there shall have been no adverse change in the credit standing, business and financial conditions of Party A that might hinder, delay or prevent Party A from performing its duties and obligations under this Contract and the security documents; (5) Party A shall have executed or delivered to Party B such documents as may be set forth herein or reasonably requested by Party B; (6) Party A shall have opened the relevant account as may be set forth herein or requested by Party B; (7) there shall be no law, rule or regulatory requirement that prohibits or restricts the provision of the loan hereunder; (8) [/]; and (9) such other conditions as may be required by Party B. 5.3 Drawdown schedule 5.3.1 Party A shall make drawdowns the loan according to such schedule as set forth in Clause [(2)] below. Each scheduled drawdown date must be a bank business day.

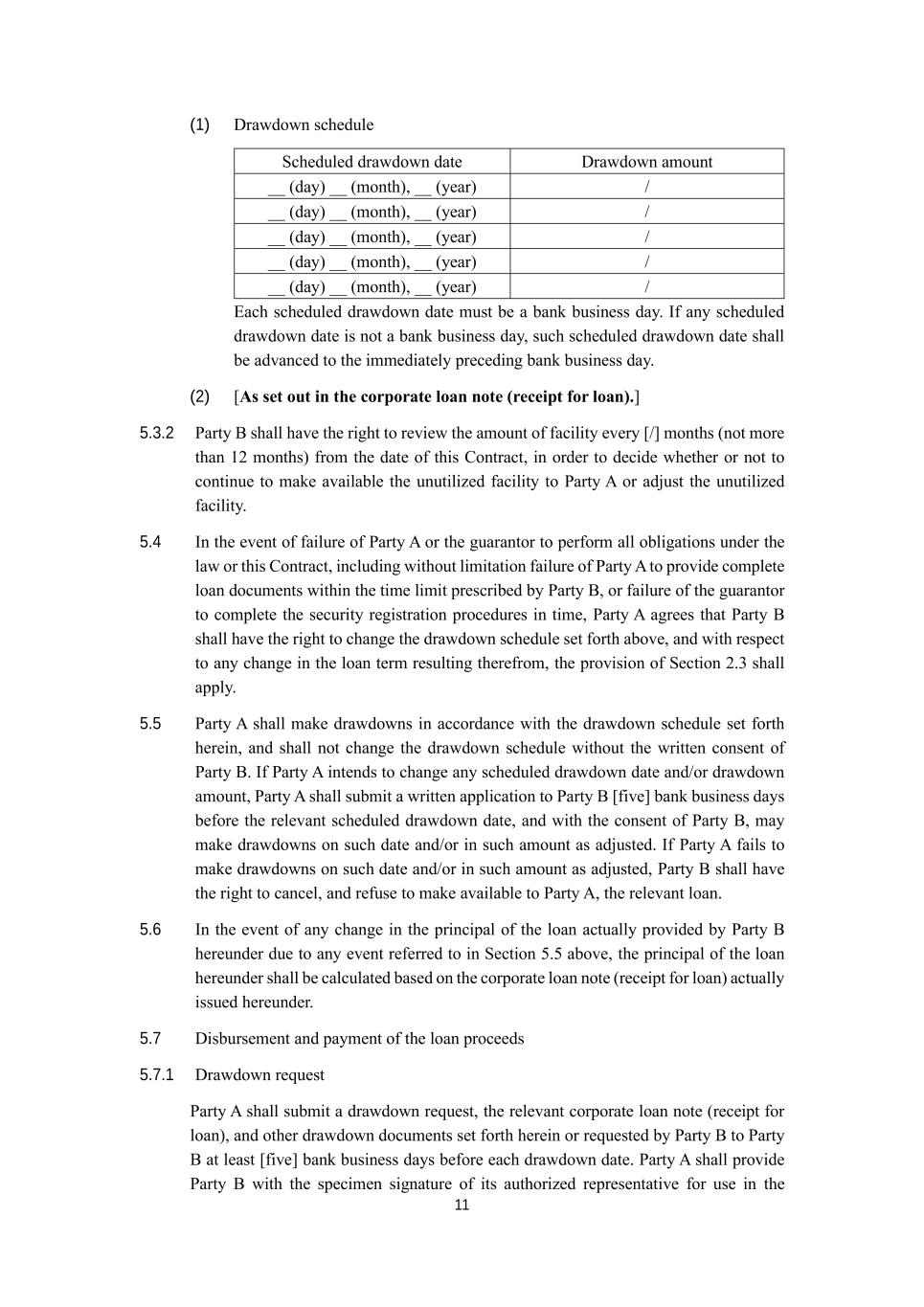

11 (1) Drawdown schedule Scheduled drawdown date Drawdown amount __ (day) __ (month), __ (year) / __ (day) __ (month), __ (year) / __ (day) __ (month), __ (year) / __ (day) __ (month), __ (year) / __ (day) __ (month), __ (year) / Each scheduled drawdown date must be a bank business day. If any scheduled drawdown date is not a bank business day, such scheduled drawdown date shall be advanced to the immediately preceding bank business day. (2) [As set out in the corporate loan note (receipt for loan).] 5.3.2 Party B shall have the right to review the amount of facility every [/] months (not more than 12 months) from the date of this Contract, in order to decide whether or not to continue to make available the unutilized facility to Party A or adjust the unutilized facility. 5.4 In the event of failure of Party A or the guarantor to perform all obligations under the law or this Contract, including without limitation failure of Party A to provide complete loan documents within the time limit prescribed by Party B, or failure of the guarantor to complete the security registration procedures in time, Party A agrees that Party B shall have the right to change the drawdown schedule set forth above, and with respect to any change in the loan term resulting therefrom, the provision of Section 2.3 shall apply. 5.5 Party A shall make drawdowns in accordance with the drawdown schedule set forth herein, and shall not change the drawdown schedule without the written consent of Party B. If Party A intends to change any scheduled drawdown date and/or drawdown amount, Party A shall submit a written application to Party B [five] bank business days before the relevant scheduled drawdown date, and with the consent of Party B, may make drawdowns on such date and/or in such amount as adjusted. If Party A fails to make drawdowns on such date and/or in such amount as adjusted, Party B shall have the right to cancel, and refuse to make available to Party A, the relevant loan. 5.6 In the event of any change in the principal of the loan actually provided by Party B hereunder due to any event referred to in Section 5.5 above, the principal of the loan hereunder shall be calculated based on the corporate loan note (receipt for loan) actually issued hereunder. 5.7 Disbursement and payment of the loan proceeds 5.7.1 Drawdown request Party A shall submit a drawdown request, the relevant corporate loan note (receipt for loan), and other drawdown documents set forth herein or requested by Party B to Party B at least [five] bank business days before each drawdown date. Party A shall provide Party B with the specimen signature of its authorized representative for use in the

12 drawdown of the loan hereunder (in such form as set out in Exhibit 1; Party A may also provide a signature card to Party B to be kept on the separate file; if Party A provides a number of specimen signatures, the use of any such specimen signature shall be deemed to reflect the true intent of Party A). When making any business request, the staff member of Party A shall provide a signature conforming to the specimen signature. Party B shall only have the obligation to check the signature provided by the staff member of Party A against the specimen signature, and upon verification of the same, handle the business request made by Party A. In the event of any change in such specimen signature, Party A shall give written notice to Party B, signed by the authorized representative of Party A on the same day, failing which, Party A shall indemnify Party B for all losses arising therefrom. Each drawdown request made by Party A shall be irrevocable, and after it is approved by Party B, Party A shall have the obligation to make drawdowns thereunder. The loan proceeds shall be transferred to the designated account opened by Party A with Party B (account No.: [8110200193101673721]), or to such counterparty of Party A as agreed upon by the Parties. 5.7.2 Method of payment of the loan proceeds 5.7.2.1 The loan proceeds shall be paid by means of discretionary payment and entrusted payment. The Parties agree that the loan proceeds shall be paid in such manner as set forth in Clause [(1)] below: (1) All loan proceeds shall be paid by Party A in its sole discretion; provided, however, upon occurrence of any event on the part of Party A referred to in Section 5.7.3.3, Party B shall have the right to change the method of payment of the loan proceeds by giving written notice to Party A, which change shall take effect immediately upon delivery thereof to Party A, to which Party A shall not raise any objection. (2) The method of entrusted payment shall be adopted in the event of any of the following: ① where the Parties have established a new credit relationship, and Party B deems it necessary to adopt the method of entrusted payment based on the credit standing of Party A; ② where the beneficiary is specifically identified, and the single amount paid by Party B to any counterparty of Party A exceeds RMB Ten Million or its equivalent in any other currency; ③ [/]; or ④ where Party B otherwise deems it necessary to adopt the method of entrusted payment. 5.7.2.2 In the event of entrusted payment of the loan proceeds by Party B (including subsequent change into such method), prior to the payment of the loan proceeds, Party B shall have

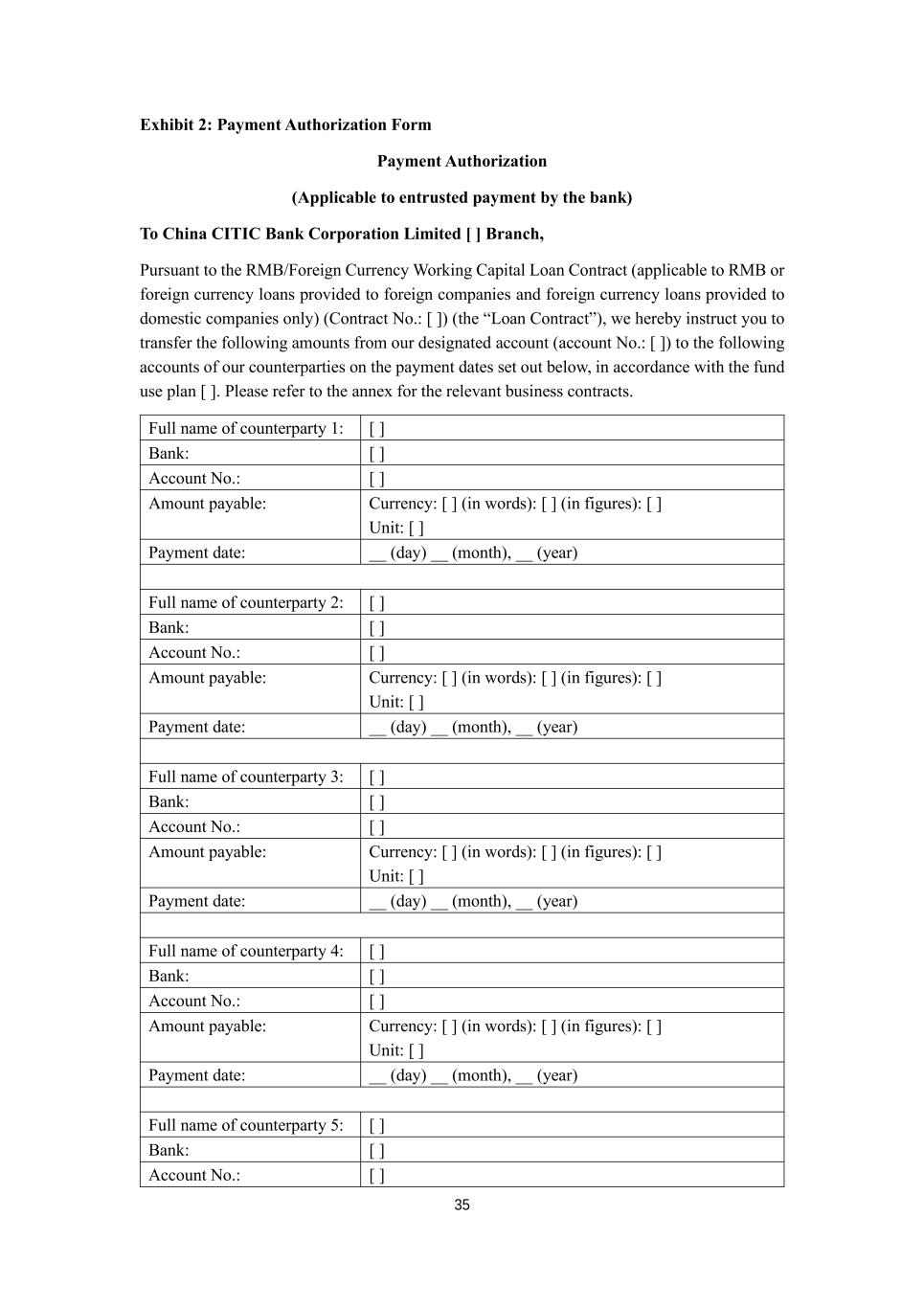

13 the right to check the beneficiary, amount to be paid, and other information contained in the payment request submitted by Party A against the relevant business contracts and other supporting documents. Upon verification of the same, Party B shall, according to the Payment Authorization Form submitted by Party A (in the form attached hereto as Exhibit 2), transfer the loan proceeds from the designated account opened by Party A with Party B (account No.: [8110200193101673721]), to the account of the counterparty of Party A as set out in the Payment Authorization Form. Any prima facie examination of the aforesaid business contracts and other documents by Party B shall not imply any confirmation by Party B of the authenticity or legal and regulatory compliance of the relevant transactions, or any involvement by Party B in any dispute between Party A and its counterparty or any third party, or in any responsibility or obligation assumed by Party A. 5.7.2.3 If the loan proceeds fail to be promptly and successfully remitted into the bank account of the counterparty of Party A due to the return of the same by the bank of the counterparty of Party A, failure of Party A to promptly provide the relevant information, provision of false information by Party A or any other reason attributable to Party A, Party B shall not be liable, while Party A shall assume all risks, liabilities and losses incurred by the Parties. No amount returned by the bank of the counterparty of Party A shall be used by Party A without the consent of Party B. 5.7.3 Payment management 5.7.3.1 After the disbursement of the loan proceeds, Party B shall have the right to review and examine whether Party A has complied with the provisions of this Contract in its use of the loan proceeds on a regular or irregular basis. Party A shall have the obligation to provide full cooperation in such review and examination, and promptly provide the record and documents in relation to the use of the loan proceeds, including without limitation business contracts, and other proofs of transaction and documents as may be requested by Party B. If Party B discovers that any use of the loan proceeds does not conform to the provisions of this Contract, Party B shall have the right to request Party A to make rectifications within a prescribed time limit, and if Party A refuses to make rectifications, enforce the provisions of Sections 13.3 and 13.5 depending on the severity of such violation. 5.7.3.2 In the case of discretionary payment by Party A, Party A shall, before the 10th day of the month immediately following the end of each quarter, provide Party B with the business contracts and other transaction documents relating to the payment of the loan proceeds in that quarter, and a summary report on the payment of the loan proceeds in that quarter. Party B shall have the right, by account analysis, voucher examination, on- site investigation or otherwise, to examine whether the loan proceeds have been used for the purpose set forth herein, whether the amounts paid correspond to the progress of the relevant project, and whether Party A has avoided the entrusted payment by breaking up the total amount into smaller payments or otherwise. 5.7.3.3 In the event of any of the following on the part of Party A during the disbursement and

14 payment of the loan proceeds hereunder, Party B shall have the right to establish supplemental conditions for the disbursement and payment of the loan proceeds or change the method of payment of the loan proceeds through consultation with Party A, or terminate or suspend the disbursement and payment of the loan proceeds, depending on the actual circumstances: ① any deterioration of the credit standing of Party A; ② any significant deterioration of the business and financial conditions of Party A; ③ use of the loan proceeds in an abnormal manner or in violation of the provisions of this Contract; ④ where Party A avoids the entrusted payment by Party B by breaking up the total amount into smaller payments; or ⑤ where Party A otherwise violates the provisions of this Contract. 5.8 Other provisions [/] Section 6 Repayment 6.1 The loan hereunder shall be repaid in accordance with Clause [(3)] below: (1) The interest shall be paid on a regular basis, and the principal shall be repaid upon maturity of the loan; (2) The principal and interest shall be repaid in one lump sum; (3) Others: [The interest shall be paid on a quarterly basis, and the principal shall be repaid on schedule.] 6.2 Party A shall repay the principal according to the schedule set out in Clause [(1)] below: (1) Repayment schedule Installment Repayment date Amount to be repaid __ (day) __ (month), __ (year) __ (day) __ (month), __ (year) __ (day) __ (month), __ (year) __ (day) __ (month), __ (year) __ (day) __ (month), __ (year) __ (day) __ (month), __ (year) __ (day) __ (month), __ (year) __ (day) __ (month), __ (year) __ (day) __ (month), __ (year) __ (day) __ (month), __ (year) (2) [/]

15 6.3 Party A shall remit an amount sufficient to pay the principal and interest due and payable then into the account opened by it with Party B (account No.: [8110200193101673721]) (“the Repayment Account”) before the close of business at each repayment date. Party A hereby authorizes Party B to automatically deduct the principal and interest due and payable on the loan from the Repayment Account. If Party A is an entity incorporated outside the People’s Republic of China (for the purpose of this Contract, excluding Hong Kong, Macau and Taiwan regions of China), Party A hereby makes the following additional covenants to Party B: 6.3.1 No deduction. All repayments made, and other fees (including default interest and compound interest, the same below) paid by Party A to Party B under this Contract or otherwise in connection with the loan hereunder shall be paid in full, without any set- off, counterclaim or retention, or deduction or withholding for or on account of any tax or charge. If Party A is required by the laws, decrees, policies or other administrative regulations of the relevant country or region to make any deduction or withholding from any repayment made or other fees paid by Party A hereunder, Party A shall immediately remit an additional amount to the Repayment Account, to ensure that Party B receives a sum net of any deduction or withholding equal to the sum which it would have received hereunder had no such deduction or withholding been made. 6.3.2 Taxes. Party A shall be responsible for all taxes payable in the relevant country or region in connection with this Contract or repayment of the loan hereunder, and the taxes assessed and imposed by the tax authorities of China on Party A; provided that the taxes assessed and imposed by the tax authorities of China by reference to the net income received by Party B shall be borne by Party B. In the event of any change in the laws, decrees, policies or other administrative regulations of the relevant country or region applicable to this Contract and the loan hereunder, resulting in any increase in the taxes and charges payable hereunder, such additional taxes and charges shall be borne by Party A. If Party B has already paid such taxes and charges or incurred losses in connection therewith, Party B shall have the right to claim compensation from Party A for such taxes and charges or the losses, or adjust the interest rate and fees hereunder through consultation with Party A. 6.3.3 Prior notice. If Party A is aware that it is or will be required by the laws, decrees, policies or other administrative regulations of the relevant country or region applicable to this Contract and the loan hereunder to make any set-off, counterclaim, retention, deduction or withholding from any repayment made or other fees paid by Party A to Party B hereunder at any time, Party A shall immediately notify Party B in writing, without prejudice to the obligations of Party A under Section 6.3.1 (No deduction) and Section 6.3.2 (Taxes). 6.3.4 Reimbursement. Party A shall pay all present and future taxes and charges (if any) arising out of this Contract, the loan hereunder and other related documents. If Party A fails to pay such taxes and charges, Party A shall immediately reimburse Party B for all debts, costs and expenses resulting from its breach of such obligation.

16 6.4 Unless otherwise provided herein, if the amount repaid or paid by Party A is insufficient to pay the total amount due and payable then, such amount shall be applied in the following order: (1) towards payment of all taxes, fees, penalties and other amounts payable pursuant to this Contract and the applicable laws; (2) towards payment of the default interest and compound interest; (3) towards payment of the interest; and (4) towards repayment of the principal of the loan. If the amount repaid or paid by Party A is insufficient to pay the amounts of the same order, such amounts shall be paid in the order of their occurrence. 6.5 Voluntary prepayment 6.5.1 Subject to the satisfaction of all of the following conditions, Party A may prepay all or part of the loan hereunder: (1) Party A shall have paid all amounts due and payable to Party B before the prepayment date; (2) Party A shall deliver a written repayment request to Party B at least 20 bank business days before the prepayment date, and obtain written consent from Party B; (3) except the repayment of the loan hereunder in full, any amount prepaid shall be an integral multiple of [/] (currency: [/]), and shall not be less than [/] (currency: [/]); (4) Party A shall pay the interest and other fees in relation to the amount prepaid to Party B, together with the amount prepaid; (5) unless otherwise approved by Party B in writing, Party A shall not make more than [/] prepayments during the loan term, and the principal prepaid shall be applied towards repayment of the principal of the loan in reverse order of the repayment schedule set forth herein; (6) other conditions: [/]. 6.5.2 Each prepayment request made by Party A shall be irrevocable. After any prepayment request is approved by Party B in writing, Party A shall prepay the loan hereunder in such amount and on such date as specified in the repayment request. If Party B has approved any prepayment request made by Party A in writing but Party A fails to prepay the loan in such amount and on such date as specified therein, Party B shall have the right to deem the relevant loan overdue. 6.5.3 The interest on the portion of the loan prepaid by Party A with the written consent of Party B shall be calculated based on the actual number of days in which such portion of the loan is used by Party A.

17 Section 7 Loan restructuring 7.1 If Party A is unable to repay any loan due, Party A shall submit an application for loan restructuring to Party B at least one month prior to the maturity date of such loan. If such application is approved by Party B, the Parties shall enter into a loan restructuring agreement. If such application is refused by Party B, Party A shall still repay the loan due at such time as set forth herein, failing which, Party B shall have the right to deem the relevant loan overdue. Section 8 Security for the loan 8.1 The security for the loan hereunder consists of the security set forth herein and other related security, as set forth in the security contract: No. Contract No. Contract title 1 2 3 4 5 8.2 During the loan term, in the event of any change in the security set forth above or inability to complete the specific security registration procedures upon the execution of this Contract, Party A hereby irrevocably covenants and agrees that it will change the form of security as agreed upon by the Parties then, and procure the new guarantor to execute the related security documents and/or complete the security registration procedures within three days after the relevant conditions have been satisfied, failing which, Party A shall be deemed to have breached this Contract, and Party B shall have the right to hold Party A liable for breach of contract, and take the relevant remedial measures. Section 9 Representations and warranties of Party A 9.1 Party A is a corporate or unincorporated organization duly registered and validly existing under the laws of the jurisdiction in which it is located or registered, has the necessary civil rights and capacity to enter into and perform this Contract according to law, is able to independently assume its civil liabilities, and has obtained all internal and external approvals and authorizations necessary for the execution of this Contract according to the law. Party A will ensure that the registration particulars conform to the actual situations. 9.2 All documents (including without limitation the trade background contracts and proofs of use of funds) provided and representations made by Party A in connection with the loan hereunder according to the law or at the request of Party B are valid, legal, true,

18 accurate and complete. 9.3 The execution and performance of this Contract by Party A will not result in any violation of the applicable laws, regulations or other documents legally binding upon it, or its articles of association, or the contracts, agreements or other documents entered into between it and any third party. The person signing this Contract and related documents on behalf of Party A has been duly authorized according to law and the internal regulations of Party A, and has the authority to sign this Contract and related documents. 9.4 Except the security set forth herein or approved by Party B in writing, Party A and the guarantor have not created any security over the collateral provided hereunder, and such collateral is free from any third-party right (including without limitation any right to occupy, right to lease, pledge, mortgage or other security interest created over the property mortgaged in favor of any third party), or any dispute or defect in title, such as attachment, seizure, freeze or other compulsory actions, or any other circumstance or condition that might prejudice the interests of Party B. Party A does not have any record of outstanding non-performing loans, advances or interest in the credit reference system of the People’s Bank of China. The actual controller and guarantor of Party A do not have any record of overdue loans in the credit reference system of the People’s Bank of China. 9.5 Except as otherwise disclosed to and accepted by Party B, Party A is not involved in any actual or potential event of default, pending or threatened litigation, arbitration proceedings or administrative penalty. 9.6 Party A will use the loan proceeds solely for the purpose set forth herein, and will not use any short-term loan proceeds for any long-term purpose, or invest the loan proceeds in securities, real property, futures or equities in any manner, or lend the loan proceeds to other persons, or use the loan proceeds to purchase other financial products for purpose of arbitrage, or apply the loan proceeds in any field prohibited by the applicable policies (such as illegal fund raising), or towards the distribution of dividends to its shareholders, investment in financial assets, fixed assets, real properties, equities or other assets, or any production or business field or purpose banned by the country, or otherwise misappropriate the loan proceeds. 9.7 The funds used by Party A to repay the loan to Party B come from legal sources. 9.8 Party A will comply with the anti-money laundering laws and regulations of the People’s Republic of China and the jurisdiction in which Party A is located, will not engage in any money laundering, terrorist financing, proliferation financing or other illegal or criminal activities, and will actively cooperate with Party B in customer identification and due diligence investigation, provide true, accurate and complete customer information, and comply with the management regulations of Party B related to anti-money laundering and anti-terrorist financing. Party B shall take necessary control measures against any customer who is reasonably suspected by Party B of engaging in laundering or terrorist financing in accordance with the anti-money

19 laundering regulations of the People’s Bank of China. Section 10 Covenants of Party A 10.1 Party A will promptly provide Party B with accounts and other documents truthfully reflecting its business and financial conditions on a regular basis or at the request of Party B from time to time, and guarantee the validity, authenticity and completeness of such documents. 10.2 During the loan term, in the event of any change in the business decisions of Party A, including without limitation share transfer, reorganization, large-sum financing, sale of assets, merger, consolidation, spin-off, conversion into a company limited by shares, bankruptcy and liquidation, joint venture, partnership, association, contractual lease, external investment, external guarantee, material increase in debt financing, change in business scope or registered capital, amendment of articles of association, or any other change that might affect the debt paying ability of Party A, Party A will give at least 30 days’ written notice to and obtain prior written consent from Party B, clarify the responsibility for repayment of the loan hereunder, or prepay the loan or offer other security to the satisfaction of Party B. 10.3 Party A covenants that Party B shall have the right to declare the loan hereunder to be immediately due and payable depending on the status of collection of funds by Party A. 10.4 Party A will actively cooperate Party B in the monitoring of its business situation, and payment of loan proceeds, and post-lending management, including investigation and monitoring of its general situation, application of the loan proceeds, management and operation, financial and business conditions, settlement of accounts receivable and payable, and related-party transactions through on-site and off-site inspections. If Party A hinders Party B from taking the relevant actions, Party A shall reimburse Party B for all expenses incurred in connection therewith. 10.5 Without the prior written consent of Party B, Party A will not transfer its debts hereunder, or do so in a disguised manner. 10.6 If Party A transfers, leases or disposes of all or part of its assets or operating revenues by creating any security interest over its debts (other than the debts hereunder) or otherwise, Party A will give at least 30 days’ written notice to and obtain prior written consent from Party B. 10.7 In the event of any of the following, Party A will notify Party B in writing and provide the relevant information within three days from such event occurs or is likely to occur: (1) any event of force majeure or default in relation to the loan hereunder; (2) any sanction, money laundering, terrorist financing, litigation, arbitration, criminal liability, administrative penalty, close-down, suspension of business,

20 reorganization, dissolution, petition for bankruptcy, acceptance of petition for bankruptcy, declaration of bankruptcy, revocation of business license, deregistration, or deterioration of financial condition in relation to Party A or its actual controller or controlling shareholder; (3) any material case or economic dispute involving, or administrative penalty imposed on, any member of the board of directors or senior officer of Party A; (4) any accident out of negligence occurred due to violation of the food safety, workplace safety, environmental protection or other applicable laws, rules, regulations or industrial standards, which has or might have an adverse effect on the ability of Party A to perform its obligations hereunder; (5) any violation of the provisions of this Contract, the relevant business contracts or the articles of associations of Party A; or (6) any other event that has an adverse effect on the repayment of the debts hereunder by Party A. 10.8 In the event that the guarantor loses all or part of its ability to guarantee the repayment of the loan hereunder due to close-down, suspension of business, petition for bankruptcy, acceptance of petition for bankruptcy, declaration of bankruptcy, dissolution, revocation of business license, deregistration, deterioration of financial condition or otherwise, or the value of the collateral, pledge or pledge right offered as security for the loan hereunder diminishes, Party A will provide new security to the satisfaction of Party B. 10.9 During the loan term, in the event of any change in the name, directors, authorized representative, person in charge or registered address of Party A, Party A will notify Party B in writing within three days after the change. 10.10 Party A will promptly notify Party B in writing of any related-party transaction that has occurred or is about to occur and represents 10% or more of the net assets of Party A, including without limitation the affiliation between the parties to the transaction, subject matter and nature of transaction, amount of transaction or relevant proportion, and pricing policy (including transactions at zero consideration or a nominal price). 10.11 The production, operation and related activities of Party A conform to the applicable industrial policies, fiscal and tax policies, market access, environmental impact assessment, energy saving and emission reduction, energy consumption and pollution control, resource utilization, land and urban planning, labor safety and other regulations. 10.12 Party A has truthfully disclosed the marital status of its actual controller (if any) to Party B. Section 11 Rights and obligations of the Parties 11.1 Party A shall have the right to utilize and use the loan proceeds within such term and

21 for such purpose as set forth herein. 11.2 Party A shall repay the principal of, and pay the interest and other fees on the loan in accordance with the provisions of this Contract. 11.3 Party A agrees with Party B to provide its credit information to the credit information basic database and/or any credit reference agency approved by the People’s Bank of China, or for other purposes to the extent permitted by this Contract, and authorizes and agrees with Party B to query, download, reproduce, print out or use its credit information on or from the credit information basic database and/or the websites of any credit reference agency approved by the People’s Bank of China, or other related entities or departments, for the purpose of this Contract, and use such information for the purposes related to this Contract to the extent permitted by the applicable laws and regulations. If Party A fails to repay the principal and interest on the loan hereunder in accordance with the provisions of this Contract, Party A shall be solely responsible for all adverse credit consequences arising therefrom. 11.4 Party A authorizes Party B to query, download, reproduce, print out and use the transaction information of Party A’s account, including without limitation transaction records and statements of account, for Party B’s purposes of review and examination, post-lending management or necessary notarization, submit such information to the competent juridical or regulatory authorities or arbitration tribunals as documentation or evidence, or use such information for other purposes permitted by this Contract. 11.5 Party A acknowledges and agrees that during the loan term, Party B has the right to transfer its claims hereunder and related security interests to any third party, and provide copies of this Contract and other documents related to the loan hereunder to the financial institutions that are prospective transferees to the extent necessary and permitted by the applicable laws and regulations, without further consent of Party A. If Party A provides the security itself, Party A agrees to continue to assume the liability for guarantee to the transferee of the claims of Party B hereunder after the transfer thereof. 11.6 Party A agrees that during the loan term, Party B has the right, in the capacity of a sponsor of credit asset securitization, transfer its claims hereunder and related security interests to a trustee to establish a special-purpose trust, and provide copies of this Contract and other documents related to the loan hereunder to such trust, for the purpose of offering asset-backed securities. If Party A provides the security itself, Party A agrees to continue to assume the liability for guarantee to such trustee. Party A agrees that, if Party B issues an announcement of transferring its claims hereunder and related security interests to a special- purpose trust on newspapers, its website or otherwise, Party B shall be deemed to have effectively given notice of such transfer to Party A. 11.7 If Party A provides the security itself, Party A understands and agrees that if Party

22 B transfers its claims hereunder to any third party or trust, Party A has the obligation to unconditionally cooperate with Party B in the security transfer registration (if necessary), and agrees to determine the allocation of costs through consultation with Party B and the relevant third party. In the absence of the security transfer registration, Party A undertakes to waive its defense in connection therewith. If Party A fails to cooperate with Party B in the security transfer registration in accordance with the applicable laws, regulations or provisions of the competent registration authority, or at the request of Party B, Party B shall have the right to hold Party A liable for breach of contract, and request Party A to bear all expenses incurred in connection therewith, including without limitation litigation costs, attorney’s fee and travel expenses. 11.8 Party B shall have the right to inspect, monitor and be informed of the business situation, use of the loan proceeds, related-party transactions and other relevant affairs of Party A at least once every quarter. 11.9 Party B shall have the right to adjust the amount of facility available and term of the loan hereunder, as it deems necessary taking into account the macro-economic situation, market conditions, changes in the credit standing, use of the loan proceeds and conditions of guarantee, related-party transactions and other conditions of Party A, and other relevant factors, and decide to cease making available the loan or suspend the business hereunder, or declare the loan already provided to Party A to be immediately due and payable, or request Party A to provide additional security, without constituting a breach of contract by Party B, to which Party A shall not raise any objection. 11.10 Party B shall have the right to request Party A to provide the relevant documents that may be required in its review of loan application. Party B shall keep confidential the data, documents and information provided by Party A, except that Party B may grant an access to or disclose such information according to the requirements of the applicable laws, regulations or competent government authorities, or share such information in accordance with the provisions hereof. 11.11 Party B shall have the right to declare all or part of the loan hereunder to be immediately due and payable depending on the status of collection of funds by Party A. 11.12 Party B shall have the right to participate in any large-sum financing, sale of assets, merger, spin-off, conversion into a company limited by shares, bankruptcy and liquidation, and other activities of Party A subject to the applicable laws, rules and regulations, and the provisions hereof. 11.13 Each Party shall be responsible for its own taxes and expenses in accordance with the provisions hereof. 11.14 Each Party may use the business, credit and other information of the other Party (including the shareholders and actual controller of the other Party) obtained as a result of business negotiations, execution and performance of this Contract, in a

23 reasonable manner according to its actual business needs, and share and disclose such information with or to its controlling shareholder or subsidiaries, provided that such Party shall procure the recipients of such information to perform the relevant obligation of confidentiality. Section 12 Account 12.1 Party A shall open the account set forth in Clause [(2)] below with Party B: (1) Dedicated domestic foreign currency loan account (account No.: [/]). With respect to such account, the Parties agree that: ① The loan proceeds hereunder shall be exclusively disbursed and paid through such account. Party B shall have the right to manage and control the payment of the loan proceeds, and monitor the use of the loan proceeds in accordance with the provisions of this Contract. ② [/] (2) Account of foreign entity (account No.: [8110200193101673721]). With respect to such account, the Parties agree that: ① The loan proceeds hereunder shall be exclusively disbursed and paid through such account. Party B shall have the right to manage and control the payment of the loan proceeds, and monitor the use of the loan proceeds in accordance with the provisions of this Contract. ② [/] (3) Settlement account (account No.: [/]). With respect to such account, the Parties agree that: [/] (4) Collection account (account No.: [/]). With respect to such account, the Parties agree that: ① Party A shall provide the information about the receipts and payments of such account, while Party B shall have the right to monitor the receipts and payments of such account. ② [/] (5) [/] account (account No.: [/]). With respect to such account, the Parties agree that: [/] Section 13 Default liability 13.1 After this Contract takes effect, each Party shall duly perform its obligations hereunder,

24 and assume the liability for breach of contract if it breaches any agreement, covenant or warranty contained herein. 13.2 Event of default 13.2.1 Party A breaches any representation, warranty or covenant contained herein, or any certificate or document provided by Party A to Party B in relation to the loan hereunder, or any representation or warranty made by Party A in Section 9 proves to be untrue, inaccurate, incomplete or intentionally misleading, or Party A breaches any covenant contained in Section 10 or obligation contained in Section 11; 13.2.2 Party A fails to pay the loan proceeds in accordance with Section 5.7; 13.2.3 Party A fails to use the loan proceeds for the purpose set forth herein, changes the purpose of the loan proceeds without permission, or misappropriates the loan proceeds, or uses the loan proceeds to engage in any illegal transaction; 13.2.4 Party A fails to repay the principal and pay the interest and other amounts due on the loan hereunder in accordance with the provisions hereof, or is, or declares that it is, unable to perform the obligations hereunder; 13.2.5 Party A conceals any material facts about its business and financial conditions from Party B, or exceeds the following financial indicators: [/]; 13.2.6 Party A obtains the loan hereunder using any false contract between it and its controlling shareholder or other affiliates; 13.2.7 Party A transfers its property at a low price or zero consideration, or acquires any property of another person at a remarkably unreasonable high price, or provides guarantee for the debts of another person, or waives or maliciously extends the term of payment of any debt owed by any third party, or is derelict in enforcing its claims or other rights; or the funds in any account of Party A (including without the collection account referred to above) fluctuate abnormally; or Party B determines through supervision and inspection that the profitability of Party A’s primary business is worsening which might affect the recovery by Party B of the debts hereunder; or the loan proceeds are used in any abnormal manner; or Party A violates the supervisory requirements of Party B with respect to its collection account; 13.2.8 Party A or its actual controller or controlling shareholder closes down, suspends business, petitions for or becomes a subject of petition for liquidation, dissolution or reorganization, enters the receivership, trusteeship or similar proceedings, petitions for or becomes a subject of petition for bankruptcy, is declared bankruptcy, has its business license revoked, is deregistered, or is involved in any private financing, litigation or arbitration proceedings or subject to any criminal or administrative penalty which might have an adverse effect on its business or financial condition, that in the opinion of Party B, affects or damages, or might affect or damage, its rights and interests hereunder; 13.2.9 Any change in the domicile, business scope, directors, authorized representative,

25 person in charge, managing partner or other registration particulars, or controlling shareholder or actual controller of Party A, or any external investment made by Party A, or other event on the part of Party A has an adverse effect on or threatens the recovery by Party B of the debts hereunder; 13.2.10 Party A suffers any financial loss or loss of assets (due to provision of external guarantee or otherwise), that in the opinion of Party B, affects or damages, or might affect or damage, its rights and interests hereunder; 13.2.11 The controlling shareholder or any affiliate of Party A falls into a business or financial crisis, or Party A enters into any related-party with its controlling shareholder or any affiliate, which affects the normal business operation of Party A, or has an adverse effect on or threatens the recovery by Party B of the debts hereunder; 13.2.12 The industry in which Party A operates undergoes any unfavorable change, which materially affects or threatens the recovery by Party B of the debts hereunder (such event shall not constitute an event of force majeure); 13.2.13 Party A defaults under other debt documents and fails to cure such default within the applicable grace period, as a result of which: (1) the debts owed by Party A under such other debt documents have been, or may be, declared immediately due and payable; or (2) though the debts owed by Party A under such other debt documents have not been, and will not be, declared immediately due and payable, Party A has already defaulted on payment; for the purpose of this Section 13.2.13, other debt documents mean the loan contracts and security documents entered into between Party A and any creditor (including Party B or any third party), or documents in relation to any bonds offered by Party A publicly or privately; 13.2.14 Party A refuses any supervision or inspection by Party B of its use of the loan proceeds and related business and financial activities; 13.2.15 Any shareholder, director, authorized representative, person in charge, senior executive or actual controller of Party A: (i) is missing or unreachable; (ii) is suspected of committing any crime, such as embezzlement, acceptance of bribe, malpractices or illegal operation; or (iii) engages in any illegal fund raising, that in the opinion of Party B, affects or damages, or might affect or damage, its rights and interests hereunder; 13.2.16 The guarantor of Party A violates any provisions of or otherwise breaches the guarantee contract, or the guarantor (if he is an individual) or its actual controller (if it is a corporate) is missing or unreachable; 13.2.17 The collateral hereunder is attached, seized, declared lost, stopped from payment, or subject to other compulsory actions, or title dispute, is or might be encroached upon by any third party, or its security or integrity is or might be adversely affected;

26 13.2.18 Party A lends the loan proceeds to other persons, or use the loan proceeds to purchase other financial products for purpose of arbitrage; 13.2.19 Party A violates the food safety, workplace safety, environmental protection or other applicable laws, rules, regulations or industrial standards, leading to any accident out of negligence; 13.2.20 Party A otherwise threatens or damages, or might threaten or damage, the rights and interests of Party B, or otherwise violates the provisions of this Contract; 13.2.21 Party A or its actual controller or controlling shareholder is subject to any sanction or engages in any money laundering or terrorist financing; or 13.2.22 Others: [/]. 13.3 Upon the occurrence of any event of default referred to above, Party B shall have the right to take one or a combination of the following remedial actions: 13.3.1 without the consent of Party A, to directly and unilaterally stop or suspend the disbursement of the loan proceeds that have not yet been utilized by Party A (including the loan proceeds for which Party A has submitted a drawdown request but has not yet drawn down), or adjust the method of payment of the loan proceeds or loan interest rate, or impose default interest, or reduce the amount of facility available to Party A, or request Party A to provide additional security; 13.3.2 without the consent of Party A, to directly and unilaterally declare all of the loan proceeds hereunder immediately due and payable, whereupon they shall be repaid by Party A on the date that Party B requests Party A to do so; 13.3.3 to immediately enforce the mortgage, pledge and other security interests under this Contract and the security documents; 13.3.4 to freeze any account opened by Party A at the China CITIC Bank, and directly deduct the funds in such account to set off the debts owed by Party A to Party B hereunder, without further consent of Party A; 13.3.5 to control any misappropriation of funds by Party A, and if Party A is found to have misappropriated any funds, request Party A to make rectifications within a prescribed time limit, or downgrade Party A in terms of the internal category of lending risk, or take other actions against Party A; and/or 13.3.6 exercise such other rights and remedies as may be available under the applicable laws, rules and regulations. 13.4 Where Party A fails to repay any principal in accordance with the provisions of this Contract, without prejudice to the rights available to Party B under Section 13.3 above, Party B shall have the right to impose default interest at the loan interest rate applicable then, plus [50%] of such loan interest rate / plus [/] basic points (1 basic point = 0.01%), on the outstanding principal so long as such principal remains unpaid. Party A agrees that the default interest shall be in such amount as calculated by Party B.

27 13.5 If Party A fails to use the loan proceeds for the purpose set forth herein, without prejudice to the rights available to Party B under Section 13.3 above, Party B shall have the right to impose default interest at the loan interest rate applicable then, plus [100%] of such loan interest rate / plus [/] basic points (1 basic point = 0.01%), on the portion of the loan proceeds misappropriated so long as such loan proceeds are misappropriated. Party A agrees that the default interest shall be in such amount as calculated by Party B. 13.6 If any loan proceeds are overdue and also fail to be used for the purpose set forth herein, Party B shall have the right to impose default interest at the higher default interest rate set forth in Sections 13.4 and 13.5. 13.7 If Party A fails to pay any interest (including the interest corresponding to all or such portion of the principal that Party B declares to be immediately due and payable) and default interest, compound interest shall accrue on the outstanding interest at the default interest rate and in accordance with the interest settlement method set forth herein, from the due date till the date of actual payment. If any loan proceeds are overdue and also fail to be used for the purpose set forth herein, compound interest shall accrue at the higher interest rate applicable, rather than at both interest rates applicable. 13.8 The provisions of Section 6.3 shall also apply to the default interest and compound interest hereunder. 13.9 Party A shall be responsible for all costs incurred by Party B in recovering the debts hereunder, including without limitation litigation costs, arbitration costs, enforcement costs, insurance expenses, travel expenses, attorney’s fees, property preservation fees, notarial and certification fees, translation fees, and evaluation and auction fees. Section 14 Continuation of obligations 14.1 All obligations of Party A hereunder shall continue in effect and be fully binding upon its successors, receivers, assigns and the surviving entities after any consolidation, reorganization, or change in name or otherwise on its part, and shall not be affected by any dispute, claim, proceedings, order of any higher authority, or any contract or document entered into between Party A and any individual or corporate, or any bankruptcy, insolvency, disqualification, amendment of articles of association, or any other substantial change on the part of Party A. Section 15 Notarization 15.1 If any Party requests notarization, such request shall be referred to a notarial office designated by the country. 15.2 If Party B requests the issuance of an enforceable notarial certificate, Party A agrees that Party B may request a notarial office to issue an enforceable notarial certificate in respect of this Contract, at the cost of [/]. If the principal and interest on the loan

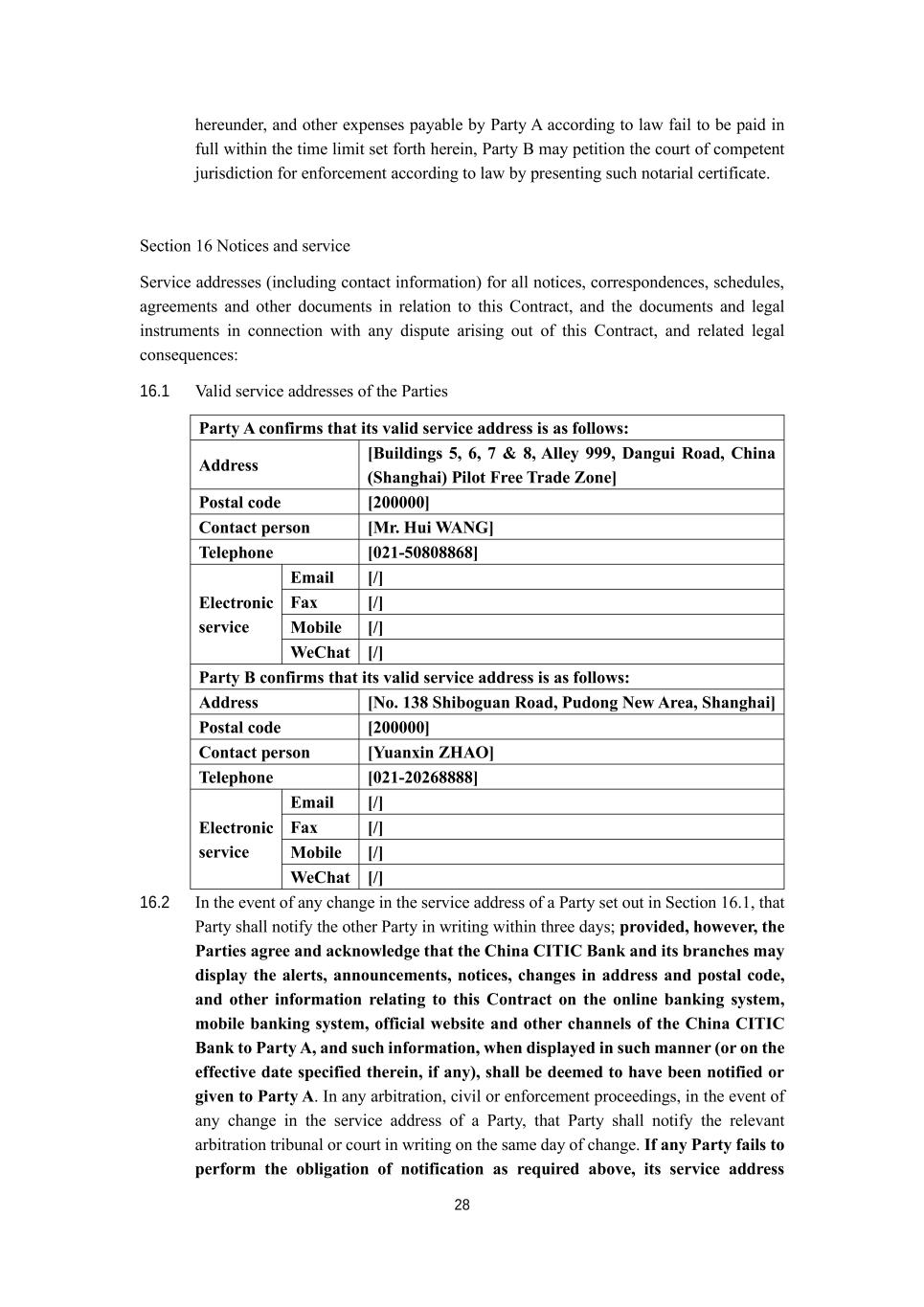

28 hereunder, and other expenses payable by Party A according to law fail to be paid in full within the time limit set forth herein, Party B may petition the court of competent jurisdiction for enforcement according to law by presenting such notarial certificate. Section 16 Notices and service Service addresses (including contact information) for all notices, correspondences, schedules, agreements and other documents in relation to this Contract, and the documents and legal instruments in connection with any dispute arising out of this Contract, and related legal consequences: 16.1 Valid service addresses of the Parties Party A confirms that its valid service address is as follows: Address [Buildings 5, 6, 7 & 8, Alley 999, Dangui Road, China (Shanghai) Pilot Free Trade Zone] Postal code [200000] Contact person [Mr. Hui WANG] Telephone [021-50808868] Electronic service Email [/] Fax [/] Mobile [/] WeChat [/] Party B confirms that its valid service address is as follows: Address [No. 138 Shiboguan Road, Pudong New Area, Shanghai] Postal code [200000] Contact person [Yuanxin ZHAO] Telephone [021-20268888] Electronic service Email [/] Fax [/] Mobile [/] WeChat [/] 16.2 In the event of any change in the service address of a Party set out in Section 16.1, that Party shall notify the other Party in writing within three days; provided, however, the Parties agree and acknowledge that the China CITIC Bank and its branches may display the alerts, announcements, notices, changes in address and postal code, and other information relating to this Contract on the online banking system, mobile banking system, official website and other channels of the China CITIC Bank to Party A, and such information, when displayed in such manner (or on the effective date specified therein, if any), shall be deemed to have been notified or given to Party A. In any arbitration, civil or enforcement proceedings, in the event of any change in the service address of a Party, that Party shall notify the relevant arbitration tribunal or court in writing on the same day of change. If any Party fails to perform the obligation of notification as required above, its service address

29 originally confirmed shall still be deemed its valid service address. 16.3 The service address confirmed by a Party in this Section 16 shall apply to all notices, correspondences, schedules, agreements and other documents in relation to this Contract, and the documents and instruments in connection with any dispute arising out of this Contract to be served on that Party, including case documents and legal instruments served at first trial, second trial, retrial, enforcement (including disposal of collateral) and other stages after any dispute enters the notarization, arbitration or civil proceedings, including without limitation all procedural instruments (such as complaints, requests for arbitration, notices of acceptance of case, notices to answer, summons, notices to produce evidence and payment notices), and legal instruments (such as arbitral awards, judgments, ruling and mediation statements). Except as otherwise provided in Section 16.2, any document delivered by a Party to the other Party at its service address shall be deemed to have been effectively served on the following dates: (1) if sent by post, including express delivery, ordinary mail and registered mail, three days after the date of posting; (2) if sent by telephone, email, WeChat or other means of electronic communication, on the date of transmission; (3) if delivered in person, on the date it is signed for by the recipient, or if it is refused by the recipient or no one comes out to receive it, when it is placed by the deliveryman at its address after recording the process of delivery by photo or video; or (4) if multiple methods of delivery are used, when it is served on the other Party at the earliest time as set forth above. If any legal instrument, enforcement instrument, arbitral award, enforcement certificate issued by a notarial office, or any other instrument or document fails to be served on any Party at all or in time, or actually received by that Party due to inaccurate service address provided or confirmed by that Party, failure of that Party to promptly notify the other Party or the relevant court, arbitration tribunal or notarial office of any change in its service address in accordance with the established procedures, or refusal by that Party or its designated recipient, such instrument or document shall still be deemed to have been effectively served on that Party when the other Party or the relevant court, arbitration tribunal or notarial office has delivered the same in accordance with the rules of service set forth above, and that Party shall assume all legal consequences arising therefrom. The Parties agree that the relevant court, arbitration tribunal or notarial office may use one or multiple methods to deliver any legal instrument, and such legal instrument shall be deemed to have been effectively served at the earliest time as set forth above. 16.4 The provisions of this Section 16 are special terms explicitly agreed upon by the Parties, and independent of other provisions contained herein. If any other

30 provision of this Contract is held invalid or revoked by any court, arbitration tribunal or other authority of competent jurisdiction due to any reason, the provisions of this Section 16 shall remain in effect. In the event of any conflict between the provisions of this Section 16 and other provisions hereof, the provisions of this Section 16 shall prevail. Section 17 Supplemental provisions [/] In the event of any conflict between the provisions of this Section 17 and other provisions hereof, the provisions of this Section 17 shall prevail. Section 18 Governing law and dispute resolution 18.1 The execution, performance, interpretation and other matters in respect of this Contract shall be governed by the laws of the People’s Republic of China (solely for the purpose of this Contract, excluding the laws of the Hong Kong Special Administrative Region, the Macau Special Administrative Region and Taiwan Region). 18.2 Any dispute arising out of or in connection with this Contract shall be settled by the Parties through consultation. In case no settlement can be reached, the Parties agree to settle such dispute in accordance with Clause [1] below: (1) to refer such dispute to the [Shanghai International Arbitration Center] for resolution by arbitration in [Shanghai] in accordance with the arbitration rules of the [Shanghai International Arbitration Center] in effect when the request for arbitration is submitted. (2) to refer such dispute to the people’s court of competent jurisdiction in the place where Party B is domiciled. Section 19 Event of force majeure 19.1 For the purpose of this Contract, event of force majeure means any objective circumstance unforeseeable, unavoidable and insurmountable that prevents any Party from performing this Contract in a normal manner, including without limitation war, strike, martial law, severe flood, fire, storm, earthquake, or other incident constituting an event of force majeure as agreed upon by the Parties. 19.2 If any Party is prevented by any event of force majeure from performing this Contract, that Party may be relieved from all or part of its duties and obligations hereunder depending on the effect of such event of force majeure, provided that the affected Party shall promptly notify the other Party in writing, in order to reduce the losses that might