Proxy

Statement

Notice of Annual Meeting of Stockholders I May 15, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant☒

Filed by a Party other than the Registrant☐

Check the appropriate box:

☐ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material Pursuant to § 240.14a-12 |

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ |

No fee required |

☐ |

Fee paid previously with preliminary materials |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Table of Contents

1 |

|

7 |

|

10 |

|

16 |

|

Director Succession Planning and Board |

17 |

19 |

|

19 |

|

21 |

|

21 |

|

22 |

|

23 |

|

Committees of the Board of Directors; Meetings of the Board of Directors and its Committees |

24 |

25 |

|

26 |

|

28 |

|

28 |

|

29 |

|

29 |

|

29 |

|

30 |

|

30 |

|

30 |

|

30 |

|

31 |

|

31 |

|

35 |

|

Proposal No. 2—Ratification of Independent |

43 |

43 |

|

Pre-Approval Policy for Services of |

44 |

45 |

|

Proposal No. 3—Non-Binding Advisory Vote |

47 |

48 |

|

48 |

|

48 |

|

49 |

|

50 |

|

51 |

|

51 |

|

52 |

|

68 |

|

71 |

|

72 |

|

73 |

|

74 |

|

75 |

|

79 |

|

80 |

|

Relationship Between Compensation |

82 |

85 |

|

86 |

|

87 |

|

89 |

|

89 |

|

89 |

|

90 |

|

91 |

|

91 |

|

91 |

|

|

A-1 |

Web links throughout this document are provided for convenience only, and the content on the referenced

websites does not constitute a part of this Proxy Statement.

|

2025 Proxy Statement |

i |

Proxy Statement

April 3, 2025

General Information

Why am I receiving these materials?

This Proxy Statement and related proxy materials are first being made available to stockholders of Invitation Homes Inc., a Maryland corporation (“Invitation Homes,” the “Company,” “we,” “our,” or “us”) on or about April 3, 2025, for use at our 2025 annual meeting of stockholders (the “Annual Meeting”) to be held on Thursday, May 15, 2025, at 11:30 a.m. Eastern Time, and any adjournments or postponements thereof. This year’s Annual Meeting will be a completely virtual meeting of stockholders. You are invited to attend the virtual Annual Meeting online, vote your shares electronically, and submit your questions during the Annual Meeting, by visiting www.virtualshareholdermeeting.com/INVH2025. Proxies are being solicited by the Board of Directors of the Company (the “Board”) to give all stockholders of record at the close of business on March 20, 2025 (the “Record Date”), an opportunity to vote on matters properly presented at the Annual Meeting. The mailing address of our principal executive offices is Invitation Homes Inc., 5420 LBJ Freeway, Suite 600, Dallas, Texas 75240.

What am I voting on?

There are four proposals to be considered and voted on at the Annual Meeting:

Proposal 1: |

To elect the director nominees listed in this Proxy Statement. |

Proposal 2: |

To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2025. |

Proposal 3: |

To approve, in a non-binding advisory vote, the compensation paid to our named executive officers. |

Proposal 4: |

To determine, in a non-binding advisory vote, the frequency of stockholder votes to approve executive compensation. |

Who is entitled to vote?

Stockholders as of the close of business on the Record Date may vote at the Annual Meeting or any postponement or adjournment thereof. As of the Record Date, there were 612,883,131 shares of our common stock outstanding. You have one vote for each share of common stock held by you as of the Record Date, including shares:

What constitutes a quorum?

The presence in person or by proxy of stockholders entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting will constitute a quorum to transact business at the Annual Meeting. Stockholders who properly authorize a proxy but who instruct their proxy holder to abstain from voting on one or more matters are counted as present and entitled to vote for purposes of determining a quorum. Shares represented by “broker non-votes,”

|

2025 Proxy Statement |

1 |

General Information

described below, that are present and entitled to vote at the Annual Meeting will be counted for purposes of determining a quorum.

What is a “broker non-vote”?

A broker non-vote occurs when shares held by a broker, bank, or other nominee are not voted with respect to a proposal because (1) the broker, bank, or other nominee has not received voting instructions from the stockholder who beneficially owns the shares and (2) the broker, bank, or other nominee lacks the authority to vote the shares at his/her discretion. Under current New York Stock Exchange (“NYSE”) interpretations that govern broker non-votes, Proposals 1, 3, and 4 are considered non-discretionary matters, and a broker, bank or other nominee will lack the authority to vote shares at his/her discretion on such proposals. Proposal 2 is considered a discretionary matter, and a broker, bank, or other nominee will be permitted to exercise his/her discretion. This means that, if you hold your shares in street name and do not provide voting instructions to your broker, bank, or other nominee, your shares will not be voted on Proposals 1, 3 and 4 but may be voted on Proposal 2 in the discretion of your broker, bank, or other nominee.

How many votes are required to approve each proposal?

With respect to the election of directors (Proposal 1), under our Amended and Restated Bylaws, effective as of May 17, 2023 (the “Bylaws”), directors are elected by a plurality vote, which means that the director nominees with the greatest number of votes cast, even if less than a majority, will be elected. There is no cumulative voting in the election of directors.

With respect to the ratification of our independent registered public accounting firm (Proposal 2), the approval, in a non-binding advisory vote, of the compensation paid to our named executive officers (Proposal 3), and the determination, in a non-binding advisory vote, of frequency of stockholder votes to approve executive compensation (Proposal 4), under our Bylaws, approval of each proposal requires a majority of the votes cast. With respect to Proposal 4, in the event that no option receives a majority of the votes cast, we will consider the option that receives the most votes to be the option selected by stockholders.

How are votes counted?

With respect to the election of directors (Proposal 1), you may vote “FOR” or “WITHHOLD” with respect to each nominee. Votes that are “withheld” will have the same effect as an abstention and will not count as a vote “FOR” or “AGAINST” a director, because directors are elected by plurality voting. Broker non-votes will not affect the outcome of this proposal.

With respect to the ratification of our independent registered public accounting firm (Proposal 2), you may vote “FOR,” “AGAINST,” or “ABSTAIN.” For Proposal 2, abstentions will not affect the outcome of this proposal; however, as this proposal is considered a discretionary matter, brokers are permitted to exercise their discretion to vote uninstructed shares on this proposal.

With respect to the approval, in a non-binding advisory vote, of the compensation paid to our named executive officers (Proposal 3), you may vote “FOR,” “AGAINST,” or “ABSTAIN.” For Proposal 3, abstentions and broker non-votes will not affect the outcome of this proposal.

With respect to the determination, in a non-binding advisory vote, of the frequency of stockholder votes to approve executive compensation (Proposal 4), you may vote “ONE YEAR,” “TWO YEARS,” “THREE YEARS,” or “ABSTAIN.” For Proposal 4, abstentions and broker non-votes will not affect the outcome of this proposal.

If you sign and submit your proxy card without voting instructions, your shares will be voted in accordance with the recommendation of the Board with respect to the proposals and in accordance with the discretion of the holders of the proxy with respect to any other matters that may be voted upon.

Who will count the votes?

Representatives of Broadridge Financial Solutions, Inc. will tabulate the votes and act as inspectors of election.

2 |

|

|

General Information

How does the Board recommend that I vote?

Our Board recommends that you vote your shares as set forth below:

Proposal 1: |

To elect the director nominees listed in this Proxy Statement. |

“FOR” the election of each director nominee listed in this Proxy Statement.

Our Board unanimously believes that all of the director nominees listed in this Proxy Statement have the requisite qualifications to provide effective oversight of the Company’s business and management.

Proposal 2: |

To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2025. |

“FOR” the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2025.

Our Audit Committee and the Board believe that the retention of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for 2025 is in the best interest of the Company and its stockholders.

Proposal 3: |

To approve, in a non-binding advisory vote, the compensation paid to our named executive officers. |

“FOR” the approval, on a non-binding advisory basis, of the compensation paid to our named executive officers.

We are seeking a non-binding advisory vote to approve, and our Board recommends that you approve, the 2024 compensation paid to our named executive officers, which is described in the section of this Proxy Statement titled “Executive Compensation—Compensation Discussion and Analysis.”

Proposal 4: |

To determine, in a non-binding advisory vote, the frequency of stockholder votes to approve executive compensation. |

“ONE YEAR,” on a non-binding advisory basis, with respect to how frequently stockholder votes to approve executive compensation should occur.

Our Board believes that an annual advisory vote on executive compensation is consistent with our policy of seeking input from our stockholders on corporate governance matters and our executive compensation philosophy, policies and practices even though it is not required by law, and unanimously recommends that you vote “One Year” with respect to how frequently non-binding advisory stockholder votes to approve executive compensation should occur.

How do I vote my shares without attending the Annual Meeting?

Your vote is important, and we encourage you to vote promptly. If you are a stockholder of record, you may vote your shares in the following ways:

By Internet—If you have Internet access, you may vote by going to www.proxyvote.com and by following the instructions on how to complete an electronic proxy card. You will need the control number included on your proxy card in order to vote by Internet.

By Telephone—If you have access to a touch-tone telephone, you may vote by dialing 1-800-690-6903 and by following the recorded instructions. You will need the control number included on your proxy card in order to vote by telephone.

By Mail—You may vote by mail by completing, signing and dating the enclosed proxy card where indicated and by mailing or otherwise returning the card in the envelope that has been provided to you. You should sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity (for example, as

|

2025 Proxy Statement |

3 |

General Information

guardian, executor, trustee, custodian, attorney or officer of a corporation), indicate your name and title or capacity.

If you hold your shares in street name, you may submit voting instructions to your broker, bank or other nominee. In most instances, you will be able to do this over the Internet, by telephone, or by mail. Please refer to information from your broker, bank, or other nominee on how to submit voting instructions.

Internet and telephone voting facilities will close at 11:59 p.m. Eastern Time on May 14, 2025, and mailed proxy cards must be received no later than May 14, 2025.

When and where will the Annual Meeting be held?

Our Annual Meeting will be held at 11:30 a.m. Eastern Time, on Thursday, May 15, 2025, via live audio webcast, online at www.virtualshareholdermeeting.com/INVH2025. For information on how to attend the virtual Annual Meeting, see “General Information—How do I attend and vote my shares at the virtual Annual Meeting.”

How do I attend and vote my shares at the virtual Annual Meeting?

Our Board of Directors considers the appropriate format of the stockholder meeting on an annual basis. This year’s Annual Meeting will be a virtual meeting, conducted via live audio webcast. Any stockholder can attend the Annual Meeting live online at www.virtualshareholdermeeting.com/INVH2025. If you virtually attend the Annual Meeting, you can vote your shares electronically, and submit your questions during the Annual Meeting, by visiting www.virtualshareholdermeeting.com/INVH2025. A summary of the information you need to attend the Annual Meeting via the Internet is provided below:

Whether you plan to attend the Annual Meeting or not, we encourage you to vote in advance over the Internet, by telephone, or mail so that your vote will be counted if you do not vote at the Annual Meeting.

Will I be able to participate in the virtual Annual Meeting on the same basis I would be able to participate in a live annual meeting?

The virtual meeting format for the Annual Meeting will enable full and equal participation by all our stockholders from any place in the world at little to no cost. Stockholders at the virtual-only meeting will have the same rights as at an in-person meeting, including the rights to vote and ask questions at the Annual Meeting. We believe that hosting a virtual meeting provides expanded access, improved communication, and cost savings for our stockholders and the Company. You may vote during the Annual Meeting by following the instructions that will be available on the Annual Meeting website at www.virtualshareholdermeeting.com/INVH2025 during the Annual Meeting.

In addition, the virtual format allows stockholders to ask questions of our Board or management during the live Q&A session of the Annual Meeting. At that time, we will answer questions as they come in, to the extent relevant to the business of the Annual Meeting, as time permits. In the event any pertinent questions cannot be answered during the Annual Meeting due to time constraints, such questions and management’s answers will be made publicly available on our investor relations website promptly after the virtual Annual Meeting. If there are matters of individual concern to a stockholder and not of general concern to all stockholders, we provide an opportunity for stockholders to contact our investor relations department separately at (844) 456-INVH (4684) or ir@invitationhomes.com.

4 |

|

|

General Information

How can I ask questions at the virtual Annual Meeting?

If you wish to submit a question during the Annual Meeting, log into the Annual Meeting website at www.virtualshareholdermeeting.com/INVH2025, type your question into the “Ask a Question” field, and click “Submit.” As noted above, we will answer questions as they come in, to the extent relevant to the business of the Annual Meeting, as time permits. Consistent with our prior annual meetings, we kindly ask stockholders not to ask more than one question to allow us to answer questions from as many stockholders as possible. Questions from multiple stockholders on the same topic or that are otherwise related may be grouped, summarized, and answered together. Off-topic, personal, or other inappropriate questions will not be answered.

To be sure that all stockholders are afforded the same rights and opportunities to participate as they would at an in-person meeting, all of our Board members and executive officers are expected to join the Annual Meeting. If you want to participate in our Annual Meeting, but cannot submit your question using the Annual Meeting website, please contact our investor relations department at (844) 456-INVH (4684) or ir@invitationhomes.com for accommodations.

What can I do if I need technical assistance during the virtual Annual Meeting?

If you encounter any difficulties accessing or participating in the Annual Meeting, please call the technical support number that will be posted on the Annual Meeting log-in page at www.virtualshareholdermeeting.com/INVH2025. Technicians will be available to assist you.

If I can’t participate in the live Annual Meeting webcast, can I listen to it later?

The Annual Meeting will be recorded. A webcast playback will be available to the public at www.virtualshareholdermeeting.com/INVH2025 and under “Investor Relations”—“News & events”—“Events & presentations” on the Company’s website (www.invh.com) within approximately 24 hours after the completion of the Annual Meeting. No one attending the Annual Meeting via the webcast or telephone is permitted to use any audio recording device.

May I change my vote or revoke my proxy?

Yes. Whether you have authorized a proxy by Internet, telephone, or mail, if you are a stockholder of record, you may change your voting instructions or revoke your proxy by:

If you hold shares in street name, you may submit new voting instructions by contacting your broker, bank, or other nominee, or as otherwise provided in the instructions provided to you by your broker, bank, or other nominee.

Could other matters be decided at the Annual Meeting?

As of the date of this Proxy Statement, we are not aware of any matters that may be properly presented at the Annual Meeting other than those referred to in this Proxy Statement. If other matters are properly presented at the Annual Meeting for consideration and you are a stockholder of record and have submitted a proxy card, the persons named in your proxy card will have the discretion to vote on those matters for you.

|

2025 Proxy Statement |

5 |

General Information

Who will pay for the cost of this proxy solicitation?

We will pay the cost of soliciting proxies. Proxies may be solicited on our behalf by our directors, officers, and other Company associates (for no additional compensation) in person or by telephone, electronic transmission, and facsimile transmission. Brokers, banks, and other nominees will be requested to solicit proxies or authorizations from beneficial owners and will be reimbursed for their reasonable expenses.

6 |

|

|

PROPOSAL NO. 1

Election of Directors

|

The Board of Directors unanimously recommends that you vote “FOR” the election of each director nominee. |

At present, the number of directors that comprise our Board is 11. At the recommendation of the Nominating and Corporate Governance Committee, effective as of the Annual Meeting, the Board set the number of directors that will comprise our Board at ten. Our Board has considered, and at the recommendation of the Nominating and Corporate Governance Committee, nominated each of the following nominees for a one-year term expiring at our annual meeting of stockholders to be held in 2026 (the “2026 Annual Meeting”) or until his or her successor is duly elected and qualifies or until his or her earlier death, resignation, retirement, disqualification or removal: Michael D. Fascitelli, Dallas B. Tanner, Jana Cohen Barbe, H. Wyman Howard III, Jeffrey E. Kelter, Kellyn Smith Kenny, Joseph D. Margolis, John B. Rhea, Frances Aldrich Sevilla-Sacasa, and Keith D. Taylor. Action will be taken at the Annual Meeting for the election of these nominees.

Our Board did not nominate Richard D. Bronson and Janice L. Sears, current members of our Board, to stand for re-election when their current terms expire at the Annual Meeting. We are grateful to have benefited from their expertise, valuable business insights and strong commitment to Invitation Homes and our stockholders. Mr. Bronson has agreed to serve as an advisor to our Company following the completion of his term as a director.

The Board, upon recommendation of the Nominating and Corporate Governance Committee, has nominated Kellyn Smith Kenny as a new director nominee to serve on our Board. The Board believes that Ms. Kenny is an excellent addition to the Board, further enhancing the diversity of backgrounds and expertise in the boardroom. Her nomination was informed by the Board’s continued focus on its composition and its annual evaluation process, which ensures the appropriate balance of skills, diversity, experience and tenure in light of our business needs. Mr. Howard, who joined our Board in October 2024, and Ms. Kenny were presented to the Nominating and Corporate Governance Committee for consideration by our Board members. See “Director Nomination Process” below for more information on our director nomination process.

All of the nominees have indicated that they will be willing and able to serve as directors, but, if any of them should decline or be unable to act as a director, the individuals designated in the proxy cards as proxies will exercise the discretionary authority provided to vote for the election of such substitute nominee selected by our Board, unless the Board alternatively acts to reduce the size of the Board or maintain a vacancy on the Board in accordance with our Bylaws. The Board has no reason to believe that any such nominees will be unable or unwilling to serve.

We believe that our director nominees bring an extraordinary wealth of experience, skills and backgrounds to the Board. Our Board plays a key role in guiding the purpose, and strategic direction of our Company. Their individual and collective expertise is essential to the execution of our long-term strategy and continuation of our position as a leading home leasing and management company. Learn more about each nominee to our Board under “—Nominees for Election to the Board of Directors in 2025.”

|

2025 Proxy Statement |

7 |

Proposal No. 1: Election of Directors

Snapshot of 2025 Director Nominees

Name and Primary Occupation |

Age |

Director Since |

Independent |

|

|

|

|

|

|

|

|

Michael D. Fascitelli Owner and Principal, MDF Capital LLC; Managing Partner, Imperial Companies; Board of Trustees Member, Vornado Realty Trust; Co-founder, Radius Global Infrastructure, Inc.; Director, Quadro Partners Inc. |

68 |

2017 |

l |

|

|

|

|

|

|

|

|

Dallas B. Tanner Chief Executive Officer, Invitation Homes; Director, Roots Management; Member, HOPE Global Board of Advisors; Member, the Policy Advisory Board of the Harvard Joint Center for Housing Studies; Member, Arizona State University Real Estate Advisory Board |

44 |

2019 |

|

|

|

|

|

|

|

|

|

Jana Cohen Barbe Director, The Boler Company; Senior Partner, Dentons (Retired) |

62 |

2018 |

l |

|

|

|

|

|

|

|

|

H. Wyman Howard III Rear Adm., USN (Ret); Director, Bridger Aerospace Group Holdings, Inc.; Partner, Frontier Scientific Solutions; Senior Advisor, McKinsey & Co. |

56 |

2024 |

l |

|

|

|

|

|

|

|

|

Jeffrey E. Kelter Founding Partner, KSH Capital; Chairman of the Board of Directors of Bridger Aerospace Group Holdings, Inc. |

70 |

2017 |

l |

|

|

|

|

|

|

|

|

Kellyn Smith Kenny Chief Marketing and Growth Officer, AT&T Inc. |

47 |

2025 |

l |

|

|

|

|

|

|

|

|

Joseph D. Margolis Chief Executive Officer, Extra Space Storage, Inc. |

64 |

2020 |

l |

|

|

|

|

|

|

|

|

John B. Rhea Partner, Centerview Partners; Director, State Street Corporation |

59 |

2015 |

l |

|

|

|

|

|

|

|

|

Frances Aldrich Sevilla-Sacasa Private Investor; Director, Camden Property Trust; Director, the Delaware Funds by Macquarie; Former Chief Executive Officer, Banco Itaú International |

69 |

2023 |

l |

|

|

|

|

|

|

|

|

Keith D. Taylor Chief Financial Officer, Equinix, Inc.; Director, Yumpingo Ltd.; Director, Frozen Logistics, LLC |

63 |

2023 |

l |

|

|

|

|

8 |

|

|

Proposal No. 1: Election of Directors

Director Nominees’ Qualifications and Background

Skills and Experience |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real Estate / Real Estate Investment Experience in real estate development, operations, investment, and asset management to guide our real estate finance and investment strategies. |

|

l |

l |

l |

|

l |

|

l |

l |

|

l |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial / Banking Financial acumen and experience to oversee the quality and integrity of our financial statements, capital structure, and financial strategy. |

|

l |

l |

l |

l |

l |

l |

l |

l |

l |

l |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Risk Management Experience overseeing assessment and management of various forms of risk we face in our business. |

|

l |

l |

l |

l |

l |

l |

l |

l |

l |

l |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Legal / Regulatory / Governance Valuable perspective on government regulations, complex legal matters, corporate responsibility, governance, sustainability, and public policy issues. |

|

l |

l |

l |

l |

|

|

l |

l |

l |

l |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operations Experience leading complex operations to help us optimize our business model. |

|

l |

l |

|

l |

l |

l |

l |

l |

l |

l |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Executive / Robust Leadership Strong strategic insights gained through multi-faceted and challenging business experiences and active leadership ability. |

|

l |

l |

l |

l |

l |

l |

l |

l |

l |

l |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Digital, Technology, or Cybersecurity Experience Expertise regarding digital capabilities, technological transformation, artificial intelligence, and information security, based on executive-level experience in an industry driving digital and technological change or cybersecurity experience through prior professional experience (or a related certification/degree). |

|

|

|

l |

l |

|

l |

|

|

|

l |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tenure |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

Years on Board (Avg. 4.9 years) |

|

8 |

6 |

7 |

1 |

8 |

0 |

5 |

10 |

2 |

2 |

||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

Background |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gender Diversity (30%) |

|

|

|

l |

|

|

l |

|

|

l |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

African American or Black (10%) |

|

|

|

|

|

|

|

|

l |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Latino / Spanish Heritage (10%) |

|

|

|

|

|

|

|

|

|

l |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Independence (90%) |

|

l |

|

l |

l |

l |

l |

l |

l |

l |

l |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2025 Proxy Statement |

9 |

Proposal No. 1: Election of Directors

Nominees for Election to the Board of Directors in 2025

The following information describes the offices held, other business directorships, and the term of service of each director nominee. Beneficial ownership of equity securities of the director nominees is shown under “Ownership of Securities” below. The biographical description for each nominee below includes the specific experience, qualifications, attributes, and skills that led to the conclusion by the Board that such person should serve as a director.

Age: 68 Director Since: 2017 Independent Committees: Chairperson of the Board of Directors Skills and Qualifications:

|

|

Michael D. Fascitelli

Mr. Fascitelli has served on our Board since November 2017 and was appointed the Chairperson of the Board in May 2021. Prior to the merger with Starwood Waypoint Homes (“SWH”) in November 2017, from January 2016 to November 2017, Mr. Fascitelli served on the Board of SWH and, from January 2014 to January 2016, served on the Board of Starwood Waypoint Residential Trust (“SWAY”), SWH’s predecessor. Since June 2013, Mr. Fascitelli has been the owner and principal of MDF Capital LLC, a private investment firm. Mr. Fascitelli is also a co-founder and a Managing Partner of Imperial Companies, a real estate investment and development company. Mr. Fascitelli has served as member of the Board of Trustees of Vornado Realty Trust (NYSE: VNO) since 1996. He served as the President of Vornado Realty Trust from 1996 to April 2013 and its Chief Executive Officer from May 2009 to April 2013. Mr. Fascitelli served as the President of Alexander’s Inc., a real estate investment trust and an affiliate of Vornado Realty Trust, from December 1996 to April 2013. Prior to joining Vornado Realty Trust in 1996, Mr. Fascitelli was a partner at Goldman Sachs & Co., an investment banking firm, in charge of its real estate practice since 1992. Mr. Fascitelli is also the Co-founder and a former Co-Chairman of Radius Global Infrastructure, Inc. (NASDAQ: RADI), one of the largest international aggregators of rental streams underlying wireless sites through the acquisition and management of ground, tower, rooftop, and in-building cell site leases. Since December 2014, Mr. Fascitelli has served as Chair of the Investment Committee, Senior Advisor and Board Member of Quadro Partners Inc. (formerly Cadre), a private online real estate investment platform. He serves as a Board member of The Rockefeller University, Urban Land Institute, and a former Board member of Child Mind Institute and the University of Rhode Island Foundation. He is currently a member of the University of Rhode Island Board of Trustees. Mr. Fascitelli is a former Commissioner of the Port Authority of New York and New Jersey and a past Chairman of the Wharton Real Estate Center where he served on the executive committee.

Our Board considered Mr. Fascitelli’s long and successful track record in various leadership roles including his executive experience as President and Chief Executive Officer of Vornado Realty Trust and his extensive knowledge of and experience in the real estate industry, which the Board believes provide us with valuable experience and insight. Additionally, our Board considered Mr. Fascitelli’s broad experience with corporate governance, risk management, and business strategy as a director of several public and private companies. |

|

||

|

||

|

10 |

|

|

Proposal No. 1: Election of Directors

Age: 44 Director Since: 2019 Committees: Investment and Finance Committee Skills and Qualifications:

|

|

Dallas B. Tanner

Mr. Tanner has served as our Chief Executive Officer (“CEO”) and a Board member since January 2019. As a founding member of our Company’s business, Mr. Tanner was at the forefront of creating the single-family rental industry. He initially served as Executive Vice President and Chief Investment Officer from the Company’s founding in April 2012 until January 2019, as well as interim President from August 2018 to January 2019, and as President and CEO from January 2019 to February 2023. Prior to the initial public offering of the Company in February 2017, he served on the Boards of the Company’s predecessor entities. Mr. Tanner has more than 20 years of real estate experience through the establishment of numerous real estate platforms. In 2005, he founded Treehouse Group, for which he privately sourced funds for platform investments, including single-family homes, multifamily properties, manufactured housing, residential land, bridge financing, and property management. Mr. Tanner currently serves as a Board member of Roots Management, a manufactured housing platform with 40,000+ homes that operates in 22 states. He also is a member of the HOPE Global Board of Advisors, the Policy Advisory Board of the Harvard Joint Center for Housing Studies, Arizona State University Real Estate Advisory Board, and the Real Estate Roundtable. Mr. Tanner is named a Henry Crown Fellow by the Aspen Institute. He is actively involved in American Indian Services and served as a missionary in the Netherlands and Belgium.

Our Board considered Mr. Tanner’s extensive hands-on experience in real estate investment, including the establishment of numerous real estate platforms, and as a founding member of our business, experience managing day-to-day operations of our Company and his prior executive positions. Mr. Tanner’s role as our CEO brings management perspective to Board deliberations and provides valuable information about the status of our day-to-day operations. |

|

||

|

||

|

Age: 62 Director Since: 2018 Independent Committees: Audit Committee Nominating and Corporate Governance Committee Skills and Qualifications:

|

|

Jana Cohen Barbe

Ms. Barbe has served on our Board since November 2018. Ms. Barbe also serves as an independent Director of The Boler Company, a family enterprise, and the owner of Hendrickson International, a primary supplier of suspensions and related systems to North American heavy-duty truck and trailer manufacturers and to most manufacturers worldwide. Since 2021, Ms. Barbe has also acted as a strategic business advisor to private equity firms, financial institutions and others on matters relating to affordable housing. Prior to 2021, Ms. Barbe was a partner at Dentons, the largest law firm in the world (and its predecessor firms) where for more than 25 years she advised many of the world's leading financial institutions and insurance companies on highly regulated affordable housing and community development investments while also serving in multiple leadership roles including as Global Vice Chair, Global Real Estate Practice Chair, and Chair of the Global Financial Institutions Sector of the law firm. Ms. Barbe was honored for her lasting contributions to the legal profession by Corporate Counsel and Inside Counsel magazines when they awarded her the 2019 Women, Influence & Power Lifetime Achievement Award. Ms. Barbe is a past Chairperson of the Board of Thresholds, Illinois' oldest and largest provider of housing and supportive services for individuals with severe and persistent mental illnesses, and remains a Life Director of Thresholds. Ms. Barbe is also a past Chairperson of the Board of Advisors of Catalyst, Inc., the much-acclaimed international women’s advocacy organization. Ms. Barbe has earned the CERT Certificate in Cybersecurity Oversight for board members from NACD and the CERT Division of the Software Engineering Institute of Carnegie Mellon University.

Our Board considered Ms. Barbe’s real estate and finance background, including her chairing Dentons’ Real Estate Practice and Financial Institutions Sector, her expertise in transactional, operational, and regulatory matters including affordable housing and community development, strategic vision, and her risk management experience, which are a complement to the skills and qualifications of our directors. The Board also considered Ms. Barbe’s leadership in strategic implementation of corporate social responsibility initiatives. |

|

||

|

||

|

|

2025 Proxy Statement |

11 |

Proposal No. 1: Election of Directors

Age: 56 Director Since: 2024 Independent Committees: Audit Committee Nominating and Corporate Governance Committee Skills and Qualifications:

|

|

H. Wyman Howard III

Mr. Howard has served on the Board since October 2024. Mr. Howard retired from the U.S. Navy in September 2022 as Rear Admiral (Upper Half) after over 32 years of service in Naval Special Warfare and Joint Special Operations. He has had multiple tours in command of Special Operations Joint Task Forces and was among the first to deploy into Afghanistan following the attacks on September 11, 2001. The combat contributions of the teams Mr. Howard commanded, and with whom he served, were recognized with five Presidential Unit Citations, a Navy Unit Commendation medal, and four Joint Meritorious Unit Awards. Mr. Howard’s joint, interagency, and intelligence experience include service as the second Director of Operations for the National Geospatial-Intelligence Agency in 2016, Commander, Special Operation Command Central from 2018-2020, and as the Commander, Naval Special Warfare Command, from 2020 to 2022, which are equivalent leadership roles of a Chief Operating Officer and Chief Executive Officer, respectively. Mr. Howard also serves on the board of Bridger Aerospace Group Holdings, Inc. (NASDAQ: BAER), an aerial wildfire suppression and aerospace services company. Mr. Howard is a Frontier Scientific Solutions partner, a provider of life sciences supply chain solutions, a McKinsey & Co. Senior Advisor, and an advisor to a portfolio of Advanced Industry sector companies. Mr. Howard holds a Professional Certificate in Artificial Intelligence and Business Strategy from the Massachusetts Institute of Technology’s Computer Science and Artificial Intelligence Laboratory.

Our Board considered Mr. Howard's distinctive leadership at the strategic, operational, and tactical levels and his unique sensitivity to strategic risks and a deep set of interagency and governmental relationships. His deep experience in risk mitigation, cyber threats, and innovative security solutions, and strong understanding of the key strategic challenges and opportunities, make him well-positioned to oversee strategic planning, operations, and logistics and to protect and advance organizational resilience in an ever-evolving landscape. |

|

||

|

||

|

Age: 70 Director Since: 2017 Independent Committees: Investment and Finance Committee (Chairperson) Nominating and Corporate Governance Committee Skills and Qualifications:

|

|

Jeffrey E. Kelter

Mr. Kelter has served on our Board since November 2017. From January 2016 to November 2017, Mr. Kelter served on the Board of SWH and, from January 2014 to January 2016, served on the Board of SWAY. Mr. Kelter is a Co-Founder and has been a Partner of KSH Capital since 2015. KSH Capital provides real estate entrepreneurs with capital and expertise to grow their platforms. Prior to founding KSH Capital, Mr. Kelter was the Founding Partner and Chief Executive Officer of KTR Capital Partners from 2005 to 2015, a leading private equity real estate investment and operating company focused on industrial properties throughout North America. KTR Capital Partners and its commingled investment funds were sold in May 2015 to a joint venture of Prologis, Inc. (NYSE: PLD) and Norges Bank Investment Management. Prior to founding KTR Capital Partners, from 1997 to 2004, Mr. Kelter was President, Chief Executive Officer and served on the Board of Trustees of Keystone Property Trust, an industrial real estate investment trust (“REIT”). Mr. Kelter founded the predecessor to Keystone Property Trust in 1982, and took the company public in 1997, where he and the management team directed its operations until its sale in 2004. Prior to forming Keystone Property Trust, he served as President and Chief Executive Officer of Penn Square Properties, Inc., a real estate company which he founded in 1982. Mr. Kelter serves as Chairman of the Board of Directors of Bridger Aerospace Group Holdings, Inc. (NASDAQ: BAER), serves on the Northwell Health Cancer Institute Advisory Council, and he is a trustee of The Urban Land Institute and Cold Spring Harbor Laboratory. Mr. Kelter formerly served as a trustee at Westminster School and Trinity College and formerly served on the Board of Gramercy Property Trust (NYSE: GPT) from 2015 to 2018.

Our Board considered Mr. Kelter’s management leadership and governance experience as President and Chief Executive Officer of Keystone and Penn Square and his extensive experience of over 20 years in commercial real estate. Our Board also considered Mr. Kelter’s deep experience and strong understanding of the key strategic challenges and opportunities of running a REIT. |

|

||

|

||

|

12 |

|

|

Proposal No. 1: Election of Directors

Age: 47 Director Since: Nominee Independent Skills and Qualifications:

|

|

Kellyn Smith Kenny

Ms. Kenny serves as the Chief Marketing and Growth Officer of AT&T, responsible for accelerating customer acquisition, increasing customer lifetime value, and strengthening AT&T’s premium position. She oversees digital, advertising, brand, media and sponsorships, market research and insights, competitive and customer intelligence, and growth products. Prior to AT&T, Ms. Kenny served as the global Chief Marketing Officer at Hilton Worldwide, where she led marketing for the company’s 18 trading brands, and the Hilton Honors loyalty program with over 100 million members. Before Hilton, Ms. Kenny held senior positions at Uber Technologies, Capital One Financial, and Microsoft Corporation. Ms. Kenny serves as Chair Emeritus of the Mobile Marketing Association, a marketing trade association, as an Executive Committee Member for AdCouncil, and as a Board Member for the Association of National Advertisers. She is among a select class of leaders to be named a Henry Crown Fellow by the Aspen Institute. Ms. Kenny has been recognized for marketing innovation, effectiveness, and leadership by Forbes, Adweek, and more. Her marketing and advertising campaigns have won multiple EFFIE Awards, CLIOs, Cannes Lions, and SHORTY Awards.

Ms. Kenny was nominated to serve on our Board because of her considerable leadership and operating experience and expertise in developing key corporate strategies with important insights and perspectives with respect to marketing, growth, and long-range planning, which is invaluable to our efforts to develop innovative marketing solutions. Ms. Kenny's experience at trusted national brands provides her a deep understanding of consumer experiences and insights. |

|

||

|

||

|

Age: 64 Director Since: 2020 Independent Committees: Compensation and Management Development Committee Investment and Finance Committee Skills and Qualifications:

|

|

Joseph D. Margolis

Mr. Margolis has served on our Board since May 2020. Mr. Margolis is a member of the Board of Directors and the Chief Executive Officer of Extra Space Storage, Inc. (NYSE: EXR). He has held this position since January 1, 2017. Previously, he served as Executive Vice President and Chief Investment Officer of Extra Space Storage, Inc. from July 2015 until December 31, 2016. From 2011 until July 2015, he was Senior Managing Director and Partner at Penzance Properties, a vertically integrated owner, operator and developer of office and other properties in the Washington, D.C. metro area. Previously, Mr. Margolis was a co-founding partner of Arsenal Real Estate Funds, a private real estate investment management firm, from 2004 through 2011. Before forming Arsenal in 2004, from 1992 to 2004, Mr. Margolis held senior positions at Prudential Real Estate Investors in portfolio management, capital markets and as General Counsel. Before that, Mr. Margolis worked for The Prudential Insurance Company of America as in-house real estate counsel from 1988 through 1992, and as a real estate associate at the law firm of Nutter, McClennen & Fish from 1986 through 1988.

Our Board considered Mr. Margolis’ extensive finance and real estate experience and senior executive experience in dealing with complex management, financial, risk assessment, business, and governance issues, which enable him to provide us with business leadership and financial expertise. Mr. Margolis’ extensive experience and instrumental role in developing key corporate strategies provide important insights and perspectives with respect to growth and long-range planning. |

|

||

|

||

|

|

2025 Proxy Statement |

13 |

Proposal No. 1: Election of Directors

Age: 59 Director Since: 2015 Independent Committees: Compensation and Management Development Committee Investment and Finance Committee Skills and Qualifications:

|

|

John B. Rhea

Mr. Rhea has served on our Board since January 2017 and, prior to our initial public offering, from October 2015 to January 2017, served on the Boards of the Company’s predecessor entities. Since September 2020, Mr. Rhea has been a partner at Centerview Partners, an independent investment banking advisory firm. In March 2021, Mr. Rhea was elected to the Board of Directors of State Street Corporation (NYSE:STT), one of the world’s leading providers of financial services to institutional investors, including investment servicing, investment management and investment research and trading. Mr. Rhea served as Senior Advisor and President, Corporate Finance & Capital Markets at Siebert Williams Shank & Co., LLC, a full-service investment banking firm, from June 2017 to September 2020. Mr. Rhea is also Managing Partner of RHEAL Capital Management, LLC, a real estate development and investment firm he founded in March 2014, specializing in affordable and market rate housing, public private partnerships, and acquisition and repositioning of commercial real estate in urban communities. Mr. Rhea previously served as a Senior Advisor to The Boston Consulting Group, a worldwide management consulting firm from July 2014 to September 2017. From May 2009 to January 2014, Mr. Rhea was a senior appointee of Michael R. Bloomberg, Mayor of the City of New York, where he served as Chairman and Chief Executive Officer of the New York City Housing Authority, the largest public housing authority in North America. Prior to his service with the Bloomberg Administration, Mr. Rhea was Managing Director and Co-Head of Consumer and Retail investment banking at Barclays Capital (and its predecessor firm Lehman Brothers) from May 2005 to April 2009. Previously, Mr. Rhea served as Managing Director at JPMorgan Chase & Co. from May 1997 to April 2005. Earlier in his career, Mr. Rhea worked at PepsiCo, Inc. and The Boston Consulting Group. Mr. Rhea has served on and chaired several non-profit boards and is currently a director of Red Cross Greater New York and University of Detroit Jesuit High School.

Our Board considered Mr. Rhea’s significant experience in our industry, including in development and regulation and his prior senior positions at real estate companies and regulatory bodies, including as Chairman and CEO of the New York City Housing Authority, and other companies. The Board also considered Mr. Rhea’s extensive experience in the investment banking industry providing a valuable insight into capital markets and trends. |

|

||

|

||

|

Age: 69 Director Since: 2023 Independent Committees: Audit Committee (Chairperson) Nominating and Corporate Governance Committee Skills and Qualifications:

|

|

Frances Aldrich Sevilla-Sacasa

Ms. Aldrich Sevilla-Sacasa has served on our Board since May 2023. Ms. Aldrich Sevilla-Sacasa is a private investor and was Chief Executive Officer of Banco Itaú International, Miami, Florida, from April 2012 to December 2016. Prior to that time, she served as Executive Advisor to the Dean of the University of Miami School of Business from August 2011 to March 2012, Interim Dean of the University of Miami School of Business from January 2011 to July 2011, President of U.S. Trust, Bank of America Private Wealth Management from July 2007 to December 2008, President and Chief Executive Officer of US Trust Company from early 2007 until June 2007, and President of US Trust Company from November 2005 until June 2007. She previously served in a variety of roles with Citigroup’s private banking business, including President of Latin America Private Banking, President of Europe Private Banking, and Head of International Trust Business. Ms. Aldrich Sevilla-Sacasa also serves on the Boards of Camden Property Trust (NYSE: CPT) and the Delaware Funds by Macquarie.

Our Board considered Ms. Aldrich Sevilla-Sacasa’s considerable experience in financial services, banking, and wealth management. In addition, the Board considered her experience as a former President and Chief Executive Officer of a trust and wealth management company, and as a director of other corporate and not-for-profit boards which has provided Ms. Aldrich Sevilla-Sacasa with expertise in the areas of corporate governance, business strategy, risk management, and financial reporting and internal controls. |

|

||

|

||

|

14 |

|

|

Proposal No. 1: Election of Directors

Age: 63 Director Since: 2023 Independent Committees: Audit Committee Compensation and Management Development Committee (Chairperson) Skills and Qualifications:

|

|

Keith D. Taylor

Mr. Taylor has served on our Board since May 2023. Mr. Taylor is the Chief Financial Officer of Equinix, Inc. (Nasdaq: EQIX), a leading multinational digital infrastructure company. He has held this position since September 2005. From 2001 to 2005, Mr. Taylor served in various roles at Equinix Inc., including Vice President, Finance, and Chief Accounting Officer. From 1999 to 2001, he served as Director of Finance and Administration of Equinix Inc. Prior to that, from 1996 to 1999, Mr. Taylor served as Vice President, Finance, and Interim Chief Financial Officer at International Wireless Communications, an operator, owner and developer of wireless communications networks. Mr. Taylor is a member of the Board of Directors of Yumpingo Ltd., a U.K. company providing a next-generation hospitality customer experience management platform, and a member of the Board of Directors of Frozen Logistics, LLC, a leading cold storage and logistics provider, specializing in direct-to-consumer fulfillment of frozen goods. Mr. Taylor is a chartered public accountant.

Our Board considered Mr. Taylor’s extensive experience in corporate finance and accounting, financial reporting and internal controls, human resources, and compensation, which he accumulated through his service as the Chief Financial Officer of a large publicly-traded company. The Board also considered Mr. Taylor's strong understanding of the key strategic challenges and opportunities of running a large business. |

|

||

|

||

|

|

2025 Proxy Statement |

15 |

Proposal No. 1: Election of Directors

Director Nomination Process

The Nominating and Corporate Governance Committee is responsible for recommending to the Board nominees for election as director, and the Board is responsible for selecting nominees for election. This nomination process occurs as part of the nomination of the slate of directors for election at our annual meeting of stockholders and at times when there is a vacancy on the Board or other need to add a director to the Board.

Current Board Skill Sets and Needs Continuous evaluation of the Board skills matrix ensures Board is strong in core competencies and has diversity of expertise, perspective, and background. |

|

As part of this nomination process, the Nominating and Corporate Governance Committee weighs the characteristics, experience, independence, diversity, and skills of potential candidates for election to the Board and, in considering such candidates, also assesses the size, composition, and combined expertise of the Board and the extent to which the candidate would fill a present need on the Board. As the application of these factors involves the exercise of judgment, the Committee does not have a standard set of fixed qualifications that is applicable to all director candidates, but rather takes into account all factors it considers appropriate such as (a) individual qualifications, including relevant career experience, strength of character, judgment, familiarity with our Company’s business and industry, independence of thought, and an ability to work collegially and (b) all other factors it considers appropriate, which may include diversity of background, existing commitments to other businesses, potential conflicts of interest with other pursuits, antitrust and other legal considerations, corporate governance background, financial and accounting background, executive compensation background, relevant industry experience and technical skills, technology, cybersecurity and data privacy training, and the size, composition, and combined expertise of the existing Board. The Nominating and Corporate Governance Committee may seek referrals and/or receive recommendations from other members of the Board, management, stockholders, and other sources, including third-party recommendations. The Committee may also retain a search firm to assist it in identifying candidates to serve as directors of the Company. The Committee uses the same criteria for evaluating candidates regardless of the source of the referral or recommendation. When considering director candidates, the Committee seeks individuals with backgrounds and qualities that, when combined with those of our incumbent directors, provide a blend of skills and experience to further enhance the Board’s effectiveness. In connection with its annual recommendation of a slate of nominees for election at the annual meeting, the Nominating and Corporate Governance Committee also may assess the contributions of those directors recommended for re-election in the context of the Board evaluation process and other perceived needs of the Board. When considering whether the directors and nominees have the experience, qualifications, attributes, and skills, taken as a whole, to enable the Board to satisfy its oversight responsibilities effectively in light of our business and structure, the Board focused primarily on the information discussed in each of the director nominees’ biographical information set forth above. |

|

|

|

Candidate Recommendations From independent directors, stockholders, independent search firms, and our management. |

|

|

|

|

|

Nominating and Corporate Governance Committee Considers exceptional candidates that possess integrity, independent judgment, broad business experience, diversity, and a skill set to meet existing or future business needs. Screens qualifications, reviews independence and potential conflicts, and recommends selected candidates to the Board. |

|

|

|

|

|

Board of Directors Evaluates candidates recommended by the Nominating and Corporate Governance Committee, analyzes independence and other issues, and selects nominees with a commitment to refreshment and diversity. Nominates candidates for election to the Board at annual meetings of stockholders or appointed to the Board during the year. |

|

|

|

|

|

Stockholders Vote on all director nominees at annual meetings. |

|

16 |

|

|

Proposal No. 1: Election of Directors

Stockholder Nominees

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders. Any recommendation submitted to the Secretary of the Company should be in writing and should include any supporting material the stockholder considers appropriate in support of that recommendation, but must include information that would be required under the rules of the Securities and Exchange Commission (the “SEC”) to be included in a proxy statement soliciting proxies for the election of such candidate and a written consent of the candidate to serve as one of our directors if elected. Stockholders wishing to propose a candidate for consideration may do so by submitting the above information to the attention of the Corporate Secretary, Invitation Homes Inc., 5420 LBJ Freeway, Suite 600, Dallas, Texas 75240. All recommendations for nomination received by the Corporate Secretary that satisfy our Bylaw requirements relating to such director nominations will be presented to the Committee for its consideration. Stockholders also must satisfy the notification, timeliness, consent, and information requirements set forth in our Bylaws. These requirements are also described under the caption “Stockholder Proposals for the 2026 Annual Meeting.”

Our stockholders also possess the right to nominate candidates to the Board through proxy access provisions of our Bylaws. The Bylaws permit a stockholder, or group of up to 20 stockholders, owning 3% or more of the Company’s outstanding common shares continuously for at least three years, to include in the Company’s annual meeting proxy materials director nominations for up to 20% of the seats on the Board, subject to the other terms and conditions of the Bylaws. Stockholder requests to include stockholder-nominated directors in proxy materials for the 2026 Annual Meeting must be received by no earlier than November 4, 2025, and no later than December 4, 2025.

Director Succession Planning and Board and Committee Refreshment

The Nominating and Corporate Governance Committee regularly oversees and plans for director succession and refreshment of the Board to cultivate a mix of skills, experience, tenure, and diversity that promote and support the Company’s long-term strategy. In doing so, the Nominating and Corporate Governance Committee takes into consideration the overall needs, composition, and size of the Board, as well as the criteria adopted by the Board regarding director candidate qualifications, which are described in the “Director Nomination Process” above. Individuals identified by the Nominating and Corporate Governance Committee as qualified to become directors are then recommended to the Board for nomination or election.

The Board, upon recommendation from the Nominating and Corporate Governance Committee, annually reviews and determines the composition of its committees. Through periodic committee refreshment, we balance the benefits derived from continuity and depth of experience with the benefits gained from fresh perspectives and enhancing our directors’ understanding of different aspects of our business.

|

2025 Proxy Statement |

17 |

Proposal No. 1: Election of Directors

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Board Refreshment Timeline |

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Nominating and Corporate Governance Committee’s work on director succession and refreshment has resulted in six new directors being added, and one new nominee, to our Board since 2018. This intentional and planned approach has resulted in a mix of skills, experience, tenure, and diversity that promotes and supports the Company’s long-term strategy. |

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Jana Cohen Barbe |

|

Joseph D. Margolis |

|

|

|

|

H. Wyman Howard III |

|

|

|

|

||||||||

Expertise in transactional, operational, regulatory, and cybersecurity matters. |

|

Executive leadership experience in complex management, financial, risk assessment, business, and governance issues. |

|

|

|

|

Distinctive leadership experience at the strategic, operational, and tactical levels, artificial intelligence and cybersecurity expertise, and a deep set of interagency and governmental relationships. |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Dallas B. Tanner Hands-on experience in real estate investment, managing day-to-day operations as our CEO. |

|

|

|

|

|

Frances Aldrich Sevilla-Sacasa Decades of leadership experience in financial services, banking, and wealth management, risk management, and financial oversight. |

|

Kellyn Smith Kenny(1) Executive leadership and operating experience, including developing key corporate strategies, and bringing innovative solutions to market. |

|

|||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Keith D. Taylor |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Deep management, operational, executive compensation, corporate governance and real estate industry experience. |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

18 |

|

|

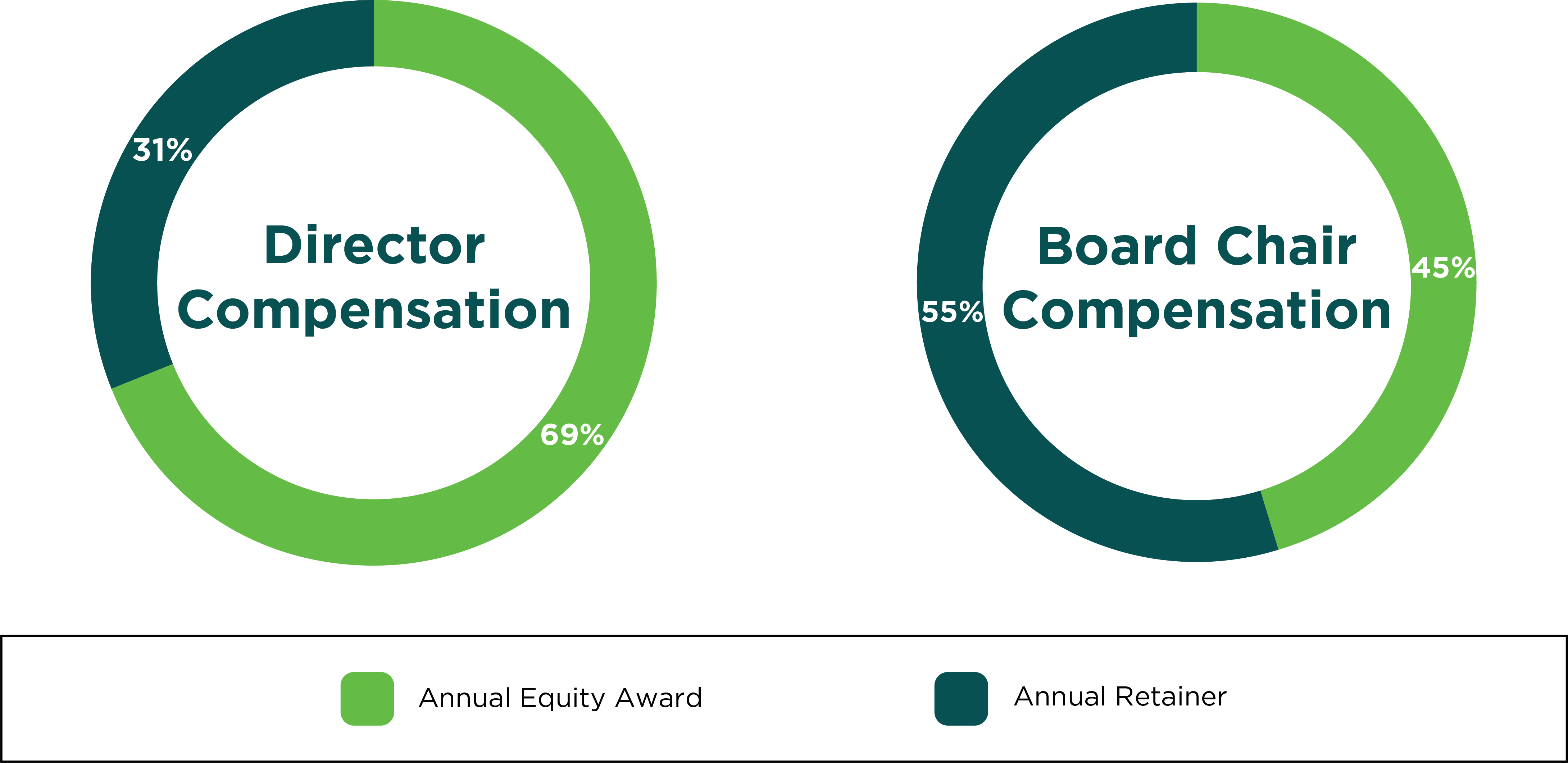

Compensation of Directors

Our non-employee directors are entitled to receive cash compensation, as well as equity compensation in the form of restricted stock units (“RSUs”), for their Board service. Mr. Tanner, our CEO, receives no compensation for serving on our Board.

Highlights of Our Non-Employee Director Compensation Program |

|

|

|

|

|

No Fees for Board or Committee Meeting Attendance: Meeting attendance is an expected part of Board service. |

|

|

|

|

|

Emphasis on Equity: There is an emphasis on equity in the overall compensation mix to further align interests with stakeholders. |

|

|

|

|

|

Recognition of Special Roles: Special roles, such as Committee chairpersons, are recognized for their additional time commitments. |

|

|

|

|

|

Annual Equity Grants: Equity awards are granted annually with a fixed value and one-year vesting schedule, providing alignment with stockholders’ interests. |

|

|

|

|

|

Robust Stock Ownership Guidelines: A guideline of five times the annual Board membership cash retainer supports alignment with stakeholders’ interests and mitigates potential compensation-related risk. |

|

|

|

|

|

No Perquisites and No Related Tax Gross-Ups. |

|

|

|

2024 Annual Director Compensation Program

Our Compensation and Management Development Committee is responsible for reviewing and advising on the compensation of our non-employee directors. To assist with this duty, they have engaged an independent compensation consultant, Ferguson Partners Consulting (“FPC”), to perform periodic reviews of our non-employee director compensation program, which includes an analysis of market trends and best practices and a comparison versus our peer group companies. In 2024, our non-employee directors received annual compensation, as follows:

|

2025 Proxy Statement |

19 |

Compensation of Directors

All RSUs granted to directors entitle the director to dividend equivalent payments in respect of the director’s RSUs, whether his or her RSUs are unvested or vested and not yet settled. The dividend equivalents are deliverable to the director on the regular payment date that such dividends are made to the Company’s stockholders and in the same form as delivered to such stockholders whether in cash or common stock. To date, all dividends declared on the Company’s common stock were paid in cash. In addition, while our directors are not paid any fees for attending meetings, each director is reimbursed for reasonable travel and related expenses associated with his or her attendance at Board or committee meetings.

Our non-employee directors who receive compensation for their service on the Board are also subject to a stock ownership policy, as described below under “Executive Compensation—Compensation Discussion and Analysis.”

Director Compensation Table for Fiscal 2024

The table below sets forth information regarding non-employee director compensation for the fiscal year ended December 31, 2024.

Name |

|

Fees Earned or Paid |

|

Stock |

|

Total ($) |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Michael D. Fascitelli |

|

|

$ |

235,000 |

|

|

|

|

$ |

190,015 |

|

|

|

|

$ |

425,015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Jana Cohen Barbe |

|

|

$ |

110,000 |

|

|

|

|

$ |

190,015 |

|

|

|

|

$ |

300,015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Richard D. Bronson |

|

|

$ |

122,500 |

|

|

|

|

$ |

190,015 |

|

|

|

|

$ |

312,515 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

H. Wyman Howard III |

|

|

$ |

21,250 |

|

|

|

|

$ |

121,281 |

|

|

|

|

$ |

142,531 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Jeffrey E. Kelter |

|

|

$ |

122,500 |

|

|

|

|

$ |

190,015 |

|

|

|

|

$ |

312,515 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Joseph D. Margolis |

|

|

$ |

110,000 |

|

|

|

|

$ |

190,015 |

|

|

|

|

$ |

300,015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

John B. Rhea |

|

|

$ |

110,000 |

|

|

|

|

$ |

190,015 |

|

|

|

|

$ |

300,015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Keith D. Taylor |

|

|

$ |

122,500 |

|

|

|

|

$ |

190,015 |

|

|

|

|

$ |

312,515 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Janice L. Sears |

|

|

$ |

110,000 |

|

|

|

|

$ |

190,015 |

|

|

|

|

$ |

300,015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Frances Aldrich Sevilla-Sacasa |

|

|

$ |

122,500 |

|

|

|

|

$ |

190,015 |

|

|

|

|

$ |

312,515 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

20 |

|

|

The Board of Directors and Certain Governance Matters

Corporate Governance

The business and affairs of the Company are managed under the direction and oversight of our Board, as provided by Maryland law, and its four standing committees: the Audit Committee, the Compensation and Management Development Committee, the Nominating and Corporate Governance Committee, and the Investment and Finance Committee. Members of our Board remain informed about our business through discussion with our executive leadership team, and other officers and associates, and by reviewing materials provided to them and participating in regular meetings of the Board and its committees.

We are committed to exercising and maintaining strong corporate governance practices. We believe that good governance promotes the long-term interests of our stockholders, strengthens Board and management accountability, and improves our standing as a trusted member of the communities we serve. The Board regularly monitors our corporate governance policies and profile to ensure we meet or exceed the requirements of applicable laws, regulations and rules, and the listing standards of the NYSE. We have instituted a variety of practices to foster and maintain responsible corporate governance, which are described in this section.

|

|

Corporate Governance Snapshot |

|

|

|

|

|

Director Nominees |

10 |

|

|

|

|