“Permitted Encumbrances” means (a) statutory Encumbrances for Taxes, assessments or other charges by Governmental Entities not yet due and payable or being contested in good faith and for which adequate reserves have been established in the balance sheet of the Company and its Subsidiaries as of the Company Balance Sheet Date (including the notes thereto) included in the Company SEC Documents, (b) mechanics’, materialmen’s, carriers’, workmen’s, warehouseman’s, repairmen’s, and similar Encumbrances granted or that arise in the ordinary course of business with respect to liabilities that are not yet due and payable or being contested in good faith and for which adequate reserves have been established in the balance sheet of the Company and its Subsidiaries as of the Company Balance Sheet Date (including the notes thereto) included in the Company SEC Documents, (c) Encumbrances securing payment, or any obligation, of the Company or any Subsidiary thereof with respect to outstanding Indebtedness (i) that is not for borrowed money so long as there is no default under such Indebtedness or (ii) under the Company Credit Facility, (d) Encumbrances granted in the ordinary course of business in connection with the insurance or reinsurance business of the Company or any Subsidiary thereof on cash and cash equivalent instruments or other investments, including Encumbrances granted (i) in connection with (A) pledges of such instruments or investments to collateralize letters of credit delivered by the Company or any Subsidiary thereof, (B) the creation of trust funds for the benefit of ceding companies, (C) underwriting activities of the Company or any Subsidiary thereof, (D) deposit liabilities, (E) statutory deposits, (F) ordinary-course securities lending, repurchase, reverse repurchase, and short-sale transactions and (G) premium trust funds and other funds held under trust in connection with conducting the business of the Company or any Subsidiary thereof and (ii) with respect to investment securities held in the name of a nominee, custodian, depository, clearinghouse, or other record owner, (e) pledges or deposits by the Company or any Subsidiary thereof under workmen’s compensation Laws, unemployment insurance Laws, or similar legislation, or good faith deposits in connection with bids, tenders, Contracts, or leases to which such entity is a party, or deposits to secure public or statutory obligations of such entity or to secure surety or appeal bonds to which such entity is a party, or deposits as security for contested Taxes, in each case incurred or made in the ordinary course of business, (f) zoning, building codes, entitlement, and other land use and environmental regulations by any Governmental Entity, (g) non-exclusive licenses of Intellectual Property granted in the ordinary course of business, (h) easements, rights-of-way, encroachments, restrictions, conditions and other similar Encumbrances incurred or suffered in the ordinary course of business and that, individually or in the aggregate, have not materially impaired, and would not be reasonably expected to materially impair, the use (or contemplated use), utility or value of the applicable real property or otherwise materially impair the present or contemplated business operations at such location, (i) transfer restrictions imposed by Law and (j) such other Encumbrances or imperfections that are not material in amount or do not materially detract from the value of or materially impair the existing use of the property or asset affected by such Encumbrance or imperfection.

“Person” means any individual, partnership, limited liability company, corporation, joint stock company, trust, estate, joint venture, Governmental Entity, association or unincorporated organization, or any other form of business or professional entity.

“Personal Information” means any information that identifies, is reasonably capable of being used to identify or is otherwise related to an individual person, including all information that meets any definition of “personal information” or any similar term provided by any applicable Law (e.g., “personal data,” “personally identifiable information” or “PII”).

“Premium Cap” has the meaning set forth in Section 6.8(c).

“Pro Rata Bonus Amount” has the meaning set forth in Section 6.7(d).

“Proceeding” means any action, demand, litigation, suit, charge, claim, complaint, audit, investigation, inquiry, hearing, originating application to a tribunal, arbitration or other proceeding at law or in equity or order or ruling, in each case whether civil, criminal or administrative.

“Producer” means any producer, broker, agent, general agent, sub-agent, managing general agent, master broker agency, broker general agency, wholesale broker, financial specialist, independent contractor, consultant, insurance solicitor or other Person responsible for soliciting, negotiating, selling, marketing or producing the Insurance Contracts.

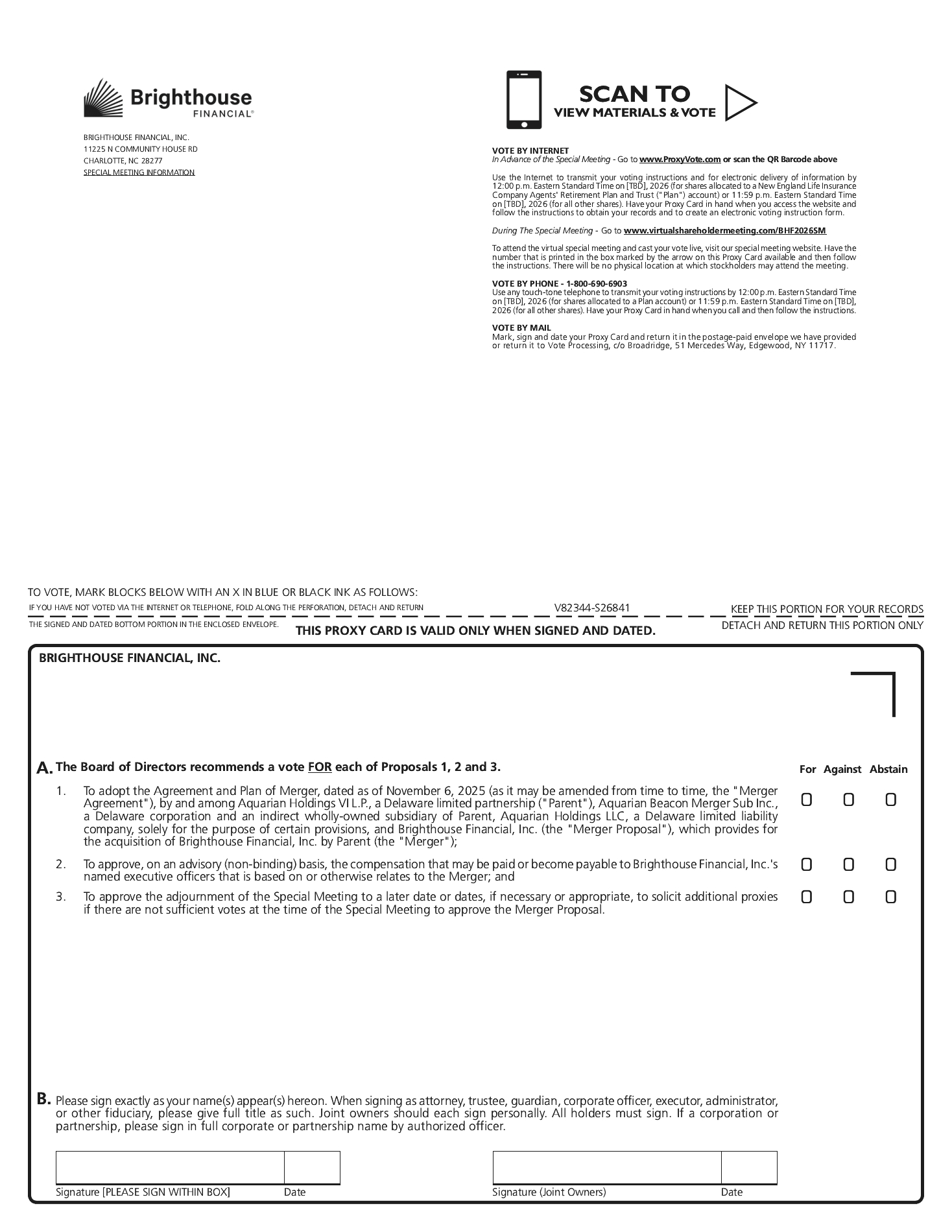

“Proxy Statement” means the proxy statement on Schedule 14A relating to the Company Stockholder Approval, including any amendments and supplements thereto.

“Proxy Statement Clearance Date” has the meaning set forth in Section 6.4(a).

“Registered Fund” means any advisory client of the RIA Subsidiary that is registered as an investment company under the Investment Company Act.

“Registered Intellectual Property” has the meaning set forth in Section 4.20(a).

“Reinsurance Agreement” has the meaning set forth in Section 4.28(a).

“Related Person Transaction” has the meaning set forth in Section 4.26.

“Release” means any release, spill, emission, leaking, pumping, pouring, emptying, escape, injection, deposit, disposal, discharge, dispersal, dumping, leaching or migration of Hazardous Substances into or through the indoor or outdoor environment, including the movement of Hazardous Substances through or in the air, soil, surface water, or groundwater.

“Representatives” means, with respect to any Person, the officers, directors, employees, accountants, consultants, agents, legal counsel, financial advisors and other representatives of such Person.