2 Non-GAAP Measures This presentation includes references to EBITDA, Adjusted EBITDA, Transaction Adjusted EBITDA and Adjusted EBITDA Margin with respect to Cactus and SPC (each of which is defined below), which are not measures calculated in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Reconciliations of EBITDA, Adjusted EBITDA and Transaction Adjusted EBITDA to net income, the most directly comparable measure calculated in accordance with GAAP, and calculations of Adjusted EBITDA margin, are provided in the Appendix included in this presentation. This presentation includes certain guidance for the non-GAAP financial measure Adjusted EBITDA Margin for Pressure Control and for Spoolable Technologies, and the non-GAAP financial measure Adjusted EBITDA for Corporate and Other. We are unable to reconcile these measures to their nearest GAAP measure without unreasonable efforts because we are unable to predict with reasonable certainty the actual impact of items included in the most directly comparable GAAP financial measure. While management believes such measures are useful for investors, these measures should not be used as a replacement for financial measures that are calculated in accordance with GAAP. Information Presented On February 28, 2023, Cactus, Inc., through one of its subsidiaries, completed its previously announced acquisition of the FlexSteel business through a merger (the “FlexSteel Merger”) with HighRidge Resources, Inc. and its subsidiaries (“HighRidge”). On February 27, 2023, in order to facilitate the FlexSteel Merger with HighRidge, an internal reorganization was completed in which Cactus Companies, LLC (“Cactus Companies”), a newly formed wholly-owned subsidiary of Cactus, Inc., acquired all of the outstanding units representing ownership interests in Cactus Wellhead, LLC, the operating subsidiary of Cactus, Inc. (the “CC Reorganization”). FlexSteel Holdings, Inc. was a wholly-owned subsidiary of HighRidge prior to the FlexSteel Merger and was subsequently converted into a limited liability company, contributed from HighRidge to Cactus Companies as part of the CC Reorganization and is now named FlexSteel Holdings, LLC (“FlexSteel”).Unless otherwise specifically noted herein or the context otherwise requires, information set forth herein with respect to periods prior to February 28, 2023 does not include the information of HighRidge and the FlexSteel business. Accordingly, unless otherwise specifically noted herein or the context otherwise requires, information with respect to Cactus, Inc. and its consolidated subsidiaries (the “Company”, “we”, “us”, “our” and “Cactus”) for the periods prior to February 28, 2023 refers only to Cactus prior to the FlexSteel Merger and does not include results and other information associated with HighRidge and the FlexSteel business. Information with respect to Cactus for periods subsequent to February 28, 2023 includes the results of Cactus’ Spoolable Technologies segment, which is comprised of the FlexSteel business. On June 2, 2025, Cactus Companies entered into a Framework Agreement with certain subsidiaries of Baker Hughes Company, pursuant to which Cactus, Inc. would acquire upon closing the transaction Baker Hughes Company’s surface pressure control business (“SPC” or “Baker Hughes Surface Pressure Control”), as described in Cactus, Inc.’s Current Report on Form 8-K filed June 2, 2025 (such transaction, the “SPC Transaction”). This presentation includes certain historical financial information related to SPC. Although such financial information has been prepared based on information provided by Baker Hughes Holdings LLC and its affiliates, which has not been confirmed by Cactus, it has not been audited. An independent audit of SPC’s financial information for the year ended December 31, 2024 has not yet been conducted, but is expected to be completed by the closing of the SPC Transaction. As such, the SPC financial information presented herein is preliminary and subject to change, and material adjustments thereto may be necessary upon completion of the audit. None of Baker Hughes Company or its affiliates or any of its or their affiliates’ respective representatives have any responsibility for the content of this presentation. Forward-Looking Statements The information in this presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact included in this presentation, regarding the SPC Transaction, SPC financial information, our strategy, future operations, financial position, expected revenue, EBITDA, Adjusted EBITDA, Transaction Adjusted EBITDA and Adjusted EBITDA margin, projected costs, pro forma financial profile, prospects, plans and objectives of management are forward-looking statements. When used in this presentation, the words “guidance,” “outlook,” “may,” “hope,” “potential,” “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on Cactus’ current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. We caution you not to place undue reliance on any forward-looking statements, which can be affected by assumptions used or by risks or uncertainties, including unanticipated challenges relating to the FlexSteel business or SPC, and our ability to realize the expected benefits and synergies of the SPC Transaction. Consequently, no forward-looking statements can be guaranteed. When considering these forward-looking statements, you should keep in mind the risk factors and other factors noted in Cactus, Inc.’s Annual Report on Form 10-K, its Quarterly Reports on Form 10-Q and the other documents that Cactus, Inc. files from time to time with the Securities and Exchange Commission (“SEC”). These documents are available on the Company’s website at https://cactuswhd.com/investors/sec-filings/ or through the SEC’s Electronic Data Gathering and Analysis Retrieval (“EDGAR”) system at www.sec.gov. The risk factors and other factors noted therein could cause actual results to differ materially from those contained in any forward-looking statement. We disclaim any duty to update and do not intend to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this presentation. Industry and Market Data This presentation has been prepared by Cactus and includes market data and other statistical information from third-party sources, including independent industry publications, government publications or other published independent sources. Some data is also based on Cactus’ good faith estimate. Although Cactus believes these third-party sources are reliable as of their respective dates, Cactus has not independently verified the accuracy or completeness of this information. Important Disclosures

3 Experienced Executive Team Scott Bender Chairman and CEO Served as Chairman & CEO since 2023 and previously served as CEO since co-founding Cactus in 2011 Joel Bender President Served as Director & President since 2023 and previously served as COO since co-founding Cactus in 2011 Steven Bender Chief Operating Officer Served as COO since 2023 and previously served as VP, Operations since 2011 Steve Tadlock EVP and Chief Executive Officer of Spoolable Technologies Served as CEO of Spoolable Tech. since 2023 and previously served as CFO from 2019 through 2023 Jay Nutt EVP, Chief Financial Officer, and Treasurer Served as CFO since joining Cactus in 2024. Previously served as CFO of ChampionX Corporation William Marsh EVP and General Counsel Served as General Counsel since joining Cactus in 2022. Previously served as Chief Legal Officer of Baker Hughes Company

4 Experienced Management Team with Significant Equity Ownership & Strong Industry Relationships Innovative and Differentiated Products & Services that Sustain Relative Margin Resilience A Leading Pure Play Equipment Solutions Provider for Onshore Markets Strong Margins and Free Cash Flow Generation Dynamic Operating and Manufacturing Capabilities 5 4 3 2 1 Through-Cycle Outperformance Investment Highlights

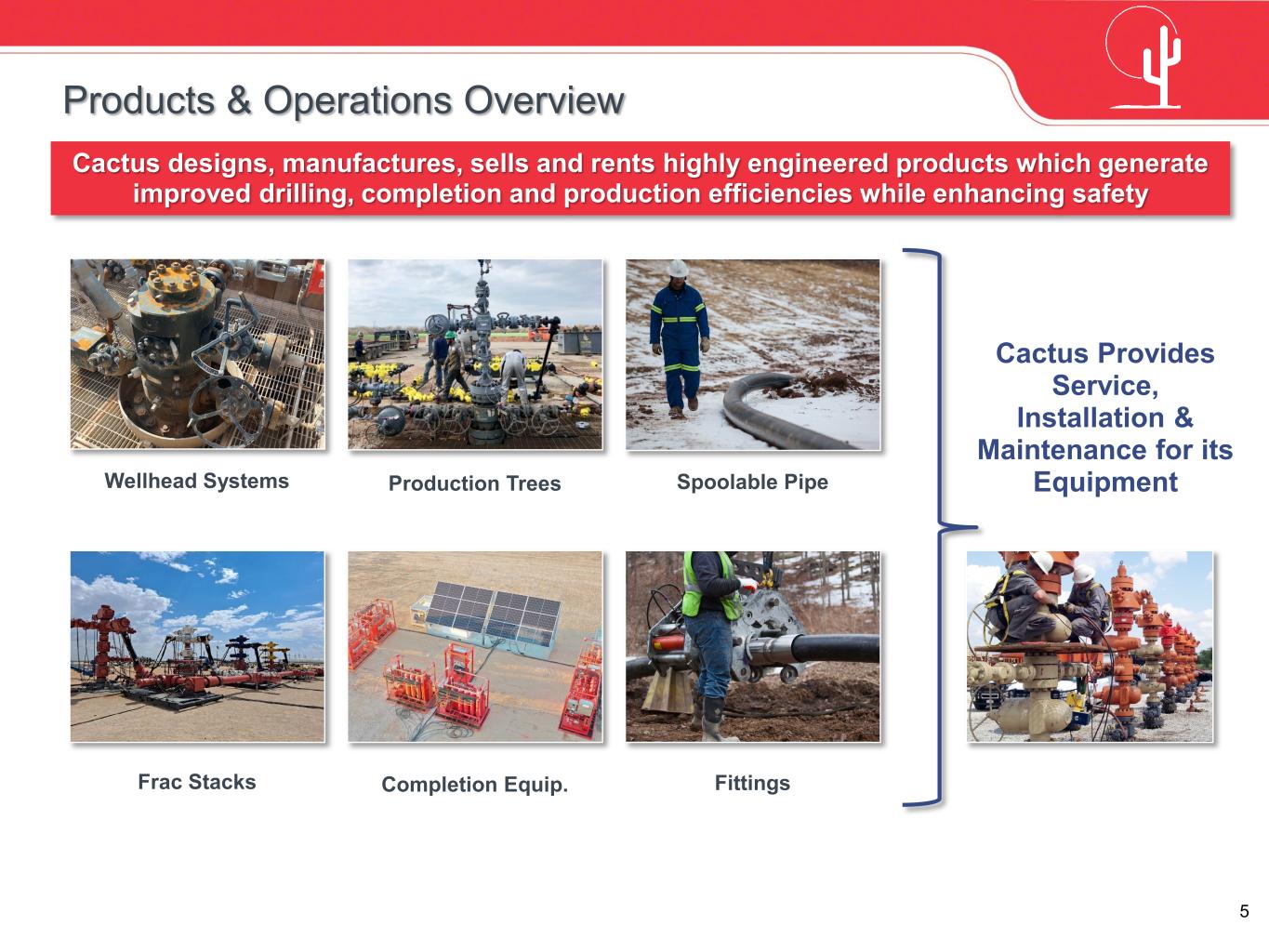

5 Products & Operations Overview Cactus designs, manufactures, sells and rents highly engineered products which generate improved drilling, completion and production efficiencies while enhancing safety 33.4% Margin 37.1% Margin Wellhead Systems Production Trees Spoolable Pipe Frac Stacks Completion Equip. Fittings Cactus Provides Service, Installation & Maintenance for its Equipment

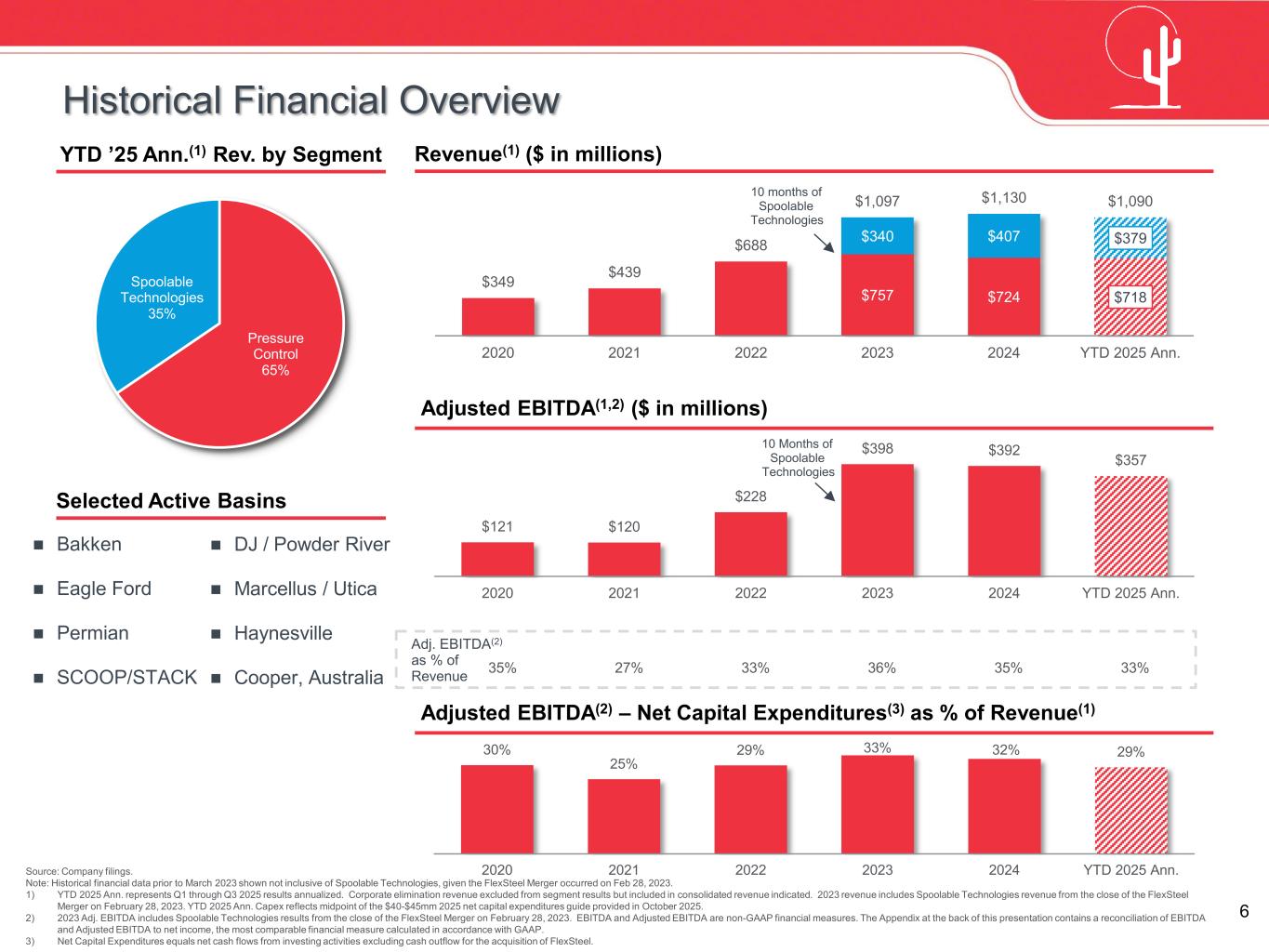

6 30% 25% 29% 33% 32% 29% 2020 2021 2022 2023 2024 YTD 2025 Ann. 35% 27% 33% 36% 35% 33% $757 $724 $718 $340 $407 $379 $349 $439 $688 $1,097 $1,130 $1,090 2020 2021 2022 2023 2024 YTD 2025 Ann. Revenue(1) ($ in millions) Historical Financial Overview Source: Company filings. Note: Historical financial data prior to March 2023 shown not inclusive of Spoolable Technologies, given the FlexSteel Merger occurred on Feb 28, 2023. 1) YTD 2025 Ann. represents Q1 through Q3 2025 results annualized. Corporate elimination revenue excluded from segment results but included in consolidated revenue indicated. 2023 revenue includes Spoolable Technologies revenue from the close of the FlexSteel Merger on February 28, 2023. YTD 2025 Ann. Capex reflects midpoint of the $40-$45mm 2025 net capital expenditures guide provided in October 2025. 2) 2023 Adj. EBITDA includes Spoolable Technologies results from the close of the FlexSteel Merger on February 28, 2023. EBITDA and Adjusted EBITDA are non-GAAP financial measures. The Appendix at the back of this presentation contains a reconciliation of EBITDA and Adjusted EBITDA to net income, the most comparable financial measure calculated in accordance with GAAP. 3) Net Capital Expenditures equals net cash flows from investing activities excluding cash outflow for the acquisition of FlexSteel. Adjusted EBITDA(2) – Net Capital Expenditures(3) as % of Revenue(1) 33.4% Margin 37.1% Margin Adjusted EBITDA(1,2) ($ in millions) Adj. EBITDA(2) as % of Revenue $121 $120 $228 $398 $392 $357 2020 2021 2022 2023 2024 YTD 2025 Ann. Pressure Control 65% Spoolable Technologies 35% YTD ’25 Ann.(1) Rev. by Segment Bakken Eagle Ford Permian SCOOP/STACK Selected Active Basins DJ / Powder River Marcellus / Utica Haynesville Cooper, Australia 10 Months of Spoolable Technologies 10 months of Spoolable Technologies

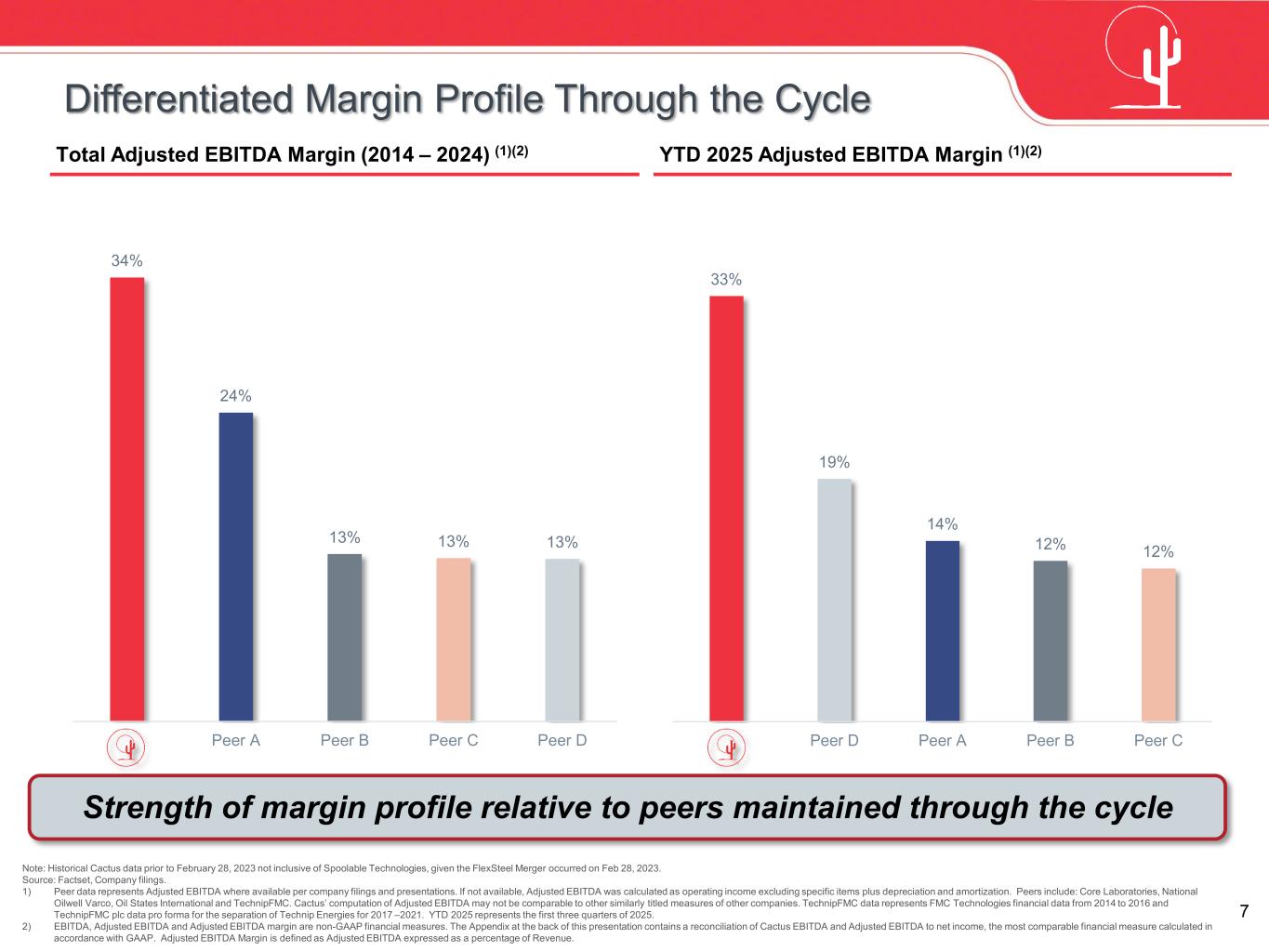

7 33% 19% 14% 12% 12% Peer D Peer A Peer B Peer C 34% 24% 13% 13% 13% Peer A Peer B Peer C Peer D Differentiated Margin Profile Through the Cycle Total Adjusted EBITDA Margin (2014 – 2024) (1)(2) Note: Historical Cactus data prior to February 28, 2023 not inclusive of Spoolable Technologies, given the FlexSteel Merger occurred on Feb 28, 2023. Source: Factset, Company filings. 1) Peer data represents Adjusted EBITDA where available per company filings and presentations. If not available, Adjusted EBITDA was calculated as operating income excluding specific items plus depreciation and amortization. Peers include: Core Laboratories, National Oilwell Varco, Oil States International and TechnipFMC. Cactus’ computation of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies. TechnipFMC data represents FMC Technologies financial data from 2014 to 2016 and TechnipFMC plc data pro forma for the separation of Technip Energies for 2017 –2021. YTD 2025 represents the first three quarters of 2025. 2) EBITDA, Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. The Appendix at the back of this presentation contains a reconciliation of Cactus EBITDA and Adjusted EBITDA to net income, the most comparable financial measure calculated in accordance with GAAP. Adjusted EBITDA Margin is defined as Adjusted EBITDA expressed as a percentage of Revenue. YTD 2025 Adjusted EBITDA Margin (1)(2) Strength of margin profile relative to peers maintained through the cycle

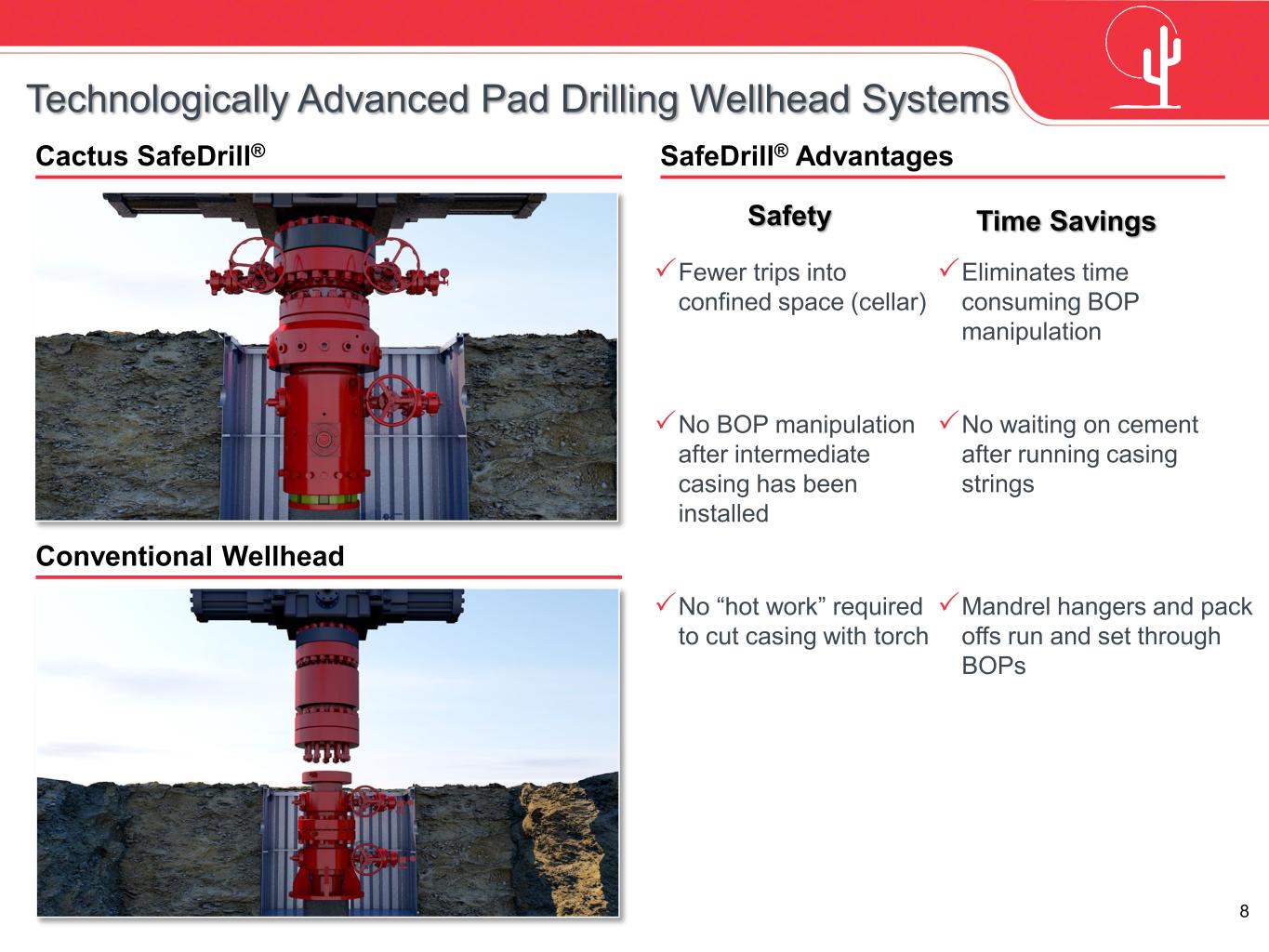

8 SafeDrill® Advantages Technologically Advanced Pad Drilling Wellhead Systems Eliminates time consuming BOP manipulation No waiting on cement after running casing strings - Mandrel hangers and pack offs run and set through BOPs Fewer trips into confined space (cellar) - No BOP manipulation after intermediate casing has been installed No “hot work” required to cut casing with torch Safety Time Savings Conventional Wellhead Cactus SafeDrill®

9 Technologically Advanced Spoolable Pipe Systems Lower maintenance cost for operators Lower cost to install Reduces operating field failures / reinstallations Reduces need for special handling or bedding tools Higher flowrates Reliable in extreme conditions Suitable for trenchless pipe installation methods (directional drilling or rehab) Durable and corrosion- resistant Faster installation times Withstands cyclic loading Lowest bend radius of any spoolable pipe Pre-leak detection Large diameter High pressure & temperature ratings Features Operator Savings Conventional Steel Line Pipe FlexSteel Spoolable Pipe FlexSteel Advantages

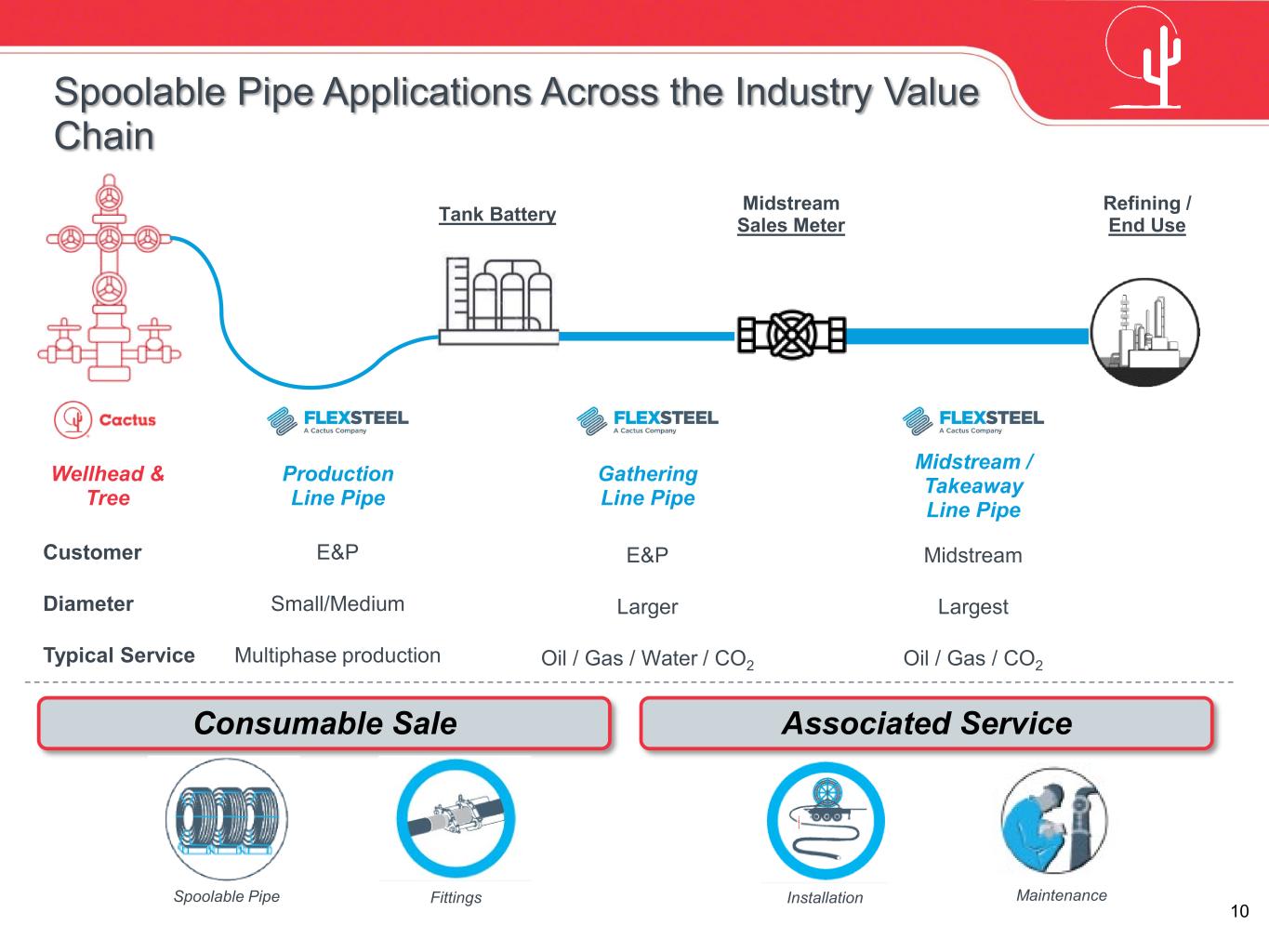

10 Spoolable Pipe Applications Across the Industry Value Chain Tank Battery Wellhead & Tree Midstream Sales Meter Refining / End Use Production Line Pipe Gathering Line Pipe Midstream / Takeaway Line Pipe Customer Diameter Typical Service E&P Small/Medium Multiphase production E&P Larger Oil / Gas / Water / CO2 Midstream Largest Oil / Gas / CO2 Consumable Sale Spoolable Pipe Associated Service Fittings Installation Maintenance

11 Differentiated Offerings Enable Customers to Meet ESG-Related Goals Equipment takes less time to install versus legacy offerings Enables customers to drill, complete and bring wells online faster Fewer people and less equipment on location Reduces carbon intensity per well Equipment enhances employee safety Automation of human- performed connections Routine tasks can be performed remotely Longer spooled length minimizes connections and fabrication required on-site Switching from diesel to solar powered generation in certain instances Spoolable pipe design allows integrity testing while operating Spoolable pipe design characteristics are well suited for CO2 transportation Faster Safer Cleaner

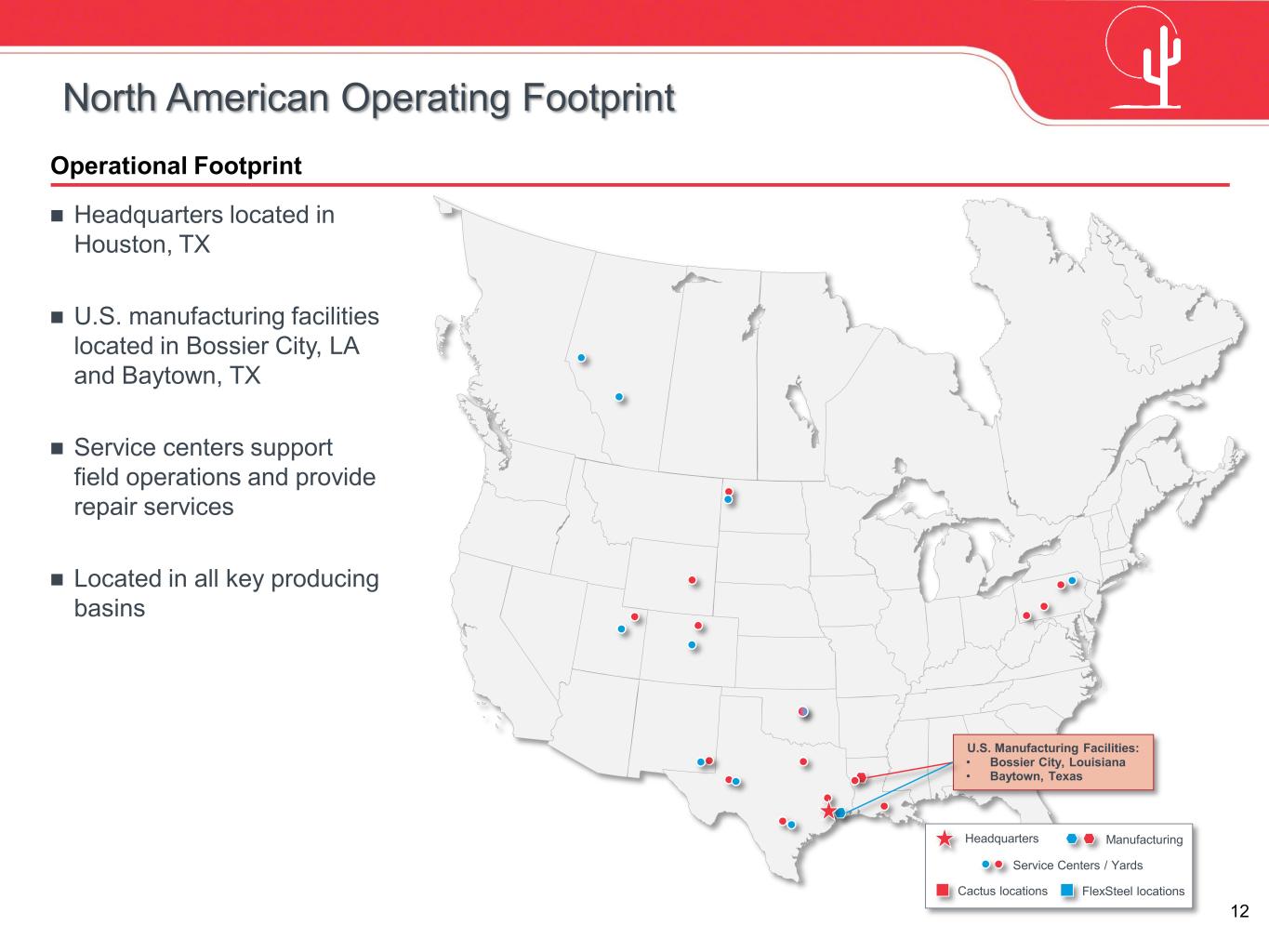

12 Headquarters located in Houston, TX U.S. manufacturing facilities located in Bossier City, LA and Baytown, TX Service centers support field operations and provide repair services Located in all key producing basins Operational Footprint North American Operating Footprint U.S. Manufacturing Facilities: • Bossier City, Louisiana • Baytown, Texas Headquarters Manufacturing Service Centers / Yards Cactus locations FlexSteel locations

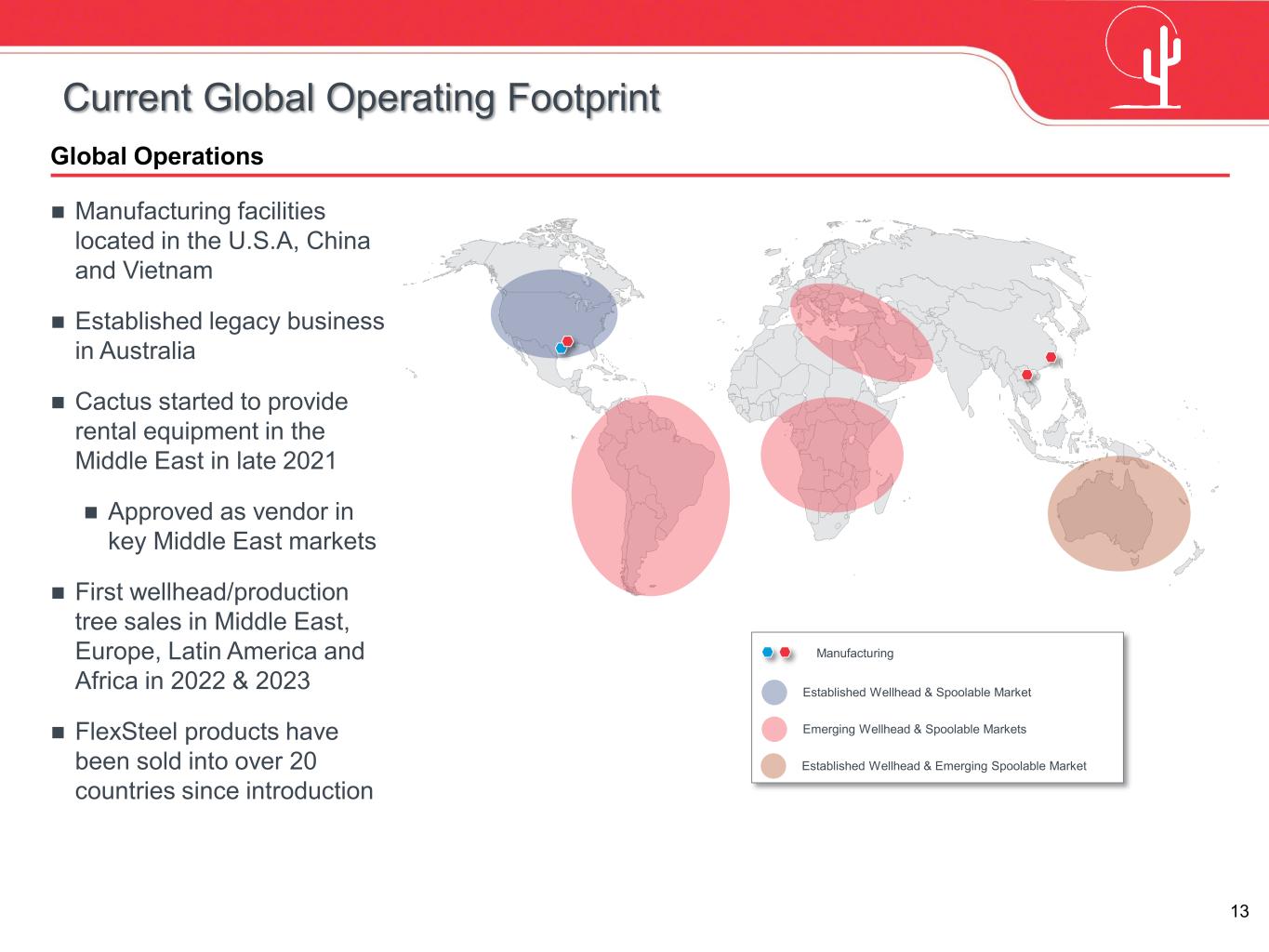

13 Global Operations Manufacturing facilities located in the U.S.A, China and Vietnam Established legacy business in Australia Cactus started to provide rental equipment in the Middle East in late 2021 Approved as vendor in key Middle East markets First wellhead/production tree sales in Middle East, Europe, Latin America and Africa in 2022 & 2023 FlexSteel products have been sold into over 20 countries since introduction Current Global Operating Footprint Established Wellhead & Spoolable Market Emerging Wellhead & Spoolable Markets Manufacturing Established Wellhead & Emerging Spoolable Market

14 Bossier City Facility Suzhou / Vietnam Facilities Rapid-response manufacturing 5-axis computer numerically controlled machines “Just-in-time” capabilities for fast delivery time & parachute orders Expanded in 2018 and 2022 Less time-sensitive, high-volume wellhead equipment Suzhou and Vietnam assembly & test facilities are wholly foreign owned enterprises Low cost of operation with low sensitivity to utilization A Dynamic Manufacturing Advantage; Responsive, Scalable and Low Cost Scalable and Low Fixed Cost Manufacturing Footprint Produces 100% of FlexSteel pipe Only manufacturer to hydro-test all pipe before leaving its facility Third production line added in 2019 API and ISO certified Baytown Facility

15 Growth in Core Production Products Market transition from traditional stick steel line pipe to spoolable products still in early stages Increase customer penetration for larger diameter gathering- focused products Expand customer penetration for under pad applications that connect to the wellhead Recently qualified and installed a new sour service product Expansion in the Midstream Segment Larger diameter capabilities required by relatively untapped customer base Customer count has significantly increased since 2020 Continued traction in 2025 in developing new midstream customer relationships International International market penetration in relatively early stages Recently awarded first gas service order from a large Middle Eastern National Oil Company and first sour service order in another Middle Eastern country supporting unconventional development Other Opportunities Continued expansion of non-oil and gas projects domestically and internationally (e.g., municipal, hydrogen, etc.) Executed on first Carbon Capture & Underground Storage project for large independent operator in 2022 and engaged in multiple CCUS opportunities as market grows Multiple Avenues of Growth for Spoolable Technologies

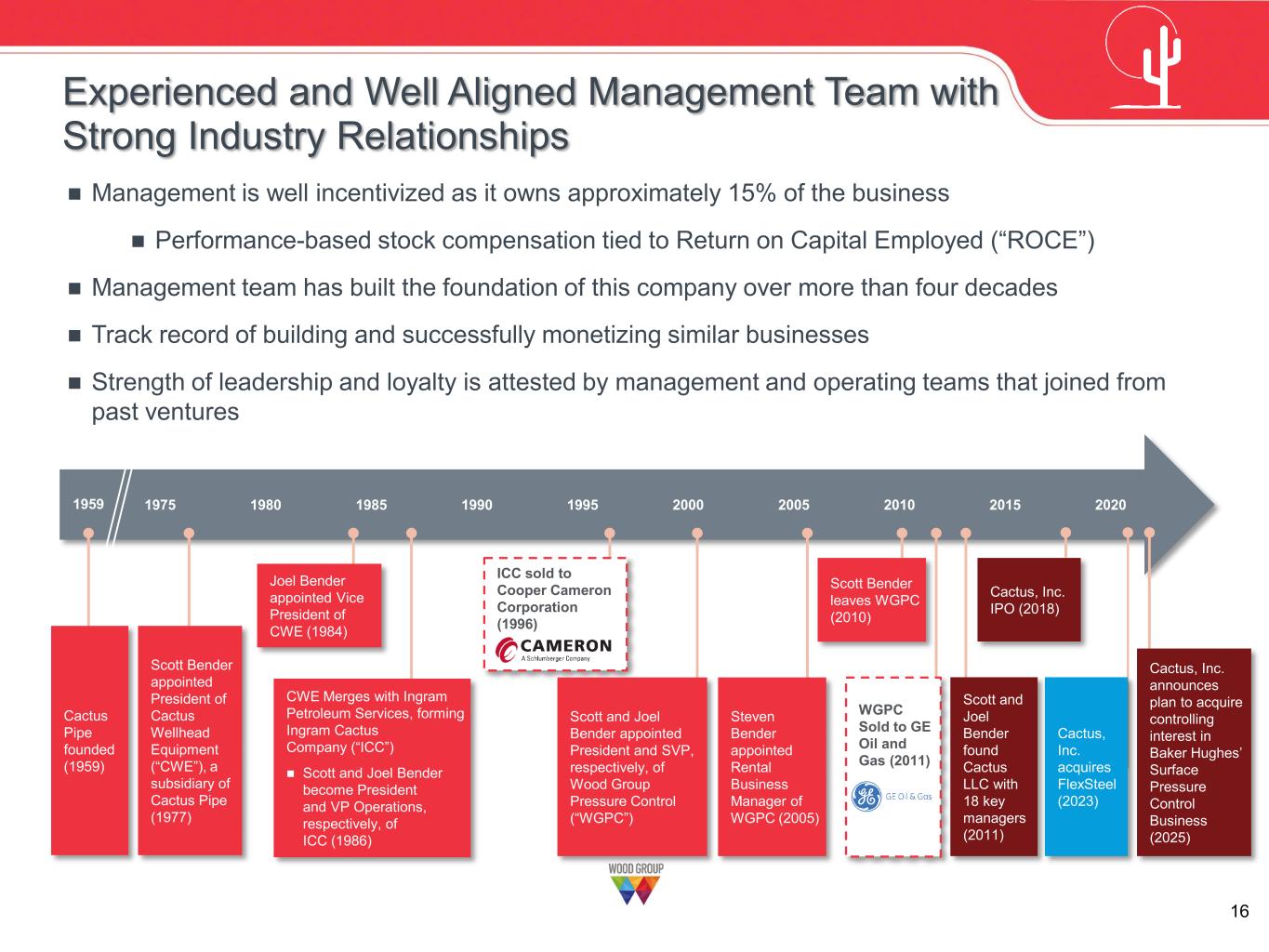

16 Current Management is well incentivized as it owns approximately 15% of the business Performance-based stock compensation tied to Return on Capital Employed (“ROCE”) Management team has built the foundation of this company over more than four decades Track record of building and successfully monetizing similar businesses Strength of leadership and loyalty is attested by management and operating teams that joined from past ventures ICC sold to Cooper Cameron Corporation (1996) Scott Bender appointed President of Cactus Wellhead Equipment (“CWE”), a subsidiary of Cactus Pipe (1977) Cactus Pipe founded (1959) CWE Merges with Ingram Petroleum Services, forming Ingram Cactus Company (“ICC”) Scott and Joel Bender become President and VP Operations, respectively, of ICC (1986) Joel Bender appointed Vice President of CWE (1984) Scott and Joel Bender appointed President and SVP, respectively, of Wood Group Pressure Control (“WGPC”) Scott Bender leaves WGPC (2010) Scott and Joel Bender found Cactus LLC with 18 key managers (2011) WGPC Sold to GE Oil and Gas (2011) Steven Bender appointed Rental Business Manager of WGPC (2005) Cactus, Inc. IPO (2018) 19801975 1985 1990 1995 2000 2005 2010 20151959 Experienced and Well Aligned Management Team with Strong Industry Relationships 2020 Cactus, Inc. acquires FlexSteel (2023) Cactus, Inc. announces plan to acquire controlling interest in Baker Hughes’ Surface Pressure Control Business (2025)

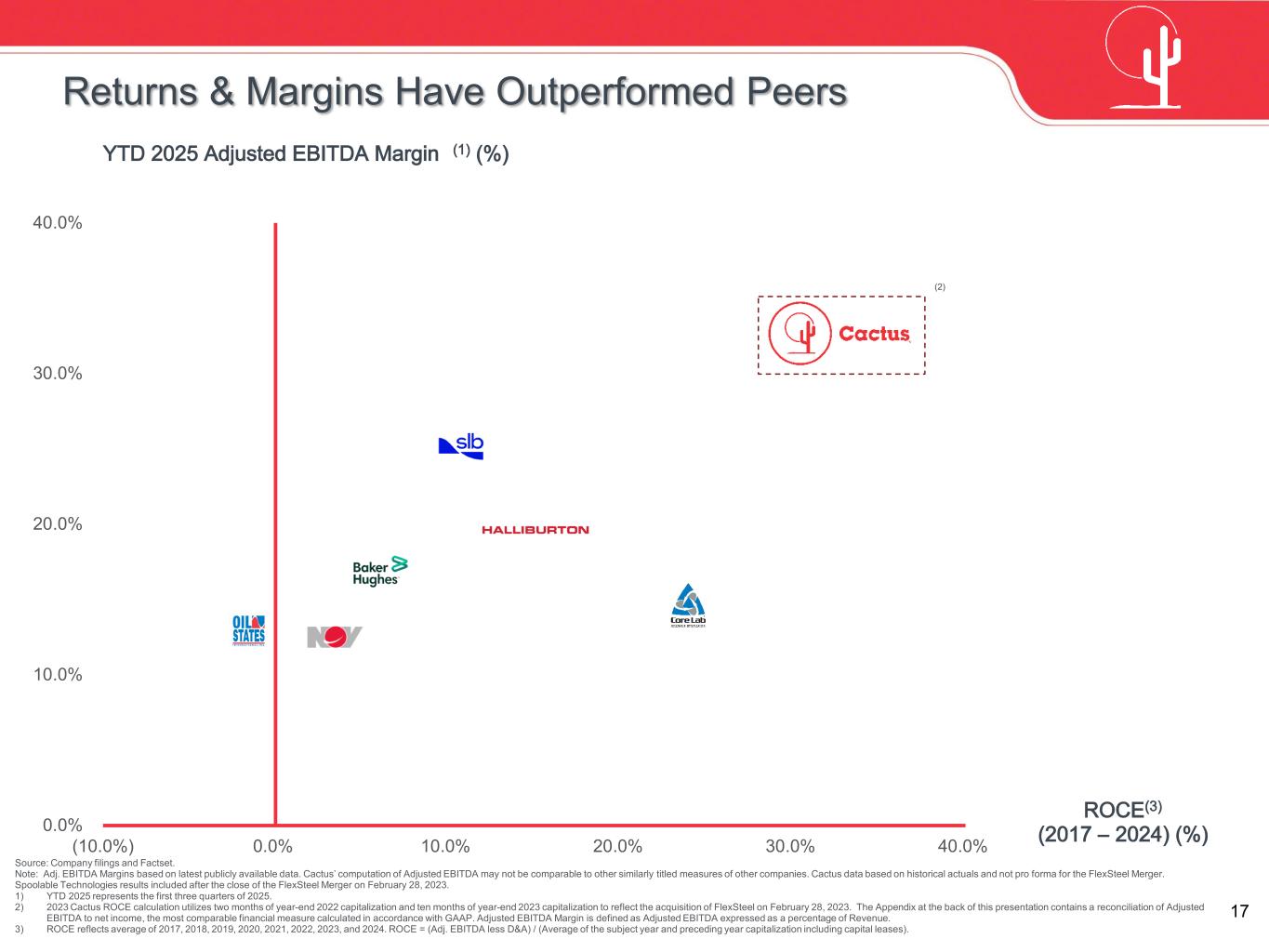

17 FTI DRQ WEIR NCSM SBO OIS HTG FETNOV 0.0% 10.0% 20.0% 30.0% 40.0% (10.0%) 0.0% 10.0% 20.0% 30.0% 40.0% Source: Company filings and Factset. Note: Adj. EBITDA Margins based on latest publicly available data. Cactus’ computation of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies. Cactus data based on historical actuals and not pro forma for the FlexSteel Merger. Spoolable Technologies results included after the close of the FlexSteel Merger on February 28, 2023. 1) YTD 2025 represents the first three quarters of 2025. 2) 2023 Cactus ROCE calculation utilizes two months of year-end 2022 capitalization and ten months of year-end 2023 capitalization to reflect the acquisition of FlexSteel on February 28, 2023. The Appendix at the back of this presentation contains a reconciliation of Adjusted EBITDA to net income, the most comparable financial measure calculated in accordance with GAAP. Adjusted EBITDA Margin is defined as Adjusted EBITDA expressed as a percentage of Revenue. 3) ROCE reflects average of 2017, 2018, 2019, 2020, 2021, 2022, 2023, and 2024. ROCE = (Adj. EBITDA less D&A) / (Average of the subject year and preceding year capitalization including capital leases). YTD 2025 Adjusted EBITDA Margin (1) (%) ROCE(3) (2017 – 2024) (%) (2) Returns & Margins Have Outperformed Peers

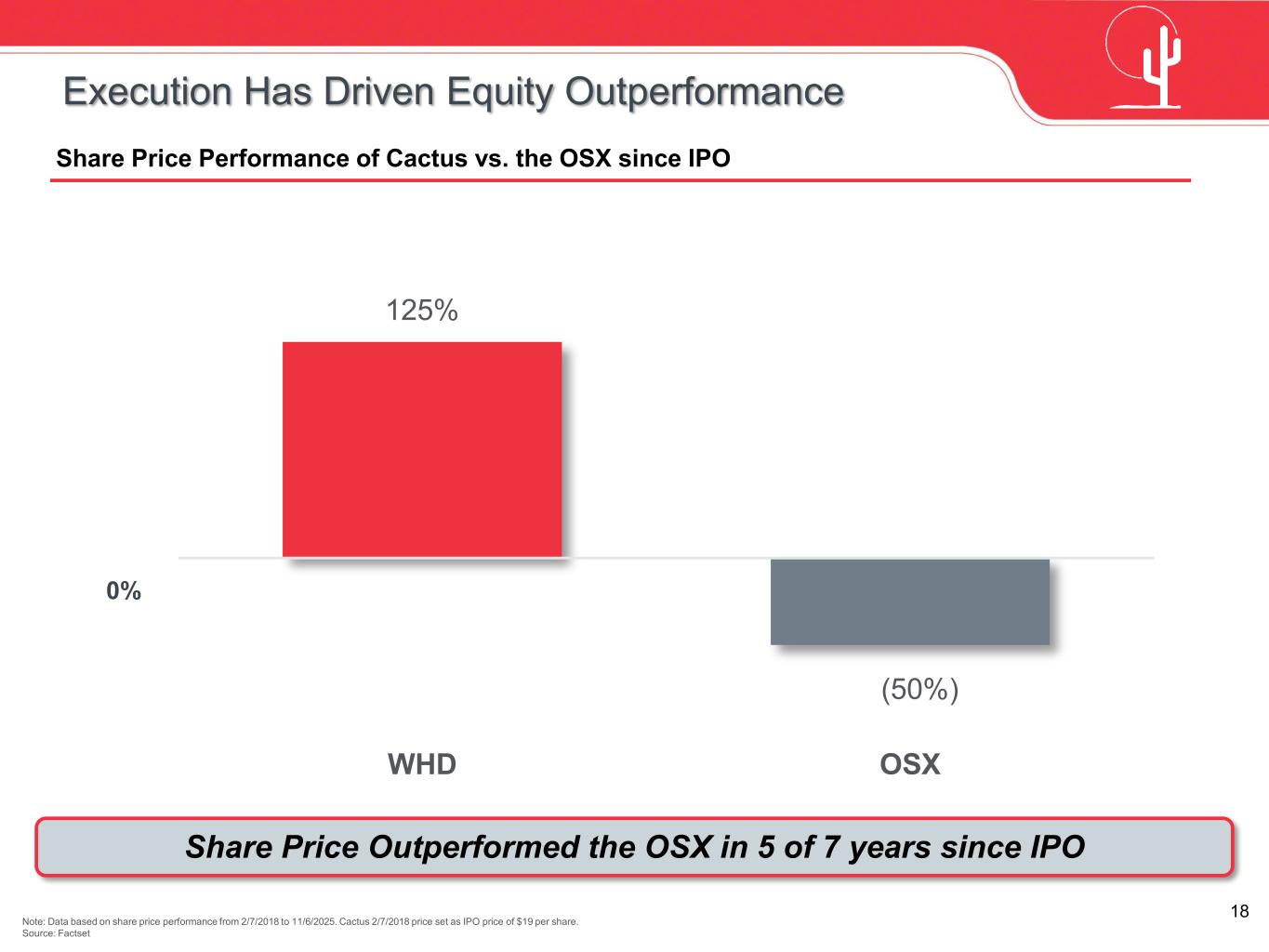

18 125% (50%) WHD OSX Share Price Performance of Cactus vs. the OSX since IPO Note: Data based on share price performance from 2/7/2018 to 11/6/2025. Cactus 2/7/2018 price set as IPO price of $19 per share. Source: Factset Share Price Outperformed the OSX in 5 of 7 years since IPO Execution Has Driven Equity Outperformance 0%

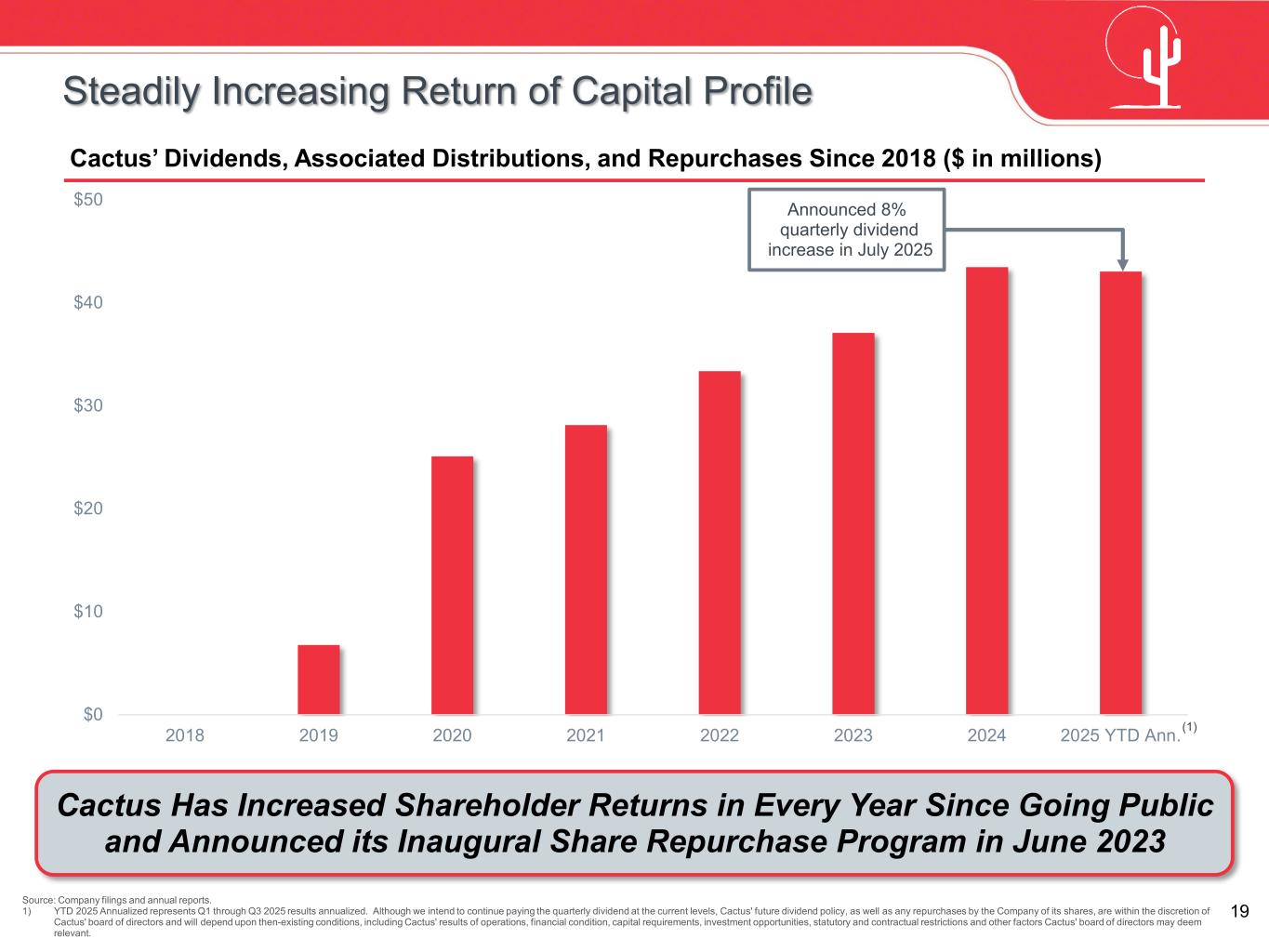

19 $0 $10 $20 $30 $40 $50 2018 2019 2020 2021 2022 2023 2024 2025 YTD Ann. Cactus’ Dividends, Associated Distributions, and Repurchases Since 2018 ($ in millions) Source: Company filings and annual reports. 1) YTD 2025 Annualized represents Q1 through Q3 2025 results annualized. Although we intend to continue paying the quarterly dividend at the current levels, Cactus' future dividend policy, as well as any repurchases by the Company of its shares, are within the discretion of Cactus' board of directors and will depend upon then-existing conditions, including Cactus' results of operations, financial condition, capital requirements, investment opportunities, statutory and contractual restrictions and other factors Cactus' board of directors may deem relevant. Cactus Has Increased Shareholder Returns in Every Year Since Going Public and Announced its Inaugural Share Repurchase Program in June 2023 Steadily Increasing Return of Capital Profile (1) Announced 8% quarterly dividend increase in July 2025

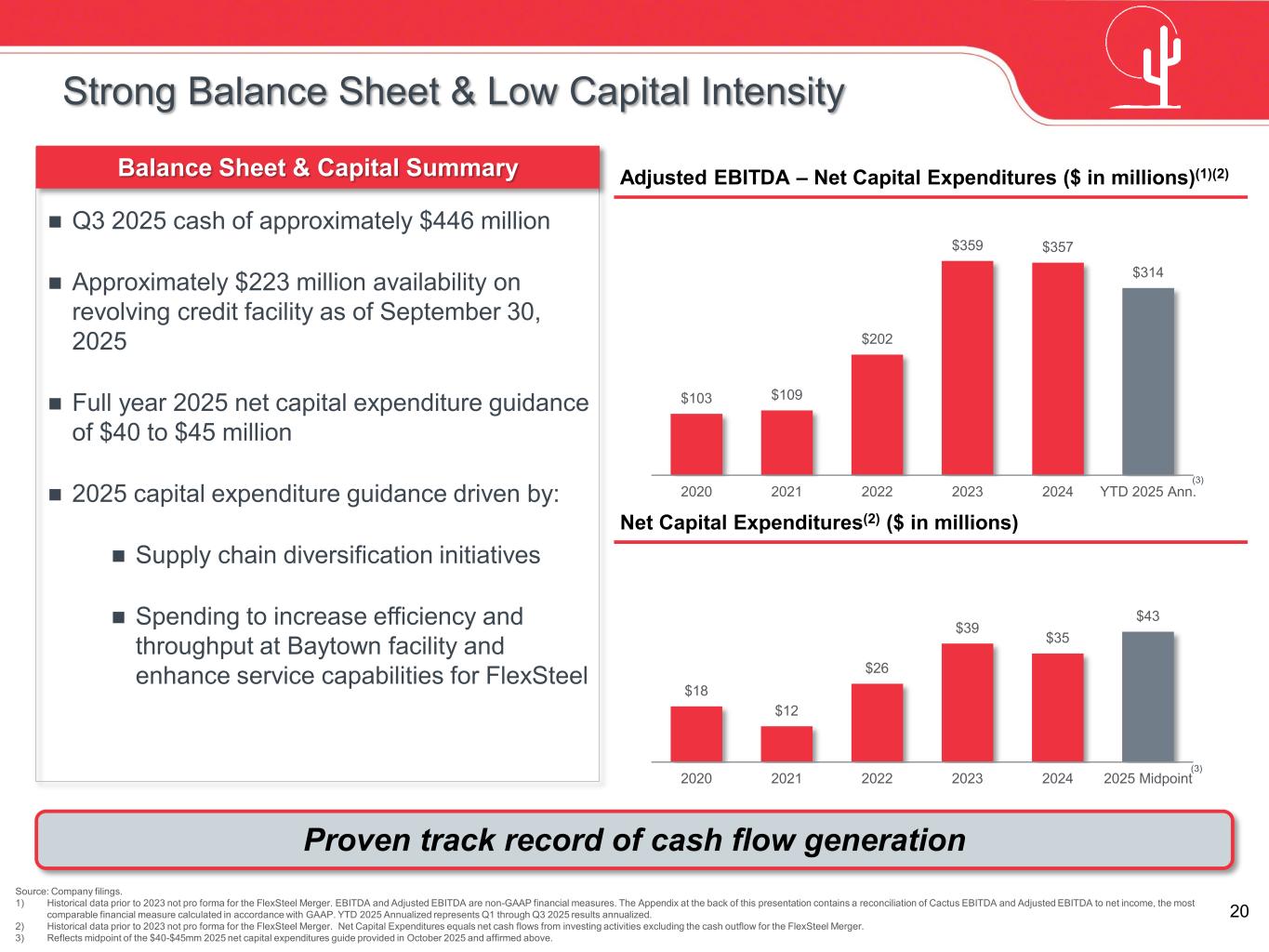

20 Q3 2025 cash of approximately $446 million Approximately $223 million availability on revolving credit facility as of September 30, 2025 Full year 2025 net capital expenditure guidance of $40 to $45 million 2025 capital expenditure guidance driven by: Supply chain diversification initiatives Spending to increase efficiency and throughput at Baytown facility and enhance service capabilities for FlexSteel Adjusted EBITDA – Net Capital Expenditures ($ in millions)(1)(2) Proven track record of cash flow generation Net Capital Expenditures(2) ($ in millions) Balance Sheet & Capital Summary Source: Company filings. 1) Historical data prior to 2023 not pro forma for the FlexSteel Merger. EBITDA and Adjusted EBITDA are non-GAAP financial measures. The Appendix at the back of this presentation contains a reconciliation of Cactus EBITDA and Adjusted EBITDA to net income, the most comparable financial measure calculated in accordance with GAAP. YTD 2025 Annualized represents Q1 through Q3 2025 results annualized. 2) Historical data prior to 2023 not pro forma for the FlexSteel Merger. Net Capital Expenditures equals net cash flows from investing activities excluding the cash outflow for the FlexSteel Merger. 3) Reflects midpoint of the $40-$45mm 2025 net capital expenditures guide provided in October 2025 and affirmed above. Strong Balance Sheet & Low Capital Intensity $103 $109 $202 $359 $357 $314 2020 2021 2022 2023 2024 YTD 2025 Ann. $18 $12 $26 $39 $35 $43 2020 2021 2022 2023 2024 2025 Midpoint (3) (3)

21 No updates to the guidance provided on the Q3 2025 conference call on October 30, 2025 Pressure Control Q4 2025 Revenue expected to be flat sequentially Expected Adjusted EBITDA margin of 31% – 33% Spoolable Technologies Q4 2025 Revenue expected to be down low double digits versus Q3 2025 Expected Adjusted EBITDA margin of 34 – 36% Expected Corporate and Other Adjusted EBITDA loss of approximately $4.0 million Fourth Quarter Outlook Outlook

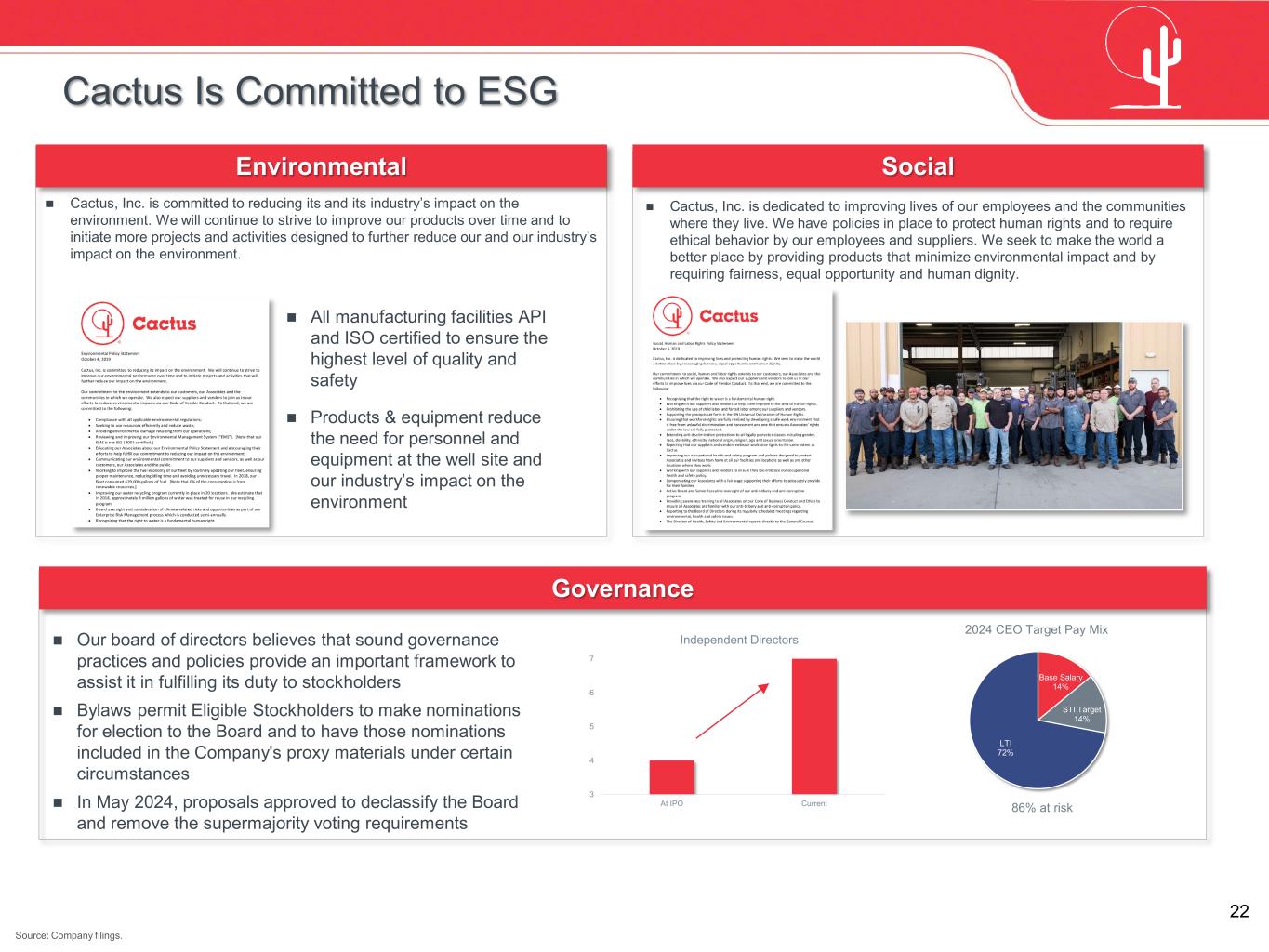

22 3 4 5 6 7 At IPO Current Independent Directors Environmental Social Governance Cactus, Inc. is committed to reducing its and its industry’s impact on the environment. We will continue to strive to improve our products over time and to initiate more projects and activities designed to further reduce our and our industry’s impact on the environment. Cactus, Inc. is dedicated to improving lives of our employees and the communities where they live. We have policies in place to protect human rights and to require ethical behavior by our employees and suppliers. We seek to make the world a better place by providing products that minimize environmental impact and by requiring fairness, equal opportunity and human dignity. Our board of directors believes that sound governance practices and policies provide an important framework to assist it in fulfilling its duty to stockholders Bylaws permit Eligible Stockholders to make nominations for election to the Board and to have those nominations included in the Company's proxy materials under certain circumstances In May 2024, proposals approved to declassify the Board and remove the supermajority voting requirements Source: Company filings. All manufacturing facilities API and ISO certified to ensure the highest level of quality and safety Products & equipment reduce the need for personnel and equipment at the well site and our industry’s impact on the environment Cactus Is Committed to ESG Base Salary 14% STI Target 14% LTI 72% 86% at risk 2024 CEO Target Pay Mix

24 Increased Scale & Geographic Diversification With Strong Growth Potential in Key Markets Manufacturer of a Highly Engineered Product Sold Directly to End-Users Improved Financial Performance Through Management Know-How & Ability to Leverage Supply Chain Low Future Capex Requirements Enhance Free Cash Flow Highly Variable Cost Business SPC Expected to Meet Cactus’ Acquisition Criteria

25 Cactus to form a JV with Baker Hughes whereby Cactus acquires 65% of SPC for $344.5 million ($530mm total enterprise value on a cash-free, debt-free basis) subject to customary purchase price adjustments Consideration to be paid in cash, with closing expected in early 2026 subject to customary closing conditions and regulatory approvals Any time after the second anniversary of closing, Cactus has the right to purchase, and Baker Hughes has the right to require Cactus to purchase, the remaining 35% interest Baker Hughes remaining as a JV partner for at least two years provides further comfort in transitioning administrative services and in maintaining critical customer relationships Upfront purchase price expected to be funded with cash on hand and available external sources, including funds from Cactus’ undrawn $225mm revolving credit facility Cactus may pursue one or more debt financing transactions before closing to preserve revolving facility liquidity The upfront purchase price of 65% represents a multiple of approximately 6.7x 2024 Transaction Adjusted EBITDA(1) Expect to achieve annualized cost synergies of approximately $10mm within 12 months of closing Transaction & Financing Overview Transaction Overview Strategic Rationale Geographic diversification increases stability of the revenue profile through the cycle Increased scale via product lines well understood by Cactus management Access to attractive customers with long-term investment horizons, including NOCs and IOCs Greater revenue, earnings and cash flow visibility provided by substantial backlog (>$600mm as of December 31, 2024) Provides expansive international footprint to accelerate growth of FlexSteel products and services Expected to be highly accretive to financial metrics, while maintaining fortress balance sheet and financial flexibility Combined business anticipated to be supportive of continued capital returns to shareholders 1) EBITDA, Adjusted EBITDA, Transaction Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP financial measures. Subsequent pages in this presentation contain reconciliations to the most comparable financial measures calculated in accordance with GAAP. Financial information related to SPC has been prepared based on information provided by Baker Hughes Holdings LLC and its affiliates, which has not been confirmed by Cactus, and has not been audited.

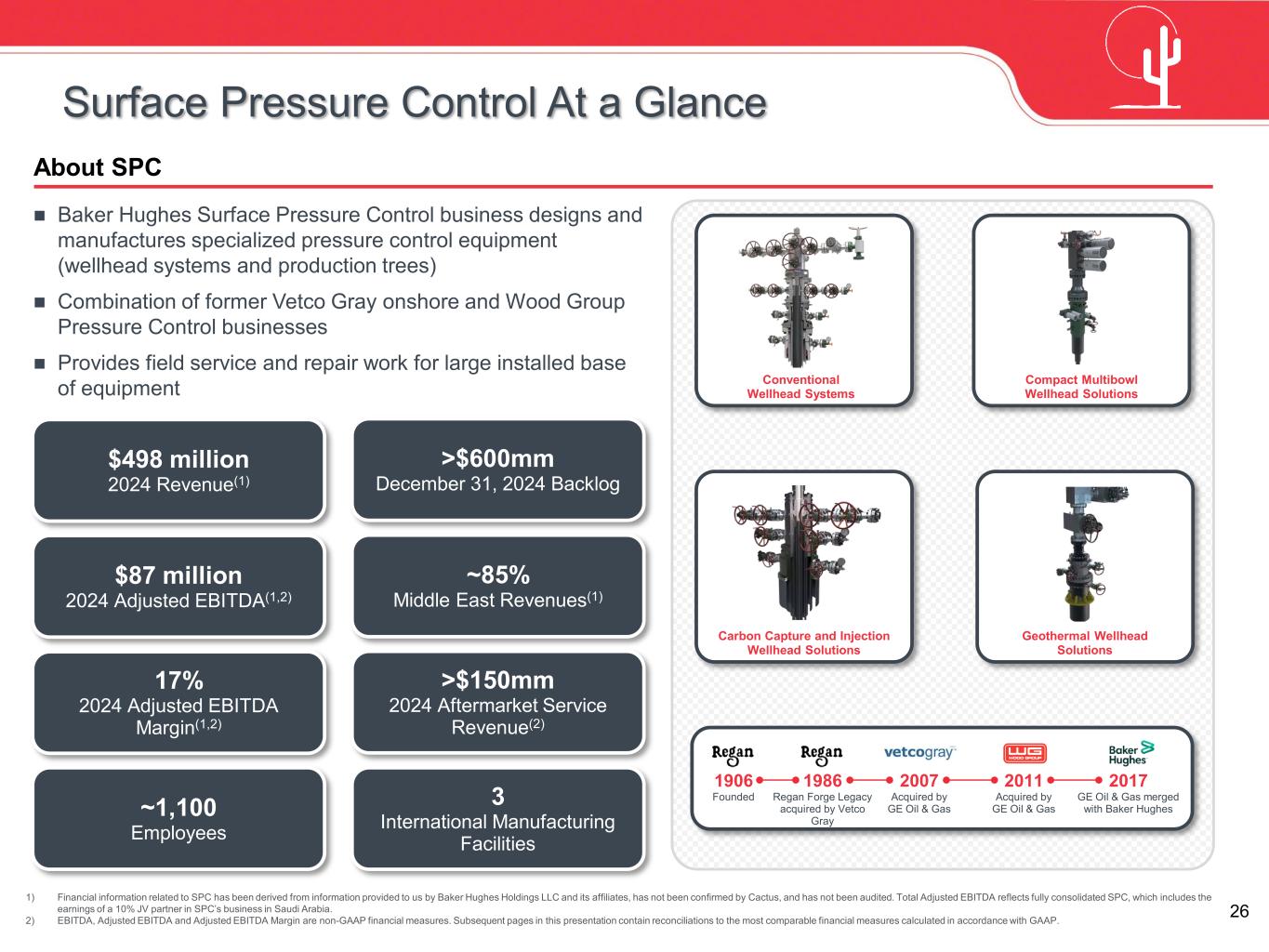

26 Surface Pressure Control At a Glance About SPC Baker Hughes Surface Pressure Control business designs and manufactures specialized pressure control equipment (wellhead systems and production trees) Combination of former Vetco Gray onshore and Wood Group Pressure Control businesses Provides field service and repair work for large installed base of equipment 1) Financial information related to SPC has been derived from information provided to us by Baker Hughes Holdings LLC and its affiliates, has not been confirmed by Cactus, and has not been audited. Total Adjusted EBITDA reflects fully consolidated SPC, which includes the earnings of a 10% JV partner in SPC’s business in Saudi Arabia. 2) EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP financial measures. Subsequent pages in this presentation contain reconciliations to the most comparable financial measures calculated in accordance with GAAP. $498 million 2024 Revenue(1) $87 million 2024 Adjusted EBITDA(1,2) 17% 2024 Adjusted EBITDA Margin(1,2) >$600mm December 31, 2024 Backlog ~85% Middle East Revenues(1) >$150mm 2024 Aftermarket Service Revenue(2) 3 International Manufacturing Facilities ~1,100 Employees Carbon Capture and Injection Wellhead Solutions Conventional Wellhead Systems Compact Multibowl Wellhead Solutions Geothermal Wellhead Solutions 1906 Founded 1986 Regan Forge Legacy acquired by Vetco Gray 2007 Acquired by GE Oil & Gas 2011 Acquired by GE Oil & Gas 2017 GE Oil & Gas merged with Baker Hughes

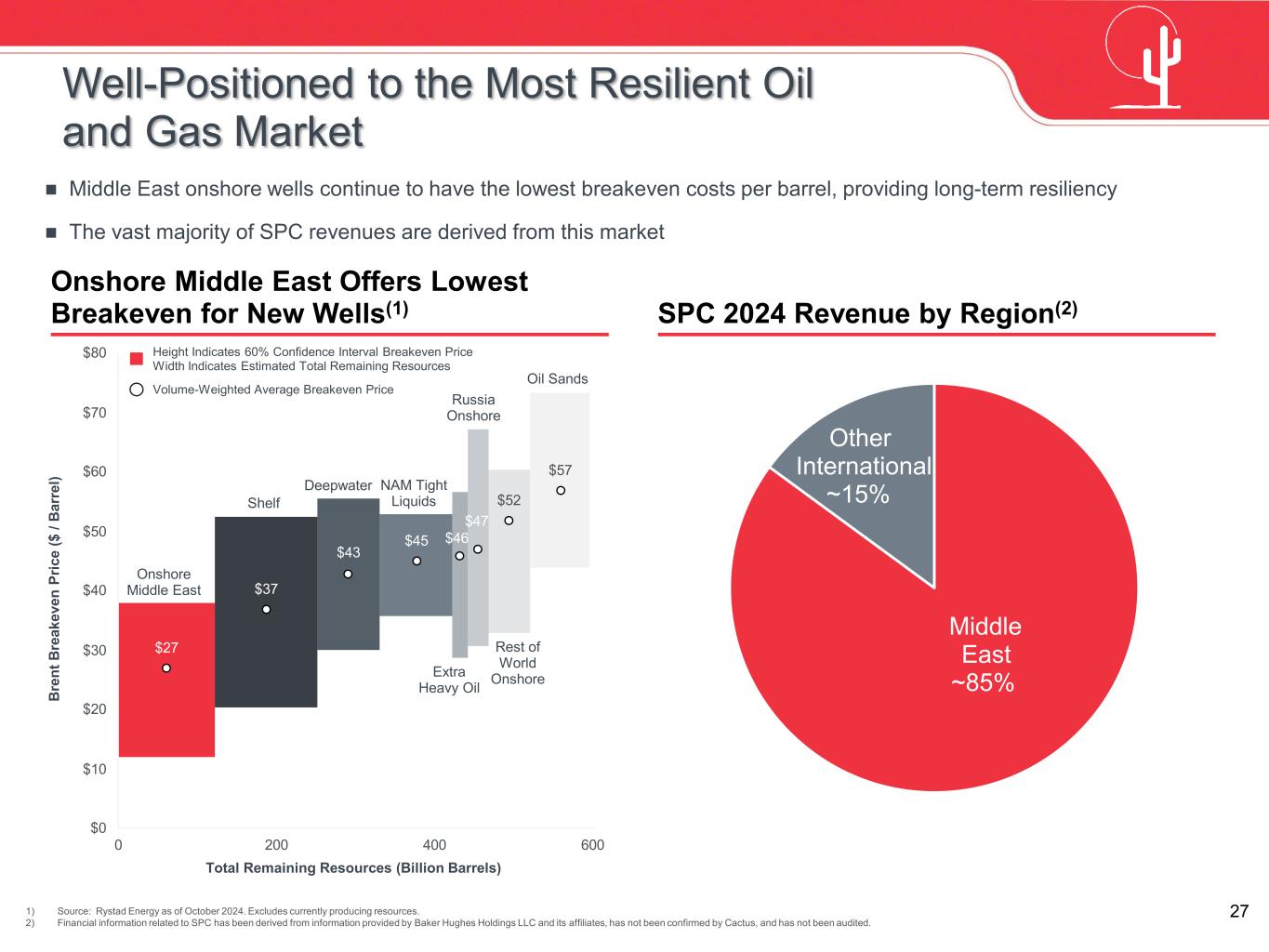

27 Onshore Middle East Shelf Deepwater NAM Tight Liquids Oil Sands Rest of World Onshore Russia Onshore Extra Heavy Oil Total Remaining Resources (Billion Barrels) $27 $37 $43 $45 $46 $47 $52 $57 $0 $10 $20 $30 $40 $50 $60 $70 $80 0 200 400 600 Volume-Weighted Average Breakeven Price Height Indicates 60% Confidence Interval Breakeven Price Width Indicates Estimated Total Remaining Resources B re nt B re ak ev en P ric e ($ / B ar re l) Onshore Middle East Offers Lowest Breakeven for New Wells(1) SPC 2024 Revenue by Region(2) 1) Source: Rystad Energy as of October 2024. Excludes currently producing resources. 2) Financial information related to SPC has been derived from information provided by Baker Hughes Holdings LLC and its affiliates, has not been confirmed by Cactus, and has not been audited. Well-Positioned to the Most Resilient Oil and Gas Market Middle East onshore wells continue to have the lowest breakeven costs per barrel, providing long-term resiliency The vast majority of SPC revenues are derived from this market Middle East ~85% Other International ~15%

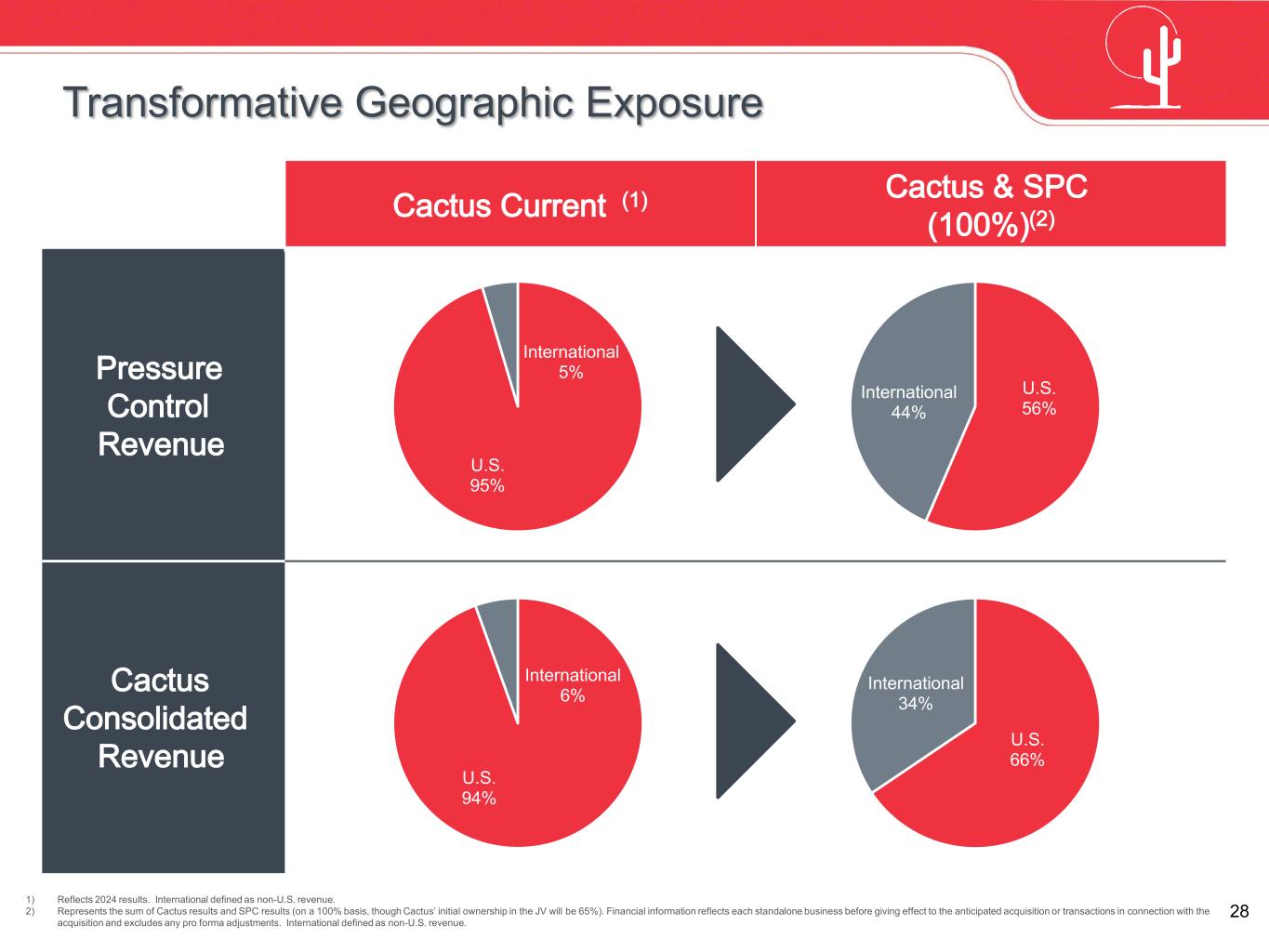

28 Cactus Current (1) Cactus & SPC (100%)(2) Pressure Control Revenue Cactus Consolidated Revenue Transformative Geographic Exposure U.S. 56% International 44% U.S. 66% International 34% U.S. 94% International 6% 1) Reflects 2024 results. International defined as non-U.S. revenue. 2) Represents the sum of Cactus results and SPC results (on a 100% basis, though Cactus’ initial ownership in the JV will be 65%). Financial information reflects each standalone business before giving effect to the anticipated acquisition or transactions in connection with the acquisition and excludes any pro forma adjustments. International defined as non-U.S. revenue. U.S. 95% International 5%

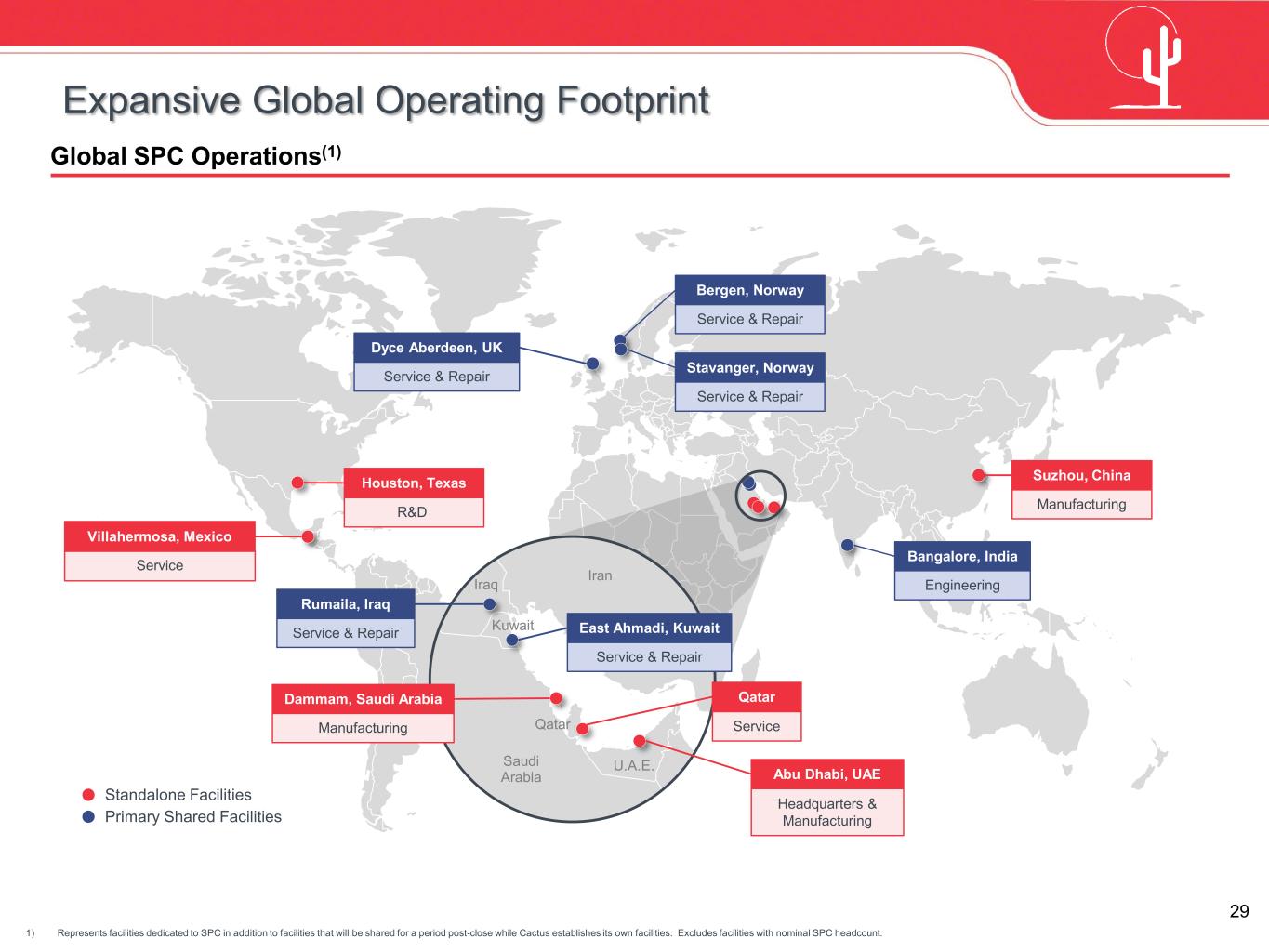

29 Global SPC Operations(1) Expansive Global Operating Footprint Iraq Iran Saudi Arabia U.A.E. Qatar Kuwait Manufacturing Dammam, Saudi Arabia Service Qatar Headquarters & Manufacturing Abu Dhabi, UAE Manufacturing Suzhou, China Service Villahermosa, Mexico R&D Houston, Texas Standalone Facilities Primary Shared Facilities Engineering Bangalore, India Service & Repair Rumaila, Iraq Service & Repair East Ahmadi, Kuwait Service & Repair Bergen, Norway Service & Repair Stavanger, NorwayService & Repair Dyce Aberdeen, UK 1) Represents facilities dedicated to SPC in addition to facilities that will be shared for a period post-close while Cactus establishes its own facilities. Excludes facilities with nominal SPC headcount.

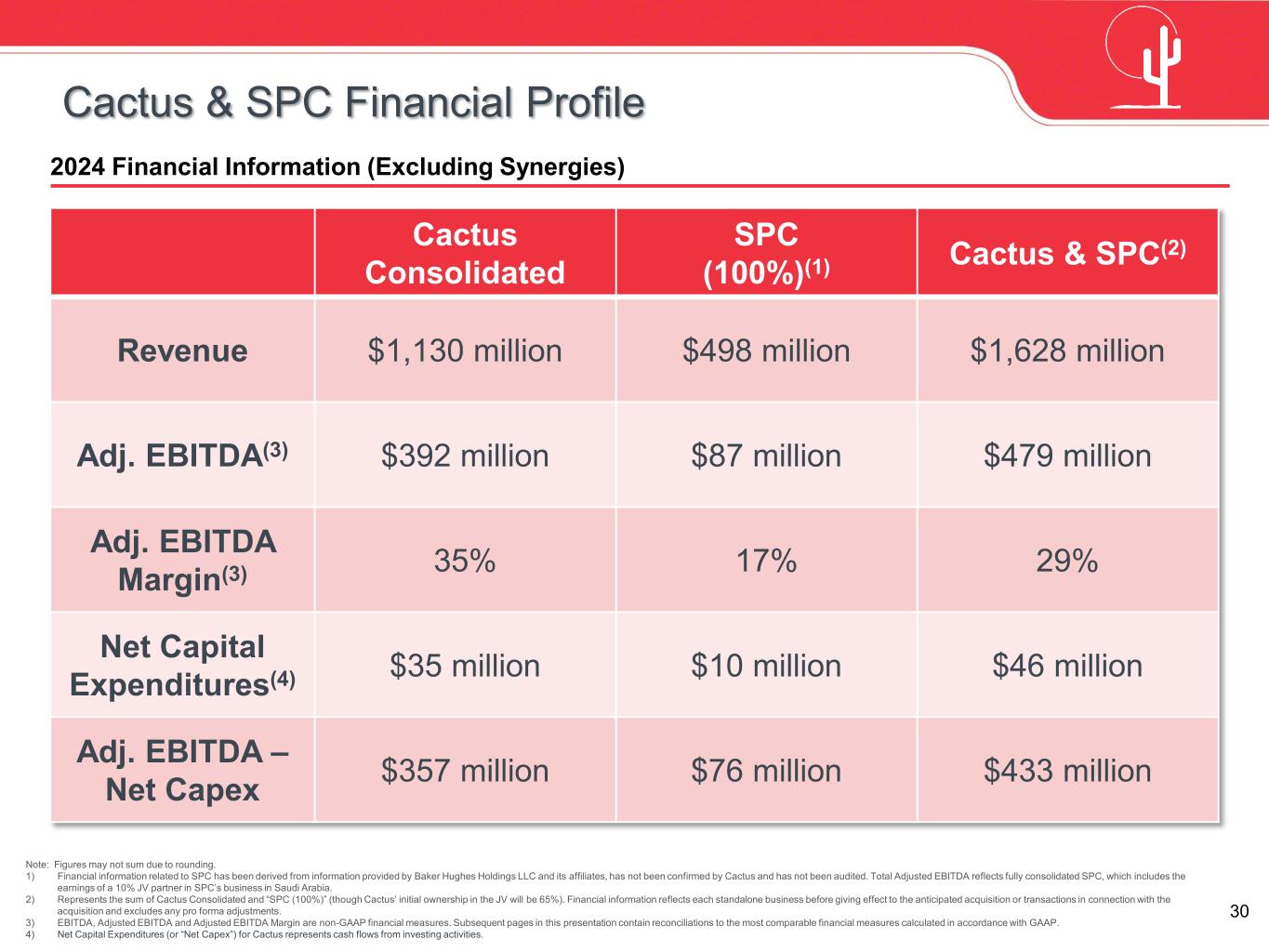

30 2024 Financial Information (Excluding Synergies) Cactus & SPC Financial Profile Cactus Consolidated SPC (100%)(1) Cactus & SPC(2) Revenue $1,130 million $498 million $1,628 million Adj. EBITDA(3) $392 million $87 million $479 million Adj. EBITDA Margin(3) 35% 17% 29% Net Capital Expenditures(4) $35 million $10 million $46 million Adj. EBITDA – Net Capex $357 million $76 million $433 million Note: Figures may not sum due to rounding. 1) Financial information related to SPC has been derived from information provided by Baker Hughes Holdings LLC and its affiliates, has not been confirmed by Cactus and has not been audited. Total Adjusted EBITDA reflects fully consolidated SPC, which includes the earnings of a 10% JV partner in SPC’s business in Saudi Arabia. 2) Represents the sum of Cactus Consolidated and “SPC (100%)” (though Cactus’ initial ownership in the JV will be 65%). Financial information reflects each standalone business before giving effect to the anticipated acquisition or transactions in connection with the acquisition and excludes any pro forma adjustments. 3) EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP financial measures. Subsequent pages in this presentation contain reconciliations to the most comparable financial measures calculated in accordance with GAAP. 4) Net Capital Expenditures (or “Net Capex”) for Cactus represents cash flows from investing activities.

Appendix

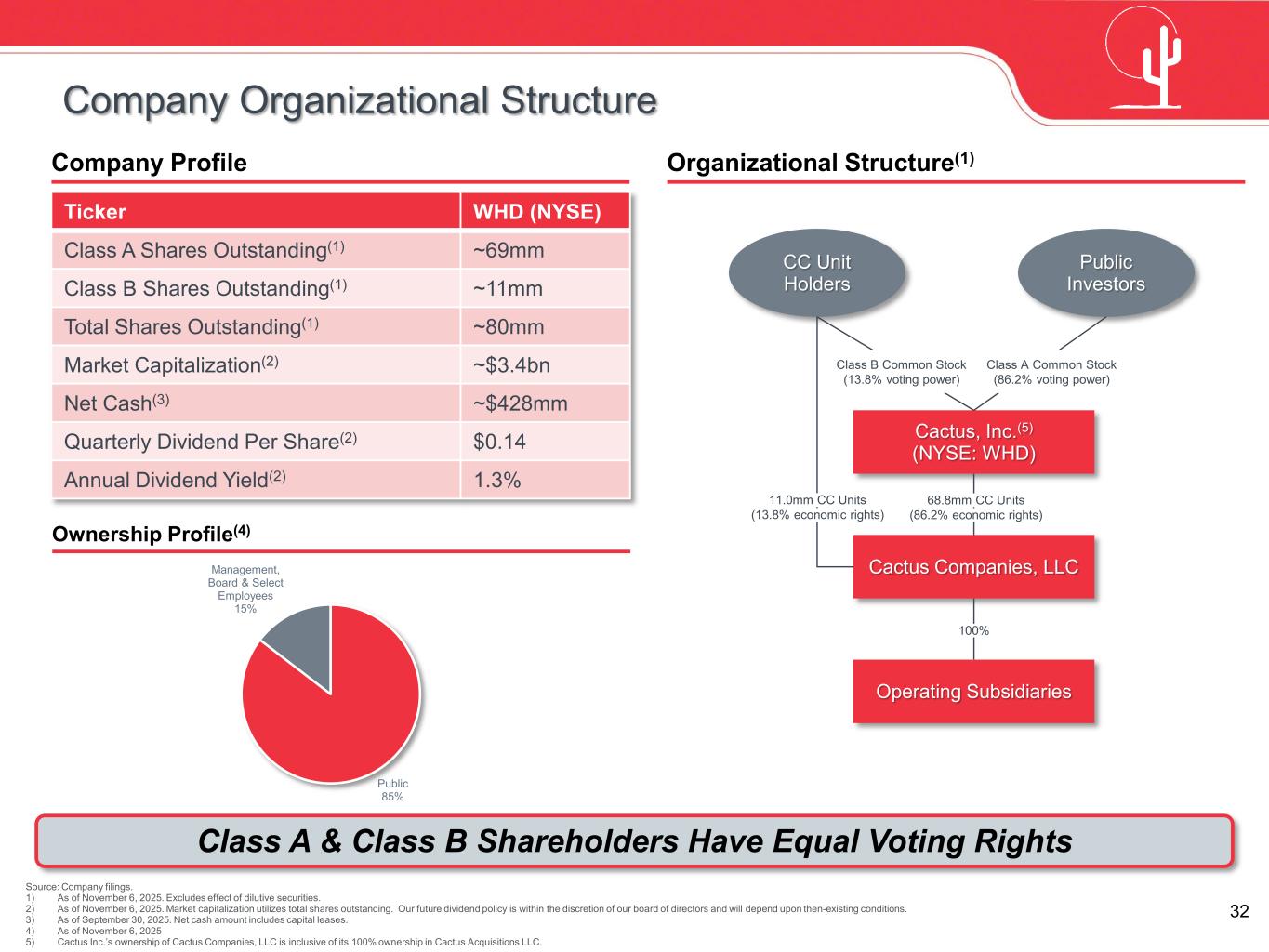

32 Public 85% Management, Board & Select Employees 15% Ownership Profile(4) Company Organizational Structure Source: Company filings. 1) As of November 6, 2025. Excludes effect of dilutive securities. 2) As of November 6, 2025. Market capitalization utilizes total shares outstanding. Our future dividend policy is within the discretion of our board of directors and will depend upon then-existing conditions. 3) As of September 30, 2025. Net cash amount includes capital leases. 4) As of November 6, 2025 5) Cactus Inc.’s ownership of Cactus Companies, LLC is inclusive of its 100% ownership in Cactus Acquisitions LLC. CC Unit Holders Public Investors Cactus, Inc.(5) (NYSE: WHD) Cactus Companies, LLC Operating Subsidiaries Ticker WHD (NYSE) Class A Shares Outstanding(1) ~69mm Class B Shares Outstanding(1) ~11mm Total Shares Outstanding(1) ~80mm Market Capitalization(2) ~$3.4bn Net Cash(3) ~$428mm Quarterly Dividend Per Share(2) $0.14 Annual Dividend Yield(2) 1.3% Company Profile Organizational Structure(1) Class A Common Stock (86.2% voting power) Class B Common Stock (13.8% voting power) 11.0mm CC Units (13.8% economic rights) 68.8mm CC Units (86.2% economic rights) 100% Class A & Class B Shareholders Have Equal Voting Rights

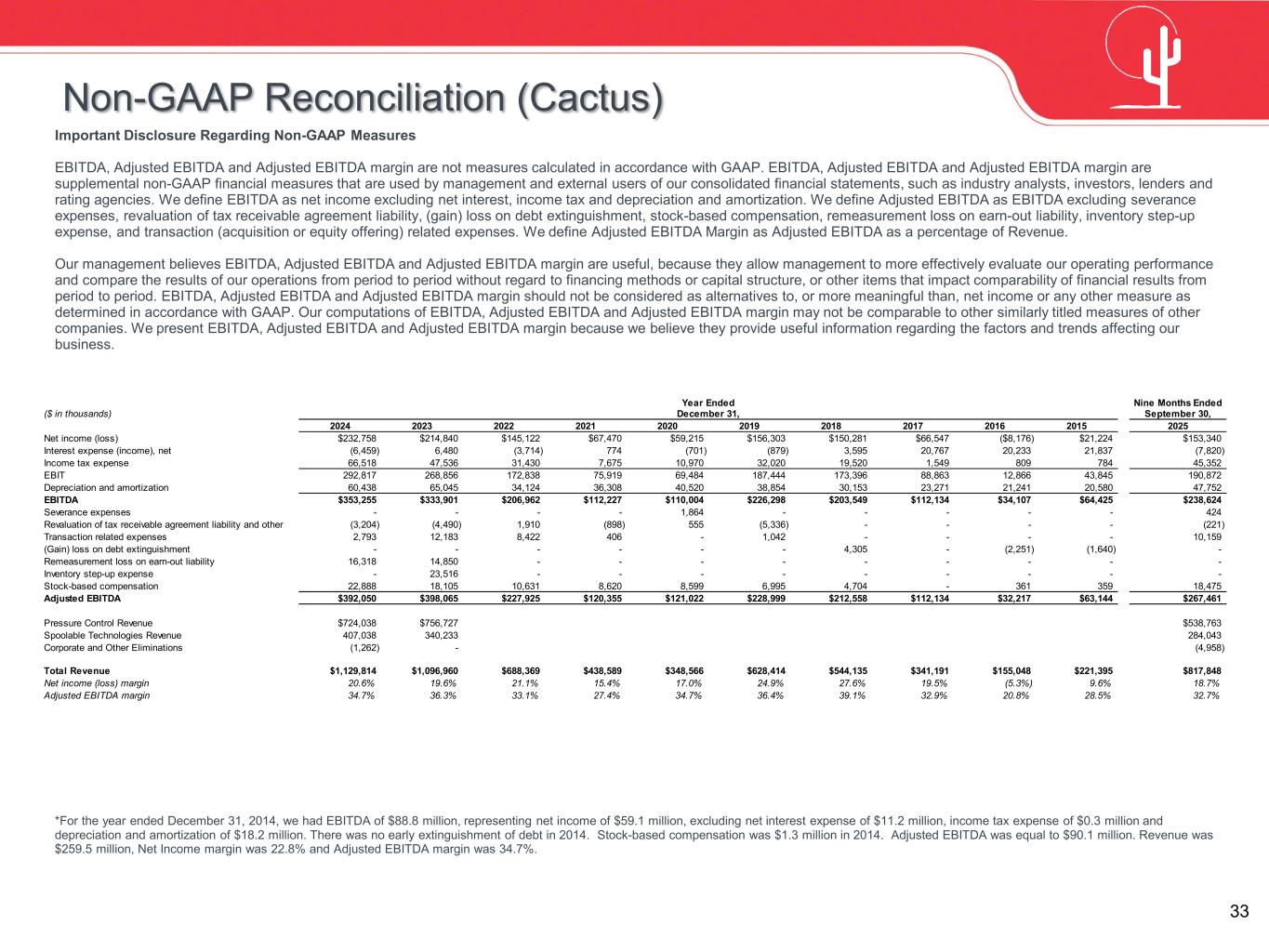

33 Year Ended Nine Months Ended ($ in thousands) December 31, September 30, 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 2025 Net income (loss) $232,758 $214,840 $145,122 $67,470 $59,215 $156,303 $150,281 $66,547 ($8,176) $21,224 $153,340 Interest expense (income), net (6,459) 6,480 (3,714) 774 (701) (879) 3,595 20,767 20,233 21,837 (7,820) Income tax expense 66,518 47,536 31,430 7,675 10,970 32,020 19,520 1,549 809 784 45,352 EBIT 292,817 268,856 172,838 75,919 69,484 187,444 173,396 88,863 12,866 43,845 190,872 Depreciation and amortization 60,438 65,045 34,124 36,308 40,520 38,854 30,153 23,271 21,241 20,580 47,752 EBITDA $353,255 $333,901 $206,962 $112,227 $110,004 $226,298 $203,549 $112,134 $34,107 $64,425 $238,624 Severance expenses - - - - 1,864 - - - - - 424 Revaluation of tax receivable agreement liability and other (3,204) (4,490) 1,910 (898) 555 (5,336) - - - - (221) Transaction related expenses 2,793 12,183 8,422 406 - 1,042 - - - - 10,159 (Gain) loss on debt extinguishment - - - - - - 4,305 - (2,251) (1,640) - Remeasurement loss on earn-out liability 16,318 14,850 - - - - - - - - - Inventory step-up expense - 23,516 - - - - - - - - - Stock-based compensation 22,888 18,105 10,631 8,620 8,599 6,995 4,704 - 361 359 18,475 Adjusted EBITDA $392,050 $398,065 $227,925 $120,355 $121,022 $228,999 $212,558 $112,134 $32,217 $63,144 $267,461 Pressure Control Revenue $724,038 $756,727 $538,763 Spoolable Technologies Revenue 407,038 340,233 284,043 Corporate and Other Eliminations (1,262) - (4,958) Total Revenue $1,129,814 $1,096,960 $688,369 $438,589 $348,566 $628,414 $544,135 $341,191 $155,048 $221,395 $817,848 Net income (loss) margin 20.6% 19.6% 21.1% 15.4% 17.0% 24.9% 27.6% 19.5% (5.3%) 9.6% 18.7% Adjusted EBITDA margin 34.7% 36.3% 33.1% 27.4% 34.7% 36.4% 39.1% 32.9% 20.8% 28.5% 32.7% Non-GAAP Reconciliation (Cactus) Important Disclosure Regarding Non-GAAP Measures EBITDA, Adjusted EBITDA and Adjusted EBITDA margin are not measures calculated in accordance with GAAP. EBITDA, Adjusted EBITDA and Adjusted EBITDA margin are supplemental non-GAAP financial measures that are used by management and external users of our consolidated financial statements, such as industry analysts, investors, lenders and rating agencies. We define EBITDA as net income excluding net interest, income tax and depreciation and amortization. We define Adjusted EBITDA as EBITDA excluding severance expenses, revaluation of tax receivable agreement liability, (gain) loss on debt extinguishment, stock-based compensation, remeasurement loss on earn-out liability, inventory step-up expense, and transaction (acquisition or equity offering) related expenses. We define Adjusted EBITDA Margin as Adjusted EBITDA as a percentage of Revenue. Our management believes EBITDA, Adjusted EBITDA and Adjusted EBITDA margin are useful, because they allow management to more effectively evaluate our operating performance and compare the results of our operations from period to period without regard to financing methods or capital structure, or other items that impact comparability of financial results from period to period. EBITDA, Adjusted EBITDA and Adjusted EBITDA margin should not be considered as alternatives to, or more meaningful than, net income or any other measure as determined in accordance with GAAP. Our computations of EBITDA, Adjusted EBITDA and Adjusted EBITDA margin may not be comparable to other similarly titled measures of other companies. We present EBITDA, Adjusted EBITDA and Adjusted EBITDA margin because we believe they provide useful information regarding the factors and trends affecting our business. *For the year ended December 31, 2014, we had EBITDA of $88.8 million, representing net income of $59.1 million, excluding net interest expense of $11.2 million, income tax expense of $0.3 million and depreciation and amortization of $18.2 million. There was no early extinguishment of debt in 2014. Stock-based compensation was $1.3 million in 2014. Adjusted EBITDA was equal to $90.1 million. Revenue was $259.5 million, Net Income margin was 22.8% and Adjusted EBITDA margin was 34.7%.

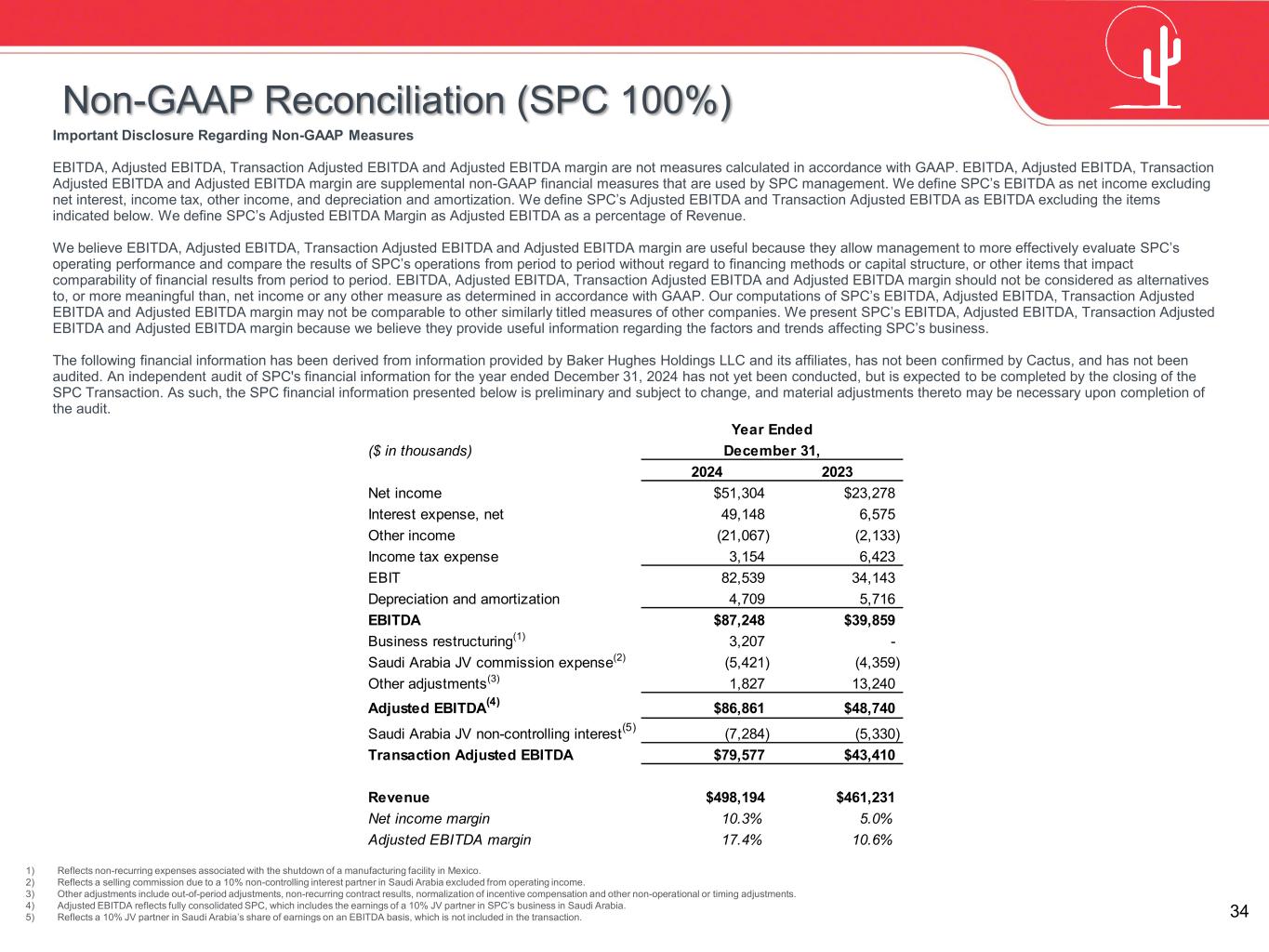

34 Non-GAAP Reconciliation (SPC 100%) Important Disclosure Regarding Non-GAAP Measures EBITDA, Adjusted EBITDA, Transaction Adjusted EBITDA and Adjusted EBITDA margin are not measures calculated in accordance with GAAP. EBITDA, Adjusted EBITDA, Transaction Adjusted EBITDA and Adjusted EBITDA margin are supplemental non-GAAP financial measures that are used by SPC management. We define SPC’s EBITDA as net income excluding net interest, income tax, other income, and depreciation and amortization. We define SPC’s Adjusted EBITDA and Transaction Adjusted EBITDA as EBITDA excluding the items indicated below. We define SPC’s Adjusted EBITDA Margin as Adjusted EBITDA as a percentage of Revenue. We believe EBITDA, Adjusted EBITDA, Transaction Adjusted EBITDA and Adjusted EBITDA margin are useful because they allow management to more effectively evaluate SPC’s operating performance and compare the results of SPC’s operations from period to period without regard to financing methods or capital structure, or other items that impact comparability of financial results from period to period. EBITDA, Adjusted EBITDA, Transaction Adjusted EBITDA and Adjusted EBITDA margin should not be considered as alternatives to, or more meaningful than, net income or any other measure as determined in accordance with GAAP. Our computations of SPC’s EBITDA, Adjusted EBITDA, Transaction Adjusted EBITDA and Adjusted EBITDA margin may not be comparable to other similarly titled measures of other companies. We present SPC’s EBITDA, Adjusted EBITDA, Transaction Adjusted EBITDA and Adjusted EBITDA margin because we believe they provide useful information regarding the factors and trends affecting SPC’s business. The following financial information has been derived from information provided by Baker Hughes Holdings LLC and its affiliates, has not been confirmed by Cactus, and has not been audited. An independent audit of SPC's financial information for the year ended December 31, 2024 has not yet been conducted, but is expected to be completed by the closing of the SPC Transaction. As such, the SPC financial information presented below is preliminary and subject to change, and material adjustments thereto may be necessary upon completion of the audit. 1) Reflects non-recurring expenses associated with the shutdown of a manufacturing facility in Mexico. 2) Reflects a selling commission due to a 10% non-controlling interest partner in Saudi Arabia excluded from operating income. 3) Other adjustments include out-of-period adjustments, non-recurring contract results, normalization of incentive compensation and other non-operational or timing adjustments. 4) Adjusted EBITDA reflects fully consolidated SPC, which includes the earnings of a 10% JV partner in SPC’s business in Saudi Arabia. 5) Reflects a 10% JV partner in Saudi Arabia’s share of earnings on an EBITDA basis, which is not included in the transaction. Year Ended ($ in thousands) December 31, 2024 2023 Net income $51,304 $23,278 Interest expense, net 49,148 6,575 Other income (21,067) (2,133) Income tax expense 3,154 6,423 EBIT 82,539 34,143 Depreciation and amortization 4,709 5,716 EBITDA $87,248 $39,859 Business restructuring(1) 3,207 - Saudi Arabia JV commission expense(2) (5,421) (4,359) Other adjustments(3) 1,827 13,240 Adjusted EBITDA(4) $86,861 $48,740 Saudi Arabia JV non-controlling interest(5) (7,284) (5,330) Transaction Adjusted EBITDA $79,577 $43,410 Revenue $498,194 $461,231 Net income margin 10.3% 5.0% Adjusted EBITDA margin 17.4% 10.6%

35 Alan Boyd Director of Corporate Development & Investor Relations 713-904-4669 IR@CactusWHD.com Investor Relations Contact