Shareholder Letter Q4 2025

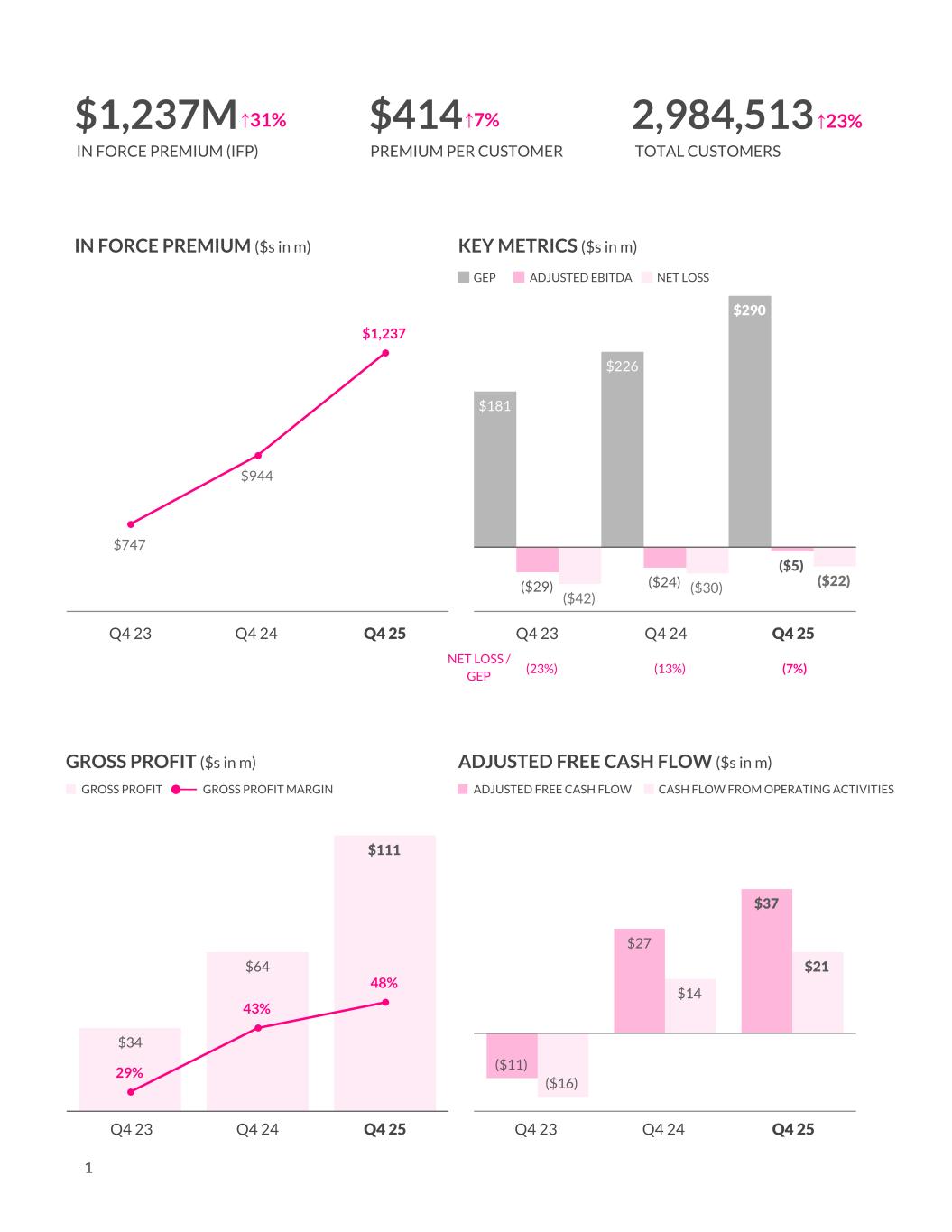

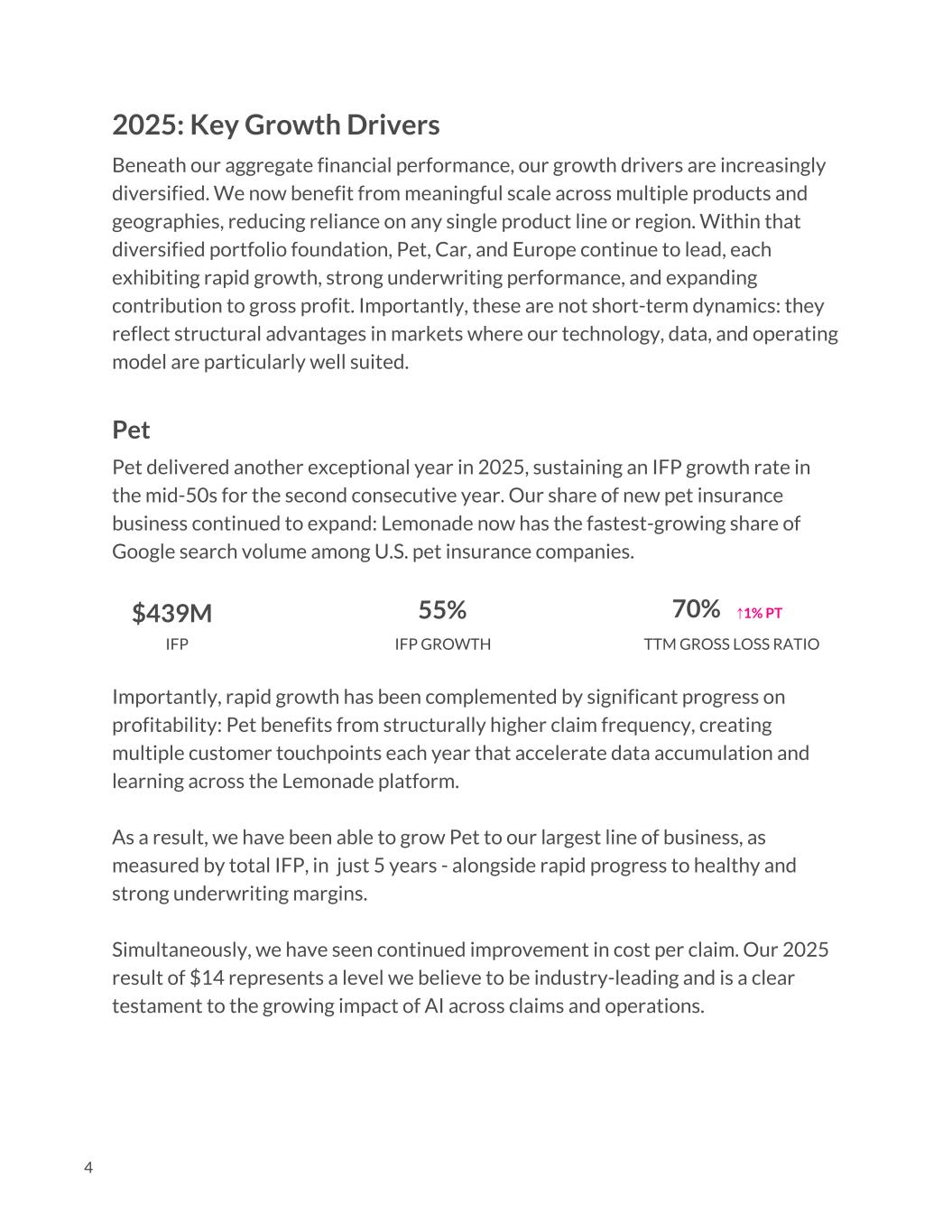

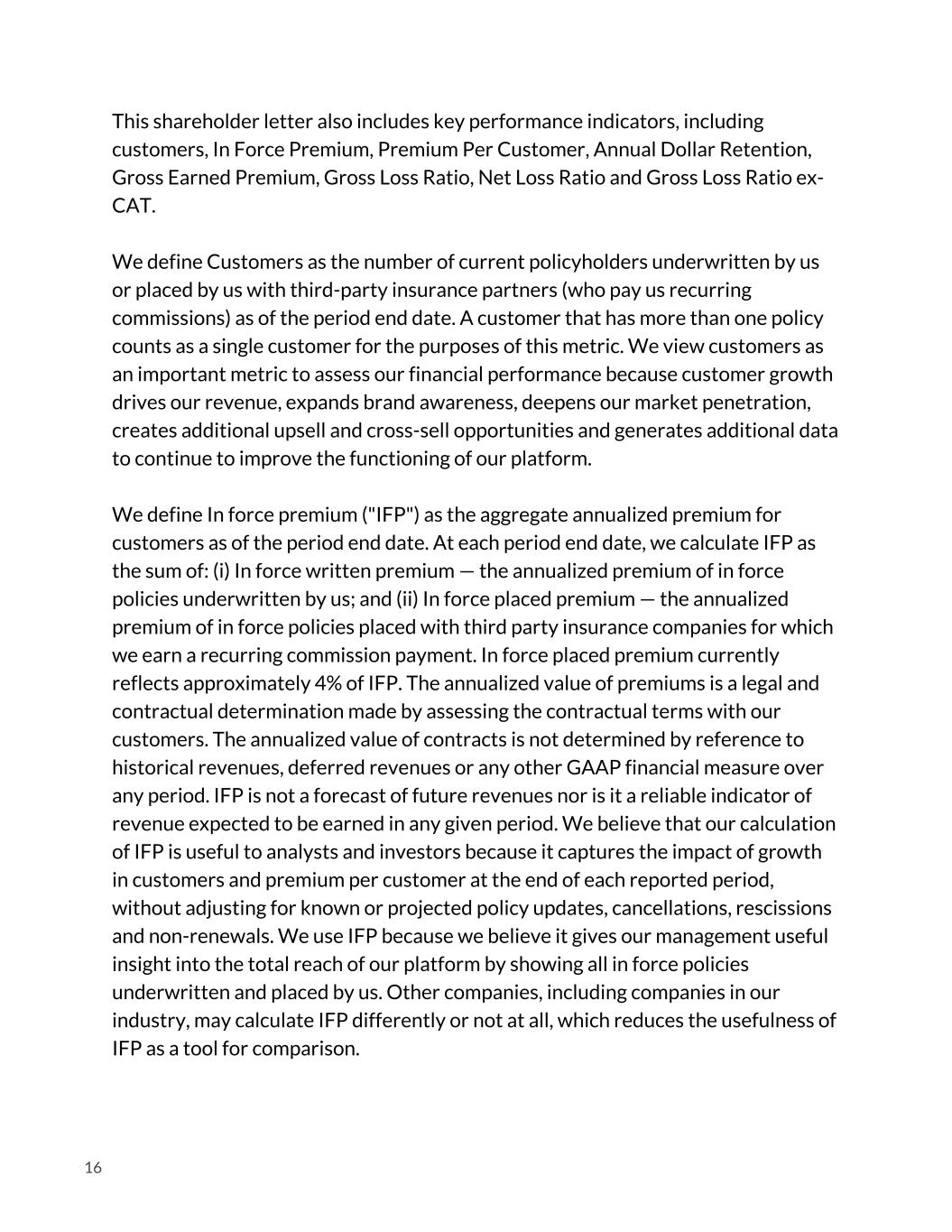

$747 $944 $1,237 $181 $226 $290 ($29) ($24) ($5) ($42) ($30) ($22) $34 $64 $111 29% 43% 48% ($11) $27 $37 ($16) $14 $21 1 $414 2,984,513$1,237M IN FORCE PREMIUM (IFP) PREMIUM PER CUSTOMER TOTAL CUSTOMERS ↑31% ↑7% ↑23% IN FORCE PREMIUM ($s in m) KEY METRICS ($s in m) Q4 23 Q4 25Q4 24 GEP ADJUSTED EBITDA NET LOSS Q4 23 Q4 25Q4 24 GROSS PROFIT ($s in m) ADJUSTED FREE CASH FLOW ($s in m) ADJUSTED FREE CASH FLOW CASH FLOW FROM OPERATING ACTIVITIES GROSS PROFIT GROSS PROFIT MARGIN Q4 23 Q4 25Q4 24 Q4 23 Q4 25Q4 24 (23%) (13%) (7%) NET LOSS / GEP

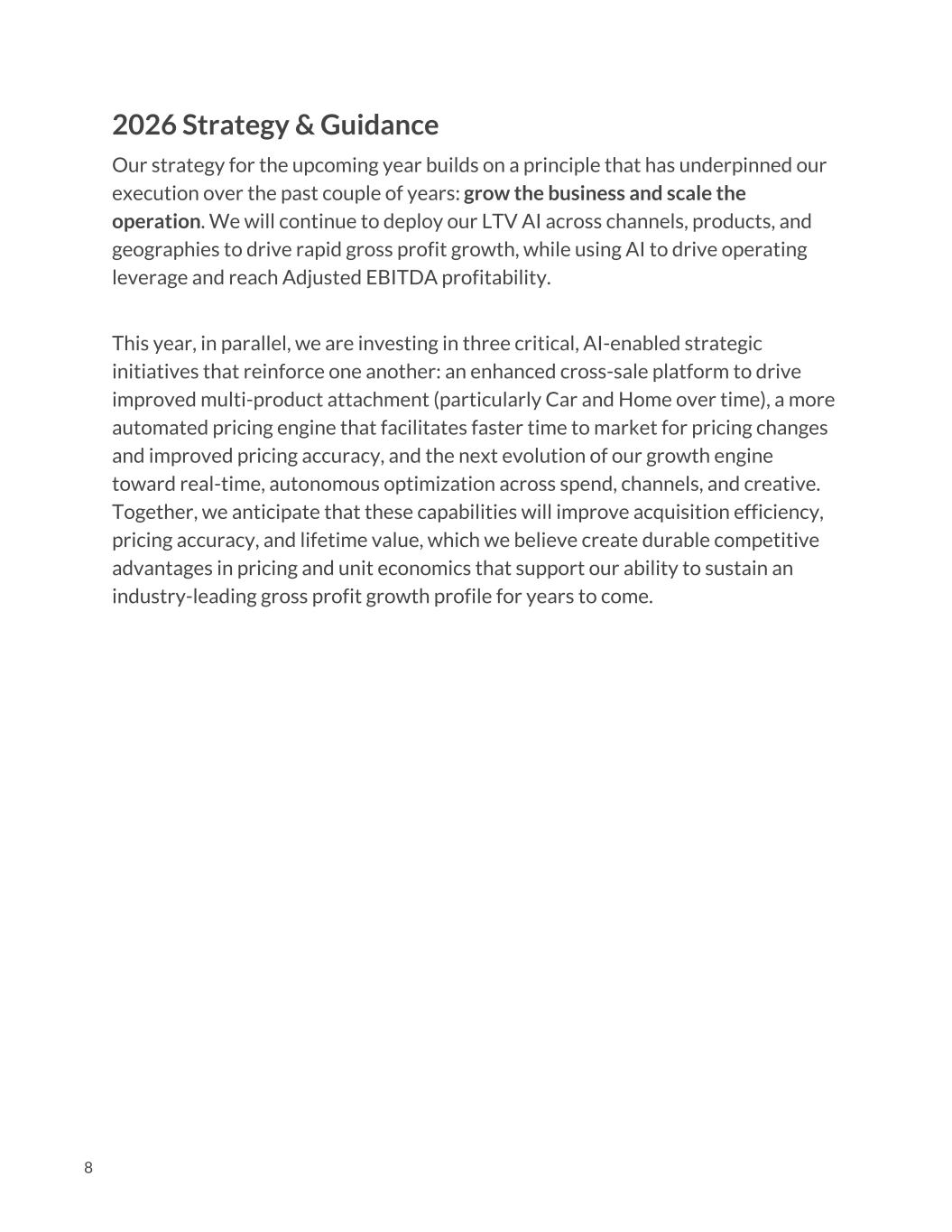

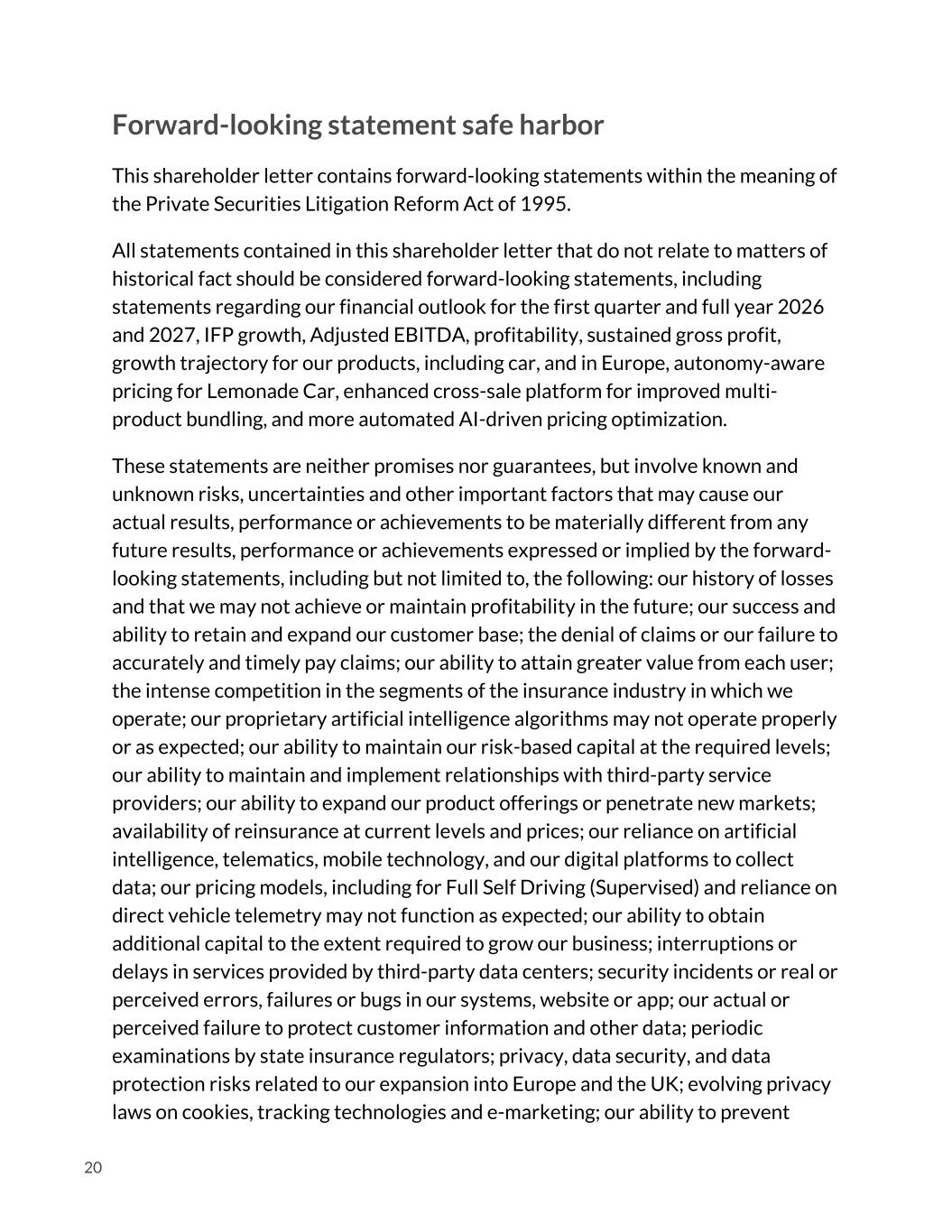

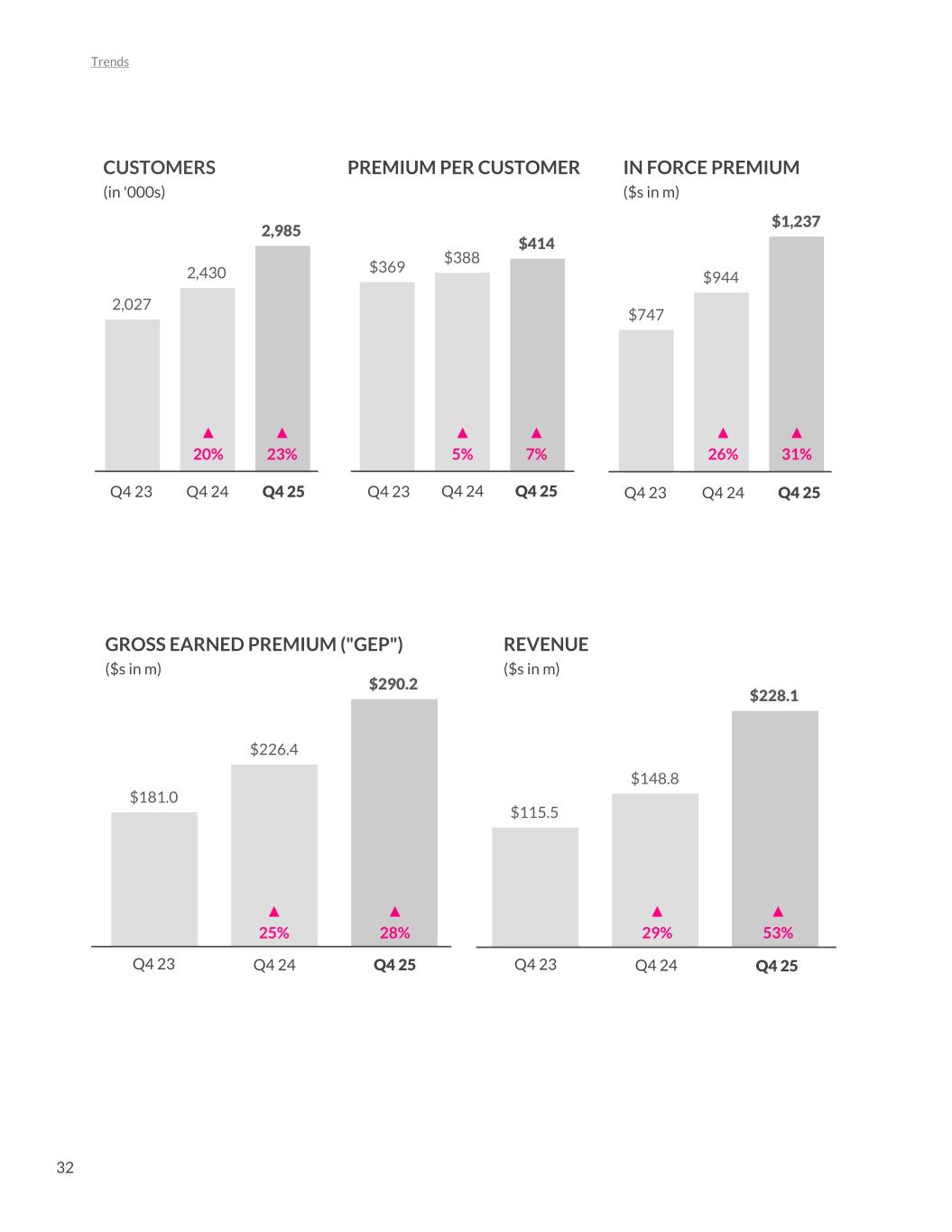

Dear Shareholders, By any measure, the fourth quarter of 2025 was our strongest ever. The quarter was characterized by growth acceleration, underwriting excellence, and operating leverage, and concluded a year in which momentum continued to build across key business drivers. Here’s a look at the metrics: • Top Line: At $1.24 billion, In Force Premium grew 31% – extending our streak of IFP growth acceleration to nine consecutive quarters. Revenue grew faster still, by 53% to $228 million. • Gross Profit: Increased 73% YoY to $111 million, due to 53% revenue growth and an 11 percentage point YoY improvement in the Gross Loss Ratio to 52%. • Adj. EBITDA: Improved $19 million to ($5) million. Net Loss in the quarter was ($22) million, 28% improved YoY. • Cash Flow: We generated $37 million of Adj. Free Cash Flow, and $21 million of Cash Flow from Operations. The strength of Q4's results reflects the compounding nature of our model. Faster growth expands our data advantage, which sharpens our AI-powered segmentation and pricing models. As these models improve, we see stronger unit economics and accelerating gross profit. That gross profit can then be reinvested to drive further growth at attractive returns, reinforcing a powerful flywheel. Simply put, growth is the gift that keeps on giving. 2

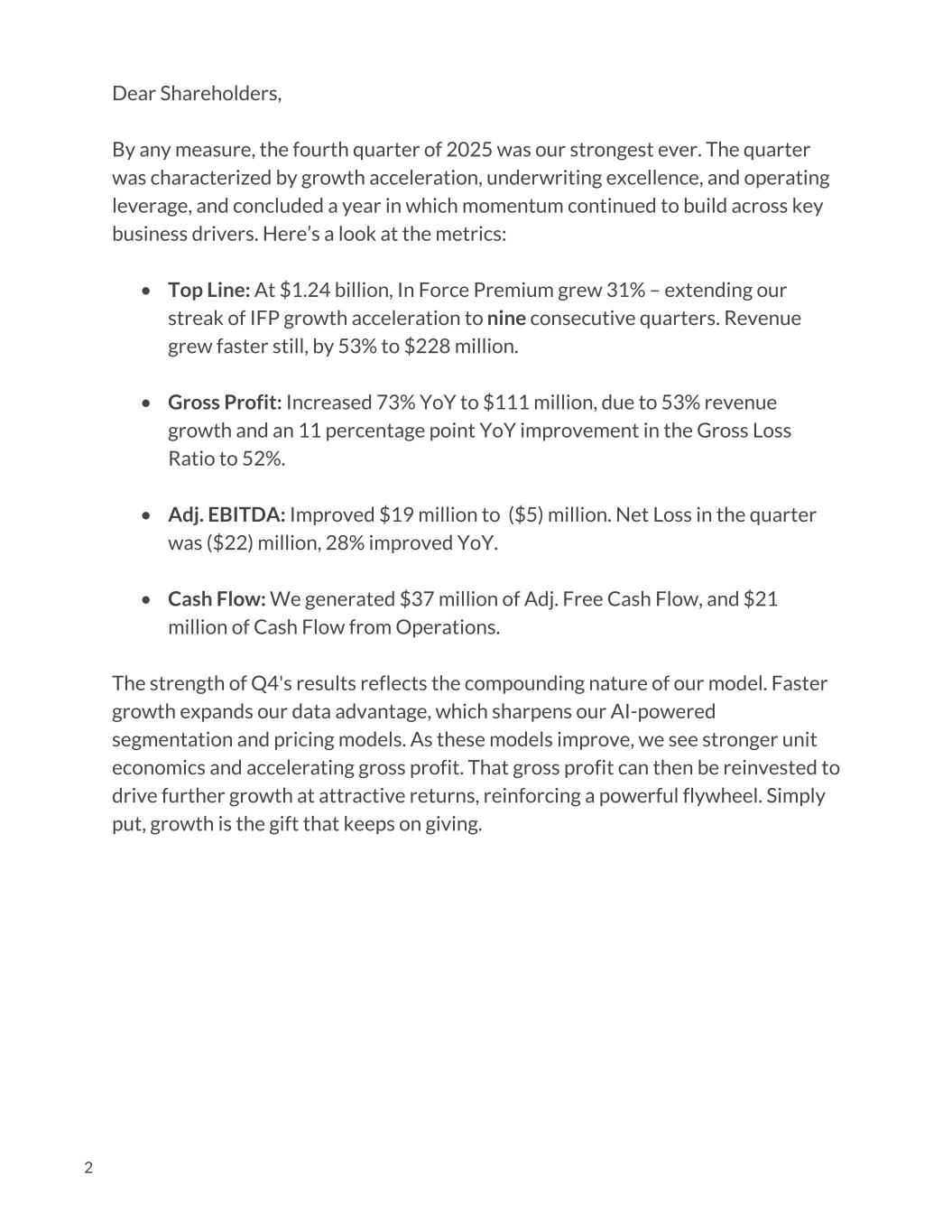

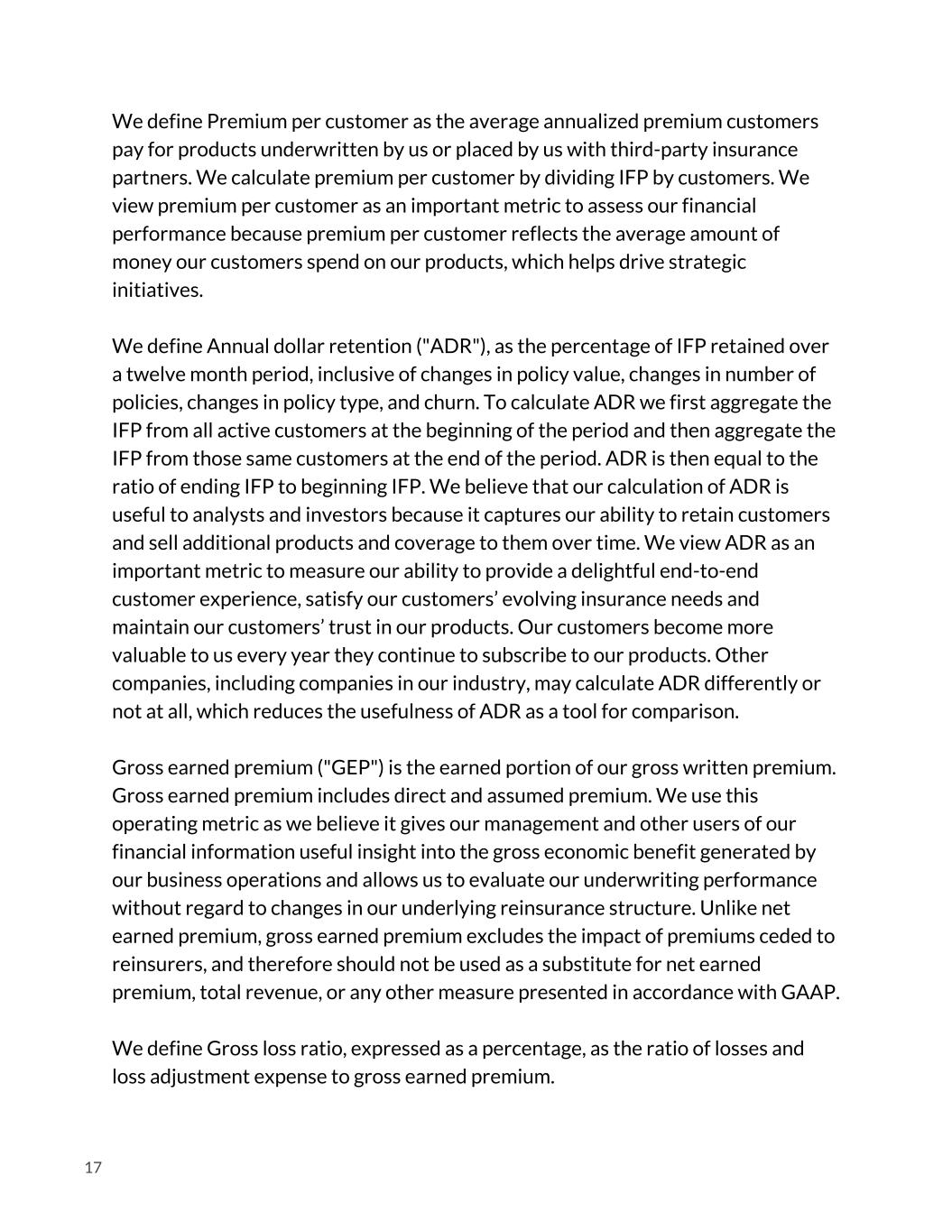

Grow the business and scale the operation Continued execution of long-standing financial strategy 3 Sustained operating leverage driven by AI and automation. Since Q3 22, added 1.2m customers while headcount declined by 6% 9 quarters of IFP growth acceleration alongside sustained gross loss ratio improvement yields a more than quintupling in gross profit 18% 20% 22% 22% 24% 26% 27% 29% 30% 31% Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 88% 85% 83% 79% 77% 73% 73% 70% 67% 64% Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 TTM GROSS LOSS RATIO IFP VS OPEX EXCL. GROWTH SPEND ($s in m) $87 $101 $609 $1,237 $0 $100 $200 $300 $500 $600 $700 $800 $900 $1,000 $1,100 $1,200 $1,300 OPEX EXCL. GROWTH IN FORCE PREMIUM (END OF PERIOD) Q4 25Q3 22 IFP YoY GROWTH RATE

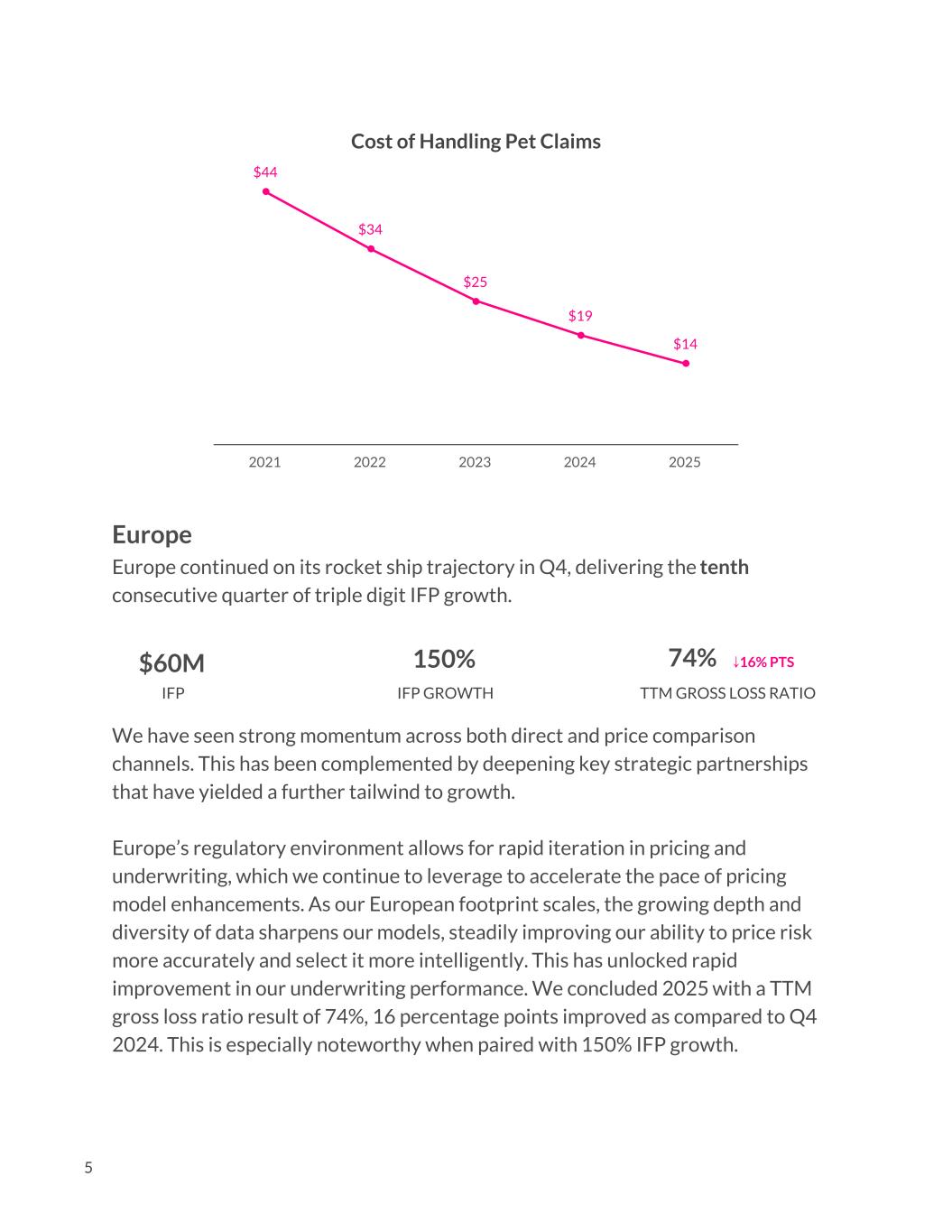

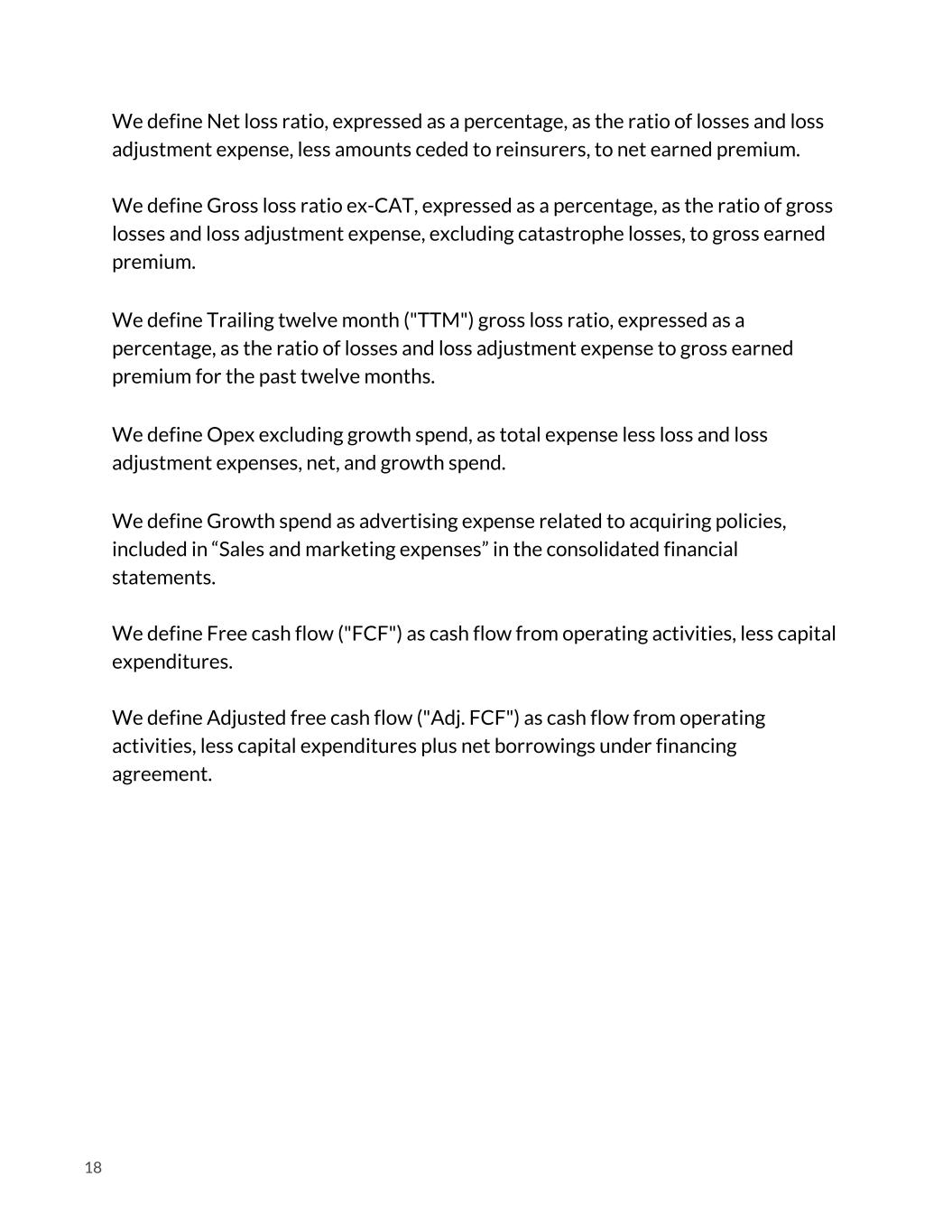

2025: Key Growth Drivers Beneath our aggregate financial performance, our growth drivers are increasingly diversified. We now benefit from meaningful scale across multiple products and geographies, reducing reliance on any single product line or region. Within that diversified portfolio foundation, Pet, Car, and Europe continue to lead, each exhibiting rapid growth, strong underwriting performance, and expanding contribution to gross profit. Importantly, these are not short-term dynamics: they reflect structural advantages in markets where our technology, data, and operating model are particularly well suited. Pet Pet delivered another exceptional year in 2025, sustaining an IFP growth rate in the mid-50s for the second consecutive year. Our share of new pet insurance business continued to expand: Lemonade now has the fastest-growing share of Google search volume among U.S. pet insurance companies. Importantly, rapid growth has been complemented by significant progress on profitability: Pet benefits from structurally higher claim frequency, creating multiple customer touchpoints each year that accelerate data accumulation and learning across the Lemonade platform. As a result, we have been able to grow Pet to our largest line of business, as measured by total IFP, in just 5 years - alongside rapid progress to healthy and strong underwriting margins. Simultaneously, we have seen continued improvement in cost per claim. Our 2025 result of $14 represents a level we believe to be industry-leading and is a clear testament to the growing impact of AI across claims and operations. 4 55% 70%$439M IFP IFP GROWTH TTM GROSS LOSS RATIO ↑1% PT

$44 $34 $25 $19 $14 2021 2022 2023 2024 2025 Europe Europe continued on its rocket ship trajectory in Q4, delivering the tenth consecutive quarter of triple digit IFP growth. We have seen strong momentum across both direct and price comparison channels. This has been complemented by deepening key strategic partnerships that have yielded a further tailwind to growth. Europe’s regulatory environment allows for rapid iteration in pricing and underwriting, which we continue to leverage to accelerate the pace of pricing model enhancements. As our European footprint scales, the growing depth and diversity of data sharpens our models, steadily improving our ability to price risk more accurately and select it more intelligently. This has unlocked rapid improvement in our underwriting performance. We concluded 2025 with a TTM gross loss ratio result of 74%, 16 percentage points improved as compared to Q4 2024. This is especially noteworthy when paired with 150% IFP growth. 5 Cost of Handling Pet Claims 150% 74%$60M IFP TTM GROSS LOSS RATIO ↓16% PTS IFP GROWTH

The combination of excellent marketing efficiency, fast learning cycles, and deepening use of AI across our platform (most notably in acquisition and pricing) has enabled Europe to grow rapidly and profitably, reinforcing our confidence that the region will deliver strong, healthy growth in 2026 and beyond. Car We previously described 2025 as a year of deliberate product optimization for Lemonade Car, with 2026 to mark a broader breakout. That is exactly how things played out, and Car’s performance in H2 2025 sets us up for a strong 2026. A series of product iterations and experiments improved conversion rates by as much as 60% as compared to a year ago; these changes have now been operationalized at scale. These gains were amplified via go-to-market enhancements across channels & creative, as well as continued TAM expansion through multiple new state launches. Growth has been accompanied by sustained underwriting improvement, with loss ratio improving meaningfully as pricing segmentation, telematics-driven loss prediction, claims efficiency, and accuracy all advanced in parallel. We saw a 23 point YoY improvement in the TTM gross loss ratio, with a result of 70% at year end 2025. Importantly, we continue to see improving underwriting performance across both new and renewal business, with a shrinking ‘new business penalty’ effect, as pricing accuracy continues to strengthen with greater scale. We are energized by our strong momentum, but are mindful that we remain in the early innings of our Car journey. We believe that we are building the best car insurance product experience in the market. Simultaneously, proprietary telematics & LTV AI models enable us to identify attractive risks and offer them competitive prices. Given these strengths, we expect Car to continue its rapid growth trajectory throughout 2026 and beyond. 6 53% 70%$187M IFP IFP GROWTH TTM GROSS LOSS RATIO ↓23% PTS

Speaking of 'beyond', we are building Lemonade Car with a long-term orientation, designed to evolve beyond today’s growth drivers. Specifically, we are positioning Lemonade Car for a future in which pricing reflects who is doing the driving: human or AI. Recent advances in autonomous driving capabilities are meaningfully increasing real-world utilization, reinforcing our conviction that autonomy-aware pricing has become increasingly relevant. Our recently announced launch of autonomous pricing for Tesla Full Self Driving (Supervised) ("FSD (Supervised)") represents an important step in that direction, leveraging vehicle telemetry (with customer permission) to distinguish autonomous miles from human-driven miles and price each accordingly. Today, autonomously driven miles under FSD (Supervised) are priced at 50% of the human-driven per-mile rate. And where the data continues to show improving FSD (Supervised) safety outcomes, as we expect, prices should continue to come down as the risk profile improves. It is our perspective that the expansion of autonomous driving plays directly to our strengths. Our platform is built around usage-based pricing, real-time data, and flexible coverage, precisely the infrastructure needed for the future. We believe we are positioned to move faster than incumbents to capitalize on this shift as driving itself evolves, leading the transition towards autonomy-aware car insurance pricing. Investor Day 2026 In keeping with our biennial cadence, we are pleased to announce that we will be hosting the next Lemonade Investor Day in New York City in November 2026. The event will provide a deeper look at our evolving financial strategy, growth outlook, and the AI capabilities underpinning our model that set us apart from the rest of our industry; we will share more detailed information closer to the event. 7

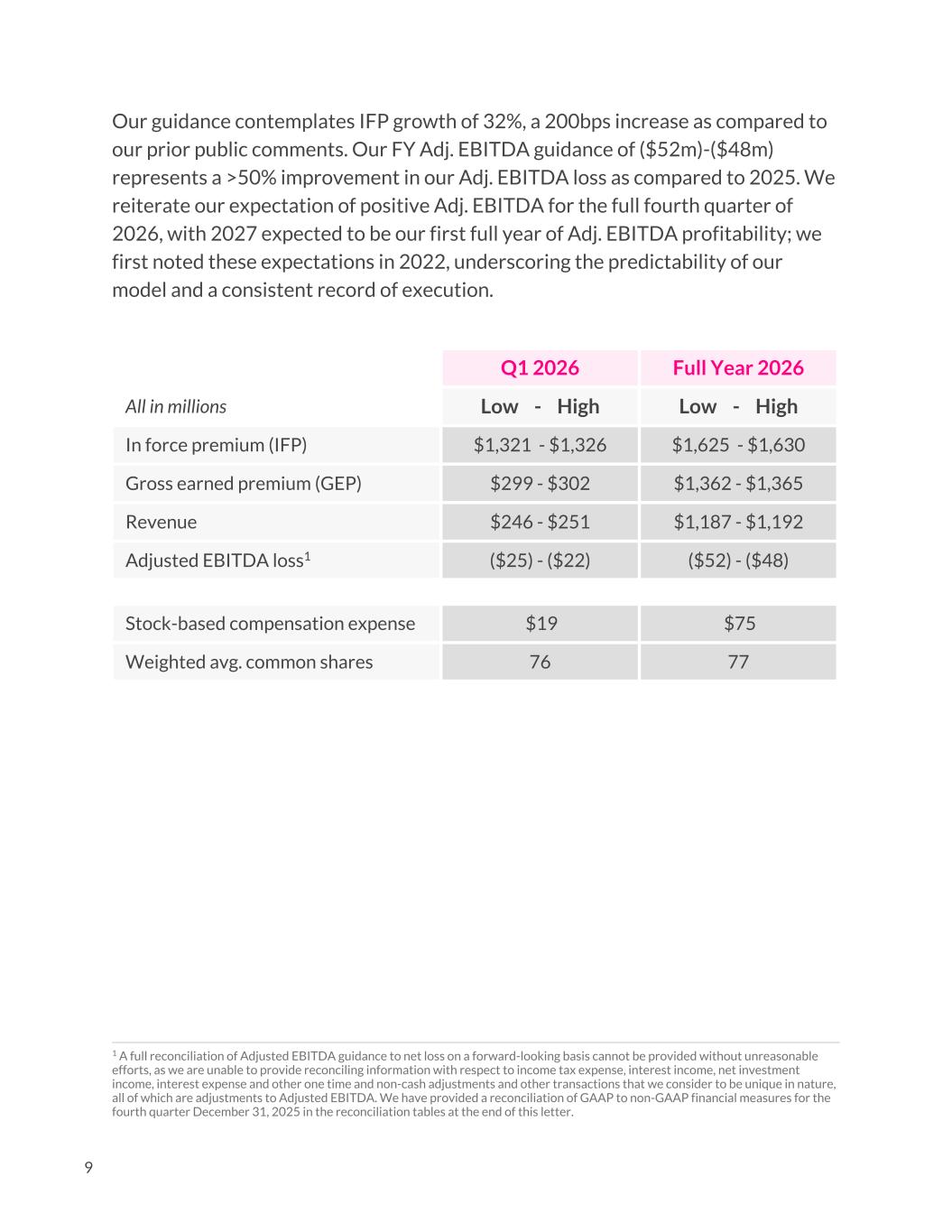

2026 Strategy & Guidance Our strategy for the upcoming year builds on a principle that has underpinned our execution over the past couple of years: grow the business and scale the operation. We will continue to deploy our LTV AI across channels, products, and geographies to drive rapid gross profit growth, while using AI to drive operating leverage and reach Adjusted EBITDA profitability. This year, in parallel, we are investing in three critical, AI-enabled strategic initiatives that reinforce one another: an enhanced cross-sale platform to drive improved multi-product attachment (particularly Car and Home over time), a more automated pricing engine that facilitates faster time to market for pricing changes and improved pricing accuracy, and the next evolution of our growth engine toward real-time, autonomous optimization across spend, channels, and creative. Together, we anticipate that these capabilities will improve acquisition efficiency, pricing accuracy, and lifetime value, which we believe create durable competitive advantages in pricing and unit economics that support our ability to sustain an industry-leading gross profit growth profile for years to come. 8

Our guidance contemplates IFP growth of 32%, a 200bps increase as compared to our prior public comments. Our FY Adj. EBITDA guidance of ($52m)-($48m) represents a >50% improvement in our Adj. EBITDA loss as compared to 2025. We reiterate our expectation of positive Adj. EBITDA for the full fourth quarter of 2026, with 2027 expected to be our first full year of Adj. EBITDA profitability; we first noted these expectations in 2022, underscoring the predictability of our model and a consistent record of execution. Q1 2026 Full Year 2026 All in millions Low - High Low - High In force premium (IFP) $1,321 - $1,326 $1,625 - $1,630 Gross earned premium (GEP) $299 - $302 $1,362 - $1,365 Revenue $246 - $251 $1,187 - $1,192 Adjusted EBITDA loss1 ($25) - ($22) ($52) - ($48) Stock-based compensation expense $19 $75 Weighted avg. common shares 76 77 9 1 A full reconciliation of Adjusted EBITDA guidance to net loss on a forward-looking basis cannot be provided without unreasonable efforts, as we are unable to provide reconciling information with respect to income tax expense, interest income, net investment income, interest expense and other one time and non-cash adjustments and other transactions that we consider to be unique in nature, all of which are adjustments to Adjusted EBITDA. We have provided a reconciliation of GAAP to non-GAAP financial measures for the fourth quarter December 31, 2025 in the reconciliation tables at the end of this letter.

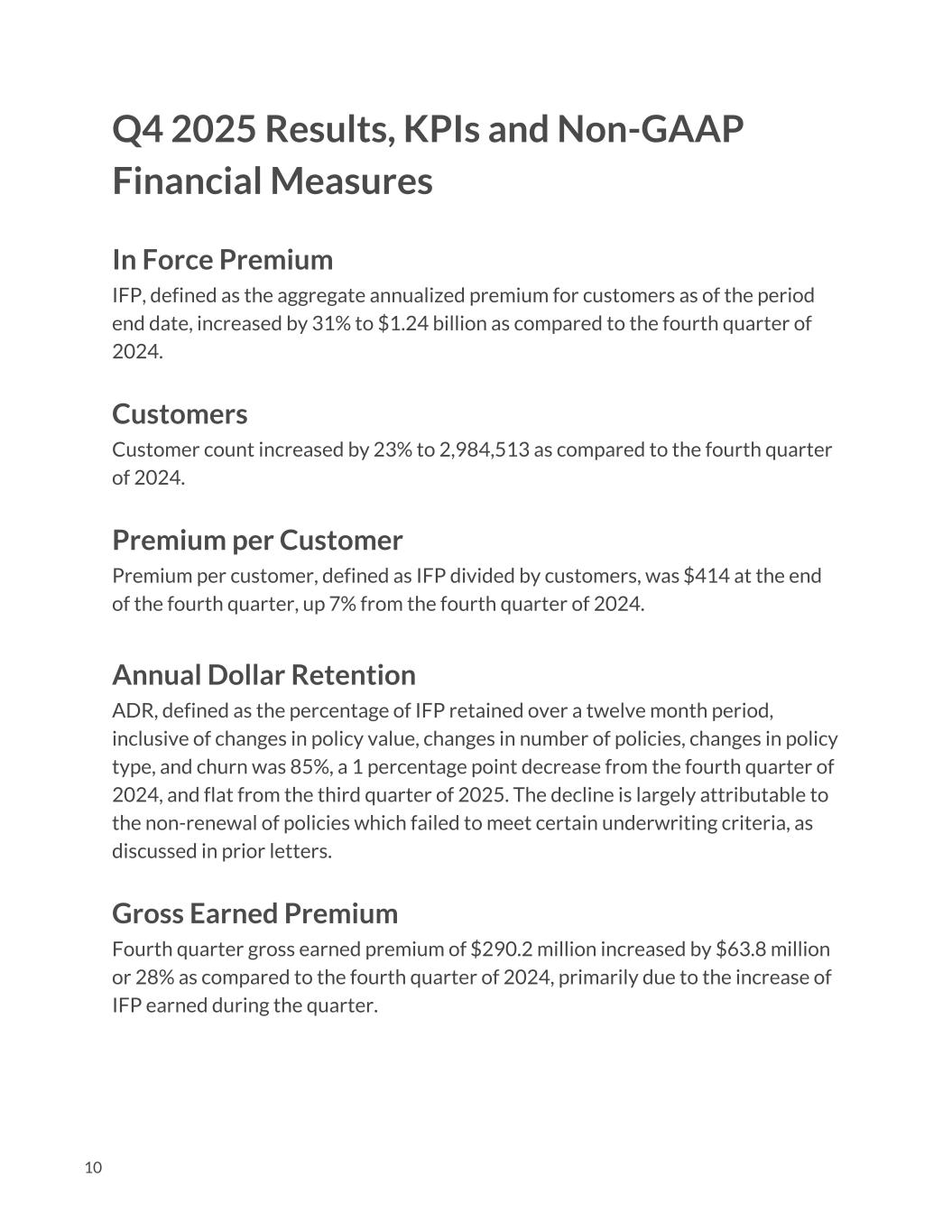

Q4 2025 Results, KPIs and Non-GAAP Financial Measures In Force Premium IFP, defined as the aggregate annualized premium for customers as of the period end date, increased by 31% to $1.24 billion as compared to the fourth quarter of 2024. Customers Customer count increased by 23% to 2,984,513 as compared to the fourth quarter of 2024. Premium per Customer Premium per customer, defined as IFP divided by customers, was $414 at the end of the fourth quarter, up 7% from the fourth quarter of 2024. Annual Dollar Retention ADR, defined as the percentage of IFP retained over a twelve month period, inclusive of changes in policy value, changes in number of policies, changes in policy type, and churn was 85%, a 1 percentage point decrease from the fourth quarter of 2024, and flat from the third quarter of 2025. The decline is largely attributable to the non-renewal of policies which failed to meet certain underwriting criteria, as discussed in prior letters. Gross Earned Premium Fourth quarter gross earned premium of $290.2 million increased by $63.8 million or 28% as compared to the fourth quarter of 2024, primarily due to the increase of IFP earned during the quarter. 10

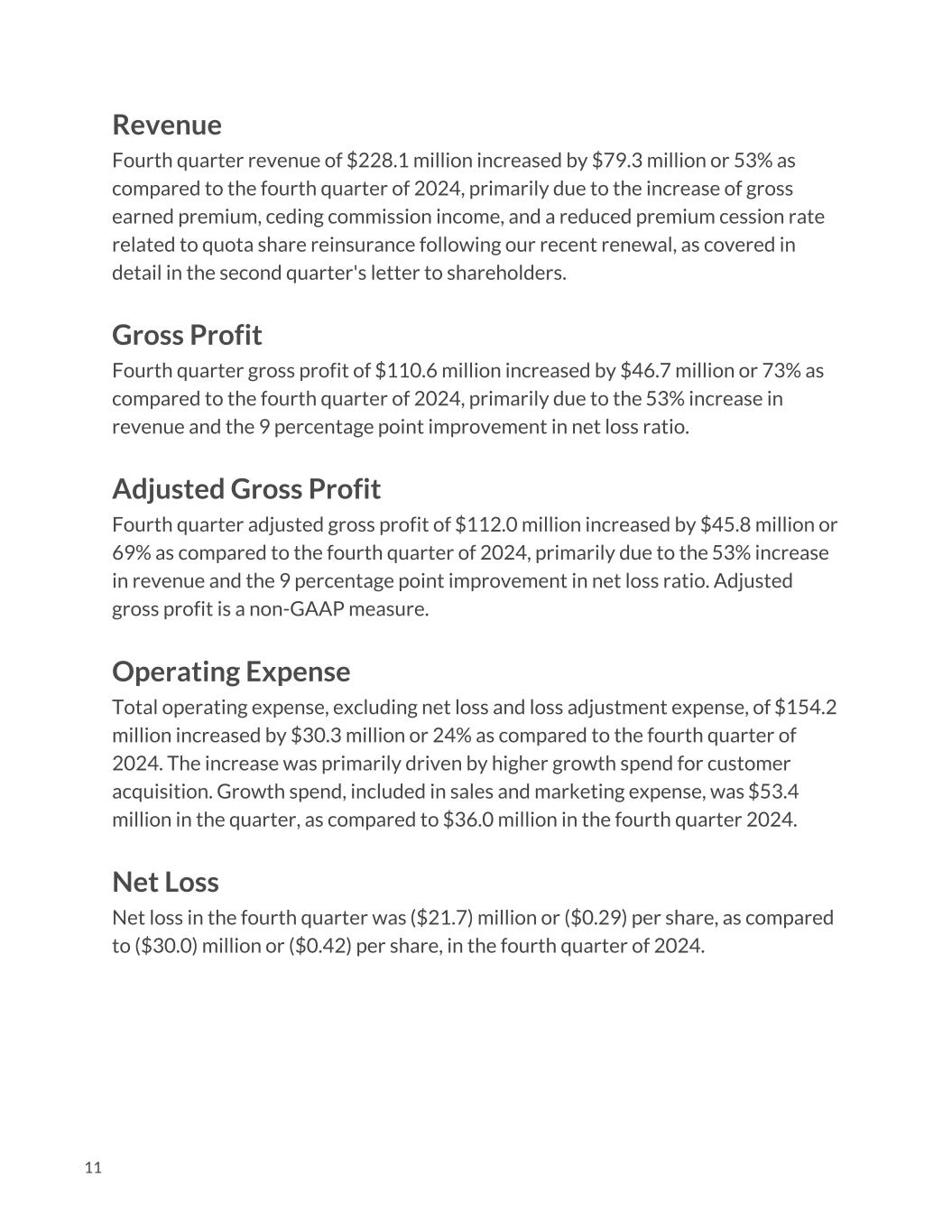

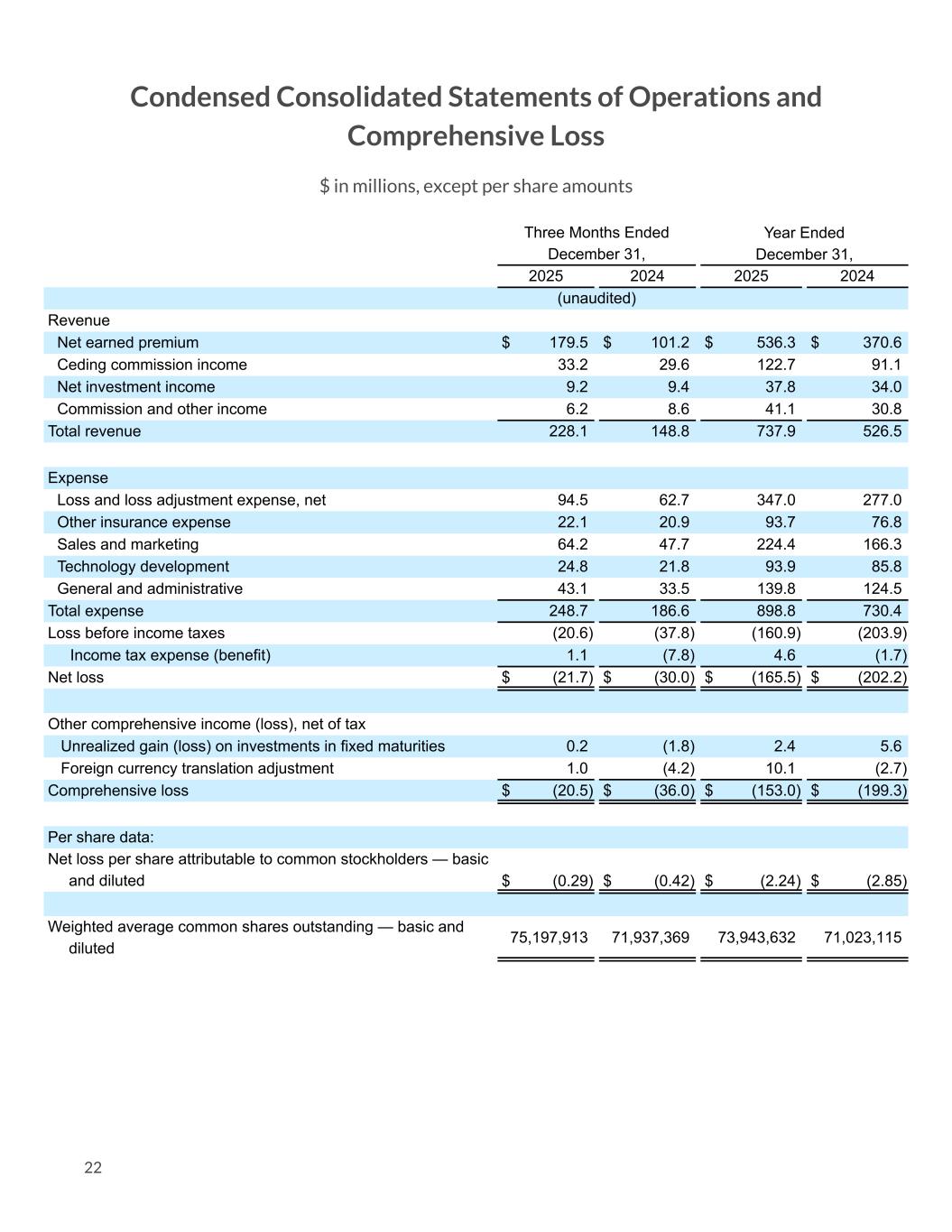

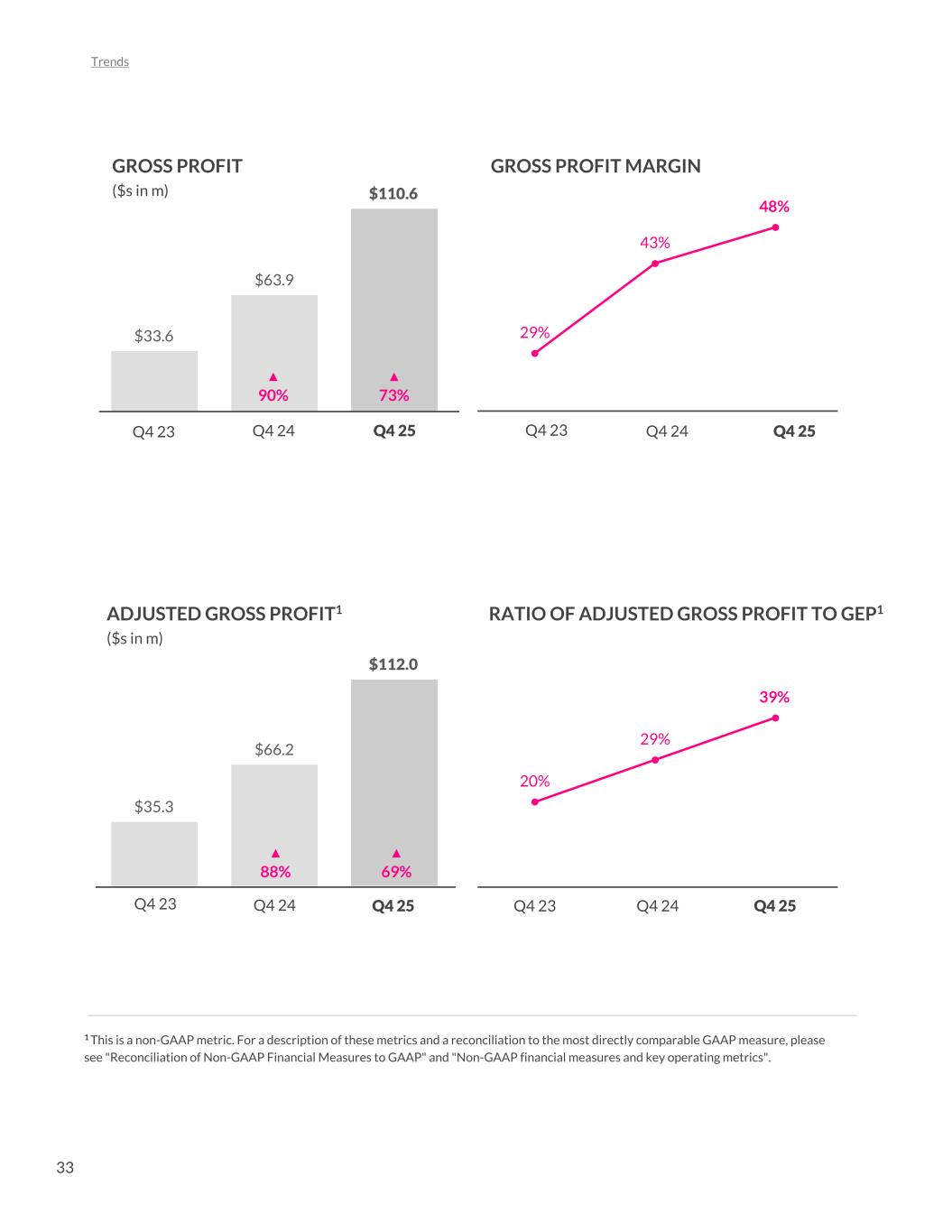

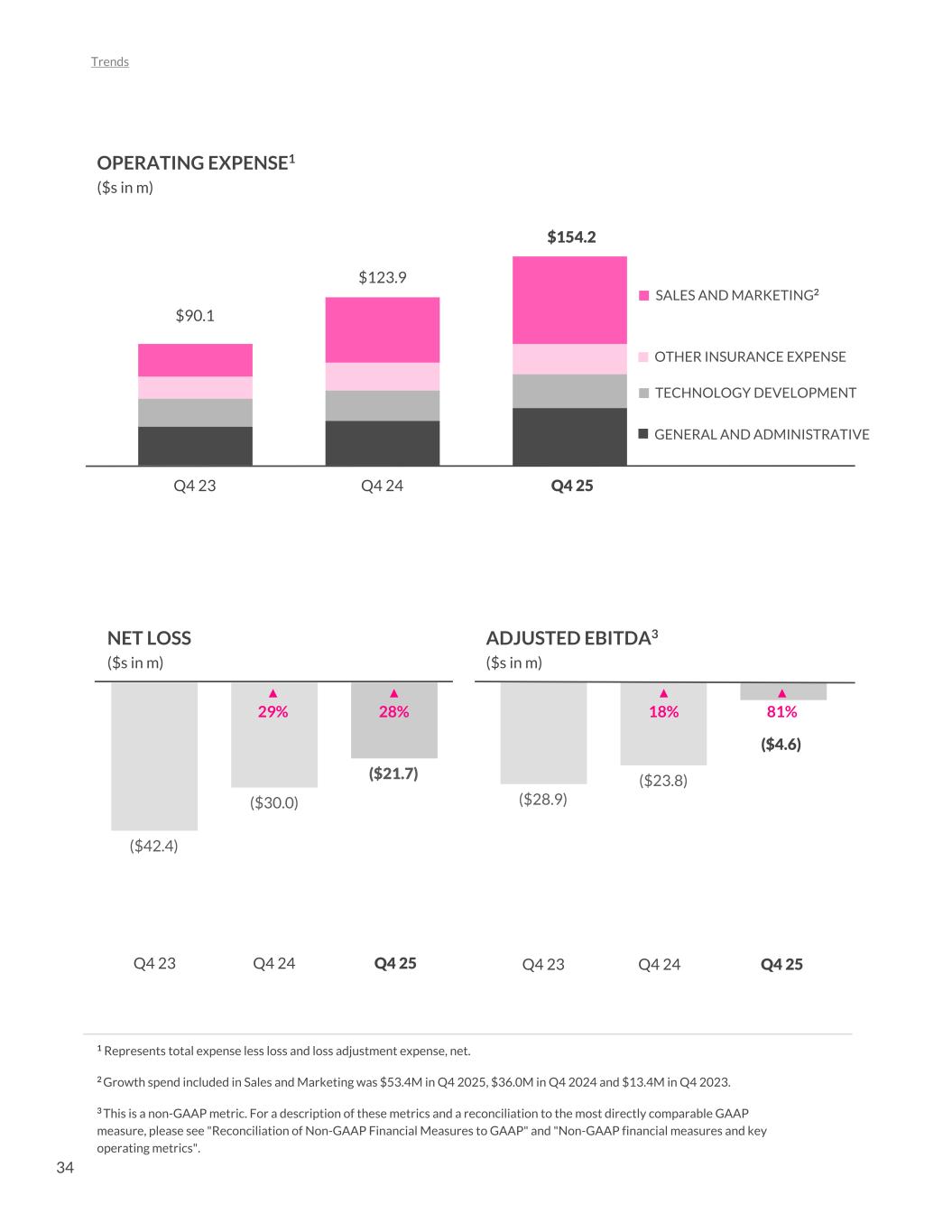

Revenue Fourth quarter revenue of $228.1 million increased by $79.3 million or 53% as compared to the fourth quarter of 2024, primarily due to the increase of gross earned premium, ceding commission income, and a reduced premium cession rate related to quota share reinsurance following our recent renewal, as covered in detail in the second quarter's letter to shareholders. Gross Profit Fourth quarter gross profit of $110.6 million increased by $46.7 million or 73% as compared to the fourth quarter of 2024, primarily due to the 53% increase in revenue and the 9 percentage point improvement in net loss ratio. Adjusted Gross Profit Fourth quarter adjusted gross profit of $112.0 million increased by $45.8 million or 69% as compared to the fourth quarter of 2024, primarily due to the 53% increase in revenue and the 9 percentage point improvement in net loss ratio. Adjusted gross profit is a non-GAAP measure. Operating Expense Total operating expense, excluding net loss and loss adjustment expense, of $154.2 million increased by $30.3 million or 24% as compared to the fourth quarter of 2024. The increase was primarily driven by higher growth spend for customer acquisition. Growth spend, included in sales and marketing expense, was $53.4 million in the quarter, as compared to $36.0 million in the fourth quarter 2024. Net Loss Net loss in the fourth quarter was ($21.7) million or ($0.29) per share, as compared to ($30.0) million or ($0.42) per share, in the fourth quarter of 2024. 11

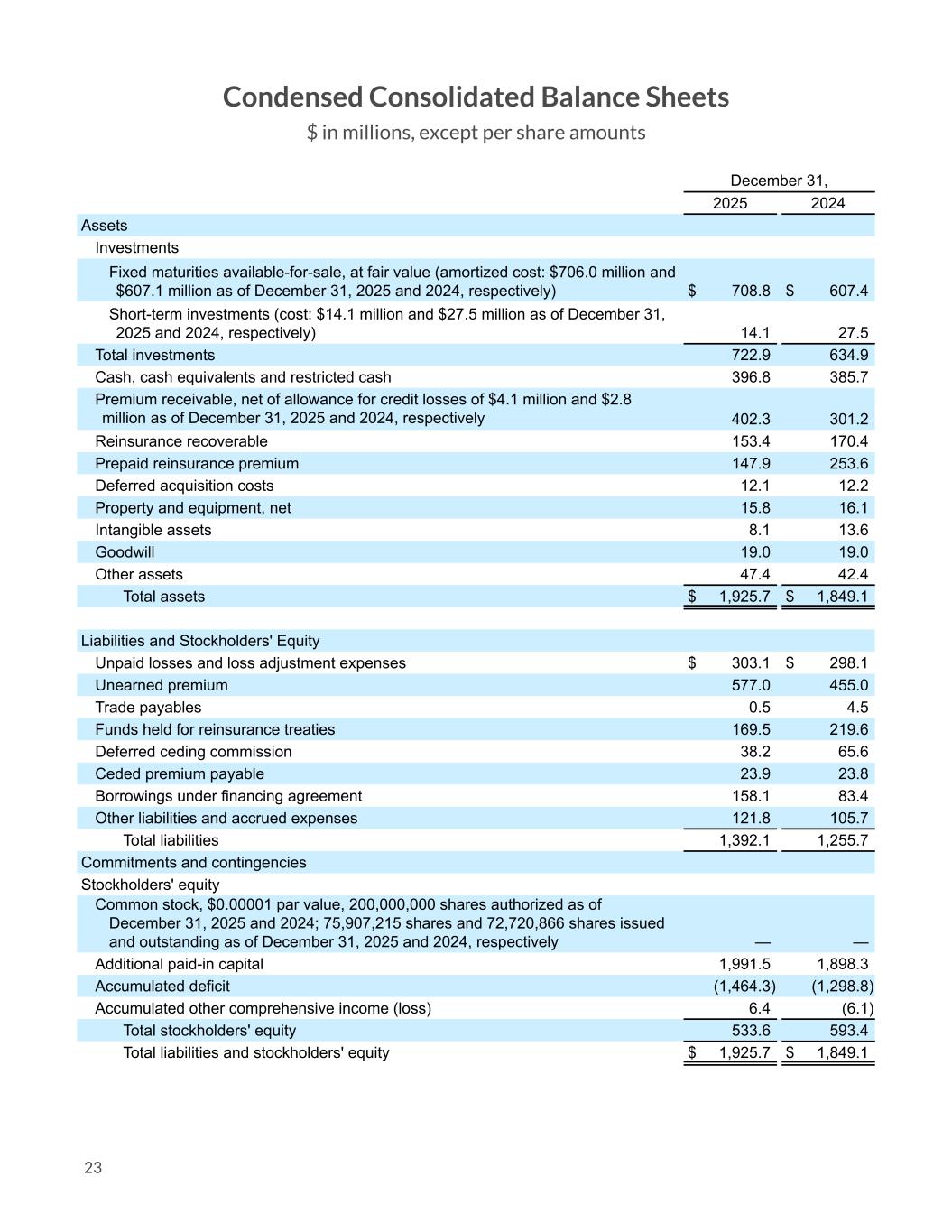

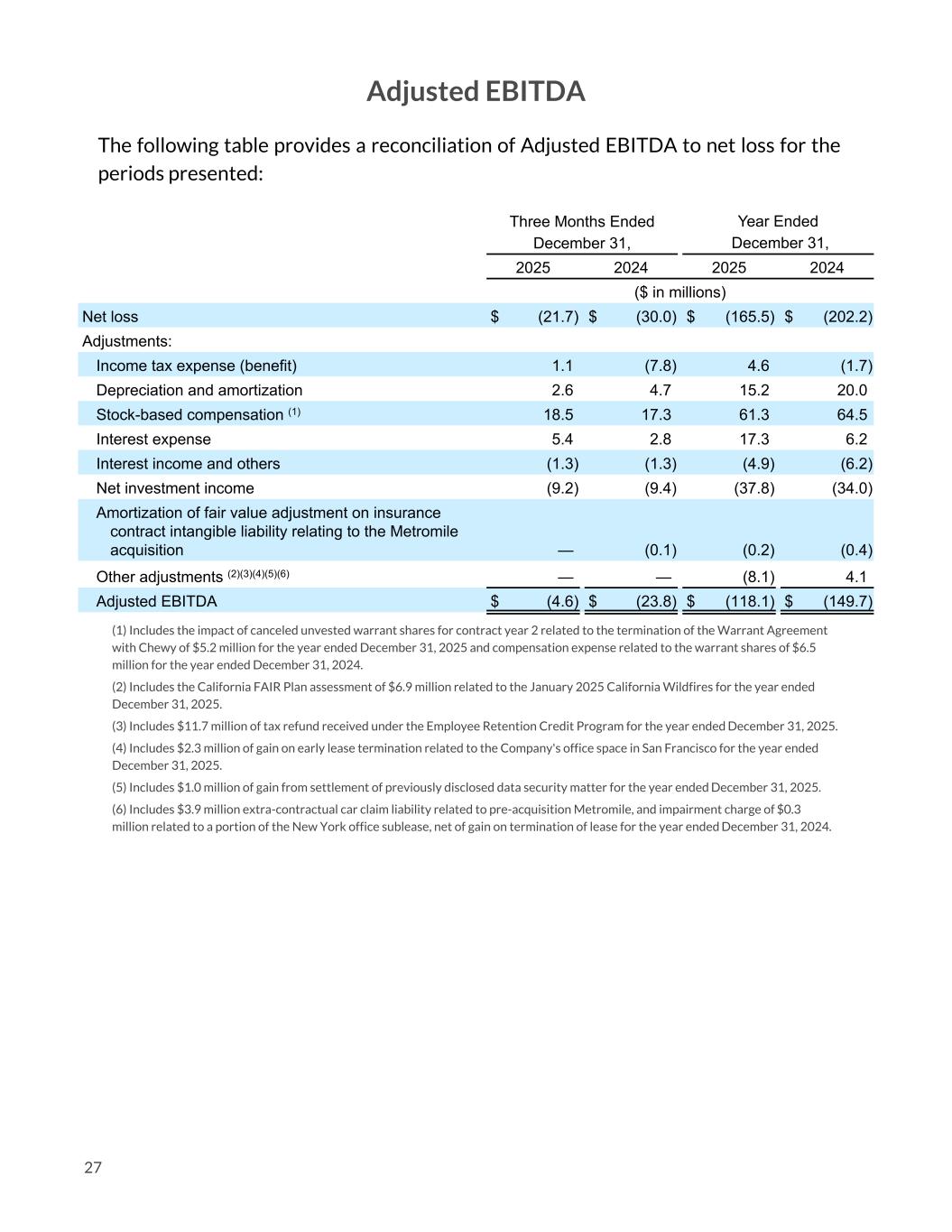

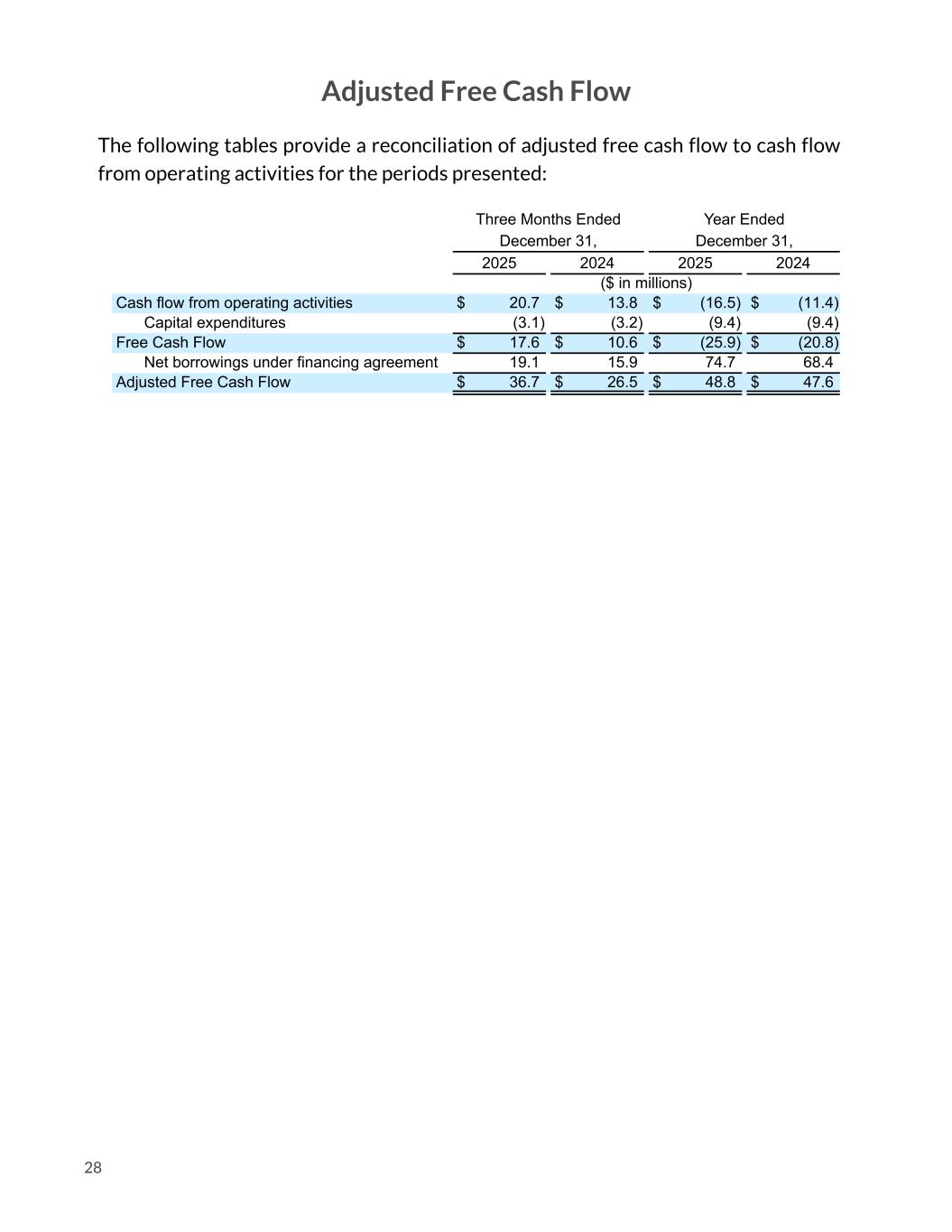

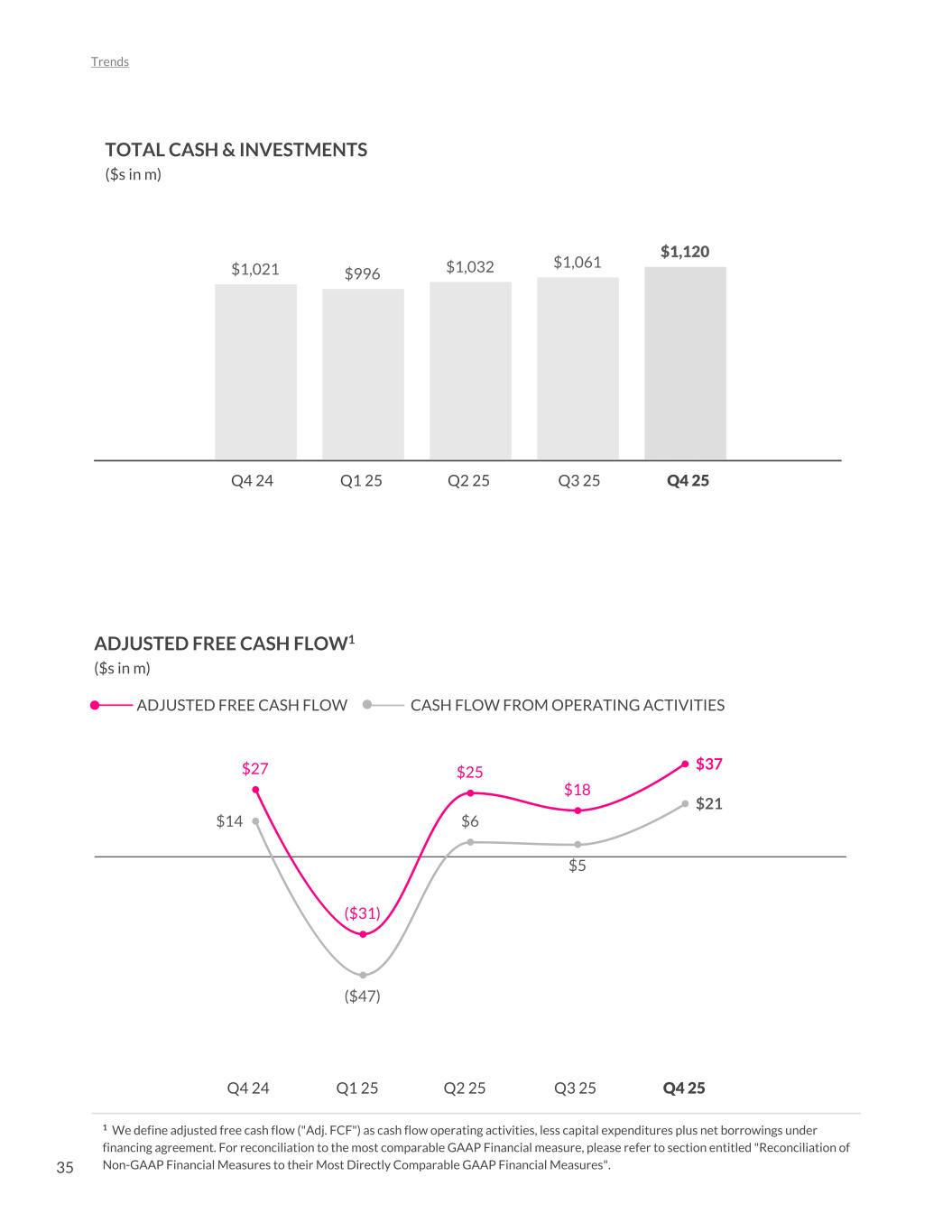

Adjusted EBITDA Adjusted EBITDA loss was ($4.6) million, as compared to an Adjusted EBITDA loss of ($23.8) million in the fourth quarter 2024. This year over year improvement is primarily attributable to revenue growth and improved underwriting results, partially offset by the increase in growth spend. Adjusted EBITDA is a non-GAAP measure. Cash & Investments The Company’s cash, cash equivalents, and investments totaled approximately $1.12 billion at December 31, 2025. As of December 31, 2025, we were required to hold approximately $250 million of regulatory surplus at our insurance subsidiaries. Adjusted Free Cash Flow Adjusted free cash flow in the fourth quarter was $36.7 million, as compared to $26.5 million in the fourth quarter of 2024. Reconciliations of GAAP to non-GAAP financial measures, as well as definitions for the non-GAAP financial measures included in this letter and the reasons for their use, are presented at the end of this letter. 12

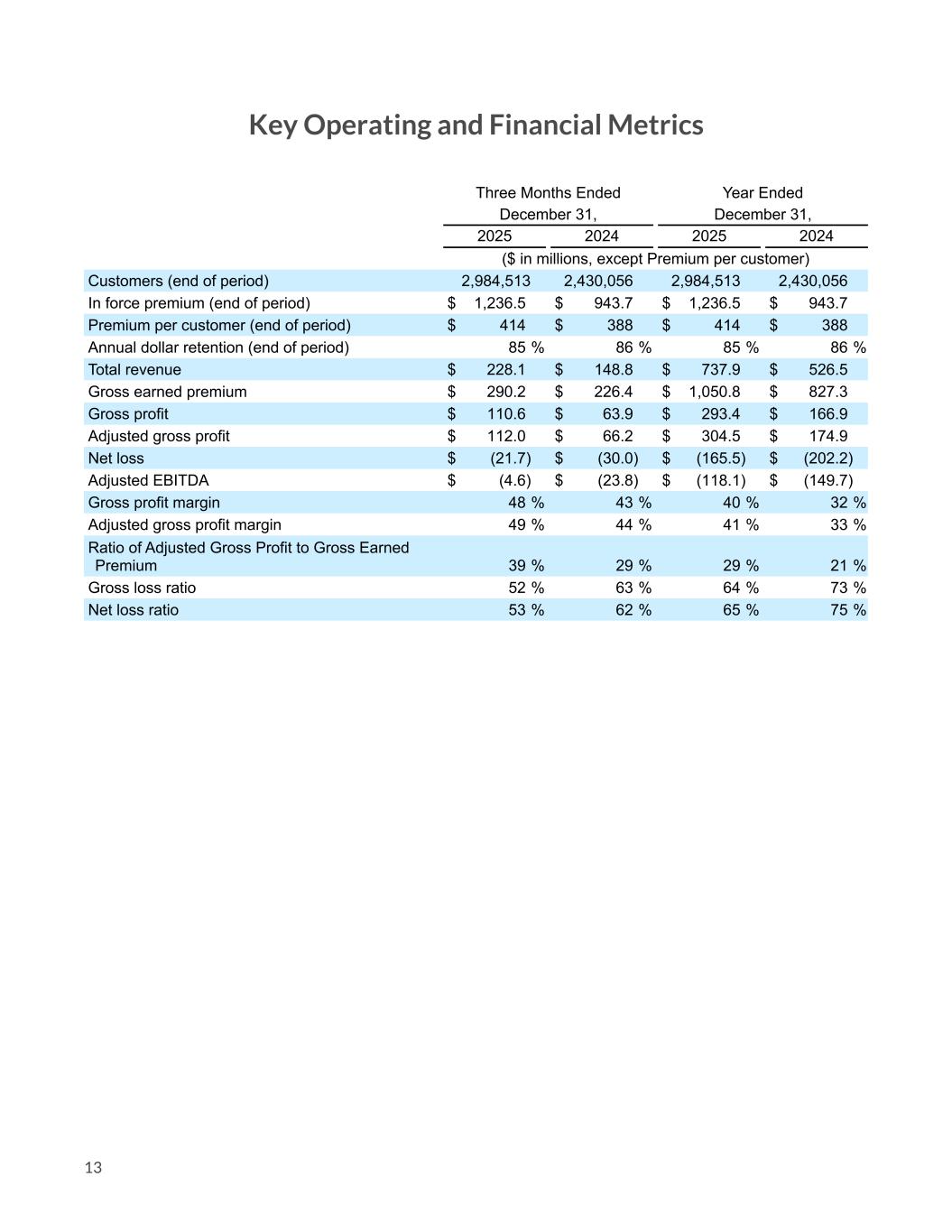

Key Operating and Financial Metrics Three Months Ended December 31, Year Ended December 31, 2025 2024 2025 2024 ($ in millions, except Premium per customer) Customers (end of period) 2,984,513 2,430,056 2,984,513 2,430,056 In force premium (end of period) $ 1,236.5 $ 943.7 $ 1,236.5 $ 943.7 Premium per customer (end of period) $ 414 $ 388 $ 414 $ 388 Annual dollar retention (end of period) 85 % 86 % 85 % 86 % Total revenue $ 228.1 $ 148.8 $ 737.9 $ 526.5 Gross earned premium $ 290.2 $ 226.4 $ 1,050.8 $ 827.3 Gross profit $ 110.6 $ 63.9 $ 293.4 $ 166.9 Adjusted gross profit $ 112.0 $ 66.2 $ 304.5 $ 174.9 Net loss $ (21.7) $ (30.0) $ (165.5) $ (202.2) Adjusted EBITDA $ (4.6) $ (23.8) $ (118.1) $ (149.7) Gross profit margin 48 % 43 % 40 % 32 % Adjusted gross profit margin 49 % 44 % 41 % 33 % Ratio of Adjusted Gross Profit to Gross Earned Premium 39 % 29 % 29 % 21 % Gross loss ratio 52 % 63 % 64 % 73 % Net loss ratio 53 % 62 % 65 % 75 % 13

Non-GAAP financial measures and key operating metrics The non-GAAP financial measures used in this shareholder letter are Adjusted EBITDA, Adjusted gross profit, Ratio of Adjusted gross profit to Gross earned premium, Free cash flow, and Adjusted free cash flow. We define Adjusted EBITDA, a non-GAAP financial measure, as net loss excluding income tax expense, depreciation and amortization, stock-based compensation, interest expense, interest income and others, net investment income, change in fair value of warrants liability, amortization of fair value adjustment on insurance contract intangible liability relating to the Metromile Acquisition, and other one time and non-cash adjustments and other transactions that we would consider to be unique in nature. We exclude these items from Adjusted EBITDA because we do not consider them to be directly attributable to our underlying operating performance. We use Adjusted EBITDA as an internal performance measure in the management of our operations because we believe it gives our management and other customers of our financial information useful insight into our results of operations and our underlying business performance. Adjusted EBITDA should not be viewed as a substitute for net loss calculated in accordance with U.S. GAAP, and other companies may define Adjusted EBITDA differently. We define Adjusted gross profit, a non-GAAP financial measure, as gross profit excluding net investment income, interest income and other income, and net realized gains and losses on sale of investments, plus fixed costs and overhead associated with our underwriting operations including employee-related expense, professional fees and other, and depreciation and amortization allocated to cost of revenue, and other adjustments that we would consider to be unique in nature. After these adjustments, the resulting calculation is inclusive of only those variable costs of revenue incurred on the successful acquisition of business and without the volatility of investment income. We use adjusted gross profit as a key measure of our progress towards profitability and to consistently evaluate the variable contribution to our business from underwriting operations from period to period. We define the Ratio of Adjusted gross profit to Gross earned premium as the ratio of adjusted gross profit divided by gross earned premium. The Ratio of Adjusted gross profit to Gross earned premium measures the relationship between the 14

underlying business volume and gross economic benefit generated by our underwriting operations, on the one hand, and our underlying profitability trends, on the other. We rely on this measure, which supplements our gross profit ratio as calculated in accordance with U.S. GAAP, because it provides management with insight into our underlying profitability trends over time. The non-GAAP financial measures used in this shareholder letter have not been calculated in accordance with GAAP and should be considered in addition to results prepared in accordance with GAAP and should not be considered as a substitute for, or superior to, GAAP results. In addition, Adjusted gross profit, and Adjusted gross profit margin, Ratio of Adjusted gross profit to Gross earned premium, and Adjusted EBITDA should not be construed as indicators of our operating performance, liquidity or cash flows generated by operating, investing and financing activities, as there may be significant factors or trends that they fail to address. We caution investors that non-GAAP financial information, by its nature, departs from traditional accounting conventions. Therefore, its use can make it difficult to compare our current results with our results from other reporting periods and with the results of other companies. Our management uses these non-GAAP financial measures, in conjunction with GAAP financial measures, as an integral part of managing our business and to, among other things: (i) monitor and evaluate the performance of our business operations and financial performance; (ii) facilitate internal comparisons of the historical operating performance of our business operations; (iii) facilitate external comparisons of the results of our overall business to the historical operating performance of other companies that may have different capital structures and debt levels; (iv) review and assess the operating performance of our management team; (v) analyze and evaluate financial and strategic planning decisions regarding future operating investments; and (vi) plan for and prepare future annual operating budgets and determine appropriate levels of operating investments. Investors are encouraged to review the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures as provided in the tables accompanying this shareholder letter. 15

This shareholder letter also includes key performance indicators, including customers, In Force Premium, Premium Per Customer, Annual Dollar Retention, Gross Earned Premium, Gross Loss Ratio, Net Loss Ratio and Gross Loss Ratio ex- CAT. We define Customers as the number of current policyholders underwritten by us or placed by us with third-party insurance partners (who pay us recurring commissions) as of the period end date. A customer that has more than one policy counts as a single customer for the purposes of this metric. We view customers as an important metric to assess our financial performance because customer growth drives our revenue, expands brand awareness, deepens our market penetration, creates additional upsell and cross-sell opportunities and generates additional data to continue to improve the functioning of our platform. We define In force premium ("IFP") as the aggregate annualized premium for customers as of the period end date. At each period end date, we calculate IFP as the sum of: (i) In force written premium — the annualized premium of in force policies underwritten by us; and (ii) In force placed premium — the annualized premium of in force policies placed with third party insurance companies for which we earn a recurring commission payment. In force placed premium currently reflects approximately 4% of IFP. The annualized value of premiums is a legal and contractual determination made by assessing the contractual terms with our customers. The annualized value of contracts is not determined by reference to historical revenues, deferred revenues or any other GAAP financial measure over any period. IFP is not a forecast of future revenues nor is it a reliable indicator of revenue expected to be earned in any given period. We believe that our calculation of IFP is useful to analysts and investors because it captures the impact of growth in customers and premium per customer at the end of each reported period, without adjusting for known or projected policy updates, cancellations, rescissions and non-renewals. We use IFP because we believe it gives our management useful insight into the total reach of our platform by showing all in force policies underwritten and placed by us. Other companies, including companies in our industry, may calculate IFP differently or not at all, which reduces the usefulness of IFP as a tool for comparison. 16

We define Premium per customer as the average annualized premium customers pay for products underwritten by us or placed by us with third-party insurance partners. We calculate premium per customer by dividing IFP by customers. We view premium per customer as an important metric to assess our financial performance because premium per customer reflects the average amount of money our customers spend on our products, which helps drive strategic initiatives. We define Annual dollar retention ("ADR"), as the percentage of IFP retained over a twelve month period, inclusive of changes in policy value, changes in number of policies, changes in policy type, and churn. To calculate ADR we first aggregate the IFP from all active customers at the beginning of the period and then aggregate the IFP from those same customers at the end of the period. ADR is then equal to the ratio of ending IFP to beginning IFP. We believe that our calculation of ADR is useful to analysts and investors because it captures our ability to retain customers and sell additional products and coverage to them over time. We view ADR as an important metric to measure our ability to provide a delightful end-to-end customer experience, satisfy our customers’ evolving insurance needs and maintain our customers’ trust in our products. Our customers become more valuable to us every year they continue to subscribe to our products. Other companies, including companies in our industry, may calculate ADR differently or not at all, which reduces the usefulness of ADR as a tool for comparison. Gross earned premium ("GEP") is the earned portion of our gross written premium. Gross earned premium includes direct and assumed premium. We use this operating metric as we believe it gives our management and other users of our financial information useful insight into the gross economic benefit generated by our business operations and allows us to evaluate our underwriting performance without regard to changes in our underlying reinsurance structure. Unlike net earned premium, gross earned premium excludes the impact of premiums ceded to reinsurers, and therefore should not be used as a substitute for net earned premium, total revenue, or any other measure presented in accordance with GAAP. We define Gross loss ratio, expressed as a percentage, as the ratio of losses and loss adjustment expense to gross earned premium. 17

We define Net loss ratio, expressed as a percentage, as the ratio of losses and loss adjustment expense, less amounts ceded to reinsurers, to net earned premium. We define Gross loss ratio ex-CAT, expressed as a percentage, as the ratio of gross losses and loss adjustment expense, excluding catastrophe losses, to gross earned premium. We define Trailing twelve month ("TTM") gross loss ratio, expressed as a percentage, as the ratio of losses and loss adjustment expense to gross earned premium for the past twelve months. We define Opex excluding growth spend, as total expense less loss and loss adjustment expenses, net, and growth spend. We define Growth spend as advertising expense related to acquiring policies, included in “Sales and marketing expenses” in the consolidated financial statements. We define Free cash flow ("FCF") as cash flow from operating activities, less capital expenditures. We define Adjusted free cash flow ("Adj. FCF") as cash flow from operating activities, less capital expenditures plus net borrowings under financing agreement. 18

Links The information contained on, or that can be accessed through, hyperlinks included herein is deemed not to be incorporated in or part of this shareholder letter. Earnings teleconference information The Company will discuss its fourth quarter 2025 financial results and business outlook during a teleconference on February 19, 2026, at 8:00 AM ET. The conference call (access code 066044) can be accessed toll-free at 833-470-1428 or at 646-844-6383. A live audio webcast of the call will be available simultaneously at https:// www.lemonade.com/investor Following completion of the call, a recorded replay of the webcast will be available on the investor relations section of Lemonade’s website. Additional investor information can be accessed at https://www.lemonade.com/investor About Lemonade Lemonade offers renters, homeowners, pet, car, and life insurance. Powered by artificial intelligence and behavioral economics, Lemonade’s full stack insurance carriers in the US, the UK and Europe replace brokers and bureaucracy with bots and machine learning, aiming for zero paperwork and instant everything. A Certified B-Corp, Lemonade donates to nonprofits selected by its community, during its annual Giveback. Lemonade is currently available in the United States, the UK, Germany, the Netherlands, and France, and continues to expand globally. For more information, please visit www.lemonade.com, and follow Lemonade on X or Instagram. Media inquiries: press@lemonade.com Investor contact: ir@lemonade.com 19

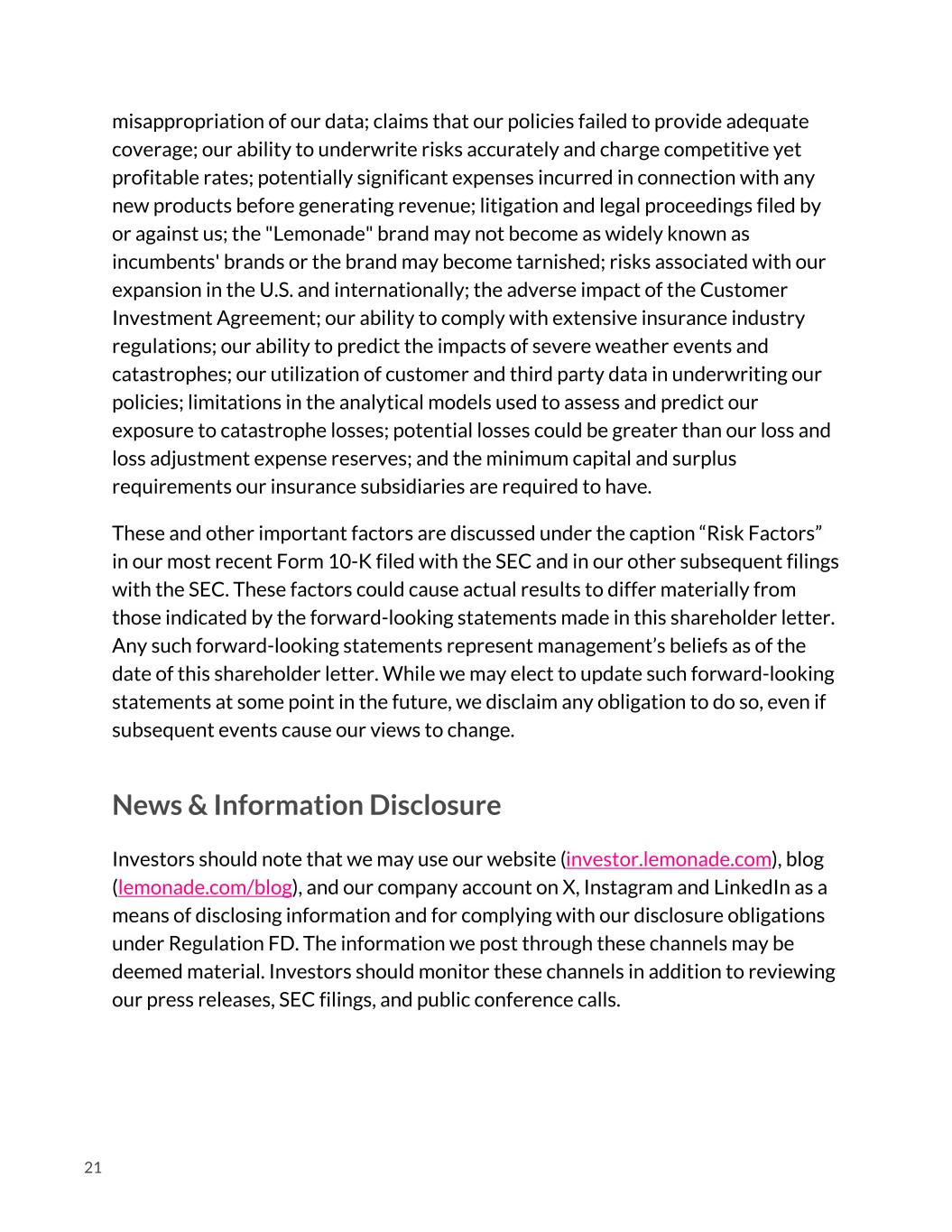

Forward-looking statement safe harbor This shareholder letter contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this shareholder letter that do not relate to matters of historical fact should be considered forward-looking statements, including statements regarding our financial outlook for the first quarter and full year 2026 and 2027, IFP growth, Adjusted EBITDA, profitability, sustained gross profit, growth trajectory for our products, including car, and in Europe, autonomy-aware pricing for Lemonade Car, enhanced cross-sale platform for improved multi- product bundling, and more automated AI-driven pricing optimization. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward- looking statements, including but not limited to, the following: our history of losses and that we may not achieve or maintain profitability in the future; our success and ability to retain and expand our customer base; the denial of claims or our failure to accurately and timely pay claims; our ability to attain greater value from each user; the intense competition in the segments of the insurance industry in which we operate; our proprietary artificial intelligence algorithms may not operate properly or as expected; our ability to maintain our risk-based capital at the required levels; our ability to maintain and implement relationships with third-party service providers; our ability to expand our product offerings or penetrate new markets; availability of reinsurance at current levels and prices; our reliance on artificial intelligence, telematics, mobile technology, and our digital platforms to collect data; our pricing models, including for Full Self Driving (Supervised) and reliance on direct vehicle telemetry may not function as expected; our ability to obtain additional capital to the extent required to grow our business; interruptions or delays in services provided by third-party data centers; security incidents or real or perceived errors, failures or bugs in our systems, website or app; our actual or perceived failure to protect customer information and other data; periodic examinations by state insurance regulators; privacy, data security, and data protection risks related to our expansion into Europe and the UK; evolving privacy laws on cookies, tracking technologies and e-marketing; our ability to prevent 20

misappropriation of our data; claims that our policies failed to provide adequate coverage; our ability to underwrite risks accurately and charge competitive yet profitable rates; potentially significant expenses incurred in connection with any new products before generating revenue; litigation and legal proceedings filed by or against us; the "Lemonade" brand may not become as widely known as incumbents' brands or the brand may become tarnished; risks associated with our expansion in the U.S. and internationally; the adverse impact of the Customer Investment Agreement; our ability to comply with extensive insurance industry regulations; our ability to predict the impacts of severe weather events and catastrophes; our utilization of customer and third party data in underwriting our policies; limitations in the analytical models used to assess and predict our exposure to catastrophe losses; potential losses could be greater than our loss and loss adjustment expense reserves; and the minimum capital and surplus requirements our insurance subsidiaries are required to have. These and other important factors are discussed under the caption “Risk Factors” in our most recent Form 10-K filed with the SEC and in our other subsequent filings with the SEC. These factors could cause actual results to differ materially from those indicated by the forward-looking statements made in this shareholder letter. Any such forward-looking statements represent management’s beliefs as of the date of this shareholder letter. While we may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if subsequent events cause our views to change. News & Information Disclosure Investors should note that we may use our website (investor.lemonade.com), blog (lemonade.com/blog), and our company account on X, Instagram and LinkedIn as a means of disclosing information and for complying with our disclosure obligations under Regulation FD. The information we post through these channels may be deemed material. Investors should monitor these channels in addition to reviewing our press releases, SEC filings, and public conference calls. 21

Condensed Consolidated Statements of Operations and Comprehensive Loss $ in millions, except per share amounts Three Months Ended December 31, Year Ended December 31, 2025 2024 2025 2024 (unaudited) Revenue Net earned premium $ 179.5 $ 101.2 $ 536.3 $ 370.6 Ceding commission income 33.2 29.6 122.7 91.1 Net investment income 9.2 9.4 37.8 34.0 Commission and other income 6.2 8.6 41.1 30.8 Total revenue 228.1 148.8 737.9 526.5 Expense Loss and loss adjustment expense, net 94.5 62.7 347.0 277.0 Other insurance expense 22.1 20.9 93.7 76.8 Sales and marketing 64.2 47.7 224.4 166.3 Technology development 24.8 21.8 93.9 85.8 General and administrative 43.1 33.5 139.8 124.5 Total expense 248.7 186.6 898.8 730.4 Loss before income taxes (20.6) (37.8) (160.9) (203.9) Income tax expense (benefit) 1.1 (7.8) 4.6 (1.7) Net loss $ (21.7) $ (30.0) $ (165.5) $ (202.2) Other comprehensive income (loss), net of tax Unrealized gain (loss) on investments in fixed maturities 0.2 (1.8) 2.4 5.6 Foreign currency translation adjustment 1.0 (4.2) 10.1 (2.7) Comprehensive loss $ (20.5) $ (36.0) $ (153.0) $ (199.3) Per share data: Net loss per share attributable to common stockholders — basic and diluted $ (0.29) $ (0.42) $ (2.24) $ (2.85) Weighted average common shares outstanding — basic and diluted 75,197,913 71,937,369 73,943,632 71,023,115 22

Condensed Consolidated Balance Sheets $ in millions, except per share amounts December 31, 2025 2024 Assets Investments Fixed maturities available-for-sale, at fair value (amortized cost: $706.0 million and $607.1 million as of December 31, 2025 and 2024, respectively) $ 708.8 $ 607.4 Short-term investments (cost: $14.1 million and $27.5 million as of December 31, 2025 and 2024, respectively) 14.1 27.5 Total investments 722.9 634.9 Cash, cash equivalents and restricted cash 396.8 385.7 Premium receivable, net of allowance for credit losses of $4.1 million and $2.8 million as of December 31, 2025 and 2024, respectively 402.3 301.2 Reinsurance recoverable 153.4 170.4 Prepaid reinsurance premium 147.9 253.6 Deferred acquisition costs 12.1 12.2 Property and equipment, net 15.8 16.1 Intangible assets 8.1 13.6 Goodwill 19.0 19.0 Other assets 47.4 42.4 Total assets $ 1,925.7 $ 1,849.1 Liabilities and Stockholders' Equity Unpaid losses and loss adjustment expenses $ 303.1 $ 298.1 Unearned premium 577.0 455.0 Trade payables 0.5 4.5 Funds held for reinsurance treaties 169.5 219.6 Deferred ceding commission 38.2 65.6 Ceded premium payable 23.9 23.8 Borrowings under financing agreement 158.1 83.4 Other liabilities and accrued expenses 121.8 105.7 Total liabilities 1,392.1 1,255.7 Commitments and contingencies Stockholders' equity Common stock, $0.00001 par value, 200,000,000 shares authorized as of December 31, 2025 and 2024; 75,907,215 shares and 72,720,866 shares issued and outstanding as of December 31, 2025 and 2024, respectively — — Additional paid-in capital 1,991.5 1,898.3 Accumulated deficit (1,464.3) (1,298.8) Accumulated other comprehensive income (loss) 6.4 (6.1) Total stockholders' equity 533.6 593.4 Total liabilities and stockholders' equity $ 1,925.7 $ 1,849.1 23

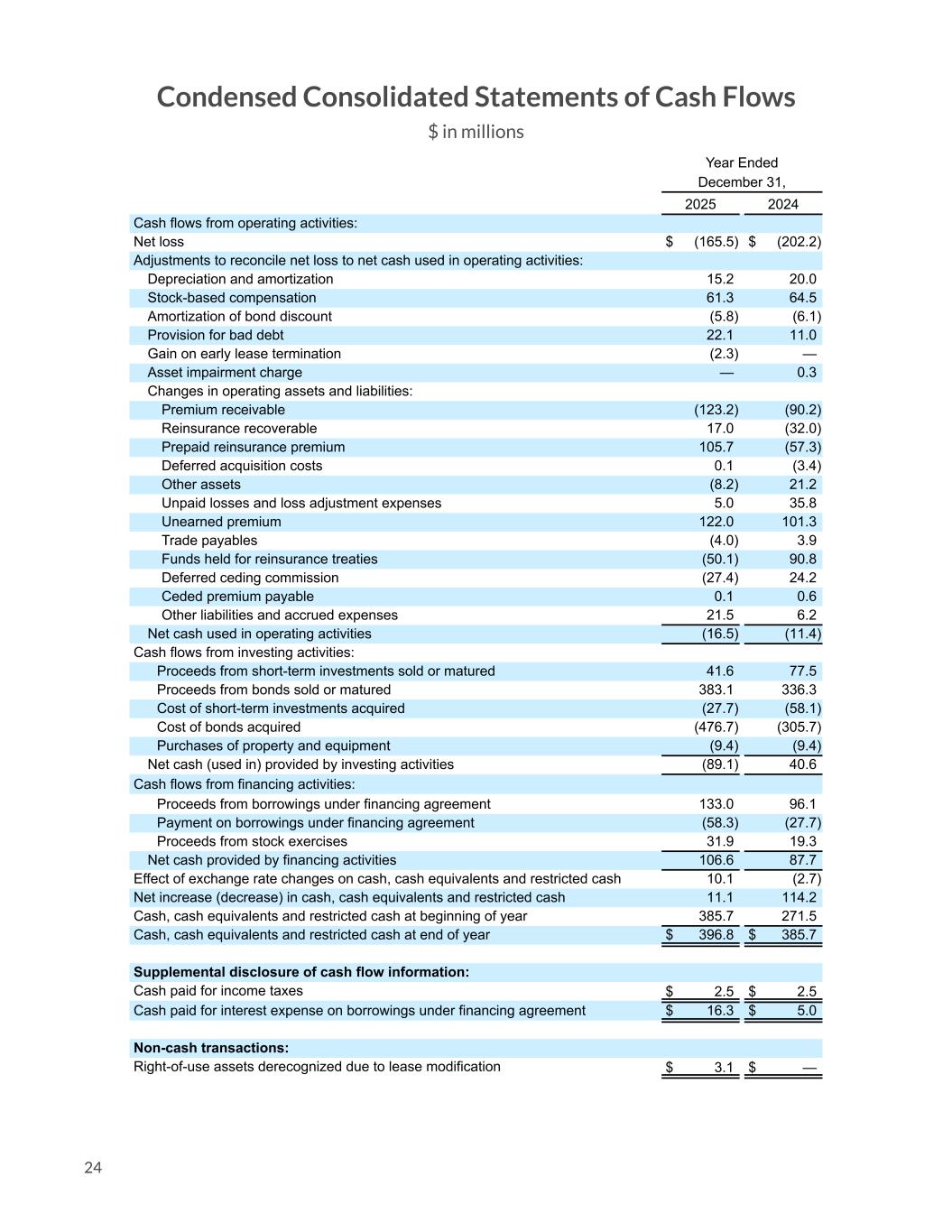

Condensed Consolidated Statements of Cash Flows $ in millions Year Ended December 31, 2025 2024 Cash flows from operating activities: Net loss $ (165.5) $ (202.2) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization 15.2 20.0 Stock-based compensation 61.3 64.5 Amortization of bond discount (5.8) (6.1) Provision for bad debt 22.1 11.0 Gain on early lease termination (2.3) — Asset impairment charge — 0.3 Changes in operating assets and liabilities: Premium receivable (123.2) (90.2) Reinsurance recoverable 17.0 (32.0) Prepaid reinsurance premium 105.7 (57.3) Deferred acquisition costs 0.1 (3.4) Other assets (8.2) 21.2 Unpaid losses and loss adjustment expenses 5.0 35.8 Unearned premium 122.0 101.3 Trade payables (4.0) 3.9 Funds held for reinsurance treaties (50.1) 90.8 Deferred ceding commission (27.4) 24.2 Ceded premium payable 0.1 0.6 Other liabilities and accrued expenses 21.5 6.2 Net cash used in operating activities (16.5) (11.4) Cash flows from investing activities: Proceeds from short-term investments sold or matured 41.6 77.5 Proceeds from bonds sold or matured 383.1 336.3 Cost of short-term investments acquired (27.7) (58.1) Cost of bonds acquired (476.7) (305.7) Purchases of property and equipment (9.4) (9.4) Net cash (used in) provided by investing activities (89.1) 40.6 Cash flows from financing activities: Proceeds from borrowings under financing agreement 133.0 96.1 Payment on borrowings under financing agreement (58.3) (27.7) Proceeds from stock exercises 31.9 19.3 Net cash provided by financing activities 106.6 87.7 Effect of exchange rate changes on cash, cash equivalents and restricted cash 10.1 (2.7) Net increase (decrease) in cash, cash equivalents and restricted cash 11.1 114.2 Cash, cash equivalents and restricted cash at beginning of year 385.7 271.5 Cash, cash equivalents and restricted cash at end of year $ 396.8 $ 385.7 Supplemental disclosure of cash flow information: Cash paid for income taxes $ 2.5 $ 2.5 Cash paid for interest expense on borrowings under financing agreement $ 16.3 $ 5.0 Non-cash transactions: Right-of-use assets derecognized due to lease modification $ 3.1 $ — 24

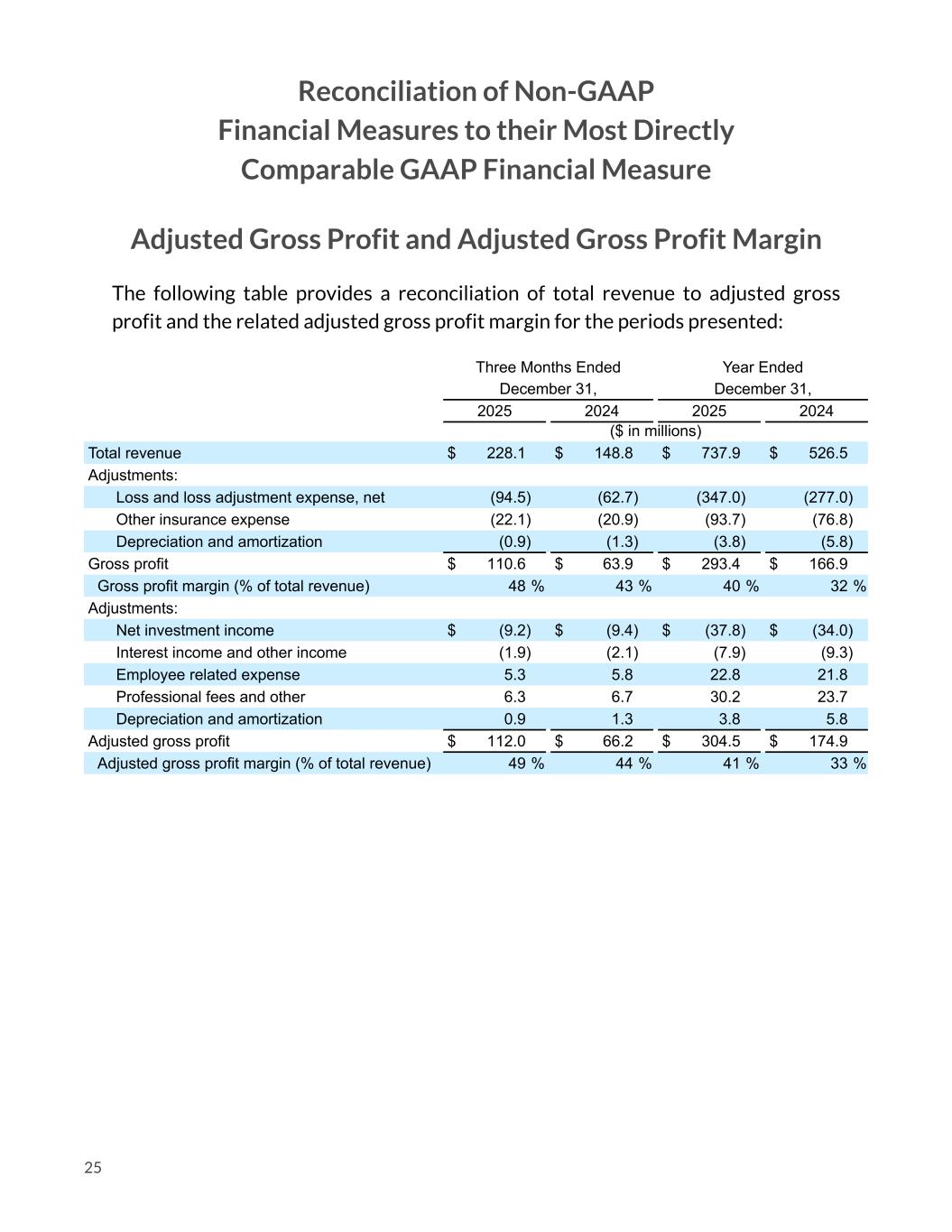

Reconciliation of Non-GAAP Financial Measures to their Most Directly Comparable GAAP Financial Measure Adjusted Gross Profit and Adjusted Gross Profit Margin The following table provides a reconciliation of total revenue to adjusted gross profit and the related adjusted gross profit margin for the periods presented: Three Months Ended December 31, Year Ended December 31, 2025 2024 2025 2024 ($ in millions) Total revenue $ 228.1 $ 148.8 $ 737.9 $ 526.5 Adjustments: Loss and loss adjustment expense, net (94.5) (62.7) (347.0) (277.0) Other insurance expense (22.1) (20.9) (93.7) (76.8) Depreciation and amortization (0.9) (1.3) (3.8) (5.8) Gross profit $ 110.6 $ 63.9 $ 293.4 $ 166.9 Gross profit margin (% of total revenue) 48 % 43 % 40 % 32 % Adjustments: Net investment income $ (9.2) $ (9.4) $ (37.8) $ (34.0) Interest income and other income (1.9) (2.1) (7.9) (9.3) Employee related expense 5.3 5.8 22.8 21.8 Professional fees and other 6.3 6.7 30.2 23.7 Depreciation and amortization 0.9 1.3 3.8 5.8 Adjusted gross profit $ 112.0 $ 66.2 $ 304.5 $ 174.9 Adjusted gross profit margin (% of total revenue) 49 % 44 % 41 % 33 % 25

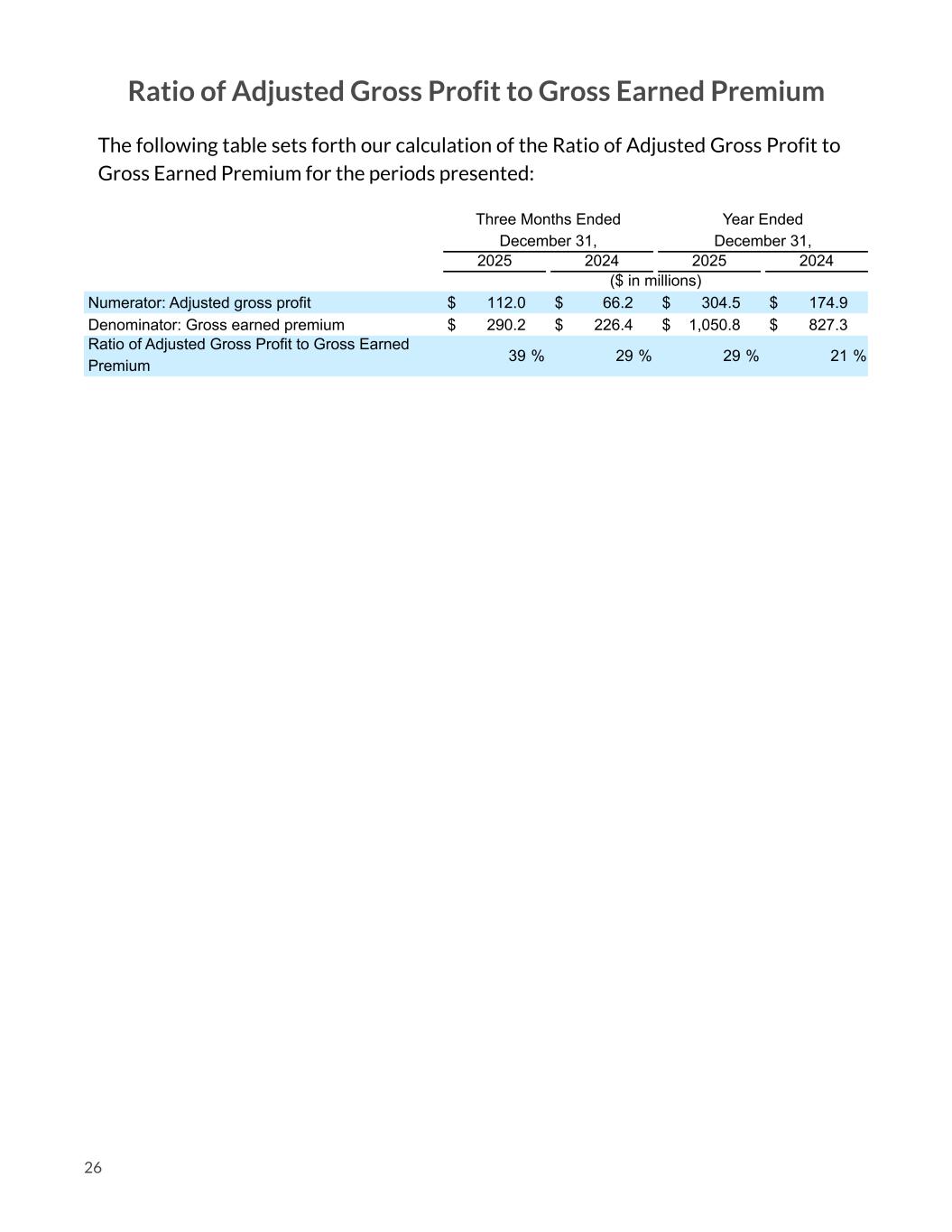

Ratio of Adjusted Gross Profit to Gross Earned Premium The following table sets forth our calculation of the Ratio of Adjusted Gross Profit to Gross Earned Premium for the periods presented: Three Months Ended December 31, Year Ended December 31, 2025 2024 2025 2024 ($ in millions) Numerator: Adjusted gross profit $ 112.0 $ 66.2 $ 304.5 $ 174.9 Denominator: Gross earned premium $ 290.2 $ 226.4 $ 1,050.8 $ 827.3 Ratio of Adjusted Gross Profit to Gross Earned Premium 39 % 29 % 29 % 21 % 26

Adjusted EBITDA The following table provides a reconciliation of Adjusted EBITDA to net loss for the periods presented: Three Months Ended December 31, Year Ended December 31, 2025 2024 2025 2024 ($ in millions) Net loss $ (21.7) $ (30.0) $ (165.5) $ (202.2) Adjustments: Income tax expense (benefit) 1.1 (7.8) 4.6 (1.7) Depreciation and amortization 2.6 4.7 15.2 20.0 Stock-based compensation (1) 18.5 17.3 61.3 64.5 Interest expense 5.4 2.8 17.3 6.2 Interest income and others (1.3) (1.3) (4.9) (6.2) Net investment income (9.2) (9.4) (37.8) (34.0) Amortization of fair value adjustment on insurance contract intangible liability relating to the Metromile acquisition — (0.1) (0.2) (0.4) Other adjustments (2)(3)(4)(5)(6) — — (8.1) 4.1 Adjusted EBITDA $ (4.6) $ (23.8) $ (118.1) $ (149.7) (1) Includes the impact of canceled unvested warrant shares for contract year 2 related to the termination of the Warrant Agreement with Chewy of $5.2 million for the year ended December 31, 2025 and compensation expense related to the warrant shares of $6.5 million for the year ended December 31, 2024. (2) Includes the California FAIR Plan assessment of $6.9 million related to the January 2025 California Wildfires for the year ended December 31, 2025. (3) Includes $11.7 million of tax refund received under the Employee Retention Credit Program for the year ended December 31, 2025. (4) Includes $2.3 million of gain on early lease termination related to the Company's office space in San Francisco for the year ended December 31, 2025. (5) Includes $1.0 million of gain from settlement of previously disclosed data security matter for the year ended December 31, 2025. (6) Includes $3.9 million extra-contractual car claim liability related to pre-acquisition Metromile, and impairment charge of $0.3 million related to a portion of the New York office sublease, net of gain on termination of lease for the year ended December 31, 2024. 27

Adjusted Free Cash Flow The following tables provide a reconciliation of adjusted free cash flow to cash flow from operating activities for the periods presented: Three Months Ended December 31, Year Ended December 31, 2025 2024 2025 2024 ($ in millions) Cash flow from operating activities $ 20.7 $ 13.8 $ (16.5) $ (11.4) Capital expenditures (3.1) (3.2) (9.4) (9.4) Free Cash Flow $ 17.6 $ 10.6 $ (25.9) $ (20.8) Net borrowings under financing agreement 19.1 15.9 74.7 68.4 Adjusted Free Cash Flow $ 36.7 $ 26.5 $ 48.8 $ 47.6 28

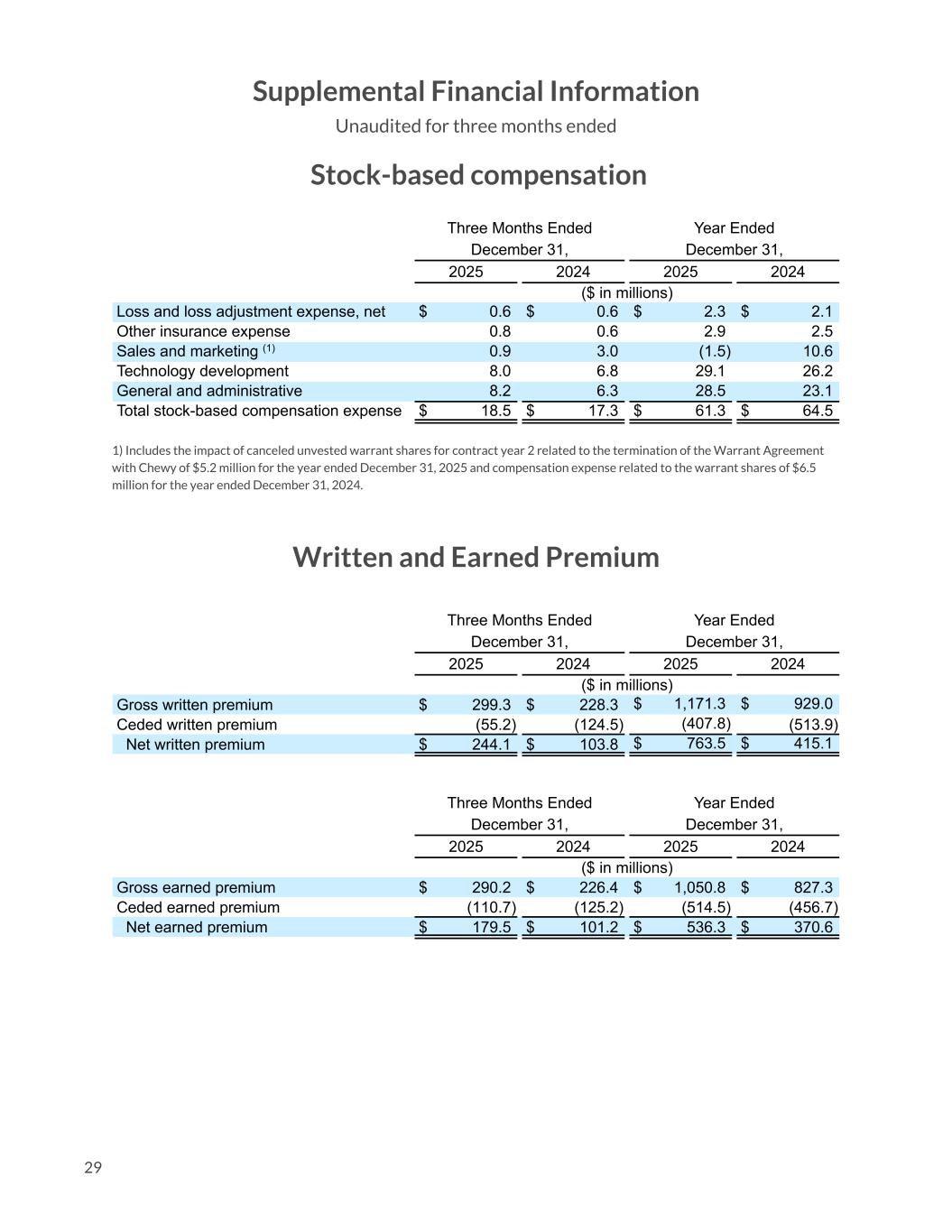

Supplemental Financial Information Unaudited for three months ended Stock-based compensation Three Months Ended December 31, Year Ended December 31, 2025 2024 2025 2024 ($ in millions) Loss and loss adjustment expense, net $ 0.6 $ 0.6 $ 2.3 $ 2.1 Other insurance expense 0.8 0.6 2.9 2.5 Sales and marketing (1) 0.9 3.0 (1.5) 10.6 Technology development 8.0 6.8 29.1 26.2 General and administrative 8.2 6.3 28.5 23.1 Total stock-based compensation expense $ 18.5 $ 17.3 $ 61.3 $ 64.5 1) Includes the impact of canceled unvested warrant shares for contract year 2 related to the termination of the Warrant Agreement with Chewy of $5.2 million for the year ended December 31, 2025 and compensation expense related to the warrant shares of $6.5 million for the year ended December 31, 2024. Written and Earned Premium Three Months Ended December 31, Year Ended December 31, 2025 2024 2025 2024 ($ in millions) Gross written premium $ 299.3 $ 228.3 $ 1,171.3 $ 929.0 Ceded written premium (55.2) (124.5) (407.8) (513.9) Net written premium $ 244.1 $ 103.8 $ 763.5 $ 415.1 Three Months Ended December 31, Year Ended December 31, 2025 2024 2025 2024 ($ in millions) Gross earned premium $ 290.2 $ 226.4 $ 1,050.8 $ 827.3 Ceded earned premium (110.7) (125.2) (514.5) (456.7) Net earned premium $ 179.5 $ 101.2 $ 536.3 $ 370.6 29

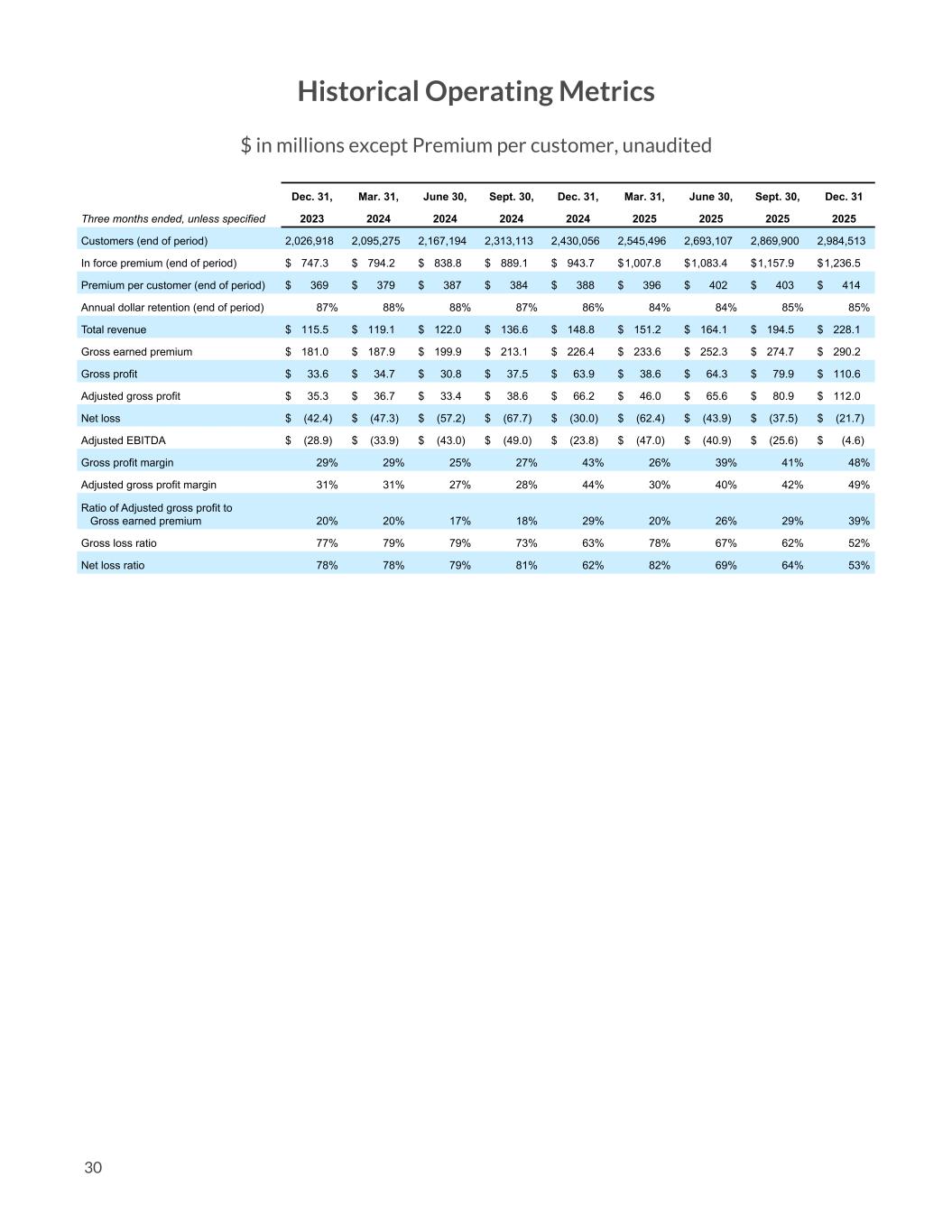

Historical Operating Metrics $ in millions except Premium per customer, unaudited Dec. 31, Mar. 31, June 30, Sept. 30, Dec. 31, Mar. 31, June 30, Sept. 30, Dec. 31 Three months ended, unless specified 2023 2024 2024 2024 2024 2025 2025 2025 2025 Customers (end of period) 2,026,918 2,095,275 2,167,194 2,313,113 2,430,056 2,545,496 2,693,107 2,869,900 2,984,513 In force premium (end of period) $ 747.3 $ 794.2 $ 838.8 $ 889.1 $ 943.7 $ 1,007.8 $ 1,083.4 $ 1,157.9 $ 1,236.5 Premium per customer (end of period) $ 369 $ 379 $ 387 $ 384 $ 388 $ 396 $ 402 $ 403 $ 414 Annual dollar retention (end of period) 87% 88% 88% 87% 86% 84% 84% 85% 85% Total revenue $ 115.5 $ 119.1 $ 122.0 $ 136.6 $ 148.8 $ 151.2 $ 164.1 $ 194.5 $ 228.1 Gross earned premium $ 181.0 $ 187.9 $ 199.9 $ 213.1 $ 226.4 $ 233.6 $ 252.3 $ 274.7 $ 290.2 Gross profit $ 33.6 $ 34.7 $ 30.8 $ 37.5 $ 63.9 $ 38.6 $ 64.3 $ 79.9 $ 110.6 Adjusted gross profit $ 35.3 $ 36.7 $ 33.4 $ 38.6 $ 66.2 $ 46.0 $ 65.6 $ 80.9 $ 112.0 Net loss $ (42.4) $ (47.3) $ (57.2) $ (67.7) $ (30.0) $ (62.4) $ (43.9) $ (37.5) $ (21.7) Adjusted EBITDA $ (28.9) $ (33.9) $ (43.0) $ (49.0) $ (23.8) $ (47.0) $ (40.9) $ (25.6) $ (4.6) Gross profit margin 29% 29% 25% 27% 43% 26% 39% 41% 48% Adjusted gross profit margin 31% 31% 27% 28% 44% 30% 40% 42% 49% Ratio of Adjusted gross profit to Gross earned premium 20% 20% 17% 18% 29% 20% 26% 29% 39% Gross loss ratio 77% 79% 79% 73% 63% 78% 67% 62% 52% Net loss ratio 78% 78% 79% 81% 62% 82% 69% 64% 53% 30

Trends Q4 2025 31

2,027 2,430 2,985 $369 $388 $414 $747 $944 $1,237 $181.0 $226.4 $290.2 $115.5 $148.8 $228.1 Trends 32 CUSTOMERS (in '000s) PREMIUM PER CUSTOMER IN FORCE PREMIUM ($s in m) ▲ 20% Q4 23 Q4 24 Q4 25 Q4 23 Q4 24 Q4 25 Q4 23 Q4 24 Q4 25 ▲ 23% ▲ 5% ▲ 7% ▲ 26% ▲ 31% GROSS EARNED PREMIUM ("GEP") ($s in m) REVENUE ($s in m) ▲ 25% ▲ 28% ▲ 29% ▲ 53% Q4 23 Q4 24 Q4 25 Q4 23 Q4 24 Q4 25

$33.6 $63.9 $110.6 29% 43% 48% $35.3 $66.2 $112.0 20% 29% 39% Trends 33 GROSS PROFIT ($s in m) GROSS PROFIT MARGIN ▲ 90% ▲ 73% Q4 23 Q4 24 Q4 25 Q4 23 Q4 24 Q4 25 ADJUSTED GROSS PROFIT1 ($s in m) RATIO OF ADJUSTED GROSS PROFIT TO GEP1 ▲ 88% ▲ 69% Q4 23 Q4 24 Q4 25 Q4 23 Q4 25 1 This is a non-GAAP metric. For a description of these metrics and a reconciliation to the most directly comparable GAAP measure, please see "Reconciliation of Non-GAAP Financial Measures to GAAP" and "Non-GAAP financial measures and key operating metrics". Q4 24

($42.4) ($30.0) ($21.7) ($28.9) ($23.8) Trends 34 OPERATING EXPENSE1 ($s in m) Q4 23 Q4 24 Q4 25 $90.1 $123.9 $154.2 NET LOSS ($s in m) Q4 23 Q4 24 Q4 25 ▲ 29% ▲ 28% 1 Represents total expense less loss and loss adjustment expense, net. 2 Growth spend included in Sales and Marketing was $53.4M in Q4 2025, $36.0M in Q4 2024 and $13.4M in Q4 2023. 3 This is a non-GAAP metric. For a description of these metrics and a reconciliation to the most directly comparable GAAP measure, please see "Reconciliation of Non-GAAP Financial Measures to GAAP" and "Non-GAAP financial measures and key operating metrics". ADJUSTED EBITDA3 ($s in m) Q4 23 Q4 24 Q4 25 ▲ 18% ▲ 81% SALES AND MARKETING2 OTHER INSURANCE EXPENSE TECHNOLOGY DEVELOPMENT GENERAL AND ADMINISTRATIVE ($4.6)

$1,021 $996 $1,032 $1,061 $1,120 $27 ($31) $25 $18 $37 $14 ($47) $6 $5 $21 Trends 35 TOTAL CASH & INVESTMENTS ($s in m) Q2 25 Q3 25 Q4 25Q1 25Q4 24 ADJUSTED FREE CASH FLOW1 ($s in m) 1 We define adjusted free cash flow ("Adj. FCF") as cash flow operating activities, less capital expenditures plus net borrowings under financing agreement. For reconciliation to the most comparable GAAP Financial measure, please refer to section entitled "Reconciliation of Non-GAAP Financial Measures to their Most Directly Comparable GAAP Financial Measures". ADJUSTED FREE CASH FLOW CASH FLOW FROM OPERATING ACTIVITIES Q2 25 Q3 25 Q4 25Q1 25Q4 24

Insurance Supplement Q4 2025 36

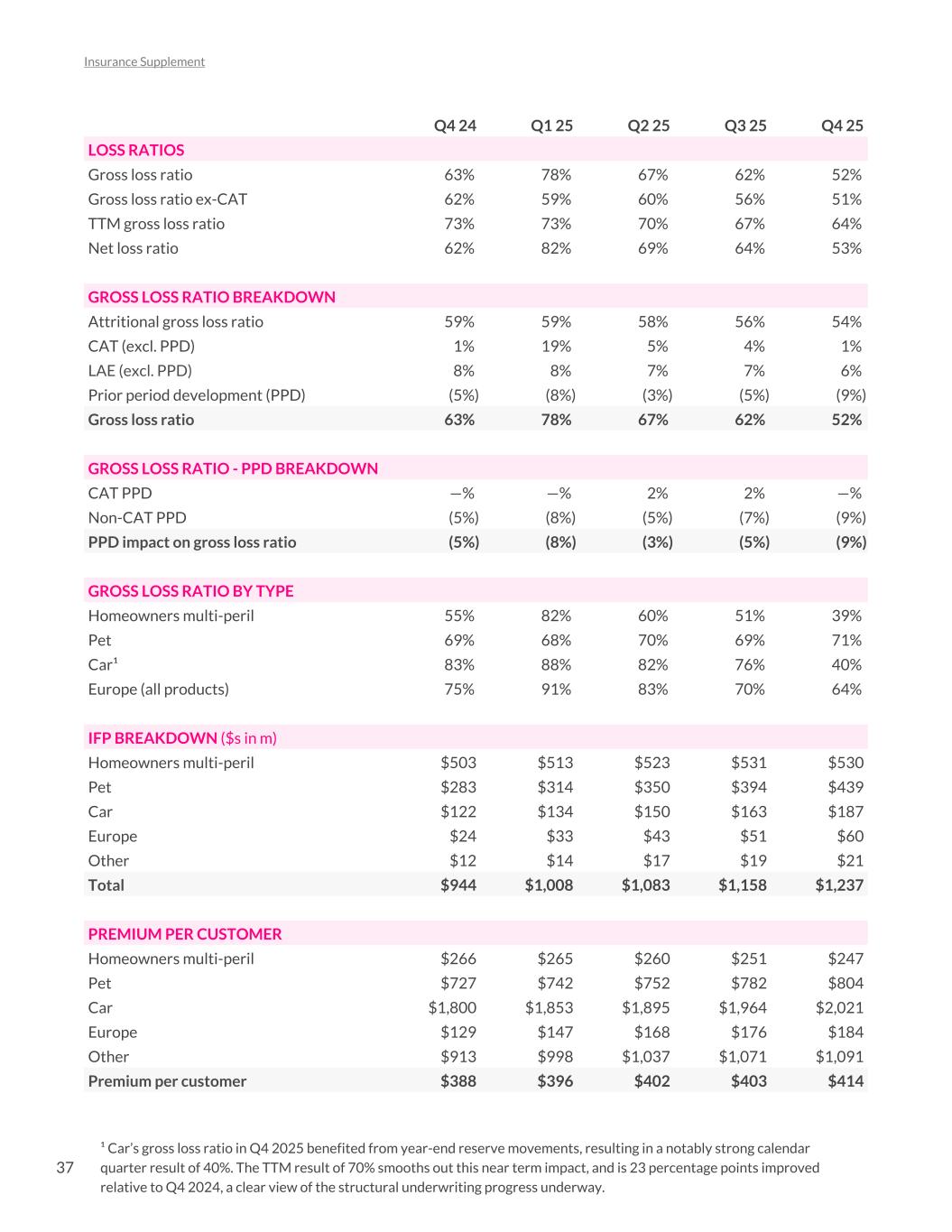

Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 LOSS RATIOS Gross loss ratio 63% 78% 67% 62% 52% Gross loss ratio ex-CAT 62% 59% 60% 56% 51% TTM gross loss ratio 73% 73% 70% 67% 64% Net loss ratio 62% 82% 69% 64% 53% GROSS LOSS RATIO BREAKDOWN Attritional gross loss ratio 59% 59% 58% 56% 54% CAT (excl. PPD) 1% 19% 5% 4% 1% LAE (excl. PPD) 8% 8% 7% 7% 6% Prior period development (PPD) (5%) (8%) (3%) (5%) (9%) Gross loss ratio 63% 78% 67% 62% 52% GROSS LOSS RATIO - PPD BREAKDOWN CAT PPD —% —% 2% 2% —% Non-CAT PPD (5%) (8%) (5%) (7%) (9%) PPD impact on gross loss ratio (5%) (8%) (3%) (5%) (9%) GROSS LOSS RATIO BY TYPE Homeowners multi-peril 55% 82% 60% 51% 39% Pet 69% 68% 70% 69% 71% Car¹ 83% 88% 82% 76% 40% Europe (all products) 75% 91% 83% 70% 64% IFP BREAKDOWN ($s in m) Homeowners multi-peril $503 $513 $523 $531 $530 Pet $283 $314 $350 $394 $439 Car $122 $134 $150 $163 $187 Europe $24 $33 $43 $51 $60 Other $12 $14 $17 $19 $21 Total $944 $1,008 $1,083 $1,158 $1,237 PREMIUM PER CUSTOMER Homeowners multi-peril $266 $265 $260 $251 $247 Pet $727 $742 $752 $782 $804 Car $1,800 $1,853 $1,895 $1,964 $2,021 Europe $129 $147 $168 $176 $184 Other $913 $998 $1,037 $1,071 $1,091 Premium per customer $388 $396 $402 $403 $414 Insurance Supplement 37 ¹ Car’s gross loss ratio in Q4 2025 benefited from year-end reserve movements, resulting in a notably strong calendar quarter result of 40%. The TTM result of 70% smooths out this near term impact, and is 23 percentage points improved relative to Q4 2024, a clear view of the structural underwriting progress underway.

DEFINITIONS GROSS LOSS RATIO We define gross loss ratio, expressed as a percentage, as the ratio of losses and loss adjustment expense to gross earned premium. GROSS LOSS RATIO EX-CAT We define gross loss ratio ex-CAT, expressed as a percentage, as the ratio of gross losses and loss adjustment expense, excluding catastrophe losses, to gross earned premium. TTM GROSS LOSS RATIO We define trailing twelve month ("TTM") gross loss ratio, expressed as a percentage, as the ratio of gross losses and loss adjustment expense to gross earned premium for the past twelve months. NET LOSS RATIO We define net loss ratio, expressed as a percentage, as the ratio of net losses and loss adjustment expense, less amounts ceded to reinsurers, to net earned premium. ATTRITIONAL GROSS LOSS RATIO We define attritional gross loss ratio, expressed as a percentage, as the ratio of gross losses, excluding catastrophe losses, loss adjustment expenses, and prior period development (PPD), to gross earned premium. PRIOR PERIOD DEVELOPMENT (PPD) We define prior period development (PPD) as the change in ultimate loss and loss adjustment expense for claims that occurred in prior quarters. HOMEOWNERS MULTI-PERIL We define homeowners multi-peril as all coverages offered under home, condo, and renters policies. IFP We define in force premium ("IFP"), as the aggregate annualized premium for customers as of the period end date. At each period end date, we calculate IFP as the sum of: 1. In force written premium - the annualized premium of in force policies underwritten by us. 2. In force placed premium - the annualized premium of in force policies placed with third party insurance companies for which we earn a recurring commission payment. PREMIUM PER CUSTOMER We define premium per customer as the average annualized premium customers pay for products underwritten by us, or placed by us with third-party insurance partners. We calculate premium per customer by dividing IFP by the number customers. Insurance Supplement 38