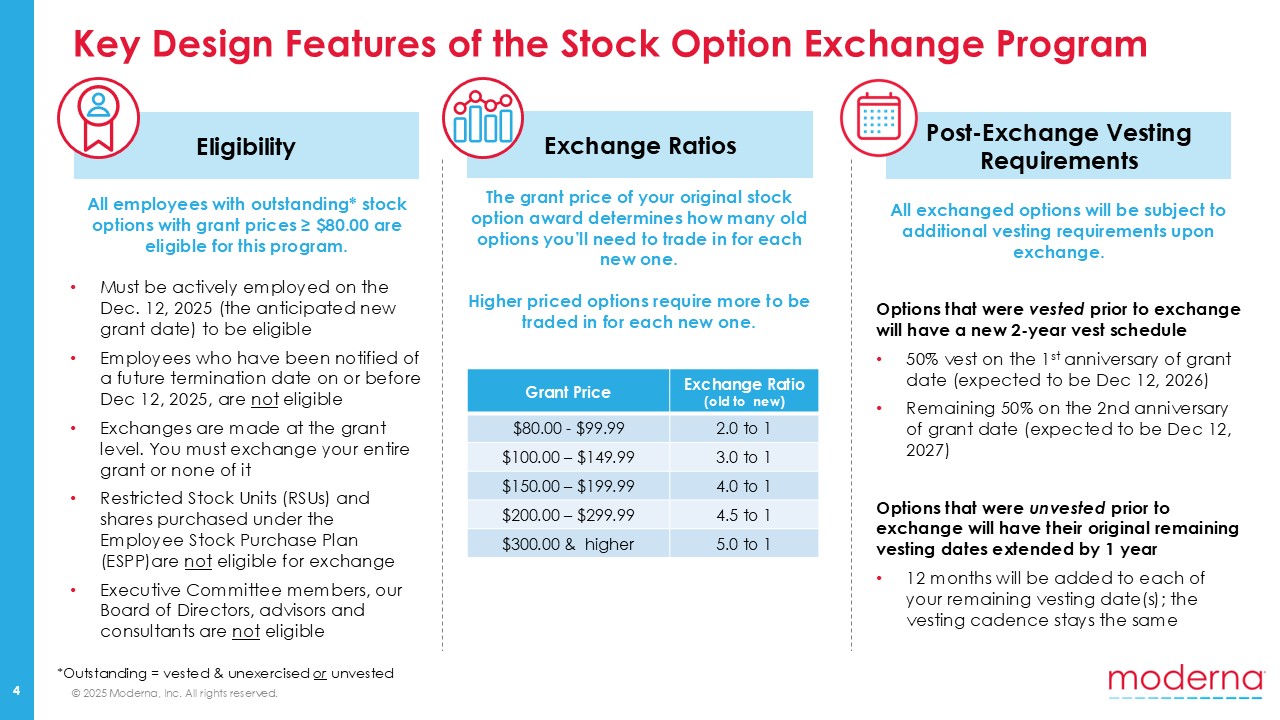

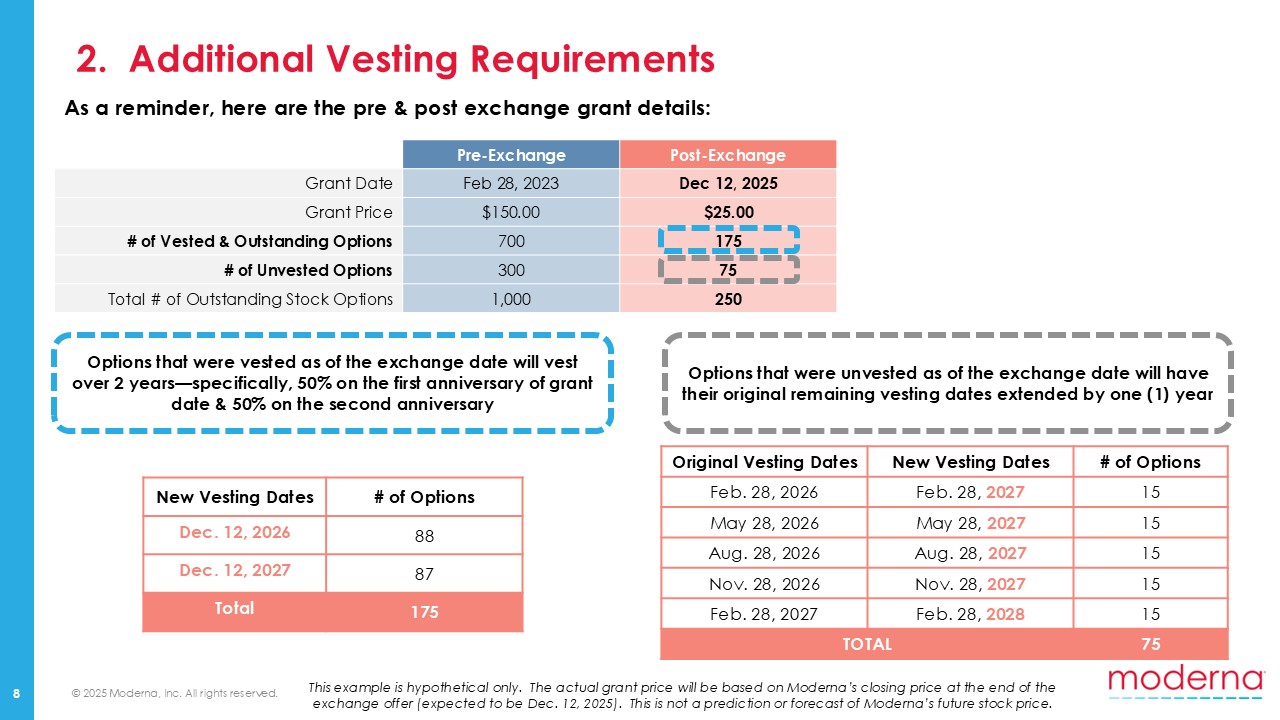

2. Additional Vesting Requirements 8 Options that were vested as of the exchange

date will vest over 2 years—specifically, 50% on the first anniversary of grant date & 50% on the second anniversary Options that were unvested as of the exchange date will have their original remaining vesting dates extended by one (1)

year Original Vesting Dates New Vesting Dates # of Options Feb. 28, 2026 Feb. 28, 2027 15 May 28, 2026 May 28, 2027 15 Aug. 28, 2026 Aug. 28, 2027 15 Nov. 28, 2026 Nov. 28, 2027 15 Feb. 28, 2027 Feb. 28, 2028 15 TOTAL 75 As

a reminder, here are the pre & post exchange grant details: Pre-Exchange Post-Exchange Grant Date Feb 28, 2023 Dec 12, 2025 Grant Price $150.00 $25.00 # of Vested & Outstanding Options 700 175 # of Unvested

Options 300 75 Total # of Outstanding Stock Options 1,000 250 New Vesting Dates # of Options Dec. 12, 2026 88 Dec. 12, 2027 87 Total 175 This example is hypothetical only. The actual grant price will be based on Moderna’s closing

price at the end of the exchange offer (expected to be Dec. 12, 2025). This is not a prediction or forecast of Moderna’s future stock price.

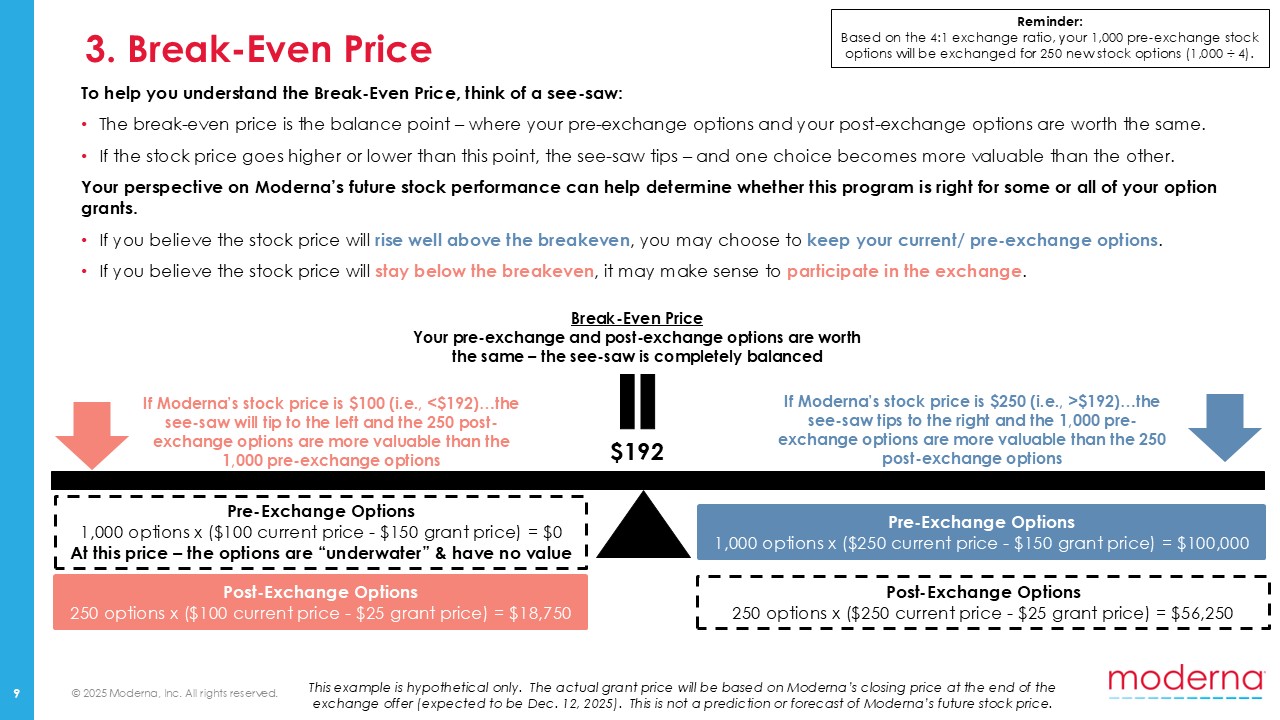

3. Break-Even Price 9 Break-Even Price Your pre-exchange and post-exchange

options are worth the same – the see-saw is completely balanced $192 If Moderna’s stock price is $100 (i.e., <$192)…the see-saw will tip to the left and the 250 post-exchange options are more valuable than the 1,000 pre-exchange

options If Moderna’s stock price is $250 (i.e., >$192)…the see-saw tips to the right and the 1,000 pre-exchange options are more valuable than the 250 post-exchange options Post-Exchange Options 250 options x ($100 current price - $25

grant price) = $18,750 Pre-Exchange Options 1,000 options x ($250 current price - $150 grant price) = $100,000 Post-Exchange Options 250 options x ($250 current price - $25 grant price) = $56,250 Pre-Exchange Options 1,000 options x ($100

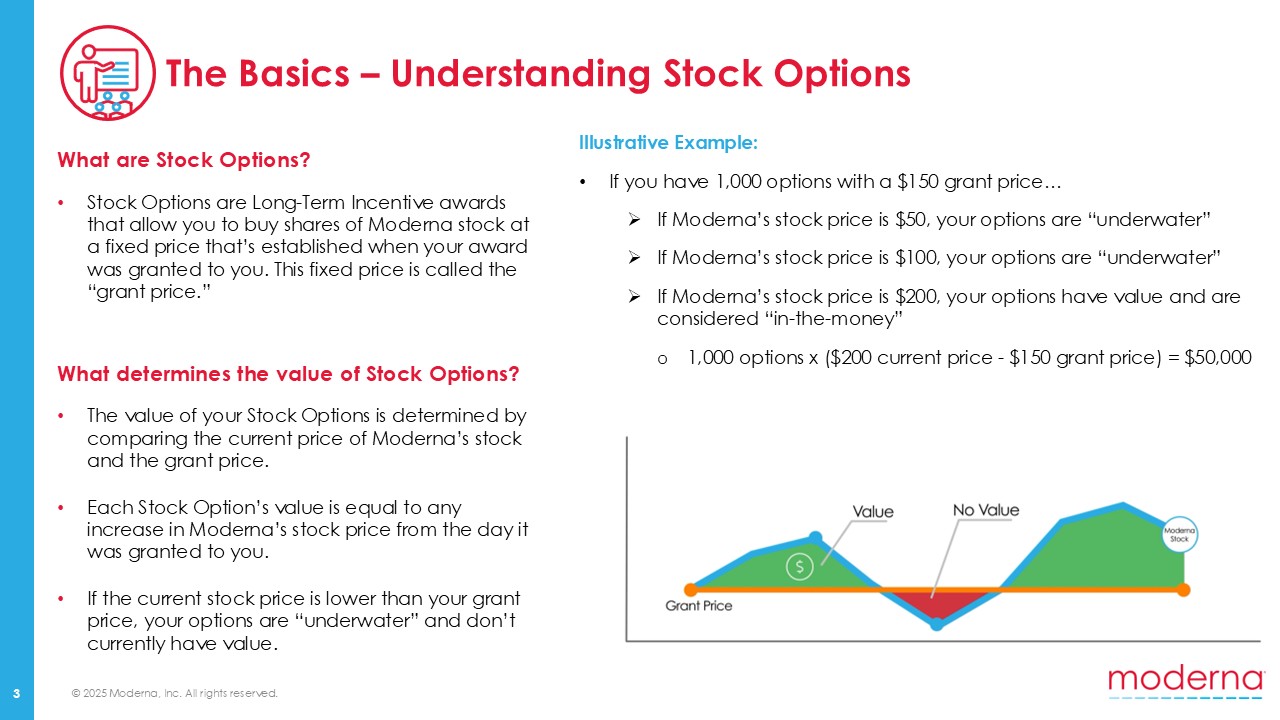

current price - $150 grant price) = $0 At this price – the options are “underwater” & have no value To help you understand the Break-Even Price, think of a see-saw: The break-even price is the balance point – where your pre-exchange

options and your post-exchange options are worth the same. If the stock price goes higher or lower than this point, the see-saw tips – and one choice becomes more valuable than the other. Your perspective on Moderna’s future stock performance

can help determine whether this program is right for some or all of your option grants. If you believe the stock price will rise well above the breakeven, you may choose to keep your current/ pre-exchange options. If you believe the stock

price will stay below the breakeven, it may make sense to participate in the exchange. This example is hypothetical only. The actual grant price will be based on Moderna’s closing price at the end of the exchange offer (expected to be Dec. 12,

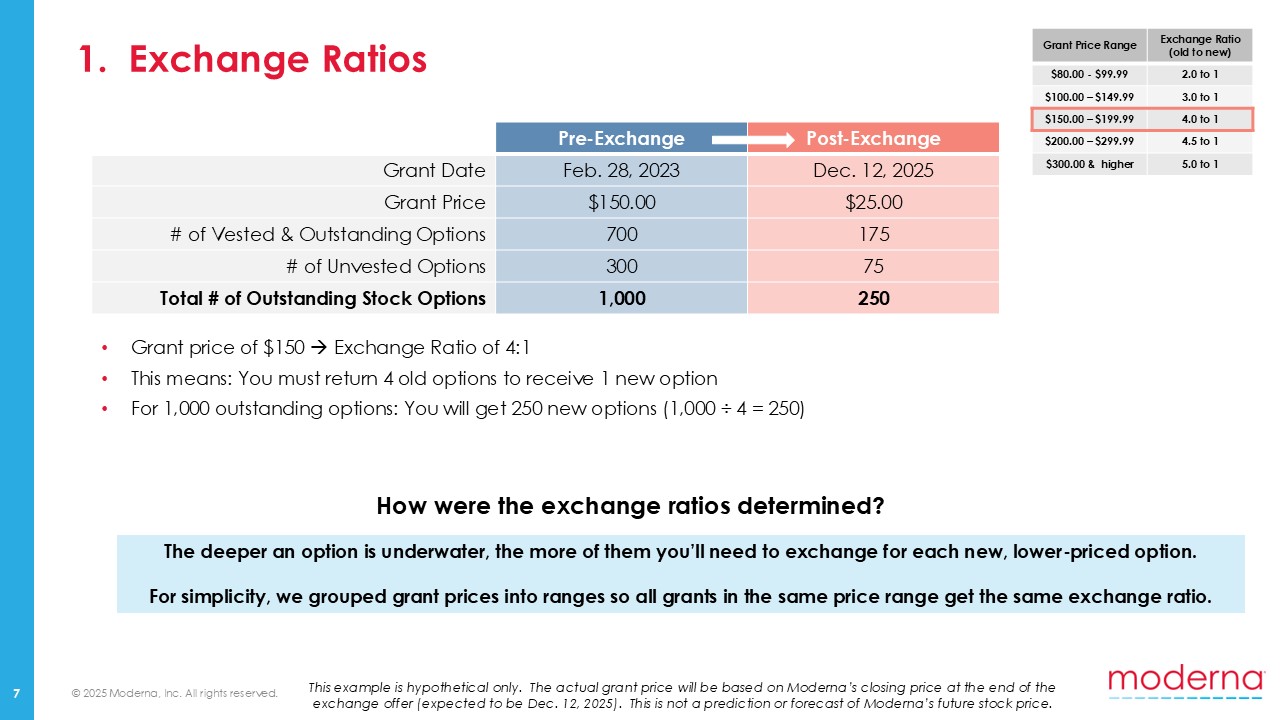

2025). This is not a prediction or forecast of Moderna’s future stock price. Reminder: Based on the 4:1 exchange ratio, your 1,000 pre-exchange stock options will be exchanged for 250 new stock options (1,000 ÷ 4).

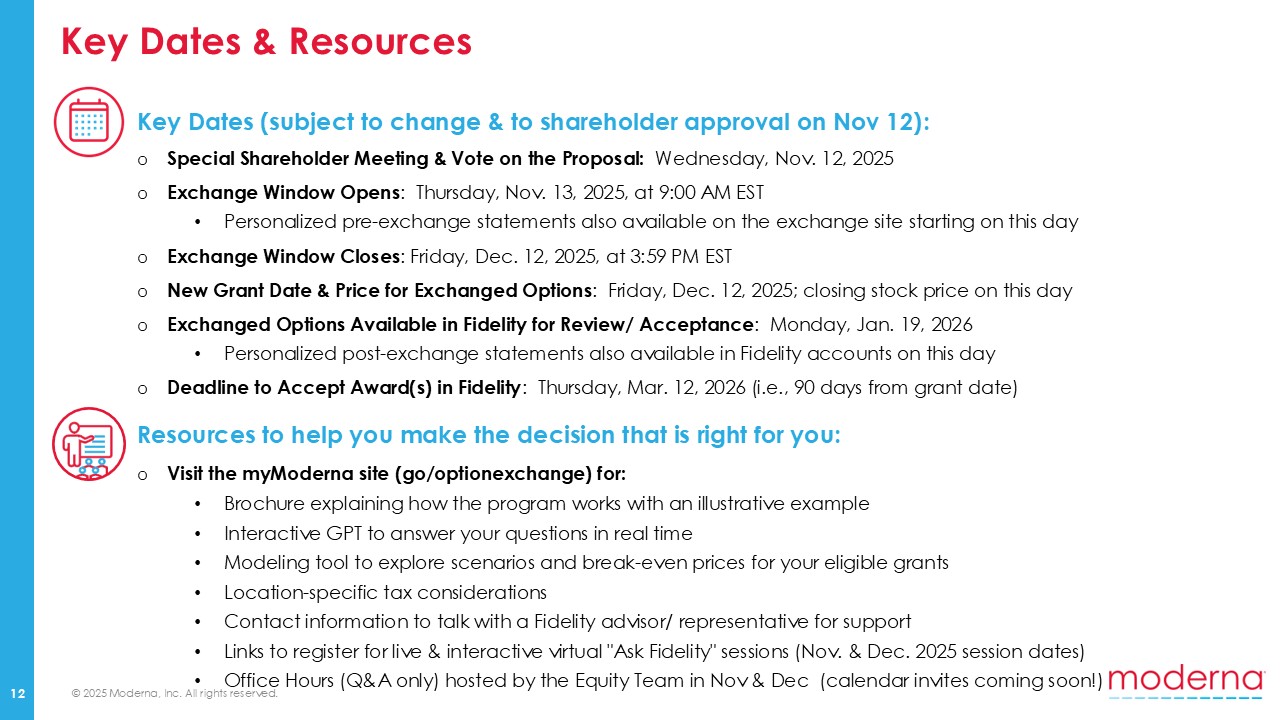

Key Dates & Resources Key Dates (subject to change & to shareholder

approval on Nov 12): Special Shareholder Meeting & Vote on the Proposal: Wednesday, Nov. 12, 2025 Exchange Window Opens: Thursday, Nov. 13, 2025, at 9:00 AM EST Personalized pre-exchange statements also available on the exchange site

starting on this day Exchange Window Closes: Friday, Dec. 12, 2025, at 3:59 PM EST New Grant Date & Price for Exchanged Options: Friday, Dec. 12, 2025; closing stock price on this day Exchanged Options Available in Fidelity for Review/

Acceptance: Monday, Jan. 19, 2026 Personalized post-exchange statements also available in Fidelity accounts on this day Deadline to Accept Award(s) in Fidelity: Thursday, Mar. 12, 2026 (i.e., 90 days from grant date) Resources to help you

make the decision that is right for you: Visit the myModerna site (go/optionexchange) for: Brochure explaining how the program works with an illustrative example Interactive GPT to answer your questions in real time Modeling tool to explore

scenarios and break-even prices for your eligible grants Location-specific tax considerations Contact information to talk with a Fidelity advisor/ representative for support Links to register for live & interactive virtual “Ask

Fidelity” sessions (Nov. & Dec. 2025 session dates) Office Hours (Q&A only) hosted by the Equity Team in Nov & Dec (calendar invites coming soon!) 12

CEO Video Script (Approx. 2 minutes)

Hello Team. Stéphane here.

I want to take a moment to talk about something important: a step that reflects our deep belief in our team, and our shared future at Moderna.

With the support of our Executive Committee and Board of Directors, we are proposing a one-time stock option exchange program.

It’s a rare and meaningful opportunity, and one that we’re very excited to be pursuing.

At Moderna, equity is an important part of how we recognize your impact and share in the value we create together.

Over the past few years, many of the stock options we’ve granted are currently “underwater” — meaning their grant price is higher than our current stock price.

These options were meant to reward your incredible work, and to give you a stake in our success.

But today, they no longer provide the value we intended when we first granted them.

This one-time stock option exchange program, if approved by our shareholders, will change that.

It gives employees the chance to trade in eligible older options for fewer new ones —

priced at the market value on the new grant date.

That means your new options will once again have the potential to grow as Moderna grows.

This program is completely voluntary and was designed thoughtfully… to be fair, transparent, and forward-looking.

It supports our ongoing efforts to retain and motivate employees, and to help ensure our long-term equity program continues to reward your commitment and performance.

You will find key dates, on-demand resources, and even a modeling tool on myModerna

to help you make the decision that’s right for you.

In closing, I’m incredibly proud of what we’re building together.

Your talent, your resilience, and your belief in our mission are what make Moderna strong and enduring.

Together, we are continuing to deliver on the promise of mRNA for people around the world — and changing the future of medicine.

Thank you for all that you do, every day.