Third Quarter 2025 Investor Presentation November 2025

Important Information Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, contained in this presentation are forward-looking statements, including, but not limited to, any statements regarding our estimates of number of gaming terminals, locations, revenues, and Adjusted EBITDA, our ability to continue to generate strong and consistent revenue and returns on capital and improve profitability, the opportunities in local gaming within the broader gaming market, and our expansion into casino operations and horse racing, including at Fairmount. The words “predict,” “estimated,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “would,” “continue,” and similar expressions or the negatives thereof are intended to identify forward-looking statements. These forward-looking statements represent our current reasonable expectations and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance and achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. We cannot guarantee the accuracy of the forward-looking statements, and you should be aware that results and events could differ materially and adversely from those contained in the forward-looking statements due to a number of factors including, but not limited to: the significant variability and unpredictability in Accel’s operating results; Accel’s ability to offer new and innovative products and services that fulfill the needs of location partners and create strong and sustained player appeal; Accel’s dependence on relationships with key manufacturers, developers and third parties to obtain gaming terminals, amusement machines, and related supplies, programs, and technologies for its business on acceptable terms; the negative impact on Accel’s future results of operations by slow growth in demand for gaming terminals and by the slow growth of new gaming jurisdictions and related regulations; Accel’s heavy dependency on its ability to win, maintain and renew contracts with location partners; Accel's expansion into casino operations and horse racing; unfavorable adverse economic conditions or decreased discretionary spending due to other factors such as terrorist activity or threat thereof, epidemics, pandemics or other public health issues, civil unrest or other economic or political uncertainties that could impact Accel’s business; Accel’s ability to operate in existing markets or expand into new jurisdictions; the geographical concentration of Accel’s business, which subjects it to greater risks from changes in local or regional conditions; Accel’s ability to maintain or improve its competitive advantages in a highly competitive industry; strict government regulations that are constantly evolving and may be amended, repealed, or subject to new interpretations, which may limit existing operations, have an adverse impact on Accel’s ability to grow or may expose Accel to fines or other penalties; Accel’s dependence on the protection of trademarks and other intellectual property; opponents’ persistence in efforts to curtail the expansion of legalized gaming; Accel’s dependence on the security and integrity of the systems and products offered, which, if breached or disrupted, could expose Accel to liability; and other risks and uncertainties indicated from time to time in the section entitled “Risk Factors” in the Annual Report on Form 10-K for the fiscal year ended December 31, 2024 and in documents filed or to be filed with the Securities and Exchange Commission (“SEC”). Accordingly, forward-looking statements, including any projections or analysis, should not be viewed as factual and should not be relied upon as an accurate prediction of future results. Any forward-looking statement made by us in this presentation is based only on information currently available to us and speaks only as of the date on which it is made. We are under no obligation to, and expressly disclaim any obligation to, update or alter our forward-looking statements, whether as a result of new information, subsequent events or otherwise, except as required by law. In addition, the inclusion of any statement in this presentation does not constitute an admission by us that the events or circumstances described in such statement are material. We qualify all of our forward-looking statements by these cautionary statements. Industry and Market Data Unless otherwise indicated, information contained in this presentation concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity, and market size, is based on information from various sources, on assumptions that we have made that are based on those data and other similar sources, and on our knowledge of the markets for our services. This information includes a number of assumptions and limitations, and you are cautioned not to give undue weight to such information. In addition, projections, assumptions, and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the Form 10-K, as well as Accel’s other filings with the SEC. These and other factors could cause results to differ materially from those expressed in the estimates made by third parties and by us. Use of Non-GAAP Financial Measures This presentation includes non-GAAP financial measures, including Adjusted EBITDA and Net Debt. Management believes that these non-GAAP measures of financial results enhance the understanding of Accel’s underlying drivers of profitability and trends in Accel’s business and facilitate company-to-company and period-to period comparisons, because these non-GAAP financial measures exclude the effects of certain non-cash items or represent certain nonrecurring items that are unrelated to core performance. Management of Accel also believes that these non-GAAP financial measures are used by investors, analysts and other interested parties as measures of financial performance and to evaluate Accel’s ability to fund capital expenditures, service debt obligations and meet working capital requirements. The non-GAAP financial measures presented in this presentation should be viewed in addition to, and not as an alternative for, financial measures prepared in accordance with GAAP that are also presented in this presentation These measures are not substitutes for their comparable GAAP financial measures and there are limitations to using non-GAAP financial measures. For example, the non-GAAP financial measures presented in this presentation may differ from similarly titled non-GAAP financial measures presented by other companies, and other companies may not define these non-GAAP financial measures the same way as Accel does. For definitions of non-GAAP financial measures and reconciliations of non-GAAP financial measures to the most directly comparable GAAP measure, please see the Appendix to this presentation. 2

Accel at a Glance 3 • Accel is a leader in the growing locals gaming segment, offering significant untapped potential within the broader gaming market • We operate a resilient business model with multiple opportunities to continue to generate strong and consistent financial performance • Our broader portfolio offers: Over 27,700 gaming machines in neighborhood restaurants, bars, and other local businesses 4,451 local retail partners across 10 states, supporting tens of thousands of local jobs $1.34 bln. in taxes contributed since Jan 2021 to support schools, healthcare, and vital community for state and local governments 1,530 employees with strong pay, benefits, and career development $2.7 million donated to 145 charities over the past five years

High Quality Turn-Key Solution Provider for Locals Gaming 4 • As of September 30, 2025, Accel owned and operated 27,714 gaming terminals across 4,451 locations in Illinois, Montana, Nevada, Louisiana, Nebraska and Georgia

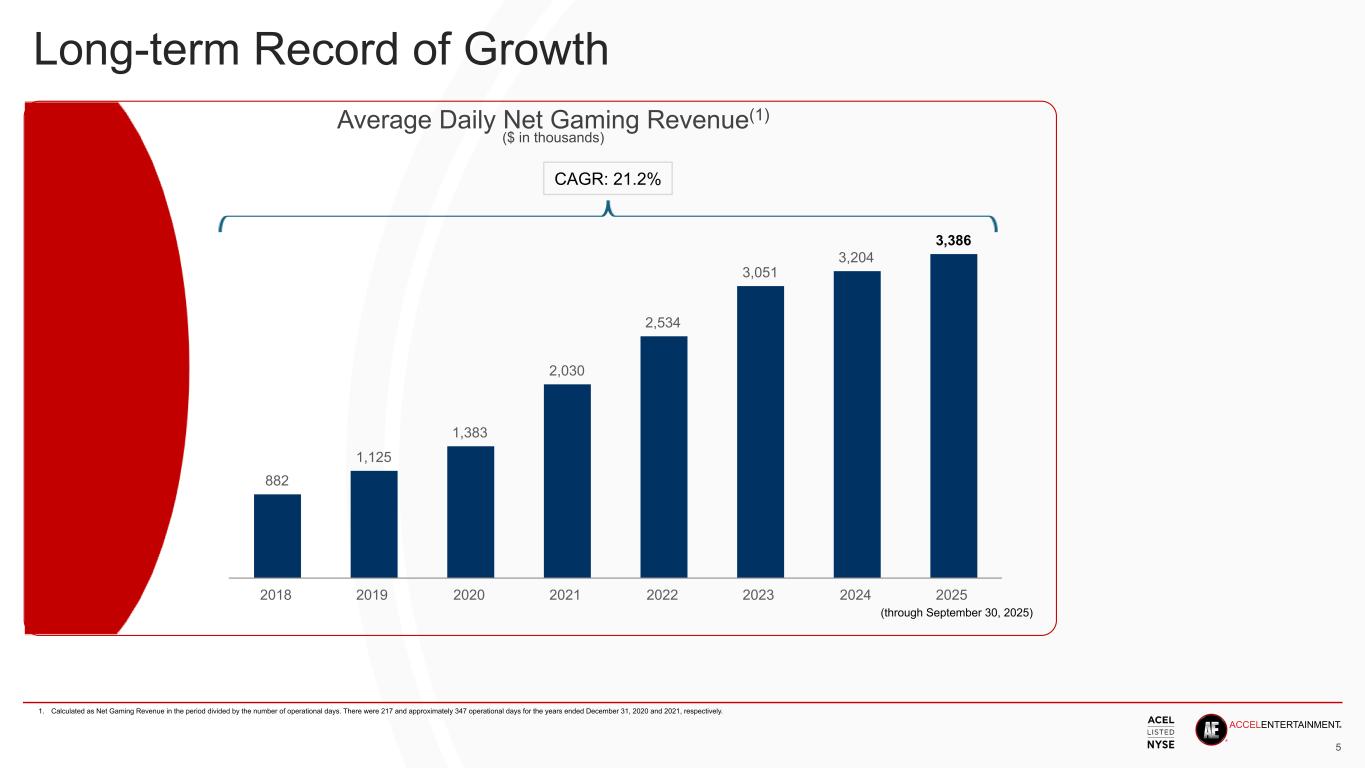

Long-term Record of Growth 1. Calculated as Net Gaming Revenue in the period divided by the number of operational days. There were 217 and approximately 347 operational days for the years ended December 31, 2020 and 2021, respectively. 5 Average Daily Net Gaming Revenue(1) ($ in thousands) 882 1,125 1,383 2,030 2,534 3,051 3,204 3,386 2018 2019 2020 2021 2022 2023 2024 2025 CAGR: 21.2% (through September 30, 2025)

Strong Visibility with Contracted, Recurring Revenue 6 Long-term recurring agreements Continued strong customer engagement Diversified pipeline of new location opportunities

Disciplined Stewards of Capital (1) Calculated using 94,081,346 shares outstanding on November 22, 2021, which was the date the Board originally approved the share repurchase program. 7 Balance sheet strength • Closed new $900 million credit facility, extending maturities to 2030, lowering cost of capital and further enhancing growth capital flexibility • $590 million of liquidity consisting of – $290 million of cash – $300 million of availability under our credit facility High returns on invested capital • Return capital to shareholders via share repurchase program • Since fourth quarter 2021, Accel has repurchased 17% of its shares outstanding at an average price of $10.40(1)

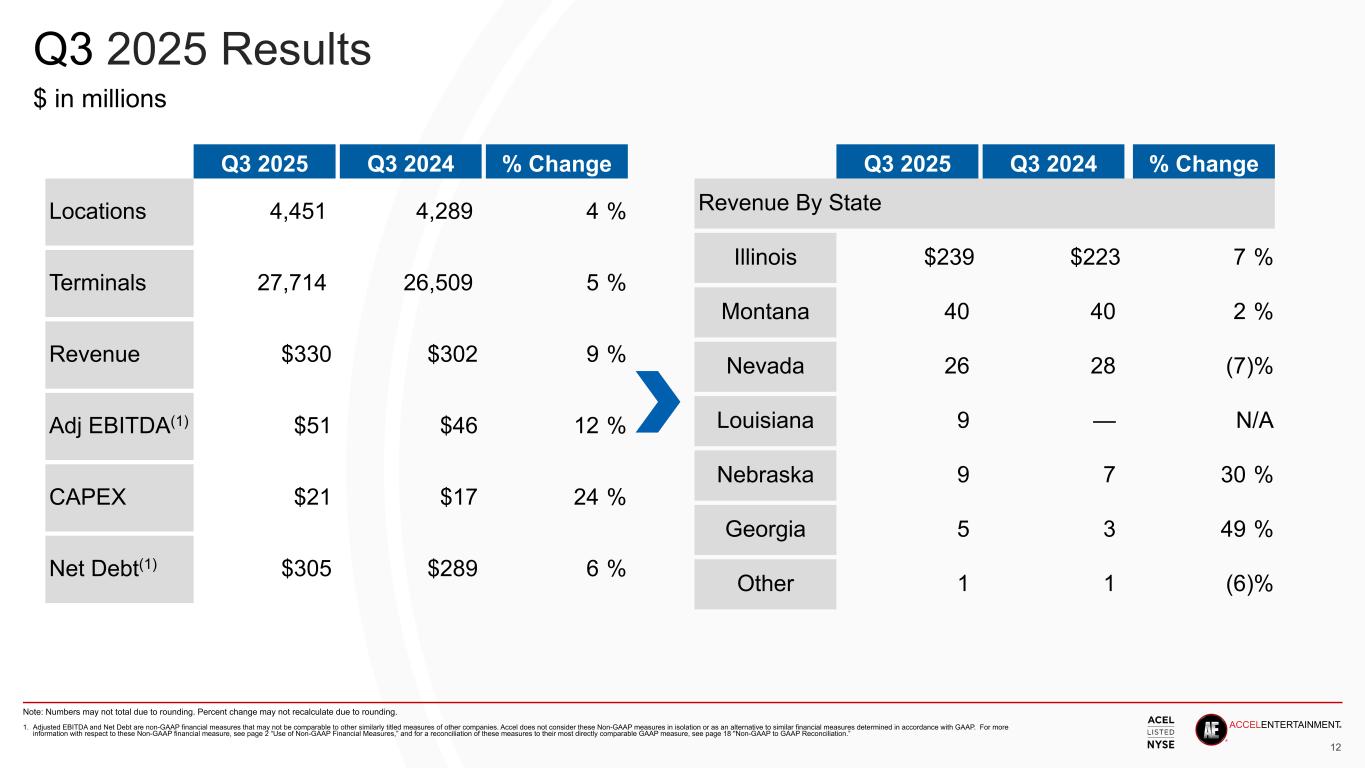

Q3 2025 Highlights • Revenues of $330 million − An increase of 9.1% compared to Q3 2024 • Without the acquisition of Fairmount Park and Toucan Gaming (Louisiana), total revenue was $310 million for Q3 2025, an increase of 2.6% compared to Q3 2024 • Net income of $13 million − An increase of 171.8% compared to Q3 2024 • Largely attributable to a gain of $2 million on the change in the fair value of the contingent earnout shares (Accel Class A-2 common stock) compared to a loss of $4 million in the prior period • Adjusted EBITDA(1) of $51 million − An increase of 11.5% compared to Q3 2024 • Was attributable to an increase in the number of locations and gaming terminals 8 1. Adjusted EBITDA is a non-GAAP financial measure that may not be comparable to other similarly titled measures of other companies. Accel does not consider non-GAAP measures in isolation or as an alternative to similar financial measures determined in accordance with GAAP. For more information with respect to our non-GAAP financial measures, see page 2 “Use of Non-GAAP Financial Measures,” and for a reconciliation of each of these measures to their most directly comparable GAAP measure, see page 18 "Non-GAAP to GAAP Reconciliation.”

Q3 2025 Highlights (Continued) • CapEx totaled $21 million in Q3 2025 and $74 million year-to-date − Excluding Fairmount Park and Louisiana, capex spend is $43 million, down 20% compared to year-to-date 2024 − We are affirming our full year 2025 forecast of $75-80 million, including approximately $39-41 million for our legacy markets, $5-7 million for Louisiana, and $31-32 million for Fairmount Park • Repurchased $7 million of Accel Class A-1 Common Stock in Q3 2025, and $167 million since the repurchase program was announced in November 2021(1) • First full quarter of casino and racing operations at Fairmount Park Casino & Racing 9 1. On November 22, 2021, the Company’s Board of Directors approved a share repurchase program of up to $200 million of shares of its Class A-1 common stock, and on February 27, 2025, the Board of Directors approved an amendment to the share repurchase program to replenish the dollar amount that may be purchased under the program back up to $200 million shares of Class A-1 common stock. The timing and actual number of shares repurchased will depend on a variety of factors, including price, general business and market conditions, and alternative investment opportunities. Under the repurchase program, repurchases can be made from time to time using a variety of methods, including open market purchases or privately negotiated transactions, in compliance with the rules of the United States SEC and other applicable legal requirements. The repurchase program does not obligate the Company to acquire any particular amount of shares, and the repurchase program may be suspended or discontinued at any time at the Company’s discretion. As of September 30, 2025, the Company has purchased a total of 16,081,203 shares under the repurchase program at a cost of $167 million.

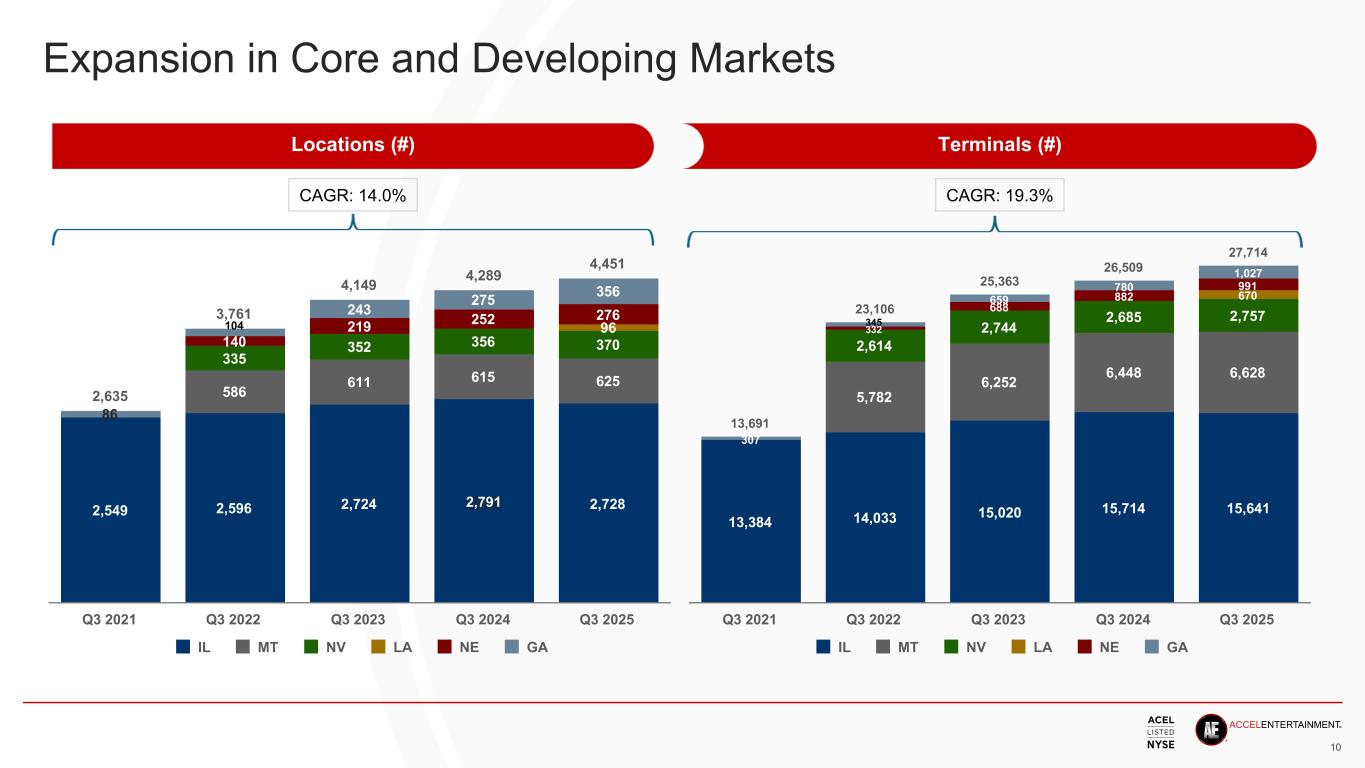

Expansion in Core and Developing Markets Locations (#) Terminals (#) 10 2,635 3,761 4,149 4,289 4,451 2,549 2,596 2,724 2,791 2,728 586 611 615 625 335 352 356 370 96 140 219 252 276 86 104 243 275 356 IL MT NV LA NE GA Q3 2021 Q3 2022 Q3 2023 Q3 2024 Q3 2025 13,691 23,106 25,363 26,509 27,714 13,384 14,033 15,020 15,714 15,641 5,782 6,252 6,448 6,628 2,614 2,744 2,685 2,757 670 688 882 991 307 659 780 1,027 IL MT NV LA NE GA Q3 2021 Q3 2022 Q3 2023 Q3 2024 Q3 2025 CAGR: 14.0% CAGR: 19.3% 332 345

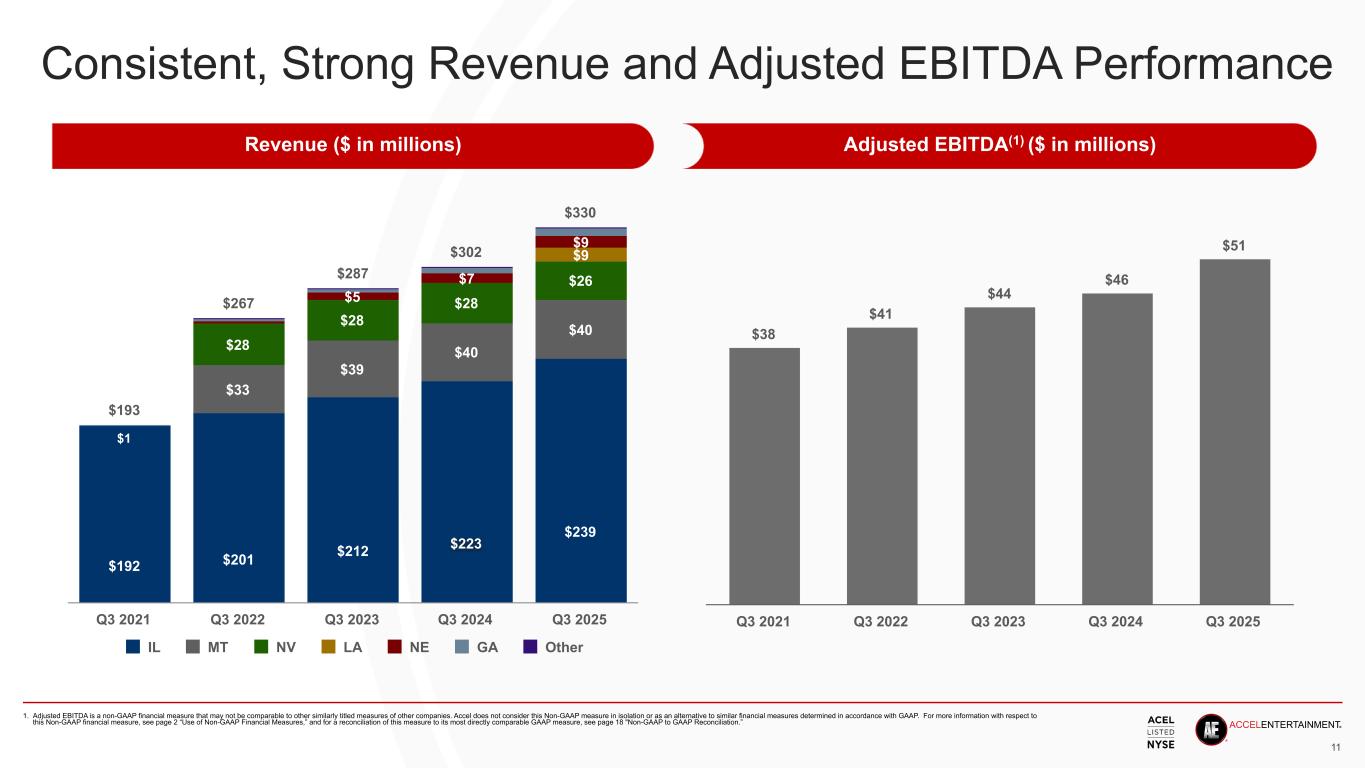

Consistent, Strong Revenue and Adjusted EBITDA Performance Revenue ($ in millions) Adjusted EBITDA(1) ($ in millions) 11 $193 $267 $287 $302 $330 $192 $201 $212 $223 $239 $33 $39 $40 $40 $28 $28 $28 $26 $9 $5 $7 $9 $1 IL MT NV LA NE GA Other Q3 2021 Q3 2022 Q3 2023 Q3 2024 Q3 2025 1. Adjusted EBITDA is a non-GAAP financial measure that may not be comparable to other similarly titled measures of other companies. Accel does not consider this Non-GAAP measure in isolation or as an alternative to similar financial measures determined in accordance with GAAP. For more information with respect to this Non-GAAP financial measure, see page 2 “Use of Non-GAAP Financial Measures,” and for a reconciliation of this measure to its most directly comparable GAAP measure, see page 18 "Non-GAAP to GAAP Reconciliation.” $38 $41 $44 $46 $51 Q3 2021 Q3 2022 Q3 2023 Q3 2024 Q3 2025

Q3 2025 Results 12 Note: Numbers may not total due to rounding. Percent change may not recalculate due to rounding. $ in millions Q3 2025 Q3 2024 % Change Locations 4,451 4,289 4 % Terminals 27,714 26,509 5 % Revenue $330 $302 9 % Adj EBITDA(1) $51 $46 12 % CAPEX $21 $17 24 % Net Debt(1) $305 $289 6 % Q3 2025 Q3 2024 % Change Revenue By State Illinois $239 $223 7 % Montana 40 40 2 % Nevada 26 28 (7) % Louisiana 9 — N/A Nebraska 9 7 30 % Georgia 5 3 49 % Other 1 1 (6) % 1. Adjusted EBITDA and Net Debt are non-GAAP financial measures that may not be comparable to other similarly titled measures of other companies. Accel does not consider these Non-GAAP measures in isolation or as an alternative to similar financial measures determined in accordance with GAAP. For more information with respect to these Non-GAAP financial measure, see page 2 “Use of Non-GAAP Financial Measures,” and for a reconciliation of these measures to their most directly comparable GAAP measure, see page 18 "Non-GAAP to GAAP Reconciliation.”

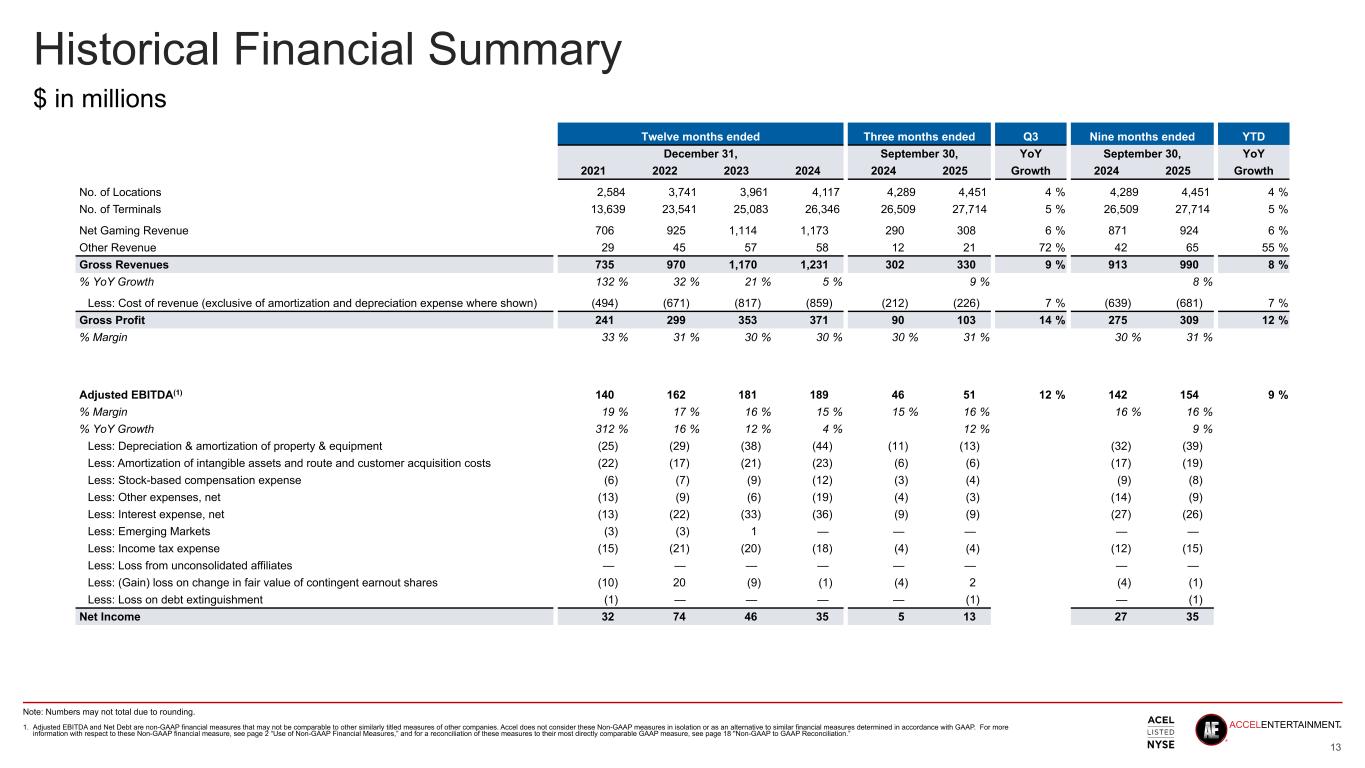

Historical Financial Summary 13 $ in millions Note: Numbers may not total due to rounding. Twelve months ended Three months ended Q3 Nine months ended YTD December 31, September 30, YoY September 30, YoY 2021 2022 2023 2024 2024 2025 Growth 2024 2025 Growth No. of Locations 2,584 3,741 3,961 4,117 4,289 4,451 4 % 4,289 4,451 4 % No. of Terminals 13,639 23,541 25,083 26,346 26,509 27,714 5 % 26,509 27,714 5 % Net Gaming Revenue 706 925 1,114 1,173 290 308 6 % 871 924 6 % Other Revenue 29 45 57 58 12 21 72 % 42 65 55 % Gross Revenues 735 970 1,170 1,231 302 330 9 % 913 990 8 % % YoY Growth 132 % 32 % 21 % 5 % 9 % 8 % Less: Cost of revenue (exclusive of amortization and depreciation expense where shown) (494) (671) (817) (859) (212) (226) 7 % (639) (681) 7 % Gross Profit 241 299 353 371 90 103 14 % 275 309 12 % % Margin 33 % 31 % 30 % 30 % 30 % 31 % 30 % 31 % Adjusted EBITDA(1) 140 162 181 189 46 51 12 % 142 154 9 % % Margin 19 % 17 % 16 % 15 % 15 % 16 % 16 % 16 % % YoY Growth 312 % 16 % 12 % 4 % 12 % 9 % Less: Depreciation & amortization of property & equipment (25) (29) (38) (44) (11) (13) (32) (39) Less: Amortization of intangible assets and route and customer acquisition costs (22) (17) (21) (23) (6) (6) (17) (19) Less: Stock-based compensation expense (6) (7) (9) (12) (3) (4) (9) (8) Less: Other expenses, net (13) (9) (6) (19) (4) (3) (14) (9) Less: Interest expense, net (13) (22) (33) (36) (9) (9) (27) (26) Less: Emerging Markets (3) (3) 1 — — — — — Less: Income tax expense (15) (21) (20) (18) (4) (4) (12) (15) Less: Loss from unconsolidated affiliates — — — — — — — — Less: (Gain) loss on change in fair value of contingent earnout shares (10) 20 (9) (1) (4) 2 (4) (1) Less: Loss on debt extinguishment (1) — — — — (1) — (1) Net Income 32 74 46 35 5 13 27 35 1. Adjusted EBITDA and Net Debt are non-GAAP financial measures that may not be comparable to other similarly titled measures of other companies. Accel does not consider these Non-GAAP measures in isolation or as an alternative to similar financial measures determined in accordance with GAAP. For more information with respect to these Non-GAAP financial measure, see page 2 “Use of Non-GAAP Financial Measures,” and for a reconciliation of these measures to their most directly comparable GAAP measure, see page 18 "Non-GAAP to GAAP Reconciliation.”

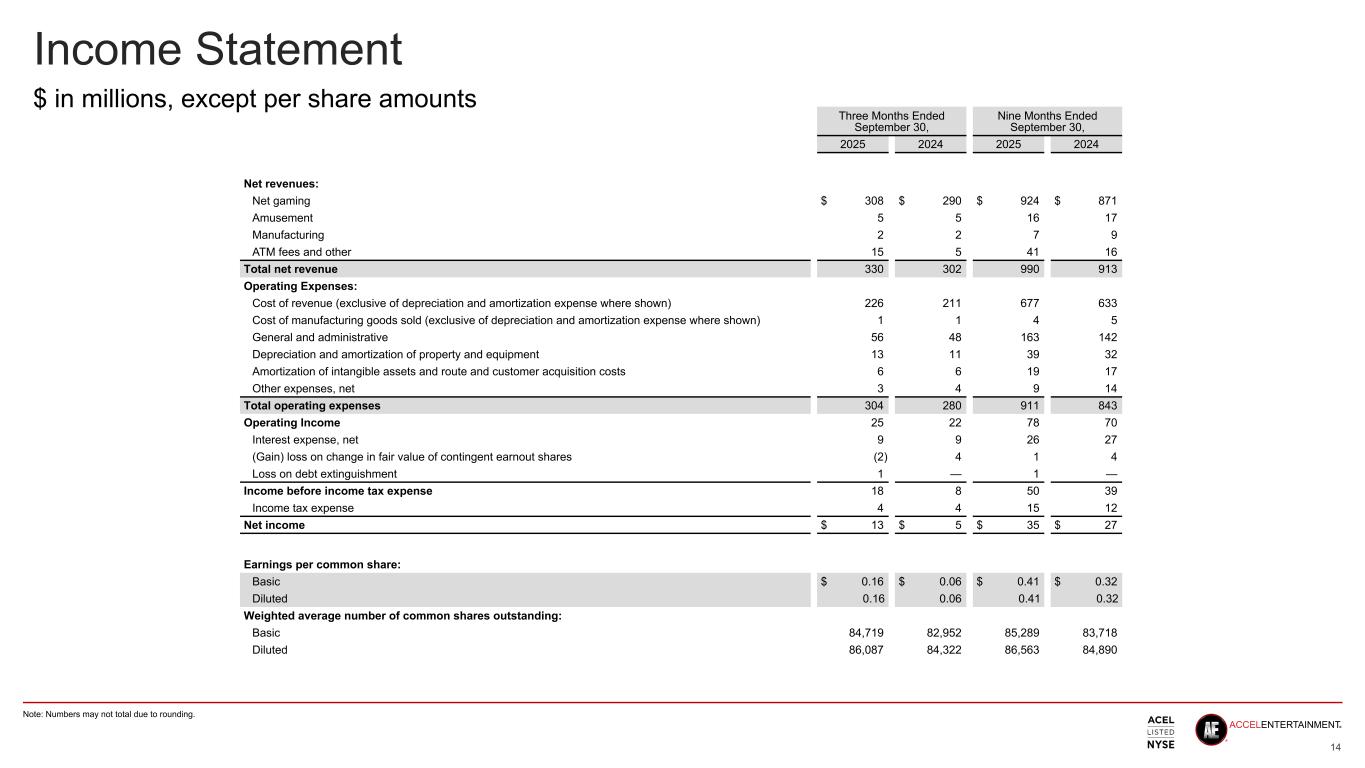

Income Statement 14 Note: Numbers may not total due to rounding. $ in millions, except per share amounts Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Net revenues: Net gaming $ 308 $ 290 $ 924 $ 871 Amusement 5 5 16 17 Manufacturing 2 2 7 9 ATM fees and other 15 5 41 16 Total net revenue 330 302 990 913 Operating Expenses: Cost of revenue (exclusive of depreciation and amortization expense where shown) 226 211 677 633 Cost of manufacturing goods sold (exclusive of depreciation and amortization expense where shown) 1 1 4 5 General and administrative 56 48 163 142 Depreciation and amortization of property and equipment 13 11 39 32 Amortization of intangible assets and route and customer acquisition costs 6 6 19 17 Other expenses, net 3 4 9 14 Total operating expenses 304 280 911 843 Operating Income 25 22 78 70 Interest expense, net 9 9 26 27 (Gain) loss on change in fair value of contingent earnout shares (2) 4 1 4 Loss on debt extinguishment 1 — 1 — Income before income tax expense 18 8 50 39 Income tax expense 4 4 15 12 Net income $ 13 $ 5 $ 35 $ 27 Earnings per common share: Basic $ 0.16 $ 0.06 $ 0.41 $ 0.32 Diluted 0.16 0.06 0.41 0.32 Weighted average number of common shares outstanding: Basic 84,719 82,952 85,289 83,718 Diluted 86,087 84,322 86,563 84,890

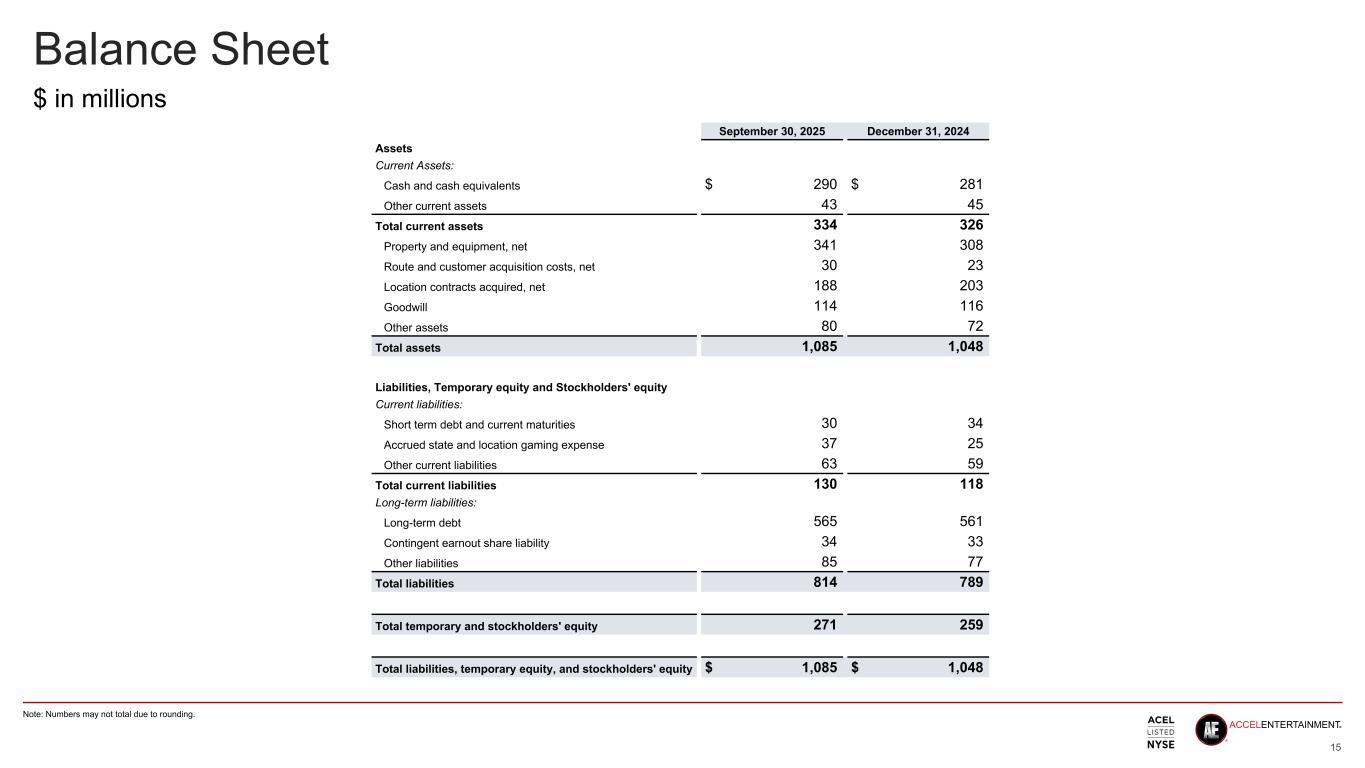

Balance Sheet 15 Note: Numbers may not total due to rounding. $ in millions September 30, 2025 December 31, 2024 Assets Current Assets: Cash and cash equivalents $ 290 $ 281 Other current assets 43 45 Total current assets 334 326 Property and equipment, net 341 308 Route and customer acquisition costs, net 30 23 Location contracts acquired, net 188 203 Goodwill 114 116 Other assets 80 72 Total assets 1,085 1,048 Liabilities, Temporary equity and Stockholders' equity Current liabilities: Short term debt and current maturities 30 34 Accrued state and location gaming expense 37 25 Other current liabilities 63 59 Total current liabilities 130 118 Long-term liabilities: Long-term debt 565 561 Contingent earnout share liability 34 33 Other liabilities 85 77 Total liabilities 814 789 Total temporary and stockholders' equity 271 259 Total liabilities, temporary equity, and stockholders' equity $ 1,085 $ 1,048

Cash Flow 16 Note: Numbers may not total due to inclusion of selected material impacts. See the Company’s Form 10-Q as of September 30, 2025 for the complete Condensed Consolidated Statement of Cash Flows. $ in millions $ in millions Nine Months Ended Q3 2025 Q3 2024 Cash flows from operating activities: Net income $ 35 $ 27 Non-cash items included in net income: Depreciation and amortization of property and equipment 39 32 Amortization of route and customer acquisition costs and location contracts acquired 19 17 Loss (gain) on change in fair value of contingent earnout shares 1 4 Stock based compensation 8 9 Deferred income taxes 6 (3) Changes in operating assets and liabilities, net of acquisition of businesses 5 14 Net cash provided by operating activities 120 108 Cash flows from investing activities: Purchases of property and equipment (74) (55) Proceeds from the sale of property and equipment 1 1 Proceeds from the settlement of convertible notes 2 — Advances against a portion of the purchase price on pending business acquisition — (12) Acquisition of intangible asset (9) — Investment in equity interest — (5) Business and asset acquisitions, net of cash acquired — (19) Net cash used in investing activities (81) (90) Cash flows from financing activities: Proceeds from debt 623 50 Payments on debt (620) (39) Repurchases of common stock (24) (21) Other financing activities (5) (3) Net cash used in financing activities (30) (14) Net increase in cash $ 9 $ 3

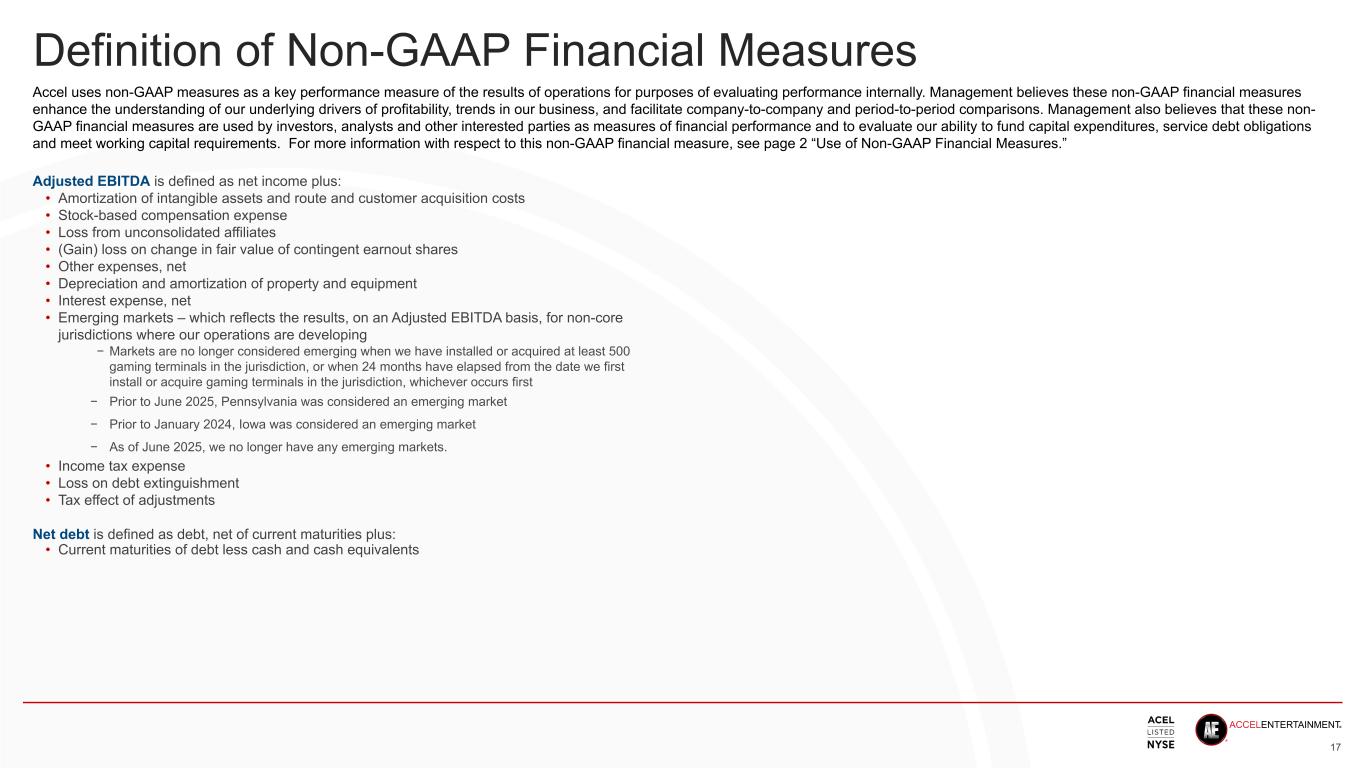

Definition of Non-GAAP Financial Measures Adjusted EBITDA is defined as net income plus: • Amortization of intangible assets and route and customer acquisition costs • Stock-based compensation expense • Loss from unconsolidated affiliates • (Gain) loss on change in fair value of contingent earnout shares • Other expenses, net • Depreciation and amortization of property and equipment • Interest expense, net • Emerging markets – which reflects the results, on an Adjusted EBITDA basis, for non-core jurisdictions where our operations are developing − Markets are no longer considered emerging when we have installed or acquired at least 500 gaming terminals in the jurisdiction, or when 24 months have elapsed from the date we first install or acquire gaming terminals in the jurisdiction, whichever occurs first − Prior to June 2025, Pennsylvania was considered an emerging market − Prior to January 2024, Iowa was considered an emerging market − As of June 2025, we no longer have any emerging markets. • Income tax expense • Loss on debt extinguishment • Tax effect of adjustments Net debt is defined as debt, net of current maturities plus: • Current maturities of debt less cash and cash equivalents 17 Accel uses non-GAAP measures as a key performance measure of the results of operations for purposes of evaluating performance internally. Management believes these non-GAAP financial measures enhance the understanding of our underlying drivers of profitability, trends in our business, and facilitate company-to-company and period-to-period comparisons. Management also believes that these non- GAAP financial measures are used by investors, analysts and other interested parties as measures of financial performance and to evaluate our ability to fund capital expenditures, service debt obligations and meet working capital requirements. For more information with respect to this non-GAAP financial measure, see page 2 “Use of Non-GAAP Financial Measures.”

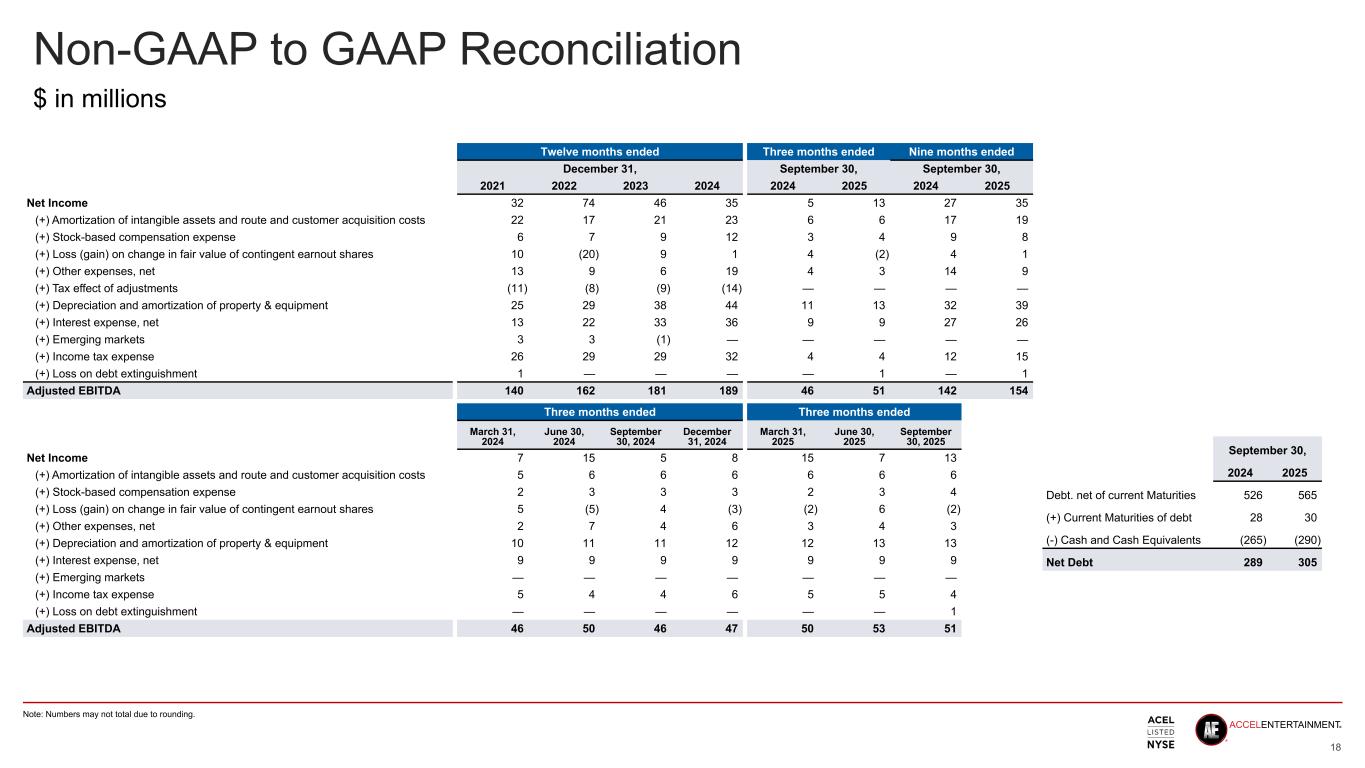

Non-GAAP to GAAP Reconciliation 18 Note: Numbers may not total due to rounding. $ in millions Twelve months ended Three months ended Nine months ended December 31, September 30, September 30, 2021 2022 2023 2024 2024 2025 2024 2025 Net Income 32 74 46 35 5 13 27 35 (+) Amortization of intangible assets and route and customer acquisition costs 22 17 21 23 6 6 17 19 (+) Stock-based compensation expense 6 7 9 12 3 4 9 8 (+) Loss (gain) on change in fair value of contingent earnout shares 10 (20) 9 1 4 (2) 4 1 (+) Other expenses, net 13 9 6 19 4 3 14 9 (+) Tax effect of adjustments (11) (8) (9) (14) — — — — (+) Depreciation and amortization of property & equipment 25 29 38 44 11 13 32 39 (+) Interest expense, net 13 22 33 36 9 9 27 26 (+) Emerging markets 3 3 (1) — — — — — (+) Income tax expense 26 29 29 32 4 4 12 15 (+) Loss on debt extinguishment 1 — — — — 1 — 1 Adjusted EBITDA 140 162 181 189 46 51 142 154 Three months ended Three months ended March 31, 2024 June 30, 2024 September 30, 2024 December 31, 2024 March 31, 2025 June 30, 2025 September 30, 2025 Net Income 7 15 5 8 15 7 13 (+) Amortization of intangible assets and route and customer acquisition costs 5 6 6 6 6 6 6 (+) Stock-based compensation expense 2 3 3 3 2 3 4 (+) Loss (gain) on change in fair value of contingent earnout shares 5 (5) 4 (3) (2) 6 (2) (+) Other expenses, net 2 7 4 6 3 4 3 (+) Depreciation and amortization of property & equipment 10 11 11 12 12 13 13 (+) Interest expense, net 9 9 9 9 9 9 9 (+) Emerging markets — — — — — — — (+) Income tax expense 5 4 4 6 5 5 4 (+) Loss on debt extinguishment — — — — — — 1 Adjusted EBITDA 46 50 46 47 50 53 51 September 30, 2024 2025 Debt. net of current Maturities 526 565 (+) Current Maturities of debt 28 30 (-) Cash and Cash Equivalents (265) (290) Net Debt 289 305