Third Quarter 2025 Earnings Presentation October 29, 2025 Christopher Stavros – Chairman, President & CEO Brian Corales – Senior Vice President & CFO Tom Fitter – Director, Investor Relations

Disclaimer FORWARD LOOKING STATEMENTS The information in this press release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of present or historical fact included in this press release, regarding Magnolia’s strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward looking statements. When used in this press release, the words could, should, will, may, believe, anticipate, intend, estimate, expect, project, the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations and assumptions about future events. Except as otherwise required by applicable law, Magnolia disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this press release. Magnolia cautions you that these forward-looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Magnolia, incident to the development, production, gathering and sale of oil, natural gas and natural gas liquids. In addition, Magnolia cautions you that the forward looking statements contained in this press release are subject to the following factors: (i) the supply and demand for oil, natural gas, NGLs, and other products or services, including impacts of actions taken by OPEC and other state-controlled oil companies; (ii) the outcome of any legal proceedings that may be instituted against Magnolia; (iii) Magnolia’s ability to realize the anticipated benefits of its acquisitions, which may be affected by, among other things, competition and the ability of Magnolia to grow and manage growth profitably; (iv) changes in applicable laws or regulations; (v) geopolitical and business conditions in key regions of the world; and (vi) the possibility that Magnolia may be adversely affected by other economic, business, and/or competitive factors, including inflation and tariffs. Should one or more of the risks or uncertainties described in this press release occur, or should underlying assumptions prove incorrect, actual results and plans could differ materially from those expressed in any forward-looking statements. Additional information concerning these and other factors that may impact the operations and projections discussed herein can be found in Magnolia’s filings with the SEC, including its Annual Report on Form 10-K for the fiscal year ended December 31, 2024. Magnolia’s SEC filings are available publicly on the SEC’s website at www.sec.gov. NON-GAAP FINANCIAL MEASURES This presentation includes non-GAAP financial measures, including adjusted net income, free cash flow, adjusted EBITDAX, adjusted cash operating costs, adjusted cash operating margin and return on capital employed. Magnolia believes these metrics are useful because they allow Magnolia to more effectively evaluate its operating performance and compare the results of its operations from period to period and against its peers without regard to accounting methods or capital structure. Magnolia does not consider these non-GAAP measures in isolation or as an alternative to similar financial measures determined in accordance with GAAP. The computations of these non-GAAP measures may not be comparable to other similarly titled measures of other companies. Adjusted net income and adjusted EBITDAX should not be considered an alternative to, or more meaningful than, net income as determined in accordance with GAAP. Certain items excluded from free cash flow, adjusted net income, adjusted EBITDAX, adjusted cash operating costs, adjusted cash operating margin, adjusted operating margin and return on capital employed are significant components in understanding and assessing a company’s financial performance and should not be construed as an inference that its results will be unaffected by unusual or non-recurring terms. As performance measures, adjusted net income, adjusted EBITDAX, adjusted cash operating costs, adjusted cash operating margin and return on capital employed may be useful to investors in facilitating comparisons to others in the Company’s industry because certain items can vary substantially in the oil and gas industry from company to company depending upon accounting methods, book value of assets, and capital structure, among other factors. Management believes excluding these items facilitates investors and analysts in evaluating and comparing the underlying operating and financial performance of our business from period to period by eliminating differences caused by the existence and timing of certain expense and income items that would not otherwise be apparent on a GAAP basis. As a liquidity measure, management believes free cash flow is useful for investors and widely accepted by those following the oil and gas industry as financial indicators of a company’s ability to generate cash to internally fund drilling and completion activities, fund acquisitions, and service debt. Our presentation of adjusted net income, adjusted EBITDAX, free cash flow, adjusted cash operating costs, adjusted cash operating margin and return on capital employed may not be comparable to similar measures of other companies in our industry. A free cash flow reconciliation is shown on page 16, adjusted EBITDAX reconciliation is shown on page 17, adjusted net income is shown on page 18, adjusted cash operating costs and adjusted cash operating margin reconciliations are shown on page 10 and ROCE is shown on page 20 of the presentation. INDUSTRY AND MARKET DATA This presentation has been prepared by Magnolia and includes market data and other statistical information from sources believed by Magnolia to be reliable, including independent industry publications, governmental publications or other published independent sources. Some data is also based on the good faith estimates of Magnolia, which are derived from its review of internal sources as well as the independent sources described above. Although Magnolia believes these sources are reliable, it has not independently verified the information and cannot guarantee its accuracy and completeness. Third Quarter 2025 Earnings Presentation 2

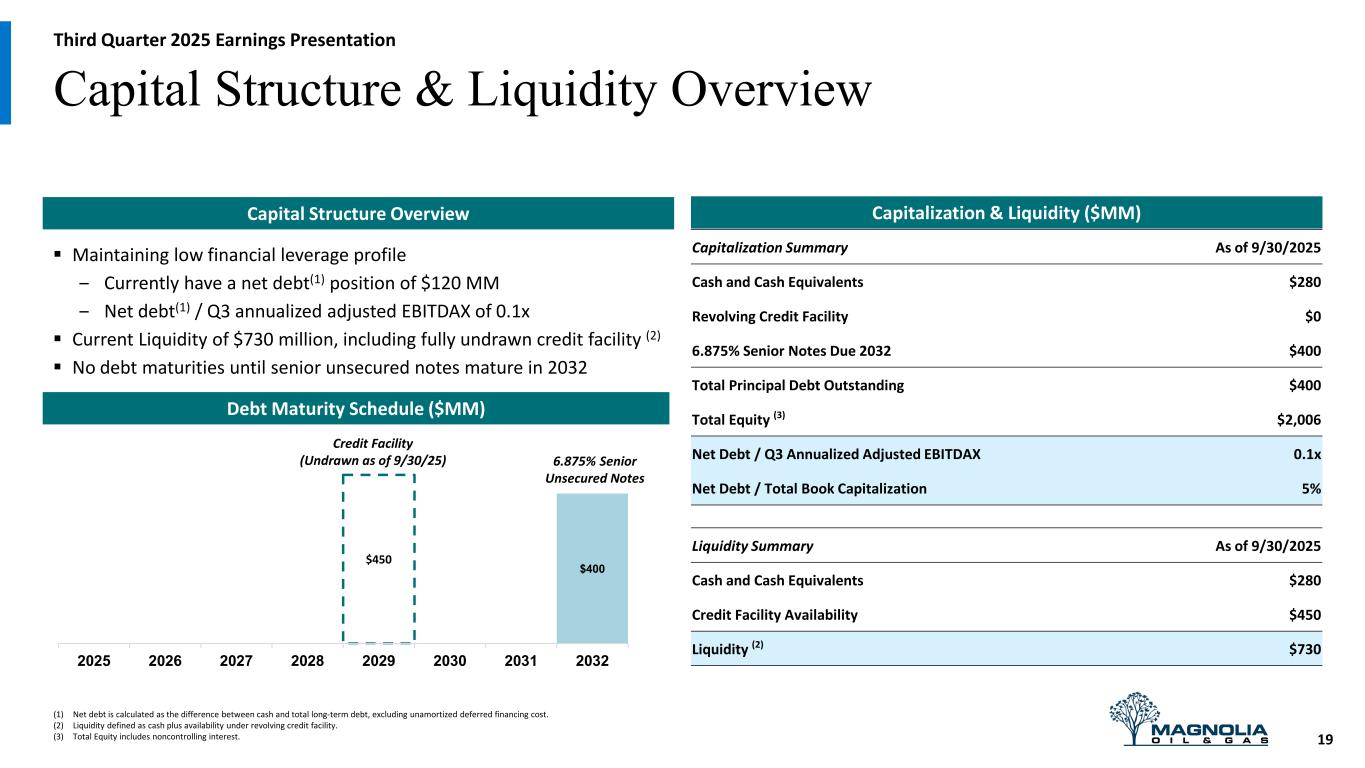

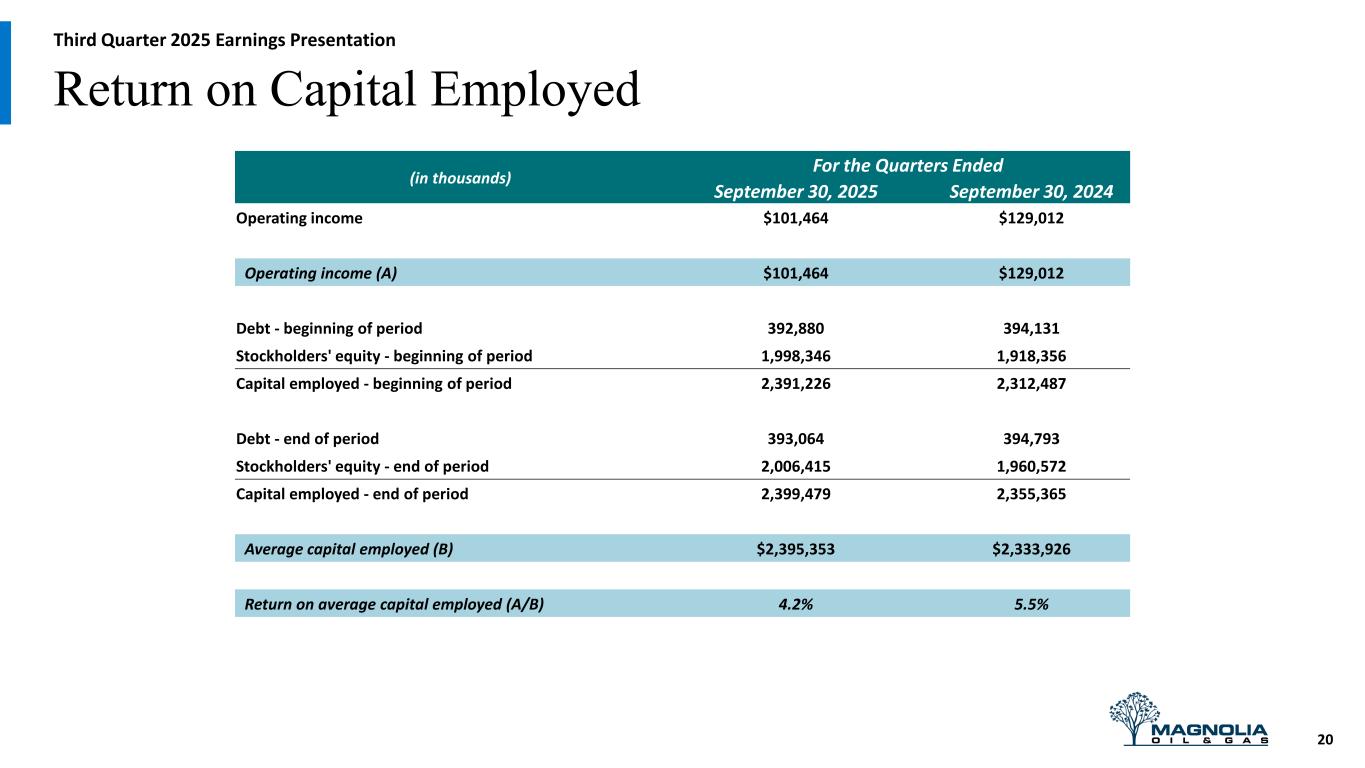

Third Quarter 2025 Highlights & Announcements OperationsFinancial Corporate • Total adjusted net income of $78 MM and operating income margin of 31% • Adjusted EBITDAX of $219 MM with a 54% capital reinvestment rate • D&C capital of $118 MM and free cash flow (FCF) of $134 MM • Q3 2025 Annualized Return on Capital Employed (ROCE) of 17% • Full-year 2025 production growth guidance of ~10%, above original 5% - 7% guidance and with ~5% lower D&C capital • Returned ~$80 MM to shareholders (60% of free cash flow), including: $51 MM of share repurchases (2.15 MM shares) and dividends of $29 MM • Maintained best-in-class balance sheet with $280 MM of cash and only $120 MM of net debt • Q3 2025 total production of 100.5 Mboe/d (company record) exceeding earlier guidance & oil production of 39.4 Mbbls/d • Giddings YoY total production growth of 15% and oil production growth of 5% YoY • 2-rig, 1-completion crew operational cadence (same activity rate since 2021) driving continued production growth (~50% growth since at same activity rate) Third Quarter 2025 Earnings Presentation 3 Continuing to execute a differentiated business model focused on enhancing per share value

Magnolia’s Consistent Business Model Return Substantial Portion of Our Free Cash Flow to Shareholders and Allocate Some Excess Cash Toward Small, Bolt-on Acquisitions that Improve the Business Long-term dividend per share compound annual growth rate of ~10% and share repurchases of at least 1% per quarter High Quality Assets Drive Low Capital Reinvestment Rate that Grows the Business Limit Capital Spending to 55% of Annual Adjusted EBITDAX Maintain Conservative Financial Leverage to Provide Financial Flexibility Through Cycle Strong balance sheet, with minimal net debt, provides ability for counter cyclical investing to increase per share value Deliver Mid-Single Digit Long-Term Production Growth with Significant Free Cash Flow 2025 BOE Growth of ~10%, above long-term growth range due to asset outperformance Third Quarter 2025 Earnings Presentation 4

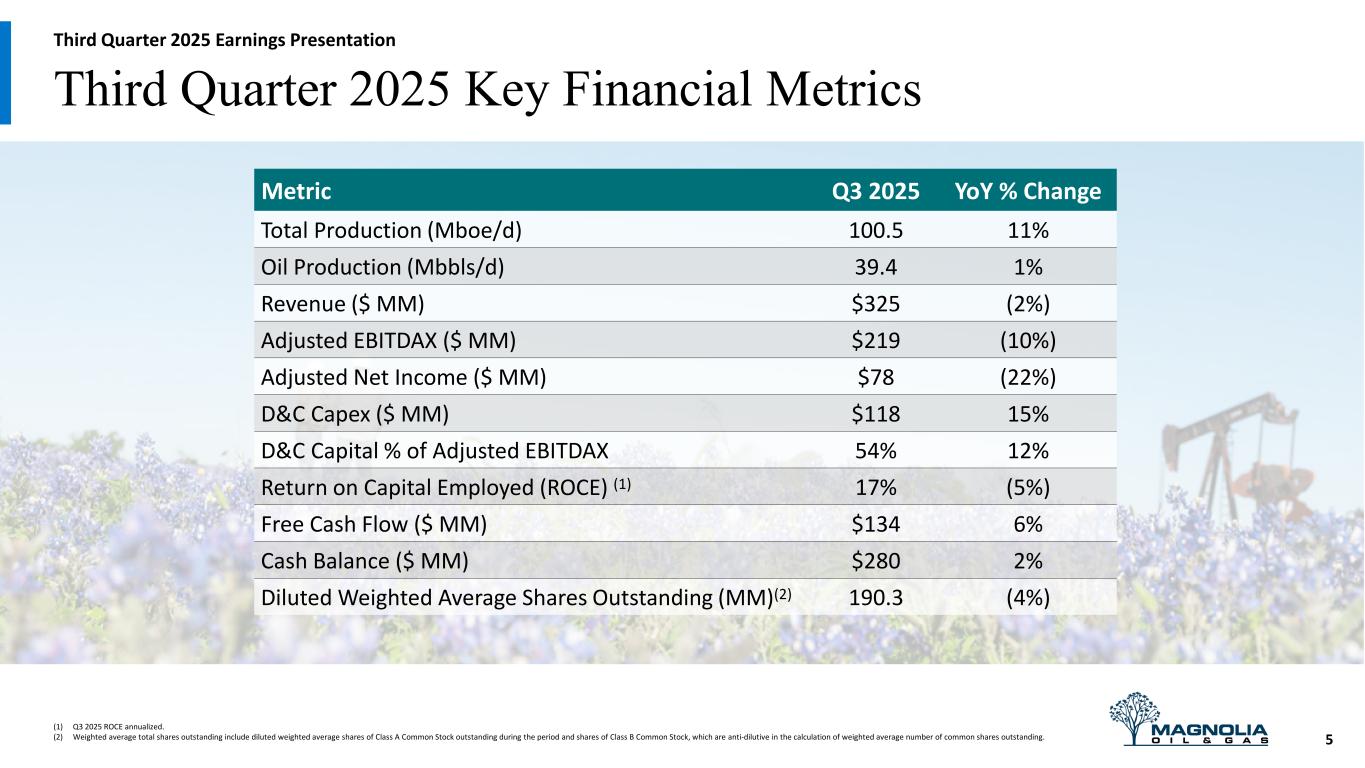

Third Quarter 2025 Key Financial Metrics (1) Q3 2025 ROCE annualized. (2) Weighted average total shares outstanding include diluted weighted average shares of Class A Common Stock outstanding during the period and shares of Class B Common Stock, which are anti-dilutive in the calculation of weighted average number of common shares outstanding. Third Quarter 2025 Earnings Presentation 5 Metric Q3 2025 YoY % Change Total Production (Mboe/d) 100.5 11% Oil Production (Mbbls/d) 39.4 1% Revenue ($ MM) $325 (2%) Adjusted EBITDAX ($ MM) $219 (10%) Adjusted Net Income ($ MM) $78 (22%) D&C Capex ($ MM) $118 15% D&C Capital % of Adjusted EBITDAX 54% 12% Return on Capital Employed (ROCE) (1) 17% (5%) Free Cash Flow ($ MM) $134 6% Cash Balance ($ MM) $280 2% Diluted Weighted Average Shares Outstanding (MM)(2) 190.3 (4%)

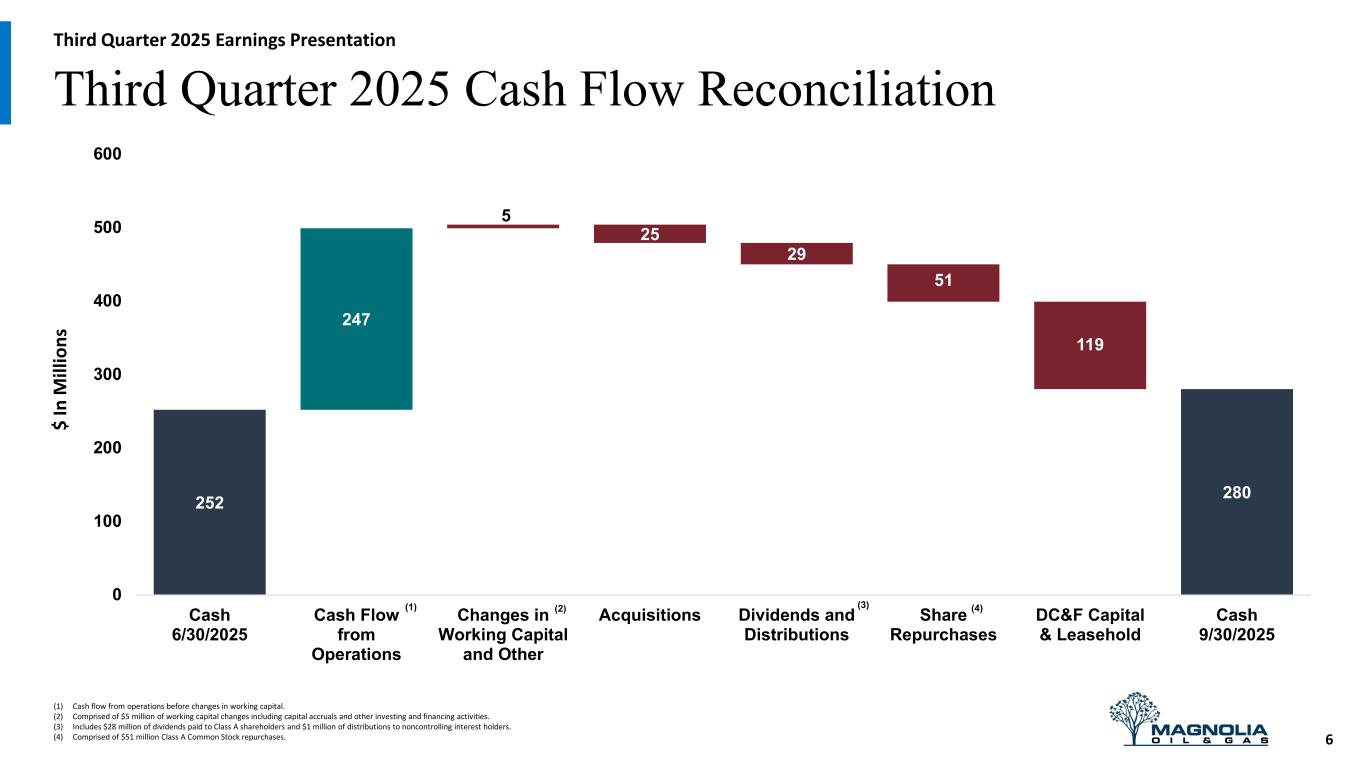

252 247 5 25 29 51 119 280 0 100 200 300 400 500 600 Cash 6/30/2025 Cash Flow from Operations Changes in Working Capital and Other Acquisitions Dividends and Distributions Share Repurchases DC&F Capital & Leasehold Cash 9/30/2025 (1) (2) (3) (4) Third Quarter 2025 Cash Flow Reconciliation Third Quarter 2025 Earnings Presentation (1) Cash flow from operations before changes in working capital. (2) Comprised of $5 million of working capital changes including capital accruals and other investing and financing activities. (3) Includes $28 million of dividends paid to Class A shareholders and $1 million of distributions to noncontrolling interest holders. (4) Comprised of $51 million Class A Common Stock repurchases. 6 $ In M ill io ns

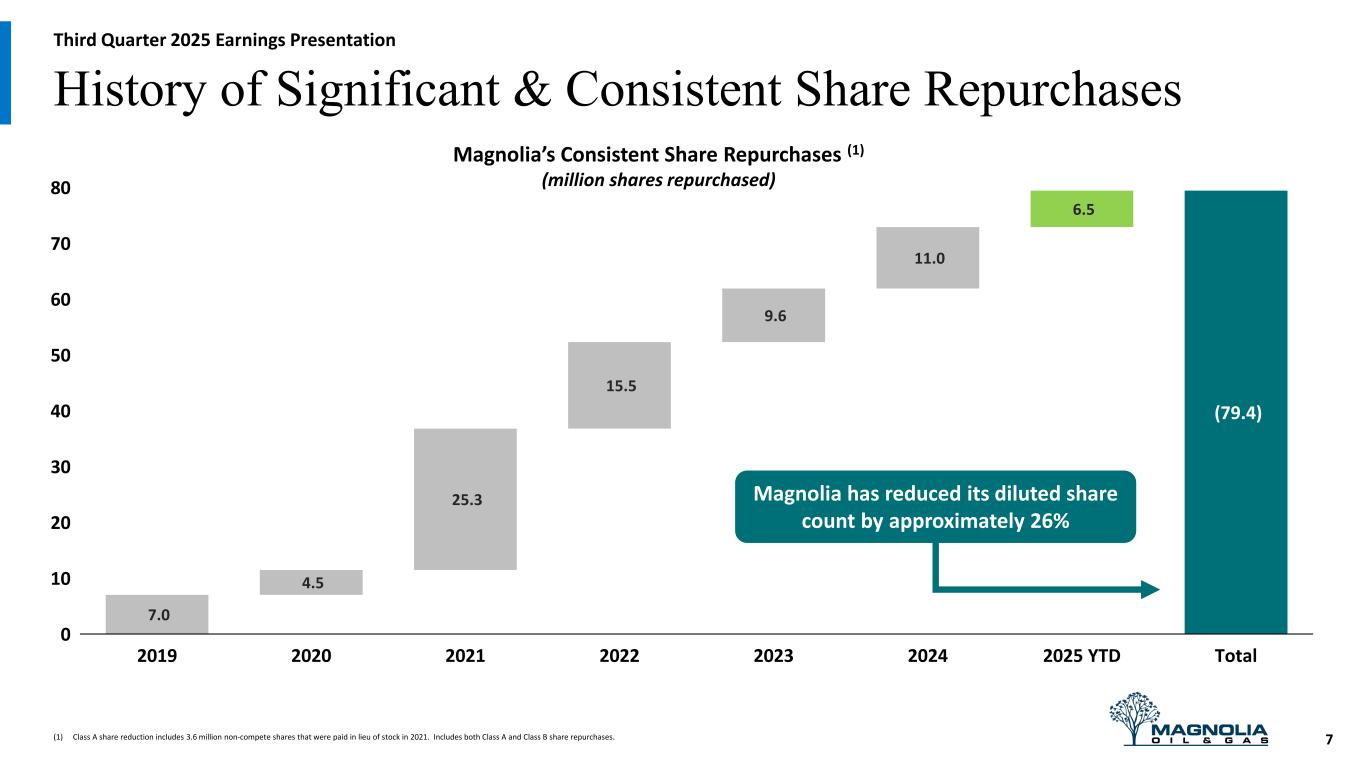

(1) Class A share reduction includes 3.6 million non-compete shares that were paid in lieu of stock in 2021. Includes both Class A and Class B share repurchases. History of Significant & Consistent Share Repurchases 7.0 4.5 25.3 15.5 9.6 11.0 6.5 (79.4) 2019 2020 2021 2022 2023 2024 2025 YTD Total 0 10 20 30 40 50 60 70 80 Third Quarter 2025 Earnings Presentation 7 Magnolia has reduced its diluted share count by approximately 26% Magnolia’s Consistent Share Repurchases (1) (million shares repurchased)

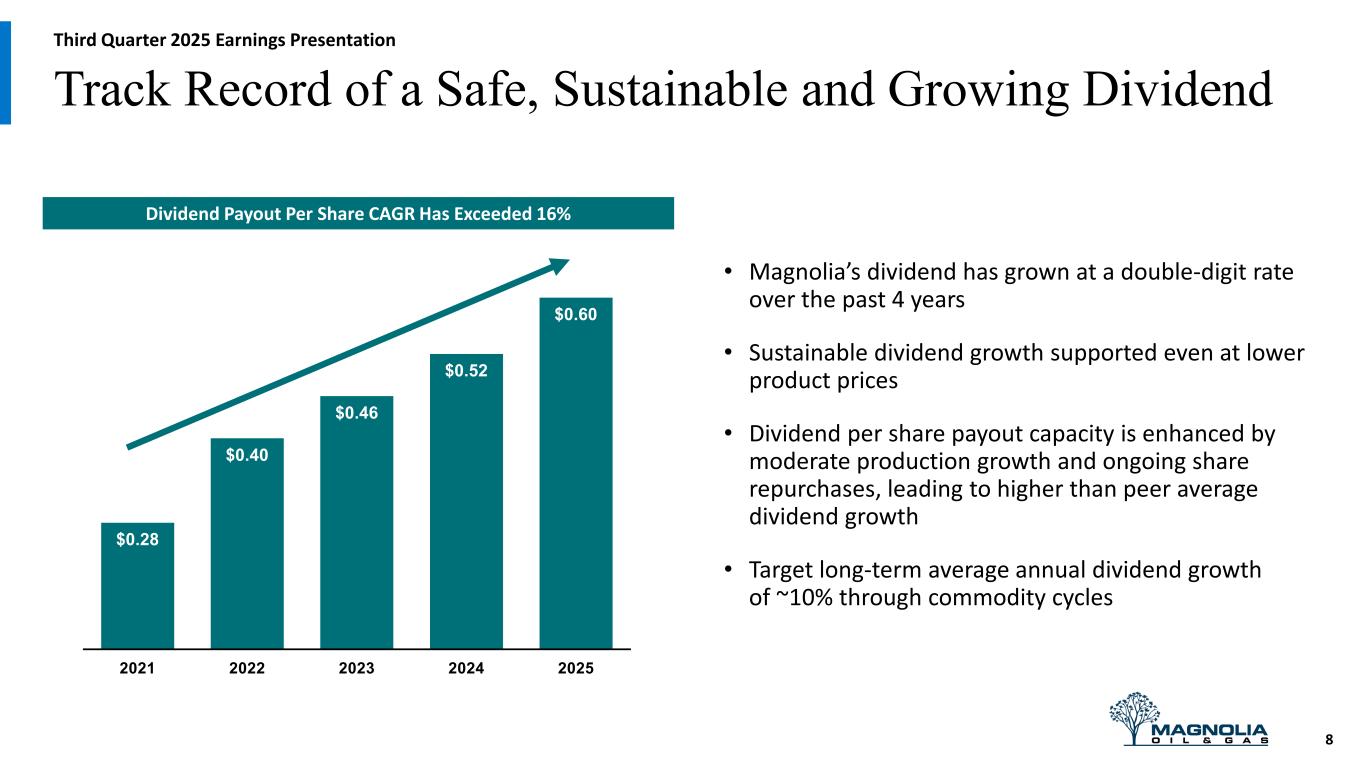

Track Record of a Safe, Sustainable and Growing Dividend • Magnolia’s dividend has grown at a double-digit rate over the past 4 years • Sustainable dividend growth supported even at lower product prices • Dividend per share payout capacity is enhanced by moderate production growth and ongoing share repurchases, leading to higher than peer average dividend growth • Target long-term average annual dividend growth of ~10% through commodity cycles Third Quarter 2025 Earnings Presentation 8 $0.28 $0.40 $0.46 $0.52 $0.60 2021 2022 2023 2024 2025 Dividend Payout Per Share CAGR Has Exceeded 16%

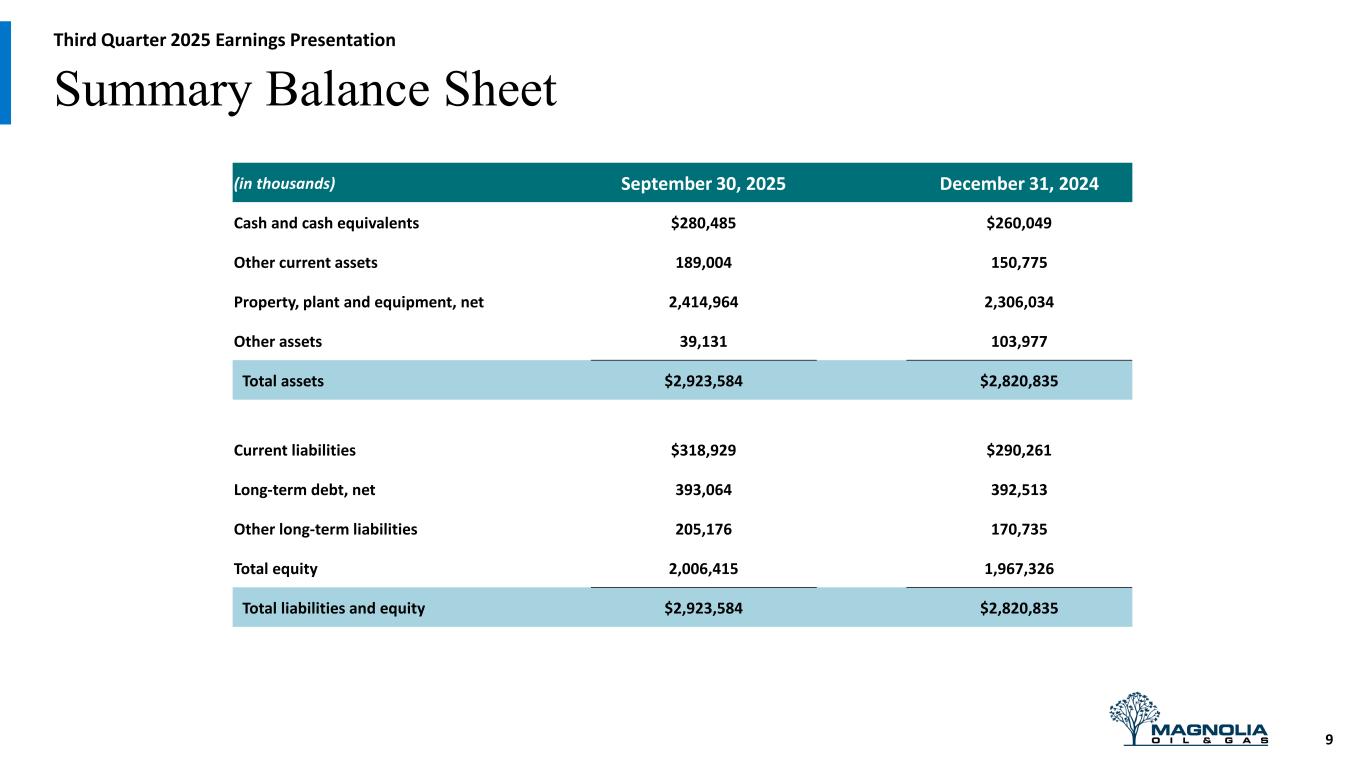

Summary Balance Sheet Third Quarter 2025 Earnings Presentation 9 (in thousands) September 30, 2025 December 31, 2024 Cash and cash equivalents $280,485 $260,049 Other current assets 189,004 150,775 Property, plant and equipment, net 2,414,964 2,306,034 Other assets 39,131 103,977 Total assets $2,923,584 $2,820,835 Current liabilities $318,929 $290,261 Long-term debt, net 393,064 392,513 Other long-term liabilities 205,176 170,735 Total equity 2,006,415 1,967,326 Total liabilities and equity $2,923,584 $2,820,835

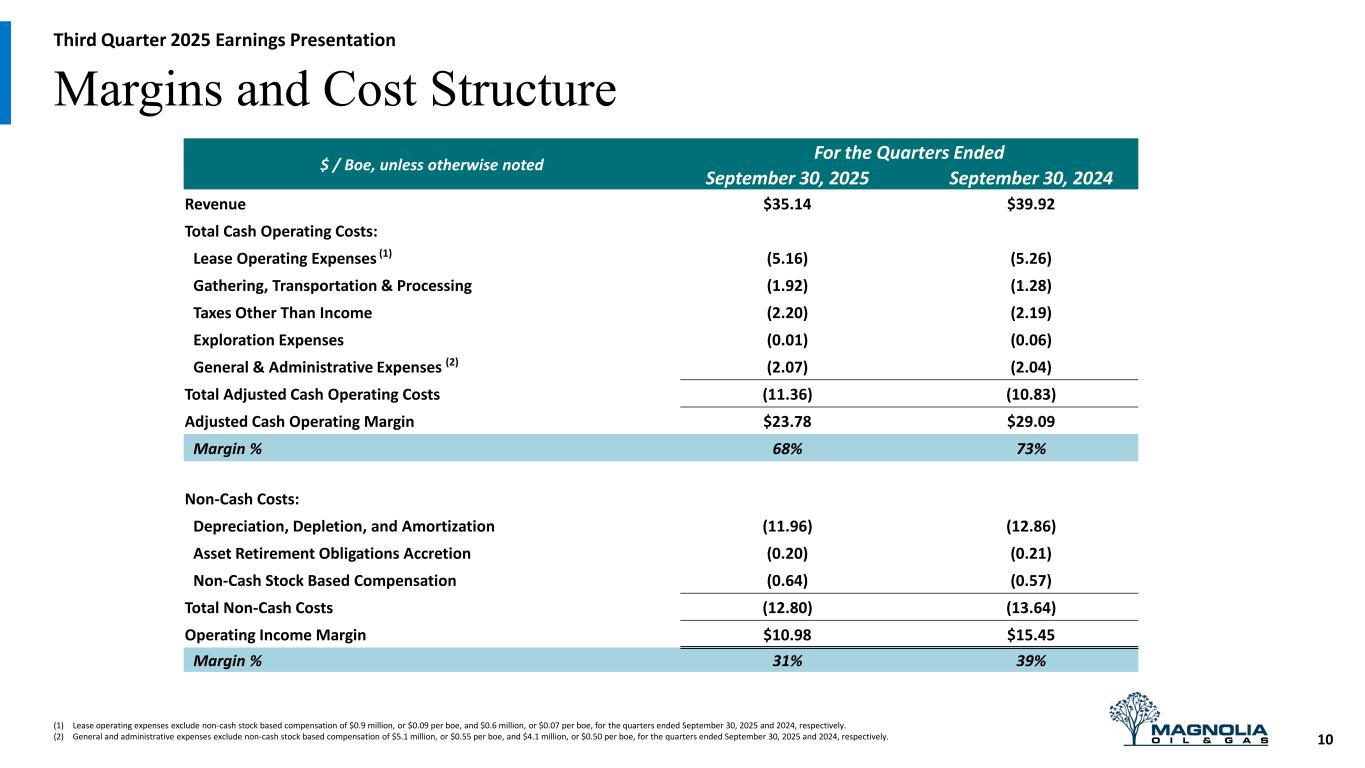

Margins and Cost Structure Third Quarter 2025 Earnings Presentation (1) Lease operating expenses exclude non-cash stock based compensation of $0.9 million, or $0.09 per boe, and $0.6 million, or $0.07 per boe, for the quarters ended September 30, 2025 and 2024, respectively. (2) General and administrative expenses exclude non-cash stock based compensation of $5.1 million, or $0.55 per boe, and $4.1 million, or $0.50 per boe, for the quarters ended September 30, 2025 and 2024, respectively. 10 $ / Boe, unless otherwise noted For the Quarters Ended September 30, 2025 September 30, 2024 Revenue $35.14 $39.92 Total Cash Operating Costs: Lease Operating Expenses (1) (5.16) (5.26) Gathering, Transportation & Processing (1.92) (1.28) Taxes Other Than Income (2.20) (2.19) Exploration Expenses (0.01) (0.06) General & Administrative Expenses (2) (2.07) (2.04) Total Adjusted Cash Operating Costs (11.36) (10.83) Adjusted Cash Operating Margin $23.78 $29.09 Margin % 68% 73% Non-Cash Costs: Depreciation, Depletion, and Amortization (11.96) (12.86) Asset Retirement Obligations Accretion (0.20) (0.21) Non-Cash Stock Based Compensation (0.64) (0.57) Total Non-Cash Costs (12.80) (13.64) Operating Income Margin $10.98 $15.45 Margin % 31% 39%

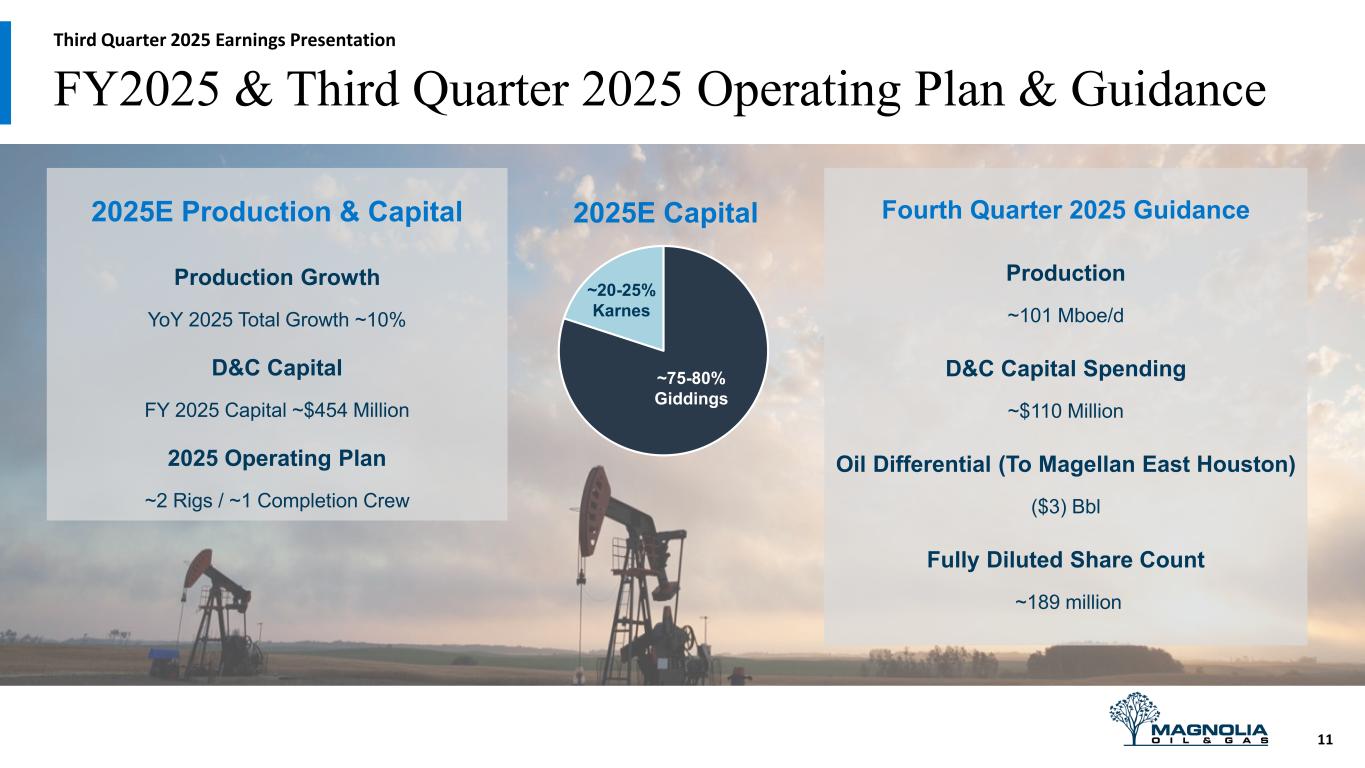

FY2025 & Third Quarter 2025 Operating Plan & Guidance Third Quarter 2025 Earnings Presentation 11 2025E Production & Capital Production Growth YoY 2025 Total Growth ~10% D&C Capital FY 2025 Capital ~$454 Million 2025 Operating Plan ~2 Rigs / ~1 Completion Crew 2025E Capital ~20-25% Karnes ~75-80% Giddings Fourth Quarter 2025 Guidance Production ~101 Mboe/d D&C Capital Spending ~$110 Million Oil Differential (To Magellan East Houston) ($3) Bbl Fully Diluted Share Count ~189 million

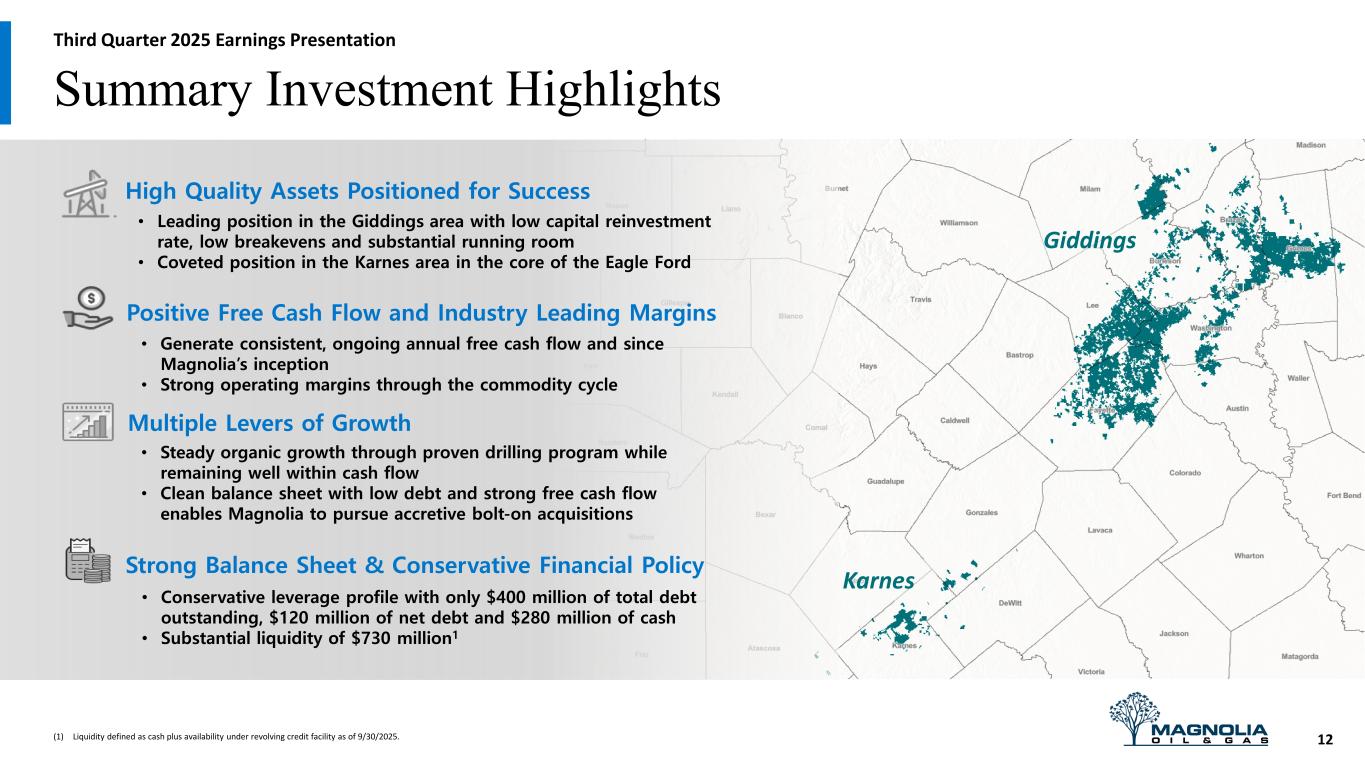

Summary Investment Highlights Third Quarter 2025 Earnings Presentation (1) Liquidity defined as cash plus availability under revolving credit facility as of 9/30/2025. 12 Giddings Karnes High Quality Assets Positioned for Success • Leading position in the Giddings area with low capital reinvestment rate, low breakevens and substantial running room • Coveted position in the Karnes area in the core of the Eagle Ford • Generate consistent, ongoing annual free cash flow and since Magnolia’s inception • Strong operating margins through the commodity cycle Positive Free Cash Flow and Industry Leading Margins Multiple Levers of Growth Strong Balance Sheet & Conservative Financial Policy • Steady organic growth through proven drilling program while remaining well within cash flow • Clean balance sheet with low debt and strong free cash flow enables Magnolia to pursue accretive bolt-on acquisitions • Conservative leverage profile with only $400 million of total debt outstanding, $120 million of net debt and $280 million of cash • Substantial liquidity of $730 million1

Appendix

Consistent & Sizable Cash Return to Shareholders 2018 2019 2020 2021 2022 2023 2024 2025 YTD • Magnolia has a strong track record of returning capital to shareholders • Returned >40% of current market cap over prior seven years • Focus on compounding per share value through share count reduction and safe, sustainable dividend growth Third Quarter 2025 Earnings Presentation 14 Inception Cumulative Return of Capital ($MM) $79 $108 $467 $908 $1,213 >$1.8 Billion Returned to Shareholders Share Repurchases Dividends $1,591 $1,831

Magnolia’s Commitment to Sustainability Review our 2025 Sustainability Report at https://www.magnoliaoilgas.com/sustainability. Third Quarter 2025 Earnings Presentation Safeguarding the Environment 21-percent reduction in gross Scope 1 greenhouse gas intensity rate since 2020, despite production growth 68-percent reduction in gas flared as a percent of total production since 2020 39,000 truckloads of water removed from local roads in 2024 through new infrastructure Supporting Employees and Communities $304 million in royalty, lease, and surface payments to Texas residents; $107 million in tax payments to Texas communities $521 million in payments made to local vendors and service providers Recognized as Top Workplace in Houston Chronicle Top Workplaces Survey Governing with Integrity 50-percent refreshment rate with 4 directors with 5 or fewer years of tenure on Board of Directors 3 new directors with specific oil & gas industry and executive leadership experience 98 percent of shareholders approved say-on-pay proposal at 2025 Annual Meeting 15

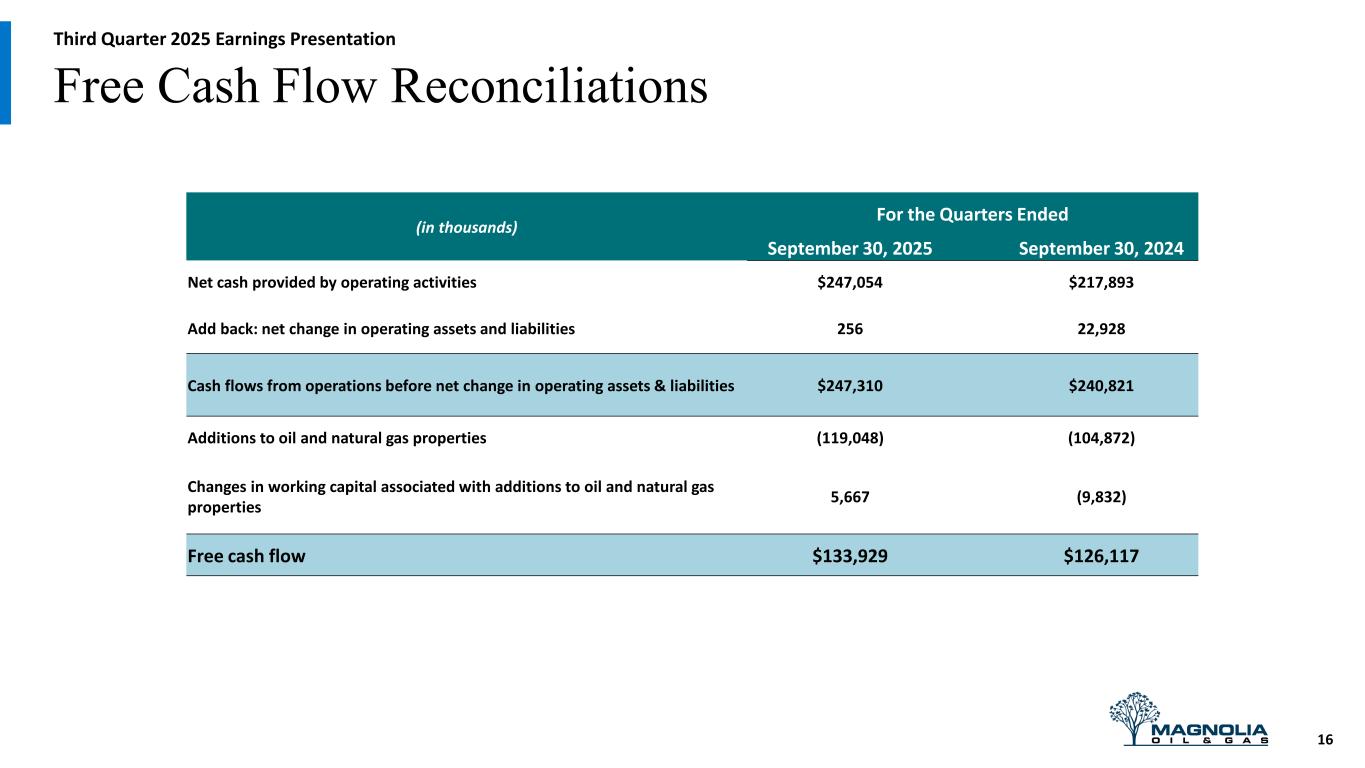

Free Cash Flow Reconciliations Third Quarter 2025 Earnings Presentation 16 (in thousands) For the Quarters Ended September 30, 2025 September 30, 2024 Net cash provided by operating activities $247,054 $217,893 Add back: net change in operating assets and liabilities 256 22,928 Cash flows from operations before net change in operating assets & liabilities $247,310 $240,821 Additions to oil and natural gas properties (119,048) (104,872) Changes in working capital associated with additions to oil and natural gas properties 5,667 (9,832) Free cash flow $133,929 $126,117

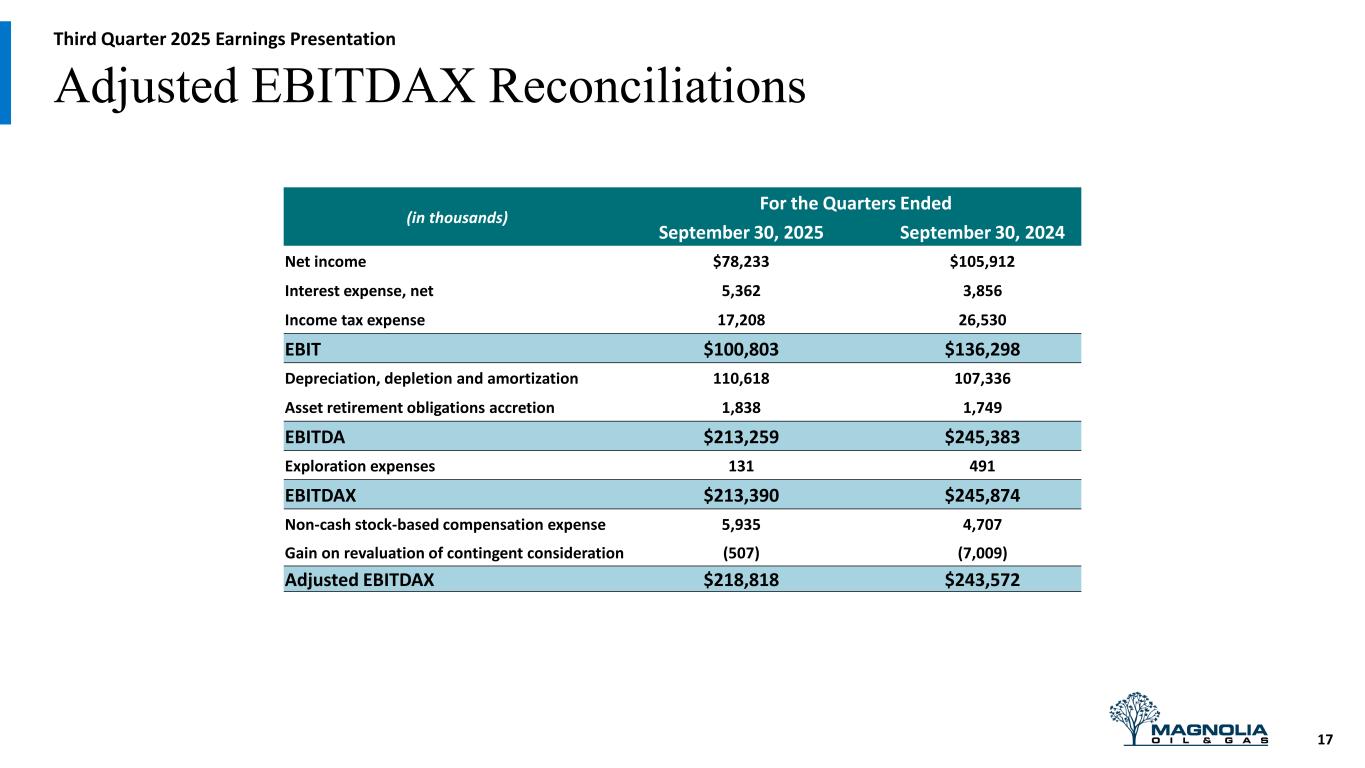

Adjusted EBITDAX Reconciliations Third Quarter 2025 Earnings Presentation 17 (in thousands) For the Quarters Ended September 30, 2025 September 30, 2024 Net income $78,233 $105,912 Interest expense, net 5,362 3,856 Income tax expense 17,208 26,530 EBIT $100,803 $136,298 Depreciation, depletion and amortization 110,618 107,336 Asset retirement obligations accretion 1,838 1,749 EBITDA $213,259 $245,383 Exploration expenses 131 491 EBITDAX $213,390 $245,874 Non-cash stock-based compensation expense 5,935 4,707 Gain on revaluation of contingent consideration (507) (7,009) Adjusted EBITDAX $218,818 $243,572

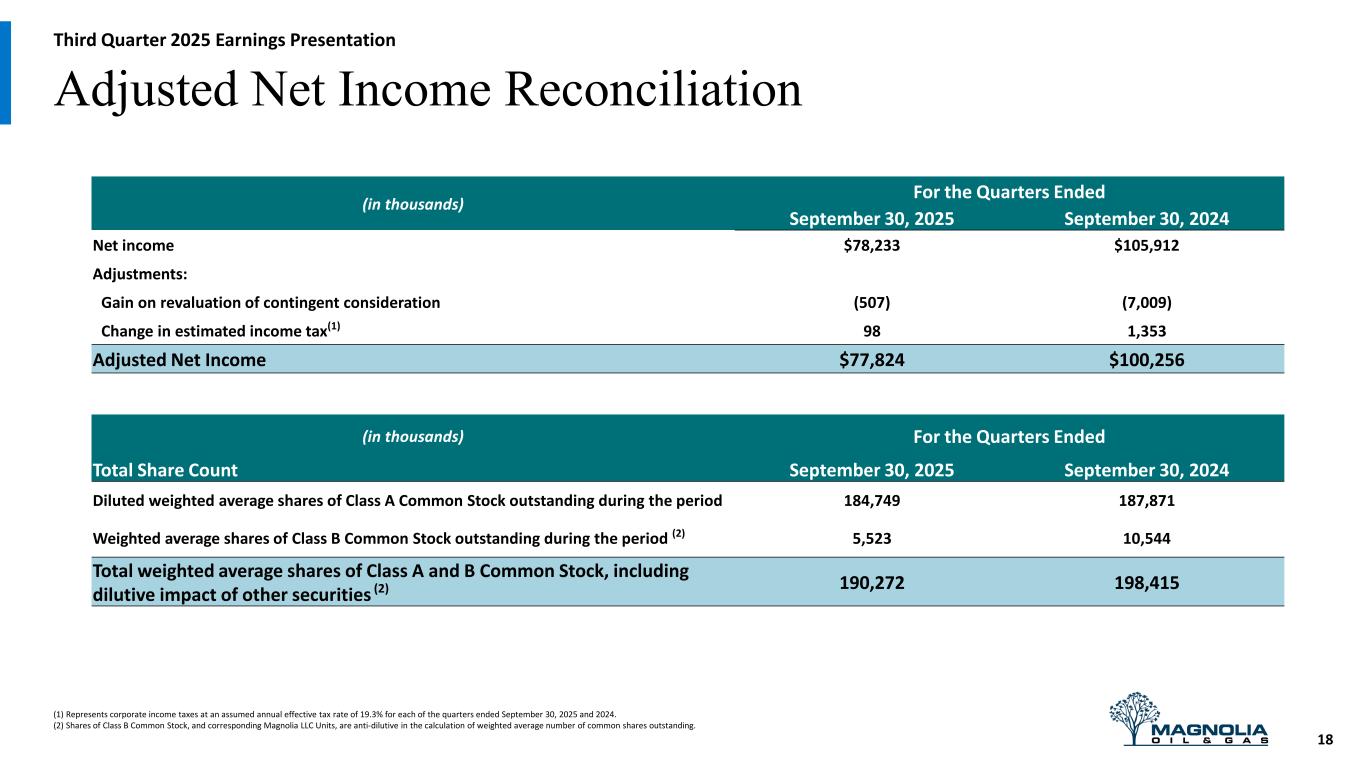

Adjusted Net Income Reconciliation Third Quarter 2025 Earnings Presentation 18 (in thousands) For the Quarters Ended September 30, 2025 September 30, 2024 Net income $78,233 $105,912 Adjustments: Gain on revaluation of contingent consideration (507) (7,009) Change in estimated income tax(1) 98 1,353 Adjusted Net Income $77,824 $100,256 (in thousands) For the Quarters Ended Total Share Count September 30, 2025 September 30, 2024 Diluted weighted average shares of Class A Common Stock outstanding during the period 184,749 187,871 Weighted average shares of Class B Common Stock outstanding during the period (2) 5,523 10,544 Total weighted average shares of Class A and B Common Stock, including dilutive impact of other securities (2) 190,272 198,415 (1) Represents corporate income taxes at an assumed annual effective tax rate of 19.3% for each of the quarters ended September 30, 2025 and 2024. (2) Shares of Class B Common Stock, and corresponding Magnolia LLC Units, are anti-dilutive in the calculation of weighted average number of common shares outstanding.

Capital Structure & Liquidity Overview $400 $450 2025 2026 2027 2028 2029 2030 2031 2032 Third Quarter 2025 Earnings Presentation (1) Net debt is calculated as the difference between cash and total long-term debt, excluding unamortized deferred financing cost. (2) Liquidity defined as cash plus availability under revolving credit facility. (3) Total Equity includes noncontrolling interest. 19 Capitalization & Liquidity ($MM) Debt Maturity Schedule ($MM) Credit Facility (Undrawn as of 9/30/25) 6.875% Senior Unsecured Notes Capital Structure Overview Maintaining low financial leverage profile ‒ Currently have a net debt(1) position of $120 MM ‒ Net debt(1) / Q3 annualized adjusted EBITDAX of 0.1x Current Liquidity of $730 million, including fully undrawn credit facility (2) No debt maturities until senior unsecured notes mature in 2032 Capitalization Summary As of 9/30/2025 Cash and Cash Equivalents $280 Revolving Credit Facility $0 6.875% Senior Notes Due 2032 $400 Total Principal Debt Outstanding $400 Total Equity (3) $2,006 Net Debt / Q3 Annualized Adjusted EBITDAX 0.1x Net Debt / Total Book Capitalization 5% Liquidity Summary As of 9/30/2025 Cash and Cash Equivalents $280 Credit Facility Availability $450 Liquidity (2) $730

Return on Capital Employed Third Quarter 2025 Earnings Presentation 20 (in thousands) For the Quarters Ended September 30, 2025 September 30, 2024 Operating income $101,464 $129,012 Operating income (A) $101,464 $129,012 Debt - beginning of period 392,880 394,131 Stockholders' equity - beginning of period 1,998,346 1,918,356 Capital employed - beginning of period 2,391,226 2,312,487 Debt - end of period 393,064 394,793 Stockholders' equity - end of period 2,006,415 1,960,572 Capital employed - end of period 2,399,479 2,355,365 Average capital employed (B) $2,395,353 $2,333,926 Return on average capital employed (A/B) 4.2% 5.5%

Oil & Gas Production Results Third Quarter 2025 Earnings Presentation 21 Combined Karnes Giddings Combined Karnes Giddings For the Quarter Ended September 30, 2025 For the Quarter Ended September 30, 2024 Production: Oil (MBbls) 3,628 1,164 2,464 3,579 1,225 2,354 Natural gas (MMcf) 17,515 2,428 15,087 14,644 2,474 12,170 Natural gas liquids (MBbls) 2,700 391 2,309 2,325 383 1,942 Total (Mboe) 9,247 1,960 7,287 8,345 2,020 6,325 Average Daily Production Volume: Oil (MBbls/d) 39.4 12.6 26.8 38.9 13.3 25.6 Natural gas (MMcf/d) 190.4 26.4 164.0 159.2 26.9 132.3 Natural gas liquids (MBbls/d) 29.3 4.3 25.0 25.3 4.2 21.1 Total (MBoe/d) 100.5 21.3 79.2 90.7 22.0 68.7