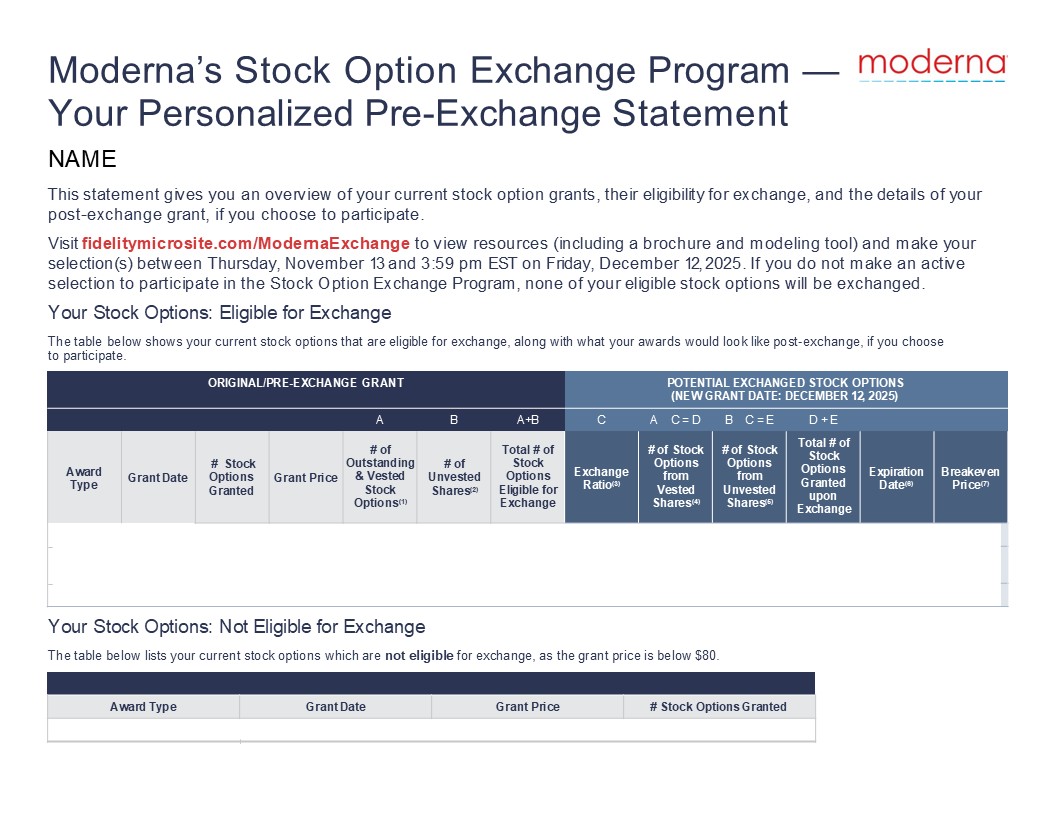

(1) Includes the # of stock options that are outstanding (i.e., not exercised) and

vested as of December 12, 2025. (2) Includes the # of stock options that are unvested as of December 12, 2025. (3) Indicates the ratio of stock options you must exchange for each new stock option granted. For example, if the exchange ratio is

2:1 and you have 100 outstanding stock options, you will receive 50 stock options post-exchange (100 stock options divided by 2). (4) Represents the # of stock options you would receive post-exchange, derived from the # of outstanding &

vested stock options. The vesting schedule will be as follows: 50% will vest on the 1st anniversary of the New Grant Date and 50% will vest on the 2nd anniversary of the New Grant Date. All share calculations will be rounded down to the nearest

whole share; no fractional shares will be granted. (5) Represents the # of stock options you would receive post-exchange, derived from the # of unvested stock options. Your original vesting schedule will be extended by one year (i.e., each

vesting date will be pushed out by 12 months). All share calculations will be rounded down to the nearest whole share; no fractional shares will be granted. (6) Represents the date you must exercise your stock options before they expire (subject

to continued employment). This is based on the original/pre-exchange grant date. (7) Represents the stock price at which the value of your original grant and the value of your post-exchange grant would be equal. For illustrative purposes, we

have assumed a new grant price of $25. This assumption should not be viewed as a prediction of Moderna’s future stock price. You may use the modeling tool to explore different grant price scenarios and break-even prices. All selected grants will

be exchanged effective December 12, 2025 (i.e., the new grant date) at a grant price equal to Moderna’s closing stock price on that day, unless Moderna is required to extend the option exchange closing date to a later date. You must be actively

employed on December 12, 2025 to be eligible to participate. In addition, if you receive notification of a future termination date on or before December 12, 2025, you are not eligible to participate. All stock options that are selected for

exchange will be cancelled and new stock options will be granted to replace them. The new stock options will have distinct characteristics, including a new grant date, grant price, and vesting schedule, as indicated in this statement. In

coordination with Moderna's tax advisors, Moderna has reviewed the tax implications of the cancellation and re-grant of options in the exchange for locations with eligible outstanding stock option grants. It is generally expected that the

exchange does not result in a taxable event, except as otherwise noted. However, this information is being provided for general purposes only and is not intended to serve as personal tax advice. Since each employee’s financial circumstance is

different, we strongly recommend that you consult with your personal tax or financial advisor regarding your personal circumstances, and for answers to your specific financial planning and tax questions. [If you choose to participate in the

stock option exchange program, this will trigger a taxing event (including both vested and unvested stock options) because the stock option exchange is expected to result in a disposal of the old options in exchange for the new options, giving

risk to an Employee Share Scheme (ESS) taxing point. Moderna will provide you with an ESS statement that includes an estimate of the income from your option awards and provide an ESS annual report to the Australian Taxation Office which includes

similar information to that contained in your ESS Statement. Any taxes will be required to be settled by you when you file your annual tax return. Please refer to the FAQs document on go/optionexchange for additional details.] [For Canada, any

QSO/NSO split in Fidelity is treated as one award. In this exchange, those parts will be treated as one grant and exchanged together - partial exchanges are not permitted. Any exchanged options will then be reclassified into QSO/NSO portions as

applicable. Please refer to the FAQs document on go/optionexchange for additional details. Fidelity Stock Plan Services, LLC, provides recordkeeping and/or administrative services to your company's equity compensation plan, in addition to any

services provided directly to the plan by your company or its service providers.] [If you choose to participate in the stock option exchange program, that decision may result in a taxable event for the vested portions of stock options you

exchange (not the unvested portions). Any taxable income arising from the exchange will be subject to a progressive tax rate of up to 49.5% (in 2025) and processed through payroll. Note that, as no proceeds will be realized from the exchange,

this will result in a dry tax charge, meaning that you need to pay the Dutch Wage taxes due upfront. Any Dutch Wage taxes due will be withheld from your paycheck. Moderna is required to withhold and remit the Dutch Wage taxes to the Dutch tax

authorities. Please refer to the FAQs document on go/optionexchange for additional details.] [If you have worked in more than one country, tax treatment may vary for your original and new option grants based on local laws.] Moderna and Stock

Plan Services, LLC Investments are not affiliated. Fidelity Stock Plan Services, LLC © 2025 FMR LLC. All rights reserved. 1224485.1.0