F i rs t Quar ter 2025 Earn ings Presentat ion May 13th, 2025

Disclaimer Forward-Looking Statements. This presentation contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, which are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different from the statements made herein. All statements other than statements of historical fact included in this presentation are forward-looking statements, including, but not limited to, the Company’s financial results, future financial position, expected growth of cash flows, business strategy, budgets, projected costs, projected capital expenditures, taxes, plans, objectives, potential synergies, industry trends and growth opportunities. Forward-looking statements discuss the Company’s current expectations and projections relating to its financial operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “aim,” “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “future,” “intend,” “outlook,” “potential,” “project,” “projection,” “plan,” “seek,” “may,” “could,” “would,” “will,” “should,” “can,” “can have,” “likely,” the negatives thereof and other similar expressions. All forward- looking statements are expressly qualified in their entirety by these cautionary statements. These forward-looking statements are only predictions, not historical fact, and involve certain risks and uncertainties, as well as assumptions. While Hydrofarm believes that its assumptions are reasonable, it is very difficult to predict the impact of known factors, and, of course, it is impossible to anticipate all factors that could affect actual results. There are many risks and uncertainties that could cause actual results to differ materially from forward-looking statements made herein including, most prominently, the risks discussed under the heading “Risk Factors” in the Company’s latest annual report on Form 10-K and quarterly reports on Form 10-Q filed with the U.S. Securities and Exchange Commission (“SEC”). Such forward-looking statements are made only as of the date of this presentation. All of the Company’s SEC filings are available online at www.sec.gov. Hydrofarm undertakes no obligation to publicly update or revise any forward-looking statement because of new information, future events or otherwise, except as otherwise required by law. If we do update one or more forward- looking statements, no inference should be made that we will make additional updates with respect to those or other forward-looking statements. Projected Financial Information. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions, and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. Non-GAAP Financial Information. This presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Management uses these “non-GAAP” measures in its analysis of the Company’s performance. Management believes these non-GAAP financial measures allow for evaluating the Company’s ability to generate earnings and better comparability of period-to-period operating performance by excluding certain items that may vary substantially in frequency and magnitude from net loss. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to similarly titled non-GAAP performance measures that may be presented by other companies. A reconciliation of the non-GAAP measures used in this presentation to the most directly comparable GAAP measures is provided in the Appendix to this presentation, and in our related press release attached as an exhibit to our Current Report on Form 8-K filing available online at www.sec.gov. 2

Business Over v iew

Drive Diverse, High-Quality Revenue Streams • Improve Proprietary Brand Mix • Targeted Investments and New Proprietary Product Innovations • Expand Non-US/Canada and Non-Cannabis Sales Improve Profit Margins • Increase Production and Efficiency in our Manufacturing Operations • Further Optimize our Distribution Center Network • Reduce SG&A Expenses Strengthen Financial Position • Improve Free Cash Flow • Maintain Strong Liquidity Focusing on our Strategic Priorities 4 Adjusted Gross Profit, Adjusted SG&A, Adjusted EBITDA, and Free Cash Flow are non-GAAP measures. AGPM% refers to 'Adjusted Gross Profit Margin’. Please see appendix for reconciliation of GAAP to non-GAAP measures.

First Quarter 2025 Highlights Sequential Improvement in Net Sales and Adj. Gross Profit Margin % • Reinvigorated focus on proprietary brand sales drove improved AGPM% vs. Q4 2024 • Relatively strong sales in key U.S. manufactured proprietary nutrient and grow media brands Significant Reductions in Adjusted SG&A • 11th consecutive quarter of year-over- year Adjusted SG&A expense reductions • Effective cost savings and restructuring actions Free Cash Flow Seasonally Negative Period • Free Cash Flow ($12.0) million in Q1’25 • Canada Lawn and Garden activity in Q1 leads to seasonally negative cash flows Adjusted Gross Profit, Adjusted SG&A, Adjusted EBITDA, and Free Cash Flow are non-GAAP measures. AGPM% refers to 'Adjusted Gross Profit Margin’. Please see appendix for reconciliation of GAAP to non-GAAP measures. 5

Update on FY2025 Outlook and Initiatives Adjusted Gross Profit, Adjusted SG&A, Adjusted EBITDA, and Free Cash Flow are non-GAAP measures. AGPM% refers to 'Adjusted Gross Profit Margin’. Please see appendix for reconciliation of GAAP to non-GAAP measures. 6 Tariff Uncertainty • High tariffs on imported products from China, or new tariffs from other countries, could impact the cost of certain products and may negatively impact performance Initiating Product Portfolio Review to Improve Efficiency • Product portfolio and footprint review underway • Expect actions to improve efficiency and focus resources on our core proprietary brand strategy Withdrawing 2025 Outlook | Providing Key Performance Indicators • Continue to expect reduced year-over-year Adjusted SG&A expense • Continue to expect improved Adjusted Gross Profit Margin compared to 2024 • Expect reduction in inventory and positive Free Cash Flow for the remainder of 2025 • Withdrawing full year 2025 guidance for Net Sales, Adjusted EBITDA, and Free Cash Flow due to tariff uncertainty and industry headwinds

F inanc ia l Over v iew

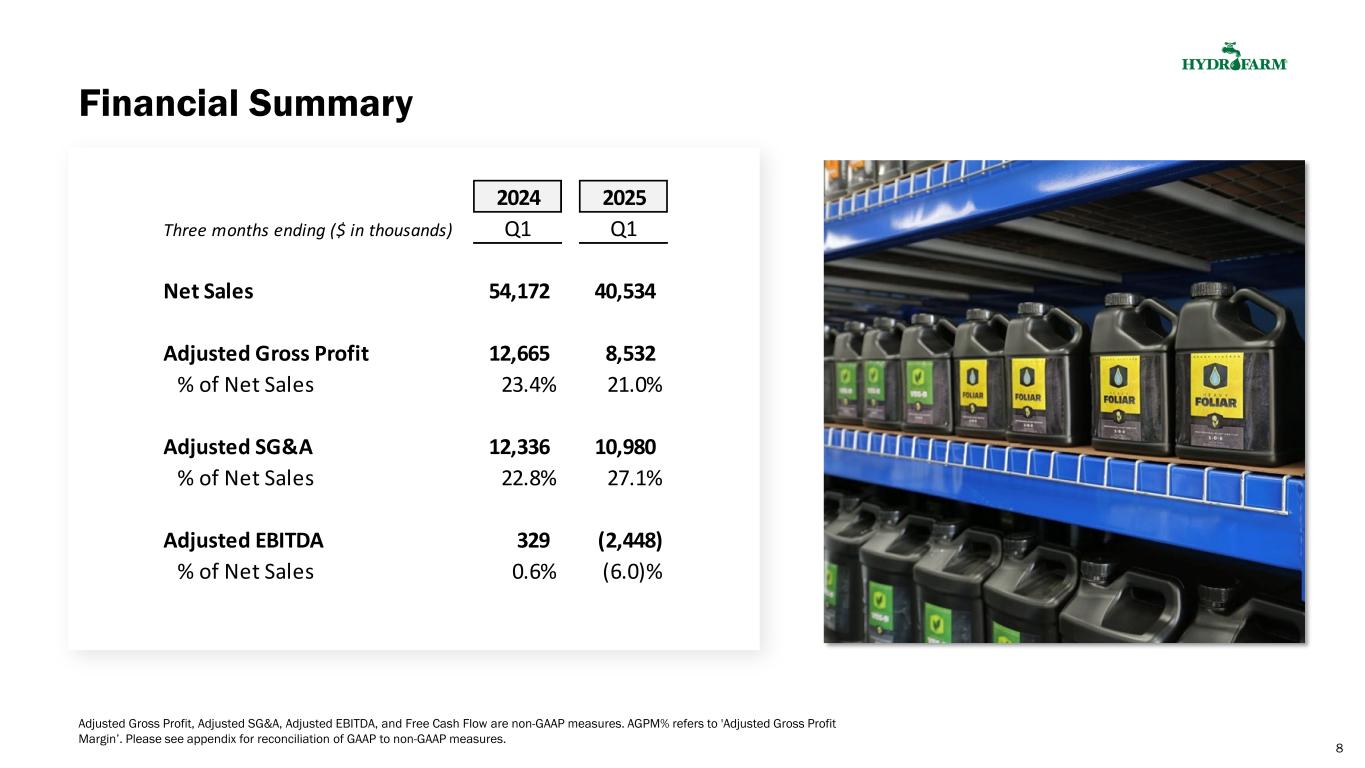

Financial Summary 8 2024 2025 Three months ending ($ in thousands) Q1 Q1 Net Sales 54,172 40,534 Adjusted Gross Profit 12,665 8,532 % of Net Sales 23.4% 21.0% Adjusted SG&A 12,336 10,980 % of Net Sales 22.8% 27.1% Adjusted EBITDA 329 (2,448) % of Net Sales 0.6% (6.0)% Adjusted Gross Profit, Adjusted SG&A, Adjusted EBITDA, and Free Cash Flow are non-GAAP measures. AGPM% refers to 'Adjusted Gross Profit Margin’. Please see appendix for reconciliation of GAAP to non-GAAP measures.

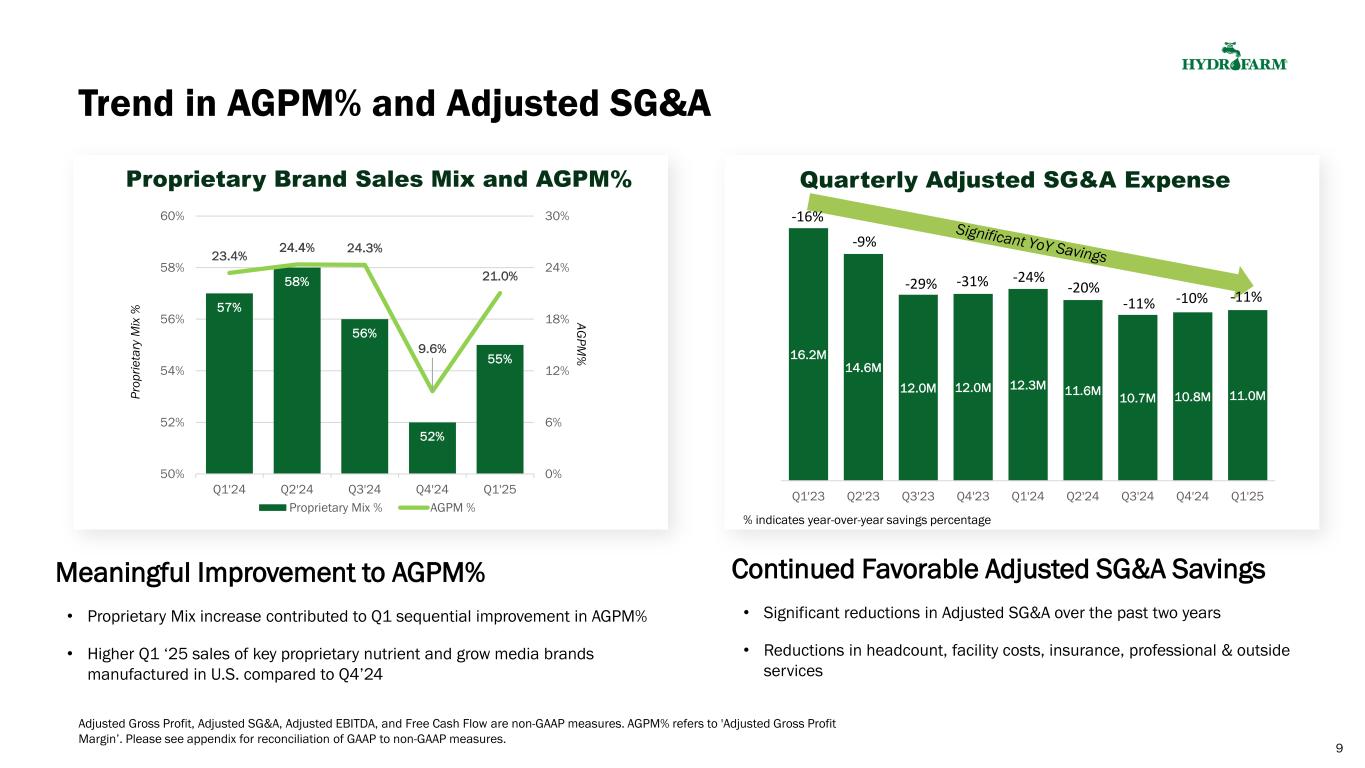

% indicates year-over-year savings percentage Quarterly Adjusted SG&A Expense Trend in AGPM% and Adjusted SG&A Meaningful Improvement to AGPM% • Proprietary Mix increase contributed to Q1 sequential improvement in AGPM% • Higher Q1 ‘25 sales of key proprietary nutrient and grow media brands manufactured in U.S. compared to Q4’24 Continued Favorable Adjusted SG&A Savings • Significant reductions in Adjusted SG&A over the past two years • Reductions in headcount, facility costs, insurance, professional & outside services 9 Pr op rie ta ry M ix % AG PM % Proprietary Brand Sales Mix and AGPM% 57% 58% 56% 52% 55% 23.4% 24.4% 24.3% 9.6% 21.0% 0% 6% 12% 18% 24% 30% 50% 52% 54% 56% 58% 60% Q1'24 Q2'24 Q3'24 Q4'24 Q1'25 Proprietary Mix % AGPM % 16.2M 14.6M 12.0M 12.0M 12.3M 11.6M 10.7M 10.8M 11.0M Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 Q1'25 -16% -9% -29% -31% -24% -20% -11% -10% -11% Adjusted Gross Profit, Adjusted SG&A, Adjusted EBITDA, and Free Cash Flow are non-GAAP measures. AGPM% refers to 'Adjusted Gross Profit Margin’. Please see appendix for reconciliation of GAAP to non-GAAP measures.

Cash and Liquidity ‘Liquidity’ is defined as Cash plus Available Borrowing Capacity on our Revolving Credit Facility. 'Total Debt' is defined as Term Loan debt principal outstanding plus finance leases and other debt. Net Debt, Liquidity and Free Cash Flow are non-GAAP measures. Please see appendix for reconciliation of GAAP to non-GAAP measures. Cash and cash equivalents $13.7 Liquidity $30.7 Total Debt $127.3 Net Debt $113.6 Net Cash Used in Operations $(11.8) Capital Expenditures $(0.2) Free Cash Flow $(12.0) 10 Balance Sheet Highlights as of March 31, 2025 Cash Flow Highlights 3 months ended March 31, 2025 USD millions USD millions

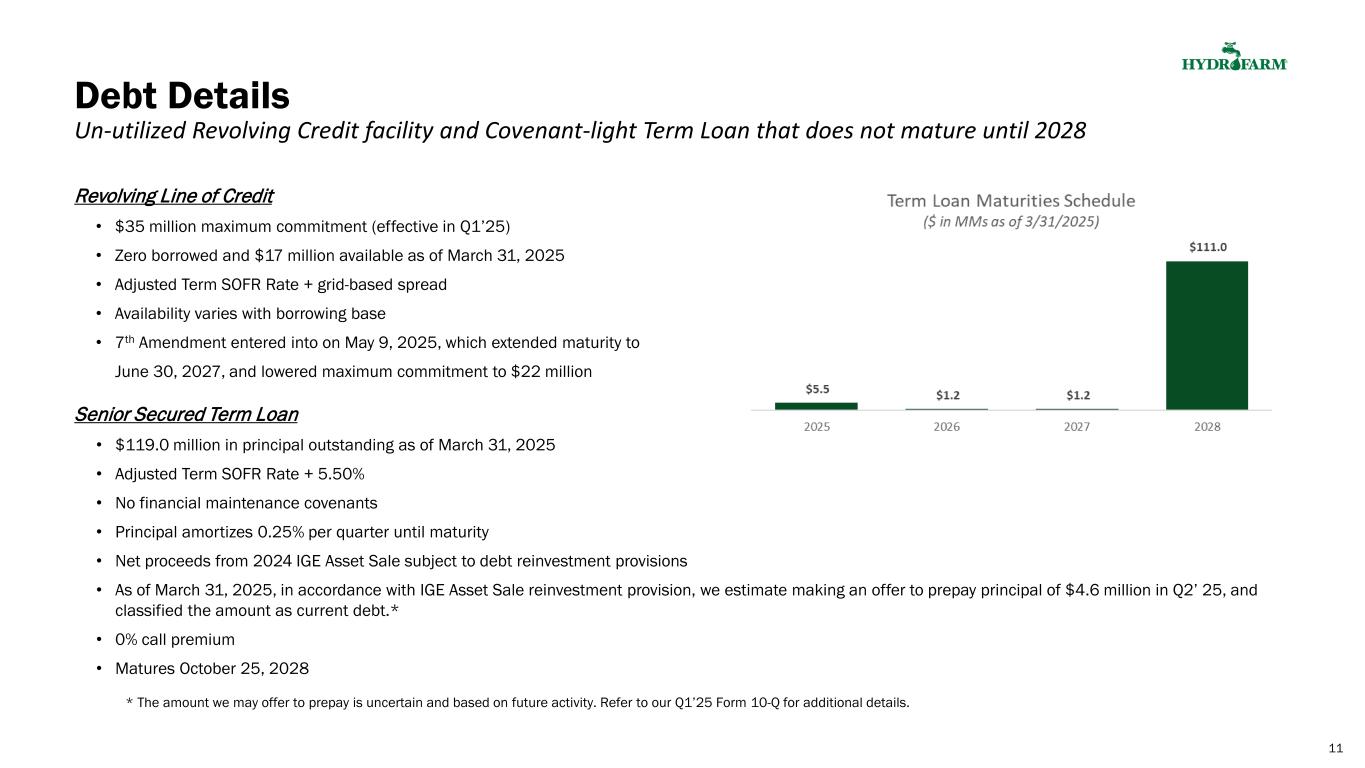

Revolving Line of Credit • $35 million maximum commitment (effective in Q1’25) • Zero borrowed and $17 million available as of March 31, 2025 • Adjusted Term SOFR Rate + grid-based spread • Availability varies with borrowing base • 7th Amendment entered into on May 9, 2025, which extended maturity to June 30, 2027, and lowered maximum commitment to $22 million Senior Secured Term Loan • $119.0 million in principal outstanding as of March 31, 2025 • Adjusted Term SOFR Rate + 5.50% • No financial maintenance covenants • Principal amortizes 0.25% per quarter until maturity • Net proceeds from 2024 IGE Asset Sale subject to debt reinvestment provisions • As of March 31, 2025, in accordance with IGE Asset Sale reinvestment provision, we estimate making an offer to prepay principal of $4.6 million in Q2’ 25, and classified the amount as current debt.* • 0% call premium • Matures October 25, 2028 * The amount we may offer to prepay is uncertain and based on future activity. Refer to our Q1’25 Form 10-Q for additional details. 11 Debt Details Un-utilized Revolving Credit facility and Covenant-light Term Loan that does not mature until 2028

Appendix

Source: Company Information Specialty hydroponic retailers Garden centers / retail eCommerce Greenhouse / channel partners Selling to a fragmented customer base… Branded manufacturer and distributor serving the CEA (Controlled Environment Agriculture) market Hydrofarm’s Value Proposition Proprietary brands Preferred & Distributed brands Approx. 35 brands, including: Complete Range of CEA Products Exceptional Service Manufacturing Capabilities Supplier Relationships and Geographic Footprint Solution-Based Approach to Serve Our Customers …that reaches an evolving mix of end users Commercial growers Individuals Consumer gardeners & hobbyists Cannabis Food & floral Over 50 brands, including: 13

We have end-to-end category coverage through innovative, well-recognized proprietary and preferred brands Strong proprietary brand portfolio with solutions across key categories Illustrative margin benefit as we improve proprietary brand mix Distributed Brands Preferred Brands Proprietary Brands Consumables Durables Nutrients Grow Media Supplies Lighting Equipment 14

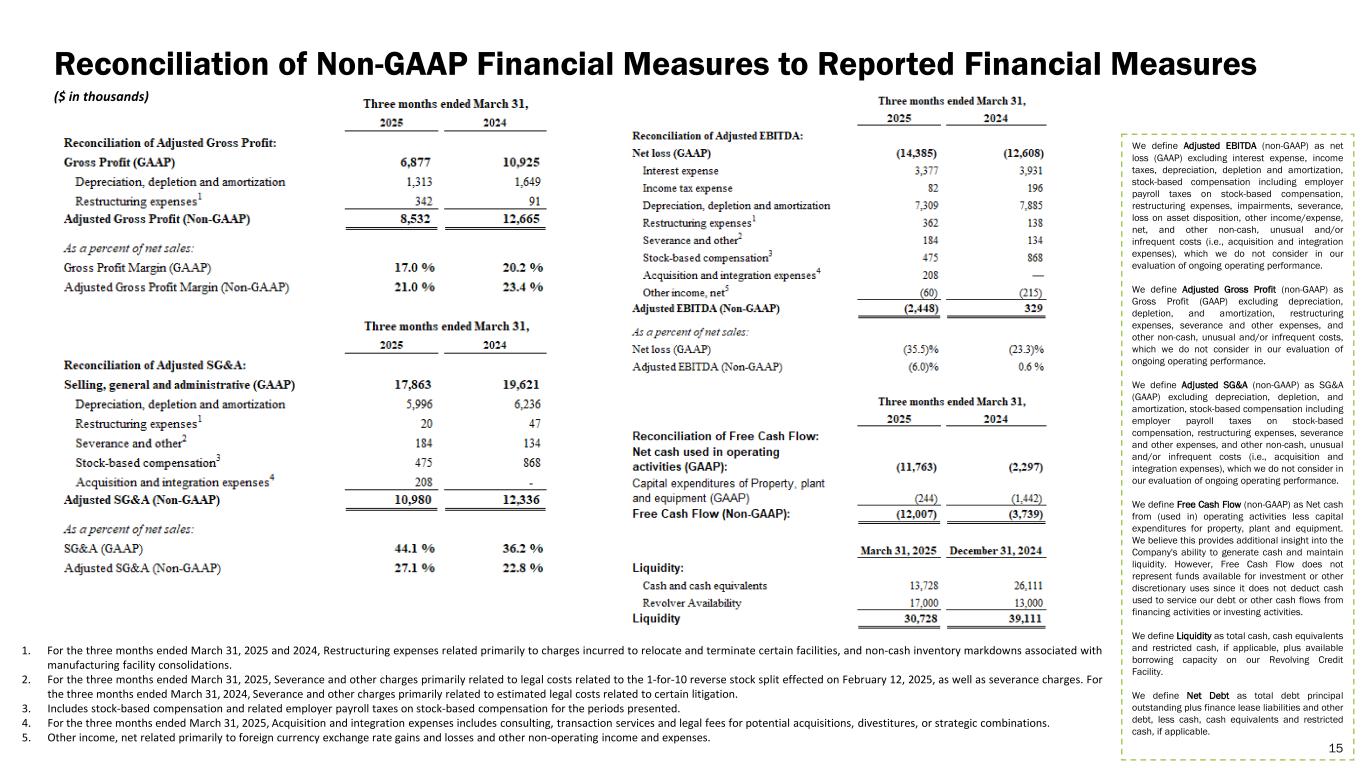

Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures ($ in thousands) We define Adjusted EBITDA (non-GAAP) as net loss (GAAP) excluding interest expense, income taxes, depreciation, depletion and amortization, stock-based compensation including employer payroll taxes on stock-based compensation, restructuring expenses, impairments, severance, loss on asset disposition, other income/expense, net, and other non-cash, unusual and/or infrequent costs (i.e., acquisition and integration expenses), which we do not consider in our evaluation of ongoing operating performance. We define Adjusted Gross Profit (non-GAAP) as Gross Profit (GAAP) excluding depreciation, depletion, and amortization, restructuring expenses, severance and other expenses, and other non-cash, unusual and/or infrequent costs, which we do not consider in our evaluation of ongoing operating performance. We define Adjusted SG&A (non-GAAP) as SG&A (GAAP) excluding depreciation, depletion, and amortization, stock-based compensation including employer payroll taxes on stock-based compensation, restructuring expenses, severance and other expenses, and other non-cash, unusual and/or infrequent costs (i.e., acquisition and integration expenses), which we do not consider in our evaluation of ongoing operating performance. We define Free Cash Flow (non-GAAP) as Net cash from (used in) operating activities less capital expenditures for property, plant and equipment. We believe this provides additional insight into the Company's ability to generate cash and maintain liquidity. However, Free Cash Flow does not represent funds available for investment or other discretionary uses since it does not deduct cash used to service our debt or other cash flows from financing activities or investing activities. We define Liquidity as total cash, cash equivalents and restricted cash, if applicable, plus available borrowing capacity on our Revolving Credit Facility. We define Net Debt as total debt principal outstanding plus finance lease liabilities and other debt, less cash, cash equivalents and restricted cash, if applicable. 1. For the three months ended March 31, 2025 and 2024, Restructuring expenses related primarily to charges incurred to relocate and terminate certain facilities, and non-cash inventory markdowns associated with manufacturing facility consolidations. 2. For the three months ended March 31, 2025, Severance and other charges primarily related to legal costs related to the 1-for-10 reverse stock split effected on February 12, 2025, as well as severance charges. For the three months ended March 31, 2024, Severance and other charges primarily related to estimated legal costs related to certain litigation. 3. Includes stock-based compensation and related employer payroll taxes on stock-based compensation for the periods presented. 4. For the three months ended March 31, 2025, Acquisition and integration expenses includes consulting, transaction services and legal fees for potential acquisitions, divestitures, or strategic combinations. 5. Other income, net related primarily to foreign currency exchange rate gains and losses and other non-operating income and expenses. 15