Delek US Update (NYSE: DK) January 2026

Delek US 2 Disclaimers Forward Looking Statements: Delek US Holdings, Inc. (“Delek US”) and Delek Logistics Partners, LP (“Delek Logistics”; and collectively with Delek US, “we” or “our”) are traded on the New York Stock Exchange in the United States under the symbols “DK” and ”DKL”, respectively. These slides and any accompanying oral or written presentations contain forward-looking statements within the meaning of federal securities laws that are based upon current expectations and involve a number of risks and uncertainties. Statements concerning current estimates, expectations and projections about future results, performance, prospects, opportunities, plans, actions and events and other statements, concerns, or matters that are not historical facts are “forward-looking statements,” as that term is defined under the federal securities laws. Words such as "may," "will," "should," "could," "would," "predicts," "potential," "continue," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates," "appears," "projects" and similar expressions, as well as statements in future tense, identify forward-looking statements. These forward-looking statements include, but are not limited to, the statements regarding the following: financial and operating guidance for future and uncompleted financial periods; financial strength and flexibility; potential for and projections of growth; return of cash to shareholders, stock repurchases and the payment of dividends, including the amount and timing thereof; cost reductions and projected cash flow and other benefits of our Enterprise Optimization Plan; crude oil throughput; crude oil market trends, including production, quality, pricing, demand, imports, exports and transportation costs; projected capital expenditures; projections of Delek US's valuation and assumptions presented therewith; the performance of our joint venture investments, and the benefits, flexibility, returns and EBITDA therefrom; the potential for, and estimates of cost savings and other benefits from, acquisitions, divestitures, dropdowns and financing activities; projections of third party EBITDA for Delek Logistics; liquidity and EBITDA impacts from strategic and intercompany transactions; long-term value creation from capital allocation; targeted internal rates of return on capital expenditures; execution of strategic initiatives and the benefits therefrom, including cash flow stability from business model transition and approach to renewable diesel; and access to crude oil and the benefits therefrom. Investors are cautioned that the following important factors, among others, may affect these forward-looking statements: uncertainty related to timing and amount of value returned to shareholders; risks and uncertainties with respect to the quantities and costs of crude oil we are able to obtain and the price of the refined petroleum products we ultimately sell, including uncertainties regarding actions of OPEC and non-OPEC oil producing countries impacting crude oil production; risks and uncertainties related to the integration by Delek Logistics of the Delaware and Permian Gathering business following its acquisition; risks and uncertainties related to the integration by Delek Logistics of the H2O Midstream and Gravity businesses following the acquisitions; Delek US’ ability to realize cost reductions; risks related to Delek US’ exposure to Permian Basin crude oil, such as supply, gathering, pricing, production and transportation capacity; gains and losses from derivative instruments; management's ability to execute its strategy of growth through acquisitions and the transactional risks associated with acquisitions and dispositions, including risks and uncertainties with respect to the possible benefit of the retail, H20 Midstream and Gravity transactions; acquired assets may suffer a diminishment in fair value as a result of which we may need to record a write-down or impairment in carrying value of the asset; changes in the scope, costs, and/or timing of capital and maintenance projects; the ability of the Red River joint venture to expand the Red River pipeline; the possibility of litigation challenging renewable fuel standard waivers; the ability to grow the Midland Gathering System; operating hazards inherent in transporting, storing and processing crude oil and intermediate and finished petroleum products; our competitive position and the effects of competition; the projected growth of the industries in which we operate; general economic and business conditions affecting the geographic areas in which we operate; and other risks contained in Delek US’ and Delek Logistics’ filings with the United States Securities and Exchange Commission. Forward-looking statements should not be read as a guarantee of future performance or results, and will not be accurate indications of the times at, or by which such performance or results will be achieved. Forward-looking information is based on information available at the time and/or management’s good faith belief with respect to future events, and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. Neither Delek US nor Delek Logistics undertakes any obligation to update or revise any such forward-looking statements to reflect events or circumstances that occur, or which Delek US or Delek Logistics becomes aware of, after the date hereof, except as required by applicable law or regulation. Illustrative DK Standalone EBITDA and free cash flow are non-GAAP financial measures. We are unable to provide a reconciliation of these forward-looking projections to the most directly comparable GAAP financial measures without unreasonable effort because certain items required for such reconciliation are not available or cannot be reasonably predicted at this time. These items could materially affect net income and cash flows from operating activities. |

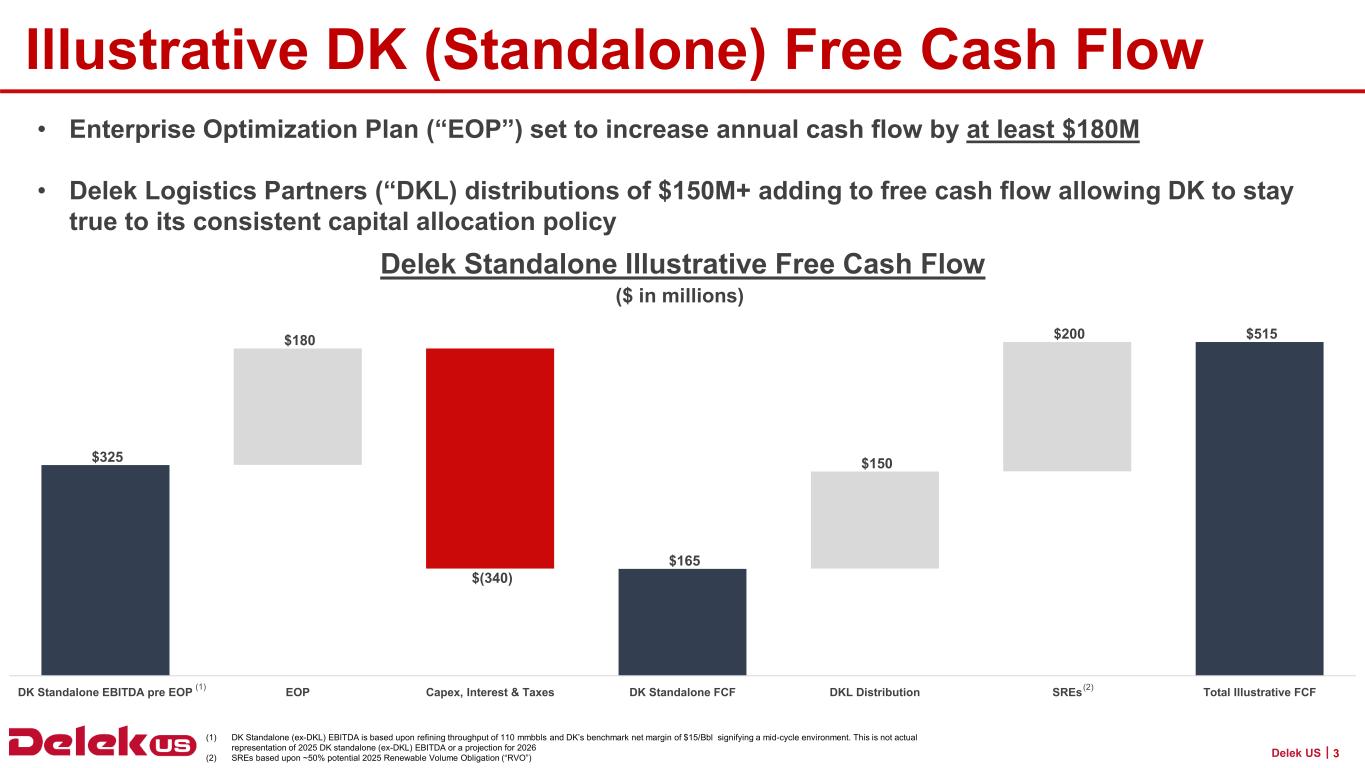

Delek US 3| Illustrative DK (Standalone) Free Cash Flow • Enterprise Optimization Plan (“EOP”) set to increase annual cash flow by at least $180M • Delek Logistics Partners (“DKL) distributions of $150M+ adding to free cash flow allowing DK to stay true to its consistent capital allocation policy (1) DK Standalone (ex-DKL) EBITDA is based upon refining throughput of 110 mmbbls and DK’s benchmark net margin of $15/Bbl signifying a mid-cycle environment. This is not actual representation of 2025 DK standalone (ex-DKL) EBITDA or a projection for 2026 (2) SREs based upon ~50% potential 2025 Renewable Volume Obligation (“RVO”) $325 $180 $(340) $165 $150 $200 $515 DK Standalone EBITDA pre EOP EOP Capex, Interest & Taxes DK Standalone FCF DKL Distribution SREs Total Illustrative FCF Delek Standalone Illustrative Free Cash Flow (2)(1) ($ in millions)

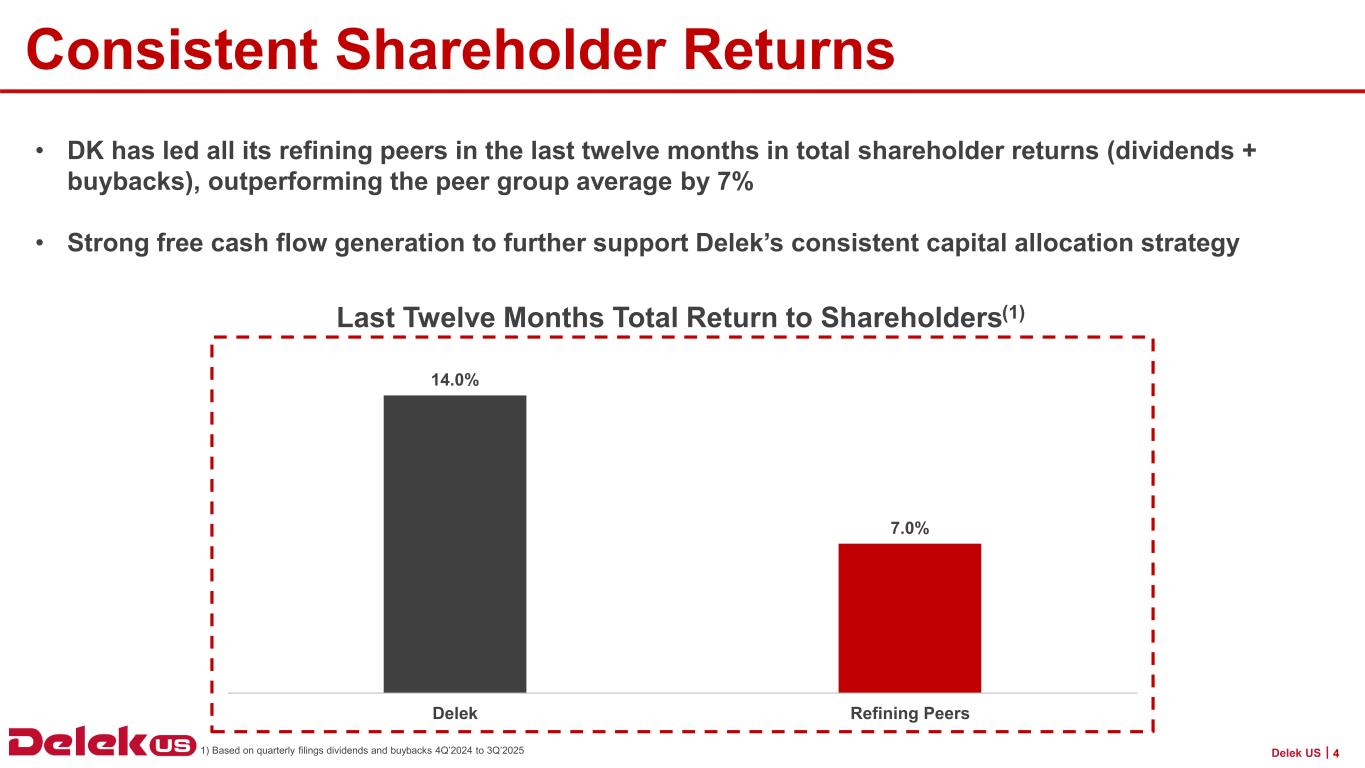

Delek US 4| Consistent Shareholder Returns • DK has led all its refining peers in the last twelve months in total shareholder returns (dividends + buybacks), outperforming the peer group average by 7% • Strong free cash flow generation to further support Delek’s consistent capital allocation strategy 1) Based on quarterly filings dividends and buybacks 4Q’2024 to 3Q’2025 14.0% 7.0% Delek Refining Peers Last Twelve Months Total Return to Shareholders(1)

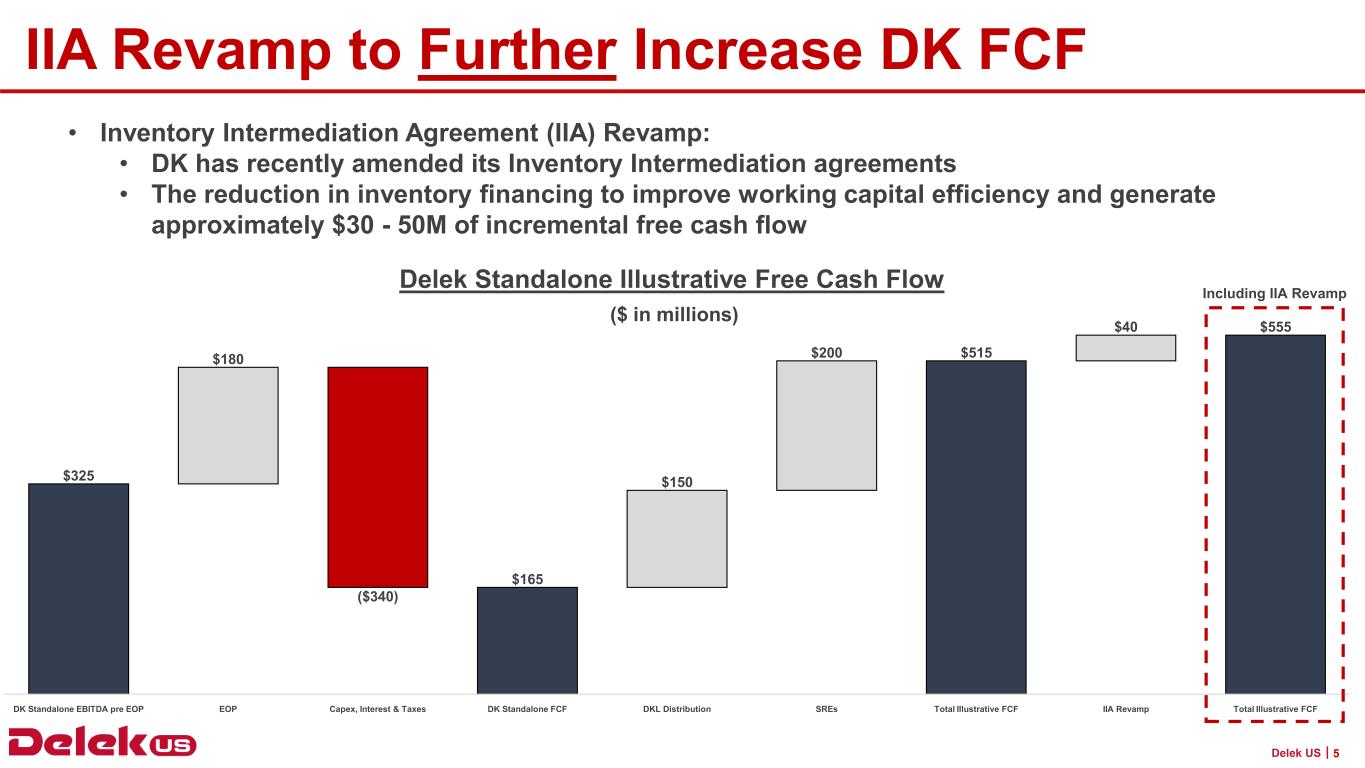

Delek US 5| IIA Revamp to Further Increase DK FCF • Inventory Intermediation Agreement (IIA) Revamp: • DK has recently amended its Inventory Intermediation agreements • The reduction in inventory financing to improve working capital efficiency and generate approximately $30 - 50M of incremental free cash flow $325 $180 ($340) $165 $150 $515 $40 $555 $200 DK Standalone EBITDA pre EOP EOP Capex, Interest & Taxes DK Standalone FCF DKL Distribution SREs Total Illustrative FCF IIA Revamp Total Illustrative FCF ($ in millions) Delek Standalone Illustrative Free Cash Flow Including IIA Revamp

Delek US 6| 2026 Delek US Holdings Guidance • DK Standalone M&R Capex (including BSR Turnaround): $200 - 220 million • Turnarounds: • BSR 1Q’2026 • Focus of BSR Turnaround is to further improve reliability and flexibility leading to cost and margin improvements • Improved reliability • Crude slate optimization • Improved product yields • Higher octane and blending options • No additional turnarounds in 2026 DK’s 2026 Expectations: