44th Annual J.P. Morgan Healthcare Conference January 12, 2026 1 Bob Ragusa, Chief Executive Officer Josh Ofman, President

This presentation contains forward-looking statements. In some cases, you can identify these statements by forward-looking words such as “aim,” “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “should,” “would,” or “will,” the negative of these terms, and other comparable terminology. These forward-looking statements, which are subject to risks, uncertainties, and assumptions about us, may include expectations and projections of our future financial performance, future tests or products, technology, clinical studies, including early or preliminary study results, regulatory compliance, potential market opportunity, anticipated growth strategies, sufficiency of cash on hand to finance our business and expected cash runway, strategies, budgets and anticipated trends in our business. These statements are only predictions based on our current expectations and projections about future events and trends. There are important factors that could cause our actual results, level of activity, performance, or achievements to differ materially and adversely from those expressed or implied by the forward-looking statements, including those factors and numerous associated risks discussed under the section entitled “Risk Factors” in our Quarterly Reports on Form 10-Q for the periods ended March 31, 2025, June 30, 2025 and September 30, 2025 and our Annual Report on Form 10-K for the period ended December 31, 2024. Moreover, we operate in a dynamic and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results, level of activity, performance, or achievements to differ materially and adversely from those contained in any forward-looking statements we may make. Forward-looking statements relate to the future and, accordingly, are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict and many of which are outside of our control. Although we believe the expectations and projections expressed or implied by the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance, or achievements. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Except to the extent required by law, we undertake no obligation to update any of these forward-looking statements after the date of this presentation to conform our prior statements to actual results or revised expectations or to reflect new information or the occurrence of unanticipated events. This presentation contains certain preliminary unaudited financial information. These amounts are preliminary, have not been subject to review by the Company's independent registered public accounting firm, and are subject to change pending completion of the Company's audited financial statements for the quarter and year ended December 31, 2025. Actual results could be materially different from the preliminary unaudited financial information. Additional information and disclosures would be required for a more complete understanding of the Company's financial position and results of operations as of and for the quarter and year ended December 31, 2025. 2

3 Agenda Business Review Bob Ragusa, Chief Executive Officer Galleri Differentiation & Opportunity Josh Ofman, President Q&A

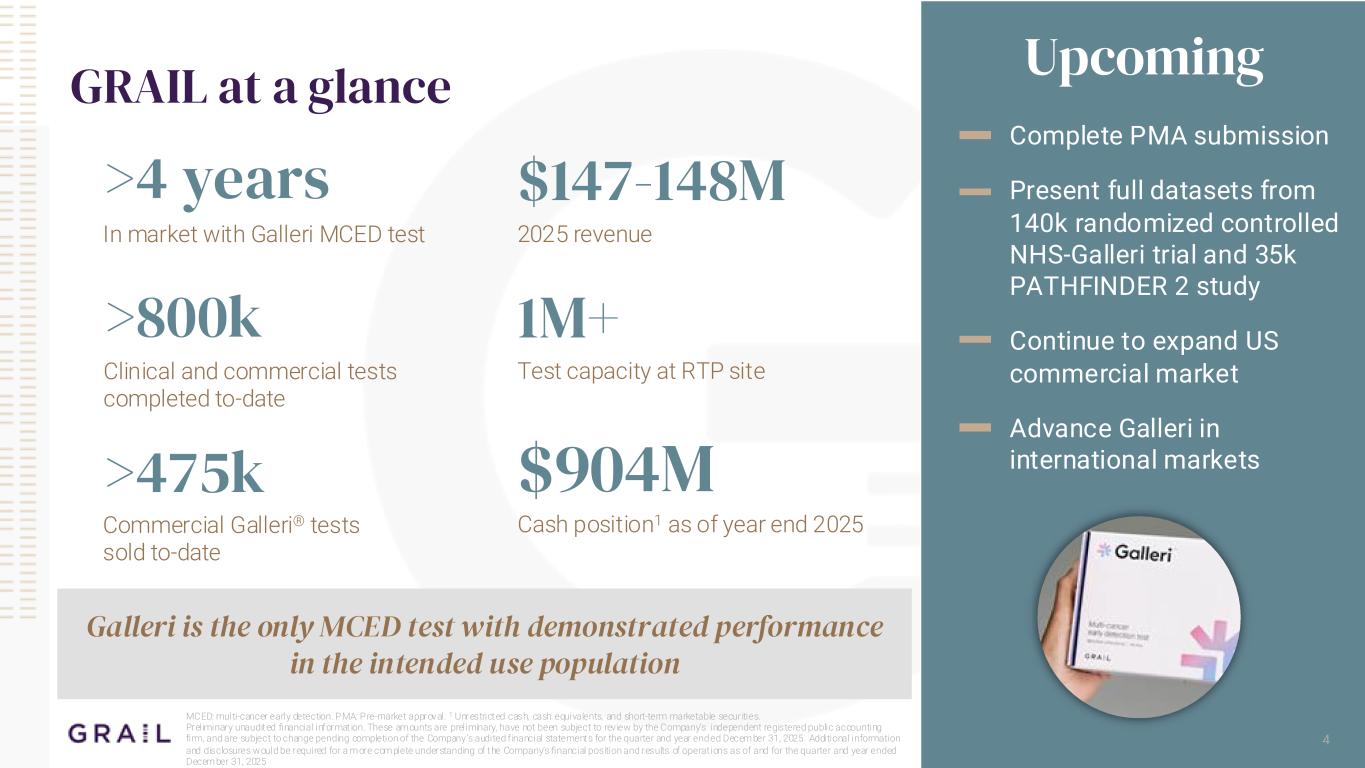

>800k In market with Galleri MCED test >4 years 4 GRAIL at a glance Upcoming Complete PMA submission Present full datasets from 140k randomized controlled NHS-Galleri trial and 35k PATHFINDER 2 study Continue to expand US commercial market Advance Galleri in international markets MCED: multi-cancer early detection. PMA: Pre-market approval. 1 Unrestricted cash, cash equivalents, and short-term marketable securities. Preliminary unaudited financial informat ion. These amounts are preliminary, have not been subject to review by the Company’s independent registered public accounting firm, and are subject to change pending completion of the Company’s audited f inancial statements for the quarter and year ended December 31, 2025. Additional information and disclosures would be required for a more complete understanding of the Company’s financial position and results of operat ions as of and for the quarter and year ended December 31, 2025 Galleri is the only MCED test with demonstrated performance in the intended use population Commercial Galleri® tests sold to-date >475k 2025 revenue $147-148M Clinical and commercial tests completed to-date Test capacity at RTP site 1M+ Cash position1 as of year end 2025 $904M

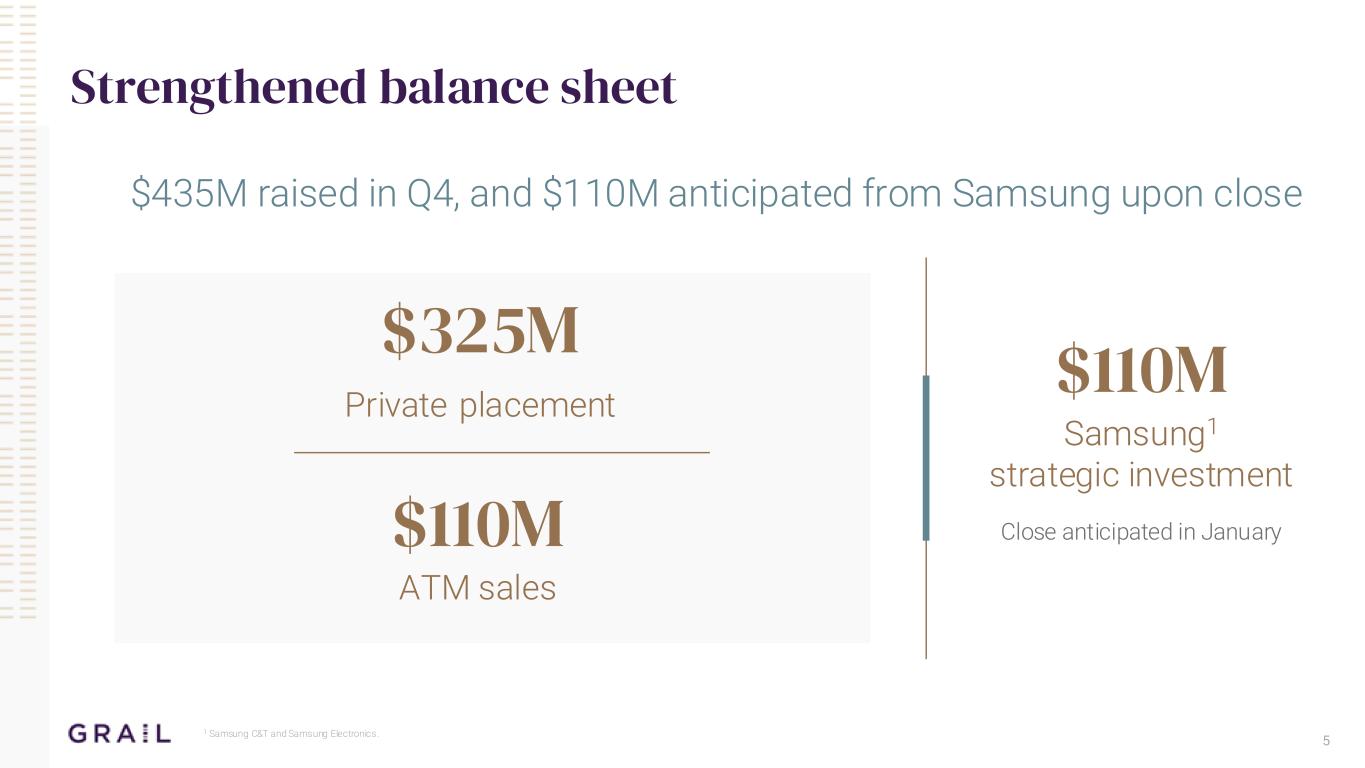

5 Strengthened balance sheet $110M Samsung1 strategic investment Close anticipated in January $325M Private placement 1 Samsung C&T and Samsung Electronics. $435M raised in Q4, and $110M anticipated from Samsung upon close $110M ATM sales

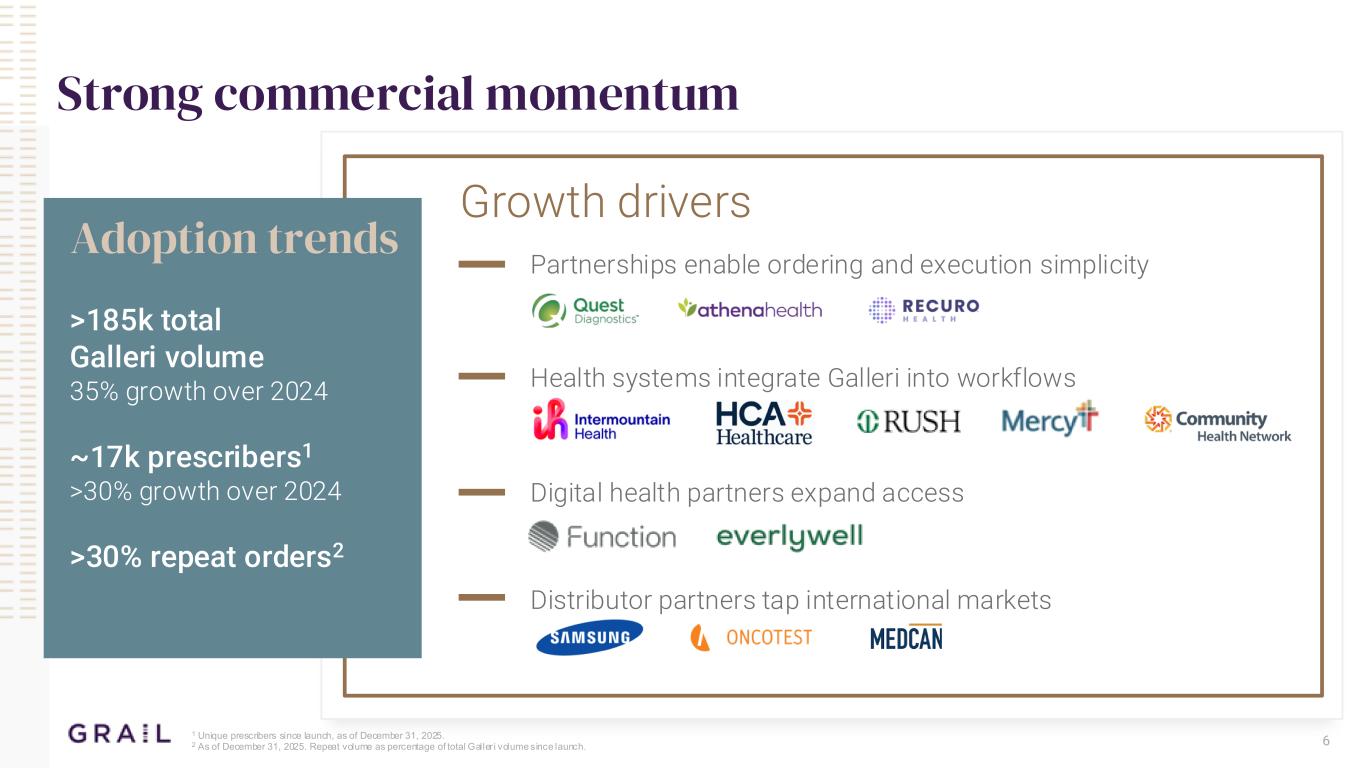

6 Strong commercial momentum >185k total Galleri volume 35% growth over 2024 ~17k prescribers1 >30% growth over 2024 >30% repeat orders2 Partnerships enable ordering and execution simplicity Distributor partners tap international markets Growth drivers Health systems integrate Galleri into workflows Digital health partners expand access Adoption trends 1 Unique prescribers since launch, as of December 31, 2025. 2 As of December 31, 2025. Repeat volume as percentage of total Galler i volume since launch.

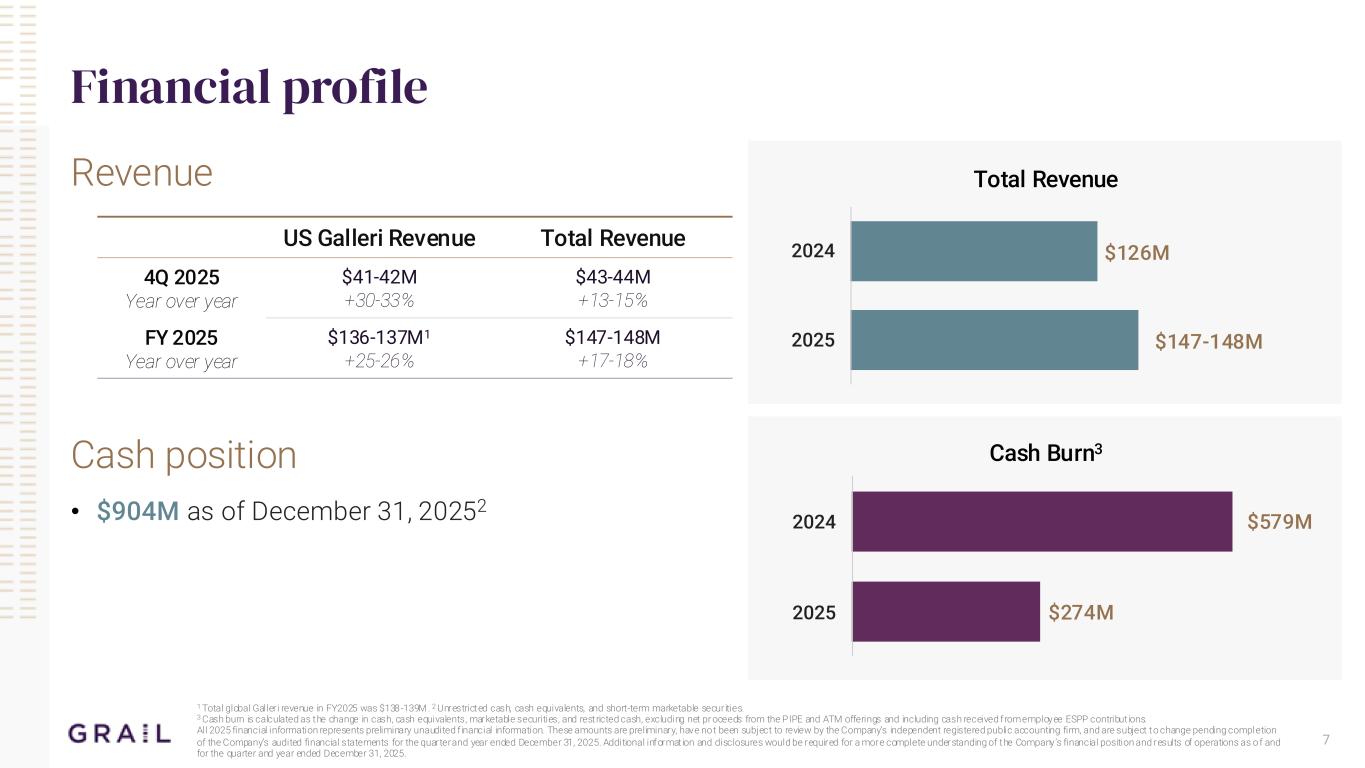

7 Financial profile Revenue Cash position • $904M as of December 31, 20252 1 Total global Galleri revenue in FY2025 was $138-139M . 2 Unrestricted cash, cash equivalents, and short-term marketable securities. 3 Cash burn is calculated as the change in cash, cash equivalents, marketable securities, and restricted cash, excluding net pr oceeds from the PIPE and ATM offerings and including cash received from employee ESPP contribut ions. All 2025 financial information represents preliminary unaudited f inancial information. These amounts are preliminary, have not been subject to review by the Company’s independent registered public accounting firm, and are subject to change pending completion of the Company’s audited financial statements for the quarter and year ended December 31, 2025. Additional informat ion and disclosures would be required for a more complete understanding of the Company’s financial position and results of operations as o f and for the quarter and year ended December 31, 2025. US Galleri Revenue Total Revenue 4Q 2025 Year over year $41-42M +30-33% $43-44M +13-15% FY 2025 Year over year $136-137M1 +25-26% $147-148M +17-18% Total Revenue Cash Burn3 $147-148M $126M 2025 2024 $274M $579M 2025 2024

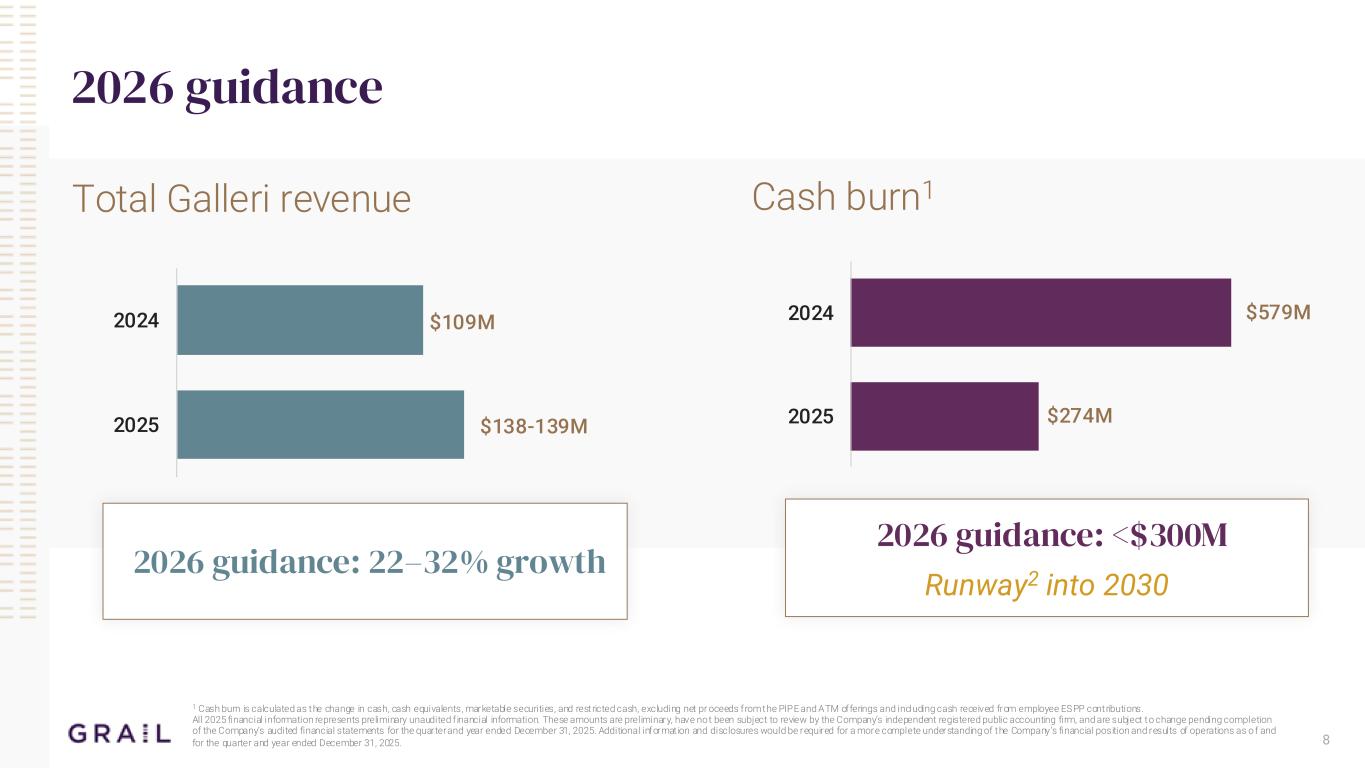

8 2026 guidance Total Galleri revenue Cash burn1 1 Cash burn is calculated as the change in cash, cash equivalents, marketable securities, and restricted cash, excluding net pr oceeds from the PIPE and ATM offerings and including cash received from employee ESPP contributions. All 2025 financial information represents preliminary unaudited f inancial information. These amounts are preliminary, have not been subject to review by the Company’s independent registered public accounting firm, and are subject to change pending completion of the Company’s audited financial statements for the quarter and year ended December 31, 2025. Additional informat ion and disclosures would be required for a more complete understanding of the Company’s financial position and results of operations as o f and for the quarter and year ended December 31, 2025. $138-139M $109M 2025 2024 $274M $579M 2025 2024 2026 guidance: 22–32% growth 2026 guidance: <$300M Runway2 into 2030

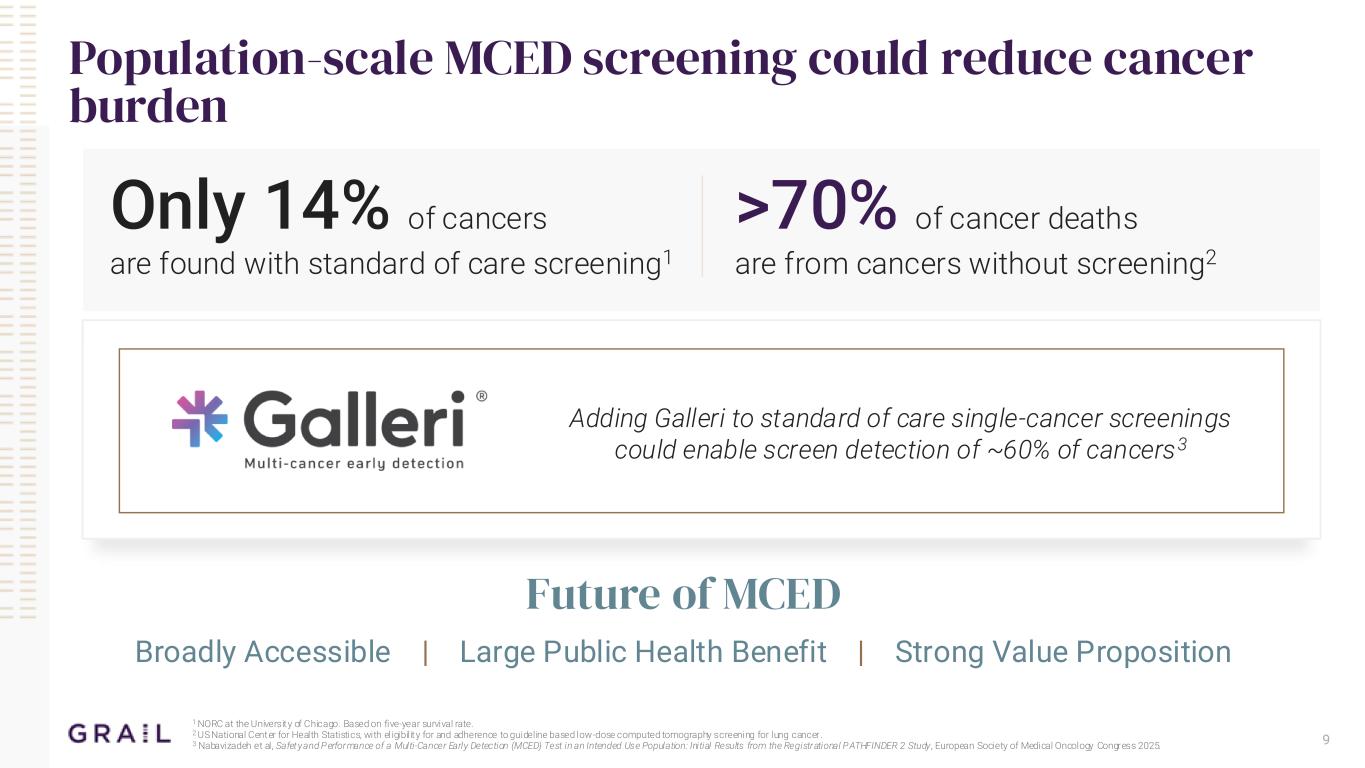

9 Population-scale MCED screening could reduce cancer burden Only 14% of cancers are found with standard of care screening1 Image of early stage cancers detected Adding Galleri to standard of care single-cancer screenings could enable screen detection of ~60% of cancers3 Future of MCED Broadly Accessible | Large Public Health Benefit | Strong Value Proposition >70% of cancer deaths are from cancers without screening2 1 NORC at the University of Chicago. Based on five-year survival rate. 2 US National Center for Health Statistics, with eligibility for and adherence to guideline based low-dose computed tomography screening for lung cancer. 3 Nabavizadeh et al, Safety and Performance of a Multi-Cancer Early Detection (MCED) Test in an Intended Use Population: Initial Results from the Registrational PATHFINDER 2 Study , European Society of Medical Oncology Congress 2025.

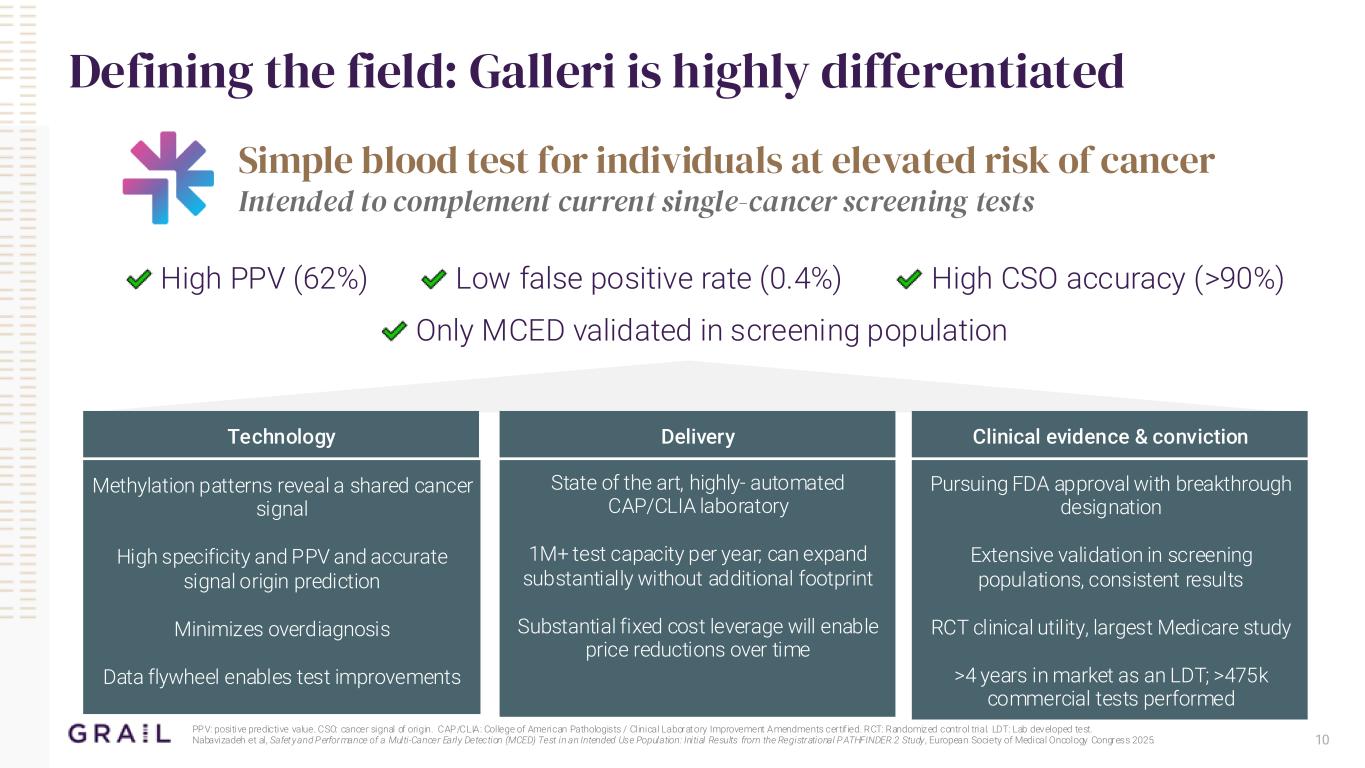

10 Defining the field: Galleri is highly differentiated Simple blood test for individuals at elevated risk of cancer Intended to complement current single-cancer screening tests High PPV (62%) Low false positive rate (0.4%) High CSO accuracy (>90%) Only MCED validated in screening population Methylation patterns reveal a shared cancer signal High specificity and PPV and accurate signal origin prediction Minimizes overdiagnosis Data flywheel enables test improvements Technology State of the art, highly- automated CAP/CLIA laboratory 1M+ test capacity per year; can expand substantially without additional footprint Substantial fixed cost leverage will enable price reductions over time Delivery Pursuing FDA approval with breakthrough designation Extensive validation in screening populations, consistent results RCT clinical utility, largest Medicare study >4 years in market as an LDT; >475k commercial tests performed Clinical evidence & conviction PPV: positive predictive value. CSO: cancer signal of origin. CAP/CLIA: College of American Pathologists / Clinical Laboratory Improvement Amendments certif ied. RCT: Randomized control trial. LDT: Lab developed test. Nabavizadeh et al, Safety and Performance of a Multi-Cancer Early Detection (MCED) Test in an Intended Use Population: Initial Results from the Registrational PATHFINDER 2 Study , European Society of Medical Oncology Congress 2025.

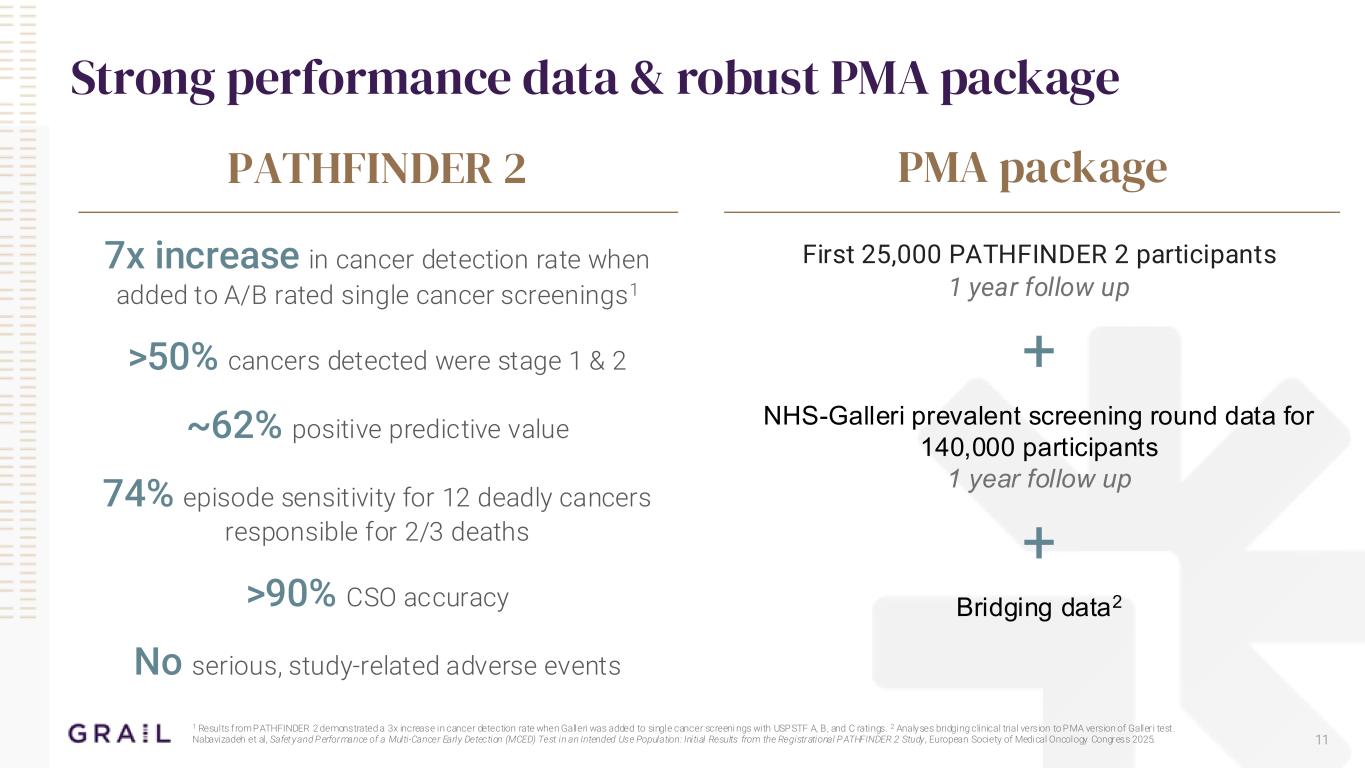

Strong performance data & robust PMA package First 25,000 PATHFINDER 2 participants 1 year follow up + NHS-Galleri prevalent screening round data for 140,000 participants 1 year follow up + Bridging data2 PMA packagePATHFINDER 2 7x increase in cancer detection rate when added to A/B rated single cancer screenings1 >50% cancers detected were stage 1 & 2 ~62% positive predictive value 74% episode sensitivity for 12 deadly cancers responsible for 2/3 deaths >90% CSO accuracy No serious, study-related adverse events 1 Results from PATHFINDER 2 demonstrated a 3x increase in cancer detection rate when Galleri was added to single cancer screeni ngs with USPSTF A, B, and C ratings. 2 Analyses bridging clinical trial version to PMA version of Galleri test . Nabavizadeh et al, Safety and Performance of a Multi-Cancer Early Detection (MCED) Test in an Intended Use Population: Initial Results from the Registrational PATHFINDER 2 Study , European Society of Medical Oncology Congress 2025. 11

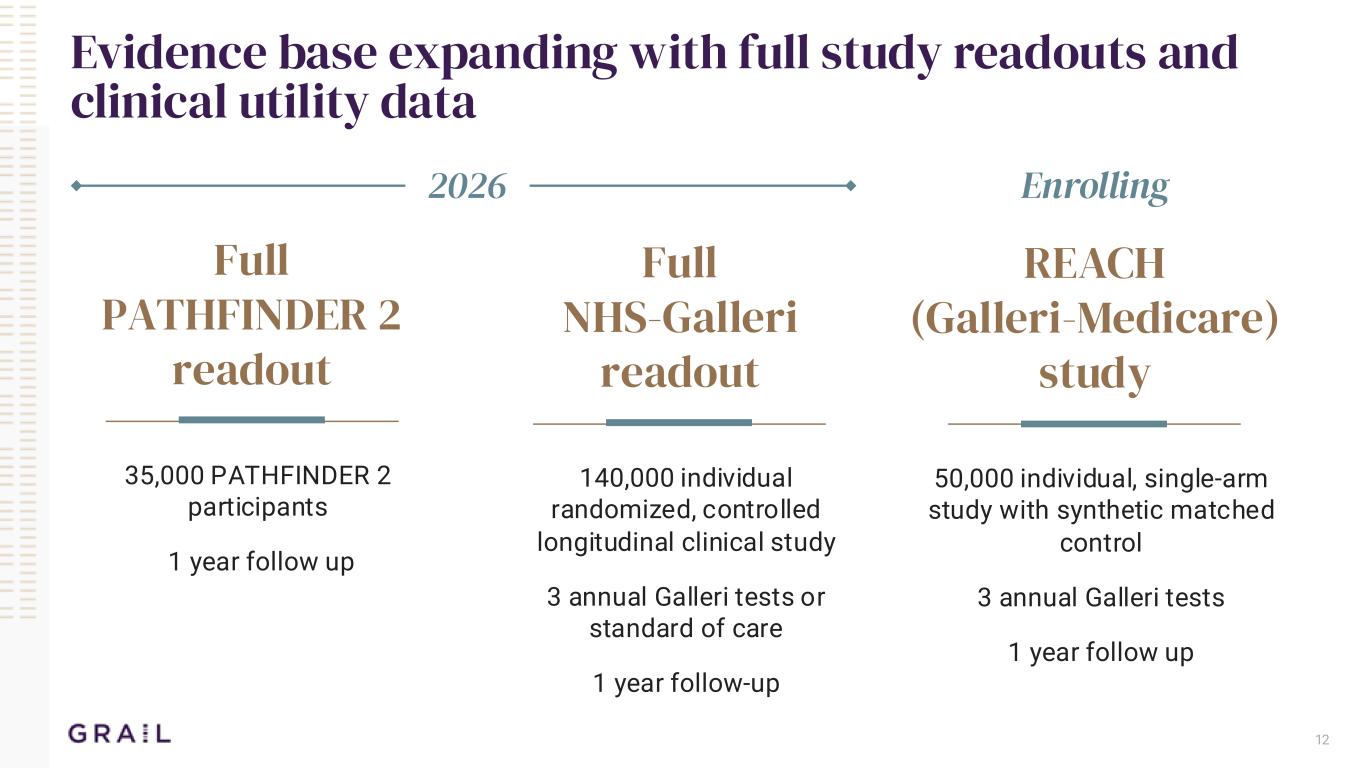

12 Evidence base expanding with full study readouts and clinical utility data Full PATHFINDER 2 readout 35,000 PATHFINDER 2 participants 1 year follow up Full NHS-Galleri readout 140,000 individual randomized, controlled longitudinal clinical study 3 annual Galleri tests or standard of care 1 year follow-up REACH (Galleri-Medicare) study 50,000 individual, single-arm study with synthetic matched control 3 annual Galleri tests 1 year follow up 2026 Enrolling

13 Near-term growth drivers prior to broad reimbursement Expanding awareness of MCED Increasing patient, provider & employer conviction with data and potential regulatory approval Further integration into health systems including electronic ordering Significant differentiation for Galleri Growth of digital health market

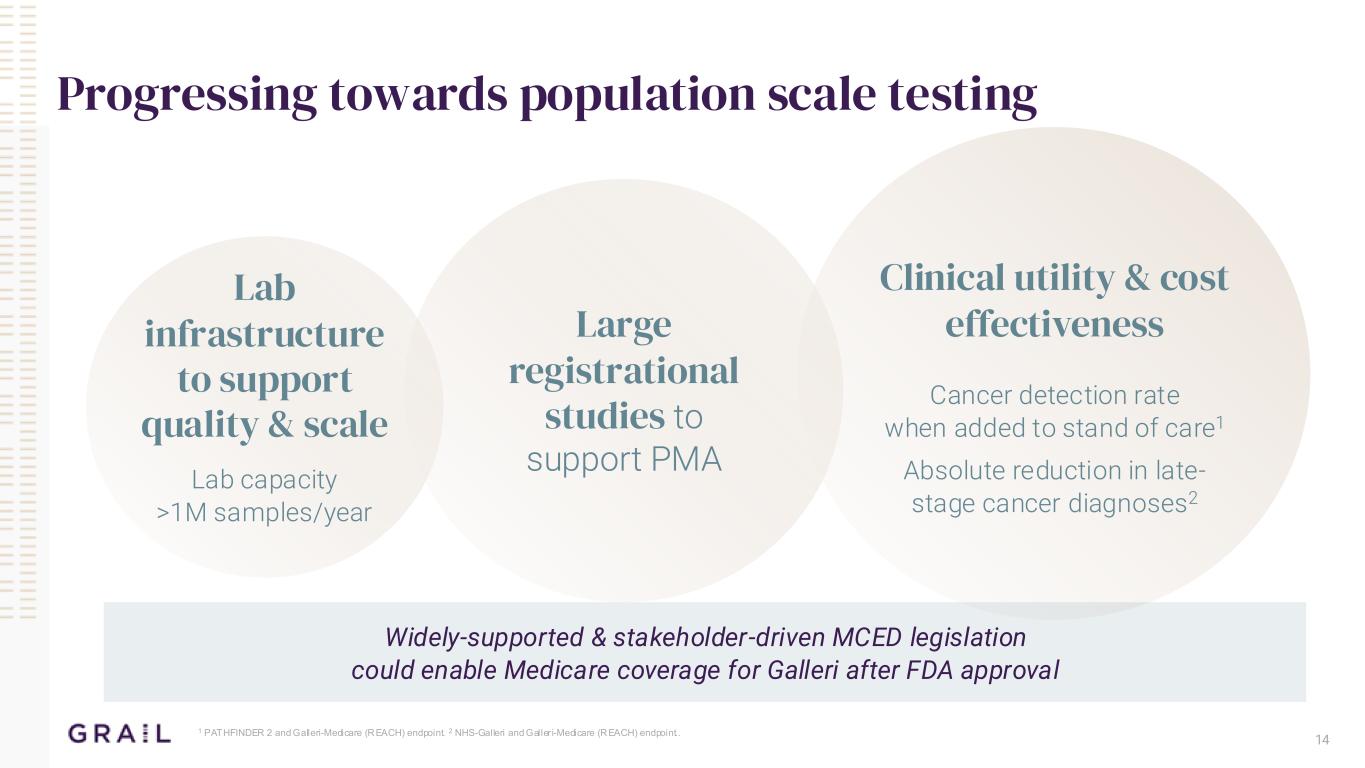

Clinical utility & cost effectivenessLarge registrational studies to support PMA 14 Progressing towards population scale testing 1 PATHFINDER 2 and Galleri-Medicare (REACH) endpoint. 2 NHS-Galleri and Galler i-Medicare (REACH) endpoint.. Lab infrastructure to support quality & scale Lab capacity >1M samples/year Cancer detection rate when added to stand of care1 Absolute reduction in late- stage cancer diagnoses2 Widely-supported & stakeholder-driven MCED legislation could enable Medicare coverage for Galleri after FDA approval

15 Advancing towards our vision of population-scale multi- cancer early detection • Complete modular PMA submission in Q1 2026 • Present full data from longitudinal randomized, controlled NHS-Galleri trial in mid-2026 (clinical utility and performance) • Present full results from PATHFINDER 2 study (35k participants) in mid-2026 Near term milestones

16 Q&A Advancing towards our vision of population-scale multi-cancer early detection